NDA SME Action Plan 2019-2022

Updated 21 April 2023

Foreword

As set out in our 2021 Strategy, the NDA's purpose is to clean up the UK's earliest nuclear sites safely, securely and cost effectively. Doing this with care for our people, communities and the environment is at the heart of our work. Our strategy is founded on our commitment to overcoming the challenges of nuclear clean-up and decommissioning, leaving our sites safe and ready for their next use.

To support our Strategy, we need to build and maintain a resilient, sustainable, diverse, ethical and innovative supply chain that optimises value for money for the UK taxpayer when sourcing goods and services.

We recognise that Small and Medium-sized Enterprises (SMEs) already play a critical role in our supply chain and are a key component of our future strategy. SMEs frequently bring new and innovative ideas, are responsive and have exceptional customer focus. In addition, they are often at the very heart of local economies and communities, and their size is not a blocker to aspiration or achievement. As the NDA group exists in some of the most geographically remote locations across England, Scotland, and Wales it is particularly important that we engage with SMEs in those locations.

We published our previous SME Action Plan in 2019. In this plan we set out our progress against this plan and how we will further improve SME engagement to ensure that SMEs have a fair opportunity to contribute to the UK nuclear sector. Our SME target remains a challenge to deliver but I am determined that we will make every effort to achieve it.

Please continue to challenge me and my team to deliver on this Action Plan. If you have suggestions on how we could do more, contact CommercialStandards@nda.gov.uk.

Samantha Bromiley

NDA group Procurement and Supply Chain Director

Introduction

The Nuclear Decommissioning Authority (NDA) is a Non-Departmental Public Body (NDPB) sponsored by the Department for Business, Energy and Industrial Strategy (BEIS). It was formed in 2005 with responsibility and accountability for dealing with the majority of the UK's public sector nuclear liability created since the birth of the nuclear sector in 1947. NDA's mission is expected to continue into the next century.

Our clean-up mission covers 17 sites across England, Scotland and Wales. These sites are grouped, regulated, and controlled under 4 Site Licence Companies (SLCs). The SLCs are responsible for the safe operation and decommissioning of the historical nuclear activities and, in doing so, they make extensive use of the supply chain. As well as the SLCs, the NDA group also includes several specialist wholly-owned subsidiaries, responsible for a wide range of activities including rail and shipping services, insurance, property and developing solutions for dealing with long term disposal of waste for England and Wales.

Updates to NDA group businesses:

- Direct Rail Services (DRS) and International Nuclear Services (INS) have been consolidated to form Nuclear Transport Services (NTS).

- The NDA has created a single waste division, incorporating waste disposal companies LLWR and RWM.

Supply Chain Strategy and SME Action Plan Objectives

NDA’s supply chain objective is ‘to build commercial capability which maintains a resilient, sustainable, diverse, ethical and innovative supply chain that optimises value for money for the UK taxpayer when sourcing goods and services’.

This document sets out how we will help SMEs to engage with the NDA group as part of the wider supply chain. Some actions will be developed by NDA while others are more site specific, reflecting local needs are developed by the group businesses.

In addition, NDA’s role is to act as a conduit to promote, incorporate and influence best practice within the group and wider Government.

Due to the scale and complexity of the work being commissioned, it is not always feasible to contract directly with SMEs and therefore indirect involvement through sub-contracting or joint-venture opportunities is actively encouraged.

NDA group spend

The NDA group has an annual budget of around £3.3bn with an annual spend with the supply chain of £1.8bn.

The NDA group procures a wide range of goods and services from complex one-of-a-kind nuclear projects to stationery, with values ranging from billions of pounds to tens of pounds. Durations also vary from one-off purchases through to projects and programmes lasting decades.

With such a wide variety of requirements delivered across often geographically remote locations, these is no standard company that we aspire to work with. However, we expect our contractors to share our high standards (environmental, safety, security and ethical) and to have a passion for doing the right thing and delivering goods and services which are affordable and deliver best value for the taxpayer.

The NDA group supply chain can be described as a tiered system.

Tier 1 includes the NDA group operating companies:

- NDA

- Sellafield

- Magnox

- Nuclear Waste Services

- Dounreay Site Restoration Services

- Nuclear Transport Solutions

Tier 2 refers to those suppliers with whom the operating companies have direct spend with.

Tiers 3, and below, form the supply chain through sub-contracted relationships.

| Spend Area | 2020/21 NDA group spend |

|---|---|

| Construction/Decommissioning Projects | £361m |

| Professional Services | £319m |

| FM | £191m |

| Regulator Charges | £121m |

| Cloud Services | £120m |

| Security | £98m |

| Resourcing | £78m |

| Transport | £59m |

| Waste Services | £56m |

| Site Ops Services | £41m |

| Equipment | £41m |

| Consumables | £41m |

| Software | £39m |

| Packaging | £36m |

| Hardware | £29m |

| Office Services | £25m |

| Estates Management | £25m |

| Energy & Utilities | £25m |

| Access & Insulation | £21m |

| Insurance | £19m |

| Learning & Development | £16m |

| Financial Services | £10m |

| Chemicals & Materials | £10m |

| HR Services | £7m |

| Voice and Data | £6m |

| Travel | £6m |

| Engineering Services | £6m |

| Fleet | £2m |

| Other | £144m |

| Total Spend | £1.9b |

*Other Spend refers to grouped spend that is either uncategorised or below £1m.

*Total Spend is inclusive of intercompany spend_

SME Spend

NDA measures direct and indirect SME spend. Indirect spend is obtained from data supplied quarterly by non-SME suppliers representing the top 80% of spend across the group. The NDA analyses trends across the NDA group and within individual businesses. Total SME spend is reported quarterly to HM Government and annual statistics published within this document. The impact of COVID-19 resulted in the suspension of operations on many of our sites which consequently impacted the SME figures achieved in 2020/21.

The NDA spend for the financial year 2020 to 2021 saw a decline due to the impact of COVID-19. During lockdown many of our sites operated at a reduced capacity, limiting operations to those that were critical. Despite a reduction in spend the NDA group continued to run SME forums and engagement sessions to ensure that SMEs were aware of the impact of COVID-19 and how to engage in ongoing business activities/opportunities.

| Fiscal Year | Direct SME Spend | Indirect SME Spend | Overall NDA group SME Spend |

|---|---|---|---|

| 2017/18 NDA group target was 25.5% |

0.9% | 27.7% | 28.6% |

| 2018/19 NDA group target was 29% |

7.8% | 24.7% | 32.5% |

| 2019/20 NDA group target was 32% |

15% | 17% | 32% |

| 2020/21 NDA group target was 33% |

12.6% | 16.1% | 28.7% |

Commercial Pipelines

The individual members of the NDA group have published commercial pipelines for several years, some going back to 2005. These plans include details of future procurement activity and they have been important to help the supply chain understand and prepare for forthcoming requirements, projects, and programmes.

Our SME communities have welcomed this level of information as it helps to reduce the burden and complexity associated with trying to understand the client's needs across a complex group where access to key individuals is restricted due to safety and security concerns.

Since 2005, we have evolved and improved these individual plans, often with constructive challenge from SMEs.

The NDA has adopted the Government’s standard Commercial Pipeline across our entire group which is progressively improving the consistency of data irrespective of which site or organisation has generated the pipeline.

These pipelines seek to look forward a minimum of 18 months to award of contract and are updated on a quarterly basis to ensure that they are as robust as possible. Whilst every effort is made to ensure that they are accurate, the nature of our work means that changes in requirements and/or timelines is inevitable.

NDA will continue to improve the quality and relevance of these pipelines and any feedback on potential improvements should be directed to CommercialStandards@nda.gov.uk

Below are links to the current pipelines across the NDA group:

- Sellafield Procurement Pipeline

- Magnox Procurement Pipeline

- DSRL Procurement Pipeline

- LLWR Procurement Pipeline

- RWM Procurement Pipeline

Actions and interventions

Our planned actions are split into four key areas, each with sub-objectives:

- Leadership / Advocacy and Challenge

- SME Supplier Support

- Efficiency and Transparency

- Data and Information

The following provides details of those actions from the original iteration of this document, progress so far, and new opportunities identified.

Leadership / Advocacy and Challenge

Objective 1 (ONGOING): NDA Corporate Objective, annual target agreed and reported to the NDA Board.

| How this supports | Setting stretching targets for the NDA group helps us to aim high, and to be accountable to the supply chain as well as to HMG. |

| 2021 Progress Review | The NDA Board is appraised of achievements against the set stretch targets on any annual basis, details of the figures reported are detailed above. |

Objective 2 (COMPLETED): SME Champion, specific role with clear responsibilities which support the SME Agenda.

| How this supports | Central accountability for influencing the initiatives and targets agreed and set for the NDA group, influencing HMG policy, and sharing best practice throughout the wider public procurement network. |

| 2021 Progress Review | The role of SME Champion has been allocated to the incumbent Head of Group Commercial Standards (see hierarchy structure (Section 5) for more detail. In addition, a SME Agenda Lead has been appointed to help drive the agenda. |

Objective 3 (ONGOING): Resolving Problems and Disputes with SMEs, providing a backstop for SMEs to raise concerns.

| How this supports | Providing a route to raise concerns which have not been resolved with the contracting NDA business, challenging processes or onerous conditions thus enabling SMEs to compete for and secure contracts. |

| 2021 Progress Review | The NDA group continues to communicate with SMEs throughout procurement processes (e.g., supplier engagement events) and more widely across the group to create an SME feedback loop (e.g., Sellafield Tier 2 SME Working Group). |

SME Supplier Support

Objective 1 (ONGOING): National Supply Chain Event, delivery of the largest nuclear network event of its kind in Europe, hosted by NDA with support from CCS, MOD and UKTI.

| How this supports | Promotion of networking and marketing opportunities, including meeting current and potential buyers, hearing about pipeline opportunities and about the challenges facing the NDA group. |

| 2021 Progress Review | The annual event was postponed for two years, due to NDA organisational Redesign and Covid-19 respectfully. The next annual event will take place on 21st July 2022. |

Objective 2 (ONGOING): Supply Chain Awards, promoting best practice and rewarding innovation in the supply chain across the NDA group, accessible to all companies. Includes a specific SME Minister’s Award to help raise the profile of SMEs working within the Nuclear Industry.

| How this supports | Award categories and criteria help the supply chain identify, promote and celebrate good examples of work across the NDA group. |

| 2021 Progress Review | The annual event was postponed for two years, due to NDA organisational Redesign and Covid-19 respectfully. The next annual event will take place on 21st July 2022. |

Objective 3 (ONGOING): Improve Direct Communication by making better use of different communication platforms to engage with the market and to deliver messages targeted at SMEs.

| How this supports | Faster dissemination of messages, as well as providing a place for direct engagement between SMEs, B2B, support agencies etc. raising the profile of the NDA group and the opportunities it offers. |

| 2021 Progress Review | Sellafield issue monthly Supply Chain bulletins to the SME community and hold Tier 2 SME Working Groups which could be adopted as best practice more widely across the estate. Further work to optimise this across the NDA Group is now underway, building on internal and external best practice. |

Efficiency & Transparency

Objective 1 (ONGOING): Forums and Webinars hosted by the NDA group or other relevant organisations on topics requested by SMEs including specific contracting opportunities, tender writing, and other improvement initiatives.

| How this supports | Demystifying how to win business within the NDA group, act as a critical friend to improvement initiatives, increasing the proportion of SMEs successfully winning business. |

| 2021 Progress Review | All NDA Group Businesses will complete the mandatory Social Value training via Commercial College, to upskill internal knowledge & capability on SME engagement. SME & Tier 2 forums & webinars have been held across the NDA group to help identify opportunities and remove barriers to entry. |

Objective 2 (ONGOING): Monitoring the Transparency of Opportunities - comprehensive procurement pipelines provide a forward plan of potential opportunities within the NDA group, monitoring and challenging the transparency of opportunities further down the supply chain

| How this supports | Pipelines enable SMEs to identify potential business opportunities so that they can prepare and align their business plans. This also ensures that there is transparency of opportunities to work with prime contractors and monitors the delivery of commitments made in contracts. |

| 2021 Progress Review | NDA Group members publish procurement pipelines on their respective websites and continue to advertise procurement opportunities through Contracts Finder/Find a Tender Service. Project Victory will ensure pipeline opportunities are advertised a minimum of 18 months prior to contract award via Lot Lot A 'Source-to-Contract' System. |

Data and Information

Objective 1 (ONGOING): SME Database, increase visibility of SME status of suppliers to NDA group.

| How this supports | identifying which suppliers to NDA group are SMEs allows us to verify spend data, and give our non-SME (large) suppliers the chance to to identify existing SMEs in their sector. |

| 2021 Progress Review | SME status of suppliers is available on request to NDA, and via the new Project Victory Commercial Systems suite which is currently in the mobilisation phase. |

Objective 2 (ONGOING): Monitoring the Transparency of Opportunities, comprehensive procurement pipelines provide a forward plan of potential opportunities within the NDA group, monitoring and challenging the transparency of opportunities further down the supply chain.

| How this supports | enabling the identification of trends in spend with SMEs and non-SMEs, to then take action as necessary. |

| 2021 Progress Review | Spend database is actively managed and fully integrated in the new Project Victory Commercial Systems suite. |

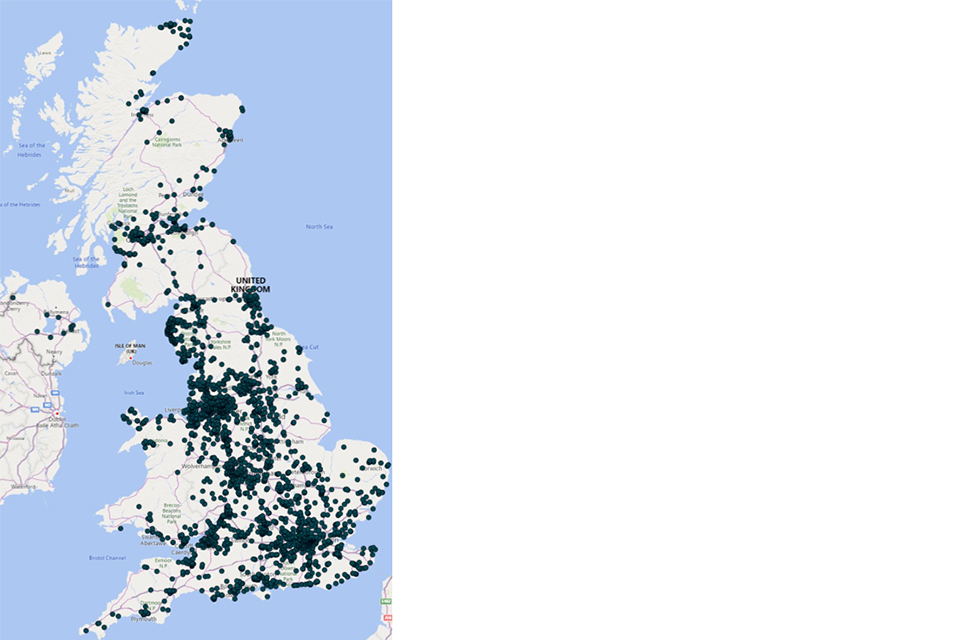

Objective 3 (ONGOING): Distribution of SMEs, create a visual distribution map of SMEs by spend across the NDA group.

| How this supports | demonstrating the distribution of SMEs across the NDA group's supply chains, highlighting regions of high and low spend, exploring the impact of NDA group spend in local economies, and identifying areas to further investigate. |

| 2021 Progress Review | To be powered by on-demand analysis in the new Project Victory Commercial Systems suite, ad-hoc analysis undertaken when required (i.e. spend in Scotland). |

Appendices

Appendix A: Distribution of Suppliers across the UK

SME spend (more than 50k) for the financial year 2020 to 2021:

| Location: | Spend amount: |

|---|---|

| Cumbria | £146.9M |

| Lancashire | £34.1M |

| Leicestershire | £28.3M |

| Caithness | £18.9M |

| Cheshire | £11.8M |

| London | £10.9M |

| Hampshire | £9.7M |

| Ayrshire | £8.2M |

| Surrey | £7.1M |

| Gwynedd | £6.7M |

| Berkshire | £5.9M |

| Midlothian | £3.9M |

| Derbyshire | £3.7M |

| Highlands | £3.3M |

| West Yorkshire | £3.3M |

| Tyne and wear | £2.8M |

| Oxfordshire | £2.7M |

| South Glamorgan | £2.7M |

| Bedfordshire | £0.246M |

| Avon | £0.240M |

| Clwyd | £0.235M |

| Kent | £0.215M |

| Worcestershire | £0.202M |

| West Sussex | £0.200M |

| Monmouthshire | £0.170M |

| Inverness-shire | £0.143M |

| Shropshire | £0.139M |

| County Durham | £0.122M |

| Lincolnshire | £0.113M |

| Nottinghamshire | £0.104M |

| Virginia | £0.103M |

| Wiltshire | £0.101M |

| Australia | £0.058M |

| Roxburghshire | £0.054M |

| Selkirkshire | £0.054M |

Supplier base (all spend) across the UK:

A map of the UK showing the supplier base for all SME spend

Appendix B: Case Studies

1) LINC (Liaise, Innovate, Network & Collaborate)

This initiative was set up by Dounreay Site Restoration Ltd (DSRL) to encourage SMEs at a local and national level to collaborate with each other to deliver innovative solutions that support the Dounreay decommissioning programme. By offering the scheme to SME companies, it is intended to ensure greater opportunities for growth, removing barriers which may be perceived when engaging with larger companies' risk of staff/expertise poaching, buy out, IP, etc). Since its launch in 2017, both Dounreay and Sellafield have launched LINC. Over 400 SME companies have registered and over 68 challenges issued.

Sellafield Success Story through LINC:

Client: OneAim

Steve Vick International (SVI) were contracted by OneAim, on behalf of Sellafield Ltd, in October 2020, to install a large diameter branch saddle on a 315mm High Density Polyethylene pipe raw watermain diversion, approximately 130 metres in length. The new connection was required so that a new building, under construction, at the Sellafield site could be included in the site fire hydrant network in case of fire. A branch saddle operation was chosen because it was deemed too high risk to fully shut down the hydrant network while a new connection was in.

As a result of this work, SVI were contacted a month later to carry out another similar job for OneAim. Due to the increasing number of Nuclear projects SVI have undertaken they have recently recruited three new members of staff to their Nuclear team.

2) Business and Technical Services Market Place

LLWR has established the Business & Technical Services (BATS) Marketplace, on behalf of the NDA group, to deliver professional services across 13 business categories. BATS replaces the Business Services Marketplace. LLWR has used the Dynamic Purchasing System procedure to deliver this opportunity, which offers a simple and efficient procurement route for both buyers and suppliers.

For further information, please access the CTM system which lists the 13 BATS categories on the Public tenders page. The DPS is due to expire on 21st November 2023.

3) Supply Chain Bulletin/SME Working Group

Sellafield release monthly Supply Chain bulletin via email. Any supplier can access the Bulletin by contacting supply.chain.enquiries@sellafieldsites.com and submitting a request to be added to the mailing list.

In addition to the Bulletin Sellafield host quarterly SME Working Groups, which aims to:

- Share best practice in increasing SME spend.

- Share knowledge and intelligence of the SME community.

- Identify and share best practice for implementation by others.

- Discuss challenges and seek to identify or create solutions.

- Identify opportunities to collaborate where a shared solution is the most appropriate route.

- Respond to any changes in government guidance as applicable.

The group is open to Tier 2 partners with over £5m spend from Sellafield Ltd. However, the level of spend is not the defining element and other Tier 2 suppliers may also attend.

Useful Links

Each NDA group company has links within its procurement pages to useful website information including local activities and actions they take to support SMEs:

- Nuclear Transport Solutions

- Dounreay Site Restoration Ltd

- Nuclear Waste Services

- Magnox Ltd

- Sellafield Ltd

Any queries regarding this SME Action Plan, please contact NDA Commercial Standards: CommercialStandards@NDA.gov.uk