HM Land Registry: Registration Services fees

Fees for common applications, for example Scale 1 and Scale 2 transactions, charges of registered land, leases, large scale and fixed fee applications.

Applies to England and Wales

Land registration is complex, designed to protect legal and financial interests in property. There can be significant consequences for any error. Please consider seeking legal representation. Find out about making an application without legal representation.

Use our Fee calculator to find the cost of each application type.

.

Let us know what you think of this PDF document. Complete a short survey (5 minutes).

Scale 1 fees

| Value or amount | Apply by post | Apply using the portal or Business Gateway, for transfers or surrenders which affect the whole of a registered title | Apply using the portal or Business Gateway, for registration of all leases and transfers or surrenders which affect part of a registered title | Voluntary first registration (reduced fee) |

|---|---|---|---|---|

| 0 to £80,000 | £45 | £20 | £45 | £30 |

| £80,001 to £100,000 | £95 | £40 | £95 | £70 |

| £100,001 to £200,000 | £230 | £100 | £230 | £170 |

| £200,001 to £500,000 | £330 | £150 | £330 | £250 |

| £500,001 to £1,000,000 | £655 | £295 | £655 | £495 |

| £1,000,001 and over | £1,105 | £500 | £1,105 | £830 |

When assessing fees under Scale 1, fees must be paid on the VAT-inclusive consideration or rent.

Fee reductions when using Scale 1

There are reduced fees for:

- voluntary first registrations (applications for first registration based on adverse possession or lost deeds are regarded as voluntary applications, unless the application includes a deed that triggers compulsory registration) (minimum 25% reduction)

- transfers of whole and surrenders of whole for registered titles when using the portal or Business Gateway (reduced by 55% compared with the fee for postal applications).

There are no reduced fees for:

- applications for first registration of title to a rentcharge, a franchise or a profit, or mines and minerals held apart from the surface (as these are not treated as voluntary applications for fee purposes)

- transfers of part and other applications affecting part of registered titles even when using the portal or Business Gateway

- applications to register leases when using the portal or Business Gateway

Transactions under Scale 1

- first registrations

- first registration of a rentcharge

- transfers of registered land for monetary consideration

- leases and surrenders

- large scale applications

- fee reductions Scale 1

First registrations

If the application is made within one year of an open market sale, base the fee on the consideration (including the amount outstanding under any continuing charge). However, for the following first registrations the fee is payable on the full current open market value of the property that is being registered:

- assents

- exchanges

- equity release transfers

- first mortgages

- first registrations where the conveyance on sale is more than one year old

- franchises

- profits

- transfers by way of gift

- transfers of a share in property

In these cases we will accept a statement of value signed by the applicant, the applicant’s legal representative or some other person competent to make such a statement.

Sometimes the deed which induces registration (for example a transfer, assent or charge) will be of both registered and unregistered land. In these cases we need a separate AP1 application form for the registered land, and an FR1 application form for the unregistered land. Separate fees are required for both parts, based on apportioned value.

If HM Land Registry decide an inspection of the property is necessary, then an additional fee of £40 is required under article 11. This will be refunded if the inspection is not undertaken for any reason.

For this type of transaction, use Scale 1 fees.

First registration of a rentcharge

Scale 1 fees do not apply to rentcharges. The fee is £40 fee, irrespective of the value of the rentcharge.

Transfers of registered land for monetary consideration

This includes transfers giving effect to dispositions of shares in registered estates. The fee payable is based on the consideration, which is usually the purchase price.

If the transfer has a purchase price, use this as the consideration to assess the fee. If the transfer contains a consideration, not in pounds (eg euros or shares in a company), you will need to supply us with the equivalent value in pounds and assess the fee accordingly.

For this type of transaction, use Scale 1 fees.

Examples

- Chris buys a property for £575,000. The fee is payable under Scale 1 on the price paid.

- England and Wales Property Portfolio Limited buys a new office building for £900,000. VAT of £180,000 is chargeable on the transaction. The fee is payable under Scale 1, assessed on the VAT inclusive price of £1,080,000.

- Europa Land Limited buys a property for €900,000. The fee is payable under Scale 1 on the sterling equivalent.

- Development Plan Limited assembles a site for development by buying sites from 3 separate landowners for £1.2 million, £1.7 million and £850,000. Three Scale 1 fees are payable, assessed on the price paid in each separate sale, regardless of whether 1 transfer form or 3 transfer forms are used.

- Yamada Taro buys a house for £350,000. The house is registered, but the garage is not. He apportions the value as to £325,000 for the registered land and £25,000 for the unregistered land. A separate Scale 1 fee is payable for both parts (If this were a transfer not for value the registered land part would pay under Scale 2 and the unregistered part under Scale 1).

- Caroline voluntarily registers her house worth £400,000. As it is a voluntary first registration she pays the Scale 1 fee reduced by 25%.

- Fitzwilliam Darcy transfers 2 properties, title numbers CS1 and CS2, for £250,000 to Elizabeth Bennett, using one transfer form. A scale 1 fee is payable on the total consideration. However different considerations will apply if the properties are in different ownership. See practice guide 21.

- Belvedere LLP buys 2 properties, part of 1 title for £30,000 and the whole of another for £300,000. One Scale 1 fee is payable based on the total consideration of £330,000 if a single transfer is used because the transfer affects part of a registered title. Separate fees would be payable if separate transfers were used.

- Court orders Mr Smith to transfer a property to Mrs Smith as a result of the breakdown of their marriage under the Matrimonial Causes Act 1973, and for Mrs Smith to pay £50,000. This is assessed under Scale 2: other applications affecting registered estates. Similar considerations apply to transfers by court orders under the Civil Partnerships Act 2004, but not court orders under any other act.

Leases and surrenders

Read the leases section.

Large scale applications

Where the deed affects 20 registered titles or more, or where a first registration comprises of 20 land units or more, refer to our guide ‘Large Scale Applications (Calculation of Fees)’.

For this type of transaction, use Scale 1 fees.

Scale 2 fees

| Value or amount | Apply by post | Apply using the portal or Business Gateway, for transfers of whole, charges of whole, transfers of charges and other applications of whole of registered titles | Apply using the portal or Business Gateway for registration of transfers of part, and all other Scale 2 applications that do not affect the whole of a registered title |

|---|---|---|---|

| 0 to £100,000 | £45 | £20 | £45 |

| £100,001 to £200,000 | £70 | £30 | £70 |

| £200,001 to £500,000 | £100 | £45 | £100 |

| £500,001 to £1,000,000 | £145 | £65 | £145 |

| £1,000,001 and over | £305 | £140 | £305 |

Fee reductions when using Scale 2

The reduced fees in the middle column of the table above apply in the following circumstances:

- transfers or assents of whole

- charges of whole

- transfer of charges

and many other applications of whole for registered titles when using the portal or Business Gateway.

There are no reduced fees for:

- transfers of part

- other applications affecting part of registered titles even when using the portal or Business Gateway

Transactions under Scale 2

- transfers or assents of registered estates not for monetary consideration

- transfers of registered charges

- charges of registered estates

- other applications affecting registered estates

- surrenders of leases not for monetary consideration

- large scale application

- charges of registered land

- fee reductions when using Scale 2

Transfers or assents of registered estates not for monetary consideration

Assess the fee on the value of the property, minus the amount outstanding on any continuing charge and any new charge (see note 1). This also applies where the transfer gives effect to the appointment of new or additional trustees.

If a sole surviving tenant in common appoints new trustees so they can sell the property and both the appointment of new trustees and the onward transfer are lodged together in the same application, then fees are only payable on the second transfer. In this situation there is no fee payable for the first transfer or deed of appointment.

For this type of transaction, use Scale 2 fees.

Examples: properties with no mortgage

-

John Smith transfers a property by gift to Sharon Jones, it is worth £200,000. The fee is assessed on the full £200,000 value and payable under Scale 2.

-

John Smith transfers a property by gift to himself and Sharon Jones in equal shares. It is worth £200,000. The fee is assessed on half the value of the property (£100,000), and payable under Scale 2.

-

Following the death of John Smith, Sharon Jones takes out probate and is appointed as the executor of his estate. She transfers the property, which is worth £200,000, to the beneficiary under John’s will by an assent. The fee is assessed on the full property value, £200,000, and is payable under Scale 2.

-

John Smith, Joseph Evans and Sharon Jones are trustees of a trust owning a property worth £200,000. They appoint Lucy Brown as a new trustee either by deed or by HM Land Registry transfer form. The fee is assessed under Scale 2 on the full value of the property.

-

John Smith, Joseph Evans and Sharon Jones were trustees of a trust owning a property worth £200,000. By a series of appointments and retirements of trustees that have not been registered, the new trustees are Lucy Brown and Rajwinder Kaur, who appoint George Murphy as an additional trustee. The three now apply to register all the changes. The fee is payable under Scale 2 on the last appointment of George Murphy only, assessed on the full £200,000 property value.

-

John Smith and Sharon Jones own a property worth £200,000 which is held as tenants in common. Following the death of John Smith, Sharon Jones appoints Joseph Evans and Lucy Brown as new trustees to act with her by HM Land Registry transfer form or deed of appointment. The fee is assessed under Scale 2 on the full value of the property (£200,000). However if they immediately sell the property to Fiona McKay and both transfers are lodged together, then fees are only payable on the second transfer.

Examples: properties being transferred subject to a mortgage

-

John Smith transfers a property as a gift to Sharon Jones. The property is worth £200,000 and is subject to a mortgage to the Cornshire Building Society, where £100,000 remains outstanding and is not repaid on completion of the transfer. To calculate the fee for the transfer, subtract the outstanding mortgage amount (£100,000) from the full value of the property (£200,000). The fee is assessed on the result: £100,000, and payable under Scale 2.

-

John Smith transfers a property as a gift to himself and Sharon Jones in equal shares. The property is worth £200,000 and is subject to a mortgage to the Cornshire Building Society where £100,000 remains outstanding and is not repaid on completion of the transfer. First, determine the value of the share, by subtracting the amount outstanding on the mortgage (£100,000) from the full value of the property, £200,000. Then divide the result (£100,000) in half to reflect the equal shares - £50,000. The fee is assessed on this figure, £50,000, and is payable under Scale 2.

-

John Smith transfers a property as a gift to himself and Sharon Jones in equal shares. The property is worth £200,000 and is subject to a mortgage to the Cornshire Building Society where £100,000 remains to be paid. The existing mortgage is repaid and a new mortgage for £120,000 taken out in favour of Newcharge Bank. Calculate the value of the share by deducting the amount outstanding on the new mortgage, £120,000, from the full value of the property (£200,000). Then halve the result, £80,000, to reflect the transfer from John to John and Sharon - £40,000. The fee is assessed on this figure, £40,000, and is payable under Scale 2.

-

John Smith, Joseph Evans and Sharon Jones hold a property valued at £200,000 in unequal shares. John transfers his 20% share as a gift to Joseph and Sharon, who take out a new mortgage of £40,000. Calculate the value of the share being transferred by deducting the amount outstanding on the new mortgage, £40,000, from the full value of the property, £200,000. Then multiply the result, £160,000, by 20% (which was John’s share), leaving £32,000. The fee is therefore assessed on £32,000 and is payable under Scale 2.

-

John Smith and Sharon Jones own a property valued at £300,000 in equal shares. Sharon transfers her 50% share to John who takes out a mortgage of £170,000. John and Sharon had two mortgages on the property, the first will be discharged on completion of the transfer, the second will remain on the register post completion, postponed in favour of the new mortgage which John has arranged. The amount outstanding on the charge that is remaining is £40,000. The total amount outstanding will therefore be £210,000. Calculate the value of the share being transferred by deducting the total amount outstanding on the new and continuing charges, £210,000, from the full value of the property, £300,000. Then multiply the result, £90,000, by 50% (which is Sharon’s share), leaving £45,000. The fee is therefore assessed on £45,000 and is payable under Scale 2.

Note 1

The reference to ‘amount outstanding’ is the amount outstanding on:

- any existing registered or noted charges, provided they have not been discharged on completion of the transfer; and

- any new charges, provided the application to register the charges is lodged along with the application to register the transfer. The registration of the charges and the transfer must be completed at the same time.

Transfers of registered charges

Fee payable on the consideration, or, where the transfer is not for value, on the amount secured by the charge at the time of the transfer. Where a transfer not for value gives effect to the transfer of a share in a registered charge the fee is payable on the value of that share.

For this type of transaction, use Scale 2 fees.

Charges of registered estates

Read the charges section.

Other applications affecting registered estates

The fee for the registration of the following is payable on the value of the estate less the amount of any continuing registered charge (where this is transfer of a share, the fee is payable on the value of that share):

- appropriations

- assents of registered estates (not if first registration)

- transfers of matrimonial or civil partnership homes as a result of court orders (under the Matrimonial Causes Act 1973 or the Civil Partnership Act 2004), payable on the value of the property even if the court orders one party to pay a consideration

- transfers by operation of law on death or bankruptcy

- vesting orders or declarations (under section 27(5) of the Land Registration Act 2002)

For this type of transaction, use Scale 2 fees.

Examples

- Jacob Marley dies owning a property worth £500,000 with no mortgage. His executor Ebenezer Scrooge takes out probate and then assents the property to the beneficiary Robert Cratchitt. The fee is assessed on the value of the property and payable under Scale 2.

- John and Mary Smith own a property worth £250,000 subject to a mortgage to the Cornshire Building Society on which £100,000 is outstanding. They are divorcing. The Court orders John and Mary to transfer the property to Mary, and for Mary to pay John £50,000. The fee is assessed on half the value of the property minus the value of the mortgage (£75,000, that is £250,000 value minus £100,000 mortgage, and then divided by 2) and payable under Scale 2. The money paid is disregarded for fee purposes.

Surrenders of leases not for monetary consideration

Read the leases section.

Large scale application

Where the deed affects 20 registered titles or more, refer to our guide ‘Large Scale Applications (Calculation of Fees)’.

Charges of registered land

Fees payable

The fees are payable using Scale 2, based on the amount of the charge (see No fee payable for exemptions):

- where the charge secures a fixed amount, base the fee on that amount

- where the charge secures further advances and the maximum amount that can be advanced or owed at any one time is limited, base the fee on the maximum amount

- where the charge secures further advances and the total amount that can be advanced or owed at any one time is not limited, base the fee on the value of the property charged

- where the charge is by way of additional or substituted security or by way of guarantee, base the fee on the lesser of:

- the amount secured or guaranteed

- the value of the property charged

- where the charge secures an obligation or liability which is contingent upon the happening of a future event, base the fee on either:

- the maximum amount or value of the obligation

- if that maximum amount is greater than the value of the property charged, or is not limited by the charge, or cannot be assessed at the time of the application, the value of the property charged

- for large scale applications when a charge affects more than 20 registered titles, refer to large scale

Separate charges contained in separate documents will attract a separate Scale 2 fee. This applies even if they secure a single debt and are submitted at the same time.

For this type of transaction, use Scale 2 fees.

Examples

-

Roisin already owns a house worth £300,000 and takes out a mortgage. The mortgage secures £150,000 and any further advances the lender may make. In this case, the fee is assessed under Scale 2 on £150,000 which is the maximum amount secured.

-

Sanjay plans a self-build home. The bank will lend £100,000 for him to buy the land, and a further £150,000 in stages as works are completed. The fee is assessed under Scale 2 on £250,000 which is the maximum amount secured.

-

Eric, who owns a house worth £500,000 has taken out a mortgage to secure an overdraft at his bank with a ceiling of £70,000. The amount secured varies depending on the overdraft account. In this case the fee is assessed under Scale 2 on the ceiling of £70,000.

-

Angela wants to remortgage her house to get a better rate of interest. The mortgage secures £200,000. In this case, the fee is assessed under Scale 2 on £200,000, which is the maximum amount secured. There is no fee to register the discharge of the existing loan.

-

A group of associated companies own several titles - Teracorp 1 Limited owns title numbers CS1 and CS2, Teracorp 2 Limited owns CS3, CS4 and CS5, and Teracorp 3 Limited owns CS6. They mortgage all 6 properties in one mortgage deed to secure £10 million. For fee purposes, this is treated as three separate mortgages, one by each company. Therefore, three fees are payable (one for each mortgage), and each fee is assessed under Scale 2 on the lesser of £10 million or the value of the properties in each of the 3 mortgages.

-

A company owns 10 titles and mortgages all these titles in one mortgage deed to secure £10 million. The properties are worth together £15m. For fee purposes, this is treated as one mortgage and the fee is payable under Scale 2 on the sum of £10 million.

No fee payable

There is no fee payable for charges of registered land for:

- a charge which accompanies a scale fee application under which the chargor becomes the registered proprietor of the land

- a charge which is lodged before the completion of an application for compulsory first registration or for the registration of a transfer of registered land. An application to register a charge that does not accompany, but is lodged before completion of, a voluntary first registration, is not exempt from a Scale 2 fee.

On a typical house purchase, there will be a transfer to the buyer, accompanied by a mortgage enabling them to buy the property (in a mortgage, the borrower is called the “chargor”). In this case, the only fee payable is on the transfer.

Examples

-

Janek buys a house for £350,000 with a mortgage to secure £150,000. He submits both on June 1 and the application is completed on June 8. The fee is payable under Scale 1 on the price paid for the house, there is no additional fee for the mortgage. This is also the case if the mortgage was sent in later before the case was completed.

-

Janek buys a house for £350,000 with a mortgage to secure £150,000. He submits the transfer on June 1 and the application is completed on June 8. He sends in the charge on June 12. The fee is payable under Scale 1 on the price paid for the house, but this time, there is an additional Scale 2 fee assessed on the value of the mortgage because the mortgage application will then become a new application.

Leases

Registration

The fee for an application by the original lessee or his or her personal representative for the registration of title to a lease, or for the registration of the grant of a lease, is assessed:

- on an amount equal to the sum of the premium and the rent

- if there is no premium, on the amount of the rent, or

- if there is no premium and either there is no rent or the rent cannot be quantified, on the value of the lease, assessed under article 7 of the Land Registration Fee Order 2021, subject to a minimum fee of £45

‘Rent’ means the largest amount of annual rent the lease reserves within the first five years of its term that can be quantified at the time an application to register the lease is made; or if the term of the lease is less than one year, the amount of the rent for the term. Please note: where the rent is a peppercorn rent or other rent having no money value, the rent is treated as if it were nothing.

For this type of transaction, use Scale 1 fees.

Examples

-

Fiona McKay buys a new flat on a 99 year lease for £150,000. The annual rent is £100 rising to £125 in year 5 and £150 in year 10. The fee would be assessed on £150,000 (premium) + £125 (highest rent in first 5 years) = £150,125.

-

John Brown buys a new flat on a 125 year lease for £200,000. The rent is 6.25% of the total service costs. In this case, the fee would be assessed on the premium of £200,000 alone, because the rent cannot be quantified.

-

Cornshire Self Storage Limited acquires a new commercial leasehold for 10 years. There is no premium, but the rent is £100,000 in year 1, rising to £150,000 in year 5 and £200,000 in year 8. In this case, the fee is assessed on £150,000 (the highest rent in the first 5 years).

Surrender of a registered lease for monetary consideration

The fee is based on the amount or value of the consideration paid or given by the landlord for the surrender.

No fee is payable to register the surrender of a registered lease where a scale fee is paid for the registration of a new lease of substantially the same property and the registered proprietor remains the same.

For this type of transaction, use scale 1 fees.

Surrender of a registered lease other than for monetary consideration

This includes where the tenant has paid a premium to the landlord in relation to the surrender or for the release of the tenant’s covenants. The fee is based on the value of the lease prior to the surrender.

No fee is payable to register the surrender of a registered lease where a scale fee is paid for the registration of a new lease of substantially the same property and the registered proprietor remains the same.

For this type of transaction, use Scale 2 fees.

Examples

-

Sara surrenders the lease of a shop to the landlord, it has one year left to run and is worth £8,000. No money changes hands. The fee is assessed on the value of the lease on the date of surrender (£8,000) and the fee is payable under Scale 2.

-

Sara extends the lease on her flat from 99 years to 999 years. In law, this is treated as the surrender of the existing lease and the grant of a new lease. The fee for the new lease is payable as in the leases section. However this time, there is no fee for the surrender of the existing lease because it is made in consideration of the grant of a new one.

Other applications relating to leases

You will pay a fixed fee of £40 (or £20 if submitted using the portal or Business Gateway) per registered title if your application is for:

- determination of a registered lease by effluxion of time, merger or forfeiture

- cancellation of entry of notice of an unregistered lease

- noting of a lease in the landlord’s title

No fee is payable if the application accompanies another application where a scale fee is payable.

No fee is payable if an application for a notice of lease in the landlord’s title accompanies an application to register the easements in the lease, where a fee is paid under Article 12 (£40 for however many titles affected, or £20 if submitted electronically).

Large scale applications

Large scale applications are scale fee applications involving 20 or more land units. ‘Land unit’ means:

- a parcel of registered land under a single title number

- a parcel of unregistered land that does not adjoin another area of unregistered land affected by the same application

The fee for a large scale application is the greater of:

- the scale fee payable for the application

- a fee calculated as follows:

- where the application relates 500 land units or less, £10 per land unit

- where the application relates to more than 500 land units, £5,000 plus £5 for each land unit above 500

Examples

-

Latifundia Limited transfers a portfolio of 50 titles for £1.2 million. The fee under Scale 1 would be £1,105, while the fee per title under article 6 would be £500. Therefore, as it is the higher, the Scale 1 fee applies.

-

Latifundia Limited transfers a portfolio of 400 titles for £1.2 million. The fee under Scale 1 would be £1,105, while the fee per title under article 6 would be £4,000. Therefore, as it is the higher, the article 6 fee applies.

-

Latifundia Limited applies for first registration of a large area of land worth £1.2 million. Using the definition above it comprises of 120 land units. The fee under Scale 1 would be £1,105, while the fee per land unit under article 6 would be £1,200. Therefore, as it is the higher, the article 6 fee applies..

For details on how to prepare an application for a large number of properties and calculating the fees involved, read our guide: Large scale applications (calculation of fees).

Applications with a fixed fee

| Type of application | Apply using the portal or Business Gateway | Apply by post or in person |

|---|---|---|

| 1. The following applications: - standard form restrictions - notices - new or additional beneficiaries of a unilateral notice - an obligation to make further advances - an agreement of a maximum amount of security or an alteration of priority of registered charges Note: no fee is payable if, for each registered title affected, the application is accompanied by a scale fee application or another application attracting a fee under this paragraph |

£20 for up to 3 titles £10 for each additional title |

£40 for up to 3 titles £20 for each additional title |

| 2. Non-standard form restrictions | £45 per title | £90 per title |

| 3. Caution against first registration | Not available | £40 per application |

| 4. Alter a cautions register | Not available | £40 per register |

| 5. Closing a leasehold or rentcharge title (not on surrender). For fees on surrender, read the leases section. Note: no fixed fee is payable if the application is accompanied by a scale fee application |

£20 per title | £40 per title |

| 6. Upgrading a title (for example: from possessory freehold to absolute freehold) Note: no fixed fee is payable if the application is accompanied by a scale fee application |

£20 per title | £40 per title |

| 7. Cancelling notice of an unregistered lease or unregistered rentcharge (See Notice: cancellation (CN1)) Note: no fixed fee is payable if the application is accompanied by a scale fee application |

£20 per title | £40 per title |

| 8. Entry or removal of a record of a defect in title under section 64(1) of the Land Registration Act 2002. Note: no fixed fee is payable if the application is accompanied by a scale fee application |

£20 per title | £40 per title |

| 9. Order to disapply or modify a restriction under section 41(2) of the Land Registration Act 2002 | £20 per title | £40 per title |

| 10. Adverse possession of a registered estate (including site inspection fee) | £130 per title | £130 per title |

| 11. Notification of an application for adverse possession | £20 per title | £40 per title |

| 12. Determination of a boundary | £90 per application | £90 per application |

| 13. Alteration of the register | £20 per application | £40 per application |

| 14. Entry in the register of right to manage | £20 per application | £40 per application |

| 15. Freehold estate in commonhold without unit holders | Not available | £40 for up to 20 units £10 for up to 20 units thereafter |

| 16. Adding land: (a) to the common parts title (b) to a commonhold unit (c) adding commonhold units |

Not available | £40 for up to 20 units £10 for up to 20 units thereafter |

| 17. Land ceases to be commonhold during the transitional period | Not available | £40 |

| 18. Freehold estate in commonhold land with unit holders | Not available | £40 per unit converted |

| 19. Amended commonhold community statement which changes the extent: (a) common parts (b) commonhold units. Note: no fee is payable if, for each registered title affected, the application is accompanied by a scale fee application or another application attracting a fee under this part, ie sections 1 to 23 of this table |

Not available | £40 for up to 3 units £40 for up to 3 units £20 for each subsequent unit |

| 20. Amended commonhold community statement which does not change the extent. Note: no fee is payable if, for each registered title affected, the application is accompanied by a scale fee application or another application attracting a fee under this part ie sections 1 to 23 of this table |

Not available | £40 |

| 21. Alteration to the Memorandum or Articles of Association of a commonhold association | Not available | £40 |

| 22. Termination of a commonhold registration | Not available | £40 per title |

| 23. Noting surrender of a development right under section 58 of the Commonhold and Leasehold Reform Act 2002 | Not available | £40 |

| 24. Designate a document an exempt information document | £12 per document | £25 per document |

Applications not otherwise referred to

A fixed fee of £40 (or £20 if submitted using the portal or Business Gateway) is payable for applications where no other fee is prescribed by the Fee Order.

These applications include the registration of the grant or acquisition of an easement (but not the noting of easements), amalgamation or subdivision under rule 3 of the Land Registration Rules 2003 and registration of rentcharge granted out of a registered estate. The fee is payable even if the application is accompanied by other applications which attract a scale or fixed fee. Where applicable and the application is delivered by electronic means, the fee payable will be reduced by 50%.

Applications exempt from fee

The following applications are exempt from fee:

-

Change the property description or the name, address or description of any person referred to in the register.

-

Change the registered proprietor following certain statutory vestings.

-

Register the surrender of a registered lease where a scale fee is paid for the registration of a new lease of substantially the same property and the registered proprietor remains the same (read the leases section).

-

Discharge a registered charge.

-

Register or renew a home rights notice, or renew a home rights caution under the Family Law Act 1996.

-

Register the death of a proprietor.

-

Cancel a notice (other than a notice of an unregistered lease or unregistered rentcharge), caution against first registration, caution against dealings, including a withdrawal of a notice of deposit or intended deposit, inhibition, restriction, or note.

-

Remove the designation of a document as an exempt information document.

-

Approve an estate layout plan or any draft document with or without a plan.

-

Give effect to an order by the registrar (other than an order under section 41(2) of the Land Registration Act 2002).

-

Deregister a manor.

-

Enter a note of the dissolution of a corporation.

-

Register a joint proprietorship restriction in form A in Schedule 4 to the Land Registration Rules 2003.

-

Application for day list information on any one occasion by electronic means.

-

Register entry in respect of a notice of disclaimer given by a trustee in bankruptcy, a liquidator, the Treasury Solicitor (on behalf of the Crown), or the Solicitor to the Duchy of Lancaster or to the Duchy of Cornwall.

How to pay fees

You can pay for services and substantive applications by:

- variable Direct Debit, if you have a Business e-services account

- cheque or postal order - make payable to ‘HM Land Registry’ and send with your application to our standard address

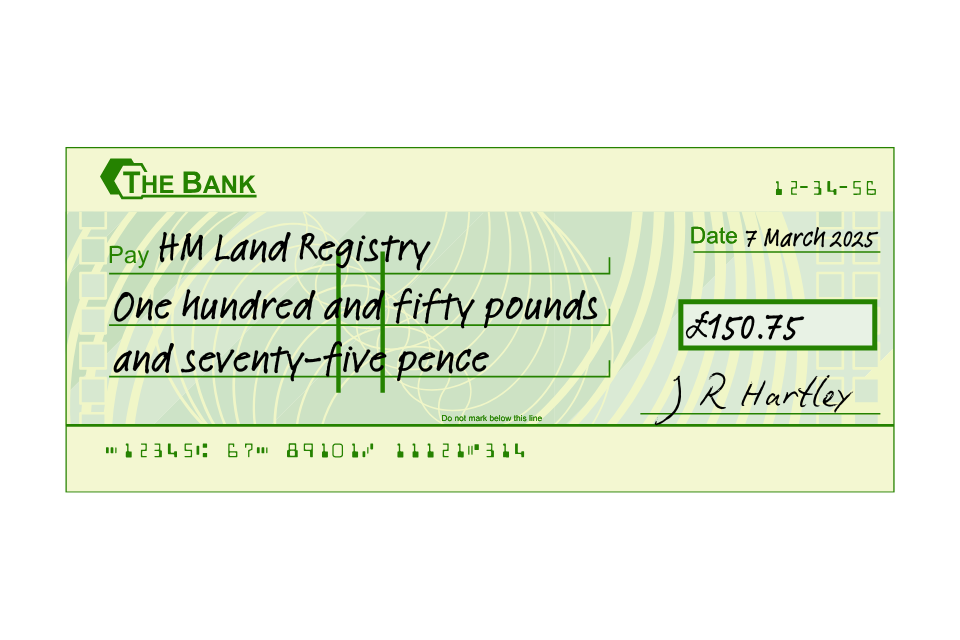

When paying by cheque:

- write out the amount payable in words on the left-hand side of the cheque and in numbers in the box on the right

- write out the date in full, for example 7 March 2025

- make sure you sign the cheque before you send it

It is helpful if you write the title number or address of the property in your application on the back of the cheque.

Your payment may be delayed if you do not fill in your cheque correctly.

Example

The wording "Pay HM Land Registry one hundred and fifty pounds and seventy-five pence" is written on the left side of the cheque. The date "7 March 2025" is written on the top right of the cheque, with the amount "£150.75" written in numbers in the box on the right side under the date. The signature is underneath the amount.

HM Land Registry statutory fees are not subject to Value Added Tax (VAT).

More information

The Land Registration Fee Order 2024 contains the provisions relating to:

- scale 1: under articles 2 and 3

- scale 2: under articles 4 and 5

- charges of registered land: under articles 5 and 8

- leases: under article 2

- large scale applications: under article 6

- applications not otherwise referred to: under article 12

- applications where a fixed fee applies: under schedule 3, Parts 1 and 4

- applications exempt from fee: under schedule 4 of the Land Registration Fee Order 2024

These fees came into effect on 9 December 2024 and still apply.

If you are still unsure of the fee, please use our online form to contact us.

Updates to this page

-

We have clarified information about transfers or assents of registered estates not for monetary consideration, under heading Transactions under Scale 2.

-

We have updated information in the section 'Transactions under Scale 2' under the heading ‘Transfers or assents of registered estates not for monetary consideration’ to clarify the fees for transfer of shares subject to a mortgage.

-

Clarified the fees payable when a transfer deed contains multiple transfers.

-

Increase to scale 1 and scale 2 fees.

-

Edited Scale 2 section to clarify the fees payable on a transfer as a result of an order of the court under the Matrimonial Causes Act 1973 or the Civil Partnership Act 2004. Not a change in practice.

-

We have added an example to show the fees payable where you have a transfer of the whole of one title and part of another.

-

We have clarified the fees payable when two or more charges are submitted together.

-

Note 1 added to better define the term ‘amount outstanding’ in transfers subject to a mortgage, to reflect the meaning of the Fee Order.

-

Section on first registrations has been updated to clarify the fees for inspections.

-

Section about 'Applications not otherwise referred to' has been amended to clarify when Article 12 fees are payable.

-

Section 'Charges of registered land': examples 5 improved and example 6 added.

-

Two updates under 'Transaction under scale 1'. Section 'First registration': information to clarify fee when a transfer includes registered and unregistered land added. Section 'Transfers of registered land for monetary consideration': examples 5 and 6 added.

-

Added translation