The Planning Inspectorate Annual Report and Accounts 2021/22

Published 7 July 2022

Applies to England and Wales

For the period 1 April 2021 to 31 March 2022

Presented to the House of Commons pursuant to Section 7 of the Government Resources and Accounts Act 2000.

Ordered by the House of Commons to be printed on 8th July 2021.

Any enquiries regarding this publication should be sent to:

The Planning Inspectorate,

Temple Quay House,

2 The Square,

Temple Quay,

Bristol

BS1 6PN

Tel: 0303 444 5000

Email:

General Enquiries: enquiries@planninginspectorate.gov.uk

Press Enquiries: press.office@planninginspectorate.gov.uk

Welsh Enquiries: PEDW.Casework@gov.wales

This publication is available in large print - contact the Inspectorate’s Bristol Office.

Introduction

At the Planning Inspectorate, we are known for fairness, openness and impartiality in our examinations, deciding appeals and handling applications. We are focused on delivering for our customers, responding to the changing environment.

Across England, our Inspectors deliver decisions and recommendations across our three public services: examinations, appeals and (also in Wales) applications. To do this, we make sure development is carefully considered, that the right homes are constructed in the right places, and that green spaces are protected. We make sure that proposed developments meet future needs for the economy, environment and society and that the communities’ views on large infrastructure applications are heard.

We uphold and promote quality, assuring the checks and balances of the planning system, so that decisions are fair, impartial and open. We examine the local plans from Local Authorities that set the framework for local economic, social and environmental priorities. We have specialist experts able to advise and decide cases on specialist subjects across environmental, ecological, historic and arboricultural matters.

The work of our Inspectors is supported by skilled professionals delivering casework support, specialist advice, customer service, corporate services, knowledge management, project management and digital expertise.

Our strategy

Our purpose is to deal with planning appeals, national infrastructure planning applications, examinations of local plans and other planning-related and specialist casework. We share our expertise with our customers, communities, businesses, local and national governments to enable good planning.

To fulfil our purpose and uphold the values of customer-focus, fairness, openness and impartiality, we have a vision to:

‘Provide our customers with high quality, timely and efficient services that support the nation’s recovery from the COVID-19 pandemic by engaging, empowering and equipping our workforce and by delivering ambitious policy changes’.

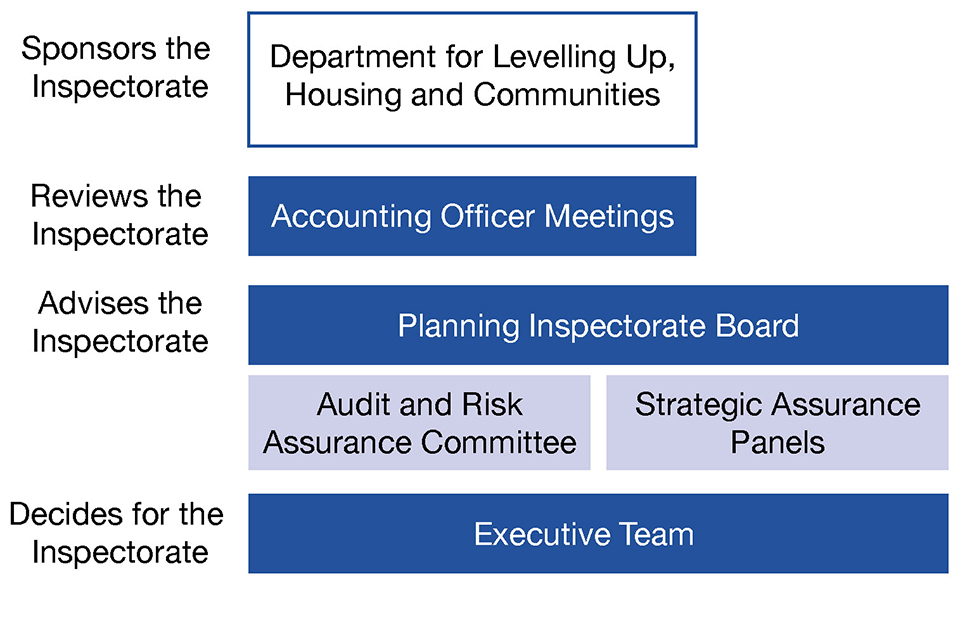

The Department for Levelling Up, Housing and Communities sets priorities for the Planning Inspectorate each year.

For 2021/22, the priorities were:

- recovery and operational performance;

- developing new digital services;

- Planning Reform and Project Speed;

- gender pay gap and diversity and inclusion strategy;

- resources; and

- Spending Review Settlement 2021/22 and Future Planning.

Our previous plan was founded on four priorities, which contained a number of objectives. As we began to feel the impact of COVID-19, we focused on the safety and wellbeing of our people and on keeping casework moving.

Our new Strategic Plan, published in October 2021, centres on our new vision. It outlines the objectives we will be delivering over the coming three financial years to make our vision a reality.

To simplify and gain wider understanding of our strategic direction, we revised the Strategic Plan to have a vision underpinned by three core strategies. Delivering these serve as our external-facing priorities and their stated objectives are therefore our strategic objectives. These are a Customer Strategy to act as a vision for our service delivery, and two strategies that would enable its delivery. The enabling strategies focus on our people and on data and digital improvement.

Strategic performance

Our performance against our strategies is summarised here.

The COVID-19 pandemic reduced our capacity and halted our progress in speeding up decisions. We received 21,300 appeals in 2021/22, 6% more than in 2020/21, and close to the pre-pandemic level. As restrictions reduced during 2021/22 we increased the number of decisions we made.

We decided more cases in 2021/22 than 2020/21, despite pandemic factors, including virtual hearings and inquiries taking longer than face-to-face equivalents, lockdown measures impacting employees and customers, and employees taking leave not taken the previous year.

During 2021/22 we focused on national infrastructure applications, local plan examinations and appeals needing a hearing or inquiry. These generally have the most community interest and potential to support the nation’s economic recovery. This meant fewer inspectors deciding higher volume casework and we decided fewer cases than we received. Some decisions were faster than in previous years but, on average, decisions took longer. We are working hard to decide more appeals so our decisions can become consistently faster.

Graph 1. Appeals in England over five years

| 2017/18 | 2018/19 | 2019/20 | 2020/21 | 2021/22 | |

|---|---|---|---|---|---|

| Cases received | 24,453 | 22,913 | 22,097 | 20,104 | 21,305 |

| Cases decided | 19,283 | 18,594 | 22,552 | 16,747 | 17,433 |

| Median time to decide in weeks | 18 | 24 | 21 | 23 | 24 |

Customer Strategy

Setting up our objectives

The Inspectorate plans to use customer insight to improve its services. Membership of the Institute of Customer Services provided us with benchmarking data that we used to develop our strategy. The Strategy lays the foundation for us to become more customer focused.

What we did in 2021/22

- Delivered our services.

- Rolled out a new customer service desk solution.

- Formalised quality assurance.

What we will do next

- Roll out our Digital Public Services.

- Explore appeal acceleration.

- Increase customer engagement.

- Enhance Public Sector Equality Duty.

Strategic risks

- Failure to embed changes.

- Failure to manage stakeholders.

- Planning reforms.

- Impact of national infrastructure applications.

- Prepare and react to change.

- Not meeting operational performance expectations.

- Sustainability of the long-term operating model.

Data & Digital Strategy

Setting up our objectives

The Data and Digital Strategy sets out an approach that focusses on outcomes and benefits rather than outputs.

This gives us flexibility to work at pace with rapidly evolving technologies. Data and digital are key to improving our services and the planning system.

What we did in 2021/22

- Designed and developed our Digital Public Services.

- Delivered change and innovation projects.

- Improved data protection.

- Developed modelling capacity.

What we will do next

- Support Planning Reform.

- Improve management information.

Strategic risks

- Data protection.

- Planning reforms.

- Prepare and react to changes.

- Value and quality of data.

- Sustainability of the long term operating model.

People Strategy

Setting up our objectives

We refreshed our People Strategy this year. It builds on our work to develop our leaders and offers our people opportunities to engage in wider work such as employee networks.

What we did in 2021/22

- Maintained high engagement.

- Delivered effective COVID-19 response.

- Improved equality diversity and inclusion.

- Developed Strategic Workforce Plan.

- Established health and safety working groups.

What we will do next

- Conduct learning analysis.

- Design future ways of working.

Strategic risks

- Planning reforms.

- Health, safety and well-being.

- Prepare and react to changes.

- Impact of national infrastructure applications.

- Not meeting operational performance expectations.

- Future skills.

- Sustainability of the long term operating model.

Board Chair’s Statement

The second year of the pandemic has required us to dig deep. I am proud of the way the Inspectorate’s people and Board have stepped up. I’m also grateful for the constructive collaboration of our partners and stakeholders and the support and interest of Ministers.

We have been tenacious in our drive to keep casework moving. We determined 17,433 appeals in 2021/22. We remained focused on improving the speed with which we determine cases and have agreed new measures with Ministers, which better reflect our customers’ needs. However, the pandemic has not helped the drive to improve timeliness. In January 2022, the Minister for Housing asked us to identify radical ways to accelerate the pace of the system. We recognise the performance challenge and its impact on customers. The Board supports the decision to focus on cases with the most community interest and potential to support the nation’s recovery, and acknowledges the issues faced in sustainably improving the speed of decision-making in the long-term.

We issued 34 new reports on Local Plans last year. Local Plans provide for 5.2 million much needed homes and shape local places. We were able to make recommendations to Ministers on key national infrastructure by holding virtual events. This infrastructure will be critical to the country’s post-pandemic recovery. We have continued to work across Government on speeding up the consenting of nationally significant infrastructure through Project Speed. The Department for Levelling Up, Housing and Communities has drawn on our expertise in the development of planning reform. Both will contribute to levelling up across the country, creating places where people can flourish.

This year saw the successful creation of the Planning and Environment Decisions Wales for the Welsh Government. We will work closely with the new organisation, wishing former colleagues well.

Continuing to prepare for the future

We have a new Strategic Plan which has three core strands: customer, people, and data and digital. These will help us provide customers with high quality, timely and efficient services. They will also drive our contribution to the delivery of the United Nations Sustainable Development Goals and Civil Service Reform. The future of the planning system will be both digital and integrated, requiring us to upskill our workforce. We will strive to make it easier for customers to access their digitalised services. A group of Local Planning Authorities have piloted accessing the services digitally. You can read more in this case study.

People are critical to our national contribution and there is a fight for talent. We have developed our first Strategic Workforce Plan for operations and Inspectors. We have a responsibility to contribute to the talent pool through developing the skills of our people and attracting a diverse workforce. This year, 9 apprentices, and 42 new inspectors joined the organisation. We have worked to improve diversity and inclusion, drawing upon the lived experience of colleagues through its employee networks, allowing their voices to be heard. We have also focused on health and safety and wellbeing. Inspectors often undertake their work remotely and alone so we have refreshed how they can do this safely. The pandemic underlined the need to address stress management and risk assessments.

In October, we adopted our first Environmental Policy and next year will deliver on the resulting action plan. We are continuing to develop our future operating model to ensure it improves the customer experience in a sustainable way.

A key role for the Board is to ensure the proper stewardship of public funds. Once again, we have received a clean bill of health from our auditors. Looking forward, the Board will continue to take assurance that we operate in a way that delivers our purpose effectively and efficiently and delivers the strategic change required to achieve our vision.

On behalf of myself and my fellow Non-Executive Directors, I would like to thank Sarah Richards and her Executive team for their skilled and tenacious leadership of the organisation and all its people for going that extra mile.

Trudi Elliott Chair of the Planning Inspectorate Board

Chief Executive’s Statement

The impact of the COVID-19 pandemic continued to loom large in our actions this year. I am very proud of how our people absorbed these impacts and continued to focus on service provision.

#Keepingcaseworkmoving

Through our use of technology, planning effectively for the future, focused resource management and robust decision making we kept casework moving through the COVID-19 pandemic. Overall, the speed of decision making for our appeals service is now steady, and in some areas has improved. We have focused our efforts on the areas that are key to the economy. These are often cases heard by inquiry and hearing, and ones with a direct impact on local communities, such as enforcement appeals. For those cases, our performance has returned to pre-pandemic levels. The Rosewell recommendations are mainstreamed in our inquiry work and we are now rolling these out into hearings. This is a notable achievement as there has been a significant rise in the number of inquiry and hearing cases this year. The way we measure and report our performance has changed this year. The new measures give our users the information they told us they want.

We have continued to meet statutory targets when delivering our applications service, with the exception of an extension for the Sizewell C application. This is another notable achievement given the increasing complexity of, and public interest in, these projects. Our examination of Local Plans has continued throughout the year with submission rates slowing from the previous years’ average.

Over 50 new Inspectors and planning apprentices have joined the Inspectorate and supported the delivery of our performance. We are becoming a customer centric organisation through the improvements we are making to our digital services. Customers will experience a more straightforward and user-friendly online interface as our new services go live.

It was with a mix of sadness and pride that on 1 October 2021 we seamlessly transferred our team based in Wales to the Welsh Government. The transfer project was successful, and we now work closely with the new Planning and Environmental Decisions Wales service.

We focused on building a more inclusive and diverse Planning Inspectorate. Cultural change doesn’t happen overnight, but the building blocks are now firmly in place. The gender pay gap in the Inspectorate has always been a matter of concern for me and is also something that will take time to change. This is particularly noticeable in the Inspector groups. The good news is that we are appointing more women to senior roles, and this will feed through to narrowing the gap in the coming years.

The past year has been challenging from a financial position and we finished the year with an underspend. This was due to the volatility of our income, the continuing impact of lockdown measures on our people, and to over optimism about filling vacancies when the employment market has become very competitive and about the pace of delivery for our change projects.

Getting ready for the future

Like many organisations, the way we work will be permanently changed by the impact of the pandemic. We are using the experience we gained to plan for the future. For example, we will use technology to enable hearings and inquiries that are flexible and inclusive of the variety of needs of those involved. This moves us away from a complete reliance on face-to-face methods. We are also planning to offer our staff more choice about where and how they work. It will take time for the full impact of these changes to be felt but we are in a good position to embrace opportunities.

In preparing the Planning Inspectorate for the future we also know that the planning system is changing. The Levelling Up and Regeneration Bill was a focus of the Queen’s Speech and will set us challenges and opportunities as it brings about planning reform. Those changes will impact on our services over the coming years, as we work closely with Local Planning Authorities to level up communities across the country. We have been putting in place a robust and flexible base that will adapt to changes in policies once the reforms are launched. Through those changes, our focus will remain on improving customer experience. This goes beyond improving the timeliness of our decision making and is underpinned by our work to create accessible public digital services. We have made good progress this year: part of our appeals service is live and the first pilot for our application service went live in April 2022. We expect users to be able to use full digital services for Appeals and Applications by March 2023. We will develop a digital service for examination once we understand how we will interact with Local Planning Authorities and communities as part of the planning reforms.

I am very proud of the people at the Planning Inspectorate and how they have continued to run good public services, making a difference in places and for people, in what has been a very disrupting and challenging time.

Sarah Richards Chief Executive, Planning Inspectorate

Our stakeholders and customers

In our Strategic Plan, we outline our ambitions to increase our customer focus, recognising the importance of gaining a deeper understanding of who our customers are and the best ways to serve them and their diverse needs.

Our customers

We have a varied group of customers across our appeals, applications, and examinations services. Our customers include Local Planning Authorities for examinations, appellants and planning agents for appeals, and applicants (including government departments) for applications. Our work also serves local residents, developers, landowners, statutory consultees and special interest groups as well as a diverse mix of stakeholders, described below. We are deepening our understanding of our customers’ needs and expectations to align our services to them. This year we have been putting foundations in place to move towards being a more customer focused organisation. A key part of this work was to develop our Customer Strategy. The strategy sets out our ambitions to continuously improve our customers satisfaction with, and experience of, our services. With our Customer Strategy now in place, we can begin to deliver the actions that will realise the noticeable improvements in service and experience we aspire to.

Our stakeholders

We know the importance of good stakeholder relationships, and the benefit they can bring to the Inspectorate. In addition to our customers, our key stakeholders include: ministers and officials at the Department for Levelling Up, Housing and Communities and other governmental bodies, Local Planning Authorities, communities, professional bodies, and news and trade media.

Engaging with our stakeholders and keeping them informed about our activities, successes and challenges is important to us. Over the summer, we conducted research with the Royal Town Planning Institute, consulting a cross section of stakeholders on the direction of our Future Operating Model for Events to complement the research and engagement with our people. This work aims to establish a long-term sustainable model for running hearings and inquiries, building on the learnings from the pandemic and incorporating the benefits of running events virtually and in person. The findings have helped us to understand the potential impacts on stakeholders and shape the design of the model.

In the autumn, we launched our refreshed corporate identity, making no changes to the Planning Inspectorate logo, but bringing in a suite of new images, colour palette and fonts. This builds on the ‘flagship’ corporate film we released last year that summarises our roles and responsibilities. Since launch it has had just under 7,000 views. Our self-assessment rating against the communication functional standard is ‘good’.

Our interactions

The Planning Inspectorate is organised in three directorates. Operations is our largest directorate and is at the forefront of our interactions with customers. Inspectors and caseworkers interact with customers and stakeholders throughout their work on cases and often directly when visiting sites and when holding inquiries and hearings. Our Corporate Services Directorate has close relationships with the Department for Levelling Up, Housing and Communities and other governmental bodies. The Strategy Directorate includes a Communications team that manages our relationship with the media and the customer service team that helps customers troubleshoot any issues they may have.

Our statutory framework in England

Our work is bound by a statutory framework. Acts of Parliament set out most key rights within the planning system.

Our part in the planning system

In England we operate a plan-led system where Local Plans are used to decide how much land should be set aside to build new homes, offices, factories, warehouses, shops and other things, usually over the next 10 to 15 years. They also show areas where development should be limited for some reason. These are then used to make decisions on planning applications for individual development proposals.

At the Planning Inspectorate we examine the soundness of Local Plans, determine a range of appeals and applications, and make recommendations on Nationally Significant Infrastructure Projects. We help deliver the government’s objectives to overcome some of the big challenges facing the country, such as climate change, housing provision and achieving sustainable development.

The big three

There are three Acts of Parliament, which are particularly significant for our work:

-

The Planning and Compulsory Purchase Act 2004 Covers the Local Plans system, as well as the statutory duty “to determine planning applications and appeals in accordance with the development plan, unless material considerations indicate otherwise.”

-

The Town and Country Planning Act 1990 Covers the right to appeal for planning, enforcement, and lawful development certificate cases, as well as our ability to determine the procedure for a variety of case types.

-

The Planning Act 2008 Covers the consenting regime for Nationally Significant Infrastructure Projects.

There is more legislation for other areas of our work, such as listed buildings, rights of way and environmental appeals.

The rules and regulations

Sitting underneath the Acts, secondary legislation provides the detail to the statutory framework. For example, it defines what development can take place without seeking planning permission and when one requires prior approval. It also sets out how to make applications and appeals and how we must handle them.

Our statutory duties

The statutory framework ensures the fair operation of the planning system. But we also carry out other statutory duties, such as those under the General Data Protection Regulation or the Public Sector Equality Duty. When doing so we must ensure that the parties involved in our casework are meeting their own obligations.

Environment Act 2021

In November 2021, the Environment Act 2021 became law. It made provision for a wide range of measures, many of which apply to planning. Some of those measures are now in force while many others need secondary legislation and/or consultation on aspects of policy development. We are monitoring that process to ensure we are aware of, and ready for, the changes when they happen.

Project Speed

Project Speed is a government-led initiative that aims to improve the process for Nationally Significant Infrastructure Projects. It challenges stakeholders to remove barriers and work faster together within the current framework of the Planning Act 2008. We are on track for significant system change by September 2023, with some improvements available earlier.

Planning for the Future and Levelling Up the United Kingdom

Proposals to reform the planning system, including local plans, were set out in the ‘Planning for the Future’ (2020) and ‘Levelling Up the United Kingdom’ (2022) White Papers. The government will make legislation for the changes it decides to pursue. Whatever changes come forward we will ensure that we are ready for them, and that we continue to operate within the statutory framework in the interests of all those involved in the planning system.

Our risk profile

As the world challenges us and as we change and evolve, we use risk management to systematically mitigate the threats that could keep us from realising our Strategic Plan.

Strategic risk management

We actively manage our strategic risks to make best use of public money, maximise our performance and achieve our objectives. Each strategic risk is owned by a member of the Executive Team who assessed it using a five-by-five scoring matrix. We rate the impact by considering the consequences of the risk. We rate the likelihood by considering the probability of the risk to materialise. Each risk is categorised and the risk appetite is agreed. The risk appetite statement defines the level and type of risk exposure we will tolerate to achieve our strategic vision. The Executive Team are responsible for setting the risk appetite and will draw upon the risk appetite statement when managing the strategic risks. Periodically the effectiveness of our Risk Management process and internal control is reviewed by our Internal Audit service provided by the Government Internal Audit Agency. No significant weaknesses have been found as summarised in the Internal Audit section.

Our risk profile through 2021/22

Table 1 summarises the strategic risk profile for the Inspectorate and the changes over the past twelve months. We conduct annual horizon scanning to identify cross-cutting risks that may impact on the Inspectorate. This includes identification of political, economic, social, technological, legal and environmental factors. These factors may impact on our existing risks and to help us identify new risks.

Our current risk profile shows that the scores for all our risks are between 12 and 16. There has been movement in the scores throughout the year. However, when comparing the scores as at 31 March 2021 and 2022, only one risk score differs. Five of our strategic risks have been closed and five new risks have been added to the register, demonstrating ongoing review of the relevance of the risks and effectiveness of mitigations.

Table 1. Risk profiles

| Risk ID | Risk title | Risk category | Risk appetite | Score in March 2021 | Score in March 2022 |

|---|---|---|---|---|---|

| S11 | Data Protection | Compliance, legal, and regulatory | Averse | 12 | 12 |

| S12 | Failure to embed changes | Operational delivery | Receptive | 16 | 16 |

| S13 | Failure to manage stakeholders | Reputation & credibility | Minimalist | 12 | 12 |

| S14 | Planning Reforms | Reputation & credibility | Minimalist | 16 | 16 |

| S15 | Impact of national infrastructure applications | Operational delivery | Averse | 16 | 16 |

| S16 | Health, Safety and Wellbeing | People | Averse | 12 | 16 |

| S18 | Ability to react to and be prepared for external change | Operational delivery | Cautious | New risk | 12 |

| S19 | Not meeting operational performance expectations | Reputation & credibility | Minimalist | New risk | 16 |

| S20 | Long term operational model not sustainable | Reputation & credibility | Minimalist | New risk | 12 |

| S21 | Future Skills | People | Eager | New risk | 16 |

| S22 | Value and quality of data | Reputation & credibility | Minimalist | New risk | 16 |

S11 - Data protection

The lack of robust controls and an immature culture of data governance could lead to a data breach.

Change in scoring - no change.

Mitigations delivered in 2021/22

- Provided an e-learning package with bespoke training to all staff.

- Appointed and trained information owners and information expert roles. Ensured accountability is understood.

- Rolled out Staff and Recruitment Privacy notice and developed the Casework Privacy notice.

- Implemented information management system to identify and manage areas of risk.

- Identified area of risk when information is shared without redaction.

Future mitigations

- Ensure Data Protection Impact Assessments are in place for processes that have a high risk of personal data breach.

- Implement redaction policy to ensure information is redacted prior to publication.

- Put data sharing agreement in place with our stakeholders.

- Improve our record retention policy and practices.

- Deliver bespoke data protection training for Inspectors.

S12 - Failure to embed changes

Due to limited capacity and capability, the Inspectorate’s digital public services may not be fully operational or provide enough value to customers and taxpayers.

Change in scoring - no change.

Mitigations delivered in 2021/22

- Appointed digital client-side advisers to support senior leadership on critical decisions and to provide assurance of the development of the digital services and project delivery.

- Appointed additional digital suppliers to increase capacity and capability in critical data and digital expertise area.

- Defined the long-term capacity and capability needed to develop the services and secured funding to meet those needs.

Future mitigations

- Use funding secured to develop capacity and capability in the Inspectorate.

S13 - Failure to manage stakeholders

Failure to manage stakeholder and customer relationships and communications or a badly handled error could impact our reputation.

Change in scoring - no change.

Mitigations delivered in 2021/22

- Monitoring of customer contacts through a new customer service desk tool.

- Captured and used insights generated by media monitoring system.

- Monitoring customer feedback through a variety of methods.

Future mitigations

- Develop a stakeholder management tool to gather intelligence used to safeguard the Inspectorate’s reputation.

- Build effective continuous improvement approach to promptly act on insights and improve customer experience.

S14 - Planning for the Future and Project Speed

Uncertainty, lack of resources, capacity and skills could delay or prevent the implementation of the changes triggered by Planning for the Future and Project Speed.

Change in scoring - no change.

Mitigations delivered in 2021/22

- Worked with the Department for Levelling Up, Housing and Communities to complete Project Speed consultation.

- Trialled several innovations on a pilot project to provide enhanced pre-application advice to applicants and stakeholders.

- Assessed the potential to expand successful innovations to similar application cases.

Future mitigations

- Expand new enhanced pre-application advice to application cases in selected sectors (for example offshore wind and solar).

- Work with the Department for Levelling Up, Housing and Communities to assess legal and policy changes and their impact on our digital services.

- Engage with Local Planning Authorities, customers, and stakeholders to prepare for changes.

- Get our systems and workforce ready to implement changes.

- Develop a programme to increase planning and environmental skills resource available to the planning system.

S15 - Impact of Nationally Significant Infrastructure Project applications

The submission of a single, large, complex, high-profile and controversial application, or overlapping of several smaller cases, could surpass our capacity to deliver.

Change in scoring - no change.

Mitigations delivered in 2021/22

- Improved the application process by increasing the capacity to accept comments about large projects.

- Engaged stakeholders to improve forecasting, modelling and resource allocation.

Future mitigations

- Increase the number of Inspectors and their experience.

- Continue the delivery of the digital application service and Project Speed.

S16 - Health, safety and wellbeing

Failure to address health, safety and wellbeing could result in a major accident, incident, near miss or ill health.

Change in scoring - The increase in scoring reflects our improved knowledge about the risk, rather than a change in circumstances.

Mitigations delivered in 2021/22

- Set the vision and ambitions for health, safety and wellbeing.

- Reviewed mandate and changed membership of the Health and Safety Committee to improve direction setting and positively influence our culture.

- Managed and mitigated key health and safety risks (lone working and personal safety, risk assessment and stress) through working groups and training.

- Implemented a learning pathway for our people.

Future mitigations

- Continue to monitor and respond to the COVID-19 pandemic.

- Implement a protection system and processes for lone working and personal safety.

- Embed practice to routinely carry out risk assessments as standard for employees and managers to reduce exposure.

- Improve the organisational capability to manage stress.

- Review, improve and ensure implementation of policies to ensure employee’s health, safety and wellbeing.

S18 - Ability to react to and be prepared for external change

Lack of intelligence analysis leads to failed identification of external changes and misinformed strategic direction which would negatively impact on our customer service.

Change in scoring - This is a new risk.

Mitigations delivered in 2021/22

- Designed a horizon scanning capability.

Future mitigation

- Increase internal skills and establish a network for capturing intelligence so we are able to make informed decisions and set strategic direction.

S19 - Not meeting operational performance expectations

The mismatch between demand and insufficient operational resource could lead to not meeting customer expectations and increased uncertainty and cost for the planning system.

Change in scoring - This is a new risk.

Mitigations delivered in 2021/22

- Continuous improvement of recruitment cycle.

- Development of digital services.

Future mitigations

- Increase flexibility of case allocation to Inspectors across all services.

- Broaden the pool of candidates and improve the inclusivity and effectiveness of our selection process to increase the number and diversity of Inspectors joining.

- Improve the retention of new Inspectors by clearly setting out expectations with potential candidates and improving training of new joiners. Enable leavers to join as a fixed term employees.

- Improve the effectiveness of our internal processes by automating our digital services and recruiting apprentices.

S20 - Long term operational model not sustainable

Customers’ and stakeholders’ behaviours, insufficient funds, and limited skilled resource could lead to no meeting customer expectations and increased uncertainty and cost for the planning system.

Change in scoring - This is a new risk.

Mitigations delivered in 2021/22

- Developed future operating model for events, based on what we learnt doing virtual and blended events.

Future mitigations

- Identify and analyse what changes could be made across the planning system to speed up the appeal service and make recommendations to the Housing Minister.

- Identify and analyse how changes to stakeholders’ behaviours could speed up the appeal service and make recommendations to the Housing Minister.

S21 Future Skills

Failure to identify future capability requirements, could put at risk the delivery of the Strategic Plan resulting in the workforce not having the capabilities to adapt to new ways of working.

Change in scoring - This is a new risk.

Mitigations delivered in 2021/22

- Embed strategic workforce planning function.

- Design the Strategic Workforce Plan for Operations.

Future mitigations

- Implement the Strategic Workforce Plan.

- Identify critical roles and put in place succession plans.

- Set up career pathways for professions across the Inspectorate.

S22 Value and quality of data

Failure to identity, integrate and quality assure data could result in delays and increased costs when making changes and innovating in response to planning system-wide improvements.

Change in scoring - This is a new risk.

Mitigations delivered in 2021/22

- Developed policies and standards on data quality.

Future mitigations

- Within documents, identify the data used to support decision making.

- Add data quality integration as a control when implementing changes to our processes.

- Reduce duplication and improve quality by identifying core data used across different services.

- Enable data integration to move information more easily across systems by putting in place an operational data warehouse.

- Work with stakeholders in the planning system to create and ensure compliance with data principles, standards and guidelines.

Risks closed

The five strategic risks that we closed this year are:

- S1 Capability and capacity and S7 Change in the organisation were closed, as the risks were merged into risk S21 on future skills.

- S2 Horizon scanning and resource planning was closed, as the risk was reframed under risk S18 Ability to react to and be prepared for external changes.

- S3 Change projects benefit realisation was closed as the risk was combined with S12 Failure to embed changes.

- S4 Operational Performance was closed, as the risk was reframed under risk S19 Not meeting operational performance expectations.

- S17 Missing opportunities to improve customers’ experience was closed, as the user research completed as part of the development of Digital Public Service identified opportunities to improve customer’s experience. The process to realise those opportunities is an objective in our customer strategy.

Our organisation

Building on what we learnt when working through the pandemic, we are now preparing for the future: creating a modern workplace that supports the wellbeing of our people, maintaining our engagement and improving our inclusivity.

Organisational design

We have continuously improved the organisational design we implemented in the previous year. Ninety-six people were recruited externally and 91 of our people were promoted. Almost 84% of our people are Inspectors or involved directly in the delivering of our services.

In October 2021, our Welsh Team were transferred to Welsh Government, and 46 planning professionals and their support teams were transferred from the Inspectorate.

Future ways of working

At the same time as managing the impacts of the ongoing pandemic, we have established a programme of work that ensures we have a modern workplace that meets the needs of our people in a sustainable way and allows us to attract and retain talented individuals. This year, we have identified the kind of workplace we want and need. One that offers flexibility to our people and our teams, promotes collaborative working and continually improves the way we deliver our services to our customers. We have started to work on delivering this, focussing on three areas: our people and policies, our estates and equipment and developing our leaders.

Strategic workforce planning

We have started to develop our strategic workforce planning, giving us the best chance of ensuring we have the skills we need to keep meeting our customers’ needs and to deliver our Strategic Plan. Strategic workforce planning is the process of looking at what roles, capabilities and skills an organisation might need, or no longer need, for the coming years. We have started with our two largest professions, Planning Inspectors and Operational Delivery. We are looking five-years ahead, assessing what changes might come in that timeframe and what the impacts might be for our people. We may need some new roles, some roles may need to adapt, and we may need fewer roles in some areas. If we get things right, colleagues will be able to learn and adapt gradually over the next five years to meet the changing demands of their roles. By looking at this routinely as an organisation, we will reduce the need for large-scale organisational capability exercises in the future.

Health, safety and wellbeing

We have reflected on the lessons learnt throughout the pandemic of the challenges faced by our people as they balance work with caring responsibilities. We also recognised that the people who carry out site visits are frequently working in communities, often on their own. We have established a programme of work to make improvements across our organisation. This programme will focus on three areas: lone working and personal safety, risk assessment and stress. We have already started with the delivery of lone working training to Inspectors and the mandated use of a lone worker system. We have also offered every line manager the opportunity to attend training by the charity MIND about improving our people’s mental health.

Learning and Development

In 2021, we started the process of modernising and developing a consistent approach to learning across our organisation. The pandemic continued to challenge traditional methods of learning, and we have brought greater innovation to delivery methods. We have met emerging learning needs, established our approach and set our central learning resource key objectives, which underpin our People Strategy and Strategic Plan.

Engagement

Our people engagement score in 2021 was 65%. This result equals our 2020 score, which was our best over the previous decade. We remain one percentage point behind the Civil Service benchmark. This result underpins the improvement trend that started in 2015, when our engagement score was 56%. We saw improvement in the results for our 2020 focus areas of leadership and line manager development and Equality, Diversity and Inclusion. Our focus areas for 2022 are to continue investing in developing leaders and line managers, and on developing our professions, with a specific focus on skills and opportunities for career development.

Graph 2. Civil Service survey engagement

| 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|

| Civil service benchmark | 61% | 62% | 63% | 66% | 66% |

| Planning Inspectorate’s engagement score | 59% | 61% | 63% | 65% | 65% |

Equality, Diversity and Inclusion at the Planning Inspectorate

We are continuing to drive our approach to improve equality, diversity and inclusion for our people. This means we are progressively adopting a better perspective to the way we approach everyday business.

Diversity of our customers

We do not routinely collect information on the personal characteristics of appellants (gender, disability, age or ethnicity). This is to avoid the perception that this information could influence our decisions, to reduce the amount of information appellants are required to provide, and to ensure that data protection principles are adhered to. This approach means that all groups receive the level of service needed. Ideally, we would be able to analyse all areas of our performance and be confident that there are no groups getting a different level of service. The fact that we are unable to produce this analysis is regrettable, and we will seek alternatives to getting this assurance.

Our gender pay gap

The pay gap reported as at 31 March 2022 was 10.4% at the mean. The current gender pay gap has decreased by 2.6 percentage points since the last report in 2020/21. Closing that gap is one of the priorities set by the Department for Levelling Up, Housing and Communities. We are committed to implementing short-term and long-term plans to address current pay gaps. We have undertaken thorough analysis of our workforce and structure to understand the reasons it exists. We are confident that we have robust plans and actions in place to further address the gap. Like other professions and industries, we are working to improve our gender balance and rewards but it will take time to correct gender imbalances created in the past.

Graph 3. Gender pay gap over five years

| 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|

| Gender pay gap | 11.4% | 15.4% | 11.6% | 13.0% | 10.4% |

Focus on Equality, Diversity and Inclusion

The Public Sector Equality Duty requires organisations to eliminate unlawful discrimination, harassment and victimisation and other conduct prohibited by the Act. It requires us to, advance equality of opportunity between people who share a protected characteristic and those who do not, and foster good relations between people who share a protected characteristic and those who do not.

We have published our objectives that relate to our Public Sector Equality Duty on our website. Currently, our objectives focus on fulfilling the duty with respect to our people. We will look to broaden this to include our customers in this coming financial year.

In October 2021, we published an analysis as part of a statistical release about the characteristics of our people. The aim of this analysis is to increase our transparency and accountability to our customers, stakeholders and the wider public, by providing reliable information about the diversity of our people. It also helps us identify initiatives that can be targeted to attract and retain people for certain professions. For example, we found that being in the Planning Inspector profession was a relevant factor for the overall diversity of our workforce. This was found to be the case for age, disability, ethnicity, sex, religion and working pattern. Other professions in the Inspectorate had greater levels of diversity within them. For that reason Inspector recruitment and the planning talent pipeline are key areas for us to improve in order to become more diverse. We will routinely update and publish this analysis, which will enable us to track the impact of our initiatives.

Graph 4. EDI breakdown

| 2018 | 2019 | 2020 | 2021 | 2022 | Civil Service (Q1 2021) | |

|---|---|---|---|---|---|---|

| Disabled staff | 9.51% | 10.44% | 9.33% | 8.72% | 8.37% | 13.60% |

| BAME staff | 2.93% | 3.29% | 3.47% | 5.03% | 6.04% | 14.30% |

| Female staff | 45.13% | 46.18% | 44.09% | 44.91% | 45.22% | 54.20% |

| Lesbian, gay, bisexual and ‘other’ staff | 3.92% | 5.07% | 3.76% | 3.75% | 4.71% | 5.60% |

The creation of Planning and Environment Decisions Wales

Work on the Welsh Government project to establish a separate appeals body for Wales culminated in the creation of Planning and Environment Decisions Wales

The project to set up a Welsh appeals body gathered momentum early 2021/22. The date for the launch of the new service was set and a new name was chosen: Planning and Environment Decisions Wales.

Planning Inspectorate Wales kept our stakeholders informed on the progress of the project through frequent updates in articles in RTPI Cymru magazine, ‘Cynllunio’ as well as conference appearances and training events by the Head of Wales. A virtual stakeholder event about local development plans for local planning authority officers was held and well received.

The project was headed by a Welsh Government Project Board. The Board covered four work- streams: staff related matters, IT systems, data transfer and records management, and finance.

In parallel, the Planning Inspectorate also set up a change project to manage, monitor and deliver its own activities in relation to the creation of the new body.

Prioritising our people

Our people’s wellbeing has been our priority throughout the pandemic and this continued to be the case in the final stage of the project. Everyone had to make a choice regarding their Employment Terms and Conditions, participate in the change projects as well as deliver their usual tasks. Communication and engagement were vital to support them through a very uncertain time. Their roles were evaluated to ensure correct grading when transferred from the Planning Inspectorate to the Welsh Government. A consultation forum was created to debate and agree the terms and conditions offered. The Welsh Government created and recruited the role of Chief Planning Inspector and an indicative structure was agreed.

Our services during the transition

To facilitate the transfer of data and records from the Planning Inspectorate to the Welsh Government, it was necessary to freeze access to our casework management system and the Appeals Casework Portal in advance of the launch date. This impacted our customers as they were not able to access their cases, submit documents or new appeals via our portal for several weeks. The quality of our service in the last month suffered as a result.

By calling on the assistance of local planning authorities and working with them, Planning Inspectorate Wales found alternative ways to progress live case work. Customers were able to view appeal documents made available on local authorities’ websites.

Working in compliance with lockdown measures, Inspectors continued to carry out site visits and virtual events were held more frequently.

Performance data between April and September 2021

Planning Inspectorate Wales didn’t receive or issue any local development plans from local authorities during those six months. They received 15 applications for Development of National Significance and issued four reports, all in line with the Welsh ministerial target.

Performance for the appeal service is broken down by appeal type and procedure type:

- In total Planning Inspectorate Wales decided 235 planning appeals: 231 through written representations and four through hearings and inquiries.

- For written representations, 92% of decisions were made in line with the ministerial targets.

- The mean decision time for the most common type of appeals, householder and minor commercial appeals, was around 7 weeks.

- The mean decision time for the other planning appeals was around 13 weeks.

- For hearings and the inquiries, the ministerial targets were not met.

- The mean decision time for hearings and inquiries was about 16 months.

- In total Planning Inspectorate Wales decided 14 enforcement appeals: 11 through written representations and three through hearings and inquiries.

- For written representations, 91% of decisions were made in line with the ministerial targets.

- The mean decision time for written representations was 12.5 weeks.

- For hearings and inquiries, only one out of three decisions was made in line with the ministerial targets.

- The mean decision time for the hearings and inquiries was about 13 months.

Information regarding performance since October 2021 will be available as part of the consolidated Welsh annual report once it is published.

Our three public services

Across our services, our independent Inspectors decide cases and make recommendations in an open, fair and impartial way. This means that they consider the evidence, make sure everyone can respond to the evidence of others and keep an open mind without prejudging one view over another.

Our services in Wales

The Welsh Government’s commitment to delivering sustainable development is underpinned by local development plans. They contain the strategy, policies and allocations to address key issues in an area, based on robust evidence. From April to September 2021, we examined those plans to ensure they will provide a solid base to support decision making once they are adopted. During the same period, the Planning Inspectorate decided appeals in Wales and made recommendations regarding National Significantly Infrastructure Projects and Developments of National Significance in Wales. From 1 October 2021, those services were transferred to Planning and Environmental Decisions Wales, part of the Welsh Government.

Examinations service

The places where people live and work significantly affect their lives and wellbeing. Councils and some other organisations produce Local Plans and other plans with their communities to identify how they will prepare for the future. We independently assess if the plans meet the legal, procedural and policy tests for them to be used.

Appeals service

Local Planning Authorities can refuse planning and related applications, and they can fail to make a decision in time, or give you an enforcement notice requiring you to do something or stop doing something.

The Inspectorate is here if you want someone independent to re-consider the decisions from councils. Our Inspectors independently review the information and evidence and, in most cases, visit the site and nearby area before deciding the case.

This service also provides independent Inspectors to consider evidence and make decisions for specialist work including:

- Tree preservation order works, hedgerow removal and anti-social high hedge appeals.

- Public rights of way such as when proposals include changes to access rights to the network or when there are objections to a new right of way.

Applications service

National Significantly Infrastructure Projects

The public all use and rely on national infrastructure. There is a reliance on power stations and wind farms to generate electricity. Similarly, there is a reliance on major roads, railways, ports and airports to move people, food and other products around the country and between countries. And on reservoirs for fresh water from taps and sewage treatment works when flushing toilets.

These are the largest and most complex development projects in the country. They take many years to develop. We provide advice during that period, identifying where the projects need improvement or where more evidence is needed to justify a design decision.

We consider the interests of developers, local authorities, local communities and other interested parties, implement government policy and consider anything else that is relevant. We then recommend to the Secretary of State whether these projects should go ahead.

Common land

We also decide other applications for government, like applications for work on common land. Common land has a long history based on ancient rights under British common law and remaining common land is now publicly accessible.

Compulsory purchase orders

Some organisations can purchase land even if the owner does not want to sell. This is normally because the land is needed for an important project such as a road, railway or a development important for the area. We independently assess whether the compulsory purchase order should go ahead.

New ministerial measures

The Minister agreed new measures for appeals which focus on what matters to customers. They focus on us making faster decisions, becoming more consistent in how long our decisions take, being open about how many cases we quality assure and supporting customers so that their appeals are valid when submitted. Targets for local plans, national infrastructure and DEFRA work have not changed.

Innovation and change

Proactively preparing for future changes to the planning system, the way we work, and keeping up to date with new ways, methods, and technology are all key to ensure we deliver a good services with best value for money

Innovation

Our Vision focuses on providing our customers with high quality, timely and efficient services. In last year’s Annual Report, we talked about the activities undertaken to become a more agile organisation. One of these activities was establishing capabilities in innovation.

Our innovation agenda has developed over the last year. Our innovation function enables us to test riskier ideas and apply more creativity in our problem solving. We have an agreed approach to innovation and a framework that supports the innovation process. We have strategic focus areas for innovation: maintaining an appropriately skilled and trained workforce, and transforming how we work through digital automation. Our focus areas set the boundaries for innovation, ensuring we are working in the right areas to deliver most value in line with our Strategic Plan.

We have taken our first step in creating a balanced innovation portfolio that focuses effort on:

- maintaining and strengthening our core services;

- developing new opportunities; and

- preparing for potential disruptive challenges.

Our current innovation portfolio tests ideas that have the potential to deliver varying degrees of impact. From lower-level incremental improvements, through to transformative new ways of working.

One of our innovation projects is helping us explore whether technology has the potential to provide a consistent and systematic approach to categorise and organise representations. Representations are written evidence from parties who wish to make a comment about a case. Cases are often very high volume, and we want our people to be able to focus on high-value activity, making best use of their skills and professional judgement. We have partnered with a technical expert to assess whether artificial intelligence can be the right technology to address our needs. This would support our decision-makers by reducing the time it takes to identify and assess the issues.

This example highlights how by transforming the way in which we work through digital automation, we can become more efficient in what we deliver, so we can focus on what matters most – quality decision-making.

Once innovative ideas have been tested and approved for implementation, they are delivered through our Change Portfolio. Through this function we control the pace of change across the organisation. We adapt to the changing political landscape, provide improved customer experience and support our people’s growth. The Department for Levelling Up, Housing and Communities is monitoring the business cases and funding approval for some of these projects. This is due to their high profile and high value.

Change Portfolio in 2021/22

In 2021/22, we delivered a number of changes, some of them have been mentioned throughout this Annual Report:

- We successfully planned and delivered the project to support the creation of Planning and Environment Decisions Wales. We pulled together expertise from across the Inspectorate to ensure appropriate, timely and considerate engagement with the people impacted and the secure transfer of the intelligence and data.

-

As mentioned in our strategic risk ‘S11 - Data protection’, we delivered a large volume of change in the way we manage our data. We ensure that everyone understands their responsibilities, and that we have processes and systems in place to ensure our compliance with regulations.

- We introduced a new Customer Service Desk system. The aim of this project was to ensure that queries are logged and responded to more quickly. You can read more about the impact of this change in ‘Our Customer Service’.

- As mentioned in ‘Our stakeholders and customers’ we used our learning from the way we worked virtually during the pandemic to design a Future Operating Model for events.

- During the last year, we have developed our ability to use system wide techniques to support Continuous Improvement. This has already delivered improvements in some areas of our service delivery. In the coming year we plan to use those same techniques on more areas across the Inspectorate.

Change Portfolio in 2022/25

Our 2022/25 Business Plan sets out how we are going to deliver our Strategic Plan through a series of activities and projects. Some key projects have already started:

- Two projects on Planning for the Future and Project Speed aim to deliver governmental ambitions.

- The case study on the next pages describes the work we are doing to improve our appeal service and our application service.

- We have a programme of works to improve our Health, Safety and Wellbeing, as described in strategic risk ‘S16 - Health, safety and wellbeing’.

- As mentioned in our Chief Executive’s opening statement, we are looking at how we can support our people to work flexibly, either from home, the office or both.

- As part of that, we will transition to a new office environment. This will be smaller and better designed to support our needs with technology and services to enable us to communicate with our customers and colleagues in the best way possible.

- We will continue to introduce new systems to our Human Resources and Financial services.

Digital Public Services - case study

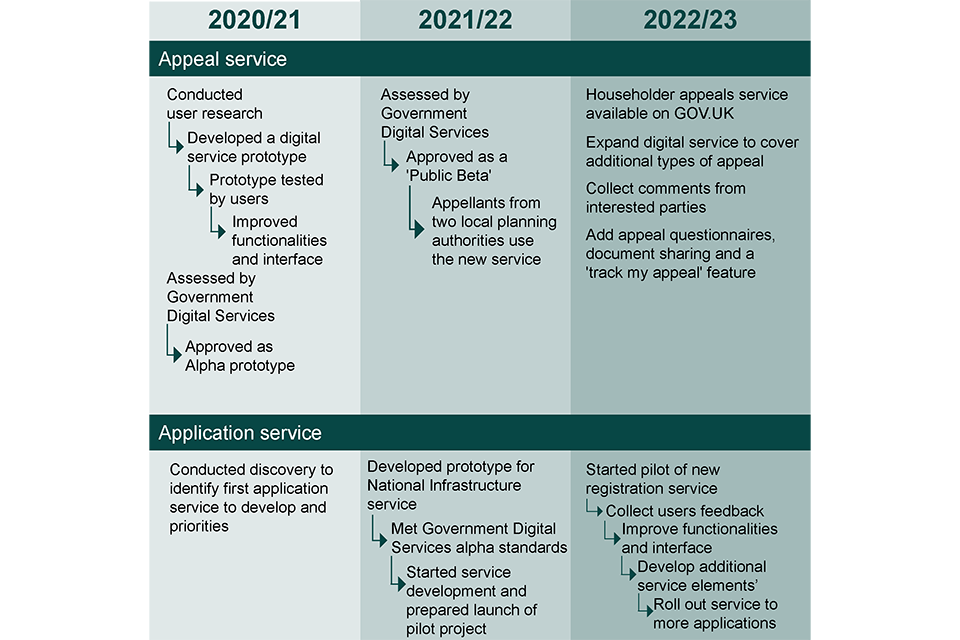

Our biggest change initiative centres on the appeals service and the applications service.

The appeals service

Our appeals service includes multiple types of appeal, and we started this work by focusing on the most straightforward type: householder appeals. Those are submitted by householders after their development permission has been rejected by their Local Planning Authorities.

We started our change project with user research, using it to develop a digital service prototype. That prototype was tested by users and we used their feedback to improve the functionalities and design. In May 2021, the service was assessed by Government Digital Services and they approved its launch as a ‘Public Beta’. This allowed us to start receiving real householder appeals as we improve the system further based on users’ feedback. We have been working with a few local planning authorities to direct appellants to this new service.

We have also reviewed the information we send to customers about their appeals, to clarify the information we need and how our process works. We have also improved the content we publish on GOV.UK, so that prospective customers can get clear information and make the decision that is right for them.

In 2022/23, we will increase the use of the householder appeals service by making it available on GOV.UK for appeals within the trial local authorities areas. Then we will expand our digital service to cover other local authorities areas and additional types of appeal, beyond just householders.

Further work will also include appeal questionnaires, submission of interested parties comments, document sharing and a ‘track my appeal’ feature.

The applications service

This change project aims to make applications for Nationally Significant Infrastructure Projects easier, faster and more cost effective. This project also started with user research. We are very grateful that 200 professional and non-professional service users have given their time and insights through various research methods. This includes one-to-one interviews, usability testing of potential website ideas and card sorting to allow us to understand how information is best grouped and labelled.

What did we learn?

- The application process for nationally significant infrastructure projects is complex and difficult to understand for first time users. They are unsure of what to expect and are unfamiliar with the technical, formal language.

- Users have difficulties finding and understanding information relating to the concerns of members of the public.

Harnessing users’ insight we developed a digital service that was assessed by the Government Digital Services and passed the Alpha Assessment in September 2021. Since then, we have been developing a modular approach for nationally significant infrastructure project applications. We anticipate that users will be able to experience the first elements of the new service as part of a pilot project starting from April 2022. We are looking forward to receiving feedback on our new and improved user journey. We will use it to make improvements prior to a wider roll out of the service.

Our Quality Assurance Process

The quality of our work is important to maintain the confidence of all those involved in planning, including the public, politicians and developers. By quality we mean everything relating to the content of the final decision and the procedures and processes that lead up to that.

Individual Inspectors are responsible for the decisions and recommendations they make, and are ultimately responsible for the quality of their own work. As an organisation, how do we support them to achieve the right quality?

This will vary depending on the type of work, but it all starts with the training we provide for new Inspectors. It focuses on the importance of weighing up opposing views to reach well-justified conclusions and on the application of the Franks Principles – open, fair and impartial.

Beyond this, the Inspectorate is responsible for providing training, quality assurance processes and knowledge management. We provide all Inspectors with a monthly update of key developments in the planning world including about significant legal judgments and policy matters.

Examinations

All Inspectors new to Local Plan work receive training backed by written advice about process and best practice. Training, advice and briefings are provided at two specific events each year and more frequently as needed, for example through monthly meetings. These allow good practice to be shared and discussed.

All Local Plan reports and soundness letters are quality assured by a panel. Quality Assurance is focused on the standard of the reasoning and drafting and Inspectors are never told what conclusions they should reach. Quality is also considered at monthly line manager meetings and in monthly conversations with Inspectors. We frequently consider the outcomes of the quality assurance process, legal challenges and complaints to assess whether we need to change anything.

In 2021/22, we published our quality framework for our examination service. It shows how all quality activities come together to improve the overall quality of our service.

Appeals

Most Inspectors decide planning or enforcement appeals at some point during their careers. The initial training is rigorous and extensive and covers the key principles for decision-makers. Guidance is provided on the approach that should be taken, having regard to legislation, policy and case law. However, we do not provide anything more than is in national policy and guidance regarding the importance to be given to relevant considerations. The outcome of any appeal is a matter for the individual Inspector’s judgement.

Training on specific topics and a legal update is delivered at twice yearly events. This often involves sharing good practice and experience. Training materials are also used in smaller meetings and in webinars.

A sample of appeal decisions are reviewed by line managers after they have been issued and feedback is given. We circulate any lessons that arise from complaints or challenges to all Inspectors.

In 2021/22, we prepared our quality framework for our appeal service. It shows how all quality activities come together to improve the overall quality of our service.

Applications

Quality assurance for applications is a similar process to that of examinations and appeals. Comprehensive initial training takes place to ensure Inspectors are ready to examine, assess and make recommendations. There are two main training events each year and frequent updates take place on best practice and matters of policy and law. All reports are quality assured on drafting and reasoning, and not on the nature of the recommendation the Examination Panel make.

Our operations

Our Inspectors use three different procedures to consider evidence. The approach they use depends on the case, the type of evidence and how they can best find out what they need to make their decision or recommendation.

Written representations

Most of our cases are decided by Inspectors after seeing written evidence and usually visiting the site. This is often called “written representations”. The appellant, the Local Planning Authority, local people and businesses and anyone else interested in the appeal make their comments in writing and the Inspector decides the case after reviewing the evidence.

Hearings

Our national infrastructure applications, local plan examinations and some appeal cases are decided after the Inspector has held a hearing. In these cases the appellant or applicant, the Local Planning Authority, local people and businesses and anyone else interested in the case make their comments in writing. The Inspector then chairs a structured discussion around some or all the issues to help them test the evidence. Hearings for applications and examinations can take place over days or weeks, but hearings for appeals cases are much shorter. Inspectors often visit the site as well, and then prepare their decision or recommendation.

Inquiries

Inquiries are held for the most complex appeals and for some other casework like compulsory purchase orders and called in planning applications. The appellant or applicant, the Local Planning Authority, local people and businesses and anyone else interested in the case also make their comments in writing. At the discretion of the Inspector, people can also make their views known verbally at the inquiry. Inquiries are more formal than hearings and evidence is tested by cross examination, normally by barristers representing the main parties interested in the appeal.

After visiting the site, the Inspector then makes their decision or recommendation.

Inspectors have historically used one of the three procedures for the entirety of a case. Legal changes now make it clear that Inspectors can use more than one procedure on a single case. We call these hybrid procedures.

Adapting operations to the pandemic

In 2020/21 the pandemic stopped the significant progress we had made in 2019/20 to improve our services for our customers. Our plans for improvement were paused while we prioritised keeping casework moving during the pandemic, keeping our employees and customers safe and supporting the wider government response. In 2021/22 the effects of the pandemic continued to affect our capacity and flexibility. Face- to-face hearings and inquiries were not permitted until the summer. We also saw increases in demand for our services. This could have been because of 2020/21 delays in submitting and deciding applications.

This year we focused on:

- National infrastructure applications, local plan examinations and appeals by hearing and inquiry. These cases often have the highest economic impact and community interest;

- Deciding as many cases by written representations as possible with the available Inspectors; and

- A resilient approach to hearings and inquiries which improves inclusive access for participants. From September 2021, councils successfully took back responsibility for organising and hosting hearings and inquiries.

We were able to maintain business continuity throughout the year, running all our services. When pandemic restrictions applied, when key participants tested COVID-19 positive or when it was necessary to protect vulnerable participants we implemented reserve plans that we had prepared in advance so that our casework continued to be considered and decided.

Adapting to changes in legislation

We track and respond to changes in legislation which affect the way we do our work. Such changes can amend existing rules and regulations or introduce new ones. They may provide us with opportunities to improve our service to customers.

For example, the 2021 Environment Act will play an important part in our work both now and in the future. We provided our staff with comprehensive guidance on the impact of the Act on our casework, and we shall continue to provide updates as additional provisions are implemented.

We also watch for changes in government policy and for Court judgments and take these into account as part of our training and guidance to staff. For example, in July 2021 the government published its revised National Planning Policy Framework. This was a significant policy change which had to be applied to our casework. On the day it was published we issued our people with guidance so they were informed about the changes and the actions they would need to take.

Modelling

We have developed a resourcing model that significantly improved how we assess the number and capability of Inspectors we need to support our workload. We use this information to decide how we train and develop our existing employees and to recruit new Inspectors at different levels of experience. We also use this information to allocate resource optimally across our services and different type of cases to reduce workload. We are developing the model further, so that scenarios based modelling can be used to assess how changes to process, training or skills could impact future performance.

Appeals acceleration

In January 2022 the former Housing Minister asked us to identify what it would take to support us in making most appeal decisions in four to eight weeks. This provides an opportunity to challenge the assumptions underlining our current services operation and to explore how a reframed appeal service could be made more sustainable. Research and engagement is taking place in Spring 2022 before we respond in early summer.

Examining Local Plans in England

Local Plans continued to be prepared and submitted to us throughout the year. We sometimes examined them virtually so that these important plans for local communities and the economy were not delayed.

Twenty Local Plans were submitted to us for examination this year. This is the fewest submitted in any of the last five years. The pandemic and ongoing reform to the planning system are two likely reasons for this. However, in February 2022 we also received the largest plan we have ever examined: the draft plan from the Greater Manchester Combined Authority. The examination started in March 2022.

Our income increased to £3.5 million in 2021/22, close to the average of the last five years. Although we issued a comparable number of reports to 2020/21, on average they took longer and cost more to conclude than in previous years. We held 72 virtual and face-to-face events to ensure plans were not delayed by the pandemic, and issued 34 reports on local plans we examined.

All our reports concluded that the Duty to Co-operate had been met by Local Planning Authorities (normally councils). This is a legal requirement for the way Local Planning Authorities prepare their plans. If the Duty is not passed the examination of the plan cannot continue.

In most cases our reports recommended changes to achieve a sound plan and to pass the legal tests. Sometimes this meant recommending removing policies or introducing new ones, amending the wording of a policy or changing a housing requirement. We worked pragmatically and constructively to help achieve this.

Graph 5. Local Plans received and reports issued

| Local Plans received | Local Plans issued | Income from local plans in £millions | |

|---|---|---|---|

| 2017/18 | 74 | 55 | 3.9 |

| 2018/19 | 65 | 52 | 5 |

| 2019/20 | 36 | 59 | 4.6 |

| 2020/21 | 24 | 32 | 2.6 |

| 2021/22 | 20 | 34 | 3.5 |

Local Plans across England provide for 5.2 million homes

Source: https://local-plans-prototype.herokuapp.com/

Local Plan housing requirement data reflects the Department for Levelling up, Housing and Communities’ understanding of adopted plans as at the end of April 2022. The data is experimental, updated monthly, and is subject to limited validation. It, therefore, should not be relied upon as a ‘real- time’ representation of local plan progress or content.

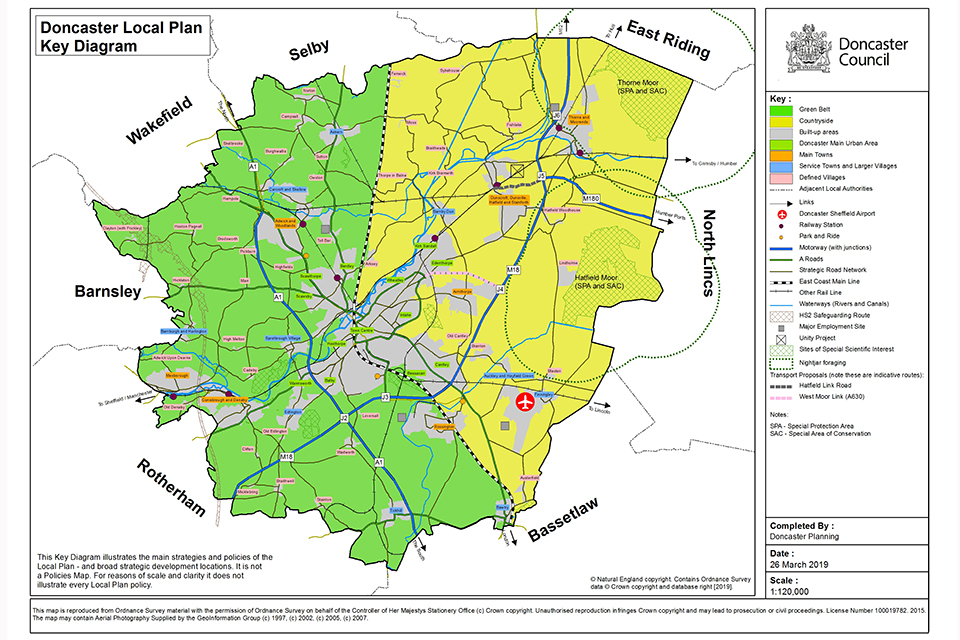

Doncaster Local Plan - case study

Doncaster Local Plan 2015 to 2035 was adopted in September 2021. The examination was conducted through hearings held using a blended approach with concurrent physical and virtual participation along with live broadcast on YouTube.

Doncaster Borough in South Yorkshire is a large metropolitan area, home to over 300,000 people. The western part of the Borough is Green Belt, and there are extensive areas at risk of flooding including much of Doncaster urban area, several other towns, and the M18 corridor.

The Council had been working for several years to prepare a new plan and policies map. A suite of documents had been submitted for examination in 2014. However, the examining Inspector at the time identified significant concerns relating to housing need, the site selection methodology, Green Belt and flood risk. In response, the Council withdrew the plan from examination. In March 2020, the council submitted a new Plan, based on significant new evidence and several rounds of public consultation.

The examination was held between March 2020 and June 2021, with hearings held between October and December 2020. Attendees that wished to attend the hearings physically were socially distanced in the Council Chamber, which was equipped to facilitate live online participation. It was the first public event to use the Council’s equipment and the first blended event for the Planning Inspectorate. The Council and other participants were positive about the blended approach used during the hearing sessions.