Food Statistics in your pocket 2017 Summary

Updated 9 October 2018

1. Food Statistics Pocketbook Summary

This summary provides a selection of information from the full Food Statistics Pocketbook covering the economic, social and environmental aspects of the food we eat. It contains statistics for different time periods, but always using latest available data at the time of release.

Data comes from surveys run by Defra and the Office for National Statistics and from a wide range of other sources including government departments, agencies and commercial organisations.

The full publication is available here:

Food statistics pocketbook

Associated datasets from this year’s publication are also available. Data are a mixture of National Statistics, Official Statistics and unofficial statistics. Unofficial statistics are used where there are gaps in the evidence base. Where National Statistics (Official Statistics that comply with the national statistics code of practice) are used this is indicated. Further information on National Statistics can be found on the UK Statistics Authority website.

The sections on Environment and Waste from the previous version published in April 2017 are no longer being reproduced.

Environmental information was previously sourced from these locations: UK Environmental accounts,ONS British Survey of Fertiliser Practice, Defra and Energy consumption in the UK,BEIS

Waste information was previously sourced from WRAP. & Digest of waste and resource statistics(Defra)

The sections on Dietary Health and Safety & Confidence are under review and so were not included in this update.

Please answer 4 short questions (opens in Google Forms) to help us make the pocketbook better for you.

1.1 Contact

Enquiries to: familyfood@defra.gov.uk Lead statistician:David Lee Tel: 0208 026 3006

Production team: David Lee, Isabella Worth, Andrew Scaife, Graham Brown, Leigh Riley, Chris Silwood.

You can also contact us via Twitter: @DefraStats

Food Statistics team

Department for Environment, Food and Rural Affairs

Foss House, Kings Pool

1-2 Peasholme Green

York YO1 7PX

The Agri-Food Chain

£113bn The agri-food sector contribution to national Gross Value Added in 2016.

3.9m People employed in the agri-food sector in Q1 2018, 13% of GB employment.

3.4% Food and non-alcoholic beverage price fall in real terms between 2008 and July 2018.

£219bn Total consumer expenditure on food, drink and catering in 2017.

£22bn The value of food and drink exports in 2017.

2. Gross Value Added of the UK agri-food sector 2016

| 2016 | £ billion |

|---|---|

| Agriculture and Fishing | £9.2bn |

| Food and Drink Manufacturing | £29.5bn |

| Food and Drink Wholesaling | £12.3bn |

| Food and Drink Retailing | £29.4bn |

| Non-Residential Catering | £32.7bn |

| Total | £113.2bn |

The agri-food sector contributed £113 billion or 6.4% to national Gross Value Added in 2016.

The GVA of the food sector (excluding agriculture and fishing) increased 2.7% in 2016, following a 3.9% increase in 2015. Wholesaling GVA increased by 6.9%, whilst manufacturing rose by 7.0% and catering rose by 4.4%. Retailing GVA fell by 4.4%.

Source: Annual Business Survey (ONS). & Chapter 4 of Agriculture in the United Kingdom (Defra).

National Statistics.

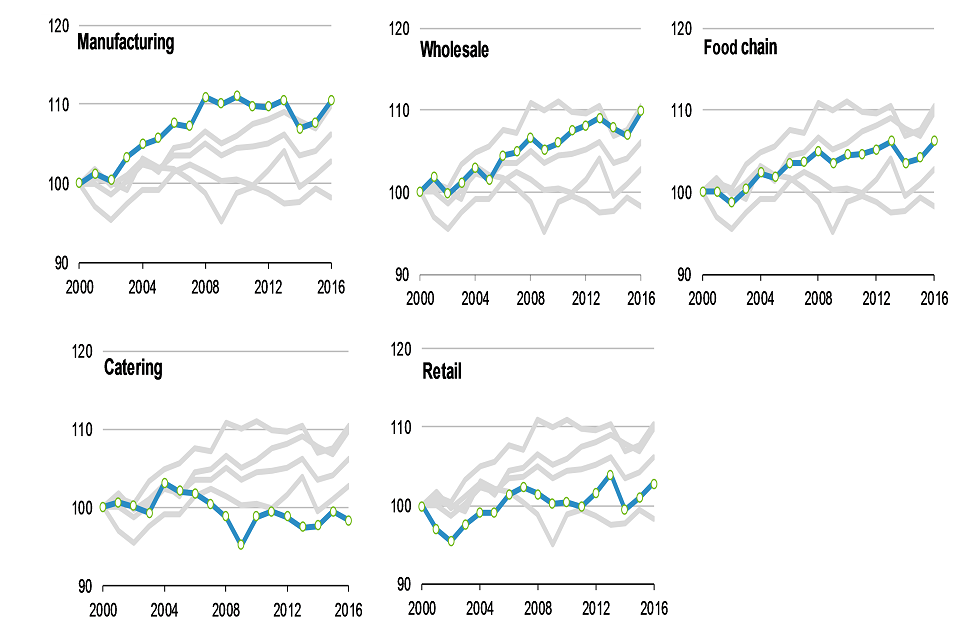

3. Total Factor Productivity of the UK food sector

Trends in the total factor productivity of the UK food sector

Total factor productivity 1 of the UK food chain beyond the farmgate has risen by 1.9% between 2015 and 2016. Productivity in the wider economy remained unchanged.

The TFP of the UK food sector is an indicator of the efficiency and competitiveness of the food industry within the UK. An increase in TFP indicates the industry is improving its competitiveness.

Source: Total Factor Productivity of the United Kingdom Food Chain, Defra.

1 See Glossary for definition of Total Factor Productivity.

National statistics.

4. Agri-food sector employees (GB), Q1 2018

| Q1 2018 | million employees |

|---|---|

| Agriculture and Fishing | 0.43 |

| Food and Drink Manufacturing | 0.39 |

| Food and Drink Wholesaling | 0.24 |

| Food and Drink Retailing | 1.12 |

| Non-Residential Catering | 1.77 |

| Total food sector | 3.52 |

| Total agri-food sector | 3.95 |

The food sector2 in GB employed 3.5 million people in Q1 2018 (3.9 million if agriculture and fishing are included along with self-employed farmers), a 1.0% increase on a year earlier. It covered 12% of GB employment in Q1 2018 (13% if agriculture and fishing are included along with self-employed farmers).

Source: Labour Market Statistics (ONS) & June Survey structure statistics (Defra).

2 Food’ includes non-alcoholic drinks. ‘Drink’ is alcoholic drinks

National Statistics.

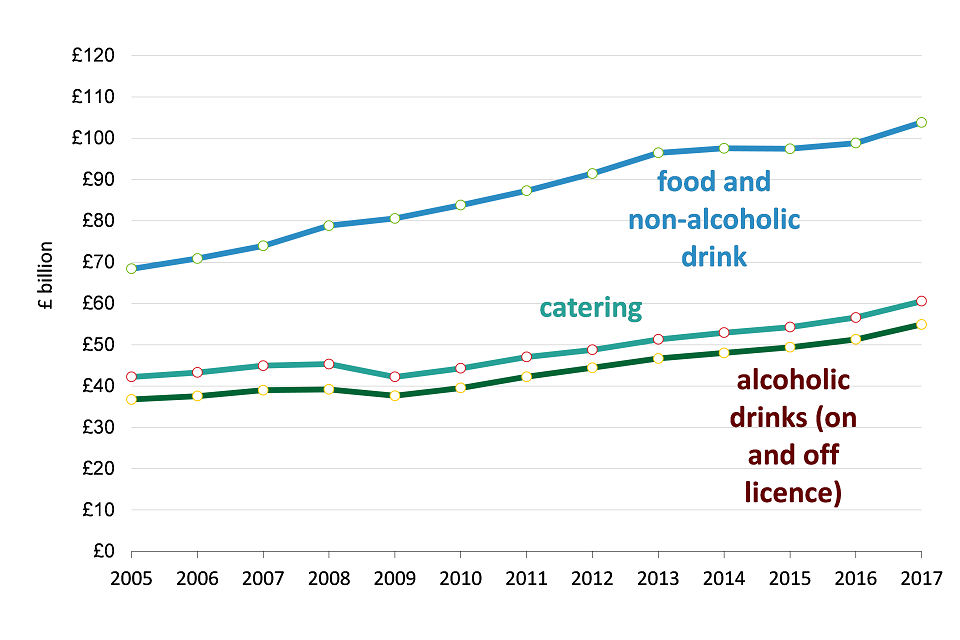

5. UK Consumer expenditure on food, drink and catering

UK Consumer expenditure on food, drink and catering

Total consumer expenditure on food, drink3 and catering has continued to rise, by 6.1% in 2017 to £219 billion. Expenditure on food (including non-alcoholic drinks) increased by 5.1%, alcoholic drinks by 7.1% and catering by 7.0%.

Source: Consumer Trends, (ONS).

3’Food’ includes non-alcoholic drinks. ‘Drink’ is alcoholic drinks.

National Statistics.

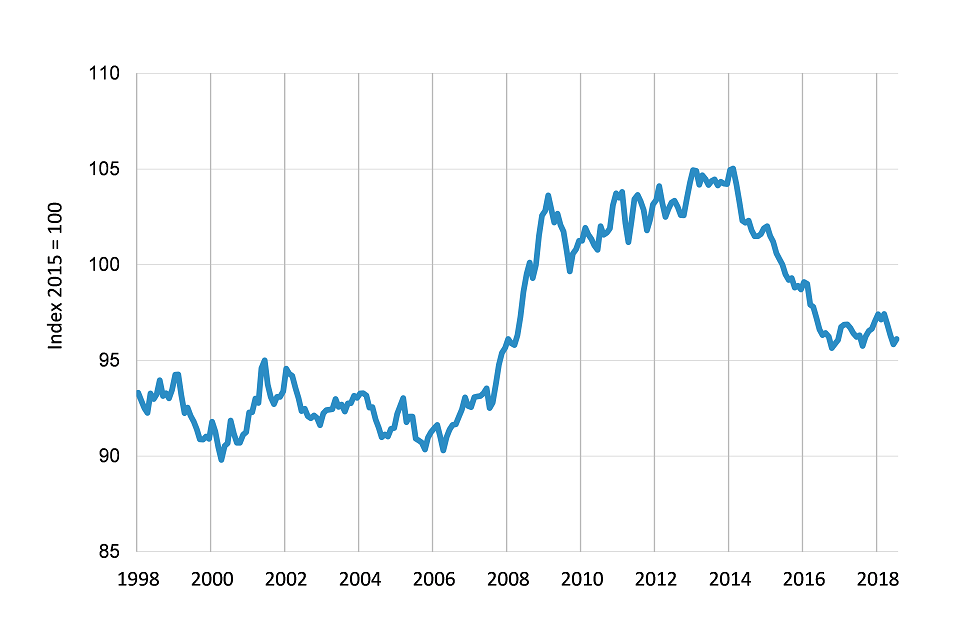

6. UK trend in food and non-alcoholic beverage prices in real terms, January 1998 to March 2018

UK trend in food and non-alcoholic beverage prices in real terms, January 1998 to July 2018

Food and non-alcoholic beverage prices4 rose 9.3% in real terms between 2008 and their peak in February 2014 as measured by the Consumer Price Index. Gradual price reductions since 2014 have resulted in a 3.4% decrease compared to 2008.

Food and non-alcoholic beverage price inflation in real terms has fallen by 0.2% since 12 months ago. In 2018 prices have fluctuated after a long period of negative inflation.

Source: Consumer Price Indices, (ONS).

4 Excludes catering.

National Statistics.

7. UK retail price changes by food group, 2007 to 2017

| Food group | % change between 2007 and 2017 |

|---|---|

| CPIH (overall index) | 24% |

| Milk, cheese and eggs | 19% |

| Vegetables including potatoes and tubers | 21% |

| Alcoholic beverages | 21% |

| Mineral waters, soft drinks and juices | 22% |

| Meat | 28% |

| Food and non-alcoholic beverages | 31% |

| Bread and cereals | 32% |

| Catering services | 34% |

| Coffee, tea and cocoa | 42% |

| Fish | 42% |

| Sugar, jam, syrups, chocolate and confectionery | 43% |

| Fruit | 44% |

| Oils and fats | 47% |

All food and non-alcoholic beverage groups have risen in price since 2007 (the start of the recession), with rises ranging from 19% to 47%. Coffee, tea and cocoa, fruit, sugar, jam and confectionery, fish and oils and fats have all risen in price by 35% or more since 2007.

Source: Consumer Price Index including owner occupiers’ housing costs (CPIH) (ONS).

National Statistics.

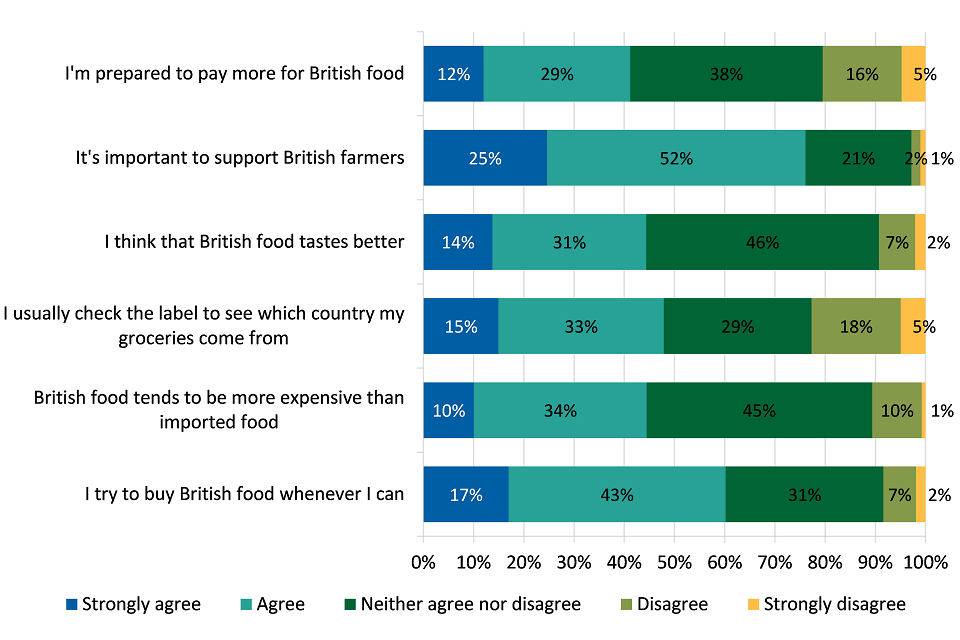

8. Attitudes towards British food purchases in the UK (2016)

Attitudes towards British food purchases in the UK (2016)

When surveyed, 60% of shoppers agree that they try to buy British food whenever they can while 8% disagree. 76% agree that it is important to support British farmers while only 3% disagree. According to the survey 45% think that British food tastes better while 9% disagree.

Source: Lightspeed GMI/Mintel

9. Origins of food consumed in the UK, 2017

| Region | Percentage supplied to the UK |

|---|---|

| UKa | 50% |

| EU | 30% |

| Africa | 4% |

| North America | 4% |

| South America | 4% |

| Asia | 4% |

| Rest of Europe | 2% |

| Australasia | 1% |

(a) UK origin consists of UK domestic production minus UK exports

Sourcing food from a diverse range of stable regions, in addition to domestically, enhances food security5. Based on the farm-gate value of unprocessed food in 20176, the UK supplied just under half (50%) of the food consumed in the UK. The leading foreign supplier of food consumed in the UK were countries from the EU (30%). Africa, Asia, North and South America eachall provided a 4% share of the food consumed in the UK. The three largest value imported commodity groups (at 2017 prices) were fruit & vegetables, meat and beverages (see 3.4).

Source: Chapter 14, Agriculture in the United Kingdom, Defra.

5 UK Food Security Assessment, January 2010 (Defra). 6 2017 figures are provisional.

10. Trend in exports of food, feed and drink

| Year | £ billion |

|---|---|

| 2000 | 11.9 |

| 2001 | 11.5 |

| 2002 | 11.8 |

| 2003 | 12.8 |

| 2004 | 12.2 |

| 2005 | 12.2 |

| 2006 | 12.5 |

| 2007 | 13.3 |

| 2008 | 15.0 |

| 2009 | 15.9 |

| 2010 | 17.7 |

| 2011 | 19.9 |

| 2012 | 19.6 |

| 2013 | 20.0 |

| 2014 | 19.6 |

| 2015 | 18.8 |

| 2016 | 20.1 |

| 2017 | 22.0 |

The total value of food and drink exports increased in 20177 to £22 billion, £1.9 billion more than the previous peak of £20.1 billion in 2016. The trade deficit in food, feed and drink increase in 2017 to a new record high of £24.2 billion, up from £22.8 billion in 2016.

Source: HM Revenue and Customs

7 2017 figures are provisional.

11. Go to Food Chain section

12. Go to Prices and expenditure section

13. Go to Global and UK supply section

14. Go to home page for downloadable data for charts

15. Glossary

15.1 Economic Definition of food and agri-food sector

The UK food sector is defined as food manufacturing, food wholesaling, food retailing and non- residential catering. In terms of the standard industrial classification (SIC 2007) it is defined as:

| Category | SIC codes |

|---|---|

| Food Manufacturing: | 10 + 11 |

| Food Wholesaling: | 46.3 (excluding 46.35) + 46.17 |

| Food Retailing: | 47.2 (excluding 47.26) + 47.11 + 47.81 |

| Non-residential Catering: | 56 |

The deductions are to remove non-food items as far as possible.

The agri-food sector is the food sector plus agriculture and fishing. Agriculture and fishing are shown in several charts for comparison.

15.2 Net capital expenditure

This is calculated by adding to the value of new building work, acquisitions less disposals of land and existing buildings, vehicles and plant and machinery.

15.3 Gross Value Added (GVA)

GVA is the difference between output and intermediate consumption for any given sector / industry. This is the difference between the value of goods and services produced and the cost of raw materials and other inputs which are used up in production.

15.4 Total Factor Productivity (TFP)

Productivity measures the efficiency at which inputs are converted into outputs. Total Factor Productivity provides a comprehensive picture of growth.

15.5 Low income

The most commonly used threshold to determine relative low income is having an income which is less than 60% of the median in that year. Absolute low income is considered to be having an income which is less than 60% of the median in that year, adjusted by inflation.

15.6 Equivalised income

The income a household needs to attain a given standard of living will depend on its size and composition. Equivalisation is a means of adjusting a household’s income for size and composition so that the incomes of all households are on a comparable basis.

15.7 Small and Medium Enterprises (SMEs)

Outside of these statistics, the definition of a SME can depend upon several factors, including turnover. For these statistics, a ‘small’ business is a private sector business with fewer than 50 employees. A ‘medium’ business is a private sector business with between 50 and 249 employees. A ‘micro’ business is a private sector business with between 1 and 10 employees, which, for the purpose of these statistics is incorporated within the ‘small’ category.