Tackling abuse and mismanagement 2016-17: full report

Published 5 February 2018

Applies to England and Wales

1. Foreword

Tackling Abuse and Mismanagement, is our annual report on the Commission’s investigations and compliance casework. Ensuring we protect charities and deal with abuse robustly, fairly and proportionately is an important aspect of maintaining public trust and confidence in charities and the regulator. There is also strong public interest in this work.

This report helps us to be as transparent and open as we can be about our casework.

The other reason we produce this report is to share the learning from these cases and help other trustees to prevent abuse from happening to their own charity.

Most charities and their trustees are doing a good job. They want to get things right and do not encounter serious problems in their charity. However, things can and do go wrong; some are minor problems, some are more serious.

In this year’s report we highlight a number of different themes. These include failure to keep basic financial receipts and records, the importance of reporting fraud, and the importance of being alert to, and discharging, safeguarding responsibilities.

But the common thread running through all the themes is the importance of good, collective decision making, and the risks that arise when the basics of sound governance and effective financial controls are not in place.

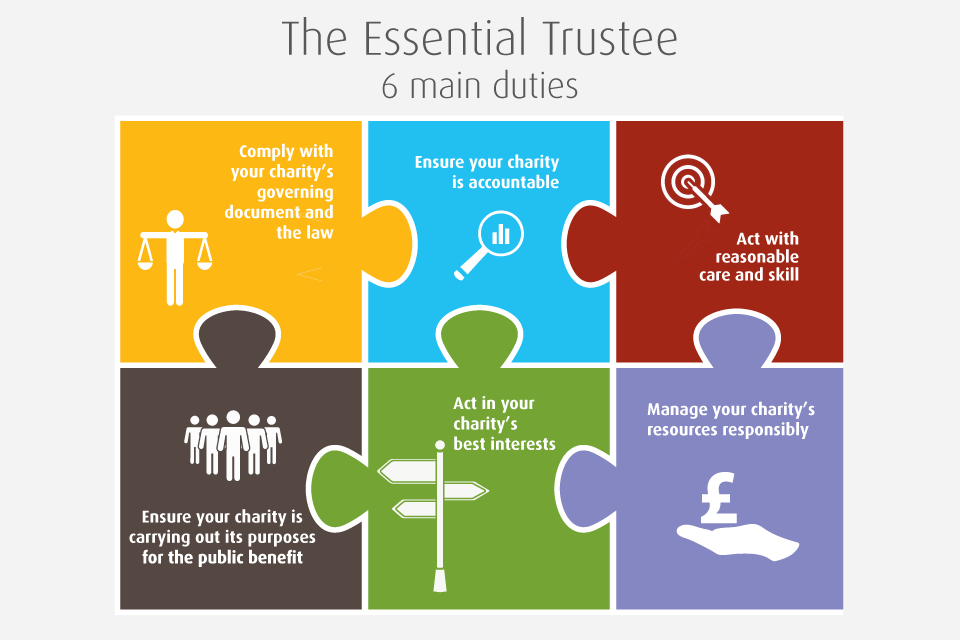

Poor governance puts charities at increased risk of internal mismanagement and of abuse by others. The basic trustee duties, as explained in the essential trustee guidance, are the building blocks of good governance:

- comply with your charity’s governing document and the law

- ensure your charity is accountable

- act with reasonable care and skill

- ensure your charity is carrying out its purposes for the public benefit

- act in your charity’s best interests

- manage your charity’s resources responsibly

We have also produced extensive guidance to explain and help trustees comply with their duties and responsibilities. The Taken on Trust report stresses the importance of trustees’ understanding their role and explores some of the challenges they face.

There are over 167,000 charities on the charity register, supporting beneficiaries across England and Wales, most of whom are not of regulatory concern to the Commission. This report enables us to be transparent about these cases where we do have concerns, but also to help trustees get it right.

Helen Stephenson CBE Chief Executive Officer, Charity Commission

2. Introduction

The Charity Commission is the registrar and regulator of charities in England and Wales. You can find out more about us on our website.

We take our responsibility very seriously and use our powers wisely. Our work is carried out in accordance with our risk framework. We follow our other published policies and procedures, including how we carry out investigations and how, and when, we exercise powers, ensuring that in making decisions and carrying out our compliance work we do so robustly, consistently and fairly.

We publish transparency data about the types of charity which are subject to our compliance work – including monitoring cases, regulatory compliance cases and our statutory inquiry investigation work.

We announce and publish individual cases of significance and public interest.

At 31 March 2017, there were 167,063 charities (and 16,455 subsidiaries) on the register, over 2,000 more than the previous year and we received 8,368 applications to register. 4556 charities were removed from the register because they ceased to exist or operate.

During the year, we regulated £74.7 billion of charity income, almost £4 billion more than the previous year, and over £71 billion of charity spend.

We received almost 100,000 emails, calls and letters and took forward 2354 matters of serious concern into compliance, monitoring and inquiry cases.

This publication draws together our analysis of the themes from our regulatory work and looks at ways in which we have worked with charities to tackle abuse and mismanagement.

In this video, Michelle Russell, the Charity Commission’s Director of Investigations, Monitoring and Enforcement explains the work of her team and introduces the themes of the last year.

Tackling Abuse and Mismanagement 2017

2.1 Key resources and statistics for this year’s report

Our general approach to dealing with concerns about charities, including the powers available to us, is explained in Annex 1: the Commission’s approach to tackling abuse and mismanagement.

Trustees can read about the different kinds of cases we conduct into charities in Annex 2: glossary.

For more statistical information about our compliance casework, see Annex 3, statistical analysis 2016-17.

3. Common types of abuse and mismanagement

Things can and do go wrong in charities – for example, last year, in addition to the concerns and complaints received from members of the public and other agencies, some 2182 serious incidents were reported from charities and 142 from whistleblowers.

Most compliance issues we come across are as a result of trustees making honest mistakes, resulting in minimal impact. As long as they act responsibly in minimising and putting right any damage, learn from it and take steps to prevent it happening again, then we will be content and will not take further action.

It is still important for us to know about these issues as part of our assurance role for the public and donors, even if it does not lead to significant regulatory engagement.

Sometimes the damage may be much more serious or may involve others taking significant advantage of the charity for their own, or even, criminal purposes. However only a relatively small proportion of charities encounter problems so serious that they become subject to a compliance case or investigation by the Commission. Last year we opened 1664 new compliance cases, 503 monitoring cases and 187 statutory inquiries.

Our message is all charities can be vulnerable to abuse or mismanagement if their trustees are not alert to the key risks, have not put in place robust systems and policies to protect their charity from harm, and crucially, if they don’t apply and use those systems and policies.

Every trustee has a responsibility to protect their charity’s assets which includes preventing abuse and non-compliance. This report highlights some of the common issues and types of abuse and mismanagement that we have been seeing in charities, based on our casework. We link to these case study examples of our work and point to further guidance and help.

The themes include the three key strategic regulatory risk areas, which we have prioritised in our risk framework:

- fraud, financial crime and financial abuse

- safeguarding issues

- abuse of charities for terrorist related purposes

As we stressed last year, these do not occur with equal frequency in charities. When they do arise however, the impact and damage they cause can be significant, not just on the individual charity in question but on wider public trust and confidence in the charitable sector.

In those areas we have identified the following themes:

- under-reporting of fraud

- lack of basic financial record keeping

- failure to manage the risks of carrying cash overseas

- defaulting on basic accounts and annual return filing

- struggling to deal with safeguarding in an international context

- failure to include mental health issues in safeguarding

- individuals connected to charities have been convicted for terrorism related offences

We have also identified the following additional themes:

- fundraising-related issues including data protection and agreements with third party fundraisers

- issues connected with charitable status and the maintaining the accuracy in the register of charities

We also cover

- the importance of speaking up – whistleblowing

- the result of our proactive monitoring reviews and work

3.1 How to prevent these types of mismanagement and abuse in a charity

Our work in all of these areas demonstrates that poor basic governance and financial controls and a lack of good, collective decision making are common threads in the areas we have identified and are often the root cause of abuse and mismanagement.

Casework

In 2016 to 17 serious governance concerns featured:

- 166 times in new inquiries, 24 times in completed inquiries

- 155 (7% of) reports of serious incidents

- 92 (65% of) whistleblowing reports

- 618 times in new regulatory compliance cases and 484 times in completed regulatory compliance cases

- 165 times in new monitoring cases; 183 times in completed monitoring cases

Events in the charity sector over the last few years have continued to demonstrate the importance of good governance underpinning both charities’ effectiveness and legal compliance. The regulator’s role is to promote and enforce compliance with legal requirements and duties.

This year we have been pleased to endorse the Charity Governance Code. Good governance in charities is fundamental to their success; it enables and supports a charity’s compliance with the law and relevant regulations.

Good governance is set by the trustees and senior people in a charity, who set the tone for the organisation and should lead by example in promoting compliance and good practice.

3.2 Fraud and Financial Mismanagement

Financial Mismanagement

In 2016 - 2017 concerns about financial abuse and/or financial mismanagement issues featured:

- 83 times in new statutory inquiries, 73 times in completed statutory inquiries

- 236 times in new regulatory compliance cases, and 206 times in completed regulatory compliance cases

- 140 times in new monitoring cases, 170 times in completed monitoring cases

- 360 disclosures between us and other agencies

What we do to promote strong financial management in charities and compliance with reporting requirements

We continued to conduct themed reviews of charity accounts to check they comply with reporting requirements, to promote high-quality financial reporting and to identify concerns about transparency.

You can view all the accounts monitoring reports we published in 2017

We also carried out a proactive scrutiny and review of various charity accounts that signaled they may be in financial difficulty and focused on charities at risk of financial distress in our programme of proactive monitoring and inspection visits.

Our scrutiny and reviews highlighted the difficult but crucial role that trustees and their senior management have in managing situations of financial distress.

Our three key messages to trustees are that we expect you to:

- address financial difficulties early on – don’t leave it until it is too late or becomes more complicated - charities that are able to identify pressures and risks early often resolve them quickly

- address financial difficulties effectively is an important part of a trustee’s duties to act in the charity’s best interests, manage the charity’s resources effectively, and ensure the charity is accountable

- take seriously any concerns expressed by their charity’s auditor or independent examiner and take appropriate action in response

3.3 Fraud

While there were a number of high profile fraud cases in 2017, there is no definitive source or assessment about the total amount of fraud in charities. We know many charities are not reporting fraud to the Commission, as we are finding out about them from other sources. We are still seeing a lot of fraud and thefts in charities.

In 2016-2017 concerns about fraud, theft or other misapplication of funds featured:

- 92 times in new statutory inquiries and 6 times in closed completed statutory inquiries

- 315 times in new regulatory compliance cases and 253 times in completed regulatory compliance cases

- 48 times in new monitoring cases, 77 times in completed monitoring cases

- 405 disclosures between us and other agencies

When charities work hard to fundraise, the last thing that the charity or the donating public want is for donations to be fraudulently taken or used. Ultimately it deprives beneficiaries of help from the charity and undermines the trust of donors and the public.

This is why we continue to promote counter fraud awareness and prevention with trustees and, when we uncover evidence of potential criminality, we always share it with the police. We work closely with the police to help bring people who have committed crimes against charities to justice. You can read more in our strategy for charity fraud, financial crime and financial abuse.

In 2016 we published detecting fraud against charities, our first analysis of reported frauds. This showed that over a third of fraud reports sampled were ‘internal’, committed by trustees, staff or volunteers.

In October 2017 we held our second Fraud Awareness Week. A group of around 40 charities, regulators, professional bodies and other stakeholders joined forces to help combat fraud targeted against charities, the aim being to:

- raise awareness of the key risks affecting the sector

- promote and share good counter-fraud practices

- promote honesty and openness about fraud

As part of this we published guidance to help you protect your charity from fraud.

Case Studies about fraud and financial mismanagement

Case study:

In our alerts we warned the public and other charities about fake fundraising after uncovering a high number of phishing emails purporting to be from ‘Migrant Helpline.’ The charity was genuine, but fraudsters had been using its name to trick members of the public. The fraud was in no way related to the real charity.

And we have seen frauds affect small and large charities. For example, two cases which reached the courts in 2017 involved the chair of one charity stealing £47,000 from the PTA at her child’s primary school – and a former head of finance at a defunct homelessness charity who pleaded guilty to a £1.3m fraud by abuse of position during his time as head of finance.

Our message to trustees is:

- put in place robust financial controls - do not place trust into one or two individuals where there are limited processes for checking

- be aware of the fraud-related risks to your charity

- report suspicions of fraud to the police straight away

- report frauds promptly to the Commission as serious incidents

Our guide protecting your charity from fraud includes good practice templates you can adapt to suit the needs of your charity and advice about what to do if you discover fraud.

Lack of basic financial record keeping

Another theme to emerge in 2016-2017 has been the failure to keep receipts or basic financial records by some charities.

The core duties of trustees include ensuring the charity keeps sufficient accounting records to explain all transactions and show the charity’s financial position. The records should show all sums of money received and spent by the charity on a day to day basis, including what the receipt and spend is for. You can read more about internal financial controls for charities (CC8) in our guidance.

As well as monitoring the end use of funds trustees must ensure that the charity’s funds are spent for the purpose for which they were raised; this includes ensuring there is an audit trail and that records are kept (for example receipts and invoices) for spending, including the movement of funds from a charity to partners or suppliers.

Case study: Masoom inquiry report

The charity was identified for a compliance visit due to its international operations in high risks areas including Pakistan and Syria.

The trustees were unable to produce sufficient evidence to show, and account for, the proper application of the funds in these areas particularly in Syria.

As a result we opened an inquiry, which uncovered evidence of poor financial management and governance, including misconduct and/or mismanagement by the trustees. For example, the trustees:

- did not keep sufficient financial records

- did not effectively manage its relationship with agents overseas who were unable to evidence and account for the proper end use of the charity’s funds

- failed to comply with the terms of the charity’s governing document

The Commission issued a direction to the trustees ordering them to take steps to improve the management and governance of the charity. The trustees’ inability to evidence and account for the end use of funds was particularly serious, given the high risk areas they were operating in.

Our message to trustees is:

- get the basics right – keep records and receipts for all income and expenditure

- implement and follow financial policies and procedures

- set up systems to record this so it’s done easily as you go

- where you work with partners and agents overseas and do not have your own staff or presence in country, you need to properly manage that relationship to ensure you can still evidence the proper expenditure of charity funds

Failure to comply with basic filing duties

Trustees have a number of legal duties in relation to accounting and financial reporting. As well as keeping the basic financial records they have to:

- prepare an annual report and statutory accounts meeting legal requirements

- formally approve the trustees’ annual report and accounts

- ensure that accounts are subject to any external scrutiny required by law or by the charity’s governing document

- ensure that the trustees’ annual report, accounts and annual return are filed on time with the Commission where required by law and, if the charity is a company, with Companies House

- meet public requests for copies of the charity’s most recent trustees’ annual report and accounts

In 2016-17 we received 85.2% of annual returns and 81% of annual accounts by the deadline. This was lower than the previous year partly due to the number of CIOs.

Unlike other types of charities, all CIOs must file accounts, irrespective of income. If you are a trustee of a charity which is a CIO a key message to remember is that the £25,000 income threshold does not apply - you must all file your accounts and reports with us no matter what your charity’s annual income.

To ensure that charities comply with their basic duties to file annual return and reports each year, the Commission has a programme to identify and follow up on charities that are 2 years or more in default of their obligation to file their trustees’ annual report and accounts. This programme takes the form of a class inquiry using the power in s46 of the Charities Act 2011.

This year, the inquiry used powers and issued 29 production orders to ensure 35 charities made good their default and filed the required outstanding documents. As a result, an extra £35.2 million of charity funds is now visible to the public on the register of charities.

Since the programme started in September 2013, as at 31 March 2017, the Commission’s work has ensured £110 million of charity income is now transparently reported and accounted for to the public.

Case study: South riverside community development centre inquiry report

In one typical case, a local community development charity, which failed to submit its annual accounts, report and annual return to the Commission for the financial years 2014 and 2015.

The charity claimed not to have sufficient accounting staff to complete the outstanding accounting documents, as existing staff were engaged on other projects.

Other excuses given by trustees in other cases (which do not excuse lateness or non-submission) include:

- an oversight

- lengthy negotiations with the auditors over the wording of the audit report

- delays while the trustees made alternative arrangements to appoint an accountancy firm to prepare the accounts

- a misunderstanding with the accountants about who was filing them

- all the former trustees having resigned and did not notify the new trustees that the outstanding accounting documents had not been submitted

- the charity’s manager was under pressure, and experiencing extreme workloads

- the trustee responsible for completing the accounting information becoming ill

We also carried out further scrutiny of a sample of 69 sets of accounts from the 27 charities that had been part of the class inquiry. These accounts covered £15.5 million of charity income.

We shared the learning with other trustees, auditors and independent examiners.

The key findings were:

- the majority of the accounts subsequently submitted were found to be of acceptable quality if trustees and advisors use our free reports and accounts templates.

- late filing is often indicative of wider governance problems in a charity

- auditors and independent examiners should recognise that trustees who are late in filing may need additional help and support in meeting their legal obligations. That is the responsibility of an independent examiner to check that their charity client is eligible for independent examination

our message to trustees is:

- simple – file and file early, do not leave it to the last minute

- complete your charity’s annual return as soon as you approve its latest accounts and trustees’ annual report

- if your charity’s income is more than £10,000, by law, you must complete an annual return within 10 months of the financial reporting period ending

- all charitable incorporated organisations (CIOs) must complete an annual return and file accounts regardless of their income

- trustees are responsible for making sure their charity’s annual return is completed on time. If you delegate this task to a member of staff, make sure they know what to do and when it is due

Not managing the risk of carrying cash overseas

Our cases, and joint work with the police, have shown us that charities are not adequately managing the risks of allowing trustees, staff and volunteers to carry cash overseas, neither are they complying with the legal requirement to declare cash being carried.

Over the last two years the Metropolitan Police’s Counter Terrorism Command - SO15 has seized in the region of £4 million at ports under the Proceeds of Crime Act 2002 (‘POCA’) and the Terrorism Act 2000 (‘TACT’) and continue to be very active in the detection and seizure of illicit cash.

This includes a number of cash seizures from the representatives of charities or individuals claiming that cash they were carrying was charitable or that they were carrying it on behalf of a charity.

Charities which work, or support activities internationally, need to move money across borders. Using formal banking systems is the most prudent and responsible way to ensure that charity funds are safeguarded, and that there are appropriate audit trails for the receipt and use of money.

Formal banking systems should always be used where they exist as they provide the safest and most auditable means of transferring charitable funds. If cash is moved instead, then charities must manage the risks, and, if €10,000 or above is to be transported outside the EU it must be declared to the authorities – as required by the law.

The effects of a cash seizures by border authorities cause charities’ beneficiaries to lose out, planned activities are affected and donor money maybe permanently lost.

Case study: ANO - Aid for the Needy and Oppressed

Our inquiry into Aid for the Needy and Oppressed was opened in April 2017 after cash totalling £19,300 belonging to the charity was seized by UK Ports Officers. Whilst detained, the funds could not be used for their intended purposes and were at risk of loss.

Case study: Anaya Aid

This inquiry opened on 5 June 2017. It followed a previous investigation when a trustee and a former trustee had £5,000 seized in December 2015 when we provided regulatory advice and guidance about the risks of cash couriering. In April 2017, we were informed again that ports officers had stopped the same trustee and seized €23,000 and £1500 belonging to the charity.

So our message to trustees is:

- don’t use cash couriers unless there is no other possible means of moving money - if you do follow the regulatory advice we publish

For more guidance, see section D of Chapter 4 of the Compliance Toolkit and the joint alert we published with the Metropolitan Police’s Counter Terrorism Command in 2017, to raise awareness amongst charities - including their trustees, employees and volunteers - of the risks of carrying cash and using cash couriers.

3.4 Safeguarding

Safeguarding should be a key governance priority for all charities, not just those working with groups traditionally considered at risk, such as children, the elderly or the infirm. Charities which fund other organisations, whose activities involve contact with children or vulnerable adults, should also ensure that those organisations have in place adequate safeguarding practices.

Failures by trustees to safeguard those in their care, or to manage risks to their care adequately, is of serious regulatory concern. We may consider this to be misconduct or mismanagement in the administration of the charity.

In 2016-17 concerns about current or historic safeguarding and beneficiaries at risk featured:

- 6 times in new statutory inquiries and 3 times in completed statutory inquiries

- 302 times in new regulatory compliance cases and 244 times in completed regulatory compliance cases

- 9 times in new monitoring cases; 6 times in completed monitoring cases

- 1,203 times in serious incidents reported

- 15 times in whistleblowing reports

- 244 disclosures between us and other agencies

In this video, Harvey Grenville, Head of Investigations and Enforcement explains about safeguarding issues.

What we do when we uncover safeguarding concerns

We will immediately contact the police if there is a risk to a child or vulnerable adult. There may be instances where the police or another statutory agency decides not to investigate or pursue a case.

The Commission may still need to engage with the trustees however because we have serious concerns about the charity, the conduct of its trustees or the adequacy of its systems to safeguard beneficiaries.

Our casework has shown that some charities forget that safeguarding also applies to mental health issues and needs, not just to a person’s physical need or age. For example, our 2017 report into military charities found that many charities were providing a wide range of services and activities that were appreciated by, and had a positive impact, on the lives of veterans.

We also identified areas of good practice, including examples of effective collaborative working to provide better services to beneficiaries, and trustees working together to make decisions in the best interests of their charity.

However, we also found some charities did not consider all their beneficiaries to be vulnerable. We found this was more likely in military charities offering support for veterans with post-traumatic stress disorder, compared with those supporting veterans with physical disabilities obtained during combat.

Our casework also showed some charities were struggling to deal with safeguarding in an overseas context.

Case study: Grail Trust

On 28 March 2017 we published an [inquiry report about the Grail Trust. This criticised the trustees over their handling of an allegation of child abuse at its partner organisation the Grail Trust India.

The Commission has no direct regulatory remit over overseas partners or not for profit organisations which are not registered with it. However, where a registered charity supports, or has overseas partners it works closely with, the Commission’s regulatory remit enables it to hold the registered charity to account over the judgement and management of that relationship.

This includes managing risk and ensuring the proper use of any funds transmitted to the partner. Charities should ensure they have reasonable assurance that the partner is capable of delivering the proposed, activities or services and also has in place appropriate systems of control, which include appropriate safeguarding measures.

Charity Commission safeguarding strategy

Our updated safeguarding strategy makes clear that safeguarding should be a key governance priority for all charities, not just those working with groups traditionally considered at risk.

Everybody has the right to be safe and the public expects charities, quite rightly, to be safe and trusted places.

We are reminding charities of the importance of:

- providing a safe and trusted environment which safeguards anyone who comes into contact with it; including beneficiaries, staff and volunteers

- setting an organisational culture that prioritises safeguarding, to enable those affected to come forward and report incidents and concerns with the assurance they will be handled sensitively and properly

- having adequate safeguarding policies, procedures and measures

- having clarity about how incidents and allegations will be handled should they arise, including how and when they are reported to the relevant authorities, such as the Commission

The Commission’s guidance makes clear that:

- trustee duties include avoiding exposing the charity’s assets, beneficiaries or reputation to undue risk - this means taking reasonable steps to protect beneficiaries, employees and volunteers from harm

- on occasion, charities may be targeted by people who abuse their position and privileges to gain access to vulnerable people, or their records, for inappropriate or illegal purposes - trustees must be alert to this risk and the need to manage it

- safeguarding goes beyond preventing physical abuse, and includes protecting people from harm generally; including neglect, emotional abuse, exploitation, radicalisation, and the consequences of the misuse of personal data

Trustees need to be satisfied that there are clear lines of responsibility and accountability for safeguarding, in particular when working with other organisations to deliver services to their beneficiaries.

Trustees should be satisfied that any partner organisation has in place adequate safeguarding arrangements, including appropriate policies and mechanisms to provide assurance on compliance. This is particularly relevant for charities that undertake overseas humanitarian or development work with affiliates or operate in a confederated structure.

Our message to trustees is:

Make sure that you:

- undertake a thorough review of your charity’s safeguarding governance and management arrangements and performance, if one has not been conducted within the last 12 months

- contact the Commission about safeguarding issues, or serious safeguarding incidents, complaints or allegations which have not previously been disclosed to the charity regulator

For further advice you can read more about our work on safeguarding vulnerable beneficiaries

3.5 Abuse of charities for terrorist and extremism related purposes

Some charities, like other types of organisations, can be at risk of abuse by extremists and terrorist groups. The risk depends on the nature of a charity’s work and where and how in the world they operate.

For many charities the risks are low. The UK’s second National Risk Assessment (NRA 2017) on money laundering and terrorist financing, was published in October 2017.

The Commission, along with law enforcement agencies and other government departments, contributed to this, and it assesses the risks relating to terrorist financing and money laundering that the charity sector in England and Wales face.

The NRA 2017 assesses the terrorist financing risk of the non-profit sector, as a whole, to be low, but recognises that certain parts– particularly charities working internationally in certain countries - face significantly higher risks. We welcome this risk based approach, in accordance with the Financial Action Task Force’s standards, that countries should not regard the entire non-profit sector as either particularly vulnerable to abuse or of equal vulnerability to abuse.

Terrorist acts, and the funding of and support for terrorist groups and activities, are criminal offences. Where there are suspicions of terrorist abuse involving charities we always work closely with the police and other law enforcement agencies. We are not a prosecuting authority and do not conduct criminal investigations.

Our role is to help charities to prevent abuse from happening in the first place, ensure trustees comply with their charity law duties, make sure that abuse is reported and stopped, to protect charity property and assets, and ensure that charities, their beneficiaries and their assets are better protected in the future.

This year we saw a number of cases involving concerns about abuse for terrorist related purposes, including the convictions of two individuals for terrorist financing who used aid convoys to transfer funds to an individual fighting in Syria. We have also dealt with a number of cases following complaints, and/or media reporting, about events and speakers, hosted by charities, where there are allegations that these provided a platform for extremists.

Case study: Didi Nwe Organisation

An inquiry was opened into the Didi Nwe Organisation following a referral from the police about the charity’s chair of trustees who was stopped by police whilst carrying charitable funds in cash on his return to the UK.

We identified misconduct and mismanagement in the administration of the charity, including the inappropriate use of the charity’s website and events as a platform to promote an individual designated by the United Nations Security Council as associated with Al-Qaida, a proscribed terrorist organisation.

The Commission removed three trustees and later removed the charity from the register.

Following the conclusion of the inquiry, one of the former trustees of the charity, Mr Hamasalih, was found guilty, in June 2017, of being a member of Daesh and possessing documents likely to be useful to the terrorist group. The Commission provided a witness statement in support of the criminal investigation and subsequent prosecution.

Case study

We published two reports relating to individuals with links to charity who were convicted of terrorist financing offences in December 2016.

In one case, an individual was provided with an open reference from one of the trustees of the charity they volunteered with. The letter requested that the volunteer be given support by governments and officials to allow them to travel freely into and across Syria. There was little to no due diligence undertaken on the individual by the trustee and as the letter was ‘open ended’ there was a failure in the trustee’s duty of care and misconduct and/or mismanagement by the trustee.

In a second case, we identified an organisation raising charitable funds which stated publicly that it was a charity, although it was not registered with the Commission nor had an application to register been received. During a criminal investigation the police found documents relating to the organisation which suggested that the individuals who were subsequently convicted were involved in the organisation’s management and administration.

Following our intervention, its directors ended its activities. We actively monitored the directors’ actions in properly winding it up, including closing its bank account, and taking down its website.

You can read the case report and press release, which have been published on our website:

- Risks to charities from an individual associated with terrorism - Syed Hoque

- Regulator publishes reports of cases involving individuals convicted of terrorism offences

Although we respond to both actual, and alleged, abuse of charities for terrorist and or extremist purposes we recognise that many charities can play an important role in challenging hate, the ideology of terrorism and those that claim religious or other justification for terrorism.

We continue to work collaboratively to help charities to protect themselves and increase their own resilience to terrorist and extremist abuse. Through outreach and one-to-one engagement we work collaboratively with charities to raise awareness of risks and vulnerabilities, and provide them with guidance and practical tools to manage the risks.

We assess the main areas of risks and vulnerabilities for charities from terrorist and extremist abuse are:

- fundraising methods– including cash, online and via social media

- movement of cash, goods and people

- diversion of aid internationally

- abuse or misuse of charitable assets, funds or goods in high-risk jurisdictions

- the use and misuse of a charity’s name, premises and resources to promote and facilitate extremist speakers and views

Casework

In 2016-2017 allegations made about abuse of charities for terrorist or extremist purposes, including concerns about charities operating in Syria and other higher risk areas featured:

- 9 new inquiries

- 19 reports of a serious incident – the majority related to looting or theft of goods and resources by terrorist groups and allegations made against employees, agents or employees of partners being involved in terrorist activity

- over 60 visits and/or monitoring cases to charities which were identified to be at greater risk of terrorist or extremist abuse by virtue of their activities or areas of operation, complaints received, or concerns raised in the media

We also recorded 912 disclosures between the Commission and other agencies involved in these matters. This figure includes general queries, and those confirming no findings on our records about whether an individual of interest to those agencies is or was a trustee or involved in charity and confirmations about whether organisations have applied for charity status or still exist or operate as a charity.

Our message to trustees is:

- be alert to the risks – these depend on factors such as working in high risk areas where terrorist groups are active and the activities your charity carries out. For some charities the risks are negligible, for others the risks are significantly higher, and they need to be more alert

- take the normal prudent steps trustees to ensure good governance, keep basic financial records and have strong financial controls and management in place. This will help protect charities against abuse of all kinds, including the risk of abuse for extremist purposes

- ensure your charity’s premises, assets, staff, volunteers or other resources cannot be misused for activities that may support or condone terrorism

- report any belief or suspicion of terrorist activity immediately, including possible financing of terrorist activity, to the police using the Anti-Terrorist Hotline

- if you are a trustee and concerned either about an activity or a risk, report a serious incident

- If you are an employee of a charity, as a whistleblower report your concerns

You can find out more about protecting your charity from terrorism in our Compliance Toolkit

3.6 Other key issues we have seen through our casework

Fundraising

CC20 Charity Fundraising sets out the Commission’s guidance to trustees on fundraising and their duties.

In 2016-2017 concerns about fundraising featured:

- 67 times in new regulatory compliance cases and 52 times in completed regulatory compliance cases

- 5 times in new inquiries and 3 times in completed inquiry cases

- 63 times in new monitoring cases and 79 times in completed monitoring cases

- 109 disclosures between us and other agencies

Data protection issues

The Information Commissioners Office (ICO) is the regulator for data protection. It determines whether there is a breach and takes any enforcement action it deems appropriate. As the charity regulator, we are concerned with whether the trustees of a charity have carried out their duties under charity law.

Our guidance to trustees on charity fundraising makes it clear that trustees need to understand and comply with the relevant data protection laws and requirements.

Case study

Last year saw a number of high profile cases involving data protection issues connected with fundraising. A number of large charities were found to be in breach of the Data Protection Act and were issued with fines by the Information Commissioner.

The Commission liaised with the ICO and the Fundraising Regulator and issued alerts to support trustees as well as to remind them of their legal duties and responsibilities in this area.

As regulators we expect trustees and charities to:

- immediately stop any activity found in contravention of data protection laws - the ICO notices published in December 2016 set out activities which were in breach of data protection law

- review and assess activities in the areas of data collection, storage and use to ensure they are compliant with data protection law - this should include reviewing fair processing statements to ensure they are explicit, clear, transparent and highly visible

- review and assess current data governance systems and processes to ensure they are fit for purpose and can evidence sufficient oversight and controls are operating and effective

- where breaches are identified ensure you review the requirements for reporting to the ICO and where a notification of breach is required, also submit a serious incident to the Commission

- where breaches have happened consider the risk to those whose data has been breached and any action required to mitigate this - including notification to those affected if appropriate following a risk assessment by the data controller

- notify the Charity Commission about any investigation by the ICO by reporting a serious incident

Our message to trustees is:

- some practices, that may have been considered ‘common practice’, have been found by the ICO to be in breach of the data protection legislation

- charities are subject to the same legal requirements as all organisations and must properly safeguard personal information according to the law

- acting in breach of their legal obligations under data protection law has, and will, incur substantial financial penalties from the ICO and generate damaging public criticism about charity fundraising

- as trustees you should ensure there is the right level of knowledge and awareness about the rules and that they are followed

- ensure your charity is prepared for the changes coming in on the 2018 General Data Protection Regulation (GDPR)

Further information for charities is available:

- on the Information Commissioner’s website for more information about data protection, and related law, for charities

- in the Commission’s guidance CC20 Charity Fundraising for information regarding trustee duties and fundraising

- in The Code of Fundraising Practice, provided by the Fundraising Regulator, which sets out the legal rules and standards that apply to fundraising activity

Campaigning and political activity

Campaigning and political activity can be legitimate and valuable activities for charities to undertake. However, charities must comply with the law.

In the summer of 2017 we published a report setting out the complaints made and cases of concern that arose in the run up to the General Election in June 2017, that featured campaigning and political activity by charities, and what the outcome was in each case.

The majority of the cases that we conducted in the pre-election period confirmed that charities have a valuable role to play in raising awareness of, and encouraging debate about, issues that affect their beneficiaries and wider society.

As long as they follow electoral law and charity law as set out in our guidance on campaigning and political activity (CC9), charities should feel confident in carrying out such activity.

Charities need to remember that they should remain compliant in the period once and election is called, as the risk of them influencing, or being seen to influence, voter behaviour is increased.

Case study involving issues around campaigning and political activity

The Scout Association

In October 2017, the Chief Scout (Bear Grylls), spoke wearing part of the Scout uniform on the main stage of the Conservative Party Conference, together with two young adults who were volunteers in Scouting.

Concerns were raised with us that this action gave support to a political party. In addition, whilst a range of views were expressed on social media, some comments also raised similar concerns. Charity law and our guidance on political activity and campaigning (CC9) are clear that a charity cannot give general support or support in kind to a political party and must always guard its independence and party political neutrality.

We engaged with the charity, which fully co-operated with us throughout. The charity explained that the idea for the appearance and speech had come from meetings between senior Scout representatives and government ministers which related to an appeal for additional Government funding for Scouting, as a solution to important social concerns.

The Chief Scout indicated that he would be happy to talk at the Conservative Party conference about how Scouting heals communities and gives purpose to young people, highlighting the growth of Scouting from members of the Muslim community.

The charity provided us with evidence that it then carried out a risk assessment, attempted to secure a similar appearance at the Labour Party Conference, and put in place active measures to mitigate the risks. These included that there was no appearance on the stage at any time with Conservative politicians, no photographs with officials, no social media by the government, as well as emphasising at the start of the speech that Mr Grylls and the Scouts were not there in a political capacity.

We concluded that it would have been more appropriate for the trustees to have avoided the risk altogether, rather than attempting to mitigate it. Speaking on the main platform at a party conference (even if no politicians are on the stage) is substantially different from taking part in fringe events.

The Commission concluded that the public perception of the charity could have been adversely affected, even though a statement was made at the outset that the appearance was non-political.

Although it was not The Scout Association’s intention, we considered that there was a high likelihood that the appearance would be seen by some as supporting the Conservative Party.

The Commission did not take any further regulatory action. However, as a result of our involvement, the board of The Scout Association, whilst having governance arrangements in place, is making a number of additions to policies and processes related to political activity and risk.

Third party fundraisers

Where a charity works with third party fundraisers, trustees need to have effective controls over the fundraising, including steps to properly protect the charity’s interests, assets and reputation.

Trustees should ensure all fundraising is legally compliant and regulations pertaining to professional fundraisers or commercial participators and be transparent to donors, supporters and the public. These rules promote transparency, protect potential donors, and give them a fair indication of the extent to which the charity (or charities) will benefit from the fundraising.

We issued an alert warning to charities to avoid entering into arrangements that include one, or more, of the following:

- arrangements with a third party fundraiser which bear all the hallmarks of a professional arrangement, but which are structured to avoid the legal rules; the fundraiser may be described as an adviser or consultant in the contract even though in reality they are really controlling the solicitation of funds on the charity’s behalf. These arrangements can also fail to clarify to donors that the fundraising is being delivered by, or with the significant involvement of, a third party at a significant cost to the charity

- medium or long term contracts that have very limited termination or adjustment provisions

- arrangements in which the charity only benefits from the arrangement at the very end of the contract term, and where there is the possibility that the charity will not benefit at all

- arrangements where the fees received by, or payments made to third party fundraisers damage public trust and confidence in that charity

Our message to trustees is:

- comply with legal requirements which apply when the third party fundraiser meets the definition of a professional fundraiser or commercial participator

- ensure that the arrangement is set up and controlled in a way which is in the best interests of the charity, and which protects its assets and reputation

- read CC20 Charity Fundraising which directs trustees to make sure that the potential benefits of working with other fundraising organisations are appropriately balanced with proper attention to protecting their charity’s interests

Case study: Hospice Aid UK

The Commission opened an inquiry following concerns that the charity had entered into a fundraising agreement which disproportionally favoured a fundraising agency.

In the three years since the charity entered into the agreement (2013-2015), the charity’s gross income was £1,448,258, but direct donations to hospices amounted to just £78,925.

The inquiry revealed that the direct mailing material lacked transparency and there was no solicitation statement – an explanation of the agency’s relationship to the charity - which explained how donations would be used and the percentage that would be received by the charity.

The inquiry concluded that the terms of the agreement substantially favoured the fundraising agency, that it was difficult to see how the agreement was in the charity’s best interests and that it did not enable the public to make an informed decision when donating to the charity.

The Commission used its legal powers to direct and require compliance with a ‘governance and management’ action plan and a ‘fundraising’ action plan - including taking action to review charity’s expenditure, overheads and fundraising.

Case study: Support the Heroes

This is an ongoing inquiry. The regulatory concerns arose from complaints about the charity, in particular about its fundraising activities.

These include serious concerns about an agreement that the charity had entered with a commercial fundraising company, about the transparency of the charity’s fundraising arrangements and the ability of the public to make an informed decision about donating. The inquiry is also examining the charity’s governance arrangements and the ability of the trustees to avoid or manage potential conflicts of interest.

In January 2017 we appointed an interim manager to the exclusion of the trustees. This followed an earlier order in November 2016 barring the trustees from parting with any of the charity’s property.

At that time the Commission used its new powers conferred under the Charities (Protection and Investment) Act 2016 to direct them to cease all fundraising and freezing the charity’s and its subsidiary’s bank accounts.

The trustees subsequently appealed the Commission’s decision to appoint an Interim Manager to the First-Tier Tribunal (charity). The Tribunal upheld the Commission’s decision in a decision published in July 2017.

Other fundraising related issues

We are working across the sector and with others to support charity fundraising, ensuring it is compliant, effective and well managed.

Some other example of issues within fundraising practices of charities include:

Case study: Gandhi World Hunger Fund

The charity relied almost exclusively on income from direct mailings to the public, which secured both regular monthly donations and one-off donations. We had a number of regulatory concerns about its operation, particularly the high cost of fundraising.

In 2015, only 7% of its income was distributed in grants, with the majority of funds being spent on fundraising costs. We issued the trustees with a detailed action plan, which prompted the trustees to conclude that the charity should be wound up. It was dissolved in January 2017 and removed from the charity register.

Trustees should have systems in place to oversee the charity’s fundraising and be satisfied that it is, and remains, in the charity’s best interests.

Case study: Didier Drogba Foundation

The charity held fundraising balls in London to finance a hospital project in the Ivory Coast. The principal concern in the case was the apparent discrepancy between the level of charitable activity claimed to have been carried out by the Foundation and the lack of funds actually spent for its charitable work, the monies been accumulated in bank accounts for future use.

This was due to confusion between the charity registered with the Commission and a not-for-profit organisation established by the same founder in the Ivory Coast. As a result, donors to the charity registered with the Commission may have thought that the activities of the Ivory Coast not-for-profit organisation were activities of the charity they were supporting.

Lessons for other charities include the importance of clarity of messaging and communication with donors – potential donors must not be misled about the activities of the charity.

In this video, Neil Robertson, Head of Technical Casework and Quality Assurance explains about fundraising.

3.7 Maintaining the Register of Charities

Charities are recognised in law as organisations whose main activities are exclusively charitable and for the benefit of the public.

There are nearly 170,000 charities on the register of charities, with a combined annual income of over £74 billion. Approximately 40% (around 65,000) are very small, with incomes of £10,000 and under. Approximately 1% (around 2000) are very large (with an income of over £5 million and a combined wealth of £53 billion).

The Commission has two duties – first, to register those which meet the definition of a charity and have an income of over £5,000 and secondly, to keep the register up to date by removing those charities that cease to operate or exist.

To maintain the accuracy of the register we ensure that at registration, we robustly assess applications so that only organisations which meet the legal tests are registered. We also investigate organisations where we have concerns that what we were told on registration is different to what is happening in practice or where an organisation may not be operating, or capable of operating as a charity.

Removals from the Register of Charities

Case study: Fresh Start Housing

Fresh Start Housing (FSH) was established to provide advice and assistance with finding accommodation for people in poverty including homeless people and ex-offenders. Our monitoring identified concerns the charity was allegedly acting as a conduit for a private business, Investing Solutions (ISL), to make money from housing benefit.

Our regulatory action concluded there were inherent conflicts of interest within FSH. From the time FSH was established it had decided to use the services of ISL, and the founder of FSH, and ISL had benefited considerably from this arrangement.

The trustees failed to demonstrate to us that they had taken decisions that were in furtherance of exclusively charitable purposes and independent of ISL. There was no clear arm’s length relationship and separation between FSH and ISL. We removed FSH from the register of charities on 1 July 2016.

Case study: Our Brave Heroes

The as-yet-to-register organisation, which stated that its aim was to relieve financial hardship among former members of the armed forces who were suffering physical or mental disability.

The organisation had come to our attention following public complaints about its fundraising practices. The charity fundraised by selling lottery tickets, working with a fundraising company.

We identified, and examined, conflicts of interests regarding the agreements between the organisation and the fundraising company and pursued those with the unregistered organisation. We continued monitoring Our Brave Heroes and warned that it would not be able to register as a charity unless reforms we had identified were implemented.

Following our continued scrutiny Our Brave Heroes ceased to operate.

We ensured that the charitable funds it had raised were passed to a registered charity to be applied in line with the donors’ intentions.

3.8 Monitoring compliance

We undertake proactive and reactive monitoring of charities which give rise to concerns about abuse and non-compliance. Monitoring may include desk-based research, corresponding with, or interviewing, trustees, visiting the charity’s premises and inspecting the financial records.

This may result in us providing the charity’s trustees with regulatory advice and guidance; or setting an action plan and then ensuring it has been implemented; or, in the most serious cases, opening a statutory inquiry to use protective powers.

Last year in our compliance work 62 action plans were set, and we issued in our inquiry work 92 directions, to direct charities to take specific steps and actions.

Our proactive monitoring work focuses on risk and intervening at an early stage. Charities are identified for proactive monitoring on the basis of various risk factors, for example those operating in high risk areas, those undertaking high risk activities, those which have previously reported regulatory issues or those who made commitments on their registration that we need to follow up.

We have been making better use of the data and information provided in annual returns and accounts to identify the charities to refer for monitoring.

The Commission’s first use of its new power to give official warnings to charities was in a case identified through our proactive monitoring of charities at risk of financial distress. Given the nature and seriousness of the issues identified, the trustees were given a chance to resolve them but failed to fully comply with the action plan to do so.

The Commission concluded it was appropriate and proportionate to issue the National Hereditary Breast Cancer Helpline with an official warning to promote compliance.

We also undertake targeted scrutiny of annual accounts - both by themes and in individual cases. During the year our team of accountancy experts scrutinised 894 sets of accounts. This comprised 380 sets of accounts as part of our proactive monitoring activities, and 514 sets of accounts to progress our regulatory casework.

As well as engaging with individual charities, we produce themed reports of our findings. These share good practice and highlight where charities are dealing with risks and difficult compliance issues well, whilst also flagging up where improvements are needed.

You can find out more about our monitoring compliance:

- Charities at risk of financial distress: group case report

- Military charities: group case report

- Accounts monitoring: Charity Commission

Post registration monitoring

We also actively monitor newly registered charities where we have concerns about them, for example potential low levels of charitable activity, or charities that operate in high risk areas internationally. Our aim is to ensure they are operating in line with their governing document, and are following any regulatory advice and guidance, to help ensure that the public can support charities with confidence.

We published our findings from a programme of post-registration monitoring of Plymouth Brethren Christian Church (PBCC) Gospel Hall Trusts. This was an important example of our proactive case work focused on recently registered charities.

We committed to monitoring a sample of recently registered PBCC charities to ensure they were complying with their governing documents, including a Deed of Variation adopted during the charities’ registration with the Commission.

Over 100 Gospel Hall Trusts have been registered since 2013; of that number 24 were selected for monitoring, including those about which the regulator had been contacted with individual concerns.

Our review was able to provide public reassurance that the trustees of Gospel Hall Trusts are taking steps to embed the principles of the Deed of Variation in the running of their charities; we also provided regulatory guidance to some individual trusts.

In this video, Kate Waring, Head of Monitoring and Enforcement explains about proactive monitoring of charities.

proactive monitoring of charities

3.9 Freedom to speak up: serious incident reporting and whistleblowing

Both serious incident reports and whistleblowing reports are an important aspect of our compliance casework.

They give us a glimpse of the types, and depth, of compliance issues and problems which different charities are experiencing, from the perspective of their employees and auditors (in the case of whistleblowing) and their own perspective as trustees (through serious incident reporting).

Serious Incidents

The Commission requires charities to report serious incidents. This regime has been in operation since 2007 and is an important compliance and monitoring tool, providing regulatory oversight of individual charities and risk assessment of the sector as a whole.

Given the challenging nature of the work undertaken and the difficult context faced by many charities, it is likely that serious incidents will occur. Where this is the case, it is the Commission’s regulatory role to ensure that trustees comply with their legal duties and that the charity manages the incident responsibly, taking steps to limit its immediate impact and where possible, prevent it from happening again.

Most problems can be resolved by trustees themselves, in some cases with timely advice from professional advisers. Taking action quickly will help protect your charity from further harm and ensure that confidence is maintained in it, as well as benefiting other charities by improving public confidence in the sector as a whole.

In late 2016, the Commission published a consultation seeking views on proposed updated guidance for charities reporting serious incidents, including; removing the requirement to report lack of a policy or procedure (reclassifying to risks rather than serious incidents), proposing new incidents under the significant financial loss grouping and introducing new reference tools such as checklists and a table of examples.

The new guidance was published in 2017 and includes new tools, such as examples and checklists to make it clearer to trustees what they should, and should not, report. It also provides greater clarity on incidents resulting in “significant financial loss”, making clear that losing significant funding or contracts that the charity cannot replace, loss of banking facilities and diversion of funds for significant litigation costs not connected with the charity’s main aims should be reported to the regulator.

Serious incident reporting also helps the Commission to gauge the volume and impact of incidents within charities and to understand the risks facing the sector as a whole, and to respond, for example with guidance or alerts to the wider sector.

In 2016-2017 there were 2182 serious incidents reported. The most common type of incidents reported were safeguarding issues (1203 – 55%), then frauds, thefts and money laundering (507- 23%), other financial losses and criminality (257 – 12%) and governance related issues (155 – 7%). See Annex A for more information about these statistics.

If a serious incident takes place, you need to report what happened and explain how you are dealing with it, even if you have reported it to the police, donors or another regulator.

Our key message to trustees is:

- report incidents and do so promptly

- handle what has happened responsibly

- think about what could have been done to prevent it happening or minimising the loss and impact on the charity for the future

In this video, Claire Parris, Policy Development Manager explains about reporting fraud.

Whistleblowing

When someone whistleblows they are raising a concern about potential harm or illegality that affects others, that may be the charity’s beneficiaries, its employees, donors or members of the public that rely on it.

People connected with a charity can speak up about these kind of concerns by formally reporting them as a whistleblowing report to the Commission:

- as a public interest disclosure, if it’s by an employee

- under charity act provisions for auditors and independent examiners

If you are an employee of a charity and you suspect serious wrongdoing within the organisation, for example criminal offences or health and safety breaches, or you discover that the charity has deliberately hidden serious incidents, you can, and should, speak out safely and report this to the Commission. To find out more, go to whistleblowing: guidance for charity employees.

If you are an auditor or independent examiner of charity accounts, there are separate whistleblowing duties and protections. Refer to the Commission’s guidance for auditors and independent examiners of charities.

The UK charity regulators also issued a guide with explanatory examples to encourage auditors and examiners to exercise their discretion and report relevant matters.

Any person appointed as an independent examiner or auditor for a charity has a duty to report matters of material significance to their respective charity regulator.

In this video, Amie Woods, Deputy Head of Accountancy Services explains about whistleblowing.

3.10 Other themes and statistics from the year

This year we also had a number of cases involving other governance and trustee duty related matters. Concerns about unmanaged conflicts of interest featured:

- 74 times in new regulatory compliance cases and 72 completed regulatory compliance cases

- 6 times in new inquiries

- 2 times in completed inquiries

- 16 times in new monitoring cases and 24 times in closed monitoring cases

Trustee pay, and concerns about trustee or other private benefits featured:

- 12 times in new statutory inquiries

- 2 times in completed statutory inquiriesy

- 10 whistleblowing reports

- 110 times in new regulatory compliance cases and 103 times in completed regulatoryF compliance cases

- 17 times in new monitoring cases and 19 times in closed monitoring cases

Concerns about trustee decision making featured in:

- 6 times in new inquiries

- 3 times in completed inquiries

- 68 times in new regulatory compliance cases and 60 times in completed regulatory compliance cases

- 22 times in new monitoring cases and 24 times in closed monitoring cases

Powers

During 2016/17, a number of the provisions strengthening the legal framework giving the Commission new powers to help regulate more effectively in line with public expectations came into force.

We used the updated (new or amended) powers introduced by the Charities (Protection and Social Investment) Act 2016 in our compliance casework 13 times up to 31 March 2017, including directing actions not to be taken and issuing the first notice of our intention to issue an official warning and have continued to use them into the rest of 2017.

We have also used the new discretionary disqualification powers. One example of this is as part of the inquiry into The Cup Trust.

In this video, Michelle Russell, Director of Investigations, Monitoring and Enforcement explains the use of powers.

Charity Commission use of powers

Case study

The Commission opened an inquiry into The Cup Trust on 12 April 2013, following receipt of information from HMRC. The scope of the investigation includes examining the governance of the charity by its trustee, management of conflicts of interest and the charity’s involvement in a gift aid scheme and whether or not the trustee had complied with its obligations.

The Commission used its powers to appoint interim managers to administer the charity to the exclusion of Mountstar (PTC) Limited, the sole trustee of the charity, in April 2013. Once the interim managers had carried out the functions required of them and had withdrawn the charity’s Gift Aid claims, they wound up the charity and were discharged.

The charity was removed from the register of charities on 26 May 2017.

The Commission used its new powers in the Charities (Protection and Social Investment) Act 2016 to disqualify the corporate trustee, Mountstar, from being a charity trustee for a period of 15 years.

The Commission will be publishing its inquiry report later in 2018, which will set out the findings and conclusions from the investigation and other action taken.

Further details about the use of our powers in compliance work is available in Annex 3.