The Adjudicator's Office annual report 2022

Published 16 June 2022

Adjudicator's Office annual report logo

The role of the Adjudicator

The role of the Adjudicator was created in 1993 to introduce an independent tier of complaint handling for Her Majesty’s Revenue and Customs (HMRC) and the Valuation Office Agency (VOA) (collectively ‘the departments’). Since December 2019 we have held an independent role in reviewing decisions made under the Home Office’s Windrush Compensation Scheme (WCS).

The Adjudicator provides a free, impartial, and independent service and investigates all complaints within her remit. We resolve individual complaints but also highlight trends in both customer service and complaint handling. The Adjudicator will continue to push the departments to improve quality in complaint handling, so that customers will only feel the need to escalate more sensitive and complex complaints to the Adjudicator’s Office.

The Adjudicator expects HMRC, the VOA and the Home Office to apply skill and understanding to their complaint handling. They should explain their decisions clearly and with reference - where appropriate - to relevant rules, guidance or legislation. Our GOV.UK pages set out the issues that the Adjudicator can look at and the boundaries to our scope of enquiry for HMRC, the VOA, and the Home Office Windrush Compensation Scheme.

Our Service Level Agreements underpin the role of our office in providing an impartial, proportionate consideration of complaints, without interference.

There are no targets for the number of cases upheld and we make all final decisions on cases with the approval, or under the delegated authority of, the Adjudicator.

During 2021 to 2022, the Adjudicator was supported by staff in two locations. Most of our staff are specialist investigators, supported by a business management team.

Our Role and Vision

Our Role

The Adjudicator’s Office:

-

resolves complaints that come to us by providing an accessible and flexible service and by making fair and impartial decisions

-

supports and encourages effective resolution throughout the complaint handling process

-

uses insight and expertise to support the government departments to learn from complaints and improve services to customers

Our Vision

By working with the departments and using our independent insight and expertise, we will achieve these positive outcomes for our customers:

-

complaint handling is trusted as fair

-

responsive to customer needs

-

insight from complaints improves services for customer

The Adjudicator’s foreword - Helen Megarry

Adjudicator, Helen Megarry

Helen Megarry

This is the Annual Report for my sixth year as Adjudicator. I am happy to be able to report on another successful year for the Adjudicator’s Office. Although in some ways we have returned to a more normal way of life this year, the pandemic continued to have a marked influence on our customers, our lives and our work. We have however maintained our performance, our service levels and our commitment to supporting learning from complaints.

During the reporting year we received 1029 complaints about HMRC for investigation. This was a 19% reduction from last year, when numbers were temporarily inflated by large numbers of complaints about the COVID-19 support schemes. We upheld 32% of complaints investigated, which is a return to a similar level as before the pandemic.

HMRC’s own complaints performance was impacted by the legacy of managing the COVID-19 support schemes. There are significant backlogs in various areas of high-volume operations, and this has a knock-on effect on complaints – with many customers struggling to get timely responses to their issues. We received an additional 930 complaints from customers that were premature, either not having been through or having failed to complete HMRC’s internal complaint process. We understand the causes of this and HMRC have a recovery plan, but the situation is clearly stressful for many customers in need of resolution to their problems. We signpost or escalate complaints directly where needed and provide focused support to customers that might be vulnerable.

We received 40 complaints about the VOA, which was a reduction from 46 in the previous year. We upheld 16% of the complaints we investigated, although overall numbers were low. The VOA have embarked on a transformation of their approach to customers and are re-aligning their complaints systems to those strategic aims. We welcome the openness with which they have approached the challenge and are pleased to be able to support them in that journey. Their current approach shows a willingness to learn from feedback to improve their service to customers.

We received 136 requests for reviews of decisions made by the Home Office under the WCS. Although the numbers are relatively small our Windrush caseload has a range of complicating features relating to the Scheme itself, the nature of the claims and the heightened political and legal scrutiny of our decisions.

We continue to work with HMRC and the VOA to support learning from complaints through the Complaints Insight Board. The group plays an instrumental part in driving through resolution of issues that raise difficult or complicated cross-departmental issues. It also provides a useful forum for seeking input to solutions from the variety of perspectives represented by the complaints community, operations, policy, and legal teams. A significant area of work was the Board’s contribution to a revised complaints strategy for HMRC.

In past years I have commented on inconsistency of approach and attitude to complaints and learning within HMRC and lack of clear accountability to creating a positive complaint environment at a senior level. Over the past 2 to 3 years this issue has been addressed and HMRC have established an over-all corporate responsibility for complaints. Adoption of the new complaint strategy by HMRC’s Executive Committee last summer was further demonstration of this commitment. The strategy confirms their ambition to seek a more transformational approach to complaint handling and learning. Work is currently underway to convert the strategy into operational practice. In alignment to this piece of work HMRC have signed up to the Parliamentary and Health Service Ombudsman’s (PHSO’s) new complaint standards which will further support an organisation wide approach to complaints.

We have been involved in discussions about embedding HMRC’s Charter. We see evidence of understanding and implementation at senior levels, but a cultural shift of the kind embodied by the Charter is not there yet across the whole of HMRC. We continue to work on our own capacity and capability to provide insight on learning from complaints – and for HMRC we will focus that on their progress against the Charter. The Charter has the potential to drive radical change within the department and delivery of the Charter commitments is a key element of their strategy to build trust with customers. We are developing mechanisms to feedback directly on delivery of services against all aspects of the Charter and have a clear role in holding them to account on those commitments.

In support of our Learning from Complaints strategy we are investing in developing productive, 2-way relationships with stakeholders across the departments. We find ourselves more regularly sighted on issues as they develop, rather than when complaints are raised with us. This demonstrates a wider change in approach that seeks to bring a customer perspective into decision making at an earlier stage and to value the potential learning from complaints.

Finally, but importantly I would once again like to thank our team for attacking the challenges of the year with so much enthusiasm, good humour and creativity. We introduced a strengths model across the organisation, involving personal profiling and coaching, and that was well received. It has supported a very positive approach to personal development, a new language for talking about our performance and an open appreciation of the diversity within our team. Our people work hard and take pride in what they do – for that I thank them.

Helen Megarry

Head of Office Update - Mike McMahon

Head of Office, Mike McMahon

Mike McMahon

Last year I was able to report an improving landscape in terms of engagement between my office and our stakeholders – HMRC, the VOA and the Home Office. Working well with those departments ultimately benefits our mutual customers. I am very pleased to report that this has continued and strengthened.

There are many areas that I could highlight but will instead focus on one overarching area: policy. Helen had raised concerns previously about how ministerial policy is operationalised. She was rightly concerned that the customer was not the first priority. We have seen a significant shift. For HMRC’s part, there is good evidence to show that subtle but important changes can be made to implementation that delivers positive outcomes for customers and increases revenue collection.

The High Income Child Benefit Charge is a case in point. HMRC recognised that they needed to do more to engage customers in the process. This improved both customer satisfaction and compliance. Regardless of motivation, be it revenue collection or great service, both can be achieved by focusing on the needs of the customer.

We have also seen a shift within the VOA to a customer-centric agenda which we warmly welcome. The VOA have made it quite clear that they see complaints not as something to defend against, but as an opportunity to learn.

But as practice improves so the bar is raised.

We see the HMRC Charter as a driver for root and branch change, focused on the needs of the customer whilst recognising the fundamental role of HMRC and the VOA to fairly collect revenue. We will be using the Charter to hold HMRC and the VOA to account. That means highlighting both what we see that is good but also where they can make improvements, anchored to the Charter principles.

We have invested significant time and resource into developing a tool that allows us to categorise complaints at the granular level. Every complaint that we see is categorised into key themes – both the positive and where there could be improvement. We are starting to use this data to drive evidence-based conversations and to allow our stakeholders to improve their practice, grounded in what we see in the round, rather than on a case-by-case basis.

Our case categorisation tool is one of the few ways HMRC and the VOA can test how they are doing against their Charters. Our offer in this area will build with increased data and understanding of the analytical opportunities it provides.

Where the news is less positive is with regards to the improvement of our systems. I had hoped to report that we had developed and delivered our new case management system – a joint Adjudicator’s Office and HMRC project.

Whilst we have worked very well with HMRC’s core business, we have found interaction with the IT program delivery functions more challenging. Our core requirements are still not met which means the timeline for delivering the new system has passed. Work continues to ensure we get the system we need now and for the future. I anticipate being able to report more positively next year.

Some of the most challenging casework we have seen over the last year has been in relation to the WCS. We have an expert team of investigators and managers dealing with these cases and we have learnt a lot. The cases are equal parts emotive and complex, and the landscape is highly political. We have also seen legal challenges come our way. With a methodical approach we have honed our practice and are able to report with authority on what we see are the strengths and weaknesses of the scheme.

It was with great pleasure that we received our People Survey results in December 2021. In every area engagement improved to record levels. There was not one indicator where we did not exceed the civil service average, in most areas, significantly.

I have seen high levels of engagement in every area of the office as we have undertaken a large-scale change programme. We have brought our people into our project and governance work in a way that perhaps felt different to what they were used to. But I can only commend the skill and enthusiasm that our people have brought to bear in numerous areas – from our case categorisation tool, to our Wellbeing, Diversity and Inclusion activities to the huge time and effort put into improving our (primarily digital) infrastructure.

On numerous occasions over the last year, our people have been celebrated externally for the work that they do. They have helped our stakeholders to improve their approach in diverse areas including recruitment, learning and development and a mature approach to supporting vulnerable customers.

Later in this report we focus on our business plan and our corporate aims. Those areas reflect the fruits of the effort our people have put into being the best they, and we, can be. I am indebted to them.

It would be remiss of me not to highlight the personal support I get from Helen and my senior team. We work closely and as critical friends in the truest sense of the term. This, combined with the energy and skill of all our people is the foundation of our success. We go into the next year from a position of continuing strength.

Mike McMahon

Performance and analysis of complaints investigated

The complaint process - HMRC and the VOA

The Adjudicator can consider how HMRC, or the VOA have handled a complaint, whether they have followed their policy and procedure and made reasonable decisions. Where the Adjudicator thinks they have fallen short, she will recommend what they need to do to put matters right. The Adjudicator will feedback lessons learnt to HMRC or the VOA where she thinks this will make their customer service better.

We do not usually accept cases that we receive more than six months after the final response from the department.

If the complaint is something we cannot look at, we will explain why. If customers are dissatisfied with any one stage of the complaint process, they have the right to take the complaint to the next stage.

Investigation

- we review information customers send us

- we carry out any necessary enquires

- we reach a decision on whether the department did anything wrong

Resolution

- we will make a formal decision on the complaint

- this will include recommendations if the Adjudicator decided the department needs to put things right

- we will write to our customer and the department explaining our decision

The Parliamentary and Health Service Ombudsman

Once we have given our decision, our part in the complaint is over. If our customer believes their complaint has not been resolved, they can ask a Member of Parliament (MP) to put their complaint to the Parliamentary Ombudsman.

Workload 2021 to 2022

Total complaints received

Number of complaints received

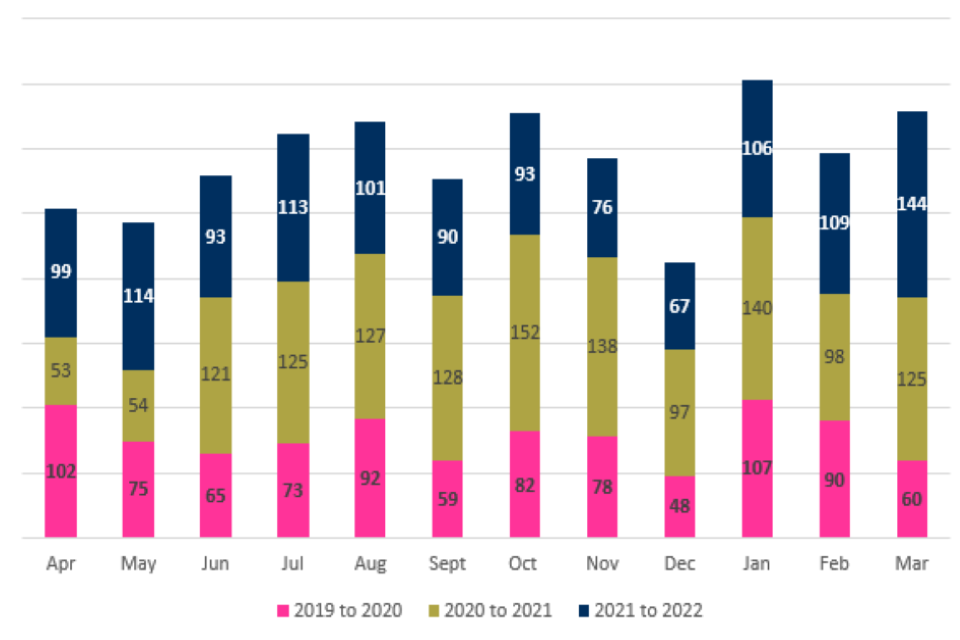

The table above compares the number of complaints received by month for the years 2019 to 2020, 2020 to 2021 and 2021 to 2022. It highlights the increase of complaints resulting from the implementation of COVID-19 compensation schemes from June 2020 onwards.

Download a spreadsheet with the underlying data for this chart in an accessible format.

Number of complaints

| Number of complaints handled | 2019 to 2020 | 2020 to 2021 | 2021 to 2022 |

|---|---|---|---|

| Cases on hand 1 April 2021 | 322 | 177[footnote 1] | 190[footnote 2] |

| New cases for investigation | 931 | 1358 | 1205 |

| Cases resolved [footnote 3] | 1078 | 1346 | 1122 |

| Cases on hand March 2022 | 175 | 189 | 273 |

The table above shows comparisons for 2019 to 2020, 2020 to 2021 and 2021 to 2022 for cases on hand at the beginning of each year, new cases for investigation, cases resolved and the number of cases on hand at the end of each year. Although work on hand has increased, it is within our tolerance levels.

Complaints on hand by department at 1 April 2022

| Department | Complaints on hand |

|---|---|

| HMRC | 215 |

| VOA | 8 |

| Home Office | 50 |

| Total | 273 |

The table above shows the breakdown of work on hand at 1 April 2022 by department.

Outcomes of complaints received

| Department | Cases investigated | Withdrawn | Out of Remit |

|---|---|---|---|

| HMRC | 991 | 10 | 204 |

| VOA | 34 | 0 | 28 |

| Home Office | 97 | 3 | 6 |

| Total | 1122 | 12 | 238 |

The ‘Outcomes of complaints received’ table shows the breakdown of the number of cases we investigated in 2021 to 2022 for HMRC, the VOA and the Home Office. A further breakdown shows how many of those cases were withdrawn and out of remit.

Outcomes of investigations completed

| Department | Not upheld | Fully upheld | Partially upheld |

|---|---|---|---|

| HMRC | 525 | 49 | 203 |

| VOA | 5 | 0 | 1 |

| Home Office | 70 | 4 | 13 |

| Total | 600 | 53 | 217 |

The table above shows the split between the outcomes of our investigations in 2021 to 2022 for HMRC, the VOA and the Home Office.

Premature complaints

| Department | Premature Complaints |

|---|---|

| HMRC | 930 |

| VOA | 13 |

| Home Office | 6 |

The table above shows the split between premature complaints 2021 to 2022 for HMRC, the VOA and the Home Office.

Redress

| Department | Worry and distress (£) | Poor complaints handling (£) | Liability given up (£) | Costs (£) | Total (£) |

|---|---|---|---|---|---|

| HMRC | 9,515 | 11,345 | 11,272 | 1,550 | 33,682 |

| VOA | 0 | 0 | 0 | 0 | 0 |

| Total | 9,515 | 11,345 | 11,272 | 1,550 | 33,682 |

The table above shows the breakdown of the redress payments we recommended for HMRC and the VOA. This year we recorded redress payments under the headings ‘Worry and distress’, ‘Poor complaints handling’, ‘Liability given up’ and ‘Costs’.

HMRC update and case studies

When we determine the outcome and learning from individual complaints, we consider the individual who complained to us, and the implications for HMRC’s wider service for all customers.

During the year 2021 to 2022 the Adjudicator resolved 991 complaints from HMRC customers. The number of complaints partially or fully upheld was higher than that in 2020 to 2021 at 32%. The lower upheld rate in 2020 to 2021 (24%) was because so many of the complaints were about the policy or the application of the rules for the COVID-19 recovery schemes. Areas in which either we had limited remit or HMRC had limited discretion.

The Adjudicator continues to stress to HMRC that a focus on a target based numeric system will not encourage a forward-looking culture of learning from complaints. We have seen improvements in this area, especially at the strategic level and would encourage HMRC and the VOA to continue to work to embed this good practice in all areas of their complaints’ teams. The Charter is the right vehicle to introduce those customer-centric principles.

| Outcome | 2019 to 2020 | 2020 to 2021 | 2021 to 2022 |

|---|---|---|---|

| Not Upheld | 459 | 743 | 525 |

| Partially Upheld | 297 | 243 | 203 |

| Fully Upheld | 61 | 66 | 49 |

| Our of Remit | 207 | 202 | 204 |

| Withdrawn | 0 | 12 | 10 |

The table above shows the comparison of ‘Not upheld’, Partially upheld’, ‘Fully upheld’, ‘Out of remit’, and ‘Withdrawn’, resolutions for 2019 to 2020, 2020 to 2021 and 2021 to 2022. It shows an overall increase in the proportion of upheld cases against 2020 to 2021.

We amended the descriptors for the categories of outcomes of our investigations for clarity, but the underlying categorisation remains the same as in previous years.

HMRC accepted all final recommendations that we made during the year.

Redress paid

Where appropriate we recommend HMRC pay customers financial redress in recognition of the poor level of service they received, and any relevant costs. We make recommendations in accordance with HMRC’s Complaints and Remedy Guidance. Redress can also include a recommendation that HMRC give up recovery of a customer’s liability.

| Type of redress | Redress Paid (£) 2021 to 2022 |

|---|---|

| Worry and distress | 9,515 |

| Poor complaints handling | 11,345 |

| Liability given up | 11,272 |

| Financial loss | 0 |

| Costs | 1,550 |

| Total | 33,682 |

The table above shows the sums recommended this year. ‘Poor complaints handling’ made up the largest figure in 2021 to 2022 followed by ‘Liability given up’.

Case Studies

Case study 1: Unreasonable delays in putting things right

Issues

In 2017, Mr A applied for and received a State Pension lump sum. He contacted HMRC shortly after receiving the money and queried if he had to pay any tax. HMRC told him he did not.

In 2020, HMRC contacted Mr A and told him tax was due on the lump sum – around a fifth of the money he received. Given what it told him in 2017, Mr A thought this was unfair. He told us that the demand had increased his depression because he was worried about how he would manage his future finances. He also said that his sleep was affected, and an existing medical condition exacerbated.

HMRC acknowledged that the advice given to Mr A in 2017 was wrong and apologised. It also offered Mr A £75 compensation. But the tax demand stood. Unsatisfied with HMRC’s response, Mr A asked us to investigate his complaint.

Investigation

HMRC had four years to notify Mr A of the underpayment from the end of the tax year when the shortfall arose.

We considered if HMRC should give up the tax under their Extra Statutory Concession A19 rules but concluded that there were no grounds to do so on this occasion. We found that the error in not applying the correct tax to the lump sum was likely to lie with the Department for Work and Pensions (DWP). Because of this, we did not think HMRC should write-off the tax.

When we looked at HMRC’s systems, we established that in 2018 an automatic reconciliation process took place that highlighted Mr A’s underpayment. But because of the level of the underpayment, no tax calculation was sent to Mr A. Instead, the records were flagged for manual review. The review did not take place until the summer of 2020. Mr A then received the tax demand.

We asked HMRC why it had taken more than two years to contact Mr A. They told us that there was no delay – it was within the four years they legally have to recover unpaid tax.

Decision and Feedback

We did not agree that there was no delay. We told HMRC that the customer service had not been good enough. We explained that while legally HMRC had four years, this did not represent good customer service for Mr A. We were also concerned that HMRC had not given enough consideration to the impact of the delay on Mr A which was clearly upsetting to him. We asked HMRC to pay Mr A £400 compensation in addition to the £75 previously offered. We also asked them to re-consider their process for reconciling tax owed in a timely manner.

Case study 2: Taking responsibility for loss of valuable documents

Issues

Mrs B sent a recorded delivery package to HMRC’s Child Benefit Office (CBO) containing her children’s birth certificates, non-UK passports and a claim form.

The birth certificates were returned to Mrs B but not the passports. When Mrs B queried this, HMRC told her that the CBO had not received the passports.

Mrs B provided the recorded delivery receipt which confirmed the weight of the package. This suggested that she had sent the passports. Mrs B asked CBO if the package was damaged and it told her they did not record this information. It did though record the birth certificates as ‘valuable items’.

CBO made enquiries of the Post Office who confirmed that passports had been sent to the relevant embassy around the time Mrs B sent them to CBO. CBO considered, based on what the Post Office told it, that it was likely that that the passports had become separated from the package in transit. Mrs B asked for compensation for the loss which she said was CBO’s fault. She explained that to get new passports, she would need to go to the country which issued them. CBO apologised for Mrs B’s inconvenience but said there was no evidence that it had lost the passports.

Investigation

We questioned CBO about their approach to handling incoming post. They told us that post was opened in a secure room and the contents scanned and recorded on a database before being returned to the customer. CBO did not record if packages were damaged when opened.

We concluded from the weight of the package that Mrs B had more likely than not sent the passports with the other documents. But we could not conclude that CBO had lost or mis-placed them. There was equally compelling evidence that the passports had been lost in transit.

Decision and Feedback

Although we did not ask CBO to compensate Mrs B for the lost passports, we were concerned about the procedures CBO had in place to deal with valuable documents. Specifically, that CBO did not record if a package was damaged. It also had no process for investigating allegations concerning lost passports. We were concerned that CBO tried to transfer responsibility onto the Post Office.

Because of this, we asked CBO to pay Mrs B £300 compensation. We also asked HMRC to reconsider its procedures when dealing with valuable documents as a matter of urgency. We are pleased that HMRC and CBO have since reviewed and improved this process.

Case study 3: Putting right system generated errors

Issues

Dr C was a locum doctor working with several National Health Service trusts. HMRC’s automated system recognised some large Pay As You Earn payments and calculated that her annual income would be over £100,000. As a result HMRC correctly issued a tax code that meant her employers would have to deduct tax at the higher rate of 40%. Her actual annual income was below the higher rate taxation threshold. She was also set up with a self-assessment account, although this was a mistake because she did not meet the criteria for self-assessment as her actual income was below the threshold.

As a result, Dr C overpaid tax of over £6000. She complained about the length of time taken to close the self-assessment account and to issue her tax refund.

Investigation

The tax overpayment was the result of Dr C paying income tax at the higher rate when her income fell below the threshold.

In the 2 weeks after Dr C alerted HMRC to the issue, they made 4 attempts to delete the self-assessment account before shutting it down. While HMRC were trying to delete the account, they were unable to reconcile the account and issue the refund. They carried out a manual reconciliation and issued the refund 5 weeks after Dr C raised the issue with them.

Decision and Feedback

HMRC acknowledged their errors and delays in this case during their complaint process. They apologised and offered redress – and we thought that was reasonable.

Although we did not uphold this complaint, it did highlight the lack of flexibility available to HMRC’s advisors when confronted with incorrect customer data.

In this case, when Dr C contacted them to query her account an HMRC advisor set her up for self-assessment because there was a system generated indicator on her account. Had they made any enquiries at that point the account would not have been set up and they could have paid the refund without delay.

HMRC confirmed that they updated their guidance relating to self-assessment indicators. This will help prevent them from setting up self-assessment accounts in error for customers who are off-payroll workers.

Case study 4: Taking responsibility for errors affecting Universal Credit

Issues

HMRC allocated Ms D’s National Insurance Number (NINO) to another taxpayer with the same name and date of birth. Ms D was receiving Universal Credit and the DWP stopped her claim in October 2020 and opened a fraud investigation.

Ms D contacted HMRC and told them what had happened. She had contacted the other taxpayer and established the error. HMRC said they could not help because their guidance directed them to wait for the fraud investigation to finish. HMRC ignored Ms D’s complaint – the impact of the error was significant. She said that she lost her home and had to rely on food banks for over 5 months.

Ms D’s Universal Credit was reinstated and backdated in March 2021. However, the problems with her compromised NINO continued.

When Ms D complained via her MP in October 2021, HMRC registered and investigated her complaint. The DWP told HMRC that they decided not to investigate because they understood that a misfeed in HMRC’s Real Time Information caused misallocation of the NINO.

HMRC acknowledged and paid redress for their errors, Ms D complained that the redress was insufficient to recognise the delays in resolving the matter, and the impact it had on her.

Investigation

Ms D tried several times to enlist HMRC in helping her to resolve the issue with her NINO. She explained to them what had happened and gave them details of the other taxpayer involved. HMRC repeatedly told her that they could not help while the DWP investigated the matter.

There was no evidence that HMRC made any proactive enquiries of the DWP to establish the outcome of their fraud investigation until they finally registered the complaint.

HMRC eventually acknowledged that the misallocation of the NINO was the result of an error in their systems. They resolved the issue a year after Ms D first reported it.

Decision and Feedback

HMRC acknowledged their mistakes and offered redress of £1500. Both the original error and the subsequent delay in putting it right had a severe impact on Ms D. However, the redress offered is significant in the context of HMRC’s Complaints and Remedy Guidance, we saw evidence that HMRC had considered the impact of their actions on Ms D and the redress offered was reasonable.

We were critical of HMRC’s actions. It was not reasonable that they delayed investigation of the complaint pending the outcome of the DWP’s investigation. Had they properly investigated when Ms D first raised the issue, HMRC could have resolved the complaint in February 2021.

HMRC took a narrow view of their responsibility and relied on guidance that indicated they should defer to the DWP while they carried out an investigation. The application of the guidance in these circumstances was flawed and we advised that they review it.

Case study 5: Considering customer circumstances with historic tax credit debt

Issues

Mr and Mrs E had a joint tax credit claim until 2011. Mr E stopped working in 2010 due to ill health. In 2021 Mrs E lost her job after a period of furlough and started to claim Universal Credit. HMRC wrote to Mr and Mrs E in May 2021 informing them of tax credit overpayments of nearly £2000 from their claim in 2011.

The customers complained that the Tax Credit Office (TCO) had not told them about the debt, and they could not afford to re-pay it.

Investigation

We saw that Mr and Mrs E received an overpayment of tax credit for 2 years between 2009 – 2011. Although the couple regularly updated the TCO with changes to their circumstances, the overpayments arose because their income at the end of the year was higher than the estimated income used to calculate their claim.

When Mr E stopped working, Mrs E took on caring responsibilities and with her part time hours, they were no longer eligible for Working Tax Credits. This meant that the TCO could not recover the overpayment from an on-going claim. When Mrs E lost her job during the pandemic, she claimed Universal Credit. The TCO transferred the debt to the DWP for recovery.

We asked the TCO to consider whether they could use their discretion to write off the debt under exceptional circumstances. TCO said no and suggested the couple contact the DWP. The TCO did acknowledge their failure to communicate with the customers about the debt and offered them £50 redress.

Decision and Feedback

We upheld the complaint. For nearly a decade after the overpayment arose and after the tax credit payments ended there was no contact by the TCO. The overpayment was legally recoverable and the TCO followed their guidance by transferring it to the DWP. However, when the Mr and Mrs E complained, the TCO failed to consider their financial and health circumstances. Neither did they consider the impact of their delays in recovering the debt on the customer’s ability to repay it.

The complaint was about the TCO’s handling of the debt and the TCO should have taken responsibility for resolving it, without referring the customers to pursue the matter with the DWP. The TCO were solely responsible for collecting the underpayment for well over six years but failed to do so. We found it unreasonable for the TCO pass responsibility for resolving the complaint to the DWP.

The TCO agreed to recall and waive the debt and paid a further £100 redress.

Case study 6: Paying reasonable agents costs

Issues

HMRC claimed that Ms F had underpaid tax for 2017 to 2018. In August 2020 her agent said that HMRC had raised a Pay-As-You-Earn assessment along with her Self-Assessment, which had duplicated her tax liabilities. They said she did not owe any tax. Ms F then received a late payment penalty notice. The agent raised a complaint and referred to their fees.

Over the next four months there was further correspondence. The agent successfully appealed against the penalty and interest. Because HMRC did not deal with the underlying tax the agent wrote again, asking them to resolve the duplicated tax liability. This was done in May 2021.

The agent expressed dissatisfaction with the delays and asked for HMRC to pay the agent’s fees. HMRC responded that the underpayment was not the result of their error but because Ms F had made payments for tax using the wrong reference number, which meant that her payment was misallocated and left an underpayment showing on her account. They apologised for delays in resolving the issue and offered £30 redress. However, the issue had not been resolved and in August 2021 Ms F received another tax liability notice.

Investigation

By the time the complaint came to us in November 2021, Ms F had incurred agent fees of £700. At that stage HMRC had offered £50 redress. There were several aspects of the complaint still outstanding.

Decision and Feedback

We considered that the complaint handling in this case had been poor and subject to considerable delays. We acknowledged that HMRC were operating in difficult circumstances during 2021 which contributed to the delays. The case demonstrates some of the wider impacts of the pandemic on HMRC’s services. However, the principles of redress do not change with the operating conditions. From the customers perspective HMRC handled the case poorly and it took a long time to resolve. We recommended a further £150 redress and reimbursement of costs in full.

Case study 7: Complaint handling – taking a customer’s vulnerability into account

Issues

Mr and Mrs G were subject to an enquiry by HMRC’s Counter Avoidance Team. When the enquiry was finalised Mr and Mrs G paid their outstanding tax in June 2021. Between 20 and 23 December 2021 the G’s received six charge notices telling them they owed over £1 million in taxes. They were unable to contact HMRC until 4 January 2022. Both Mr and Mrs G are in poor health and the demands caused them distress and impacted on both their physical and mental wellbeing.

Mr G emailed their Counter Avoidance caseworker about the charge notices in early January and received a call back two days later. The caseworker confirmed that they owed no further tax and signposted them to make a complaint. Mr G submitted a complaint asking for £75,000 in redress. HMRC responded, acknowledging that an error in their system had generated the notices and explaining how it had occurred. They noted that the charge notices contained outdated contact information. They apologised and offered £1000 redress.

Mr G remained dissatisfied and pursued his complaint, he considered the redress offered ‘derisory’ and revised his request to £40,000. His calculation of redress was based on the interest that he paid on his settlement. HMRC responded explaining that he paid interest as a part of the contractual settlement.

Investigation

Sending out the charge notices in error undoubtedly had an impact on Mr G and was compounded by the timing over the Christmas period and the outdated contact information given on the notices. However, HMRC acknowledged their mistake and the impact it had on Mr and Mrs G as soon as they raised the issue. They also offered redress that is substantial under their policy.

Decision and feedback

We did not uphold the complaint. We considered that HMRC provided a thorough response to the complaint in the first instance. They carried out a full review of the customers circumstances and clearly took account of their vulnerabilities when assessing the level of redress.

In his complaint Mr G was persistently confusing the interest that he paid on his tax settlement with the redress that he thought he should receive as compensation for distress caused by the error in sending out tax notices. While HMRC gave a clear explanation of the interest payments, they could have been clearer in explaining the relevance of their Complaints Remedy Guidance as context for their offer of redress. However, we considered the complaint well-handled and the redress appropriate.

Stakeholder Feedback

HMRC – First Permanent Secretary and Chief Executive Jim Harra

Jim Harra

Jim Harra

HMRC greatly values our engagement with the Adjudicator and her feedback helps us to deliver both our strategic objectives and Charter commitments. I am pleased that the Adjudicator recognises our Charter commitments as a key driver to support our ambition to be a trusted, modern tax and customs organisation.

As the Adjudicator stated, the legacy of the COVID-19 pandemic has continued to affect HMRC’s activities. HMRC are proud of our role in the government’s response to the COVID-19 pandemic. Throughout 2021 to 2022 we flexibly deployed our people and resources in the most effective way to meet emerging priorities and shifting customer needs.

During the pandemic, our focus was on supporting our customers through the various COVID-19 support schemes. As a result, we made choices on the work we prioritised to protect our essential services and the livelihoods of our customers. This meant that some of our customer service levels weren’t where we would normally expect them to be. As HMRC works to restore normal service standards, we recognise that some customers may experience delays as we work through our backlog. This has resulted in an increase in the number of complaints prematurely escalated to the Adjudicator. We acknowledge this increase and are committed to working with the Adjudicator’s office to reduce the impact on our customers. We have provided focussed support for customers who need extra help and improved customer communications, including updating the Complain about HMRC pages on GOV.UK.

Working in collaboration with the Adjudicator’s office, we are pleased to have launched a strategy to transform the way we handle complaints in HMRC, placing the customer and their individual needs at the heart of our decision making. The strategy will also align the department to the PHSO’s new UK Central Government Complaint Standards, which will be launched in Autumn 2022.

As part of this we are introducing a new case management system through a joint project with the Adjudicator’s office. Although the project is behind schedule, we are confident that we will successfully deliver the new system this year. The system will provide significant improvements to the complaints handling processes and enable better use of complaint feedback to gain insight and support improvements to the overall customer experience.

I was pleased to see the publication of the Adjudicator’s 3-year Business Plan in September 2021, including their new Corporate Aims and note the good progress made in this year’s report. The Adjudicator’s People Survey results are a testament to the work that has taken place within the Adjudicator’s office to achieve its ambition to become a learning organisation.

HMRC published its formal response to the Adjudicator’s last Annual Report in November 2021 and is committed to publish a response to this report by Autumn 2022.

Jim Harra

VOA update and case studies

During the period 2021 to 2022 we received 40 new complaints. We resolved 34 cases in total but only 6 were in our remit to investigate.

The Adjudicator is unable to consider complaints about valuation decisions as these are outside of her remit. A significant number of the complaints that come to us ultimately relate to valuation decisions which results in a high percentage of complaints out of remit.

Although this has always been the case, we have seen a significant drop in the number of cases coming to us that are eligible for investigation. We are working with the complaints teams at the VOA to understand the reasons behind this. We are also able to give the VOA feedback on complaint handling from the cases that we see, regardless of whether they are in remit to investigate.

Of the cases we closed this year, most were about council tax and included concerns about the correct council tax banding of properties.

| Outcome | 2019 to 2020 | 2020 to 2021 | 2021 to 2022 |

|---|---|---|---|

| Not Upheld | 21 | 19 | 5 |

| Partially Upheld | 3 | 3 | 1 |

| Fully Upheld | 0 | 1 | 0 |

| Out of Remit | 28 | 31 | 28 |

| Withdrawn | 0 | 0 | 0 |

The table above shows the outcome of VOA cases investigated. It shows ‘Out of remit’ complaints continue to make up most cases that come to us.

Redress Paid

On occasion, the Adjudicator recommends that the VOA pay a monetary sum of redress to customers in recognition of the poor level of service they received, and other relevant costs.

During the 2021 to 2022 year we made no recommendations to pay redress.

The VOA accepted all the Adjudicator’s recommendations.

Case Studies

Case study 1: Correct decision making let down by inadequate explanations

Issues

Ms H claimed a refund of council tax for her property on the ground that it was in the wrong council tax band during the time that she lived there. She complained that the VOA ignored information she provided in support of her claim and that they misadvised her during their investigation.

Investigation

When Ms H asked for a refund of council tax paid, the VOA initially told her that she could not request a banding review as she no longer lived at the property. She maintained that she did not want a banding review, only a refund. The VOA then advised her to submit evidence of the open market sales value of the property, but when she did, they told her again that only the current occupant of the property could apply for a review. Ms H complained

throughout the complaint’s process that she wanted a refund of what she said she had overpaid, not a re-banding of the property. The complaint handlers acknowledged that she had received poor advice to submit evidence in support of a claim that she could not make.

Decision and Feedback

We are unable to consider challenges to council tax banding as a part of a complaint. The position the VOA took in relation to the claim was correct – Ms H could not challenge the banding and was not entitled to a refund. However, there were failures in customer service and the VOA had not acted in line with their Charter. The responses that she received to her early enquiries were brief, repetitive and did not give a comprehensive response to the issues she raised or explain the limitations of the outcomes she could expect. Had the responses at the earlier stage been more engaged it is quite likely that Ms H would not have needed to escalate her complaint.

Case study 2: Managing unreasonably persistent complaints

Issues

Mr I complained that the VOA had delayed unreasonably in considering his request to review council tax banding of his property. He first approached us in August 2019. At that point we took the view that he was using the complaint process to seek to challenge the council tax banding, which was out of our remit.

When we initially considered the complaint, we noted that Mr I had been raising challenges about the banding from 1998. The VOA had reviewed the banding and considered it correct. Because Mr I continued to raise the same issues, the VOA wrote to him in May 2019 explaining that they would not engage in any further communication with him about the issue. We considered that their decision that Mr I’s actions fell under their policy for unreasonably persistent complaints was reasonable. We told Mr I that we would not consider any complaints about handling issues that were an attempt to re-open the banding decision.

Investigation

When Mr I raised his complaint with us again, we found that the VOA had written to Mr I in May 2021 agreeing to review his council tax banding. We also found that Mr I had continued to raise the issue using the VOA’s online ‘Challenge your council tax band’ system. This generated automated responses, but the VOA did not generally engage.

Decision and Feedback

The VOA acknowledged that they should not have written to Mr I about his challenge in May 2021. We decided not to consider the complaint further. We took the view that Mr I was seeking to reopen the substantive issue of the banding, and that to re-consider the issue would be inconsistent with our earlier decision.

We gave the VOA feedback noting the importance of acting consistently when dealing with customers that are pursuing their complaints unreasonably. It is important to review any new complaints to see if they are raising new issues, but equally they must manage such complaints robustly and consistently. The VOA made an entirely reasonable decision to draw a line under Mr I’s requests for a review of council tax banding after over 20 years of complaints. That action must be supported by a system that allows them to recognise when a customer is raising a new complaint – or continuing to raise an old one.

Although the number of customers that raise complaints in this way is relatively low, they are a feature of any complaint handling operation and they can be very resource intensive. Policies need to be underpinned by systems that support fair and consistent application.

Stakeholder Feedback

VOA – Chief Executive Jonathan Russell

Jonathan Russell

Jonathan Russell

Having held the post on an interim basis since March 2020, I was appointed as the VOA’s permanent Chief Executive in September 2021.

The VOA has a number of large changes on the horizon including a transformation of our IT systems and major changes to the Business Rates system. Alongside this we are also successfully delivering a revaluation of all non-domestic properties, which has been made all the more challenging by the COVID-19 environment. It is important to me that the Agency has a strong focus on making the customer journey as smooth and productive as possible while these changes embed.

Complaints have an important place in the VOA and the Adjudicator’s Office is a key part of our complaint process both for the organisation and for customers. I welcome the constructive and impartial challenge that the Adjudicator brings, as well as their insightful feedback. I am delighted with the Adjudicator’s positive comments about the work we’ve been doing across the VOA to transform our approach to customers and to align our complaints systems to our objective of providing an excellent customer experience.

Our productive relationships with the Adjudicator’s Office both on an operational and strategic level are helping drive continuous improvement in our complaints handling, and I am grateful for the advice and support they have given as we evolve and modernise our services.

Jonathan Russell

Home Office update and case studies

Since 2019 the Adjudicator’s Office has provided an independent review of decisions made under the WCS.

The government set up a fund the WCS to compensate people treated poorly because of decisions made by officials in relation to their immigration status. The issues are clearly emotive. People found their lives significantly damaged by poor decision making, with impact in some cases on multiple generations or spanning several decades.

Our remit however is narrow; we can only consider if the Home Office have fairly applied the rules relating to compensation. We cannot decide if the rules are in themselves fair. Neither can we substitute our judgement for that of the Home Office in assessing appropriate compensation. We can recommend that the Home Office reconsider a decision taking into account our findings. We also provide feedback to the Home Office on the service people have received when making a claim and the overall administration of decisions under the Scheme.

Through our individual reviews we provide feedback to the Home Office on their decisions, explanations and consideration of evidence. We have also reported on more of a thematic basis on a range of issues that come to our attention, for example: signposting of redress routes, providing clarity about the process and scope of the Scheme and the language used in their correspondence.

The Adjudicator reports to the Home Office’s External Windrush Compensation Scheme Oversight Board on a quarterly basis. She is also a member of the Administrative Justice Council’s Windrush Working Group.

We have seen this year a significant increase in numbers as the scheme gains traction with those affected. We anticipate similar levels next year.

Total of new requests for review

| New requests for review | 2019 to 2020 | 2020 to 2021 | 2021 to 2022 |

|---|---|---|---|

| Number received | 4 | 35 | 136 |

The table above shows the number of cases received each year for 2021 to 2022, 2020 to 2021 and 2019 to 2020.

Outcomes of Investigations

| Outcome | 2019 to 2020 | 2020 to 2021 | 2021 to 2022 |

|---|---|---|---|

| Not Upheld | 1 | 10 | 70 |

| Partially Upheld | 0 | 0 | 13 |

| Fully Upheld | 0 | 1 | 4 |

| Out of Remit | 1 | 0 | 6 |

| Withdrawn | 0 | 15 | 3 |

The table above shows outcomes of investigations for the years 2021 to 2022, 2020 to 2021 and 2019 to 2020.

Case studies

Case study 1: Impact on life - inability to demonstrate lawful status.

Issues

Mr J accepted the Home Office’s award for immigration fees and under impact on life as a primary claimant under the WCS. Mrs J claimed as a close family member and the Home Office also received an award under impact on life. This was because Mr J was unable to obtain a passport, which caused them to miss multiple family events outside the UK and negatively affected their relationship and family life.

The claimants asked us to review the Home Office’s decision on loss of access to employment, homelessness and discretionary awards. Mr J said he could not secure work due to his status and Mrs J stopped working due to the decline of her health. Mr J said that because he could not work, his pension contributions were 11 years short.

They said this set in motion a sequence of events that resulted in them having to sell their home and use the proceeds to rent privately. They subsequently became homeless when their funds were exhausted, and they could not afford rent. The claimants then accrued debts while their possessions were in storage, before the storage company sold up, and lost their possessions during the sale of the business.

In their claim they attributed this sequence of events and associated financial impacts directly to Mr J being unable to work due to being unable to demonstrate his lawful status.

Investigation

During their investigation the Home Office requested details of Mr J’s tax and benefit records from HMRC and the DWP. These records showed numerous instances of agency employment, several periods of fulltime employment that lasted multiple years and successful benefits claims during his periods of unemployment.

Mr J could not provide any documentary evidence from employers confirming that he was denied employment because he was unable to demonstrate his lawful status. In addition, the employment Mr J said he was unable to accept in 1997 and 2006, took place before the introduction of right to work checks in 2008.

The Home Office found Mr J’s claim did not meet balance of probability that he had been unable to access employment because he could not demonstrate his lawful status. This was because he had been able to access employment on and off during the period of loss claimed. He also successfully claimed benefits during his periods of unemployment. Both outcomes would have required him to demonstrate his lawful status.

As the claims under homelessness and discretionary heads were knock-on effects of his employment issues, the Home Office made no award under these categories.

Decision and Feedback

We found the Home Office’s decision to not pay an award under loss of access to employment, homelessness and discretionary heads of claim consistent with the WCS rules and guidance for decision makers. While Mr and Mrs J had experienced non-financial impacts because he could not obtain a passport, the Home Office were reasonable to conclude that their difficult financial circumstances; while occurring during the same timeframe as the uncertainty around his lawful status, did not meet balance of probability to have occurred as a direct result of his being unable to demonstrate his lawful status.

This case demonstrates a common theme of the WCS cases. Many claimants undoubtedly experience periods of financial and personal difficulty. However, even where there is evidence of those difficulties, their claims fall because they are unable to demonstrate a causal link to an inability to demonstrate lawful status. Many applicants misunderstand this aspect of the Scheme when applied to their own circumstances.

Case study 2: Impact on life - Loss of Access to Employment

Issues

Mr K was dismissed from his job in 2015 because he did not have documents to prove his right to work in the UK. This precipitated a range of applications as he tried to regularise his immigration status. When he lost work, he said that his physical and mental health deteriorated significantly. He had no funds, was unable to claim benefits and relied on friends and family for handouts.

Mr K made a claim under the WCS for compensation for Immigration Fees and Legal Costs, Loss of Access to Employment, Loss of Access to Benefits, Denial of Access to Banking, Denial of Access to Health Services, Impact on Life and Discretionary. The Home Office offered him over £100,000 in compensation for a combination of Loss of Access to Employment and Impact on Life. Mr K asked us for a Tier 2 review.

Investigation

It was not disputed that Mr K’s employment was terminated because he could not demonstrate his lawful status, which he successfully held for a number of years prior to 2015. The Home Office made a general employment award, compensating him for the period from when he lost his job to when he started new work.

Despite his medical problems, with treatment Mr K managed his conditions, and he was able to gain employment. He explained that losing his job was particularly destructive given his life history and after the loss, his mental health deteriorated, he suffered from anxiety and depression, and he received counselling and medication.

The Home Office offered an award at level 4 for Impact on Life. But they concluded that he had only demonstrated that his ability to live a relatively normal life was ‘seriously compromised’ with cumulative impacts experienced for a prolonged period as described under level 4. Mr K said he would never recover from the trauma and was entitled to an award at level 5.

Decision and Feedback

The Home Office considered medical evidence going back over a decade demonstrating long standing mental health issues. It did not dispute that Mr K suffered from mental health issues, or that his pre-existing condition was exacerbated when he experienced setbacks associated with being unable to demonstrate his lawful status. The only issue in dispute was the extent to which he could hope to recover in future.

An award at level 5 requires; profound impacts on a claimant’s life which are likely to be irreversible…involve major physical or mental health impacts, where the claimant has been permanently affected or where recovery or return to a relatively normal life is likely to take several years.

We concluded that the Home Office did not have sufficient evidence to safely decide that Mr K was not entitled to an award at level 5. It made the offer at level 4 on the assessment of historic medical records without a qualified psychiatric opinion as to long term impact. We recommended they obtain a suitable, up to date psychiatric report and review Mr K’s Impact of Life award considering appropriate evidence.

The Home Office agreed with our recommendation and made Mr K an additional award of £100,000 under Impact on Life at level 5.

Stakeholder feedback

Home Office - Permanent Secretary Matthew Rycroft CBE

Matthew Rycroft

Matthew Rycroft CBE

Throughout the last year the Home Office is pleased to have received continued support from the Adjudicator’s Office. Independent feedback is an essential contribution to ensuring that the Home Office can support WCS claimants and provide the best quality service possible.

Where the Adjudicator’s Office have made recommendations, Home Office staff working on the WCS give them careful consideration. When appropriate, they make fundamental changes to how they assess claims, and embed those changes in the WCS.

The Home Office is committed to continuing to learn from the wrongs of the past and making decisions that put the customer at the heart of everything we do.

Matthew Rycroft CBE

Wider office achievements

Our wider office achievements against our published business plan for the period September 2021 to March 2022

In September 2021 we published our 2021 to 2024 Business Plan which set out proposed activity for the next three years. As with our previous Business Plans, we continue to focus on four key themes: Our people, Our customers, Our organisation and Learning from complaints.

What was different from last time is that we committed to reporting on the success of our corporate aims as detailed in the plan for the period September 2021 to March 2022.

We have set out below our organisational achievements against the goals for year one of our business plan.

Our people - We will develop and engage our people to benefit from their experience and potential

Our Corporate Aim: We will develop and deliver a learning and development programme to improve the skills of all our people

-

all staff have completed a strength-based assessment followed by coaching with a senior manager all of whom have achieved an accredited coaching qualification

-

all managers have taken part in a 12-week bespoke leadership and development programme led by the Adjudicator and Head of Office

-

68% of our investigators have been awarded delegated authority to investigate and issue recommendations on behalf of the Adjudicator

-

3 members of staff have been accepted on to HMRC’s STRIDE programme, a tailored mentoring scheme for people from lower socio-economic backgrounds

Our Corporate Aim: Our diversity, wellbeing and inclusion plans will ensure all our people feel supported and valued

-

our People Survey results for 2020 to 2021 showed a 4% increase in inclusion scores to 87%, which is 5% above the civil service average

-

we have increased discussion of our organisational values and how they are relevant to our daily work through team meetings and all office activities

-

we have set up a dedicated Diversity, Wellbeing and Inclusion plan which oversees our wellbeing activities and promotes ongoing discussion around diversity and inclusion issues

-

our dedicated Community Group supports initiatives for work-life balance by encouraging fun activities aimed at promoting wellbeing and supporting charitable causes

Our Corporate Aim: To build and develop an engaged organisation through inclusive and proportionate communications

-

we have recruited a dedicated communications officer

-

our new Smarter Ways of Working (SWoW) project supports staff with both advances in IT developments and to adapt to our new working environment in a way that is easy for all to understand

-

bi-monthly all office dial ins provide an opportunity for all staff to share important messages and updates on both work issues and pastoral initiatives

-

we have held two virtual away days in the last 12 months, ‘Building on a position of strength’ and ‘Developing our Learning Organisation’. Our most recent away day in March 2022 was face to face. These were great opportunities to harness engagement across the organisation, using feedback to enhance our aspirations as a learning organization

Our Corporate Aim: We will enhance our quality assurance process that highlights both areas of development and strength

-

our new Quality Assurance project has brought together staff from all grades and areas of the organisation to focus on this crucial area

-

for the first time, we have clear sight on the quality of our work at individual, team and organisational levels, allowing us to direct development resources proportionately

-

our Business Management Team have put in place rigorous quality measures to ensure all data we report is wholly reliable

Our customers - We will continually improve the service we provide our customers

Our Corporate Aim: We will ensure that our customers feel heard when they raise concerns about our service

-

we treat all complaints about our service seriously and aim to resolve any issues raised that are within our control promptly. We promote use of a third-party online survey for customers to comment on the quality of the service we provide

-

we have developed and introduced a new forecasting tool to ensure that we are properly resourced to meet demand – which has fluctuated significantly during the pandemic

-

our internal processes ensure we deal with Freedom of Information (FOI) and Subject Access Request (SAR) requests in accordance with legislation. We have not in any case exceeded the time limits set out in law

Our Corporate Aim: We will work with customer groups to support strong customer service

-

we have contributed to PHSO’s review of cross government complaint standards – and regularly contribute to cross-government complaints initiatives

-

we have worked closely with HMRC to ensure that their Charter is something that we can test in the complaint environment

Our Corporate Aim: We will establish strong working relationships with and engage fully with all internal and external customers and stakeholders

-

we are a key player in the delivery of our new digital systems (a replacement case management system and improved telephony platform), working with HMRC, IT providers and stakeholders

-

through our Learning from Complaints project work we are developing the reach of our HMRC stakeholder meetings to include the full range of customer complaint teams

-

we are providing support to the VOA as it looks to revitalise its customer offer

Our Corporate Aim: We will reduce the number of complaints that come to us prematurely

-

we have worked closely with HMRC to understand why we see premature complaints. By using better data and in partnership with HMRC we have analysed the complaint journey and identified where issues occur

-

to provide increased confidence in our data we have improved our internal processes and relevant training to our complaint investigators

Our organisation - We will continue to transform the way we work, responding to the needs of our customers to become a more efficient and accountable organisation

Our Corporate Aim: We will ensure that our digital platforms are fit for purpose and support easy access for our customers and usability for our people

-

our new case management system and telephony platform will be introduced in 2022

-

our ability to work remotely with minimum disruption has been held up as an example to HMRC stakeholders. One of our technical team was recognised for a piece of significant work in this area and received the HMRC ‘Even Smarter Working’ award

Our Corporate Aim: We will learn from the Coronavirus (COVID-19) pandemic and ensure that the positives of a flexible approach to work are maintained while ensuring our culture remains strong

- throughout the year we have had ongoing conversations with our people about what the working world will look like post-pandemic. This has included specific sessions and surveys. We have committed to greater flexibility and are at the forefront of implementing HMRC’s Smarter Ways of Working initiative

Our Corporate Aim: We will operate efficiently, balancing strong performance and cost effectiveness

-

our new forecasting tool has provided increased flexibility in terms of case-management and our ability to better manage our resources, allowing space for our people to explore development opportunities to improve their skills

-

we produced our Corporate Aims following office-wide conversations, now reflected in the aims and objectives of all our people at every grade contributing to our collective success

-

we have recruited to maintain staffing levels, whilst remaining within our allocated budget constraints

Learning from complaints - We will use our insight and expertise to help our stakeholders learn from complaints to improve services to customers

Our Corporate Aim: We will build strong working relations with our stakeholders

-

we have prioritised engagement with our stakeholders this year with success. The strategic Complaints Insight Board continues to ensure that strong customer outcomes are at the forefront of HMRC and the VOA’s minds. Every issue we have raised at the board has been successfully addressed in a timely manner

-

we have begun reaching out directly to departmental complaints teams, this has improved engagement and understanding at the practitioner level and is popular within our office and with HMRC and the VOA

-

we are revitalising our Single Point of Contact meetings, using improved data to promote focused conversations

-

we have delivered awareness sessions on the role of the Adjudicator’s Office to new HMRC employees, which were well received

Our Corporate Aim: We will share insight in the best way possible

-

a significant piece of work undertaken this year has been our case categorisation tool. This easy-to-use approach ensures that we categorise the types of complaints we receive and provides our stakeholders with information to make customer-focused change

-

we have been working hard to improve the way we communicate with our stakeholders. seeking feedback on what works for both HMRC and the VOA to ensure that our performance reporting is pitched at the right level

Our Corporate Aim: We will create groups that support learning from complaints

Internally

- we have strengthened our learning feedback loops by promoting and encouraging greater involvement with our Learning Champions and our Learning from Complaints project

Externally

- we have begun this process at the practitioner level and continue to support strategic activities – including contributing the recent HMRC complaint strategy paper presented to and accepted by HMRC’s Executive Committee

Feedback on our corporate aims from our HMRC stakeholders

For the first time we have asked our stakeholders to feedback on how they think we are doing under our corporate aims. We have published HMRC, the VOA and the Home Office’s senior leadership responses above. In addition to the formal contributions, HMRC also responded specifically in relation to how we are meeting our business objectives:

Corporate aim: Our Customers – we will improve the service we give our customers

- ‘HMRC greatly values the feedback and challenges received from the Adjudicator and her office to help us become a trusted and modern tax and custom department’

- ‘the Adjudicator’s role as a critical friend has allowed HMRC to move closer to achieving its ambition to become more customer focussed by learning from customer feedback including complaints’

- ‘the new Complaint Handling and Reporting Tool will further support and enhance the department’s ability to learn from complaints’

- ‘the improved categorisation of premature complaints has allowed a better understanding of the root causes and better sign posting for customers on GOV.UK’

Corporate aim: Learning from Complaints - We will use our insight and expertise to help our stakeholders learn from complaints to improve services to customers

- ‘the transparent way of working between both organisations has and continues to pay dividends’

- ‘HMRC values the Adjudicator’s contribution at the Customer Experience Committee’

- ‘HMRC’s Complaint Insight Board continues to ensure coherence between customer complaints, wider customer experience issues and HMRC’s strategic objectives’

- ‘HMRC are encouraged by the work undertaken by the Adjudicator’s office to continuously improve the way data and actionable insight is provided’

Corporate Aims 2022 to 2023

In line with our Business Plan and in the spirit of continuous improvement we have set stretching organizational aims for the period April 2022 to March 2023. We hope to be able to report similar success in our 2023 annual report.

Our people:

we will develop and engage our people to benefit from their experience and potential

| Corporate aim | Measure |

|---|---|

| We will identify knowledge gaps and development needs, implementing appropriate learning to improve the skills of all our people. | Our managers will maximise use of their own leadership skills to develop and support their people. Our people will have access to learning appropriate to both their technical and development needs. Following the roll out of strength assessments in 2021 all staff will continue to use their reports to facilitate development conversations. We will see the benefit of that through improved feedback in the annual civil service People Survey and by regular small-scale surveys, measured over two years. |

| Our diversity, wellbeing and inclusion plans will ensure all our people feel supported and valued. | We will measure the success of our activities through regular surveys of our people and through improved engagement scores as part of the annual People Survey. |

| To build and develop an engaged organisation through inclusive and proportionate communications. | We will develop and deliver a robust communications plan to ensure our use of communication are proportionate and meet the needs of our people. We will measure the success of our activities through regular surveys of our people and improved engagement scores as part of the annual People Survey, linking outputs to our planning activity. |

| We will further develop our quality assurance process to highlight both areas for development and existing strengths. | Our Quality Assurance project will ensure we track improvements in quality of outputs over the next 12 months supporting the development of our people. |

Our customers:

we will improve the service we give our customers

| Corporate aim | Measure |

|---|---|

| We will ensure that our customers feel heard when they raise concerns about our service. | We will monitor all FOI and SAR requests, post recommendation reviews and service complaints. Using categorisation techniques, we will report our findings annually on areas we could improve to support continuous improvement in this area. |

| We will work with customer groups to support strong customer service. | We will work closely with organisations such as the PHSO and the Ombudsman Association on areas of common interest. We will support the HMRC charter and complaints strategy and implementation of revised PHSO complaint standards. We will use greater flexibility in our improved case management system to identify trends in customer complaints sooner. We will develop a customer accessibility strategy which will inform our customer-focused project work. |

| We will establish strong working relationships with and engage fully with all internal and external customers and stakeholders. | We will share our insight and approach on case categorisation as part of our Learning from Complaints offer. We will work internally and with stakeholders to fine tune new reporting methods as we move into a business-as-usual state. |

| We will reduce the number of complaints that come to us prematurely. | We have provided good quality data to HMRC and the VOA and improved our own categorisation - the ambition now is to ensure that volumes decrease through targeted action. |

Our organisation:

we will transform the way we work, responding to the needs of our customers in order to become a more efficient and accountable organisation

| Corporate aim | Measure |

|---|---|

| We will continue to ensure that our digital platforms are fit for purpose and support easy access for our customers and usability for our people. | Once implemented in 2022 we will maximise use of our new technology (case management and telephony) for benefit of customers, stakeholders and staff. |

| We will support HMRC’s commitment to hybrid working. | We will implement a SWoW plan - focussing on the opportunity this provides to offer greater flexibility of working patterns whilst ensuring our business needs are met and enhanced. |

| We will operate efficiently, balancing strong performance and cost effectiveness. | We will adhere to our timeliness standards and ensure cases are progressed quickly and to a high standard. We will embed our revised Risk Framework to ensure all strategic and operational risks are regularly reviewed and mitigation action taken as necessary. We will set clear performance measures for our people, taking account of complexity of casework and where people are adding value elsewhere. We will use our new forecasting tool to ensure that we are properly resourced to meet fluctuations in demand to meet customer expectations. We will continue to benchmark quality standards and report on adherence to those standards in a consistent way. For our business management team we will set strong performance standards to ensure delivery of quality outputs to support the business. We will recruit to meet need, balancing that against efficient use of resources. |

Learning from complaints:

we will use our insight and expertise to help our stakeholders learn from complaints to improve services to customers

| Corporate aim | Measure |

|---|---|

| We will build strong working relations with our stakeholders. | We will ask our stakeholders and customers what they need from us as an independent complaints body and factor into our plans. We will regularly ask for feedback on the success of our activities in improving customer service from both stakeholders and customers. We will work internally and with stakeholders to fine tune our reporting methods into finished products. We will Establish how best to share data and learning at different levels of HMRC, the VOA and the Home Office - from local to higher levels. |

| We will share insight in the best way possible. | We will provide robust, actionable information for our stakeholders to help them improve their customer service and complaint handling. Develop a suite of potential options for sharing connected data and learning for different levels of HMRC, the VOA and the Home Office. And we will set up groups, at all levels and grade, to promote the same. |

| We will create groups that support learning from complaints. | We will establish internal structures that ensure learning is understood and shared across the organisation, harnessing our project strands around quality assurance, learning and development and policy decision making. |

Customer feedback about our service

We always welcome feedback from customers as it helps us to review and improve our processes.

We apply the same approach when investigating complaints about our office as for complaints about HMRC, the VOA and the Home Office. Our GOV.UK website tells our customers how to raise concerns about our service. They can do this through our new electronic complaints form or by writing to us.

During the period April 2021 to March 2022 we received 7 complaints about the level of service we provided. The main areas of complaint related to customers unable to open our emails sent from the encrypted mailbox and the lack of clarity in respect of our document retention policy.

We always consider feedback and where wider lessons are raised; we use these opportunities to improve our customer service.

Queries about Adjudicator’s Office recommendations