The Adjudicator's Office annual report 2024

Published 26 September 2024

The Adjudicator’s Office annual report 2024

The role of the Adjudicator

The role of the Adjudicator was created in 1993 to introduce an independent tier of complaint handling for HM Revenue and Customs (HMRC) and the Valuation Office Agency (VOA). Since December 2019 the Adjudicator has held an independent role in reviewing decisions made under the Home Office’s Windrush Compensation Scheme (WCS). Collectively they are ‘the departments’.

The Adjudicator’s Office provides a free, impartial, and independent service and investigates all complaints within our remit. We resolve individual complaints but also highlight trends in both customer service and complaint handling. The Adjudicator will continue to push the departments to improve quality in complaint handling, so that customers will only feel the need to escalate more sensitive and complex complaints to the Adjudicator’s Office.

The Adjudicator expects HMRC, the VOA and Home Office to apply skill and understanding to their complaint handling. They should explain their decisions clearly and with reference, where appropriate, to relevant rules, guidance or legislation. Our GOV.UK pages set out the issues that the Adjudicator can look at, and the boundaries to our scope of enquiry for HMRC, the VOA, and the Home Office Windrush Compensation Scheme.

Our Service Level Agreements underpin the role of our office in providing an impartial, proportionate consideration of complaints, without interference.

We make all final decisions on cases with the approval, or under the delegated authority of, the Adjudicator.

During 2023 to 2024, the Adjudicator was supported by staff in two locations. Most of our staff are investigators, supported by specific leads for people matters, quality assurance, learning and development, stakeholder engagement and business planning.

Between April and September 2023, we appointed an interim Adjudicator, Paul Douglas, whilst recruitment for a permanent appointment was underway.

Our Role and Vision

Our Role

The Adjudicator’s Office:

- resolve complaints by providing an accessible and flexible service and make fair, trusted and impartial decisions

- support and encourage effective resolution throughout the complaints handling process whilst being responsive to customer needs

- use insight and expertise to support HMRC to learn from complaints and improve services to customers in line with the Charter commitments

Our Vision

By working with the departments and using our independent insight and expertise, our vision in 2023 to 2024 was to achieve the following positive outcomes for our customers:

- complaint handling is trusted as fair

- responsive to customer needs

- insight from complaints improves services for customers

The Adjudicator’s foreword – Mike McMahon

Mike McMahon

This is my first annual report as Adjudicator, having previously been our Head of Office. I would like first to thank Helen Megarry, who served as Adjudicator for seven years, and Paul Douglas, who was our interim Adjudicator for a period in 2023, for setting the bar in terms of professionalism and showing through their actions what the role can be. I am very conscious of the responsibility that comes with the position, and I will do all that I can to lead the organisation with the same skill and commitment of my predecessors.

This reporting year we have seen a significant increase in our workload. This has been driven by an increase in complaints and requests for reviews by both HMRC and the Home Office. We received 1,046 complaints from HMRC compared to 950 in 2022 to 2023 and 139 requests for review under the Windrush Compensation Scheme compared to 78 in 2022 to 2023. The VOA’s numbers remain steady at 58 compared to 57 the previous reporting year.

It has been another challenging year for HMRC. They have struggled to deal with high volumes of complaints. Issues with customers accessing help – primarily through their phone lines – are significant and have been reported in the media.

However, there are signs more recently of an improved picture:

- HMRC has committed to action aiming to end a peak and trough cycle of complaint handling we have seen over the last few years. There has been a tendency for complaint volumes to increase, for recovery action to be taken that reduces wait times before the cycle begins again. Initiatives to rectify this include greater empowerment of frontline staff to fix problems at first contact before they develop into a complaint

- HMRC’s strategic direction is to move more of its activity online. The data suggests that customer satisfaction is considerably better through digital channels and the approach is intended to free up more resource for those who are vulnerable, digitally excluded or have complex issues that require someone to help

A significant step by HMRC this reporting year was its decision to close its Self-Assessment helpline between June and September 2023. HMRC explained that customers using this helpline were more likely to be able to engage with them online, and in doing so, make it easier to speak to customers on the phone who need that support most. In theory, this makes sense. We challenged HMRC to demonstrate the efficacy of its decision.

In March 2024, HMRC announced that it would be closing a number of other helplines . It said that it had learned from the initial trial and that in doing so, more people could be moved into digital channels and in doing so, staff would be freed up to deal with vulnerable or digitally excluded customers.

However, there was significant feedback on HMRC’s readiness to implement this change without adversely impacting customers and HMRC quickly reversed their decision. This will have inevitably impacted its operational plans and demonstrates the significant pressure HMRC is under to deliver its digital transformation whilst maintaining existing services.

It is too early to say that HMRC have in place a long-term sustainable solution that ensures great customer service and complaint handling. We will continue to hold HMRC to account especially in relation to service that is too slow or doesn’t answer the problem raised and for those who find it difficult to interact digitally with HMRC. As we have said before, the mechanism for that is HMRC’s Charter which sets out simply and clearly what HMRC aspires to as a modern, responsive, trusted tax authority.

We received 58 complaints about the VOA which is in line with what we saw the previous year. The VOA’s transformation activities, especially in relation to customer service and complaint handling, continue to support generally good outcomes for their customers. It is clear that in recent years their customers have been prioritised in ways they have not been previously, but we will support the VOA with feedback on where we think they can improve.

The WCS remains challenging work for both us and the Home Office. We received 139 requests for review which was a 78% increase on the previous year. This reflects increased recruitment by the Home Office meaning waiting times for a decision have reduced significantly. We have developed a constructive relationship with the Home Office meaning we have been able to influence, to claimants’ advantage, on areas where the scheme can be improved. This is a group of people who deserve quick and fair outcomes to their claims.

A key strategic objective of ours is harnessing good engagement with the departments we work with to ensure we can positively influence to the benefit of our mutual customers. We regularly challenge all of our stakeholders through the boards we sit on and the reports we produce. I am pleased that this annual report will see our first published in-depth enquiry into applying customer circumstances to decision making. I am keen that we become more transparent and publishing more information is part of that.

I also want to open up more conversations with customer stakeholder groups to hear more about what the reality of dealing with HMRC, the VOA and the Home Office (under the WCS) actually feels like. We will reach out to advocacy groups to ensure that all sides of the conversation are taken into account.

Finally, I wanted to share my thanks to the wonderful people who work at the Adjudicator’s Office and who have helped me make the move from Head of Office to Adjudicator. I am unstintingly supported by a group of people who are dedicated to what they do and would be the envy of any comparable organisation. It is also with great pleasure that I hand the reins over to Richard Fowler as our new Head of Office. Richard brings energy and ideas which I do not doubt will ensure the next few years build on the success we have had to date.

Head of Office Update – Richard Fowler

Richard Fowler

2023 to 2024 has been a transitional year for the Adjudicator’s Office following Helen Megarry’s departure in March 2023, Paul Douglas acting as interim Adjudicator and then Mike McMahon becoming our new permanent Adjudicator in September 2023.

I was delighted to join as Head of Office in February 2024, taking over from Mike. We are fortunate to be retaining his expertise and experience and I look forward to working closely with him to build on the firm foundations laid over the last three years.

The work the team does has never been more important. Customers of the organisations we work with – HMRC, VOA and the Home Office (in relation to the Windrush Compensation Scheme) – are entitled to have their voices heard. If they are not happy with the response they are receiving from these departments when they complain, it is right that they can get an impartial, fair second opinion. I have been struck by the passion which colleagues have for providing this service and for sharing the insight we see with our stakeholder organisations to drive improvements.

The last year has seen some notable achievements. We value the constructive relationships we have with our stakeholders. Although we guard our independence at all times, we also know that the best way to bring about improvements in service is through positive relationships.

Some highlights from last year are:

- We resolved 38% more cases than in 2022 to 2023

- We reduced our active caseload by over 26% between 31 March 2023 and 31 March 2024

- Our three-tiered insight approach has provided structure to the feedback we provide to our stakeholder organisations

- We have developed our quality reporting metrics by using Power BI, helping us to drive a culture of continuous improvement.

Our insight has helped deliver several specific improvements. For example we underlined the need for a joined up approach to complaint handling on cross-cutting issues such as debt transfer from HMRC to the Department of Work and Pensions (DWP). HMRC has assured us they are carrying out further work to ensure customer vulnerability is taken into consideration ahead of making the transfer.

We suggested HMRC provide learning to complaint handlers and managers around the implications of failing to fully answer all points of customer complaints. This is being addressed as part of HMRC’s Complaints Strategy with renewed vigour on assurance of draft Tier 1 and Tier 2 complaint responses. In addition the department is strengthening feedback loops between operational complaint teams to achieve the correct outcome at the first instance and reduce complaints and escalations.

Looking forward, today we are also publishing our new 3-year business plan taking us up to 2027. It has given us the opportunity to reframe our vision even more tightly around our core priorities: a customer focused service, high quality decisions, meaningful insight and supporting our people to do their best work. These will also be my personal priorities in supporting Mike in his role as Adjudicator and I look forward to the coming year.

Performance and analysis of complaints investigated

The complaint process: HMRC and the VOA

The Adjudicator can consider how HMRC, or the VOA have handled a complaint, whether they have followed their policy and procedure and made reasonable decisions. Where we think they have fallen short, we will recommend what they need to do to put matters right. We will feed back lessons learnt to HMRC or the VOA where we think this will make their customer service better.

We do not usually accept cases that we receive more than six months after the final response from the department. If the complaint is something we cannot look at, we will explain why. If customers are dissatisfied with any stage of the complaint process, they have the right to take the complaint to the next stage.

Investigation

- we review information that customers send us

- we carry out any necessary enquiries

- we reach a decision on whether the department did anything wrong

Resolution

- we will make a formal decision on the complaint

- this will include recommendations if the Adjudicator decides the department needs to put things right

- we will write to our customer and the department explaining our decision

The Parliamentary and Health Service Ombudsman

Once we have given our decision, our part in the complaint is over. If our customer believes their complaint has not been resolved, they can ask a Member of Parliament (MP) to put their complaint to the Parliamentary and Health Service Ombudsman.

Workload 2023 to 2024

Total complaints received

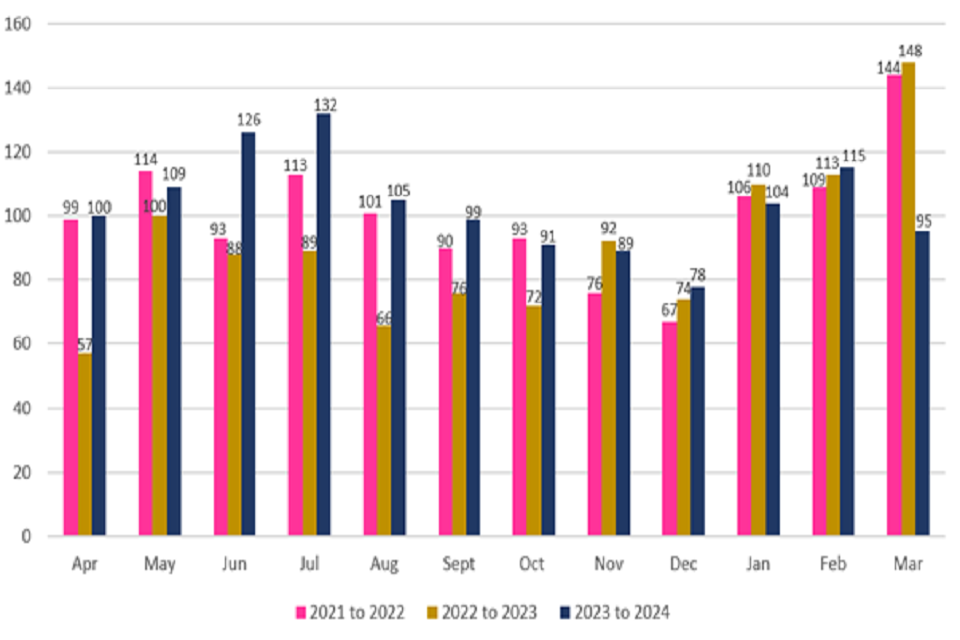

The following table compares the number of complaints received by month for the years 2021 to 2022, 2022 to 2023 and 2023 to 2024.

Total Complaints Received Chart

Download a spreadsheet with the underlying data for this chart in an accessible format.

Number of complaints

The following table shows comparisons for 2021 to 2022, 2022 to 2023 and 2023 to 2024 for cases on hand at the beginning of each year, new cases for investigation, cases resolved and the number of cases on hand at the end of each year.

Over the last year we have seen our casework almost entirely transition back to non-COVID related complaints. COVID complaints, whilst numerous, tended to be more straightforward.

| Number of complaints handled | 2021 to 2022 | 2022 to 2023 | 2023 to 2024 |

|---|---|---|---|

| Cases on hand 1 April | 190[footnote 1] | 241[footnote 2] | 347 |

| New cases for investigation | 1,205 | 1,085 | 1,243 |

| Cases resolved[footnote 3] | 1,122 | 957 | 1,320 |

| Cases on hand 31 March | 273 | 369 | 270 |

Complaints on hand by department on 1 April 2024

The following table shows the breakdown of work on hand on 1 April 2024 by department.

| Department | Complaints on hand |

|---|---|

| HMRC | 236 |

| VOA | 6 |

| Home Office | 28 |

| Total | 270 |

Outcomes of complaints received

The following table shows the breakdown of the number of cases we investigated in 2023 to 2024 for HMRC, the VOA and the Home Office. The table also includes information on how many cases were withdrawn by the customer or were deemed out of remit (i.e. we could not look at it).

| Department | Cases investigated | Withdrawn | Out of Remit |

|---|---|---|---|

| HMRC | 843 | 51 | 238 |

| VOA | 22 | 0 | 39 |

| Home Office | 117 | 5 | 5 |

| Total | 982 | 56 | 282 |

Outcomes of investigations completed

The following table shows the split between the outcomes of our investigations in 2023 to 2024 for HMRC, the VOA and the Home Office.

| Department | Not Upheld | Fully Upheld | Partially Upheld |

|---|---|---|---|

| HMRC | 499 | 51 | 293 |

| VOA | 17 | 0 | 5 |

| Home Office | 82 | 1 | 34 |

| Total | 599 | 52 | 331 |

Premature complaints

The following table shows the number of premature complaints (those that have not completed our stakeholder’s complaint process) that we have seen in 2023 to 2024 for HMRC, the VOA and the Home Office.

| Department | Premature Complaints |

|---|---|

| HMRC | 1150 |

| VOA | 8 |

| Home Office | 26 |

Redress paid

Where appropriate we recommend HMRC pays customers financial redress in recognition of the poor level of service they received, and any relevant costs. We make recommendations in accordance with HMRC’s Complaints and Remedy Guidance. Redress can also include a recommendation that HMRC gives up recovery of a customer’s liability.

The table within the redress section below shows the sums recommended this year for HMRC cases.

Redress (£) 2023 to 2024

The table below shows the breakdown of the redress payments we recommended for HMRC and the VOA. This year we recorded redress payments under the headings ‘Worry and distress’, ‘Poor complaints handling’, ‘Liability given up’ (i.e. money no longer pursued), ‘Costs’ and ‘Financial loss’.

| - | Worry and distress (£) | Poor complaints handling (£) | Liability given up (£) | Costs (£) | Financial loss (£) | Total (£) |

|---|---|---|---|---|---|---|

| HMRC | 19,655 | 20,190 | 45,691 | 6,174 | 11,353 | 103,063 |

| VOA | 400 | 125 | 0 | 0 | 0 | 525 |

HMRC update and case studies

During this reporting year, we resolved 843 fully investigated HMRC complaints, a 34% increase on 2022 to 2023. Our uphold rate (including both fully and partially upheld) decreased from 47% in 2022 to 2023 to 41% in 2023 to 2024.

HMRC has had a challenging year. High volumes of complaints have meant HMRC’s two main operational directorates, Customer Compliance Group and Customer Services Group have struggled to consistently keep on top of their first and second tier complaints. As a result, delay has featured in most of the work that we see. It has also meant our workload has increased through the year.

In recent months, HMRC seem to be turning the corner and getting back to reasonable service levels across both directorates.

HMRC has been open with our office about the difficulties they have faced. We were invited to participate in workshops that sought to address the cycle of the numbers of outstanding complaints rising, action being taken to reduce them and then numbers being allowed to rise back again. HMRC felt they needed to take some risks to interrupt this cycle and presented a range of proposals to its Executive Committee (ExCom) which were approved. They included greater empowerment of frontline staff so they could be equipped with the support and resources needed to deal with issues in or as close to real time as possible.

Currently, if someone expresses dissatisfaction, the issue is passed to a complaint team which builds in delays. Everyone should have a right to air a complaint and have their concerns listened to but most people just want the problem fixed as quickly as possible. So we support this initiative.

For the first time alongside this annual report, we are publishing a Level 3 report. A Level 3 report is a significant look into a particular area, grounded in the evidence we see. In it, we point out that HMRC does not always take account of its customer’s needs when it has the means to do so. HMRC has committed at ExCom to respond to this report as part of their wider response to the annual report.

We hope to see improvements this year in HMRC’s complaint handling and general customer service. It has been building to a better position, though this isn’t always obvious. Regardless, we will continue to hold HMRC to account through the casework we see.

Outcome of HMRC investigations

The following table shows the comparison of ‘Not upheld’, Partially upheld’, ‘Fully upheld’, ‘Out of remit’, and ‘Withdrawn’, resolutions for 2021 to 2022, 2022 to 2023 and 2023 to 2024.

| - | 2021 to 2022 | 2022 to 2023 | 2023 to 2024 |

|---|---|---|---|

| Not Upheld | 525 | 337 | 499 |

| Partially Upheld | 203 | 227 | 293 |

| Fully Upheld | 49 | 66 | 51 |

| Out of Remit | 204 | 142 | 238 |

| Withdrawn | 10 | 20 | 51 |

HMRC accepted all final recommendations that we made during the year.

Case studies

HMRC is responsible for a vast and complex tax system. This is reflected in the casework we see. Managing that effectively and producing high-quality recommendations is challenging, but there are things that help us with that.

HMRC’s Charter applies to everything HMRC does. The case studies below are reflective of the range, complexity and impact of HMRC’s decisions. In each case we considered if the Charter has been followed. This allows us, regardless of how complex or emotive a complaint is, to weigh up if HMRC has done all that it could and should have done.

We do see certain themes, regardless of the type of complaint. Delays feature a lot and we regularly challenge HMRC to improve in this area. We also see complex customer needs being a feature of complaints – either as a factor in understanding why something happened, or as a consequence of a decision made by HMRC.

More often than not, HMRC do what they should have done. Sometimes it goes above and beyond what might reasonably be expected of it. But other times HMRC does not serve their customers well, when they have the tools to do so.

Our role is to always be impartial – we act for neither HMRC nor our customers – and we defend that fiercely. But we also know that often, the customer is not on a level playing field. HMRC’s resources are under huge pressure – but they are still significant compared to most complainants. We believe that it is right to factor that into our complaint handling, particularly when HMRC should be able to act with fairness whilst fulfilling its fundamental role to collect tax due.

Case study 1

HMRC said Customer A owed them money for tax they had claimed back, which subsequently materialised they had not been entitled to. By the time HMRC asked for the money back, Customer A had spent it on equipment to aid their mobility. Customer A told us HMRC’s decision to request the repayment of the money had caused them financial hardship and impacted their health.

Complaint

In the tax year 2016 to 2017, Customer A received compensation for mis-sold payment protection insurance. This was incorrectly carried forward by HMRC into the tax years 2018 to 2019 and 2019 to 2020 which indicated that Customer A was owed a £1,499 rebate for each year.

HMRC considered if the tax could be given up under the Extra Statutory Concession A19 (ESCA-19). Whilst HMRC had made a mistake carrying the money forward and paying it to Customer A, it had notified them of the error within the time-limits specified under ESCA-19. Therefore, the regulations set out that HMRC could not write-off the money it had paid to Customer A by mistake.

We looked into Customer A’s allegation that HMRC had invited them to claim the money. We could not find evidence of this.

However, we did find that HMRC had failed to take account of its Debt Management guidance when dealing with vulnerable customers like Customer A. We also found that HMRC had not been proactive in speaking to Customer A.

Our decision

We recommended HMRC pay Customer A £75 redress and asked that they apologise to them and consider their circumstances in line with its Debt Management guidance for vulnerable customers when considering if the debt was recoverable.

Learning

Customer A’s complaint is representative of issues we commonly see, particularly in relation to ESCA-19. The terms of ESCA-19 are narrow meaning it rarely leads to HMRC giving up tax.

But ESCA-19 is not the only avenue available to HMRC. In many cases it has discretion to act in a customer-focused way. In this case, debt management guidance provided an opportunity for HMRC to consider the circumstances of a vulnerable person when making their decision and that opportunity was not taken until the case came to us.

Case study 2

Customer B contacted us because an overpayment of Child Tax Credits of more than £6,000 was being recovered, significantly impacting their mental and physical wellbeing.

Complaint

HMRC said that two of the overpayments occurred in 2 tax years. At the end of both years, HMRC sent out renewal packs for Customer B but on each occasion Customer B did not respond. As a result, the money paid for both years was recorded as an overpayment.

HMRC said the final overpayment occurred as a result of a compliance check. HMRC contacted Customer B but did not receive a response so the claim for Customer B’s children was stopped, creating a further overpayment.

During this period, Customer B told us that they were in an abusive relationship. This manifested itself, in part, in their partner controlling their finances. They told us they were unaware claims were being made in their name.

HMRC was proactive in investigating Customer B’s serious concerns. Its records indicated that the claims were for a single person – Customer B – and that the bank account the money was paid to was their own.

HMRC’s records did show that a housing association contacted HMRC on Customer B’s behalf to explain they were living in challenging circumstances. The evidence we saw was that HMRC took this seriously. They called the charity but could not get a response so wrote to it asking that it contacted them. They did not respond. HMRC subsequently held a Mental Health case review but concluded that because of a lack of contact, the overpayments remained recoverable.

HMRC also considered if the money should be given up under Code of Practice 26 (COP 26). This allows HMRC to write-off tax credit debts in certain circumstances. In this case, COP 26 did not apply because HMRC had done what they should have done and Customer B – on the face of it – had not met their obligations.

Eventually the debt was transferred to the Department for Work and Pensions, in line with legislation. HMRC contacted the DWP when the complaint was made, asking them to consider if the debt could be given up. DWP said it could not give up the debt but offered to speak to Customer B about ways to make the repayments more manageable.

Our Decision

Whilst sympathetic to Customer B’s circumstances, we didn’t find that HMRC had done anything wrong. HMRC had met their obligations and tried hard to understand Customer B’s circumstances, over a number of years, to determine if there was anything further they could do.

Learning

Allegations of physical and/or mental abuse being a factor in complaints are unfortunately not unusual. We have found that HMRC has not always done everything they could to understand these often complex issues. But that was not the case here. Over a period of years, HMRC had sought to engage with Customer B and do all they could to help them.

If someone is in an abusive relationship, their ability to interact with life can be significantly impeded and we do not always see that this is recognised. In this case however HMRC continued to try to help Customer B after the debt was transferred to DWP. The case illustrates the challenges both parties can face when dealing with complex customer needs. Our expectation is that HMRC takes concerns raised by customers, such as Customer B’s, seriously and in this case it did.

Case study 3

Customer C was a victim of multiple fraudulent claims made in their name to both HMRC and DWP. As a result of the claims, legitimate Tax Credit claims were stopped while HMRC investigated the fraud. This caused a lot of hardship for Customer C, a single parent.

Complaint

The fraudulent claims to HMRC covered Tax Credits, Self-Assessment and Value Added Tax (VAT). They occurred over a number of years. The fraudulent claims to DWP concerned Universal Credit (UC). Each time Customer C reported a fraudulent UC claim to HMRC, in line with HMRC’s guidance, it stopped Customer C’s Tax Credits claims, which caused significant financial hardship to them.

Once each claim was shown to be fraudulent, the genuine Tax Credit claims were reinstated. Customer C was concerned that there was no way to end the cycle of their legitimate claim being halted whilst an investigation was undertaken.

Customer C promptly told HMRC the VAT and Self-Assessment claims were bogus. However, automatic letters were sent on a number of occasions asking Customer C to confirm their identity to ‘unlock’ their Self-Assessment account, which had been fraudulently set up. HMRC took too long – more than 6 months – to investigate the VAT claim and establish it was fraudulent.

The complaint investigation also took too long. It was unfortunate that when Customer C raised concerns about delays for the VAT claim, they were told by HMRC that the delay was not unreasonable because there were no financial consequences.

Our Decision

We accepted that in the case of each fraudulent claim, HMRC had followed its guidance. However, the service provided during both the handling of the issues and throughout the complaint process was not good enough. We recommended HMRC pay Customer C further £200 redress in recognition of the distress they experienced.

Learning

This case illustrated the challenges people face when their identity is hijacked. Customer C had to raise their concerns multiple times. They described how vulnerable and anxious this made them feel over an extended period. HMRC did everything it should as each individual claim was identified but it took a very long time which increased Customer C’s anxiety.

This case is a good example of how we use insight from individual cases to improve systems. We asked HMRC if there were ways to improve and highlighted that there are systems in place to notify multiple government departments when someone has died. For Customer C, the reality was that they had to contact different Government departments and different directorates within a Department each time a new fraud was identified by them. HMRC has indicated that this is something they would like to look into further which could be great news for their customers in a world where, regrettably, fraud is common.

Case study 4

Customer D’s National Insurance Number (NINO) became mixed up with that of another person. This meant Customer D received demands for underpaid tax that were not theirs. Customer D told us this caused them significant stress, exacerbated by the time it took to resolve.

Complaint

In April 2021, Customer D contacted HMRC and told them that an incorrect employment was registered on their tax record. HMRC did not respond so Customer D made a complaint at the end of July 2021.

The erroneous employment appeared again on Customer D’s tax record in July 2022 so they complained again. HMRC responded on 31 December 2022 and Customer D promptly replied. Nothing further was heard from HMRC so Customer D wrote to them again in June 2023. Finally, in September 2023, HMRC wrote to Customer D and explained that they were using the incorrect NINO and sent them a new one. But when Customer D logged onto the Government Gateway, it showed another person’s tax details. By November 2023, Customer D had received letters from HMRC about another person’s tax calculations.

Our investigation established that Customer D had been using the incorrect NINO for around 40 years. HMRC had assumed that an administration error at that time had mixed up the two customers. It appeared that both had similar personal information. Ultimately HMRC resolved the NINO issue, albeit around two and a half years after Customer D had first contacted HMRC.

Our Decision

We advised Customer D that the understandable concerns they raised about data protection breaches should be passed to the Information Commissioner’s Office. We were concerned however about the level of service that Customer D had received. We pointed out that HMRC had not upheld their Charter commitment to ‘be responsive’. We upheld the complaint and recommended HMRC pay £150 compensation on top of £100 already offered by them. The amount we recommended was mitigated somewhat by periods where Customer D had not responded to HMRC, although they were few.

Learning

This case is typical of many we see where there are protracted delays in resolving a confusing, but not overly complicated issue. HMRC could have resolved this at the first contact. We have been strongly urging HMRC to empower their people to resolve issues as soon as they can. Very often they do, but not in this case.

We also established through our investigation that the service standards for dealing with NINO issues is around a year. This is not acceptable but reflects the significant pressures on many of HMRC’s services.

Case study 5

Customer E was unhappy that HMRC did not provide them with 30 hours free childcare funding. HMRC said that Customer E did not register and confirm their request for the funding within a reasonable timeframe.

Complaint

Customer E first applied for funding in December 2022. HMRC sent Customer E 2 secure emails; one confirming an account had been opened and the second that provided the eligibility code for Customer E ’s child. Both emails explained that Customer E had until 14 February 2023 to check and reconfirm the details to receive the funding.

2 reminder emails were sent on 17 and 31 January to Customer E, setting out the date by which they needed to confirm their details. No action was taken by Customer E so a further email was sent to them on 15 February. That email explained that the funding was due to stop. But because Customer E ’s child had started their funded childcare place, Customer E would be able to continue to access the system – and confirm the details – during a ‘grace period’ until 31 March 2023. Unfortunately, the details were only confirmed on 17 April 2023.

Customer E told us that two issues were a factor here; that they had been in hospital during the period in question and that they also had issues with their emails. When Customer E first raised their concerns with HMRC, the email issue was mentioned but not the hospital stays.

We recognised that both issues could make complying with the deadlines difficult; but we established that neither was a factor throughout the entire period in question.

Our Decision

We couldn’t establish that the issues Customer E had raised wholly prevented them from finishing the registration process. HMRC had also been very proactive in reminding Customer E of what they needed to do and extended the time limits. We didn’t uphold the complaint.

Learning

This was an example of HMRC’s automated systems working well and that the policy underpinning them being both fair and proportionate. At some point HMRC has to draw a line. We sympathised with Customer E and didn’t doubt that life events made the process more complicated for them. But there was some inconsistency in what they were telling first HMRC then us about what happened.

This case demonstrates how we weigh the evidence we are provided and balance that against the policy and guidance HMRC are obliged to follow. In this case HMRC had done all it reasonably could to help Customer E comply with the time limits.

HMRC – First Permanent Secretary and Chief Executive Jim Harra

Jim Harra

HMRC values the continued engagement and feedback from the Adjudicator and the Adjudicator’s Office, which support us in achieving our vision of being a trusted, modern tax and customs organisation. I want to take this opportunity to formally welcome Mike McMahon as the new Adjudicator and thank him for his contributions as the previous Head of Office at the Adjudicator’s Office. I would also like to congratulate Richard Fowler on his recent appointment as the new Head of the Adjudicator’s Office and look forward to building upon the existing collaboration between our organisations.

I am pleased that the Adjudicator’s report references an improving picture in terms of complaints handling in HMRC. We are grateful for the Adjudicator’s help in identifying improvements we can make to address the root causes of complaints. This supports the aims of our complaints strategy and includes greater empowerment of our frontline colleagues who deal with complaints, which is a theme highlighted in the Adjudicator’s Level 3 report on Applying Customer Circumstances to Decision Making.

The standards set out in our Charter should always be at the heart of what we do, and we value the Adjudicator’s commitment to holding us accountable for delivering those standards and improving customer experience.

The Adjudicator’s annual report notes that we are developing and enhancing our digital services and encouraging more customers to self-serve online. We recognise the opportunities and challenges as we become a digital-first organisation and want to support our customers by delivering quick and straightforward digital services. This year, we have made several improvements to our digital complaints service, including updating our internal guidance, making our GOV.UK complaints page easier for customers to navigate and launching an online form enabling agents to complain digitally.

For customers who still need to contact us by phone or post, we recognise that service levels remain below our service standards. We’re making strong progress in our efforts to improve our customer service and additional funding has been secured to help achieve this. We’re also working hard to improve our digital services and encourage those who can do so to make use of them, to free up our helplines to support those who are vulnerable or have more complex queries. Whilst we remain committed to expanding our digital services and promoting the benefits of these to our customers, we will also be considering what improvements we need to make to help customers feel more confident in using our digital services.

The Adjudicator and his office continue to play an important role by acting as HMRC’s critical friend during a challenging period, providing us with insight that enables us to improve our processes and services.

Finally, I am pleased to see the Adjudicator’s Office updated objectives for 2024 to 2027 in their new business plan and endorse their reframed vision.

HMRC published its formal response to the Adjudicator’s last annual report in December 2023 and will publish a response to this report and the Level 3 report in December 2024.

VOA update and case studies

During the period 2023 to 2024 we received 58 new complaints. We resolved 61 cases in total but only 22 were within our remit to investigate.

The Adjudicator is unable to consider complaints about valuation decisions as these are outside of his remit. A significant number of the complaints that come to us ultimately relate to valuation decisions which results in a high percentage of complaints being out of remit.

Outcome of VOA investigations

The table below shows the outcome of the VOA cases investigated. It shows ‘Out of remit’ complaints continue to make up most cases that come to us.

| - | 2021 to 2022 | 2022 to 2023 | 2023 to 2024 |

|---|---|---|---|

| Not Upheld | 5 | 9 | 17 |

| Partially Upheld | 1 | 3 | 5 |

| Fully Upheld | 0 | 1 | 0 |

| Out of Remit | 28 | 42 | 39 |

| Withdrawn | 0 | 0 | 0 |

Redress Paid

On occasion, the Adjudicator recommends that the VOA pay a monetary sum of redress to customers in recognition of the poor level of service they received, and other relevant costs.

The table under the redress section above shows we recommended the VOA pay £525 redress this year.

The VOA accepted all the Adjudicator’s recommendations.

Case Study

The VOA have been on a significant customer improvement journey over the last few years and although the number of cases we see from them are small, that work is apparent.

The VOA are very keen to engage with us and embed the learning we share. We are now at a stage where the VOA are coming to us with its ideas to improve service, so the process is cyclical.

Many of the reasons someone might complain to the VOA are outside of our remit – for example Council Tax bandings. So we perhaps do not always see or are able to investigate, what we are sure causes customers frustration. But when we do see areas where the VOA can improve, we find they are open to the learning we provide.

Case study

Customer F complained that their property had been banded incorrectly for years. They were unhappy with the amount of money they ultimately received in overpayments of council tax.

Complaint

Customer F discovered that their house had been in the wrong council tax band since 2005. At that time, the Welsh Government had undertaken a review of council tax bands and it appeared that the error occurred then.

The customer was refunded 6 years worth of overpayments; the maximum allowable under legislation. But Customer F pointed out that by not going back to 2005, they were not refunded more which they calculated to be around £17,000.

Our decision

As discussed above, a lot of the VOA’s decision-making is grounded in legislation. We agreed with the VOA that Customer F could not be legally refunded more.

However, we did accept that Customer F was distressed and inconvenienced when they found out they had been overpaying for so long. And crucially, this is a separate matter to the legislative obligations. We recommended the VOA pay Customer F £200 redress.

Learning

This case highlights the limits to what we and indeed the VOA can do in many complaints it receives. The law is sometimes a blunt instrument. We could see why Customer F was so upset – they had overpaid for years and there was no way to get most of the money back and the VOA acknowledged that it had made mistakes when the property was re-banded

The consequence of that was the upset Customer F felt on discovering the overpayment. Although the redress payment was significantly less than the outstanding overpayment, the VOA still needed to acknowledge it had caused Customer F distress and compensate them accordingly.

Stakeholder feedback

VOA – Chief Executive Jonathan Russell

Jonathan Russell

The Valuation Office Agency’s work supports the collection of around £60 billion in business rates and Council Tax each year.

Over the last year, we have seen increased customer demand for, and use of, our services. This is partially as a result of us starting work on the 2023 non-domestic revaluation and closure of the 2017 revaluation period, alongside more customers seeking to query their Council Tax band.

As the use of our services has increased, we have also seen a consequential rise in the number of complaints received – although these still remained low in the context of the number of cases we dealt with last year.

For example, we handled around half a million Council Tax band challenges last year – both formal and informal, yet only 707 Council Tax complaints were dealt with. Overall, we handled 1346 complaints in 2023/24, a 58% increase from 567 the previous year.

I am encouraged that we have not seen a similar rise in escalations to the Adjudicator’s Office. The numbers remain consistent with previous years. This demonstrates the effective resolutions the complaints team are delivering and their commitment to providing excellent customer service.

I am delighted to see the Adjudicator recognises this, and the work we have done to learn from complaints. This includes the introduction of quarterly complaints insight reports which are shared with me and senior operational leaders. The team now also regularly communicate learnings from complaints to the wider agency to support better outcomes for our customers.

Looking ahead, we are keen to work with the Adjudicator to ensure our shared complaints data is accurate and purposeful.

We enjoy a positive working relationship with the Adjudicator and welcome their insight and feedback. The recommendations they share with us help us to improve our policies, processes and practices.

Home Office update and case studies

We reported last year that the Home Office was struggling to deal with the volume of WCS claims they were receiving. Since then, the Home Office have significantly improved both pace and output, largely due to increasing the number of staff dealing with WCS cases. This in turn is reflected in the number of substantive reviews we completed.

This is critical to the success of the scheme. As we have reported previously, the Windrush generation and their families are people who should not wait any longer than is absolutely necessary. In many cases they have undergone incredibly difficult life events due to being unable to prove their lawful status – something most of us take for granted.

We also highlight in the case studies below that our mutual customers bring wider adverse experiences that the scheme is designed only in part to remedy. Stories of appalling racism that impacted mental and physical health are unfortunately common. We never lose sight that behind the headlines are real people who have suffered. Our role is to ensure that the Home Office have applied the scheme fairly but to do that with care and sensitivity.

In our day to day working relationships with the Home Office, we see the same level of respect from them that we have for the people who apply to the scheme. We work closely with the Home Office to improve the scheme which has undergone positive changes this year, including improvements to awards under the different areas of claim. This is only possible due to a willingness on the part of us and the Home Office to improve and to work together to achieve that.

Total of new requests for review

The table below shows the number of cases received each year for 2021 to 2022, 2022 to 2023, and 2023 to 2024.

| Year | Cases Received |

|---|---|

| 2021 to 2022 | 136 |

| 2022 to 2023 | 78 |

| 2023 to 2024 | 139 |

Outcomes of investigations

The table below shows outcomes of investigations for the years 2021 to 2022, 2022 to 2023, and 2023 to 2024.

| - | 2021 to 2022 | 2022 to 2023 | 2023 to 2024 |

|---|---|---|---|

| Not Upheld | 70 | 66 | 82 |

| Partially Upheld | 13 | 17 | 34 |

| Fully Upheld | 4 | 2 | 1 |

| Out of Remit | 6 | 11 | 5 |

| Withdrawn | 3 | 14 | 5 |

Case studies

Case study 1

Lawyers acting for Customer G requested a review of the Home Office’s decision under the Impact on Life category of the Windrush Compensation Scheme. They had initially been awarded £70,000.

Complaint

Customer G came to the UK in the 1960’s from the Caribbean. In 2015, they were working as a carer for a London Council when, they had to leave their job. To help support themselves, they applied for Housing Benefit and Jobseeker’s allowance but were told they failed the habitual residency test and had not shown they had lawful status in the UK.

Into 2016, Customer G’s debts accumulated and they were served with an eviction notice. Their family raised £5,000 to clear some of the debt and they agreed to pay the remaining arrears by instalments.

In June 2017, Customer G was given a residency permit confirming their Indefinite Leave to Remain. As a result, in April 2018 they were returned around £6,500 that should have been covered by Housing Benefit.

Customer G suffered panic attacks as a result of these challenges and both their physical and mental health declined. In 2018 they were diagnosed with Alzheimer’s disease. By the time the case came to us, they no longer had the mental capacity to deal with their affairs.

Medical evidence was provided that confirmed that stress can be an exacerbating factor with Alzheimer’s disease. But in Customer G’s case, a clinician said it was outside of their remit to determine the extent to which different factors had impacted them. Customer G’s lawyers indicated that the Home Office had made an error because they had inferred that it needed to be shown that the sole factor in their ill health was stress caused by their inability to prove their lawful status. Customer G’s lawyers argued that if stress caused by problems proving lawful status was a contributing factor, this moved the appropriate award into the level 5 category – because the impacts in Customer G’s case were irreversible.

Our decision

The WCS guidance helps the Home Office’s caseworkers to assess claims. What is apparent is that they are expected to weigh the evidence and not expect that it will conclusively prove something; they must weigh the impact of a situation on the balance of probabilities. In this case we were concerned that the Home Office had to some extent misdirected themselves by assuming that there needed to be definitive proof. As a result, we asked the Home Office to review their decision again.

Learning

Unfortunately it was too late for Customer G to meaningfully understand the outcome. It was also representative of the people who use the scheme who have actively engaged in society for many years, suddenly finding that rights they thought they had were not believed. Customer G, with the support of their family, had to fight to prove what most of us take for granted.

We do see the Home Office generally trying hard to apply the balance of probabilities in a fair way. But where we find that the Home Office hasn’t weighed the scheme and its guidance as well as it should, we will ask them to look again.

Case study 2

Customer H made a claim under a number of categories of the WCS. The Home Office didn’t make an award. When Customer H came to us, they asked that we consider their claim under Denial of Access to Housing Services, Loss or Refusal of a Driving Licence and Impact on Life.

Complaint

Customer H came to the UK in 1951, one of the first of the Windrush generation. Customer H explained their experiences of being refused housing in the private sector and their testimony reflected what many have told both us and the wider public. Essentially, Customer H and their family were subject to appalling racism despite being told they could expect good treatment, a good job and a good home; none of which materialised.

The issue with this case was that what Customer H described was largely about the impact of racism. We could not find that Customer H had specifically been refused housing or a driving licence because they could not demonstrate their lawful status.

Our decision

We did find in this case that the Home Office did not correctly weigh up difficulties Customer H had setting up a business and having access to support in doing that. So, we asked the Home Office to review their decision under the Impact on Life category. But much of what Customer H told us was not within the remit of the scheme, as we discuss below.

Learning

This is another typical case that we see; the impact of racism on people after being invited to the UK to help rebuild the country and being promised a warm welcome.

However, the WCS is about compensating people for the impact of not having access to a range of services that they were entitled to. It doesn’t compensate for the racism and related disadvantage that many people experienced. Quite understandably, many people whose cases we see find that difficult to accept.

The role of our office is to ensure that the Home Office does everything they should to apply the WCS rules fairly, taking account of the often-significant passage of time that has passed and the challenges faced by claimants. Very often we see the Home Office do that well, but where it doesn’t happen, our role is to make sure it does. The issue in cases like this is the extent of the scheme which goes only so far. We try to explain that as empathetically as we can and have encouraged the Home Office to be clear about what the scheme can and cannot do, as early as possible.

Stakeholder feedback

Home Office - Permanent Secretary Sir Matthew Rycroft KCMG CBE

Sir Matthew Rycroft

The Home Office is committed to working collaboratively with the Adjudicator’s Office and to continuously learning from recommendations. This approach supports our broader aim of ensuring consistent decisions on compensation claims and allows us to offer the highest possible compensation as quickly as possible.

In the last reporting year, it is encouraging to see that improvements within the Windrush Compensation Scheme are reflected in the reduced numbers of ‘Upheld’ Tier 2 reviews and subsequent recommendations and increased numbers of ‘Not Upheld’ Tier 2 reviews and maintained decisions. We will continue to learn how to communicate better with Windrush Compensation Scheme claimants to ensure that decisions are provided with compassion and clarity for each individual.

Feedback from the Adjudicator’s Office is essential for the Home Office to remain open to external scrutiny and right the wrongs of the past.

Wider office achievements

In September 2021 we published our 2021 to 2024 business plan which set out proposed activity for the next three years. As with our previous business plans, we focused on 4 key themes: Our people, Our customers, Our organisation and Learning from Complaints.

In the plan we committed to reporting on the success of our corporate aims for each year measured against the aims outlined in the preceding year’s annual report.

We have set out below our organisational achievements over the last year against the goals set out in September 2021.

Our people: We will develop and engage our people to benefit from their experience and potential

Quality casework is at the heart of what we do. We have developed an approach where the investigation and articulation of our decisions is checked by experienced members of the team, including the Adjudicator, and we categorise that learning in terms of what we do well and what we can improve. This has allowed us to develop Quality Assurance dashboards at the individual, team and organisational level which tell us quickly and simply where we need to direct our finite resources.

Learning and development remains crucial to our continued success. We have a dedicated Learning and Development lead who has been developing a root and branch casework skills programme. This has included ‘sprints’ to test the efficacy of our practice and challenge our existing processes.

We have also welcomed external speakers to the office covering diverse issues from the Art of Communication to enhancing the learning we see in the individual complaints we deal with.

And internally, we have maintained the impetus of our wellbeing, diversity and inclusion group to ensure that the Adjudicator’s Office remains a great place to work.

Our customers: We will continually improve the service we provide our customers

With a new Adjudicator, we have taken the opportunity to review our Service Level Agreement with HMRC and the VOA to ensure that it is fit for purpose and takes account of all that we do. Crucial to this is ensuring the work that we do holding HMRC to account on their Charter is central to that agreement.

We remain an active participant on recognised bodies such as the Ombudsman Association. In 2023 we presented at their annual conference, highlighting the value and success we have had bringing our insight to bear on the departments we serve. We see any success that we have as something to share more widely so that other customers in different sectors can benefit. And we take the learning we see in other organisations and apply it in our setting. For example, working with an Irish Ombudsman scheme to enhance the way we share our insight.

We have also begun reaching out more to customer advocacy groups and organisations to hear from them what they see as the challenges their groups experience dealing with our stakeholders. This work will continue and gain greater impetus in the coming year.

Finally, we have been working to ensure that we are aligned with the principles of the UK Central Government Complaints Standards. This blueprint for best practice is something we ascribe to and we will continue to review our services and use it as a benchmark.

Our organisation: We will continue to transform the way we work, responding to the needs of our customers to become a more efficient and accountable organisation

Last year was a period of embedding the digital transformation that we have been engaged in over the last 3 years. Our new case management system is up and running and working well, as is our new telephony system.

We have also responded to HMRC and wider Civil Service activity intended to make the buildings we work in dynamic and conducive to flexible working. It was not so long ago that almost all of our people worked at home 100% of the time, so the transition back required care and understanding.

We have also improved productivity across the organisation by critically assessing our practices and ensuring that our people have the right support to do what they do well.

Finally, we have emphasised our ambition for all of our people to have some level of delegated authority to issue decisions on behalf of the Adjudicator. Almost all of our people have some delegated authority, which is carefully assessed, meaning casework can be completed quickly without additional checks before decisions leave the office. And we maintain our confidence in the quality of the work we do through our rigorous quality assurance approach, discussed above.

Learning from Complaints: We will use our insight and expertise to help our stakeholders learn from complaints to improve services to customers

Learning from complaints, which we will refer to simply as ‘insight’ going forward, is and will remain a key component of what we do. It is not uncommon for a scheme like ours to deal with complaints only and not share the learning that is derived from the casework we see. We are different – a huge amount of our time and resource is devoted to insight to ensure that lessons are learned not only in individual cases, but also more widely.

Our reporting structure is fully embedded. Level 1 is a self-serve report for stakeholders based on our data. Level 2 focusses on supporting stakeholders to achieve effective complaint resolution through identifying themes and trends that drive poor customer experience. In our Level 3 report we use our insight and expertise to analyse specific themes and make recommendations to improve services for customers. Our recommendations are managed through a director-led board and regularly updated and reported back on to ensure action is taken. Our membership of key boards continues, including HMRC’s Customer Experience Committee (CEC). It is crucial that we have a voice in rooms such as the CEC to ensure that HMRC’s plans are subject to scrutiny.

Another example of this influence is the contribution we make to HMRC’s Charter annual report. This is an opportunity for us to comment on what we see HMRC doing well, and where they can improve.

Feedback on our corporate aims from our HMRC and VOA stakeholders

As we did last year, we asked our stakeholders to feed back on how they think we are doing under our corporate aims. In addition to the formal contributions, HMRC and VOA responded specifically in relation to how we are meeting our business objectives:

Our Customers: we will improve the service we give our customers

HMRC

We recognise the importance of learning from complaints and values the feedback and challenge received from the Adjudicator and the Adjudicator’s Office to help us move closer to delivering a trusted and modern tax and customs service.

The standards set out in our Charter remain at the heart of what we do, and we value the Adjudicator’s commitment to holding us to account for delivering those standards and improving the customer experience.

Our relationship with the Adjudicator continues to be open and transparent and the various levels of engagement from a working-level through to senior engagement further strengthens this relationship. We recognise there is always more we can do and remain committed to learning from the real-time feedback the Adjudicator and his office provide. Our joint enhanced liaison initiative is a great example of how open and transparent engagement between both organisations has helped early resolution of contentious/complex cases.

HMRC are aware of the issues relating to premature complaints and recognise the impact they have on customers and the Adjudicator’s Office workload. We continue to work collaboratively to address these issues and recent work to identify and prioritise customers who need extra support has had a positive impact on improving the customer experience.

We have worked collaboratively with the Adjudicator at a working level to improve services for customers on several issues, and a good example is on the transfer of tax credits debt to DWP, making sure our cross departmental protocols enable a good customer journey.

This together with other sources of customer insight are vital as we continue working towards improving all elements of the service we provide, including process, customer communications and our internal culture.

VOA

We have been impressed with the Adjudicator’s commitment to improving customer service. This can only improve outcomes for our shared customers, something we are passionate about at the VOA.

Learning from Complaints: We will use our insight and expertise to help our stakeholders learn from complaints to improve services to customers.

HMRC

HMRC values the insight gained from the Adjudicator’s three-tier reporting process, acknowledging the positive influence it has had in supporting the department to maximise its learning from complaints. Feedback received via this revised reporting process has always been constructive, fair, and proportionate with colleagues at the Adjudicator’s Office always being helpful, proactive and willing to engage on matters that are more complex.

HMRC greatly appreciates the insight and knowledge the Adjudicator has provided the department through various workshops, supporting the department to identify new ways of working to resolve the root causes of complaints.

The Adjudicator’s contribution at the Customer Experience Committee and HMRC’s Complaint Strategy and Insight Board is welcomed, and ensures there is coherence between customer complaints, wider customer experience issues and HMRC’s strategic objectives.

Working collaboratively with the Adjudicator and his office we have updated and strengthened the service level agreement between both organisations to further enhance the customer offer.

We continue to listen to and take appropriate action on the complaint trends identified by the Adjudicator’s Office. For example, we have been working closely on a growing issue around Simple Assessment, and High-Volume Repayment Agents.

VOA

Complaints are a valuable source of feedback, and we are committed to learning from them. Your recommendations and feedback help us to recognise what we can do better, and the VOA would welcome the opportunity to be involved in future initiatives to promote this work.

Our objectives 2024 to 2027

This year we have updated our vision and objectives in our new business plan.

The Adjudicator’s updated vision is to work closely with the departments to achieve the following positive outcomes:

- an effective customer-focussed complaint handling service

- high-quality, fair decisions

- insight which drives action to improve services for customers

To achieve this, we will have a fourth priority strand to make the Adjudicator’s Office a great place to work and support our people to deliver our vision.

Our next annual report will report on our progress in achieving these new objectives.

Customer feedback about our service

We always welcome feedback from customers as it helps us to review and improve our processes.

We apply the same approach when investigating complaints about our office as for complaints about HMRC/VOA and the Home Office. Our GOV.UK website tells our customers how to raise concerns about our service. They can do this through our new electronic complaints form or by writing to us.

During the period April 2023 to March 2024, we received 26 complaints about the level of service we provided. The main areas of complaint related to customers unable to open our emails sent from the encrypted mailbox and the lack of clarity in respect of our document retention policy.

We always consider feedback and where wider lessons are raised; we use these opportunities to improve our customer service.

Queries about Adjudicator’s Office recommendations

The Adjudicator’s Office does not reconsider cases because the customer does not agree with our decisions. However, in some cases we can decide to provide a further response to clarify the recommendation. All our recommendation letters explain the process for referring a case to the Parliamentary and Health Service Ombudsman if the customer remains dissatisfied with our handling of their complaint.

Statutory reporting requirements

Freedom of Information (FOI) Requests

As a public authority we must publish certain information about our activities and members of the public can request information held by a public authority. During April 2023 to March 2024, we received 16 Freedom of Information requests.

Subject Access Requests (SAR)

Under Article 15 of the UK General Data Protection Requirement (GDPR), we must provide customers with any personal data we hold if they request it. During the period April 2023 to March 2024, we received 26 Subject Access Requests.

Funding for the financial year 2023 to 2024

HMRC customers form the largest group of users of the Adjudicator’s services. The Service Level Agreement between HMRC and the Adjudicator ensures staff, accommodation, equipment, and materials are supplied to enable him to provide an independent review of unresolved complaints. A funding agreement is in place between the Adjudicator’s Office and the Home Office to provide resources for the Windrush Compensation Scheme. The Adjudicator is an independent appointment agreed by the organisations for which he adjudicates.

The Adjudicator’s salary is set by reference to the Civil Service SCS2 pay scale.

Our delegated budget for 2023 to 2024 was £2.925m and expenditure from the same period £2.869m.

How we are organised

The Adjudicator

Helen Megarry left the Adjudicator’s Office on 31 March 2023. Paul Douglas was appointed as interim Adjudicator in April 2023 until September 2023 when Mike McMahon was appointed as the permanent Adjudicator.

Head of Office

Deputy Head of Office

Head of Strategy and Corporate Services

Head of Operations

How to contact us

Online

https://www.gov.uk/government/organisations/the-adjudicator-s-office

Post

The Adjudicator’s Office

PO Box 11222

Nottingham

NG2 9AD

Phone

Telephone: 0300 057 1111

Monday to Friday, 9am to 5pm

Closed weekends and bank holidays.

Please note that we are only able to help with complaints about HMRC and the VOA, and complaints and reviews for the Home Office’s Windrush Compensation Scheme.

-

2021 to 2022 adjusted to 190 following review, 2 cases removed as premature, and 3 cases included as additional late receipts ↩

-

32 case adjustment due to being identified as premature and deducted from total figure in 2021 to 2022 ↩

-

includes investigation, withdrawn, out of remit and department reconsidered ↩