Accountability report

Published 14 July 2022

Applies to England and Wales

Corporate governance report

Directors’ report

This section sets out the membership of our key directing boards and committees and explains their responsibilities.

Our governance structure

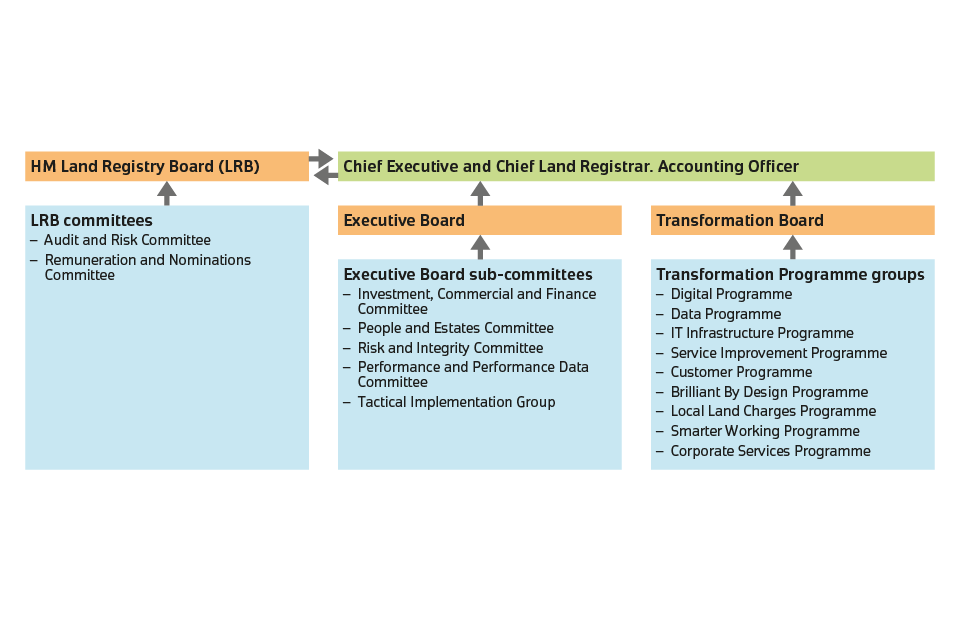

HM Land Registry has a two layered system of governance:

- HM Land Registry Board (comprising non-executive board members and executive directors)

- HM Land Registry Executive Board (comprising executive directors)

This structure enables the non-executive board members to provide appropriate challenge to the Executive Board while allowing executives to make effective decisions on the day-to-day running of HM Land Registry.

HM Land Registry Board

The role and responsibilities of the HM Land Registry Board (LRB) are set out in the Framework agreed with the Department for Business, Energy and Industrial Strategy (BEIS). The purpose of the Board is to support, constructively challenge and provide advice and guidance to the Chief Executive and Chief Land Registrar and their senior management team on performance, operation and development. The LRB supports senior management on setting the strategic vision of HM Land Registry, ensures the Secretary of State receives appropriate information, and assists the Chief Executive and Chief Land Registrar in their responsibility as Accounting Officer of HM Land Registry. This includes ensuring it operates within statutory and administrative requirements and within the limits of is authority and any delegated authority.

In line with Cabinet Office guidance, the LRB is tasked with advising on, challenging and supervising five main areas:

-

Strategic clarity – Commercial sense

-

Talented people – Results focus

-

Management information

The LRB, supported by its Audit and Risk Committee, also ensures HM Land Registry is working within a framework of prudent and effective governance arrangements and controls that enable risk to be appropriately assessed and managed. As part of that function, the LRB agrees the key activities that HM Land Registry will need to undertake to meet strategic objectives as set out in its published Business Strategy. The LRB supports the Chief Executive and Chief Land Registrar in ensuring the necessary financial and human resources are in place for us to meet objectives. It agrees HM Land Registry’s risk appetite, approves the annual budget and business plan and regularly reviews performance in relation to agreed targets.

The LRB contains a mix of executive directors and non-executive board members. The non-executive board members of LRB are highly skilled, with appropriate experience in relevant fields to support and challenge the Executive Board. Following a recruitment process two new non-executive board members joined in June 2021. In addition, there was a change in representation of the non-executive board member representative from UK Government Investments (UKGI).

The non-executive board members are independent of management. All board members are required to sign an annual statement recording any potential conflict of interests and declare any new interests in the interim. A central ‘Register of Interests’ record is retained. See note 17 to the accounts on page 120 for related party disclosures.

Between February-March 2022, the LRB underwent an independent external assessment of its effectiveness. The results were discussed at a Board meeting in March. The assessment showed the LRB to be broadly effective, but with opportunities for continuous improvement in strategic forward planning and strengthening Board dynamics following the past two years of mostly remote working. It also concluded that LRB committee and working groups have a valuable role to play in enabling LRB to fulfil its role. The Board will give consideration as to whether these continue to have the right areas of focus going forward. Actions from the final report will be implemented throughout 2022-23.

Non-executive

| Name | Role |

|---|---|

| Michael Mire | Non-executive Chair |

| Kirsty Cooper | Non-executive Board Member |

| Ann Henshaw | Non-executive Board Member |

| Angela Morrison | Non-executive Board Member |

| Jeremy Pee | Non-executive Board Member |

| Elliot Jordan | Non-executive Board Member |

| Katy Baldwin | Non-executive Board Member |

Executive

| Name | Role |

|---|---|

| Simon Hayes | Chief Executive and Chief Land Registrar |

| Iain Banfield | Chief Financial Officer |

| Mike Harlow | General Counsel, Deputy Chief Executive and Deputy Chief Land Registrar |

| Chris Pope | Chief Operations Officer |

| Karina Singh | Director of Transformation |

| Simon Morris | Director of Human Resources |

| Jon Parry | Interim Director of Digital, Data and Technology |

LRB membership

| Non-executive | |

|---|---|

| Michael Mire | Non-executive Chair |

| Katy Baldwin | Non-executive Board Member, UK Government Investments (nominated representative of the BEIS Secretary of State) (from 6 October 2021) |

| Kirsty Cooper | Non-executive Board Member and Senior Independent Board Member, Interim Chair of Remunerations and Nominations Committee (RemCo) (to 31 May 2021) |

| Ann Henshaw | Non-executive Board Member (from 1 June 2021) |

| Elliot Jordan | Non-executive Board Member and Chair of Audit and Risk Committee |

| Angela Morrison | Non-executive Board Member |

| Jeremy Pee | Non-executive Board Member (from 1 June 2021) |

| Ed Westhead | Non-executive Board Member, UK Government Investments (nominated representative of the BEIS Secretary of State) (to 13 August 2021) |

| Executive | |

| Simon Hayes | Chief Executive and Chief Land Registrar |

| Iain Banfield | Chief Financial Officer |

| Mike Harlow | General Counsel, Deputy Chief Executive and Deputy Chief Land Registrar |

| Chris Pope | Chief Operations Officer |

A year in focus

During 2021-22 matters covered by the LRB included:

-

response to COVID-19 and impact on performance, risk and finances;

-

business planning, budget and performance framework, including revision of priorities throughout the reporting year, strategic oversight of the Spending Review 2021 and annual business planning;

-

the development of an ambitious new business strategy for HM Land Registry to be launched in 2022;

-

accessibility and potential of HM Land Registry’s data assets;

-

HM Land Registry’s contribution to improving the conveyancing market and customer experience of that market;

-

operational improvement and performance;

-

transformation progress, prioritisation and planning;

-

consideration of HM Land Registry’s risk appetite;

-

Civil Service People Survey 2021 results, evaluation of the culture and development of future ways of working across the organisation; and

-

internal governance arrangements.

Board meetings

The LRB met 13 times in 2021-22. In light of the COVID-19 pandemic LRB met mostly virtually and the Board meeting schedule had been reorganised to meet more frequently to enable LRB to keep pace with the changing environment. Longer board meetings were held every six weeks, with shorter meetings, focusing on performance and risk, held in between. As the situation of the pandemic and accompanying restrictions changed, LRB felt confident to combine the shorter and longer meetings and return to their previous schedule of meeting every six weeks. In line with Government guidance the Board met in person when it was safe to do so.

In November the LRB held an organisation-wide virtual question and answer event with colleagues. The event saw a high level of colleague engagement and the Board plan to hold further events in 2022-23.

Engaging with stakeholders

Engaging with stakeholders is a key part of ensuring LRB is well informed.

-

The Chair continued to engage regularly with the Geospatial Commission and Board members meet regularly with the six core Geospatial Commission partner bodies.

-

The Chair and Chief Executive and Chief Land Registrar regularly engage with the Department for Business, Energy and Industrial Strategy (BEIS) Minister.

-

Quarterly meetings took place between the Chair, Chief Executive and Chief Land Registrar and Chief Financial Officer with UK Government Investments (UKGI), including informal meetings in between, to discuss governance, financial performance and other relevant matters as set out in the Framework.

-

Members of the Board engaged with their counterparts at other government departments such as HM Treasury and the Department for Levelling Up, Housing and Communities as required.

-

Members of the Board regularly met market stakeholders who are members of the Land Registry Advisory Council and Industry Forum and drew upon their knowledge and expertise, tested ideas, shared information and discussed land and property related issues.

-

Among many meetings HM Land Registry holds with other land registries around the world, Board members participated in a virtual information exchange with counterparts from Kadaster, who deliver land registration services in the Netherlands.

Committees of the HM Land Registry Board

Audit and Risk Committee

The Audit and Risk Committee met four times in 2021-22. The Audit and Risk Committee supports the LRB and the Accounting Officer by reviewing and seeking assurance on the risk management framework, the control framework, governance, compliance with policies, procedures, external standards and statutory requirements. It reviews the Principal Risks of the organisation and provides oversight and challenge in the preparation of the annual report and accounts. The Audit and Risk Committee updates the Board on progress of the committee’s work.

At every meeting, the Audit and Risk Committee sees an overall risk report incorporating the risk register and detailed reporting on issues like cyber security. The committee also receives a more detailed risk management report of at least one Principal Risk, so that over time all the Principal Risks are given a detailed review.

During 2021-22 matters covered by the Audit and Risk Committee included:

-

oversight and input into the development of the risk and assurance framework, maturity plans, risk taxonomy and the risk appetite statement;

-

monitoring and challenge of HM Land Registry’s Principal Risks;

-

oversight and input into the development and monitoring of a three-year internal audit plan;

-

oversight of and challenge to internal governance structures;

-

oversight of and challenge to data and register quality;

-

oversight of and challenge to the indemnity fund provision;

-

monitoring and challenging fraud controls and the counter fraud strategy; and

-

consideration and challenge of key financial judgements.

| Audit and Risk Committee membership | |

|---|---|

| Elliot Jordan | Non-executive Board Member and Chair of Audit and Risk Committee |

| Katy Baldwin | Non-executive Board Member, UK Government Investments (nominated representative of the BEIS Secretary of State) (from 6 October 2021) |

| Angela Morrison | Non-executive Board Member |

| Ed Westhead | Non-executive Board Member, UK Government Investments (nominated representative of the BEIS Secretary of State) |

| Attendees | |

| Simon Hayes | Chief Executive and Chief Land Registrar |

| Mike Harlow | General Counsel, Deputy Chief Executive and Deputy Chief Land registrar |

| Iain Banfield | Chief Financial Officer |

| Harnaik Dhillon | Head of Internal Audit (from 5 April 2021) |

| Joanna Horrocks-Potts | Deputy Director, Risk and Assurance |

| Representative of the National Audit Office | National Audit Office |

Remuneration and Nominations Committee

The Remuneration and Nominations Committee met twice in 2021-22. The committee ensures that remuneration and nomination arrangements support HM Land Registry’s aims and oversees the recruitment, retention and performance of the executive team and other Senior Civil Servants in line with Civil Service pay policies.

During 2021-22 the main matters covered by the Remuneration and Nominations Committee included:

-

performance of the Chief Executive and Chief Land Registrar;

-

senior Civil Service performance and pay; and

-

senior leadership structure, development and succession planning.

| Remuneration and Nominations Committee membership | |

|---|---|

| Kirsty Cooper | Interim Chair of the Remuneration and Nominations Committee (from 8 January 2021), Non-executive Board member |

| Ann Henshaw | Chair of the Remuneration and Nominations Committee and Nonexecutive Board Member (from 1 June 2021) |

| Katy Baldwin | Non-executive Board Member, UK Government Investments (nominated representative of the BEIS Secretary of State) (from 6 October 2021) |

| Ed Westhead | Non-executive Board Member, UK Government Investments (nominated representative of the BEIS Secretary of State) (to 13 August 2021) |

| Simon Hayes | Chief Executive and Chief Land Registrar |

| Attendees | |

| Simon Morris | Director of Human Resources |

Attendance schedule for LRB, Audit and Risk Committee and Remuneration and Nominations Committee

| Name | Title | Period* | Board | Committee | |

|---|---|---|---|---|---|

| Non-executive board members | LRB | Audit | Remuneration | ||

| Michael Mire | Non-executive Chair | 12/13 | - | - | |

| Katy Baldwin | Non-executive Board Member, UKGI representative | From 6 October 2021 | 5/5 | 3/3 | 1/1 |

| Kirsty Cooper | Non-executive Board Member and Senior Independent Board Member | 11/13 | - | 2/2 | |

| Ann Henshaw | Non-executive Board Member | From 1 June 2021 | 10/10 | - | 1/1 |

| Elliot Jordan | Non-executive Board Member | 12/13 | 4/4 | - | |

| Angela Morrison | Non-executive Board Member | 12/13 | 4/4 | - | |

| Jeremy Pee | Non-executive Board Member | From 1 June 2021 | 10/10 | - | 1/1 |

| Ed Westhead | Non-executive Board Member/UKGI representative | To 13 August 2021 | 5/6 | 1/1 | - |

| Executive board members | |||||

| Simon Hayes | Chief Executive and Chief Land Registrar | 13/13 | 4/4 | 2/2 | |

| Iain Banfield | Chief Financial Officer | 13/13 | 4/4 | - | |

| Mike Harlow | General Counsel, Deputy Chief Executive and Deputy Chief Land Registrar | 13/13 | 4/4 | - | |

| Chris Pope | Chief Operations Officer | 13/13 | - | - | |

| Simon Morris | Director of Human Resources | - | - | 2/2 |

*appointment relates to the whole of the reporting year unless otherwise specified.

Executive Board

The Executive Board (EXB) is chaired by the Chief Executive and Chief Land Registrar and its members are HM Land Registry’s executive directors. Through the mechanism of individual letters of delegation, members of the EXB handle the day-to-day running of HM Land Registry. During 2021-22 the EXB met twice a week. Most meetings have taken place virtually but the EXB has been able to meet in person on several occasions.

The EXB is responsible for leading and managing the delivery of HM Land Registry’s approved Business Strategy, annual business plan, agreed performance targets and for the day-to-day operational management of the organisation, including compliance with the Framework.

Every month the EXB holds a focused session to monitor progress against delivery of the transformation portfolio. The purpose of these meetings is to oversee the delivery of operational and digital change within the organisation through oversight of delivery programmes and projects, their strategic alignment, benefits, risks and finance. The Transformation Portfolio Office oversees the programme and project boards which report into these monthly sessions. Significant progress has been made across programme areas on digital and data, service improvement, customers, local land charges, IT infrastructure and people and team development.

On a quarterly basis the EXB reviews the principal risks of the organisation. The outcomes of these discussions are then reported to and considered by the Audit and Risk Committee of the HM Land Registry Board.

The EXB has continued to work with the wider ‘Leadership Group’ to develop a broader leadership team by establishing weekly performance discussions and ‘lunch and learn’ sessions to pick up specific topics. All the EXB members and members of the wider Leadership Group have taken part in 360 feedback to inform development. As restrictions from the pandemic eased the Leadership Group were able to meet in person twice in 2021-22.

The EXB underwent an internal review in 2021 to consider the effectiveness of its structures, including committees and operational methods. The outcome of the review resulted in the implementation of actions to streamline the running of the EXB.

| Executive Board membership | |

|---|---|

| Simon Hayes (Chair) | Chief Executive and Chief Land Registrar |

| Iain Banfield | Chief Financial Officer |

| Mike Harlow | General Counsel, Deputy Chief Executive and Deputy Chief Land Registrar |

| Simon Morris | Director of Human Resources |

| Jon Parry | Interim Director of Digital, Data and Technology (from 2 August 2021) |

| Chris Pope | Chief Operations Officer |

| Karina Singh | Director of Transformation |

| Andrew Trigg | Acting Director of Digital, Data and Technology (to 31 July 2021) |

| Attendees | |

| Joanna Horrocks-Potts | Deputy Director, Risk and Assurance (from 1 June 2021 |

| Cathy Jenkins | Chief of Staff |

| Ronal Patel | Head of Corporate Communications |

| Alastair Vella-Sultana | Interim Deputy Director, Risk and Assurance (to 31 May 2021) |

Other executive committees and panels

Four committees report to the EXB. These were reviewed and refreshed during 2021-22 to bring them in line with best practice, to ensure clear accountability and to meet the needs of the EXB better. They now comprise:

-

Investment, Commercial and Finance Committee: Advises the EXB on the overall commercial and financial frameworks that are used by HM Land Registry, including scrutiny of and provision of advice on business cases, contract management and advice to the Accounting Officer on the Financial Delegation Framework;

-

People and Estates Committee: Develops recommendations for the EXB on people and estates strategies and policies. Provides assurance on the effective application of these strategies and policies, including workforce planning, cumulative impact of change on people, engagement, culture and health and safety;

-

Performance and Performance Data Committee: Oversees the monitoring of performance and performance management information including making recommendations to the EXB for future performance monitoring and key performance indicators and providing assurance that performance related data is collected and managed appropriately; and

-

Risk and Integrity Committee: Supports HM Land Registry’s objective of maintaining trust and confidence in the data that HM Land Registry holds in its registers and to understand, monitor and coordinate effort to control risks across the organisation including reviewing risk data, considering emerging trends and risks, periodic reviews of strategies and audit reports and has oversight of practice change proposals with a material risk impact.

All the EXB committees meet at least ten times a year and report back to the EXB after every meeting. Each committee is chaired by an Executive Director and membership comprises senior leaders drawn from across the organisation. Committees are supported by a number of working groups on specific items such as diversity and inclusion, health and safety, counter-fraud and security and resilience.

In addition to the EXB Committees, HM Land Registry also has a Tactical Implementation Group. This group meets as required, at the EXB’s direction, to plan and implement events/activities that require cross-organisation coordination beyond that which is readily achievable via normal management arrangements. In 2021-22 they met in response to changing work from home guidance.

Personal data-related incidents

There were three data-related incidents reported to the Information Commissioner’s Office (ICO) during this reporting period. The ICO determined that no further action was required by them in relation to all the incidents reported.

Statement of Accounting Officer’s responsibilities

Resource Accounts

Under the Government Resource and Accounts Act 2000, HM Treasury has directed HM Land Registry to prepare, for each financial year, resource accounts detailing the resources acquired, held or disposed of during the year and the use of resources by the department during the year. The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of the department and of its income and expenditure, Statement of Financial Position and cash flows for the financial year.

In preparing the accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual and in particular to:

-

observe the Accounts Direction issued by HM Treasury, including the relevant accounting and disclosure requirement, and apply suitable accounting policies on a consistent basis;

-

make judgements and estimates on a reasonable basis;

-

state whether applicable accounting standards as set out in the Government Financial Reporting Manual have been followed, and disclose and explain any material departures in the accounts;

-

prepare the accounts on a going-concern basis; and

-

confirm that the Annual Report and Accounts as a whole is fair, balanced and understandable and take personal responsibility for the Annual Report and Accounts and the judgments required for determining that it is fair, balanced and understandable.

HM Treasury has appointed the Chief Executive and Chief Land Registrar as Accounting Officer of HM Land Registry. The responsibilities of an Accounting Officer, including responsibilities for the propriety and regularity of the public finances for which the Accounting Officer is answerable, for keeping proper records, and for safeguarding HM Land Registry’s assets, are set out in Managing Public Money published by HM Treasury.

As the Accounting Officer, I have taken all the steps that I ought to have to make myself aware of any relevant audit information and to establish that HM Land Registry’s auditors are aware of that information. So far as I am aware, there is no relevant audit information of which the auditors are unaware.

Governance statement by Simon Hayes, Chief Executive and Chief Land Registrar

Scope of responsibility

As the Accounting Officer for HM Land Registry I have responsibility for maintaining corporate governance structures that support the achievement of HM Land Registry’s aims, objectives and targets, while safeguarding public funds and HM Land Registry’s assets.

I was appointed Chief Executive and Chief Land Registrar from 11 November 2019. I have received a ministerial letter of appointment pursuant to the Land Registration Act 2002 and a letter from the Permanent Secretary to HM Treasury, appointing me as Accounting Officer.

HM Land Registry became a Non-Ministerial Department on 1 April 2020. My duties as Accounting Officer are set out in Managing Public Money, which are to ensure public money is safeguarded, properly accounted for and used economically, efficiently and effectively.

The main statutory duties relating to maintaining the registers HM Land Registry holds are found in the Land Registration Act 2002, the Land Charges Act 1972 and the Local Land Charges Act 1975.

Purpose of the governance framework

The governance framework is designed to give assurance that HM Land Registry carried out its duties in a manner that fulfils the appropriate standards of effective internal control and risk management. The framework is based on processes designed to identify and prioritise the opportunities and risks to the delivery of HM Land Registry’s strategy, its strategic objectives and performance targets. It aligns with our statutory duties and is designed to support the governance and strategic aims of HM Land Registry’s sponsor department, the Department for Business, Energy and Industrial Strategy (BEIS). The governance of HM Land Registry and its relationship with other government bodies is set out in a Framework which was agreed with Ministers in November 2020 and published on GOV.UK on 8 January 2021. Our approach to governance is in line with HM Treasury’s Corporate Governance in Central Government Departments: Code of Good Practice. HM Land Registry’s governance team attend BEIS Partners Governance Network meetings to share and learn from best practice.

Central controls

My role as Chief Land Registrar is referred to in the Land Registration Act 2002, the Land Charges Act 1972, the Agricultural Credits Act 1928 and the Local Land Charges Act 1975. The Chief Executive and Chief Land Registrar is responsible for keeping those registers established for the purposes of those Acts and has all the power, responsibilities and duties conferred and imposed on the Registrar by those Acts and by the rules and other secondary legislation made under them. In carrying out those specific statutory functions, the Chief Executive and Chief Land Registrar is not subject to any ministerial control or direction. Those functions are subject to supervision by the court.

In managing its business more generally, HM Land Registry operates within the delegations framework as defined by the Cabinet Office for arm’s length bodies, the specific delegations authorised by officials at BEIS and HM Treasury and the Framework. The Framework sets out the relationship HM Land Registry has with the Geospatial Commission. Separately, there is also a requirement to work with the Government Digital Service to ensure that product releases conform to standards in terms of security, effectiveness and consistency.

Government functional standards guide people working for and with the UK Government and promote consistent and coherent ways of working. HM Land Registry has embedded relevant Government functional standards and introduced a system to monitor compliance and continuous improvement.

In 2021-22 an internal audit provided reasonable assurance of HM Land Registry’s organisational governance structures. These structures were considered compliant with best practice and predominantly effective. Work to implement recommendations for improvement is already underway.

Business Strategy 2022+

During 2021-22 HM Land Registry Board and the Executive Board have worked on refreshing the 2017-22 Business Strategy as referenced in the Performance report.

HM Land Registry has set an ambitious new Business Strategy to be published this year. Secure and efficient land registration will always be our priority. HM Land Registry’s strategy over the next three years will build on this by seeking to improve our speed of service and by contributing to the transformation of the property market by becoming an exemplar service provider of useful and usable property data that will support a sustainable and innovative national economy.

Risk management and assurance

Our approach to risk management

To deliver our objectives it is vital we manage our principal and other organisational risks effectively. Everyone in HM Land Registry, from board level down, has a clear role to play in both identifying and managing risks.

Principal risks are risks to the management of HM Land Registry and the delivery of our strategic objectives. These risks are managed across all levels of HM Land Registry, from decision making on individual cases through to delivering large-scale change and strategic policy making.

We manage these risks through a risk and assurance framework and through an integrated data analysis process with our performance and strategic objectives. The Risk and Integrity Committee (RIC), Executive Board, Land Registry Board and the Audit and Risk Committee (Audit Co) regularly review the principal risks. Other risks are reviewed by each directorate and relevant projects and programmes but escalated as appropriate. The Audit and Risk Committee provides independent assurance to the LRB and Accounting Officer on the integrity of financial statements and the comprehensiveness and reliability of assurances across HM Land Registry.

Our EXB committees also scrutinise and provide assurance. Information on the risk and assurance framework is readily available in HM Land Registry, enabling a culture of integrated governance and continual improvement.

HM Land Registry’s risk and assurance framework

We continually take steps to improve the way we are managing risks. We take an integrated approach to manage risks through a control framework based on the application of the ‘three lines of defence’ assurance model. The model seeks to outline the different roles people have and the types of activities that might be seen in the management of risks. RIC, EXB, Audit Co and LRB also take assurance from a range of activities across our ‘three lines of defence’ that HM Land Registry is able to deliver on its overall strategy and objectives.

HM Land Registry’s three lines of defence

First Line

Controls in place to mitigate risks to strategic objectives and business processes

Second Line

Assure and report on the effectiveness of controls in the First Line

Third Line

Independently assure control effectiveness, risk management and assurance processes

The risk and assurance framework brings together the tools and standards that allow us to manage our business better, make better decisions, stop things going wrong and make things easier for HM Land Registry. It also helps to ensure we are doing this in a safe environment with sensible, proportionate controls in place. The risk and assurance framework covers:

-

governance: ensuring that authorities and accountabilities are clear and that our success in operating the framework is reflected in the annual governance statements;

-

process management: taking the necessary action to ensure our processes are defined and effective, efficient and well-controlled;

-

risk management: identifying, assessing, managing and reporting the risks to the delivery of our strategic objectives and activities;

-

controls: embedding effective controls in our business processes to ensure HM Land Registry’s objectives are met, and any risks reduced;

-

management assurance: assuring the controls in place are sufficient and operating as intended, and taking the necessary action to address any weaknesses;

-

independent assurance: internal and external audit to challenge or confirm the findings of assurance provided by the First and Second Line; and

-

data: ensuring that the data on which our business relies is secure and accurate.

Managing risks to our delivery

In order to protect public money, optimise performance and make sure we are likely to achieve our strategic objectives, we identify and manage closely our portfolio of principal risks. This portfolio is continuously reviewed to ensure we keep pace with our delivery of a modern land registration system and identify and respond to the risks now and in the future.

We ensure we have mitigating controls to manage our risk within appetite and to target levels. The impacts continue to be assessed, new ones identified, and our risks adjusted to ensure an effective strategic portfolio.

Each risk is linked to the strategic objectives and key performance indicators, ensuring the mitigating activity is focused efficiently on securing the achievement of objectives. Where sub-optimal performance within those objectives is indicated, the risks are adjusted to regain the appropriate mitigating focus.

Below is a summary of each of our 10 principal risks, with each led and owned by a director on behalf of our Executive Board. These principal risks are underpinned by associated directorate, programme and team risks, all of which are regularly reviewed by senior leaders.

Principal risks to the delivery of our strategic objectives

HM Land Registry’s 10 principal risks (March 2022)

- Integrity of the register

- People and culture

- Resilience of technology

- Transformation delivery

- Changing market

- Business Continuity

- Processing capacity and capability

- Local Land Charges Programme

- Cyber Threat/Attack

- Capability and Capacity to deliver strategic objectives

We worked hard to deliver proportionate mitigations for our principal risks throughout the financial year.

We have focused mitigations and investment in maintaining and protecting a fit-for-purpose register. Significant investment in processing capacity and capability has also been made to address the workload and to deliver registration services.

Security risks associated with legacy IT systems, cyber and external threats are being continually mitigated and we remain vigilant to the new and evolving threats in these areas.

We have also focused on our people-related risks during this challenging year, taking action to drive cultural change and keep our people at the heart of all that we do.

We have a number of risks related to delivering our core purpose and how we support our customers’ changing needs. We continue to have clear, regular and collaborative communications with market participants.

We plan and forecast to ensure we deliver on our targets within our business strategy, and we continue to prioritise transformation of our services and key programmes.

HM Land Registry has a robust whistleblowing policy in place and remains committed to the highest standards of public service. There were no new cases of whistleblowing during the reporting period.

The coronavirus (COVID-19) national emergency continued to impact HM Land Registry and the property market generally throughout 2021-22. HM Land Registry has continued to adapt and respond to the changing situation.

It has been important to us to make sure that HM Land Registry can maintain the Land Registry with integrity and deliver the services that customers need, but we have been open to innovations and opportunities that came out of changed working practices. We have been reflecting on hybrid working models and have been monitoring productivity in different working environments. As offices and other spaces opened up we followed social distancing guidance and worked hard to make sure that our colleagues returning to offices felt safe in doing so while continuing to ensure all staff feel connected and supported, however and wherever they are working.

Performance reporting

I receive monthly financial reports from the Chief Financial Officer. In addition, I also receive information on organisational performance, which is submitted monthly to the EXB and compiled from wider performance data received and reviewed by the Performance and Performance Data Committee. As laid out in the Performance section of the Annual Report, our performance framework includes eight key performance indicators providing a balanced scorecard across operational, financial, people and customer impacts of what we do.

HM Land Registry has a dedicated analysis team falling under the umbrella of the Finance and Business Services Directorate, which quality assures the management information in use throughout the organisation. On a biweekly basis, the EXB receives near real-time data on service delivery alongside business-critical management information. Appropriate levels of management information (MI) are also provided to other key committees and to managers throughout the organisation.

HM Land Registry operates a number of models critical to its core business. A dedicated Modelling and Decision Support Oversight Group provides oversight and relevant challenge to our business-critical models, and we have implemented Aqua Book-compliant ownership structures and quality assurance (QA) documentation. Similarly, our appraisal of projects and delivery options is consistent with Green Book guidance, and we are developing monitoring and evaluation approaches consistent with the Magenta Book.

Financial performance is monitored and reported monthly. There is a procedure for setting annual budgets and reviewing financial performance and full-year forecasts. Quarterly forecast reviews are in operation and give the EXB and LRB appropriate oversight and assurance. LRB receives briefer finance and performance updates at meetings when quarterly updates are not provided.

I have carried out virtual ‘office’ and ‘national’ question and answer sessions throughout the year, as have other members of the EXB and deputy directors. The sessions provided vital opportunities to engage with staff at all levels of the organisation. I and other members of the EXB regularly write blogs covering important key messaging, which are published on a platform allowing comment and conversation.

Over the last 12 months, I have held frequent one-to-one meet-ups with the Chair of the LRB. I have also met with a wide range of external stakeholders through regular meetings and formal stakeholder engagement groups to understand their concerns and operational context. These meetings with the Chair and other stakeholders have taken place virtually and in person.

I report quarterly to BEIS ministers and hold regular meetings throughout the year to discuss HM Land Registry’s progress against strategic objectives and other areas of concern.

Procurement assurance

I am assured by the Chief Financial Officer, regarding specific procurements, that procurement activities are conducted in line with procurement regulations and Cabinet Office and HM Treasury guidance, and that senior managers have complied with these and HM Land Registry-specific procurement guidelines. Throughout COVID-19, we have considered and applied where relevant the Cabinet Office guidance on supplier relief from contractual obligations and emergency procurement approaches. We have also adopted enhanced supplier financial stability monitoring for our most business-critical contracts.

The Investment, Commercial & Finance Committee (ICFC) is a committee of the EXB that was created in 2020. The ICFC regularly reports on, and now holds responsibility for, approval of contracts over £1m, and advises on approvals of investment cases for contracts over £10m. Over the last year work has taken place to expand the remit of this group to take on oversight of contract management assurance. The remit of the committee may expand further to take responsibility for decisions on Fees & Charges.

Internal Audit and opinion

HM Land Registry has an adequate and effective framework for risk management, governance, and internal controls to support the satisfactory achievement of its business objectives and enable key risks to be effectively managed. While our work found some control issues during its audits there were no notable trends in control failings. Enhancements to the risk and assurance processes over the year has led to an ability to rely more on 2nd line assurance activity and while an integrated assurance approach is still developing, this will further strengthen independent assessment of the control environment as key transformation activity continues to a more digital and automated business. The overall rating remains unchanged from the prior year.

Simon Hayes

Chief Executive and Chief Land Registrar

8 July 2022

Parliamentary accountability report

1. Remuneration Report

Policy for senior civil servants

The remuneration of senior civil servants (SCS) is set by the Prime Minister following independent advice from the Senior Salaries Review Body.

In reaching its recommendations, the Review Body has regard to:

-

the need to recruit, retain and motivate suitably able and qualified people to exercise their different responsibilities;

-

regional/local variations in labour markets and their effects on the recruitment and retention of staff;

-

Government policies for improving the public services including the requirement on departments to meet the output targets for the delivery of departmental services;

-

the funds available to departments as set out in the Government’s departmental expenditure limits; and

-

the Government’s inflation target.

The Review Body takes account of the evidence it receives about wider economic considerations and the affordability of its recommendations.

The salary of the Chief Land Registrar and Chief Executive is set by the Department for Business, Energy & Industrial Strategy. The HM Land Registry Remuneration and Nominations Committee, acting on the authority of the HM Land Registry Board, considers pay recommendations provided by line managers and note the annual pay strategy (including base pay, pay awards, pay gaps and performance pay) for the executive team and other SCS staff within HM Land Registry.

Both base pay and non-consolidated performance-related awards are dependent on performance, which is assessed through an annual appraisal system for senior civil servants, more details of which can be found at https:// www.gov.uk/government/publications/senior-civil-service-performance-management

During the year the members of the Remuneration Committee were non-executive directors Kirsty Cooper, Ann Henshaw, Ed Westhead and Katy Baldwin, and Simon Hayes as Chief Executive and Chief Land Registrar. The committee is also attended by Simon Morris, Director of Human Resources and Organisation & Employee Development.

Policy for other civil servants

Pay for HM Land Registry employees who are not in SCS grades is determined each year following negotiation and consultation between HM Land Registry and the recognised unions and is subject to approval by the Secretary of State, taking into account guidance issued by HM Treasury.

Service contracts

The Constitutional Reform and Governance Act 2010 requires Civil Service appointments to be made on merit on the basis of fair and open competition.

The Recruitment Principles published by the Civil Service Commission specify the circumstances when appointments may be made otherwise.

Unless otherwise specified, all the directors covered by this report hold appointments that are open-ended and are subject to a notice period of three months. Early termination for the directors on open-ended service contracts, other than for misconduct, would result in the individual receiving compensation as set out in the Civil Service Compensation Scheme.

Find further information about the work of the Civil Service Commission.

Salary and performance pay – executive directors (1) 2021/22

| Name | Salary (£’000) | Performance pay (£’000) | Benefits in kind (To nearest £100) | Pension benefits (2) | Total (£’000) |

|---|---|---|---|---|---|

| Simon Hayes, Chief Executive and Chief Land Registrar | 135 – 140 | – | – | 33,000 | 165 – 170 |

| Mike Harlow, General Counsel, Deputy Chief Executive and Deputy Chief Land Registrar | 120 – 125 | – | – | 39,000 | 160 – 165 |

| Dr Andrew Trigg (3), Interim Director of Digital, Data and Technology | 85 – 90 | – | – | 108,000 | 190 – 195 |

| Annual equivalent | (90 – 95) | – | – | – | (90 – 95) |

| Jon Parry (4), Interim Director of Digital, Data and Technology | 250 – 255 | – | – | – | 250 – 255 |

| Annual equivalent | (380 – 385) | – | – | – | (380 – 385) |

| Simon Morris (5), Director of Human Resources and Organisation & Employee Development | 110 – 115 | – | – | 45,000 | 155 – 160 |

| Iain Banfield, Chief Financial Officer | 110 – 115 | 5 – 10 | – | 31,000 | 150 – 155 |

| Chris Pope, Chief Operations Officer | 130 – 135 | – | – | 52,000 | 185 – 190 |

| Karina Singh, Director of Transformation | 110 – 115 | 5 – 10 | – | 23,000 | 145 – 150 |

-

Audited.

-

The value of pension benefits accrued during the year is calculated as (the real increase in pension multiplied by 20) plus (the real increase in any lump sum) less (the contributions made by the individual). The real increases exclude increases due to inflation or any increases or decreases due to a transfer of pension rights.

-

Andrew Trigg’s appointment ended as Interim Director of Digital, Data and Technology on 1 August 2021. The disclosed amounts above relate to his appointment as Interim Director of Digital, Data and Technology.

-

Jon Parry’s appointment as Interim Director of Digital, Data and Technology commenced on 2 August 2021. The disclosed amounts above relate to the period of 2 August 2021 and 31 March 2022.

Salary and performance pay – executive directors (1) 2020/21

| Name | Salary (£’000) | Performance pay (£’000) | Benefits in kind (£100) | Pension benefits (2) (£) | Total (£’000) |

|---|---|---|---|---|---|

| Simon Hayes, Chief Executive and Chief Land Registrar | 135 – 140 | – | – | 142,000 | 275 – 280 |

| Mike Harlow, General Counsel, Deputy Chief Executive and Deputy Chief Land Registrar | 120 – 125 | 10 – 15 | – | 52,000 | 185 – 190 |

| John Abbott (3) Director of Digital, Data and Technology | 10 – 15 | – | – | 0 | 10 – 15 |

| Annual equivalent | (120 – 125) | – | – | – | (120 – 125) |

| Dr Andrew Trigg (4), Interim Director of Digital, Data and Technology | 85 – 90 | – | – | 108,000 | 190 – 195 |

| Annual equivalent | (90 – 95) | – | – | – | (90 – 95) |

| Simon Morris (5) Director of Human Resources and Organisation & Employee Development | 90 – 95 | – | – | 37,000 | 130 – 135 |

| Annual equivalent | (110 – 115) | – | – | – | (110 – 115) |

| Jon Cocking (6) Acting Director of Human Resources and Employee & Organisation Development | 15 – 20 | 5 –10 | – | 36,000 | 60 – 65 |

| Annual equivalent | (85 – 90) | – | – | – | (85 – 90) |

| Iain Banfield, Chief Financial Officer | 110 – 115 | 10 – 15 | – | 60,000 | 185 – 190 |

| Chris Pope, Chief Operations Officer | 130 – 135 | – | – | 52,000 | 185 – 190 |

| Karina Singh, Director of Transformation | 110 – 115 | – | – | 78,000 | 190 – 195 |

-

Audited.

-

The value of pension benefits accrued during the year is calculated as (the real increase in pension multiplied by 20) plus (the real increase in any lump sum) less (the contributions made by the individual). The real increases exclude increases due to inflation or any increase or decreases due to a transfer of pension rights.

-

John Abbott’s appointment ended on 11 May 2020. His pension benefits are 0 as he was not in the pension scheme during the financial year 2020-2021.

-

Dr Andrew Trigg’s appointment as Acting Director of Digital, Data and Technology began on 1 May 2020. The disclosed amounts above relate to his appointment as Acting Director of Digital, Data and Technology.

-

Simon Morris’s appointment as Director of Human Resources and Organisation & Employee Development began on 8 June 2020.

-

Jon Cocking’s appointment as Acting Director of Human Resources and Organisation and Employee Development ended on 5 June 2020. The disclosed amounts above relate to his appointment as Acting Director of Human Resources and Organisation & Employee Development.

| Name | 2021/22 (£’000) | 2020/21 (£’000) |

|---|---|---|

| Michael Mire, Non-executive Chair | 55 – 60 | 55 – 60 |

| Ed Westhead, Non-executive Director (2) | – | – |

| Katy Baldwin Non-executive Director (3) | – | – |

| Kirsty Cooper, Non-executive Director | 20 – 25 | 20 – 25 |

| Angela Morrison, Non-executive Director | 20 – 25 | 20 – 25 |

| Elliot Jordan, Non-executive Director | 20 – 25 | 10 – 15 |

| (Annual equivalent) | – | 20 – 25 |

| Ann Henshaw Non-executive Director (4) | 15 – 20 | – |

| (Annual equivalent) | (20 – 25) | – |

| Jeremy Pee, Non-executive Director (5) | 15 – 20 | – |

| (Annual equivalent) | (20 – 25) | – |

-

Audited.

-

Ed Westhead represents the interest of UK Government Investments (UKGI) and does not receive any remuneration from HM Land Registry. Ed’s appointment ended on 13 August 2021.

-

Katy Baldwin represents the interest of UK Government Investments (UKGI) and does not receive any remuneration from HM Land Registry. Katy’s appointment started on 6 October 2021.

-

Ann Henshaw’s appointment started on 1 June 2021.

-

Jeremy Pee’s appointment started on 1 June 2021.

Salary

‘Salary’ includes gross salary, reserved rights to London weighting or London allowances, recruitment and retention allowances and any other allowance to the extent that it is subject to UK taxation. The tables on pages 77 to 79 are based on accrued payments made by HM Land Registry and thus recorded in these accounts.

Benefits in kind

The monetary value of benefits in kind covers any benefits provided by HM Land Registry and treated by HM Revenue and Customs as a taxable emolument.

Performance awards

Awards are based on performance levels attained and are made as part of the performance review process as discussed and noted at the Remuneration Committee in May 2021. The awards reported relate to the performance in the year in which they were paid to the individual. There were two performance payments made in 2021-22. The awards reported in 2021-22 relate to performance in 2020-21.

Pension benefits (1)

| Real increase in pension and lump sum at 60 | Total accrued at March 2022 | Cash equivalent transfer value (CETV) at 31 March | Real increase in CETV after adjustment for inflation and changes in investment factors | ||||

|---|---|---|---|---|---|---|---|

| Name | Pension (£’000) | Lump sum (£’000) | Pension (£’000) | Lump sum (£’000) | 2022 (£’000) | 2021 (£’000) | (£’0000 |

| Simon Hayes, Chief Executive and Chief Land Registrar | 0 – 2.5 | 0 | 40 – 45 | 80 – 85 | 759 | 706 | 11 |

| Mike Harlow, General Counsel, Deputy Chief Executive and Deputy Chief Land Registrar | 0 – 2.5 | 0 | 35 –40 | 0 | 562 | 512 | 19 |

| Dr Andrew Trigg, Interim Director of Digital, Data and Technology | 0 – 2.5 | 0 | 35 – 40 | 110 – 115 | 895 | 840 | 2 |

| Jon Parry, Interim Director of Digital, Data and Technology | – | – | – | – | – | – | – |

| Simon Morris, Director of Human Resources and Organisation & Employee Development | 2.5– 5 | 0 | 0 – 5 | 0 | 56 | 25 | 22 |

| Iain Banfield, Chief Financial Officer | 0 – 2.5 | 0 | 35 – 40 | 55 – 60 | 447 | 440 | 8 |

| Chris Pope, Chief Operations Officer | 2.5 – 5 | 0 | 35 – 40 | 55 – 60 | 344 | 289 | 39 |

| Karina Singh, Director of Transformation | 0 – 2.5 | 0 | 55 – 60 | 50 – 55 | 973 | 912 | 6 |

- Audited

Civil Service pensions

Pension benefits are provided through the Civil Service pension arrangements. From 1 April 2015 a new pension scheme for civil servants was introduced – the Civil Servants and Others Pension Scheme or alpha, which provides benefits on a career average basis with a normal pension age equal to the member’s State Pension Age (or 65 if higher). From that date all newly appointed civil servants and the majority of those already in service joined alpha. Prior to that date, civil servants participated in the Principal Civil Service Pension Scheme (PCSPS). The PCSPS has four sections: three providing benefits on a final salary basis (classic, premium or classic plus) with a normal pension age of 60; and one providing benefits on a whole career basis (nuvos) with a normal pension age of 65.

These statutory arrangements are unfunded with the cost of benefits met by monies voted by Parliament each year. Pensions payable under classic, premium, classic plus, nuvos and alpha are increased annually in line with Pensions Increase legislation. Existing members of the PCSPS who were within 10 years of their normal pension age on 1 April 2012 remained in the PCSPS after 1 April 2015. Those who were between 10 years and 13 years and 5 months from their normal pension age on 1 April 2012 will switch into alpha sometime between 1 June 2015 and 1 February 2022. All members who switch to alpha have their PCSPS benefits ‘banked’, with those with earlier benefits in one of the final salary sections of the PCSPS having those benefits based on their final salary when they leave alpha. (The pension figures quoted for officials show pension earned in PCSPS or alpha – as appropriate. Where the official has benefits in both the PCSPS and alpha the figure quoted is the combined value of their benefits in the two schemes.) Members joining from October 2002 may opt for either the appropriate defined benefit arrangement or a ‘money purchase’ stakeholder pension with an employer contribution (partnership pension account).

Employee contributions are salary-related and range between 4.6% and 8.05% for members of classic, premium, classic plus, nuvos and alpha. Benefits in classic accrue at the rate of 1/80th of final pensionable earnings for each year of service. In addition, a lump sum equivalent to three years initial pension is payable on retirement. For premium, benefits accrue at the rate of 1/60th of final pensionable earnings for each year of service. Unlike classic, there is no automatic lump sum. Classic plus is essentially a hybrid with benefits for service before 1 October 2002 calculated broadly as per classic and benefits for service from October 2002 worked out as in premium. In nuvos a member builds up a pension based on his pensionable earnings during their period of scheme membership. At the end of the scheme year (31 March) the member’s earned pension account is credited with 2.3% of their pensionable earnings in that scheme year and the accrued pension is uprated in line with Pensions Increase legislation. Benefits in alpha build up in a similar way to nuvos, except that the accrual rate is 2.32%. In all cases members may opt to give up (commute) pension for a lump sum up to the limits set by the Finance Act 2004.

The partnership pension account is a stakeholder pension arrangement. The employer makes a basic contribution of between 8% and 14.75% (depending on the age of the member) into a stakeholder pension product chosen by the employee from a panel of providers. The employee does not have to contribute, but where they do make contributions, the employer will match these up to a limit of 3% of pensionable salary (in addition to the employer’s basic contribution). Employers also contribute a further 0.5% of pensionable salary to cover the cost of centrally-provided risk benefit cover (death in service and ill health retirement).

The accrued pension quoted is the pension the member is entitled to receive when they reach pension age, or immediately on ceasing to be an active member of the scheme if they are already at or over pension age. Pension age is 60 for members of classic, premium and classic plus, 65 for members of nuvos, and the higher of 65 or State Pension Age for members of alpha. (The pension figures quoted for officials show pension earned in PCSPS or alpha – as appropriate. Where the official has benefits in both the PCSPS and alpha the figure quoted is the combined value of their benefits in the two schemes, but note that part of that pension may be payable from different ages.)

For further details, see the Civil Service pension website.

Cash equivalent transfer values

A Cash Equivalent Transfer Value (CETV) is the actuarially assessed capitalised value of the pension scheme benefits accrued by a member at a particular point in time. The benefits valued are the member’s accrued benefits and any contingent spouse’s pension payable from the scheme. A CETV is a payment made by a pension scheme or arrangement to secure pension benefits in another pension scheme or arrangement when the member leaves a scheme and chooses to transfer the benefits accrued in their former scheme. The pension figures shown relate to the benefits that the individual has accrued as a consequence of their total membership of the pension scheme, not just their service in a senior capacity to which disclosure applies.

The figures include the value of any pension benefit in another scheme or arrangement which the member has transferred to the Civil Service pension arrangements. They also include any additional pension benefit accrued to the member as a result of their buying additional pension benefits at their own cost. CETVs are worked out in accordance with The Occupational Pension Schemes (Transfer Values) (Amendment) Regulations 2008 and do not take account of any actual or potential reduction to benefits resulting from Lifetime Allowance Tax which may be due when pension benefits are taken.

Real increase in CETV

This reflects the increase in CETV that is funded by the employer. It does not include the increase in accrued pension due to inflation, contributions paid by the employee (including the value of any benefits transferred from another pension scheme or arrangement) and uses common market valuation factors for the start and end of the period.

Staff report

Staff costs for 2021/22 (1)

| Costs | Permanent staff (£’000) | Apprentices (£’000) | Others (£’000) | Total (£’000) |

|---|---|---|---|---|

| Salaries | 196,598 | 760 | 1,390 | 198,748 |

| Social security costs | 19,887 | 46 | 123 | 20,056 |

| Other pension costs | 49,888 | 200 | 295 | 50,383 |

| Total staff costs | 266,373 | 1,006 | 1,808 | 269,187 |

- Audited

Staff report as at 31 March 2021

| Staff | 2021-22 | 2020-21 |

|---|---|---|

| Number of employees (including fixed-term appointments) | 6,677 | 6,393 |

| Permanent full-time equivalents on 31 March (1) | 6,077 | 5,800 |

| Number of apprentices | 75 | 57 |

| Number of temporary/contract staff on 31 March (1) | 70 | 87 |

| Average sickness days per employee | 8.1 | 5.1 |

| Average number of training days per employee | 6.5 | 5.8 |

| Training days per apprentice | 51.9 | 53 |

| Training spend as percentage of salary bill | 0.25 | 0.42 |

| Female employees | 60.6% | 60.1% |

| Employees working part-time | 30.7% | 31.4% |

| Employees from ethnic minorities | 5.9% | 5.8% |

| Employees who report they have a disability | 6.7% | 7.8% |

| Staff turnover | 5.7% | 4.5% |

| Staff engagement scores | 71% | 71% |

| Mean Gender Pay Gap | 5.7% | 7.5% |

| Mean Bonus Gender Pay Gap | 4.9% | 7.3% |

Gender analysis at 31 March 2022

| Role | Male | Female | Total |

|---|---|---|---|

| Non-executive board members | 3 | 4 | 7 |

| Executive directors (1) | 6 | 1 | 7 |

| Senior Civil Service – band 2 (1) | 5 | 1 | 6 |

| Senior Civil Service – band 1 (1) | 9 | 12 | 21 |

| Permanent employees (not including SCS) (2) | 2,617 | 4,033 | 6,650 |

| Apprentices (2) | 33 | 42 | 75 |

-

Some Senior Civil Service employees are also directors and are included in both categories.

-

Some apprentices are also permanent employees and are included in both categories.

Average full-time equivalent in year

| Year | Average full-time equivalent in year |

|---|---|

| 2016/17 | 4,242 |

| 2017/18 | 4,549 |

| 2018/19 | 4,872 |

| 2019/20 | 5,136 |

| 2020/21 | 5,503 |

| 2022/22 | 6,072 |

Off-payroll disclosures

Off-payroll engagements as at 31 March 2022, for more than £245 per day and that last for longer than six months:

| 2021/22 | 2020/21 | |

|---|---|---|

| Existing engagements as of 1 April 2022 | 37 | 26 |

| Of which existing: | ||

| — for less than one year at time of reporting | 29 | 22 |

| — for between one and two years at time of reporting | 7 | 4 |

| — for between two and three years at time of reporting | 1 | – |

| — for between three and four years at time of reporting | – | – |

| — for four or more years at time of reporting | – | – |

New off-payroll engagements, or those that reached six months in duration, between 1 April 2021 and 31 March 2022, for more than £245 per day and that last for longer than six months

| 2021/22 | 2020/21 | |

|---|---|---|

| New engagements, or those that reached six months in duration, between 1 April 2020 and 31 March 2021 | 35 | 35 |

| Of which: | ||

| * have been assessed as caught by IR35 | 35 | 34 |

| * have been assessed as not caught by IR35 | – | 1 |

| * have been terminated as a result of assurance not being received | – | – |

| Number engaged directly (via PSC contracted to department) and are on the departmental payroll | – | – |

| Number of engagements reassessed for consistency/assurance purposes during the year | 35 | 35 |

| Number of engagements that saw a change to IR35 status following the consistency review | – | – |

| Off-payroll engagements of board members and/or senior officials with significant financial responsibility between 1 April 2019 and 31 March 2020 | ||

| Number of off-payroll engagements of board members, and/or senior officials with significant financial responsibility during the financial year | – | – |

| Total number of individuals on-payroll and off-payroll that have been deemed “board members, and/or senior officials with significant financial responsibility”, during the financial year. This figure includes both off-payroll and on-payroll engagements | 7 | 9 |

Expenditure on consultancy (1)

| Cost | 2021/22 (£’000) | 2020/21 (£’000) |

|---|---|---|

| Cost of consultancy | 1,804 | 1,442 |

| Total | 1,804 | 1,442 |

- Audited

Resourcing

Recruitment is key to the long-term health of HM Land Registry and core to successful delivery of our People Strategy, particularly in supporting the growth of capability and capacity to deliver core services. An annual strategic workforce plan supports the development of resourcing plans that deliver a programme of planned, regular and proactive recruitment.

This year we have recruited externally to ensure that core operational and support services have the capacity to deliver statutory functions to agreed service standards. We have addressed front-line needs and future workforce sustainability by recruiting Registration Officers and two cohorts of Executive Registration Officers in volume. Alongside this, significant internal development and training activity has been undertaken to ensure our colleagues have the essential skills in place at the right level.

We have enhanced specific capability areas, particularly in digital transformation and agile development skills; through regular quarterly recruitment and engagement of delivery partners through the Government Frameworks. This has improved digital capacity, to deliver our aims for a digital Land Register and help towards redefining the future role of caseworkers. We have supported the Local Land Charges Programme by increasing capacity within the team, including the use of contingent labour to support the rapid growth and expansion of the programme.

We have built on our existing entry routes and our apprenticeship schemes have provided the opportunity for people to gain a qualification in legal, human resources, information technology and finance. We have also recruited Civil Service Fast Streamers across a range of disciplines and recruited IT student placements in our Digital, Data and Technology function.

As part of the annual workforce plan we actively encouraged increased representation across all diverse groups. We are governed by the Civil Service Commission Recruitment Principles which requires the selection of people for appointment to be on merit and on the basis of fair and open competition and maintained compliance. All our job opportunities are advertised supporting the Disability Confident Scheme which ensures disabled people will progress to the next stage of the selection process if their application meets the minimum criteria. It is our policy to ensure that any tests used do not discriminate against disabled candidates and adequate reasonable adjustments are made where required.

Recruitment

Innovative marketing and attraction strategies have been used to source candidates for hard to fill digital roles and we have strengthened our employer brand through advertising on different social channels with increased use of video, use of employee blogs and targeted candidate packs. The implementation of hybrid working has enabled advertising significantly more vacancies in all our 14 office locations, utilising remote interviewing which supports candidate attraction in an increasingly competitive market.

HM Land Registry is committed to equality of opportunity and diversity and we have introduced government schemes to support those who may need extra help in obtaining employment such as prison leavers and veterans and a diversity internship.

HM Land Registry currently uses the Public Sector Resourcing (PSR) framework for the procurement of non-payroll contractors. Contractors have been used to meet short-term and/or urgent needs for specialist or skilled resource, and information regarding compliance and disclosures is included on page 83. HM Land Registry is supporting new reporting requirements for the use of contractors so Cabinet Office can track its use across the Civil Service.

Health and wellbeing

Supporting our People Strategy – HM Land Registry’s attendance, health and wellbeing delivery plan

The aim of our attendance, health and wellbeing delivery plan is to create a culture in HM Land Registry that recognises the importance of health and wellbeing, and to build an environment that supports our wellbeing and helps us to look after our own health. Our vision is to create an environment where leaders embed wellbeing into their strategies, decision making and change management, ensuring that initiatives are felt, supported and visible throughout the organisation. In respect of mental health, we want to make a real difference in the way we view, talk and act on mental health – for HM Land Registry to be an organisation where mental health issues are widely understood and destigmatised; where our people are confident to talk about their mental ill health; and where our managers are equipped to identify and understand the spectrum of mental health issues they may encounter, and to be able to support those affected. Our plan is aligned to external drivers – the ‘Thriving at Work: the Stevenson/Farmer review of mental health and employers’; the Mental Health at Work Commitment standards (we signed up to these commitments in 2020); and the Civil Service Strategic Priorities for Health and Wellbeing.

This year we have delivered a variety of initiatives to support our colleagues and the organisation:

-

HM Land Registry achieved a Gold Award in the 2020-21 MIND Workplace Wellbeing Index. This was the second time that HM Land Registry has taken part in the Index (the first being in 2018 when we achieved a Silver Award). To receive a Gold Award means that HM Land Registry was rated as successfully embedding mental health into our policies and practices, using a variety of best practice approaches and demonstrating a long-term, in-depth commitment to colleague mental health. In addition to the survey, MIND invited HM Land Registry colleagues to nominate individuals in their Workplace Wellbeing Index Employee Awards 2020- 21. HM Land Registry had nearly 20 individuals nominated, with two colleagues shortlisted and two colleagues being highly commended;

-

we launched our Wellbeing Hub which is accessible from the home page of our intranet and which provides a one stop shop for practical information, advice, and support for individuals’ wellbeing;

-

we devised and delivered a Health and Wellbeing calendar of events and campaigns to increase awareness of information and provide support, help and advice. The calendar takes into account sickness absence data; Civil Service health and wellbeing priority areas; and national awareness campaigns. Every year we proactively support Time to Talk Day; Mental Health Awareness Week; World Mental Health Day (this year we focused on burnout); World Suicide Prevention Day; and National Grief Awareness Week;

-

we ensured that visible leadership for health and wellbeing is provided through our Executive Board Health and Wellbeing Champion who headed up and supported a number of the campaigns and encouraged leaders to act as role models, actively promoting the importance of health and wellbeing, and challenging myths and stigma;

-

we have a network of mental health first aiders (MHFAs) throughout the organisation. The role of the MHFA is to support colleagues with mental health concerns and to promote mental health awareness across the organisation. We have provided all of our established first aiders with refresher training to ensure their skills and knowledge are kept up to date. During Mental Health Awareness Week the MHFAs held three bite-sized sessions to raise awareness of their role, to address the easing of lockdown concerns and to raise the profile of the Employee Assistance Progamme (EAP) through a personal story of how the service helped a colleague with their mental health condition;

-

HM Land Registry Swansea Office won a prestigious Healthy Working Wales award which celebrates employers across Wales who have demonstrated innovation, creativity and dedication to their colleagues’ wellbeing in response to the COVID-19 pandemic. We entered the category, Best COVID-19 Company Response – internal (supporting employees) large company, and in winning the award we received recognition for the work the office did to ensure our people and their wellbeing were at the forefront of any initiatives introduced throughout the pandemic;

-

we have supported people to stay at work or return to work by ensuring the awareness of the EAP service (and its scope) is promoted across the organisation. We monitor usage of the service to target interventions, and proactively use the service to support health and wellbeing campaigns; and

-

we have created a new attendance, health and wellbeing dashboard to record and publicise health and wellbeing data to help improve communication and transparency. The data is also tracked as part of our internal engagement KPI.

Capability

This year key priorities for the development of our colleagues have included:

-

a increased focus on effective performance conversations

-

development and launch of pilot Leadership Talent Programmes;

-

growth of our Land Registration Academy; and

-

increasing our digital skills capability in a hybrid working environment.

More detail can be found in Simon Morris’ update in the Performance report.

Employee involvement

We continue to engage both informally and formally with our colleagues and their representatives.

Chief Executive and director blogs have continued to be issued during the year on a weekly basis and colleagues have been encouraged to respond to these with the aim of creating open and honest dialogue and exchange of views. This has been complemented with regular virtual question and answer sessions, with high attendance from the workforce overall.

Managers are required to have regular monthly discussions with individual team members to discuss openly employee performance, ideas for improvements to working practices, wider organisational issues, changes and any employee concerns. Our investment in Brilliant Teams, Inspiring Leaders has re-enforced that approach. During the COVID pandemic and the move to remote working, a heightened focus on employee wellbeing has resulted in more regular discussions and support.

We meet regularly with our recognised trade unions. The Chief Executive and members of his team formally meet representatives at the Departmental Whitley Council meetings twice a year. There are structures in place for local Whitley meetings, and unions are consulted on specific issues.

Informal regular dialogue between the Chief Executive and trade union leads has continued during the year. Day-to-day operation of employment relations is managed through monthly Engagement and Consultation meetings between senior management and departmental trade union representatives, alongside fortnightly Transformation and Change meetings. We have also introduced an additional informal weekly meeting as a result of the introduction of remote working and the need to issue additional guidance and support, and to resolve issues and concerns promptly.

We continue to co-monitor the use of facility time with union colleagues, and are within the 0.1% paybill guide figure set by and reported to Cabinet Office.

We have continued a focus on our culture maturity in line with our defined aspirations. The COVID pandemic response enabled our culture to change rapidly and the continuing response of the organisation has been incredible. The focus on the wellbeing of our people remained at the forefront of all considerations and as a result we have again seen further positive improvements in our engagement scores in the Civil Service People Survey. Regular internal surveys held during the year have shown these improvements have been maintained and people are positively referencing the way HM Land Registry has responded. We are committed to maintaining and building on what we have learned from working and managing differently.

Our culture maturity model, developed with the involvement of a wide range of stakeholders, including managers and leaders, colleague networks and union colleagues, has provided a valuable structure to measure our progress.

The People and Estates Committee will now oversee progress against the model and, through annual re-baselining, ensure that key corporate initiatives are applied in a way that makes a difference. Our principal risk and specific controls are aligned on this basis. Similar activity replicated and monitored within each directorate.

Feedback from colleagues continues to be a key component in planning and assessing progress towards our desired culture. In addition survey feedback, continued constructive discussion with unions at both departmental and local level, encouraging colleague involvement on other committees (including health and wellbeing, social and sports, diversity and charity), and directors’ visits with question and answer sessions, are all essential in ensuring our colleagues’ views are heard and understood.

Diversity and inclusion

In April 2021, we published our Diversity and Inclusion (D&I) Strategy for 2021-24 based around three themes: improving representation, creating an inclusive culture, and embedding D&I. Supporting the strategy is an underpinning action plan focusing on year one priorities to develop a baseline of data, to measure our inclusive culture and a focus on our networks and inclusion champions.

We have a strong cultural focus on diversity and inclusion, with widespread directorate activity and a broad approach to communicating inclusivity, with stories about menopause, grief, suicide, and so on.

HM Land Registry currently has networks for disability; lesbian, gay, bisexual, transgender+; carers; age; women; black, Asian and minority ethnic; and faith and belief which provide support for those who share their characteristic and those who do not. They deliver a wide variety of online events ranging from speakers to interactive sessions which form part of a corporate events calendar. The disability network supports user testing for assistive technology as new business systems are developed as part of digitisation and transformation programmes and projects.

Our commitment to fairness and inclusion was recognised in our latest People Survey with an 88% positive score in inclusion measures, a 2% increase on the year before. We also maintained our Disability Confident leader status.

We continue to push to improve representation through our recruitment practices. We recruit externally by default and use name blind recruitment. We offer the Disability Confident guaranteed interview scheme and ensure all our panel members are trained on supporting disabled and neurodiverse colleagues. A recruitment video has been produced to supplement the employee blogs and candidate packs that highlight the colleague networks and Disability Confident scheme.

Reporting of Civil Service and other compensation schemes – exit packages (1)

| Exit package cost band | Number of compulsory redundancies | Number of other departures agreed | Total number of exit packages by cost band | |||

|---|---|---|---|---|---|---|

| 2021/22 | 2020/21 | 2021/22 | 2020/21 | 2021/22 | 2020/21 | |

| £0–£10,000 | – | – | 4 | 1 | 4 | 1 |

| £10,001–£25,000 | – | – | 1 | 2 | – | 2 |

| £25,001–£50,000 | – | – | 2 | 1 | 2 | 1 |

| £50,001–£100,000 | – | – | – | – | – | – |

| £100,001–£150,000 | – | – | – | – | – | – |

| £150,001–£200,000 | – | – | – | – | – | – |

| £200,000 | – | – | – | – | – | – |

| Total number of exit packages | – | – | 8 | 6 | 8 | 6 |

| Total cost | – | – | £184,641 | £181,523 | £184,641 | £181,523 |

- Audited.

There were eight ex-gratia payments in 2021-22 totalling £184,641.23 (2020-21: 6, £181,522.63).

Compensation for loss of office