Annual Report and Accounts 2024 to 2025

Published 10 July 2025

Performance report

Performance overview: our performance this year at a glance

Doug Gurr, Interim Chair - Competition and Markets Authority

Interim Chair’s foreword

It has been a privilege to take on the interim Chair role during the 2024 to 2025 reporting year. In today’s challenging economic environment, the UK needs its regulatory landscape to be a national asset – and we know the CMA has an important part to play.

Stepping up to help create the best possible conditions for investment, innovation and productivity in UK markets. Being prepared to listen in good faith to what we can do differently or better, then acting decisively on that feedback. And, of course, continuing to maintain the trust of consumers, who deserve to be treated fairly and whose spending fuels growth across the economy.

2024 to 2025 has been a year of recalibration and considerable progress for the CMA. We are evolving, without losing sight of the fundamentals of our role – an independent body to promote competition and protect consumers.

There are several key things I see us doing differently today.

We’re embedding a pro-growth mindset across the organisation. That means really challenging ourselves to apply this lens when we prioritise and carry out our work, including thinking hard about how we can maximise the impact of our activities. And it means working to strengthen business and investor confidence, minimise uncertainty and avoid unnecessary burdens. That’s what our ‘4Ps’ framework is designed for. Pace, predictability, proportionality and process: common sense principles that can make a real difference to how we operate. We’re now rolling out tangible actions under these 4Ps across all our functions – from mergers and digital markets to consumer protection, competition enforcement and markets. This is a major shift, and while there’s more to do, I’m encouraged by the leadership and momentum behind it.

Listening more, and acting on what we hear, is becoming a defining feature of our approach. This is a big part of how we build confidence in a stable, coherent and well-informed regulatory environment. So, we launched the CMA Growth and Investment Council (GIC), helping to anchor our work firmly in the commercial realities facing businesses across the economy. We’re having more direct, constructive conversations, so we can learn from businesses’ experiences of dealing with the CMA. We’re building bridges with the startup and the investor communities, which are so fundamental to the growth mission. And we’re engaged in active dialogue across Parliament, government, the consumer protection landscape and wider civil society – strengthening accountability, forging collaborations and deepening our expertise.

At the same time, we’re continuing to deliver on our fundamentals. We can’t support growth and prosperity for all without driving forward our independent work to protect UK consumers and promote competition. Many examples in this Annual Report and Accounts (ARA) underscore the real-world impact this can have. Proposals for improvements in the infant formula market, to put money back in the pockets of parents and caregivers. Investigating Ticketmaster’s sale of Oasis tickets, to secure a fairer deal for fans. Launching our first 2 investigations under the new Digital Markets Competition Regime (DMCR), to boost investment and innovation in a critical growth sector. Supporting small businesses through our work on fake reviews. And tackling anti-competitive behaviour across multiple sectors – from pharmaceuticals to vehicle recycling.

Guided by a new Strategic Steer from government, we’re now making good headway against our 2025 to 2026 Annual Plan – keeping our contribution to the growth mission and to a predictable, proportionate regulatory environment front and centre. Transformative change doesn’t happen overnight, but the CMA has shown its ambition and laid out a clear path forward. I would like to extend my thanks to the Board, Sarah and the leadership team, and of course the CMA’s hardworking staff – all of whom have helped to set us firmly on the right track this year.

About us

The CMA is an independent non-ministerial UK government department and has been the UK’s primary competition and consumer authority since 2014. Our statutory duty is to ‘promote competition, both within and outside the UK, for the benefit of consumers’. The CMA has a UK-wide remit, with offices in Belfast, Cardiff, Darlington, Edinburgh, London and Manchester. At the end of the 2024 to 2025 year, we employed around 1130 people.

We adopt an evidence-based and integrated approach to our work, selecting the tools we believe will achieve the maximum positive impact for people and businesses (wherever they live and operate in the 4 nations), as well as for the UK economy.

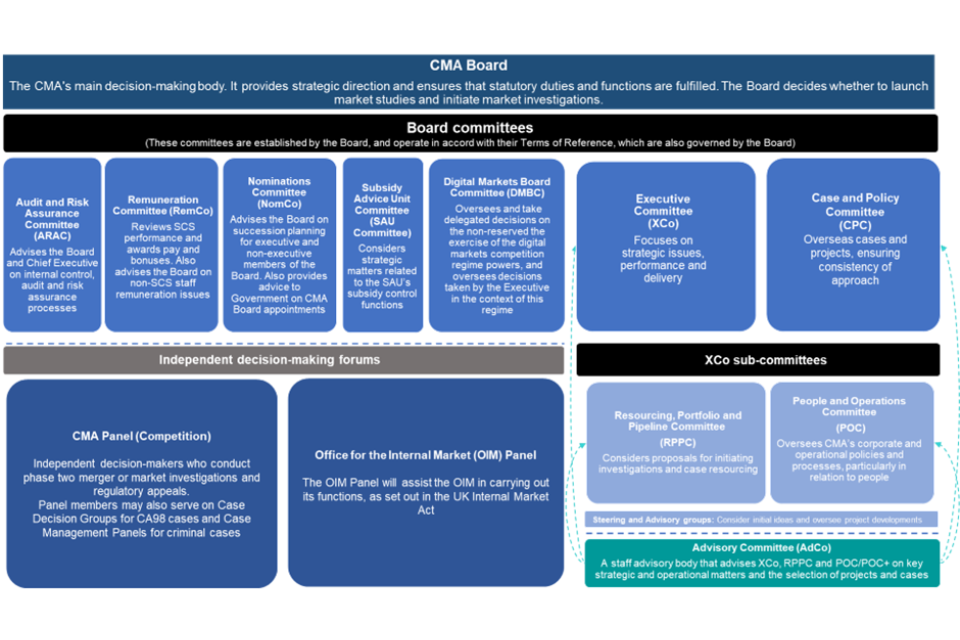

The CMA is funded by HM Treasury (HMT), sponsored by the Department for Business and Trade (DBT), and is accountable to the UK Parliament. We lay our Annual Plan and ARA in Parliament and each of the devolved legislatures. Our governance structure ensures fairness, independence, integrity, rigorous analysis, careful handling of sensitive information, and effective use of public funds.

We are governed by a Board, which consists of the Chair, Chief Executive, Non-Executive Directors (2 of whom are also members of the CMA Competition Panel, and one of whom is Chair of the Office for the Internal Market), Executive Directors and the Chief Operating Officer. The Chief Executive, as the CMA’s Principal Accounting Officer, is responsible for the economy and efficiency of the CMA’s handling of public monies. Some functions of the CMA must be performed by members of the CMA Panel. CMA employees are civil servants.

How the CMA supported growth this year

The 2024 general election brought an important change to the CMA’s operating environment: a new government whose number one priority is economic growth. While our purpose and statutory mandate to promote competition and protect consumers are unchanged, late last year we set out how we would rise to the challenge of supporting growth in both the work we do and how we go about it. With the clarity of a new Strategic Steer from government, and valuable stakeholder insights about how we can support business confidence, the second half of 2024 to 2025 marked a major shift in pace and ambition for the CMA in this area.

We began with a commitment to rapid transformation of the way we work, through our ‘4Ps framework’: Pace, Proportionality, Predictability and Process.

Following extensive engagement with businesses and investors, both domestic and international, the importance of these principles to business and investor confidence was clear. So we began an extensive change programme to embed them across our work. This activity is ongoing and has so far notably included:

In mergers

Ambitious new KPIs to significantly speed up pre-notification and straightforward phase 1 cases. We also launched a review of our approach to merger remedies; updated guidance to improve predictability over when the CMA may intervene; and published a Mergers Charter with clear principles and overarching expectations for how the CMA will engage with businesses and their advisors during merger reviews.

In digital markets and consumer protection

Publishing ‘Approach’ documents clearly setting out how the 4Ps would be at the heart of our implementation of the new regimes. From enhanced predictability, through new forward-looking ‘roadmaps’ of actions we might take in digital markets, to overhauling our consumer protection guidance to support proportionality for businesses working to become compliant with new rules.

In competition enforcement

Improving pace through rigorous streamlining of processes, changes to procedural guidance and greater use of technology, as well as more support for companies seeking to collaborate to achieve beneficial aims, such as innovation.

In markets

We will shortly be publishing an ‘Approach’ document which will set out how we intend to avoid any disproportionate or unnecessary chilling effect for businesses and investors when we dive deep into the issues that could be holding back the effective functioning of important UK markets. Our aims include shortening the end-to-end process for our markets work, bringing in sector expertise early in our analysis, adopting a more participative approach, and introducing a more disciplined focus on costs to business as we prioritise, scope and design remedies.

We instilled a strong pro-growth lens as we developed our 2025 to 2026 Annual Plan portfolio, with considerable progress thus far, including:

-

action in the UK’s £300 billion-a-year public procurement market, where competition is critical to the support provision of key public services, boost public sector efficiency and deliver value for money for taxpayers

-

action in critical infrastructure markets which form the backbone of a growing economy, including our recently launched civil engineering market study into rail and road

-

expert advice to government in key areas like industrial strategy, including 2 recently completed ‘policy sprints’ on innovation programmes and defence procurement to support development of the government’s white paper

-

a new Growth Programme of microeconomic research and analysis, focussed on the critical drivers and blockers of growth, with recent published work evaluating the impact of past industrial policies

-

guiding and supporting business collaboration that has a pro-growth impact, building on our work in net zero and healthcare to support the provision of critical skills for the UK

-

laying out how we will reflect the priorities in the Strategic Steer in our workplan for the year, including incorporating the Steer into our Pipeline and Planning discussions

Fostering new channels of constructive dialogue and feedback with businesses of all shapes and sizes, across the UK and internationally – from the largest global firms to challengers, new entrants, entrepreneurs, and investors.

-

established the CMA GIC with the CEOs and Chairs of 12 leading industry and representative bodies

-

a fresh approach to proactive, direct engagement, particularly with startups, scaleups, venture capital and private equity investors. This has included a series of roundtable discussions focused on investor confidence; targeted engagement initiatives, such as our Mergers Outreach Series with techUK and the StartUp Coalition; and high-profile events, including a webinar with the CBI exploring our approach to the new consumer regime

-

a roadshow to hear from businesses across the UK about how they would like to see the CMA contribute to growth through our 2025 to 2026 Annual Plan

These efforts have been underpinned by progress throughout the year across our core competition and consumer protection work – supporting innovation, productivity and incentives to invest while giving consumers confidence to engage in markets.

-

tackling anti-competitive behaviour in relation to pharma, housebuilding, the construction and repair of school buildings, digital advertising, wage-fixing and the trade of UK government bonds

-

securing commitments from Google and Amazon in relation to tackling fake online reviews, which will help business grow and win custom fairly

-

our work on the Vodafone/Three merger, which has been cleared with legally binding commitments to ensure 5G rollout, including an £11 billion investment over an 8-year period

-

launching strategic market status investigations into core digital markets of search and mobile ecosystems, as well as our ongoing market investigation into cloud services

-

supporting the smooth working of £129 billion of annual intra-UK trade, through our Office for the Internal Market (OIM); and providing 44 reports on subsidies through our Subsidy Advice Unit (SAU) to support government action in range of policy areas – including many relevant to the Industrial Strategy

2024 to 2025 summary

Our work this year was underpinned by the Ambitions in our strategy:

-

people can be confident they are getting great choices and fair deals. The CMA will always fulfil our mandate to uphold and protect consumer interests. This year, we secured the agreement of Google and Amazon to tackle fake reviews on their platforms; made recommendations to government to help parents make better choices for their babies when buying infant formula; and secured increased transparency and redress for consumers when faced with misleading sales practices

-

competitive, fair-dealing businesses can innovate and thrive. We are creating opportunities for businesses and investors across UK markets. This year, we launched our first investigations under the new DMCR; kept markets open and contestable through targeted and proportionate use of our merger control tool; and enabled businesses to collaborate whilst staying on the right side of competition law in relation to environmental sustainability initiatives

-

the whole UK economy can grow productively and sustainably. This year, we cleared the merger of Vodafone/Three with binding commitments to significant investment in the UK telecoms sector; launched a new Growth Programme of research and analysis to support the development of Industrial Strategy; and progressed competition enforcement in areas that help secure better value for public services and the UK taxpayer

Our impact this year includes an annual average of more than £3 billion in direct consumer benefits - over £24 for every £1 spent on our operations

Our indirect impact goes broader. We are helping businesses comply with competition and consumer law by issuing 67 warning and advisory letters, through guidance and campaigns. We have responded to 41 requests for advice from government. We have supported growth, including through casework in strategically significant areas of the economy.

We are responding to risk, and harnessing opportunities, so that we can continue to deliver effectively for those we serve.

We are:

-

leveraging our role in the international competition and consumer protection community to respond to an uncertain and fast-evolving external environment

-

driving forward inclusive stakeholder engagement, participative approaches, and our 4Ps framework to carry the confidence of the business community and the consumers we protect

-

doubling down on the way we measure and demonstrate our impact and performance, with the intention to introduce a new set of KPIs

-

introducing a new forward-facing operating model so we become more efficient and productive

Performance analysis: our performance this year in more depth

Sarah Cardell, CEO - Competition and Markets Authority

Chief Executive’s introduction

A new government was elected in July 2024 with a priority mission to drive economic growth. Public bodies can play an important part in this shared endeavour, helping to secure a more stable and prosperous future for the UK. This reporting year, the CMA has not only thought deeply about how we can best contribute to this critical effort – we have taken action.

At Chatham House in November 2024, I set out the ways in which a competition and consumer protection authority could best serve the UK in today’s uncertain and volatile environment. With helpful clarity brought by a new Strategic Steer from government, we have challenged ourselves to ensure that this year, particularly the latter half, marked a pivotal moment in the CMA’s contribution to growth, opportunity and prosperity for the UK.

How have we done this?

Firstly, by leaning into the challenge of the growth mission, particularly the focus on incentivising investment and delivering a modern Industrial Strategy.

Through a new Growth Programme, run by the CMA’s specialist Microeconomics Unit (MU), we are delivering valuable research and insights to help government refine its Industrial Strategy, including fresh analysis on industrial policy and its impact on productivity, investment, innovation, employment and competition.

Beyond this, we leveraged our cross-economy remit and expertise to deliver policy analysis and tailored advice to government around innovation programmes and defence procurement, feeding into development of the Industrial Strategy white paper. We focussed intensively on areas where the CMA could best contribute through direct action – notably public procurement and preparations to launch a market study on civil engineering. And we launched a CMA GIC, to help us collaborate with business leaders and investor groups and better understand opportunities to maximise the positive impact of our work.

Secondly, by recognising that how we go about our work matters to business confidence and the UK’s attractiveness to the investment our country needs, and without which we cannot secure sustained growth. The CMA opened our door, and our minds, this year to direct feedback about how we can evolve the way we work. This was the genesis of our ‘4Ps’ programme – the most significant transformation of the way we work since the CMA’s inception. We began with merger control but moved quickly – as we committed to doing – to embed ‘Pace, Proportionality, Predictability and Process’ across all CMA functions.

Finally, underpinning all of this – by maintaining our focus on the fundamentals of promoting competition and protecting consumers within an independent regime. The benefits of this work are profound and far-reaching – not just lower prices, but more choice, quality, security of supply, productivity, innovation and investment. This year, they delivered £3 billion in direct consumer benefits – over £24 for every £1 spent on our operations, with the indirect impact likely to be multiples of this figure. Doubling down on our core activities, situating them firmly within the context of our new Strategic Steer, not only supports growth. It can help maximise long-term benefits across the UK – unlocking opportunities for businesses of all shapes and sizes, securing fairer deals for consumers, and ultimately contributing to a more prosperous future for everyone.

We have challenged ourselves to be both ambitious and strategically focused in this work. This has included action in areas of essential spend like infant formula and vets services, which not only impact consumer finances but have a deep emotional resonance, as seen through the upswell of public engagement during the course of these cases. We have also targeted resources toward unlocking public sector productivity, taxpayer savings, and more efficient public services through tackling anti-competitive behaviour in a range of markets where government is the principal buyer.

After several careful years of preparation for our new responsibilities under the Digital Markets Competition and Consumers Act (DMCCA), we were ready to begin implementation of 2 landmark new regimes. In both cases, we set clear expectations and engaged with businesses and broader stakeholders to bring them on the journey with us. Reflecting the Strategic Steer and our 4Ps, we have applied a pro-growth lens and embedded pace, predictability, proportionality and process into both our approaches – from new forward-looking roadmaps of actions we might take, to phased implementation approaches to minimise burdens on business.

Through all our work this year has been a golden thread of listening, understanding and responding – to critical shifts in the policy landscape and to the views of key stakeholders. This has included work with established partners, like those we work with across the consumer protection landscape; and forging new and closer relationships, for example with the startup and investment community. We are grateful to everyone who contributed their time, perspectives and ideas – these have been fundamental to the transformation the CMA has started to make over the last year.

We will continue to progress with confidence and commitment against our 2025 to 2026 Annual Plan, which laid out how we will deliver our fundamental responsibilities in support of growth, opportunity and prosperity for the UK. Our Plan includes continued progress of our 4Ps (which is well underway), as well as updating our approach to measurement and reporting of our performance and the impact. We know this matters to the trust and confidence stakeholders have in us and our work – particularly as our contribution increases in important areas outside of formal casework, like economic research and helping businesses collaborate or do the right thing for their customers.

Looking back at what we have delivered through 2024 to 2025, and the transformation we have begun in response to a changing landscape, I am energised for what lies ahead and – as always – grateful to our committed and talented CMA staff.

Transparency and accountability

Parliamentary accountability

The CMA is accountable to Parliament for upholding our statutory duty to ‘promote competition, both within and outside the UK, for the benefit of consumers’. Alongside our regular reporting to Parliamentary Committees, we continue to deliver high levels of communications and outreach with Parliamentarians throughout the UK on diverse issues relating to our work. With a large intake of new MPs following the general election, the CMA also prioritised building understanding of our role among new Parliamentarians, including the impact of our work for their constituents.

Engagement and reach

The CMA has ramped up engagement considerably in recent years, with 2024 to 2025 representing another year of demonstrable progress. This activity continues to help us better understand the issues, identify where and how to act, and maximise the impact of our work. We’ve maintained constructive dialogue with consumer and business advocacy groups, as well as academic and third sector stakeholders. This year, we have placed particular emphasis on opening new channels with businesses and investors – including startups, scaleups, venture capital, and private equity who are vital to the UK’s growth ambitions. More detail on individual engagement activities is detailed in the remainder of this Performance Analysis.

Engagement snapshot

This year the CMA:

-

gave formal evidence to 4 Parliamentary committees at Westminster and in the devolved legislatures and engaged with 4 Westminster All-Party Parliamentary Groups (and Parliamentary groups) to explain our work

-

launched a new Growth and Investment Council (GIC) - and hosted a series of investor engagement events as part of our efforts to bring the perspective of the business community into our work

-

held 18 CEO and Chair bilateral meetings with leading business and consumer stakeholders

-

contributed expert speakers to more than 230 events, including conferences, webinars, podcasts and other events, communicating our work and listening to our stakeholders

-

built understanding of the new consumer regime with an engagement programme that captured more than 400 attendees at 6 events

-

met with more than 90 diverse stakeholders during the course of our first investigations under the new digital markets competition regime – living our commitment to a participative process

-

marked the tenth anniversary of the CMA in April 2024, bringing together over 150 external stakeholders to gather perspectives on our work at the start of a second decade of delivery

-

held an Annual Plan roadshow with 4 events across the country, discussing our plan to deliver growth, opportunity and prosperity for the UK

-

hosted an event on how the CMA could support growth in Greater Manchester, attended by 80 stakeholders

Our work this year: people can be confident they are getting great choices and fair deals

Overview

The CMA will always fulfil our mandate to uphold and protect consumer interests. This is one of our fundamentals: consumers deserve to know that the CMA has their back.

This year we continued our focus on areas where consumers spend the most money and time or need help the most, including areas of vulnerability. This work helps put money back in people’s pockets across everyday products and services. It also gives people the confidence to be active participants in markets – making informed choices, taking up new products and services and driving spending across the economy.

With many people in the UK still struggling financially, we continued our extensive efforts in relation to the cost of living this year, notably our work on veterinary services and groceries. We also undertook significant work to deter poor corporate practices which erode consumer trust and confidence, securing increased transparency (and in some cases redress) for consumers.

With the new Consumer Protection regime under the DMCCA in force, the CMA is now equipped to enforce consumer protection law more directly and effectively (see spotlight below).

Case study 1: Fake reviews

UK consumer spending is estimated at £23 billion annually, with 89% of people using online reviews when researching products or services. [footnote 1] Fake or misleading reviews, or scores influenced by fake reviews, can lead shoppers into purchases that are not right for them, as well as unfairly disadvantaging businesses which play by the rules. The CMA has taken extensive action to tackle these harms. As well as working closely with government to help shape new rules, we have investigated Google and Amazon over concerns they may have been breaching consumer law by failing to sufficiently protect people from fake reviews. In January 2025, we concluded our investigation into Google, one of the most used review platforms in the world, securing legally binding undertakings so people can have more trust in reviews they see. Google has agreed to take rigorous steps to detect and remove fake reviews; impose tough sanctions for rogue reviews; flag suspicious activity to consumers, including through ‘warning’ alerts; and make it easier for consumers to report concerning reviews. In June 2025, Amazon also committed to enhance its existing systems for tackling fake reviews, as well as tough sanctions for businesses using fakes to boost their product ratings, and users who post them.

These investigations, along with an explicit ban under the DMCCA, will reinforce consumer trust and confidence and help level the playing field for the millions of UK businesses who deserve to win out fairly for the products and services they deliver.

The CMA is now conducting an initial sweep of review platforms following the publication of our Fake Reviews Guidance in April 2025, seeking to identify those that may need to do more to ensure they are complying with consumer law.

Case study 2: Infant Formula

For many parents and carers across the UK looking to give their babies the best possible start in life, infant formula is a vital part of the weekly shop. Our work on price inflation and competition in the groceries sector identified this as an area of particular concern. Prices in the UK rose by 18-36%, depending on the formula brand, in the 2 years up to December 2023. In February 2025, we concluded a market study that found a combination of factors leading to poor outcomes for parents, who could be saving around £300 a year by switching to a lower priced brand. Many people choose a formula brand for the first time in vulnerable circumstances (often in hospital immediately after birth) and frequently without clear, accurate and impartial information. Many assume that choosing a more expensive product means better quality, despite NHS advice stating that all brands will meet your baby’s nutritional needs.

We set out comprehensive recommendations to UK and devolved governments to help parents make the best choices for them and their babies, including the removal of brand influence in healthcare settings and the strengthening of labelling and advertising rules. Governments across the UK are committed to the tight regulation of infant formula for public health reasons. So, our proposals are designed to help parents make the best choices for them and their babies, with access to better information, while sharpening the effectiveness of the existing rules. We have strongly encouraged governments to act on them to stop well-intended regulation driving poor outcomes for consumers. We stand ready to help implement the changes and support thinking around further measures.

Other significant work for people

We deepened our focus on markets where consumers spend the most money and time, progressing work in both groceries and veterinary services. In November 2024, we were able to provide reassurance to shoppers that almost all the 50,000 supermarket loyalty prices we analysed offered genuine savings against the usual price. We progressed our market investigation into veterinary services, a complex market of deep emotional resonance to the 16 million UK households that own a pet. We have consulted on proposed remedies and have now extended our investigation to ensure we can properly consider what we have heard. We are committed to delivering measured, well-targeted and proportionate remedies to address any concerns that are borne out at the end of our investigation, potentially including very limited price transparency, considerable dissatisfaction with the complaints system, and a lack of choice for budget-conscious pet owners across the UK.

The CMA has also progressed workstreams to tackle poor corporate practices that undermine consumer trust and confidence. In relation to potentially misleading online sales practices, we secured over £4 million in refunds for Wowcher customers and changes to such practices by both Wowcher and Simba Sleep, with the CMA taking Emma Sleep to court after it failed to address all of the CMA’s concerns. Building on landmark changes we secured in relation to misleading green claims in the fashion sector last year, Worcester Bosch committed to changing marketing of its ‘hydrogen-blend ready’ boilers. We are also progressing an investigation into Ticketmaster following widespread complaints about the sale of Oasis’ concert tickets.

We published 6 pieces of bespoke guidance to businesses about the application of consumer law in certain sectors:

-

trader recommendation sites (co-badged with Trading Standards partners)

-

environmental claims for fashion and green heating

These were backed up by extensive engagement and communications: for example, our guidance on fashion was supported by 10 events, 4 webinars and a podcast that have helped us reach over 2000 businesses.

The CMA harnessed our merger control powers to ensure that people do not suffer from worse deals and services through a loss of competition in consumer-facing markets. Topps Tiles offered solutions to our concerns about the impact of its merger with CTD Tiles in several areas of the UK, meaning we could clear the deal with remedies following a phase 1 investigation.

We also used our competition enforcement powers to reinforce well-functioning UK labour markets that help people access the right jobs and appropriate pay. This included fining 4 sports broadcast and production companies over £4 million after they admitted to breaking the law by colluding on rates of pay for freelancers.

Engagement and collaboration

As a leading member of the Consumer Protection Partnership we coordinated with organisations across the consumer landscape this year – from enforcers, like Trading Standards, to consumer advocates in the devolved nations, like Consumer Scotland – to identify and prioritise issues affecting UK consumers. We continue to lead the Consumer Concurrency Group, bringing together UK consumer protection enforcers to discuss best practice and joined-up approaches to emerging issues.

We engaged a broad range of stakeholders to ensure the new consumer protection regime under the DMCCA launched with strong understanding and support. This involved valued collaboration with consumer advocacy groups and business representatives keen to prepare their members for the new rules. Our outreach included a programme of engaging digital communications and 6 in-person and online events prior to the April launch, reaching over 400 business, industry, and consumer stakeholders across the UK.

Spotlight: New DMCCA consumer protection regime

Effective, proportionate consumer protection should give UK consumers the confidence that the CMA is actively standing up for their interests. It should also help fair-dealing businesses grow and invest on a level playing-field, confident that competitors cannot gain an unfair advantage by breaking the law. Under the DMCCA, the CMA will now be able to decide whether consumer protection laws have been infringed, order redress to affected consumers, and sanction businesses that fail to comply.

In our ‘Approach’ document, we set out our ambition for consumer protection (aligned with the new Strategic Steer) to promote consumer trust and confidence – helping to grow the economy while deterring poor corporate practices. We clearly outlined the robust and proportionate approach we will take to the new regime, including priorities during the first 12 months.

We expect early action on more egregious practices where the law is clear, including:

-

aggressive sales practices that prey on consumers in vulnerable positions

-

providing information to consumers that is objectively false

-

banned practices, including the new banned practice relating to fake reviews

-

fees that are hidden until late in the purchasing process – harming consumers and fair dealing businesses, by hindering effective price competition

-

contract terms that are clearly imbalanced and unfair, including those that impose unfair exit charges on consumers

At the same time, we have made clear our intention – through constructive engagement and clear guidance – to support the vast majority of well-intentioned businesses who want to do the best for their customers. So far, for example, we have published guidance on unfair commercial practices and on fake reviews, accompanied by short guides to help businesses understand what they need to do.

We recognise that, especially where the law has been updated or is less clear-cut, some businesses may be unsure what is needed or require time to put in place new processes. We will therefore focus initially on supporting compliance – because when businesses get it right, customers benefit.

Competitive, fair-dealing businesses can innovate and thrive

Overview

A level playing field in markets instils confidence to invest and creates the conditions for businesses to scale, supporting more dynamic UK markets and driving productivity, innovation and growth.

The CMA’s cross economy remit means we are well positioned to support these outcomes using a range of tools, aligned with the priorities in the Strategic Steer:

-

our markets work helps ensure that markets across the UK economy function effectively – identifying and removing barriers to entry and growth, and opening up opportunities for innovators, entrepreneurs, and investors

-

targeted and proportionate use of our merger control powers helps keep markets open and contestable, supporting innovation and productivity and incentives for investment

-

competition enforcement deters anti-competitive practices by a minority of firms, fostering a level playing field for fair dealing businesses. We are also actively identifying ways to help support lawful collaboration between firms in support of important policy objectives (like innovation), including through guidance and predictability around the types of conduct we will prioritise for investigation

-

through proportionate, targeted and transparent use of DMCR powers, we will help unlock opportunities for growth across the tech sector and wider economy

Case study 1: DMCR — our first investigations

In January 2025, a new digital markets competition regime came into force, representing a landmark opportunity to harness the benefits of investment and innovation from the largest digital firms, whilst supporting a fair shot at success for businesses across the UK tech sector. Aligned with the Strategic Steer, the CMA will use the regime to flexibly, proportionately and collaboratively unlock opportunities across the digital and wider economy.

In the broader landscape of evolving international intervention in digital markets, [footnote 2] the DMCR represents a unique UK approach, reflecting best practice principles for modern regulation of innovation-led markets – including our 4Ps: pace, predictability, proportionality and process. Procedurally, the regime applies only to the very largest firms, with clear conditions related to turnover, market power, and strategic significance. Rather than blanket rules, if a firm is designated with Strategic Market Status (SMS), the CMA can take a tailored approach to identifying and addressing specific harms.

We launched our first SMS investigations in January in relation to Google’s position in search and search advertising services, and Apple’s and Google’s position in their respective ‘mobile ecosystems’ which include the operating systems, app stores and browsers that operate on mobile devices.

Search

Google search accounts for more than 90% of all general search queries in the UK – with millions of people relying on it as a key gateway to the internet and more than 200,000 businesses in the UK relying on Google search advertising to reach their customers. These services matter to our economy and society – so it is vital that competition works well.

In June 2025 we published a proposed decision to designate Google with SMS in search. To support pace and predictability, alongside our SMS investigation we are looking in parallel at potential actions we might take were Google to be designated. Specifically, to provide greater predictability for Google and other market participants, we are going further than legislation requires by publishing a roadmap of how we propose to prioritise these actions during the first half of any designation period. Measures in the roadmap have 2 objectives. First, to ensure consumers and businesses are treated fairly and can have confidence in the way they interact with Google in search.

Second, to promote competition and innovation through targeted actions, such as ensuring that all firms (including Google) can compete and innovate in new AI-based search interfaces.

We have laid out a phased approach for any action we may take, including early priorities (‘Category 1 measures’) which we would expect to deliver some of the quickest benefits for UK businesses and consumers.

These focus on greater choice and control, including through:

-

choice screens: ensuring people can easily choose and switch between search services (potentially including AI Assistants) – by making default choice screens a legal requirement

-

fair ranking principles: ensuring Google’s ranking and presentation of search results is fair and non-discriminatory – with an effective process for raising and investigating issues

-

publisher controls: ensuring transparency, attribution and choice for publishers in how their content, collected for Search, is used in Google’s AI services (including AI Overviews and Gemini AI Assistant)

-

data portability: helping innovative new businesses to bring products and services to market by ensuring people can transfer their data (such as search history)

Following our consultation on the proposed SMS designation, we will make a final decision by 13 October. We expect to consult on a first set of Category 1 actions shortly after any designation decision, and to consider a second category of actions to address more complex issues over a longer period (starting in the first half of 2026).

Mobile ecosystems

Mobile ecosystems play a fundamental role in our society and economy. Almost 15,000 businesses are involved in the development of apps used on mobile devices in the UK, with revenue for app development totalling an estimated £28 billion. The CMA has undertaken a range of work focused on competition in mobile ecosystems. In particular our mobile browser and cloud gaming market investigation concluded in March 2025 and found that mobile browser markets are not working well for consumers and businesses, and holding back innovation in the UK. In January 2025 we launched SMS investigations into Apple’s and Google’s positions in their respective mobile ecosystems which include the operating systems, app stores and browsers that operate on mobile devices. We will soon publish our provisional decisions in these investigations, plus an accompanying intervention roadmap that sets out a workplan for interventions we will explore if the firms are designated with SMS.

Metrics

The DMCR includes a reporting requirement via a Monitoring and Evaluation Plan. Metrics relating to impact and value for money will only be available following conclusion of our first investigations. We will begin reporting on these in next year’s ARA. The following metrics relate to process and how effectively the regime has been designed, implemented and delivered:

| Metric | Search | Mobile ecosystems |

|---|---|---|

| Invitation to Comment (ITC) | Responses received: 51. Responses published: 47. ITC open 14 January to February | Responses received:55. Responses published: 53. ITC open 23 January to 7 March |

| Requests for Information (RFI) sent | Total sent: 87. Period between investigation launch (14 January) and 31 March | Total sent: 136. Period between investigation launch (23 January) and 31 March. |

| Stakeholders met with | 67 in total, comprising: 15 industry, 17 publishers, 12 advertisers, 12 trade associations/ industry bodies, 3 government bodies/ regulators, 8 other. Period between investigation launch (14 January) and 31 March | 30 in total, comprising: 17 industry, 4 trade associations/ industry bodies, 3 government bodies/ regulators, 6 other. Period between investigation launch (23 January) and 31 March |

Case study 2: Green Agreements Guidance

The CMA is committed to robust action to tackle and deter genuinely anticompetitive agreements that harm consumers and fair dealing businesses. However, we also recognise there will be situations where lawful collaboration between competitors could support innovation and other important objectives, including environmental sustainability goals. Here, we are keen to think creatively and provide clarity where possible.

Building on the launch of our Green Agreements Guidance and ‘open door policy’ in 2023, this year we published informal guidance to the Builders Merchants Federation (BMF) trade association. The BMF contacted the CMA while developing a proposal to help merchants assess the environmental impact of their supply chains using a single assurance provider. Based on the information provided, the CMA advised that we would not expect to take enforcement action. We went further, publishing our guidance to help support similar agreements by other businesses and industries. Separately, the Mineral Products Association Northern Ireland told us that the Green Agreements Guidance has empowered pioneering collaboration in the construction materials sector.

Further opportunities to support lawful business collaboration

We are also working with government and business stakeholders to identify other areas where the CMA could support beneficial collaborative activity – through bespoke advice, tailored guidance and making aspects of our existing guidance more accessible. We intend to supplement our existing labour markets guidance for employers, who have told us they want to better understand how to ensure hiring practices stay on the right side of the law. We have also been working with government and the higher education sector to understand concerns which may be preventing providers from working together in ways that could support research and innovation, and equip people with critical skills.

Other significant work relevant to our Businesses Ambition

The CMA creates opportunities for businesses using the full range of our statutory functions. We used our merger control powers in a proportionate and targeted way this year. More than 40,000 deals were announced last year. [footnote 3] Of these, we:

-

considered 1035 merger cases

-

carried out 41 phase 1 reviews

-

carried out 6 phase 2 reviews

In terms of outcomes for reviews that concluded this year:

-

27 were cleared unconditionally (at either phase 1 or phase 2)

-

7 were cleared with remedies (at either phase 1 or phase 2)

-

one was abandoned during the course of an investigation

-

no merger was subject to a prohibition decision

We also launched a wide-ranging review of our approach to merger remedies in March 2025 to support our aim that every deal that is capable of being cleared with effective remedies should be.

In carrying out our merger review function, we have helped ensure that business customers continue to benefit from choice and competitive prices in a wide range of markets. From grocery warehousing services (our phase 2 investigation into GXO’s purchase of Wincanton); to vital components in both aircraft design (our Safran/Collins phase 1 investigation) and construction (our phase 2 investigation into Lindab’s acquisition of HAS-Vent).

We also helped keep important markets open to innovation, which can be particularly important in high growth, high productivity parts of the economy. This year, for example, we cleared Synopsys’ purchase of Ansys at phase 1, agreeing remedies to resolve competition concerns in relation to the supply of semiconductor chip design and light simulation products in the UK.

Beyond merger control, we progressed our Competition Act investigation into Google’s open-display ad tech, provisionally finding that Google is using anti-competitive practices that could be harming thousands of UK publishers and advertisers. £1.8 billion is spent annually on open display ads, enabling many businesses to keep their digital content free or cheaper by using online advertising to generate revenue. It is essential that publishers and advertisers can benefit from effective competition and get a fair deal when buying or selling digital advertising space.

Engagement and collaboration

Throughout 2024 to 2025, we actively ramped up engagement with a diverse range of businesses – from global industry leaders to emerging challengers, entrepreneurs, and investors. We sought direct, constructive feedback on experiences of engaging with the CMA to understand how we can best contribute to a regulatory environment that makes the UK an attractive place to invest and do business. This was the genesis of our 4Ps framework.

As part of this work, for the first time we created opportunities for direct dialogue with the UK private equity and venture capital community through a series of roundtable discussions. We also sought to demystify the CMA and build confidence in our work among UK startups and scaleups as well as improving our understanding of this vital investment ecosystem. This included regular bilateral meetings with the Startup Coalition and Founders Forum, and speaking at conferences like tech.EU and the British Business Bank’s finance week, designed to support startup talent in the UK. We also created a bespoke outreach series around mergers, where a first webinar in March 2025 was attended by 120 stakeholders.

Spotlight: Deepening engagement and understanding of business - CMA Growth and Investment Council (GIC) and Strategic Business and Financial Analysis function (SBFA)

We know that the way in which we go about our work matters to business and investor confidence. We are committed to deepening both our engagement and our own expertise and understanding of the realities of doing business and investing in the UK. To support this goal, our GIC was launched at the start of 2025. This GIC brings together the leaders of 12 major UK business and investor groups in service of a common goal: to ensure that effective competition and consumer protection drive innovation, investment, and growth across the UK economy. The GIC has so far held 3 meetings and is already proving valuable as a source of insight and feedback (outside of individual cases), as well as relationship building across the economy. In particular, the GIC is helping to inform the CMA’s contribution to successful industrial strategy – for example, by helping us identify how we can best remove barriers to innovation and play a role in supporting the development of a competitive ecosystem from which globally consequential companies can grow.

The CMA’s new SBFA function aims to embed deep understanding of corporate strategies, investment and business models within our organisation. This has never been more important as AI reshapes markets, and investment strategies shift in response to global competition and technological disruption. SBFA will bring a stronger business and investor lens into our work in new and impactful ways.

Key areas of focus include:

-

understanding ‘digital ecosystem’ strategies – how firms structure and expand their influence across interdependent markets

-

business models in fast-moving areas like AI – the commercial realities of AI development, deployment, and monetisation

-

investment strategies and funding models – how firms raise capital, scale, and structure financial incentives across different stages of growth

Embedding business and investor perspectives across our work helps ensure that our regulatory decisions are rooted in commercial realities, enabling competition to drive sustainable growth, innovation, and consumer benefits. We are actively recruiting to the SBFA function to enhance our in-house business and investment acumen. In parallel, we are enhancing our use of external experts with deeper understanding in markets we are reviewing.

The whole UK economy can grow productively and sustainably.

Overview

Our work to secure great choices and fair deals for people, and to foster a level-playing field for businesses, both provide foundational support for a pro-growth economic environment. The CMA’s strategy goes further than this, however, by consciously prioritising sectors that offer the biggest potential for impact on innovation, productivity and promoting resilience through competition.

Since the general election in July 2024, the CMA has redoubled our efforts in support of the government’s growth mission, with helpful clarity from the new Strategic Steer:

-

we have supported investment, innovation and growth, including in strategically important sectors – for example, critical telecoms and digital infrastructure that businesses across the economy rely on

-

we have prioritised areas where competition can play an important role in the provision of key public services, helping to boost public sector efficiency and productivity (which are fundamental to growth) as well as supporting savings for UK taxpayers. We have opened or progressed investigations in several UK markets where the public sector is the principal buyer, or that government and taxpayers otherwise rely on – such as pharmaceuticals supplied to the NHS and the construction and repair of school buildings. We are now focusing on public procurement and working to reduce the vulnerability of this £300 billion market to bid rigging, which can inflate prices by 20% or more [footnote 4]

-

we have applied our expert advisory and research capabilities in a broad range of growth-related policy areas. We launched a new economic research programme out of our MU, specifically designed to analyse the levers and blockers for growth. We are supporting development of the Industrial Strategy by providing targeted policy advice to government in areas such as innovation programmes and defence procurement. Through our SAU, we are helping government and public authorities deliver important activity to achieve growth and other public policy objectives through subsidies. Our OIM supports national governments to provide regulatory clarity and stability for businesses to invest, grow and innovate

Case study 1: Vodafone/Three merger

Mobile services play an integral role in the daily lives of UK consumers and businesses, with demand for mobile data expected to grow further as customer and business needs evolve. The Vodafone/Three merger is a significant event in the evolution of this essential sector and for the access to 5G ‘standalone’ (5G SA) technology needed to support UK economic growth. Following an in-depth Phase 2 investigation, the CMA cleared the merger subject to legally binding commitments for the merged company to roll out a combined ‘best-in-class’ 5G SA network across the UK, requiring an estimated £11 billion investment over an 8-year period. [footnote 5] To protect consumers during the network rollout, price caps will be placed on certain mobile tariffs for three years, and wholesale prices and contract terms will be regulated. This is expected to prevent price rises and save UK consumers up to £216 million a year. [footnote 6]

This combined network will directly benefit over 30 million mobile connections, improving network quality and intensifying competition in the telecoms market. Consumers and businesses will benefit from more reliable data and voice services across the country, including better indoor coverage and services in remote and rural areas. The economic impact of the merger and the adoption of 5G SA technology is likely to be substantial and widespread. According to Ofcom, 5G SA promises faster speeds, greater capacity and low latency.[footnote 7] In terms of innovation, 5G SA has the potential to support a variety of uses, including ‘smart’ applications beyond mobile broadband, for example in e-healthcare, smart cities, connected vehicles and automated manufacturing. The merger will also expand fixed wireless access (FWA) access in the UK, offering a high-quality mobile-based service to compete with fixed broadband.

Case study 2: Competition enforcement to drive public sector efficiencies

Competition enforcement can drive down prices for consumers and businesses, as well as keeping markets open and creating a level playing field. As analysis by our MU this year found, the macro-economic benefits of this work for innovation, productivity and growth can be widespread. In particular, tackling anti-competitive behaviour in markets where government is a significant buyer can boost the public sector productivity that is foundational to growth, as well as helping to secure a better deal for the UK taxpayer. For instance, it is vital that the NHS gets maximum value from its spend on essential drugs – over £19 billion each year in England. [footnote 8] We built on our strong track record of protecting and delivering savings for the NHS this year through our investigation into Vifor Pharma, who we suspected of spreading misinformation about the safety of a rival treatment for iron deficiency. We secured a £23 million direct payment to the NHS and a commitment from the manufacturer about how it will interact with healthcare providers going forward.

Beyond healthcare, we took a range of actions this year in respect of public procurement, where the value of public investments can be severely compromised by anti-competitive behaviour. We launched an investigation into suspected bid-rigging in relation to a key government fund for improving the condition of school buildings, where we had reason to suspect that several companies providing roofing and construction services illegally colluded to rig bids to secure contracts. We took forward more than 40 engagements with public sector commercial teams to raise awareness of bid-rigging (around 80,000 officials have now been reached by the CMA in total). We engaged extensively right across government – from working level to Cabinet – offering to leverage our extensive data science and AI capability to identify anomalies in bidding data and indicators of potential illegal conduct. We stand ready to progress this work which could potentially deliver billions of pounds for UK taxpayers.

Other significant work relevant to our UK Economy Ambition

This year, the CMA settled a number of competition enforcement cases which will help to deter the unlawful behaviours which undermine the effective functioning of important markets. We imposed fines of over £77 million on car manufacturers and industry bodies that admitted to breaking competition law in relation to vehicle recycling and related advertising claims – behaviour that may lower the incentive for companies to innovate and invest in green initiatives. We found that 5 pairs of banks had broken competition law through past exchanges of information about UK government bonds and imposed fines totalling over £100 million. The CMA will shortly conclude our market investigation into the cloud services market, which provides vital infrastructure supporting improved innovation, productivity and scaling for businesses and organisations across the UK.

Our specialist advisory functions provided valuable insight to policymakers in areas relevant to growth. The OIM’s annual report found that intra-UK trade, worth £129 billion each year, continues to be stable, with no adverse impacts from regulatory developments across UK nations. An in-depth review of Single-Use Plastics shone a light on how businesses have adjusted to regulatory restrictions, and how governments are working together. The SAU published 44 reports to a range of public authorities, all of which were for subsidies meeting the threshold for mandatory referral to the SAU (including many that were relevant to the Industrial Strategy in areas such as clean energy, creative industries and life sciences).

Alongside output from our MU Growth Programme, we published our third State of Competition report this year. Findings indicate a modest weakening of competition in the UK over the last 25 years. This was less pronounced here, however, than in many other advanced economies including the US. We engaged closely with government on the findings (including around reduced economic dynamism), which offer valuable insights for policymakers when considering which sectors might best support growth and productivity.

Engagement and collaboration

The CMA has made concerted efforts this year to convene, listen and learn from stakeholders about how we can best support growth. Alongside our GIC and targeted engagement with investors and startups, we hosted a roundtable for trade associations (including manufacturing, defence and life sciences) to discuss drivers of and barriers to investment, innovation and growth in key industrial strategy sectors. We engaged extensively with stakeholders in the Nations and regions of the UK, including an engagement roadshow to Belfast, Cardiff and Edinburgh around our 2025 to 2026 Annual Plan to support growth, opportunity and prosperity in the UK. In November 2024, we hosted an event on how the CMA could support growth in Greater Manchester, attended by 80 stakeholders. Our OIM has engaged with governments across the UK as it carries out its advisory and reporting functions, with an additional focus on engagement with expert stakeholders to support development of its data strategy roadmap. The SAU actively engages with a wide range of public authorities across the UK to explain its role and to guide best practice in subsidy assessments.

Spotlight: Industrial Strategy

In our response to the UK government’s Industrial Strategy green paper, we welcomed the vision for a modern industrial strategy as a central pillar of the growth mission. We offered 2 central contributions the CMA could make:

-

provision of expert, cross-economy advice to government on how it can harness the power of competitive rivalry to maximise the long-term impact and value of its Industrial Strategy across the whole UK economy

-

use our powers directly in priority sectors to promote growth, through market studies and investigations

Aligned with the new Strategic Steer, the CMA has progressed this work through multiple strands of activity this year, working closely with government, our GIC, and businesses across the economy. Our Public Policy function led the development of 2 targeted ‘policy sprints’ to support the Industrial Strategy white paper: how innovation programmes can be designed increase competition and support new entrants and scaleups; and how we can increase the success of new entrants, and innovative scale-ups in defence procurement. Through our MU Growth Programme, we published new analysis on past industrial policies used by the UK and OECD peers, including their impact on productivity, investment, innovation, employment and competition. There is more to come from the Growth Programme, including workstreams on the impact of competition through the investment lifecycle; competition in supply chains; and barriers to the spread of new technology adoption and diffusion across the economy.

We are also looking proactively at the role of competition policy in supporting UK firms to scale up – recognised in the Industrial Strategy as a means of spurring sustainable, inclusive and resilient growth. We have heard from our GIC that the UK’s strong start-up ecosystem fails to translate into sufficient numbers of scaled up firms. We see several potential routes for a competition authority to help here.

Beyond research and advisory work, we have prioritised helping to unlock growth in priority sectors. We have been preparing to launch a Civil Engineering market study into road and railway infrastructure. This was launched in June to align with the publication of the 10-year Infrastructure Strategy and with the support of the National Infrastructure Commission, and will analyse structural issues that might be leading to slower, more expensive projects in the UK.

The impact of our work and the performance of the CMA

Impact

In our 2024 to 2025 Annual Plan, we committed to evolving our overall approach to measuring and reporting on our impact. Our new Strategic Steer also asks the CMA to continue developing a contemporary evidence base to demonstrate our impact on the UK economy, including how competition improves consumer outcomes, encourages innovation, drives investment and, ultimately, delivers economic growth. We have progressed considerable thinking in this area over the past year, with a clear plan in place to take forward further work.

Direct impact

The CMA regularly updates on the impact of our work through our formal reporting and communications across the year. In particular, our annual Impact Assessment (IA) published alongside this ARA, provides a measure of our direct impact, meaning the direct financial benefit of our work for UK consumers.

This year’s IA shows:

-

estimated annual average consumer benefits delivered over the last 3 years: £3 billion

-

estimated ratio of consumer benefits: operating spend: 24.5:1

As in previous years, the ratio of consumer benefits to operating spend exceeds the 10:1 target set by government. This also does not take account of the CMA’s fining and penalties income, which this year was £129.2 million.

Indirect impact

Our IA methodology is long-established, robust and internationally recognised. However, as highlighted in our 2024 to 2025 Annual Plan, it has limitations. The methodology covers direct, identifiable change as a result of CMA intervention – such as a merger being prohibited or cleared with remedies, or where a CMA intervention puts an end to anti-competitive conduct.

However, long-standing evidence (as well as a new MU literature review conducted this year) suggests this is a materially incomplete picture due to the exclusion of potentially significant indirect impacts from our work.

These include:

-

work to guide business behaviours: this includes efforts to encourage businesses towards compliance with competition and consumer protection laws, for example communications campaigns and issuing formal guidance

-

deterrence effects: both from fines imposed in formal cases and from other steps we take, such as issuing warning letters. Evidence suggests this is likely to be multiples of our direct impact

-

advocacy work: including recommendations and advice to government to support policy development and implementation

-

research and analysis: such as the work of our MU, which contributes to policy development and broader thought leadership

Evolving our approach

It can be challenging to quantify these indirect benefits, particularly when attempting to isolate the impact of the CMA’s work from broader factors (such as macroeconomic conditions or government policy interventions). However, it is becoming increasingly relevant in today’s shifting policy landscape – where independent, expert advice to government is more valuable than ever and with the CMA making greater use of informal tools to respond in an agile way to areas of public concern.

We are therefore:

-

exploring ways to update our methodology in the remainder of the 2025 to 2026 reporting year, aiming for a more holistic view of both our direct and indirect impact to be included in our 2025 to 2026 ARA

-

planning deeper research into indirect effects, including survey work similar to that conducted by the Office of Fair Trading, one of our predecessor bodies, between 2007 and 2011

-

developing a new Impact Assessment Framework for CMA teams to complete at project initiation

Guiding business behaviours

Consumer law

-

provided guidance to businesses to help them understand new obligations under the DMCCA, including shorter, more digestible guides for businesses on unfair commercial practices and fake reviews, along with an engagement programme for over 400 participants

-

published 6 pieces of bespoke guidance to businesses about the application of consumer law in certain sectors, backed up by engagement

-

issued 37 advisory letters related to concerns about possible law breaking

Competition law

-

in 2024 to 2025, the CMA’s income from fines was £129.2 million, representing a considerable deterrent impact

-

issued 17 warning letters and 13 advisory letters to businesses across a range of sectors - in relation to competition law, we collect and publish data on the geographical spread of letters issued

-

supported lawful collaboration between businesses, innovation, and environmental sustainability goals through our Green Agreements Guidance

Advocacy

-

privately responded to 41 requests for advice from UK and devolved governments, helping ensure that ongoing policy development considers competition and consumer protection implications

-

formally responded to 12 government consultations, including 4 devolved government consultations

-

made 11 separate recommendations to UK and devolved governments in relation to the infant formula market intended to improve consumer outcomes in this particularly vulnerable market.

Research and analysis

-

expert advice and analysis through the MU Growth Programme and ‘policy sprints’ on innovation programmes and defence procurement

-

valuable evidence gathering and reporting from the OIM on the impact of regulatory policy divergence between UK Nations through its Annual Report and deep dive on Single-Use Plastics

-

contribution to a joined-up regulatory approach in digital markets through the Digital Regulation Cooperation Forum (DRCF). Joint research on topics this year including synthetic media and digital identity, and on consumer use of generative AI

-

actively shaping the debate on the application of competition and consumer law at an international level through the Competition Committee of the OECD, and International Competition Network (ICN). The CMA assumed the chair of the ICN technologist forum and hosted the ICN’s annual conference in May 2025, welcoming almost 500 delegates from around 100 jurisdictions to Edinburgh to share the latest developments in competition law globally, with a particular focus on the role of competition in driving productivity, growth and unlocking technology innovation. We also offered practical assistance to sister agencies across the world, responding to 113 technical assistance requests throughout the year

Indirect macro-economic impact of competition and consumer enforcement

Analysis by the MU this year found that the indirect impact of competition and consumer enforcement beyond immediate, case-specific outcomes (like stopping a merger or penalising a cartel) can be significant.

Broader, economy-wide impacts that occur over time can include:

-

greater productivity, placing pressure on firms to become more efficient, ensuring more productive firms gain market share

-

a positive effect on innovation, for example leading to improvements in innovation diversity and technological advancement

-

increased economic growth (as measured by GDP) in the long-run

-

a positive and significant impact on welfare in an economy

Our performance

The CMA is committed to continuous evolution of the way we work, to ensure we deliver maximum impact for the UK. At the same time, regulators (including the CMA) are being asked by government to improve measurement and transparency of their performance, as well as to reduce costs to businesses by 25% over the course of this Parliament. Reflecting this context, we have undertaken considerable work to review and upgrade our approach to tracking and measuring our performance this year.

Under the guidance of our new Chief Operating Officer (COO), we have evaluated and overhauled our Management Information, carefully considering both the content and cadence of internal reporting and senior level discussion. Our 4Ps (designed to reduce burdens and strengthen business and investor confidence) provide a clear framework against which to track and measure progress on improving how we work. And, as above, we have progressed our thinking around how best to capture and report against the full impact of our work.

Evolving our approach

Going forward, we believe the CMA should hold a picture of our current performance which helps inform the following considerations:

-

have we delivered benefits for UK consumers?

-

have we fostered competition, particularly in key sectors of the economy?

-

have we increased awareness of, and compliance with, competition and consumer protection rules?

-

have we enhanced business confidence to invest in the UK?

-

have we reduced our regulatory cost for businesses?

Working with DBT, we are therefore developing a new suite of KPIs to equip us with a reasonable number of key metrics relating to:

-

the impact of our work (as described above)

-

the speed and efficiency with which we operate (reporting against our 4Ps framework, as we have done in this ARA)

-

engagement with, and views of, key stakeholders

We expect these KPIs to form part of the CMA’s new Framework Agreement with DBT, to be progressed through the Autumn and reported on in our 2025 to 2026 ARA.

We are also planning a range of surveys to give us more regular insights from our key stakeholders. This will encompass:

-

compliance awareness: are we driving greater awareness and compliance with our enforcement regimes?

-

impact on business environment/confidence: what is the CMA’s impact on themes like innovation, productivity, investment and growth (critical to the health of the UK economy)?

-

deterrence: to inform our understanding of the CMA’s deterrent effect

-

direct experience of engaging with the CMA: to understand what it’s like to engage with us, and where we can improve

Evolving the way we work

Whilst staying true to the fundamentals of our role, we are challenging ourselves to ensure the competition regime supports UK global competitiveness, investment and growth. Evolving how we go about our work is a core part of this commitment.

That includes embedding pro-growth considerations into our prioritisation decisions, in line with our new Strategic Steer from government. Consistent with the Steer, and reflecting feedback from businesses and investors, it also includes an extensive programme of operational transformation begun during the latter half of this reporting year. This 4Ps framework constitutes the most significant evolution of the way we work since the CMA’s inception - reinforcing business and investor confidence in the competition and consumer protection regimes and contributing to a pro-growth regulatory environment.

In this section, we provide further detail on how we are integrating the Steer and rolling out our 4Ps programme.

Strategic Steer: update on implementation

The UK government’s new Strategic Steer for the CMA was published in draft form in February and finalised in May 2025. It provides an important framework to guide the CMA as we carry out our statutory functions to promote competition and protect consumers.

Since publication of the draft Steer, we have been working to apply its themes in our work, including integrating considerations in the Steer into our Resourcing and Pipeline process. Some key areas of progress are detailed below.

1: Prioritise pro-growth and pro-investment interventions, wherever we have discretion

-

strong pro-growth lens across our 2025 to 2026 Annual Plan portfolio

-

action in areas like public procurement, where competition can help support provision of key public services, boost public sector efficiency and support taxpayer savings

-

action in critical infrastructure markets which underpin a growing economy, including our recently launched Civil Engineering market study

-

exploring how we can best support business collaboration and innovation, building on our Green Agreements Guidance, now working with universities in relation to skills

2: Prioritise action where there is a clear and direct impact in the UK, and think carefully about when and how we engage in global issues

- stringent prioritisation with impact on UK consumers and businesses top of mind – explicitly reflected in our Approach to the new DMCR, as well as the more proportionate approach we are taking to intervention in global deals under the merger regime

3: Work with other relevant regulators to ensure regulatory action is coherent, timely and that it supports dynamic markets, growth and investment in the UK

-

proactive and collaborative work with partners across the regulatory landscape such as the UK Regulators’ Network, the Consumer Protection Partnership and the UK Competition Network

-

dialling up co-operation with sector regulators further to review of competition concurrency arrangements

-

helping to drive joined-up regulation in digital markets through DRCF, including pilot of AI and Digital Hub which offered a one-stop service for expert, informal advice on cross-regulatory questions to UK tech innovators

4: Use the new digital markets competition regime independently, flexibly, proportionately and collaboratively to unlock opportunities for growth

-

approach to the new regime firmly rooted in the Strategic Steer and our 4Ps framework, including publication of new roadmaps to increase predictability

-

highly participative, ecosystem-wide engagement process around our first SMS investigations in January 2025

5: Use our range of tools to help grow the economy through promoting consumer trust and confidence, while deterring poor corporate practices

-

our approach to the new consumer protection regime explicitly reflects this steer, prioritising egregious conduct to shore up consumer confidence and safeguard the level playing field, whilst minimising burdens on business seeking to do the best for their customers (includes new guidance on the regime and in relation to 6 bespoke areas)

-

continued programme of markets work in consumer-facing sectors, including infant formula and veterinary services

-

secured significant outcomes through formal consumer enforcement investigations – including commitments from Google and Amazon on fake reviews; and from Wowcher, Simba Sleep, and Worcester Bosch on misleading sales practices

6: Tackling anti-competitive conduct which harms businesses and consumers as swiftly as possible, in line with the new duty of expedition

- embedding the 4Ps into Competition Enforcement, including careful consideration of how to get to the right outcomes in investigations in a timely manner – building on our approach this year, such as settling our investigation into Vifor Pharma with commitments. In general, achieving the right suite of interventions across the regime – including potential use of softer tools or consensual outcomes, where appropriate

7: Prioritise areas where competition can play an important role in driving efficiency and an enhanced user experience in the provision of key public services

-

strong focus on public procurement, as government pursues essential programmes to improve public services and invest in economic infrastructure

-

competition enforcement in areas where potentially unlawful conduct could be impacting the value of taxpayer spend and public sector productivity – including pharmaceuticals and school construction

8: Continue to provide government with evidence and advice on key policy issues, including on the development and implementation of Industrial Strategy

-

launch of new MU Growth Programme, focused on critical drivers and blockers of growth

-