Social Outcomes Partnerships and the Life Chances Fund

Information and guidance on Social Outcomes Partnerships (also known as Social Impact Bonds) and the Life Chances Fund.

Applies to England

Social Outcomes Partnerships - overview

There are a range of entrenched social problems which, due to their intersecting nature, have been consistently challenging to address through conventional approaches to public service commissioning. Social outcomes partnerships (SOPs) create partnerships between the public, private and voluntary sectors to help solve these challenges through a clear focus upon delivering the outcomes and real world impact we want to see.

SOPs are outcome-based contracts that use private funding from social investors to cover the upfront capital required for a provider to set up and deliver a service. The service is set out to achieve measurable outcomes established by the commissioning authority (the outcome payer) and the investor is repaid only if these outcomes are achieved. For example, payments would be made if a young person has entered a job or if a homeless person has been supported into sustainable accommodation. SOPs differ from traditional fee-for-service contracts due to a focus on outcomes rather than inputs or activities.

In the UK, SOPs are also widely referred to as Social Impact Bonds (SIBs). Outside the UK, several different terms are used. For example, they are called Social Impact Partnerships or Social Impact Contracts in Europe, Pay For Success schemes in the US, and Social Benefit Bonds in Australia. Regardless of the term used, all of these programmes are fundamentally partnerships that focus on achieving better outcomes and on measuring the real world impact on people in the most vulnerable situations.

The first SOP was implemented in Peterborough in 2010 with the goal of reducing reoffending rates. The number of SOPs has grown rapidly in the UK over the last decade and are working across a range of sectors, including supporting children on the edge of the social care system, helping homeless people find sustainable housing and supporting children and young people into education, employment or training. We are learning from our experience in creating and delivering SOPs and there have now been over 80 SOPs launched across the UK.

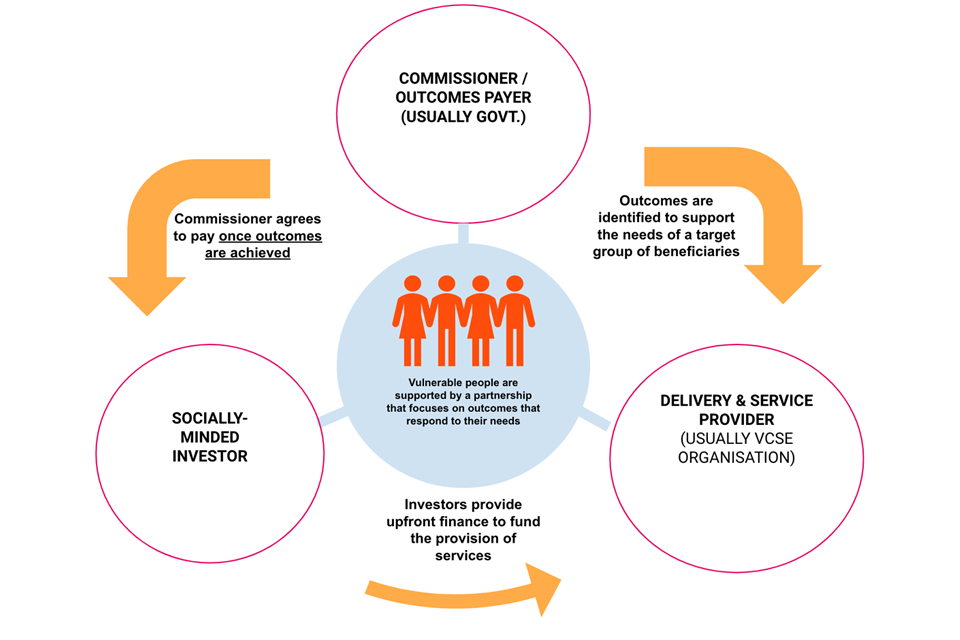

The key partners in a Social Outcomes Partnership

SOP contracts are founded on partnerships between outcome payers, service providers and social investors.

The outcomes payer is most often a statutory commissioner or group of commissioners, though private organisations have also opted to pay for outcomes in some SOPs. They identify social issues and specify measurable outcomes that must be achieved to address them. The commissioner pays for these outcomes when they are achieved.

The social investor is typically a social investment fund seeking social as well as financial returns. It provides upfront funding to finance a service designed to achieve the commissioner’s outcomes. The investment is repaid by the commissioner on the achievement of specified outcomes.

The service provider is often a social enterprise or charity organisation. It works with the target group to deliver the outcomes defined by the outcome payer. It receives payments from investors based on the achievement of specified outcomes.

Several other organisations may also be involved in a SOP partnership, including intermediaries, consultants, performance managers or evaluators.

The potential benefits of Social Outcomes Partnerships

SOPs can bring several benefits to public service delivery, including:

- fostering broad stakeholder partnerships and collaboration that bring together a range of knowledge and expertise

- enabling new interventions or programmes to be tried and greater flexibility in the delivery of interventions

- enabling a focus on prevention and early intervention which improves individual outcomes

- providing upfront capital enables local providers with a clear understanding of social issues and target populations

The potential challenges of using Social Outcomes Partnerships

Despite the benefits, commissioners should be aware that SOPs can also be complicated to establish, and require commitment and capacity to set up. They are unsuited to cases where contracts are small and setup costs cannot be justified, or when outcomes cannot be clearly measured.

Further information on the challenges and benefits of commissioning SOPs can be found in the Social Impact Bond Commissioning and Replication report, undertaken by Ecorys and ATQ Consultants on behalf of DCMS.

How to decide whether a Social Outcomes Partnership is appropriate

Before embarking on the development of a SOP it is important to carefully consider the feasibility and business case for such an approach, and how it compares to alternative ways to fund the programme or intervention. Outcome payers will need to consider both the technical processes involved, and the relationships that need to be built with other partners (such as the social investors and the service providers).

In order to consider whether a SOP is feasible, an organisation should also consider:

- whether the desired outcome is clear and measurable (for example reducing re-offending)

- whether the quality of outcomes can improve (and improvements wouldn’t have happened anyway)

- whether there is a clearly defined set of service users

- whether the time and budget to develop a SOP are available (and that the contract is large enough to justify the set-up costs)

The evidence base on Social Outcomes Partnerships

In July 2018 the Government Outcomes (GO) Lab produced a report collating all of the evidence gathered in the UK on the impact of SOPs. The report found that impact bonds have the potential to overcome perennial challenges in government including the fragmentation of public services, a short term political and financial focus, and difficulty creating change. The report found that impact bonds may help to reform the public sector through facilitating collaboration, prevention and innovation.

Since the publication of the report, further data and evidence has emerged from the practice in the UK and internationally. For further information on the evidence of SIBs from the UK and internationally, visit the GO Lab website.

Further information

Public Service Partnerships Team (DCMS)

The Public Service Partnerships Team (previously the Centre for Social Impact Bonds) is responsible for delivering the Life Chances Fund (LCF), a £70m outcomes fund delivering 29 projects across England (details below). The LCF was launched in 2016 and followed the £20m Social Outcomes Fund, launched in 2012. The team aims to share learning and insight from the delivery and evaluation of these funds with partners across national and local government. We work in partnership with a range of stakeholders, including local commissioners, service providers, academics, social investors, intermediaries and departments across government.

For more information please contact the Public Service Partnerships Team via psp-team@dcms.gov.uk.

The Government Outcomes Lab

The Government Outcomes Lab (GO Lab) is a centre of academic research and practice based at the Blavatnik School of Government, University of Oxford. It was created in 2016 as a partnership between the School and the UK government (Centre for Social Impact Bonds), and is now funded by a range of organisations. GO Lab’s role is to investigate how governments can develop fruitful cross-sector partnerships to deliver greater social impact and value. GO Lab’s research explores how governments, businesses and civil society can forge effective partnerships, how such partnerships emerge, and how they can be sustained. Alongside its research, GO Lab hosts a global knowledge hub for all those interested in deepening their understanding of outcomes-based partnerships, and runs a comprehensive programme of engagement and capacity building for government policymakers and their partners in other sectors.

Key GO Lab resources for policymakers and practitioners include:

The GO Lab team can assist commissioners in local authorities and other public sector organisations across the UK, who seek guidance on key issues relating to the development and implementation of outcome-based contracts. You can get in touch with the GO Lab team at: golab@bsg.ox.ac.uk.

Further resources

- The Knowledge Box: Developing a Social Impact Bond provides guidance for organisations that are considering developing a SIB.

- Good Finance provides guidance for charities on social investment, including a SIB provider toolkit to support organisations thinking of using SIBs

- Research: Social Impact Bond Commissioning and Replication (2019)

- Cost Benefit Analysis Guidance and Cost Benefit Analysis Model

The Life Chances Fund

The Life Chances Fund - Overview

The Life Chances Fund (LCF) aims to help those people in society who face the most significant barriers to leading happy and productive lives. The £70m fund contributes to outcome payments for locally commissioned social outcomes contracts which involve socially-minded investors.

Running until 2025, the LCF aims to support over 60,000 individuals to achieve better life outcomes in areas such as health, employment, and housing. The Fund is supporting 29 projects up until 2025, and is managed by The National Lottery Community Fund on behalf of DCMS.

The LCF has 7 primary objectives:

-

Increase the number and scale of SOPs in England.

-

Make it easier and quicker to set up a SOP.

-

Generate public sector efficiencies by delivering better outcomes, and understand how cashable savings are achieved.

-

Increase social innovation and build a clear evidence base for what works.

-

Increase the amount of capital available to voluntary, community and social enterprise (VCSE) providers to help them compete for public sector contracts.

-

Provide better evidence of the effectiveness of the SOP mechanism and the savings resulting.

-

Grow the scale of the social investment market.

The LCF empowers commissioners in local government to find locally-led place-based solutions to entrenched social problems. In doing so, it supports the development of effective local partnerships that are well-placed to deliver what’s really needed.

Note: The LCF was reduced to £70m in 2020. This does not affect individual projects’ budgets or delivery.

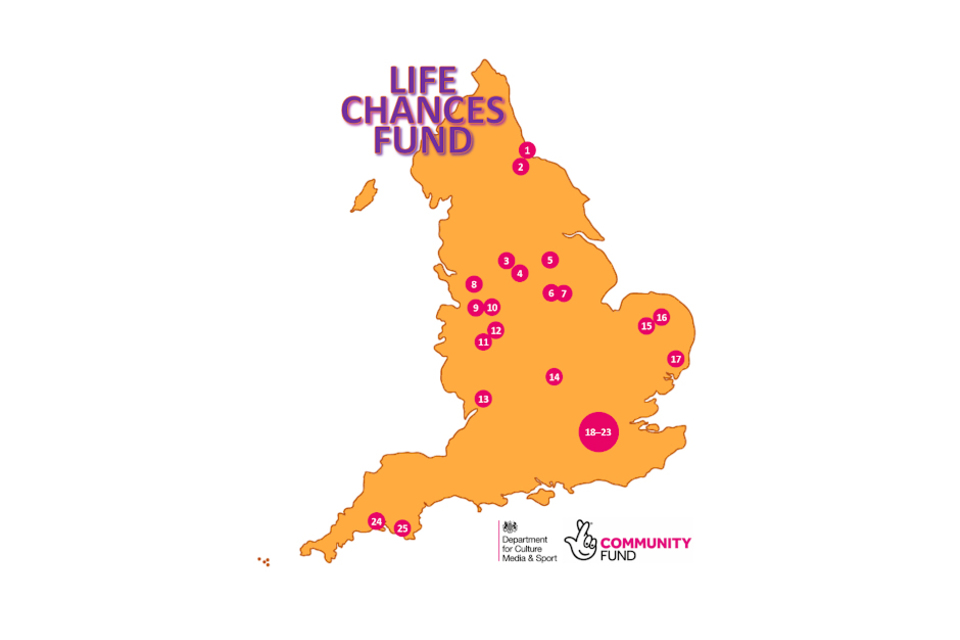

The geographical spread of LCF projects

The LCF is supporting 29 projects across England, 70% of which are currently operating outside of London and the South-East.

The Mental Health and Employment Partnership (#20) operates 5 LCF projects across London and Shropshire, supporting individuals with mental illness and learning disabilities into employment.

- Chances – Sunderland and 22 other England-wide locations

- The Skill Mill – Durham and 7 other England-wide locations

- Kirklees Better Outcomes Partnership – Yorkshire

- Promoting Independence – Sheffield

- Big Picture Learning – Doncaster

- DN2 Children’s Services – Nottingham

- Future Impact – Nottingham

- Fostering Better Outcomes – Cheshire

- Integrated Family Support Service – Staffordshire

- Pyramid Project – Staffordshire

- DFN - MoveForward – West Midlands (plus London and Kent)

- Midlands Regional Pause Hub – Midlands

- Gloucester Positive Behaviour Support – Gloucestershire

- Social Prescribing Project – Northamptonshire

- A Norfolk SIB for Carers – Norfolk

- Stronger Families Norfolk – Norfolk

- Children at Risk of Care – Suffolk

- West London Alliance – London

- Single Homeless Prevention Service – London and Norfolk

- Mental Health and Employment Partnership – 5 projects across London and Shropshire

- ParentChild+ – West London

- Enhanced Dementia Care – Hounslow

- West London Zone – West London

- Cornwall Frequent Attenders Programme – Cornwall

- Pause Project – Plymouth

Further details of projects which are being funded through the Life Chances Fund can be found in the Government Outcomes Lab’s Impact Bond Dataset

LCF learning and evaluation

The LCF is accompanied by an evaluation strategy which seeks to obtain evidence on the effectiveness of the LCF as a whole; the impact of individual projects on outcomes and beneficiaries; and the effectiveness of SOPs as a commissioning tool.

The following evaluation reports have already been published:

Implementation process evaluation

Primary evaluation

Kirklees Better Outcomes Partnership

Mental Health and Employment Partnership

-

First interim evaluation of the Mental Health and Employment Partnership LCF project

-

Second interim evaluation of the Mental Health and Employment Partnership LCF project

-

Final evaluation of the Mental Health and Employment Partnership LCF project

The Government Outcomes (GO) Lab is the government’s primary evaluation partner for the LCF. See further information about their work, as well as LCF project case studies and achievements to date

GO Lab’s evaluation work is being supplemented by individual evaluations commissioned by the LCF projects themselves. Read the reports published so far from the LCF projects’ own evaluations

Other UK government outcomes funds supporting SOPs

The Life Chances Fund has built on learning from the Social Outcomes Fund and Commissioning Better Outcomes Fund (run by the Cabinet Office and The National Lottery Community Fund)

Other UK government SOP funds include:

- the Refugee Transitions Outcomes Fund (Home Office), part-funded by the Life Chances Fund

- the Rough Sleeping SIB Fund (Department for Levelling Up, Housing and Communities)

- the Care Leavers SIB Programme (Department for Education)

- the Fair Chance Fund (Cabinet Office and the Department for Levelling Up, Housing and Communities)

- the Youth Engagement Fund (Department for Work and Pensions)

- the Innovation Fund (Department for Work and Pensions)

Further detail on UK government outcomes funds for impact bonds can be found on the Government Outcomes Lab’s website.

The Government Outcomes Lab manages an Impact Bond Dataset which includes information on SOPs at various stages of development in the UK and around the world.

Updates to this page

-

Links to new evaluation reports have been added

-

We have updated the page to include links to two further published outputs from the evaluation of the Life Chances Fund.

-

A link to the process evaluation for the Life Changes Fund report has been added to the LCF learning and evaluation section.

-

Updated page title and summary to reflect page includes info on the Life Chances Fund.

-

Page update.

-

Updated guidance and information about support to develop a Social Impact Bond.

-

Added link to new guidance on the template contract for social impact bonds and payment by results.

-

Added the Social Outcome Fund's Expression of Interest application form for SIB funding

-

First published.