Steps to take before calculating your claim using the Coronavirus Job Retention Scheme

Find out what steps you need to take before you calculate how much you can claim for furloughed and flexibly furloughed employees.

The Coronavirus Job Retention Scheme closed on 30 September 2021.

If you’re using the Coronavirus Job Retention Scheme to claim for employees’ wages, the steps you’ll need to take are:

-

Steps to take before calculating your claim.

Before you can calculate how much you can claim from the Coronavirus Job Retention Scheme you’ll need to work out your employees’ wages. To do this you must work out:

- the length of your claim period

- what you can include when calculating wages

- your employees’ usual hours and furloughed hours

For periods starting on or after 1 May 2021, you can claim for employees who were employed on 2 March 2021, as long as you’ve made a PAYE RTI submission to HMRC between 20 March 2020 and 2 March 2021 (inclusive), notifying a payment of earnings for that employee.

From 1 July 2021, the level of grant will be reduced and you’ll be asked to contribute towards the cost of your furloughed employees’ wages.

Find out about earlier claim periods by reading previous versions of this guidance on The National Archives.

Deciding the length of your claim period

Your claim period is made up of the days you’re claiming a grant for. The start date of your first claim period is the date your first employee was furloughed.

Claim periods must start and end within the same calendar month and last at least 7 days.

You can claim for a period of less than 7 days if you’re claiming for the first few days or the last few days in a month. Your claim must include either the first or last day of the calendar month, and you must have already claimed for the period ending immediately before it.

You should match your claim period to the dates you process your payroll, if you can. You can only make one claim for any period so you must include all your furloughed or flexibly furloughed employees in one claim even if you pay them at different times. If you make more than one claim, your subsequent claim cannot overlap with any other claim that you make. Where employees have been furloughed or flexibly furloughed continuously (or both), the claim periods must follow on from each other with no gaps in between the dates.

You can claim before, during or after you process your payroll as long as your claim is submitted by the relevant claim deadline. You cannot submit your claim more than 14 days before your claim period end date.

When making your claim you:

- do not have to wait until the end date of the claim period for a previous claim before making your next claim

- can make your claim more than 14 days in advance of the pay date (for example, if you pay your employee in arrears)

When claiming for employees who are flexibly furloughed you should not claim until you’re sure of the exact number of hours they will have worked during the claim period. This means that you should claim when you’ve certainty about the number of hours your employees are working during the claim period. If you claim in advance and your employee works for more hours than you’ve told us about, then you’ll have to pay some of the grant back to HMRC. If you make an error in your claim, you can find out how to correct it.

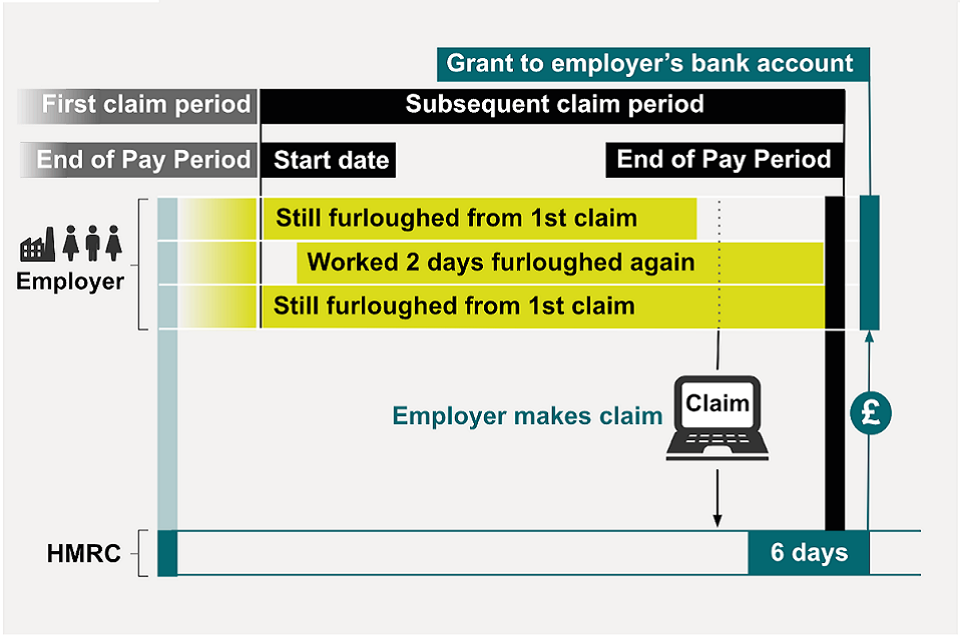

Payments will be made 6 working days after you make your claim.

Example of a first claim – The image shows an employer who furloughs 2 employees at the start of the pay period and adds a third a short time later. The start date of the claim period is when the first employee was put on furlough. The employer should include all employees who were furloughed during this claim period, even if they were put on furlough at different times within the period or are paid at different times in the pay period. The claim is then made 6 days before the end of the pay period, to make sure the grant is available to be paid out on time.

Example of a second claim – The image shows an employer who makes another claim after the first one has ended. Two employees have been furloughed continuously since the first claim, and the claim periods follow on with no gaps in between the dates – though one returns to work before the end of the pay period. One employee worked for 2 days at the start of the second period but is then furloughed again. The employer should include all employees who were furloughed during this claim period, even if they were put on furlough at different times or are paid at different times in the pay period. The claim is made 6 days before the end of the pay period, to make sure the grant is available to be paid out on time.

If the pay period you’re claiming for includes days in more than one month

Claim periods must start and end within the same calendar month.

If your pay period includes days in more than one month, you’ll need to submit separate claims covering the days that fall into each month. You should calculate each of those claims separately.

Claim periods cannot overlap, so you’ll need to make sure you include all of the employees you want to claim for in each claim you make.

Find an example of a pay period spanning 2 months.

What to include when calculating wages

The amount you should use when calculating 80% of your employees’ wages for hours not worked, is made up of the regular payments you’re obliged to make. This includes:

- regular wages you paid to employees

- non-discretionary payments for hours worked, including overtime

- non-discretionary fees

- non-discretionary commission payments

- piece rate payments

You cannot include the following when calculating wages:

- payments made at the discretion of the employer or a client – where the employer or client was under no contractual obligation to pay, including:

- any tips, including those distributed through troncs

- discretionary bonuses

- discretionary commission payments

- non-cash payments

- non-monetary benefits like benefits in kind (such as a company car), including benefits received in exchange for giving up an amount of pay under a salary sacrifice scheme

- employer pension contributions, including pension contributions received in exchange for giving up an amount of pay under a salary sacrifice scheme (you can still include pension contributions that the employee makes from their wages, such as through a Net Pay Arrangement pension scheme)

- amounts of pay given up under a salary sacrifice scheme

Find an example of calculating wages for different types of pension scheme.

The entirety of the grant received to cover an employee’s subsidised furlough pay must be paid to them in the form of money. No part of the grant should be netted off to pay for the provision of benefits or a salary sacrifice scheme.

Where the employer provides benefits to furloughed employees, including through a salary sacrifice scheme, these benefits should be in addition to the wages that must be paid under the terms of the Job Retention Scheme.

Normally, an employee cannot switch freely out of most salary sacrifice schemes unless there is a life event. HMRC agrees that coronavirus counts as a life event that could warrant changes to salary sacrifice arrangements, if the relevant employment contract is updated accordingly.

Non-discretionary payments

When working out if a payment is non-discretionary, you must only include payments which you have a contractual obligation to pay and to which your employee has an enforceable right.

When variable payments are specified in a contract and those payments are always made, then those payments may become non-discretionary. If that is the case, they should be included when calculating 80% of your employees’ wages.

Non-discretionary overtime payments

If your employee has been paid variable payments due to working overtime, you can include these payments when calculating 80% of their wages as long as the overtime payments were non-discretionary.

Payments for overtime worked are non-discretionary when you’re contractually obliged to pay the employee at a set and defined rate for the overtime that they’ve worked.

Apprenticeship Levy and Student Loans

You should continue to pay the Apprenticeship Levy as usual. Grants from the Job Retention Scheme do not cover the Apprenticeship Levy.

You should also continue to make Student Loan deductions from the wages you pay to employees.

National Minimum Wage

Individuals are entitled to the National Living Wage, National Minimum Wage or Apprentices Minimum Wage for the hours they’re working (or treated as working) under minimum wage rules.

No less than minimum wage rates must be paid for all hours worked. Furloughed workers who are not working can be paid the lower of 80% of their wages or £2,500 even if (based on their usual working hours), this would be below their appropriate minimum wage.

Time spent training whilst furloughed is treated as working time for the purposes of the minimum wage calculations and must be paid at the appropriate minimum wage rate. Employers must make sure that the wages and furlough payment provide enough monies to cover all working time including these training hours. Where the pay is less than the appropriate minimum wage entitlement, the employer will need to pay additional amounts until at least the appropriate minimum wage is paid for both working time and 100% of the training time whilst furloughed.

Where a furloughed worker is paid close to minimum wage levels and asked to complete training courses for a substantial majority of their usual working time, employers are recommended to seek independent advice or contact Acas.

If you’re claiming for a member of a Limited Liability Partnership (LLP)

If a member of an LLP is treated as an employee (because of salaried members rules), you must only include payments that are either:

- fixed

- variable, but are varied without reference to the overall amount of the profits or losses of the LLP

- not affected by the overall amount of the LLP’s profits or losses

Holiday Pay

Furloughed employees continue to accrue leave as per their employment contract.

The employer and employee can agree to vary holiday entitlement as part of the furlough agreement, however almost all workers are entitled to 5.6 weeks of statutory paid annual leave each year which they cannot go below.

Employees can take holiday while on furlough. If an employee is flexibly furloughed then any hours taken as holiday during the claim period should be counted as furloughed hours rather than working hours. Employees should not be placed on furlough for a period simply because they are on holiday. This means that employees should only be placed on furlough because your operations have been affected by coronavirus and not just because they are on paid leave. This applies equally during any peak periods.

Working Time Regulations require holiday pay to be paid at the employee’s normal rate of pay or, where the rate of pay varies, calculated as an average of pay received by the employee in previous working weeks. Therefore, if a furloughed employee takes holiday, the employer should pay their usual holiday pay in accordance with the Working Time Regulations.

Employers will need to pay additional amounts over the grant but will also have the flexibility to restrict when leave can be taken if there is a business need. This applies for both the furlough period and the recovery period.

If an employee usually works bank holidays, the employer can agree that this is included in the grant payment. If the employee usually takes the bank holiday as leave, the employer would either top up their usual holiday pay or give the employee a day of holiday in lieu.

Find out more information on holiday pay during furlough.

Employees returning from family-related statutory leave

Family-related statutory leave includes:

- maternity leave

- paternity leave

- shared parental leave

- adoption leave

- parental bereavement leave

- unpaid parental leave

For employees on fixed pay, claims for full or part time employees furloughed on return from family-related statutory leave should be calculated against their salary, before tax, not the pay they received whilst on family-related statutory leave. The same principles apply where the employee is returning from a period of unpaid statutory family-related leave.

For claim periods starting on or after 1 May 2021, when you calculate the average wages for employees on variable pay, you should not include days during, or wages related to a period of family-related statutory leave or reduced rate paid leave following a period of family related statutory leave.

However, if the employee was on family-related statutory leave or reduced rate paid leave throughout the entire period used to calculate their average wages then you should include the days during, and wages related to the period of leave as the reference salary would otherwise be zero.

This only applies when you are using the averaging method to work out your employee’s wages – the calendar lookback method is based on the amount they actually earned, even if they were on a period of statutory leave.

Employees returning to work after being on sick pay

For employees on fixed pay, claims for full or part time employees furloughed on return to work after time off sick should be calculated against their salary, before tax, not the pay they received whilst off sick.

For claim periods starting on or after 1 May 2021, when you calculate the average wages for employees on variable pay, you should not include days during, or wages related to a period of statutory sick pay leave or reduced rate paid leave following a period of statutory sick pay leave.

However, if the employee was on statutory sick pay leave or reduced rate paid leave throughout the entire period used to calculate their average wages then you should include the days during, and wages related to the period of leave as the reference salary would otherwise be zero.

This only applies when you are using the averaging method to work out your employee’s wages – the calendar lookback method is based on the amount they actually earned, even if they were on a period of statutory leave.

Unpaid sabbatical or unpaid leave

For employees on fixed pay, if your employee has been on unpaid sabbatical or unpaid leave during their reference period, you’ll need to use the amount they would have been paid if they were on paid leave when calculating 80% of their wages.

Find out your employee’s reference date

You need to identify the employee’s reference date to know which calculation rules you should use and because some calculations use the employee’s reference date in the calculation steps.

The employee’s reference date is 19 March 2020 if any of the following apply:

- you made a payment of earnings to the employee in the tax year 2019 to 2020 (and reported this to HMRC on a Real Time Information (RTI) Full Payment Submission (FPS) on or before 19 March 2020)

- you made a valid Coronavirus Job Retention Scheme claim for the employee for a claim period ending on or before 31 October 2020

- the employee was on their previous employer’s payroll on 28 February 2020, was transferred to you by that employer after 28 February 2020 and the TUPE or business succession rules applied to the transfer

Where the 19 March 2020 employee reference date does not apply, then the employee’s reference date is 30 October 2020 if any of the following apply:

- you made a payment of earnings to the employee which was reported to HMRC on an RTI FPS between 20 March 2020 and 30 October 2020 (inclusive)

- you made a valid Coronavirus Job Retention Scheme claim for the employee for a claim period between 1 November 2020 to 30 April 2021

- the employee was on their previous employer’s payroll on or before 30 October 2020, was transferred to you by that employer after 31 August 2020 and the TUPE or business succession rules applied to the transfer

Where neither 19 March 2020 nor 30 October 2020 reference dates apply the employee is not eligible for periods starting before 1 May 2021. If you made a payment of earnings to the employee which was reported to HMRC on an RTI FPS between 31 October 2020 and 2 March 2021 (inclusive) they may be eligible for periods starting on or after 1 May 2021 and their reference date will be 2 March 2021.

If an employee with variable pay has a reference date of 19 March 2020 or 30 October 2020 because they were transferred to you by their previous employer under the TUPE or Business Succession rules, you may have to take into account their period of employment with their previous employer in your calculations. See how this affects how you calculate their usual hours and usual wages.

Work out your employee’s usual hours and furloughed hours

If your employee is fully furloughed, you do not need to work out their usual and furloughed hours but you should work out the maximum wage amount. An employee is fully furloughed if they do not do any work for you during the claim period.

If your employee is flexibly furloughed, you’ll need to work out your employee’s usual hours and record the actual hours they work as well as their furloughed hours for each claim period.

You can calculate the usual hours for the entire claim period or for each pay period, or part of a pay period, as long as they fall within the claim period. This guidance assumes that you’ll calculate on a pay period basis but either method is acceptable.

If you calculate the usual hours for the entire claim period and the result is not a whole number, you should round it up to the next whole number. If you calculate the usual hours on a pay period basis you should round the result up or down to the nearest whole number.

There are 2 different calculations you can use to work out your employee’s usual hours, depending on if they work fixed or variable hours.

You should work out usual hours for employees who work variable hours, if either your:

- employee is not contracted to a fixed number of hours

- employee’s pay depends on the number of hours they work

If neither of these apply, you should work out your employee’s usual hours for an employee who is contracted for a fixed number of hours.

The employee’s working pattern does not have to match their pay period (for example, an employee could be contracted to a fixed 40 hours a week, but then be paid a variable monthly amount because of shift allowances). HMRC will not decline or seek repayment of any grant based solely on the particular choice between fixed or variable approach to calculating usual hours, as long as a reasonable choice is made.

Work out your employee’s usual hours for an employee who is contracted for a fixed number of hours and whose pay does not vary according to the number of hours they work

To calculate the number of usual hours for each pay period (or partial pay period):

-

Start with the hours your employee was contracted for at the end of the last pay period ending on or before the employee’s reference date.

-

Divide by the number of calendar days in the repeating working pattern, including non-working days.

-

Multiply by the number of calendar days in the pay period (or partial pay period) you’re claiming for.

-

Round up or down if the result is not a whole number.

If an employee with fixed hours was on annual leave, off work sick or on family related statutory leave at any time during the last pay period ending on or before the employee’s reference date, the usual hours should be calculated as if the employee had not taken that leave.

Find examples of how to work out usual hours for employees who are contracted for a fixed number of hours.

If your employee has fixed hours and their first pay period ended after their reference date

You can still claim for employees on fixed hours whose reference date is 30 October 2020 or 2 March 2021 and whose first pay period ends after that date as long as HMRC received the details of their wages on a PAYE Real Time Information (RTI) Full Payment Submission (FPS) on or before their reference date and the other eligibility conditions are met.

When you calculate the employee’s usual hours, use the hours they were contracted for at the end of the pay period for which a PAYE RTI FPS was submitted to and received by HMRC on or before their reference date.

Work out your employee’s usual hours for an employee who works variable hours

Where the pay varies by the amount of time worked, you’ll have shown the number of hours worked on your employees’ payslips in line with legislation introduced by BEIS in April 2019 (Employment Rights Act 1996, section 8). You’re therefore likely to have records of the number of hours worked.

Employers should identify the hours the employee worked by using pay records, time sheets and other records which show time worked. If these are not available then use other records, such as rotas or work diaries. If these records are not available, employers may use the pay rate to work back from gross pay.

If your employee has variable pay you’ll complete a similar comparison to calculate their usual wages but the result may be different.

When you calculate the usual hours, you should include any hours:

- of leave for which the employee was paid their full contracted rate (such as annual leave)

- worked as ‘overtime’, but only if the pay for those hours was not discretionary

If you’re calculating the usual hours for an employee who is part of a flexible work time arrangement (‘flexi-leave’), you should:

- not count unpaid hours as hours worked where the employee instead accrued paid time off which they could take later

- count hours the employee took as paid time off as hours worked where they had accrued that time by working additional hours at some other time

You’ll use differing approaches to calculate your employee’s ‘usual hours’ for an employee who works variable hours depending on the employee’s reference date.

For employees with a reference date of 19 March 2020, calculate ‘usual hours’ based on the higher of either the:

- average number of hours worked in the tax year 2019 to 2020

- hours worked in the corresponding calendar period in a previous year

For other employees, you’ll calculate ‘usual hours’ based on the average number of hours worked in the period they worked for you from 6 April 2020 up to (and including) the day before the employee’s first day spent on furlough on or after either:

- 1 November 2020 (for those with a reference date of 30 October 2020)

- 1 May 2021 (for those with a reference date of 2 March 2021)

For employees, calculate the average number of hours worked from 6 April 2020 up to (and including) the day before the employee’s first day spent on furlough on or after 1 May 2021.

Averaging method for a variable hours employee whose reference date is 19 March 2020

To work out the usual hours for each pay period (or partial pay period) based on the average number of hours worked in the tax year 2019 to 2020:

-

Start with the number of hours actually worked (or on paid annual leave or flexi-leave) in the tax year 2019 to 2020 before the employee was first furloughed, or the end of the tax year if earlier.

-

Divide by the number of calendar days the employee was employed by you in the tax year 2019 to 2020, up to (and including) the day before they were first furloughed, or the end of the tax year if earlier.

-

Multiply by the number of calendar days in the pay period (or partial pay period) you’re claiming for.

-

Round up or down if the result is not a whole number.

When you calculate the number of calendar days in step 2, you should not count any calendar days where the employee was on a period of:

- statutory sick pay related leave

- family related statutory leave

- reduced rate paid leave following a period of statutory sick pay related leave

- reduced rate paid leave following a period of family related statutory leave

Calendar lookback method

When you work out the usual hours based on the corresponding calendar period in a previous year, the period you look back to depends on the period you’re claiming for:

| Claim Month | Lookback period |

|---|---|

| May 2021 | May 2019 |

| June 2021 | June 2019 |

| July 2021 | July 2019 |

| August 2021 | August 2019 |

| September 2021 | September 2019 |

If your employee did not work for you in the lookback period for the month you are claiming for, you can only use the averaging method to calculate their usual hours.

To work out the usual hours for a pay period or partial pay period based on the corresponding calendar period in a previous year:

-

Identify the pay periods that include at least one calendar day in the lookback period and correspond to at least one calendar day in the pay period (or partial pay period) you’re claiming for.

-

If the pay period (or partial pay period) you’re claiming for starts and ends on the same calendar days as the pay period identified in step 1 – use the number of hours they actually worked in that pay period.

-

If the pay period (or partial pay period) you’re claiming for does not start and end on the same calendar days as the pay periods identified in step 1 – you’ll need to add together a proportion of the hours worked in each of the pay periods you’ve identified.

If your pay periods end on the last day of February, you’ll need to adjust the number of hours worked, because 2020 being a leap year, means they will not end on the same calendar day

If you need to work out the usual hours based on the hours worked in more than one pay period in a previous year:

-

Start with the number of hours worked in the first pay period identified in the lookback period.

-

Multiply by the number of calendar days in that pay period which correspond to at least one calendar day in the pay period (or partial pay period) you’re claiming for.

-

Divide by the total number of calendar days in the pay period identified in step 1.

-

Repeat steps 1, 2 and 3 for each subsequent identified pay period in the lookback period.

-

Add them all together.

-

Round up or down if the result is not a whole number.

Averaging method for a variable hours employee whose reference date is 30 October 2020 or 2 March 2021

Before you work out the average number of hours using this calculation, you need to know what date to calculate up to.

For employees whose reference date is 30 October 2020, the date to calculate up to is the day before the employee’s first day spent on furlough on or after 1 November 2020.

For employees whose reference date is 2 March 2021, the date to calculate up to is the day before the employee’s first day spent on furlough on or after 1 May 2021.

To work out the usual hours for each pay period (or partial pay period) based on the average number of hours worked from 6 April 2020 (or the day the employee’s employment started if later) up to (and including) the day before the employee’s first day spent on furlough on or after 1 November 2020 or on or after 1 May 2021:

-

Start with the number of hours actually worked (or on paid annual leave or flexi-leave) from 6 April 2020 (or the day the employee’s employment started if later) and up to (and including) the date to calculate up to.

-

Divide by the number of calendar days the employee was employed by you from 6 April 2020 (or the day the employee’s employment started if later) – including non-working days – up until (and including) the date to calculate up to.

-

Multiply by the number of calendar days in the pay period (or partial pay period) you’re claiming for.

-

Round up or down if the result is not a whole number.

When you calculate the number of calendar days in step 2, you should not count any calendar days where the employee was on a period of:

- statutory sick pay related leave

- family related statutory leave

- reduced rate paid leave following a period of statutory sick pay related leave

- reduced rate paid leave following a period of family related statutory leave

If your variable hours employee was transferred to you under the TUPE or Business Succession rules

If an employee with variable hours has a reference date of 19 March 2020 or 30 October 2020 because they were transferred to you by their previous employer under the TUPE or Business Succession rules, you may have to take into account their period of employment with their previous employer when you calculate their usual hours.

If the employee has a reference date of 19 March 2020:

- when you work out the usual hours based on the corresponding calendar period in a previous year, you should include hours and days in the lookback period where they worked for their previous employer (this must be the employer who transferred them to you under the TUPE or Business Succession rules)

- when you work out their usual hours using the averaging method, the date to calculate from is the later of 6 April 2019 or the first date they were employed by their previous employer

- the date to calculate up to is the earlier of 5 April 2020 or the day before they were first furloughed by you or by their previous employer (this must be the employer who transferred them to you under the TUPE or Business Succession rules)

If the employee has a reference date of 30 October 2020:

- when you work out their usual hours using the averaging method, the date to calculate from is the later of 6 April 2020 or the first date they were employed by their previous employer

- the date to calculate up to is the day before they were first furloughed on or after 1 November 2020 by you or by their previous employer (this must be the employer who transferred them to you under the TUPE or Business Succession rules)

Work out your employee’s usual hours if they are paid per task or piece of work done

You should work out the usual hours for these employees in the same way as for other employees who work variable hours, if possible.

If you do not know what hours the employee worked, you can estimate the hours based on the number of ‘pieces’ they produced and the average rate of work per hour (which you should already have worked out to comply with National Minimum Wage rules).

Calculating the number of working and furloughed hours for each employee

You’ll have agreed how many hours your flexibly furloughed employee is going to work in the claim period. They will be furloughed for the rest of their usual hours.

To calculate the number of furloughed hours:

-

Start with your employee’s usual hours.

-

Subtract the number of hours they actually worked in the claim period – even if this is different to what you agreed.

You should not claim until you are have certainty about the number of hours your employees are working during the claim period. If you claim in advance and your employee works for more hours than you agreed, then you’ll have to pay some of the grant back to HMRC. If you make an error in your claim, you can find out how to correct it.

You must pay the employee their contractually agreed rate for any hours they work. Check the latest National Minimum Wage rates.

Calculating the number of working and furloughed hours for an employee that is furloughed or flexibly furloughed for part of a claim period

If your employee is only furloughed or flexibly furloughed for part of your claim period, when calculating the number of furloughed hours you can claim for, you must:

- only calculate the employee’s usual hours for the days covered by the furlough agreement

- not include any working hours on days not covered by a furlough agreement

This applies even if your claim period includes days before or after the employee’s furlough agreement (for example, because you’re claiming for multiple employees and some of them are furloughed for a different period).

If your employee takes leave while they are flexibly furloughed

You cannot claim for an employee under the scheme for any time they are on unpaid leave or statutory sick pay related leave.

You can claim for an employee who is on:

- annual leave

- leave taken on account of time worked under a flexible work time arrangement (flexi-leave)

- family related statutory leave

- reduced rate paid leave following a period of family related statutory leave

Any time they’re on these types of leave while flexibly furloughed will count as furloughed hours and does not count as time actually worked.

What to do next

Once you’ve finished these steps, you can calculate your claim.

Updates to this page

-

Information updated because the Coronavirus Job Retention Scheme closed on 30 September 2021.

-

Claims for furlough days in May 2021 must be made by 14 June 2021.

-

Claims for furlough days in April 2021 must be made by 14 May 2021.

-

Added translation

-

Section about employee reference dates added and changes made throughout the page to include employee reference dates.

-

Claims for furlough days in March 2021 must be made by 14 April 2021.

-

Dates for when employers can make a claim have been updated.

-

The scheme has been extended until 30 September 2021. From 1 July 2021, the level of grant will be reduced each month and employers will be asked to contribute towards the cost of furloughed employees’ wages. New information on claim periods from May 2021 added.

-

Claims for furlough days in February 2021 must be made by 15 March 2021.

-

The section 'What to include when calculating wages' has been updated to give more information about non-monetary benefits and employer pension contributions under salary sacrifice schemes.

-

Added translation

-

New sections added under 'Work out your employee’s usual hours and furloughed hours' called 'Averaging method for employees whose earnings were reported on an RTI FPS on or before 19 March 2020' and 'Calendar lookback method'.

-

Added Welsh translation.

-

Updated to reflect that the Coronavirus Job Retention Scheme has been extended to 30 April 2021.

-

The information about holiday pay and unpaid sabbatical or unpaid leave has been updated.

-

Guidance updated to reflect that 30 November claims deadline has now passed.

-

More information about fixed hours employees whose first pay period ends after 30 October 2020 has been added.

-

There has been a minor amendment to clarify how to work out 80% of your employee’s average earnings between the date their employment started and the day before they are furloughed.

-

Information relating to claim period deadlines and timings has been clarified.

-

The scheme has been extended. This guidance has been updated with details of how to claim for periods after 1 November 2020. 30 November 2020 is the last day employers can submit or change claims for periods ending on or before 31 October 2020.

-

Information call out updated to state that the scheme is being extended until 31 March 2021.

-

Information call out has been updated to confirm that the guidance on this page reflects the rules for the period until 31 October 2020. This page will be updated to include the rules relating to the scheme extension shortly.

-

The Coronavirus Job Retention Scheme is being extended until December 2020.

-

Information call out has been updated - the scheme is now closed. 30 November 2020 is the last date you can submit claims.

-

The information call out at the top of the page has been updated with the changes to the scheme. 30 November 2020 is the last day employers can submit or change claims for periods ending on or before 30 October 2020.

-

New subsection 'Work out your employee's usual hours and furloughed hours' to tell employers how to calculate the number of working and furloughed hours for an employee that comes off furlough or flexible furlough partway through a claim period. Employers using this calculation do not need to amend previous claims.

-

The information call out at the top of the page has been updated with the changes to the scheme from 1 September.

-

Deleted sections on working out claims on or before 30 June 2020 and on calculate your claim for pension contributions for claim periods up to and including 30 June 2020.

-

Wording has been added to make it clear that HMRC will not decline or seek repayment of any grant based solely on the particular choice between fixed or variable approach to calculating usual hours, as long as a reasonable choice is made.

-

Page updated with information on holiday pay that employees can be recorded as on furlough during time spent on holiday. Also added information on how to calculate furloughed hours for different sets of circumstances.

-

First published.