Export Strategy: supporting and connecting businesses to grow on the world stage (web version)

Published 21 August 2018

Foreword from the Prime Minister

One of my first actions as Prime Minister was to develop a modern Industrial Strategy, to help businesses create better, higher-paying jobs with investment in the skills, industries and infrastructure of the future, as part of a truly global Britain.

This Export Strategy builds on that work, seeking to unlock the great potential of UK business, and realising the prosperity, stability and security benefits of trade.

Exporting is vital to the UK economy and our strategy for a Global Britain. Businesses that export are more productive, create more jobs, and pay higher wages[footnote 1].

Our export success spans across sectors and regions of the UK, from aerospace in Northern Ireland to transport in Wales; oil extraction in Scotland and financial services in England. And these exporters employ millions of people.

Trade is also an important part of our efforts to support countries out of poverty in a way that aid-spending alone cannot, whilst creating our trading partners of the future.

That is why we are setting a new national ambition to transform our export performance, raising exports as a proportion of GDP from 30% to 35%[footnote 2]. This is a formidable challenge that reflects our desire for the UK to be at the forefront of global trade.

This Export Strategy sets out how government, working with the private sector, aims to put in place the right practical, promotional and financial support to help businesses to grow sustainably by exporting. But this is just the start. We now begin work across government aimed at making wider changes to our business environment, backing UK business to achieve this bold aspiration.

Theresa May, Prime Minister

Foreword from the Secretary of State for International Trade

Global trade is growing and changing rapidly, representing a world of opportunity for UK exporters. Approximately 90% of global economic growth in the next 10 to 15 years is expected to be generated outside the EU[footnote 3], while the growth of the digital economy and trade in services is making the world smaller than ever.

UK businesses are superbly placed to take advantage of these trends, and I see examples of the market and demand for British goods and services on every overseas visit I make.

This is hardly surprising. The United Kingdom is one of the world’s largest and most successful economies. We are at record levels of employment while our legal system holds a reputation that is second to none. Home to some of the world’s finest universities, our research and development capabilities sit at the forefront of global innovation, and our workforce is highly skilled.

We not only boast world-class, innovative companies, but also a highly capable export support market, offering high-quality business and export support to UK businesses. We are home to world-leading financial institutions and our knowledge economy is vibrant and growing.

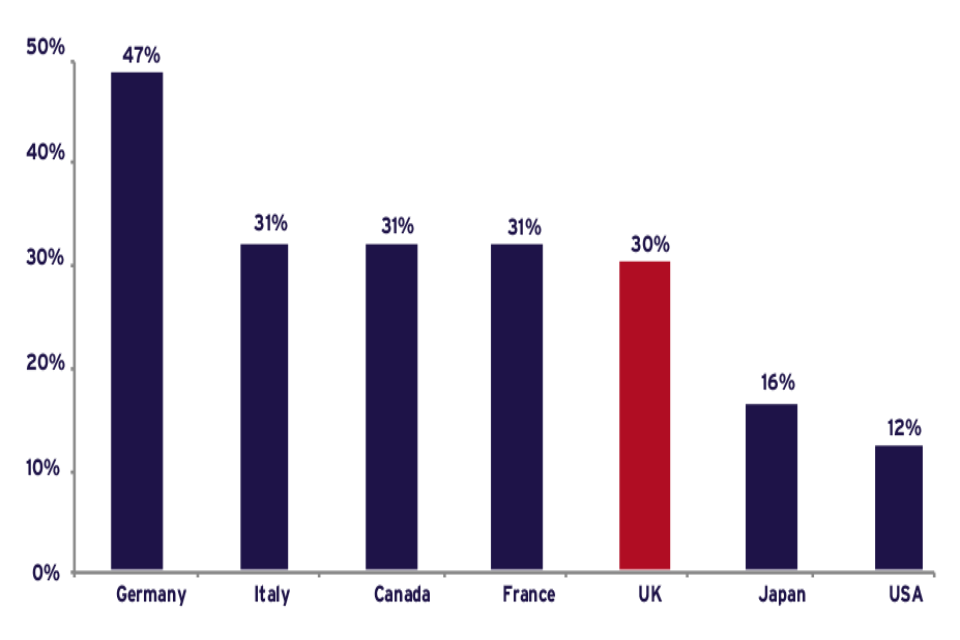

But while the UK punches above our weight in exports, we also punch significantly below our potential. Exports represent 30% of our GDP, which is broadly similar to France, Italy and Canada, but substantially behind Germany. Given all the above strengths, we should be at the top of this pack, not in the middle.

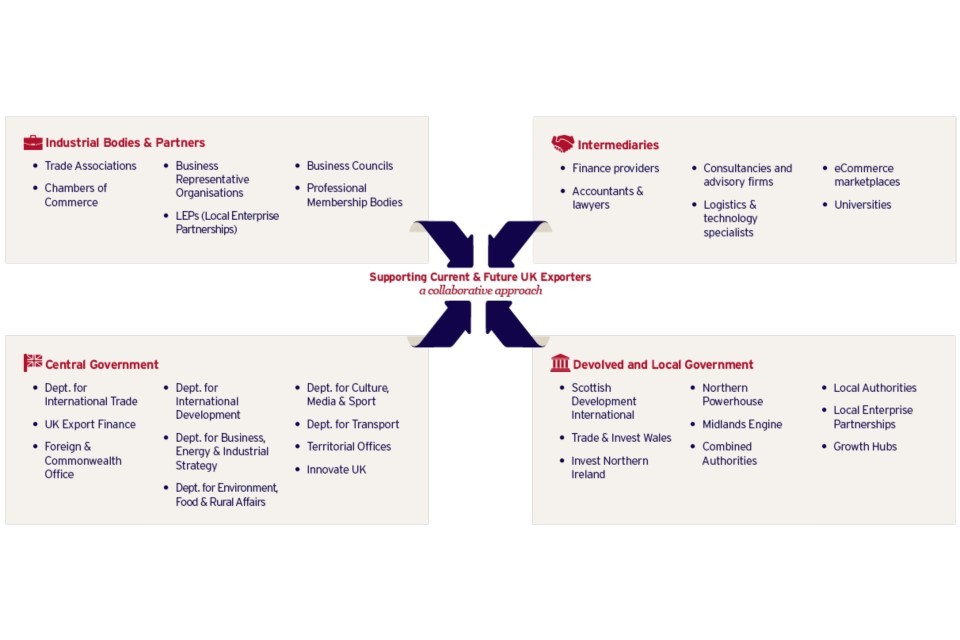

This is the UK’s export challenge: working together to access a greater proportion of world trade to drive growth, productivity and prosperity. It is a challenge for the whole of the UK, and I want organisations across the public and private sectors to address this challenge together.

We all have a part to play, so this paper sets out the government’s role, taking a whole-of-government approach and working with partners in devolved and local governments as well as industry bodies and intermediaries to provide the support that exporters need.

From our large multinationals to micro-businesses, I want all of them to maximise their export potential.

Dr Liam Fox MP, Secretary of State for International Trade and President of the Board of Trade

Foreword from the Minister of State for Trade and Export Promotion

This strategy is the first step towards achieving our national ambition for exports to represent 35% of our GDP.

It is developed through extensive engagement with businesses, business associations and key export support providers. We’ve consulted with companies right across the UK – from large, experienced world-leading exporters to micro start-ups who are taking their first export steps and we are enormously grateful for all their input.

We recognise that typically government doesn’t export, businesses do. So our focus is on identifying where government can help companies to achieve the increased growth, productivity and job creation associated with export success.

We are not acting from a standing start. Businesses have confirmed that there are a significant number of current government services that they value. Our plan is to build on these, while also addressing areas of support which need improvement.

It is clear that too many businesses face barriers that prevent them from reaching their exporting potential. For some, the barrier is not having the right contacts in overseas markets; for others, it is concerns about payment risk or non-tariff barriers and for others still, it is a concern about not having the right skills or capabilities. This strategy aims to address these barriers.

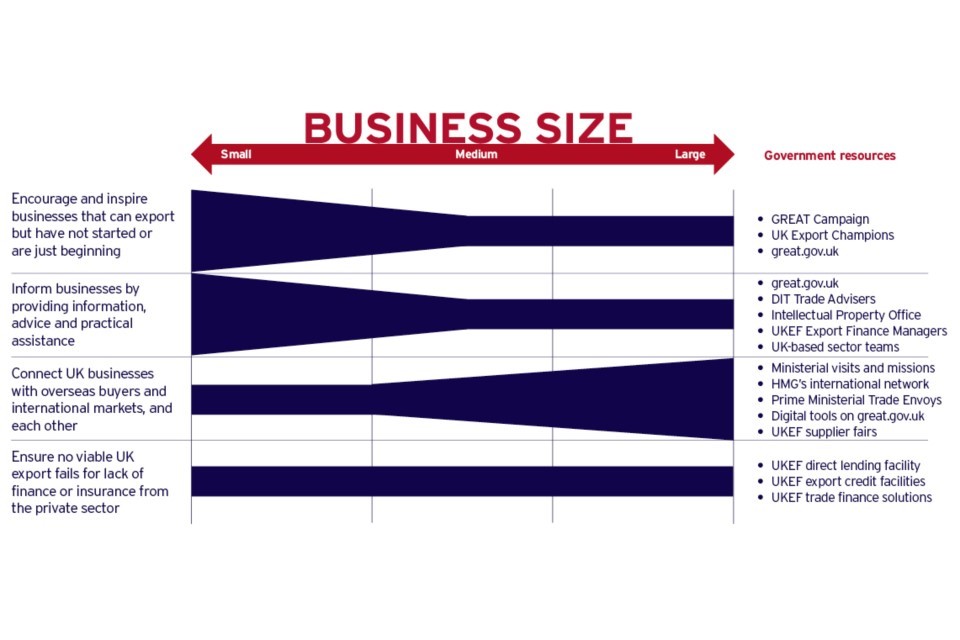

Businesses have been clear that government has a vital role to play in overcoming these exporting barriers, but that our focus should be on providing those services that only government can supply. With this in mind, we have designed a strategy which focuses on the 4 core functions that government can perform in UK exports.

We will:

- encourage and inspire businesses that can export but have not started or are just beginning; placing a particular focus on peer-to-peer learning

- inform businesses by providing information, advice and practical assistance on exporting

- connect UK businesses to overseas buyers, markets and each other, using our sector expertise and our networks in the UK and overseas

- place finance at the heart of our offer

Critical to the delivery of the Export Strategy is the effective joining-up of government actions – not just across departments but also with trade associations and other export support providers. The strategy builds on the Industrial Strategy, coherently linking UK government support both domestically and internationally, to ensure that businesses will encounter no wrong door in asking government for export support.

Alongside this, government is strengthening its ties with the private sector so that UK exporters have a complete spectrum of services available to them both at home and overseas. We also recognise the vital need to promote the UK’s world-class cultural, educational, and creative assets and institutions as we grow our brand and build trading relationships around the world.

We know there is more we can do across government to maximise our impact. Work is already underway as the government prioritises resources towards high-potential sectors, markets and opportunities. We are committed to seeking continual feedback and engagement from UK businesses and stakeholders to deliver the best services possible.

This strategy is the first step in a renewed national focus on improving our export performance and government and business will continue to work together to assess the new approach and develop further actions.

Raising our exports as a share of GDP from 30% to 35% is a formidable challenge, but the world is calling out for the quality goods and services the UK provides. It’s an ideal time for us all to step up, work together, and answer that call.

Baroness Fairhead, Minister for Trade and Export Promotion

Table showing Export strategy overview

Executive summary

The UK’s export challenge

There is a world of opportunity for UK exporters.

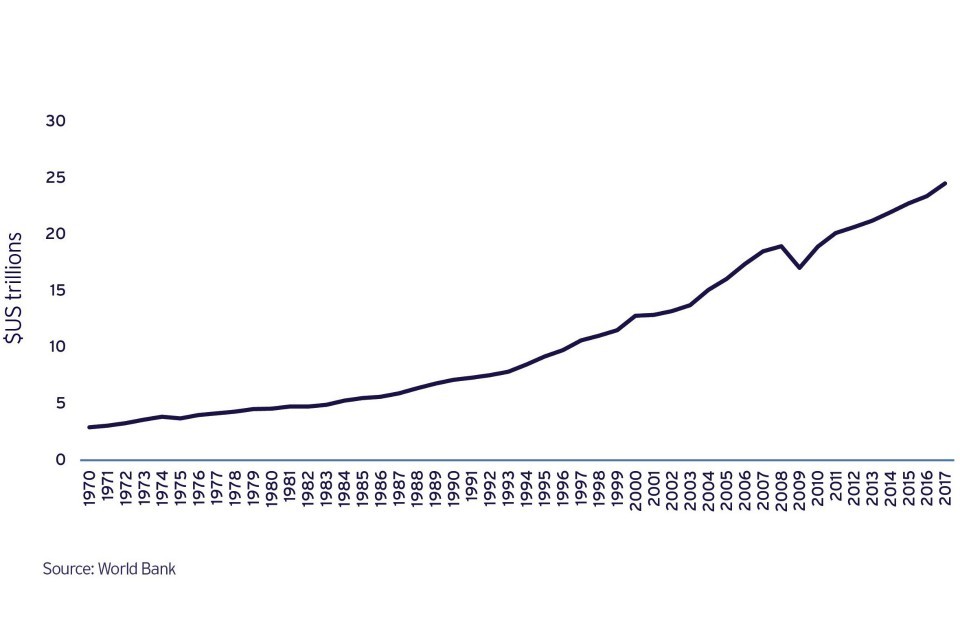

The global economy is changing fast. Despite the global financial crisis and other short-term factors, global exports were worth around 2 times more in 2017 than in 1997 in real terms[footnote 4]. Only by exporting can we tap into the trends that are transforming the world economy right now and take full advantage of the changing pattern of economic growth.

The UK is punching above our weight but below our potential.

The UK is well placed to seize these opportunities. According to the latest provisional data from the IMF, we were the world’s sixth largest exporter of goods and services in 2017[footnote 5]. We have a global reputation for innovation, a skilled workforce and a well-regulated economy.

Our ambition is to strengthen our position as one of the 21st century’s great trading nations.

We want to raise exports as a percentage of GDP from 30% to 35%, towards the top of the G7 by this measure[footnote 6]. This is challenging, but it is also achievable, and to achieve this we need businesses – the drivers of exports and growth – to expand their global footprint and take full advantage of our trading relationships in every part of the world.

The Industrial Strategy provides a platform for international success.

In 2017 the government published its Industrial Strategy to make the UK economy fit for the future. It sets out the government’s commitment to strengthening the foundations of productivity – ideas, people, infrastructure, business environment, and places –– and to meeting the Grand Challenges that will position the UK to succeed in the face of world-changing economic trends. These are Grand Challenges for the world, not just for the UK, and if we get them right the export potential will be huge.

The government’s trade policy is setting out a new framework for UK trade.

Leaving the European Union means we can pursue an independent trade policy for the first time in 4 decades, which we will use to maximise our trade opportunities across the world and deliver benefits for business, workers and consumers around the whole of the UK.

The Export Strategy builds on and supports the government’s foreign policy and development agenda.

Trade and investment and foreign policy mutually reinforce the government’s agenda for Global Britain and its ambitions for prosperity, stability and security worldwide, and this is reflected in the priorities of each Embassy and High Commission.

Trade with developing countries is one of the most cost-effective ways of reducing poverty[footnote 7]. The UK engages with developing countries to promote economic development. This not only alleviates poverty but also creates new markets and openings for UK businesses. We will help establish the conditions for inclusive growth and ensure our firms are well positioned to contribute to, and benefit from, such growth.

Businesses have told us they also face a range of practical barriers.

These barriers include attitudinal barriers affecting some businesses that may not believe they are suited to overseas sales, or lack the confidence to pursue them; a lack of knowledge or capacity to pursue exporting opportunities; issues such as customs procedures, non-tariff barriers and local regulations; and access to trade and export finance.

The role of government in export support

All businesses are different. Businesses that are less experienced exporters face different issues from those that are seasoned exporters. We want businesses of all sizes to overcome the barriers that are holding them back to help them achieve sustainable export growth.

So, our strategy is based on the 4 ways the UK government can make a difference in partnership with other providers of export support in the public and private sector. These roles are focused directly on breaking down the barriers to export, and each is supported by a set of resources and initiatives.

The 4 ways are:

Encourage

We will encourage and inspire businesses that can export but have not started or are just beginning.

To do this, we will invest in our digital platform, great.gov.uk, the award winning GREAT campaign and our UK networks to amplify the voices of existing exporters across the UK and raise awareness of the benefits of exporting.

We will test how we can use targeted messages to motivate small and medium enterprises (SMEs) to consider exporting at key points in their business lifecycle or when new trade agreements are introduced. We will also create a network of Export Champions across the UK who offer expertise and guidance to support other companies on their exporting journey.

Inform

We will inform businesses by providing information, advice and practical assistance on exporting from the public or private sector, or their peers.

We will develop great.gov.uk into a single digital platform for all of government’s business growth and export support.

We will ensure our trade support networks and International Trade Advisers in the UK and overseas are optimised to help businesses build their exporting knowledge and capability. We will encourage SMEs to access the specialist advice and support from the private sector including by:

- assessing the potential for financial incentives such as vouchers, grants and loans

- improving signposting to the relevant export support in the public and private sector

Connect

We will connect businesses to overseas buyers, international markets, and each other. We will help them overcome trade barriers, especially in emerging and developing markets where barriers are likely to be greater, create international networks, and collaborate with other businesses as ‘team UK’.

We will strengthen our international trading relationships through our ministerial visits, Prime Minister’s Trade Envoys, and new government-to-government commercial models to facilitate business introductions and improve market access through reducing non-tariff barriers.

To facilitate this, we will develop a digital service to enable business and trade associations to report non-tariff barriers from around the world.

We have also already appointed a network of Her Britannic Majesty’s Trade Commissioners (HMTCs) to lead the Department for International Trade (DIT) overseas network at a regional level. The HMTCs will cooperate closely with Ambassadors and High Commissioners. They are supported by UK-based teams with deep industry knowledge and enhanced collaboration across government.

We will also improve our commercially-minded relationship support for strategically important UK exporters and investors, and work with industry to make it easier to access e-commerce markets.

Finance

We will put finance at the heart of our offer.

In UK Export Finance (UKEF), we have one of the most innovative and flexible export credit agencies in the world, and a suite of products and services to support UK exporters to ensure that no viable UK export fails for lack of finance or insurance.

We will raise awareness of how UKEF’s trade and export finance and insurance products can increase the global competitiveness of exporters, and bring together the UK supply chain and consortia around large UK exporters engaged in overseas opportunities.

In addition, we will analyse the full range of UKEF’s statutory powers to identify where we can consider creating new products and enhancing existing ones.

Maximising our impact

Five principles

We will adhere to 5 principles, developed through our consultation with businesses, which define how we will engage with exporters and what they can expect of us. These principles are:

1. A business-led approach

Businesses are the drivers of growth and exports, and so this strategy has been informed by engagement with a wide range of businesses and representative bodies across the UK. We will ensure our support is designed around the needs of businesses and we will continue to engage with businesses and use our intelligence on market access barriers as we implement the strategy and develop our future trade policy.

2. Doing what only government can do

Government has a vital role in helping UK businesses to export by using its unique assets such as its international and UK network, government-to-government relationships, and our ability to ‘convene’ and ‘connect’ businesses. With these, government can open markets and unlock opportunities for UK businesses, provide trade and export finance to viable UK exports where the private sector cannot, promote the UK’s strengths and capabilities across the globe.

3. Joining up across government, with local partners and the private sector

There are a wide range of public and private sector organisations, such as Local Enterprise Partnerships (LEPs), Growth Hubs, Chambers of Commerce, the devolved administrations, trusted advisers, and intermediaries, who support businesses to export or to grow. Businesses have told us that this marketplace can be difficult to navigate. We want to work in partnership with the private sector and wider stakeholders to complement and improve the support available for businesses.

To facilitate this, we will create an Export Strategy Partnership Group, led by the Minister of State for Trade and Export Promotion, bringing together senior leaders from across the export support market ecosystem. In addition, we want to take a whole-of-government approach to support businesses in their growth ambitions. This will utilise the expertise of each public body to support exporters, and we will ensure that businesses encounter ‘no wrong door’ across government when they seek the available business or export support.

4. Digital by design

Maximising the potential of digital services and data science is essential if we are to provide both effective and scalable export support and a better customer experience for UK businesses. We will build digital services that make it as easy as possible for businesses to find, access and successfully navigate all export advice, support and information provided by government. In addition, we will invest in our ability to analyse and utilise data, to improve the services and products we provide and ensure they are tailored to the needs of businesses.

5. Value for money

To achieve the most impact and widen our reach, it is essential that we continually look to improve the value for money of our services. We will monitor and track the impact that we have in helping businesses export, and use feedback from businesses to ensure that we are allocating resources to the areas where we can make the biggest difference. We will consider harnessing cross-government funds and continue to share the costs or charge for our services, where appropriate, to allow us to reinvest in our capabilities and serve a larger number of clients.

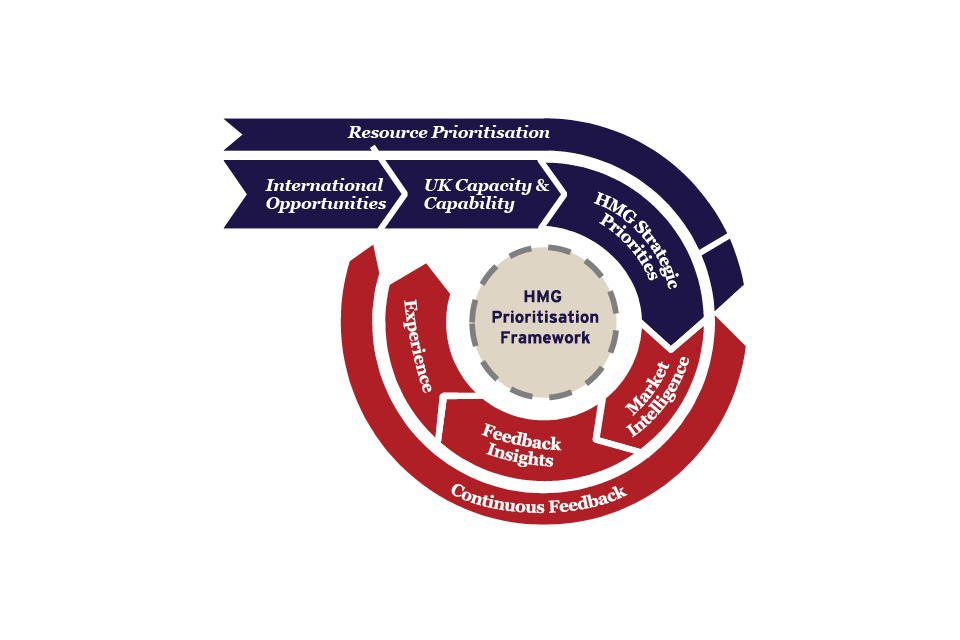

Resource prioritisation

We will prioritise our resources so that we allocate the most effort to areas that will generate the largest or most strategic return. The government’s prioritisation approach will be informed by:

- international demand trends

- the UK’s strengths and capabilities

- the government’s wider priorities (our future trade policy, the Industrial Strategy, and our prosperity, stability and security objectives)

This will be implemented and communicated through DIT’s overseas Regional Trade Plans, led by HMTCs and setting out trade priorities and plans for the region. They will be delivered in close cooperation with Ambassadors and High Commissioners. This will mean:

- focusing our resources on fast growing and developing markets, where the majority of global growth will come and where government can have the greatest impact, while maintaining or deepening our trade relationships with existing trade partners

- addressing market access issues which impact multiple businesses or sectors while remaining flexible to shorter term commercial opportunities where government can make a difference

- reflecting the Industrial Strategy and its export potential via the Grand Challenges and Sector Deals, while remaining flexible to other opportunities

- communicating and providing tailored support to maximise the opportunities created by our future free trade agreements

- supporting the government’s prosperity agenda to harness trade’s potential to boost economic prosperity, create jobs, support greater participation by women and under-represented groups in the economy, and lift communities out of poverty around the world

First steps

This is only the first step to address the UK’s export challenge.

This challenge is complex, but it will bring rewards to all of us if we get it right. We know there is always more we can do. We will continuously improve our support for business, and, over the coming months, departments across the UK government will assess the policy and regulatory changes necessary to achieve a step change in the UK’s exporting performance.

The UK’s export challenge

There is a world of opportunity for UK exporters

The global economy is changing fast. Despite the global financial crisis and other short-term factors, the value of global exports was worth 2 times more in 2017 than in 1997[footnote 8]. Despite some uncertainty over future global trade growth, many new opportunities will still be generated. Only by exporting can we tap into the trends that are transforming the world economy right now and take full advantage of the changing pattern of economic growth for the future.

Global exports of goods and services 1970 to 2017 in constant 2010 $US

Graph showing global exports of goods and services 1980 to 2016 in constant 2010 $US: Source World Bank

Rise of emerging markets

There have been significant shifts in shares of world trade over recent years. Developed economies’ share of global exports fell from 69% in 1980 to 55% in 2015, with the rise of China as a global power and exporter accounting for much of the change[footnote 9]. These trends are expected to continue and approximately 90% of global economic growth in the next 10 to 15 years is expected to be generated outside the EU[footnote 10].

Established trade partners

While emerging markets, such as those in the Asia Pacific region, are going to be increasingly important for our exports in the future, our established trade partners will continue to be essential. For instance, the USA is the single largest export market for the UK, accounting for 18.2% of the UK’s exports in 2017, while the EU accounted for 44.5% of the UK’s exports[footnote 11] .

As we leave the EU, we want the broadest and deepest possible partnership – covering more sectors and co-operating more fully than any free trade agreement (FTAs) in the world, while being able to negotiate our own trade agreements across the globe.

We have already established multiple working groups and high-level dialogues with established trade partners to strengthen bilateral and plurilateral trade and investment relationships. For instance, we have set up a UK-US Trade and Investment Working Group and, in September 2017, we signed the first ever UK-US science agreement to strengthen research collaboration which included £65 million of UK investment[footnote 12].

Global value chains

As supply chains become more global, different stages of production are increasingly located across different countries. Approximately 80% of world trade is estimated to take place within the international production networks of multinational companies[footnote 13]. For example, a fifth of exports from the UK consist of intermediate components that have been imported[footnote 14].

This fragmentation of production in recent decades has been facilitated by trade liberalisation policies and a decline in the costs of transportation and information communication technology. This has also contributed to a substantial rise in the trade of intermediate goods and services.

These complex and multi-dimensional global value chains are often not captured adequately in traditional international trade statistics, as the latter record the entire value of a product that is exported rather than the value a country adds to the production of goods and services it exports.

Global value chains provide a strong justification for deep FTAs that will help provide access to intermediate goods which in turn improve the quality of the UK’s final goods - and equally allow the UK to export our best intermediate goods.

Trade in services

Trade in services over the last 20 years has been the most dynamic segment of world trade, growing more quickly than trade in goods[footnote 15]. It already represents around a quarter of the value of world trade[footnote 16], and in 2017 services accounted for 35% of the value of UK trade[footnote 17].

Services are also a key intermediate input in global value chains, and when including the value of services embedded in manufacturing, services account for close to two thirds of the value added of UK exports[footnote 18].

Currently, international trade architecture is dominated by goods and the evidence points strongly to barriers to trade in goods falling more than barriers to trade in services[footnote 19].

The evidence also suggests that gains from more open services sectors spill over to manufacturing. Business services are key manufacturing inputs, so an open services sector helps support manufacturing firms. It is estimated that manufacturing productivity could increase by 7 to 18% if some OECD countries were as open to services trade as the UK[footnote 20].

The digital economy

The digital economy, and e-commerce in particular, are an important driver to wider economic growth and trade. Virtually every type of cross-border transaction now has a digital component, and cross-border data flows added $2.8 trillion to world GDP in 2014[footnote 21]. The UK is a strong supporter of modern and ambitious digital provisions in trade, including: e-commerce, data and telecommunications; while understanding the importance of ensuring personal data protections are not put at risk.

E-commerce has also already greatly helped many small and medium sized businesses (SMEs) access international markets and sell directly to overseas customers. It is estimated that cross-border e-commerce accounted for 12% of global goods traded in 2016 and is expected to grow at twice the rate of domestic e-commerce until 2020[footnote 22]. The UK is one of the most advanced e-commerce markets in the world and has a reputation for creating and nurturing world-renowned retailers and brands.

The Commonwealth

The Commonwealth is home to almost a third of the world’s population, half of the globe’s top 20 emerging cities, and 60% of its population is under 30[footnote 23]. With its unparalleled network of common language and laws, trade costs between Commonwealth countries are also estimated to be 19% lower than between other trading partners[footnote 24]. In 2016, total intra-Commonwealth trade in goods and services was estimated to be $560 billion and is projected to reach $700 billion by 2020[footnote 25].

Following the 2018 Commonwealth Heads of Government Meeting (CHOGM) in the UK, during which Leaders agreed concrete actions towards a more prosperous, fair, secure and sustainable future, the UK is now the Chair-in-Office of the Commonwealth until 2020.

We will, as Chair-in-Office, continue to work with the other 52 members of the Commonwealth to promote free trade in a transparent, inclusive, fair, and open rules-based multilateral trading system, which takes into account the special requirements of least developed countries and small and vulnerable economies. We will also continue to strengthen our existing trade links and deliver our programmes launched at CHOGM, which aim to boost open and inclusive trade across the Commonwealth, and address systemic barriers to the full and equal participation of women in the economy.

Overseas regional initiatives

There are also investment initiatives led by overseas governments to boost regional prosperity where the UK government is an important partner to unlock mutual benefits. Examples include China’s Belt and Road Initiative (BRI) and the GCC States’ economic diversification plans.

Belt and Road Initiative

The UK is well positioned to benefit from the BRI which was launched in 2013. This initiative will provide significant investment across Asia (and further into Africa and Europe) in new infrastructure, including seaports, airports, rail freight, highways, telecoms, oil/gas pipelines and power generation. This investment will offer opportunities for UK exporters, particularly in terms of:

- project design, implementation and governance

- financial design and legal services

- equipment, clean energy, and other innovative technologies

- construction and related services

Working with the new HM Treasury’s BRI Envoy, the Minister of State for Trade and Export Promotion will give strong leadership and focus to BRI, through a London coordinating team and new staff in selected markets. The government will focus on trilateral working with China (government departments, company headquarters, and their subsidiaries overseas) and third countries (project owners and their governments) to develop a pipeline of BRI opportunities.

GCC states economic diversification plans

The Gulf Cooperation Council (GCC) countries (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates), have embarked upon major programmes to improve their economic resilience through diversifying their revenue streams. They aspire to build knowledge-based economies, reduce public expenditure, grow their private sectors, and upskill their people to work in these restructured economies.

The UK is a natural strategic partner for them in realising their ambition. For example, there are huge new opportunities in sectors that are strengths for the UK – like technology, cyber, life sciences, creative services, renewables, and vocational training.

At the same time, we will continue to focus on our traditional areas of strength in these regions – oil and gas, aerospace, defence, and infrastructure. Diversification also provides a regional opportunity in education and healthcare as the GCC governments seek to upskill their people.

The UK is punching above its weight but below its potential

The UK business environment

The UK is known for its excellent legal system, a skilled workforce, a competitive tax regime, and a well-regulated economy. The UK also has a global reputation for innovation – we are home to some of the world’s finest universities, our research and development (R&D) capabilities are cutting-edge, and our intellectual property (IP) framework is numbered among the best in the world[footnote 26].

The economy has grown for 8 consecutive years, exceeding expectations in 2017, and is now 16.7% larger than it was in 2010 and 10.4% above its pre-crisis peak[footnote 27]. Employment has increased by over 3 million since 2010, which is the equivalent to an average of 1,000 people finding work every day[footnote 28].

Raising productivity is one of the government’s key priorities and is core to the UK’s Industrial Strategy. While the UK has some of the most productive companies in the world, there is a large proportion of businesses that perform less well in terms of productivity; these are the long tail of low productivity businesses. By improving productivity while simultaneously keeping employment high, we can boost our earning power – raising living standards, providing funds to support our public services and improving the quality of life for all our citizens.

We have already taken significant action to boost productivity, including important investments in R&D through the Industrial Strategy Challenge Fund, in infrastructure through the £31 billion National Productivity Investment Fund, and in skills through our work to establish a world class technical education system. To complement these measures, we have also launched the Business Productivity Review, led by the Department of Business, Energy and Industrial Strategy (BEIS) and HM Treasury, to build our understanding of how firm-level interventions, by public and private sector actors, can support growth and productivity for the long tail of low productivity businesses.

Greater participation by women in the UK economy is also a great opportunity. There are huge gains to be made from closing the gender pay gap and supporting women to participate equally in the economy – both for women’s empowerment and for the economy[footnote 29].

To help businesses connect with buyers, markets, and each other, the UK government is driving strategic investment across transport, telecommunication and digital infrastructure through the Industrial Strategy. The National Infrastructure Commission has undertaken work to assess the issues faced by freight, and will recommend solutions to support its continued success in the UK. An interim ‘Freight fit for the Future’ report will be published in Autumn 2018, with a final report by Spring 2019.

Innovate UK

Innovate UK is the business-facing part of UK Research and Innovation (UKRI), the new body overseeing science and innovation funding in the UK. Innovate UK supports high potential UK businesses, especially SMEs, to find partners, investors and knowledge to drive new products and services from concept to commercialisation.

Its Global Business Innovation Programme helps UK SMEs develop international partnerships on research and development as a first step towards international business activity. Innovate UK and DIT will establish a framework to build on supporting the most innovative UK businesses so that they are ready to export and participate in global supply chains.

Find more information on Innovate UK’s global offering to UK businesses.

World-class sectors

The UK has a significant number of large, internationally competitive sectors. We are relatively specialised in areas as diverse as financial services, insurance and pensions services, cultural and recreational services, chemicals (including pharmaceutical products), other business services (which includes R&D, consultancy and trade-related services), transportation (including vehicles, aircraft and spacecraft), food products and defence equipment[footnote 30] .

As detailed in the Industrial Strategy, through specific Sector Deals, the government has set an open challenge to all sectors of the economy to come forward with a clear, long-term set of proposals to establish a partnership with government to transform the productivity of their sector.

Sector Deals are strategic, long-term partnerships between industry and government, backed by sizeable private sector co-investment. Construction, life sciences, artificial intelligence, creative industries and automotive will be the first to benefit, and we are also setting out a process for the next phase of deals.

Sector Deals

We have already published 6 Sector Deals and we are committed to extending these successful partnerships to other parts of the economy:

- Artificial Intelligence (AI) Sector Deal: a partnership between government and the AI sector to make the UK a global leader for AI innovation and investment. We are committing to working together to build and maintain the leading AI workforce in Europe

- Automotive Sector Deal: co-investment in the next generation of electric and connected and autonomous vehicles, including an ambition for 50% UK suppliers as part of a programme to improve the competitiveness of the UK supply chain

- Construction Sector Deal: government and industry will co-invest to create an integrated innovation hub to develop and commercialise digital and manufacturing technologies for the construction sector

- Creative Industries Sector Deal: unlocking growth for creative businesses and investing more than £150 million across the lifecycle of creative businesses, including in augmented and virtual reality and a Cultural Development Fund to support creative clusters across the UK, and in the creative skills of the future via a careers programme that will open up creative jobs to people of every background

- Life Sciences Sector Deal: developing a Health Advanced Research Programme where charities, industry, government and the NHS jointly collaborate on ambitious, long-term projects to develop transformative healthcare technologies and create new UK industries

- Nuclear Sector Deal: an ambitious programme to invest in emerging nuclear technologies and commit to increasing gender diversity in the civil nuclear workforce with a target of 40% women in nuclear by 2030

Leading destination for international investment

The UK’s competitive business environment is a significant incentive for businesses to invest and grow. It supports efforts to attract innovative businesses in the manufacturing and technology sectors to invest in the UK and develop high quality UK goods and services that are attractive to both global and domestic consumers.

Attracting foreign direct investment (FDI) into the UK supports the economy, increases the capability of UK businesses, strengthens the UK’s supply chains, and can generate export opportunities[footnote 31].

To ensure that we continue to be a global leader in attracting FDI, DIT has launched a new FDI Strategy that will deliver new ways to target support for the FDI projects that create the most value for investors and national wealth, and make DIT the world’s most sophisticated investment promotion organisation.

The strategy has a 3-part approach that will make use of data in new ways to measure the economic impact of projects, identify opportunities across the UK with the greatest potential for international investment, and target government support precisely where it will make the biggest difference for the economy.

However, the UK is not fulfilling its exporting potential

In terms of the value of exports according to provisional IMF data in 2017 the UK ranked[footnote 32]:

- sixth in the world for exports of goods and services

- third in Europe for exports of goods and services

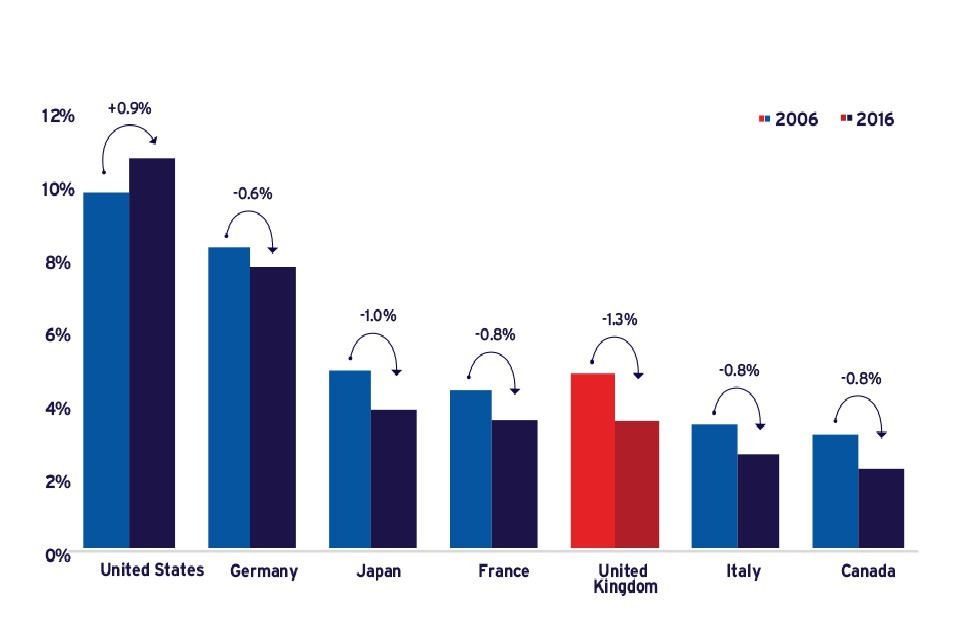

However, the UK can do more to achieve its full exporting potential. Although most G7 economies have witnessed a fall in their share of global exports over the past 10 years, there is evidence that the UK’s share has fallen faster than other major advanced economies.

Share in world exports 2006 to 2016

Bar chart showing share in world exports 2006 to 2016.

Source: OECD

This has especially been the case with the UK’s share of goods trade with developing countries which has fallen from 6% in 2002 to 2% of the market in 2016. In the same period, the average rate of growth of UK exports to developing countries was 4%, which is half of that of Germany’s (8%) and almost a fourth of Turkey’s (15%)[footnote 33].

This is partially due to the nature of the UK’s exports, since they are often of high value and based around services, whereas consumers in developing markets tend to be more price-sensitive and goods-driven. As incomes in emerging markets continue to grow, this offers an opportunity for UK business to raise their ambition beyond established export markets.

Our ambition is to strengthen our position as one of the 21st century’s great trading nations

When taken as a percentage of GDP, the UK’s level of exports ranks mid-table in the G7. Our long-term aspiration is to increase exports as a percent of GDP to 35% from 30%.

This is a challenging ambition. It could be met if every existing exporting business exported 16% more[footnote 34].This will require government working in partnership with industry to establish the conditions for businesses to thrive. While there are a number of ways to set an ambition for exports, this approach more accurately reflects changes in the UK’s underlying export performance, is less affected by short-term economic fluctuations in the business cycle, and is not fixed to a specific time frame. This strategy is the first step on this journey.

Exports of goods and services as a % of GDP for G7 nations [footnote 35]

Bar chart showing exports of goods and services as a % of GDP for G7 nations

Source: UNCTAD

Note: Figures for Canada, Japan and the USA are from 2016 as 2017 figures are not yet available

Since 2010, the UK’s exports have grown by nearly 40%, totalling £616 billion in 2017, and exports as a percentage of GDP has also risen from 28% to 30% over the same period[footnote 36]. Nevertheless, as a great trading nation with a wide range of world-class sectors, there is more we can do to reach our potential.

The UK starts from a position of strength. The government launched the Industrial Strategy in November 2017, setting out our long-term plan to boost the UK’s productivity and earning power. In addition, as we leave the EU, we will be able pursue an independent trade policy to maximise opportunities around the world.

The Industrial Strategy provides a platform for international success

In 2017 the government published its Industrial Strategy to make the UK economy fit for the future. It sets out the government’s vision for a strategic state that will create the right conditions to allow us to thrive in the long term by making a difference to productivity and the economy. The strategy outlines the government’s commitment to strengthening the foundations of productivity – ideas, people, infrastructure, business environment, and places – and to meeting the Grand Challenges that will position the UK to succeed in the face of world-changing economic trends.

The Industrial Strategy announced measures to build on the foundations of productivity including:

- a clear ambition to raise total investment in R&D to 2.4% of UK GDP by 2027 and 3% in the longer term, placing us in the top quartile of OECD countries

- investing an additional £725 million in new Industrial Strategy Challenge Fund programmes that make the most of new technologies and capture the value of innovation

- investment in high-quality infrastructure, increasing the National Productivity Investment Fund to £31 billion

- boosting our digital infrastructure, with over £1 billion of public investment, including £176 million for 5G and £200 million for local areas to encourage roll out of full-fibre networks

- driving over £20 billion of investment in innovative and high potential businesses, including by establishing a new £2.5 billion investment fund, incubated in the British Business Bank

- a tax regime that supports exports and investment; since 2010 the UK corporation tax rate has been reduced from 28% to 19% – the lowest overall rate among G20 countries – and government has increased the R&D tax credit to 12%

- developing our skills base to support innovation and participation in global supply chains, including investing an additional £406 million in maths, digital and technical education, helping to address the shortage of science, technology, engineering and maths (STEM) skills. We do not want to miss talent from underrepresented groups and this focused action will support the take-up of STEM subjects amongst women as well as men

The Grand Challenges

The Industrial Strategy set out 4 Grand Challenges, focused on long-term global trends which will shape our future which are:

- artificial intelligence and the data-driven economy

- the future of mobility

- the ageing society

- clean growth

These challenges will direct the focus of government and engage the private sector, academics and civil society to ensure we take advantage of major global trends, improving people’s lives and the country’s long-term competitiveness and productivity.

Growing the artificial intelligence and data-driven economy

We will make the UK a global centre for AI and data-driven innovation. Artificial Intelligence (AI) and data-driven technologies are general purpose technologies, that are already starting to transform the global economy. These technologies have the potential to significantly improve productivity in the UK – the calculated equivalent of an additional £232 billion by 2030[footnote 37]. Globally, AI could contribute up to $15.7 trillion to the economy by 2030[footnote 38].

The UK’s digital sector has been a strong contributor to the country’s exports, and exported a record £46.4 billion worth of services in 2016, accounting for 18.9% of UK service exports. Of this, £20.8 billion worth of services were sold to the EU while £25.6 billion were sold to the rest of the world[footnote 39].

The UK is well placed to take advantage of global opportunities in this area and we are investing £9 million in a new Centre for Data Ethics and Innovation, and will invest £45 million to support additional doctoral studentships in AI and related disciplines by 2020 to 2021.

Future of mobility

We are on the cusp of a profound change in how we move people, goods and services around our towns, cities and countryside. Significant investments are being made in the electrification and automation of road vehicles; in the modernisation of rail services to deliver higher capacity, speed and connectivity; and in the development of autonomous aerial and marine transport.

The automotive industry has been a core strength for UK manufacturing in the past few decades. In 2017, the UK exported automobile products worth £44 billion representing 13% of total UK goods exports[footnote 40].

In 2016, around 15% of the total UK R&D spend was generated by UK automotive companies[footnote 41]. This has been supported by major investments from the UK government such as:

- the £246 million Faraday Challenge designed to boost the development of battery technology

- £250 million for connected and autonomous vehicle research and the development and testing infrastructure

- £200 million in electric vehicle charging infrastructure

Further government actions, including a Future of Urban Mobility Strategy and a thorough regulatory review, will help address barriers to innovation and continue the UK’s long tradition of bringing transport solutions to the world.

Case Study: a range of YASA-powered cars

Originally founded as a spin-out from Oxford University in 2009, YASA is now a leading manufacturer of axial-flux electric motors and controllers for automotive and aerospace applications. YASA motors and controllers are designed and manufactured at YASA’s new 100,000 unit capacity production facility, which was opened in February 2018 by the Secretary of State for Business, Energy and Industrial Strategy.

YASA’s electric motors are designed and manufactured in Oxford, bringing 150 jobs to the area across design, engineering, manufacturing and other disciplines. 80% of the company’s products are destined for international export to Europe, America and China.

Since its foundation, YASA has benefited from significant support from UK government initiatives and grants targeted at high-tech start-ups and high-growth SMEs, including from Innovate UK. The funds have supported YASA’s R&D, product development, production capability and growth plans.

YASA powered cars

Chris Harris, YASA’s CEO, said:

Automotive and aerospace manufacturers are embracing the growing opportunity of electric power, announcing accelerated timescales for the launch of hybrid and pure electric vehicles and aircraft.

With continued support from our customers, investors and government initiatives such as Innovate UK, YASA is well positioned to capitalise on the global opportunities of this electric revolution and become the world-leading manufacturer of electric motors and controllers.

Ageing society

Globally, there are likely to be 1.4 billion people over the age of 60 by 2030[footnote 42]. It is estimated that between 2008 and 2030, over 55s will be responsible for 50% (USA), 67% (Japan) and 86% (Germany) of the growth in consumer spending[footnote 43].This will result in increased global demand for health and social care and related technologies.

The UK has unique strengths including powerful health datasets in the NHS, world-leading design institutes, and strong life sciences, healthcare, and medtech sectors. We have invested over £300 million to develop innovations and technologies to help meet the diverse needs of an ageing society.

Clean Growth

Whole new industries will be created, and existing industries transformed, as we move towards a low-carbon, more resource-efficient economy. Global trade in a selection of low-carbon goods and services could increase from around £150 billion in 2015 to £1.0 to £1.8 trillion in 2030[footnote 44]. In addition, according to one estimate, the UK’s clean economy could grow at up to 11% per annum between 2015 and 2030[footnote 45].

The UK has been at the forefront of international efforts to tackle climate change, leading the G7 in growing our economy while reducing emissions. We have cut emissions by over 43% since 1990[footnote 46]. To continue this progress, we are investing over £2.5 billion in low-carbon innovation by 2021.

We have already set up a Green Finance Taskforce to both accelerate investment into the UK’s clean economy and extend the UK’s global leadership in setting standards in this area. Our recently published Clean Growth Strategy sets out our ambitious proposals for continuing this progress through the 2020s.

The government’s trade policy initiatives are setting out a new framework for UK trade

Trade policy work provides the context in which businesses can engage in trade and promote UK and global prosperity, and for UK exporters, trade policy secures access to and breaks down barriers in markets around the world. Within that context, trade promotion addresses key market failures, such as the lack of information on the benefits of exporting or on international commercial opportunities, that deter UK business from engaging in or developing their export activities.

The UK’s exit from the European Union will give us the opportunity to pursue an independent trade policy for the first time in over 4 decades, and create new opportunities for our exporters. As published in our White Paper, ‘Preparing for our future UK trade policy’, the overarching objective of our new trade policy is enhanced economic prosperity for the UK, through the development and delivery of a trade policy that delivers benefits for business, workers and consumers across the whole of the UK. In doing this, the government commits to the following underlying principles.

The UK will:

- pursue economic prosperity for the UK and lead by example through our liberal economy and pursuit of free trade

- develop, support and enforce a fair and proportionate rules-based system for trade, domestically and internationally

- develop a trading framework which supports foreign and domestic policy, sustainability, security, environmental and development goals

- develop a trade agenda that is inclusive and transparent

However, increasingly, free and open trade cannot be taken for granted. While the UK is a champion for global free trade, openness and economic cooperation, research by the OECD shows that the number of trade barriers operated by the biggest economies in the world has risen by almost 400 between 2012 and 2016[footnote 47].

We want to maximise our trade opportunities globally and across all countries – both by boosting our trading relationships with old friends and new allies, and by seeking a deep and special partnership with the EU. The UK will look to secure greater access to overseas markets for UK goods exports as well as push for greater liberalisation of global services, investment and procurement markets.

We are already talking to a number of countries on a variety of future trading options, exploring the best ways of progressing our trade and investment relationships, which could include new FTAs. We have announced 14 working groups and high-level dialogues with 21 trade partners countries, to explore the best ways of progressing our trade and investment relationships, which includes potential new FTAs and trade continuity agreements.

To ensure that we are transparent and inclusive when developing our trade policy priorities, we will engage with businesses and stakeholders across the UK. This will also deepen our understanding of the opportunities and barriers to international trade.

For example, DIT have recently launched public consultations on future free trade agreement negotiations. These consultations are one of a number of means by which Parliament, the devolved administrations, the public, businesses, civil society and trade unions can have their say on the government’s approach to new trade agreements.

The Export Strategy builds on and supports the government’s foreign policy, and trade and development agenda

Trade and investment and foreign policy mutually reinforce the government’s agenda for Global Britain and its ambitions for prosperity, stability and security worldwide, and will be critical to making new partnerships and strengthening existing ones.

DIT, the Foreign and Commonwealth Office (FCO) and Department for International Development’s (DFID) will work together overseas to ensure that all our priorities reinforce one another and that our existing policies are used to support the UK’s new independent trade policy objectives, gaining better market access for British business in line with the Industrial Strategy.

Trade with developing countries is one of the most cost-effective ways of reducing poverty[footnote 48]. Economic growth is fundamental for sustained poverty reduction, and opening up to trade increases a country’s GDP because it allows a country to use its resources more efficiently through specialisation, incentivises innovation, and creates new employment opportunities. As a result, it will help build more prosperous economies to the mutual benefit of all our citizens and businesses[footnote 49].

Targeted interventions can also help ensure that developing markets industrialise at pace with well-regulated and open economies. This is at the heart of DFID’s new Economic Development Strategy.

DFID now has ambitious economic support programmes in the majority of countries where it operates. Through the UK shareholding in the World Bank Group and other Regional Banks, we have driven an ambitious package of support for economic transformation, infrastructure investment and trade openness. Innovative programmes, such as TradeMark East Africa, Invest Africa and new programmes to drive urban and city growth, are targeting specific trade and investment barriers and helping to improve the business environment.

We are also working to harness the world-class expertise of the City of London as the finance hub of choice for developing countries. Many firms in these countries do not have access to bank loans or lines of credit and 2 billion people globally are excluded from the formal financial system. We want to ensure access to finance for investment is sustainable, inclusive and more affordable.

By creating the conditions for increased trade and investment, it will open up opportunities for UK businesses to expand into, and access, new markets, and build the UK’s trading partners of the future. We will work to ensure our firms are well positioned to fully take advantage of these opportunities.

DFID, the FCO, DIT and UKEF have also enhanced their collaboration to ensure development and global prosperity are at the heart of UK trade policy. The government is trialling new ways to strengthen existing, and establish new, trading partnerships. To support this aim, UKEF’s increase in risk appetite limit has facilitated a greater capacity to support DFID priority markets in 40 developing countries within the parameters of the OECD Sustainable Lending Principles.

Case study: government support for trade and development

As a result of UKEF, DIT, DFID, and FCO collaboration, UKEF is providing a £235 million direct loan to the Ugandan government to help finance the construction of a new international airport in Kabale – a top priority for the Ugandan government.

By opening access for the delivery of equipment, materials and services, which had previously been a challenge in the region, Kabale airport will enable vital work to be carried out on large-scale infrastructure and energy projects planned in the area. This will result in significant long-term benefits for the country’s developing economy and energy independence. A second phase of development is planned to improve the airport’s capacity to support tourism and international trade.

A number of HMG departments worked together to help Sussex-based, Colas UK, as a member of the UK-based joint venture SBC (Uganda) Ltd, win this important order.

DIT and FCO provided support to Colas in country, while UKEF worked to establish this as a priority and fully budgeted project and DFID sought to ensure it was debt sustainable, appropriately appraised by the Ugandan government, which would provide long-term economic benefit for the country. On completion this was the largest ever UKEF direct loan to an African government.

Businesses have told us they face a range of practical barriers

Many businesses already do export successfully. In 2016, it was estimated that there were 206,800 registered businesses in Great Britain who were exporting goods and/or services, 8.8% of the total number of businesses in the non-financial business economy in Great Britain[footnote 50]. This has been broken down by business size in the table below:

Table 1: Profile of UK exporters[footnote 51]

| Business size | Count of business | Number of exporters | % of number of businesses |

|---|---|---|---|

| Micro (1 to 9 employees) | 2,106,800 | 151,400 | 7.3% |

| Small (10 to 49 employees) | 208,500 | 39,800 | 20.2% |

| Medium (50 to 249 employees) | 35,500 | 12,300 | 35.3% |

| Large (250 or more employees) | 8,300 | 3,300 | 40.4% |

| Total | 2,359,100 | 206,800 | 8.8% |

Supporting our exporters means understanding the challenges they face. In developing this strategy, government has engaged closely with businesses and representative bodies, and analysed existing empirical data, to identify where government help is most needed.

From this engagement and research, we know that businesses of all sizes can face a range of barriers when looking to export because of the higher costs, especially those associated with transport, and other difficulties associated with exporting. These barriers can impact those businesses looking to export for the first time, or those seeking to expand or restart their exporting activity. The barriers also vary in frequency, intensity and importance according to a business’s size, its export history, sector, and the market in which it operates or is planning to enter.

Our offer of support is shaped by these barriers and designed to help businesses overcome them.

Barriers to exporting for UK businesses

Graphic showing barriers to exporting.

Attitudinal

Attitudinal barriers affect some companies which may believe their business is not suited to overseas sales based on a misperception about the relative costs and benefits of exporting, or those companies who believe their business is suited to overseas sales but may not have the confidence to pursue them, or who do not think there is a demand for their products. A fifth (19%) of all UK registered businesses said they have never exported but believe they have goods or services which could potentially be exported or developed for export. This translates to more than 400,000 UK firms[footnote 52].

Global awareness

Global awareness of the UK’s strengths and capabilities is low in some sectors among international buyers, which can mean that the UK is not considered by overseas buyers when looking for suppliers or businesses to enter their value chains.

Lack of knowledge

Lack of knowledge means businesses may not know how to go about exporting, what they need to consider when entering a new market, and where they can access the support they need. 24% of businesses, for whom exporting is possible, reported a low level of knowledge on how to export in general, with 52% indicating their knowledge was only moderate. Moreover, 21% reported a low level of knowledge on where to go for information about exporting, with 51% reporting moderate knowledge[footnote 53].

Lack of capacity

Lack of capacity within businesses can constrain their ability to export. 52% of businesses who believe their products and/or services could be exported reported that lack of capacity was a strong or moderate barrier to exporting. Among businesses that identify lack of capacity as a barrier, the most cited reasons were a lack of managerial time to focus on internationalisation, not having enough staff to expand their operation, and not having the capacity to assess the cost of internationalisation[footnote 54].

Limited networks and contacts

Limited networks and contacts often act as a barrier to exporting because communication problems and distance makes it difficult for businesses to establish relationships with their customers or distributors, and collaborate with other businesses on international opportunities. 61% of businesses, for whom exporting is possible, reported that lack of access to contacts, customers and networks was a strong or moderate barrier to exporting[footnote 55].

Market access issues

Market access issues create a range of systemic barriers that can impact a businesses’ exports, including tariff and non-tariff barriers, such as differing IP frameworks and local regulations, which differ across markets and countries. Many of these can be addressed through trade policy and sometimes through Trade Agreements and other trade measures. However, there is also an important role, outside these formal agreements, for government to address market access barriers, including regulatory issues.

Access to finance

Access to finance is important in ensuring that businesses have the capacity to deliver on export contracts. These requirements can include access to trade and export finance, such as for working capital or contract bonds, or insurance against not being paid for export contracts. Among all the firms for whom exporting is possible and who mentioned costs (in general) as a barrier, roughly a quarter (23%) mentioned an inability to access finance or a lack of working capital as a specific issue[footnote 56].

The role of government in export support

All businesses are different. Businesses that are less experienced exporters face different issues from those that are seasoned exporters. We want to help businesses export for the first time, as well as help existing exporters be even more successful.

We will do this through the 4 ways the UK government can make a difference in partnership with other providers of export in the public and private sector:

These roles are focused directly on breaking down the barriers to export, and each is supported by a set of resources and initiatives. We also want to align better our export support with the wider business growth support provided by government as both have fundamentally the same objective of helping businesses to growth whether through domestic or non-domestic sales.

Encourage

We will encourage and inspire those businesses that can export but have not started or are just beginning.

Exporting can be an essential step in a business realising its growth potential.

Changing attitudes towards exporting

While there can be real barriers and costs to exporting, there are many misconceptions about the risks. Our ambition is to make exporting ‘business as usual’ for firms looking to expand and reach new customers by working with the private sector to dispel myths around exporting.

Businesses have told us that they want to learn from the experience of their peers. As a result, we want to amplify the voice of existing exporters and share their stories.

International awareness of the UK’s strengths and capabilities

We want to ensure that all international buyers are aware of the UK’s strengths and capabilities. Insight from our international network suggests that international buyers may not have the time or capacity to undertake sufficient analysis to assess all their options. In addition, buying decisions can be influenced by information that is familiar or easy to recall, and by positive or negative associations with a national brand.

As a result, overseas companies may rely on traditional suppliers at the expense of better suppliers. We will champion the UK’s high-quality services and goods, and our world-renowned innovations, creativity and scientific research to demonstrate that Britain is open for business.

The GREAT Britain Campaign

The GREAT Britain Campaign is the government’s most ambitious international marketing campaign ever and showcases the very best of what our whole nation has to offer. The GREAT Campaign delivers jobs and growth for the UK by encouraging the world to visit, study and do business with us.

For every pound we spend on the GREAT Campaign, over £20 is returned to the UK economy and the campaign has already secured confirmed economic returns of £3.4 billion for the UK, with a further £3.3 billion currently being validated. Hundreds of UK businesses use the brand overseas because they see real value in aligning themselves to the UK’s story and strengths through the GREAT brand which is valued at £271 million.

The Exporting is GREAT campaign aims to inspire and engage with businesses across the country, encouraging them to seize global export opportunities. We support companies at every stage of their exporting journey – from getting export ready, identifying opportunities and winning contracts overseas.

The GREAT International Trade campaign promotes the strength of UK industries to overseas buyers, both businesses and governments, opening doors for British businesses overseas by raising awareness of and ultimately increasing the propensity to buy, goods and services from the UK. The campaign creates a high impact presence which promotes exceptional UK companies on a global stage, showing the world what the UK has to offer.

We will implement the following new initiatives:

- promote peer-to-peer learning by forging a community of thousands of UK Export Champions as part of the new phase of the award-winning Exporting is GREAT campaign. Export Champions are successful UK exporters who offer expertise and guidance to support other companies on their exporting journey. This builds on existing programmes in the Northern Powerhouse and Midlands Engine. We will achieve this with our private sector partners to maximise our reach, and empower the Export Champions to:

- communicate, frankly and credibly, the challenges exporters face and how to overcome them

- demonstrate that many similar companies have achieved sustainable growth by exporting successfully

- raise awareness of the help and support provided by government and the private sector, to the help businesses to export with confidence

- test how we can motivate SMEs to consider exporting at significant moments of change in the external environment, such as the implementation of new FTAs, or at milestones moments in their business lifecycle, for example, when first setting up a company or scaling up

- share best practice, tools and advice on exporting by working with the ‘Be the Business’ initiative to create place-based peer-to-peer communities across particular sectors and regions in the UK. We will also pilot different approaches to enable businesses to learn from their peers, and support businesses to build more connections through events and trade missions

Be the Business

Be the Business is building a movement of businesses across the UK that want to improve their own performance and share their advice and experiences to help others do the same. Be the Business, which is chaired by Sir Charlie Mayfield and backed by some of Britain’s most high-profile business leaders, focuses on identifying practical steps to raise productivity among British businesses through the adoption of best practice.

Based on their research capability and building on the Industrial Strategy, Be the Business helps SMEs better understand the simple changes they can make to super-charge their earning power and raise their productivity by utilising proven management techniques and making use of practical digital technologies.

Be the Business engages and enables businesses from across the UK to improve their performance by helping them benchmark their current levels of productivity on its national digital platform and through peer-to-peer workshops, access best practice advice, and improve through structured management training. It offers the inspiration, tools and resources for businesses to identify improvement opportunities and develop tried and tested approaches to boost their productivity through expert analysis and advice from businesses.

Building on the success of existing measures, we will:

- champion UK businesses and showcase the UK’s strengths and our Industrial Strategy priorities, through overseas Ministerial visits, the Prime Minister’s Trade Envoys, our International network including HM Trade Commissioners, Ambassadors and High Commissioners, trade missions with the support of our private sector partners and trade associations, the GREAT Campaign, and at international forums

- incentivise businesses to export by celebrating excellence and innovation in trade and investment across the whole of the UK, and recognise those delivering prosperity to their local communities through the recently launched Board of Trade Awards

- continue to promote the best of British, by highlighting the strength and innovation capabilities of UK industries and technology to buyers from overseas businesses and governments through the award winning GREAT International Trade campaign. The campaign creates a regular high impact presence on a global stage through which exceptional UK companies are celebrated

- promote the strength and diversity of UK businesses through great.gov.uk, which is currently available in 8 languages – English, French, German, Spanish, Portuguese, Chinese, Japanese and Arabic

Inform

We will inform businesses by providing information, advice and practical assistance.

We know that some businesses do not have the relevant information about how to export, or the capability and capacity to export or export more.

Advice and information on exporting

Some businesses have told us that they do not know how to undertake the initial steps of exporting, such as developing an export business plan, access trade and export finance, or comply with local regulations and administrations. In addition, they may not have the local insight or knowledge to enter an international market.

We want to ensure that all businesses are able and know how to access the information they need to export, from either the private sector or government.

Exporting capability and capacity

Firms may have insufficient time or funds to invest in exporting and lack staff with the right skills to ‘internationalise’ their products. The private sector and other public bodies already provide a range of support services for businesses who are seeking to export. However, businesses have told us the market for export support is difficult to navigate because of its opacity, and many prefer to rely on peer-to-peer networks and existing trusted business advisers, in particular their accountant, to access the support they need.

We want to encourage firms to build their exporting capability, and make it easier for them to access the support they need from the private sector or government. The Business Productivity Review is looking at the effectiveness of the broader public and private market for business support, which includes export support, and the ability for businesses to navigate this market.

We also want to better integrate export support into general business support provided by Growth Hubs, as both have the same objective of helping businesses to grow sustainably. Growth Hubs are local public/private sector partnerships led by LEPs which join-up national and local business support to make it easier for businesses to find the help they need.

HMG: Guidance and information on exporting

Government already provides a wide range of guidance and information on exporting through:

- great.gov.uk: launched in November 2016, it is an important tool for businesses seeking information and guidance on exporting as well as access to DIT’s services. Since its launch, it has been visited by around 3.6 million users. It offers a range of services and tools to help businesses increase their knowledge and capacity to export, and connect with overseas buyers.

- HMG’s international network: the network of HM Trade Commissioners, Ambassadors and High Commissioners and their teams utilise their government-to-government relationships and local insight to open new markets, reduce market access barriers, provide market insight, and support UK businesses to reach new customers. This network includes: International Export Finance Executives, who support the unlocking of opportunities where availability of finance generally, and UKEF’s support specifically, is key to securing export wins

- the Intellectual Property Office: Offers advice and information to help exporters realise value from their IP and mitigate potential IP-related risks when moving into new markets. In key markets they have on-the-ground support available through their IP attaché network who also work to improve the IP protection and enforcement environment

- DIT’s UK-based sector teams: teams of civil servants and sector specialists working with industry and the international network to understand the exporting capabilities of their sector, tailor DIT’s services to the needs of the sector, co-ordinate government-to-government engagement, and represent exporters to improve the policy environment domestically and overseas

- UKEF’s Export Finance Managers: Located across the UK as a first point of contact for UK exporters, they offer guidance on trade and export finance and insurance from UKEF. The network also provides information on where the private sector may be able to offer trade finance solutions for a local business

- DIT’s international trade and e-commerce advisers: Located across England, they provide face-to-face support to help SMEs develop their export plan and online strategies to access overseas markets, in partnership with local businesses, LEPs, Growth Hubs, trade associations, and Chambers of Commerce

We will implement the following new initiatives:

- support and encourage SMEs to access new markets and invest in export support from the private sector by assessing financial incentives (such as vouchers, grants and loans), and reviewing the role of International Trade Advisers. Support is currently provided to meet local needs (according to Local Enterprise Partnership’s priorities) and the nature of support is inconsistent

- enable businesses to access government services more easily by developing great.gov.uk into a single digital platform for both domestic business growth and export support. This will include information about export tariffs and licences, market access issues, and trade and export finance, and we will consider how to provide tailored guidance for different sectors on entering new markets. In addition, we will provide information on great.gov.uk on the new trading environment as we leave the EU

- build the capability and capacity of supply chains in the UK to export by piloting new ways of working with large companies, to share best practice on how to grow the export footprint of others, including their supply chains

- investigate how the public and private sector export support market can be better signposted and simplified for business, and how data could be shared to provide better customer experiences. DIT and BEIS will explore the potential for customer feedback and online ratings to help businesses assess the availability and quality of business advice, including on export support

- support businesses to trade and invest in developing countries by strengthening business partnerships and finding mutually beneficial commercial opportunities which are aligned with our development objectives and promote inclusive economic growth

Building on the success of existing measures, we will:

- provide guidance, through our UK and international networks, to businesses on developing their export plan and online export strategies, accessing trade and export finance and insurance, entering new markets, and signpost them to the relevant public or private sector export support

- upskill and engage businesses and students about international trade through the recently launched Board of Trade National Trade Academy Programme. The programme helps our future exporters turn their ideas and ambitions into reality through a variety of initiatives including the prestigious International Trade Summer School

- building on the success of the Tradeshow Access Programme, consider how we can improve our offer to help SMEs, who are new to exporting, attend overseas trade exhibitions

- raise awareness among business advisers and at business events of the issues that exporters need to consider when trading their IP overseas and provide support through the IP attaché network

- support businesses to establish new trading relationships in developing markets, while promoting high standards of integrity and ethical behaviour in line with the UK Bribery Act 2010, through the Business Integrity Initiative

E-commerce case study: Red Herring Games