Practice guide 14: charities

Updated 19 May 2025

Applies to England and Wales

Please note that HM Land Registry’s practice guides are aimed primarily at solicitors and other conveyancers. They often deal with complex matters and use legal terms.

To view the update history for this practice guide, please see practice guide 14: update history.

1. Introduction

The Charities Act 2011 defines:

- ‘charity’ as:

‘….an institution which—

(a) is established for charitable purposes only, and

(b) falls to be subject to the control of the High Court in the exercise of its jurisdiction with respect to charities.’ (section 1 of the Charities Act 2011. The definition also applies in the Land Registration Rules 2003 – see rule 217)

- ‘charitable purpose’ as:

‘….a purpose which—

(a) falls within section 3(1) of the Charities Act 2011 which lists 13 descriptions of purposes, and

(b) is for the public benefit’ section 2 of the Charities Act 2011

Companies registered in England and Wales under the Companies Acts are, therefore, subject to the Charities Act 2011 if their purposes are exclusively charitable under English law.

-

‘Trusts’, in relation to a charity, means the provisions establishing it as a charity and regulating its purposes and administration, whether those provisions take effect by way of trust or not (section 353(1) of the Charities Act 2011). For example, they include the memorandum and articles of a company charity.

-

‘Trust corporation’ means the Public Trustee (who is not allowed to accept trusts for charitable purposes), a corporation appointed by the court in any particular case to be a trustee and a corporation entitled by rules made under section 4(3) of the Public Trustee Act 1906 to act as custodian trustee (section 205(1)(xxix) of the Law of Property Act 1925; section 17(1)(xxx) of the Settled Land Act 1925. See also section 3 of the Law of Property (Amendment) Act 1926). The corporations so entitled are listed in rule 30 of the Public Trustee Rules 1912 (SR & O 1912/348 (as amended)).

-

‘The Charity Commission’ means the Charity Commission for England and Wales. The Charity Commission is a body corporate incorporated pursuant to section 13 of the Charities Act 2011.

The 2011 Act defines ‘charity trustees’ as:

‘…. the persons having the general control and management of the administration of a charity.’(section 177 of the Charities Act 2011. The definition also applies in the Land Registration Rules 2003 – see rule 217)

In the case of a charitable company the charity trustees will normally be the directors of the company. Many of the duties imposed by the Charities Act 2011 in connection with land owned by or in trust for a charity fall on the charity trustees as so defined. This is the case whether or not the charity trustees are themselves the registered proprietors of the land.

For guidance on charitable incorporated organisations, which are not covered by this guide, see practice guide 14A: charitable incorporated organisations.

1.1 The Charities Acts

There have been numerous statutes and regulations regulating charities’ activities. In modern times, significant changes were introduced by the Charities Act 1960 and the Charities Act 1992, which was followed by a consolidation Act in 1993. Further important developments were introduced in the Charities Act 2006, which was again followed by a consolidation in the Charities Act 2011 which is currently the main Act governing charity law. Most recently, the Charities Act 2022 amended existing legislation, particularly the Charities Act 2011. The amendments to the Charities Act 2011 made by the Charities Act 2022 Act are being implemented in stages.

Some of the references to provisions of the Charities Act 1993 in the Land Registration Rules 2003 (LRR 2003) have been updated to the relevant provisions in the Charities Act 2011 (as amended by sections 18 and 23 of the Charities Act 2022), by virtue of the power in the Charities Act 2022 to make consequential amendments. However, rules 176 to 179 and 217 of (and standard form F restriction in Schedule 4 to) the LRR 2003 still contain references to the Charities Act 1993 despite the 1993 Act having been repealed by the Charities Act 2011. The effect of paragraph 3(1) of Schedule 8 to the Charities Act 2011 is that reference to a provision of the Charities Act 1993 is to be read as being or including a reference to the corresponding provision of the Charities Act 2011.

1.2 The requirements of the Charities Act 2011

In addition to the requirements of the Land Registration Act 2002 and the Land Registration Rules 2003, you need to take into account the requirements of the Charities Act 2011 (as amended by the Charities Act 2022) when making applications to register dispositions in favour of or by charities.

The Charities Act 2022 (Commencement No. 3, Consequential and Saving and Transitional Provisions) Regulations 2024 (the Commencement Regulations 2024) brought into force part of section 18 and section 23 of the Charities Act 2022 and amended rules 176 and 180 of (and standard form E restriction in Schedule 4 to) the Land Registration Rules 2003.

For deeds made on or after 7 March 2024, the prescribed statements should set out the corresponding relevant provisions of the Charities Act 2011 as amended by the Charities Act 2022. However, HM Land Registry will still accept statements and certificates that refer to the provisions of the Charities Act 2011 as they were before 7 March 2024, provided that the disposition is pursuant to a contract for the sale or for a lease or other disposition of the land entered into before 7 March 2024 and the deed itself states, or the applicant certifies, that that is the case.

Most charities are subject to the jurisdiction of the Charity Commission. These are referred to in this guide as ‘non-exempt’ charities. This is to distinguish them from exempt charities – see Exempt charities and bodies to which the 2011 Act does not apply. The trustees of non-exempt charities are generally allowed to sell, mortgage or otherwise dispose of the charity’s land without an order of the court or of the Charity Commission if they follow the correct procedures. These procedures are not binding on exempt charities (sections 117(4)(a) and 124(10) of the Charities Act 2011), and do not apply to certain specific transactions (sections 117(3) and 124(9) of the Charities Act 2011 as amended by the Charities Act 2022).

All dispositions of an estate in favour of a charity must contain a statement as to whether the charity is exempt or non-exempt and, if the latter, as to the restrictions on dispositions imposed by the Charities Act 2011 as amended by the Charities Act 2022. These statements are described in Statements required in a disposition to a charity.

All dispositions of an estate by a charity must contain an appropriate statement, as described in Dispositions by charities.

The statements enable the registrar:

-

when registering a non-exempt charity or its trustees as proprietors of land, to enter an appropriate restriction, and

-

when registering a disposal by a non-exempt charity, to be satisfied that the restriction has been complied with

A transfer of a registered or unregistered estate on or in consequence of the appointment of a new charity trustee is not a ‘disposition’ for the purposes of sections 117-121 of the Charities Act 2011. Therefore, none of the statements described in Statements required in a disposition to a charity and Dispositions by charities are required to be included in a deed that appoints, or by virtue of section 334 of the Charities Act 2011 has the effect as if it appointed, a new trustee or is made in consequence of the appointment of a new charity trustee.

However, a transfer of an unregistered freehold estate or an existing leasehold estate with more than seven years to run, which is made on or in consequence of the appointment of a new charity trustee, will trigger compulsory first registration under section 4(1)(aa) of the Land Registration Act 2002 (as introduced by Land Registration Act 2002 (Amendment) Order 2008) and, in the case of a non-exempt charity, the application for first registration must be accompanied by an application to enter the appropriate restriction (rule 176(2)(a) of the Land Registration Rules 2003 (as amended)). See First registration of a non-exempt charity

The form of restriction is set out in Registration of charities as proprietors. Old forms of register entries explains how the registrar will treat older forms of restrictions entered in the register prior to 13 October 2003 (the date of commencement of the Land Registration Act 2002).

1.3 Universities and College Estates Act 1925

The Universities and College Estates Act 1925 (UCEA 1925) applies to the Universities, colleges, and halls of Oxford Cambridge and Durham, and to Winchester and Eton Colleges.

Section 24 of the Charities Act 2022 repealed a large number of provisions in UCEA 1925, replacing a number of specific powers in relation to dealing with land, and removing requirements to obtain the consent of the Secretary of State for certain disposals.

As a result of this change, sections 18(2)(b) and 18(3)(b) of the Charities Act 2022 have removed references to dispositions for which the Secretary of State’s consent is required under UCEA 1925 from sections 117(3) and 124(9) of the 2011 Act.

Section 24 (and so section 18(2)(b) and (3)(b)) of the 2022 Act commenced on 19 May 2025, after section 23 and the rest of section 18 of the 2022 Act. A transitional provision (regulation 10 of the Commencement Regulations 2024) provided that the references to sections 117(3)(b) continue to be included in section 122(2) of the 2011 Act and rule 180 of the Land Registration Rules 2003 until 19 May 2025.

This means that the statement required by section 122(2) of the Charities Act 2011 and rule 180 of the Land Registration Rules 2003 in an instrument made before 19 May 2025 is still required to refer to section 117(3)(b) of the Charities Act 2011 where appropriate.

1.4 Exempt charities and bodies to which the Charities Act 2011 does not apply

Some charities, which are covered by the Charities Act 2011 for certain purposes, are largely exempted from the jurisdiction of the Charity Commission although they remain subject to that of the High Court. These are termed ‘exempt charities’. Some exempt charities are subject to the Universities and Colleges Estate Acts 1925 and 1964. The Charities Act 2006 (Changes in Exempt Charities) Order 2009 removed exempt charity status from the colleges and halls in the universities of Cambridge and Durham and from the colleges in the University of Oxford.

The Charities Act 2006 (Changes in Exempt Charities) Order 2010 removed exempt charity status from universities and university colleges in Wales, higher education corporations in Wales, and the Board and Governors of the Museum of London.

An exempt charity is one of the following.

-

A body set out in Schedule 3 of the Charities Act 2011

-

A charity which is an exempt charity by virtue of any other enactment

The expression ‘charity’ in the Charities Act 2011 does not generally apply to (section 10 of the Charities Act 2011):

-

any ecclesiastical corporation in respect of its corporate property, except a corporation aggregate having some purposes which are not ecclesiastical in respect of its corporate property held for those purposes

-

any Diocesan Board of Finance, or any subsidiary of such a Board, in respect of the diocesan glebe land of the diocese

-

any trust of consecrated land for the purposes for which it was consecrated

You can find more information on Church of England land in Church of England property, although this guide does not attempt to cover all aspects of this subject.

With a few exceptions, the provisions of the Charities Act 2011 apply only to charities established in England and Wales (section 356 of the Charities Act 2011).

2. Making applications

For dispositions of registered estates, there is no restriction on who may apply for registration of the disposition.

An application for first registration should be made by the charity or charity trustees in whose name(s) the estate is to be registered. If the estate is being registered in the name of a custodian trustee, the application may also be made by the charity provided the estate is its corporate property. In the case of unregistered estates that become subject to a first legal mortgage, the mortgagee is also able to apply for first registration.

Form FR1 must be used if the application is for first registration of a freehold estate or for first registration of a leasehold estate where the freehold is not registered.

When registering a charity, the registrar is obliged by law to enter some restrictions. Other restrictions must be applied for using form RX1 as explained in the relevant sections of this guide.

Practice guide 1: first registrations and practice guide 19: notices, restrictions and the protection of third party interests in the register give further information on these subjects.

Original documents are normally required only if your application is a first registration. We will return the originals once the application has been completed.

If your application is not a first registration, then we will need only certified copies of deeds or documents you send to us with HM Land Registry applications. Once we have made a scanned copy of the documents you send to us, they will be destroyed. This applies to both originals and certified copies.

When uploading documents, you will be able to certify any scanned documents by confirming them to be a true copy of the original using the certification statements available.

3. Dispositions in favour of charities

3.1 Form of the disposition

Transfers of registered land in favour of charities must be in one of the forms in Schedule 1 to the Land Registration Rules 2003. Transfers of the whole of one or more titles should be made on form TR1, form TR2, form TR5 or form AS1. The numbers of the corresponding forms for transfers of part are form TP1, form TP2, form TR5 and form AS3.

There is no prescribed form for leases.

3.2 Statements required in a disposition to a charity

Any conveyance, transfer or lease in favour of a charity is required, by section 122(8) of the Charities Act 2011, to contain a statement relating to that charity. Any other disposition that will result in an estate being held by, or in trust for, a charity is also required to contain a similar statement. If the disposition is required to be registered by virtue of section 27 of the Land Registration Act 2002 or triggers the requirement for first registration under section 4 of the Land Registration Act 2002 the statements must be in the form prescribed by rule 179 of the Land Registration Rules 2003 (section 123 of the Charities Act 2011).

The effect of Schedule 8, paragraph 3(1) to the Charities Act 2011, is that rule 179 should be read as if the statements are:

- Exempt charity:

‘The land transferred (or as the case may be) will, as a result of this transfer (or as the case may be), be held by (or in trust for) (charity), an exempt charity.’

- Non-exempt charity:

‘The land transferred (or as the case may be) will, as a result of this transfer (or as the case may be), be held by (or in trust for) (charity), a non-exempt charity, and the restrictions on disposition imposed by sections 117-121 of the Charities Act 2011 will apply to the land (subject to section 117(3) of that Act).’

Where an exempt charity holds land on trust for a non-exempt charity, the second statement is required as the restrictions on disposition imposed by sections 117-121 of the Charities Act 2011 (as amended by the Charities Act 2022) apply.

The above statements are not required in a charge in favour of a charity, a disposition of an advowson or release of a charity rentcharge (section 122(9) of the Charities Act 2011).

3.3 A charity that is a company

If the disposition is in favour of a charity that is also a company registered in England and Wales under the Companies Acts, the application must state the company’s registered number.

3.4 Charity trustees incorporated under Part 12 of the Charities Act 2011 (or Part VII of the Charities Act 1993)

Where the charity trustees are incorporated as a body corporate under Part 12 of the Charities Act 2011 (or Part VII of the Charities Act 1993) then any disposition in favour of the charity must describe the trustees as:

‘a body corporate under Part 12 of the Charities Act 2011 (rule 177 of the Land Registration Rules 2003)’ (or ‘a body corporate under Part VII of the Charities Act 1993’ if the charity was incorporated under that Act).

The application to register the disposition should be accompanied by a certified copy of the certificate of incorporation granted by the Charity Commission under section 251 of the Charities Act 2011 or section 50 of the Charities Act 1993.

3.5 The Official Custodian for Charities

To apply, you should include a vesting order transaction in your application. Where land is vested in the Official Custodian for Charities you must also upload with the application either:

-

a certified copy of an order of the court made under section 90(1) of the Charities Act 2011 (or section 21(1) of the Charities Act 1993)

-

a certified copy of an order of the Charity Commission made under sections 69(1)(c) or 76(3) of the Charities Act 2011 (or sections 16 or 18 of the Charities Act 1993) (rule 178(1) of the Land Registration Rules 2003). The Charity Commission does not issue paper sealed orders; it normally sends a PDF document by email. HM Land Registry will accept a copy of the Charity Commission’s email certified as being a true copy with a copy of the PDF order set out in the email or attached to it.

Since 28 April 2017, the Charity Commission normally makes a single monthly bulk order under section 69 or 90. Each order identifies a number of different charities whose property has vested in the Official Custodian. Where the land is registered the order will include the title numbers for the properties concerned; where a property is unregistered a full description is included. Any application to register the vesting in the Official Custodian must be accompanied by a certified copy of the order. The Charity Commission will make single-charity orders under sections 69 and 90 in urgent cases. Orders made under section 76 where the Charity Commission intervenes in a charity will also relate to a single charity only.

The address of the Official Custodian for Charities will be entered as the address for service if the land is vested in them by virtue of an order under section 76(3) of the Charities Act 2011 (or section 18 of the Charities Act 1993). Otherwise, you should supply the address of the charity trustees or, in the case of a charity that is a corporation, the address of the charity for entry in the register (rule 178(3) of the Land Registration Rules 2003).

3.6 Exempt charities – production of trust document

Where the disposition is in favour of an exempt charity holding on charitable, ecclesiastical or public trusts, a certified copy of the document creating the charitable trust should be uploaded (rule 182(1) of the Land Registration Rules 2003).

We will need only certified copies of deeds or documents you send to us with HM Land Registry applications. Once we have made a scanned copy of the documents you send to us, they will be destroyed. This applies to both originals and certified copies.

When uploading documents, you will be able to certify any scanned documents by confirming them to be a true copy of the original using the certification statements available.

3.7 A non-exempt charity incorporated otherwise than under the Companies Acts or the Charities Act 1993 or the Charities Act 2011

In this case, you should lodge a copy of the charity’s charter, statute, rules, memorandum and articles or other document constituting the corporation. Alternatively, a certificate may be given by the applicant’s conveyancer in Form 8 that there are no limitations on the charity’s power to hold or deal with land (rule 183 of the Land Registration Rules 2003).

We will need only certified copies of deeds or documents you send to us with HM Land Registry applications. Once we have made a scanned copy of the documents you send to us, they will be destroyed. This applies to both originals and certified copies.

When uploading documents, you will be able to certify any scanned documents by confirming them to be a true copy of the original using the certification statements available.

3.8 Registered social landlords and unregistered housing associations that are charities

In most cases, the application must contain or be accompanied by an appropriate certificate (See rule 183A of the Land Registration Rules 2003).

3.9 Applications for restrictions

In some circumstances, application should be made either in the disposition or on form RX1 for an appropriate restriction to be entered in the register. This is dealt with in Registration of charities as proprietors.

3.10 Other points to remember

-

Unlike private trusts, there is no limit to the number of trustees who may hold an estate vested in them under a charitable trust (see section 34(3) of the Trustee Act 1925). When making an application to register more than four registered proprietors under section 34(3)(a) of the Trustee Act 1925, our digital services will only allow up to four transferees to be selected. You should upload written confirmation of the name, representation and address for service for additional registered trustees.

-

The addresses for service stated in the disposition in favour of the charity or in the application form will be entered in the register and will then be used for the service of any notices (rules 197 and 198 of the Land Registration Rules 2003). You should, therefore, take care to use an address, or addresses, where such notices will be received by the charity.

-

If the transfer contains covenants or declarations by the transferee(s), or an application for a restriction, it should be executed by the transferee(s).

4. Registration of charities as proprietors

4.1 Background

Registration of a proprietor vests the legal estate in that registered proprietor (section 58 of the Land Registration Act 2002). Generally, third parties acting in good faith may assume that a registered proprietor has full power to enter into any disposition authorised by the Land Registration Act 2002, unless the register contains a restriction or other entry to the contrary.

In the case of non-exempt charities, section 123(2) of the Charities Act 2011 imposes an obligation on the registrar to enter a restriction that reflects the powers of the proprietor. We will be able to decide whether such a restriction is necessary from the statement made in the disposition. If the estate is vested in the Official Custodian for Charities, an additional restriction may be necessary.

For exempt charities, the registrar is not obliged to enter a restriction. If a restriction is required because of limitations on the powers of the charity, you should apply for an appropriate restriction to be entered in the register. See practice guide 19: restrictions, notices and the protection of third-party interests for further information on how to apply.

Further details about restrictions are given later in this section.

4.2 Entry of proprietors

If a charity is a corporation, we will enter its name and address in the register in the normal way, with the company registration number if applicable.

Where charity trustees are individuals we will enter them as proprietors in the usual way, except that we will enter an appropriate description after the names and addresses of the proprietors. The following example shows this.

‘(date) Proprietor: Fred Lawson of 27 Cromwell Way, Kerwick, Hertland, AB1 2XY, Angela Beech of 13 Pym Road, Kerwick, Hertland, CD1 2XY, and Philomena Tomlin of 1 Hampden Green, Kerwick, Hertland, EF3 3XY, the trustees of the charity known as the Hertland Countryside Trust’.

Where the charity trustees have been incorporated under Part 12 of the Charities Act 2011 (or Part VII of the Charities Act 1993) the registration will be completed as follows.

‘(date) Proprietor: The Trustees of the Hertland Countryside Trust of 101 Hereward Street, Fenbury, Hertland, GH3 4YX, incorporated under Part 12 of the Charities Act 2011 (or Part VII of the Charities Act 1993)’.

Charity trustees incorporated under the Charitable Trustees Incorporation Act 1872 are now treated as having been incorporated under Part 12 of the Charities Act 2011 (section 17(2)(b) of the Interpretation Act 1978).

Where the land has vested in or transferred to the Official Custodian for Charities by virtue of an order under section 69 or section 90 of the Charities Act 2011 (or section 16 or section 21(1) of the Charities Act 1993), then the registration will be completed as follows.

‘(date) Proprietor: The Official Custodian for Charities on behalf of the Hertland Countryside Trust of 101 Hereward Street, Fenbury, Hertland, GH3 4YX’.

Similar entries will be made where a charity is registered as proprietor of a charge.

As mentioned in The Official Custodian for Charities, where the land is vested in the Official Custodian for Charities by virtue of an order under section 76 of the Charities Act 2011 (or section 18 of the Charities Act 1993) the address for service entered in the register will be that of the Official Custodian for Charities.

4.3 Restrictions for non-exempt charities

The registrar is under an obligation to enter an appropriate restriction in the register when registering a disposition in favour of a non-exempt charity (section 123 of the Charities Act 2011). The statement in the disposition, as mentioned in Statements required in a disposition to a charity, will show if the charity is non-exempt. The appropriate restriction is in Form E as set out in Schedule 4 to the Land Registration Rules 2003 (rule 176 of the Land Registration Rules 2003). The wording of the Form E restriction is as follows:

‘No disposition by the proprietor of the registered estate to which sections 117 to 121 of the Charities Act 2011 apply, or section 124 of that Act applies, is to be registered unless the instrument contains a statement complying with section 122(2A) or 125(1A) of that Act as appropriate.’

For further information about the effect of restrictions and the dispositions they may cover see section 3.1 of practice guide 19: notices, restrictions and the protection of third-party interests.

4.3.1 The Official Custodian for Charities

In addition to the above restriction, when the Official Custodian for Charities is being registered as proprietor as a result of a vesting order made by the Charity Commission under section 76 of the Charities Act 2011 (or section 18 of the Charities Act 1993) (see also The Official Custodian for Charities) a further restriction is required. An application, using form RX1, must be made for entry of this restriction which will be in Form F (rule 178 of the Land Registration Rules 2003). The effect of Schedule 8, paragraph 3(1), to the Charities Act 2011 is that Form F should be read as:

‘No disposition executed by the trustees of [name of charity] in the name and on behalf of the proprietor shall be registered unless the transaction is authorised by an order of the court or of the Charity Commission, as required by section 91(4) of the Charities Act 2011.’

A former version of this restriction referred to the Charity Commissioners rather than the Charity Commission.

4.4 Restrictions for exempt charities

When you make an application to register an exempt charity as proprietor, you must provide a copy of the document creating the charitable trust (rule 182(1) of the Land Registration Rules 2003). If the trust document limits the power of the charity to deal with land, you should consider applying for a restriction to be entered in the register reflecting the limitations. The application should be made using form RX1.

4.5 Restrictions where trustees are registered as proprietors

Under section 6 of the Trusts of Land and Appointment of Trustees Act 1996 trustees of charity land have all the powers of disposition of an absolute owner. These powers are, however, limited by the provisions of that Act insofar as they apply to such trustees.

4.5.1 Provisions regarding the payment of capital money

Under section 6(6) of the Trusts of Land and Appointment of Trustees Act 1996 the powers conferred by that section must not be exercised in contravention of any other enactment. Section 27(2) of the Law of Property Act, as amended, provides that:

‘Notwithstanding anything to the contrary in the instrument (if any) creating a trust of land or any trust affecting the net proceeds of sale of the land if it is sold, the proceeds of sale or other capital money shall not be paid to or applied by the direction of fewer than two persons as trustees, except where the trustee is a trust corporation.’

When registering joint proprietors, whether or not one of them is a trust corporation, the registrar will enter a restriction in Form A to reflect this limitation as follows (section 44(1) of the Land Registration Act 2002 and rule 95(2)(a) of the Land Registration Rules 2003).

‘No disposition by a sole proprietor of the registered estate (except a trust corporation) under which capital money arises is to be registered unless authorised by an order of the court.’

In the case of a sole trustee or a custodian trustee, it is for you to apply for the restriction either in the transfer to the trustee or on form RX1 (rule 94(2) of the Land Registration Rules 2003). This will ensure compliance with section 27(2) of the Law of Property Act 1925.

4.5.2 Provisions regarding consents

Under section 8(2) of the Trusts of Land and Appointment of Trustees Act 1996, if the disposition creating the trust requires a consent to be obtained, the powers conferred by section 6 may not be exercised without that consent. For an exempt charity an appropriate restriction should be applied for as indicated in Restrictions for exempt charities. In the case of a non-exempt charity, this point will be covered by the certificate to be provided under the terms of the Form E restriction, so no further restriction is required.

4.6 First registration of a non-exempt charity

When a non-exempt charity applies for first registration voluntarily under the provisions of section 3 of the Land Registration Act 2002 or following an event that triggers compulsory registration under section 4, in circumstances where that event is not a disposition for the purposes of the Charities Act 2011 (such as the transfer of a qualifying estate on or in consequence of the appointment of a new trustee which triggers compulsory first registration under section 4(1)(aa) of the Land Registration Act 2002), there will not be a deed containing the statement referred to in Statements required in a disposition to a charity. In these circumstances, an application must be made, using form RX1, for the entry of a restriction in Form E (Rule 176(2), Land Registration Rules 2003).

4.7 Other restrictions

Where there are any other limitations on the powers of particular charities, you should consider applying on form RX1 for any appropriate restrictions to be entered in the register.

For how to apply see section 3.5 of practice guide 19: notices, restrictions and the protection of third-party interests.

5. Dispositions by charities

5.1 Exempt charities

A disposition by an exempt charity of a registered estate or of an unregistered estate that must be registered is required to contain a statement about the land and the charity (sections 122 and 125 of the Charities Act 2011 as amended by the Charities Act 2022). The statement to be included depends on whether or not the disposition is a mortgage.

Rule 180(1)(a) of the Land Registration Rules 2003 sets out the statement for dispositions other than mortgages, which is as follows.

‘The land transferred (or as the case may be) is held by [(proprietors) in trust for] (charity), an exempt charity.’

Rule 180(2)(a) of the Land Registration Rules 2003 sets out the statement for mortgages by exempt charities and is as follows.

‘The land charged is held by (or in trust for) (charity), an exempt charity.’

If you lodge a disposition by an exempt charity that does not contain one of these alternatives, it will be returned to you to have the appropriate statement included.

5.2 Non-exempt charities

5.2.1 Background

Non-exempt charities need to go through certain procedural steps before disposing of land (sections 117-121, 124 and 125 of the Charities Act 2011 (as amended by the Charities Act 2022)). This guide does not describe them in detail but they include, in most cases, obtaining and considering a written report on the proposed disposition of land from a “designated adviser”, as defined within section 119 of the Charities Act 2011 (as amended by the Charities Act 2022). In the case of a charge the charity trustees should normally obtain and consider written advice on the charge before entering into it. When they have taken the prescribed steps then, provided that they have power under the trusts of the charity to make the disposal and the transaction is not in favour of a connected person (a term not confined to the trustees – see sections 117(2), 118 and 350-352 of the Charities Act 2011 as amended by the Charities Act 2022), the charity trustees or the charity can dispose of the land without an order of the Charity Commission or the court. In all other cases (subject to section 117(3) of the Charities Act 2011) such an order is required (which will be made by the Charity Commission, usually under section 105 of the Charities Act 2011). The Charity Commission does not issue paper sealed orders; it normally sends a PDF document by email. HM Land Registry will accept a copy of the Charity Commission’s email certified as being a true copy with a copy of the PDF order set out in the email or attached to it.

As already explained in Restrictions for non-exempt charities, in the case of registered land the requirements of the Charities Act 2011 are reflected by entering the appropriate restriction, in Form E, in the register. The restriction provides that no disposition by the proprietor of the land is to be registered without a statement in the appropriate form.

Before 14 March 2012 the restriction was entered in the register as:

‘No disposition by the proprietor of the registered estate to which section 36 or section 38 of the Charities Act 1993 applies is to be registered unless the instrument contains a certificate complying with section 37(2) or section 39(2) of that Act as appropriate.’

A restriction in this form should now be read as if it referred to the provisions of the Charities Act 2011 (as amended by the Charities Act 2022).

Before 7 March 2024 the restriction was entered in the register as:

‘No disposition by the proprietor of the registered estate to which section 117–121 or section 124 of the Charities Act 2011 applies is to be registered unless the instrument contains a certificate complying with section 122(3) or section 125(2) of that Act as appropriate.’

Any provision contained in the trusts of a charity, or in any provision establishing or regulating a charity, that requires the consent of the Charity Commission or the Secretary of State (under the Education Acts 1944 or 1973) to any disposition has ceased to have effect (section 36 of the Charities Act 1992).

Provided any disposition by a non-exempt charity contains the relevant statement, as explained in the following sections, the requirements of the restriction in Form E will be met and the disposition can be registered.

5.2.2 The statement required in dispositions made on or after 7 March 2024

When a disposition is made by a non-exempt charity the deed must contain a statement about the estate, the charity and the nature of the transaction. This is required by section 122(2) of the Charities Act 2011 (as amended by the Charities Act 2022) for dispositions other than mortgages and by section 125(1) of the Charities Act 2011 (as amended by the Charities Act 2022) for mortgages.

The statement to be included in any disposition of land depends on whether or not the disposition is one falling within section 117(3)(a)-(d) of the Charities Act 2011 (as amended by the Charities Act 2022) or in the case of a mortgage whether it is one falling within section 124(9) of the Charities Act 2011 (as amended by the Charities Act 2022).

The categories of disposition covered by section 117(3)(a)-(d) of the Charities Act 2011 (as amended by the Charities Act 2022) are:

- any disposition for which general or special authority is expressly given by a statutory provision or a legally established scheme (section 117(3)(a))

- any disposition by a liquidator, provisional liquidator, receiver, mortgagee or an administrator (section 117(3)(aa))

- any disposition for which the authorisation or consent of the Secretary of State is required under the Universities and College Estates Act 1925 (section 117(3)(b)) - see Universities and College Estates Act 1925

- any disposition of an estate in land which is made to another charity otherwise than as:

(i) a disposition made with a view to achieving the best price, or

(ii) a disposition that is a social investment for the purposes of Part 14A (social investments) (section 117(3)(c))

- any disposition by way of lease to a beneficiary under the trusts of the charity which:

(i) is granted for less than the best rent that can reasonably be obtained, and

(ii) is intended to enable the demised premises to be occupied for the purposes of the charity (section 117(3)(d)).

Under section 124(9) of the Charities Act 2011 there is no restriction on a mortgage for which general or special authority is expressly given as mentioned in section 117(3)(a) or one granted by a liquidator, provisional liquidator, receiver, mortgagee or an administrator as mentioned in section 117(3)(aa).

Prior to the implementation of the Charities Act 2022 on 7 March 2024, section 117(3)(b) confirmed there was also no restriction on mortgages for which the authorisation or consent of the Secretary of State is required. However, section 117(3)(b) was repealed by the Charities Act 2022 on this date but that change did not come into force until 19 May 2025.

Rule 180 of the Land Registration Rules 2003 sets out the various forms of statement to be included in dispositions of registered estates and in dispositions of unregistered estates that will require the estate to be registered, depending on whether or not the disposition is a mortgage, and whether or not it is subject to the restrictions imposed by sections 117-121 or 124 of the Charities Act 2011 (as amended by the Charities Act 2022).

Rule 180 of the Land Registration Rules 2003 provides that the statement required by section 122(2) of the Charities Act 2011 must be in one of the following forms.

(a) For a disposition by a non-exempt charity, other than a mortgage either:

-

‘The land transferred (or as the case may be) is held by [(proprietors) in trust for] (charity), a non-exempt charity, but this transfer (or as the case may be) is one falling within paragraph ((a), (aa), [(b)], (c) or (d) as the case may be*) of section 117(3) of the Charities Act 2011’

-

‘The land transferred (or as the case may be) is held by [(proprietors) in trust for] (charity), a non-exempt charity, and this transfer (or as the case may be) is not one falling within paragraph (a), (aa), [(b)], (c) or (d) of section 117(3) of the Charities Act 2011, but the disposition has been sanctioned by an order of the court or of the Charity Commission ’ or

-

‘The land transferred (or as the case may be) is held by [(proprietors) in trust for] (charity), a non-exempt charity, and this transfer (or as the case may be) is not one falling within paragraph (a), (aa), [(b)], (c) or (d) of section 117(3) of the Charities Act 2011, but there is power under the trusts of the charity to effect the disposition and sections 117 to 121 of that Act have been complied with’.

*You need to select which paragraph or paragraphs affect and delete the ones that don’t.

The reference to paragraph (b) in the statements above is required (where appropriate) in instruments made before 19 May 2025, but not from that date.

(b) For a mortgage by a non-exempt charity, either:

-

‘The land charged is held by (or in trust for) (charity), a non-exempt charity, but this charge (or mortgage) is one falling within section 124(9) of the Charities Act 2011’

-

‘The land charged is held by (or in trust for) (charity), a non-exempt charity, and this charge (or mortgage) is not one falling within section 124(9) of the Charities Act 2011, but the charge (or mortgage) has been sanctioned by an order of the court or of the Charity Commission’ or

-

The land charged is held by (or in trust for) (charity), a non-exempt charity, and this charge (or mortgage) is not one falling within section 124(9) of the Charities Act 2011, but there is power under the trusts of the charity to grant the charge (or mortgage) and the requirements of section 124(2) of that Act have been complied with’.

In addition, a mortgage by a non-exempt charity that results in an application for first registration (section 4(1)(g) of the Land Registration Act 2002) should also contain the following statement required by section 126(2)(b) of the Charities Act 2011:

- ‘The restrictions on disposition imposed by sections 117 to 121 of the Charities Act 2011 also apply to the land (subject to section 117(3) of that Act)’.

5.2.3 The statement required in dispositions made before 7 March 2024

The effect of Schedule 8, paragraph 3(1), to the Charities Act 2011 is that rule 180 of the Land Registration Rules 2003 should be read as if the statements to be included in the deed are as follows. This will still apply to dispositions made before this date.

(a) For a disposition by a non-exempt charity, other than a mortgage, either:

-

‘The land transferred (or as the case may be) is held by [(proprietors) in trust for] (charity), a non-exempt charity, but this transfer (or as the case may be) is one falling within paragraph (a), (b), (c) or (d) (as the case may be*) of section 117(3) of the Charities Act 2011’ or,

-

‘The land transferred (or as the case may be) is held by [(proprietors) in trust for] (charity), a non-exempt charity, and this transfer (or as the case may be) is not one falling within paragraph (a), (b), (c) or (d) of section 117(3) of the Charities Act 2011, so that the restrictions on disposition imposed by sections 117-121 of that Act apply to the land’

(b) For a mortgage by a non-exempt charity, either:

-

‘The land charged is held by (or in trust for) (charity), a non-exempt charity, and this charge (or mortgage) is not one falling within section 124(9) of the Charities Act 2011, so that the restrictions imposed by section 124 of that Act apply’ or

-

‘The land charged is held by (or in trust for) (charity), a non-exempt charity, but this charge (or mortgage) is one falling within section 124(9) of the Charities Act 2011’.

In addition, a mortgage by a non-exempt charity that results in an application for first registration (section 4(1)(g) of the Land Registration Act 2002) should also contain the following statement:

- ‘The restrictions on disposition imposed by sections 117-121 of the Charities Act 2011 also apply to the land (subject to section 117(3) of that Act)’.

*You need to select which paragraph or paragraphs affect and delete the ones that don’t.

5.2.3.1 The certificate required in dispositions made prior to 7 March 2024

Where a non-exempt charity or the trustees of such a charity are registered as proprietors of an estate there should be an appropriate restriction in the register. This restriction will be in Form E, as explained in Restrictions for non-exempt charities, or in a form used before the Land Registration Act 2002 came into force (see Old forms of register entries). The effect of this restriction is to require that, in addition to the appropriate statement referred to in the previous section, the disposition must also contain a certificate where either:

- the restrictions on dispositions imposed by sections 117-121 of the Charities Act 2011 apply

- if it is a charge, the restriction imposed by section 124 of the Charities Act 2011 applies.

The certificate should normally follow the appropriate statement in the deed effecting the disposition. The Land Registration Act 2002 does not prescribe any particular wording, but the certificate must meet the requirements of sections 122((3) or 125(2) of the Charities Act 2011, as existing prior to 7 March 2024. The form of the certificate depends on whether the charity trustees have power under the trusts of the charity to make the disposition or charge and have complied with the relevant provisions of the Charities Act 2011, or whether the disposition or charge has been sanctioned by an order of the Court or the Charity Commission.

For a disposition (not being a charge) made other than pursuant to an order of the Court or the Charity Commission the certificate should be on the following lines.

‘(Description of charity trustees and capacity in which they certify) certify that they have power under its trusts to effect this disposition and that they have complied with the provisions of the said sections 117-121 so far as applicable to this disposition.’

For a charge made other than pursuant to an order of the Court or the Charity Commission the certificate required should be on the following lines.

‘(Description of charity trustees and capacity in which they certify) certify that they have power under its trusts to effect this charge and that they have obtained and considered such advice as is mentioned in section 124(2) of the said Act.’

If the charity does not have trusts in the ordinary sense, the words ‘under its trusts’ may be replaced by:

‘under the provisions establishing it as a charity and regulating its purposes and administration.’

Where the disposition has been sanctioned by an order of the Charity Commission or the Court, the certificate required should be on the following lines.

‘(Description of charity trustees and capacity in which they certify) certify that this disposition (or charge) has been sanctioned by an order of the Charity Commission (or the Court).’

Where a person acquires an interest in an estate for money or money’s worth under a disposition containing any of the certificates described above, it shall be conclusively presumed that the facts are as stated in the certificate (sections 122(4) and 125(3) of the Charities Act 2011).

5.2.3.2 Who gives the certificate?

The certificate must be given by the charity trustees (sections 122(3) and 125(2) of the Charities Act 2011, as existing prior to 7 March 2024) so they will need to join in and execute the disposition or charge in order to give the certificate. Section 177 of the Charities Act 2011 defines ‘charity trustees’ as the persons having the general control and management of the administration of the charity. Where the charity is a trust, this will generally be the managing trustees, whether or not they are also the registered proprietors. Where the charity is a body corporate, for example a company limited by guarantee or a parochial church council, it will generally be the directors or members. Occasionally, some form of governing council may administer the charity.

5.2.3.3 How should the charity trustees be described?

Where the charity is a trust, we suggest that the charity trustees (whether or not they are incorporated under Part 12 of the Charities Act 2011) be described in one of the following ways.

- ‘The transferors (or chargors as the case may be), the trustees of the charity’.

The following wording is appropriate where the charity trustees are not the registered proprietors.

-

‘The trustees of the charity ___’;

-

‘The members of the ___ of the charity, being the persons who have the general control and management of its administration ___’.

If the land is vested in holding trustees or a custodian trustee and the charity is administered by managing trustees or a governing council, it is generally convenient for 2 of them (or more, if desired) to be authorised to execute the deed on behalf of them all (see Execution of deeds). In this case there is no need to give the names of all the charity trustees, and the wording in the second or third examples above may be used. If there is no delegated authority all the trustees or members of the governing council should be named in the certificate and should execute the deed.

Where the charity is a company and the directors are giving the certificate, as they usually will, they may be described as:

- ‘The directors of the charity (or, if preferred, of the company), being the persons who have the general control and management of its administration ___.’

Where the charity is some other kind of corporate body and the members are giving the certificate, they may be described as:

- ‘The members of the charity (or use term by which charity is generally known, e.g. the society, the association, the board, the council, the fund), being the persons who have the general control and management of its administration.’

If the incorporated charity has a governing council, the above wording may be adapted, for example:

- ‘The members of the governing council of the association, being the persons who have the general control and management of its administration.’

In these cases, it is usual for 2 (or more, if desired) of the directors or members to be authorised to execute the deed on behalf of them all (see Execution of deeds). There is no need to give the names of all the directors or members. If there is no delegated authority all the directors or members should be named in the certificate and should execute the deed.

5.2.4 The statement required in dispositions made on or after 7 March 2024, but made pursuant to a contract entered into prior to 7 March 2024

For dispositions made on or after 7 March 2024, the prescribed statements should set out the corresponding relevant provisions of the Charities Act 2011 as amended by the Charities Act 2022. However, HM Land Registry will still accept statements and certificates that refer to the provisions of the Charities Act 2011 before 7 March 2024 (see The statement required in dispositions made before 7 March 2024, provided that the disposition is pursuant to a contract for the sale or for a lease or other disposition of the land entered into before 7 March 2024 and the deed itself states, or the applicant certifies, that that is the case.

5.2.5 Unregistered land

Where an unregistered estate is held by or in trust for a charity, the owners’ powers to dispose of it are restricted in much the same way as they would be if their title were registered. Therefore, when examining a title on first registration, we will apply the principles outlined above as if the appropriate restriction had applied to the charity disposing of the estate. We will be able to determine if a certificate is appropriate because the requirement that the disposition contains statements about the land, the charity and the nature of the disposition also applies to conveyances, mortgages and leases of unregistered land.

We therefore recommend that any disposition, to which section 117-121 or 124 of the Charities Act 2011 applies, of an unregistered estate by a non-exempt charity contains a certificate along the lines of one of those set out in this section when it is appropriate to the circumstances of the disposition.

A mortgage by a non-exempt charity that results in an application for first registration (section 4(1)(g) of the Land Registration Act 2002) should also contain the following statement (rule 180(3) Land Registration Rules 2003):

- ‘The restrictions on disposition imposed by sections 117-121 of the Charities Act 2011 also apply to the land (subject to section 117(3) of that Act)’.

5.2.6 When a certificate is not required

There will be some occasions when a certificate should not be included in a deed because the disposition is not subject to the restrictions on disposition imposed by section 117-121 or, if a charge, to section 124 of the Charities Act 2011. These are dispositions referred to in section 117(3) of that Act and charges to which the provisions of section 124 are disapplied by section 124(9) of that Act.

These types of dispositions will have one of the second of the alternative statements referred to in The statements required in the disposition, depending on whether or not the disposition is a charge. Also, a certificate should not be included in a deed that is not a disposition for the purposes of section 117-121 of the Charities Act 2011, such as a deed that appoints, or by virtue of section 334 of the Charities Act 2011 has effect as if it appointed, a new trustee or is made in consequence of the appointment of land held by or in trust for a charity. See Change of trustee for further details of the procedure on the appointment of new charity trustees under section 334 of the Charities Act 2011.

5.3 Land not held solely for the charity’s own benefit

Section 117(1A) of the Charities Act 2011 (as amended by the Charities Act 2022) confirms land is held by or in trust for a charity only if the whole of the land which forms the subject matter of the disposition is held:

(a) by the charity solely for its own benefit (and, accordingly, is not being held as nominee or in trust for another person), or

(b) in trust solely for the charity.

Therefore, when the charity is one of several beneficiaries of the land and the trustee is disposing of the entirety of the land, the restrictions in section 117(1) of the Charities Act 2011 do not apply.

5.4 Summary table of statements required

| Type and date of instrument | Required statement and/or certificate |

|---|---|

| Transfer, conveyance, lease or other instrument disposing of land made before 7 March 2024 | See sections 5.2.3(a) and 5.2.3.1 |

| Charge or mortgage granted before 7 March 2024 | See sections 5.2.3(b) and 5.2.3.1 |

| Transfer, conveyance, lease or other instrument disposing of land made on or after 7 March 2024 but pursuant to a contract for sale or other disposition made before 7 March 2024 | See section 5.2.4 |

| Transfer, conveyance, lease or other instrument disposing of land made on or after 7 March 2024 | See section 5.2.2(a) |

| Charge or mortgage granted on or after 7 March 2024 | See section 5.2.2(b) |

5.5 Complying with restrictions

5.5.1 Form E

This restriction will be complied with if the disposition contains the relevant statement.

5.5.2 Form F

A restriction in Form F in Schedule 4 to the Land Registration Rules 2003 will have been entered in the register when an order under section 76 of the Charities Act 2011 (or section 18 of the Charities Act 1993) has been made and the Official Custodian for Charities has been registered as proprietor. If a disposition has been executed in the name of and on behalf of the Official Custodian for Charities by the charity (if it is a corporation) or the charity trustees (if it is not) then whichever version of the restriction appears in the register, an order of court or of the Charity Commission will be required to authorise the disposition (section 91(4) of the Charities Act 2011). If this is the case, the disposition should include a statement stating that it has been sanctioned by an order of the Charity Commission or of the court, as appropriate (sections 122(2A) and 125(1A) of the Charities Act 2011).

Before 14 March 2012 the restriction entered in the register referred to sections 22(3) of the Charities Act 1993 rather than section 91(4) of the Charities Act 2011. Such a restriction should now be read as if it referred to sections 91(4).

The restriction does not apply to dispositions executed by the Official Custodian for Charities.

5.5.3 Form A

If this restriction has been entered in the register, it will not affect a disposition by joint proprietors. However, if the proprietor is a sole trustee or a custodian trustee, it will be necessary for a second trustee to be appointed for the purposes of any disposition under which capital money arises, unless the trustee is a trust corporation. Following the coming into force of section 32 of the Charities Act 2022 on 31 October 2022 (which inserted a new section 334A into the Charities Act 2011), if the sole trustee is a corporation that is also a charity, that trustee will have trust corporation status even if it was appointed prior to 31 October 2022. However, the trust corporation status will not be retrospective.

5.5.4 Other restrictions

Other restrictions will be satisfied by producing evidence that the disposition complies with the terms of the restriction. The evidence will take the form of a certificate if the restriction calls for one or a copy of the required consent or order should be uploaded if appropriate. If no consent or order is required in the circumstances, the position should be explained in an accompanying letter.

5.6 Cancellation of restrictions

Where a charity’s powers are limited and there is a restriction in the register in Form E, Form F or one of the previous versions referred to in Old forms of register entries, then this will be cancelled automatically where an application is made to register a transfer of the title by the proprietor provided:

- the restriction has been complied with, and

- the other aspects of the application are in order

There is no need for an application to be made to cancel the restriction.

If a charity is remaining as proprietor of a title following a disposition, such as a lease or a charge, any charity restriction will remain in the register. If the restriction was in the former wording of Form E, then this will normally be updated to the current wording.

There may be rare occasions when a charity wishes to cancel a restriction in the register when no disposition has been made. For example, it may be that the trusts of the charity change and the restriction in the register is no longer appropriate. In such cases, an application should be made to cancel the restriction using form RX3, accompanied by the relevant evidence.

6. Keeping the register up to date

6.1 Introduction

Estates owned by charities tend to be held for a long time. During this ownership many events may occur that affect the charity’s powers, status and trustees. For example, there may be deaths, resignations or appointments of new trustees. The charity may be reclassified as an exempt charity, it may become incorporated, the estate may be vested in a trust corporation or the Charity Commission may intervene. If any of these changes occur the register must be updated to reflect the current position.

6.2 Change of trustee

Where a registered estate is owned by charity trustees, a change in the trustees will not automatically change the ownership of the registered title. The general law relating to the appointment and discharge of trustees (See in particular Part III of the Trustee Act 1925) applies also to charities. However, section 334 of the Charities Act 2011 makes additional provisions relating to charity trustees. Under section 334(1) of the Charities Act 2011 a charity may, provided its trusts permit it, appoint and discharge trustees by resolution of a meeting of the charity trustees, members or other persons. A memorandum signed at the meeting is sufficient evidence of the resolution(s). To be effective to transfer the legal estate, the memorandum must:

- be executed as a deed

- be executed by the person presiding at the meeting or in some other manner directed by the meeting

- be witnessed by 2 persons present at the meeting, and

- relate to land to which section 40 of the Trustee Act 1925 extends, See section 40(4) of the Trustee Act 1925 for land to which section 40 does not extend.

In order for the registrar to alter the register so as to vest the land or charge in the current trustees the original memorandum, evidence of the death of any trustee currently shown in the register who has died, and a certificate by the solicitor acting for the charity that it has power to use the procedure set out in section 334 of the Charities Act 2011 must be produced. Since the memorandum will not necessarily identify all the current trustees it will help us if you provide a complete list of their full names, certified as such by the secretary or solicitor to the trustees.

Appointment of a new trustee may be made by way of a transfer and, as such a transfer is not a sale, lease or other disposal by the charity, section 122(3) of the Charities Act 2011 does not apply to it. The registrar will accept any transfer by way of appointment of a new trustee, provided it is so expressed, without any certificate under that sub-section.

Where an application is made to the registrar to effect a change of trustees of a non-exempt charity, under the provisions of rule 161 of the Land Registration Rules 2003 (rule 161(3) of the Land Registration Rules 2003 relates to vesting declarations. A memorandum executed as a deed under section 334(3) of the Charities Act 2011 operates under section 40 of the Trustee Act 1925 as if the appointment or discharge were effected by the deed), or where the application is made to register an appointment made by way of transfer, there is a duty to apply for a restriction in Form E to be entered in the register. This is unless such a restriction has already been entered (rule 176 of the Land Registration Rules 2003). The application for the restriction must be made either on form RX1 or in the transfer.

We will only need certified copies of deeds or documents you send to us with HM Land Registry applications. Once we have made a scanned copy of the documents you send to us, they will be destroyed. This applies to both originals and certified copies.

When uploading documents, you will be able to certify any scanned documents by confirming them to be a true copy of the original using the certification statements available.

6.3 Intervention by the Charity Commission

The Charity Commission has extensive powers by order to intervene in the administration of non-exempt charities, particularly under section 76 of the Charities Act 2011. Broadly, the powers are exercisable to ensure the proper administration of charities and to protect charity property against misconduct or mismanagement. They include a power to appoint an interim manager who shall act as receiver and manager in respect of the property and affairs of a charity.

Where an interim manager is appointed the order may confer on them such powers and duties of the charity trustees as are specified in the order and provide for those powers to be exercised by them to the exclusion of the charity trustees. See Execution by interim managers on the execution of documents in such a case.

Where any application is made to the registrar pursuant to any such order you must produce a certified copy of the order. The Charity Commission does not issue paper sealed orders; it normally sends a PDF document by email. Land Registry will accept a copy of the Charity Commission’s email certified as being a true copy with a copy of the PDF order set out in the email or attached to it.

The Charity Commission may, by order, appoint new trustees or vest land in the Official Custodian for Charities. If an order under section 76 of the Charities Act 2011 vests an estate in the Official Custodian for Charities, an application must be made for entry of a restriction in Form F in the register (rule 178 of the Land Registration Rules 2003) (see The Official Custodian for Charities). This will prevent the charity trustees from exercising their powers in the name of the Official Custodian for Charities without authorisation.

6.4 Change of circumstances

There are some situations when no disposition has been made but when it is necessary for an application to be submitted to HM Land Registry to enter a restriction in the register. In the following circumstances you should make an application on form RX1 to enter a restriction in Form E.

- Where a registered estate is held by or in trust for an exempt charity and the charity becomes a non-exempt charity (section 123(5)(a) of the Charities Act 2011).

- Where a registered estate not previously so held becomes held in trust for a non-exempt charity as a result of a declaration of trust by the proprietor (section 123(5)(b) of the Charities Act 2011).

- Where a registered estate is held by or in trust for a corporation and the corporation becomes a non-exempt charity (rule 176(3) of the Land Registration Rules 2003).

- Where the charity by or in trust for which an estate is held becomes an exempt charity, the charity trustees must apply for the restriction to be cancelled (section 123(4) of the Charities Act 2011). The application should be made to cancel the restriction using form RX3.

6.5 Incorporation under Part 12 of the Charities Act 2011 (or Part VII of the Charities Act 1993)

Under Part 12 of the Charities Act 2011 (formerly Part VII of the Charities Act 1993), charity trustees may apply to the Charity Commission to be incorporated. If the Charity Commission grants the application then it issues a certificate to that effect. Upon the granting of the certificate the trustees become a body corporate under the name specified in the certificate. The property of the charity vests in the body corporate, except for that held on behalf of the charity by the Official Custodian for Charities.

To keep the registers up to date, an application for amendment of the register should be made against all titles of which the charity trustees are the registered proprietors. The application should be described as ‘Application to amend the register on the incorporation of a charity’ and be accompanied by a certified copy of the certificate of incorporation. No fee is payable.

The registrar will complete the application by cancelling the existing proprietorship entry and entering the name of the body corporate as shown in the example given in Entry of proprietors.

The registrar will not automatically remove any restriction in standard Form A when updating the registered proprietor. If that restriction is no longer required, the charity trustees may apply to cancel it using form RX3. Practice guide 19: notices, restrictions and the protection of third-party interests in the register contains further details about such applications.

6.6 Dissolution of a body corporate under Part 12 of the Charities Act 2011

Part 12 of the Charities Act 2011 also gives the Charity Commission power by order to dissolve a body corporate incorporated, or treated as being incorporated (section 17(2)(b) of the Interpretation Act 1978), under that part.

The order has the effect of vesting the land in the trustees of the charity where it has up to then been held by the body corporate or by any other person (apart from the Official Custodian for Charities) on trust for the charity. The order may also direct that particular land be vested in a specified person as trustee for, or nominee of, the charity or in such persons other than the charity trustees as the Charity Commission may specify.

6.7 Change of name of a charity

The Charity Commission has power to require a non-exempt charity to change its name (sections 42, 43 and 44 of the Charities Act 2011). Where that charity is a company incorporated under the Companies Acts the Registrar of Companies must issue a new certificate of incorporation for the company (section 45 of the Charities Act 2011).

A charity can change its name by its own decision. Where the charity is a registered charity it must notify its change of name to the Charity Commission.

Whether or not the change of name was compulsory, you should make an application to change the name of the charity or the description of the trustees in the register. Any new certificate of incorporation must be lodged. There is currently no fee for this application.

6.8 Merger of charities

The Charities Act 2006 contains provisions to facilitate the merger of charities. As an alternative to executing a number of transfers of registered estates, the transferring charity may execute a pre-merger vesting declaration under section 310 of the Charities Act 2011. The declaration must be made by deed for the purposes of the section by the charity trustees of the transferor, must be made in connection with a relevant charity merger, and must provide that all of the transferor’s property is to vest in the transferee on such date as is specified in the declaration (section 310(1) of the Charities Act 2011).

The declaration operates on the date specified therein to vest the legal title to all of the transferor’s property in the transferee, without the need for any further document transferring it. However, the declaration is ineffective to vest registered land unless registered under the Land Registration Act 2002 (section 310(4) of the Charities Act 2011). The declaration is also ineffective to vest any land held by the transferor under a lease or agreement if, had the transferor assigned its interest in the land on the specified date to the transferee, that assignment would have given rise to either:

-

an actionable breach of covenant or condition against alienation,

-

a forfeiture, or

-

any shares, stock, annuity or other property which is only transferable in books kept by a company or other body or in a manner directed by or under any enactment.

The declaration need not be in a form prescribed by the Land Registration Rules 2003. It should however contain the statements prescribed by rules 179 and 180 of the Land Registration Rules 2003. Where the transferor is a non-exempt charity the statement will usually refer to paragraph (c) of section 117(3) of the Charities Act 2011. In this case the disposition is not caught by the terms of a restriction in Form E in Schedule 4 to the Land Registration Rules 2003 and need not include the statement under section 122(2A) of the Charities Act 2011 Act.

However, an order of the Charity Commission will be required to effect the merger if the trusts of the charity do not authorise it. In that case the disposition will not be within section 117(3) of the Charities Act 2011 so that it must contain the statement that the restrictions on disposition imposed by sections 117-121 of the Charities Act 2011 apply and the certificate that it has been sanctioned by an order of the Charity Commission (see The statements required in the disposition and The certificate required in the disposition). The Charity Commission does not issue paper sealed orders; it normally sends a PDF document by email. HM Land Registry will accept a copy of the Charity Commission’s email certified as being a true copy with a copy of the PDF order set out in the email or attached to it.

7. Execution of deeds

A disposition containing a certificate by the charity trustees must be executed by them as well as by the registered proprietor. If, however, the charity trustees are also the registered proprietors, a single execution by each of them is sufficient. Where any proprietor has died, or if a company or other body corporate has been dissolved, evidence to that effect must be provided with the application. Where appointments or discharges of trustees have not previously been reflected in the register an application to give effect to them must be made before, or at the same time as, any application for registration of a disposition by the trustees.

8. Execution by charity trustees

Charity trustees may delegate to no fewer than 2 of their number an authority to execute in the names and on behalf of the trustees any deed giving effect to a transaction to which the trustees are a party (section 333 of the Charities Act 2011). The effect is that where land is registered in the names of charity trustees any 2 or more of them may be authorised to execute a transfer, charge or other disposition of the land on behalf of all the registered proprietors. However all trustees must still be named in the deed, or otherwise accounted for in the application.

It is considered that the charity trustees may also delegate the power to give the required certificates under the Charities Act 2011.

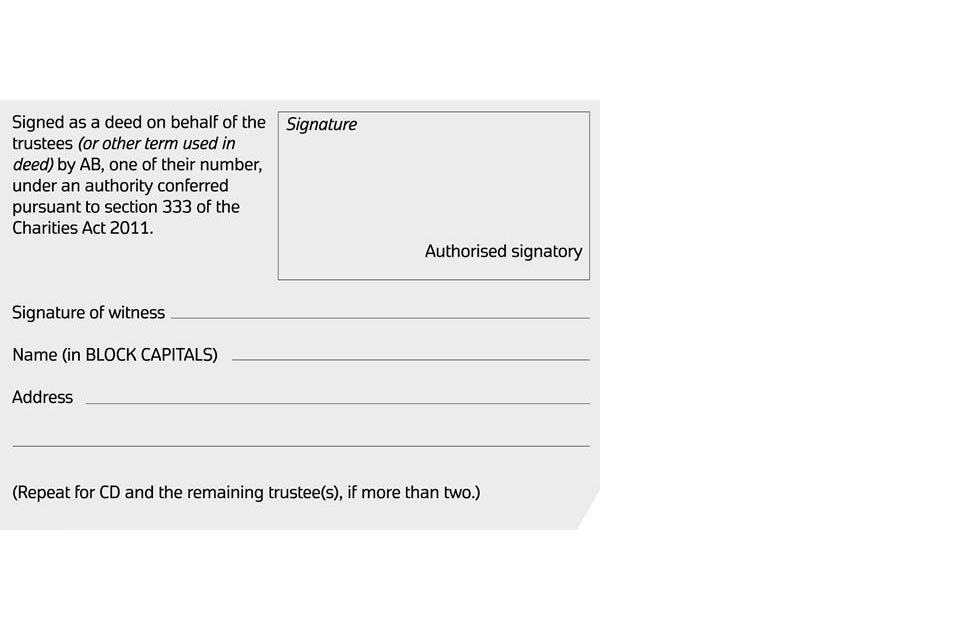

The following is a suggested form of wording.

image 1

This wording assumes that the authorised trustees will meet to execute the deed at the same time. If the authorised trustees will be executing the deed at different times, a separate execution clause in the following terms should be provided for each of them.

image 2

The registrar will not require any evidence of the delegation if:

- the transfer, charge or other disposition states that it has been executed in pursuance of section 333 of the Charities Act 2011, and

- the disposition is for money or money’s worth and there is no reason to doubt the good faith of the person in whose favour it is made

In any other case, the registrar will require strict proof that the authority has been properly conferred and is still subsisting.

The procedure can also be used if the registered proprietor is the Official Custodian for Charities. See Execution in the name of the Official Custodian for Charities for further information on this.

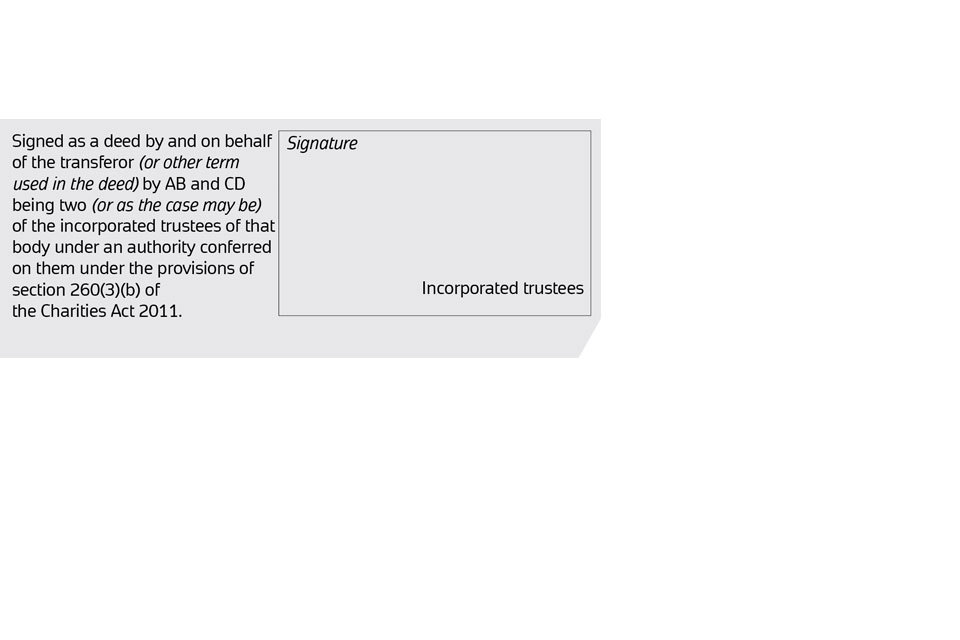

In the absence of a delegation under section 333 of the Charities Act 2011 the deed must be executed by all the trustees using the form of execution appropriate to an individual as follows (See Schedule 9 to the Land Registration Rules 2003).

image 3

8.1 Execution by incorporated trustees under Part 12 of the Charities Act 2011

Provision is made for execution of deeds by a body of trustees incorporated under Part 12 of the Charities Act 2011 (section 260 of the Charities Act 2011). It is considered that these provisions apply both to the execution of the deed as registered proprietor and, when the deed contains a certificate by the charity trustees, to the execution of that certificate.

Where the body corporate has a common seal, a disposition can be executed by the affixing of the common seal. The wording appropriate to a company (See Schedule 9 to the Land Registration Rules 2003) may be adapted for the purpose. The registrar will not question the attestation of the seal if it appears to have been affixed in the presence of appropriate officers of the charity.

Where the incorporated trustees do not have a common seal or choose not to use it, the Charities Act 2011 provides 2 other methods of execution. Provided that the disposition purports to be executed in either way it is deemed to have been duly executed in favour of a purchaser (section 260(5) of the Charities Act 2011). This presumption does not apply where the transaction under which either procedure is used is not in favour of a purchaser in good faith for valuable consideration. If it appears to the registrar that a transaction is in favour of a connected person, strict evidence of the execution will be required). It appears that a deed does not, in such cases, have to be signed in the presence of a witness (section 260(4) of the Charities Act 2011).

The other options are as follows.

It may be executed by a majority of the individual charity trustees and expressed to be executed by the body.

There is no prescribed form of words, but it is suggested that the following would be sufficient.

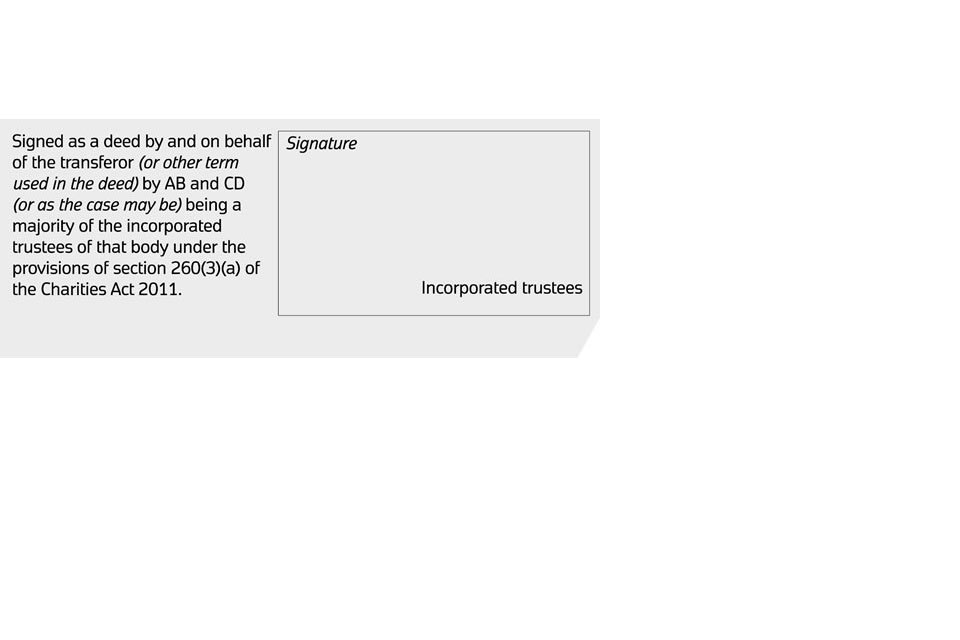

image 4

It may be executed in pursuance of an authority conferred on any 2 or more trustees to execute in the name and on behalf of the body corporate, under section 261(1) of the Charities Act 2011. The authority:

- must be in writing or by resolution of a meeting of the trustees

- may be framed so as to permit any of the trustees to act or may be restricted to named trustees or in any other way, and

- subject to any such restriction, and until it is revoked, must, notwithstanding any change in the charity trustees, have effect as a continuing authority

image 5

8.2 Execution in the name of the Official Custodian for Charities

Charity trustees have full power to execute any deed in relation to any transaction where the Official Custodian for Charities is the registered proprietor of any estate. The exception is where the estate has been vested in the Official Custodian for Charities under section 76 of the Charities Act 2011 and a restriction in Form F is entered in the register – see The Official Custodian for Charities.

The Official Custodian for Charities will no longer execute deeds personally. All the charity trustees should execute the deed and the registrar will assume that they have done so unless there is any evidence to the contrary. Alternatively, it is open to charity trustees to use section 333 of the Charities Act 2011 (see Execution by charity trustees). Likewise, where the charity trustees have been incorporated under Part 12 of the Charities Act 2011, the procedure available under sections 260 and 261 of the Charities Act 2011 may be used, as described in Execution by incorporated trustees under Part 12 of the Charities Act 2011.

8.3 Execution by other bodies corporate