Appendices and glossary

Published 23 July 2021

Appendix A: En-route Charging

Introduction

This appendix sets out evidence and analysis relevant to en-route electric vehicle (EV) charging. It provides background information on this segment, evidence relating to current competition and the key issues identified in en-route charging as set out in chapter 4.

Background

What is en-route charging?

En-route charging refers to EV charging by consumers on longer journeys (eg along motorways at MSAs or other major A-roads). It involves high-powered rapid/ultra-rapid charging speeds, relative to other charging segments, since drivers prefer not to be delayed en-route; a rapid charging session takes 20 minutes to an hour depending on battery capacity and its starting state of charge (with scope for improved technology to speed up charging over the next decade). [footnote 1]

Key routes for en-route charging include roads on the Strategic Road Network (SRN) in England (which includes all motorways and trunk A roads, and is managed by Highways England), and trunk roads and motorways managed by national governments in Scotland, Wales and Northern Ireland. Many A roads throughout the UK, which are managed by Local Authorities (LAs), are also likely to be relevant for en-route charging.

Why is en-route charging important?

The UK Government has identified extensive public charging infrastructure across the motorway network and major A roads as a key part of the transition to EVs. [footnote 2] The Governments of Wales, Scotland and Northern Ireland have similarly identified the importance of rapid charging, especially for long distance journeys. [footnote 3]

One study forecasts that in England in 2030 approximately 17% of the energy consumed by EVs will be from en-route charging. MSAs will be key locations for en-route charging; one estimate forecasts that 56% of all en-route charging will be delivered at MSAs. [footnote 4]

Several respondents to the CMA’s invitation to comment referred to the role which en-route charging can play in addressing ‘range anxiety’, and therefore encourage EV adoption. For example:

-

RAC Motoring submitted rapid charging ‘will also help to reduce so-called ‘range anxiety’ which is recognised as being a barrier to EV take-up.’

-

The Association of Convenience Stores submitted ‘to solve the issues with ‘range anxiety’ facing the market, there will need to be a good provision of rapid charging across the UK’.

-

Fastned submitted ‘provision of EV chargers on MSAs is essential to further the transition to e-mobility in the UK, because it will dramatically reduce range anxiety (fear of not being able to reach a long distance destination due to lack of charging opportunities on the way), which is continually cited as a key barrier for consumers to switch to e-mobility.’

-

Many individual respondents referred to range anxiety. One noted that range anxiety is a ‘real thing, especially whilst driving on motorways’; another submitted that ‘it is actually ‘charging anxiety’ that is the biggest issue for EV owners travelling distances longer than 170 miles in the UK.’

Competition in en-route charging

In choosing between chargepoints, evidence shows that EV drivers value factors including location, reliability and ease of use,. [footnote 5] A key current issue for consumers is the lack of available chargepoints. [footnote 6] This issue is especially acute in en-route charging, which often takes place away from drivers’ regular charging locations. This was reflected in responses to the CMA’s invitation to comment. For example, E.ON submitted that it is:

the lack of predictability in price, service and geographic availability of charging points that often makes long journeys challenging. Whilst many early adopters have adapted to such challenges with a pioneering spirit (often building in a plan B and plan C for longer journeys in case of charger unavailability/malfunction), this must change urgently as we move to mass adoption of EVs.

Shares of supply

Electric Highway, BP and Chargeplace Scotland are the largest providers of rapid and ultra-rapid en-route charging in the UK. However, while BP’s chargepoints are deployed at a wide range of locations, the Electric Highway and Chargeplace Scotland have had more targeted chargepoint deployment strategies – ie most of the Electric Highway’s chargepoints are located at MSAs, and Chargeplace Scotland is only active within Scotland.

Table 1: Shares of supply of rapid and ultra-rapid en-route charging within 0.5 miles of motorway or principal A road in Britain (February 2021)

| Chargepoint operator | Rapid and ultra-rapid chargepoints | Share of rapid and ultra-rapid chargepoints |

|---|---|---|

| Electric Highway | 270 | 25.6% |

| bp pulse | 206 | 19.5% |

| ChargePlace Scotland | 148 | 14.0% |

| InstaVolt | 143 | 13.5% |

| ESB Energy | 61 | 5.8% |

| GeniePoint/Engie | 55 | 5.2% |

| Ionity | 50 | 4.7% |

| Shell | 41 | 3.9% |

| Other | 82 | 7.8% |

| Total open-network chargepoints | 1,056 | 100% |

| Tesla | 446 | 29.7% |

| Total including Tesla | 1,502 | 100% |

Source: CMA analysis of Zap-Map data 26 February 2021

As described below in paragraphs 37-43, EV charging at MSAs is far more concentrated than the overall en-route segment.

Chargepoint operators

The Electric Highway

The Electric Highway is one of the largest providers of en-route charging in the UK, with revenues of £754,000 (year to April 2020) (prior to Gridserve’s acquisition in 2021).[footnote 7]

Founded by Ecotricity, a renewable energy company, the Electric Highway was the first chargepoint operator to install chargepoints at scale at MSAs. It entered [REDACTED] in partnership with Welcome Break and rapidly grew its network; [REDACTED] it had chargepoints at around 90% of MSAs in Britain.

The Electric Highway has a network of 293 chargepoints at service stations on the motorway and A roads, plus at IKEA stores, and at handful of ports and airports and other strategic locations; it is present at nearly all MSAs. Almost all of its chargepoints were 50kW chargepoints.[footnote 8] As described below (paragraph 54 onwards), through its agreements with three MSA operators, the Electric Highway has the exclusive right (save for Tesla and in one case Ionity) to install chargepoints at the main retail sites of around two-thirds of MSAs.

Between March and June 2021, Gridserve (an international sustainable energy and EV charging business) acquired the Electric Highway. As part of the first stage of this acquisition in March 2021, the Electric Highway announced plans to replace all its existing chargepoints with new technology, doubling these chargepoint’ capacity, and to add a further six to 12 350 kW chargepoints at some of these sites.[footnote 9] Gridserve has also announced plans to develop more than 100 ‘Electric Forecourts’ with chargepoints at sites off the motorway. [footnote 10]

BP

BP is a multinational energy business with a revenue of $184 billion (year to December 2020) and a wide range of activities.[footnote 11] BP established its presence in EV charging in the UK via its acquisition of Chargemaster in 2018.[footnote 12] BP’s network is now branded as bp pulse. Chargemaster made revenues of £18 million (year to December 2019).[footnote 13]

Chargemaster launched its public charging network in 2011, and by its acquisition in 2018 had already become the largest open charging network in the UK.[footnote 14] As bp pulse it has continued to grow, including at BP forecourts, and is currently the largest open rapid charging network in the UK.[footnote 15]

A number of BP forecourts are located very close to MSAs but are not covered by the Electric Highway’s exclusivity agreements with MSAs. BP has installed a total of 22 chargepoints at 5 of these sites in the UK, which should shortly become available to the public.

InstaVolt

InstaVolt is a chargepoint operator which entered the market in 2017, backed by Zouk Capital, a private equity firm. It has since been a major beneficiary of the UK Government’s Charging Infrastructure Investment Fund. It had a revenue of £363,000 (year to March 2020).[footnote 16]

InstaVolt operates rapid and ultra-rapid chargepoints (50kW and above). While many of InstaVolt’s sites are suitable for en-route charging, it has developed much of its network in partnership with retailers such as KFC, Starbucks, Costa and Burger King (we discuss destination charging in chapter 6).[footnote 17]

Tesla

Tesla is an EV manufacturer with a revenue of $31.5 billion (year to December 2020).[footnote 18] It has constructed a network of rapid chargepoints which currently can only be used by Tesla cars, branded as its Tesla Supercharger network. As non-Tesla EV drivers cannot use its chargepoints, Tesla is not in direct competition with other chargepoint operators.

Tesla has rapidly grown its Supercharger network, which is the largest en-route ultra-rapid charging network in the UK today. However, unlike other chargepoint operators, Tesla has concentrated its chargepoints at a relatively small number of locations; [REDACTED]. As set out in further detail below, we note that Tesla has been carved out of the Electric Highway’s exclusive contracts with MSAs.

Publicly owned providers

Chargeplace Scotland is a network of chargepoints funded by the Scottish Government. Chargepoints on this network are owned and controlled by hosts (typically LAs) who are able to set tariffs; many chargepoints are free to use. It was formerly operated by Charge Your Car (a BP subsidiary), but from July 2021 has been operated by SWARCO (a chargepoint operator which also operates many other publicly owned chargepoints). Chargeplace Scotland is the largest public charging network in Scotland, and many of its rapid chargepoints are likely to be suitable for en-route charging.

ecarNI provides free public charging in Northern Ireland, including 17 rapid chargepoints.[footnote 19] It was set up by the Government of Northern Ireland in 2011, and is operated by ESB.[footnote 20]

Investment in en-route charging

Chargepoint operators deploying en-route charging pay an upfront cost to install rapid/ultra-rapid chargepoints, which they recoup over time. In response to the CMA’s invitation to comment, Motor Fuel Group submitted that the ‘current pre-tax pay-back periods for high powered (150kW) EV charging hubs is c.8 years’. Other stakeholders provided models using similar assumptions to the CMA with payback periods of between six and eight years, on the basis of installing chargepoints ahead of demand. As EV ownership increases, and therefore chargepoint utilisation increases, the profitability of investment in rapid charging is expected to increase; according to one model provided by a chargepoint operator, the payback period for a bank of newly installed chargepoints could fall to as little as three years.

Few private chargepoint operators provide en-route charging in Scotland and Northern Ireland. In its response to the CMA’s invitation to comment, bp pulse suggested that this is a consequence of ‘public investment in infrastructure with free charging for consumers for a longer period. Whilst this led to a baseline level of infrastructure, it has delayed private sector investment in public charging (whilst the majority of charge points remained free)’. Other chargepoint operators also commented that free public charging has made installing new chargepoints less commercially attractive in Scotland.

Competition off the motorway

We found that there are over 20 chargepoint operators providing en-route public charging in the UK, many of which provided plans to the CMA demonstrating their ambitions to rapidly expand their chargepoint networks.

Chargepoint operators told the CMA that, in addition to chargepoints deployed at petrol forecourts and dedicated charging hubs, many destinations such as supermarkets and retail parks are commercially attractive sites for rapid chargepoints and will be suitable for many en-route drivers.

Off the motorway in areas where chargepoints are commercially viable, we consider that EV drivers are likely to be able to switch easily between chargepoint operators located at different sites. Most stakeholders have not raised concerns about the ability of chargepoint operators to find suitable sites for chargepoints off-motorways.

However, in the short-term at least, there are likely to be gaps in rapid chargepoint availability in rural areas, given the lower density of passing traffic, which decreases the commercial attractiveness of rural chargepoints. Several submissions raised concerns that chargepoint operators will be slower to deploy chargepoints in rural areas:

-

The British Holiday & Home Parks Association expressed concern about ‘the infrastructure needed to enable people to travel to their end destination which, for domestic tourism, is likely to be in a rural or coastal location’, and submitted that ‘there is less incentive for EV charging providers to install the infrastructure needed in more remote regions of the UK – areas where many holiday and residential parks are located’ and that more remote areas of the UK may be ‘left behind’.

-

The Camping and Caravanning Club submitted that there are a ‘very low number of publicly accessible charging points in rural locations’, and that there is a ‘lack of electrical grid network capacity in rural locations being able to cope with the increased demands’.

This is consistent with the evidence the CMA has received on chargepoint operators’ expansion plans.

Competition on motorways

In contrast to en-route charging off the motorway, the evidence set out below demonstrates that there is currently very limited competition on the motorway.

Concerns about poor reliability and limited provision

Many respondents to the CMA’s invitation to comment (ITC) submitted concerns about a poor level of service in charging at motorways in the absence of competition:

-

Fastned submitted that the lack of competition has resulted in ‘poor quality and availability of charging infrastructure on Motorway Service Areas (MSAs)’.

-

The Electric Vehicle Association England submitted that ‘Motorway and A-road service stations are also a concern. Competition on those is currently limited or absent and if the current EV charging suppliers and fossil fuel companies are not challenged by wider competition this will lead to a negative impact on pricing, reliability and the general service experience’.

-

An individual respondent submitted that ‘On the motorway services, I am not one to name and shame normally, but Ecotricity have had a devastating impact on most first time buyers and magazine journalists first impressions of public charging through unreliability, difficulty of payment and poor customer service.’

-

Another individual respondent submitted that ‘More public money and grants should be available to companies providing reliable services, companies like InstaVolt and Osprey should be having money thrown at them to provide reliable services - companies such as Ecotricity/Electric Highway should not.’

- An individual respondent submitted that ‘The greatest issue when choosing a charging network is reliability and knowing you will be able to top up simply when you arrive. I will actively avoid using motorway services and Ecotricity for this reason.’

-

An individual respondent submitted that ‘The Motorway facilities seem to be monopolised by Ecotricity whose chargers are now getting old and have reliability issues.’

- An individual respondent submitted that ‘The ecotricity network is unreliable, they have old charging units, the app doesn’t always work or unlock the charge.’

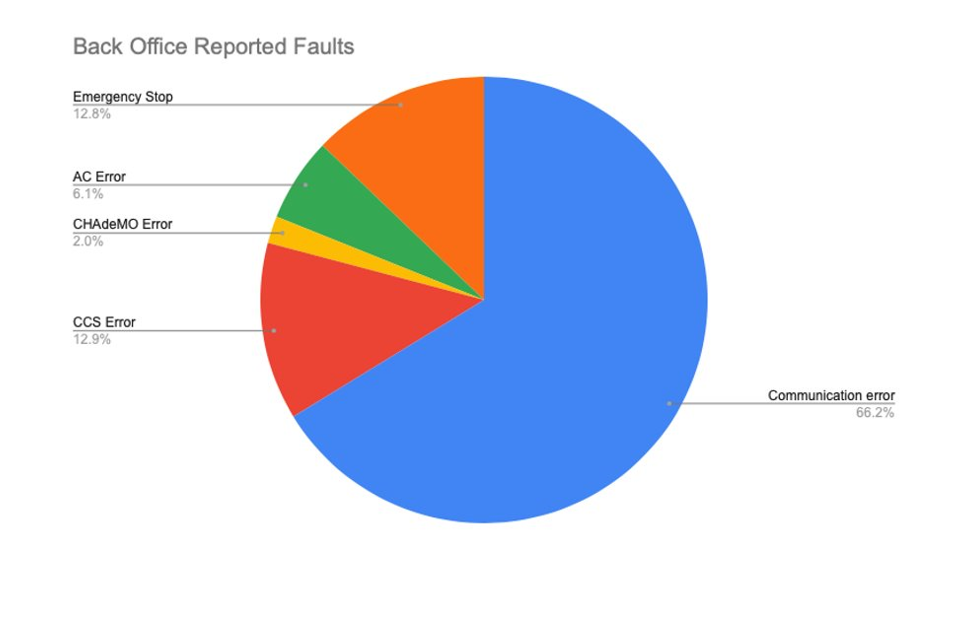

The Electric Highway had the lowest customer satisfaction score in Zap-Map’s 2020 survey of customer satisfaction at the top 16 chargepoint operators.

Figure 1: EV drivers’ satisfaction-levels with chargepoint networks

""

Source: Zap-Map.

Several respondents to the ITC suggested that the Electric Highway’s poor level of service and poor reliability is a consequence of underinvestment:

-

One individual respondent submitted that: In my experience Ecotricity provide a poor offering, with only two chargers installed at MSA’s. These chargers are very unreliable and Ecotricity are poor/slow at repairing them. They are therefore often out of service and let EV drivers down. Anecdotally a lot of EV drivers avoid using them due to their unreliability – so again you get the downward spiral of them not being used. Additionally, the Chargers are now out of date and slow. The[y] are mostly only 50kW chargers and the type of Charger is not a very good model, so usually isn’t capable of producing 50kW of output. Ecotricity are always offering ‘jam tomorrow’, with better reliability, new chargers, and faster We chargers – but it hasn’t happened.

-

Another individual respondent submitted that ‘The Ecotricity chargers are now some of the oldest charging hardware in the UK. They can only charge at 50Kw whereas many of the newer charging networks have chargers that can manage 100Kw or more. This age contributes to the lack of reliability but the lower power also increases the charge time and therefore the journey time for EV’s.’

Following its acquisition of the Electric Highway, Gridserve has announced that it is upgrading the Electric Highway’s chargepoints.[footnote 21]

Key issue: Limited electricity network capacity

At many MSAs, grid capacity is limiting the speed at which en-route chargepoints can be deployed. This is reflected in MSAs’ internal strategy documents. For example, one MSA operator’s strategy paper stated that it had ‘no spare capacity’ for new charging hubs at almost all of its sites. An operator told the CMA that ‘at the moment capacity is not constrained by power, but with the 2030 ban [on the sale of petrol cars] it is going to become so pretty quickly’.

Many chargepoint operators told the CMA that one of the main challenges they encounter in growing their en-route charging networks is the cost of connecting new chargepoints to the electricity network. While network connection can be a barrier to chargepoint installation across many segments, chargepoint operators told the CMA that this challenge is especially acute in en-route for two reasons:

-

En-route charging has a particularly high peak power demand. En-route EV chargepoints are rapid (50kWh and above) chargepoints, to minimise the duration for which charging interrupts drivers’ journeys. For example, one chargepoint operator told the CMA that at MSAs ‘you need to put in a large number of high-powered chargers’ and a large substation, which is ‘a genuine technical issue’.

-

(En-route charging locations (such as MSAs) are often located in rural locations, which are especially expensive to upgrade. For example, one chargepoint operator submitted that grid connections ‘can be prohibitively expensive particularly in remote areas where are substantial groundworks (digging) to take place between the EV chargepoints and the point of connection’.

Limited competition on motorways

The supply of en-route rapid charging on the motorway is very highly concentrated. As shown in Table 2, the Electric Highway is by far the largest provider of rapid en-route EV charging on the motorway.

Table 2: Shares of supply of open-network rapid and ultra-rapid EV chargepoints in Britain, within 0.5 miles of the motorway (February 2021)

| Chargepoint operators | Share of supply (%) |

|---|---|

| The Electric Highway | 58.8 |

| InstaVolt | 10.2 |

| bp pulse | 9.6 |

| Ionity | 9.2 |

| ChargePlace Scotland | 3.4 |

| GeniePoint | 2.4 |

| Shell Recharge | 2.4 |

| Other | 3.2 |

| Total | 100 |

Source: Zap-Map.

Note: These figures are based on an initial dataset produced by Zap-Map to scope the CMA’s work. There were some adjustments to the chargepoint classification between segments in later datasets and thus these figures are likely to include some minor errors. Tesla is excluded as it does not provide open-network charging; if included it would have a 43.5% share of supply.

Looking at MSAs in particular, the Electric Highway’s position is even stronger with a share of 80%, or 83% excluding chargepoints at petrol forecourts (Table 3).

Table 3: Shares of supply of open-network rapid and ultra-rapid chargepoints at MSAs in Britain (June 2021)

| Chargepoint operator | Including chargepoints at petrol forecourts (%) | Excluding chargepoints at petrol forecourts (%) |

|---|---|---|

| Electric Highway | 80 | 83 |

| Ionity | 15 | 12 |

| InstaVolt | 5 | 5 |

Source: CMA, data for June 1 2021.

Note: Excludes Tesla chargepoints, which are not open-network.

Many respondents to the ITC expressed concern about the state of competition on motorways:

-

The Association for Renewable Energy and Clean Technology submitted that its ‘leading area of concern for the market is around the potential for monopoly of the public charging at existing motorway service area (MSA) sites.’

-

BP submitted that ‘only a handful of sites offer a choice of providers due to exclusivity arrangements in place’ at motorway service areas.

-

Fastned submitted that ‘lack of competition’ at MSAs is a key risk.

-

Individual responses noted that the ‘only other [non-Tesla] network available on the motorways is Ecotricity’, that ‘we need to relook into the current company who seem to have the monopoly on motorway service stations’, that ‘there must be an element of competition especially at motorway services’, that ‘there is a monopoly of EV charging provision here in England Motorway Service Stations’, that ‘one operator, Ecotricity, has a monopoly for chargers on Motorway Service Areas’, that ‘Ecotricity have some form of Monopoly agreement with the MSA operators’, that ‘Motorway facilities seem to be monopolised by Ecotricity’, and that ‘there is no competition for EV charging at motorway services across 90% of the motorways in the UK’.

We considered the extent of competitive constraints on the Electric Highway from nearby chargepoints that are not located at MSAs. There is evidence to suggest that this constraint is weak in general and that EV drivers may be even less willing and able than drivers of petrol/diesel vehicles [footnote 22] to switch to alternatives away from the motorway:

-

Chargepoint operators told the CMA that few sites along the motorway, other than MSAs, are suitable for the installation of chargepoints. For example, one chargepoint operator told the CMA that for ‘the majority of the strategic road network, MSAs are by far the highest value locations where customers will look to stop and charge. This severely limits the opportunity to deploy outside of MSAs.’ Another chargepoint operator submitted that ‘off-highway locations are important in the overall story of serving the e-mobility transition, but ultimately serve a different customer group from the MSAs.’ However, another chargepoint operator noted that some retail parks located close to the motorway may be suitable for en-route charging.

-

EVs typically have smaller ranges than petrol/diesel vehicles, currently, and therefore must stop more frequently. Zouk Capital submitted that ‘The comparatively shorter range of an EV versus an ICE vehicle will place a higher demand’ on MSAs. One individual respondent described motorway service EV charging as ‘utterly essential’, unlike for drivers of ICE vehicles, given EVs’ range constraints.

-

EVs take longer to refuel than petrol/diesel vehicles, and therefore EV drivers may prefer the amenities of a MSA (restaurants, toilets etc) more strongly than petrol/diesel vehicle drivers. One individual respondent submitted that ‘when charging, you want access to toilet facilities and perhaps somewhere to get a drink, have a snack, and take a break for 20-30 minutes, preferably away from the car. Motorway service stations are better equipped for this, but local petrol stations are not.’

At a minority of MSA sites the petrol forecourt is operated by a fuel supplier, which could install chargepoints. However, a chargepoint operator told the CMA that such sites are often unsuitable for the installation of chargepoints due to their size and the inaccessibility of the MSA’s amenities. This is consistent with one operator’s internal documents which notes that forecourts are ‘not of particular concern [REDACTED] as the footprint of petrol forecourts is limited, making inclusion of HPC charge points adjacent to petrol pumps difficult, and customers are not expected to choose to charge at a forecourt given the alternative of the main MSA retail area’.

MSA operators did not raise concerns about the Electric Highway’s competitive position or service provision, although one MSA told the CMA that the Electric Highway’s chargepoints had become ‘outdated’. Two MSA operators told the CMA that utilisation at their sites was still low. One MSA operator told the CMA that ‘given the low demand, Ecotricity is doing everything in line with the contract…. Ecotricity has an obligation to keep their equipment in good working order and they are doing this.’

However, several stakeholders raised concerns about the incentives of MSAs in the context of en-route charging. For example, The Association for Renewable Energy and Clean Technology submitted that ‘MSAs lack the incentive to run competitive tender processes that lead to positive outcomes for EV drivers.’

Cost of network upgrades

A recent study on the feasibility of EV charging at MSAs in England estimated that future proofing the network connections to meet long-term EV charging demand could cost over £10 million per MSA at the most expensive sites.[footnote 23]

The cost of connecting MSAs is highly variable. Connection costs at some MSA sites are relatively cheap and can be met by commercial operators. However, many MSA sites are located away from the existing electrical distribution network, which substantially increases the cost of upgrading their connection. At such sites, large scale roll-out of chargepoints is more commercially challenging (especially in the near-term, when chargepoint utilisation will be lower). Chargepoint operators and MSAs told the CMA that the private sector would be unlikely to fund the more expensive network upgrades, especially where demand was not likely to quickly become high enough to produce a commercial return on chargepoints installed using the additional network capacity.

The high cost of en-route network connections create a barrier to entry and expansion by chargepoint operators. If left unaddressed, there is a risk that this will lead to a shortage in charging capacity at high volume en-route sites in the short term, if network upgrades fall behind EV uptake.[footnote 24]

High network upgrade costs will act as a barrier to entry in three ways:

-

Existing sites with chargepoints will be less able to expand to compete more effectively with each other. For example, MSAs currently have few chargepoints, and as utilisation rises the availability of chargepoints at each site is likely to decrease as more will be in use at a time. Capacity constrained sites will not competitively constrain other sites, as EV drivers will not be able to switch to using them (unless they are willing to wait longer).

-

Chargepoint operators which create new charging sites (such as FastNed) will expand less rapidly to compete with existing sites.

-

High network upgrade costs can prevent competition within sites, by increasing the cost of entry. Indeed, this can be used strategically by chargepoint operators to defend an incumbent position. By buying network connection rights an incumbent chargepoint operator can raise the cost for its rivals to enter, as they will have to pay additional costs to reinforce the network to support their new grid connection. [REDACTED] This can hinder competition by making it more difficult for the site owner to switch to a different chargepoint operator.

Network upgrade funding

Although EV ownership is rapidly increasing, and the Government’s 2030 ban on the sale of new petrol/diesel cars and light vans has increased investors’ confidence in the direction of travel, the rate at which demand will increase in future remains uncertain, and this complicates the commercial investment case at marginal sites (since investors require higher rates of return where they bear additional risk).

The UK Government plans to invest £950 million (the ‘Rapid Charging Fund’) in future proofing grid capacity along motorways and key A roads in England to prepare for 100% uptake of EVs ahead of need.[footnote 25] In particular, it ‘will fund a portion of costs at strategic sites across the strategic road network where upgrading connections to meet future demand for high powered chargepoints is prohibitively expensive and uncommercial’.[footnote 26]

The Devolved Administrations are also developing policies to support en-route charging, although there is no equivalent of the Rapid Charging Fund. For example, Transport for Wales is leading a £2 million project consisting of proposed concession agreements to facilitate the installation of rapid charging and key points in Wales’ transport network.[footnote 27] Transport Scotland has already deployed a network of rapid chargepoints, operated by Chargeplace Scotland,[footnote 28] and has the most rapid chargepoints per capita of any region in the UK.[footnote 29] While Northern Ireland has its own network of 17 publicly-owned rapid chargepoints, it has the fewest rapid chargepoints per capita of any region in the UK,[footnote 30] and one stakeholder noted that the ‘charging network in Northern Ireland has been contracting dramatically in recent years, instead of growing, discouraging the uptake of EVs.’[footnote 31]

In addition, Ofgem has announced investments for network upgrades needed for 1,800 new ultra-rapid chargepoints at MSAs and key trunk road locations.[footnote 32] This funding comes as part of the RIIO ED1 price control, and funded selected investment projects proposed by distribution network operators which would support near-term network utilisation and would be deliverable within the remaining period of the RIIO-ED1 price control (ie before April 2023).[footnote 33] Relative to the RCF, this funding is focused on meeting the short-term need for grid upgrades.

The above public funding will help to address the barrier to entry that network upgrade costs represent, and in doing so provides an important opportunity to open up competition.

Key issue: Long-term exclusive supply arrangements

As described above, the Electric Highway has a high share of supply and a very strong position in competition on the motorway. Its position is reinforced by lengthy exclusive agreements with MSA operators, which are a further barrier to entry by other chargepoint operators.

The Electric Highway’s exclusive agreements

The Electric Highway has exclusive agreements with three MSA operators (MOTO, Roadchef and Extra).[footnote 34] Under these arrangements, save for Tesla and in one case Ionity, only the Electric Highway can install and operate EV charging equipment at the MSA operators’ main retail sites, subject to carve-outs.

The Electric Highway has had relationships with three MSA operators [REDACTED]:

-

[REDACTED]

-

[REDACTED]

-

[REDACTED][footnote 35]

The Electric Highway is not the only chargepoint operator at every MSA. For example, Tesla is carved-out from the arrangements with some MSAs and has chargepoints at many MSAs.[footnote 36] However, these are a ‘closed network’ only available for use by Tesla drivers and therefore do not compete with the Electric Highway.[footnote 37]

While petrol stations at MSAs are outside the scope of the exclusivity, and have some potential to install chargepoints, as evidenced above in paragraph 41, these sites have limited space, are in a less desirable location for accessing MSAs’ amenities and have constraints in locating chargepoints next to petrol pumps.

Many chargepoint operators listed the Electric Highway’s exclusive agreements as one of the most significant barriers to installing en-route EV chargepoints. Examples of submissions include:

-

‘MSAs have signed exclusive arrangements with another EVC provider which prevent others from installing EV charge posts in the amenities areas… …[REDACTED] is not able to provide service on motorways due to Ecotricity exclusivity. Without fair and open competition allowing multiple EVC operators access to these critical locations, we believe the consumer offer will suffer in terms of reliability, suitability and competitive pricing.’

-

‘There is significant unserved demand for EV charging on the motorways, but a monopoly seems to exist with one EV operator across the MSAs meaning that other chargepoint operators [REDACTED] cannot install chargers at those locations. That operator has a reputation for poor reliability and under-investment in hardware, thus creating dissatisfaction with drivers who are active on social media calling for other networks to invest’.

-

‘While [REDACTED] has not had sight of confidential contracts, some of the MSA operators have indicated they are not able to enter into agreements with [REDACTED] due to the exclusive nature of the agreements with Ecotricity.’

-

Electric Highway’s exclusive agreements ‘prevent open competition between alternative providers, where competition would see only those chargepoint operators with the best reliability and pricing offers be successful, as customers would vote with their feet. If the MSA operators were forced to run competitive tenders for multi-brand EV charging sites, awarding contracts with strict reliability and service SLAs, then drivers could be confident in buying and driving an EV for long journeys on the UK Strategic Road Network.’

-

‘A major roadblock for the development of the sector, and for the transition to e-mobility more broadly, is the situation on the MSAs…The cumulative effect of the majority of MSAs granting exclusive rights to a single operator has been to eliminate all effective competition.’

Need for exclusive agreements and viability of within-site competition

The Electric Highway argued that its exclusivity is justified in order to protect its investments’ economic viability, submitting that:

-

The EV charging market is nascent and installing chargepoints requires large scale capital investment, especially where a network upgrade is required. It is a risky investment, given the highly uncertain nature of the market: investors do not know when demand for EV charging will increase, whether en-route charging will be heavily used, and whether competitors will enter.

-

Multiple competing operators at MSAs ‘would have the net result of requiring even longer agreements to be negotiated to ensure [return on investment] could be delivered’.

We consider that chargepoints located at the same site would compete more closely than the same chargepoints located further apart ie between-site competition, for the reasons set out at paragraph 40 above.

There are some existing cases of multiple chargepoint operators competing at or in proximity to the same MSA, today:

-

InstaVolt has, since January 2021, deployed 15 chargepoints across two Welcome Break sites, alongside the Electric Highway’s chargepoints.

-

Ionity operates chargepoints alongside the Electric Highway at Extra MSAs, albeit that these are higher powered 350kwh chargepoints provided at a higher price.

-

BP has, since January 2021, installed chargepoints at five of its forecourts adjacent to MSAs.

Some chargepoint operators told us that exclusivity is sometimes required in order to invest in installing EV chargepoints: one chargepoint operator stated that ‘exclusivity is a necessary tool to encourage investment’; and another chargepoint operator stated that ‘they would be less likely to invest in an MSA site where there was direct competition from other operators on the site, as this would likely reduce the opportunity to build a sustainable business case’.

However, other respondents told us that they saw less need for exclusivity at MSAs. In response to the CMA’s invitation to comment, bp pulse stated that exclusivity may be required to recoup investment costs, but that it was ‘unclear whether that is the case for MSAs (excluding forecourts). Another stakeholder told us that there are minimal economies of scale, and that multiple chargepoint operators at a site is therefore a ‘commercially attractive proposition.’

The CMA notes that given the scale of charging which is expected to take place at MSAs, multiple chargepoint operators could operate within an MSA. [REDACTED].

Five chargepoint operators told us that they would be willing to compete within-site at most or all MSAs, in principle. They noted that the business case would become attractive at more sites with the planned Government funding for network connections as part of the RCF.

Appendix B: On-street charging

Introduction

On-street chargepoints refer to chargepoints that consumers can use while parking outside or near their home, often overnight, using slow charging. On-street chargepoints are set up on the kerbside (eg installed in lampposts or bollards) and may also include car parks where residents typically park their cars on a regular basis. We refer to charging at these locations as on-street unless otherwise stated.

This appendix summarises relevant evidence on the development of on-street charging in the UK. It sets out the key evidence relating to the importance of on-street charging for supporting the take-up of EVs; current competition in on-street; and key issues in relation to barriers to investment from commercial challenges, difficulties faced by LAs in supporting on-street, and the risks to effective competition.

Background

Importance of on-street residential charging for supporting the take-up of EVs

This section sets out evidence from driver surveys, qualitative consumer research and chargepoint operator business documents to understand consumer needs and preferences for local charging.

The average car is parked at home for about 80% of the time, parked elsewhere for about 16.5% of the time, and only actually used for the remaining 3.5%, with the average journey being about 20 minutes.[footnote 38] Given how much time a car is parked close to the home, this is a key location for EV charging.

Most early EV adopters have access to home charging. A 2020 Zap-Map survey of EV drivers found that 98% of respondents had access to private off-street parking with only 1% relying on on-street parking.[footnote 39] This is illustrative of the importance of having charging options close to home, including on-street charging, for EV take-up.

Looking at the attitudes of drivers who have not yet adopted EVs, many drivers are hesitant about buying EVs if they cannot see charging options at home or close to home, highlighting the importance of on-street charging to widespread EV take-up.

-

An October 2020 AA survey of drivers found that one in seven drivers would not consider buying an EV on their next purchase because of a lack of off-street parking / home charging.[footnote 40]

-

A literature review[footnote 41] covering over 50 EV charging studies of existing EV drivers, new vehicle buyers and the general public across a number of countries (including the UK) found that home and on-street charging is the most important piece of infrastructure in convincing consumers to purchase a EV and is the most frequently used charging location.[footnote 42]

-

One chargepoint operator’s EV consumer research (covering six European countries including the UK) found that most consumers envisage they will predominantly charge overnight at home and if they ‘can’t see overnight charging options [they are] likely to park [the] idea of getting an EV, intentions become more theoretical’. The research concludes that the ability to charge overnight/at home is often a crucial prospect for market development with associated cost and convenience benefits.

Consumer research also suggests that future EV drivers would not expect to charge an EV car in the same way as they would fuel a petrol or diesel car.

-

EV focus group research commissioned by a chargepoint operator[footnote 43] found that respondents thought rapid charging hubs would be used rarely or for emergency occasions which they would mainly use on longer journeys (which not many take). When they thought through the time involved for rapid charging, ‘20 minutes [is] an awkward time – too long not to notice, too short to really use. Petrol stations at least as they look now [are] not particularly pleasant places to be’.

-

A March 2019 AA survey of drivers[footnote 44] found most (62%) respondents who have not yet bought an EV but would consider doing so reported that an advantage of EVs is that they can be charged while users are not waiting around eg overnight at home or in a car park.[footnote 45]

We also reviewed evidence from business plans and internal evidence submitted by chargepoint operators which was largely consistent with the consumer research in highlighting the importance of on-street charging to EV take-up. Evidence submitted by chargepoint operators included:

-

One chargepoint operator submitted an internal business document that concludes ‘on-street charging infrastructure for residents without off-street parking is essential to enable mass market adoption of EVs’ as it offers ‘the most convenient solution for EV users’. The convenience of low power charging is described as being ‘the car is charged while it is parked and the customer leaves every morning with a full charge’ whereas for DC high power charging, EV drivers need to drive to a specific place and wait while charging. The document concludes that low power charging wherever the vehicle is parked ‘is and will remain the main charging solution for electric vehicles, covering 80-90% of energy needs of a vehicle.’

-

Figure 1 sets out one chargepoint operator’s illustration of the potential future requirement for different charging speeds 2019 compared with 2035. This shows in its view there will need to be substantial increase in low powered charging provision.

Figure 1: Current vs future EV charging requirements

A graph showing EV drivers' satisfaction-levels with chargepoint networks (includes 16 chargepoint operators). It shows that satisfaction is lowest for the Electric Highway network.

Source: Chargepoint operator.[REDACTED]

-

An online survey by one chargepoint operator with 500 respondents[footnote 46] looked at what persuaded existing EV drivers to take-up EVs, and what put others off. It found that the majority (67%) of existing EV driver respondents would not have bought an EV if they did not have access to overnight charging at home. It also found that, out of the respondents who do not own EVs, 40% do not have somewhere to park and charge it overnight and that this was a barrier to them purchasing an EV.

-

A chargepoint operator submitted third-party commissioned research [] which found that having a chargepoint at or near a consumer’s home (65% of respondents) is more important than having them near or at their workplace (57% of respondents). This was based on a survey of 9,000 drivers in eight countries including the UK.[footnote 47]

Fast and rapid charging hubs may be another option (especially where it is difficult to locate on-street residential chargepoints) but this can take up more of a consumers’ time (travel to hub, waiting for the car to charge) and is typically more expensive (see Appendix E).[footnote 48]

Competition in on-street charging

Key players

Chargepoint operators bid for contracts with LAs, which currently act as gatekeepers who grant access to on-street sites (see chapter 5). There are 2 broad types of chargepoint operator active in on-street charging:

-

Chargepoint operators that provide above the ground physical chargepoints with or without operation. These can include lamppost chargepoints which deliver between 3-7kWh charging and standalone charging units or bollards which deliver up to 22kWh charging. The main players include: bp pulse (formerly BP Chargemaster), Char.gy, Electric Blue, Source London and Ubitricity. In Northern Ireland the main provider of fast and slow chargepoints is EcarNI. In Scotland, LAs provide or contract out installation and maintenance but use a single back-office provided by Swarco under the Chargeplace Scotland brand.

-

Operators or vendors that provide long-life below the ground infrastructure (cabling) such as Connected Kerb and Liberty Charge. The chargepoint operator or another operator can connect a chargepoint onto this below ground infrastructure.[footnote 49]

Shares of supply

Figure 2 shows the shares of supply on February 2021 for the number of UK on-street chargepoints. These statistics are presented for descriptive purposes and should not be interpreted as a geographic market assessment.

Ubitricity has the largest share of supply of 53% in on-street charging. Other chargepoint operators include Source London, Char.gy, Electric Blue, bp pulse, ChargePlace Scotland, with shares of supply ranging from 23-2%.

Figure 2: Shares of supply for on-street charging

""

Source: CMA analysis of Zap-Map data, 26 February 2021. These statistics are presented for descriptive purposes and should not be interpreted as a geographic market assessment.

Entry and expansion

There has been some entry in the on-street segment, for example by ubitricity and Char.gy adding chargepoints to lampposts as an alternative to using dedicated bollards. There has also been some expansion into on-street charging from firms that started in the provision of taxi/fleet charging for LAs such as Electric Blue. Recently we have seen entrants from complementary sectors such as Liberty Charge, part of Liberty Global which owns Virgin Media.

The entry of new firms may have led to greater competition in tenders run by LAs to award contracts for the provision of on-street charging. However, when new entrants have won such tenders, this has mainly been to serve areas where there is a lack of on-street charging provision rather than to increase competition between on-street chargepoint operators serving the same households.

There has also been acquisitions of on-street chargepoint operators by operators active in rapid charging. Specifically, Source London was acquired by Total in September 2020 and ubitricity by Shell in February 2021.

Key issues

In the following sections we set out evidence relating to the key issues affecting the roll-out of on-street chargepoints.

There are 2 overarching concerns in the supply of on-street charging:

- lack of investment leading to limited and patchy EV roll-out and reduced consumer appetite and confidence in taking up EVs

- risk of ineffective competition in the longer-term leading to poor consumer outcomes for sufficient, low cost and convenient local charging options

A number of issues are leading to these concerns and this section sets out the evidence on each of these in turn:

- barriers to investment and chargepoint operator contracting needs in on-street charging

- difficulties faced by LAs in supporting on-street roll-out

- evidence on risks to effective competition

Barriers to investment – commercial challenges and contracting needs

Chargepoint operators face a number of challenges developing viable on-street commercial models which are needed to build a sustainable EV charging network in the long-term that meets EV drivers’ needs.

In this nascent segment there are not yet established business models or approaches for supporting large scale delivery of on-street charging, though operators told us they are ready to roll-out on-street charging on a greater scale should the right contracting and concession approaches be deployed by contracting bodies such as LAs and other relevant authorities.[footnote 50] However, this is a significant undertaking which requires a combination of contracting models that support business incentives to invest, financing solutions, motivated and resourced LAs, and strategic planning with distribution network operators (DNOs).[footnote 51]

Low utilisation when deploying ahead of EV demand

The single largest issue for private investment is the low utilisation of installed chargepoints, as it is typically necessary to deploy ahead of local EV uptake and demand.[footnote 52] This has meant that the business case for the installation of large numbers of on-street chargepoints has to date been poor. For example:

-

One on-street chargepoint operator told us that at this stage on-street chargepoints are generally not commercially viable without support. It stated that the usage patterns combined with a low price to use the amenity means on-street chargepoints cannot pay for their investment and running costs purely from utilisation revenue. It estimates that to breakeven it would need an average of [REDACTED] utilisation across its network of chargepoints. At present its average utilisation across its entire network is [REDACTED]. It considers [REDACTED] would require a ratio for on-street of [REDACTED] to 1 chargepoint (alternatively this could be achieved through a [REDACTED] ratio with a high usage EV driver such as a taxi or a [REDACTED] ratio for low mileage recreational EV users).

-

Another on-street chargepoint operator provided financial modelling that indicates payback is achieved after around 7 to 9 years (depending on the speed of growth of the market). It also submitted that each chargepoint would need to service 1 to 4 vehicles, with 2 or more vehicles or a high usage user such as a taxi driver required to break even. Data on revenue per chargepoint shows it is loss-making on most chargepoints.

-

Similarly, the business case for on-street chargepoints was not obvious to LAs. Oxford City Council thought that on-street chargepoints were not an attractive business model for a chargepoint operator given the cost of installation and annual maintenance against a potential initial revenue of only around £500 per chargepoint per year (<£1.50 a day) and chargepoints unlikely to grow beyond 10% utilisation.

In light of low utilisation, many operators told us that grant funding for LAs procuring on-street charging is very important.[footnote 53] See more on the grant funding available, in particular for capital costs of on-street chargepoints.

Contract lengths

Long payback periods as a result of low utilisation has meant that operators have looked for long contracts to justify investment. For example:

- One chargepoint operator told us that it required scale and contracts in excess of 15 years to provide the required return.

- Another operator told us that while contracts can be 2 or 3 years, if they are 10 years or more its financial model means that it is able to contribute to the funding of the chargepoint.

While chargepoint operators have sought long term contracts, the availability of these have varied across LAs. For example:

- Milton Keynes’s contract [REDACTED] (covering a variety of slow and fast charging) has a [REDACTED] year term. Milton Keynes [City] Council stated that longer contract lengths are attractive as they get certainty of having a viable network.

- Oxford City Council told us that since concession contracts for on-street are really only available in areas with high utilisation, the best areas for charging in the cities are being operated by chargepoint operators on very long contracts. Oxford City Council told us that it had extended its initial on-street contracts under the Go Ultra Low Cities scheme for lamppost chargepoints by another year.[footnote 54]

- In London, contract terms under recent tenders have generally between 5 to 8 years depending on the purchasing framework used.

- Nottingham City Council’s contract with bp pulse is an initial term of [REDACTED].

The role of scale and density

We have been told by a number of operators that scale and density are important.

Some chargepoint operators told us that the nature of costs that they face also encourages density of provision. For example:

- A chargepoint operator told us that the upfront cost of digging up streets to install below the ground infrastructure is a factor encouraging it to deploy dense networks at scale. It told us that 50% or more of its costs goes into digging the streets. To future proof its sites for future demand (and reduce digging costs over time), it tends to install between 5-10 chargepoints on each residential street which involves installing 5-10 node boxes below ground and with 5-6 active chargepoints. By way of an example, [REDACTED]. It does not favour alternative lower density strategies, for example providing 1 to 2 parking spaces per location is a less attractive business proposition, as the lack of scale makes them expensive to pay for and maintain and means that as demand rises, the street will have to be re-dug repeatedly.

- Another chargepoint operator submitted that service and maintenance are its biggest costs and it is cheaper to maintain a dense charging network over a smaller area to minimise time travelling to chargepoints.

Scale helps alleviate some of the commercial challenges in terms of dealing with procurement, choices of site location and liaising with lots of LAs. Related to this:

- Some chargepoint operators said that consistency in frameworks and procurement requirements across LAs would help reduce their costs in liaising with lots of LAs (see later section).

- A chargepoint operator noted that scale is important for accessing lower cost capital funding from infrastructure financers. It also gave us an example of how it is ‘bundling’ projects together in order to increase the overall size as this would help it achieve lower cost infrastructure financing.

Scale may also address coverage issues while balancing the need to support business incentives to invest. Oxford City Council acknowledged that operators will naturally tend to pursue the most attractive areas with highest likely utilisation rates and so other areas with lower initial likely utilisation would have poorer coverage. It considered that a solution to help increase commercial incentives may be to issue contracts at scale, with requirements for installation to include some provision in areas with lower utilisation.

Exclusivity

Some chargepoint operators told us that some form of exclusivity may be necessary to enable them to recoup their investment in the immediate term, although this may be less necessary longer-term in some densely populated areas as EV demand increases.

- One chargepoint operator asks for no rival chargepoint operators to be within 250 metres of its chargepoints (although it stated it would agree to having [REDACTED] chargepoints from other operators on the same street).

- Another chargepoint operator told us that its standard exclusivity term was [REDACTED] years.

- Oxford City Council told us that for on-street, it had not entered into exclusivity clauses, although it had heard of long contracts elsewhere of 15 years with exclusivity clauses.

Variation in procurement process across LAs

Some chargepoint operators told us that LAs each run their own procurement differently and this raises costs for chargepoint operators in engaging with these tenders. For example, a chargepoint operator submitted that one of the main barriers to installing on-street chargepoints is that framework agreements are fragmented across the country, requiring operators to work with several frameworks and LAs per installation.

Difficulties faced by LAs in supporting on-street roll-out

LAs face a number of challenges for supporting on-street roll-out. This section sets out evidence on the nature of the challenges.

Lack of clear LA role and mixed appetite among LAs

Many stakeholders told us that chargepoint provision (including in terms of scale and coverage) is constrained by a lack of clarity in, and support for, the role LAs play in enabling EV roll-out.

For example, London Councils, Transport for London (TfL), the GLA and the Local Government Technical Advisers Group (LGTAG) submitted that the role of LAs for local EV charging roll-out is not closely defined.

Whilst there are strong messages from central government to extend charging opportunities, there is no obligation or duty on authorities to do so in the same way as there is in respect to general asset maintenance of the highway…There is no obligation even to provide an outline strategy for how charging facilities will be developed in future, along the lines of that pioneered for Local Cycling and Walking Implementation Plans for example.

The submission also stated that the provision of comprehensive national guidance[footnote 55] for LAs on how best to develop an EV chargepoint implementation plan would be a good place to start in helping to remove barriers to market development from public sector actors.

Stakeholders told us there are bottlenecks for on-street roll-out arising in some cases from lack of appetite by local leadership to set direction on these issues and competing considerations of the needs of different street users. For example:

- A chargepoint operator told us that LAs fear that deploying chargepoints will create street clutter and that LAs have to balance this with for example disability access on pavements.

- Nottingham City Council told us that it avoided on-street charging due to concerns around street clutter, as well as potential concerns around seeming to allocate parking bays to specific users (EV owners) where on-street parking is naturally limited, or creating a postcode type lottery where one street got chargepoints but another didn’t.[footnote 56]

No clear team and lack of capability within LAs

Several chargepoint operators and other stakeholders told us that there was sometimes no clear team with LAs responsible for EV charging and on-street charging delivery and this can make it more difficult for chargepoint operators. For example, the Local Government Association told us that responsibilities for EVs varies across LAs (it could sit in transport, climate change, parking etc) and without a formal place for it to sit, the ability to share knowledge and oversee effective roll out becomes difficult – ultimately no-one has clear responsibility for EVs and this also makes it hard for operators to establish who is responsible and who they should engage with.

LAs and chargepoint operators told us that lack of expertise within LAs constrains on-street delivery and consequently that more support to enable LAs to fulfil this role would be beneficial. For example:

- A chargepoint operator told us that EV knowledge / capability varies a lot across LAs, directly affecting their ability to articulate their EV requirements to the market and develop economically viable propositions that operators want to bid for. It recommended that national government policy focus should shift to funding the education of all LAs on how best to deploy charging points within the EV market.

- Nottingham City Council told us that there is a vast difference between LAs as to the amount of expertise on EV charging and that LAs can struggle to apply successfully for grant funding schemes. It would be useful for LAs that are starting in this area to have broader support to fulfil all the necessary stages involved including operational, connection and planning considerations.

Lack of central support

Some stakeholders told us that LAs could be better supported by greater central support and direction. For example, Liberty Charge told us that ‘LA capabilities and process complexities are the key barrier for on-street charging […] and this needs to be addressed through much greater policy direction from government’. It also flagged the need for cross-agency co-ordination alongside financial assistance for resource and expertise at LA level, as well as other enabling mechanisms to fast track deployment.

Lack of planning and coordination

A number of stakeholders told us of the need for, and benefits of, improved local area EV charging planning. For example, Engie recommended that more focus should be given to forecasting infrastructure requirements at both a national and local level. It said that investment decisions would be enhanced with local area energy planning by the public sector and by the provision of data to help coordinate and support the efficient rollout of EV charging infrastructure.

The evidence also illustrates the need to develop a better understanding of future electricity network demand and upgrades. For example, the NAO found that there is currently no single data set for planning purposes to show which residential areas will pose the most serious challenges to installing chargepoints or where additional network infrastructure will be needed.[footnote 57] Oxford City Council told us currently LAs are investing in ‘sweet spots’ (ie where network infrastructure is already there and installation is cheap) rather than adopting a strategic approach.[footnote 58]

London City Councils, together with TfL and GLA, has been particularly active at planning on-street delivery. An EV Taskforce was set up in 2018, comprised of public sector and chargepoint operator representatives, which set direction in terms of modelling the number and mix of chargepoints needed, along with initiatives to facilitate smoother installation. These include a pan-London coordination body and a tool to identify energy network constraints and areas where new charging capacity will be cheaper and easier. Further analysis by the ICCT,[footnote 59] building on the work of the EV Taskforce, looked at borough level infrastructure needs.

The evidence also indicates that there are bottlenecks in coordination and information flow between LAs, DNOs and chargepoint operators which can constrain on-street roll-out.

Many chargepoint operators said there were challenges in engaging with DNOs – for example it can be a slow process to obtain quotes, understand costs and get the necessary connections, with variations in approach between DNOs. There was recognition that DNOs could play a greater role in helping chargepoint roll-out eg through strategic planning – but they are not currently sufficiently incentivised (see chapter 3).

Nottingham City Council told us engagement with DNOs is a bottleneck with, in its view, the inconsistent interpretation of regulations across DNOs meaning that different information is provided for different costs (although this is better than previously, it still presents challenges).

Lack of demand-led approach

The evidence indicates that there has been a lack of a demand led-approach in developing on-street charging with LAs tending to focus on ‘quick wins’ rather than planning for on-street provision more broadly.

For example, Nottingham City Council told us that almost all its chargepoints are installed in council-owned car parks with no kerbside on-street chargepoint provision. This approach was decided early on because this was seen as the best way to get chargepoints installed relatively quickly given funding constraints and concerns about the needs of different street users.

This contrasts with the demand-led approach taken by some London boroughs, where planning of new chargepoint installations is informed by data collected from residents without off-street parking via an online chargepoint request form.[footnote 60]

Difficulties relating to government funding schemes

The main UK Government funding scheme aimed at on-street residential charging is the On-street Residential Charging Scheme (ORCS), launched in 2017. This scheme is available for LAs throughout the UK.[footnote 61] Chapter 5 sets out more details on the level of funding and the patchy uptake by LAs. Evidence indicates there are some funding bottlenecks for LAs.

ORCS partially funds capital expenditure (it provides funding of up to 75% of the capital costs of procuring and installing the chargepoint and an associated dedicated parking bay where applicable). The remaining 25% has to be raised privately or funded by the LA. In most cases this funding element has been provided by the LA, but the scale in which they can do so is limited. In particular:

- One chargepoint operator told us that it has become apparent over the past 2 years that in most instances LAs do not have either the capital available to deploy at the scale required to drive the transition to EV, nor the risk appetite to invest ahead of the EV adoption / demand curve.

- London Councils told us that in the last couple of years it has been difficult for LAs to provide the capital funding independently. It stated that for most London Boroughs, a key source of capital funding has been Local Implementation Plan funding through TFL.

- Milton Keynes Council told us that currently it does not have the financial capacity to fund 25% of a new EV project.

Grant funding is also not generally available to help cover LA resource costs, thereby reducing the ability and appetite of LAs to proactively lead roll-out. To access ORCS funding, a LA needs to put together a scheme plan and then apply for funding of that plan. This requires LAs to use their own funding and resources or incur external consultancy fees (these costs are not covered by any scheme). In addition, post-implementation, LAs need to manage the chargepoint operator and the contract. In relation to this:

- A chargepoint operator stated that providing EV chargepoints for residents is a new obligation for councils and that council budgets have been especially stretched by Covid-19 response programmes on top of austerity-related cuts in funding from central government.

- Milton Keynes council told us that one of the biggest challenges for LAs is the ongoing issue of maintaining and keeping the charging networks operational.

Some LAs have been able to fund part of their resource costs via contractual arrangements with the chosen chargepoint operator, but development of these arrangements happens after the LA has incurred what can be significant resource costs to get to the tender phase.[footnote 62]

Another issue is that annual funding rounds for schemes and the need to implement a scheme within the funding year has led to a stop-start approach to installing chargepoints. Nottingham City Council told us that it approached the problem by setting out a total procurement value of £23 million, not just the initial £2 million required because they knew that there were various government funding schemes that they might be able to access over time.

Furthermore, some chargepoint operators told us that the focus on grant funded capex creates the risk that LAs will not explore different types of contract that can support commercially viable business models, for example:

- through longer term contracts that allow operators to recoup private sector investment;

- business models based on installing ‘dormant’ infrastructure upon which additional ‘active’ chargepoints can be more easily and cheaply expanded as and when sufficient demand increases. One chargepoint operator told us that current funding schemes tend to exclude these models as they pay out per active chargepoint; and

- using complementary activities such as the repairing of roads as an opportunity to also install chargepoints. Milton Keynes told us that this was an approach they considered and sought OZEV funding for – therefore more flexibility in funding would support this.

More broadly, some chargepoint operators told us that LAs may wait to initiate tenders until receiving grant funding; but grant funding may not strictly be necessary in all cases to support commercially viable concession contracts (for example, if LAs provide sufficient tenure to the chargepoint operator).

Risks to effective competition

There are a number of risks to competition in the on-street segment and we set out further evidence on this below.

Ultra-local competition for EV drivers

Demand for on-street charging is likely to be highly localised, so strong competition for drivers among chargepoint operators (‘within-market’ competition) in this segment may be difficult to achieve. Evidence from on-street chargepoint operators indicates that EV drivers value convenience and proximity to home. For example:

- One chargepoint operator told us that on-street residential is ‘hyper-local’ with each chargepoint likely servicing 1 to 4 vehicles; and

- Another operator told us that for their regular charging needs, drivers want to charge as close to home as possible, wherever they park normally. It uses a 30-50 metre radius as the distance an on-street parker will tend to walk from their home to a chargepoint.

- Qualitative consumer research[footnote 63] commissioned by 1 operator found that location is important for those relying on on-street parking, with the distance to the next chargepoint seen as main obstacle for those without access to home charging and chargepoints outside the home preferred to those ‘close to home’. On-street chargepoints further from home or destination charging tends to be used for ‘serendipitous top-ups’ or emergency charging when there is no other option.

Alongside this, EV drivers tend to engage in habitual charging with familiar chargers used over other options. For example, one on-street chargepoint operator has found that its customers tend to have up to 3 preferred chargepoints and should these not be not available, they will wait until the next day to use them rather than seeking other options.

Local Authority role in tenders and setting prices

The evidence also highlights that some LAs favour working with a single chargepoint operator for on-street charging[footnote 64] on LA-owned sites and are not actively thinking about competition.[footnote 65] A number of stakeholders told us that it takes time and resource for LAs to prepare procurement and concessions, reducing the frequency in which LAs engage with market. For example:

- Nottingham City Council told us that [REDACTED] it has had operators enquiring about installing chargepoints in the area (for example recently an operator relatively new to the market contacted them wanting to install around 100 chargepoints). However, Nottingham City Council reported practical challenges for resourcing because engagement with other operators implies a resource cost for LAs in terms of running the procurement process. Even if operators bring their own resource there are costs for the LAs in terms of having the relevant conversations, so Nottingham City Council needed to think whether just to focus on the existing network or potential new opportunities.

- A chargepoint operator told us that it about has recently seen unsuitable frameworks (procured a long time ago and without most market participants included) being used to quickly procure a stopgap solutions to community requests for charging, rather than investing thorough procurement processes.

Many stakeholders told us there are complexities for LAs in engaging with the sector and difficulties in assessing value. For example,

- [REDACTED] told us that a number of operators have recently offered fully funded chargepoints including for slow charging with much longer contract terms (around 20 years), but the lack of LA resource to assess these opportunities and determine whether they are good value for money is a barrier.

- A chargepoint operator told us that customers like LAs often have a limited knowledge of the EV market and are looking for a ‘trusted advisor’ to guide them through the process of EV charging and help them understand the available financing options. On the prospects of introducing staggered contracts with different operators locally, this would not be a favourable model because LAs often seek a single solution and want to build a relationship with a specific supplier within a specific segment of the market.

- The Local Government Association said procurement can be difficult as the offers or approaches they get from different chargepoint operators are often made on a very different basis, making it difficult for councils to compare and assess which is ultimately best. On top of this, each LA has varying fleet profiles and traffic networks which contributes to the difficulty in comparing offers.

Evidence from chargepoint operators indicates that in many cases LAs play an important role in setting prices,[footnote 66] rather than using the competitive tendering process to determine prices. In particular, LAs are generally setting on-street charging prices largely by reference to the prices that other LAs set, rather than using the competitive tender process to determine prices.

Appendix C: Home and workplace charging

Introduction

This appendix sets out relevant evidence and analysis on home and workplace EV charging. It provides background information on these segments, evidence relating to current competition and the supply and demand-side issues identified in home and workplace charging as set out in chapter 6. We did not find any key issues relating specifically to competition in destination charging (as discussed in chapter 6) therefore we have not covered it further in this appendix.

Home charging

Background

It is estimated that around 80% of EV charging is done at home and it is expected that home charging will remain a key part of the sector going forward.[footnote 67] For those that have access to a garage, driveway or other off-street parking, it can also be a highly convenient and cost-effective charging option (see Appendix E for an assessment of the price differential between different charging segments).

Smart charging, which allows charging to be modulated and scheduled during off-peak periods when demand on the electricity system is low, benefits consumers through cheaper electricity tariffs and also allows better balancing of the electricity system. Shifting EV charging demand to off-peak times will minimise network congestion, reduce the need for network upgrades and maximise the use of clean, renewable electricity.[footnote 68]

The UK Government has supported the development of the home charging segment in the 4 nations through the provision of UK-wide grants via the Electric Vehicle Homecharge Scheme (EVHS) (formerly the Domestic Recharging Scheme, DRS). These grants go towards the cost of installing a home chargepoint. In Scotland, an additional grant of up to £250 is available, with a further £100 available for those in the most remote parts of Scotland.[footnote 69] Since July 2019, eligible chargepoints for the EVHS have been required to be capable of smart charging.[footnote 70]

Through the EVHS, and its predecessor the DRS, UK Government has provided over £100 million in grant funding and supported the installation of nearly 180,000 home chargepoints.[footnote 71] The National Audit Office (NAO) estimates that 9% of total UK Government spending on supporting EV infrastructure has been spent on the EVHS and DRS.[footnote 72]

Since the inception of the EVHS in 2014, grants have declined from £900 in 2014 to £350 in 2020 and to date. In February 2021, UK Government announced changes to the existing EVHS and an intention to re-focus the scheme on leaseholders and those in rented accommodation, which it confirmed in its recently published 2035 Delivery Plan[footnote 73] These proposed changes are detailed in paragraphs 31 to 32.

The UK Government is supporting the home charging segment and encouraging the adoption of smart charging in other ways in addition to providing grant funding:

- Following consultation, the UK Government recently announced plans to require all home and workplace chargepoints installed in the UK to be smart.

- It is currently consulting on proposals to alter building regulations for new residential buildings to include requirements for EV chargepoint installations.

As set out in the main report (see chapter 2) the supply of electricity to homes (and, therefore, to home chargepoints) is regulated by Ofgem in Great Britain and Uregni in Northern Ireland, however chargepoints are not in themselves regulated.[footnote 74] Ofgem is also responsible for consumer protection in energy supply and sets rules on the communication of information to consumers by energy suppliers among other aspects.[footnote 75]

Competition in home charging

In this section, we set out estimated shares of supply (based on EVHS data provided by OZEV) [footnote 76] , provide a brief overview of the key players currently active in the supply of home chargepoints in the UK and consider entry in the home charging segment.

Shares of supply

Table 1 sets out the top 20 chargepoint operators in home charging, based on EVHS approved chargepoints to March 2021.

Table 1 EVHS funded chargepoints installed per year by top 20 manufacturers[footnote 77]

| Row Labels | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | Total | % of Total |

|---|---|---|---|---|---|---|---|---|---|

| POD Point | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] |

| bp pulse | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] |

| Rolec Services Ltd | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] |

| EO Charging | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] | [REDACTED] |