HMRC annual report and accounts 2021 to 2022

Published 18 July 2022

Performance overview

Read an overview of our performance in financial year 2021 to 2022, including information about our vision, objectives and the way we operate.

1. Performance analysis

This section provides an analysis of how we delivered against our strategic objectives and the commitments we made for financial year 2021 to 2022. It also includes analysis of our financial performance and strategic risks.

Financial review

This financial review covers our financial performance, setting out how we have managed our operational costs, delivered efficiencies, and met our commitments around benefits and credits payments and expenditure on COVID-19 and UK Transition. It sets out how we have performed over time, illustrating trends in expenditure, running costs and comparisons against budget.

Where our funding comes from

This year we spent £5,717 million on resource costs (£4,998 million in operational costs and £719 million in one-off working tax credit payments) and £665 million on capital investments. We also paid £51,319 million in benefits, tax credits and reliefs.

Our funding for this expenditure comes directly from government, based on funding settlements at Spending Reviews, which we closely monitor and use to measure our financial performance.

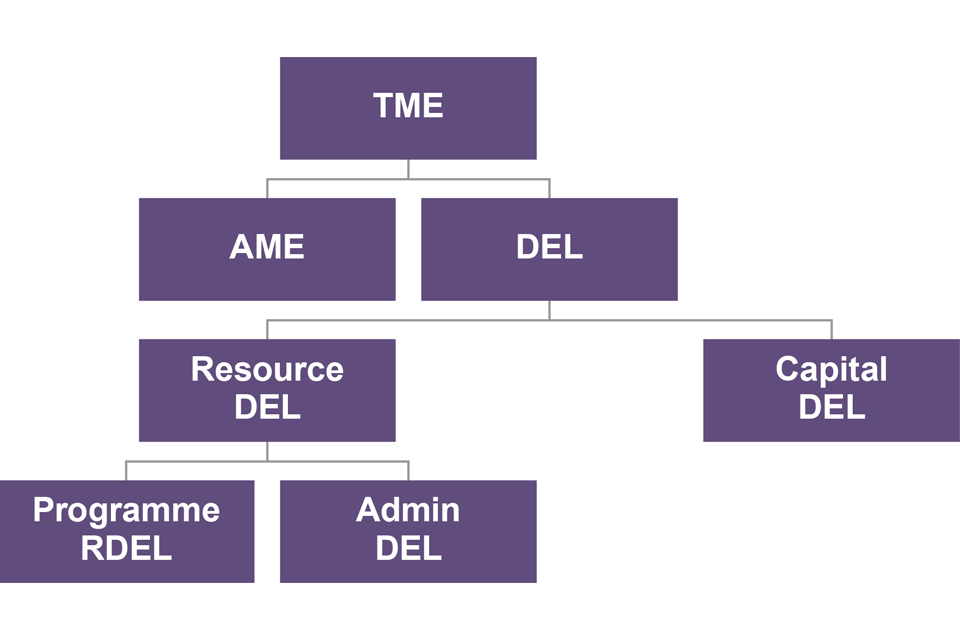

Figure 1: Our budgetary framework

HM Treasury sets the budgetary framework for government spending including our Supply Estimate that sets out the proposed maximum spending for each department and is voted on by Parliament at the start of the financial year.

The total amount a department spends is referred to as Total Managed Expenditure (TME). This funding is subject to strict HM Treasury controls and consists of budgets voted by Parliament (including HMRC running costs, COVID-19 support payments and Child Benefit payments) and those where appropriation is covered in other legislation (including tax credits, other reliefs and allowances and the National Insurance Fund).

TME is split into:

-

Departmental Expenditure Limit (DEL): this is the firm budget set for our controllable expenditure. It is split between spending on day-to-day resources and administration (operational) costs, otherwise known as ‘Resource (RDEL)’, and spending on investment, otherwise known as ‘Capital (CDEL)’. RDEL is further split between two strands called ‘Programme’, which covers areas like front-line activities, and ‘Administration’, which covers areas like support services and corporate services.

-

Annually Managed Expenditure (AME): these are our more flexible budgets for volatile or demand-led expenditure, including personal tax credits, other reliefs and allowances, and Child Benefit. This spending may be unpredictable and is more challenging to control, so it requires careful monitoring. HM Treasury reviews these budgets annually.

How we performed against our budget

The following table summarises how we performed against our budgetary controls.

Table 1: Financial performance

| Estimate/Budget (£m) | Expenditure (£m) | Expenditure compared to estimate (£m) | |

|---|---|---|---|

| Operational (RDEL) | 6,024.0 | 5,716.7 | 307.3 |

| Investment (CDEL) | 738.1 | 664.5 | 73.6 |

| Total DEL | 6,762.1 | 6,381.2 | 380.9 |

| Benefits, credits, reliefs (AME) | 59,069.1 | 51,319.1 | 7,750.0 |

| Total Managed Expenditure | 65,831.2 | 57,700.3 | 8,130.9 |

In 2021 to 2022 we had an operational (RDEL) underspend of £307.3 million. This underspend has been mainly driven by; a technical non-cash accounting change - depreciation charges £141 million lower than budget (due to an annual review of the amortisation periods for intangible assets under IAS 38, which identified a need to update useful lives and/or net book values), lower than expected costs of £74 million in UK Transition activity and £51.8 million in our transformation portfolio. Through these and other underspends (£40.5 million total, due mainly to recruitment delays and lower than expected IT system costs in our core work), we absorbed some costs of our COVID-19 activity.

The investment (CDEL) underspend of £73.6 million is mainly comprised of £34.6 million within UK Transition activity and £54.4 million within our transformation programme portfolio, offset by an overspend of £15.4 million within our core business as usual activity.

The benefits, credits and other reliefs (AME) underspend of £7,750 million is made up of £2,432 million COVID-19 costs, £2,609 million in personal tax credits and around £2,709 million in other reliefs and allowances. There are small variances across other benefit and credit lines.

Our financial performance is broken down further in the Statement of Parliamentary Supply (SOPS) tables, where more detail of the underspend is set out. The SOPS is a key accountability statement that shows, in detail, how a department has spent against their Estimate.

There are some technical differences between how our expenditure appears in the financial statements and how it appears in relation to our funding and the wider government accounts. To make this difference easier to understand, we have included a reconciliation in SOPS 2.

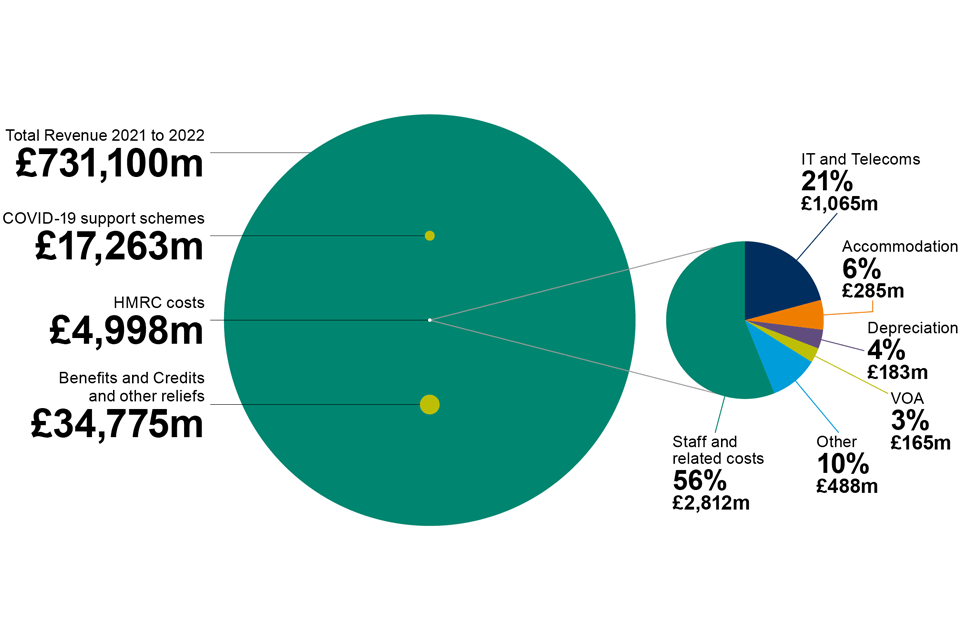

Expenditure compared to total tax revenue in 2021 to 2022

Figure 2 shows what it cost to run HMRC in financial year 2021 to 2022. For a running cost of £4,998 million, we raised £731.1 billion of tax for the UK’s public services and provided £52,038 million in financial support for COVID-19, personal tax credits, Child Benefit and other reliefs.

Figure 2: RDEL and AME expenditure relative to total revenue (note 1)

Note 1: Numbers may not sum due to rounding.

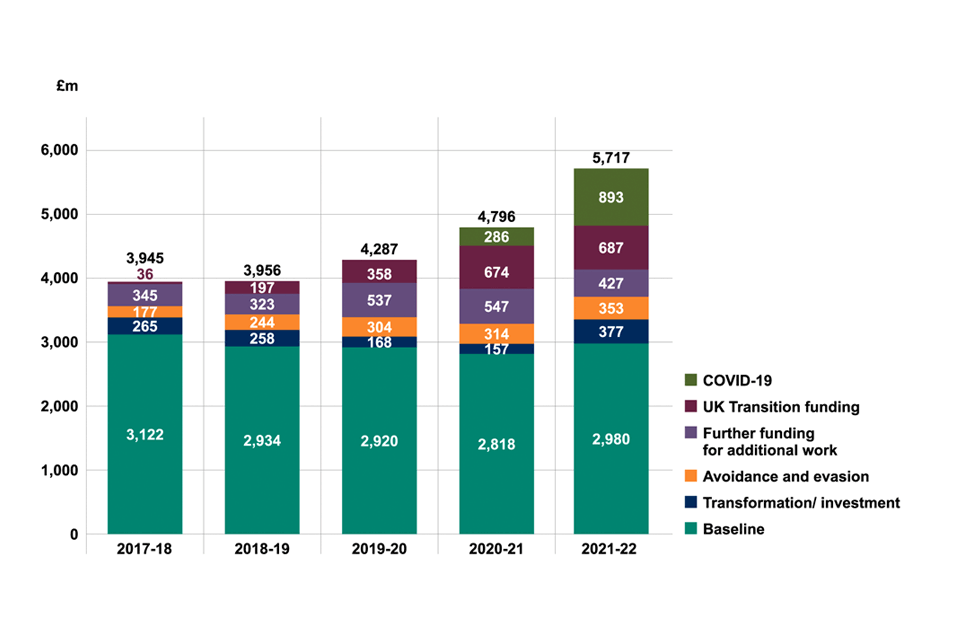

Figure 3 shows that operational (RDEL) expenditure increased in 2021 to 2022 due to the COVID-19 pandemic response, UK Transition and the increased use of service-based, rather than capital-based delivery in transformation projects. We have been delivering core business as usual activity throughout this time, but this was impacted by the need to prioritise responding to the COVID-19 pandemic and UK Transition activity.

Figure 3: Operational RDEL

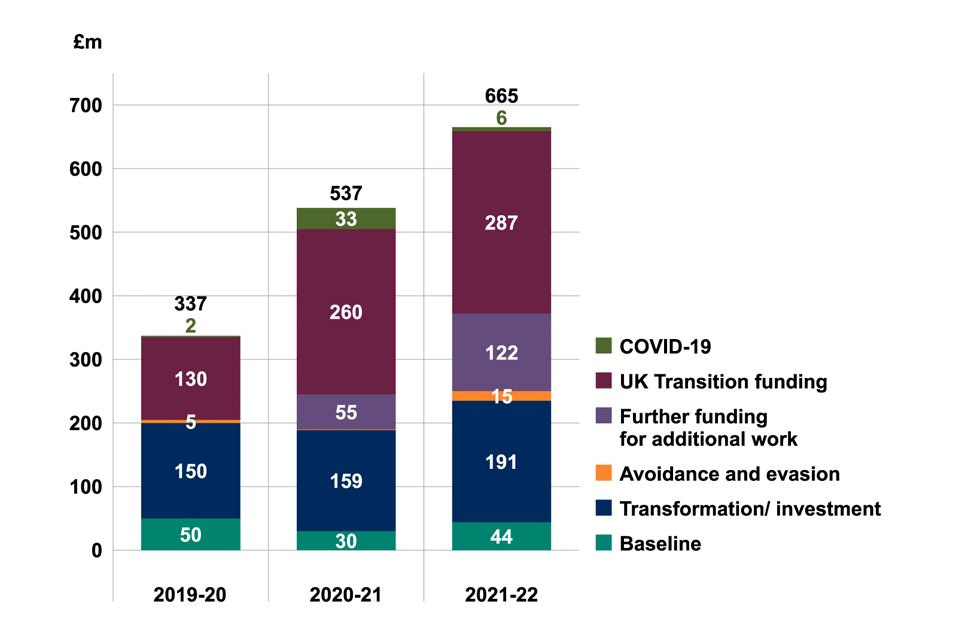

Figure 4 shows there has been an increase in our capital investment funding. This is largely due to UK Transition activity, for example delivering the Northern Ireland Trader Support Service and Inland Border Facilities. In addition, and as part of our transformation, we have increased activity on our Locations Programme, as well as a number of other major programmes such as Making Tax Digital, Securing our Technical Future, Technical Sourcing Programme, and our Contact Engagement Programme.

Figure 4: Capital Investment CDEL (note 1)

Note 1: Breakdown of capital investment figures between 2017 and 2019 is unavailable. Numbers may not sum due to rounding.

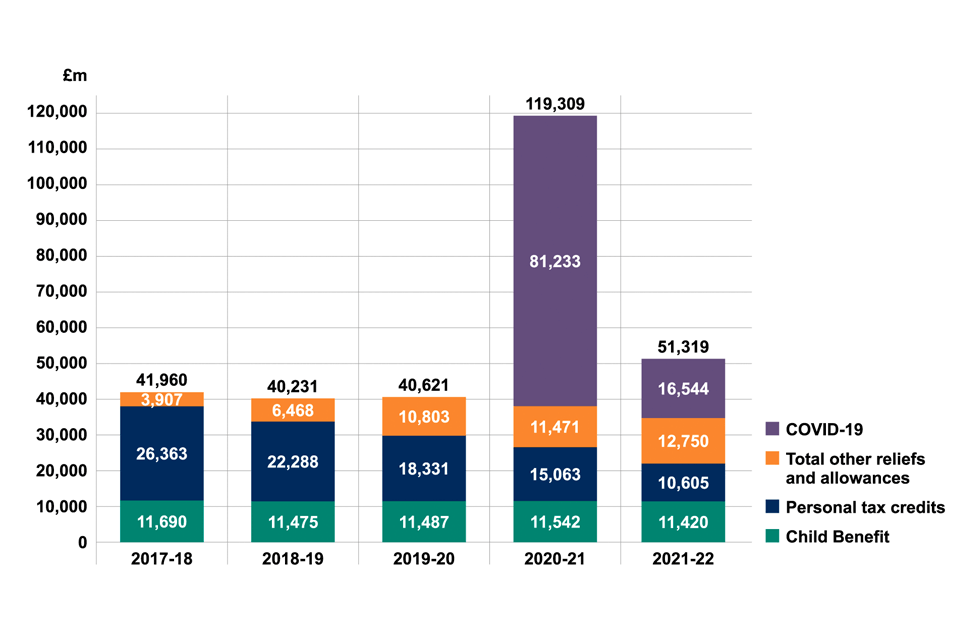

Figure 5 shows the trend of AME expenditure over time between 2017 to 2018 and 2021 to 2022.

Figure 5: Annually Managed Expenditure

AME expenditure significantly increased during 2020 to 2021 as a result of COVID-19 financial support scheme payments. This decreased in 2021 to 2022 following the closure of COVID-19 schemes on 30 September 2021. There was also a decrease in personal tax credits payments, as anticipated in the Office for Budget Responsibility forecast.

How we delivered more efficiently

We delivered sustainable efficiencies of £131 million over 2021 to 2022, compared to £100 million in 2020 to 2021. We achieved these efficiencies primarily through using fewer staff and making better use of technology and our estate.

Our Customer Compliance Group contributed £62 million of efficiency savings towards our overall total, through continuous improvement activities such as moving from manual to electronic records and making greater use of robotics and automation in day-to-day tasks.

Additionally, our locations programme contributed £37 million of efficiency savings towards our overall total. This programme enables us to become a smaller and more digital organisation. This is through making better use of the data we have to change the way we do our compliance work, as well as bringing colleagues together in 13 regional centres.

Figure 6 shows that over the five-year period starting in 2017 to 2018 and ending in 2021 to 2022, we have delivered total sustainable efficiencies of £746 million. Over this period, to ensure challenges such as our COVID-19 response were met, we had to reprioritise some of our transformation work, which has had an impact on our ability to deliver sustainable cost savings. We anticipate sustainable cost savings will rise in 2022 to 2023.

Figure 6: Cumulative sustainable efficiencies

| Year | £m |

|---|---|

| 2017 to 2018 | 229 |

| 2018 to 2019 | 395 |

| 2019 to 2020 | 515 |

| 2020 to 2021 | 615 |

| 2021 to 2022 | 746 |

Figure 7 shows that in 2021 to 2022, the cost of collecting taxes was 0.50p for every pound we collected in tax revenue. Factors affecting the cost of collection include the continuation of COVID-19 financial support schemes in the first half of 2021 to 2022 and economic recovery, as the measures taken during the pandemic were eased.

Figure 7: Cost in pence per £1 collected

| Year | Cost in pence per £1 collected |

|---|---|

| 2017 to 2018 | 0.53 |

| 2018 to 2019 | 0.52 |

| 2019 to 2020 | 0.51 |

| 2020 to 2021 | 0.51 |

| 2021 to 2022 | 0.50 |

A change to the methodology for the overall cost of collection has been made in 2021 to 2022 and the ratio is now shown net of Customs and International Trade. This is because the nature of expenditure has moved towards border control rather than revenue collection. The 2019 to 2020 and 2020 to 2021 ratios are also restated net of Customs and International Trade. The previously stated figures that included Customs and International Trade were: 0.54p (2019 to 2020) and 0.59p (2020 to 2021).

Impacts on our expenditure: COVID-19

Our central role in providing financial support to customers during the COVID-19 pandemic had an impact on expenditure within our Resource Accounts.

On 20 March 2020, as part of the government’s response to the COVID-19 pandemic, the Chancellor announced a number of financial support schemes to protect jobs and businesses which we were responsible for delivering.

In 2021 to 2022 we continued to deliver two of these financial support schemes – the Coronavirus Job Retention Scheme and the Self-Employment Income Support Scheme – until the schemes closed on 30 September 2021. On 3 March 2021 the Chancellor also announced an additional one-off payment of £500 to eligible working households receiving tax credits who may have seen a reduction in their wages as a result of the pandemic. Overall, we provided £17,263 million of support payments to individuals and businesses affected by the pandemic in 2021 to 2022, and a total of £98,496 million across both financial years in which the schemes ran. These payments are shown in table 2.

Table 2: COVID-19 support scheme payments

| COVID-19 support schemes spend | Resource Account note | 2021 to 2022 Outturn (spent) (£m) | 2020 to 2021 Outturn (spent) (£m) |

|---|---|---|---|

| Coronavirus Job Retention Scheme | 4 | 8,201 | 60,677 |

| Self-Employment Income Support Scheme | 4 | 8,343 | 19,716 |

| Eat Out to Help Out | 4 | – | 840 |

| Working Households Receiving Tax Credits | 4 | 719 | – |

| Total | 4 | 17,263 | 81,233 |

Our day-to-day running costs have continued to be impacted by COVID-19. This was primarily due to staff costs (including contingent labour) that were necessary in order to deliver the financial support schemes and compliance work, as well as estates and other running costs.

Table 3: COVID-19 administrative expenditure

| COVID-19 RDEL | 2021 to 2022 Outturn (spent) (£m) | 2020 to 2021 Outturn (spent) (£m) |

|---|---|---|

| Staff costs | 126 | 197 |

| IT costs | 7 | 53 |

| Other costs | 41 | 36 |

| Capital costs | 6 | 33 |

| Total | 180 | 319 |

Within the overall total expenditure on COVID-19, an amount of £125 million was ringfenced (as per the 2021 to 2022 Supplementary Estimate). Of this amount we spent £119 million, which resulted in an unused ringfence underspend of £6 million. This is due to reductions in estates, IT and output management costs following the closure of the COVID-19 financial support schemes.

Impacts on our expenditure: UK Transition

Our total budget for supporting the UK’s Transition from the EU was £1,082.5 million for 2021 to 2022, and our outturn was £973.8 million. The underspend of £108.7 million (10%) was mainly due to:

- lower demand for UK Transition activities: £31.4 million lower staff and other costs and £2.6 million reduction to support grants for small and medium-sized businesses

- £36.5 million reduction in spend on infrastructure delivery and operational running of Inland Border Facilities

- £30.9 million reduction in spend on border IT systems due to policy driven scope and design changes

- £7.3 million saved in the running of the Trader Support Service through efficiencies within the live service

Table 4: UK Transition programme expenditure

| UK Transition | 2021 to 2022 Outturn (£m) | 2020 to 2021 Outturn (£m) |

|---|---|---|

| Staff and other costs | 250.5 | 340.7 |

| Customs and SME support grants | 24.6 | 54.3 |

| Infrastructure | 161.5 | 112.2 |

| IT project costs | 388.5 | 325.9 |

| Trader Support Service | 148.7 | 102.7 |

| Total | 973.8 | 935.8 |

Significant balance sheet movements in 2021 to 2022

The following movements in asset and/or liability balances took place during this financial year:

Transfer of 100 Parliament Street (our head office) to the Government Property Agency

The decision for the Government Property Agency to take ownership of government offices (in line with the stated aim of delivering greater resilience and flexibility across the Crown Estate) resulted in a £207.6 million reduction in our balance sheet and a £40.1 million impact on our expenditure.

Increase in balance sheet value of our intangible assets by £471.3 million (29%)

The majority of intangible software assets are acquired as assets under construction, prior to going into live service.

The increase in the net book value of £471.3 million from the balance at 31 March 2021 (£1,606.5 million) to 31 March 2022 (£2,077.8 million) is mainly due to:

- additions to assets under construction of £526.5 million mainly comprising the development of IT software

- net increase to net book value from revaluation of IT software of £64.0 million

Significant reduction of £5.2 billion in cash and cash equivalents

The most significant element of the cash and cash equivalents balance at 31 March 2021 was the balance of monies drawn down to fund the COVID-19 support scheme payments. HM Treasury confirmed that part of the balance could be used for 2021 to 2022 ‘business as usual’ (BAU) spending rather than monies required for this purpose being drawn down separately. Between 1 December 2021 and 31 March 2022, £4,333.6 million of funds had therefore been transferred to the account for BAU spend, thus contributing substantially to the reduction in cash and cash equivalents at 31 March 2022.

COVID-19: our vital role in supporting customers and the UK economy

HMRC was at the very centre of the government’s economic response to the COVID-19 pandemic. We acted quickly and effectively to deliver financial support schemes that helped millions of individuals and businesses and protected the UK economy during unprecedented circumstances. Our latest estimates show that error and fraud rates in these schemes were significantly lower than originally thought.

How we delivered financial support

-

Coronavirus Job Retention Scheme (CJRS): CJRS was created to pay a proportion of the wages of employees who were furloughed during the COVID-19 pandemic. From April 2020, CJRS supported 11.7 million unique employments and 1.3 million businesses. HMRC expenditure on CJRS was over £68 billion. The scheme was initially due to end in April 2021 but was extended and closed on 30 September 2021. With each extension, the cut-off date changed, making more of the employer population eligible. From July 2021, an employer contribution towards the cost of unworked hours was introduced, which began at 10% in July and rose to 20% in August and September.

-

Self-Employment Income Support Scheme (SEISS): SEISS was created to support self-employed individuals and members of partnerships whose businesses had been impacted by COVID-19. A total of 5 grants were available, covering the period from the start of the pandemic to the closure of the scheme on 30 September 2021. SEISS grants 4 and 5 were paid out in financial year 2021 to 2022, and were based on 2019 to 2020 tax returns, which meant more individuals were potentially eligible to claim a SEISS grant for the first time. In 2021 to 2022, we paid out over £8.3 billion via SEISS 4 and 5. In total we paid out over £28 billion across all five SEISS grants.

-

Statutory Sick Pay Rebate (SSPR): SSPR was launched to help small to medium-sized employers with the cost of statutory sick pay during a severe wave of COVID-19. The original scheme ended on 30 September 2021, with customers allowed to make claims and amendments up to 31 December 2021. In 2020 to 2021 the scheme paid out a total of £62.5 million. In December 2021 the government announced that the SSPR scheme would be reintroduced due to the Omicron variant. We re-opened the online SSPR claims service on 19 January 2022, allowing claims to be backdated to 21 December 2021. The scheme closed on 24 March 2022, and in total we paid over £126 million.

-

Working Households Receiving Tax Credits scheme (WHRTC): The government made a one-off payment of £500 to working households receiving tax credits, to provide extra support during the pandemic. In 2021 to 2022, over 1.4 million customers were paid a total of £719 million.

-

Other measures: In January 2022, we gave Income Tax Self Assessment customers an additional month to file their tax return whilst avoiding a penalty, and until 1 April 2022 to pay or set up a Time to Pay agreement without incurring further penalties. We also introduced a route for agents to submit a bulk appeal for late filing penalties on behalf of their clients, if they had claimed COVID-19 as a reasonable excuse.

Over the course of the pandemic, we also delivered more than 80 targeted smaller measures in response to COVID-19. These clarified tax rules and made temporary changes to make tax easier for customers. Of these easements, 17 have since been made permanent.

Estimates of error and fraud rates in the COVID-19 financial support schemes

We published error and fraud estimates for the COVID-19 financial support schemes in our 2020 to 2021 Annual Report and Accounts. Since then, additional data has become available, and we have refined our methodology to improve the quality of our estimates for 2020 to 2021 as well as providing new estimates for 2021 to 2022.

We have recently completed and reviewed the results of a Random Enquiry Programme (REP) for CJRS claim periods from 1 March 2020 to 30 June 2020 and from 1 July 2020 to 31 October 2020. For SEISS, we now have Income Tax Self Assessment tax returns for 2020 to 2021. We also have further insight from our ongoing compliance activity.

This new data and analysis has led us to assess the total level of error and fraud in the schemes as significantly lower than we originally thought. This is largely driven by our reassessment of error and fraud in CJRS.

Previous provisional estimates for the total value of error and fraud in 2020 to 2021 across CJRS, SEISS and EOHO (Eat Out To Help Out) stood at between £4.5 billion and £8.0 billion, with a most likely estimate of £5.8 billion (an error and fraud rate of between 5.5% and 9.9% with a most likely estimate of 7.2%).

Across the full two-year lifecycle of the three schemes (covering 2020 to 2021 and 2021 to 2022), the total value of error and fraud is now estimated to be between £3.2 billion and £6.4 billion, with a most likely estimate of £4.5 billion (an error and fraud rate of between 3.3% and 6.5% with a most likely estimate of 4.6%). This is less than the previously published range for 2020 to 2021 alone.

For CJRS, new data means that we now attribute a larger proportion of the error and fraud to error than we previously published and, where we have more granular data from the REP, we have observed that the value of error and fraud in claims made by employers is low. As the economy began to re-open, the government changed the design of the CJRS scheme to recognise that some businesses could start to trade again, and people could begin returning to work in a measured way. The level of CJRS error and fraud fell considerably following the introduction of flexible furlough, which enabled customers to bring back employees part-time and still receive a grant to pay employees for hours not worked.

Table 5: Detailed error and fraud provisional estimates for CJRS by grant claim period (note 1) (note 2)

| Claim periods to which the policy applied: | 1 March 2020 to 30 June 2020 | 1 July 2020 to 31 October 2020 | 1 November 2020 to 30 September 2021 |

|---|---|---|---|

| CJRS rate | 8.0% [5.2% to 12.0%] | 2.8% [2.0% to 3.8%] | 2.8% [2.0% to 3.7%] |

| CJRS value | £2,335m [£1,607m to £3,708m] | £382m [£253m to £480m] | £742m [£534m to £987m] |

Note 1: Most likely estimates are presented together with the simulated 95% confidence interval for each phase of the CJRS scheme.

Note 2: The final claim period of the CJRS policy runs across the two financial years 2020 to 2021 and 2021 to 2022 as shown in the table above.

For SEISS, increased targeting in SEISS grants 4 and 5 resulted in a reduction in total expenditure in 2021 to 2022. We designed SEISS grants 4 and 5 using 2019 to 2020 tax returns as the basis for eligibility and grant calculation, then introduced the financial impact declaration turnover test for the fifth grant, which helped to target and reduce its cost. As anticipated, when we introduced grants 4 and 5, this opened additional avenues for error and fraud, so rates did increase.

Table 6: Detailed error and fraud provisional assessments for SEISS during financial year 2020 to 2021 by grant phase (note 1)

| Grant phase: | SEISS 1: 13 May 2020 to 13 July 2020 | SEISS 2: 17 August 2020 to 19 October 2020 | SEISS 3: 20 November 2020 to 29 January 2021 | SEISS 4: 22 April 2021 to 1 July 2021 | SEISS 5: 29 July 2021 to 30 September 2021 |

|---|---|---|---|---|---|

| SEISS rate | 3.4% [2.5% to 4.2%] | 3.3% [2.5% to 4.0%] | 2.9% [2.1% to 4.0%] | 2.3% [1.5% to 3.8%] | 8.6% [7.5% to 11.1%] |

| SEISS value | £258m [£192m to £320m] | £197m [£150m to £239m] | £176m [£130m to £251m] | £130m [£81m to £212m] | £246m [£212m to £316m] |

Note 1: Most likely estimates are presented together with the simulated 95% confidence interval for each grant phase of the SEISS scheme.

The estimated levels of error and fraud in the Working Households Receiving Tax Credits scheme (WHRTC) were very low, only between 0.4% or 0.6% (£2.6 million to £4.2 million), attributable to the design of this payment. Post-payment compliance on this work is carried out by our tax credits compliance teams and is not part of the Taxpayer Protection Taskforce.

Table 6 shows our updated provisional estimates for 2020 to 2021 and our new provisional estimates for 2021 to 2022 for all the support schemes, except WHRTC.

Read more detailed breakdowns of error and fraud in the COVID-19 financial support schemes in the Principal Accounting Officer’s Report and within note 4 of the Resource Accounts.

More detail on our approach to estimating the level of error and fraud can be found in our supporting technical publication.

Table 7: Estimates of error and fraud in the COVID-19 support schemes prior to HMRC’s post-payment compliance activities

| 2020 to 2021 | CJRS | SEISS | EOHO | Total |

|---|---|---|---|---|

| Claims plus accruals (£m) (note 1) | 61,507 | 19,745 | 842 | 82,094 |

| Unprompted repayments and disclosures (£m) | (797) | (41) | (2) | (840) |

| Net cost (£m) (note 2) | 60,710 | 19,704 | 840 | 81,254 |

| Error and fraud (%) (note 3) | 5.3% [3.7% – 7.6%] | 3.2% [2.4% – 4.1%] | 8.5% [5.1% – 11.8%] | 4.8% [3.4% - 6.8%] |

| Error and fraud amount (£m) (note 3) | 3,218 [2,246 – 4,614] | 631 [473 – 808] | 71 [43 – 99] | 3,920 [2,762 - 5,521] |

| 2021-22 | CJRS | SEISS | EOHO | Total |

|---|---|---|---|---|

| Claims plus accruals (£m) | 8,727 | 8,372 | – | 17,099 |

| Unprompted repayments and disclosures (£m) | (113) | (17) | – | (130) |

| Net cost (£m) (note 2) | 8,614 | 8,355 | – | 16,969 |

| Error and fraud (%) (note 3) | 2.8% [2.0% – 3.7%] | 4.5% [3.5% – 6.3%] | – | 3.6% [2.7% – 5.0%] |

| Error and fraud amount (£m) (note 3) | 241 [172 – 319] | 376 [292 – 526] | – | 617 [464 – 845] |

| Cumulative totals | CJRS | SEISS | EOHO | Total |

|---|---|---|---|---|

| Net cost (£m) | 69,324 | 28,059 | 840 | 98,223 |

| Error and fraud (%) (note 3) | 5.0% [3.5% – 7.1%] | 3.6% [2.7% – 4.8%] | 8.5% [5.1% - 11.8%] | 4.6% [3.3% - 6.5%] |

| Error and fraud amount (£m) (note 3) | 3,459 [2,418 – 4,933] | 1,007 [765 – 1,334] | 71 [43 to 99] | 4,537 [3,226 to 6,366] |

| COVID-19 yield achieved (£m) (note 4, note 5) | 762 | |||

| Error and fraud amount minus COVID-19 yield to date (£m) (note 6) | 3,775 [2,464 – 5,604] |

Note 1: Claims and accruals as reported in HMRC’s Annual Report and Accounts 2021 to 2022. Accruals are amounts relating to claims made in a financial year that were paid out in a later financial year.

Note 2: Repayments occur when customers entitled to a grant choose to repay it, or when customers repay following a prompt from HMRC or an unprompted disclosure. For the error and fraud calculation, when the repayment is prompted, this is considered as covid yield so is deducted later in the calculation. The error and fraud estimate then represents the amount available for recovery by HMRC through post-payment compliance.

Note 3: Ranges as presented in square brackets represent the lower and upper limits of the simulated 95% confidence interval presented together with the most likely estimate. Total percentages by scheme and financial year have been rounded to the nearest 0.1%.

Note 4: Defined as post-payment compliance only.

Note 5: Of which £536 million is from before the Taxpayer Protection Taskforce commenced and £226 million reported above to the end of 2021 to 2022 year.

Note 6: Totals given do not account for ongoing compliance activity in 2022 to 2023.

How we acted to prevent or recover error and fraud

In 2021 to 2022 we prevented more than £350 million from being lost through error and fraud in the COVID-19 financial support schemes, either by preventing losses through pre-payment compliance activity or by recovering overclaimed grants. This brought the total amount stopped or recovered since the start of the schemes to more than £1.2 billion, with compliance activity still ongoing.

Preventing losses before payments were made

We designed the COVID-19 support schemes so that payments reached claimants quickly and prevented fraud and error through eligibility criteria and the claim process itself. We always knew they could be attractive to fraudsters and claimants could make mistakes. However, volume of claims for essential support, and the speed at which this had to be provided, meant it was not possible to prevent every case of fraud and error prior to a payment being made. We prevented over 100,000 ineligible or mistaken claims from being made by building automated controls into the digital claim process, while our data and risking experts blocked suspicious claims that showed signs of criminal activity.

Since the schemes started, we blocked claims worth a total of £425 million via pre-payment checks, including 38,000 claims worth over £125 million in 2021 to 2022 and 29,000 claims worth over £300 million in 2020 to 2021.

Table 8: 2021 to 2022 pre-payment compliance activity results from blocked/rejected claims

| Number of pre-payment blocked/rejected claims | Value of pre-payment blocked/rejected claims £m | |

|---|---|---|

| CJRS | 18,796 | 86.25 |

| SEISS | 20,034 | 38.90 |

| EOHOS (note 1) | 0 | 0 |

| Total | 38,830 | 125.15 |

Note 1: EOHOS (Eat Out To Help Out Scheme) was closed in August 2020.

Post-payment compliance

We began post-payment compliance activity in July 2020 as soon as we had the powers to do so. Since then, we have taken a supportive and reasonable approach where mistakes have been made, giving customers the opportunity to correct them without fear of sanctions.

The government invested over £100 million in a Taxpayer Protection Taskforce of around 1,200 HMRC staff to combat error and fraud in the schemes. In 2021 to 2022 the taskforce opened more than 27,000 one-to-one compliance interventions and contacted over 63,000 people via letter campaigns. We have recovered around £226 million in 2021 to 2022, in addition to the £536 million we recovered during 2020 to 2021.

We do not seek to actively identify or address claimants who have made small errors, although we will correct them, working with the claimant, if we find them. We are focussing on identifying claimants who have knowingly overclaimed grants or retained them when they know they are not entitled to do so.

The table below sets out the post-payment compliance activity we have undertaken for each of the schemes during 2021 to 2022.

Table 9: 2021 to 2022 post-payment compliance activity results

| Number of One to Many nudge letters (note 1) | Value of One to Many Disclosures (£m) | Number of One to One Enquiries opened | Number of One to One Enquiries closed | Value of One to One Enquiries (£m) | |

|---|---|---|---|---|---|

| CJRS | 9,640 | 14.9 | 5,476 | 4,262 | 152.4 |

| SEISS | 53,986 | 7.0 | 21,816 | 20,225 | 44.9 |

| EOHOS | – | – | 605 | 327 | 6.4 |

| Total | 63,626 | 21.9 | 27,897 | 24,814 | 203.7 |

Note 1: Letters for CJRS are issued to employers who claim on behalf of employees, whilst for SEISS letters are issued to individuals.

Where we identify that the recipient of a COVID-19 support payment was not entitled to the amount they received, we recover that money via an Income Tax or Corporation Tax charge. As of 31 March 2022, £114 million of these charges remained outstanding, which is included within receivables reported in the Trust Statement.

In some cases, customers make an unprompted choice to repay money. From claims made in 2021 to 2022, a total of £130 million was returned to HMRC without any intervention or prompting, either because the claimant decided they no longer needed the money they claimed, even though they were entitled to it, or because they recognised an error and returned the money. Claimants also returned £840 million from claims made in 2020 to 2021.

Where we find fraudulent behaviour, we continue to take tough action to tackle it. Anyone who has kept money despite knowing they were not entitled to it, faces repaying up to double the amount, plus interest and potentially criminal prosecution in serious cases.

Our Taxpayer Protection Taskforce investigates the most serious abuses of the COVID-19 financial support schemes. We opened 16 criminal investigations during 2021 to 2022 – which are now at various stages – and made 26 arrests involving CJRS, SEISS and Eat Out to Help Out. These investigations often include fraud against more than one financial support scheme, and can involve a large number of companies, claims and suspects.

The majority of fraud is addressed through civil fraud investigation procedures, but where appropriate we will conduct criminal investigations and seek criminal prosecutions if it is in the public interest, particularly where the behaviour is very serious or where a criminal prosecution will act as a strong deterrent.

Table 10: Total number of criminal investigations and arrests 2021 to 2022 (note 1)

| Total number of criminal investigations (note 1) | Total number of arrests | |

|---|---|---|

| CJRS | 11 | 5 |

| SEISS | 0 (note 2) | 7 |

| EOHOS | 5 | 14 |

Note 1: Included in overall one-to-one enquiries into the COVID schemes.

Note 2: Due to cases either being opened in the previous financial year and where cases involved both CJRS and SEISS fraud, where the arrests are included in CJRS arrest figures.

Strategic objective 1: Collect the right tax and pay out the right financial support

Our first strategic objective reflects our core purpose and is a priority outcome for us as a department. We want to ensure that every part of the tax and customs administration system works for the benefit of society: bringing in the revenue due under the law, reducing the tax gap, giving the right financial support and operating in a transparent and even-handed way.

Our commitments in 2021 to 2022

In our Outcome Delivery Plan for 2021 to 2022, we made 8 commitments as part of our core work to collect the right tax and pay out the right financial support.

| Commitment | What we delivered | Status |

|---|---|---|

| Budget 2020, avoidance, evasion and non-compliance | We are on track to deliver Budget 20 measures to tackle tax avoidance, evasion and other forms of non-compliance that will raise an additional £4.7 billion between 2020 to 2021 and 2024 to 2025 | On track or complete |

| Budget 2021 compliance measures | We are delivering a range of Budget 2021 measures to tackle non-compliance and set up a Taxpayer Protection Taskforce to combat fraud in the COVID-19 support schemes. | On track or complete |

| Budget 2021 policy measures | In 2021 to 2022 we legislated for, and implemented, Budget 2021 policy measures including: a new 130% first-year capital allowance for qualifying plant and machinery assets and a 50% first-year allowance for qualifying special rate assets; a temporary extension to the loss carry back rules for trading losses of both corporate and unincorporated businesses; red diesel changes introduced through Finance Bill 2021 to restrict the entitlement to use red diesel and rebated biofuels from April 2022 for qualifying purposes | On track or complete |

| National Insurance Contributions (NICs) Bill 2021 | We supported ministers to successfully legislate for the 2019 manifesto commitments on Freeports NICs relief (which can be claimed if you have business premises in a Freeport) and an employer NICs veterans’ holiday (providing a zero-rate of secondary Class 1 NICs for employers who hire veterans on a civilian contract after leaving the regular armed forces). | On track or complete |

| New anti-evasion measures | We continued to implement measures to tackle tax abuse in the construction sector, crack down on illicit tobacco and prevent profit-shifting by multinational companies to avoid paying taxes. Measures that tackle tax abuse in the construction sector and require large businesses to notify HMRC where there is an uncertain tax treatment in their tax return have now been delivered. | On track or complete |

| Manage Time to Pay | We continued to support our customers with their finances as they recovered from the pandemic, including offering ‘Time to Pay’ arrangements where necessary. By the end of 2021 to 2022, we were supporting 843,000 taxpayers in this way. | On track or complete |

| Breathing space for problem debt and the Debt Respite Scheme | In May 2021 we implemented a Breathing Space scheme which allows customers with debt problems up to 60 days ‘breathing space’ from all creditor actions. In 2021 to 2022, 4,495 customers with a tax debt signed up for this. The second phase of the Debt Respite Scheme (the Statutory Debt Repayment Plan) is on track for implementation in 2024. It will allow qualifying customers to repay their debts over a 3-to-10-year period, depending on their circumstances. | On track or complete |

| Supporting introduction of Universal Credit | We continued to support the Department for Work and Pensions with the introduction of Universal Credit, aiming to close the tax credits system in September 2025. This included supporting DWP with their campaign to encourage tax credit customers to move voluntarily to Universal Credit. | On track or complete |

How we performed

Collecting the right tax

A key measure of whether the right tax is being collected is the UK tax gap – the difference between the amount of tax that should, in theory, be paid to HMRC, and what is actually paid. The latest tax gap figure available is for financial year 2020 to 2021 and this is estimated to be 5.1% (£32 billion) of total theoretical tax liabilities. This means that in the unprecedented circumstances of the onset of the COVID-19 pandemic, we secured almost 95% of all tax due. There has been a long-term reduction in the overall tax gap, falling from 7.5% in 2005 to 2006 to 5.1% in 2020 to 2021. Between 2017 to 2018 and 2020 to 2021 the overall percentage tax gap has remained low and stable.

During financial year 2021 to 2022, as the pandemic continued to have a major impact on our customers and the UK economy, we collected total revenues of £731.1 billion (£122.3 billion more than the previous year). Figure 8 shows how total tax revenues have increased steadily up to financial year 2019 to 2020, before falling in 2020 to 2021, reflecting the significant impact of the COVID-19 pandemic on the economy. Most taxes saw increased revenue during the 2021 to 2022 financial year. Income Tax, National Insurance Contributions and VAT make up the three largest elements of total tax revenue, but it also includes a wide range of other taxes and duties (see a full breakdown chart by type of tax in figure 8).

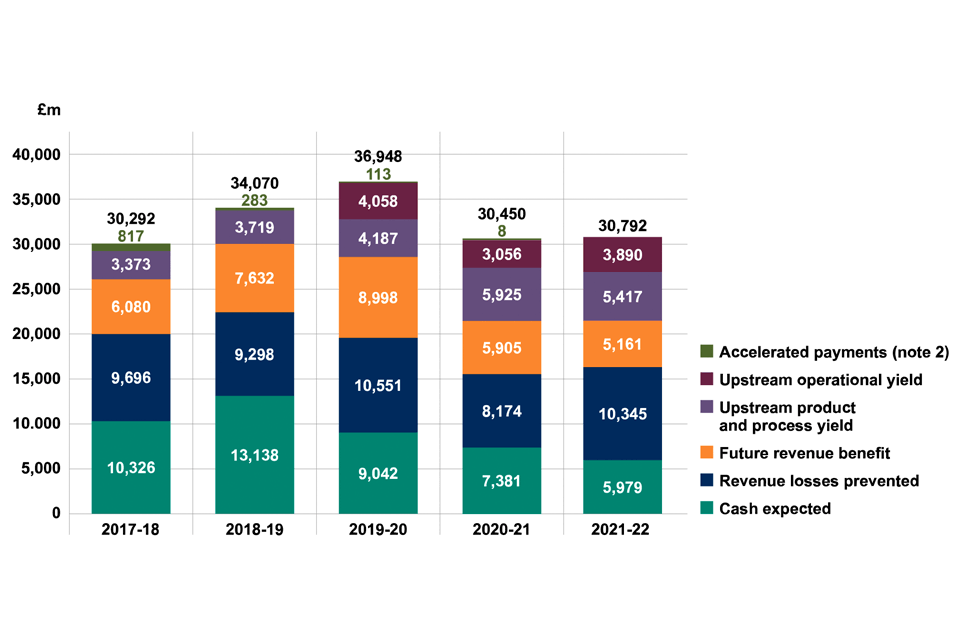

Compliance yield

Every year, we collect and protect billions of pounds of ‘compliance yield’ through our policy and process design and risk-based work to tackle non-compliance. This is tax revenue that would otherwise have been lost to the Exchequer through error, fraud and other non-compliance, so our compliance activity is a crucial part of keeping the tax gap small.

We collected and protected £30.8 billion in compliance yield in 2021 to 2022, similar to the £30.4 billion we delivered in 2020 to 2021 and lower than the £36.9 billion secured in 2019 to 2020, which was the last financial year prior to the COVID-19 pandemic (and also featured two exceptionally large and non-recurring cases). This measure does not include revenue collected or protected from our compliance work on the COVID-19 support schemes, which is measured separately – see Table 9.

Economic conditions, the COVID-19 pandemic and a number of other factors have impacted on compliance yield.

-

in 2020 to 2021, reduced levels of economic activity meant that tax liabilities and tax receipts were significantly lower, so we would naturally expect to collect less compliance yield. Tax receipts recovered in 2021 to 2022 to the levels we had forecast prior to the pandemic, but there is a lag from when a tax liability is created to compliance activity and then to yield. The reduced economic activity in 2020 to 2021 has led to less compliance yield in both 2020 to 2021 and 2021 to 2022

-

we redeployed HMRC tax compliance staff onto the Taxpayer Protection Taskforce to tackle non-compliance in the COVID-19 support schemes. We received additional funding for new people to backfill these tax compliance posts and as these new people are trained, we expect their performance to offset any opportunity cost from this year. This will be tracked as part of our usual engagement with the Office for Budget Responsibility on the Exchequer Impact of fiscal event measures

-

our most complex compliance activity can often take several years, and it is not unusual for the end date to move significantly with such variations averaging out over time. There were delays to several such cases which we had expected to close this year. This yield is still forecast to be delivered in future years

We make data-led, risk-assessed decisions on which cases to prioritise within our compliance work. Throughout the pandemic, we continued to work a balanced portfolio of risks to ensure our interventions had the greatest impact on overall compliance and protect the health of the tax system.

Read more detail on our response to error and fraud in the COVID-19 financial support schemes.

For more detail on tax and compliance activities across different customer groups, please see our technical note ‘Tax by different customer groups’.

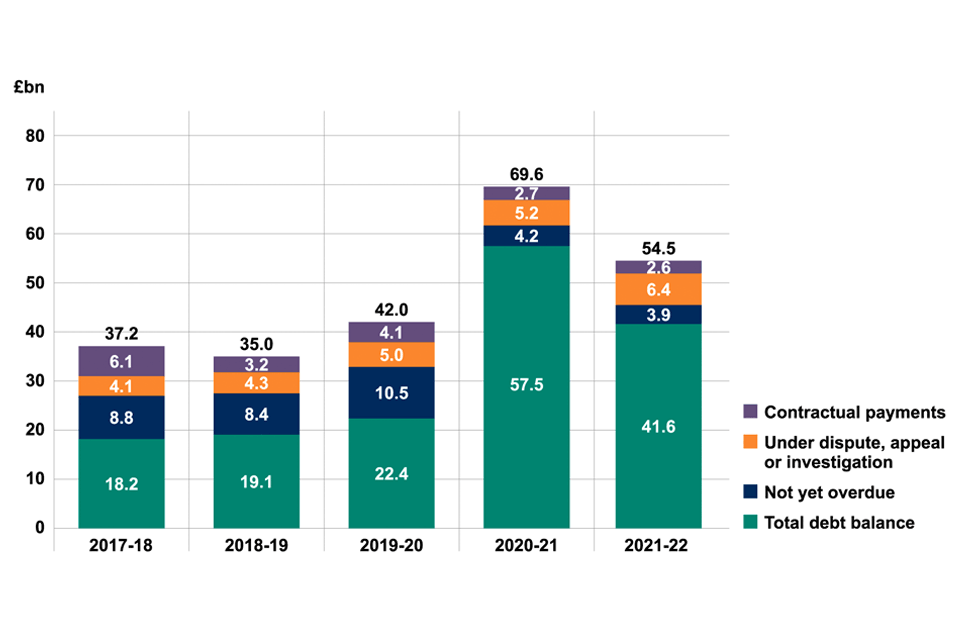

Managing money owed to HMRC

When individuals and businesses owe taxes and duties, or tax credits to HMRC, we call these amounts ‘receivables’ for accounting purposes. At 31 March 2022, gross receivables amounted to £54.5 billion, compared to £69.6 billion at 31 March 2021, consisting of:

-

£51.2 billion for taxes and duties owed to HMRC (see Trust Statement). This has reduced from £65.3 billion as at 31 March 2021, mainly due to tax that was deferred under government measures during the pandemic being paid

-

£3.3 billion for tax credits owed to HMRC (see Resource Accounts)

Receivables in the Statement of Financial Position are reported after impairment, which is an estimate of potential non-payment. Therefore, they reflect the amount that is likely to be collected, taking into account the uncertain economic conditions.

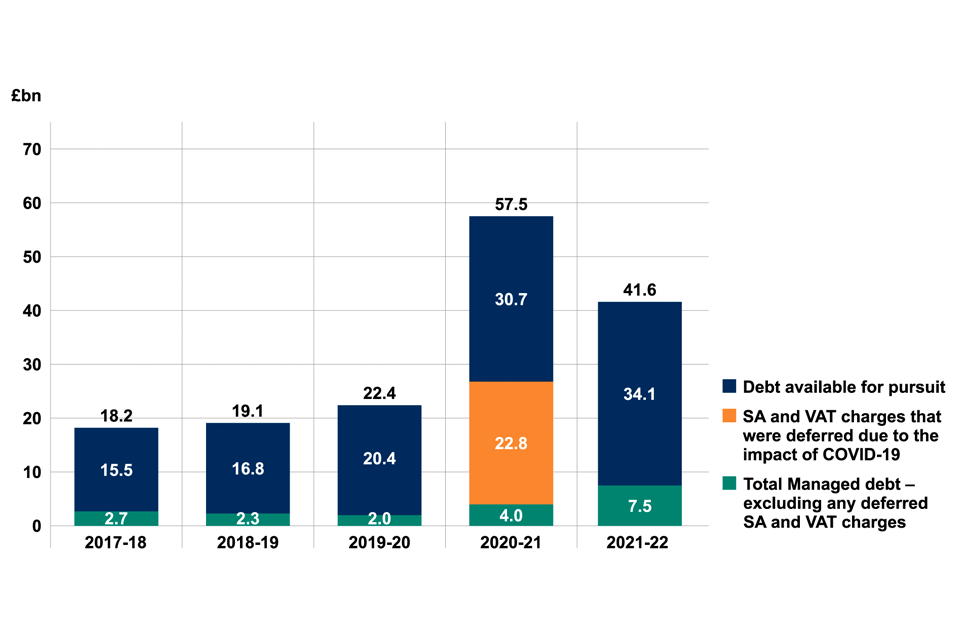

HMRC’s debt balance

When amounts owed to HMRC become overdue for payment and are not under appeal, we categorise these as debts.

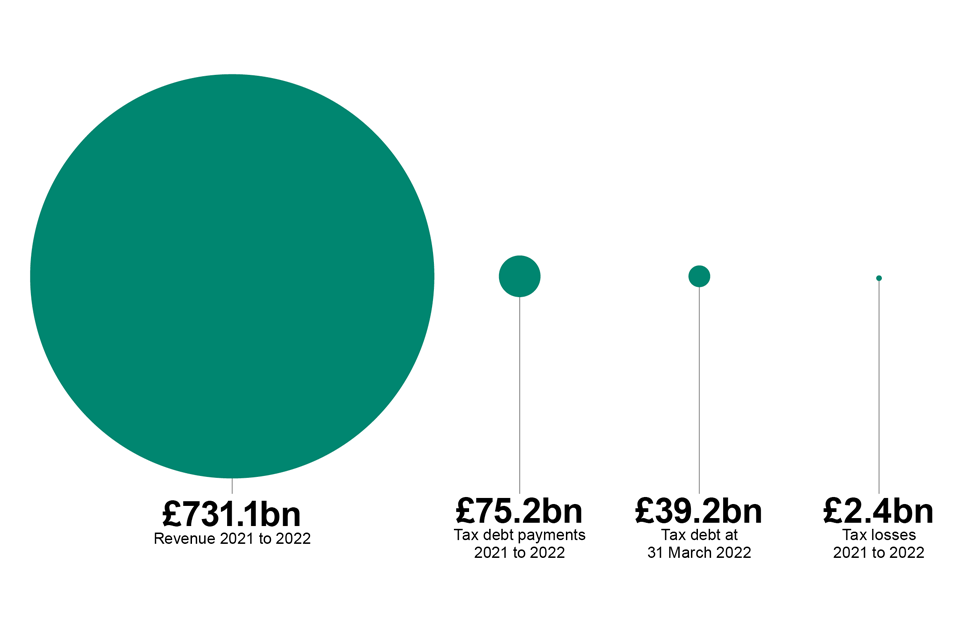

The debt balance at end of March 2022 was £41.6 billion, which is £15.9 billion lower than the balance at the end of March 2021. This includes £39.2 billion of tax debt (which equates to 5.4% of tax revenues) and £2.4 billion of tax credits debt.

The debt balance hit its lowest point since the start of the pandemic in January 2022 at £38.8 billion. Since then, it has steadily increased to £41.6 billion at the end of March 2022. We continue to secure payments significantly above pre-pandemic levels but not enough to prevent the debt balance increasing.

We understand that customers’ ability to pay is affected by macro-economic conditions, such as supply chain pressures and high inflation, and that some customers still have constrained finances from the pandemic. These conditions may persist beyond 2023 to 2024, with an associated impact on the debt balance. Therefore, we anticipate the debt balance remaining broadly static through 2022 to 2023, with initiatives to reduce it having a material impact during 2023 to 2024 and future years. The tax debt balance is likely to remain above the pre-pandemic average of 2.4% of tax revenues for some years.

At the end of March 2022, around 18% of the debt balance was in a managed position. In most cases this means the customer has entered an arrangement to pay in instalments. This was an increase of 7 percentage points on the pre-pandemic average. We expect the proportion of the debt balance in a managed position to increase steadily in the coming years as we engage with customers and many of them request to have an instalment arrangement.

In focus: How we helped customers to pay what they owe in instalments

UK VAT-registered businesses could defer VAT payments due between 20 March and 30 June 2020 either to 31 March 2021, or, if they applied for our ‘New Payment Scheme’, they could spread their payments across financial year 2021 to 2022.

As a result of the deferral period ending, during 2021 to 2022 we reduced the amount of deferred VAT debt from £22.5 billion to less than £1 billion, driving a reduction in the debt balance.

Time to Pay is a longstanding policy available to all businesses and individuals in temporary financial difficulty and unable to pay their tax in full on time. When agreeing a Time to Pay arrangement, we tailor the amount of payment and length of the repayment period to the customer’s circumstances to ensure payments are affordable, while clearing the debt as quickly as possible.

At the end of March 2022, we had £5.4 billion in Time to Pay arrangements. We aim to agree affordable and sustainable arrangements, and over 90% of debt entering a Time to Pay arrangement is paid as agreed.

Impacts on the debt balance in 2021 to 2022

The debt balance at the beginning of 2021 to 2022 was high due to the economic impact of the pandemic and decisions the government and HMRC made to mitigate this, such as allowing VAT from the first quarter of 2020 to 2021 to be deferred, and because we paused the majority of our debt pursuit activity for a total of 7 months during the highest level of public health restrictions (April to mid-June 2020 and mid-December 2020 to end of April 2021).

During the time we paused debt pursuit activity, we did not contact customers to seek payment or use any of our enforcement or collection powers. We continued to provide support – helping customers manage their tax debt, taking payments or agreeing arrangements to pay debt later or over longer periods as appropriate.

The COVID-19 pandemic continued to impact the debt balance throughout 2021 to 2022. Public health restrictions affected many customers’ ability to pay and hampered many of those with pre-existing debts from paying what they owe. We saw record levels of new debt created in 2021 to 2022.

We also saw record levels of debt cleared in 2021 to 2022. This was driven by our engagement with customers, the VAT New Payment Scheme managing down the deferred VAT debt and promoting the use of Time to Pay instalment arrangements.

Sometimes we can’t collect money owed to us - we take decisions on a case-by-case basis, and where we decide we can’t collect an amount it becomes a ‘tax loss’. Tax losses in 2021 to 2022 were £2.4 billion, split between remissions of £0.5 billion and write-offs of £1.9 billion. ‘Remissions’ describes money owed to us which we have decided not to pursue – for example, on the grounds of value for money. ‘Write-offs’ is the term used for money owed that we consider to be irrecoverable – for example, because there are no practical means of pursuing it.

Our approach to the debt balance in 2022 to 2023

Our approach in 2022 to 2023 remains that we strike a balance between doing everything we can to help customers with short-term financial difficulties and taking steps where customers don’t engage with us or refuse to pay. This balance is important – we need to collect money that funds public services and create a fair and even playing field for all customers, where everyone pays their fair share, but we understand the situation many of our customers find themselves in.

We are recruiting around 2,000 staff in 2022 to 2023, to make sure we’ve got more people available to support customers who need it. This represents both filling existing vacancies, as well as using the additional £62 million we received to fund around 500 additional Debt Management staff over the next three years.

We have resumed most of our debt enforcement activities, including in-person visits and insolvency action, and the placing of debts with Debt Collection Agencies (DCA). Our DCA partners only undertake desk-based activities, such as phoning customers, sending letters and SMS, and broadly speaking we only place debt with them after we’ve been unsuccessful in contacting the customers ourselves.

We will publish our plan to accelerate the rate we address the elevated debt balance in September 2022. This will include more detail on ways of measuring our performance in the current economic climate.

While the level of future losses is difficult to accurately forecast, as it is highly dependent on customers’ ability to pay, which is affected by the ongoing macro-economic conditions described above, we can anticipate losses from write-offs will increase in the coming years. This increase is anticipated due to both a ‘catching up’ of those insolvencies that would ordinarily have arisen during the pandemic period (but were temporarily prohibited as a result of the Corporate Insolvency and Governance Act 2020) as well as higher levels of new business failures reflecting tougher trading conditions.

Delivering financial support

Giving financial support to people is a core part of our purpose as a government department. In 2021 to 2022, we provided Child Benefit to more than seven million eligible families, supporting around 12.3 million children. Since we implemented our new Child Benefit IT service in February 2021, we have processed over 700,000 claims using the new service.

We also administer Tax-Free Childcare – and in 2021 to 2022 we saw a continuing upward trend of working parents claiming this. In March 2022, we supported 384,000 families with Tax-Free Childcare for 458,000 children, which compares with 282,000 families and 329,000 children in the previous year.

Although we are gradually transferring customers from tax credits to Universal Credit, administered by the Department for Work and Pensions (DWP), or Department for Communities (DfC) in Northern Ireland, we still provided tax credits to around 1.4 million families and 2.7 million children in 2021 to 2022. As part of the transfer to Universal Credit we also ended 152,000 claims during this financial year, of which over 146,000 involved active payments. We continued to work closely with DWP and DfC to help customers get their claims right before they move across to Universal Credit and maintained our performance in processing new UK claims and changes, taking an average of 15.4 days. For international customers we took an average of 84.1 days.

Tackling tax credits and Child Benefit error and fraud

Our approach to tackling error and fraud in tax credits and Child Benefit payments is increasingly focused on prevention - guiding customers to voluntarily meet their obligations and effectively manage their awards, through education and reminder campaigns.

We worked to keep overpayments in the tax credits system at no more than 5% of paid entitlement. As it takes around 14 months after the end of the tax year until all tax credits claims are finalised, our latest estimate of error and fraud for tax credits relates to 2020 to 2021. Our estimate suggests we met our expectation, with an error and fraud overpayment rate of 5.0% (£0.78 billion) of paid entitlement, in comparison to a final estimate of 5.3% or £0.94 billion in financial year 2019 to 2020. This level of error and fraud is in the context of ongoing pressures on resourcing for tax credits compliance work and changes to our usual compliance processes in response to COVID-19. To continue to support tackling error and fraud in tax credits, we secured additional compliance resource as announced in the March 2022 Spring Statement.

Our estimate of the overall level of Child Benefit error and fraud overpayment in 2021 to 2022 is 0.9% of total Child Benefit expenditure (£105 million), compared to the 2020 to 2021 estimate of 0.8% (£90 million).

Tax credits underpayments occur when an award for a tax year is finalised and it is found that HMRC has paid the claimant less than their finalised entitlement. Read more details on HMRC’s commitment to resolving underpayments.

Read more about error and fraud in the Principal Accounting Officer’s report.

Key performance metrics: Strategic objective 1

Figure 8: Total tax revenues

Total tax revenues represent all money HMRC received (or was due to receive), less any money that we owed or repaid. They are driven by the overall level of activity in the economy and the rates of taxation, allowances and reliefs set by Parliament and affected by our compliance activity. The chart below shows total tax revenues between financial years 2017 to 2018 and 2021 to 2022.

Figure 9: Compliance yield

Compliance yield is revenue collected and protected that would have otherwise been lost to the Exchequer through error or deliberate non-compliance, such as tax avoidance or evasion. It consists of a number of components as shown below (note 1).

Note 1: Numbers may appear not to sum due to rounding.

Note 2: Accelerated payments are incorporated within cash expected and upstream product and process yield from 2021 to 2022.

Accelerated payments: Disputed amounts of tax that people using tax avoidance schemes are required to pay up front within 90 days, and an estimate of the behavioural change caused by this policy.

Upstream product and process yield: Estimated annual impact on net tax receipts of legislative changes to close tax loop holes and changes to our processes which reduce opportunities to avoid or evade tax.

Future revenue benefit: Estimated effect of our compliance work on customers’ future behaviour.

Revenue losses prevented: Revenue that we prevented from being lost to the Exchequer.

Upstream operational yield: (Categorised with cash expected until 2019 to 2020) Estimated impact of operational activities undertaken to promote compliance and prevent non-compliance before it occurs. Does not include yield from legislative changes.

Cash expected: Additional revenue due when we identify past non-compliance, with a reduction to reflect revenue that we know will not be collected.

Figure 10: Receivables

When individuals and businesses owe taxes, duties, or tax credits to HMRC, we call these amounts ‘receivables’ for accounting purposes. The chart below shows receivables between financial years 2017 to 2018 and 2021 to 2022.

Figure 11: Total debt balance

The chart below shows the trend of our total debt balance between financial years 2017 to 2018 and 2021 to 2022

Figure 12: Tax debt and tax losses compared to revenue

The chart below shows a comparison of tax debt to total tax revenue.

Strategic objective 2: Make it easy to get tax right and hard to bend or break the rules

The most effective way of ensuring everyone pays the right tax is through the overall design of the tax system. Our approach is to make it easier for people to pay their taxes through good customer service, while making it hard to make errors or to avoid and evade paying tax.

Our commitments in 2021 to 2022

In our Outcome Delivery Plan for 2021 to 2022, we made 3 specific commitments as part of our work to make it easy to get tax right and hard to bend or break the rules.

| Commitment | What we delivered | Status |

|---|---|---|

| Supporting customers and making it easier to pay | We made progress towards delivering a Unique Customer Record (UCR) and Single Customer Account (SCA), powered by data received from taxpayers and a range of third parties. This year we determined the technical architecture for SCA, but there are risks to delivering UCR as planned due to resource availability and cost. | Risk to delivery |

| Contact Engagement Programme | Our Contact Engagement Programme will introduce a new telephony system which provides an intuitive user interface for customer-facing colleagues, allowing them to deal with queries in a more timely and accurate way. In May 2022, migration of the new platform commenced positively. There is a staged approach to migration of the platform, across lines of business throughout the course of 2022 to 2023, with the final line of business completing migration in August 2022. The new service will be rolled out to colleagues in HMRC, VOA and the Adjudicator’s Office. Programme closure is planned by the end of March 2023. | Risk to delivery |

| Making Tax Digital | We rolled out the mandating of Making Tax Digital for VAT-registered businesses with a turnover below £85,000 from April 2022. We also continued to pilot the Income Tax and Self Assessment (ITSA) service, which will be mandated from April 2024 for customers with business and / or property income over £10,000 per year. There are some challenges to getting the ITSA service right, which we are working to resolve. | Risk to delivery |

How we performed

Ensuring customers get tax right

It’s everyone’s responsibility to get their own tax right – but we can prevent non-compliance before it happens through well designed policies, processes, services and systems that make it harder to get things wrong. We can also help promote good compliance by educating and supporting our customers in their tax affairs, while continuing to respond robustly to those remaining non-compliant.

We apply this ‘prevent, promote, respond’ approach consistently for all our customers, whether they are individuals or small businesses with simple tax affairs, someone who needs extra support, or a large business or wealthy individual with complex circumstances. In all cases our actions are informed by a clear understanding of the risks and behaviours within each customer group.

In focus: How do customers rate their experience with us?

We conduct regular surveys of our customers on their experience with us. We use them to gain insight, understand what our customers need, and take action to improve the way we operate. Here is how small businesses, individuals and agents rated their experience of dealing with HMRC.

Ease of dealing with tax issues

Individuals: positive

57%

Small Businesses: positive

73%

Agents: positive

43%

Overall experience of dealing with HMRC over the last 12 months

Individuals: positive

62%

Small Businesses: positive

76%

Agents: positive

48%

Ease of finding information from HMRC

Individuals: positive

53%

Small Businesses: positive

64%

Agents: positive

47%

Promoting good compliance and preventing non-compliance

To support customers to get it right first time, and to remove opportunities and incentives for error or fraud, we undertake activity ‘upstream’ before a tax return is made. We base our activity on the known risks within each customer group and we engage with trade and industry groups to focus our interventions on those we believe will benefit most.

In 2021 to 2022 we:

- Undertook a range of activity to improve the experience of our customers undergoing compliance checks. See more about our work to embed the standards of the HMRC Charter in the Strategic objective 3 section

- Introduced the Domestic Reverse Charge to combat VAT fraud and the use of contrived supply chains and missing traders in the construction industry, resulting in increased payments and better compliance in the sector

- Worked with large retail stores to improve their understanding of how alcohol duty fraud was being committed using their wholesale products, enabling the retailers to cut off the illicit supply at source

- Provided targeted guidance to agents on the correct approaches to complex tax issues, enabling them to ensure returns were correct before being submitted to HMRC

- Started to publicly name tax avoidance schemes and those we consider promoted, or were involved in supplying, those schemes, using new powers

In focus: Using digital prompts to help customers get tax right

Digital prompts are a simple tool but can make a big difference to helping customers get their tax right – for example, flagging when a customer’s entry on our online Self Assessment (SA) system is out of line with what we expect to see. Our activity included:

- trialling more personalised and targeted prompts, including a prompt to customers in receipt of COVID-19 support scheme grants to account for the payments properly

- working on prompts in collaboration with commercial tax software vendors to maximise the impact on the large customer populations who no longer use HMRC software for their filing obligations

- developing a SA prompt targeted at self-employed people who do not contribute to private pensions, directing them to the Money Helper website for free impartial guidance

Customer experience on our digital and traditional channels

Providing a good experience for our customers across all our service channels is a vital element in preventing non-compliance and ensuring customers get their tax right.

Over the course of the pandemic, we made choices about the work we prioritised in order to protect our essential services and the livelihoods of our customer groups. We prioritised the COVID-19 support schemes, the UK’s smooth transition from the European Union (EU) and the essential services that keep the tax system running. In the first half of the year we stabilised our phone service and our tax credits and Child Benefit services, while we maintained our customs services well within expectations and supported the smooth running of the COVID-19 support schemes until they closed in October. This meant that some of our customer service levels were not where we would normally expect them to be, although we continued to see high levels of customer satisfaction with our digital services.

Across all our telephone helplines, adviser attempts handled – the proportion of callers wanting to speak to an adviser who were able to do so – was significantly below where we wanted it to be in April 2021 at 66.2%, but we improved as the year went on, achieving 71.2% by March 2022 and averaging 77.3% across the year. See more information in Figure 14: Telephony adviser attempts handled. We also faced challenges with our correspondence workload, which grew significantly driven by claims for tax relief for homeworking expenses and for repayment of tax deducted from interest in Payment Protection Insurance (PPI) compensation. The proportion of customer correspondence that we turned around within 15 working days was at 29.7% in April 2021, but by the end of March 2022 it had improved significantly to 65.4%.

We focussed on stabilising our phone service in the first half of the financial year. Once the bulk of the COVID-19 support schemes activity had been delivered, we were able to move more resources back into our core tax activities and add capacity through temporary recruitment.

Our focus over the second half of the financial year was on reducing the stock of correspondence that had built up during the pandemic whilst keeping our helpline service levels stable. By the end of the year, we had succeeded in reducing our correspondence stock to 1.9 million, down from a peak of 3.3 million in July 2021 and much closer to normal volumes. This stock level equates to around one month’s worth of correspondence receipts.

In December, we ran a trial reducing the hours on some of our telephony services so we could dedicate the time to working through our stocks of customer correspondence. We closed our VAT (with the exception of the bereavement line), and Corporation Tax (CT) phone lines on 3,10 and 17 December. This allowed us to successfully focus on processing CT repayments and VAT post, delays to which had been a key area of concern for customers and agents.

We also paused most of our webchat service for 3 months from 4 January 2022 to allow us to fully review these services. We found that webchat is most effective when we use it to answer simple queries or educate and coach customers in using our digital tools, but less efficient when supporting customers with complex queries. We’ll use this knowledge to help us deliver a more effective webchat service in the future.

Transforming our services

Our flagship Making Tax Digital (MTD) programme is designed to make it easier for businesses to get tax right by reporting closer to real time and with reduced risk of non-compliance. More than 1.7 million businesses have joined MTD for VAT since it was introduced in 2019, with independent research showing that users find preparing and submitting VAT returns easier, and that MTD has increased their confidence in managing their tax affairs and using technology.

In March 2022, we published research conducted by HMRC and peer reviewed by independent academics, which indicated that MTD for VAT is likely to have generated additional tax revenue (ATR) through reducing error. The latest MTD for VAT ATR estimate for 2021 to 2022 is £230 million, underpinned by methodology certified by the Office for Budget Responsibility (OBR). MTD for VAT was extended to include all VAT-registered businesses with a turnover below £85,000 for their first return on or after 1 April 2022.

Over the past year we have worked closely with partners in the business and tax communities on the design and scope of MTD for ITSA. In September 2021 we laid regulations in Parliament to help those impacted by the changes to prepare, and for their representatives to develop their own support and guidance. In recognition of challenges faced by many UK businesses and their representatives during the COVID-19 pandemic, and following stakeholder feedback, we will now introduce MTD for ITSA a year later than previously announced, in April 2024.

In March 2021, we also announced a new system of penalties for late payment and late submission of tax, beginning with VAT and ITSA. The new penalties will be introduced for VAT from 1 January 2023 and for customers mandated to use Maxing Tax Digital for ITSA from April 2024. For all other ITSA customers, the penalties will apply from April 2025.

Read Evaluating additional tax revenue from Making Tax Digital for VAT for more information.

Responding to non-compliance when it happens

When customers are not compliant with the rules, we work with them to get them back on the right track, and we tackle businesses and individuals who have tried to cheat the tax system – for example, in 2021 to 2022 we:

- recovered £195 million of assets from criminals and fraudsters, taking the overall figure recovered since 2016 to over £1 billion

- opened 265,000 compliance checks and closed 256,000

- collected or protected over £4.3 billion from our activity to tackle Serious Fraud

- achieved 215 criminal convictions, with a total of 262 years of custodial sentences. HMRC is increasingly targeting criminal investigations against the most serious fraud and delivering fewer, but better targeted, interventions against the hardest-to-reach targets. COVID-19 restrictions and pressure in the criminal justice system has resulted in additional reductions to the level of investigations, but numbers are expected to increase in 2022 to 2023 as pressures ease and HMRC is able to bring compliance activity, including criminal investigations, back to desired levels

- undertook our first seizure of cryptoassets including non-fungible tokens, as part of wider action taken against the use of Electronic Money Institutions for fraud

Our activity to tackle serious non-compliance has wider impacts beyond that which can be measured through compliance yield. It’s important that we take a broad view of our success in helping customers get tax right, taking account of harm prevention and the customer experience. To reflect this, we’re working on a broader range of measures, which will be introduced next year. See the Protecting society from harm section for more information about our work to respond to non-compliance.

Key performance metrics: Strategic objective 2

Figure 13: Customer experience – Net Easy

Our Net Easy performance metric is based on a survey offered after every telephone and digital interaction asking the question ‘How easy was it to deal with us today?’ The score represents the total of positive responses minus the total of negative responses to achieve a net score. The range for this score is -100 to +100, so a positive score reflects that more customers found it easy to deal with HMRC services than found it hard. HMRC started tracking Net Easy on our digital interactions in 2020 to 2021, expanding the scope to include telephone interactions in 2021 to 2022.

Figure 14: Telephony adviser attempts handled

Telephony Adviser Attempts Handled Percentage (AAH) is another core customer service performance metric that measures the proportion of callers that successfully got through to an adviser after hearing the automated messages and choosing to speak to an adviser. In 2021 to 2022 we received 35.2 million phone calls of which 29.0 million were handled either by an adviser or our automated systems, compared to receiving 33.3 million in 2020 to 2021.

In 2021 to 2022, ongoing challenges with recruitment and retention, as well as dealing with the additional correspondence demands and the level of stocks that built up as a consequence, meant HMRC’s AAH across all phone lines was 77.3%.

Historically we have reported against customer facing telephone numbers (such as tax credits, PAYE and SA) only. From 2021 to 2022, to enable HMRC to provide a complete picture of our telephony performance, we now include all HMRC helplines.

Webchat adviser attempts handled

The proportion of customers who requested a webchat that were then able to chat to an adviser remained consistent throughout 2021 to 2022 and averaged 92.9% for the year. Many of our webchat services were paused from January 2022 to March 2022 while we reviewed their effectiveness.

Figure 15: % of customer correspondence responded to within 15 working days of receipt

Customer correspondence this year included both post and iForms. In 2021 to 2022 we received a total of 16.3 million post items and 2.3 million iForms, compared to 15.7 million post items and 2.6 million iForms in 2020 to 2021 respectively. Out of the total customer correspondence received this year, 14.6 million required a direct response from HMRC. Where this is the case, we track the proportion we turned around within 15 working days of receipt, which was 45.5% across the year.

In 2021 to 2022, ongoing challenges with recruitment and retention, as well as a significant increase in our correspondence workload, meant stocks of correspondence accumulated while we prioritised work to stabilise telephone performance, alongside our work on the COVID-19 support schemes and the UK’s transition from the EU.

Strategic objective 3: Maintain taxpayers’ consent through fair treatment and protect society from harm

We want to ensure that we treat customers fairly when they are trying to get their tax right – providing support based on our Charter standards. We also have an important role to play in protecting society from harm by tackling promoters of tax avoidance, enforcing the minimum wage, preventing and tackling money-laundering and supporting wider law enforcement priorities, including modern slavery, economic and environmental crime.

Our commitments in 2021 to 2022

In our Outcome Delivery Plan for 2021 to 2022, we made 6 commitments as part of our work to maintain taxpayers’ consent through fair treatment and protect society from harm.

| Commitment | What we delivered | Status |

|---|---|---|

| Consolidating anti-evasion and avoidance measures and powers | This year we took further steps to ensure that our use of powers builds trust, and that safeguards are effective for taxpayers. We made improvements to guidance, including explaining how our safeguards operate, and assessed data ensuring our powers are applied proportionately and fairly. Having published additional compliance data, we are exploring wider publication of data on the use of our powers. Read more in the Powers and Safeguards section. | On track or complete |

| Tax credits underpayments | We helped customers to claim their full tax credits entitlement, so that underpayments through error would be no more than 0.7%. As it takes around 14 months after the end of the tax year until all tax credits claims are finalised, the latest estimate for underpayments relates to 2020 to 2021 and is 0.8% (£120 million). This means we were unable to meet our ambition to bring underpayments through error down to no more than 0.7%, likely due to the impact of the pandemic and the context of ongoing pressures on resourcing for tax credits compliance work and changes to our usual compliance processes in response to COVID-19. Underpayments are not significantly different in percentage terms from the 2019 to 2020 estimate of 0.9% (£170 million). COVID-19 had a significant impact on the administration of tax credits as frontline compliance staff were redeployed to customer service work and COVID-19 support schemes. | Risk to delivery |

| Tackling promoters of tax avoidance | We continued to tackle promoters of tax avoidance in line with our promoters strategy published in March 2020, including implementing legislation introduced in Finance Acts 2021 and 2022. Read more in the Protecting society from harm section. | On track or complete |

| HMRC Charter | We continued to increase colleagues’ awareness of our Charter and support them to develop the skills they need to deliver its standards. An internal staff survey in 2021 to 2022 suggested that 74% of HMRC colleagues knew about the Charter and 33% believed it influenced their work. While we recognise there is more to do, this provides a valuable baseline for measuring progress in embedding Charter standards. Read more in the Building public trust section. | Risk to delivery |

| Plastic Packaging Tax | We continued preparations to implement the new Plastic Packaging Tax, to encourage greater use of recycled plastic. All the necessary legislation was implemented and the IT service enabling businesses to register for the tax went live on 1 April 2022. | On track or complete |

| Sustainability targets | We achieved a reduction in carbon emissions to support our Net Zero ambitions and our targets under the Greening Government Commitments. We aim to achieve an 85% awareness score among colleagues of our Net Zero commitment by the end of 2022. Read more in the Becoming more sustainable section. | On track or complete |

How we performed

Building public trust

Ultimately, the tax system depends on public trust – this is founded on the experience customers have in their dealings with HMRC, as well as seeing that we apply the rules even-handedly and operate in a way that is recognised as fair.

We aim to increase transparency and build public trust by publishing more data and information on the exercise of powers. We publish key figures on our performance and activities online, as well as findings from our external research programme and a wide range of official and national statistics releases.

We have taken on board National Audit Office (NAO) recommendations and since September 2019, we have published several new metrics on a quarterly basis. These include customer experience, debt management, customs and compliance metrics such as net easy, closed civil and criminal compliance checks, prosecutions and criminal sentences, and outcomes of court decisions. We continue to work with external stakeholders to identify what other data and information could be published. We published HMRC’s Evaluation Framework in November 2021, outlining HMRC’s ambition for systematic evaluation, including the activities identified to achieve this and how it fits with wider government best practice guidance. It sets out HMRC’s criteria for making decisions about undertaking evaluation, which demonstrates how the department is moving towards its goal of maximising the impact of its spending through appropriate decisions on evaluation.

Customers want to know that we follow consistent standards – and the interactions they have with us shape their trust in the tax system. We define the service and standard of behaviour that customers should expect in our Charter and report on our performance in our Charter Annual Report. The Charter is underpinned by the principles of support for customers who need extra help. Although most of our customers can manage their own tax affairs, some need extra help when interacting with us as they go through life events, and the principles set out our commitment to providing tailored support and reasonable adjustments at the earliest opportunity.

In 2021 to 2022, our work to embed the standards of the HMRC Charter included:

- improving professional standards in our compliance activities, ensuring that compliance managers and their teams have the right skills to deliver the Charter standards, as well as continuing to develop new measures of professionalism and customer experience

- improving our processes, systems and guidance – for example, providing a smooth handover between compliance and debt management for customers who need extra help

- improving the quality of our customer letters by developing a single set of customer writing guidelines and training our colleagues to improve their clarity, empathy and tone

- publishing new guidance on GOV.UK to make sure our customers are aware of the extra help that is available to them if they need it

- strengthening links with the voluntary and community sector to support customers

Read our Charter Annual Report for 2021 to 2022 and our principles of support for customers who need extra help for more information.

In focus: Improving research and development tax reliefs

We are committed to ensuring that tax reliefs are used in the right way and that any attempt to abuse them to unfair advantage is prevented. At Spring Budget 2021 the Chancellor announced a review of the Research and Development (R&D) tax reliefs to ensure that they remain up to date, competitive and well-targeted. In response to the review, at Autumn Budget (and with further detail provided at Tax Administration Maintenance Day 2021), the government announced a package of measures to target abuse and improve compliance.

Read our tax relief statistics for more information.

Read more on tax reliefs error and fraud in the Principal Accounting Officer’s Report.

Powers and safeguards