DVLA's annual report and accounts 2016 to 2017

Published 19 July 2017

0.1 Non Executive Chair’s introduction

I am pleased to introduce the DVLA’s Annual Report and Accounts for 2016-17, which sets out the agency’s performance over the last financial year.

2016-17 has been another successful year for us where we’ve continued to focus on anticipating our customers’ needs and exceeding their expectations - giving them choice in how they access our services.

We’ve built new and innovative digital services and laid the foundation for future technology. From live web chats to a dedicated online portal for reporting medical conditions, the last year has seen us develop more responsive and tailored services online.

As one of the largest employers in South Wales we’re committed to playing a significant role in the community. Throughout the year we’ve supported employment initiatives and offered work placement opportunities to local people.

We also became Science Technology Engineering and Maths (STEM) Ambassadors for the area and supported local primary schools to engage young people in technology through ‘code club’ sessions.

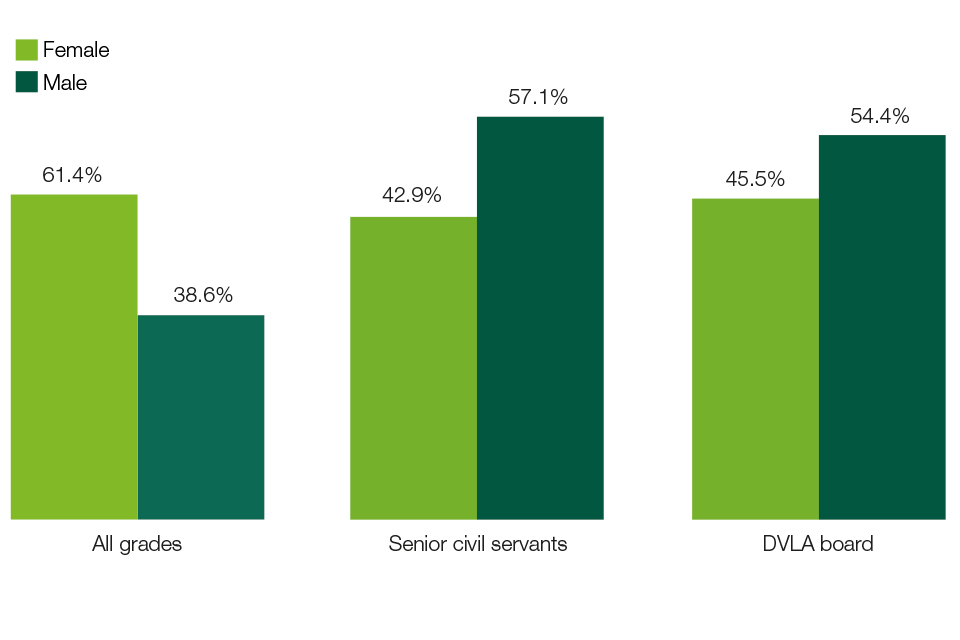

In 2016-17 we were awarded Investors in People silver accreditation and successfully retained our silver award in the Corporate Health Standard accreditation scheme. We’ve continued to drive for a diverse workforce, that reflects the customers and communities we serve and has the right attitudes, behaviours and skills to deliver and improve our services.

I’m proud of what we’ve achieved over the past year, ultimately providing customers with simpler, better and more secure ways of transacting with us. These achievements would not have been possible without the talents and hard work of our staff.

I look forward to the opportunities that lie ahead and to working together with our Board and staff in delivering our Strategic Plan for 2017-20.

Lesley Cowley OBE

Non-Executive Chair

28 June 2017

0.2 Chief Executive’s message

This last year has been one of significant achievement for the Agency. We completed our Strategic Plan 2014-17 whilst delivering our core responsibilities, we were also recognised on a national level for our digital services.

The previous 3 years have been very much about transforming our services and business. We’ve focused on providing excellent online services, hand-in-hand with other channels and recognising opportunities to continuously improve these, delivering best in class customer services.

Our goal is clear and it is what drives us every day - to get the right drivers and vehicles on the road as simply, safely and efficiently as possible.

2016-17 was an exceptional year for our digital services, which were recognised at the Digital Leaders Top 100 awards where among other accolades we won the overall prize of Digital Leaders 100 Award.

During the year we:

- Made our systems ready for the new vehicle tax rates which came into force on 1 April 2017. This was a huge piece of work which involved working closely with vehicle manufacturers and dealers to make sure that new cars could be registered and licensed without delay.

- Introduced a new online service allowing customers to tell us they have a medical condition. This service has helped provide quicker decisions to customers.

- Exceeded our efficiency target of 14%, achieving an 18% reduction, equating to around £45 million cost savings. Revenues paid over to HM Treasury increased by 23%, contributing £201.6m to the Exchequer. Our net income for the year represents 20% of total income, a significant improvement on the 10% reported last year.

Last year was not without its challenges. A Parliamentary and Health Services Ombudsman’s investigation into our Drivers Medical Group highlighted the need for improvements in the way we manage medical cases. We apologised to customers affected and continued to make improvements.

Our achievements have been possible due to the dedication and passion of DVLA staff. My thanks go to the commitment and support of my Executive team and the hard work of our staff for getting us to where we are today.

Looking forward, our new Strategic Plan 2017-20 focuses on 5 key areas: best-in-class customer services; dynamic technology and services; hub for digital motoring; modern workplace; unrivalled safety, security and compliance.

We’re looking forward to taking the opportunities offered by cloud services, agile methodology and our recently in-sourced IT to continue to build dynamic technology and services that respond to changing customer demand. Motoring technology is changing fast, and our commitment to innovation and excellent customer-service will enable us to become a hub for digital motoring.

I look forward to the year ahead.

Oliver Morley CBE

Accounting Officer and Chief Executive, DVLA

28 June 2017

0.3 Highlights for the year

Highlights for the year

Highlights for the year

Highlights for the year

Highlights for the year

Highlights for the year

Highlights for the year

1. Who we are and what we do

DVLA is an Executive Agency of the Department for Transport and is part of the DfT Roads, Devolution and Motoring Group.

Our goal is to get the right drivers and vehicles taxed and on the road, as simply, safely and efficiently as possible.

We maintain the registration and licensing of over 47 million drivers in Great Britain and the registration of over 39 million vehicles, together with the collection and enforcement of VED in the UK.

Our services

Our award winning digital services provide the public with a simpler, better and more secure way of transacting with us. During the year we continued to look at ways to improve our services whilst delivering our core responsibilities.

Our multi-channel contact centre provides customers with the option to talk to our customer service advisors, email or to use our new webchat service for certain transactions.

We have a personalised registration scheme for customers to purchase personalised registrations online or through one of our auctions. The scheme has raised over £2.4 billion since it started in 1989.

During the year, we continued to work closely with our stakeholders to ensure that our services were tailored accordingly. We also worked with the police and local authorities to deal with vehicle related crime.

For more information about our services visit our website.

Our strategic plan

This is the final year of our Strategic Plan 2014-17 and we have delivered significant changes to our business and introduced new services for our customers.

Some of the major changes delivered over the last 3 years were:

- moving away from a large scale contract to deliver our IT in-house

- abolition of the tax disc

- abolition of the paper counterpart to the driving licence

- introduction of direct debit to pay VED

- 7 new online services

- reductions in various driving licence fees which has resulted in savings of around £20 million per year for motorists

In March 2017, we published our Strategic Plan 2017-20 which details our plans for the next 3 years.

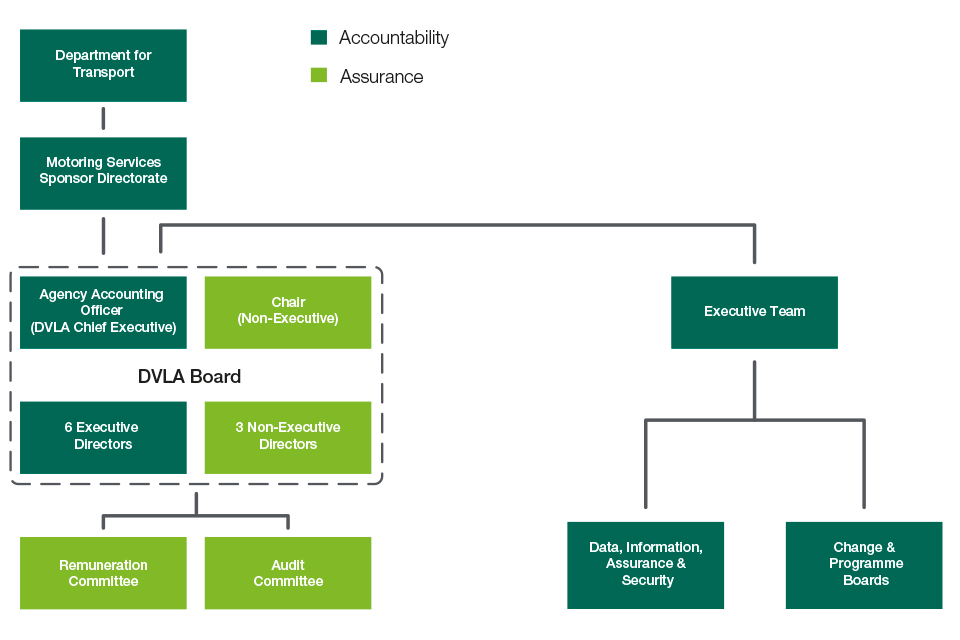

How we manage our agency

We work within a framework which sets out our governance, accountability, key relationships and financial management arrangements. The core of our management is our board consisting of a Non-Executive Chair, Chief Executive and Accounting Officer, 6 Executive Directors and 3 Non-Executive Directors. For more information about our board and its members visit our website. For more information about our governance see our Accountability Report.

Risk management

Risk management is embedded into our culture and plays an important part in the development and everyday running of our business.

During the year, we have facilitated events promoting risk management and awareness both internally and externally. These events have focused on risk handling, leadership and partnership, openness and the value of risk identification.

We have formed a Welsh Risk Networking Group bringing together best practice within the public sector.

Social responsibility

We are committed to our corporate social responsibility policy and are dedicated to proactively supporting initiatives that empower and benefit Welsh communities and individuals. As one of the largest employers in the Swansea area, we are committed to giving as much back to the local area as possible.

We played an active role in supporting employment initiatives in Wales, offering a number of work placement opportunities throughout 2016.

Our software development community has continued to support local primary schools, holding weekly ‘code club’ sessions with children between the ages of 9 to 11. Working in collaboration with Swansea University, we have played a big part in becoming Science Technology Engineering and Maths (STEM) Ambassadors for the area. We have presented at festivals and road shows to demonstrate how ‘computational thinking’ is a skill and how it can help young people to transfer these skills into the workplace.

We have continued our relationship with Swansea Techhub which led to a move into the new building in 2016. Our new sponsored event space named Furnace has become a home for the tech community which can be used for workshops, meetings, conferences and hackathons.

Our staff chose the Alzheimer’s Society as its charity of choice for 2016. Since launching the ‘Charity of Choice’, we have seen a year-on-year increase in the amount of funds raised. £70,906 was raised, £25,000 more than the previous year.

The purpose of this document

This Annual Report and Accounts sets out our performance and achievements for the year and should be read in conjunction with our Business Plan 2016-17.

2. Delivering against our 2016-17 business plan

| 1. Changing our agency | Target | Result |

|---|---|---|

| 1.1 Vehicle Excise Duty (VED) reform: we will implement the new vehicle registration and licensing rules (announced by the Chancellor in July 2015) | As of 31 March 2017 | We have made changes to our systems and processes to deliver VED Reform from 1 April 2017 |

| 1.2 Drivers medical reform: introduce an online service for customers to notify us of a medical condition and renew their short period driving licence | August 2016 | A new online service for customers to notify us of their medical condition and renew their short period licence was introduced in August 2016 |

| 1.3 Contact centre modernisation: - to deliver an online self-service facility to support customers with their enquiries - to deliver an automated telephone call analysis solution providing valuable customer insight to improve and simplify our services |

February 2017 June 2016 |

- Following further exploration of an online self-service facility, it was decided that a change of approach was required. A new improved e-mail solution was delivered in place of this. - This was delivered by our contact centre introducing a speech analytics system |

| 2. Our services | Target | Result |

|---|---|---|

| 2.1 Collecting VED: develop and agree with Her Majesty’s Treasury and DfT a strategy to reduce VED evasion | September 2016 | In September 2016, Her Majesty’s Treasury, HMT, DfT and DVLA agreed a strategy to reduce evasion |

| 2.2 IT resilience: to provide scheduled availability (taking into account scheduled downtime) of: - Vehicle Tax - Vehicle Management - Personalised Registration - Driver Licence online services |

99.5% availability |

99.9% 99.9% 99.9% 99.9% |

| 2.3 Our total digital and automated transactions at March 2017 will exceed | 80% | 96.2% |

| 2.4 To despatch a: - first driving licence in 8 days - vocational driving licence in 6 days - digital tachograph in 8 days |

98% of cases |

99.9% 99.6% 100% |

| 2.5 Reduce the number of drivers medical casework (drivers who notify us of a medical condition) by 25% to 89,000 cases waiting for action against the 2015-16 baseline | 89,000 cases | 82,204 cases |

| 2.6 To answer calls queued to an advisor in 5 minutes | 95% of cases | 98.3 % |

| 3. Meeting customer needs | Target | Result |

|---|---|---|

| 3.1 Customer Service Excellence standard | Retain accreditation | Retained accreditation |

| 3.2 Customer Contact Association Global standard | Retain accreditation | Our contact centre achieved this through accreditation to the Customer Contact Association’s new Global Standard 6. |

| 3.3 Customer satisfaction – maintain customer satisfaction for key transactions: - I want to tax my vehicle - I want to amend my vehicle registration document - I want to renew my driving licence |

95% 90% 93% |

96.1% 90.9% 95.8% |

| 3.4 Improve customer satisfaction on drivers medical transactions against the 2015-16 baseline of 77% | March 2017 | 83.9% |

| 3.5 Customer complaints – reduce the number of formal complaints by 5% (from the March 2016 baseline) - Drivers - Drivers medical - Vehicles |

5% |

Exceeded (-12%) Not achieved (+9%) Exceeded (-21%) |

| 3.6 Freedom of Information Act – provide a response within 20 working days | 93% | 98% |

| 3.7 Parliamentary questions – provide a response by due date | 100% | 100% |

| 3.8 Ministerial correspondence – provide a response within 7 working days | 100% | 99.7% |

| 3.9 Official correspondence – provide a response within 20 working days | 80% | 99.80% |

| 3.10 Prompt payments – payment of invoices within 5 working days | 80% | 86.7% |

| 4. Financial responsibilities | Target | Result |

|---|---|---|

| 4.1 Deliver the CSR efficiency saving of 14% by March 2017 (34% by March 2020) | 14% | 18.2% |

| 4.2 Financial expenditure – VED collection and enforcement expenditure will not exceed | £131 million | £119 million |

| 4.3 Headcount – by March 2017, DVLA full time equivalents will number fewer than | 5,497 | 5,351 |

| 4.4 Sick absence – reduce the number of working days lost (by full time equivalents) due to sickness by 0.5 against the 2015-16 baseline and work towards the DfT target of not exceeding 7 days | 8.13 days | 8.33 |

2.1 Changing our agency

Vehicle Excise Duty reform

In July 2015 the Chancellor announced that cars and some motorhomes first registered from 1 April 2017 would be subject to new Vehicle Excise Duty (VED) rates.

We have added the new rates to our systems and processes to allow customers to tax their vehicles at the correct rate from 1 April 2017. We have also made changes to the first registration service to capture the list price of the vehicle, so that the appropriate rate is charged.

For more information on the new VED rates visit our website.

Tell DVLA about a medical condition that could affect your driving

We currently deal with approximately 660,000 paper based medical transactions each year. In August 2016, we introduced a new online service to allow drivers with car and motorcycle entitlement to tell us about a medical condition that may affect their driving. Drivers can currently use the service to tell us about diabetes, vision, epilepsy, stroke, Parkinson’s disease, certain heart conditions, sleep apnoea and narcolepsy. We have also introduced an online service to allow drivers with similar medical conditions and criteria to renew their short term medical driving licence.

Our online services provide instant advice to the user, meeting their needs until a licensing decision is made. Due to the efficiencies of the online services we can now provide quicker decisions to users, aiding road safety.

For more information visit our website.

Contact centre modernisation

We have a responsibility to provide excellent services and value for money to the public. Our contact centre receives around 7.8 million driver licence enquiries and 17.3 million vehicle enquiries a year.

Our contact centre is currently undergoing a modernisation programme, with the potential to be a ‘Centre of Excellence’ in Government. Our contact centre will have the ability to provide services across departments and the public sector.

We have been successful in achieving high level industry recognised awards over the last 10 years. We have achieved the prestigious accreditation to the Customer Contact Association (CCA) new Global Standard 6 award in 2016-17.

In 2017, a new improved email solution was introduced. Customers can now make an enquiry through an online web form and receive an answer from an advisor or automatic email response. This approach significantly improves the customer journey when contacting us by email.

In addition to the delivery of the new email service, we have developed an internal knowledge database for advisors, it provides quick access to the information they need to answer the customer’s enquiry.

During the year, we introduced a new speech analytics solution. This solution provides insight around call demand and has improved both the services we offer and the customer experience. This also helps reduce call demand and provides a more efficient telephone service for our customers.

In 2016, we introduced a new webchat service, it provides online support to our customers on personalised registration, view driving licence and electronic vehicle licensing services. Webchat provides real- time support for customers who are trying to transact through these services. Since the service has been introduced the number of customers using the service has increased from 3,000 to 25,000 a month. 91% of our customers are satisfied with the service.

Our contact centre uses social media to answer customer enquiries, receiving over 14,000 enquiries a year. This is supported by the introduction of a social media marketing and analytical tool, which provides a greater understanding around the effectiveness of any social media campaigns. This tool also helps to identify whether new initiatives are being communicated and understood on our social media channels.

2.2 Our services

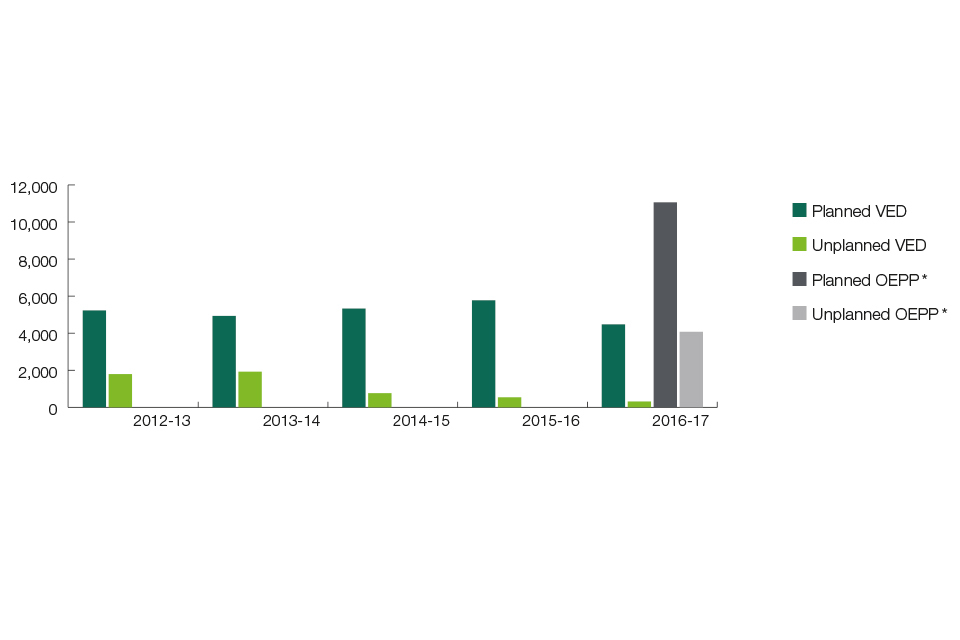

VED collection

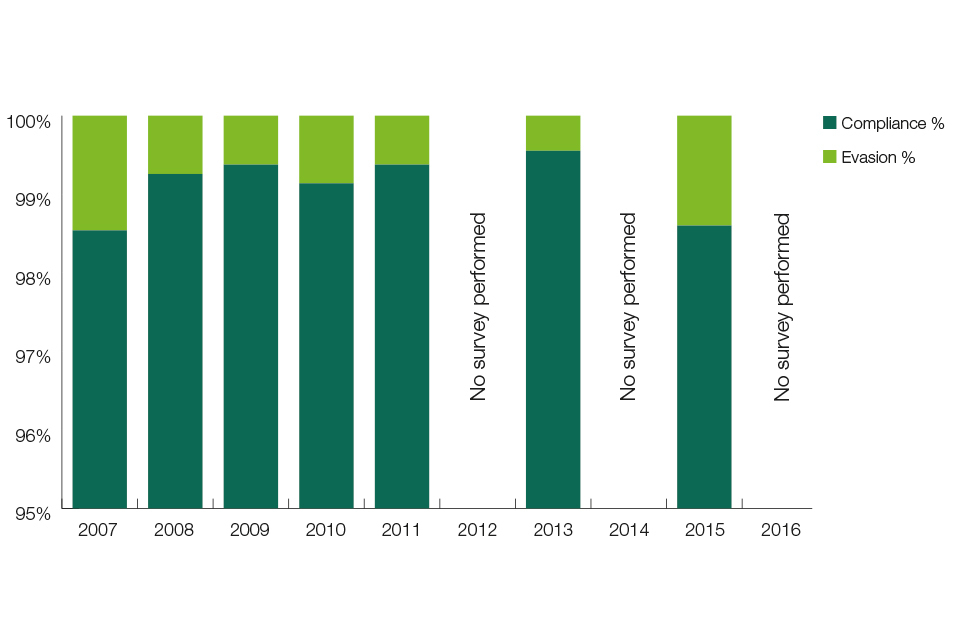

We collect around £6 billion in VED each year. VED compliance is high, largely due to the convenience and simplicity of our online services. In 2015, the DfT Roadside Survey on VED estimated that 1.4% of vehicles were unlicensed.

Although this reflects that the vast majority of VED is collected, we did see some change in customer behaviour following the abolition of the tax disc and the rules around non-transferability of VED. As a result we refreshed our approach to compliance and enforcement and developed a strategy which makes VED even easier to pay and harder to evade.

In September 2016, HM Treasury, DfT and DVLA agreed a strategy to reduce evasion. The recommendations are to:

- reduce evasion to under 1% by 2019 and show an improvement by 2017

- carry out a DfT roadside survey in June 2017 (reporting findings in November 2017)

- create an enforcement approach that is sustainable, efficient and delivers a digital service wherever possible.

We will continue to introduce new online services to ensure that we make it easier for customers to comply with the law. In 2016 we introduced a facility for customers to pay enforcement penalties online. This supports the government’s digital agenda, making it easier for customers to use our services. For more information, visit our website.

In 2017-18 we will be increasing the range of penalties payable through our online services. For more information about our enforcement strategy see our Strategic Plan 2017-20 and Business Plan 2017-18.

Digital services

We have continued to focus on providing excellent online services to our customers, building new and innovative digital services and laying the foundation for new technology.

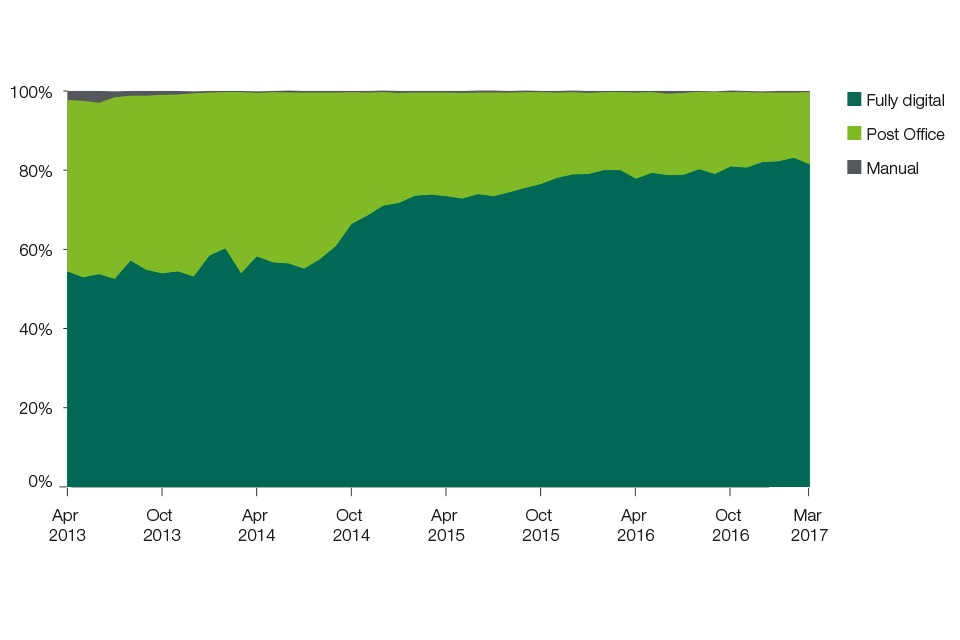

To meet customer expectations and provide a service that meets their needs, our online service is available 24/7. In 2016-17 take up of our digital and automated transactions increased to 96.2%.

We have gained an impressive list of accomplishments over the last year, winning the prestigious Digital Leaders Top 100 Awards for our share driving licence service. We received the Digital Public Service Innovation of the Year Award which honours the highest achievements of the year, for teams and individuals from the private and public sector.

Over the next 3 years we will further transform our IT and services. We will become a hub for digital motoring, removing paper and documents where we can with digital options. We will provide interactive software to allow business and government to develop new services on top of ours.

Drivers medical

Our drivers’ medical department deals with all aspects of driver licensing when there are medical conditions that could affect safe control of a vehicle.

We operate under national medical guidelines on fitness to drive that we have published on our website. The guidance is intended to assist doctors and other healthcare professionals in advising their patients:

- whether or not we require notification of a medical condition

- what the licensing outcome from our medical enquiries is likely to be.

In 2016-17, we recruited and trained over 100 staff to be able to investigate and process a wider range of notifiable medical conditions. To increase the resource dedicated to deal with the more complex cases, we ran recruitment campaigns for qualified and experienced doctors and nurses. In 2016-17, 4 doctors and 3 casework nurses joined the agency. In addition to this up to 8 doctors and additional nurses will join the agency in 2017-18.

Additional resource has had a significant impact in improving the levels of drivers’ medical customer service. In 2016-17 a medical licensing decision was made in 92.3% of cases within 90 days compared to 84.4% in 2015-16. In 2016-17, the average number of days taken to make a decision on fitness to drive was 37 days compared to 55 in 2015-16.

Throughout 2016-17, we have worked on a range of initiatives to continually improve the drivers’ medical service, including:

- extending medical licences for specific conditions (for example diabetes and Parkinson’s disease) from 3 years to 5 years

- launching and updating the Assessing Fitness to Drive guidance

- reviewing customer facing letters

- streamlining internal process to support a quicker licensing decision without compromising medical standards.

Customer service standards

We are committed to delivering excellent services to our customers. We work closely with a wide range of customers to ensure that we provide a service that they expect. In 2016-17, we exceeded all of our customer service standards.

For more information about our service standards visit our website.

2.3 Meeting customer needs

Customer Service Excellence

Customer service and satisfaction is pivotal to what we do. In 2016, we successfully retained the Customer Service Excellence (CSE) accreditation. CSE demonstrates our commitment to achieve service excellence and ‘best in class’ customer service.

Customer satisfaction

In 2016-17 we obtained customer insight through surveys, focus group discussions and in-depth interviews.

To test our services with customers we have used our ‘state of the art’ UX lab. Our UX@DVLA is one of the best user experience testing labs in the country. The UX lab gives us detailed feedback to help us improve our services further.

We also conducted a number of different research projects to support the development of new and existing online services. This ensures that our customers are at the heart of service development.

| Customer satisfaction measure | Target | Result |

|---|---|---|

| I want to tax my vehicle | 95% | 96.1% |

| I want to amend my vehicle registration details | 90% | 90.9% |

| I want to renew my driving licence | 93% | 95.8% |

| Drivers medical transactions | 77% | 83.9% |

Customer complaints

In 2016-17 the number of overall customer complaints reduced by 13.8% compared to 6.5% in 2015-16.

Both driver and vehicle complaints have seen a considerable decrease of 17% and 24% respectively, which exceeds the 5% reduction target. These have been achieved through the continued development and continuous improvement to processes and online services that have had a positive impact on customers dealing with the agency.

Drivers’ medical complaints has increased during the period by 4%. While this clearly fails the reduction target, complaint volumes account for only 0.14% of case volumes. This may have increased due to media interest. To address this, additional resource was introduced and combined with process enhancements, has led to improved performance with substantially more cases closured.

Corporate customers

We have continued to deliver and improve services that meet the business needs of our corporate customers. During the year, we worked closely with our corporate customers, continuously improving our services through customer insight and feedback. Results of the 2016 survey showed that 94% of our corporate customers were happy with our service.

VED reform – we formed and chaired an Industry Steering Group to ensure that the motor industry had all the information they required in preparation for VED reform. This group supported and informed the development of the services that supported the changes. Early and regular engagement with the industry on VED reform implementation was well received. We hosted workshops and webinars to increase understanding across the industry. This has enabled early cascade and feedback channels to obtain clarity for smooth implementation.

Vocational driver guide – this was an excellent example of collaborative working between DfT, the Traffic Commissioner for Wales and the trade associations from the passenger transport and haulage industry. Our work with corporate customers helped inform drivers of the complex rules and regulations around driving lorries and buses.

Fitness to Drive – our collaboration with charities and motoring organisations throughout the year has resulted in them supporting our digital driver service developments and communications. It has also improved mutual understanding of the issues affecting both the charities and our customers.

Fleet companies – corporate customers who operate large fleets of vehicles have benefitted from the introduction of new services through our fleet scheme. This allows operators to better organise and manage compliance in their fleets.

We hosted and visited trade associations, motoring organisations, charities and police forces during the year. This has provided the opportunity to showcase the benefits and efficiencies of our digital services.

Business development

We have an experienced and cost-efficient workforce with a wide mix of skills. We want to make the best use of these opportunities as a service provider both for government and the private sector. Our aim is to use our assets to build new revenue and transactional opportunities across government using our own commercial enterprise.

During the year, we continued to build on cross-government working, securing work to produce 14.5 million annual tax summaries for HM Revenue and Customs (HMRC).

We also carried out a 6 month pilot with Highways England, issuing warning letters to drivers using Red X lanes or who drive on the hard shoulder.

In December 2016, we launched a new workplace charge point grant scheme for the Office for Low Emission Vehicles (OLEV) and are working towards designing a single online portal to facilitate a further 3 grant schemes in 2017-18.

This has been a successful year for our personalised registration scheme. During the year we:

- launched the 66 and 17 new series registrations

- introduced some P prefix registrations.

Our auction programme of selling older style registrations achieved over £22 million.

We also continued to introduce new Northern Ireland format registrations for sale on our website and at auction which raised £1.9 million (£1.4 million in 2015-16). The total overall revenue raised for 2016-17 was £114.0 million (£102.2million in 2015-16).

2.4 Financial responsibilities

Our accounts are made up of the Business Account and the Trust Statement.

Business Account

The Business Account is segmented into:

- maintenance of the driver and vehicle database and related services

- sale of personalised registrations, which represents commercial income generated directly from the public. We retain income to recover our costs in administering personalised registrations services with the excess paid to HM Treasury as Consolidated Fund extra receipts

- collection and enforcement of VED including enforcement recoveries (the income stream from the collection of VED is accounted for in the Trust Statement)

- services delivered to other government departments.

Financial results

Our total income for the year was £564 million against £541 million in 2015-16. An increase of £23 million is due to a number of variances, the key increase being due to the sale and transfer of personalised registrations marks.

Our total expenditure for the year was £451 million against £485 million in 2015-16. The reduction of £34 million is mainly due to the decrease in IT costs following PACT exit in 2015-16.

Net income for the year has increased from 10% of total income in 2015-16 to 20% in 2016-17.

Departmental Expenditure Limit

As a government body, we have budgets set at the start of the financial year in respect of our Business Account activities. The resource (RDEL) out-turn for the year is £91 million, £22 million under our original settlement for the year. This reduction results from the increased income and reduced expenditure.

Trust Statement

Our Trust Statement details the revenue in respect of VED, fines and penalties and HGV levy falling outside of the boundary of our Business Account.

Financial results

During the year the Trust Statement gross revenue amounted to over £6 billion.

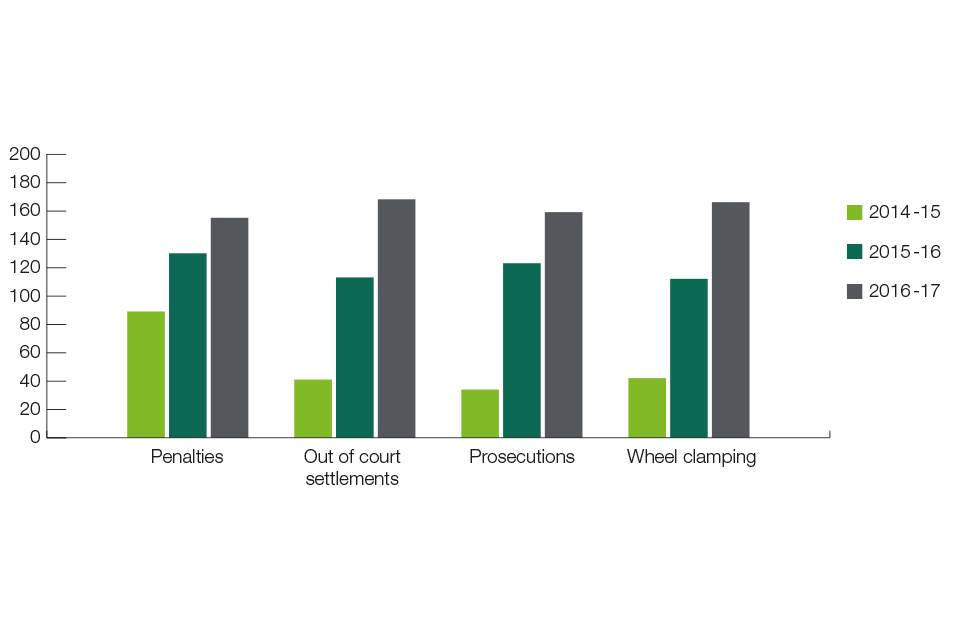

The net cost of collecting VED and the enforcement action taken as a result of non-compliance (brought to account in the Business Account) was £119 million, a decrease of £18 million when compared to expenditure in 2015-16. This is £12 million less than our 2016-17 business plan measure (VED collection and enforcement expenditure will not exceed £131 million). The overall reduction is due to efficiencies which more than off-set the £4.2 million increase in the direct cost of wheelclamping.

Efficiency

The Spending Review 2015 committed us to make a 14% resource budget reduction by 31 March 2017 in comparison to the 2015-16 baseline (34% total reduction by 31 March 2020). We have exceeded the target by achieving a 18% reduction.

In total, we have reduced costs by £45 million (unadjusted for inflation) against the baseline, through:

- realising the benefits of moving away from a large IT contract and bringing IT services in-house. These include removing over 60% of our hardware/software contracts and challenging contractor rates to drive savings

- introducing new online services and increasing take-up of existing services which has resulted in reduced intermediary and consumables costs

- commercial efficiencies through negotiating reduced unit prices, achieving economies of scale and challenging requirements to reduce contract costs.

Sustainability

In 2016 the Greening Government Commitments (GGC) were revised as 3 year targets, ranging from 2016-17 to 2019-20, set against the original baseline of 2009-10. They continue to focus on greenhouse gas emissions, waste, water and paper. More details of the new commitments can be found on GOV.UK.

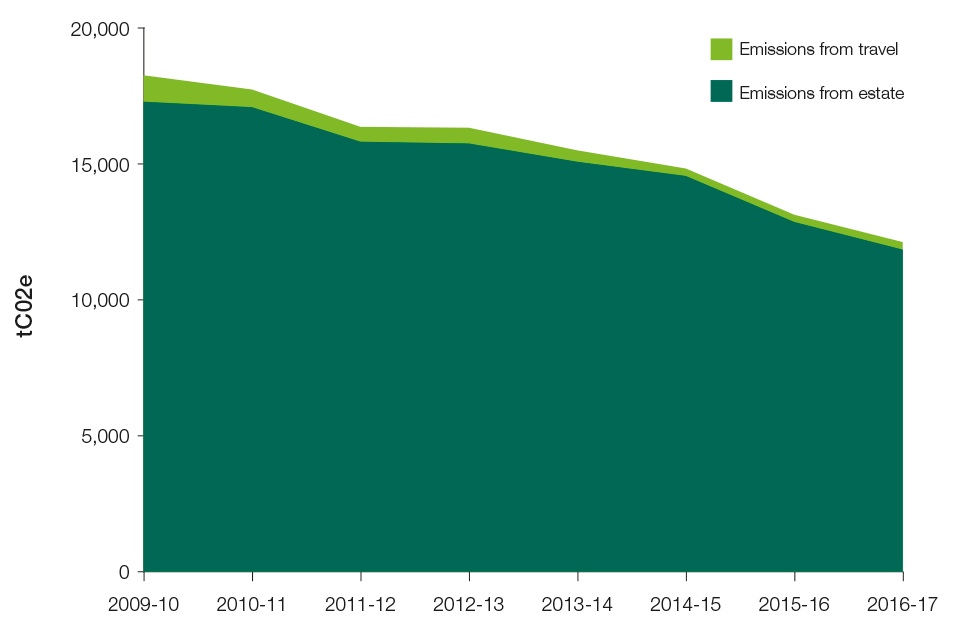

We have exceeded all but 1 of our ambitions for the year including reducing carbon emissions by a further 2% currently at 36% less than 2009-10. Details of the targets we set for 2016-17 to contribute to the 2020 commitments and our performance can be found below.

| Measure | Target towards the Greening Government Commitment | Outturn 2016-17 |

|---|---|---|

| Greenhouse Gas Emissions | Achieve a further 2% reduction in our greenhouse gas emissions against the 2009-10 baseline. (34% in 2015/16) | 36% |

| Greenhouse Gas Emissions | Maintain our reduction of domestic business travel flights of more than 90% from the 2009-10 levels (number of flights). | 94% |

| Waste | Send no more than 10% of our waste to landfill Maintain a reduction in waste generated at 49% against our 2009-10 baseline Recycle and compost at least 70% of our waste |

6% 52% 71.5% |

| Water | Reduce water consumption year on year (Office m3/ Office FTE) (4m3 per Office FTE in 2014-2015) | 7.7 |

| Administrative Paper | Maintain our reduction in paper use of more than 60% from the 2009-10 baseline | 66% |

Further information is available in our Sustainability Report, published on our website. The following section details the minimum sustainability reporting requirements in accordance with the HM Treasury Public Sector Annual Reports: Sustainability Reporting Guidance 2016-17 and Greening Government Commitments Guidance.

Greenhouse gas emissions

The total reduction in greenhouse gas emissions (carbon equivalent) is 36%; this is made up of 2 components:

- emissions from travel at 70%

- emissions from the estate at 34%.

Emissions from the estate

There has been a marked reduction in emissions from our estate during the last 12 months. we were able to achieve the further 2% reduction in total emissions by continued good practice in the management of our heating and cooling systems and have also replaced existing lighting with LEDs in trial areas, which we intend to roll out across the estate in the next few years.

Emissions from travel

We continue to perform well in ensuring the emissions created by business travel are kept to a minimum. We achieved a 70% reduction of emissions from business travel against the 2009-10 baseline. Although this is a good result, we have increased emissions from business travel by 12.3% compared to last year.

The majority of the increase in business travel has been identified as the result of our IT transformation and the in-housing of our IT services. Some travel, previously undertaken by IT contractors is now carried out by our staff.

The remainder of the increase is largely attributed to the recent purchase of 3 further Automatic Number Plate Recognition (ANPR) fleet cars. This has increased mileage by 20% but will allow for additional road side identification of VED evasion.

Total Greenhouse Gas Emissions

Total greenhouse gas emissions

Waste

The GGC target requires us to reduce the amount of waste created year on year and increase the amount recycled to ensure that we send less than 10% of that waste to landfill.

In 2016-17 we created 52% less waste than the baseline 2009-10. This equated to an 7.5% reduction during the year, compared to 2015-16.

The main contributing factor was a reduction in paper waste, which reduced by just under 85 tonnes. General waste also reduced by over 20 tonnes, both of which are around a usual month’s total. Our reduction in paper demonstrates the continued benefits realised from the digitalisation of our services. In addition, operational activities to reduce paper waste include the work of our printing facilities to reuse end of operational paper reels to feed smaller batches of work.

Of the 1060 tonnes of waste created, just 6% was sent to landfill, 71.5% was recycled or reused and the remainder was incinerated for energy.

During 2016-17 we continued to divert nearly 600 items that were at the end of their useful life away from becoming waste. This was due to significant changes in process or technology refresh, had little financial value but could be of use to others. These items, such as paper, operational stationery, IT equipment and furniture, wherever possible, were found new homes in local schools, charities or local government organisations.

Water

We have committed to continue to reduce total water consumption from 2014-15 levels by 2019-20.

During 2016-17 we achieved a 4% reduction.

This has been achieved through increased monitoring of sub-meters leading to the prompt resolve of any leaks and allows the identification of wasteful processes. As we have redefined what is considered as office accommodation throughout our estate we have increased the level of m3 per full time equivalent employee from 4m3 to 7.7m3.

Procurement

We recognise the impact that our procurement decisions have on our sustainability outcomes. We successfully achieved the CIPS accreditation which demonstrates our compliant policies, processes and practices, which includes a sustainability agenda, against the accreditation standard.

We are represented on the government-wide sustainable procurement group and continue to be committed to meeting the Government Buying Standards (GBS) best practice specifications wherever possible.

During 2016-2017, we established a sustainability action log to identify process/organisational improvements and provide key delivery milestones and timescales.

We have increased the level of awareness of our commercial staff relating to sustainability within the procurement process through:

- mandated product knowledge sessions to commercial advisors

- senior management attendance at external sustainable procurement courses

- mandated sustainability module for commercial advisors undertaking CIPS Level 5 examinations.

Transparency commitments

| Climate change adaptation | One of our properties is at risk of flooding. Mitigating actions have been taken by the local council within the area and we have business continuity plans in place to reflect this risk. |

|---|---|

| Biodiversity and natural environment | We have continued to see an increase in the number of fauna and flora species on site, now standing at 162, including 11 section 7 species of the Environment (Wales) Act 2016. Our staff have been leading regular nature themed activities as part of staff engagement and awareness. We have been working collaboratively with our Private Finance Initiative (PFI) service partners to maintain and enhance biodiversity. As a result of this, new initiatives and management plans relating to biodiversity have been created. The Environment (Wales) Act 2016 is to replace the NERC Act 2006 in Wales and the new Biodiversity Action Plan 2017 will reflect these changes. |

| Procurement of food and catering services | Our PFI contractor provides all food and catering services and the contract stipulates sustainable requirements. We audit the requirements annually to ensure compliance and actions of improvement if necessary. Results of audits can be found in our Sustainability Report. |

| Sustainable construction | No construction activities have been undertaken in the past 12 months. |

| People | We are proactive in our support of people within the agency and the communities in which we works. More detailed information can be found in our Sustainability Report. |

3. Corporate governance report

Directors’ report

Purpose of the directors’ report

This report is presented in accordance with the requirements of the Companies Act 2006 (Strategic Report and Directors’ Report) Regulations 2013.

Members of the board

Full disclosure of the serving directors for 2016-17 is available in the Governance Statement of this document. Directors have declared that they hold no significant third party interests that may conflict with their board duties.

Pension liabilities

Our employees are civil servants to whom the conditions of the Superannuation Acts 1965 and 1972 and subsequent amendments apply.

The Principal Civil Service Pension Scheme (PCSPS) and the Civil Servant and Other Pension Scheme (CSOPS) – known as ‘alpha’ – are unfunded multi-employer defined benefit schemes. We are unable to identify our share of the underlying assets and liabilities. Provision is made in note 11 of the Business Account to meet early retirement costs payable by us up to employee’s normal retirement age.

Employees

Information about our policies and arrangements relating to staff is shown in the staff report.

External auditors’ remuneration

The external auditors did not undertake any non-audit work in the year.

Sickness absence data

Our sickness absence measure is shown in the Performance Report.

HM Treasury cost allocation and charging requirements

Full disclosure of our compliance with the cost allocation and charging requirements of HMT is reported within note 2 of the financial statements.

Personal data related incidents

Full disclosure of our data controls is made through the Governance Statement.

Future developments

Our future developments are detailed in our Strategic Plan 2017 - 20 and Business Plan 2017-18.

Statement of Accounting Officer’s responsibilities

Business Account

Under the Government Resources and Accounts Act 2000, HM Treasury has directed us to prepare for each financial year a statement of accounts in the form and on the basis set out in the Accounts Direction. The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of our comprehensive net expenditure, cash flows and changes in taxpayers’ equity for the financial year.

In preparing the Business Account, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual and in particular to:

- observe the Accounts Direction issued by HM Treasury, including the relevant accounting and disclosure requirements and apply suitable accounting policies on a consistent basis

- make judgements and estimates on a reasonable basis

- state whether applicable accounting standards as set out in the Government Financial Reporting Manual have been followed and disclose and explain any material departures in the financial statements

- prepare the financial statements on a going concern basis.

The Permanent Secretary of DfT has appointed the Chief Executive of DVLA as the Accounting Officer of the agency. The responsibilities of an Accounting Officer, including responsibility for the propriety and regularity of the public finances for which the Accounting Officer is answerable, for keeping proper records and for safeguarding our assets, are set out in Managing Public Money published by HM Treasury.

Trust Statement

Under the Exchequer and Audit Departments Act 1921, HM Treasury has directed us to prepare, for each financial year, a Trust Statement detailing the revenue and expenditure in respect of VED, fines and penalties and HGV levy falling outside of the boundary of our Business Account. The Trust Statement is prepared on an accruals basis and must give a true and fair view of the collection and allocation of VED, fines and penalties and HGV levy, including the revenue and expenditure, financial position and cash flows. Whilst we are concerned with compliance, the Trust Statement does not estimate the duty foregone because of non-compliance with the VED regime.

In preparing the Trust Statement, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual and in particular to:

- observe the Accounts Direction issued by HM Treasury, including the relevant accounting and disclosure requirements and apply suitable accounting policies on a consistent basis

- make judgements and estimates on a reasonable basis

- state whether applicable accounting standards as set out in the Government Financial Reporting Manual have been followed and disclose and explain any material departures in the Trust Statement

- prepare the financial statements on a going concern basis.

HM Treasury has appointed the Permanent Secretary of DfT as Principal Accounting Officer of the Department. Our Chief Executive holds the role of Accounting Officer for the purposes of the Trust Statement. The Accounting Officer is also responsible for the fair and efficient administration of the VED regime including the assessment, collection and proper allocation of VED revenue.

Disclosure of audit information

The Accounting Officer confirms that, as far as he is aware, there is no relevant audit information of which the Agency’s auditors are unaware and he has taken all steps that he ought to have taken to make himself aware of any relevant audit information and to establish that the agency’s auditors are aware of that information.

Responsibility for the annual report and accounts

The Accounting Officer has confirmed that the annual report and accounts as a whole are fair, balanced and understandable and that he takes personal responsibility for the annual report and accounts and the judgments required for determining that they are fair, balanced and understandable.

Governance Statement

Introduction

The Permanent Secretary of DfT has appointed me as Accounting Officer and Chief Executive for DVLA. As Accounting Officer, I have responsibility for the proper, effective and efficient use of public funds and may be required to appear before Parliamentary Select Committees. I am accountable to the minister for the performance of DVLA in accordance with the framework document, which sets out the accountability and key relationships between DVLA and DfT. I am also required as Accounting Officer by HM Treasury’s Managing Public Money and the Government Financial Reporting Manual to provide a statement on how I have discharged my responsibility to manage and control the resources for which I am responsible during the year.

We are sponsored by DfT’s Roads, Devolution and Motoring Group which is also sponsor to the Driver and Vehicle Standards Agency (DVSA) and the Vehicle Certification Agency (VCA). We are responsible for providing driver licensing services in Great Britain and the registration of vehicles and collection of VED throughout the UK. Regular meetings are held with ministers to discuss the current issues and general progress. These are attended by our Non-Executive Chair, Chief Executive and DfT sponsor as required.

Driver licensing in Northern Ireland is a devolved power and is undertaken by the Driver and Vehicle Agency (DVA), sponsored by the Department of Infrastructure in Northern Ireland. However, responsibility for licensing and registering of vehicles in Northern Ireland lies directly with DfT Secretary of State.

Governance framework

I have ensured that our governance framework is designed to comply with the good practice guidance laid down in HM Treasury Corporate Governance in Central Government Departments: Code of Good Practice 2011.

We are managed by a board and an Executive Team (ET). Our board is chaired by a Non-Executive Director. We have both strategic and business oversight responsibilities supported by the Audit and Risk Committee and the Remuneration Committee. Our ET is responsible for the day-to-day management in delivering our commitments to the government and the public as set out in our annual business plan. Our high level governance structure is given below.

Governance structure

Governance structure

DVLA board

Our board comprises a Non-Executive Chair, the Chief Executive, 6 Executive Directors and 3 independent Non-Executive Directors and focuses on our strategic direction. Our board gives assurance to the Secretary of State for Transport on the effectiveness with which our agency is run and is meeting our objectives. It holds the ET to account for the delivery of those objectives. The Non-Executive Chair is appointed by the Secretary of State. I appoint the Executive Directors with approval from the Permanent Secretary. Non-Executive Directors are recommended for appointment by the Chair to the DVLA Board, in partnership with the Director General of Roads, Devolution and Motoring at DfT. There is a clear demarcation between our DVLA Board and the ET.

Our board meets formally each month to consider:

- the strategic direction and plans, including oversight of our change agenda and progress against the business plan

- oversight of the key risks and issues identified by our ET and the effectiveness with which they are mitigated.

Our Executive Directors have specific areas of functional responsibility and accountability as below:

- Operations and Customer Services: Tony Ackroyd

- Human Resources and Estates: Phil Bushby (to 27 June 2016); Louise White (from 28 June 2016)

- Technology: Iain Patterson (to 29 February 2016); Dave Perry (from 03 June 2016). (See note)

- Strategy, Policy and Communications: Julie Lennard

- Finance: Rachael Cunningham; Tracy Nash (Interim from 25 May 2016 to 30 September 2016)

- Commercial and Business Development: Andrew Falvey.

The Non-Executive Chair and the 3 Non-Executive Directors act through the monthly board meetings and as members of the Audit and Risk Committee and Remuneration Committee and have private sector backgrounds:

- Lesley Cowley, Non-Executive Chair (appointed October 2014 and re-appointed October 2016) in leadership and digital transformation

- Jeremy Boss, Audit and Risk Committee Chair (appointed January 2016), in accountancy, audit, finance and IT

- Christopher Morson (appointed October 2013 and re-appointed in October 2016) in strategy and digital service transformation

- Emma West (appointed November 2014) in talent management and organisational development.

(Note: Oliver Morley assumed the role of SRO during the period from Iain Patterson leaving on the 29 February 2016 to Dave Perry joining on the 3 June 2016).

Executive Team

The ET meets formally each week and has responsibility and accountability for delivering our business plan. This is together with day-to-day management of the business. I chair this meeting and its membership is drawn exclusively from our Executive Directors.

The focus of these meetings changes and follows a regular weekly cycle which repeats itself each month:

- Week 1 – Change Portfolio Delivery and Investment Decisions

- Week 2 – Operations

- Week 3 – Finance and Commercial

- Week 4 – Human Resources, Estates, Policy and Communications

- Week 5 – Open agenda

This regular and consistent rhythm builds a strong team ethic with a keen focus on business issues driving productivity and delivering change.

Board and Audit and Risk Committee attendance

Figures denote meetings attended (meetings available to attend) between 1 April 2016 and 31 March 2017.

| Name | DVLA Board | Audit and Risk Committee |

|---|---|---|

| Lesley Cowley, Non-Executive Chair | 11 (11) | N/A |

| Oliver Morley, Chief Executive | 10 (11) | 3 (4) |

| Rachael Cunningham Tracy Nash (May 2016 to September 2016) |

6 (8) 2 (3) |

3 (3) 1 (1) |

| Phil Bushby (to June 2016) Louise White (from June 2016) |

3 (3) 8 (8) |

N/A N/A |

| Tony Ackroyd | 9 (11) | N/A |

| Julie Lennard | 11 (11) | N/A |

| Andrew Falvey | 10 (11) | N/A |

| Dave Perry | 9 (9) | N/A |

| Jeremy Boss, Non-Executive Director and Audit and Risk Committee Chairman | 11 (11) | 4 (4) |

| Christopher Morson, Non-Executive Director | 11 (11) | 3 (4) |

| Emma West, Non-Executive Director | 10 (11) | 3 (4) |

| Paul Rodgers, Independent Member | N/A | 4 (4) |

| Sarah Scullion, Independent Member (to June 2016) | N/A | 1 (2) |

| Helen John, Independent Member (from October 2016) | N/A | 2 (2) |

The ET has met 50 times in the year with non-attendance agreed in advance on an exceptional basis.

DVLA board effectiveness

The Chair meets regularly with the Non-Executive Directors to discuss their performance and to ensure we gain greatest value from their external perspectives and experience.

The board periodically undertakes self assessment reviews of its performance against Cabinet Office, National Audit Office and external good business practice guidance. The latest review was undertaken in December 2016. The review concluded there were no significant issues to address, and provided evidence of the growing maturity and effectiveness of the board, a view supported by external stakeholders. As in previous years the board has agreed a number of continuous improvement activities in the areas of strategic planning and development and external stakeholder engagement.

As Chief Executive, my role is to formally agree specific targets and success criteria with each ET member at the start of each year, directly from our published business plan and I review progress against these objectives with them at face-to-face monthly meetings.

Remuneration committee

The role of the remuneration committee is to make recommendations to DfT and myself on all aspects of remuneration decisions for our ET (including the Chief Executive) in accordance with current pay guidance and with particular regard to equal opportunities.

It also considers the wider talent in the organisation and ensures visibility in respect of potential successors into agency senior civil service positions.

The Committee will normally meet once a year in February, but may do so more often if necessary, at the discretion of the Chair.

Audit and Risk Committee

Our Audit and Risk Committee has formally agreed terms of reference which are reviewed on an annual basis. The Committee provides advice and support to the Chief Executive in discharging the responsibilities of our Accounting Officer.

The Audit and Risk Committee is comprised of 3 Non-Executive Directors and 2 independent members who are Senior Civil Servants (SCS) in other Government Departments. The members are:

- Jeremy Boss, Audit and Risk Committee Chair (appointed January 2016)

- Christopher Morson (appointed October 2013 and re-appointed in October 2016)

- Emma West (appointed November 2014)

- Paul Rodgers, accountancy and commercial operations (DfT SCS appointed October 2012)

- Sarah Scullion, human resources (DWP SCS appointed June 2013 retired June 2016)

- Helen John, sponsorship of arm’s length bodies and finance (DWP SCS appointed October 2016)

I attend along with the Finance Director and Head of Internal Audit as observers; National Audit Office and KPMG as sub-contracted auditors to National Audit Office. Other ET members attend as observers by rotation and when the committee has asked to discuss matters for which they are accountable. Representatives of DfT Finance have a standing invitation to attend every meeting.

The Audit and Risk Committee has access to all internal audit reports, major project assurance reports, external reviews, risk registers and management reports. The agenda follows a cyclical pattern for external reporting but consider the following at each of their 4 meetings:

- progress against assurance plans; adequacy of response to the risk register and that correct risks have been identified

- management responses and action progress against assurance reviews

- response to fraud and bribery threats

- ICT security and any breaches reported.

The Audit and Risk Committee challenges and approves the agency Management Assurance Statement and the Annual Report and Accounts.

Wider governance

DfT Sponsor helps ensure sufficient priority is afforded to operational delivery, progress towards business plan performance measures and the management of risk through regular challenge meetings with myself and the Finance Director.

We contribute monthly to DfT transparency reporting on progress towards financial targets and cash forecasting, expenditure and contracts in respect of our own activities. Our reports, together with emerging escalated risks and issues, are aggregated with those of other agencies and considered at DfT Executive Committee and Group Audit and Risk Committee as appropriate.

Managing our risks

Our risk policy is updated on an annual basis to ensure the risk management framework and approach to risk appetite is appropriately defined and remains effective. The current agency risk policy is published on our internal intranet site and remains aligned to the overarching DfT policy.

Risks are identified and managed at several levels and captured on a standard reporting template. There is an established process for escalating risks to the Corporate Risk Register which is reviewed by the Executive Team on a monthly basis and quarterly by our board and our Audit and Risk Committee.

The ET and board consider potential new risks that we face on an ongoing basis. A specific risk identification exercise was undertaken in August 2016 identifying risks to be included on the Corporate Risk Register.

The main risks at the 2016-17 year end included a number of inherent risks that we will always need to monitor. Such risks include ensuring robust business continuity plans are in place to address a range of potential disruptive scenarios; and the ongoing risks based around resource and resilience.

We have a continuous focus on the security and integrity of the data and information for which we are responsible. The Data Governance Board (DGB) provides the Senior Information Risk Owner (SIRO) and through the SIRO, the board with the necessary assurances in relation to the data and information for which we hold responsibility.

Significant risks are escalated as appropriate to DfT in accordance with requirements set by the Department and HM Treasury.

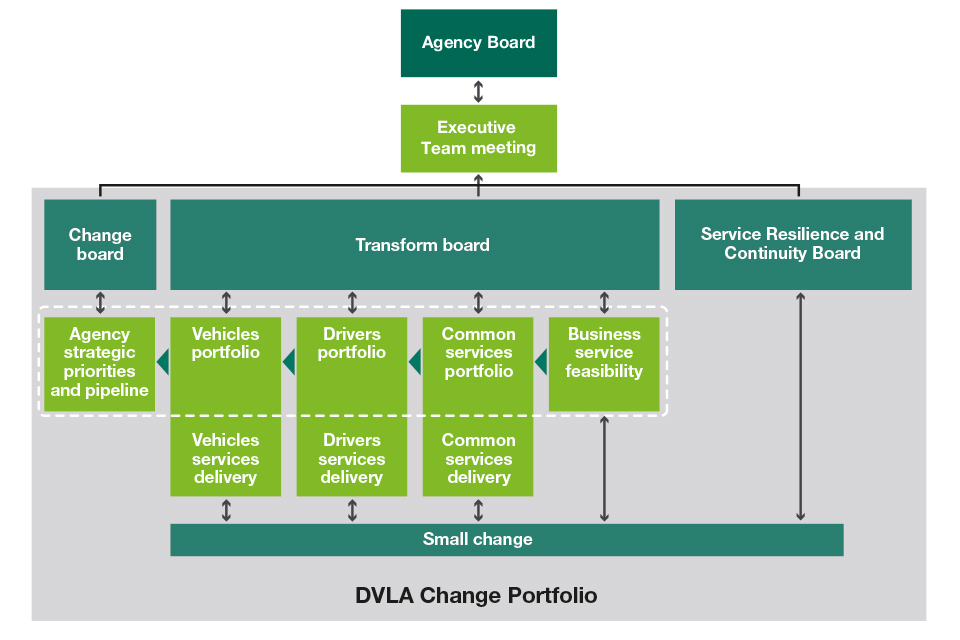

Managing the business – change and investment

We manage the introduction of change through the strategic pipeline along with assignment of strategic priority. The key features of this process are:

- a rolling pipeline of planned change including projects, contracts, business as usual and business development activities

- a fortnightly Change Board consisting of the ET and representatives from business, finance and Information Technology Services (ITS), which acts as the first decision making forum in the pipeline process

- a fortnightly Business Impact Panel (BIP) consisting of representatives from across the agency. This panel assesses the potential impact of any change and allocates up to £50k funding to initiate discovery work and validate the scope of any change, agree requirements and consider options for delivery. The outcome of the discovery enables investment decision making

- our business case process determines the appropriate governance route for each investment. A 3-stage business case process (following HM Treasury Green Book guidance) is undertaken for changes with a lifecycle cost greater than £1 million with smaller value investments requiring a cost benefits analysis

- all business cases are subject to internal specialist review and approval, prior to approval at the appropriate investment board, depending on value (for example, programme, Executive Team, DVLA Agency Board).

Governance model

Cabinet Office spending controls

In addition to the rules set out in Managing Public Money, Cabinet Office operates a set of additional spending controls.

We have worked with DfT and Cabinet Office spend approval teams (for digital and technology spend) to develop and pilot a new and more responsive spend control process. This has been based on our pipeline view of change and an assessment of our governance and controls. The pilot has run in parallel with the existing spend controls process and a positive outcome will enable rollout of the new pipeline approval across all change portfolios through 2017-18. We meet with DfT and Cabinet Office on a monthly basis to review individual projects and assess progress against spend plans, with quarterly assessments also being undertaken by Cabinet Office. This new approach allows DfT and Cabinet Office to concentrate on fewer, but higher profile items. Our change pipeline is key to this process by giving a forward view of change plans.

The Cabinet Office spend controls process requires Ministerial approval for ICT spend over a threshold of £5m. One issue was identified during the year with an element of the overall PACT exit spend not receiving appropriate approval. However, we have an excellent record in this space, being recognised as an exemplar across government, as evidenced by the pilot mentioned above and our very positive record since April 2015 to March 2017, receiving approval for 48 different ICT initiatives with a total value of £168m.

Financial controls

Review of operational budgets and project affordability takes place at the monthly finance ET meeting with confirmation of affordability given by the Finance Director. Budgetary controls are supported by a robust and formal full monthly planning and re-forecasting cycle, monitoring volume and change demand. A summary of the results are reported monthly to our board.

As the Accounting Officer, I hold a letter of Financial Delegation issued by the Permanent Secretary of DfT. I sub-delegate financial delegations to Executive Directors and key finance staff.

Staff who have been allocated a delegation must ensure that they have completed the mandatory training programme and been assessed to ensure competence to fulfil the role.

We have developed and implemented a strategy and framework for the analytical assurance of both business case models and statistic reports. The framework details roles and responsibilities and ensures we enshrine the principles of the Macpherson Review in the day-to-day operation of our business. We ensure a robust body of documentation is available for audit. Analytical assurance statements are produced as standard reflecting best practice. Specialist review sign-off of business cases ensures analytical assurance is undertaken before investment decisions being made. A periodic review is undertaken assessing our organisation’s business models against DfT criteria to establish if the model in question is classified as ‘business critical’. At present we do not have any models classed as ‘business critical’.

Shared Services

Since divestment, Shared Services has provided services to DfT and DVLA. Commercial discussions with Arvato have been concluded and both platforms are to be maintained with DfT managing the contract directly. This has led to DfT being in control of ensuring continuity of service; standardisation of process; securing value for money; and its future direction.

As the framework authority, DfT Accounting Officer is now responsible for providing DfT and DVLA, with assurance that Independent Shared Service Centre (ISSC) 1 is meeting its contractual obligations. The DfT Accounting Officer is supported in this role by a dedicated Shared Service Audit Committee.

DfT has received an International Standards of Assurance Engagement (ISAE) 3402 report produced by KPMG on Arvato’s operation of the control environment at ISSC1. DfT has also received a number of internal audit reports on ISSC1 risk controls. DVLA has placed reliance on these reports for assurance over ISSC1’s control environment during the 2016-17 financial year.

Commercial controls

As a central government body, our commercial activity is governed by legislation within the Public Contracts Regulations 2015. Governance and control of commercial activity is administered by the Commercial Directorate and overseen by the Commercial Director.

Our Commercial Directorate is responsible for ensuring that commercial practice is compliant with the regulations. In line with the government’s transparency agenda, all tender opportunities are published, including single tender actions and contracts over £10,000.

The Commercial Directorate has developed Commercial Procedures and a Commercial Policy which act as the 2 primary control documents governing commercial activity.

Contractual authority emanates from me as Accounting Officer and is delegated to individuals in specific posts (primarily Commercial Director, Head of Procurement and senior commercial managers) and is not transferable. Only those with contractual authority are allowed to commit us to any commercial activity. Contractual authority is distinct from financial authority and no individual is permitted to exercise both for the same requirement.

We have developed an efficient and effective practice whereby all contracts are sponsored at ET level. This is supplemented by making day-to-day contract management the shared responsibility of a business owner and a professional Commercial Advisor from within Commercial Directorate; supported by a professional Financial Advisor.

Data controls

The governance arrangements for control of data have not changed significantly. Embedded processes whilst under constant review have proved fit for purpose and are mature.

The SIRO who is also the Director of Strategy, Policy and Communications is accountable for information risk and is supported by a Chief Information Security Officer (CISO) and Information Asset Owners (IAO’s) the latter being accountable for the day to day control of information.

Data control and risk is co-ordinated through a DGB chaired by the SIRO and attended by subject matter experts from across the organisation. The Chief Executive also attends this board.

There have been 15 incidents of personal data breaches this year which is a decrease from last year (21 in 2015-16). All of these breaches have been low volume and largely attributed to human error, none required reporting to the Information Commissioners’ Office.

The threats to our information from both criminal and other activity are increasing globally. Our controls are under constant review with privacy impact assessments being made for data releases, new systems or changes to existing processes. This allows us to adjust control frameworks ranging from contractual arrangements to technical controls as needed.

With the increasing threats to personal data globally we have focused on awareness and training for staff with various events across the agency such as security awareness week. We have targeted training events for our IAO’s and Information Assurance Staff. In addition all staff have to pass an annual assessment on information security principles and best practice with the pass mark set at 80%. This assessment is also used to raise awareness of current risk and threat trends.

Looking forward we have started preparatory work for compliance with the General Data Protection Regulation coming into force during 2018. As part of this preparation we are reviewing our ISO27001 compliance against our core datasets.

Fraud, error and debt

The management of fraud, error and debt is a critical part of good governance. Losses and recoveries are reported to Cabinet Office. Overall responsibility for our management of this area sits with the Director of Strategy, Policy and Communications, supported by a cross-agency Fraud, Error and Debt Board.

Counter fraud initiatives and fraud investigations are taken forward by the Fraud Policy and Investigations Team, often in liaison with our operational Criminal Intelligence Officers. The Government Internal Audit Agency (GIAA) provides support and input to fraud investigations, advising on aspects of control and risk management.

The Fraud Policy and Investigations team review all changes initiatives and work closely with individual business areas to fraud risk assess business processes, providing support and advice on fraud mitigation. The team is currently working with DfT to review the new government counter fraud standards which will be in place from April 2017. These are being rolled out to standardise and improve counter fraud practices across government and we will be assessing current processes in line with these standards. A new Government Counter Fraud profession will also be introduced in 2017.

Accounting Officer assurance

The system of internal control is designed to manage risk to a reasonable level, rather than to eliminate all risk. It should provide reasonable and not absolute assurance of effectiveness. The system of internal control supports the achievement of our policies, aims and objectives, whilst safeguarding the funds and assets of the organisation, in accordance with HM Treasury’s Managing Public Money.

As Accounting Officer for DVLA, I have responsibility for reviewing the effectiveness of the systems of internal control. This is primarily informed by our internal audit reviews, along with the management assurance reporting of our managers who are responsible for the development and maintenance of the internal control framework.

Twice a year, a Management Assurance Statement review is undertaken to review all facets of management assurance, policy and practice. The 2016-17 Management Assurance Statement review asked our senior managers to provide performance commentary and evidence on the application of 40 aspects of assurance. There were 31 areas of substantial assurance and 9 areas of assurance were classed as moderate. Responses were compiled by subject matter experts, challenged by internal audit, ET, DfT and signed off by Audit and Risk Committee. The areas with moderate assurance (and not substantial) correspond with internal audit expectations. Action plans are in place to address any further improvements where required.

Audit and Risk Committee

Our board and Audit and Risk Committee assist in developing and overseeing governance assurance processes and the plans to address any identified weaknesses. This ensures that continual improvement of the systems remains a priority.

These processes apply to all our activities and transactions in the Business Account and Trust Statement. The Chair of the Audit and Risk Committee reports regularly to the board on the Audit and Risk Committee’s views on the effectiveness of our governance, risk management and internal control arrangements.

Internal audit

Our internal audit team are now part of the GIAA. This move increases the independence of the internal audit function and follows wider government priorities for internal audit services within the Civil Service. Benefits include greater consistency and joined up working for the provision of internal audit services across government.

The internal audit team operates to prescribed Public Sector Internal Audit Standards and complies with procedures and standards set by the GIAA. The internal audit report provides me with an independent and objective opinion on the adequacy and effectiveness of our system of internal control, together with recommendations agreed to by management for improvement to address identified areas of risk or control enhancement.

The Head of Internal Audit has unfettered access to the Chair of the Audit and Risk Committee and as Accounting Officer, I also work closely with the DfT Group Chief Internal Auditor within GIAA. The audit plan for the year is informed by the main risks to our business and encompasses a broad range of internal controls. This includes assurance over the security and use of our data, as well as contractual commitments and data protocols for those organisations that interact with us.

Head of Internal Audit opinion

On the basis of the evidence obtained during 2016-17 the Head of Internal Audit was able to provide a moderate level of assurance that the framework of governance, risk management and control is appropriately defined and working effectively throughout 2016-17.

The Head of Internal Audit has advised that this opinion reflects the maturity of our Risk Management Framework; and our continued focus on further strengthening existing governance arrangements.

Established key controls were found to be generally working effectively but with some improvements required to enhance the adequacy and effectiveness of the framework of governance, risk management and control. The areas for further improvements and which would benefit from strengthening procedural controls are predominantly areas impacted by the significant change. There have been notable improvements in IT functions after being brought in-house as a result of the exit from the PACT contract. This reflects a change in leadership within Information Technology Services; focussing on harmonising IT services combined with organisational restructure.

The cases where internal audit identified the need for control enhancements were not deemed significant in the context of the overall control environment. Where enhancements were proposed, corrective action has been agreed with management. Delivery against those actions is monitored closely by the Executive Team and where relevant, by the appropriate governance board (such as the DGB and Audit and Risk Committee).

Actions agreed with management against weaknesses identified as part of the internal audit programme have contributed to the overall assurance reported within this Governance Statement.

Monitoring of specific control issues

The Agency identified during the year that an element of the PACT exit costs relating to expenditure incurred on operational transition services, owing to an omission, did not have full and appropriate prospective ICT spend approval from Cabinet Office. However the Agency did receive Cabinet Office approval for the wider PACT Exit project. Cabinet Office was immediately informed and the Agency pursued this approval through the established retrospective approvals process offered under Cabinet Office guidelines; however retrospective approval was not received. Procedures have subsequently been reviewed.

A number of ‘deep dive’ internal audit review activities during 2016-17 have identified instances where we could make further control improvements. These have covered specific actions to address very specific control issues – predominantly (not limited to) those areas that have been the transition of IT services. Management have agreed actions to take forward; and are closely monitored in line with the established arrangements described above.

In the opinion of the Head of Internal Audit there are no further significant weaknesses that fall within the scope of issues that should be reported here.

4. Remuneration and staff report

Remuneration report

Remuneration policy

The remuneration of senior civil servants is set by the Prime Minister following independent advice from the review body on senior salaries.

The review body takes account of the evidence it receives about wider economic considerations and the affordability of its recommendations. Further information about the work of the review body can be found at Office of Manpower Economics.

We have our own remuneration committee in line with board best practice, chaired by a Non-Executive Director. Further details can be found within the Governance Statement.

Service contracts

Civil Service appointments are made in accordance with the Civil Service Commissioners’ Recruitment Code, it requires appointments to be based on fair and open competition but also includes the circumstances when appointments may otherwise be made. Unless otherwise stated below, the officials covered by this report hold appointments that are open-ended. Early termination, other than for misconduct, would result in the individual receiving compensation as set out in the Civil Service Compensation Scheme. The standard period of notice to be given by directors is 3 months.

Salary and pension entitlements

The remuneration and pension interests of the Chief Executive and directors are set out below.

The senior civil servant annual pay award bonus is determined by performance. These pay award bonuses are awarded to the top 25% of senior civil servants. They are made to reward in-year performance in relation to agreed objectives, or short-term personal contributions to wider organisational objectives.

Salary

Salary includes gross salary, overtime, recruitment and retention allowances and any other allowance to the extent that it is subject to UK taxation. This report is based on payments made by us and recorded in these accounts. The directors did not receive any non-cash benefits during the current or prior year.

Performance bonus

Performance is assessed annually for directors through the appraisal processes. These are stipulated by DfT and entitlement to performance enhancements or bonuses established in comparison across the DfT family is through the departmental evaluation committee, chaired by the Permanent Secretary. Our remuneration committee provides advice to DfT on performance of directors.

Civil Service pensions

Pension benefits are provided through the Civil Service pension arrangements. From 1 April 2015 a new pension scheme for civil servants was introduced – the Civil Servants and Others Pension Scheme (CSOPS) or alpha, which provides benefits on a career average basis with a normal pension age equal to the member’s State Pension Age (or 65 if higher). From that date all newly appointed civil servants and the majority of those already in service joined alpha. Before that date, civil servants participated in the Principal Civil Service Pension Scheme (PCSPS). The PCSPS has 4 sections: 3 providing benefits on a final salary basis (classic, premium or classic plus) with a normal pension age of 60 and one providing benefits on a whole career basis (nuvos) with a normal pension age of 65.