VAT on movements of goods between Northern Ireland and the EU

How to charge and account for VAT on the movement of goods between Northern Ireland and EU member states (VAT Notice 725).

This notice cancels and replaces Notice 725 (December 2020).

It applies to movements of goods from Northern Ireland to the EU and movements of goods from the EU to Northern Ireland.

Services are covered in Notice 741A Place of supply of services.

Goods exported from Northern Ireland to non-EU destinations outside the UK are covered in Notice 703 Goods exported from the UK.

Goods imported to Northern Ireland from outside the UK and EU are covered in Notice 702 imports.

1. Overview

1.1 Information in this notice

This notice explains the way VAT is charged and accounted for on movements of goods between Northern Ireland and the EU and how businesses trading under the Northern Ireland Protocol should account for VAT on goods they buy from or sell to EU member states.

1.2 Changes to this notice

Section 6 of this notice has been updated to reflect changes to the VAT treatment of distance selling between Northern Ireland and the EU with effect from 1 July 2021.

Updated to reflect changes to VAT interest that apply to VAT periods starting on or after 1 January 2023.

1.3 Who should read this notice

You should read this notice if you’re involved in the movement of goods between Northern Ireland and EU member states.

1.4 Legal status of this notice

Under, The Northern Ireland Protocol Northern Ireland aligns with EU VAT rules for the movements of goods. The Principal VAT Directive (2006/112) is the primary EU VAT law.

The UK law implementing this in Northern Ireland can be found in:

- Value Added Tax Act 1994, Schedules 9ZA and 9ZD

- VAT Regulations (Statutory Instrument 1995/2518)

- Regulations allow HMRC to specify the form and reporting requirements for EC Sales List. Some or all of paragraphs 17.10 and 17.11 contain the specifications and requirements

- Regulations permit HMRC to make conditions that have force of law

Some or all of paragraphs 4.3, 4.4, 4.5, 5.4 and 15.2.8 have force of law.

1.5 Imports and exports

The term ‘import’ is only used for goods coming into Northern Ireland from countries outside the EU. For further information on imports, see Imports and VAT (Notice 702).

The term ‘export’ is only used for goods leaving Northern Ireland to go to countries outside the EU. For information about exports, see VAT on goods exported from the UK (Notice 703).

2. VAT in the EU

2.1 Definition of the EU territory

The VAT territory of the EU is made up of 27 member states.

Find details of the EU VAT territory. For further information about the territory of the EU for Intrastat purposes, see Notice 60: Intrastat general guide.

2.2 Other areas not within the EU

Liechtenstein, the Vatican City, Andorra and San Marino are not within the EU for VAT purposes.

2.3 Status of the territories

You need to know which territories are included, or excluded from an EU member state because movement of goods between Northern Ireland and any of the:

- countries, or their included territories, are treated as EU supplies for VAT purposes

- excluded territories are treated as imported or exported goods for VAT purposes

2.4 VAT collected on goods moving between Northern Ireland and EU member states

VAT on goods traded with the EU is not collected at the frontier. The way VAT is accounted for on these supplies largely depends on whether the recipient of the supply is registered for VAT in the country of arrival. For further information see sections 3 and 6.

For these purposes movements of goods between Northern Ireland and EU member states within the same legal entity (often referred to as a transfers of own goods) are treated as supplies (see section 9). Special rules apply in the case of natural gas and electricity, along with heat and cooling (see VAT Information Sheet 21/10 Place of supply of natural gas and electricity (also heat and cooling).

2.5 VAT collected on supplies of excise goods

For information about the VAT treatment of supplies involving excise goods, see paragraph 15.4.

2.6 Trade statistics on goods moving between Northern Ireland and EU member states

The system for collecting statistics on the trade in goods within the EU is known as Intrastat. All Northern Ireland businesses carrying out trade with EU member states must declare the totals of their sales and acquisitions on their VAT Return. Businesses whose EU trade exceeds a legally set threshold have to complete additional statistical information called Supplementary Declarations. Statistics are compiled from the Supplementary Declarations and information supplied on the VAT Return.

For further information on this, see section 18 and Notice 60: Intrastat general guide.

2.7 Northern Ireland and EU member states VAT and Intrastat rules

The general rules are the same, but there may be some small variations. If you want to check the position in Northern Ireland or an EU member state you should contact the relevant VAT authority (see paragraph 2.8).

2.8 VAT in Northern Ireland and EU member states

Details of contact addresses and other useful information provided by the VAT authorities in EU member states can be found on the European Commission website.

2.9 Equivalent of ‘Value Added Tax’ and ‘VAT’ in EU member states

The equivalent in each EU member state is:

| EU member state | VAT equivalent |

|---|---|

| Austria | Mehrwertsteuer (Mwst) Umsatzsteuer (Umst) |

| Belgium | Belasting over de Toegevoegde Waarde (BTW)Taxe sur la Valeur Ajoutée (TVA) |

| Bulgaria | Данък Добавена Стойност or Данък Добавена Стойност |

| Cyprus | Фόρος ΠροστιΘέμενης Αξίας (ΦΠΑ) |

| Croatia | PDV Id. Broj (PDV-1D) |

| Czech Republic | Daň z přidané hodnoty (DPH) |

| Denmark | Omsaetningafgift |

| Estonia | Käibemaks |

| Finland | Arvonlisavero (ALV) |

| France | Taxe sur la Valeur Ajoutée (TVA) |

| Germany | Mehrwertsteuer (Mwst) Umsatzsteuer (Umst) |

| Greece | Φόρος Προστιθέμενης Αξίας (ΦΠΑ) |

| Hungary | Általános Forgalmi Adó (ÁFA) |

| Ireland | Value Added Tax |

| Italy | Imposta sul valore Aggiunto (IVA) |

| Latvia | Pievienotãs vértîbas nodoklis |

| Lithuania | Pridetines vertes mokestis (PVM) |

| Luxembourg | Taxe sur la Valeur Ajoutée (TVA) |

| Malta | Value Added Tax |

| Netherlands | Omzetbelasting (OB) Belasting over de Toegevoegde Waarde (BTW) |

| Poland | Podatek od towarów i uslug |

| Portugal | Imposto sobre o Valor Acrescentado (IVA) |

| Romania | Tăxa pe valoarea adăugată |

| Slovakia | Daň z přidanej hodnoty (DPH) |

| Slovenia | Davek na dodano vrednost (DDV) |

| Spain | Impuesto sobre el Valor Anadidio (IVA) |

| Sweden | Mervardeskatt (MOMS) |

2.10 Normal rules for claiming input tax

The amount you can reclaim as input tax is subject to the ‘normal rules’. These include the evidence you must get and any additional partial exemption calculations you’re required to carry out. For further information about this see dealing with input tax in the VAT guide (Notice 700) and Notice 706: partial exemption.

3. Supplies to VAT registered customers

3.1 Accounting for VAT

The normal VAT treatment of goods supplied within the EU is as follows:

- the supply in the EU member state of dispatch is zero-rated (how this applies in Northern Ireland is explained in more detail in section 4)

- VAT is due on the acquisition of the goods in the country of arrival and is accounted for by the customer on their VAT Return at the rate in force in that country (how this applies in Northern Ireland is explained in more detail in section 7)

3.2 Special rules

There are various special rules that apply in particular circumstances. These are explained in the following sections of this notice.

3.3 Supplies to Great Britain, the Isle of Man and the Channel Islands

Goods sent to the Isle of Man from Northern Ireland are treated the same way as supplies to Great Britain. Goods sent to the Channel Islands are treated as exports from the EU for VAT purposes. For further information about exports, see VAT Notice 703: export of goods from the UK.

3.4 Time of supply (tax point) for goods supplied to EU member states

The tax point for a supply of goods to a VAT-registered customer in an EU member state is the earlier of either the:

- 15th day of the month following the one in which you send the goods to your customer (or your customer takes them away)

- date you issue a VAT invoice for the supply

3.5 Tax point for your supplies

You should use the tax point as the reference date for including the supplies on your VAT Return, EC Sales Lists and, normally, your Intrastat Supplementary Declarations.

But if it’s more convenient, you may use the calendar month during which the goods arrive in, or are dispatched from Northern Ireland for your Intrastat Supplementary Declaration, see Notice 60: Intrastat general guide.

3.6 Payments received in advance of an invoice or delivery

The receipt of a payment in these circumstances does not create a tax point for your EU supply. But you must issue a VAT invoice to your customer for the amount paid to you (see paragraph 16.8) and the date of issue of the VAT invoice will be the tax point.

Where you issue a series of invoices relating to the same supply of goods, the time limit for getting valid evidence of removal begins from the date of the final invoice (see paragraph 4.4).

3.7 Reporting requirements

| Type of movement | VAT Return | EC Sales List (see section 17) | Supplementary Declaration (see section 18) |

|---|---|---|---|

| Goods supplied to VAT-registered customers in EU member states where zero rating conditions in paragraph 4.3 are met. (Supplies may be zero-rated.) | Boxes 6 and 8 – value of supply | Yes – customer’s VAT number and value of supply | Yes – as a dispatch (value of supply) |

| Goods supplied to customers in EU member states where zero rating conditions in paragraph 4.3 are not met. (UK VAT charged at appropriate rate, but see paragraph 6.4 about distance selling.) | Box 1 – output tax* and 6 - value of supply (*see paragraph 16.9 in cases where the time limits for removal and getting evidence are not met) |

No | Yes – as a dispatch. See paragraph 6.17 for distance sales and Notice 60: Intrastat general guide. |

3.8 Goods that are lost, destroyed or stolen

As the supplier your liability to account for VAT depends on the circumstances.

| Where goods are lost, destroyed or stolen and this occurs | then |

|---|---|

| in Northern Ireland before you have supplied them (for example, whilst in storage awaiting delivery or collection) | if there has been no supply, no VAT is due |

| while being transported in Northern Ireland by either you or your customer | VAT is due unless you hold evidence of loss, destruction or theft (for example, an insurance claim or police investigation) |

| while being transported outside Northern Ireland by either you or your customer | the goods may continue to be zero-rated (see paragraph 4.3) provided you have valid proof of removal of the goods from Northern Ireland and the VAT registration number of your customer. (Your customer may still be liable to account for acquisition tax. Also there may be additional VAT liabilities if the loss, destruction or theft occurs en route through an EU member state. In that event you should check on the position with the VAT authority in the EU member state concerned – see paragraph 2.8). |

4. Zero-rated supplies to VAT-registered customers in an EU member state

4.1 EU law covered by this section

Article 138 of the Principle VAT Directive (2006/112/EC) states that EU member states shall exempt certain supplies subject to conditions (Article 131) laid down for the purpose of ensuring the correct and straightforward application of such exemptions (zero rating) and preventing any evasion, avoidance or abuse. UK uses the term ‘zero rating’ rather than ‘exemption’ used in EU law to avoid confusion with the use of exemption elsewhere in UK law.

4.2 UK law on removals

UK VAT law relating to the zero rating of removals of goods for VAT purposes can be found in the Value Added Tax Act 1994, Schedule 9ZA and regulations in the Value Added Tax Regulations 1995.

4.3 Zero-rated supply of goods

Regulations provide that a supply from Northern Ireland to a customer in an EU member state is liable to the zero rate where:

- your customer is VAT registered in an EU member state and has notified you of that VAT number

- the goods are sent or transported out of Northern Ireland to a destination in an EU member state

- you must submit an EC Sales List accurately accounting for the supply

Paragraph 4.6. explains what will happen if the conditions are not met.

A supply can be zero-rated at the time of the supply and in advance of the completion and submission of the relevant EC Sales List.

The VAT number of the customer does not need to have been issued by the member state to which the goods are sent but please read paragraphs 7.7 to 7.9 of this notice, which explains the fall-back rule.

If you deliver to a Northern Ireland address or your customer collects the goods from your premises, then please read the guidance in paragraph 4.7.

You should show the customer’s EU VAT registration number notified to you on your VAT sales invoice, including the 2-letter country prefix code.

Paragraph 4.9 covers the checks that you must undertake to make sure that your customer’s EU VAT number is valid.

You must not zero rate a sale, even if the goods are subsequently removed to an EU member state, if you supply the goods to a UK VAT registered customer unless that customer is also registered for VAT in an EU member state and the conditions are met.

The following sentence is a condition that has force of law. You must get and keep valid evidence (section 5) that the goods have been removed from Northern Ireland within the time limits set out at paragraph 4.4

4.4 Time limits for removal of goods and evidence of removal

The following paragraph has force of law.

Where goods are removed from Northern Ireland and the call-off stock conditions are met paragraph 15.2 , the time limit for getting valid evidence of removal is 3 months from the time the goods leave Northern Ireland.

If the supply is New Means of Transport (NMT) to a business registered for VAT in the EU the NMT must be removed within 2 months of supply.

In all other cases the time limits for removing the goods and getting valid evidence of removal will begin from the time of supply. For goods removed to an EU member state the time limits are:

- 3 months (including supplies of goods involved in groupage or consolidation prior to removal)

- 6 months for supplies of goods involved in processing or incorporation prior to removal

4.5 Goods removed to customers in EU member states after processing or incorporation

When you make a supply of goods to a VAT-registered customer in an EU member state, but have to deliver them to a third person in Northern Ireland who’s also making a taxable supply of goods or services to that customer, you can zero rate the supply provided you meet the following conditions:

The following 11 bullet points have force of law.

- you must meet the conditions of paragraph 4.3, which have force of law

- the goods are only being delivered and not supplied to the third person in Northern Ireland

- no use is made of the goods other than for processing or incorporation into other goods for removal, and

and your records show:

- the name, address and VAT number of the customer in the EC

- the invoice number and date

- the description, quantity and value of the goods

- the name and address of the third person in Northern Ireland to whom the goods were delivered

- the date by which the goods must be removed

- proof of removal obtained from the person responsible for transporting the goods out of Northern Ireland, and

- the date the goods were actually removed from Northern Ireland

- the goods you supplied have been processed or incorporated into the goods removed from Northern Ireland

In cases where the third person is not in Northern Ireland but in an EU member state, the same conditions will generally apply to allow you to zero rate your supply.

4.6 If you cannot meet the conditions

(What to do if you cannot meet all the conditions in paragraphs 4.3, 4.4 or 4.5.)

If you cannot meet the conditions you must charge and account for tax at the appropriate UK rate.

If the goods are not removed or you do not have the evidence of removal within the time limits you must account for VAT as described in paragraph 16.11. No VAT is due on goods which would normally be zero-rated when supplied in the UK. Paragraph 16.12 explains what to do if you subsequently meet the conditions.

If you fail to meet the requirements (without reasonable excuse – paragraph 17.13) to obtain the customer’s VAT number or to submit an accurate EC Sales List, then zero rating is not permitted and is liable to be revoked from the due date of the EC Sales List. See paragraph 16.11.

4.7 If your customer arranges for the removal of the goods

If your customer arranges to collect the goods, or you deliver the goods to premises in Northern Ireland you should agree with your customer what evidence of removal will be provided to you and when. You may wish to consider taking a deposit for the VAT (see paragraph 5.5) if you have reason to doubt that the goods will be removed.

Extra caution may be advisable if your customer:

- is not previously known to you

- pays in cash

- purchases types or quantities of goods inconsistent with their normal commercial practice

4.8 How to get your EU customer’s VAT registration number

You should carry out normal commercial checks such as bank and trade credit worthiness references before you start making supplies to an EU customer. As part of these checks you should ask your customer to supply you with their EU VAT number in writing. You should keep the letter or advice you’ve had from your customer for future reference because one of the conditions for zero rating your supply is that you hold a valid EU VAT number for your customer.

For further information on normal commercial checks, see Joint and several liability for unpaid VAT (Notice 726).

4.9 How to make sure your EU customers give you their VAT registration numbers

When you write to your customer, ask them to provide you with the number which has been allocated to them for EU trade. In certain EU countries businesses are required to register their VAT number for intra-EU use and if they do not do this, the number will show as invalid on the Europa website. If they do not supply you with their VAT number then you’re obliged to charge UK VAT on any supplies of goods.

4.10 Checking the validity of an EU customer’s VAT registration number

You should check the validity of the number you have been given by making sure it follows the format at paragraph 16.18. Further checks on the validity of a customer’s number should be made using the Europa website.

All EU member states share these arrangements, as does the UK in respect of Northern Ireland, and businesses in EU member states can similarly verify the VAT registration number of a UK business identified as operating under the Northern Ireland protocol in the same way.

When making an enquiry on the Europa website you must identify yourself by entering your own VAT registration number and record of the date and time that the enquiry was made and the result of the enquiry. You must also regularly check your EU customer’s VAT registration number to make sure that the details are still valid and that the VAT registration has not been recently cancelled.

Alternatively you can contact the VAT: general enquiries helpline to validate your customer’s VAT registration number and to verify that the name and address is correct.

4.11 If your customer’s VAT number turns out to be invalid

If it later turns out that the customer’s number was invalid, for example, a tax authority’s database was not up to date, the validation record will help show your compliance with the rules in the event that any VAT fraud and revenue losses occurred.

You do not have to account for VAT, but only if you have genuinely done everything you can to check the validity of the VAT number, can demonstrate you have done so, have taken heed of any indications that something might be wrong and have no other reason to suspect the VAT number is invalid.

4.12 The meaning of ‘reasonable steps’

HMRC does not expect you to go beyond what’s reasonable, but will be seeking to identify what actions you took to check the validity of your customer’s EU VAT registration number. This will focus on the due diligence checks you undertook and, most importantly, the actions taken by you in response to the results of those checks.

We would consider ‘reasonable steps’ to be, you genuinely doing everything you can to check the integrity of the VAT registration number, being able to demonstrate you have done so and taking heed of any indications that the number may be invalid.

Some examples of not having taken ‘reasonable steps’ would be using a VAT number:

- that does not conform to the published format for your customer’s EU member state as shown in paragraph 16.18

- that you have not regularly checked using the Europa website or with HMRC

- which you’ve already been told is invalid

- which you know does not belong to your customer

4.13 If reasonable steps are not taken

VAT will be chargeable if we do not consider you’ve taken reasonable steps. You’ll have to account for VAT at the appropriate UK rate.

4.14 Supplies of freight containers

The supply of a container for removal to an EU member state is treated as the removal of goods and the treatment follows the general EU rules. The lease or hire of a container is a supply of services and you will need to refer to the rules set out in Notice 741A: place of supply of services.

The temporary movement of containers from Northern Ireland to EU member states (whether involved in transporting goods or where the container is on lease or hire to other customers) is not treated as a removal from Northern Ireland with a subsequent acquisition in the destination member state. But, you’ll need to keep commercial evidence that the containers have left the UK and have later returned. In the case of a temporary movement of a container, you will need to make an entry in your Register of Temporary Movements.

5. Evidence of removal of goods

5.1 Overview

Paragraph 4.3 (which has force of law) includes a requirement that you get and keep valid commercial evidence to show that the goods have been removed from Northern Ireland within the time limits set out at paragraph 4.4.

Article 45a of Council Implementing Regulation 282/2011 sets out the conditions under which the goods can be presumed to have been removed. The Implementing Regulation is directly applicable, so no further legislation is required to implement it into UK law.

Paragraph 5.2 sets out the ‘presumption’ rules.

Businesses which have difficulty gathering the information required can continue to rely on the rules set out in the rest of this section.

5.2 Presumption of removal

The effect of the rules is that, where the conditions are met, it is presumed that the goods have been transported from Northern Ireland. This presumption can be challenged by HMRC. If the relevant conditions are met, it is for HMRC to prove that the goods have not been transported from Northern Ireland.

The presumptions are met where the supplier arranges for the transport of the goods and is in possession of one of the following issued by 2 different parties that are independent of each other, of the vendor, and of the acquirer:

- at least 2 items of non-contradictory acceptable evidence from list A

- any single item from list A together with any single item of non-contradictory acceptable evidence from list B

Where the acquirer arranges the transport of the goods, the supplier must be in possession of a written statement from the acquirer, stating that the goods have been dispatched or transported by the acquirer, or by a third party on behalf of the acquirer, and identifying the destination member state of the goods.

That written statement should state:

- the date of issue

- the name and address of the acquirer

- the quantity and nature of the goods

- the date and place of the arrival of the goods

- in the case of the supply of means of transport, the identification number of the means of transport

- the identification of the individual accepting the goods on behalf of the acquirer

The statement must be provided by the 10th day of the month following the supply.

Acceptable evidence

List A: Documents relating to the dispatch or transport of the goods, such as:

- a signed CMR document or note

- a bill of lading

- an airfreight invoice

- an invoice from the carrier of the goods

List B: The following documents:

- an insurance policy with regard to the dispatch or transport of the goods or bank documents proving payment for the dispatch or transport of the goods

- official documents issued by a public authority, such as a notary, confirming the arrival of the goods in the destination member state

- a receipt issued by a warehouse keeper in the destination member state, confirming the storage of the goods in that member state

5.3 Evidence of removal

A combination of these documents must be used to provide clear evidence that a supply has taken place, and the goods have been removed from Northern Ireland:

- the customer’s order (including customer’s name, VAT number and delivery address for the goods)

- inter-company correspondence

- copy sales invoice (including a description of the goods, an invoice number and customer’s EU VAT number)

- advice note

- packing list

- commercial transport documents from the carrier responsible for removing the goods from Northern Ireland, for example an International Consignment Note (CMR) fully completed by the consignor, the haulier and signed by receiving consignee

- details of insurance or freight charges

- bank statements as evidence of payment

- receipted copy of the consignment note as evidence of receipt of goods abroad

- any other documents relevant to the removal of the goods in question which you would normally get in the course of your EU business

Photocopy certificates of shipment or other transport documents are not normally acceptable as evidence of removal unless authenticated with an original stamp and dated by an authorised official of the issuing office.

5.4 What to show on documents used as proof of removal

The following paragraph including bullet points has force of law.

The documents you use as proof of removal must clearly identify the following:

- the supplier

- the consignor (where different from the supplier)

- the customer

- the goods

- an accurate value

- the mode of transport and route of movement of the goods, and

- the EU destination

Vague descriptions of goods, quantities or values are not acceptable. For instance, ‘various electrical goods’ must not be used when the correct description is ‘2,000 mobile phones (make ABC and model number XYZ2000)’. An accurate value, for example, £50,000 must be shown and not excluded or replaced by a lower or higher amount.

If the evidence is found to be unsatisfactory you as the supplier could become liable for the VAT due.

5.5 Evidence of removal of goods to the Republic of Ireland across the Irish Land Boundary

The evidence you get must clearly show that the goods have left Northern Ireland. The types of documentary evidence required are explained in paragraphs 5.3 and 5.4. See paragraph 5.7 for advice when goods are collected by your customer. Depending on the circumstances of the removal, we recommend that you get the following types of evidence to meet the conditions for zero rating.

| If the goods are | Then commercial evidence should include |

|---|---|

| removed by road by an independent carrier | a copy of the carrier’s invoice or consignment note, supported by evidence that the goods have been delivered to a destination in the Republic of Ireland (for example, a receipted copy of the consignment note) |

| removed by rail | the consignor’s copy of the consignment note signed by the railway official accepting the goods for delivery to your customer |

| removed in your own transport | a copy of the delivery note showing your customer’s name, address, EU VAT number and actual delivery address in the Republic of Ireland if different, and a signature of your customer, or their authorised representative, confirming receipt of the goods |

| collected by your customer or their authorised representative | a written order completed by your customer, which shows their name, address, EU VAT number, the name of the authorised representative collecting the goods, the address in the Republic of Ireland where the goods are to be delivered, the vehicle registration number of the transport used, and a signature of your customer, or their authorised representative, confirming receipt of the goods |

Where you sell a motor vehicle, which is collected by your customer or their representative, it may be difficult to get satisfactory evidence of removal from Northern Ireland. In these circumstances, a copy of the vehicle registration document issued by the authorities in the Republic of Ireland will normally provide satisfactory evidence of removal if supported by other evidence described in paragraph 5.3 and paragraph 5.5.

5.6 If you deliver the goods to your customer in an EU member state

In addition to the examples of acceptable documents relating to the sale listed in paragraph 5.3, travel tickets can also be used to demonstrate that a Northern Ireland-EU journey took place for the purpose of removing the goods from Northern Ireland.

5.7 If your customer collects the goods or arranges for their collection and removal from Northern Ireland

If your VAT-registered EU customer is arranging removal of the goods from Northern Ireland it can be difficult for you as the supplier to get adequate proof of removal as the carrier is contracted to your EU customer. For this type of transaction the standard of evidence required to substantiate VAT zero rating is high.

Before zero rating the supply you must ascertain what evidence of removal of the goods from Northern Ireland will be provided. You should consider taking a deposit equivalent to the amount of VAT you would have to account for if you do not hold satisfactory evidence of the removal of the goods from Northern Ireland. The deposit can be refunded when you get evidence that proves the goods were removed within the appropriate time limits.

Evidence must show that the goods you supplied have left Northern Ireland. Copies of transport documents alone will not be sufficient. Information held must identify the date and route of the movement of goods and the mode of transport involved. It should include the following.

| Item | Description |

|---|---|

| 1 | Written order from your customer which shows their name, address and EU VAT number and the address where the goods are to be delivered |

| 2 | Copy sales invoice showing customer’s name, EU VAT number, a description of the goods and an invoice number |

| 3 | Date of departure of goods from your premises and from Northern Ireland |

| 4 | Name and address of the haulier collecting the goods |

| 5 | Registration number of the vehicle collecting the goods and the name and signature of the driver and, where the goods are to be taken out of Northern Ireland by a different haulier or vehicle, the name and address of that haulier, that vehicle registration number and a signature for the goods |

| 6 | Route, for example, Channel Tunnel, port of exit |

| 7 | Copy of travel tickets |

| 8 | Name of ferry or shipping company and date of sailing or airway number and airport |

| 9 | Trailer number (if applicable) |

| 10 | Full container number (if applicable) |

| 11 | Name and address for consolidation, groupage, or processing (if applicable) |

5.8 How long to keep your evidence of removal

You must make sure that the proof of removal is:

- kept for 6 years

- made readily available so that any VAT assurance officer is able to substantiate the zero rating of your removals

5.9 Using an agent

You, as the supplier of the goods, or your customer can appoint a freight forwarder, shipping company, airline or other person to handle your EU supplies and produce the necessary evidence of removal.

But you remain legally responsible for ensuring that the conditions for zero rating supplies of goods to EU member states, as set out in paragraphs 4.3, 4.4 and 4.5, are met. This includes getting and holding evidence of removal of the goods from Northern Ireland.

5.10 Groupage or consolidation transactions

If you use a freight forwarder, consignments (often coming from several consignors) may be aggregated into one load, known as groupage or consolidation cargo. The freight forwarder must keep copies of the original bill of lading, sea waybill or air waybill, and all consignments in the load must be shown on the container or vehicle manifest.

You’ll be issued with a certificate of shipment by the freight forwarder, often supported by an authenticated photocopy of the original bill of lading, a sea waybill or a house air waybill.

Where such consignments are being removed, the forwarder may be shown as the consignor in the shipping documents.

(a) Certificate of shipment

Certificates of shipment are usually produced by packers and consolidators involved in road, rail and sea groupage consignments when they themselves receive only a single authenticated transport document from the carrier. It’s an important document, which should be sent to you as soon as the goods have been removed from Northern Ireland.

The certificate of shipment must be an original and authenticated by an official of the issuing company unless it is computer produced, on a once-only basis, as a by-product of the issuing company’s accounting system. A properly completed certificate of shipment will help you to meet the evidential requirements described in paragraph 5.3.

(b) Information

Although the certificate of shipment can be in any format, it must be an original and will usually contain the following information:

- the name and address of the issuing company

- a unique reference number or issuer’s file reference

- the name of the supplier of the goods (and VAT number if known)

- the place, port or airport of loading

- the place, port or airport of shipment

- the name of the ship or the aircraft flight prefix and number

- the date of sailing or flight

- the customer’s name

- the destination of the goods

- a full description of the goods removed to an EU member state (including quantity, weight and value)

- the number of packages

- the supplier’s invoice number and date if known

- the bill of lading or airway bill number (if applicable)

- the identifying number of the vehicle, container or railway wagon

5.9 Postal services

Goods sent by post may be zero-rated if they’re sent directly to your customer registered for VAT in an EU member state, and you hold the necessary evidence of posting. The receipted forms described, plus the Parcelforce Worldwide statement of account or parcel manifest listing each parcel or multi-parcel, will provide evidence of removal.

Letter post or airmail

A fully completed certificate of posting form presented with the goods and stamped by the Post Office. Acceptable forms are:

- form C&E132 for single or multiple packages taken to the Post Office

- form P326 available from the Post Office and used for single packages taken to the Post Office, or a Certificate of Posting for international mail only, or a Royal Mail Collection Manifest, available from a Royal Mail sales adviser, for use by customers using their Business Collections Service, where the Royal Mail collection driver signs the certificate

You can find further information on Parcelforce Worldwide international services.

Parcels

Parcelforce Worldwide operates a range of international parcel services. If you use any of these services you will be provided with:

- a service specific barcoded label

- a customs export declaration (for non-EU destinations only)

- a copy of the Parcelforce Worldwide conditions of carriage

- a printed receipt, which is your proof of shipment for all destinations

An individual barcode label must be affixed to every parcel. You do not need to complete the customs export declaration for goods being sent to an EU member state.

If you arrange for the parcel to be collected from your premises the collecting driver will sign your printed receipt. This is your proof of shipment for EU destinations.

If the parcel is taken to a Post Office, the counter clerk will provide you with a printed proof of shipment from the Post Office SmartPost system. This will show the overseas delivery address, date of dispatch and unique consignment number. You should keep this printed proof of shipment as your evidence of removal.

In addition to the individual parcel declarations, account customers of Parcelforce Worldwide have 2 further potential sources of information listing multiple parcel dispatches. These are:

- Worldwide Dispatch manager (WDM) – online users can print a manifest which lists all dispatched parcels

- a Statement of Account

All of the individual parcel declarations, plus either the manifest or the statement of account listing each dispatch will provide proof of removal for VAT purposes.

You can find further information on Parcelforce Worldwide international services.

5.12 Couriers and fast parcel services

Courier and fast parcel operators specialise in the shipment of goods to overseas destinations within guaranteed timescales.

(a) Operators who do not issue separate certificates of shipment

Most courier and fast parcel operators do not issue separate certificates of shipment. The invoice for moving goods from Northern Ireland, which bears details of the unique airway bill numbers for each shipment, represents normal commercial evidence of removal. In addition, many express companies are able to offer a track and trace service on their websites where the movement of goods can be traced through to the final destination. This information can be used to confirm removal from Northern Ireland.

(b) Operators who use the system based upon a dispatch pack

A few companies still use a documentary system based upon a dispatch pack containing accounting data, a customs export declaration and receipt copies of the relevant house airway bill or consignment note. These packs are issued to customers to complete for each removal from Northern Ireland.

An export declaration does not need to be completed for goods being sent to an EU member state but a dispatch pack must be completed for each overseas address and consignee. The driver collecting the parcels will endorse the receipt copy and return it to the consignor. This, plus the statement of account listing each removal, will provide evidence of removal from Northern Ireland.

(c) Use of more than one courier or fast parcel company

Due to the complexities of the movement of goods within the courier or fast parcel environment, there is often more than one company involved in the handling and ultimate removal of the goods. Ultimately, you as the supplier may not be certain as to which courier or fast parcel company has removed the goods. If you’re aware that this may happen you will need to establish what proof of removal you will receive from the company to whom you give your goods. The proof available is described in (a) and (b).

(d) Overseas customer arranging the removal by courier

If your EU customer arranges for the goods to be removed by courier you should ascertain what proof of removal they will be providing to allow you to zero rate the supply. You should consider taking a deposit equivalent to the amount of VAT you would have to account for if you do not hold satisfactory evidence of the removal of the goods from Northern Ireland. The deposit can be refunded when you get evidence that proves the goods were removed within the appropriate time limits.

6. Supplies to customers (including private individuals) who are not registered for VAT

6.1 Accounting for VAT

For supplies to non-taxable persons VAT is normally accounted for by the supplier as a domestic supply where the goods are dispatched from. Non-taxable person includes private individuals, public bodies, charities and businesses which are not VAT-registered because their turnover is below the registration threshold or whose activities are entirely exempt.

6.2 Tax point for supplies where UK VAT is chargeable

As a domestic supply, liable to UK VAT, the normal tax point rules apply. For further information about the normal rules, see the sections dealing with time of supply in the VAT guide (Notice 700).

6.3 Special arrangements for supplies of goods to consumers

Special arrangements apply to the following:

- supplies to non-taxable persons of new means of transport including boats, aircraft and motor vehicles (for further information, see VAT on new means of transport (Notice 728))

- supplies of excise goods for private purposes (for further information see paragraph 15.4)

- distance sales (for further information see paragraph 6.4 and VAT Notice 700/1: should I be registered for VAT?)

- purchases by exempt bodies and non-taxable organisations (for further information about how this can make the purchaser liable to register for VAT, see VAT Notice 700/1: should I be registered for VAT?)

6.4 Distance selling

Distance selling occurs when a taxable person in Northern Ireland or an EU member state supplies and delivers (or facilitates the delivery of) goods across an EU border to a non-taxable person (Business to Consumer (B2C)). The most common examples of distance sales are goods supplied by mail order or ordered over the internet.

6.5 How to treat distance sales from Northern Ireland to EU member states

(a) Accounting for VAT

Businesses registered for VAT in the UK and which make distance sales from Northern Ireland should tell HMRC that they are as trading under the Northern Ireland Protocol.

If you make distance sales from Northern Ireland you should charge UK VAT until:

- the value of your supplies in a calendar year exceed the distance selling threshold of £8818 (€10,000) in respect of goods

- you exercise the option described in paragraph 6.10

Once the value of your distance sales exceeds this threshold, you’ll be liable to register and account for VAT in all EU member states where you make supplies to (see paragraph 2.8). The threshold test is set out in paragraph 6.6.

(b) One Stop Shop (OSS)

To simplify the reporting of distance sales you will be able to submit a single quarterly return and payment for all your sales to the EU through an optional online portal. This will mean you do not need to register for VAT in every member state you make supplies to.

Further information on registering for and using the OSS can be found in Register to report and pay VAT on distance sales of goods from Northern Ireland to the EU.

(c) Intrastat

If you trade above the Intrastat threshold you must report your distance sales to all non-taxable persons on your Intrastat Supplementary Declaration, even when your distance sales from Northern Ireland are below the distance selling threshold in the EU member states of arrival. For further information, see Notice 60: Intrastat general guide.

6.6 Distance selling threshold for each EU member state

From 1 July 2021 the pan-EU threshold is £8818 (€10,000). The £8818 is the total value of sales made to customers throughout the EU.

6.7 Distance sales of excise goods

If you make any distance sales of any excise goods (alcohol and tobacco) to an EU member state you’ll be required to register and account for VAT in that EU member state, irrespective of the value involved.

6.8 Records of distance sales to each EU member state

You must keep a separate record of your distance sales to EU member states. This will allow you to monitor any liability to register for VAT on your distance sales in the destination EU member states, or for the OSS.

6.9 Appoint someone to act on your behalf in an EU member state

If you register in an EU member state, you may need to appoint someone to act on your behalf there. You should check this with the relevant VAT authority (see paragraph 2.8). Alternatively, you may register for the OSS.

6.10 Opting to account for VAT on supplies in the EU member state to which the goods are sent

If your distance sales of goods are below the pan-EU threshold you may, nevertheless, opt to register and account for VAT on the sales in that state or through the OSS.

6.11 How to exercise the option

If you decide to exercise the option you must notify HMRC by writing to the appropriate written enquiries team and either:

- apply for VAT registration with the VAT authority for the EU member state to which the goods are sent

- register for the OSS

You will then be subject to, and must comply with, the VAT rules in the EU member state or of the OSS.

6.12 UK VAT accounting

Once you are required to or have taken up the option to account for VAT as a distance sale, you’ll no longer charge UK VAT on the goods covered by the option.

6.13 When you can cancel the option

You’ll normally be required to remain registered for at least 2 calendar years from the date of registration. After this time, if the value of your supplies remains below the threshold and you decide to cancel your option, you must notify HMRC by writing to the appropriate written enquiries team. This should not be less than 30 days before the date of the first supply you intend to make after the cancellation. Once cancelled you will restart accounting for UK VAT as before.

6.14 What to do if you’re required to register for VAT in an EU member state

The registration requirements in each EU member state vary. If you’re required to register for VAT in an EU member state, you must notify the appropriate VAT authority (see paragraph 2.8). You’re responsible for making sure that you register at the correct time and that you account for tax to the correct VAT authority. Alternatively you can register for the OSS.

6.15 Distance selling rules and group registrations

Group treatment Notice 700/2 is a facility which allows 2 or more corporate bodies controlled by the same person, to account for VAT as a single VAT registration. Although each VAT group member is, and remains, a legal entity in its own right, it’s treated as a single taxable person in the UK. But UK VAT groups are not recognised in EU member states.

Group members must therefore individually monitor the value of their own distance sales. Where the value of sales in a calendar year exceeds a pan-EU distance selling threshold, that group member will be liable to register in their own right.

A group member is entitled to exercise the option described at paragraph 6.10.

6.16 What to do if you’re making distance sales into Northern Ireland

From 1 July 2021 distance sales of goods into Northern Ireland will count towards the pan-EU threshold of £8818 (€10,000) and you will be liable to register and account for UK VAT on all these sales.

Prior to 1 July 2021 if you made distance sales to Northern Ireland, and the value of these sales in a calendar year exceeded the UK threshold of £70,000, you would have been liable to register for VAT in the UK.

But any supplies involving goods subject to Excise Duty are not subject to the threshold and you must register for VAT immediately you make a supply of this kind. You can also register voluntarily if you notify your home authorities see paragraph 6.10.

For more information about registering for VAT in the UK for distance sales into Northern Ireland, see VAT Notice 700/1: should I be registered for VAT.

6.17 Reporting requirements

| Type of movement | VAT Return | EC Sales List (see section 17) | Supplementary Declaration (see section 18) | Notes |

|---|---|---|---|---|

| Distance sales from Northern Ireland below the pan-EU threshold | Box 1 – output tax. Box 6 – value of supply |

No | Yes – as a dispatch (use VAT exclusive value). (See Notice 60: Intrastat general guide) | Treated as a domestic supply for VAT purposes, but must still be declared on your Supplementary Declaration |

| Distance sales from Northern Ireland on or above the pan-EU threshold in the EU member state of arrival (or where option to register there has been exercised – see paragraph 6.10) | Boxes 6 and 8 – value of supply | No | Yes – as a dispatch (value of supply) | Although VAT is chargeable on the supply in the EU member state of the arrival, the value must still be declared on your UK VAT Return or through the OSS, and Supplementary Declaration |

| Distance sales to Northern Ireland above the pan-EU threshold (or where option to register here has been exercised, see paragraph 6.16) | Box 1 – output tax Box 6 – value of supply |

No | Yes – as an arrival (value of supply) if the Intrastat threshold for arrivals has been exceeded. (See Notice 60 Intrastat General Guide for details of the current Intrastat threshold) | Treated as a supply in UK and supplier required to register here, or account for the VAT through the OSS |

| Distance sales to Northern Ireland below UK distance selling threshold | No | No | No | No |

7. Northern Ireland acquisition of goods from an EU member state

7.1 The definition of an ‘acquisition’

An acquisition in Northern Ireland occurs where:

- there’s a movement of goods from an EU member state to Northern Ireland

- the goods are received by a VAT-registered business

- the supplier is registered for VAT in the EU member state of departure

In which case the recipient is required to account for VAT on the goods acquired into Northern Ireland.

7.2 Account for acquisition tax in Northern Ireland

You must account for any tax due on your VAT Return for the period in which the tax point occurs (see paragraph 7.3) and you may treat this as input tax on the same VAT Return subject to the normal input tax deduction rules (see paragraph 2.13).

7.3 Time of acquisition

The time of acquisition is the earlier of either the:

- 15th day of the month following the one in which the goods were sent to you

- date your supplier issued their invoice to you

7.4 Rate of VAT on acquisitions into Northern Ireland

Acquisitions are liable at the same rate as domestic supplies of identical goods in the UK. So, for example, no tax is due on acquisitions of goods which are currently zero-rated in the UK.

7.5 Account for acquisition tax if you make a part or full payment for the goods

Part or full payment for an EU supply of goods does not create a tax point for the acquisition.

7.6 What to do if your supplier sends you an invoice for the amount you paid

You should account for the acquisition tax, provided the date of issue of the invoice is earlier than the 15th day of the month following the one in which the goods were sent to you.

7.7 Where acquisition tax is due

The VAT on an acquisition is always due in the place (Northern Ireland or EU member state) where the goods are physically received. But there’s a ‘fallback’ provision that applies where the VAT registration number quoted to the supplier to secure zero rating has been issued by a different tax authority. In that event the acquisition tax must be accounted for in the place of VAT registration used, but the customer also remains liable to account for acquisition VAT in the place to which the goods have physically been sent.

7.8 Account for acquisition tax whenever you give your UK VAT number identifying you as trading/operating under the Protocol to an EU supplier

You’re liable to account for acquisition tax in the UK unless you can demonstrate that you have already accounted for acquisition VAT in the EU member state to which the goods were dispatched where this is different (see paragraph 7.7). Acquisition tax accounted for under the ‘fallback’ is not deductible as input tax in any circumstance.

7.9 Refund of UK acquisition tax if VAT is also accounted for in the EU member state of physical arrival of the goods

You can get a refund of any UK acquisition tax accounted for in the circumstances described in paragraph 7.8.

7.10 Changes to your VAT registration

It’s in your own interest to let us know of changes to your business details. This allows us to make sure that our records and the Europa website are kept up to date at all times. We can also reply correctly and without delay to any enquiries made about your registration number.

If you acquire goods from EU member states you will need to inform your suppliers of any changes to your VAT registration number. Otherwise they’ll have to charge you VAT on their supplies.

7.11 Reporting requirements

| Type of movement | VAT Return | EC Sales List (see section 17) | Supplementary Declaration (see section 18) | Notes |

|---|---|---|---|---|

| Acquisitions of goods from VAT-registered suppliers in EU member states | Box 2 – acquisition VAT for goods positive-rated in UK Box 4 – input tax subject to normal rules (see paragraph 2.13 Boxes 7 and 9 – value of acquisition |

No | Yes – as an arrival (value of supply) | You must provide your EU supplier with your VAT number to quote on the sales invoice |

8. Tax value of acquisitions

8.1 Calculating the amount of tax due on an acquisition

The amount of tax due on an acquisition is the tax value multiplied by the appropriate VAT rate. The tax value is normally what you paid for the goods and is also called the ‘consideration’. VAT Guide Notice 700 gives for further information on calculating the consideration.

8.2 What to do if the value of your acquisition is in a foreign currency

Where the value of your acquisition is in a foreign currency, you should convert it to sterling using the rules in VAT Guide Notice 700, paragraph 7.6, which has force of law.

8.3 Include any excise duty in the tax value of an acquisition

For goods subject to excise duty or, in the case of EU accessionary states, customs duty or agricultural levy, the value of the acquisition is the value determined according to the principles outlined in Notice 700 plus the duty or levy arising from the removal to Northern Ireland.

9. Transfers of own goods between Northern Ireland and EU member states

9.1 Position if you transfer your own goods

A transfer of your own goods from Northern Ireland to an EU member state within the same legal entity, for example between branches of the same company, is deemed to be a supply of goods for VAT purposes.

9.2 Supply liable to VAT

The transfer of your own goods is liable to VAT in the same way as other EU supplies of goods described in this notice.

9.3 Zero-rated supply

The supply may be zero-rated subject to the conditions in paragraph 4.3.

9.4 Acquisition tax

You’ll normally be liable to account for acquisition VAT in the EU member state to which the goods are transferred.

9.5 Register for VAT in the EU member state to which the goods are sent

You may need to register for VAT in the EU member state to which the goods were dispatched in order to meet your obligations to account for acquisition tax and also to account for VAT if you subsequently supply the goods there. You’ll also be able to use that VAT registration number to support zero rating of the deemed supply from Northern Ireland (see paragraph 4.3).

9.6 What to do if you’re not registered in the EU member state to which the goods are sent

If you are not registered for VAT in the EU member state to which you transfer your own goods, you should treat the supply as a domestic supply (see paragraph 6.1). You must account for VAT on the transfer at the appropriate UK rate.

9.7 Register for VAT in the UK if you transfer your own goods from an EU member state

This will depend on whether you exceed the UK VAT registration thresholds. For further information about registering for VAT in the UK, see VAT Notice 700/1: should I be registered for VAT?. You will also need tell HMRC that you are trading or operating under the Northern Ireland Protocol.

9.8 Exceptions to the rule

There are some exceptions which are covered in sections 10 and 11.

9.9 Reporting requirements

| Type of movement | VAT Return | EC Sales List (see section 17) | Supplementary Declaration (see section 18) | Notes |

|---|---|---|---|---|

| Transfers from Northern Ireland to EU member states | Boxes 6 and 8 – value based on cost of goods | Yes – value based on cost of goods | Yes – as a dispatch (value based on cost of goods) | A deemed supply in the UK. It may be zero-rated subject to the conditions in paragraph 4.3 |

| Transfers from EU member states to Northern Ireland | Box 2 – acquisition VAT for positive-rated goods in UK Box 4 – input tax subject to normal rules (see paragraph 2.10) Boxes 7 and 9 – value based on cost of goods |

No | Yes – as an arrival (value based on cost of goods) | There’s an acquisition into Northern Ireland by the owner of the goods |

10. Temporary movement of goods

10.1 Temporary movements of goods treated as a transfer of your own goods

The following temporary movements are not treated as deemed supplies of goods as described in section 9:

- goods transferred temporarily to an EU member state in order to make a supply of services there provided all of the conditions at paragraph 10.2 are met

- goods transferred to an EU member state for temporary use there provided all of the conditions at paragraph 10.4 are met

In each case no acquisition VAT is due in the EU member state to which the goods are transferred.

10.2 Conditions for the temporary movement of goods used to make a supply of services

You must meet all of the following conditions:

- You do not have a place of business in the EU member state to which the goods are temporarily transferred.

- You have a specific contract to fulfil.

- You intend to return the goods to the EU member state from which they were dispatched.

10.3 Circumstances this might apply

This can apply to your tools and equipment which you take to an EU member state (or bring to Northern Ireland) to use there, for example to repair or service machinery. It also applies to goods that are loaned or leased to somebody.

10.4 Conditions for goods transferred for temporary use

You must meet both of the following conditions:

- the goods would be eligible for temporary importation relief if they were imported from outside the EU

- they’re to remain in the EU member state (or Northern Ireland) for no longer than 2 years

10.5 Goods eligible for temporary import relief

For further information about this, see Notice 3001: customs special procedures for the Union Customs Code.

10.6 If circumstances change

The conditions described at paragraphs 10.2 or 10.4 may later cease to be met (for example, in the case of paragraph 10.2, where the goods are disposed of locally rather than returned to Northern Ireland or, in the case of paragraph 10.4, they are to remain in an EU member state for more than 2 years). In that event the original movement should be treated belatedly as a deemed supply and acquisition, as described in section 9.

10.7 Evidence of removal and return to Northern Ireland

Although these transfers of your own goods are not treated as supplies for VAT purposes, you still need commercial evidence that the goods left Northern Ireland and have later returned. You must also maintain a register of temporary movements of goods, as described in paragraph 16.8.

10.8 Reporting requirements

| Type of movement | VAT Return | EC Sales List (see section 17) | Supplementary Declaration (see section 18) | Notes |

|---|---|---|---|---|

| Goods sent from Northern Ireland used in making a supply of services in an EU member state that remain outside of Northern Ireland for less than 2 years | No | No | No | Requirement to keep a register of goods moved temporarily (see paragraph 16.8) |

| Goods sent from Northern Ireland used in making a supply of services in an EU member state that remain outside of Northern Ireland for more than 2 years | No | No | Yes – as a dispatch (value based on cost of goods) | Requirement to keep a register of goods moved temporarily (see paragraph 16.8) |

| Temporary transfer of goods from Northern Ireland which would be eligible for temporary importation relief if sent from outside EU that remain outside of Northern Ireland for less than 2 years | No | No | No | Requirement to keep a register of goods moved temporarily (see paragraph 16.8) |

11. Installed or assembled goods

11.1 The meaning of ‘installed or assembled goods’

A supply of installed or assembled goods occurs when you supply goods and there’s a contractual obligation for you to install or assemble the goods for your customer. For example, a supplier of studio recording equipment where the supply involves installation at the customer’s studio.

11.2 Place of supply of installed or assembled goods

The supply takes place where the installation or assembly of the goods is carried out.

11.3 Register for VAT for supplies of installed or assembled goods

You’re liable to register for VAT in the UK or any EU member state in which you’re supplying installed or assembled goods. But some EU member states operate a simplified procedure which permits the VAT-registered customer to account for the VAT due. You’re not required to register in an EU member state which has this facility.

11.4 EU member states that operate the simplified procedure

Adoption of the simplified procedure is optional. To find out if it’s available in a particular EU member state you should contact the VAT authority there (see paragraph 2.8).

11.5 Liability to acquisition tax

The movement of the goods (for example, the component parts) between Northern Ireland and EU member states as part of a supply of installed or assembled goods is not treated as a supply of own goods. Consequently, there is no acquisition into Northern Ireland or the EU member state of installation or assembly.

11.6 Accounting for VAT on goods installed or assembled in Northern Ireland

If you supply goods from outside the UK to be installed or assembled in Northern Ireland (your supply is liable to VAT in the UK and you may be required to register here. But the simplified procedure mentioned in paragraph 11.3 is available in Northern Ireland. You may use that simplified procedure provided:

-

your customer is registered for VAT in the UK and is identified as trading/operating under the Protocol

- you’re registered for VAT in an EU member state

- you’re not required to be registered in the UK for any other reason

11.7 The simplified procedure

Under the simplified procedure your customer is treated as acquiring the goods into Northern Ireland and must account for acquisition VAT on the full value of your supply. As a result you’re no longer liable to account for VAT.

11.8 Using the simplified procedure

If you’re a supplier in an EU member state and you wish to use these simplified arrangements you must do all of the following:

Step 1

Issue your customer with a VAT invoice.

Step 2

Issue that invoice within 15 days of the date on which your supply would otherwise have taken place under normal UK time of supply rules for goods. (For further information about this, see the sections dealing with time of supply in the VAT guide (Notice 700)). These include receipt of a payment, or completion of the installation or assembly.

Step 3

Tell us you intend to use this arrangement by writing to:

HM Revenue and Customs – VAT Written Enquiries

123 St Vincent Street

Glasgow City

Glasgow

G2 5EA

United Kingdom

Include the following information:

- your name, address and EU VAT registration number

- the name, address and VAT registration number of your customer (you must make a separate notification for each customer no later than the date of issue of the first invoice to the customer concerned)

- the date on which you began, or will begin, the installation or assembly of the goods

Step 4

Send a copy of the notification to your customer to advise them that you’re using the simplified arrangements and so they’re required to account for the VAT. You must send this no later than the date you issue the first invoice to your customer.

11.9 Notification for further supplies to the same customer

You only have to make one notification for each customer, the notification will cover all future supplies to them. You will only have to make further notifications for new customers.

11.10 Receive installed or assembled goods from a supplier using the simplified procedure

As the customer receiving the supply in Northern Ireland you should account for VAT on the supply to you as an acquisition by including the tax in box 2 of your VAT Return. You may also include this as input tax on the same VAT Return subject to the normal input tax deduction rules (see paragraph 2.13).

11.11 Reporting requirements

| Type of movement | VAT Return | EC Sales List (see section 17) | Supplementary Declaration (see section 18) |

|---|---|---|---|

| Goods sent from Northern Ireland for installation or assembly in an EU member state | Box 6 – value of supply Box 8 – value based on cost of goods at time of dispatch |

No | Yes – as a dispatch (value based on cost of goods if known, otherwise open market value) |

| Goods sent from an EU member state for installation or assembly in Northern Ireland where supplier registers for VAT in UK and is identified as trading/operating under the Protocol | Box 1 – output tax Box 6 – value of supply |

No | Yes – as an arrival (value based on cost of goods if known, otherwise open market value) |

| Goods installed or assembled in Northern Ireland where supplier elects to use simplification procedure. (Customer is responsible for reporting requirements) | Box 2 – acquisition VAT Box 4 – input tax (subject to normal rules see paragraph 2.13) Boxes 7 and 9 – value of acquisition |

No | Yes – as an arrival (value based on cost of goods if known, otherwise open market value) |

12. Movements of goods for process, repair, and so on

12.1 This section

This section outlines the VAT treatment of goods that are moved between Northern Ireland and EU member states in circumstances where some form of service is to be applied to those goods. The services can include things like processing, repair and valuation.

12.2 Goods sent from Northern Ireland for work to be carried out elsewhere in the EU

This can include goods sent to more than one service provider in the EU member state or in different EU member states provided, in all cases, the goods are returned to Northern Ireland after the services have been completed. Where it applies there is no deemed supply of own goods as described in section 9.

You must:

Step 1

Record the movement of the goods in your temporary movements register (see paragraph 16.8).

Step 2

Hold commercial documentary evidence that the goods have been removed from Northern Ireland.

Step 3

Account for VAT on each of the supplies of services you have received as a reverse charge. (For further information about the reverse charge, as it applies to work carried out on goods, see VAT Notice 741A: place of supply of services.)

Step 4

Where applicable complete an Intrastat Supplementary Declaration (see paragraph 12.7). For more information about Intrastat, see Notice 60: Intrastat general guide.

12.3 Goods sent to Northern Ireland for work to be carried out

As the supplier of the service there is no requirement for you to account for VAT on the movement of the goods provided you return them to your customer when the work has been completed. VAT Notice 741A: place of supply of services. Tells you about the treatment of your supply of work on the goods.

You must:

Step 1

Record the arrival and return of the goods in your temporary movements register (see paragraph 16.8).

Step 2

Hold commercial documentary evidence that the goods have been removed from Northern Ireland.

Step 3

Where applicable complete an Intrastat Supplementary Declaration (see paragraph 12.7). For more information about Intrastat, see Notice 60: Intrastat general guide.

12.4 Goods not returned to the EU member state of departure

These arrangements do not apply if, for any reason, the goods are not eventually returned to the EU member state from which they were originally sent. In that event they become subject to the normal EU supply and acquisition rules and the owner of the goods may be liable to register for VAT in the EU member state concerned.

12.5 Work performed on goods in an EU member state before removal to Northern Ireland

This can occur where you buy goods from an EU member state and have work performed on them before they’re removed to Northern Ireland. The work may be performed by more than one supplier and they may be located in different EU member states. Whatever the position you’re required to:

Step 1

Account for acquisition VAT on the supply of the goods in the normal way.

Step 2

VAT Notice 741A: place of supply of services tells you about the treatment of the supply to you of work on the goods.

Step 3

Where applicable complete an Intrastat Supplementary Declaration (see paragraph 12.7). For more information about Intrastat, see Notice 60: Intrastat general guide.

12.6 Work performed on goods before removal from Northern Ireland

This can occur if you make an EU supply of goods and your customer has work performed on them before they leave Northern Ireland. In this situation you can continue to treat the supply under the normal rules described in section 3 provided you meet all the relevant conditions. You will therefore need to make sure that your customer provides you with evidence of removal of the goods from Northern Ireland once the work has been completed (see paragraph 4.5).

12.7 Reporting requirements

Repaired goods

| Type of movement | VAT Return | EC Sales List (see section 17) | Supplementary Declaration (see section 18) | Notes |

|---|---|---|---|---|

| Goods sent to an EU member states for repair – owner’s reporting requirements | No | No | No | |

| Goods received back in Northern Ireland by owner after repair in an EU member state - UK owner’s reporting requirements | Box 1 – output tax* Box 4 – input tax, subject to normal rules (see paragraph 2.13) Box 6 – value of repair services |

No | No | *Output tax accounted for on repair services as a reverse charge (see paragraph 12.2) |

| Goods for repair received in Northern Ireland from EU member states – UK repairer’s reporting requirements | No | No | No | |

| Repaired goods returned to customer in an EU member state – UK repairer’s reporting requirements | Boxes 6 – value of repair service | No | No | VAT on repair services accounted for by EU customer as a reverse charge (see paragraph 12.3) |

Processed goods

| Type of movement | VAT Return | EC Sales List (see section 17) | Supplementary Declaration (see section 18) |

|---|---|---|---|

| Goods sent from Northern Ireland for process in an EU member state – UK owner’s reporting requirements | No | No | Yes – as a dispatch (value based on cost of goods) |

| Goods returned to Northern Ireland from EU processor – UK owner’s reporting requirements. (Output tax accounted for on processor’s services as a reverse charge (see paragraph 12.2) | Box 1 – output tax* Box 4 – input tax subject to normal rules (see paragraph 2.13) Box 6 - value of the processing services |

No | Yes – as an arrival (value based on cost of goods and cost of process) |

| Goods received for process in Northern Ireland from EU customer – UK processor’s reporting requirements | No | No | Yes – as an arrival (value based on cost of goods if known, otherwise open market value) |

| Goods returned after process in Northern Ireland to EU customer – UK processor’s reporting requirements. (VAT on processing services accounted for by EU customer as a reverse charge (see paragraph 12.3) | Box 6 – value of process | No | Yes – as a dispatch (value based on cost of goods, if known, otherwise, open market value and cost of process) |

13. Triangulation

13.1 The meaning of ‘triangulation’

Triangulation is the term used to describe a chain of EU supplies of goods involving 3 parties. But, instead of the goods physically passing from one to the other, they’re delivered directly from the first to the last party in the chain. For clarity references in this section to UK company means a UK VAT registered business identified as trading/operating under the Protocol.

For example:

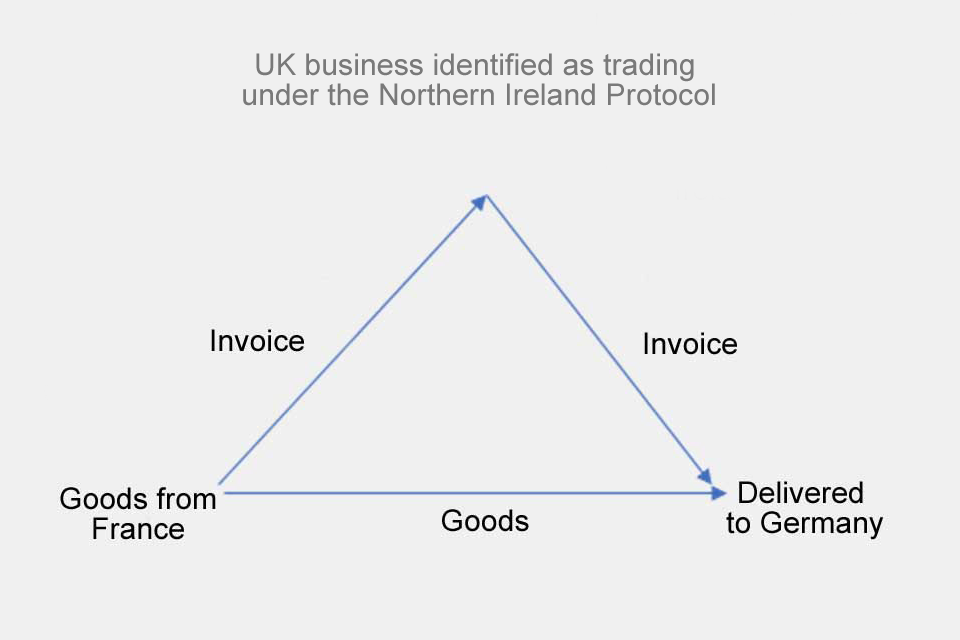

Image showing an example of triangulation

The image shows a business in France invoice a UK based business identified as trading under the Northern Ireland Protocol, whilst at the same time sending goods to Germany. The UK business then invoices the business in Germany.

Here a UK company receives an order from a customer in Germany. To fulfil the order the UK supplier in turn orders goods from their own supplier in France. The goods are delivered from France to Germany.

13.2 The supply position

| There’s a supply of goods by the | and this means that |

|---|---|

| French company to the UK company | the French company can zero rate the supply subject to the conditions described in paragraph 4.3 |

| UK company to the German company | the UK company is acquiring and supplying those goods in Germany and is liable to register for VAT there unless the simplified procedure described at paragraph 13.5 is used |

13.3 Involved in triangulation

You might be involved in triangulation as either the:

- first supplier of the goods (the French company in the example)

- intermediate supplier (the UK company in the example)

- final customer (the German company in the example)

13.4 Treatment of supplies for VAT purposes

The VAT treatment without triangulation simplification would normally be, if you’re the:

- first supplier, you may zero rate your supply of the goods subject to the conditions in paragraph 4.3

- intermediate supplier, you may be liable to register for VAT where the goods are delivered and account for VAT on the acquisition and on your supply

- final customer, you may not need to do anything as you’re receiving a domestic supply (but see the simplified procedure described in paragraph 13.5)

13.5 Registration of the intermediate supplier

An intermediate supplier is not necessarily required to register where the goods are delivered (see paragraph 13.2) as there’s a simplified procedure which can be used in these circumstances.

13.6 When to use the simplified procedure

As the intermediate supplier you can use the simplified procedure if you:

- are already registered for VAT within the EU or are VAT registered in the UK and identified as trading/operating under the Protocol.

- are not registered, or otherwise required to be registered, in the EU member state (or identified as trading/operating under the Protocol) where the goods are physically delivered

- your customer is registered for VAT in the EU member state (or identified as trading/operating under the Protocol) where the goods are physically delivered.

13.7 Use of the simplified procedure as a UK intermediate supplier

To use the simplified procedure if you’re a UK intermediate supplier making supplies of goods to a customer in an EU member state, you must do all of the following:

Step 1

Use your UK VAT registration number together with the identifier that you are trading/operating under the Protocol to allow your EU supplier to zero rate the supply of goods in the EU member state from which the goods were dispatched.

Step 2

Issue a VAT invoice to your customer containing all the details normally required for EU supplies.

Step 3

Include the supply on your EC Sales List (see section 17), quoting the VAT number of your customer in the EU member state of destination of the goods.

Step 4

On your EC Sales List enter the total value of triangulated supplies to a customer separately from any other EU supplies to that same customer.

Step 5

Identify your triangular transactions by inserting the figure 2 in the indicator box (the notes on the reverse of the EC Sales List give further details).

Step 6