HMRC Annual Report and Accounts 2015-16 - Executive Summary

Updated 21 July 2016

1. Who we are and what we do

1.1 Our mission statement

We are the UK’s tax, payments and customs authority, and we have a vital purpose: we collect the money that pays for the UK’s public services and help families and individuals with targeted financial support.

We do this by being impartial and increasingly effective and efficient in our administration. We help the honest majority to get their tax right and make it hard for the dishonest minority to cheat the system.

1.2 Objectives

Our key objectives in 2015 to 2016, set by the government, were to:

- maximise revenues

- improve the service that we give our customers

- make sustainable cost savings

We revised these at the start of 2016 to 2017, with HM Treasury’s agreement, to reflect our rapid transformation into a more highly-skilled and digital organisation.

Our key objectives are now to:

- maximise revenues due and bear down on avoidance and evasion

- transform tax and payments for our customers

- design and deliver a professional, efficient and engaged organisation

1.3 What we do

We are one of the UK’s biggest organisations. At 31 March, we had around 58,600 full-time equivalent employees in 167 offices across the UK, collecting tax and duties from 45 million individuals and more than 5.4 million businesses, and paying tax credits to 4.4 million families and Child Benefit to 7.4 million families.

We contribute to the country’s economic and social wellbeing, support growth and as a socially-responsible organisation, we monitor closely our economic, social and environmental impact.

The UK is one of the largest economies in both the EU and the world and we work closely with HM Treasury through the Policy Partnership to deliver effective tax policy which meets government objectives, working together on policy design through to implementation. We are uniquely placed to provide advice on the implementation of tax policies using our considerable expertise, knowledge and insight of our customers and their behaviour, tax compliance and tax legislation.

We also work with a number of other government departments to help deliver their objectives; for example, in collecting student loans and in enforcing the National Minimum Wage and National Living Wage.

2. At a glance - our performance in 2015 to 2016

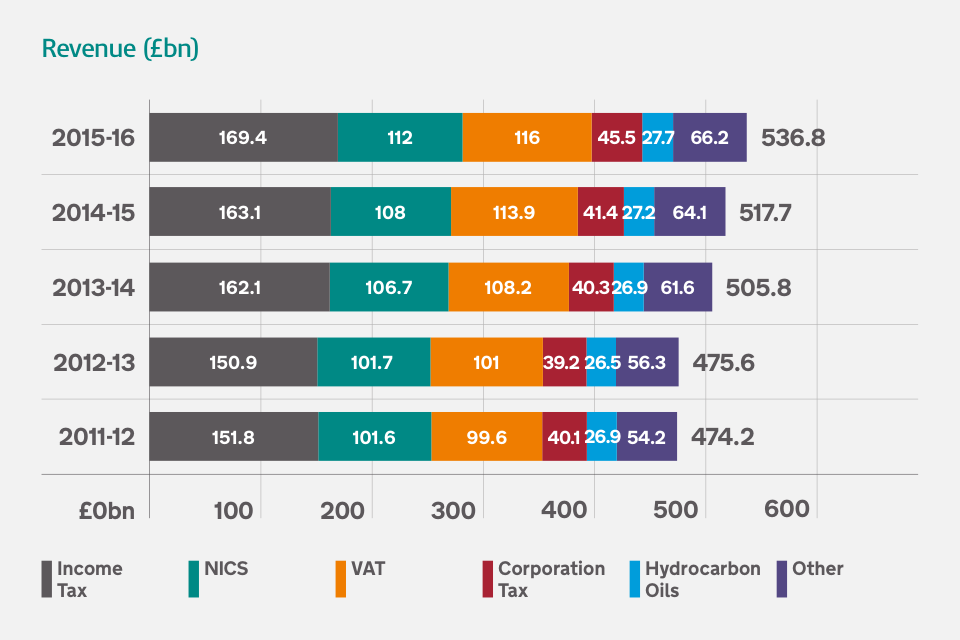

£536.8bn total tax revenues - that’s £19.1 billion more than last year, an increase of 3.7%

We’ve now brought in record total tax revenues for the sixth consecutive year

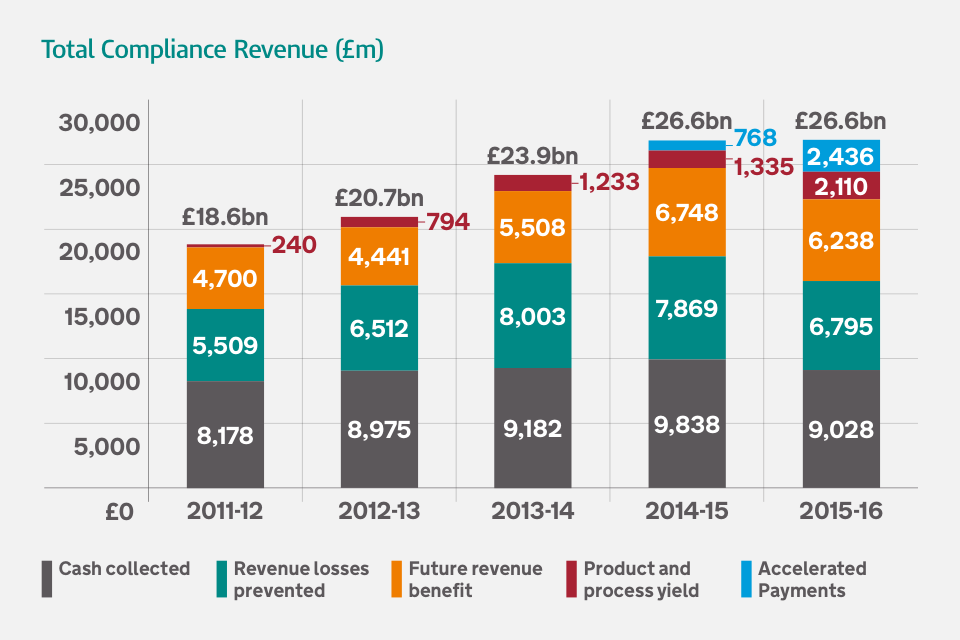

£26.6bn compliance revenues secured - making a total of more than £110 billion since 2011 to 2012

£14.9bn tax protected through successful litigation

£210m annual sustainable cost savings, exceeding the target set by the government

Other key achievements:

- 754,900 tax credits customers renewed online using our digital service - almost double the 2014 figure

- 46,000+ staff attended 616 Building our Future events across 84 locations to discuss our transformation

- 2.5 million people are now using the new online Personal Tax Account

- 89% of Self Assessment returns were done online by the 31 January deadline - a new record

- 94% of all customs clearances for trade cleared within 2 hours

- 537 apprentices recruited

We’ve highlighted our achievements over the past year in this short animation:

HMRC achievements 2015-16 animation

3. Performance – how we did and our plans

We brought in record total tax revenues for the sixth consecutive year of £536.8 billion, and secured additional compliance revenues of £26.6 billion, which exceeded our target for last year. We also exceeded our sustainable cost savings targets set by ministers. In the first part of the year, service levels were substantially below our targets on both customer calls handled and post turnaround times. We responded swiftly by recruiting additional customer service staff to deliver improvements, which we then sustained throughout the year.

Reviewing our performance

We have a bold vision for the future of HMRC. Over the next few years, we will invest a further £1.3 billion to transform into one of the most digitally advanced tax administrations in the world, finishing the delivery of our multi-channel digital services so we become a digital-by-default organisation.

3.1 Maximising revenues

In 2015 to 2016, total revenue increased by £19.1 billion, or 3.7%, to £536.8 billion.

In summary, and compared to 2014 to 2015:

- income tax (32% of total revenue), and National Insurance Contributions (21% of total revenue) increased 3.8% due to higher levels of employment and higher wages

- Value Added Tax (22% of total revenue) increased 1.8%, due to increases in receipts for the automotive, business services and utilities sectors. Household spending has also continued to rise

- Corporation Tax (8% of total revenue) increased 9.9%

- hydrocarbon oils (5% of total revenue) increased 1.8%, due to the reduction of pump prices increasing the amounts purchased

A number of other taxes, including stamp taxes, alcohol and tobacco duties, Capital Gains Tax, Inheritance Tax and Air Passenger Duty, accounted for the remaining 12%.

There were some significant increases in:

- Capital Gains Tax (up £1.6 billion — 28%)

- Inheritance Tax (up £0.3 billion — 7.9%)

- Insurance Premium Tax (up £0.8 billion — 27.6%)

Figure 1: shows revenue (£bn)

Compliance revenues – 2015 to 2016 performance

While the vast majority of individuals and businesses pay what is due, we work very hard each year to make sure that those who try to cheat the system also pay what they should. We refer to the amount of revenue that we either collect or protect through our compliance activities as ‘compliance revenue’.

Our compliance revenue amounts to billions of pounds that would have otherwise been lost to the UK. We have strengthened our grip on those who deliberately cheat the system through fraud, avoidance and evasion, and continue to pursue those who refuse to pay what they owe. We apply the most appropriate civil and criminal sanctions against this dishonest minority. The decision to carry out a criminal investigation is based on a number of factors, for example the nature and scale of the alleged fraud or our ability to obtain the evidence to prove the case.

During the last year we secured £26.6 billion from our compliance work, which exceeded our target for the year. As well as our on-going compliance work, our priority this year has been to increase our capacity to tackle avoidance and evasion, as well as to improve the skills and capabilities of our people. This recruitment and training has put us in a much stronger position to address the increasing challenges we face over the next few years.

How we calculate the full impact of our compliance activity is based on a well-established methodology that we have regularly refined and improved, and which is designed to capture the impacts of the wide range of compliance work we undertake.

Compliance revenue includes not only cash collected but also an estimate of the amount of revenue we prevent from being lost, together with an estimate of the impact of our current compliance interventions on future customer behaviour. Compliance revenue also captures the continued impact of the Accelerated Payments regime, which requires up-front payment from users of certain tax avoidance schemes.

Cash collected is the amount of additional revenues due when we identify past noncompliance, reduced by a discount rate to reflect the fact that some of the amounts we identify will not be collected. We use an estimate due to the difficulties we would face in tracking all the payments made against all of our compliance interventions across the multiple IT systems we currently need to use, as well as to reflect that we know we will not collect every penny arising, due to businesses becoming insolvent, for example.

Following advice from the National Audit Office (NAO) we will change the way that we report future revenue benefit from 2016 to 2017, so that we will report it in the year in which it has an impact on tax receipts, rather than in the year that we complete our compliance interventions.

Figure 2: shows total compliance revenue

Accelerated Payments

Accelerated Payment Notices are one of the most significant tools that we have to tackle avoidance by individuals and companies. Those who have entered tax avoidance schemes which are under investigation are now required to pay the disputed tax up-front within 90 days. During the last financial year we issued more than 36,000 notices, worth £3.1 billion in tax.

Since the start of the Accelerated Payments regime in 2014 we have issued more than 46,000 notices, worth £4.8 billion and are on course to issue more than 70,000 payment notices to individuals and businesses involved in avoidance schemes currently under dispute with HMRC by the end of 2016.

Accelerated payments does not change the amount of tax that should be paid or affect anyone’s right to pursue their dispute with us, if they feel they are legally entitled to the tax advantage claimed by the avoidance scheme. Instead, it sets out who holds the money while the dispute is resolved. Should they win their case, we will repay the tax with interest.

3.2 Improving customer services

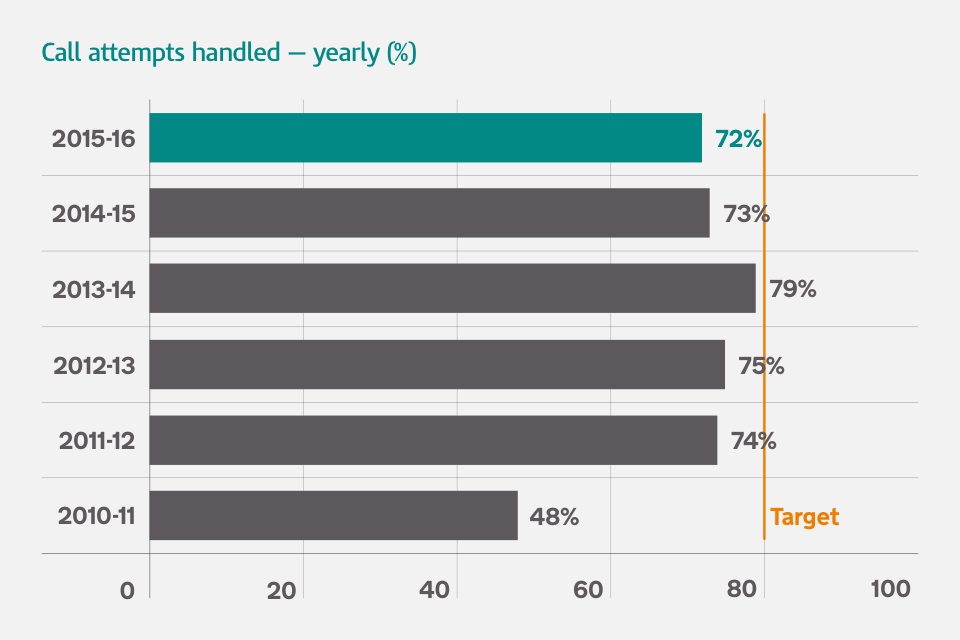

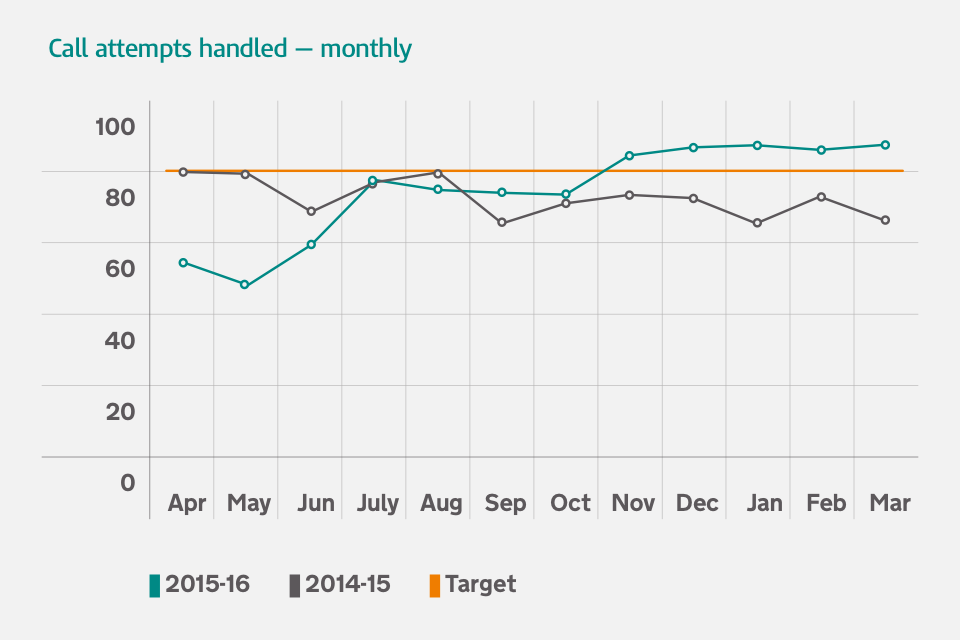

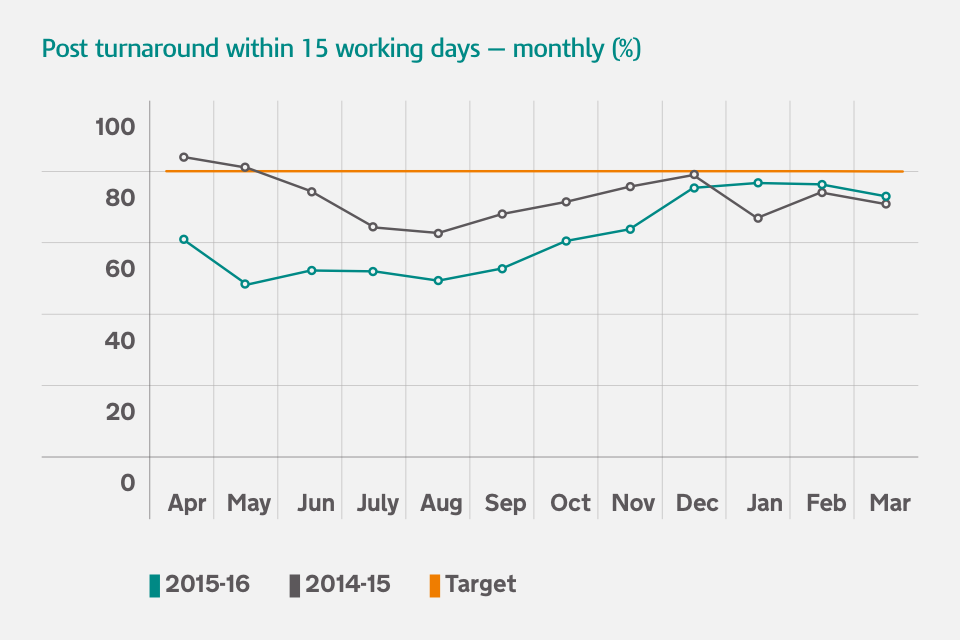

In the first part of the year, service levels were substantially below our targets on both customer calls handled and post turnaround times. We responded swiftly by recruiting additional customer service staff to deliver improvements, which we then sustained throughout the year. Overall call answering levels recovered quickly and by the end of the year, we were answering 88% of call attempts. Our average speed of answering calls was also too lengthy at the start of the year, but is now around six minutes and on an improving trend.

We also moved more than 900 people from across HMRC to work on post. Our post handling performance took longer to recover but by the end of the year we were handling 70% of post within 15 days and we are now building on this improvement.

We worked hard to deliver the consistent level of service that customers expect from us, and while our performance wasn’t good enough in the first quarter of the year and, as a result, we did not meet our overall targets for calls and post, we made significant and sustained improvements during the rest of the year.

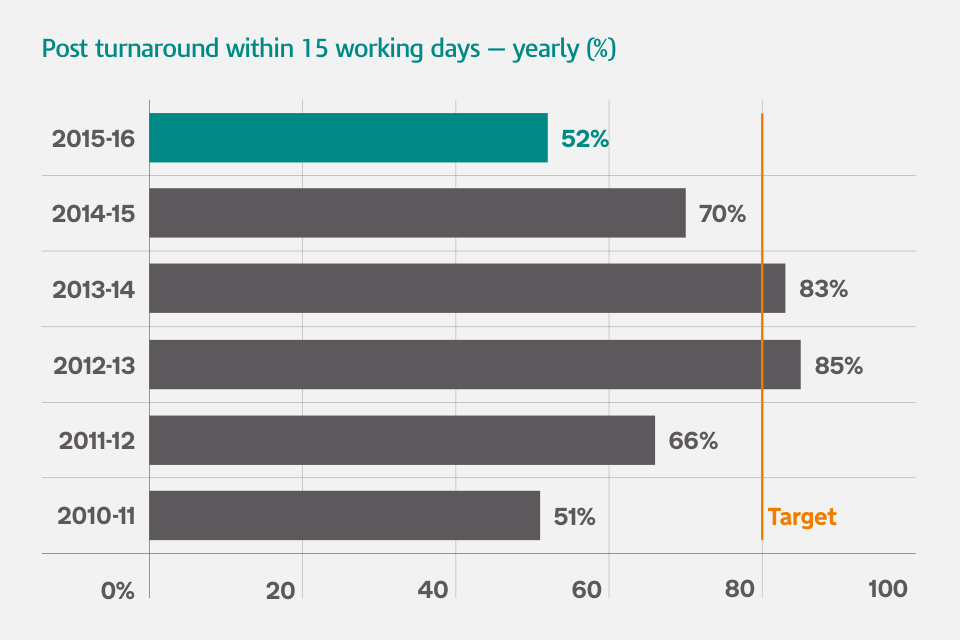

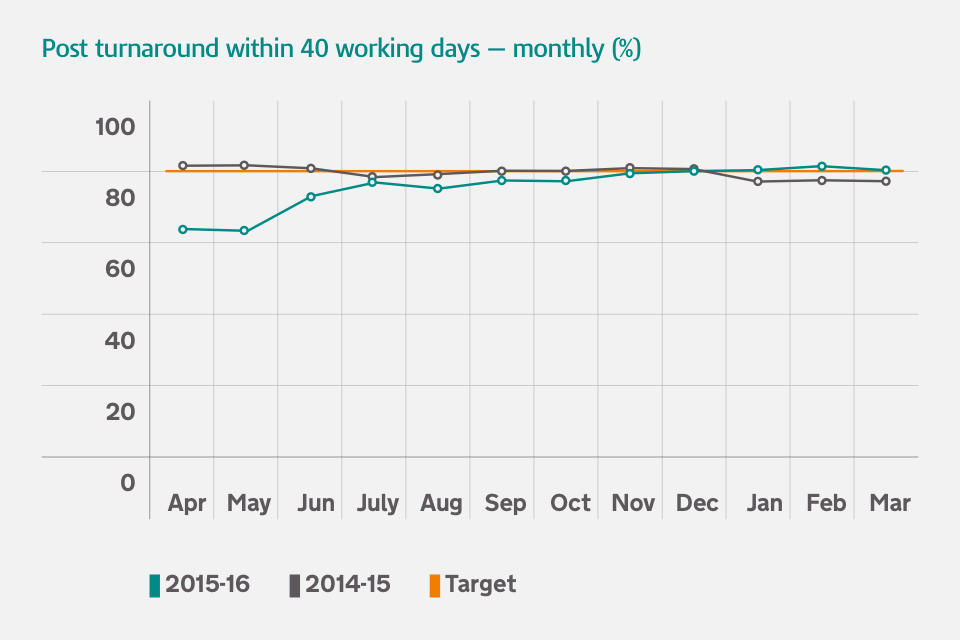

Across the year, we handled 72% of calls (against our target of 80%), handled 52% of post within 15 days (against a target of 80%) and handled 87% of post within 40 days (against our target of 95%), although we did significantly improve performance in quarters two and three and sustained that improvement across the year.

Our phone performance dropped to 48% of call attempts handled in May. We were able to deliver and maintain improvements from that point, with performance above 70% in quarter two and above the target of 80% from November onwards. Similarly, at the start of the year our average speed of answer performance fell to 18-20 minutes. However, performance improved and averaged around six minutes over the last four months.

Figure 3: shows number of call attempts handled – yearly

Figure 4: shows number of call attempts handled – monthly

Our post performance also dropped in May, to 31% of post handled within 15 days.

Again, we subsequently improved performance across the rest of the year, and by December were handling 75% of post within 15 days against the 80% target. During the early part of the year we prioritised handling calls over handling post which had a negative impact on the post turnaround times.

However, our efforts to reduce the level of post on hand did result in improved service levels. We turned around over 95% of post within 40 days and over 70% within 15 days in all of the last four months of the year.

Figure 5: shows post handled within 15 working days – yearly

Figure 6: shows post handled within 15 working days – monthly

Figure 7: shows post handled within 40 working days – monthly

During the year, we also:

- maintained our performance in processing tax credits and Child Benefit claims and changes of circumstance in 17 days for UK claims and 63 days for international claims - well within our target of 22 days and 92 days respectively

- delivered yet another strong performance in dealing with our busiest periods of demand, such as the tax credits renewals deadline in July 2015 and the online Self Assessment deadline in January 2016

- had some excellent results in dealing with tax credits renewals. We received more than 2.5 million applications by the 31 July renewals deadline, including more than 750,000 through our new online renewals service. During the last week before the deadline, we received 1.2 million applications and answered 85% of calls

- achieved a marked improvement in our Self Assessment performance compared with the previous year. A total of 89% (86% in 2014-15) of the 10.39 million returns we received were submitted online. On the 31 January deadline day, we answered 98% of phone calls, compared with just 34% of calls on the same day in 2010, the last time the deadline fell on a Sunday

To address our poor performance in the early part of the year we also:

- recruited many of our 3,000 new staff on flexible working patterns, giving us 1,800 additional people working on telephone helplines at evenings and weekends when many of our customers choose to call

- gave 1,600 staff training to enable them to handle a wider range of customer queries and moved more than 900 people from other areas of HMRC to work on post

- supported our most vulnerable customers by handling more than 100,000 enquiries through our Needs Extra Support service with face-to-face visits and specialist phone help

We are committed to transforming the entire customer experience of HMRC, and have set ourselves a new strategic objective to ‘transform tax and payments for our customers.’ Investment of an additional £1.3 billion announced by the Chancellor at the 2015 Spending Review will transform HMRC into one of the most digitally advanced tax administrations in the world, finishing the delivery of our multi-channel digital services so we become a ‘digital-by-default’ organisation.

We will transform the tax system over the Parliament by introducing simple, secure and personalised digital tax accounts, removing the need for annual tax returns. This will give individuals, businesses and their authorised agents a more convenient real-time view of their tax affairs, providing them with greater certainty about the tax they owe and payments they are due to receive. These reforms will deliver the biggest transformation of the tax system in a generation, making it more effective, efficient and easier for taxpayers.

We want the customer experience to be consistently excellent by building on our progress in rolling out new digital services that will make dealing with tax and payments quicker, easier and more efficient for millions of our individual and business customers. We call this approach ‘Making Tax Digital’.

3.3 Investment, efficiency and providing value for money

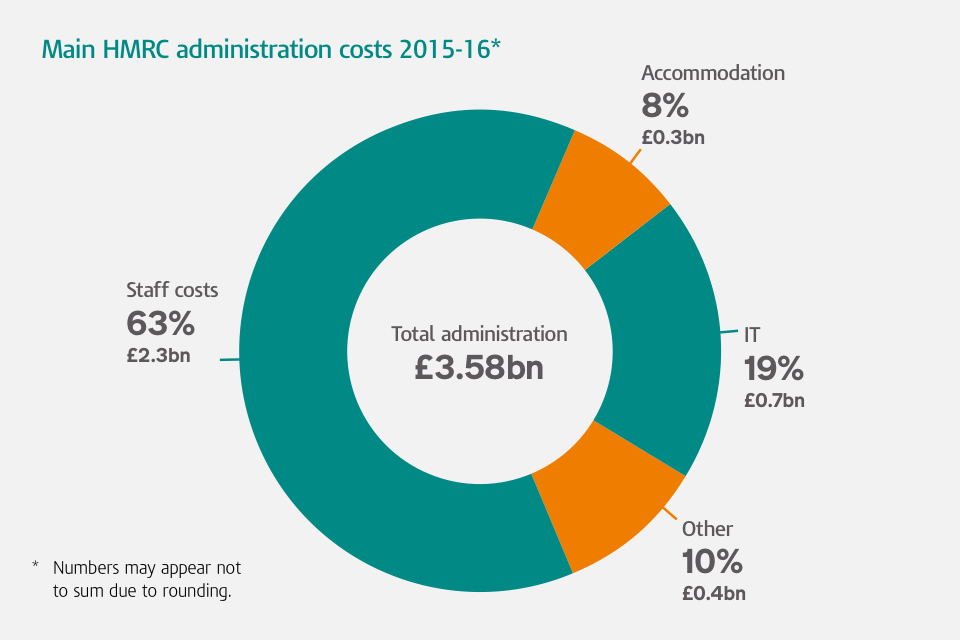

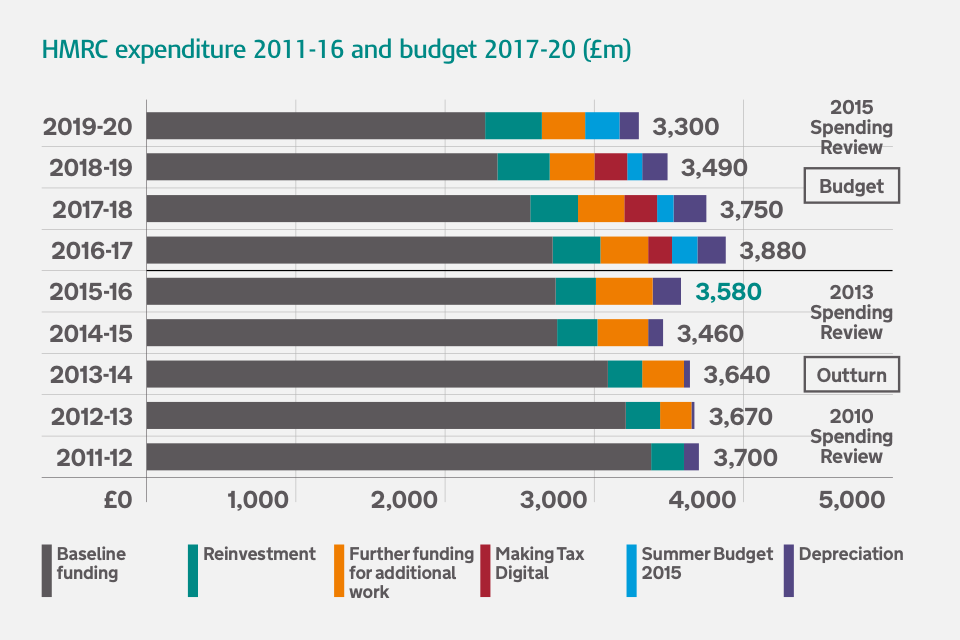

We have exceeded our 2010 Spending Review investment and efficiency commitments by continuing to drive out efficiency savings. We made £210 million sustainable cost savings last year, and have now made £1.2 billion in savings since 2010 to 2011, exceeding the targets set by government.

We are now investing a further £1.3 billion to transform HMRC into one of the most digitally advanced tax administrations in the world. This will enable us to deliver world class digital services, invest significantly in technology and people, make use of data to make compliance the easy option and identify non-compliance, and do this through a more flexible, highly- skilled workforce in fewer locations. This investment builds on earlier funding, and we expect to spend £1.8 billion on transformation over the next four years in total, contributing £643 million to our efficiency savings target.

In November we announced the next step in our ten-year transformation programme to create a tax authority fit for the future. We plan to bring our employees together in 13 large, modern offices, equipped with the digital infrastructure and training facilities needed to build a more highly-skilled workforce, with a greater opportunity to build their careers.

Figure 8: shows main HMRC administration costs 2015 to 2016

Figure 9: shows HMRC expenditure 2011 to 2016 and budget 2017 to 2020

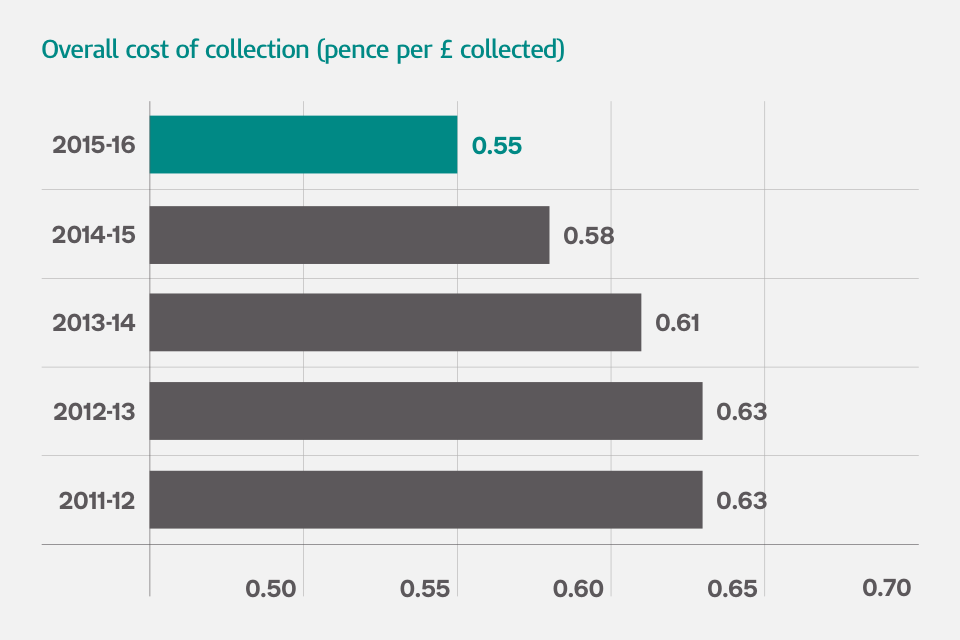

Compared to the total revenues we collect, our administration costs are very low.

The efficiencies we have delivered, together with increasing revenues, mean that the cost of collecting taxes in the UK dropped from 0.63 pence per pound in 2011 to 2012 to 0.55 pence last year.

Figure 10: shows overall cost of collection (pence per £ collected)

4. Managing risks to our objectives

The most significant risks faced by HMRC in 2015 to 2016, together with key mitigating actions, are outlined below. Following the decision to leave the European Union on 23 June 2016, we will be reviewing all our risks and working through what this means for delivering our strategic objectives in the coming weeks and months.

4.1 The risks to delivering our objectives: what they are and how we deal with them

Maximising revenues

| Principal risks | Key mitigating actions |

|---|---|

| Total revenue | |

| As the country’s tax, payments and customs authority, we fail to bring in the revenue to the Exchequer to help pay for essential public services | To support a clear understanding of the overall flow of revenue we: provided detailed data on tax receipts and repayments to ExCom as part of HMRC’s performance reporting process and results are discussed in monthly ExCom performance meetings; monitored tax and duty inflows regularly throughout each day and provided updates to HMT, allowing them to compare actual receipts with forecasts |

| Tax compliance | |

| As the country’s tax, payments and customs authority, a lack of understanding and proactive management of our tax compliance risks could prevent us from maximising the effectiveness of our compliance activities | To ensure we understand and proactively manage our tax compliance risks we: continued to develop the strategic picture of risk (SPR) to drive planning and operational activity in relation to various customer groups; focused our compliance activity around different customer groups to bring together |

| Data exploitation | |

| We fail to sufficiently utilise the full range of data sources we have available to us and, as a result, inhibit our ability to meet our intended transformational needs | To ensure the data we hold is reliable and up-to-date we: built an Enterprise Data Hub (EDH) to capture data currently held in eleven separate data warehouses in a consolidated, linked and standardised manner; commenced phase 2 of the EDH project which will draw priority data from other departmental systems and/or storage locations, so more data is available to analysts; built the Data Engineering Centre to maintain the hub and its data and support the business in defining new ways to exploit the available data |

Improving customer services

| Principal risks | Key mitigating actions |

|---|---|

| Customer service | |

| Our levels of customer service fall below those expected of us, leading to long wait times, risking delivery of our objectives, loss of public confidence and reputational damage | We developed a number of ways to deliver sustainable improvements in customer service. During the year we: developed sophisticated and responsive monitoring and planning strategies to ensure that we have trained available staff to maintain our services, flexing staff from across HMRC to achieve our best ever results for tax credits renewals; commenced the roll-out of digital tax services that are designed to meet customer needs, including digitising our forms so they can be submitted online and scanning mail so correspondence can be dealt with more quickly and effectively |

| Managing our cyber-security | |

| We must maintain and safeguard the availability, resilience and security of our systems to protect customers’ information | During the year, we: developed a cyber-security command centre, providing a continuous monitoring and response capability to identify and respond to cyber threats as they occur; raised awareness among HMRC staff and customers of the dangers of phishing emails and malware; adopted increased governance through the ‘10 steps to cyber security’ model; developed effective identity verification protocols |

| Customer understanding | |

| There is a risk that we fail to use our understanding of customers consistently and effectively when designing and implementing policies, processes and services, resulting in a failure to fully deliver our objectives | During the year we: launched an internal ‘customer zone’ that we are developing to provide the research, data and tools so we can understand our customers better; implemented new approaches to the design and implementation of products and services that involve the use of greater customer insight and customer involvement; developed a suite of customer performance measures to better target areas for improvement |

| Exploiting digital opportunities | |

| If we do not deliver robust IT infrastructure and secure, high quality, digital services, there is a risk that customer confidence will be low which will result in low take-up of services impacting the success of our digital transformation and realisation of benefits and efficiencies | Our future plans require us to make greater use of new digital technology. To this end we: communicated the benefits of our digital services to our customers, in order to increase take up and enable them to take more control of their tax affairs; developed a bespoke authentication process, used for logging into our digital services, to increase the safety and security of customers and their data; launched the Personal Tax Account, paving the way for customers to submit their Self Assessment return online via their tax account; introduced a range of new digital infrastructure and services both for businesses and individuals |

Reducing costs and providing value for money

| Principal risks | Key mitigating actions |

|---|---|

| Delivering affordable and sustainable transformation | |

| The pace and nature of the transformation programme could outstrip our capability and capacity to deliver the level of efficiencies and service improvements agreed | During the year we: launched a new transformation function to oversee the delivery of our programmes of change, including governance, resourcing and progress reporting; developed business cases and plans to track our progress against benefit commitments; introduced business change managers in all lines of business to help identify and manage the cumulative impacts of change |

| Providing IT services | |

| There is a risk that our revised commercial IT supply and operating model may not deliver the expected benefits in a timely, efficient and effective manner and threaten the stability of tax collection and customer services | During the year we: developed a coherent business plan, setting out the commercial and operational model, including a robust transition plan and budget; recruited people with the necessary commercial, technical and operational skills; ensured that the decision making and governance framework, as well as the scope and the roles in the programme is effective |

| Maximising our people’s performance | |

| We need to continue to develop our leaders’ innovation and resilience to ensure we are able to deliver the department of the future. We do not have sufficiently high levels of employee engagement to be confident that we are maximising our performance leading to reduced ability to meet our customer, tax revenue and cost-efficiency targets. We fail to create an organisation that is able to respond to the future needs of the business, meaning that we don’t have the right people and skills in place | During the year, we continued to build the skills of our leaders and talk to all our people about our plans for the future, which included: the launch of a Leadership and Management Academy for all our senior people, asking them to undertake five days leadership training per year; working towards building trust in leadership and understanding sources of employee disengagement; continuing investment in Building our Future, our national conversation with our people about how we will transform over the coming years; acting on employee feedback and supporting a coaching and mentoring culture locally and centrally; actively engaging in trust workshops and linked together leadership and management capability and ‘Building our Future’ action plans |

| Delivering estates transformation | |

| The scale and complexity of the programme, and uncertainty over cost and affordability of suitable property, mean that we may not have the capability or the funding to move to 13 Regional Centres and to deliver HMRC’s future workplaces | Over the past year we: recruited people with professional, specialist skills including strategic delivery partners, legal services and interior designers and plan to utilise further experts to deliver our working environment; actively maintained control of employee numbers at each regional centre, including rigorous change control and working with other government departments where buildings will be shared; held regular cost reviews to ensure maximum value for money; been realistic about what office design is affordable; implemented clear governance processes for decision making at defined decision points |

5. Our people

Our people are vital to everything we do as an organisation. We need to have the right people in the right place, doing the right work at the right time, and we are achieving this by carefully managing our workforce. We need strong leaders to take us through change and people with the skills required to work in an increasingly flexible environment, so we continue to invest in leadership and skills.

We are investing significantly in the development of leaders and managers through our Leadership Academy. Within this, our Leading our Future programme is at the heart of developing our leadership capability and by 2021 we’ll have rolled this out to all our senior leaders.

We are committed to improving our understanding of the needs of our customers and employees to enable them to give their best, feel they are treated fairly and valued for their contributions, and be able to progress their careers.

Building a stronger employer and employee relationship, while developing and maintaining effective union relationships, is a priority. We are confident that the majority of the workforce reductions we need will be made as people retire, reduce their hours or take jobs outside the department. While we have already announced a small number of unavoidable redundancies we continue to minimise these wherever possible. As businesses transform and develop regional career paths, new roles and resource requirements will be identified and evaluated.

During 2015 to 2016 we:

- continued our national conversation with our people to engage them with the transformation of the department, delivering 616 events to more than 46,500 staff across 84 locations

- recruited 7,700 new people, including 847 people via graduate recruitment, 537 apprentices and more than 4,500 people were promoted, ensuring we have the skills in the locations we need

- supported more than 5,400 people leaving the department through a combination of natural and managed reductions, including 472 people leaving under exit schemes

- increased our response rate to the Civil Service People Survey by 12% points across HMRC to 65% and we saw an increase in our Employee Engagement Index to a record high of 45%

- delivered tax training to more than 20,000 of our people using our Tax Academy

- successfully launched our Leadership Academy and by the end of March this had been accessed by 3,289 leaders and 58% of our senior leadership community were using the academy

- developed our people’s skills and knowledge - our staff spent an average of 7.28 days on recorded learning activities, increasing flexibility so they can move more easily between areas of work

6. Further information

Find out more about our:

- role and responsibilities

- governance and how we’re organised

- research programme

- statistics programme

Our key publications: