Competition and Markets Authority Annual Report and Accounts 2017/18

Published 24 July 2018

Overview

The Competition and Markets Authority (CMA) works to promote competition for the benefit of consumers, both within and outside the UK. Our aim is to make markets work well for consumers, businesses and the economy. We are an independent non-ministerial department. We employ around 600 people, who work mainly at our office in London. We work across the whole of the UK, and we have representatives in Northern Ireland, Wales and an expanding presence in Scotland.

This section of the CMA Annual Report 2017/18 gives a summary of our performance over the course of the year. It aims to help the reader understand the CMA, what we do, how we have performed, how we are governed, and the key risks to the achievement of our objectives.

- we help make sure people get a good deal from businesses and that firms treat their customers fairly

- we enforce the law against price-fixing cartels and other anti-competitive and unfair practices

- we prevent mergers that would harm competition

- we examine whole areas of the economy to help people to get the best possible deal

- we help government to design policies that support well-functioning markets

Chairman’s foreword

In 2017/18, building on our progress and capitalising on the investments we made in our early years as the UK’s primary competition and consumer agency, we have carried out important work in markets that really matter to millions of households and businesses across the UK.

We believe that vigorous competition helps consumers, spurring businesses to be more efficient, to innovate, and to make better offerings at keener prices to entice customers from their competitors. The result is that as customers we enjoy better quality goods and services and better value. As taxpayers we benefit from better value for money in the delivery of goods and services to government if anti-competitive practices that raise prices or reduce quality are stamped out. And we all benefit if the economy performs well because of the higher productivity that results from more vigorous competition.

This is good for ordinary people who benefit from better products and services, and good for the economy because it means that the best, most efficient, productive and innovative businesses succeed and grow.

Our work in the past three years is expected to achieve benefits to consumers of more than £3 billion – greater than 10 times our cost to the taxpayer; a target set for us by government. This is an impressive figure; it shows that we are a good investment for the taxpayer and that we have made a real difference for millions of households and businesses across the UK. In another measure of success, Global Competition Review named the CMA as European Agency of the Year, recognising that our 2017 work was strategic, innovative and creative.

In June, I left the CMA, handing over to Andrew Tyrie. I am proud of what the CMA achieved in my time as its Chairman. The organisation is working well as a single competition and consumer body for the UK, helping ensure consumers get a better deal, and securing lasting change across a wide range markets that really matter to millions of households and businesses across all nations and regions of the UK. I am confident that Andrew, the Executive Team and all CMA staff will work together to take the organisation into the next phase of its development, principally in its preparations for the UK’s exit from the EU, including taking on the enforcement of State aid rules, and will continue in the CMA’s mission to make markets work well for consumers, businesses and the UK economy.

David Currie, CMA Chairman

Chief Executive’s report

I will begin my reflections on the past year with work that is central to our purpose in promoting competition for the benefit of consumers – protecting them, as well as fair-dealing businesses, from anti-competitive practices and unfair trading.

Protecting consumers through effective enforcement

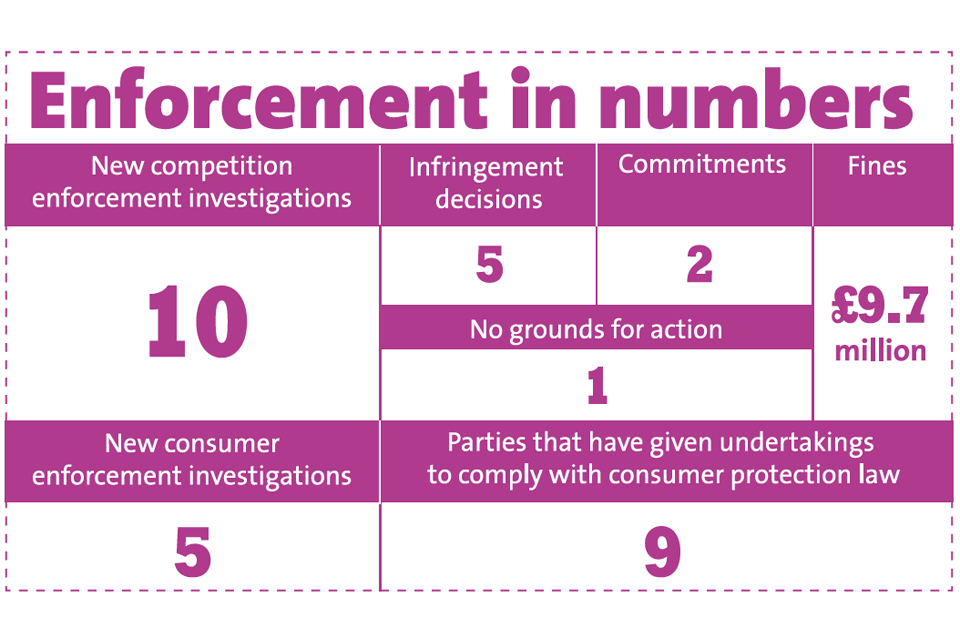

We sustained our increased level of competition enforcement in 2017/18, opening 10 new investigations into anti-competitive agreements and abuses of dominance; 60% higher than the annual average between 2010 and 2015 This includes 4 new investigations into potentially anti-competitive pricing practices in pharmaceutical supplies to the National Health Service.

Whilst 2017/18 has seen a range of important enforcement outcomes across a range of sectors, including online auction platforms, residential estate agency services, fairgrounds and supplies of household fuels, it has also been about making good progress in the high number of cases we launched both this year and last year. We have worked efficiently and innovatively, without compromising fairness and rigour, successfully decreasing the average time to carry out competition enforcement investigations against a rolling three-year average.

We used our full range of powers to halt practices which were harming consumers, including, where appropriate, settlements (in two investigations) and commitments (in two further investigations). To provide transparency and clarity for businesses and professional advisers, we have also not shied away from publicly issuing a reasoned ‘no grounds for action’ decision, rather than privately de- prioritising an investigation.

We are also using advanced digital marketing techniques to raise awareness of the law and drive new leads to our cartels hotline, launching a ‘Stop cartels’ campaign that reached over 21 million people, led to around 45,000 visits to our campaign webpage and a 41% rise in contacts to our cartels hotline in this period. Our free digital Screening for Cartels tool helps public procurers identify potential bid-rigging, which can cost taxpayers millions of pounds, and was shortlisted for a public finance innovation award.

Bolder enforcement brings with it a higher risk of litigation. Having achieved hard- hitting enforcement outcomes in 2016/17, we vigorously defended three of our competition enforcement decisions at the Competition Appeal Tribunal (the CAT).

The CAT upheld our decision and fine in an investigation into the sharing of pricing information amongst water tanks suppliers – reinforcing that any exchange of commercial information with competitors risks a fine, even when a business refrains from participating in price-fixing or market sharing. Following the appeal against our decision in the pay-for-delay investigation, in which we fined a number of pharmaceutical companies £45 million, the CAT dismissed several grounds of the appeal and referred others to the Court of Justice of the European Union. In June 2018, the CAT handed down its judgment in the appeal against our infringement decision in the Phenytoin investigation, remitting part of the case back to us for further consideration, after setting aside the abuse element of our decision. We have sought permission to appeal against the CAT’s judgment to the Court of Appeal.

Our consumer protection law enforcement is a natural complement to our competition work. In both, we make sure that markets can be trusted, and help people to know that ‘what they’re seeing is what they’re getting’. Making sure that firms abide by consumer law, treating their customers fairly in ways which promote, rather than damage, trust, helps to create a more competitive marketplace. Our work enables consumers to make better-informed choices, meaning that firms have to work harder to earn customers’ custom, offering better products and services at keener prices to both attract and retain them.

Much of our ambitious programme of consumer enforcement focuses on digital commerce, with investigations in markets as diverse as online dating, secondary ticketing, hotel booking, car hire and gambling. As part of our work on gambling, 4 leading operators formally committed to stop unfair online promotions that trap players’ money; landmark changes that must now be adopted across the sector. In a more traditional market, a consumer protection investigation following our care homes market study, one of the UK’s leading care home providers voluntarily dropped its policy of charging fees after a resident has died and another major provider agreed to provide more than £2 million in compensation to a large number of residents who paid substantial upfront charges.

Looking ahead, the government increased our enforcement funding by £2.8 million every year from April 2018, to allow us to take on even more cases against companies which are breaking competition law – further evidence of confidence in the CMA and of the importance of our work to millions of households and businesses, as well as to the overall UK economy.

Operating an effective and efficient merger regime

Reviewing mergers is another way we protect consumers; preventing any harmful effects such as higher prices, lower quality or reduced innovation.

We continued to build on previous years’ improvements to the efficiency of our merger control, minimising burdens on business and costs to the UK taxpayer. We are targeting our resources at those mergers we really need to look at: 60-70 per year out of the more than 500 brought to our attention annually – significantly fewer than during the years of the CMA’s predecessors, the Office of Fair Trading and the Competition Commission.

Where possible, we use our powers to accept undertakings in lieu of a phase 2 reference, ensuring our concerns are addressed with minimal cost to business and the taxpayer (12 in 2017/18, the highest annual total since the passing of the Enterprise Act 2002).

We carried out several high-profile merger investigations of great significance to the UK economy, including Fox/Sky, Tesco/Booker and Wood/Amec. You can read more about these later in this report.

To further assure an efficient end-to-end process, we fast-tracked appropriate mergers to phase 2, including Tesco/Booker; a pragmatic approach which helps us to achieve a timely outcome whilst retaining high procedural standards.

In our Just Eat/Hungryhouse investigation, we issued our first procedural penalty in a merger case for not complying with a formal information request. We hope that demonstrating our intent to penalise procedural infringements will act as a deterrent to companies and their law firms in future.

Making markets work better

This year our in-depth reviews focused on markets which have long been central to people’s lives (care homes) alongside rapidly evolving areas of the economy (digital comparison tools). We have also launched a market study into heat networks, which are a key part of the government’s decarbonisation strategy, and we are undertaking an in-depth review of the investment consultancy sector following a reference to us by the Financial Conduct Authority.

In both the care homes and comparison tools studies, we set out far-reaching and challenging remedies to ensure these markets work in people’s favour. We also joined up our markets and enforcement toolkits, by launching enforcement following each of these market studies: a competition investigation into the use of certain ‘most favoured nation’ clauses by a price comparison site in relation to home insurance products, a consumer protection investigation into online hotel booking, and a consumer protection investigation into a number of care home providers.

Millions of households and businesses are seeing the benefits from our market-wide reviews of energy, retail banking and legal services in England and Wales, with a range of innovative and important remedies coming into effect during 2017/18. Alongside protecting vulnerable consumers, these in-depth whole-market reviews have laid the foundations for a transformative change to competition in these sectors.

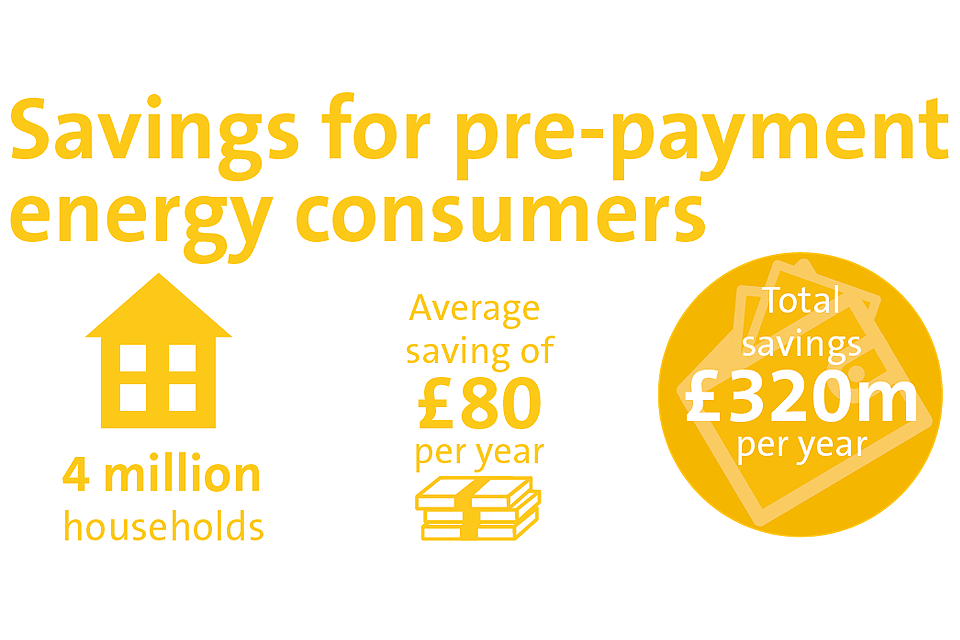

Four million energy customers on pre-payment meters are paying lower bills thanks to a price cap and smaller businesses are no longer trapped into expensive auto-rollover contracts.

Our banking orders have now come into force, requiring banks to work harder for their customers and helping people take control of their banking using innovative new services. Banks must support the tech-enabled Open Banking revolution; it is easier for customers to switch banks; banks must warn personal account customers if they are about to slip into an unarranged overdraft, and must publicly announce the maximum monthly charges for doing so. Smaller businesses can more easily understand the costs of taking out a loan and find the best deal for them.

Following our legal services market study, 8 regulators in England and Wales published their plans for implementing our recommendations to make the market more competitive and to make sure consumers can be confident about the price and service they can expect when they hire a lawyer.

In 2017/18, we implemented all our remedies without extensions to the statutory timescales, exceeding our Annual Plan commitment. We have continued to actively manage our stock of existing (markets and merger) remedies, ensuring they have the desired effects and removing them where they have become redundant.

A strong voice for competition

We remain a strong voice for competition across the UK and overseas, advising and challenging policy-makers domestically to use pro-competitive measures to achieve policy objectives where possible. We have also supported the development of the competition and consumer regimes internationally.

Our influence with government departments remains high, and over the year we have privately guided early-stage policy development. This includes making a series of informal recommendations and publicly responding to UK government consultations on the Green Paper on Industrial Strategy and on proposals to extend the scope of the national security public interest test. You can read more about our advocacy work in the working across government section.

Strong partnerships at home and overseas

Our partnerships, at home and overseas, remain strong.

Our latest Annual Concurrency Report shows that the concurrency arrangements, whereby the CMA and sector regulators work more effectively together to improve competition and competition law enforcement, have been working well. Almost all the regulators with concurrent powers have opened a competition enforcement investigation since the start of the new concurrency regime in 2014, and 4 new investigations in the regulated sectors have been launched in 2017/18, compared with two in each of the previous two years.

There has been a step-change in the level of cooperation between the CMA and regulators. We have carried out or are carrying out significant markets work alongside our regulatory partners, including the market studies on digital comparison tools (Ofcom, the Financial Conduct Authority (FCA) and Ofgem) and on heat networks (Ofgem), and the in-depth market investigation into the investment consultancy services and fiduciary management services markets following referral by the FCA. You can read more about our work with sector regulators in The CMA across the UK and the world section.

With the importance of devolution to the political and business landscape of the UK, we are stepping up our approach to the devolved nations and the English regions, including by establishing a network of Regional Champions drawn from amongst our Directors. We aim to give due prominence to nation- and region- specific issues in our work, improve staff knowledge of regional issues, and ultimately achieve a more inclusive, relevant and informed CMA work programme. You can read more about this work in The CMA across the UK and the world section.

Following extensive planning, in June 2018, we opened an expanded office in Edinburgh, which will grow to up to 25-30 staff by the end of 2018/19. As well as allowing us to build stronger and wider relationships with business and consumer groups, the Scottish government and Parliament, it will increase our capability to carry out UK-wide projects by drawing on a new and talented labour market.

We continued to work closely with other competition authorities and in competition and consumer protection networks across the world, including the International Competition Network, the OECD, and the International Consumer Protection and Enforcement Network.

Preparing for the UK’s exit from the EU (Exit)

Exit from the EU presents opportunities for the CMA as we expect to take on a bigger role on the world stage. Planning for the new arrangements will continue to be an important priority for us, working closely with the government.

Over the past two years we have stepped up our antitrust enforcement activity, and streamlined and clarified aspects of our mergers and markets work, meaning the UK regime is in good shape to meet the challenges and make the most of the opportunities which Exit will bring.

We are fully focused on ensuring operational readiness for our post-Exit role, predicated on an assumption that we will take a significantly increased merger and antitrust review role, as well as the enforcement of State aid rules. If we are to deliver the additional cases and meet these further responsibilities efficiently whilst maintaining a healthy portfolio of other enforcement and markets work (including more local cases), we need more resources to do so. We have been carrying out detailed planning for what our additional needs would look like post- Exit, and welcome the increase to our budget from April 2018 of up to £23.6 million to allow us to prepare for Exit.

Key risks and challenges

As well as presenting opportunities, exit from the EU presents challenges for the CMA.

At this point we do not know the exact characteristics of the UK’s future relationship with the EU, and although it now seems probable that there will be an overall implementation period until December 2020, we do not yet know exactly when we will take on new casework. From our perspective, we are keen to ensure a smooth transition as and when jurisdictional changes take effect, both to avoid unnecessary duplication and also to minimise the risk of enforcement gaps and ensure UK consumers are properly protected. As the future arrangements and responsibilities become clearer, we must be able to make tough decisions on our priorities, at pace, so that we can be flexible in new circumstances. A significant risk arises if we fail to recruit enough highly skilled staff to take on our new responsibilities at the point of transition. This is a major undertaking in a competitive labour market, and we are developing a range of recruitment initiatives to deliver this, now that the government has provided the necessary funding.

More widely, there is active political and public debate over the role of markets and when governments should step in to fix problems. In this context, our work is given added relevance. It is our task to intervene robustly in markets, where necessary, to make sure they work in people’s favour. By doing our job well we can help build trust that markets benefit wider society. Consistent with our statutory role as an adviser within government, where appropriate we will also argue, both behind the scenes and through our powers to comment publicly, against short-termist interventions that could put at risk long-term consumer benefits, particularly where this concerns vulnerable consumers.

Spurred on by technological advances, our economy, the way people shop and the way businesses operate continue to evolve rapidly. We welcome the benefits digitisation can bring, including increased choice, convenience, lower prices and the increased spurs to efficiency of companies trading online. We must, however, also ensure that those who hold market power do not abuse it to the detriment of consumers or other businesses, that algorithms and forms of artificial intelligence do not become a vehicle for collusion, and that less digitally literate customers are not left behind.

As we press ahead with robust enforcement of the law, we can expect an increased risk of litigation against our decisions and the fines we impose. This will not dissuade us from being bold and pursuing big, challenging cases through which we can deliver significant benefit for consumers, taxpayers and the economy more generally. We have to expect that some judgments will go against us. We will learn lessons from such decisions but such setbacks will not diminish our appetite for important cases.

In September 2019, we will likely relocate our London head office. Offices moves can be disruptive, but we will work hard to ensure that disruption to our work is minimised.

Looking ahead

We will continue to push ahead with our work on all fronts, including to prepare for Exit and our new responsibility for State aid.

We will remain active in markets large and small: enforcing the law, protecting consumers (in particular vulnerable consumers), preventing anti-competitive mergers and making markets work better for households and businesses. Ensuring that markets can be trusted is another priority for us, alongside making sure that we better connect the role of competition, and of the CMA, to wider society.

We will continue to prioritise work in online and digital markets, and invest to further build our knowledge and capabilities in spotting and tackling anti-competitive and unfair trading practices online. We will deepen our understanding of how business practices and markets are evolving in an increasingly-digitised era, including through the creation of a digital, data and technology team, led by the Chief Data and Digital Insights Officer, a new role within the CMA. Not least, we will continue to address problems in markets which are important to economic growth and thus help to address the UK’s productivity challenge.

Andrea Coscelli, Chief Executive and Principal Accounting Officer 10 July 2018

Year in highlights

Consumer benefit

The CMA benefits the consumer by over £3 billion, greatly exceeding our cost to the taxpayer.

Enforcement in numbers

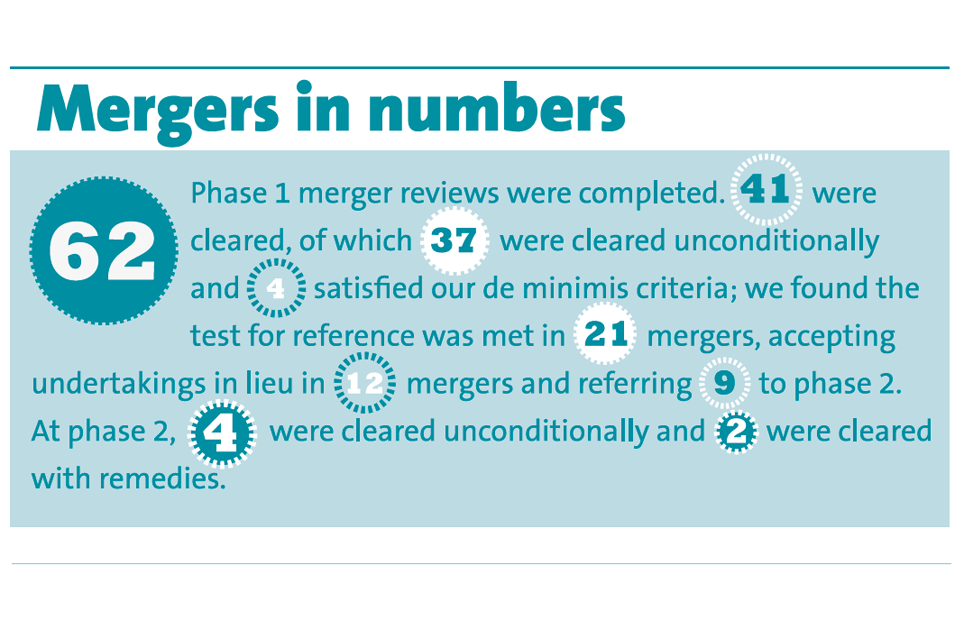

Mergers in numbers

Remedies coming into force

- Energy market investigation: 9

- Retail banking market investigation: 12

Savings for pre-payment energy consumers

Stop Cartels campaign

- People reached: 21.3 million

- Visits to campaign page: 45,000

- Rise in contacts to the cartels hotline: 41%

About us

The CMA has a primary duty, set by Parliament, to promote competition, both within and outside the United Kingdom, for the benefit of consumers.

Our mission is to make markets work well in the interests of consumers, businesses and the economy, and our overall ambition is consistently to be among the leading competition and consumer agencies in the world.

We are an independent non-Ministerial government department, taking on our powers as the UK’s lead competition and consumer authority in April 2014. We adopt an integrated approach to our work, selecting those tools we believe will achieve maximum positive impact for consumers and the UK economy. We have a UK-wide remit and, whilst most of our staff are located in our London office, we have representatives in Wales, Northern Ireland and an expanding presence in Scotland.

The CMA’s functions include:

- to investigate mergers that have the potential to lead to a substantial lessening of competition

- to conduct studies and investigations into particular markets where there are suspected competition and consumer problems

- to investigate businesses and individuals to determine whether they have breached UK or EU competition law and, if so, to end and deter such breaches, and pursue individuals who commit the criminal cartel offence

- to enforce a range of consumer protection legislation, tackling issues which suggest a systemic market problem or which affect consumers’ ability to make choices

- to promote stronger competition in the regulated industries (gas, electricity, water, aviation, rail, communications and health)

- to conduct regulatory appeals and references in relation to price controls, terms of licences or other regulatory arrangements under sector-specific legislation

- to give information or advice in respect of matters relating to any of the CMA’s functions to the public and to Ministers

Governance

The CMA is a non-ministerial government department, funded by the taxpayer, reporting to parliament through its annual plan and report. Our staff are civil servants.

We are governed by a Board, comprising the Chair, the Chief Executive, executive and non-executive directors, and a number of members of the CMA panel. The Chief Executive, as the CMA’s Principal Accounting Officer, is responsible for the economy and efficiency of its handling of public monies.

The Board:

- ensures that we fulfil our statutory duties and functions and that we observe the principles of good corporate governance

- establishes that the overall strategic direction of the CMA fits within the policy framework laid down under the Enterprise and Regulatory Reform Act 2013

- has regard to any opinions and reports of the CMA Principal Accounting Officer and ensures that we make appropriate use of public funds

The Board also:

- decides whether to publish a market study notice and whether to refer a market for a phase 2 investigation

- considers the draft Annual Plan and consultation on the proposals

- is responsible for the annual performance and concurrency reports

- makes rules of procedure for merger reference groups, market reference groups, and special reference groups

Some functions of the CMA must be performed by members of the CMA Panel who have clearly defined responsibilities and act as fresh decision-makers between the two phases of market and mergers cases to avoid confirmation bias.

Our governance structure helps us to maintain our reputation for fairness, independence, integrity, rigorous analysis, careful handling of sensitive information, and efficient use of public money. More detail on our governance can be found in the CMA governance structure section.

Performance summary

Funding

The CMA is accountable to Parliament for its expenditure. Parliamentary approval for our spending plans is sought through the Main Estimates presented to the House of Commons, specifying the estimated expenditure and asking for the necessary funds to be voted. The CMA draws down voted funds in-year from the Consolidated Fund as required and within the remit of its Voted Estimates.

The Estimates include a formal description (‘ambit’) of the services to be financed. Voted money cannot be used to finance services that do not fall within the ambit.

In the 2015 Spending Review (SR15) HM Treasury awarded the CMA a Resource Departmental Expenditure Limit (Resource DEL) of £69.4 million and a Capital Departmental Expenditure Limit (Capital DEL) of £1.3m for the financial year 2017/18. The Resource DEL included a ring- fenced budget of £3.5 million to cover depreciation and placed a limit of £18.9 million (including £1.1 million of depreciation) on administration expenditure.

In the 2017/18 Supplementary Estimates Resource, the CMA’s DEL was increased by £71 million. This was to cover possible litigation costs of £70 million and £1 million allocated in the 2017 Autumn Budget to undertake critical preparations, between October 2017 and March 2018, to prepare for EU Exit. No change was made to Capital DEL. The CMA’s Net Cash Requirement increased by £71 million to £139.2 million, reflecting the cash requirement of movements in Resource DEL.

Outturn

For the year ended 31 March 2018 the CMA reported comprehensive net expenditure of (£8.2 million). This compares to £135.5 million for the year to 31 March 2017.

As set out in the Statement of Parliamentary Supply, the CMA’s 2017/18 Resource DEL outturn was £63.2m, compared with an Estimate of £140.4 million. Of this total variance saving of £77.3 million, £70 million related to additional budget received to cover litigation costs that did not materialise during the year. The remaining £7.3 million represents 5% of the CMA Resource DEL limit. This saving arose from various sources, including a requirement to ensure sufficient headroom in the budget to cover potential dilapidations payment arising from the CMA’s intention to relocate from Victoria House, as well as an associated adjustment for rent smoothing as a result of the intended lease break. Other factors include a ruling agreed during SR15 that allows the CMA to offset 50% of litigation costs against Competition Act 1998 fines income received through the Trust Statement account.

The Capital DEL outturn of £0.8 million was lower than the Estimate by £0.5 million.

The CMA’s Net Cash Requirement outturn of £64.3 million was £75 million lower than Estimate (£139.2 million). This variance arose predominantly from litigation costs which did not materialise in year.

Creditor payments, target and performance

The CMA’s target is to pay suppliers promptly in line with our standard terms and conditions, which are to pay all undisputed invoices within 30 days of receipt of invoice. In 2017/18, 94.2% of undisputed invoices were paid within the 30-day target (2016/17: 98.6%). The CMA is reviewing internal procedures and working actively with suppliers to ensure that performance improves in 2018/19.

HM Treasury guidance is that government departments should aim to pay 80% of undisputed invoices within 5 days. In 2017/18 CMA paid 47% of invoices within 5 working days (2016/17: 57%). In 2018/19 we will significantly improve upon systems and reporting to ensure we make meaningful headway towards meeting this target.

Going concern

The going concern basis is set out in note 1.14 of the CMA’s financial statements. The financial statements for the CMA in respect of the year to 31 March 2018 are prepared on a going concern basis in accordance with the FReM issued by HM Treasury.

The Statement of Financial Position at 31 March 2018 shows net liabilities of £8,307k (2016/17: £80,842k). Provision for resource and capital expenditure for 2017/18 for the functions performed by the CMA have been included in Supply Estimate submissions, which have been approved by Parliament.

Performance analysis

How we measure performance

We have a well-developed reporting framework. An overall framework sets out the performance the government expects of the CMA, describing how it will fulfil the performance reporting requirements of the Enterprise and Regulatory Reform Act 2013, and recognising the CMA’s full operational freedom to make case decisions and prioritise its use of resources and its activity.

These expectations are reflected in our strategic goals and in key commitments and initiatives set out in the CMA’s Annual Plan. These are a challenging, ambitious set of targets to work towards based on our known budget and portfolio, and are set out in the following two pages along with an indication of whether we have achieved the commitment. More widely we have ensured that we have reported on our framework and strategic priorities within the text of our Performance Analysis. Performance reporting through our Annual Report is underpinned by more detailed management reporting and performance measures which are reviewed regularly by the CMA’s Executive Committee and Board.

Competition means that people can expect a good deal

Performance against our commitments

Enforcement

| Launch as many new civil competition enforcement investigations as possible, where we have the requisite evidence, with 6 as a minimum | Achieved: 10 opened |

|---|---|

| Open new criminal investigations and pursue prosecutions as appropriate, having regard to lessons from our most recent cases as well as the change in the law in respect of cartel activity occurring from April 2014 | None opened |

| Continue to improve processes and challenge our ways of working to decrease the time taken to conclude competition enforcement investigations against a rolling three-year average benchmark | Achieved: 5-week reduction in average time taken for all investigations |

| Launch as many consumer cases or projects as possible where we have the requisite evidence, with 4 as a minimum | Achieved: 5 opened |

| Conclude our consumer enforcement cases or projects effectively either by agreement or by proceeding to litigation, with the majority to be concluded within 18 months of being publicly opened | Achieved |

| Conduct further research into businesses’ awareness and understanding of the law, to track progress and help target our compliance activity | Achieved |

| Carry out further cartel lead generation events and communications activity with public procurement and anti- fraud teams in central and local government across the UK | Achieved |

Markets and mergers

| Launch 2 to 4 new markets projects in the course of the year | Achieved: 2 opened |

|---|---|

| Conclude the review of how we carry out market investigations and take appropriate steps to improve how we undertake these projects in the future, including consulting on the strategic role of market investigations and revised markets guidance | Achieved |

| Seek to clear at least 70% of phase 1 merger cases that are less complex (and therefore do not require an issues meeting and case review meeting) within 35 working days | Achieved: 91% |

| Seek to complete 70% of phase 2 merger cases without an extension to the statutory deadline, measured as a 3 year average of all relevant merger cases | Achieved: 83% |

| Continue our ongoing programme of reviews of older remedies and launch 3 to 4 further reviews of existing merger or market remedies in the course of the year | Achieved: 7 reviews opened |

| Commence an internal review of the rules and guidance applicable to merger remedies across phase 1 and phase 2 investigations | Achieved |

| Review and update, as appropriate, the procedural rules and guidance applicable to our various regulatory appeals functions | Achieved |

| Seek to implement phase 2 merger and market investigation remedies without the need for an extension to the statutory deadline in at least 80% of cases, as measured as a three-year average of all relevant merger and markets cases | Achieved: 100% |

| Conclude our joint programme of work with the UKCN to develop a better understanding of consumer behaviour to inform proposed remedies, and publish our findings | Achieved |

Partnership and advocacy

| Continue to play a leading role in the development of competition and consumer protection internationally | Achieved |

|---|---|

| Within the UK, continue to play an active role in the CPP and continue to work closely with consumer enforcement, regulatory and advisory bodies in the wider consumer landscape | Achieved |

| Launch 1 or 2 new evaluations of previous cases | Achieved: 2 launched |

| Publish 2 economic research reports | Achieved: 2 published |

| Based on our work, make recommendations to the government on the impact of policy frameworks on competition in at least two sectors | Achieved: 2 sets of recommendations made |

| Support and challenge the government in its implementation of its economic (and other) strategies and its development of policies affecting markets following the UK’s exit from the EU | Achieved |

Developing the CMA

| Build our leadership and management skills to improve the engagement score in the annual Civil Service People Survey and become one of the Civil Service High Performers, fulfilling our ambition to make the CMA a great place to work | Partially achieved |

|---|---|

| Make further progress towards the objectives set out in our Single Equality Scheme Action Plan to promote equality of opportunity, diversity and inclusivity across the CMA. We will give a progress report on how the CMA is demonstrating its achievement of these against its published objectives and our desire to create a diverse and inclusive environment and culture | Achieved |

| Offer new apprenticeship starts equivalent to 2.3% of headcount | Not achieved: 1.6% |

| During the year, meet the government target of paying 80% of undisputed invoices within 5 working days of receiving them | Not achieved: 47% |

Competition rewards businesses that treat their customers fairly

Protecting consumers through effective enforcement

Effective enforcement of competition and consumer law is central to our purpose as an organisation. As well as stopping and penalising unlawful anti-competitive conduct and unfair trading where it is ongoing, enforcement plays a vital role in deterring future breaches by others. It is thus central to making markets work well, both by protecting customers and by protecting the competitive dynamic, which is the spur to increased productivity and economic growth.

In 2017/18, we committed to taking forward a higher volume of cases, doing so as efficiently and quickly as possible, without compromising fairness and rigour.

We maintained our sharp step-up in competition enforcement, launching 10 new competition enforcement investigations; matching the previous year and 60% higher than the 2010-15 annual average.

Competition Act 1998 (CA98) investigations opened in 2017/18:

- Roofing materials (Ch.1)

- Design, construction and fit-out services (Ch.1)

- Pharmaceutical sector (Ch.1)

- Pharmaceutical sector (Ch.1 and Ch.2)

- Pharmaceutical sector (Ch.1 and Ch.2)

- Pharmaceutical sector (Ch.1 and Ch.2)

- Price comparison website: use of most favoured nation clauses (Ch.1)

- Transport sector (facilities at airports) (Ch.1)

- Residential estate agency services (Ch.1)

- Mobility scooters – lifting immunity from fines (Ch. 1)

Ch.1 refers to investigations under the Chapter 1 prohibition in the Competition Act 1998, which covers anti-competitive agreements, collusion and coordination (including cartels); Ch.2 refers to investigations under the Chapter 2 prohibition in the Competition Act 1998 which covers abuse of a dominant position

Average number of months to conclude CA98 investigations

All cases

| Period | Average number of months (all cases) |

|---|---|

| 2012/15 | 24 |

| 2013/16 | 23 |

| 2014/17 | 23 |

| 2015/18 | 18 |

Infringement decisions only

| Period | Average number of months (Infringement decisions only) |

|---|---|

| 2012/15 | 24 |

| 2013/16 | 24 |

| 2014/17 | 25 |

| 2015/18 | 22 |

Our competition and consumer protection investigations spanned digital markets, major global companies, and markets for goods and services that matter to the economy and people’s everyday lives, including the most vulnerable: buying and insuring our homes, booking hotels, hiring a car at home and abroad, medicines for the NHS and ensuring our elderly relatives are well-cared for.

There were several clear themes to our competition and consumer enforcement this year: protecting the vulnerable, tackling illegal and unfair practices online, cracking down on cartels, and making sure that we use our powers flexibly and join up our toolkit to get the best outcome for consumers and fair-dealing businesses.

Protecting the vulnerable

Four of the new competition enforcement investigations we opened in 2017/18 were into alleged anti-competitive practices in the pharmaceutical sector. At year-end, we were pursuing 8 investigations in this sector; half of our competition enforcement portfolio.

These investigations relate to alleged anti- competitive practices that risk leading to higher prices for essential drugs supplied to the NHS – and therefore all of us as taxpayers – and diverting resources that could otherwise be spent on patient care, including for the most vulnerable.

Alongside our competition powers, we pursued a consumer enforcement investigation to protect the elderly in residential care homes, and their families, from overcharging and from misleading practices. As a result of this investigation, one of the UK’s leading care home providers voluntarily dropped its policy of charging fees after a resident has died and another voluntarily reimbursed some families for fees they were charged upfront.

Protecting the NHS, protecting patients, protecting taxpayers

This year, we have continued to pursue investigations into a range of alleged illegal anti-competitive practices by several pharmaceutical companies.

Such practices would harm consumers in any market; but if the NHS has to pay significantly more than it should for essential medicines and treatments because of anti-competitive practices, there is less money available to fund other treatments, so millions of NHS users lose out.

This is 1 of the reasons why we have devoted considerable resources to our investigations into alleged practices in this vital market.

We issued statements of objections in two investigations, both relating to alleged abuse of a dominant position: into an anti-competitive discount scheme which was likely to restrict competition from ‘biosimilar’ versions of the drug that were new to the market; and into charging excessive prices for an essential thyroid drug.

The latter centred on a drug primarily used to treat hyperthyroidism, which affects at least 1 in every 50 people and which can lead to depression, tiredness and weight gain. While there are other treatments, for many patients there is no suitable alternative. Our investigation uncovered that in 2016 the NHS spent more than £34 million on the drug, an increase from around £600,000 in 2006. The amount it paid per pack rose by almost 6,000% between 2007 and 2017, while production costs remained stable.

These cases remain under way with no final decision on whether the law has been broken.

To protect the NHS, its patients and UK taxpayers, we are determined to crack down on any illegal behaviour in the pharmaceutical sector and will push ahead with our existing investigations, to determine whether the law has been broken and if so take appropriate steps.

Tackling illegal and unfair online practices

Trust in online markets is essential if the digital economy is to develop towards its full potential. Over the year we have continued to use our full range of competition and consumer protection tools to promote better competition and more choice in online markets, and to sharpen the spurs to efficiency and innovation by firms.

Using our competition enforcement powers, we clamped down on online resale price maintenance by a lighting supplier, fining it £2.7 million for requiring retailers to use a minimum price when selling its products online. We also fined a major golf club manufacturer £1.45 million for banning UK retailers from selling its clubs online; the relatively low level of the fine reflecting that the illegal activity occurred in the context of a genuine commercial aim of promoting in-store custom fitting. This case is currently subject to appeal at the Competition Appeal Tribunal.

Consumer protection enforcement investigations opened in 2017/18:

4 out of the 5 new consumer protection law investigations we opened this year centre on online practices or markets. Working with the Gambling Commission, we secured landmark changes to how online gambling operators offer bonus promotions, which will ensure that players will not face unfair restrictions that prevent them from getting to their money. You can read more about this case in a case study below. The other investigations are ongoing and we look forward to securing more good outcomes for consumers in the coming year. We concluded two consumer protection investigations, both within 18 months of publicly opening them.

Case study: online gambling

Gambling always carries a risk, but the cards shouldn’t be unfairly stacked against players.

As part of a major overhaul of how the £4.7 billion online gambling sector operates, 4 leading firms formally committed to change the way they offer bonus promotions to ensure players can always access and release their own money.

Working alongside the Gambling Commission, we closely examined promotions designed to attract players onto casino-like gaming websites by offering bonus funds when players put in their own money. We found that certain terms in these promotions were likely to be unfair, in breach of consumer protection law, and could mislead consumers. We were particularly concerned that people could be made to play for longer than they had bargained for before being able to withdraw their own money.

The firms have agreed to be more upfront and clear in the terms and conditions of their bonus promotions, to allow players to withdraw their own money when they play as part of a bonus promotion, and to make it easier for them to stop gambling when they want to.

As a result of the CMA’s close partnership working with the Gambling Commission, licensed gambling firms will be required to review the promotions and sign up deals they offer customers and take whatever steps they need to take to ensure they comply with consumer law. They will otherwise face regulatory action.

Cracking down on cartels

We are committed to tackling cartels wherever we find them and more people are reporting illegal activity to us.

We fined 6 Somerset estate agents over £370,000 for agreeing minimum commission rates, meaning that local homeowners were denied a fair deal when selling their property. In April 2018, we secured the disqualification of two directors of 1 of the estate agents concerned and are investigating others. We also launched a digital ‘stop cartels’ campaign.

Case study: tackling a market sharing cartel

In March, we fined two of the biggest suppliers of coal and charcoal for households in the UK £3.4 million for taking part in a market sharing cartel.

Millions of people buy these products to help keep their homes warm in winter and fire up their barbecues in summer. It is important that shoppers are offered the best price and this only happens when companies compete fairly.

These two suppliers admitted rigging competitive tenders to supply Tesco and Sainsbury’s supermarkets and petrol stations, and sharing confidential pricing information. Our investigation started after intelligence work following a tip-off to the CMA’s cartels hotline which led us to carry out surprise inspections at their premises.

Annual contacts to the CMA’s Cartel Hotline

Contacts to the Cartels Hotline may have been handled by other teams in the CMA, based on which team is best placed to respond appropriately.

| Year | Contacts |

|---|---|

| 2014/15 | 343 |

| 2015/16 | 480 |

| 2016/17 | 593 |

| 2017/18 | 686 |

Defending our decisions in court

Having secured important outcomes in our competition enforcement last year, this year we defended three of those decisions at the Competition Appeal Tribunal (CAT). The UK has one of the most rigorous systems of judicial oversight of competition regimes in the world, which requires that our legal analysis and procedural approach must meet the highest standards.

In our investigation into a water tanks cartel, we fined a company £130,000 for illegally sharing competitively-sensitive information at a meeting with competitors, which we secretly recorded. Although the company did not join the long-running price-fixing cartel, it is well-established that it can be illegal for competitors to exchange competitively-sensitive information. The clear message of our decision is that illegally exchanging such information, even without actual price- fixing or market-sharing, and even if at only 1 meeting, will not be tolerated. In the appeal, the CAT upheld our decision and our fine on the information exchange; the party has been granted permission to appeal to the Court of Appeal.

The CAT also issued a judgment in the appeal by three pharmaceutical companies of our decision to impose fines of £45 million on them for breaking competition law. The case concerned a ‘pay for delay’ arrangement relating to the anti-depressant medicine paroxetine. The CAT supported many of our findings of fact, dismissed several grounds of appeal, and decided to refer the rest to the Court of Justice of the European Union before issuing its final judgment.

In May 2018, the Supreme Court ruled in our favour in an appeal related to the Office of Fair Trading’s tobacco competition enforcement investigation.

In June 2018, the CAT handed down judgment in the appeal against our decision findings for unfair and excessive pricing in the supply to the NHS of the anti-epilepsy drug phenytoin. The CAT upheld several aspects of our case; however, it decided to remit the case back to us for further consideration, after ruling against our finding of abuse element. We have sought permission to appeal against this judgment to the Court of Appeal.

Using our whole toolkit to best effect

We have a broad range of powers to make sure people get a good deal from businesses and that firms treat their customers fairly. In some cases, these powers can achieve a good outcome when used in isolation; in others, we are able to get an even better result if we use them together. This year, we have gone even further in using our whole toolkit to best effect.

Market studies and investigations are our most flexible powers, on which you can read more from page 51. Such reviews provide us with a wealth of information about how well businesses within a market are serving the interest of their customers, and sometimes flag up practices which may be against the law. This year what we discovered in market studies led to us launching targeted competition and consumer protection investigations.

Following our digital comparison tools markets study, we launched a competition enforcement investigation into how a price comparison website has set up its contracts with insurers, which we suspect may result in higher home insurance prices.

We subsequently launched a consumer protection investigation into hotel comparison sites, following concerns about the clarity, accuracy and presentation of information, which could mislead people, stop them finding the best deal and potentially break consumer law.

In our care homes market study, we carried out a market-wide consumer law compliance review. Following this, and whilst the market study was ongoing, we launched a targeted consumer protection investigation to explore concerns about certain care homes charging families for extended periods after a resident has died, and homes charging large upfront fees. This has already led to 1 of the UK’s leading care home providers voluntarily dropping its policy of charging ‘after death’ fees and another major provider agreed to reimburse a large number of families who had paid substantial upfront fees.

We are pressing ahead with our ongoing investigations and will look to launch further investigations in these markets or following future market-wide reviews, if we think that enforcement can get the right result for customers and fair-dealing businesses.

This is not the only way we join up our functions. During a merger investigation in 2014, we identified practices in a market sharing agreement that caused us concern. We subsequently launched a competition law enforcement investigation into the two companies concerned in the ‘cleanroom’ laundry services market, leading to fines of £1.7 million when the case concluded this year.

We also use our statutory function of giving information or advice to the public and to Ministers as an active part of our toolkit. We consistently amplify the deterrent effect of our enforcement cases through communications campaigns targeted at specific sectors – you can read more about this on page 40. And we follow up on recommendations to government from our markets projects, working with officials to help ensure that our remedies are taken forward and get the right results. You can read more about our approach to advocacy in the working across government section.

Using our powers flexibly

Securing infringement decisions is important in setting precedent and driving deterrence, but Competition Act investigations, if they are to be fair and rigorous, inevitably take time. In this context we have a range of options available to us that can help us achieve a good outcome more swiftly.

Settlements and commitments

A settlement is a formal legally-binding decision in circumstances where a business admits that it has broken the law, and the fine is reduced because of the benefit to the taxpayer of being able to reach a conclusion more swiftly and cost effectively. A commitment is also legally-binding, and leads to a change in behaviour that addresses the CMA’s concerns, but it is not an admission of liability and it does not result in fines.

In 2017/18, we secured commitments in the online auctions and Showmen’s Guild investigations. We reached infringement decisions by way of settlements in the investigation into a market sharing cartel in the supply of charcoal and coal for households in the UK and in the investigation into an estate agents cartel. You can read about these cases on page 35.

We will not reach settlements or commitments in every case. But sometimes, as part of a balanced portfolio, it is appropriate to do so. We can then close the case sooner, releasing resources to look into, and combat, other suspected anti-competitive practices.

Interim measures

Sometimes, particularly in fast-moving markets such as technology sectors, an anti-competitive practice can so weaken a competitor that the damage to competition, and therefore to consumers, has been done before we can reach a final decision. In such cases of urgency, we may impose an order to stop the alleged anti-competitive practice for the duration of the competition investigation. We dealt with an interim measures application this year, in our online auctions investigation.

Withdrawal of immunity from fines

Firms that make illegal agreements with other companies where their combined turnover is no more than £20 million are generally immune from fines under UK law. However if, as a result of our investigation, we consider that any such agreement is likely to break competition law, we may withdraw this immunity. This year we did so for a mobility scooter supplier that was stopping its retailers from advertising prices online. We opened the investigation in April, withdrew immunity in August (the first time that immunity has been withdrawn so early in an investigation) and closed the investigation in October following action from the supplier to address our concerns. Should the behaviour recur, we would be able to fine the company.

Warning and advisory letters

Where we think there is or may be illegal activity, but we do not think it appropriate to pursue a full investigation, we often send the business(es) concerned an advisory or warning letter – the latter being stronger than the former in that it requests that the business writes back to us with details of what it has done to address our concerns.

case study: online auction platforms In June 2017, 8 months after we opened the investigation, we accepted legally-binding commitments from the largest provider of live online bidding platforms in the UK, to cease practices about which we had competition concerns. These platforms are used by auction houses to allow people to bid without having to attend in person.

The company was acting in ways which, in our view, prevented its rivals from being able to compete effectively in the market and prevented consumers for getting a better deal for online bidding.

Early in our consideration of this case, we received an application from a third party for interim measures to halt the practices pending the outcome of a full investigation. We carefully considered this application, but the firm then made its commitments offer. The legally-binding commitments prevent it from carrying out any of these practices for 5 years. We now believe that alternative platforms or new entrants will be able to compete more easily and offer cheaper commission rates to bidders.

Securing commitments in this case allowed us to bring the alleged anti-competitive practices swiftly to a halt: protecting consumers and releasing resources early to enable us to combat other anti- competitive practices.

Promoting compliance

We know that most businesses want to comply with the law and we are committed to helping them do so.

Our enforcement and compliance work are two sides of the same coin. We can significantly amplify the deterrent effect of a successful enforcement investigation through a compliance campaign, which helps to ensure that businesses understand the law better, are more likely to comply with it and are more likely to report illegal activity to us – a virtuous circle.

This year, we have followed up our casework with compliance messaging to sectors including estate agents, creative industries and light fittings suppliers.

Particularly notable has been our work with estate agents. Our 2015 investigation generated a new case and a second successful enforcement outcome. The extensive compliance work following this led to a further investigation which we carried out this year. In that investigation, we imposed fines on the companies and, in April 2018, we secured the disqualification of two company directors.

We also ran a new digital ‘stop cartels’ campaign, encouraging people to be ‘safe, not sorry’ and to ‘do the right thing’ by coming to us first with information that will help us hunt out illegal cartels.

This campaign reached 21.3 million people, generating over 45,000 visits to our campaigns page and led to 108 tip offs to our cartels hotline – a significant increase on the number we would expect to see monthly.

Competition spurs higher efficiency and productivity, promoting long-term economic growth

Operating an effective and efficient merger regime

We continue to review cases across a wide range of sectors of the economy, stepping in where necessary to protect consumers and setting out well-reasoned decisions to provide those considering mergers in future with as much predictability as possible.

We sought to refine our approach further over the year, and make it even clearer for businesses thinking of merging. This consistency and clarity of our approach really matters for businesses and is important in making the UK an attractive place to invest, and to grow a business. You can read more about the improvements we made in the refining our approach section.

To manage the end-to-end process in the most efficient way, we continued to fast-track appropriate mergers to phase 2, as soon as possible. In previous years, we have done so with BT Group plc’s acquisition of EE Limited, the merger between Ladbrokes plc and certain businesses of Gala Coral Group Limited and a merger between two Manchester hospital trusts; in 2017/18, we fast-tracked Tesco PLC’s acquisition of Booker Group plc, allowing us to achieve a timely outcome whilst retaining procedural rigour.

Phase 2 merger outcomes

| Year | Cleared | Prohibited | Remedies | Cancelled/abandoned |

|---|---|---|---|---|

| 2014/15 | 2 | 0 | 1 | 1 |

| 2015/16 | 8 | 0 | 1 | 3 |

| 2016/17 | 1 | 1 | 5 | 1 |

| 2017/18 | 4 | 0 | 2 | 0 |

Case study: Tesco/Booker

In May, we opened our phase 1 investigation into Tesco’s proposed acquisition of wholesale supplier Booker.

This is a huge merger for the high street, affecting millions of shoppers. Tesco, the UK’s biggest supermarket chain by market share, operates more than 3,000 stores across the UK. Booker supplies services to over 5,000 independent grocery retailers operating under the Premier, Londis, Budgens or Family Shopper brands – also known as ‘symbol’ stores.

We heard concerns that, after the merger, Booker might reduce the wholesale services or terms it offers the stores it currently supplied, in order to drive customers to their local Tesco. In addition, as many Tesco shops and ‘symbol’ stores are close to each other, we initially found a risk that shoppers could face worse terms when buying groceries in over 350 local areas.

The companies requested a ‘fast track’ referral to phase 2, and on the basis of what we had already found during phase 1, we agreed that this was the most efficient way to get to the heart of what this merger could mean for customers.

Our in-depth investigation found that Tesco, as a retailer, and Booker, as a wholesaler, do not compete head-to-head in most of their activities. Although Booker supplies stores that do compete with Tesco, those stores independently decide what to sell and for how much. A survey of hundreds of retailers also showed that most shops use more than 1 wholesaler and frequently switch. And nearly half of the ‘symbol’ retailers we surveyed said that if Booker raised its prices, they might stop buying from Booker altogether.

Our final decision was to clear the merger. UK retail and wholesale markets are highly competitive and it is vital that millions of shoppers continue to enjoy enough choice to secure the best deal for them. Having examined the evidence in depth, we were satisfied that this will remain the case following this particular merger.

We also investigate mergers which are referred to us by the UK government on public interest grounds; on either national security, financial stability or media plurality. This year, we carried out an investigation into 21st Century Fox’s proposed acquisition of the shares in Sky it doesn’t already own.

Case study: 21st century fox/sky

Following a referral from the Secretary of State for Digital, Culture, Media and Sport in September, we investigated how 21st Century Fox’s acquisition of the shares in Sky it doesn’t already own would affect media plurality and broadcasting standards in the UK.

Media plurality goes to the heart of our democratic process. It means that a diversity of independent viewpoints is available to and consumed by members of the public, and no media owner has too much influence over the political agenda. Broadcasting standards apply to programmes broadcast on TV and radio in the UK. They include reporting the news with accuracy and impartiality, and ensuring that harmful or offensive material is not broadcast on radio and TV.

We reviewed around 100,000 submissions from across the inquiry phases, including Ofcom’s phase 1 investigation and from the Secretary of State, and received around 12,600 submissions directly. We held a roundtable on media plurality with academic and industry experts, and carried out hearings with over 40 different people and organisations, including news organisations, campaign groups and politicians. We also engaged with over 75 third parties through requests for information and evidence gathering.

With such scrutiny, we had to make sure that we carried out our work as efficiently as possible whilst retaining our high procedural standards. We are always transparent in how we carry out our work. In this case, given the unusually high level of interest and engagement, we published the full transcripts of our hearings, rather than the summaries, and summaries of the hearings with the merging companies themselves, which we would not usually publish.

We sent our final report to the Secretary of State for Digital, Culture, Media and Sport on 1 May. On 5 June, he accepted our recommendation that the anticipated acquisition was not in the public interest due to media plurality concerns, and accepted the CMA’s recommendation that the most effective and proportionate remedy is for Sky News to be divested to a suitable third party.

To ensure that we target our resources where they are most needed, we have raised the figure at which markets are generally considered to be sufficiently important to warrant a merger reference from above £10 million to above £15 million per annum. We expect this change to reduce the number of mergers that are subject to investigation, including those subject to initial phase 1 examination.

The overall number of mergers we review remains low compared to the previous regime; businesses’ self-assessments of how their intended merger may affect competition are increasingly accurate, which has decreased both the number of mergers notified to us and the number we call in. This is in part due to the consistency and clarity of our process; it is also in part due to our willingness to accept informal briefings from companies considering a merger, and consider whether it is likely to be called in or raise competition concerns.

Our approach is as light-touch as possible, minimising burdens on merging companies as far as we can whilst still ensuring that we protect consumers, businesses and the UK economy from any potentially harmful effects. In total, we reviewed less than 10% of UK mergers and acquisitions activity (by transaction value) in 2017/18 with the vast majority able to proceed with limited or no interaction with the CMA, as they do not harm competition.

Over the year, we cleared 91% of less complex phase 1 mergers[footnote 1] within 35 working days, well ahead of our Annual Plan commitment, and completed 83% of our phase 2 investigations without an extension to the statutory deadline.[footnote 2]

Refining our approach

Over the CMA’s first 4 years, we have consistently sought ways to refine how we investigate mergers. This helps to ensure that we have a process which is clear and consistent, which minimises the burden on businesses and on the CMA, whilst preserving analytical rigour and, most importantly, protecting consumers, businesses and the UK economy from any harmful effects of potential mergers.

Alongside raising the thresholds to reduce the number of mergers we investigate in depth in smaller markets, we made 3 further improvements this year.

The first change is the publication of additional guidance on the CMA’s use of Initial Enforcement Orders. These are orders that we may put into place during our investigations to prevent merging companies from coming together in a way that could affect the outcome or interfere with our ability to introduce any necessary measures to protect consumers.

Secondly, we made several improvements to the merger notice form to reduce the overall amount of information that businesses need to provide, and we improved guidance on our merger intelligence function.

Taken together, these improvements further reduce the burdens on companies and their advisers, help them to better understand how we work and help them cooperate better with us in the course of our investigations.

| Merger performance | 2015/16 | 2016/17 | 2017/18 |

|---|---|---|---|

| Average number of working days across all phase 1 cases | 34 | 34 | 34 |

| Percent of less complex merger cases cleared within 35 working days | 74% | 81% | 91% |

| Percent of phase 1 investigations completed in 40 working days | 100% | 100% | 100% |

Phase 1 merger outcomes

| 2014/15 | 2015/16 | 2016/17 | 2017/18 | |

|---|---|---|---|---|

| Referred | 6 | 11 | 5 | 9 |

| Undertakings in lieu accepted | 3 | 9 | 9 | 12 |

| De minimis | 7 | 4 | 3 | 4 |

| Unconditional clearance | 56 | 36 | 39 | 37 |

Phase 2 investigations are time-consuming and costly – both for the businesses involved and the CMA – so we only want to carry them out where we find a competition problem arising from a merger that the companies cannot or will not resolve through offering acceptable solutions, or undertakings, at phase 1.

We continued to make good use of this power to accept undertakings in lieu of a phase 2 referral, saving money and time for firms and taxpayers by allowing our concerns to be addressed proportionately and promptly in 12 separate cases; the highest since the Enterprise Act 2002 came into force.

Case study: john wood group/amec foster wheeler

In June, we began investigating the merger of these two companies which provide engineering services to the offshore oil and gas sector in the UK Continental Shelf.

After we found that competition concerns could arise in the supply of engineering and construction services and operation and maintenance services, the companies offered to sell Amec Foster Wheeler’s businesses in these areas.

In this case, to carry out our investigation and get the right result as quickly and efficiently as possible, we worked constructively with the companies on a ‘twin-track’ approach, engaging with them on shaping solutions that might address our concerns, if any were found, whilst still investigating whether such concerns arose. We ensured separate decision-making for the investigation and for the potential remedies, to avoid pre-judging the outcome of the investigation.

This enabled us to promptly reach a final view on the proposed remedy after competition concerns were identified, helping to reduce uncertainty about the potential impact of the merger for customers within this industry.

Qualifying mergers which created a realistic prospect of a substantial lessening of competition (SLC) at the end of phase 1 (SLC decisions in 2017/18)

| Name | Outcome | SLC date | Phase 2 decision date |

|---|---|---|---|

| Cygnet/Cambian | Referred to Phase 2 and cleared with remedies | 21.4.17 | 15.12.17 |

| Cardtronics / DirectCash Payments | Referred to Phase 2 and cleared | 3.5.17 | 22.9.17 |

| Euro Car Parts / Andrew Page | Referred to Phase 2 and cleared with remedies | 10.5.17 | 12.1.18 |

| Capita / Vodafone | SLC finding: merger was cancelled after the parties abandoned the transaction | 10.5.17 | n/a |

| Just Eat / Hungryhouse | Referred to Phase 2 and cleared | 10.5.17 | 16.11.17 |

| Solera / Autodata | Accepted undertakings in lieu after Phase 1 decision | 17.5.17 | n/a |

| David Lloyd Clubs / Virgin Active Gyms | Accepted undertakings in lieu after Phase 1 decision | 19.5.17 | n/a |

| Heineken / Punch Taverns | Accepted undertakings in lieu after Phase 1 decision | 13.6.17 | n/a |

| Electro Rent / Microlease | Referred to Phase 2 and investigation ongoing | 14.6.17 | 30.5.18 |

| 21st Century Fox / Sky | Final report sent to the Secretary of State, DCMS on 1 Mary 2018 | 20.6.17 - advice to Secretary of State | 1.5.18 |

| FirstGroup / South Western rail franchise | Accepted undertakings in lieu after Phase 1 decision | 11.7.17 | n/a |

| Tesco / Booker | Referred to Phase 2 and cleared | 12.7.17 | 20.12.17 |

| Origin UK / Bunn Fertiliser | Accepted undertakings in lieu after Phase 1 decision | 14.7.17 | n/a |

| John Wood Group / Amec Foster Wheeler | Accepted undertakings in lieu after Phase 1 decision | 2.8.17 | n/a |

| Vision Express / Tesco Opticians | Accepted undertakings in lieu after Phase 1 decision | 28.9.17 | n/a |

| Refresco / Cott | Accepted undertakings in lieu after Phase 1 decision | 3.1.18 | n/a |

| European Metal Recycling / Metal & Waste Recycling | Referred to Phase 2 and currently ongoing | 24.1.18 | n/a |

| Mole Valley Farmers / Countrywide Farmers | SLC finding: merger reference was cancelled after the parties abandoned the transaction | 21.2.18 | n/a |

Competition ensures that firms that put their customers first can succeed and grow

Making markets work better

We aim to secure lasting change in sectors that matter to consumers, businesses and the UK economy. Our work takes us into markets at the heart of people’s lives and at the centre of the UK’s rapidly changing economy.

We have powers to bring about change to make markets work in people’s favour even where there has been no formal breach of competition or consumer protection law.

We often work in large and important markets, seeking to achieve positive changes for consumers, businesses and the economy. This year, we completed market studies in two markets that affect many people either in their daily lives or when they are at their most vulnerable: digital comparison tools and care homes for the elderly.

Case study: digital comparison tools (DCTs) market study

‘DCTs’ range from price comparison websites to smartphone apps. They help people to compare products and services on quality as well as price, and to switch between suppliers.

DCTs have become an important way for many people to buy services such as insurance and utilities. For example, our survey showed that 84% of people looking for car insurance had used a comparison site, 67% looking for energy had done so, and 52% for broadband.

Our year-long examination found that these tools offer a range of benefits, including helping people shop around by making it easier to compare prices and forcing businesses to up their game. This is particularly helpful in sectors such as energy where people are less inclined to shop around.

We found that most consumers have a good experience of such tools – 60% of recent users were very or fairly satisfied – but we also heard concerns, especially on DCTs’ transparency, accessibility and clarity about their use of personal information. Although some vulnerable consumers cannot access DCTs, we heard that those who are able to do so can find them helpful. However, some DCTs appear not to be doing all they could or should to make their sites user-friendly for some vulnerable people and some may not be meeting the requirements of relevant equality law.

We laid down clear ground rules for how sites should behave, as well as being clear on how regulators can help DCTs to work better for consumers.

Our CARE principles demand that DCTs are Clear, Accurate, Responsible and Easy to use. They need to be upfront about how they make money and how they are filtering the search results, and be clear on how they protect personal information and how people can control its use.

We continue to work with the sector, regulators, and other bodies to ensure our recommendations are understood and taken on board.

Joining up our markets and enforcement toolkit, we launched a competition law investigation into how 1 site has set up its contracts with insurers, which we suspect may result in higher home insurance prices, and a consumer protection investigation into online hotel booking sites to find out whether their customers really are able to choose the best hotel deal for them.

We launched two new markets projects this year: a market study into domestic heat networks and a market investigation into the investment consultancy and fiduciary management sector, following a referral from the Financial Conduct Authority.

We are running this complex market investigation under our improved streamlined process, which should allow us to complete the work more quickly but without reducing its effectiveness. Under the improved process, we can have discussion with parties from the start about potential remedies alongside discussions about possible competition issues, we are reducing the number of fixed formal consultation points, and we are strengthening links between market studies and market investigations by ensuring a smoother transition between them.

2017/18 was a big year for our market remedies from our market investigations into energy and retail banking, and our market study into legal services in England and Wales, taking effect. Taken together, these markets have a combined market turnover of over £80 billion and affect millions of households and businesses across the UK. They are also big contributors to the UK economy.

Following our energy market investigation, 4 million households on pre-payment meters are benefitting from a price cap, which we imposed with effect from April 2017. This is helping to keep costs down for some of the most vulnerable households, reducing their bills by an average of £75 per customer per year, or around £300 million in total.

We found that around 45% of microbusinesses were stuck on their supplier’s expensive default tariffs. It was difficult for these customers to shop around as energy price information was not easily available. In some cases, microbusinesses also found themselves being ‘rolled over’ onto these contracts, with limited opportunities to switch, when their original deal ended. We ordered suppliers, from June 2017, to stop locking small firms into automatic rollover contracts and to make it easier for microbusinesses to compare the cheapest energy prices, by making information clearly available on their website, or via a link to a price comparison website.

Case study: care homes market study

Following an extensive review of whether the residential care homes sector is working well for older people and their families, we called for urgent reform so that people get the support they need in their old age, and took action against some homes.

Care homes provide a vital service to some of the most vulnerable people in our society. It is essential that residents and their families can make informed choices, understand how these services will be paid for, and be confident they will be fairly treated and able to complain effectively if they have concerns.

We found that fee rates paid by local authorities were below the level needed to sustain the industry. We also found that providers are not investing in new care homes intended for local authority-funded residents because of uncertainty about future social care policy and levels of future funding, including whether local authority fee rates will cover the full costs of care. Most care homes serve a mix of local authority-funded and self-funded residents, where there are substantial differences in the fee rates they pay; we estimated the fee differential for larger care homes at 41 per cent. We do not think this is sustainable.

We identified an immediate shortfall in the funding shortfall of care homes of around £1 billion a year across the UK. This sum is the minimum needed to support the existing care homes most at risk of closure just to maintain current service provision. Beyond the challenges of continuing to meet existing needs, the sector must also invest substantially to meet growing care needs for an ageing population.