Code on Genetic Testing and Insurance: 3-year review 2022

Published 13 December 2022

Introduction

The Code on Genetic Testing and Insurance (the Code) was published in October 2018, replacing the concordat and moratorium on genetics and insurance. The Code is the sixth iteration of a long-standing voluntary agreement between the UK government and the Association of British Insurers (ABI), whereby insurers who are signed up to the Code will never require or pressure any applicant to undertake a predictive or diagnostic genetic test and will only consider the result of a predictive genetic test for a very small minority of cases. To date, there is only one test for which insurers can request disclosure of results, which is a predictive genetic test for Huntington’s disease, in applications for life insurance cover which total over the financial limit of £500,000. Additionally, genetic testing results obtained through participation in research do not need to be disclosed to insurers.

The government and insurers are of the view that it is important that everyone has access to good insurance at the right price. The Code aims to provide reassurance to the public about how and whether genetic testing could affect their access to life, critical illness, and income protection insurance products in the UK. It also ensures that insurers have the minimum information needed to accurately price insurance premiums for all consumers.

3-year review and annual reporting

The Code is open-ended with no expiry date. The government and ABI have agreed to publish 3-yearly reviews to allow for the Code to be kept up to date. The review was scheduled for 2021 but delayed to 2022 due to the COVID-19 pandemic reducing the ability to effectively review the Code. The ABI and the government agreed this delay was feasible due to the absence of any immediate concerns having been raised by government, the ABI, or other stakeholders about how the Code was working in practice.

This document outlines actions being taken for the first triennial review of the Code, including plans to collect further evidence on aspects of the Code that may need amendments considering an evolving genomics landscape. These aspects have been identified through extensive stakeholder engagement.

Alongside the commitment to review the Code every 3 years, the government and ABI have agreed to publish annual reports to provide commentary on the state of the insurance market and developments in genomic technologies, as well as details on compliance with the Code. The third annual report under the Code has been incorporated into this review, with data on compliance with the Code included at Annex A. Compliance with the Code is monitored by insurers reporting data to the ABI on the number of genetic test results disclosed by applicants and the total number of complaints received about breaches of the commitments.

To ensure the Code remains fit for purpose, the government and the ABI agree we must maintain a well-informed shared understanding of the current state of genomic technologies and the insurance market. To that end, the ABI commissioned research in 2021 with The Cambridge Centre for Health Services Research (CCHSR) RAND Europe and Cambridge University to assess the current impact of genetic testing on the UK insurance market. The key findings are set out in the ABI’s 2021 annual report, and further details can be found in the full independent research report.

Genomics policy landscape

The investment made by the UK government and the NHS in genomics over the last decade has laid foundations for the use of genomics in routine clinical care across the NHS. The COVID-19 pandemic has accelerated advances in the field of genomics through providing an urgent need for the research community to collaborate, rapidly sequencing pathogen genomes and sharing data on a global scale. Continuing to build on this, the UK government are keeping genomics front and centre over the coming years, and this has been demonstrated by a wealth of commitments over the course of 2022.

Pioneering genomics in healthcare

In October 2022, NHS England published Accelerating genomic medicine in the NHS – a strategy setting out a 5-year plan to step up the use of genomic medicine within the NHS. The strategy includes commitments to embed the cutting-edge benefits delivered by genomics to patients in all areas of the NHS – from cancer to inherited diseases. As part of the strategy, it was announced that all babies and children who end up seriously ill in hospital with a suspected genetic condition will have their whole genome sequenced to identify a diagnosis as rapidly as possible. The strategy also commits to the establishment of a Genomics Medicine Service Ethics Advisory Board, to consider the introduction of new technologies, return of results, data protection and genomic research across the NHS.

With genomic testing set to become part of routine clinical care, it is important to note that the Code states that insurance companies cannot require or pressure any applicant to undertake a predictive or diagnostic genetic test to obtain insurance.

A UK-wide approach to genomics

In March 2022, the government published the Genome UK: shared commitments for UK-wide implementation 2022 to 2025 which sets out how the genomics community across the UK will collaborate during 2022 to 2025 to progress delivery of Genome UK, the government’s genomic healthcare strategy published in 2020.

Genome UK covers 3 main pillars:

- diagnosis and personalised medicine

- prevention

- research

And 5 cross-cutting themes:

- public engagement

- workforce development

- supporting industrial growth

- maintaining trust

- delivering nationally coordinated approaches to data and analytics

The shared commitments for UK-wide implementation cover these pillars.

Working with key partners across the genomics sector, the government has recently published Genome UK: 2022 to 2025 implementation plan for England. The plan showcases some of the outstanding research and policy work that will take place across England over the next 3 years to develop, evaluate and implement new genomic technologies across the health and care system and life sciences sector.

Priorities for rare diseases

It is currently estimated that there are over 7,000 rare diseases, with new conditions continually being identified as research advances. Genomics has the potential to offer enormous potential for increasing diagnosis of rare disease as 80% of rare diseases have a strong genetic component. In January 2021, the UK government published the UK Rare Diseases Framework which outlined the future priorities in tackling rare diseases: helping patients get a final diagnosis faster, increasing awareness of rare diseases among healthcare professionals, better coordination of care, and improving access to specialist care, treatment and drugs. It committed to publishing nation-specific action plans which would provide more detail on the steps each government will take to meet the shared priorities of the framework.

All 4 nations have now published action plans, setting out how the framework will be delivered. Across all nations, actions are included which build on the UK’s strengths in genomics to more rapidly diagnose and better understand those rare diseases with a genetic cause. In England, annual updates to the action plan will be published, reporting on progress against existing actions and setting out new ones.

Thinking about genomics beyond health

The Government Office for Science published their future thinking report, Genomics Beyond Health, in January 2022 which explored how the genome can provide insights into people’s traits and behaviours beyond health, and how studying our DNA can present both benefits and challenges to society. The report seeks to generate debate on a range of topics of how genomics could be used in the future – beyond its current application in healthcare. It’s important to note however that many of the topics discussed in the report are not at a stage where they are being used in the real-world and are yet to be scientifically validated. It is instead being used as an important tool enabling policymakers to consider key ethical, societal and data issues associated with the possible future of genomics.

Whilst the report discusses how advances in genomics could inform insurance policies in the future, it recognises that the Code on Genetic Testing and Insurance sets strict limitations on the use of health-related genomic information in determining eligibility for insurance and there are currently no plans to amend the Code in such a way that would dramatically change the way the insurance industry currently uses genetic data.

Genomics research

There are several ground-breaking research programmes underway across the UK that will enable a greater understanding of how changes in our genomes can affect our health. These programmes aim to provide more precise diagnoses, develop better treatments, and help predict the risks of developing certain diseases. Crucially, participants involved in research studies do not have to tell an insurance company about the results of a predictive genetic test, or any other genetic information that they receive exclusively in the context of scientific research.

Research to better diagnose rare genetic diseases in babies

In 2021, Genomics England announced plans for an innovative research programme to study the effectiveness of using whole genome sequencing to find and treat rare genetic diseases in newborn babies. This Newborn Genomes Programme – led by Genomics England in partnership with the NHS and parents – will sequence the genomes of up to 100,000 babies shortly after they are born. The data will be used to speed up diagnosis and access to treatment for affected children and gather data and evidence on its effectiveness to consider whether it could be rolled out across the country. The programme could help thousands of children, as 9 children are born in the UK every day with a treatable rare condition. The initiative will also bolster approaches to children’s health and wellbeing across their lifetime. For example, if a child falls sick when they are older, there may be an opportunity to use their stored genetic information to help diagnose and treat them. A wide-ranging public dialogue has shown overall support for the use of genomics in newborn screening, providing the right safeguards are in place. As a result, Genomics England has, and will continue to, consult widely with the public, parents, families with rare disease, healthcare professionals and scientists to navigate the scientific, clinical, ethical, and societal issues that newborn screening presents.

Our Future Health

The Our Future Health programme, launched in 2021, aims to help people live healthier lives for longer through better prevention, earlier detection, and improved treatment of diseases. Planned to be the UK’s largest health research programme, Our Future Health aims to recruit up to 5 million adults from across the UK and will combine multiple sources of health and health-related information, including genetic data, to create an incredibly detailed picture that truly reflects the whole of the population. Researchers will register and apply to study the de-identified information to make new discoveries about human health and diseases – data made available by Our Future Health will only be used for this purpose. Participant’s health information will be used to calculate disease risk scores, which participants will have an opportunity to receive and will provide the ability to test the potential of new diagnostic tests or interventions as they are discovered and to see how effective they could be for people at higher risk of certain diseases.

Using genomics for better cancer care

Genomics England, working with NHS England and the National Pathology Imaging Co-operative (NPIC), will lead a new programme aimed at reduced diagnosis time and improving care for NHS cancer patients. The programme, known as Cancer 2.0, will test the effectiveness of new genomics sequencing technology in speeding up a patient’s diagnosis and allowing them quicker access to tailored, personalised treatments based on their unique genome. By leveraging innovative technologies – used in the analysis of cancer data – the programme aims to support the transition towards providing more predictive, preventative, and personalised cancer treatment services.

Diversity in genomic data

Genomics England will carry out world-leading research, in partnership with patient groups, leading clinicians, academic and commercial researchers, to reduce inequalities in genomics-enabled personalised medicine, particularly amongst minoritised communities. This 3-year initiative will cover a comprehensive programme of research and discovery, community engagement, sequencing and data-generation, and the creation of new products, tools and approaches. The programme will carry out tailored sequencing of over 15,000 participants from diverse, under-represented ancestries in biomedical research by 2024 to 2025 in partnership with patient communities and academic and clinical trialists. Through the initiative’s activities, it aims to earn and sustain the trust of diverse communities in genomic medicine, drive more and better genomics research with diverse populations, and enable key improvements in diagnosis, prognosis, treatment and care involving genomics for diverse populations.

Insurance and genetics

The UK insurance and long-term savings market

The Association of British Insurers (ABI) is a trade association representing the voice of the UK’s world-leading insurance and long-term savings industry. The role of the ABI includes helping to inform public policy debates, engaging with politicians, policymakers and regulators, highlighting the importance of the sector to the wider economy, encouraging consumer understanding of the sector’s products and practices, and supporting a competitive industry. The ABI’s membership includes over 200 companies, including most household names and specialist providers.

The UK insurance and long-term savings industry manages investments of over £1.9 trillion, contributes over £16 billion in taxes to the government and supports communities across the UK by enabling trade, risk-taking, investment and innovation.

The purpose of insurance

The social purpose that underpins insurance is to protect people against the impact of risks they face. In 2021, the insurance industry paid out 98% of life insurance, income protection and critical illness insurance claims, totalling £6.8 billion and equivalent to £18.6 million a day – the highest on record. The average pay out on life insurance policies was £80,485 and £23,380 on income protection policies and pay outs for COVID-19 related individual claims almost doubled from £141 million in 2020 to £261 million in 2021.

Insurers are in the business of protecting against the impact of health risks and strongly support changes which improve health and reduce claims. The evolution of genomic medicine and technologies to improve diagnosis and treatment of patients is a significant development in the UK. Insurers support that development and do not want concerns over access to insurance to inadvertently hinder the uptake of genetic testing. The insurance industry recognises that the public have concerns about the use of genomic information by insurance companies, and how their data is used. The ABI and its members continue to work with government, patient, consumer and health professional representatives to achieve a well-balanced relationship regarding the fair and transparent use of genetic test results in the limited instances when they are used in insurance.

Why genetics is relevant to insurance

The ABI and its members support progress in genomic medicine. Insurers recognise that the development of genetic testing is a valuable means for informing the diagnosis, prevention, and treatment of ill health. This has significant societal value, but it is also good for insurers and their customers. Prevention minimises the risk of ill-health and reduces claims which can have a positive impact on insurance premiums and improve access to insurance.

Insurers welcomed the steps the government has taken to roll out the world’s first whole genome sequencing service for patients with a suspected rare disease and certain cancers. The industry also supports the government’s 10-year strategy – Genome UK: The Future of Healthcare – to extend the UK’s leadership in genomic healthcare and research and its vision to create the most advanced genomic healthcare system in the world to help deliver better health outcomes. Insurers support the developments in genomic medicine by not asking for, or ignoring, results of genetic tests, including predictive, that are undertaken exclusively in the context of scientific research.

The government also recognises that it is important for insurers to access appropriate health information with relevant consumer consent. This allows insurers to effectively assess the level of risk to be covered and accurately price premiums. Asking for relevant information such as details about an individual’s family history and socioeconomic data, such as health and lifestyle, enables insurers to understand the range of risks they are insuring.

Although predictive genetic results may provide an additional source of useful information for insurers, insurers currently believe the information they already have available to them allows a robust assessment of an individual’s risks. That said, the increased use of genetic testing may lead to a cause for concern for the insurance industry if the information individuals have about themselves – but which insurers do not ask for – changes how individuals buy insurance. If a material information asymmetry develops, whereby individual policyholders understand their risk in ways insurers are not allowed to, this could result in inaccurate pricing of insurance cover for individuals. In the longer term, this could lead to unsustainable risk management, rising insurance premiums, and reduced availability of insurance. This is why it is important for the government and the ABI to regularly review the Code to ensure it remains relevant for both the consumer and the insurance industry.

Differences between insurance products

The Code applies to all insurance products but, in practice, is only relevant to those products which use health information to assess risk:

- protection insurance (providing life, income protection and critical illness)

- health insurance (providing private medical insurance)

Health and protection products are different, but both are concerned about the potential for anti-selection arising from genetic testing. Anti-selection is when there is an asymmetry of information between the customer and the insurer – when a customer knows information the insurer does not – and that information increases the customer’s likelihood of claiming. If anti-selection becomes widespread, insurers could see significantly more claims than they price for, which in turn could lead to an increase in prices for all consumers.

Protection products are long-term and pay out lump sums or regular amounts of money. The underwriting process to assess risk and offer policy terms generally only takes place at the start of the policy, but with claims possible at any point from day one to as long as 50 years or more. For those products, trying to assess future risk is critical to helping set the right price for premiums at the start of the policy. Once customers have agreed to the policy terms offered by the insurer, for most policies, the insurer cannot alter the terms of cover for the duration of the policy. Therefore, an inability to accurately predict future health risk could lead to more claims than insurers expect and price for.

For health insurers, private medical insurance pays for healthcare rather than paying financial sums. The current inability of health insurers to use genetic information could lead to insurers paying large claims that they weren’t able to predict and price for. That could lead to insurers excluding certain, more expensive, treatments in new policies if they feel the Code stops them from understanding the genetic risks that lead to significant claims. Conversely, the use of genetic information by health insurers could provide an opportunity to help customers reduce health risks shown by predictive genetic tests using preventative treatments.

Travel insurers currently have little interest in genetic information – they use health information to underwrite policies but are more interested in the risk of emergency medical treatment when travelling than long-term health risk.

Community engagement

In 2022, DHSC conducted the first 3 yearly review of the Code collaboration with the ABI. A stakeholder workshop was held in July 2022 to explore whether the Code remained fit for purpose in the current context, and which aspects may require updating. The workshop was hosted in partnership with the ABI and brought together stakeholders to provide expert opinion including policy makers from across the 4 nations, NHS England, charities, patient organisations, and the insurance industry.

Participants shared their experiences and opinions on issues relating to the Code and discussed questions including:

- do you find the Code easy to understand?

- is the Code operating well?

- are the definitions of genetic testing used in the Code still relevant?

- how can we improve stakeholder engagement for future reviews?

In addition to this workshop, the ABI seek feedback through regularly hosting discussions on the review of the Code with their Genetics Working Group – made up of experts from across the insurance industry. The Working Group’s ambition is to continue to provide reassurance to those taking a genetic test and worried about accessing insurance, whilst also enabling insurers to accurately assess and price risk in a way that supports access to insurance. The ABI also hosts open and industry events as a forum for discussion on genetic testing and insurance, including an event in 2022 which featured a keynote address by guest speakers from Our Future Health and RAND Europe.

2022 review actions

The key issues raised by stakeholders in the workshop and through wider engagement are summarised below, along with actions we will take over the next year to address the challenges raised, and to update the Code accordingly.

Accessibility of the Code – a new consumer guide

Stakeholder engagement identified that accessibility of the Code could be improved, with the wording often leading to confusion amongst consumers as to how it applied to real life situations. There is a risk that if the Code is not easily accessible, members of the public may be put off from seeking insurance policies because they are unsure what information to disclose to insurers or whether they would face higher premiums based on results of genetic tests. We recognise we can do more to ensure all consumers understand the Code, including what information they are required to disclose to insurers upon application of a policy.

In 2018 the government and the ABI published a consumer guide alongside the publication of the Code, as well as a series of frequently asked questions providing further information about the Code. Following this year’s review of the Code, we commit to publishing a revised consumer guide in 2023 to ensure the Code remains accessible and useful. This guide will aim to provide further clarity on how the Code works for consumers, as well as providing healthcare professionals with more information about how they should use the Code when interacting with patients. Healthcare professionals, in particular GPs, are often the individuals who receive requests from insurers for appropriate health information regarding policies. It is therefore imperative the healthcare community understand the Code, its limitations, and what types of information they are required to provide upon request.

As part of the development of a new consumer guide, we have committed to working closely with Genetics Alliance UK – the largest alliance of organisations supporting people with genetic, rare and undiagnosed conditions in the UK – to better understand the most commonly asked questions about the Code from their membership base. This information will help us to empower individuals to feel more confident seeking genetic tests when advised to do so by a medical professional, and to understand how this applies in the context of their insurance applications. We will also work with healthcare professionals to ensure that the consumer guide clarifies the Code’s requirements and enables them to provide accurate information to patients with concerns about the implications of a genetic test for accessing insurance.

Defining different types of genetic test

The Code refers to 2 different kinds of genetic test results which insurers may use for individuals who are applying for insurance:

- diagnostic genetic tests which confirm or rule out a diagnosis based on existing symptoms, signs or abnormal non-genetic test results which indicate that the condition in question may be present

- predictive genetic tests which predict a future risk of disease in individuals without symptoms of a genetic disorder

The Code commits insurance companies to not require or pressure any applicant to undertake a predictive or diagnostic genetic test to obtain insurance. In addition, only the result of a predictive genetic test for Huntington’s disease when buying life insurance above the financial limit of £500,000 will need to be disclosed in an insurance application – in 2020, 96% of life insurance policies were below the financial limit. Other predictive test results, or the fact that predictive tests have been taken, do not have to be disclosed. In the same way as the diagnostic results of a blood test or MRI scan, an existing diagnostic genetic test result should be provided as part of relevant medical information when making an application for insurance.

Stakeholder engagement highlighted that there were emerging issues surrounding the distinction between predictive and diagnostic tests, as some predictive tests may show an increased risk of developing a condition and as such may result in increased surveillance for the condition. It was questioned whether in this scenario, the enhanced surveillance would count as treatment or management of a condition – causing the predictive test to become a diagnostic one.

It is vital for us to ensure this distinction is clear for consumers, medical practitioners and insurers, so that the correct diagnostic test results can be disclosed to insurers and to avoid confusion over the disclosure of predictive test results when making an application. It is important to note that even if a predictive test result is mistakenly disclosed in an application, it will be ignored by the insurer and will not impact the insurance premium offered. We recognise the need to clarify these definitions in the context of genomic testing today, rather than how it was defined in 2018. For us to do this, we want to ensure we can engage with further stakeholders and experts to enable us to fully understand the best way to capture these definitions for the Code. Our approach to doing this is set out in the forward look section below.

A transparent process for amendments going forwards

There are currently no plans to include additional conditions in the Code that would require consumers to provide additional genetic test results to insurers. At present, the Code allows for the ABI to submit a written application and evidence for the Government to consider proposed amendments to the list of relevant predictive genetic tests. The ABI have not made any such applications to date. However, considering a rapidly advancing genomics landscape we recognise the need to provide transparency for how conditions would be assessed for inclusion, or exclusion, under the Code should an application be made in the future.

In 2021 the ABI commissioned Cambridge Centre for Health Services Research (CCHSR) to undertake research to identify the current and potential impact of developments in genetics on the UK insurance industry. Central to this research was the development of a framework for evaluating the impacts arising from predictive genetic tests (tests that predict the future risk of developing a health condition). The framework considers the characteristics of genetic tests as well as behavioural aspects that influence the use of genetic tests in the population, for example living a healthier lifestyle if a test indicates you may have a higher risk of developing a certain, preventable, condition. It is intended to provide a transparent approach for evaluating whether a specific condition for which a test is available could have an impact on the insurance industry, either currently or in the future, and understanding the key factors that influence this.

The research in 2021 did not show evidence of significant negative impacts on the insurance industry based on current genetic testing across the UK. However, the study identified several important gaps in the evidence base. More evidence is needed on motivations for engaging in genetic testing and how this information is used, both in terms of behavioural change and sharing with healthcare providers and insurers, especially in the UK context. This would help to further characterise the potential impact of genetic testing on the UK insurance industry

As genetic testing continues to evolve and becomes more incorporated into the healthcare system in the UK, the potential impacts of these tests on the insurance sector may shift. Eligibility criteria for genetic testing in the NHS, the availability of tests via direct-to-consumer genetic testing companies and scientific and technological developments in genetics will all play a role in determining whether genetic tests present risks to the insurance industry. The framework produced in 2021 provides a structured approach to monitoring and assessing these developments going forward.

In the framework, consideration of these factors is guided by 4 key questions:

- How useful is the genetic test for characterising the risk of developing a condition?

- How many people take the test?

- What is the impact of the condition in terms of the length and quality of life of people who develop it?

- What is the potential for reducing the risk of developing the condition and managing its effects if it develops?

We would like to gather further input on this framework and whether stakeholders consider it an appropriate solution to transparently assessing additional conditions if required in the future. Our approach to doing this is set out in the forward look section below.

Forward look

The government is committed to maintaining the UK’s global status as a leader in genomics. The importance and benefits of genomics are already being realised, with the world-leading NHS Genomics Medicine Service already delivering cutting-edge benefits for patients in the NHS. As time goes on, we anticipate that there will be further advances in genomics and reductions in the cost provides exciting opportunities for improving diagnosis, prevention, and treatment of disease for UK patients. In turn, the Code on Genetic Testing and Insurance will need to remain flexible to manage change in the wider genetics landscape, to ensure consumers feel confident when engaging in genetic testing, and so that insurers can effectively assess risk and continue to provide low-cost insurance to as many people as possible.

This year’s review has highlighted some key areas of development needed for the Code to remain both relevant and useful in today’s genetics and insurance landscape. These are: the way in which we define both predictive and diagnostic genetic testing in the Code; and a need to outline a transparent and accessible approach to assessing conditions that may require inclusion into the Code in the future.

These 2 issues raised through this year’s review will be explored through a call for evidence, and through additional stakeholder workshops in 2023 to assess how the Code could be refreshed to better reflect the changing landscape. We will invite comment on the most appropriate way to define genetic tests going forwards to ensure the definitions remain relevant and useful for the Code. We will also be seeking opinion on the CCHSR framework, and our future approach to assessing conditions under the Code, during the same call for evidence. This evidence will help to shape a more transparent and accessible process and will be incorporated into the Code going forwards. This process will enable us to gather expert opinion to ensure the Code remains mutually beneficial for both consumers and the insurance industry and is representative of a wide variety of views. The call for evidence will allow us to seek views from vital stakeholders including patients and carers, healthcare professionals, the insurance industry, and the public.

Alongside our call for evidence, we will also publish an updated Consumer Guide – incorporating the most frequently asked questions from consumers looking to undertake informative genetic testing as part of their healthcare journey. This refreshed guide will serve 2 purposes:

- helping people to better understand the Code and feel empowered to respond to our call for evidence

- providing users of the Code with the information they need to utilise it effectively

Looking forwards, we will continue to publish annual reports and review the Code again in 2025 as part of our commitment to ensure it remains relevant and fit for purpose in the face of increasing advances in the field of genomics that are shaping the future of healthcare across the UK.

Annex A: 2022 annual report on the Code on Genetic Testing and Insurance

Exceptions within the Code

The financial limits for life insurance, critical illness and income protection products have remained constant without change, and Huntington’s disease remains the only exempt illness (and only for applications for life insurance above £500,000). This means that 100% of applications for life insurance up to the total value of £500,000 are protected from having to share predictive genetic test results.

Companies compliant with the Code

Compliance with the Code and the adoption of the Commitments in the Code is a condition of membership for all ABI members. Most insurance companies who are not members of the ABI have also signed up to the terms of the Code. See a list of all insurance companies who are compliant with the Code.

Compliance data

Under the terms of the Code, the ABI commits to publishing data that demonstrates how insurers are complying with the terms of the Code. This transparency aims to provide confidence in how the Code is working.

The table below sets out the total number of diagnostic, predictive and unknown tests reported to insurance companies. Under the terms of the Code, insurers can ask for, and use the diagnostic test results reported to them. Insurers do not request predictive and unknown tests and therefore will not include those results in their risk assessments. Insurers can use predictive results supplied by a customer voluntarily to potentially improve the underwriting decision that was prompted by the customer’s family history. This is typically by lowering premiums or removing restrictions on cover.

The table shows consistent increases in both predictive and diagnostic tests over time and reflects the increasing number of genetic tests taking place in the UK. In 2020 the total number of tests disclosed increased by only one. This could be related to the pandemic, which may have impacted the total number of tests taken and disclosed.

The increasing trend in diagnostic tests is a more reliable data point than the number of predictive tests. This is because customers should disclose diagnostic tests in insurance applications but in most cases do not have to disclose predictive test results. Insurers will ignore tests when they should not have been disclosed. It is also important to note the data does not yet breakdown the number of predictive genetic test results to show how many were used to benefit the consumer by mitigating an adverse family history. The ABI hope to be able to show a breakdown in the future.

Table 1: number of genetic tests per year disclosed to insurers

| Type of test | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|

| Predictive results | 1,700 | 1,458 | 1,336 | 1,407 | 1,754 | 1,937 | 2,123 | 2,118 |

| Diagnostic results | 2,035 | 1,879 | 1,753 | 1,827 | 2,061 | 2,779 | 3,476 | 3,502 |

| Other or do not know | 314 | 331 | 328 | 360 | 310 | 338 | 388 | 368 |

| Total | 4,049 | 3,668 | 3,417 | 3,594 | 4,125 | 5,054 | 5,987 | 5,988 |

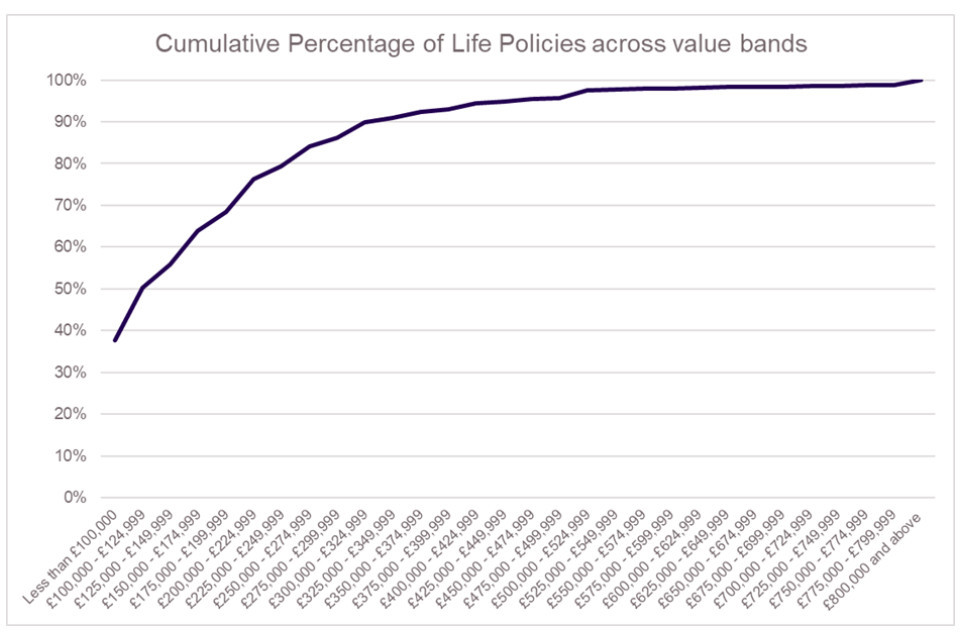

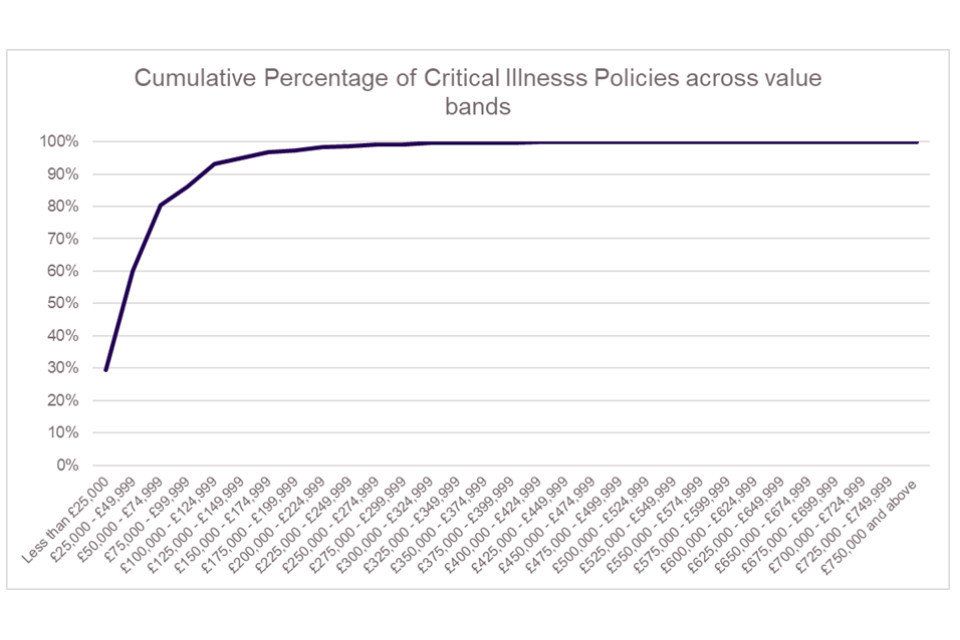

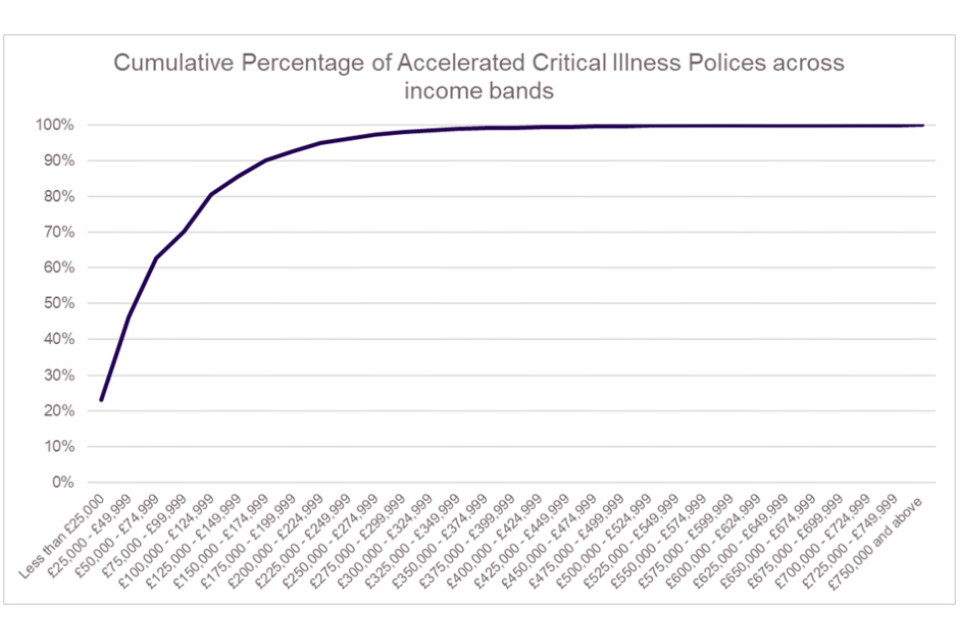

How the financial limits apply to policies

The graphs below show the distribution of life, income protection and critical illness insurance policies written against their respective financial limits within the Code. These graphs only look at new insurance policies which start that year, rather than all existing policies. This is because it is only at the start of the policy that the financial limit is applied and so this provides a more accurate picture and helps identify any emerging trends.

There are 2 types of critical illness policy shown in the graphs:

- critical illness

- accelerated critical illness

Both pay out a lump sum at claim but whereas critical illness policies pay out upon diagnosis of a specified illness, accelerated critical illness will pay out either on diagnosis of a specified illness or upon death (as a life insurance policy does) depending on which comes first.

Although it is important to monitor the number of policies underneath these limits, in practice, only the life insurance limit is currently relevant. This is because Huntington’s disease for life insurance is the only exception within the Code. The other limits only become relevant in the event of a new exception be applied for and approved.

Currently, 96% of life insurance policies fall within the financial limit of £500,000; 92% of income protection policies fall within the limit of £30,000 (per annum); and, 99% of critical illness policies and 98% of accelerated critical illness policies fall under the limit of £300,000.

Figure 1: cumulative percentage of life policies across value bands for 2020

The graph shows the cumulative percentage of life insurance policies as the policy value increases. 38% of life insurance policies are less than £100,000 in value, and the figure gradually increases such that 96% of all life insurance policies are for a value of lower than £500,000. After £500,000 the increase is more gradual until it reaches 100%.

Figure 2: cumulative percentage of income protection policies across value bands for 2020

The graph shows the cumulative percentage of income protection policies as the policy value increases. 46% of life insurance policies are less than £10,000 in value and the figure gradually increases such that 92% of all income protection policies fall below the value of £30,000 per year.

Figure 3: cumulative percentage of critical illness policies across value bands for 2020

The graph shows the cumulative percentage of critical illness policies as the policy value increases. 29% of life insurance policies are less than £25,000 in value and the figure gradually increases such that 99% of all critical illness policies fall below the value of £300,000 per year. After this point the figure increases only marginally until it reaches 100%.

Figure 4: cumulative percentage of accelerated critical illness policies across value bands for 2020

The graph shows the cumulative percentage of critical illness policies as the policy value increases. 23% of life insurance policies are less than £25,000 in value and the figure gradually increases such that 98% of all critical illness policies fall below the value of £300,000 per year. After this point the figure increases only marginally until it reaches 100%.

Complaints

Under the terms of the Code, insurers must report any complaints to the ABI and set out if and how a complaint is resolved. In 2020, there were no complaints reported about the use of a genetic test results by an insurance company.

Conclusion

The Code continues to work well. In the compliance data there is no evidence of information asymmetry which might have an adverse effect on the provision of life insurance policies. The research undertaken by the Cambridge Centre for Health Services Research did not show any evidence of a current risk to insurers as a result of the Code.

With no complaints reported in 2020, the Code on Genetic Testing and Insurance is providing reassurance on how tests are used and not used by insurers. The Code continues to provide reassurance to consumers whilst providing the flexibility to manage change in the wider genetics landscape to ensure that insurers can effectively assess risk and provide insurance to a wide range of people.