Rural Payments Agency

Agency

- Funding for farmers, growers and land managers

- Rules for farmers and land managers

- Rural payments service: check for maintenance and downtime

- Register and update your details with the Rural Payments Agency

- Sign in to the Rural Payments service

- Register land or update digital maps for rural payments

- Use Cattle Tracing System (CTS) Online

- Apply for a CPH number

- Extreme weather guidance

- Cross compliance

Featured

Blog post

The new SFI offer for 2026

The new Sustainable Farming Incentive (SFI) offer will launch this year. It will continue to support sustainable farming in England and help encourage growth.

Press release

Strong uptake for Countryside Stewardship Mid Tier agreements

£59m in Countryside Stewardship Mid Tier agreement extensions taken up by farmers

Blog post

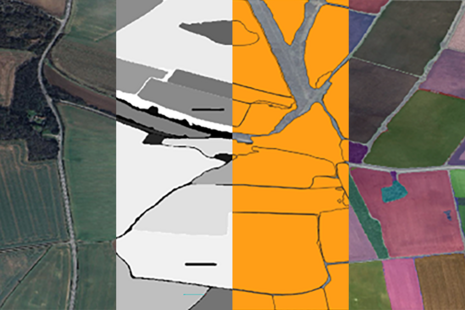

How RPA uses remote monitoring technology to monitor environmental land management agreements

If you have a Sustainable Farming Incentive (SFI) agreement or a Countryside Stewardship (CS) agreement with RPA, you’ll be aware that we use a range of methods to monitor environmental outcomes.

Blog post

Farming Equipment and Technology Fund 2026: guidance now available

The application window for the next round of the Farming Equipment and Technology Fund (FETF 2026) will open on 17 March.

Blog post

SFI26: details, definitions and what to expect

In this post, we explain what to expect from the Sustainable Farming Incentive (SFI) offer in 2026.

Blog post

NFU26: how we’re building farming resilience

Today at the National Farmers Union (NFU) conference, the Secretary of State Emma Reynolds shared more detail on how government will deliver its vision for agriculture in England.

Latest from the Rural Payments Agency

What we do

We pay out over £2 billion each year to support a thriving farming and food sector, supporting agricultural and rural communities to create a better place to live.

RPA is an executive agency, sponsored by the Department for Environment, Food & Rural Affairs, supported by 1 public body.

Follow us

Documents

Transparency and freedom of information releases

Our management

Contact RPA

Rural Payments Agency

Reading

RG1 3YD

United Kingdom

Main switchboard

03000 200 301

(Official correspondence only)

Find out about call charges at www.gov.uk/call-charges

Rural Payments Agency

PO Box 352

Worksop

S80 9FG

United Kingdom

Main switchboard

03000 200 301

General correspondence address

Defra rural services helpline

PO Box 352

Worksop

S80 9FG

United Kingdom

Defra rural services helpline

03000 200 301

Contact the Defra Rural Services helpline for farming-related advice from the Rural Payments Agency.

Monday to Friday, 8.30am to 5pm.

You should also call us 24/7 to report suspicion of notifiable disease in animals. Please choose the option for Animal and Plant Health Agency.

Find out about call charges at www.gov.uk/call-charges.

Cattle tracing

0345 050 1234 (General)

0345 050 3456 (Welsh)

RPA fraud line

PO Box 69

Reading

RG1 3YD

United Kingdom

Fraud line (freephone)

0800 347 347

If you suspect that a fraud has been committed, please let us know by e-mail or by calling the freephone fraud line.

Your details and the information you provide will be treated in the strictest confidence.

Agricultural Wages complaints

Rural Payments Agency

Sterling House

17 Dix's Field

Exeter

EX1 1QA

United Kingdom

Agricultural Wages Team

01392 315719

Search for 'agricultural wages complaint form' at www.gov.uk for more information.

RPA media enquiries

Seacole Building

2 Marsham Street

London

SW1P 4DF

United Kingdom

Telephone

03300 416560

Out of Hours (queries before 9am and after 6pm on weekdays, and on weekends and public holidays)

0345 051 8486

This telephone number is for press calls only. Please see above for helpline / main switchboard.

Make a Freedom of Information (FOI) request

- Read about the Freedom of Information (FOI) Act and how to make a request.

- Check our previous releases to see if we’ve already answered your question.

- Make a new request by contacting us using the details below.

Rural Payments Agency

Rural Payments Agency

Eden Bridge House

Lowther Street

Carlisle

Cumbria

CA3 8DX

United Kingdom

Phone

03300 416 502

FOI requests can be made in writing only, either by post or by email. An EIR request can be made in writing or by phone.

High profile groups within RPA

Corporate information

Jobs and contracts

Read about the types of information we routinely publish in our Publication scheme. Find out about our commitment to publishing in Welsh. Our Personal information charter explains how we treat your personal information.