Creative industries sector vision: a joint plan to drive growth, build talent and develop skills

Updated 20 June 2023

Prime Minister’s foreword

Culture is something we all share. All of us have favourite songs that soundtrack the most meaningful moments in our lives. All of us remember childhood stories we want to read to our own children. All of us have a TV show we’re binge watching and turn to films, games, or the theatre to transport us to a different world.

Many of our favourite things are made here, in the UK. And that’s true for people the world over. The creative industries are a true British success story, from global music stars like Adele and Ed Sheeran to world-class cultural institutions like the National Theatre. These industries have a special place in our national life and make a unique contribution to how we feel about ourselves as a country. You can see it in events like Eurovision, shows like Life of Pi, or games like Football Manager: so often the creative industries help to strengthen the bonds between communities.

As well as projecting our values on the world stage, the creative industries drive our economy at home. The contribution they make has often been underappreciated. These industries generate £108 billion a year. Employ over 2.3 million people in every corner of the country. And there is a real sense of energy in the sector, which has grown at more than 1.5 times the rate of the wider economy over the past decade.

I’m personally committed to the success of the creative industries – and so is the government I lead. That’s why, at the height of the pandemic, when the very survival of our cultural industries was on the line, I was proud to introduce the £1.57bn Culture Recovery Fund. And it worked. A recent research report showed it protected over 5,000 organisations and supported 220,000 jobs.

Now, we’re determined to go further. Growing our economy is one of my priorities. And growing the economy means growing the creative industries. So today we’re setting out this new vision to realise the enormous potential of our creative entrepreneurs and businesses.

Our ambition is nothing less than to grow the creative industries by an extra £50 billion while creating one million extra jobs by 2030.

To do that, we need to play to our unique strengths. As technology increasingly infuses the creative industries, our competitive advantage in both sectors means this country has an unparalleled opportunity in the decades ahead.

We need to level up. Projects like the British Library’s landmark new centre in Leeds show us the way – a brilliant way to mark their 50th anniversary. But to go even further, we’re expanding the numbers of creative clusters across the country. Creating new centres of excellence in areas like film and TV, design and video games. And building a pipeline of talent and opportunity for our young people.

And we need to do more to equip our young people with the skills to thrive and succeed in a world where technology is changing the industry. That includes extending maths teaching in some form to 18; because we know that from games design to set design, quantitative skills are ever more important.

These are ambitious and stretching goals. So we’re beginning our work in earnest with over £75 million of new investment into the sector, building on over £230 million of support since 2021. This funding will allow our young people to release their inner creativity, help our start-ups become scale-ups, and turn local businesses into international exporters.

The UK has a centuries-long heritage of extraordinarily creative and vibrant arts and culture. Now, we have an opportunity to secure those enduring strengths and lead the world, long into the future. And with this new Vision, that’s exactly what we’ll do.

The Rt Hon Rishi Sunak MP

Prime Minister

DCMS and industry foreword

Our creative industries are world-leading, an engine of our economic growth and at the heart of our increasingly digital world. From 2010 to 2019 they grew more than one and a half times faster than the wider economy and in 2021 they generated £108 billion in economic value. In 2021, they employed 2.3 million people, a 49% increase since 2011. Their impact reaches beyond their borders to other sectors, with advertising, marketing and creative digital innovation supporting sectors across our economy. This is why the government has identified the creative industries as 1 of 5 priority sectors in the 2023 Spring Budget to deliver future growth.

The importance of the creative industries also goes well beyond the economy. They provide the news that informs our democracy, the designs that shape our cities and the content and performances that enrich our lives and strengthen our global image. The sector has proved that it is an essential positive force for society, bringing joy, inspiration and opportunity to our lives. The creative industries form the national conversation through which we define our shared values.

Our creative industries rival any country in the world. The imagination of our designers, writers, artists and creators are driving innovation and growth across the economy. This is, in part, due to how the government and the sector have worked together to make the UK one of the most opportune places in the world to create. But we cannot rely on past success. We can do more to unlock the growth potential of the sector and create opportunities across the UK, such as for young people and the next generation of creative talent, wherever it is.

This sector vision, developed across the UK government and in partnership with the Creative Industries Council (CIC), is central to achieving our ambitions for growth. By 2030 we want to:

- grow our creative industries in creative clusters by an extra £50 billion

- deliver a creative careers promise that builds a pipeline of talent into the sector and supports a million extra jobs

- intensify the creative industries’ ability to enrich our lives and create pride in place

To do this, this sector vision sets out actions that the UK government and industry have committed to delivering now. This includes £310 million in government spending, with approximately £233 million of existing public funding since the 2021 Spending Review and £77 million in new government spending announced at the 2023 creative industries growth moment. This new spending is focused on boosting creative clusters and supporting businesses to grow and export, underpinned by a new commitment to deliver a pipeline of skills and talent. It is accompanied by a plethora of undertakings from creative industries sub-sectors.

The sector vision also sets out the spirit in which we will adapt to a world that is constantly being re-invented. It is a living policy framework establishing clear, shared goals as the foundation for how we will work in partnership, led by a refreshed CIC.

We are a creative, innovative country which has a long history of creating opportunities for all. The sector vision is a plan to build on this, breaking down barriers, capitalising on the tech opportunities of the Fourth Industrial Revolution and keeping our world-class creative industries ahead of the growing international competition. We want to ensure that the sector can attract and develop the very best creative talent and skills from all backgrounds and parts of the country, from video game businesses in Nottingham to book publishers in Newcastle and theatres in Norwich.

Now is the time to address challenges and to come up with new, creative ideas to meet them. Now is the time to be ambitious to realise the creative industries’ potential for growth and to create opportunities for people across the UK, fuelling our economy, culture and society.

The Rt Hon Lucy Frazer KC MP

Secretary of State for Culture, Media and Sport

Sir Peter Bazalgette

Industry Co-Chair of the Creative Industries Council

Executive summary: Our 2030 vision

Credit: JM Enternational

With limitless creativity, imagination and entrepreneurial spirit, our creative industries are fundamental to the UK’s future economic growth. Over the last decade, the sector’s output has grown at over one and a half times faster than the rest of the economy and its workforce has grown at almost 5 times the UK rate.[footnote 1] [footnote 2] With the right support, we want to realise the growth potential in creative clusters, create opportunities for young people and others, and enrich lives and strengthen pride in place across the UK.

Creative industries sector deal successes

Innovation in almost 2,250 UK businesses stimulated by UKRI’s £95 million Creative Clusters and Audiences of the Future programmes.

Turnover increase of £13.5 million following the Creative Scale Up pilot.

92,000 students inspired by the England only Creative Careers Programme.

218,790 new jobs and £13.48 billion in GVA from screen sector tax reliefs.

Exports increased by 320% from the Music Export Growth Scheme.

The government’s support for the creative sector is longstanding. Since the CIC was established in 2011, the government has:

- reformed and expanded the highly impactful creative industries tax reliefs, including through the introduction of the high-end TV and animation reliefs in 2013, the video games and theatre tax reliefs in 2014, the children’s television tax relief in 2015, the orchestra tax relief in 2016, and the museums and galleries tax relief in 2017 — the Spring Budget 2023 announced extensions to tax reliefs for orchestras, museums and galleries, and reforms to audiovisual tax reliefs that will provide a greater benefit to recipients

- worked with the CIC to deliver the Creative Industries Sector Deal in 2018 which set out almost £150 million of public investment, matched by more than £200 million from industry. This included support for creative clusters in the form of the £56 million Creative Industries Clusters Programmes which drove Research and Development (R&D) across the UK.

More recently, the industry’s ingenuity and the government’s staunch support, including the Department of Culture, Media and Sport’s (DCMS) £500 million Film and TV Restart Scheme and the unprecedented £1.57 billion Culture Recovery Fund, have helped ensure that activity in nearly all the creative sub-sectors has recovered to pre-pandemic levels.[footnote 3] In the 2023 Spring Budget, the government also set out steps aimed at giving businesses the stability and confidence they need to invest and grow during the challenges with cost of living.

Looking forward, we can expect another surge of growth and employment.[footnote 4] The pandemic’s impact was not just short-term, it accelerated changing consumer habits with more people accessing creative works online, using platforms such as Netflix, Amazon, Audible and Etsy.[footnote 5] In tandem, creative businesses embraced new technologies, from live streaming to augmented reality.[footnote 6] New technologies, and the R&D behind them, will be the key to future growth in the creative industries. Using artificial intelligence (AI) as a tool, building immersive worlds, and developing virtual production will inspire even more incredible content. These wider shifts present an opportunity to leverage the UK’s global technological leadership to turbo-charge growth in the creative industries.

This sector vision sets out how the government and industry will work together to unlock the growth potential of the sector by unleashing more investment and building the creative businesses and jobs of the future. It will also set out how we can create opportunities, including for young people to participate in creative activities and build careers in the creative industries, as well as how we can enhance the sector’s positive impact on our lives and our pride in place. It sets out shared goals and commitments to ensure the sector builds on the success of the last decade.[footnote 7]

COVID support made available to the creative industries

£1.57 billion UK Government Culture Recovery Fund

£500 million UK Government Film and TV Production Restart Scheme

£800 million UK Government Live Events Reinsurance Scheme

£256 million Scottish Government COVID support (including support for the culture, creative, heritage and events sectors)

£108 million Welsh Government Cultural Recovery Fund, including Freelancer Fund

£37.5 million Northern Ireland Executive COVID support

Our 2030 goals and objectives

This sector vision sets out our 2030 goals and objectives to deliver growth. It is a vision for the creative industries to become an even greater growth engine and where creative talent from all backgrounds, and creative businesses from all areas in the UK, can thrive.

Goal 1: Grow creative clusters across the UK, adding £50 billion more in Gross Value Added (GVA).

This goal of a £50 billion increase in annual GVA by 2030 is compared to 2019 levels, as the latest reliable data available before the pandemic, and is based on projecting forward the compound average growth rate for 2010-2019. This represents the level of ambition set in this vision and the scale of challenge we want to rise to.

By 2030, we want to unlock the potential for growth in creative clusters across the UK and to grow opportunities for creative businesses.[footnote 8] Our objectives are:

2030 innovation objective: increased public and private investment in creative industries’ innovation, contributing to the UK increasing its R&D expenditure to drive R&D-led innovation.

2030 investment objective: creative businesses reach their growth potential, powered by a step-change in regional investment.

2030 exports objective: creative businesses grow their exports and contribute to the UK reaching £1 trillion exports per year.

Goal 2: Build a highly-skilled, productive and inclusive workforce for the future, supporting 1 million more jobs across the UK.

By 2030, we want to ensure our creative workforce embodies the dynamism and talent of the whole of the UK, while addressing skills gaps and shortages.[footnote 9] Our objectives are:

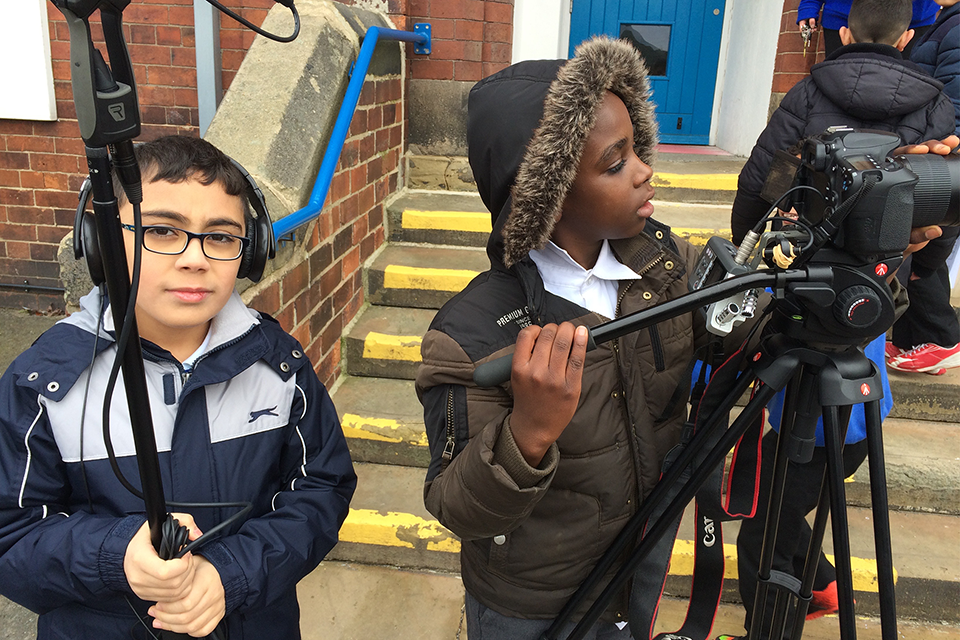

2030 education objective: a foundation of education and opportunities to foster creative talent from a young age.

2030 skills objective: stronger skills and career pathways generate a workforce that meets the industry’s skills needs.

2030 job quality objective: all parts of the creative industries are recognised for offering high quality jobs, ensuring a resilient and productive workforce that reflects the whole of the UK.

Goal 3: Maximise the positive impact of the creative industries on individuals and communities, the environment and the UK’s global standing.

By 2030, we want the creative industries to further enrich lives, create pride in place across the UK, and strengthen our soft power. Our objectives are:

2030 wellbeing objective: creative activities contribute to improved wellbeing, help to strengthen local communities, and promote pride in place.

2030 environment objective: Creative industries play a growing role in tackling environmental challenges, helping the UK reach the targets set out in the Powering Up Britain plan.

2030 soft power objective: creative industries increase their reach to global audiences, strengthening the UK’s soft power and positive influence on the world.

These goals and objectives will help deliver the government’s wider growth agenda, as set out in government strategies, papers and Levelling Up missions to boost living standards, spread opportunities and restore local pride.[footnote 10]

Actions and ambitions

To deliver, we need to start now. This is why the government and industry, coordinated by the CIC, are committing to actions to create the right foundations to meet our 2030 goals and objectives. This includes almost £310 million in public funding since 2021.

Since the 2021 Spending Review, the government has already committed to providing approximately £233 million of growth-focused public funding to boost innovation, regional investment, exports, talent and skills[footnote 11].

As part of the 2023 creative industries growth moment, the government has committed to more, providing an additional £77 million in new government spending and policy announcements to unlock the growth potential of the creative industries and creative clusters across the UK. As with the sector deal, the government expects its commitments to lead to larger amounts of private investment into the sector.

Over £200 million in growth support

| Fund | Funding amount |

|---|---|

| AHRC CoStar | £75.6m |

| Innovate UK’s Creative Catalyst Programme | £30m |

| AHRC Design Programme | £25m |

| Innovate UK’s Excellent Design in Innovation Programme | £25m |

| DCMS UK Global Screen Fund | £21m |

| DCMS Create Growth Programme | £17.5m |

| UKRI Circular Fashion Programme | £15m |

| DCMS UK Games Fund | £8.4m |

| DCMS Creative Careers Programme | £1m |

| MEGS and ISF (for 1 year) | £0.54m |

This funding is made up of several policies and programmes that government and industry will collaborate on to deliver. This includes the following.[footnote 12]

Our support will unlock the potential that exists in the creative industries to drive growth across the economy.

We will:

- deliver the next £50 million wave of the Creative Industries Clusters Programme to support R&D in at least 6 new clusters

- provide £75.6 million to set up 4 new R&D labs and an Insight Foresight Unit across the UK as part of the Convergent Screen Technologies and Performance in Realtime (CoSTAR) programme

- increase the Create Growth Programme’s (CGP) budget by £10.9 million to a total of £28.4 million to support businesses in another 6 English regions

- provide an additional £5 million for the UK Games Fund to invest in early-stage games studios, bringing its total value to £13.4 million

- extend and increase funding for Arts Council England’s (ACE) Supporting Grassroots Live Music fund with an additional £5m over the next 2 years

- triple the funding for the Music Export Growth Scheme (MEGS) to £3.2 million over 2023-25 to enable emerging artists to break into new international markets

- in partnership with the Royal Anniversary Trust, launch a challenge designed to encourage innovation and growth in the creative industries

- welcome the recommendations of the Pro-innovation Regulation of Technologies Review and make rapid progress to develop a code of practice on text and data mining to ensure creator rights are appropriately protected

Our creative careers promise will build a pipeline of talent into the creative industries.

We will:

- publish a new Cultural Education Plan (CEP) in 2023, deliver the National Plan for Music Education (NPME) including £25 million for musical instruments, and explore opportunities for enrichment activities as part of the government’s wraparound childcare provision

- improve creative apprenticeships, with regards to Small and Medium Enterprise (SME) engagement, training provision, relevance of standards and the effectiveness and sustainability of the Flexi-Job Model

- support the rollout of T-Levels, and complementary high-quality, employer-led Level 3 qualifications that focus on good progression outcomes

- work with industry so that they can take advantage of Skills Bootcamps at national and regional levels, and benefit from new Local Skills Improvement Plans (LSIPs) and the forthcoming Lifelong Loan Entitlement

- set out, with industry, an action plan in response to the independent Good Work Review: Job Quality in the Creative Industries. The CIC will launch a Charting Progress Tool to track the effectiveness of diversity and inclusion interventions.

Our support will enhance the creative industries’ ability to enrich lives, create pride in place and strengthen our soft power.

We will:

- deliver on the government’s commitment to support creative excellence - supporting and promoting the very top end of our cultural and creative output to enhance soft power and boost exports. The government will provide new funding of £2 million to London Fashion Week to support 5 fashion weeks from 2023-25 and £1.7 million to the London Film Festival 2024

- deliver the £80 million Research infrastructure for conservation and heritage science (RICHeS) programme to secure the UK’s reputation for excellence in conservation and heritage science

- deliver the Music Venue Trust’s £3.5 million Own Our Venues pilot

- implement the broadcasting white paper, Up Next

- introduce an industry-led Creative Climate Charter

- support Bradford to deliver the next UK City of Culture in 2025

Delivery

Industry and government will work together to deliver on all of the sector vision’s 2030 ambitions. The partnership between government and industry will be coordinated through the refreshed CIC co-chaired by Sir Peter Bazalgette and the Secretaries of State for DCMS and Business and Trade (DBT). The CIC will work closely with creative organisations across the UK to achieve our shared goals and objectives. We would like to thank former CIC members for their tremendous contribution and to welcome new colleagues who will help take this work forward.

We will also strengthen our collaboration with the Local Government Association, local authorities and leaders to support them in the development of local creative industries strategies, building on the examples that the Greater London, Greater Manchester and the North of Tyne authorities have set in recent years.[footnote 13] These collaborations will ensure creative businesses can increasingly become the engines of local economies, driving regeneration and creating opportunities for young people.

The government and industry, supported by the publicly-funded Creative Industries Policy and Evidence Centre (PEC), are also committed to further improving the underlying evidence base to inform how we support the sector. The PEC has had a positive impact on our understanding of the sector’s profile and economic impact across the UK. The Arts and Humanities Research Council (AHRC) have extended the PEC for another 5 years with increased funding to £11 million. Effective policy depends on good data.

Scope of the vision

The creative industries

We were the first in the world to define ‘creative industries’ — as ‘those industries which have their origin in individual creativity, skill and talent and which have a potential for wealth and job creation through the generation and exploitation of intellectual property.’[footnote 14] This ‘individual creativity’ is reflected in the large proportion of freelancers in the creative workforce,[footnote 15] double that of the rest of the economy.[footnote 16] The creative industries are bound together by the generation of intellectual property (IP), which is the engine behind the sector’s sustained growth.

For statistical purposes, DCMS groups the creative industries into 9 sub-sectors.[footnote 17] However, there are overlaps. For example, ‘TV, radio and publishing’ and ‘IT, software and computer services’ are also included in the government’s definition of the digital sector, exemplifying the importance of digital technologies to the creative industries. Although they may rely more on subsidies than other sub-sectors, ‘performing and visual arts’ and ‘museums, galleries and libraries’ are also included in our definition of the cultural sector, delivering a significant return on that public investment, including wellbeing impacts (see Chapter 3) and developing talent. Sub-sectoral boundaries are fluid with shared opportunities, particularly where technology and creative skills converge. The TV programmes and films we watch or the video games we play often have their roots in our broader arts and culture.

In this sector vision, we cover all the creative industries but with a particular focus on their fastest growing areas, and acknowledging that certain issues require a sub-sectoral response. We recognise that this vision will not cover all policy areas and will not cover some areas specific to certain creative industries sub-sectors. Different parts of this sector vision will also apply to different extents to parts of the creative industries.

Each sub-sector has its own strengths, but collectively the creative industries are an economic powerhouse. As with all that goes into a great band or a spell-binding catwalk show, bringing together skills from across the sector can deliver the greatest impact. This sector vision addresses common challenges and opportunities across the sub-sectors, and capitalises on their shared strengths to maximise their value to our economy, people, places and planet.

Jobs in the creative industries

1 in 14 UK jobs are in the creative industries, employing 2.3 million in 2021.

Almost 5 x UK total. Employment growth rate from 2011 to 2021 in the creative industries.

Source: DCMS sector economic estimates

Creative industries output growth

| Sector | Growth (2010 to 2019) |

|---|---|

| Creative industries | 32% |

| All UK industries | 20% |

Employment in the UK creative economy 2020

A. 1,023,000 non-creative employment in the creative industries

B. 1,198,000 creative occupations in creative industries

C. 1,297,000 creative occupations outside creative industries

Total 3.4 million jobs in the UK wider creative economy

Creative economy = A + B + C

Creative industries = A + B

UK creative industries GVA 2021 (£m)

44,579 IT, software and computer services

19,743 Advertising and marketing

17,419 Film, TV, radio and photography

11,422 Publishing

8,361 Music, performing and visual arts

2,942 Architecture

2,537 Design and designer fashion

920 Museums and galleries

449 Crafts

Total GVA figure: 108,373 million - 5.6% of the UK’s GVA

Source: DCMS sector economic estimates

2020 creative industries exports

£8.9 billion in creative goods, accounting for 2.9% of UK exports in good worldwide.

£41.4 billion in services, accounting for 14.2% of UK exports in services worldwide.

Source: DCMS sector economic estimates

Devolution

The sector vision has been drafted by the UK Government in collaboration with the CIC and with input from the devolved administrations of Scotland, Wales and Northern Ireland. This document sets out the UK government and industry’s ambition to support the creative industries in England and across the UK where policies are reserved. Where we refer to ‘the government’ in this document, we are referring to the UK government. When we say ‘we’ or ‘our’ in this vision, we mean the UK government and industry, represented by the CIC.

The vision also sets out the UK government’s and the devolved administrations’ ambition to work together to support our world-leading creative industries. We want to collaborate to support and grow the creative industries across the UK - from film and TV production companies in Cardiff and Belfast to fashion designers in Edinburgh and music labels in Liverpool.

Policy support for the creative industries covers both devolved and reserved areas.[footnote 18] In particular, education and training (covered in Chapter 2), health and social care, environment, the majority of culture and arts (covered in Chapter 3), and some areas of media, economic matters and taxation are all devolved.[footnote 19] By contrast, the majority of media, financial and economic, employment, and trade and industry matters (covered in Chapter 1) are reserved for the UK government.[footnote 20]

In devolved areas, the devolved administrations have individual strategies and policies to support the creative industries, which have been set out in boxes in each chapter. In these areas, our ambition is to work together to share best practice and, where possible, align goals to ensure we provide coherent support to the creative industries across the UK. We will look to deepen collaboration between Scotland, Wales, Northern Ireland and England through the refreshed CIC, which now has a new membership that ensures each nation is represented. The UK government and devolved administrations will set up an Inter-Ministerial Group on Culture and Creative Industries to identify opportunities to work together, share best practices and work constructively through issues.

In this vision, we discuss a range of programmes which are both devolved and UK-wide. We have included a list of actions and programmes covered by this sector vision in Annex A, specifying whether they are UK-wide or England only.

Chapter 1. Growth

Credit: Rebellion

Goal 1: Grow creative clusters across the UK, adding £50 billion more in gross value added (GVA).

In 2030, we want to see dynamic creative clusters driving growth and employment around the UK. In our towns and cities, the creative industries already represent an increasing share of local employment and businesses. We will accelerate this trend by supporting ecosystems of creators, businesses and investors to innovate and harness new technologies, to secure the investment they need to fulfil their growth ambitions and to access markets across the world.

The creative industries are a major driver of UK economic growth and can play an important role in levelling up the country.[footnote 21] The sector showed strong growth over the last decade, rebounding after the pandemic, and is expected to continue to grow over the next decade.[footnote 22] However, this future growth cannot be taken for granted and circumstances can change quickly, as demonstrated by recent high inflation both increasing costs for businesses and impacting household spending.[footnote 23] We therefore cannot rely on past success. We need to build on the support we have provided to unlock the sector’s future growth potential.

Key to future growth is embracing technological change and the creative industries are at the forefront of this work with innovation being central to the creative process. Creative businesses spent £3.3 billion on R&D in 2020, equivalent to 3.2% of the total GVA of the creative industries and a greater proportion than the UK economy average of 2.3%.[footnote 24] The technologies of the Fourth Industrial Revolution, such as AI and virtual reality, will continue to radically alter creative production processes, consumption patterns and business models.[footnote 25] As set out in the government’s National AI Strategy, the UK has an opportunity over the next 10 years to position itself as the best place to live and work with AI.

The creative industries can help achieve this as the increasing digitisation of creative content opens up opportunities for the application of AI and machine learning.[footnote 26] Working together, we can ensure the creative industries can weather economic storms and make the most of these opportunities. We must also recognise the importance of supporting creative exports to reach even broader audiences, increase the consumption of more British content and drive growth for our products.

To maximise growth, we must also look at where our creative businesses are located. Successful creative industries have a tendency to cluster, from the video game sector in Leamington Spa to the community of architects based in Liverpool. Our public service broadcasters have also been vital to the development of creative clusters across the UK and indeed analysis has found that a 1% increase in the BBC’s local footprint results in a 4.5% increase in the rate of cluster growth in the creative sector as a whole.[footnote 27]

DCMS-commissioned research, carried out by Frontier Economics, identified 55 creative clusters across the UK and further analysis finds that over 90% of creative industries turnover is generated within these clusters.[footnote 28] [footnote 29] The PEC also identified a further 709 micro-clusters from the Shetland Islands to Penzance.[footnote 30]

Clustering can improve access to a skilled workforce, supply chains and customers, as well as creating stronger ties and knowledge sharing between creative businesses, workers and institutions.[footnote 31] As a result, creative businesses in creative clusters are shown to grow faster than those not located in creative clusters.[footnote 32] Non-creative businesses also tend to benefit from their close proximity to creative businesses.[footnote 33]

However, there are significant disparities in cluster size, with London currently accounting for more than 50% of the sector’s economic output.[footnote 34] We will work to open up opportunities and accelerate growth right across the UK, supporting the government’s levelling up ambitions.

While there is no ‘one size fits all’ approach to growing clusters, DCMS-commissioned research has identified 5 key drivers: innovation, investment, talent and skills, exporting and the wider business environment.[footnote 35] By supporting these drivers, we can create the conditions for the sector to thrive in clusters across the UK. Focusing solely on one of the drivers will not be enough. For instance, improving local skills without also nurturing local businesses risks accelerating the brain drain from the area.

Chapter 2 will cover access to talent and skills, while in Chapter 1 we focus on the 3 objectives of innovation, investment and exports.

Innovation is the seed of growth. We need to back innovative creative businesses that have the potential to be world-leading; government R&D support is crucial to stimulating private investment in these firms. By bolstering innovation across the creative industries and enabling businesses to develop new products and ideas, we can make the most of new technologies and changing markets.

Investment is the fertiliser of growth. By building knowledgeable and engaged investor communities across the UK, and by ensuring creative entrepreneurs and businesses have the skills and knowledge to access finance, we can create the right environment for investment to help creative businesses scale up and grow.

Exports enable creative firms to grow their markets and ambitions. By supporting access to new international markets, improving export skills and knowledge, and seeking beneficial terms in future free trade agreements, the sector can maximise its international competitiveness.[footnote 36]

As for the fifth driver of cluster growth, the wider business environment relates to the context (physical, social, digital, legal) in which creative businesses operate.[footnote 37] Many of these are not specific to the creative industries and so are outside the scope of this vision, however they are the focus of wider government initiatives such as:

- Spring Budget 2023

- Autumn Statement 2022

- Energy Bills Discount Scheme

- UK Digital Strategy

- UK Innovation Strategy

- Levelling Up White Paper

- Export Strategy

- 5G and Project Gigabit rollout

Central to our business environment is the UK’s IP framework. It is what allows creators and creative businesses to monetise their content and grow. We are committed to ensuring high levels of copyright protection and will continue to strive for a licensing framework that works for all. We will also continue to provide support through the following opportunities:

The British Library’s Business and IP Centre national network which provides entrepreneurs and businesses with business support and advice on IP.

The British Library also delivers the Get Ready for Business Growth programme with ACE which includes teaching businesses how to maximise their IP.

We continue to look for opportunities to ensure the UK’s IP framework keeps pace with technological change and continues to incentivise the commercialisation of creative ideas.

We also understand that technology must advance in harmony with the creative sector to ensure creators are not unintentionally negatively impacted by these advancements. For example, the UK International Technology Strategy also sets out that the government will promote the responsible development of AI and shape global AI governance in line with the UK’s values and priorities.

Similarly, the UK’s competition regime ensures a fair and level playing field, including for small creative businesses and those starting up and entering the market. The Digital Markets, Competition and Consumers Bill aims to ensure the UK continues to lead the world by taking a targeted and innovation-friendly approach to competition issues in digital markets. In parallel, the Competition and Markets Authority (CMA) will continue to ensure competition is working to the benefit of consumers across markets, as it has recently in the context of music streaming.[footnote 38]

The 2022 Autumn Statement and 2023 Spring Budget also outlined cross-economy actions to support innovation. Investment Zones will catalyse growth in some of the highest potential growth clusters, including by leveraging local research strengths. The creative industries are highlighted as one of the programme’s priority growth sectors. Meanwhile, a 35% increase in funding for UK Catapults, totalling £1.6 billion, will de-risk commercial delivery, accelerate innovation clusters and draw in private investment.

Finally, the government has recently closed the consultation which sought views on the design of a simplified R&D tax relief scheme, merging the existing R&D expenditure credit and the SME R&D relief. While the government is considering the response to the consultation, the government will publish draft legislation of a merged scheme for the technical consultation, with any decision being made at a subsequent fiscal event.

Devolved administrations’ growth policies

Scotland

The Scottish Government is committed to supporting creative industries’ growth, in particular by unlocking innovation. Following the publication of the Scottish Technology Ecosystem Review, the Scottish Government has committed £60 million to implement the report’s recommendations to support infrastructure, education and fund enabling organisations and activities. This includes £42 million to create 7 Technology Hubs across Scotland to help creative tech businesses, including video games, to access advice and support such as Tech Scaler. To support creative businesses, the Scottish Government has delivered the £1 million Creative Digital Initiative to upskill their digital capabilities and grow, including over £290,000 to Creative Scotland to deliver a digital commissioning programme via The Space, a Digital Pivot mentoring and peer support programme, and the Next Level Up programme.

Wales

The Welsh Government is prioritising creative industries growth in its Programme for Government. As part of this, they launched a new Production Fund, which has supported 31 screen productions, with £16.7 million creating £187 million in local economic impact and nurturing Welsh screen exports. The Welsh Government is organising trade missions to unlock further opportunities for the sector in overseas markets. Creative Wales has also co-funded the media.cymru programme to drive inclusive and sustainable economic development of the third largest media cluster in the UK which is located in the Cardiff Capital Region.

Northern Ireland

The Northern Ireland Executive is supporting the growth of creative clusters through its 10X economic vision, in particular digital, ICT and creative industries clusters that have the potential to grow through innovation. This includes significant annual investment in the screen sector to support production, content development and infrastructure. In September 2022, the Executive announced an investment of over £25 million in Studio Ulster, a cutting edge large scale virtual production studio, as part of the Belfast Region City Deal.

2030 innovation objective: increased public and private investment in creative industries’ innovation, contributing to the UK increasing its R&D expenditure to drive R&D-led innovation.

Credit: Creative Informatics, Chris Scott

In the UK Innovation Strategy the creative industries are identified as critical to the government’s ambition to make the UK a global hub for innovation. Creative firms are engaging in innovation at a higher rate than other sectors[footnote 39] and are more productive than the UK average.[footnote 40]

The creative industries spend the equivalent of 3.2% of the creative industries’ total GVA on R&D. But we can go much further, including by supporting innovation to leverage the latest wave of digital technologies.[footnote 41] For instance, Digital Catapult is focusing on the creative industries to build the sector’s capabilities in areas such as AI and immersive technology. Through the development of innovation and acceleration programmes, and the testing and trialling of new R&D capabilities, the Catapult is expanding the UK’s creative and advanced media production economy.

We also need to make the most of universities, their ability to champion spin-outs and their ability to enrich local SMEs with their applied research. For example, both the number and value of equity investments secured by academic spinouts has increased significantly over the last decade, rising from 209 deals with a combined total value of £405 million in 2012 to 389 deals worth £2.54 billion in 2021.[footnote 42]

Creative businesses that are developing new technologies or adapting existing technologies in novel ways (‘Createch’ businesses) have seen similar upwards growth trajectories to other tech companies.[footnote 43] However, they undertake R&D activity in different ways to traditional tech companies, from the technology they use to how they spend on R&D.[footnote 44]

Increasing innovation in the sector will lead not only to growth within the sector, but also across the economy. Evidence suggests that greater links to the creative industries and their innovative new ideas, through supply chains and labour movements between industries, also increases innovation for non-creative firms. Firms that have above average connection to the creative industries both undertake more innovation activity and have a higher probability of successful innovation. There are therefore ‘spillover’ benefits from the creative industries that improve the outcomes of other firms and the wider economy. Recent research suggests that, due to these positive spillovers not being accounted for, creative industries firms will undervalue and underproduce their own innovations.[footnote 45]

A DCMS-commissioned report carried out by the Design Council documents how creative technologies are being used by non-creative sectors, such as real-time 3D rendering used by property developers and healthcare providers.[footnote 46] The research also highlights that creative skills are increasingly used in non-creative sectors, such as design skills utilised in manufacturing and logistics. It is therefore not surprising that the Royal College of Art is in the top 10 for spinout start-ups in the UK, with new creative enterprises not just in the creative industries, but also in agriculture, construction and healthcare.[footnote 47]

However, some creative businesses - in particular the micro-businesses that make up 94% of companies in the creative industries[footnote 48] — often do not have the resources, infrastructure or capabilities to innovate effectively.[footnote 49] They may also choose not to invest in innovation if they are concerned that their creations will be copied and their IP infringed.[footnote 50]

The government and industry have demonstrated how we can leverage public funding, the UK’s world-leading university base, and the creative sector’s ingenuity to overcome these challenges and achieve a step-change in R&D investment. The UK Research and Innovation (UKRI) Creative Industries Clusters Programme, Audience of the Future Programme and Creative Industries Fund provided infrastructure and investment to help creative businesses innovate. As part of the Department for Science, Innovation and Technology’s (DSIT) Innovation Accelerators pilot, new projects in Greater Manchester and the Glasgow City Region will develop innovation in immersive technologies and museums in the metaverse.

The Intellectual Property Office (IPO) has also tackled online infringements of IP through the UK’s world-leading IP framework and by bringing together creative industries and digital platforms to better understand online infringements and agreeing actions where appropriate. In 2017, the IPO helped broker an agreed Voluntary Code of Practice between search engines and creative industries, dedicated to the removal of links to infringing content from the first page of search results.

Likewise, following the 2018 Sector Deal, the IPO facilitated roundtable discussions between social media platforms and UK creative businesses on new approaches to prevent piracy. These roundtables served to increase trust and collaboration across industry and government, whilst identifying new policies to further reduce piracy online. The roundtables raised the profile of existing measures available to block or remove infringements, and led to the identification of preventative policies, such as the removal of piracy tutorial videos from platforms and procedures to prevent links to rogue piracy sites.

Actions and ambitions

To achieve our 2030 innovation objective, we will work together with key partners such as investors, universities and local authorities to encourage R&D across all creative businesses and nurture creative entrepreneurship. The government will also continue to facilitate a close dialogue between the creative and technology sectors to ensure our IP framework enables them to grow together in partnership.

Headline actions[footnote 51]

UKRI and DSIT will deliver the next £50 million wave of the Creative Industries Clusters Programme to support R&D in at least 6 new clusters.

AHRC, in partnership with universities and creative businesses from across the UK, is delivering the new £75.6 million Convergent Screen Technologies and Performance in Realtime (CoSTAR) programme over 6 years. CoSTAR will provide a new national infrastructure to drive the next generation of R&D for building creative and digital economies. In June 2023, UKRI announced the preferred bidders for: the national CoSTAR lab led by Royal Holloway University of London which will be based at Pinewood Studios; 3 new network labs, one led by University of York to be based at Production Park in West Yorkshire; one led by Abertay University to be located in Dundee, and a third led by Ulster University based at Studio Ulster in Belfast; and a new Insight and Foresight Unit led by Goldsmiths and the British Film Institute (BFI). This announcement is matched by £63 million of co-investment, bringing total government and industry investment in CoSTAR to over £138 million.

Through a code of practice for text and data mining, we will help to ensure the UK copyright framework continues to promote and reward investment in creativity, while also meeting our ambition to make the UK a world leader in research and AI innovation. We want rights holders to be assured that their content is appropriately protected under the existing copyright framework, with reasonable opportunity to monetise that content, and we want to ensure AI-generated outputs are labelled appropriately to provide confidence in the origin of creative content. We are aiming for a principles-based code, to be published in draft before the summer Parliamentary recess.

The government, in partnership with the Royal Anniversary Trust, will launch a challenge designed to encourage innovation and growth in the creative industries. It will bring together the brightest minds from academia and industry to address challenges and opportunities the sector faces from emerging technologies, in order to identify solutions.

We welcome the recommendations of the Pro-innovation Regulation of Technologies Review.

In addition, we will:

Ensure that businesses in creative clusters across the UK are incentivised to invest in R&D and innovation.

- Innovate UK is delivering the £30 million Creative Catalyst to support creative businesses to develop and commercialise breakthrough ideas. Innovate UK have announced the winners from the 2023 round of the Creative Catalyst which will provide funding of up to £50,000 for over 200 creative businesses across the UK to invest in innovation, with 55% of funding being delivered to regions outside of the Greater Southeast.

- Innovate UK is delivering a £25 million Design in Innovation programme to inspire and invest in excellent design for innovation across the economy.

- AHRC, with co-funding from DCMS, has awarded an additional £2.5 million to explore options for expanding the R&D model into new areas and sectors, giving a further boost to creative businesses, spreading more jobs across the country, and testing new potential areas for investment.

- Through programmes like Bridge AI, Innovate UK will invest in a number of activities to stimulate the adoption and diffusion of AI in a number of high growth potential sectors, including the creative industries. This will increase productivity and support the UK’s transition to an AI-enabled economy.

- Through the Creative Research Capability programme, AHRC has also recently awarded £14.4 million to Higher Education Institutions across the UK to support R&D capabilities for the creative economy, focusing on practice research in fashion, design, and music.

- AHRC, ACE, Arts Council of Northern Ireland, Creative Scotland and Arts Council of Wales are working together to support the adoption and implementation of creative immersive technologies within the arts and culture sector across the UK, building on the learning and successes of the CreativeXR and Creative Industries Clusters programmes. A consortium of research organisations, cultural organisations and creative businesses will deliver a £6 million, 3-year creative research and development innovation programme, featuring a pipeline of funding opportunities to support organisations and individuals at different scales and readiness, leading to new immersive innovations.

Work with industry to ensure that the UK’s creative IP rights are the best protected in the world, setting the gold standard globally.

- Between 2020 and 2023 DCMS invested £13 million into the expansion and acceleration of the British Library’s Business and IP Centre network. Delivered through public libraries, it provides business support for creative businesses as well as advice on how to protect their IP.

- DSIT, IPO and DCMS will ensure a robust IP framework, including through the Counter-Infringement Strategy and continued provision of tailored IP tools and training products to help creative firms protect and maximise their IP.

- Building on the previous roundtables, the government will actively engage with the tech and creative sectors to explore potential Know Your Business Customer requirements and consider issues highlighted by the CMA, such as online platforms taking proactive steps to tackle infringing content facilitated through their platforms.

Work with industry to develop comprehensive data and evidence on creative industries’ R&D and innovation.

- Learning from the significant progress already made to understand creative R&D and innovation, we will work with academia and the PEC to develop granular data on the types of R&D undertaken and its economic benefits.

- The Council for Science and Technology – the Prime Minister’s independent scientific advisory Council – will engage with industry to develop recommendations for the government to consider how it can support R&D, innovation and technology in the creative industries, to which the government will respond.

Case Study: Edinburgh’s Creative Informatics

£56.8 million Creative Industries Clusters programme has supported nine creative clusters in the UK. Collectively, these research and innovation clusters have generated £252 million of public and private co-investment, engaged over 2,500 businesses and 60 research organisations and supported 900 business R&D projects. These projects create new products and experiences that give regional businesses a competitive advantage and a chance to scale up.

Creative Informatics is one of the nine clusters. Based in Edinburgh with co-investment from Creative Scotland, it focused on nurturing the city’s world class creative and tech sectors. It has supported a range of companies to undertake more R&D and to embed it at the heart of their business activity. One such company is TouchLab, which applied for funding to qualify for the £10 million Avatar XPrize competition for creating physical robotic avatar systems. Combining advanced robotics with virtual reality interfaces developed in the creative industries, TouchLab gives users an immersive experience when controlling a remote avatar. It could be essential when, for instance, working remotely in disaster areas.

TouchLab is now based at the Higgs Centre for Innovation business incubator, which is funded by the Science Technology Facilities Council, and has recently secured £3.5 million investment from Octopus Ventures. They have developed the potential use of their technology in other sectors such as healthcare and nuclear decommissioning. Examples like this demonstrate that creative solutions developed within clusters are often able to benefit not just creative companies but the wider economy.

2030 investment objective: creative businesses reach their growth potential, powered by a step-change in regional investment.

Credit: Ian Wallman

In the Levelling Up White Paper, the government outlined its priority to boost productivity, pay, jobs and living standards across the UK. The creative industries are critical to meeting this ambition with investment pouring into many parts of the sector, enabling business expansion.

Some creative sub-sectors have proven incredibly successful at securing inward investment. UK film and high-end TV production spend reached £6.3 billion in 2022, the highest on record, and £1.8 billion higher than in 2019. £5.4 billion of this was driven by inward investment, highlighting the UK’s reputation for world-leading film and TV production.[footnote 52]

To meet this demand, studio facilities have expanded across the UK. For example, in 2021 Pinewood Studios announced the expansion of its iconic Shepperton Studios — with approximately 1 million square feet of new production space. This space has now been leased on long-term contracts with commitments from both Amazon Prime Video and Netflix. More widely, one study in 2021 concluded that Createch firms — creative businesses that use technology - raised a record of nearly £1 billion in venture capital in 2020, putting the UK third in the world for Createch investment, behind China and the US.[footnote 53]

While parts of the creative industries are attractive to investors, many entrepreneurs and creative businesses find it hard to access investment.[footnote 54] The value of creative businesses commonly lies in their intangible IP, which can be hard to value, and project-based business models often create peaks and troughs of activity and revenue.[footnote 55] Moreover, some products such as music or films can be ‘hits’-based, with unpredictable consumer demand. These factors, coupled with a lack of market intelligence and data, can make creative businesses appear a risky proposition to investors.

These challenges are felt more keenly outside of London, with early stage equity finance and venture capital investors much less prevalent.[footnote 56] The government and industry will work together to improve data on investment into the sector, to improve benchmarking against other sectors, and to better understand new and emerging business models and their finance needs.

Creative industries sub-sectors are highly entrepreneurial, which is a key source of the sector’s dynamism, but can also come with a relative lack of experience or skills in raising outside investment. It is critical to ensure we nurture new creative entrepreneurs with the right support. For example, the BFI has committed £54 million of National Lottery funding between 2023-26 to its Filmmakers funds, as set out in their National Lottery Funding Plan (2023-26).

Previous government and industry support has looked to tackle these challenges. The government’s creative industries tax reliefs, including the audiovisual ones, have been vital to the sector’s growth.[footnote 57][footnote 58]The British Business Bank (BBB) has across its programmes to date provided over £4 billion of finance to more than 6,800 creative businesses to help them grow and access investment.[footnote 59] From 2018 to 2021, DCMS piloted the £4 million Creative Scale-Up Programme, which supported over 200 creative businesses in 3 regions in England in accessing angel investment. Local authorities have also worked with industry to deliver locally-led initiatives, such as the North of Tyne’s Culture and Creative Investment Programme, delivered in partnership with Creative UK. This provides specialised support for creative businesses to win investment.

The 5 steps of a creative business

| 01 | 02 | 03 | 04 | 05 |

|---|---|---|---|---|

|

Pre-seed A business that has been operating for less than a year. |

Seed A company looking into market research, product testing and prototype development. |

Early-stage A business starting to generate revenue and moving onto pilot testing, customer validation and business model |

Growth-stage A business that has its product on the market and is looking to expand into new markets |

Scale-up A business that is growing exponentially and is wanting to improve efficiency and productivity |

| Creative Clusters | Creative Catalyst | Create Growth Programme | → | → |

| Creative Industries Fund | - | British Library Business Support Programme | → | → |

| - | - | - | - | Creative Scale Up |

Actions and ambitions

To achieve our 2030 objective, we will go further and increase investment into start-ups and creative businesses across the UK. We will work with the BBB and local authorities to strengthen business skills and encourage investor communities, at home and abroad, to invest in UK creative businesses.

Headline actions

The government is committed to ensuring the audio-visual tax reliefs remain world-leading and continue to best serve the needs of creative companies. As set out in the Audio-Visual Tax Reliefs consultation response, the government is considering the case for further targeted support for visual effects work, and will provide an update on this later in the year.

DCMS will provide £10.9 million in additional funding between 2023 and 2025 to expand the Create Growth Programme into a £28.4 million programme. The CGP will grow from 6 to 12 English regions outside of London, supporting over 2,000 businesses to access private investment and scale up, turning today’s start-up founders into tomorrow’s CEOs. The CGP recently awarded more than £3 million to over 100 businesses spread across the 6 regions currently covered by the programme.

DCMS will provide an additional £5 million, between 2023 and 2025, for the UK Games Fund to invest in early-stage games studios, bringing its total value to £13.4 million.

DCMS and ACE will extend and increase funding for Arts Council England’s (ACE) Supporting Grassroots Live Music fund with an additional £5m over the next 2 years. This will support grassroots music venues, the lifeblood of our world-leading music sector and cornerstones of communities. We will work together to identify options to secure the longer-term sustainability of grassroots music venues.

In addition, we will:

Drive increased investment into creative businesses across the UK.

- The government will maintain the UK’s competitive offer of creative industries tax reliefs to support and incentivise production in the UK. HM Treasury (HMT) announced reforms to the audiovisual tax reliefs at the 2023 Spring Budget, which included increased credit rates for film, high-end TV and video games (34%) and animation and children’s TV (39%).[footnote 60] The government has also extended the higher rates of Theatre Tax Relief, Orchestra Tax Relief and Museums and Galleries Exhibitions Tax Relief for a further 2 years until 31 March 2025.

- Creative businesses will continue to be able to access the BBB’s £1.6 billion Regional Investment Funds and £150 million Regional Angels Programme. These will develop and support investor communities, encouraging them to back creative businesses across the UK, turbo-charging investments in the most promising and fastest growing creative start-ups and scale ups.

- The BBC’s Across the UK plan will see an additional £700 million investment outside of London, supporting business and creating jobs.[footnote 61]

- The Department for Levelling Up, Housing and Communities (DLUHC) launched a consultation on permitted development rights that proposes further flexibilities for filmmaking at temporary sites. DLUHC will consider the evidence and decide on next steps.

Ensure that creative entrepreneurs and firms have the skills to grow and access investment and nurture new forms of creative entrepreneurship.

- DBT and BBB will continue to deliver Help to Grow: Management. This programme is designed to give businesses the tools and skills they need to raise private investment and turbo-charge their growth.

- The government, industry and the BBB will collaborate so that current and future programmes and funds continue to support creative businesses at all growth stages across all regions of the UK.

- We will promote our offer to support creative businesses to access finance and insurance to win contracts, fulfil orders, and get paid for their exports of goods, services and intangibles such as intellectual property.

Empower local areas with the provision of resources to support place-based creative industries development and to unlock further investment.

- Local areas will be able to access resources through pan-economy programmes where their local priorities align with these funds, such as DLUHC’s UK Shared Prosperity Fund and DCMS’s Cultural Development Fund (England only), and we will support these programmes to accelerate creative cluster growth.

- We are supporting local partners to consider how the creative industries could feature within new Investment Zones proposals, to maximise the potential of local creative strengths and boost growth and productivity.

- We will work with the PEC to build on their Resources for Local Authorities and provide enhanced data and evidence to understand local business environments and creative clusters, which also supports local authorities’ decision-making alongside access to industry insights and expertise.[footnote 62]

- We will strengthen partnerships with areas that are ambitious to support their creative industries development and build local knowledge and skills, through programmes such as the CGP and North of Tyne Culture and Creative Investment Programme (see case study).

Case Study: Programmes empowering local areas

The government, local authorities and industry are supporting local regions to help them grow their creative clusters and create jobs. In 2022, DCMS announced the £17.5 million Create Growth Programme (CGP), in partnership with Innovate UK and 6 regions in England. Supported by industry, the CGP will empower Greater Manchester, South East Coast, the West of England, Norfolk and Suffolk, Leicestershire and parts of North East of England to support their creative businesses to attract private investment through a combination of capital, business support and investor capacity building. In 2023, the CGP awarded more than £3 million to over 100 businesses spread across the 6 regions. The CGP will receive a further £10.9 million to expand its territorial scope from 6 to twelve regions.

The CGP expands on the DCMS-funded £4 million Creative Scale-Up (CSU) pilot programme, which supported creative businesses in the West Midlands, West of England and Greater Manchester from 2019 to 2022. One company that benefited from the CSU was Blake Mill Ltd, a fashion and design company based in Manchester, which creates ethically produced men’s clothing. Thanks to the workshops and mentoring provided by CSU, Blake Mill Ltd gained an understanding of how to use IP and they have since increased their profitability and doubled their export activity.

The CGP is complementing existing programmes in local areas. For example, in the North of Tyne, the Culture and Creative Investment Programme is unlocking creative businesses’ growth at every stage of their journey and supporting freelancers in North Tyneside, Northumberland and Newcastle. Funded by the North of Tyne Combined Authority, the programme offers specialised investment in the form of £500,000 of grants, £625,000 of equity finance and £1.5 million of flexible loans. This includes an easy-to-access, fixed-term, unsecured loan offer called Creative Boost. It also includes a challenge fund and a tailored programme of business support and mentoring.

2030 exports objective: creative businesses grow their exports and contribute to the UK reaching £1 trillion exports per year.

The government’s Export Strategy sets the goal for the UK to reach £1 trillion in total annual UK exports by the mid-2030s and to boost competitiveness and jobs across the UK.[footnote 63] The creative industries are identified as a priority sector to deliver this ambition with opportunities for the government and industry, in partnership, to grow exports and reach new markets.

The UK is a world leader in creative exports,[footnote 64] with the creative industries exporting £8.9 billion in goods and £41.4 billion in services in 2020.[footnote 65] Creative services exports in particular have increased rapidly in recent years, amounting to 14.2% of total UK services exports.[footnote 66] In the future, increasing digitisation and greater use of new technologies will generate more opportunities for UK creative businesses, with almost 90% of global growth between 2021 and 2026 expected to be outside the European Union (EU).[footnote 67] With the UK’s new trading independence, we aim to be more agile in working to increase our presence in high growth and emerging markets, while maintaining close relationships with Europe and North America.[footnote 68]

While there are proportionally more exporters in the creative industries than in most other sectors, many creative businesses face challenges in exporting.[footnote 69] There are strong regional differences, with over half of creative industry exporters based in London and the South East.[footnote 70] Structural factors, such as a predominance of micro-businesses and reliance on intangible assets like IP, mean that creative businesses often lack the resources and skills to investigate and enter new markets. This is particularly the case in riskier markets, where there may be trade barriers, such as reduced enforcement of IP rights.[footnote 71] Creative businesses also need to adapt to new trading rules with European markets following the UK’s departure from the EU. An example would be creatives looking to tour EU Member States.

Support to help creative businesses overcome challenges to export has come in several forms. Active assistance for businesses is vital, which the DBT and DCMS channel through a variety of initiatives and programmes. Having left the EU, the government has agreed ambitious Free Trade Agreements (FTAs), including with Japan, Australia and New Zealand, which include provisions to support creative businesses to trade in important markets. For example, in the UK-New Zealand FTA, New Zealand committed to extending the term of copyright by 20 years for authors. We have also agreed a deal on mobility with Australia, giving greater certainty about working in Australia to deliver services on a temporary basis. We are also working on ambitious deals with India, Canada, Mexico, Israel, the Gulf Cooperation Council, South Korea and Switzerland. The government has also substantially concluded accession negotiations to join the eleven countries in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

Actions and ambitions

To achieve our 2030 objective, we will work with industry, including through the Creative Industries Trade and Investment Board (CITIB), to support creative businesses to access new markets and grow their presence around the world. The CITIB is an industry-led forum set up by the 2018 Sector Deal with industry-wide representation and expertise on exports and inward investment.[footnote 72] With its new strategy published in 2022, the CITIB brings together insight and evidence from across the creative sector to advise and help coordinate steps taken by the government and industry to boost creative exports.

Headline actions

The government will triple funding for the Music Export Growth Scheme (MEGS) to £3.2 million over 2023-25). MEGS will provide grants to support touring which will enable emerging artists to break into new international markets.

DBT will more than double the number of creative industries trade missions from 4 in 2022-23 to 10 in 2023-24. The programme includes trading partners such as Australia, Japan, India and Mexico and a strong future creative economy focus including an esports mission to Saudi Arabia, and Createch missions to India and South by Southwest Sydney.

The DBT Export Support Service (ESS), which now has global coverage, is helping creative exporters by providing guidance and direct support. The ESS has scope to look at specific issues affecting the creative industries such as ATA Carnets. The ESS will be expanded and will help creative exporters through guidance, direct support and by exploring solutions, including on areas most relevant to creative industries such as the temporary movement of creative professionals.

The new Creative Industries Faculty of DBT’s Export Academy, launched in September 2022, will deliver quarterly events and masterclasses to help businesses develop export strategies, including in more challenging markets such as in the Asia Pacific, India and the Gulf.[footnote 73]

DCMS will continue to support the screen sector to export their content through the 3-year £21 million UK Global Screen Fund.

In addition, we will:

Ensure that more creative businesses have the specialist resources and knowledge to access international markets.

- Innovate UK (IUK) and DBT will work with their regional advisor networks to support English regions participating in the Create Growth Programme to embed advice on exporting in their business support programme, and develop a referral process for participating businesses.

- DBT will encourage trade bodies and business partners to expand Exporter Accelerators, such as the export accelerator established for TV by PACT.

- The government, supported by industry and the CITIB, will deliver and increase awareness of tailored support and resources.

- We will support foreign direct investment into the creative sector through the Export Development Guarantee, enabling future exporters to grow their business and seize global export opportunities.

Ensure the UK has beneficial trade terms and minimised market barriers for the creative industries in priority markets.

- We will continue to work together to ensure that the UK’s trade policy reflects industry priorities and delivers access to priority markets. This includes business engagement, seeking to ensure that the interests of the creative industries are pursued in FTAs, including on IP, digital trade, audiovisual products and services, the movement of creative professionals and goods and mutual recognition of professional qualifications. DBT is also looking to more closely align its activity with markets with which we are negotiating or have already negotiated free trade agreements, such as the Gulf, India and CPTPP member countries.

- DBT will ramp up work to increase awareness of the benefits of FTAs to creative SMEs and use bilateral government-to-government dialogues to further creative trade with priority markets.

- We will work together to help the sector adapt to the new relationship with the EU and its Member States, particularly touring musicians and performers.

Increase the profile of the UK’s creative industries at overseas events and trade shows.

- We will ensure the UK creative industries have a significant presence at major creative global trade shows and events to showcase their creative excellence, such as South by Southwest, Cannes Lions, Fashion Weeks, the Games Developers Conference, Kidscreen and Realscreen.

- DBT will put greater focus on supporting creative technology companies as the department develops its future creative economy strategy, with creative industries having a higher profile at key tech global conferences and events such as the Web Summit in Lisbon.

- Innovate UK is increasing the number of innovation missions, as part of the Creative Catalyst. This work will build on past successes such as the LA Sync mission, the virtual production mission to the US and creative services missions to the Gulf.

- DBT will work closely with the sector to deliver targeted activity, including meetings with international buyers, potential co-production partners and investors.

- DBT will continue to support the International Showcase Fund (ISF).

Case Study: The UK Global Screen Fund (UKGSF)

Credit: BFI National Archive (image by Linda Nylind)

The UK Global Screen Fund was launched by DCMS in 2021 to grow the international reach and revenues of the UK’s independent screen sector across film, TV, animation and video games. Following a successful £7 million pilot, DCMS invested a further £21 million over three years to support even more UK screen content to reach new audiences around the world.

The fund is aimed at boosting the global competitiveness of UK screen content and growing the international revenues, reach and partnerships of domestic independent businesses. It provides targeted funding for companies to develop and produce projects with international appeal, supports the worldwide distribution of UK content and encourages collaboration with international partners.

Over the pilot year, the British Film Institute (BFI), who administer the UK Global Screen Fund, made 75 awards across all funding strands. This included 34 International Distribution awards, 11 International Co-Production awards and 30 International Business Development awards. Projects supported so far include Good Luck to You, Leo Grande (starring Emma Thompson), Living (starring Bill Nighy) and The Miracle Club (starring Maggie Smith).

Productions backed by UKGSF also saw considerable success at film awards season, with 3 BAFTA nominations, including an award for Living and a shortlisting for Good Luck To You, Leo Grande, and Brian and Charles, and 2 Oscar nominations for Living.

UKGSF has funded companies based across the UK, and these funded companies also reported activities (shooting, production and post production) across the length and breadth of the UK.

Already, the results from the evaluation of the Pilot Year (2021-2022) have shown that the UKGSF pilot year has laid the groundwork for future benefits to the UK’s screen sector and established a positive trajectory for the future success of the Fund, which has since been funded for an additional 3 years from 2022-2025.

Chapter 2. Workforce

Credit: Academy of Live Technology.

Goal 2: Build a highly-skilled, productive and inclusive workforce for the future, supporting 1 million more jobs across the UK.

In 2030, we will have delivered on a creative careers promise. We will build a pipeline of talent into our creative industries, from primary school to post-16 education and those returning to the workforce. We want to generate more fruitful opportunities through an inspiring and fulfilling education. This is to ensure our creative workforce will meet the needs of industry and embody the diversity, dynamism and talent of the UK.[74] We will enable a new generation of highly-skilled workers to enter the creative workforce, as well as supporting the current generation to learn new skills and progress. We want to see the sector create even more new jobs, with creative careers providing high quality work across the UK.

Over the previous decade, the creative industries’ workforce grew at almost five times the rate of the rest of the economy, and it has the potential to continue growing rapidly.[footnote 75] There are a huge range of roles in the creative industries and collectively they are the jobs of the future: more resistant to automation, highly-skilled and highly rewarding. The sector also has high levels of project-based working and reliance on freelancers, who make up over a quarter of the total creative industries workforce (about double the whole-economy average).[footnote 76] A skilled, inclusive and productive workforce is vital to ensuring creative businesses can adapt to changes, compete commercially and identify new areas to innovate and grow.

Sir Peter Bazalgette’s 2017 Independent Review of the Creative Industries forecast that in 2030 there would be 1 million extra jobs in the sector compared to 2016. By 2021 one third of these jobs had been created, with a total workforce of 2.3 million.[footnote 76] To build on this strong trend of employment growth and to reflect our heightened ambitions for the sector, we are re-setting the count so that from 2021 to 2030, we want to see 1 million additional jobs in the creative industries.