Guidance note for residence, domicile and the remittance basis: RDR1

Updated 16 May 2025

This guidance is about:

- how your residence status and your domicile status affect the payment of tax in the UK on foreign income or foreign chargeable gains from the 6 April 2013 onwards

- the remittance basis of taxation from 6 April 2013, but does not yet incorporate the guidance on remittance basis changes from 2012, which are covered in the information note and guidance note

- the new Statutory Residence Test (SRT), which was introduced in Finance Bill 2013

You should read this guidance in conjunction with the SRT legislation and the SRT Guidance Note (RDR3).

The previous guidance Residence, Domicile and the Remittance Basis (HMRC6) applies for all tax years ending on or before 5 April 2013.

This guidance offers general information on how the rules apply, but whether the guidance is appropriate in a particular case will depend on all the facts of that case. If you’ve any difficulty in applying the rules in your own case, you should consult HMRC. We may wish to verify your residence or domicile status as part of a check into your tax return.

More information is available on Inheritance Tax.

1. Impact of residence and domicile

1.1 This section is about the impact of your residence and domicile status on your Income Tax and Capital Gains Tax liabilities in the UK.

1.2 It’s important to know if you’re a UK resident or not. This may affect:

- your UK tax liability

- your entitlement to Income Tax allowances and exemptions

UK residence – tax liability

1.3 When you’re UK resident you’re normally taxed on the arising basis of taxation. This means that all your worldwide income and gains will be taxable in the UK. Therefore, even if your foreign income and gains have already been taxed in another country they will still be taxable in the UK and you must declare all of your foreign income and gains on your tax return.

1.4 In many cases, relief is given in the UK for foreign tax paid on foreign income and gains under the provisions of the relevant Double Taxation Agreements (DTAs) or via unilateral relief. There is more information about DTAs in section 10.

UK domicile – tax liability

1.5 If you’re UK resident but not domiciled in the UK there are special rules which might apply to your foreign income and gains. In these circumstances you’ve a choice of whether to use the arising basis of taxation or the remittance basis of taxation. If you choose to use the remittance basis for a tax year you will pay UK tax on:

- any of your income and gains which arise/accrue in the UK

- any of your foreign income and gains that you, or another relevant person, brings (or remits) to the UK, even if that remittance occurs in a later tax year

If you’re a long-term UK resident and you choose to be taxed on the remittance basis, you may also be liable to pay the Remittance Basis charge.

If you’re deemed domiciled in the UK because you meet either Condition A or Condition B, you cannot claim the remittance basis of taxation, and will be taxed on the arising basis.

Section 5 of this guidance gives more information about domicile.

Dual residence

1.6 It is possible for you to be UK resident under UK tax rules and at the same time be resident in another country under that country’s rules. This is sometimes referred to as ‘dual residence’. If you’re UK resident and resident in another country, and the UK has a DTA with the other country, there may be provisions that determine where you will pay tax. You will need to look at the guidance in section 10.

Members of the UK Parliament and House of Lords

1.7 Members of the House of Commons (MPs) and House of Lords (Peers) are treated as resident and domiciled in the UK for Income Tax, Inheritance Tax and Capital Gains Tax purposes. This applies to the whole of each tax year in which a person is a member of either House. It applies even if that person is a member for only part of the tax year and regardless of whether or not they are on a leave of absence.

1.8 It does not apply to either the Lords Spiritual or peers who are disqualified from sitting and voting as a result of becoming a Member of the European Parliament or a judge.

Resident abroad with income from a UK source

1.9 Although you may not be UK resident under the SRT you may earn income in the UK, for example from employment or self-employment where you carry out some work when you’re physically in the UK, or you may come to the UK on a short secondment for your overseas employer. You will normally pay UK tax on any earnings for work that you do in the UK and on any other income you have which arises in the UK, for example bank interest, rental income from UK properties, or payments by the government to crown servants working overseas. However, there may be a DTA in place which contains provisions about where you pay tax.

Resident abroad – sales and disposals of UK residential property

1.10 If you’re not resident in the UK and sell a UK residential property you may have to pay Capital Gains Tax on the gains you make. See Capital Gains Tax for non-residents: UK residential property for details. Also see paragraph 3.17 for information about these disposals in the overseas part of a split year.

1.11 If you’re not UK resident, your domicile does not impact your tax liabilities.

Non-resident landlords

1.12 If you will have rental income from property in the UK, this income will be liable to UK tax whether or not you’re resident in the UK. If you sell or dispose of a UK residential property you may have to pay Capital Gains Tax on the gains you make. See Capital Gains Tax for non-residents: UK residential property for details.

1.13 There is a special scheme for payment of UK tax on your income from rental property. You should read the section on non-resident landlords in this guidance. It is your ‘usual place of abode’ and not non-residence under the SRT that determines whether or not you’re included in the scheme. Impact of residence and domicile

1.14 If you’ve rental income from overseas, this will be taxed in the UK on the same basis as all other foreign income dependant on your residence status. Section 6 gives information on the taxation of different types of income.

Tax liability in the year you arrive in or depart from the UK

1.15 Under the SRT you’re either UK resident or not UK resident for a full tax year. If you leave or come to the UK part way through a tax year, the year may be split: this is referred to as split year treatment. Broadly speaking, this is where you pay UK tax on the foreign income and gains which arise in the UK part of the split year, but not on those foreign income and gains which arise in the overseas part of that tax year. We explain the terms UK part and overseas part further on. You can find out more about tax when coming to the UK in section 3 and tax when leaving the UK in section 4.

Split year treatment

1.16 There are 8 cases where split year treatment can apply. If, during a year, you meet all the conditions of one or more of these cases, for example you leave the UK to live or work abroad or come to the UK to live or work, your tax year will be split into 2 parts:

- a UK part in which you’re charged to UK tax as a UK resident

- an overseas part in which, for most purposes, you’re charged to UK tax as someone who is not UK resident

More information is available in section 5 of the SRT Guidance Note (RDR3).

Contacting HMRC when arriving in or leaving the UK

1.17 You should tell HMRC immediately if you come to the UK to live or work or leave the UK to live or work overseas. You should also tell HMRC if those circumstances change while you’re in the UK.

What if I come back to the UK after a period abroad?

1.18 If you come to the UK having been here before, your earlier presence in the UK may affect your tax liability and whether split year treatment will be applied.

1.19 You will need to consider whether or not your absence from the UK was a period when you were:

- still UK resident

- temporarily non-resident (see section 6 of the SRT Guidance Note (RDR3)

- not UK resident

2. Residence

Statutory residence test (SRT)

2.1 The Finance Act 2013 introduced the SRT. This is a set of rules to determine your tax residence; it sets out what makes you UK resident for tax purposes. The SRT came into force from the start of the 2013-2014 tax year. The SRT Guidance Note (RDR3) explains what factors are taken into account when deciding your residence status.

2.2 The SRT cannot be used to determine your residence status for the purposes of determining your tax liabilities for tax years before 2013 to 2014. You should refer to Residence, Domicile and the Remittance Basis (HMRC6).

3. Tax when coming to the UK

Am I UK resident for tax purposes?

3.1 From the tax year 2013 to 2014 onwards, you’re likely to be treated as UK resident under the SRT if you:

- spend 183 or more days in the UK in the tax year

- have a home in the UK, and do not have a home overseas

- work full-time in the UK over a period of 365 days

Whether or not you’re in full-time work is a matter of fact, based on the hours you actually work. You should read paragraph 1.41 of the SRT Guidance Note (RDR3) for details on how to calculate whether you meet this condition or not.

3.2 You could still be treated as UK resident even if you do not satisfy these conditions. This will depend on the number of connections you’ve to the UK and the amount of time you spend here. The SRT rules are explained in the SRT Guidance Note.

What should I do if I work in the UK as an employee?

3.3 When you work for an employer in the UK, your employer will tell HMRC that you’re working for them and they will deduct tax from your earnings under the Pay As You Earn (PAYE) scheme.

3.4 If you work for an employer who is not present in the UK, you should contact HMRC for advice.

3.5 If you receive shares or other securities by reason of your employment, there are special rules relating to residence, split-year treatment and the remittance basis that are described in the International section of the Employment-Related Securities Manual at ERSM160000.

3.6 If you continue to be a resident of a country with which the UK has a Double Taxation Agreement (DTA), it may contain provisions about where you pay tax. You can find more information about double taxation in section 10.

3.7 The GOV.UK website contains general information on things you might need to know when you come to the UK as an employee.

What should I do if I come to the UK to work for myself?

3.8 If you’re self-employed you can find out what you need to do on the GOV.UK website or you can telephone our self-employed helpline. The helpline adviser will give you the advice you need to pay the right amount of UK tax at the right time.

3.9 If you continue to be a resident of a country with which the UK has a DTA, it may contain provisions about where you pay tax. You can find more information about this in section 10.

Self employment - business commencement and cessation provisions

3.10 As a resident of the UK you will pay UK tax on the profits of your trade, profession or vocation (business) regardless of where the business is carried on. There are special rules which apply when you start or end your business (‘commencement’ and ‘cessation’ rules). These rules may apply when you become resident in the UK even though you’ve not started or ended your business.

3.11 The cessation and commencement rules will apply if:

- you become UK resident

- you’ve been carrying on a business wholly or partly outside the UK

and you continue to carry on that business. You’re ‘deemed’ to have ceased one business and started another from the date of the change in your UK residence status or if split year treatment applies, from the split year date.

3.12 Unless split year treatment applies, the commencement of your residence in the UK takes place at the start of the tax year in which your change of residence occurs. Your business is deemed to have ceased and a new business to have commenced at that time. This may affect the amount of tax you’ve to pay.

3.13 If the business:

- was carried on wholly in the UK or partly in the UK before the change in your UK residence status, and

- is deemed to have ceased and commenced when you became UK resident

for UK tax purposes any unused losses in the UK business, or in the UK part of the business, before the deemed cessation can be:

- carried forward

- set against the profits of the ‘deemed’ commencing business

3.14 If the location of your UK business or the UK part of your business changes, generally the deeming rules do not apply. The fact that your business is in a completely new location is likely to mean that it has:

- a different structure

- a different customer base

- different employees

and that the business has in fact ceased and a new business has commenced. In these circumstances you will not be able to carry forward unused losses from the old business to set against the profits of the new one.

3.15 Some businesses are not localised in this way. These businesses are mainly carried on by professional people, wherever in the world the person happens to be. Examples of this would include:

- actors

- sportsmen or women

- authors

- musicians

Effect of split year treatment when you carry on a trade, profession or vocation

3.16 If split year treatment applies to you, the deemed cessation and commencement of your business takes place at the beginning of the UK part of the tax year. For the year of arrival in the UK you will be liable to UK tax on:

- the proportion of your profits which reflect the profits you made in the UK part of the tax year

- the profits from a UK business or any part of a business carried on in the UK during the overseas part of the tax year — if the deeming rule applies, for UK tax purposes any unused UK losses before the deemed cessation can be carried forward and used against profit of the deemed commencing business

3.17 For Capital Gains Tax if you dispose of an asset:

- in the UK part of a split year, the normal Capital Gains Tax rules will apply

- in the overseas part of a split year:

- where the asset was situated in the UK and was used or held for the purposes of a business that was carried on through a branch or agency in the UK, the disposal would be liable to Capital Gains Tax. Additionally, the cessation of the business, or the removal of the asset from the UK would give rise to a deemed disposal of the asset (see CG25500+ for more detailed guidance)

- where the disposal was of any other asset, the gain may be liable to Capital Gains Tax if it falls within a period of temporary non-residence. For more information on temporary non-residence, see section 6 of the SRT Guidance Note (RDR3)

- where the disposal was of a UK residential property, the gain may be liable to Capital Gains Tax. See Capital Gains Tax for non-residents: UK residential property for details

National Insurance number

3.18 You need a National Insurance number to work in the UK. See our website for further information about National Insurance, and how to apply for a National Insurance number if you do not already have one. See section 11 for more information about National Insurance.

What if I come to the UK but I am not working?

3.19 If you’ve come to the UK to live, even if you’re not working here, you could still have overseas income and gains or UK source income and gains. You should consider whether you need to complete a Self Assessment tax return.

What if I come to the UK to perform as an entertainer, sportsman or sportswoman?

3.20 There is a special scheme for taxing the income of foreign entertainers and sportspersons who come to perform in the UK (but not to live here), for example actors, musicians and other entertainers performing on stage or screen and those participating in all kinds of sports:

- the person who is paying you should deduct withholding tax from your payments

- in some circumstances you may need to complete a Self Assessment tax return

What if I come to the UK as a student?

3.21 If you come to the UK as a student you should refer to the SRT Guidance Note (RDR3) to help you decide whether or not you’re UK resident.

3.22 If you get a job while you’re here you might have to pay UK tax on your earnings. Earnings for any work you do in the UK are liable to UK tax whether or not you’re UK resident. If you’re going to work in the UK you will need a National Insurance number.

3.23 How much tax you’ve to pay depends on the amount you earn during a tax year. If you’re entitled to UK personal tax allowances these will reduce the amount of any UK tax you’ve to pay.

3.24 You should check if there is a DTA between the UK and the country in which you usually live. Most DTAs make provision for the tax treatment of any payments that you receive from overseas:

- for course fees

- for your maintenance while you’re studying here

You can find more information in section 10.

Short-term repeated visits

3.25 For residence purposes, it does not matter whether your visits to the UK are for the same purpose, different purposes, or varying lengths of time. The number of days spent in the UK is one factor, alongside others, which needs to be taken into account when considering your UK residence status. You should refer to the SRT Guidance Note (RDR3) for further information.

4. Tax when leaving the UK

4.1 If you leave the UK you may become not resident in the UK. From the tax year 2013 to 2014 onwards you’re likely to be treated as not resident in the UK for Income Tax or Capital Gains Tax purposes in the tax year if:

- you did not spend more than 45 days in the UK and were not resident in the UK in any of the 3 previous tax years

- you did not spend more than 15 days in the UK and were resident in the UK in one or more of the 3 previous tax years

- you’re working full-time overseas:

- you spend fewer than 91 days in the UK

- you do not work in the UK for 3 hours or more on more than 30 days

Whether or not you’re in full-time work is a matter of fact, based on the hours you actually work. You should read paragraph 1.10 of the SRT Guidance Note (RDR3) for details on how to calculate whether you meet this condition or not.

4.2 If none of the conditions apply to you, you may still be treated as not resident in the UK for tax purposes, depending on the number of connections you’ve with the UK and the amount of time you spend here. You should read the SRT Guidance Note (RDR3) for further information.

4.3 You do not stop being resident in the UK simply because you become resident elsewhere. You can be resident in more than one country at the same time. If you’re resident in the UK and another country you can find out about:

- what income may or may not be taxed in the UK

- what relief you can have if your income is taxed in more than one country

- whether you’re able to claim personal allowances

in section 10, Double Taxation.

Contact HMRC when leaving the UK

4.4 If you’re leaving the UK you must tell HMRC. We will tell you if you need to complete:

- a UK tax return after you’ve left

- a form P85 to get any tax refund you may be owed, or to obtain an amended tax code

More information is available about tax if you leave the UK to live abroad.

Changes to your employment or self-employment when overseas

4.5 If your work circumstances change while you’re overseas, for example there is a break in full-time working, you should reconsider your residence status as it may have changed. You will find detailed information about this in paragraph 3.19 of the SRT Guidance Note (RDR3).

4.6 You must contact HMRC if your residence status has changed. You must also tell us when you return to the UK at the end of an overseas work period, even if you’re planning to go abroad again to work. You must do this even if you consider your return to the UK as temporary and for a very short period.

Self-employment – business commencement and cessation provisions

4.7 As a non-UK resident you will pay tax on profits:

- from a trade, profession or vocation (business) you carry on in the UK

- from the UK part of a business carried on partly in the UK and partly elsewhere

4.8 There are special rules which apply when you start or end your business (‘commencement’ and ‘cessation’ rules). These rules may apply when you cease to be resident in the UK even though you’ve not started or ended your business. The commencement and cessation rules will apply if you:

- have been carrying on a business

- cease being resident in the UK

And you continue to carry on that business. You’re ‘deemed’ to have ceased one business and started another from the date of the change in your UK residence status or, if split year treatment applies, from the split year date.

4.9 Unless split year treatment applies, the cessation of your residence in the UK takes place at the end of the last tax year of UK residence. Your business is deemed to have ceased and a new business to have commenced at that time. This may affect the amount of tax you’ve to pay.

4.10 Where the ‘deemed’ cessation of one business and commencement of another applies, for UK tax purposes any unused losses in the UK business, or in the UK part of the business, before the change in your UK residence status can be carried forward and set against the profits of the ‘deemed’ commencing business that arise in the UK.

4.11 Most trades and professions are carried out in a particular location such as a shop or factory. Therefore, ceasing to be UK resident usually means the location of the business changes (for example from one country to another). The fact that the business is in a completely new location is likely to mean that it has:

- a different structure

- a different customer base

- different employees

and that the business has in fact ceased and a new business has commenced. In these circumstances you will not be able to carry forward losses from the old business to set against profits of the new one.

4.12 Some businesses are not carried out from a single location in this way. These businesses are mainly carried on by professional people, wherever in the world the person happens to be. Examples of this would include:

- actors

- sportsmen or women

- authors

- musicians

Effect of split year treatment when you carry on a trade, profession or vocation

4.13 If split year treatment applies to you, the deemed cessation and commencement takes place at the end of the UK part of the year. For the year of leaving the UK, you will be liable to UK tax on:

- the proportion of your profits which reflect the profits you made in the UK part of the tax year

- the profits from a UK trade, or profits from the part of the trade carried on in the UK, during the overseas part of the tax year — if the deeming rule in paragraph 4.9 apply, any unused losses in the UK trade or the UK part of the trade before the deemed cessation can be carried forward and used against profit of the deemed commencing business

4.14 For Capital Gains Tax if you dispose of an asset:

- in the UK part of a split year, the normal Capital Gains tax rules will apply

- in the overseas part of a split year:

- where the asset was situated in the UK and was used or held for the purposes of a business that was carried on through a branch or agency in the UK, the disposal would be liable to Capital Gains Tax — additionally, the cessation of the business, or the removal of the asset from the UK would give rise to a deemed disposal of the asset (see CG25500+ for more detailed guidance)

- where the disposal was of any other asset, the gain may be liable to Capital Gains Tax if falls within a period of temporary non-residence

- where the disposal was of a UK residential property, the gain may be liable to Capital Gains Tax. See Capital Gains Tax for non-residents: UK residential property for details

For more information on split year treatment see section 5 of the SRT Guidance Note (RDR3) or for information on temporary non-residence, section 6 of the SRT Guidance Note (RDR3).

Special taxation rules for certain employees and offices working abroad

4.15 There are special rules for some employees who work abroad or hold certain offices. These are summarised with links to further guidance where applicable.

Crown servants

4.16 If you’re a crown servant you will continue to be taxed in the UK in full on your Crown employment income whether or not the duties of the employment are carried out in the UK or overseas. Residence is not a material issue for the purpose of determining the tax liability on your Crown employment income. However, the taxation of other income is dependent upon your residence status. You can find more information about the taxation of crown servants on the GOV.UK website. Crown servants living overseas can contact HMRC on the Crown Servants Helpline to discuss Income Tax or Capital Gains Tax queries.

UK Merchant Navy seafarers

4.17 Seafarers working on UK ships, who usually live in the UK when not at sea, are resident in the UK. However, if you’re working as a seafarer wholly or partly outside the UK, you may be entitled to the ‘Seafarers’ Earnings Deduction’ which can reduce the tax you’ve to pay. You will find information about this at Seafarers’ Earnings Deduction: tax relief if you work on a ship.

Oil and gas workers

4.18 If you’re working in the oil or gas exploration/extraction industry within the UK’s territorial waters, or other designated areas, you will be taxed in full in the UK on those earnings irrespective of your residence status. Different rules can apply for individuals working outside the designated areas or those working for non-UK employers. You will find information about this on the GOV.UK at EIM40208.

Students

4.19 The UK has entered into DTAs with many countries. Many of these agreements provide special rules for students and business apprentices who go abroad solely for the purpose of education or training. Under these rules payments which you receive for the purpose of your education, training or maintenance will not be taxable in the country of study. You can find more information in section 10.

Employees of the EU

4.20 If you’re a resident in one member state and you go to live in another member state to work for the EU, your residence status does not change. You will remain resident in the last state you were resident in. For example, if you’re a UK resident and you go to Luxembourg to work for the EU you remain resident in the UK. Because the UK is no longer a member of the EU, if you first worked for the EU after 31 December 2020, your residence status does change. For example if you’re a UK resident and you first worked for the EU after 31 December 2020 and you go to Luxembourg to work for the EU you become a Luxembourg resident.

5. How does domicile affect your UK Income Tax and Capital Gains Tax liability?

5.1 For Income Tax and Capital Gains Tax purposes, whether or not you’re domiciled in the UK may affect what UK tax you pay on any foreign income and gains during a tax year. If you do not have foreign income and gains then your domicile status has no bearing on your UK Income Tax or Capital Gains Tax position and you do not need to consider it.

5.2 Your domicile status may also be relevant for Inheritance Tax and you should consult our Customer Guide to Inheritance Tax for more details.

5.3 When your affairs are straightforward, this guidance will help you to reach a decision on your domicile status. The fact that you:

- were born in the UK

- have lived here for most of your life

- are now living here permanently

gives a good indication that you might be domiciled in the UK.

5.4 If your affairs are more complex, and you require more detailed information on domicile for Income Tax and Capital Gains Tax purposes, you should refer to the manual RDRM20000. You may want to seek advice from a professional adviser.

5.5 If you’re UK resident but are not domiciled in the UK, you may have to pay UK tax on any income and gains which arise or accrue here. You can choose to pay tax on your foreign income and gains using the remittance basis of taxation. Section 9 gives more information on the remittance basis.

What does domicile mean?

5.6 Your domicile status is decided under general law, which means it must be interpreted according to previous rulings of the courts. There are many things which affect your domicile. Some of the main points are:

- you cannot be without a domicile

- you can only have one domicile at a time

- you’re normally regarded as domiciled in the country where you’ve your permanent home — there is more about residence for domicile purposes in the Remittance Basis and Domicile Manual at RDRM22310

- your existing domicile will continue until you acquire a new one

- your domicile is distinct from your nationality, citizenship and your residence status, although these can have an impact on your domicile

5.7 ‘Home’ in the third bullet in section 5.6, has a broader interpretation in relation to domicile than home does for statutory residence test purposes.

5.8 The fact that you register and vote as an overseas elector is not normally taken into account when deciding whether or not you’re domiciled in the UK.

UK domiciliary territories

5.9 The UK has 3 territories for domicile:

- England and Wales

- Scotland

- Northern Ireland

References we make in this guidance to being ‘domiciled in the UK’ are references to being domiciled in any part of the UK.

Types of domicile

5.10 There are 3 types of domicile:

- domicile of origin

- domicile of choice

- domicile of dependence

Domicile of origin

5.11 You normally acquire a domicile of origin from your father when you’re born (see also ‘domicile of dependence’). Your domicile of origin will often be the country in which you were born. However, if you were born in a country and your father was not domiciled there at the time you were born, then your domicile of origin may be your father’s country of domicile.

5.12 Furthermore, the fact that you were born in the UK does not automatically mean that you’re domiciled here. That is to say:

- you were born in the UK to a non-UK domiciled father

- you move to live indefinitely in a different country

you will not be domiciled in the UK. Your domicile of origin would be the same as the domicile of your father, for example non-UK. Unless you return to the UK and plan to remain here permanently or indefinitely, you will continue to be domiciled outside the UK.

Example 1

Arnd was born in the UK; his parents were married. His father was a non-UK domiciled soldier of another country serving in the UK. His domicile of origin is the same as the domicile of his father – non-UK.

5.13 Your domicile of origin may change if you’re adopted, but otherwise it is not easy to displace.

Example 2

Arnd’s parents died when he was a child and he was adopted. His adoptive father is UK domiciled. Arnd’s domicile of origin will change to a UK domicile as a result of the adoption. His original domicile of origin has been changed.

5.14 If your parents were not married at the time of your birth, you would acquire your domicile of origin from your mother.

5.15 If you leave the country of your domicile of origin, you will continue to be domiciled there until you acquire a domicile of choice elsewhere.

Domicile of choice

5.16 You’ve the legal capacity to acquire a new domicile at the age of 16 (in Scotland this has previously been from a younger age, see RDRM22020). Broadly, to acquire a domicile of choice, you must:

- leave your current country of domicile

- settle in another country

5.17 When you reach 16, you will acquire a domicile of choice if you:

- are already living in a country other than that of your domicile of origin

- you intend to remain there permanently or indefinitely

In either case, we may ask you to provide evidence that you intend to live in that other country permanently or indefinitely.

Example 3

Naoto was born in the UK. His father was a non-UK domiciled designer working in the UK. While he was a child his domicile of origin was the same as the domicile of his father. Naoto was brought up, educated and started working in the UK. When he was 21 his father retired and decided to return to the country of his domicile of origin. Naoto stayed in the UK and has since bought a home, married and made the UK his permanent home which he does not intend to leave. He will not be joining his father abroad for anything other than occasional visits.

By deciding to stay in the UK permanently or indefinitely Naoto has established a domicile of choice in the UK.

Domicile of dependence

5.18 Until you’ve the legal capacity to change it (see RDRM22020), your domicile will follow that of the person on whom you’re legally dependent, for example your father. If the domicile of that person changes, you will automatically acquire the same domicile as that person. If their domicile changes your domicile of origin will become dormant.

Women married before 1974

5.19 Before 1974, a married woman automatically acquired her husband’s domicile. If you’re a married woman who married before 1974, you retain your husband’s domicile until you legally acquire a new domicile. If you’re a woman who married on or after 1 January 1974, your domicile does not automatically follow your husband’s. Your domicile is decided in the same way as any other individual who is able to have an independent domicile. Your marriage will only be one factor taken into account when deciding your domicile.

5.20 There is an exception to this general rule: the DTA between the UK and the USA provides that a marriage before 1974 between a woman who is a US national and a man domiciled within the UK is deemed to have taken place on 1 January 1974.

Example 4

Zuine had a domicile of origin outside the UK; she married Albert, a man domiciled within the UK, in January 1970. Upon their marriage she became UK domiciled – her domicile of dependence being the same as her husband’s domicile. As from 1 January 1974 Zuine can acquire an independent domicile of choice, which could be different from her husband’s domicile, by settling elsewhere. If Zuine was a US national at the time of her marriage to Albert, her marriage will be deemed to have taken place on 1 January 1974 and any review of her domicile would be independent of the domicile of her husband.

Deemed domicile

5.21 From 6 April 2017 new deemed domiciled rules apply which change the way a previously UK resident but not UK domiciled individual is treated. An individual who is not domiciled under English common law will be treated as domiciled in the UK for tax purposes if they meet 1 of 2 conditions.

Condition A – the individual:

-

was born in the UK

-

their domicile of origin was in the UK

-

was resident in the UK for 2017 to 2018 or later years

Condition B – the individual:

- has been UK resident for at least 15 of the 20 years immediately before the relevant tax year

When might HMRC challenge your domicile status?

5.22 We do not normally challenge any person who says they have a UK domicile. If you say you’ve a non-UK domicile, we might want to check whether or not that is correct, particularly if you were born in the UK.

5.23 By its very nature, a check aimed at establishing your domicile will be an in-depth examination of:

- your background

- lifestyle

- your intentions over the course of your lifetime.

Any check of this sort will extend to areas of your life, and that of your family, that you might not normally think are relevant to your UK tax affairs. We will need to ask these questions and sometimes ask you to provide us with evidence about these areas of your life, as part of our check. This may involve meeting with you in person.

Working out your domicile

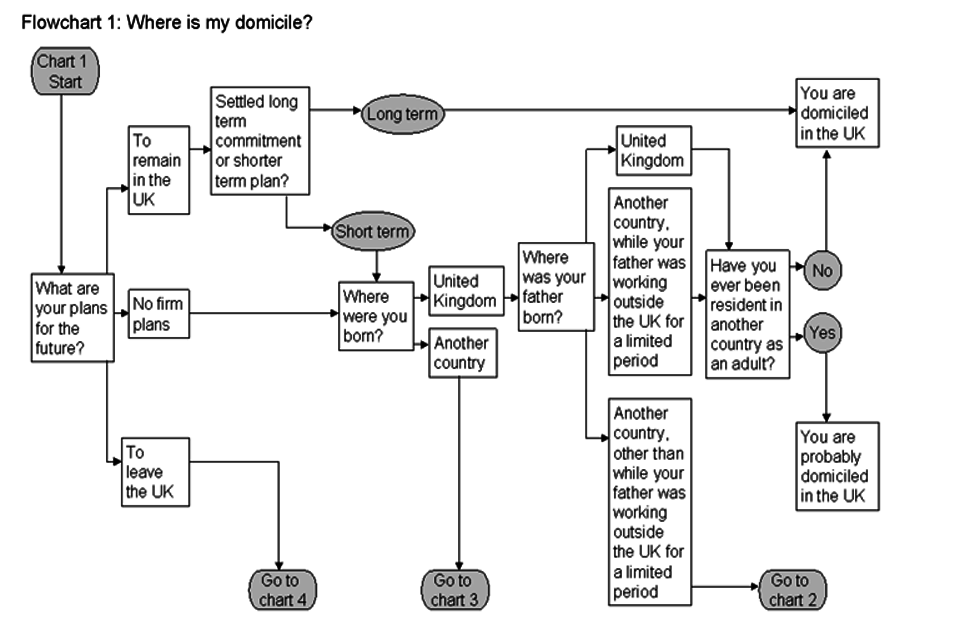

5.24 Domicile can be a complex subject; the flowcharts on this page have been included to help you work out your own domicile. These flowcharts give you no more than a likely indication of your domicile, although they will give the right answer for the majority of people. In the UK, only a court can make a formal ruling on your domicile.

Notes to domicile flowcharts

- Your domicile status depends on the facts of your individual case. The flowcharts will give as strong an indication as possible, based on various generic factors. However, if your affairs are more complicated the flowcharts may not provide a definitive answer.

- Your domicile status may be dependent on someone else’s domicile (usually your father’s). The flowcharts each provide a sequence of questions without reference to domicile itself to reach a conclusion showing what your likely status will be.

- If your parents were not married at the time of your birth, references in the flowcharts to ‘father’ should be read as ‘mother’.

- If you were adopted, ‘father’ should be read as ‘adopted father’.

- If your father’s domicile status changed when you were a child, you should not use the flowcharts, as the apparent conclusion could be misleading.

- If, when using the flowcharts, you arrive at the conclusion you’re ‘domiciled in the UK’ or ‘probably domiciled in the UK’ you may simply accept that conclusion. If you do, you should not tick the ‘non-domiciled’ box on form SA 109 (Residence, remittance basis etc. Self Assessment supplementary page). You will then be taxed on the arising basis.

- If the flowchart leads you to the conclusion that you’re ‘domiciled outside the UK’ or ‘probably domiciled outside the UK’, you may feel that this confirms your own view. Or, you may consider consulting the Remittance Basis and Domicile Manual or a professional adviser.

- Your domicile relates to a particular territory. In most cases, this will be a country, but in federal countries, such as the USA and Australia, it relates to the individual state. Although the UK has 3 territories for domicile purposes, it does not operate as a federal system.

- You’re responsible for ensuring that any declarations you make are correct.

This image shows flowchart 1: where is my domicile?

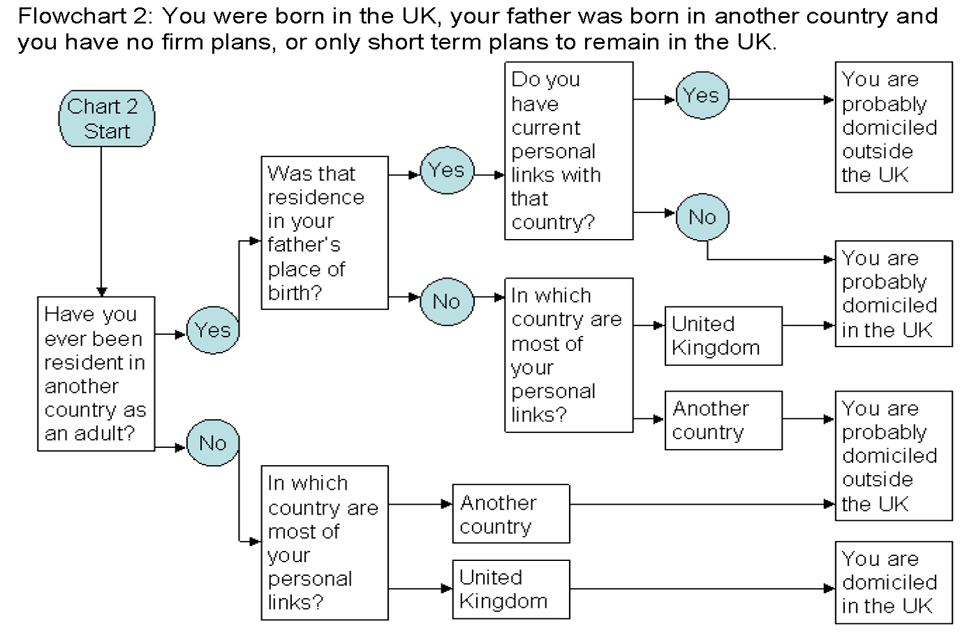

This image shows flowchart 2: you were born in the UK, your father was born in another country and you have no firm plans, or only short term plans to remain in the UK.

Example 5

Catherine is living in the UK and has no firm plans about where she will live in the future. She was born in Scotland. Her father was born in Sweden and her grandfather and ancestors were Swedish.

Catherine’s father was a business executive and the family lived in various countries, of which the UK was one. A musician, she has lived in several countries as an adult, but not yet in Sweden. Catherine is an only child. Her parents are dead and she has one surviving aunt. She rarely visits her family in Sweden. Her profession and lifestyle mean that she develops links with the place in which she is living.

Catherine uses flowchart 2 and concludes that she is probably domiciled in the UK. Given this, and the possibility that neither she nor her father ever settled anywhere outside Sweden, she might wish to consult more detailed guidance or seek the opinion of a professional adviser.

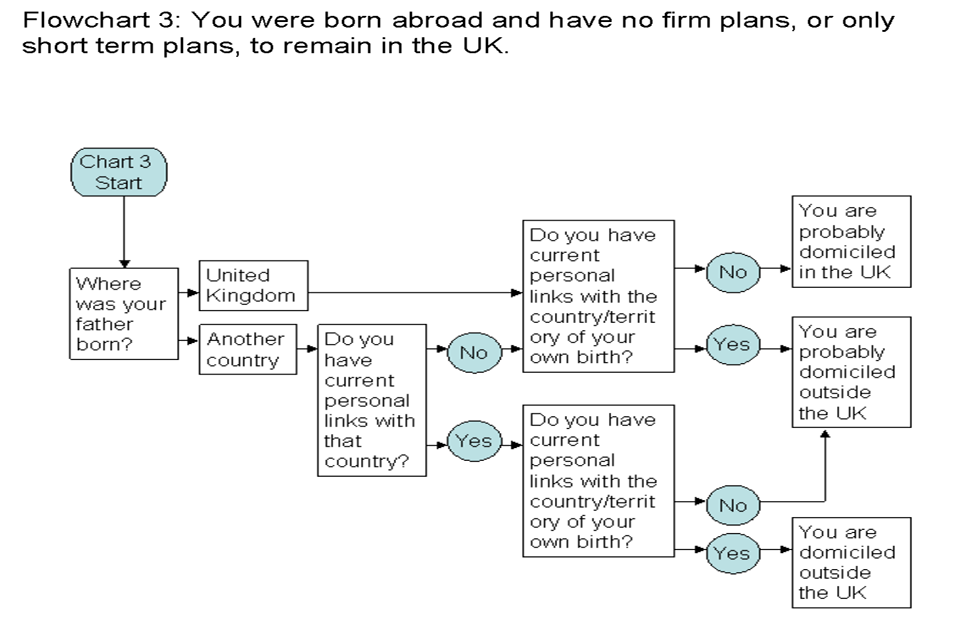

This image shows flowchart 3: you were born abroad and have no firm plans, or only short term plans, to remain in the UK.

Example 6

Daniel was born in New South Wales. He lives in England and intends to stay for at least another 2 years. Daniel follows the link from flowchart 1 to flowchart 3.

Daniel’s father was Greek. Daniel has retained few links with Greece; he visits his family once every 2 or 3 years. His 2 sisters have lived in Western Australia for many years and his widowed mother lives there with his elder sister. Daniel owns property in Western Australia and has an interest in a business there. The family has little connection with New South Wales, although Daniel is in touch with a couple of childhood friends there.

Daniel finds it difficult to reach a conclusion about his domicile, as he has links with Australia but not specifically with New South Wales. He consults detailed guidance and realises that his current intentions cannot be considered in isolation. Daniel realises that his residence in the UK for over 30 years and his intentions during that period have to be taken into account.

Daniel concludes that he is domiciled in the UK (the result flowchart 1 would have given him if he had considered his long-term UK commitment from the outset). This is reinforced by Daniel’s relative lack of links with the territory of his birth.

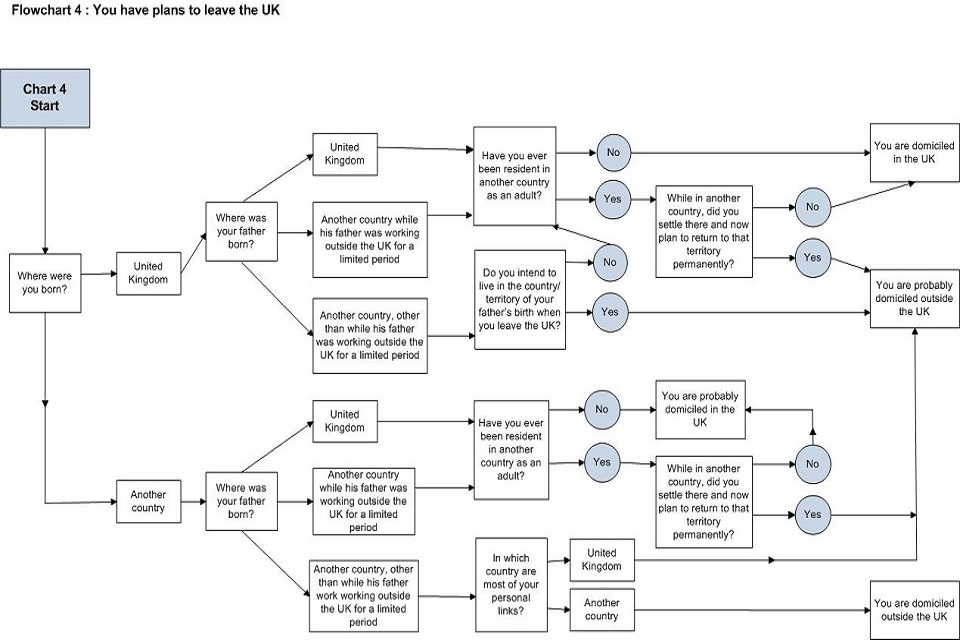

This image shows flowchart 4: you have plans to leave the UK.

Example 7

Aleksy, an electrician, was born in Poland and intends to return there in 3 or 4 years. His family background is Polish and his immediate family live in Poland.

Brian, an investment banker, was born in New York and intends to retire to France at the age of 60, just over 5 years from now. He has lived in London for much of his life, although he has spent several periods living abroad because of his employment.

Both Aleksy and Brian consider flowchart 1 and conclude that they should go to flowchart 4.

Both were born in another country; each must consider his father’s place of birth. Aleksy’s father was born in Poland; his grandfather lived his entire life in Poland, just as several generations of his family had done. Brian’s father was born in Ireland, into a wealthy family the members of which divided their time between Ireland and England.

Aleksy believes that most of his personal links are with Poland and concludes that he is domiciled outside the UK. (Aleksy is typical of the majority of individuals who come to live and work in the UK without intending to remain here indefinitely).

Brian has personal links with England, Ireland, France and New York. He thinks that, on balance, most of his personal links are with England but reaches the conclusion that he is probably domiciled abroad. Brian recognises that this is an indication of his domicile status and, because of his more complex circumstances, consults HMRC’s more detailed guidance and then seeks the views of a professional adviser.

Example 8

Ethan was born in the UK and has lived here all his life apart from a year spent travelling around Europe and annual holidays spent abroad. His father was also born in the UK. Ethan plans to retire to France and has already purchased a house there which he, and his entire family visit whenever they can.

While Ethan has clear and firm plans to move to France he is currently domiciled in the UK and flowchart 4 leads him to that answer.

6. Types of income

6.1 This part provides guidance to help you understand, depending on your residence and domicile status, your liability to UK tax on earned and investment income and your liability to Capital Gains Tax on gains realised on the disposal of assets.

Earned income

What is earned income?

6.2 Your earned income is:

- any payment you receive as a result of an employment

- profits from a trade, profession or vocation you carry on, or if you’re a partner, profits from your notional trade

- any payment you receive from a pension

- income and gains from employment-related share schemes

It also includes any taxable social security benefits you receive during a tax year.

General rules

6.3 The UK tax you have to pay on your earned income, whether earned in the UK or any other country, will depend on whether or not you’re:

- UK resident

- domiciled here

and where your duties are carried out.

6.4 If:

- your work is normally carried out overseas, but

- you’ve to carry out some of your duties in the UK

the work you do in the UK will be part of your duties overseas only when you can show that the work you do in the UK is merely incidental to the duties of your employment overseas.

6.5 Earnings which are earned:

- in the UK are liable to UK tax on the arising basis

- overseas in a year for which you’re not a UK resident are not taxable in the UK

- overseas in a tax year for which you’re a resident of the UK and for which the remittance basis does not apply to you, are taxable in the UK on the arising basis

- overseas in a tax year for which you’re a resident of the UK and for which the remittance basis does apply to you, may not be taxable in the UK unless and until they are remitted to the UK. This is subject to certain conditions:

- If the conditions are met, and the overseas earnings are not remitted to the UK in the tax year that you receive them, those earnings are not taxable in the UK in that tax year. This is known as Overseas Workday Relief (OWR)

If the conditions are not met, such earnings are taxable in the UK on the arising basis.

Employment income – where your duties are carried out

6.6 Where you actually carry out your employment duties determines whether your earnings from the employment are earned in the UK or overseas. Where you perform duties in the UK and overseas in a tax year, your annual earnings are normally apportioned based on the number of workdays you’ve done in the UK and the number of workdays you’ve done overseas.

UK tax on earned income – when you’re UK resident

6.7 If you’re UK resident, you’re liable to UK tax on the arising basis on income earned in the UK. You will also be liable to UK tax on earned income arising elsewhere, except when you’re taxed on the remittance basis for your foreign income earned in a tax year. If you come to or leave the UK part way through a tax year the year may be split for UK tax purposes so that, broadly speaking, earnings attributable to the overseas part of the year are not chargeable if they relate to overseas work. See paragraphs 1.15 and 1.16.

See ERSM160000 for the special residence rules relating to employee share schemes.

6.8 Profits from your trade, profession or vocation, will be liable to tax on the arising basis whether the trade, profession or vocation is carried on in the UK or in another country. If you come to or leave the UK part way through a tax year the year may be split for UK tax purposes, see paragraph 3.16. Special rules apply if you’re eligible to use, and choose to use, the remittance basis – see paragraph 6.13.

6.9 Throughout the remainder of this chapter, when we refer to paying tax on the remittance basis (and similar phrases), we do this on the premise that you’re eligible to and choose to use this basis of taxation.

Pensions when you pay tax on the arising basis

6.10 When you’re UK resident you’re liable to UK tax on the arising basis on most pensions whether they are from the UK or another country. If you receive pension payments from another country (an overseas pension) you might be entitled to a 10% deduction from the amount chargeable. For more detail see EIM74500.

Earnings from your employer when you use the remittance basis

6.11 If your employment duties in a tax year for a foreign (non UK) employer are performed:

- wholly overseas, your earnings from the employment for that tax year are only taxable if you remit them to the UK

- wholly or partly in the UK, your earnings from the employment for that tax year are taxable in the UK but you may be entitled to Overseas Workday Relief

6.12 If your employment duties in a tax year are performed wholly or partly outside the UK for a UK employer, your earnings from the employment are taxable in the UK but you may be entitled to OWR.

See ERSM160000 for the special remittance rules relating to employee share schemes.

Earnings from a trade, profession or vocation when you use the remittance basis

6.13 Your profits from any trade, profession or vocation carried on wholly outside the UK will be taxed only if they are remitted here. If you carry on the trade, profession or vocation partly in the UK and partly overseas, your profits are treated as arising wholly in the UK.

Pensions when you pay tax on the remittance basis

6.14 If you’re liable to UK tax on the remittance basis, you will pay UK tax on:

- any UK pensions you receive

- the amount of any income from an overseas pension that you remit to the UK

You’re not entitled to the 10% deduction for overseas pensions when you use the remittance basis.

Lump sum pension payments

6.15 If you receive lump sums from overseas pension schemes or provident funds, the guidance at paragraph 6.35 explains your UK tax liability on the lump sum payments you receive.

Earned Income – Seafarers’ Earnings Deduction

6.16 If you’re a seafarer (or ‘mariner’) who is UK resident or resident in any of the European Economic Area (EEA) states, you might be entitled to a deduction in your UK tax. This is called the Seafarers’ Earnings Deduction (SED). A seafarer is a person who performs the duties of their employment on a ship. An offshore installation, for example an oil rig, is not a ship for the purposes of SED.

UK tax on earned income – when you’re not UK resident

Earnings from your employer

6.17 When you’re not UK resident you’re liable to UK tax on any earnings for employment duties you carry out in the UK, unless those UK duties are ‘merely incidental’ to the duties of an employment overseas. You will not pay UK tax on any earnings for employment duties which you carry out overseas.

6.18 If your employment duties are carried out partly in the UK and partly overseas you need to keep sufficient details to allow you to identify the earnings you’ve received for duties carried out in the UK. The income that relates to duties you carried out in the UK will be liable to UK tax.

Earnings you receive from a trade, profession or vocation

6.19 When you’re not UK resident you’re liable to UK tax on profits from a trade, profession or vocation that you carry on wholly in the UK. There is a special tax withholding scheme in place for visiting foreign entertainers and sportspersons who come to perform in the UK. You will not pay UK tax on any income or profits from a trade, profession or vocation that you carry on wholly overseas.

6.20 If you’re not UK resident and you carry on your trade, profession or vocation partly in the UK and partly outside the UK you will pay UK tax on the profits from the part of the trade, profession or vocation you carry on in the UK.

Pensions

6.21 When you’re not UK resident you’re liable to UK tax on most pensions from sources in the UK. You will not pay UK tax on pensions from sources outside the UK.

Double Taxation Agreements

6.22 If you’re not UK resident or are treated as resident in another state under the terms of a relevant DTA you may be able to claim exemption from UK tax on your:

- UK earnings

- UK source pensions and

- taxable UK social security benefits

This will depend on the content of the DTA between the UK and the other country concerned.

6.23 If, for the whole tax year, you:

- are not UK resident, and

- do not claim relief under the terms of a DTA

your liability on taxable UK social security benefits is limited to the tax, if any, deducted before payment. More information on DTAs can be found in section 10 of this guidance.

Offshore oil and gas workers

6.24 If you’re working offshore in the UK oil or gas exploration or exploitation industry you’re not a seafarer and are not eligible to the Seafarers’ Earnings Deduction unless you’re on a ship.

6.25 If you’re not UK resident, working offshore in the UK oil and gas industry and carrying out your work:

- on the UK continental shelf, but

- outside the UK’s territorial sea

you will be treated as having performed those duties in the UK and your employment income will be liable to UK tax. More detail can be found at EIM67100 or at Seafarers’ Earnings Deduction: tax relief if you work on a ship. You may not be due a repayment of Income Tax.

6.26 If you’re a resident of a country with which the UK has a DTA, or treated as resident in another state under the terms of a relevant DTA, there may be specific provisions for the offshore oil and gas industry. You will need to look at the relevant articles in the specific DTA for your circumstances. Any queries you’ve about this should be addressed to South Wales Area Office, Cardiff.

Workers on board aircraft, ships and other vessels – where your duties are carried out

6.27 If you:

- work on planes, ships, trains or other vehicles which make cross-border trips

- perform employment duties as you travel through

- the UK

- UK airspace

- UK territorial waters

- the UK continental shelf

you may be considered to be carrying out duties in the UK. If you carry out duties on a cross-border trip starting in the UK you will be treated as having a UK work day. If you carry out duties on an international journey starting overseas, the day will be counted as an overseas work day.

6.28 If you’re not UK resident, whether you’re relieved from UK tax on duties carried out in the UK will depend on:

- the terms of any relevant DTA

- the country of residence of the company operating the ship or aircraft on which you’re employed

You will need to find out the residence of the operator and look at relevant articles in the DTA with that other country. More information on DTAs can be found in section 10 of this guidance.

Merely incidental work

6.29 Whether or not the duties you perform in the UK are merely incidental to your overseas duties will always depend on the circumstances of your particular case. Any decision has to be based on the nature of the work you carry out in the UK and not simply the amount of time spent on it.

6.30 If the work you perform in the UK is the same or is of similar importance to the work that you do overseas, it will not be merely incidental.

6.31 Incidental work includes:

- an overseas employee visiting the UK and whilst here arranges a meeting with a client overseas and the associated travel

- a short period of time spent training in the UK by an overseas employee, provided that no productive work is carried out in the UK by the trainee

However, training that is a necessary requirement for your employment, for example simulator training for aircraft pilots, is not merely incidental work.

6.32 Non incidental work includes:

- time spent in the UK as part of the duties of a member of the crew of a ship or aircraft

- attendance at directors’ meetings in the UK by a director of the company who normally works overseas

More detail can be found in EIM40203 and EIM40204.

Leave pay

6.33 When you’re UK resident any leave pay you receive is normally taxable. If you’ve been working overseas and are paid for a period of leave spent in the UK, it will be taxed here as ‘terminal leave pay’. It is taxed as arising in the period to which it relates – even if your entitlement to the leave pay was built up during a period of overseas employment. Any leave pay you receive for a period when you’re UK resident is normally taxable.

6.34 If you’re able to claim the Seafarers’ Earnings Deduction, you may be exempt from UK tax on your leave pay but this will depend on your individual circumstances. See more detailed guidance at EIM33052.

Lump sums received from overseas pension schemes and provident funds

6.35 From tax year 2011 to 2012 onwards, for the purpose of the disguised remuneration rules where those apply to non-registered pension schemes, if you receive lump sum retirement benefits which meet the following conditions you might not be charged UK Income Tax or be charged on a reduced portion of the benefit. The lump sum must be:

- from an overseas Employer Financed Retirement Benefits Scheme (EFRBS)

- which is operated by a third-party (which concept might include a provident fund)

- in respect of service outside the UK

A different tax treatment might apply when lump sums are paid from certain overseas pension schemes that are holding funds that have benefitted from UK tax relief. For more detail see the Pensions manuals.

6.36 What portion of the benefit is actually charged to Income Tax will depend on the extent of your foreign service. Full relief is available for rights accrued after 5 April 2011 for periods of service outside the UK when you were not UK resident.

Example 9

On 31 December 2020 Sonny receives £10,000 from an EFRBS in respect of 6 years service in circumstances that meet the relevant conditions. 50% of Sonny’s service was in the UK and 50% of his service was given overseas in periods when he was not UK resident.

Only £5,000 is charged to Income Tax.

6.37 For

-

benefits accrued in tax years up to 2010 to 2011

-

benefits provided directly by the employer without involvement of a third-party EFRBS

a more detailed rule applies (known as ESC A10). For payments you receive under ESC A10 schemes, you will receive a full exemption if, in the employment to which the pension relates:

- at least 75% of your total service was overseas

- your total foreign service is more than 10 years and the whole of the last 10 years service was overseas

- your total foreign service is more than 20 years and not less than 50% of the total service was overseas, including any 10 of the last 20 years

6.38 For the purpose of this paragraph ‘service’ ignores periods after 5 April 2011. Foreign service broadly means service overseas when you were not UK resident. If you do not meet these conditions treatment of your service up to 5 April 2011 reverts to the proportionate reduction described in paragraph 6.37.

6.39 If you’ve a mix of rights from a third-party EFRBS from both before 6 April 2011 and later, then the rules in paragraph 6.37 will need to be applied to the earlier part, and paragraph 6.40 to the later part. If you’ve a mix of rights provided directly by your employer (for example without the involvement of a third-party) then the rules in paragraph 6.40 will apply to the entirety of the service without cut-off on 6 April 2011.

6.40 Under certain circumstances, you will be charged to tax if you receive the sum during a period of temporary non-residence. For more information on temporary non-residence, see section 6 of the SRT Guidance Note (RDR3).

Investment income

6.41 Investment income is any income you have which is not a pension and has not been earned by you as an employee, or by carrying out your profession or by running your own business.

6.42 Although this list is not exhaustive, unearned income includes:

- interest from bank and building society accounts

- dividends on shares

- interest on stocks

- rental income received unless the rental income is part of the income of a trading business

6.43 Investment income can arise in the UK and anywhere else in the world. The UK tax you have to pay on investment income will depend on whether you’re UK resident or not UK resident.

UK tax on investment income – when you’re UK resident

Liability on the arising basis

6.44 When you’re UK resident you’re liable to UK tax on your worldwide income and gains when you’re taxed on the arising basis.

6.45 Most banks, building societies and other deposit takers in the UK deduct UK tax from interest they pay or credit to your account. Most investment income from sources outside the UK, and some from sources in the UK, will not have had UK tax deducted before it is paid to you. This does not make it ‘UK tax free’ and you may be liable to UK tax on such income. You should tell HMRC about all such income and include it on any Self Assessment tax return you complete.

6.46 If your foreign investment income was subject to tax in the country where it was generated, you may be able to offset this against your UK tax liability. You need to be able to produce documentary evidence of these foreign tax payments if we ask to see it. If the foreign tax you’ve paid is more than that payable as UK tax, you’ll only get relief up to the amount of UK tax payable.

Liability on the remittance basis

6.47 If you use the remittance basis you may be charged UK tax on all of your investment income from UK sources, but your foreign investment income will only be liable to UK tax if it is remitted here. When using the remittance basis, certain types of investment income from sources outside the UK are often referred to as ‘relevant foreign income’.

UK Tax on investment income – when you’re not UK resident

6.48 Although you’re not UK resident you’re liable to UK tax on investment income from UK sources. There is a restriction on your tax liability for investment income (See SAIM1170). This restriction is not available for any tax year in which split-year treatment applies (see section 5 of the SRT Guidance Note (RDR3)). You might also be able to receive tax relief under the terms of a double taxation agreement, if one applies.

6.49 You will not be liable to UK tax on any investment income from sources outside the UK.

Interest from building societies and banks

6.50 Most building societies, banks and other deposit takers in the UK deduct UK tax from interest they pay or credit to your account. Up to 5 April 2014, if you’re not ordinarily resident in the UK, you may be able to have your interest paid without tax being deducted. Whether you can do this depends on the terms and conditions of your account and whether or not your building society, bank or other deposit taker offers that facility.

6.51 To receive your interest without UK tax being deducted, you should complete a declaration form R105 and give it to your building society, bank or other deposit taker. A declaration will only have effect from the date it is received by your building society, bank or other deposit taker — it cannot be back-dated.

6.52 After 5 April 2014 a similar declaration will be able to be made by an investor who is not UK resident. Existing declarations made before that date will continue to have effect. If the account is a joint account you will only be able to complete a declaration if all the people who are beneficially entitled to the interest are not UK resident.

6.53 If you (or, in the case of joint accounts, any of the people who are beneficially entitled to the interest) become UK resident, you must tell your bank, building society or deposit taker right away so they can start to deduct tax from the interest paid.

Income from property in the UK

6.54 If you’ve profits from letting property situated in the UK, you’re liable to tax in the UK on those profits, even if you’re not UK resident. Retention of tax from UK property income is dealt with under the Non-resident Landlords Scheme.

UK government securities

6.55 The government issues Free of Tax to Residents Abroad (FOTRA) securities. If you acquired FOTRA securities on the basis that you were not ordinarily resident before 6 April 2013, these will continue to remain free of tax for any subsequent year for which you’re not ordinarily resident in the UK. If you’re not UK resident and acquire UK government FOTRA securities after 5 April 2013, you will not pay UK tax on the interest that arises on them unless the interest received forms part of the profits of a trade or business which is carried on in the UK.

6.56 If you hold securities with a nominal value of more than £5,000 during a tax year in which you’re UK resident at any time, special tax provisions (the ‘Accrued Income Scheme’) will apply when the securities are transferred. You will be liable to UK Income Tax on the interest that has built up (‘accrued’) over the period you owned the securities following the last interest payment, even if you were not UK resident for part of that period.

Capital gains and Capital Gains Tax

6.57 Capital Gains Tax is a tax on the gain you make when you dispose of assets. In the context of capital gains, ‘dispose of’ means sell, exchange or give away, and it also includes part-disposals. More information is available at Is your asset liable to Capital Gains Tax?.

6.58 The Capital Gains Tax you’ve to pay on your gains, whether they are realised in the UK or any other country, will depend on whether you’re:

- UK resident

- domiciled in the UK

- not domiciled in the UK but you’re taxed on the remittance basis for the tax year

CG26100+ gives detailed information about the effect of residence and domicile on your liability to Capital Gains Tax.

UK tax on capital gains – when you’re UK resident

6.59 If you’re resident and domiciled in the UK you’re liable to UK tax on the arising basis on capital gains made in the UK or elsewhere.

If you’re resident but not domiciled in the UK, you’re liable to UK tax on capital gains arising on the disposal of assets situated in the UK. If you dispose of assets that are not situated in the UK and you use the remittance basis you’re normally only taxed on your foreign gains if they are remitted here.

If you come to the UK part way through a tax year the year may be split for UK tax purposes. See paragraphs 1.15 1.16 and 3.17. In addition, CG14380 gives detailed information about Capital Gains Tax and double taxation relief.

UK tax on capital gains – when you’re not UK resident

6.60 When you’re not UK resident you’re not normally liable to UK tax on any capital gains realised. However, you may be liable to Capital Gains Tax on:

- gains from sales of UK residential property, see Capital Gains Tax for non-residents: UK residential property

- gains realised within a period of temporary non-residence, see section 6 of the SRT Guidance Note (RDR3)

- a gain that arises on an actual or deemed disposal of an asset connected with a trade, profession or vocation carried on through a branch or agency in the UK, see CG25500+ for more detailed guidance

Double Taxation Agreements

6.61 If you’re not UK resident or are treated as resident in another state under the terms of a relevant DTA you may be able to claim exemption from UK Capital Gains Tax. This will depend on the content of the DTA between the UK and the other country concerned. See paragraph 10.25 for information about DTAs and gains from disposals of assets.

Table showing the scope of liability of income to UK tax

6.62 The table summarises the rest of this section, and is designed to help you identify your liability to UK tax on particular types of income, based upon your UK domicile and UK residence status and, if appropriate, whether you claim the remittance basis.

You need to decide whether you’re:

- domiciled in the UK or outside the UK

- UK resident or not UK resident

If you’re UK or EEA resident and are employed as a seafarer, you may be able to claim a deduction against your general earnings chargeable to tax in the UK if you meet certain conditions. More information on SED can be found on our website.

6.63 Use of this table is subject to any different treatment provided for under the terms of the relevant article in a DTA.

Domiciled in the UK

| UK resident | Not UK resident | |

|---|---|---|

| Arising or remittance basis claimed | Arising basis | Arising basis |

| Employment duties wholly or partly in the UK but duties performed in the UK | Liable | Liable |

| Employment duties wholly or partly in the UK but duties performed outside the UK | Liable | Not liable |

| Employment duties wholly outside the UK with UK resident employer | Liable | Not liable |

| Employment duties wholly outside the UK with overseas resident employer | Liable | Not liable |

| Trade or profession wholly or partly in the UK with profits arising in the UK | Liable | Liable |

| Trade or profession wholly or partly in the UK with profits arising outside the UK | Liable | Not liable |

| Trade or profession carried on wholly outside the UK | Liable | Not liable |

| UK Pension | Liable | Liable |

| Non-UK (overseas) pension | Liable | Not liable |

| Investment income from a UK source | Liable | Liable |

| Investment income from a non UK source | Liable | Not liable |

| UK government FOTRA securities | Liable | Not liable |

Domiciled outside the UK

| UK resident arising basis | UK resident remittance basis | Not UK resident arising basis | |

|---|---|---|---|

| Employment duties wholly or partly in the UK but duties performed in the UK | Liable | Liable | Liable |

| Employment duties wholly or partly in the UK but duties performed outside the UK | Liable | Liable on remittance | Not liable |

| Employment duties wholly outside the UK with UK resident employer | Liable | Liable | Not liable |

| Employment duties wholly outside the UK with overseas resident employer | Liable | Liable on remittance | Not liable |

| Trade or profession wholly or partly in the UK with profits arising in the UK | Liable | Liable on remittance | Not liable |

| Trade or profession wholly or partly in the UK with profits arising outside the UK | Liable | Liable | Not liable |

| Trade or profession carried on wholly outside the UK | Liable | Liable on remittance | Not liable |

| UK Pension | Liable | Liable | Liable |

| Non-UK (overseas) pension | Liable | Liable on remittance | Not liable |

| Investment income from a UK source | Liable | Liable | Liable |

| Investment income from a non UK source | Liable | Liable on remittance | Not liable |

| UK government FOTRA securities | Liable | Liable | Not liable |

Notes on the table

1.Liability to UK tax on this overseas pension will be subject to the terms of any relevant DTA. If the pension is liable to UK tax only 90% of the gross pension is chargeable.

2.If you make claim to the remittance basis the 10% deduction referred to at 1 is not available.

3.Interest on ‘FOTRA’ securities, if you are not UK resident, is exempt from tax when relevant conditions are met. See SIAM1180 for more information.

4.Certain types of investment income from a non UK source are also known as ‘relevant foreign income’.

5.Liable on remittance if you qualify for Overseas Workday Relief. If you do not qualify for OWR this income is liable to UK tax on the arising basis.

6.Unless within s615 Income and Corporation Taxes Act 1988 – for example a UK pension scheme set up by a UK employer for an overseas workforce purely to provide benefits for service for their operations entirely outside the UK.

7.Unless lump sums within reach of Finance Act 2004 Schedule 34 — this typically extends to certain overseas schemes, the UK tax charging rules normally relating to ‘registered pension schemes’ or certain related arrangements (see the Registered Pension Schemes Manual for further information).

Transitional provisions for ordinary residence

6.64 For tax years 2013 to 2014 onwards the concept of ordinary residence will no longer exist for most purposes of UK Income Tax and Capital Gains Tax. However, where:

- you were resident but not ordinarily resident at the end of the tax year 2012 to 2013

- that year was the first, second or third year of your UK residence

Your income will continue to be taxed on the basis of the rules that were in place before the introduction of the statutory residence test for:

- 2013 to 2014 (where that is the 4th year of residence)

- 2013 to 2014 and 2014 to 2015 (where they are the third and 4th years of residence)

- 2013 to 2014, 2014 to 2015 and 2015 to 2016 (where they are the second, third and fourth years of residence)

Provided that you would have met the conditions to be not ordinarily resident in those years.

6.65 If you acquired ‘FOTRA’ securities before 6 April 2013 these will continue to remain free of tax for any subsequent year for which you’re not ordinarily resident in the UK.

6.66 Transitional provisions in relation to OWR are set out in paragraphs 17 and 18 of the Guidance Note: Overseas Workday Relief (RDR4).

7. Special rules for certain occupations

Entertainers and sportspersons

7.1 There is a special scheme for taxing the income of foreign (non-UK resident) entertainers and sportspersons who come to perform in the UK. This applies, for example, to actors and musicians performing on stage or screen and those participating in all kinds of sports. If this applies to you then the person who is paying you should deduct withholding tax from the payments made with respect to that performance, for example your appearance fee, expenses paid on your behalf or prize money. In some circumstances you may need to complete a Self Assessment tax return. See ‘Foreign entertainer tax rules’ for more information about this scheme.

7.2 Entertainers and sportspersons who come to perform in the UK may be entitled to taxation relief under a Double Taxation Agreement. See paragraph 10.20.

Non-resident landlords

7.3 If your ‘usual place of abode’ is outside the UK and you’ve UK land or property which you rent out, all rental and income from that property, remains chargeable to UK tax.

7.4 The Non-resident Landlord scheme is a tax scheme which operates to collect the tax due from non-resident landlords on the rental income from their UK properties. It is your ‘usual place of abode’ rather than your residence status that determines whether or not you’re included in the scheme. If your usual place of abode is outside the UK and you use a letting agent to collect the rents on your behalf, the letting agent is responsible for the deduction of basic rate tax from your rental income and passing this onto HMRC. If you do not use a letting agent,

- any friend or relative you appoint

- the tenant

must deduct basic rate tax from your rental income and pass this onto HMRC on your behalf. You can set this tax off against your own tax bill at the end of the tax year.

Receiving rental income with no tax deducted

7.5 As a non-resident landlord you can apply to HMRC to have your UK rent paid to you with no deduction of tax by completing form NRL1. HMRC will usually approve your application on the understanding you will self assess any tax due. The approval does not mean that your rental income is exempt from Income Tax; you must include rent you receive in any Self Assessment tax return sent to you at the end of each tax year.

Property owned in joint names

7.6 If you own your property with another person, such as your spouse or civil partner, each person must decide whether their usual place of abode is outside the UK. Any owner whose usual place of abode is outside the UK is a non-resident landlord. Where you and your partner or any other person jointly own a property and both have your usual place of abode outside the UK, each person is treated as a separate non-resident landlord and must complete a separate form NRL1.

Members of HM armed forces and other crown servants

7.7 If you’re a member of HM armed forces or other crown servant, including a diplomat, you may use the Non-resident Landlord scheme in the same way as other non-resident landlords. If your usual place of abode is outside the UK, you will need to make an application to HMRC on form NRL1 if you want your rental income paid to you with no tax deducted.

7.8 For full details of the scheme see the Non-resident Landlord scheme.

8. UK personal tax allowances

What are UK tax allowances?

8.1 The Income Tax Personal Allowance is an amount of income you can have each tax year without having to pay tax on it. Almost all people who are UK resident are entitled to an Income Tax Personal Allowance. The amount of your Personal Allowance depends on your age and the total income you receive from all taxable sources in the tax year. Depending on your circumstances, you may also be eligible for other tax-free allowances.

How do UK tax allowances work?

8.2 If you’re an employee in the UK, you will have a tax code which reflects your UK personal allowances (if you’re entitled to any) and any other reliefs. As an employee in the UK you will have tax deducted at source from your wages or salary under the Pay As You Earn (PAYE) system. Your employer deducts tax on the basis of your individual tax code.

How do you receive UK tax allowances?

8.3 If you’ve employment or an occupational pension in the UK you should get your personal allowances automatically through your tax code. The other way to get tax allowances is via your Self Assessment tax return (if you complete one).

Are you entitled to UK tax allowances when using the remittance basis?

8.4 Some categories of people who choose to use the remittance basis are still entitled to UK personal allowances. If you’re UK resident and:

- are not domiciled or deemed domiciled in the UK

- have less than £2,000 in unremitted foreign income and/or gains

- claim the remittance basis

you’re entitled to UK personal allowances.

8.5 If you hold dual residence status you may also qualify for allowances under certain DTAs. You need to be UK resident and at the same time Treaty resident in one of the countries listed in the International Manual at INTM334580.

8.6 Normally when you make a claim to use the remittance basis for a tax year you will not be entitled to the following allowances:

- all levels of the Income Tax Personal Allowance

- Blind Person’s Allowance

- tax reductions for married couples and civil partners

8.7 You will also lose: