Medical technology strategy

Updated 9 April 2024

Foreword

The role of medical technology in improving health outcomes

Medical technology, or ‘medtech’, is of vital importance to the UK health and care system. It includes items we rely on every day, from a simple plaster for a scraped knee, to life-saving blood tests that detect cancer early and robots that can perform highly complex surgeries. Medtech products can be found in hospitals, ambulances, doctors’ surgeries and even our own homes and play a crucial role in the whole pathway of care, supporting people from prevention, through to diagnosis, treatment and ongoing management of health. Although medtech products come in many shapes and forms, they all have one thing in common - they are designed to help us understand and improve people’s health.

This document presents the inaugural UK medtech strategy and the timing could not be better. The COVID-19 pandemic highlighted the vital importance of medtech, with ventilators and lateral flow tests playing an indispensable role in our pandemic response. We must take the learnings from these experiences and use them to build a stronger future. Effective use of medtech will be critical in moving forwards from the pandemic, supporting the elective recovery plan by reducing diagnostic bottlenecks and waiting lists, and by delivering new and improved ways to treat and support patients.

Medtech can reduce health disparities by improving the assessment of health risks and help us to better manage long-term conditions, supporting people to live longer, healthier, more independent lives. Innovations in medtech will also support the NHS in delivering its net zero ambition in a variety of ways, from using materials more efficiently to the introduction of more sustainable models of care. As a significant area of spend, medtech also has an important role to play in the long-term financial sustainability of the UK health and care system.

Medtech is a vitally important industry for the UK economy, representing over half of all life sciences employment, with businesses situated across the UK and contributing billions of pounds to the economy. As a country we are known for world-leading scientific research and development capabilities, and the UK health and care system is globally recognised as a successful and trusted health system, making the UK a major player on the global healthcare stage. We must encourage ambitious, innovative research and turn innovation into real benefits for society, helping secure the position of the UK as a global science superpower. Moving forwards, we have the opportunity to make the UK an even more attractive market for businesses by improving access, shaping our own regulatory framework, leading in research and development, and maintaining a strong international market presence.

As we set out on this journey, I would like to extend my thanks to our colleagues across the health and care system, the medtech industry and devolved administrations for their valuable input. We have been exceptionally fortunate during the development of this strategy to be able to engage and collaborate with a wide range of people and organisations to help us build a broad and balanced picture of how we can drive the sector forwards, and I am confident this strategy, and the continued collaborative effort behind it, will deliver tangible benefits across the UK as a whole for patients and care providers as well as the UK medtech industry and those working in the sector.

Will Quince

Minister of State (Minister for Health and Secondary Care)

Introduction

Medical technology (medtech) is vital to helping people live more independent, healthier lives for longer. As an integral part of our health and care system, it has a vital role in our ability to deliver the best care for patients.

The UK health and care system is currently facing a sustained increase in pressure driven by rising healthcare needs. The demographics of the country are changing - the population is becoming older, people are living with more co-morbidities, and have higher expectations of the health and care system. These financial and delivery pressures have been further exacerbated by the COVID-19 pandemic.

Our approach to medtech policy must therefore go hand-in-hand with the significant transformation happening across the UK health and care system and must complement and strengthen it. Despite the importance of medtech to the health and care system, there has not to date been a central governmental approach. Moving forwards, we must co-ordinate and align action across all our system partners, and drive improvement in priority areas to deliver effective and meaningful change that benefits patients.

Aim of the strategy

This document outlines how we will ensure the health and social care system can reliably access safe, effective and innovative medical technologies that support the continued delivery of high-quality care, outstanding patient safety and excellent patient outcomes in a way that makes the best use of taxpayer money.

The medtech sector is complex, broad and varied with multiple participants and stakeholders. We will bring clarity to this complex landscape by focussing on a clear vision, centred on the most important issues. This will set the direction of travel for medtech across the UK health and care system.

Building on the broader Life Sciences Vision, this high-level document reviews the current UK medtech landscape and identifies and prioritises the areas for action. This strategy will form the basis of future implementation plans that will set out in detail how these priorities will be addressed, and how these actions will build towards achieving the vision for medtech. In some areas existing research and areas of best practice will provide frameworks from which these implementation plans can be built, but it is recognised that in some areas there will need to be additional work to determine the actions to take.

We recognise that any transformation of the medtech market is a long-term challenge and will need to be delivered incrementally through collaboration between the health system, patients, and clinical, academic and industry partners.

Definition of medical technology

A medical device is any instrument, apparatus, appliance, software, material or other article, whether used alone or in combination, together with any accessories, including the software intended by its manufacturer to be used specifically for diagnosis or therapeutic purposes or both and necessary for its proper application, which is intended by the manufacturer to be used for human beings for the purpose of:

- diagnosis, prevention, monitoring, treatment or alleviation of disease

- diagnosis, monitoring, treatment, alleviation of or compensation for an injury or handicap

- investigation, replacement or modification of the anatomy or of a physiological process

- control of conception

A medical device does not achieve its main intended action by pharmacological, immunological or metabolic means although it can be assisted by these - Medical Devices Regulations 2002 (SI 2002 No 618, as amended) (UK MDR 2002). Medical devices can be:

- general medical devices - such as syringes, dressings, heart valves, ECG monitors, CT scanners and dialysis machines, including any software used to drive them

- active implantable medical devices (AIMDs) - powered implants or partial implants that are left in the human body, such as implantable cardiac pacemakers, implantable nerve stimulators, cochlear implants and implantable active monitoring devices

- in vitro diagnostic medical devices (IVDs) - equipment or systems intended for use in vitro to examine specimens including all instruments, software, reagents and calibrators, such as blood grouping reagents, pregnancy test kits and hepatitis B test kits

- digital health and software - such as standalone software, decision support and mobile apps

Medical technology is an evolving domain, with scientific and engineering breakthroughs prompting new innovations and changing societal needs provoking creative approaches. In this strategy we will focus on general medical devices, AIMDs, IVDs, and the digital tools that drive them directly. This will include their associated uses and markets and providing support in areas of overlap between physical devices and digital tools.

Vision for medtech

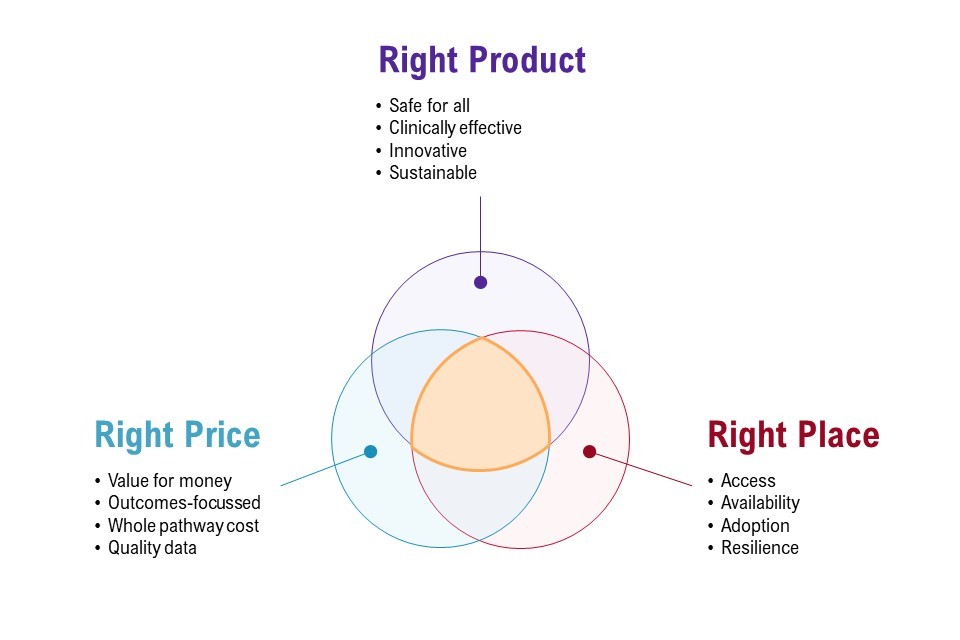

Our vision focusses on 3 central objectives:

- right product

- right price

- right place

These concepts centre on delivering the highest quality of care for patients and interact with and balance against each other - often, as focus on one component increases, focus on the others can decrease. Striking the best possible balance between these objectives is difficult, but we will aim to reach an optimal point where all 3 elements are weighted appropriately so the UK medtech sector best supports the UK health and care system in delivering improved health outcomes for patients (see figure 1).

Figure 1: the 3 core components of the medtech vision

Figure 1 shows the 3 core components of the medtech vision presented as a Venn diagram. There are 3 circles:

- right product, which must be safe for all, clinically effective, innovative and sustainable

- right price, which must be value for money, outcomes-focussed, whole pathway cost and quality data

- right place, which must include access, availability, adoptions and resilience

The area connecting these circles represents a place of optimal balance between the objectives.

Right product

We will ensure products are clinically safe and effective for all by developing best-in-class regulations and upholding safety standards. We will encourage innovative and sustainable product development to better meet patient needs, diagnosis and outcomes.

The UK has a diverse population, and it is vitally important that every person has timely access to effective, safe, medical technology regardless of ethnicity, sex or any other attribute. We want to put clinical leadership at the forefront of medtech, making sure healthcare professionals and patients can make informed decisions on medtech products with clarity and confidence. We want to support innovation that meets the needs of the UK population, such as by addressing clinical priorities and increasing sustainability.

Right price

We will create an environment that supports the understanding and delivery of value for money and affordability across the whole patient pathway, using high-quality data to ensure that prices are reasonable for both the health system and sustainable for suppliers.

To ensure the best value for public money, the value of medtech products should not be considered in isolation but across the whole patient pathway. Affordability, long-term value and above all patient outcomes must form part of this assessment, as well as an acknowledgement that ‘lowest price’ does not always translate to ‘best value’. Ensuring we have clear, reliable data to underpin our decisions will help us to achieve this.

The importance of getting the right products at the right price will be even more important as we address the pressures on affordability presented by factors such as changing demographics and inflation.

Right place

We will ensure the UK is positioned internationally and domestically to increase access, diversity and resilience in the supply market, to get technology to the patients and healthcare professional who need them.

Confidence in the availability of medtech products at the time they are needed is critical to the functioning of the health and care system. Access to the right products, delivery of them via a responsive and resilient supply chain and supporting their adoption into the UK health and care system ensures everyone has access to medical technology as and when they need it.

The medtech landscape

UK medtech key facts and figures

The UK has a large and diverse medical technology industry, with a broad footprint across the UK. Medtech products are used by millions of patients every day and are critical to our health and social care system. The medtech landscape is unique and complex in many aspects.

Medtech is a vital UK industry

Total current healthcare expenditure in the UK accounted for 12.0% of gross domestic product (GDP) in 2020, compared with 9.9% in 2019. Of this, spend on medtech makes up a significant amount - the NHS alone spends an estimated £10 billion a year on medtech (DHSC Estimate, 2021, based on multiple data sources). The medtech sector is an important provider of opportunities for jobs and development of specialist skills in local areas across the UK.

For both the core medtech and service and supply chain sectors, the South East, London and the East of England account for 41% of the employment, and 59% is located outside of these regions, with significant UK-wide regional clusters. A significant amount of medtech employment in the UK, around 31%, is in small and medium-sized enterprises (SMEs), which make up over 85% of the companies in the UK medtech sector.

The UK is also a major player in the international market, exporting over £5.6 billion of medtech products in 2021.

Figure 2: UK medtech industry key figures

Figure 2 illustrates the UK medtech industry figures. The UK medtech industry has an annual turnover of £27.6 billion. This includes:

- 138,100 UK jobs

- over £5 billion in exports annually

- 31% of life sciences turnover

- over 85% SMEs

- 4,190 UK businesses

Sources: Bioscience and health technology sector statistics 2020, MedTech Europe’s facts and figures 2021 and DHSC estimates 2021 based on multiple data sources.

The commercial landscape is broad and highly varied

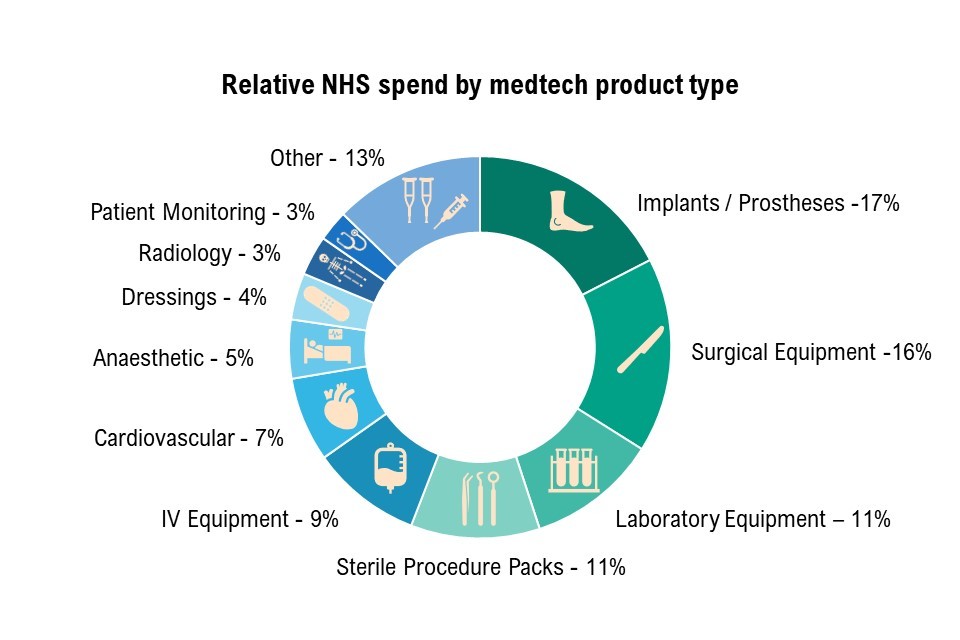

There are just under 2 million products registered for use on the UK market (Medicines and Healthcare products Regulatory Agency (MHRA) figures April 2022). Currently, around a third of spend in the NHS (an estimated 33%) is on implants and prostheses, and surgical equipment, which account for 17% and 16%, respectively, of annual spend in the UK on medtech (DHSC internal analysis) (see figure 3).

Figure 3: the top 10 medtech product types by spend, 2021

Figure 3 illustrates the top 10 medtech product categories by spend (DHSC internal analysis, December 2021). The figure is titled ‘relative NHS spend by medtech product type’ and shows a ring divided into 11 segments demonstrating the percentage of spend on medtech product types. These are:

- implants and prosthesis 17%

- surgical equipment 16%

- laboratory equipment 11%

- sterile procedure packs 11%

- IV equipment 9%

- cardiovascular 7%

- anaesthetic 5%

- dressings 4%

- radiology 3%

- patient monitoring 3%

- other 13%

Sources: MHRA figures, April 2022 and DHSC internal analysis, NHS purchasing for 12 months to December 2021. Early analysis based on NHS purchase order data, categorised by eClass category, and further grouped into custom medtech categories. Original data on file.

The supply chains for medical technology products are diverse

Supply chains often involve multiple stages and can span across multiple countries, relying on extensive use of outsourcing for materials, components, assembly and supporting services (such as sterilisation and logistics). Many medtech products are made from multiple sub-components and rare materials, and these further add to the complexity of the supply chain. In 2021, the UK imported around £7.5 billion of medtech products, excluding materials and subcomponents.

Medtech is a high-paced area of innovation

In 2021, the UK made 471 medical technology patent applications - 1 in 12 of all UK patents - to the European Patent Office. This focus on novel technology is supported by a broad range of funding and support schemes. The desire to stimulate and support innovation has resulted in a wide range of initiatives being set up in this space. In 2021, there were around 60 different programmes supporting innovative technologies, representing over £1 billion of funding (estimates based on NHS Accelerated Access Collaborative data and DHSC internal analysis, May 2022).

Despite the multiple pathways and significant funding, the innovation frameworks can be difficult to navigate, with the majority supporting only one of the many steps in the route to market - it is up to the innovator to research and link different programmes.

The development of the strategy

We have taken a multi-faceted approach to strategy development to take into account the currently available evidence, the views and needs of our stakeholders, and the wider priorities of the government. In developing the strategy, it has been a priority for us to understand and align with these vital points. This strategy seeks to support the existing work across the broader health and care landscape and to avoid duplicating any existing actions where these are already proving to be effective. Instead, we wish to focus on areas where there are gaps and significant opportunities for improvements.

Together these approaches have given us a broad understanding of the sector from many different viewpoints and have allowed us to take these into account to build an ambitious but achievable vision and strategy.

More information on the development of the strategy is available in Annex A: approach to strategy development.

Engaging with our stakeholders

Through extensive engagement with stakeholders across the UK health and social care system we have identified the policy priorities which will enhance UK strengths, the most pressing challenges we face, and where we can bring about the most significant change for the UK medtech sector.

Industry, the health and care system, and patients

Dialogue between government, industry, the clinical and commercial healthcare community and patient groups has shown a very consistent picture - the medtech sector currently has many strengths, and it is our ambition to maintain and support these while responding to the challenges we face. We have combined stakeholder feedback with an overview of initiatives across government and our delivery partners to identify the policy priorities we wish to focus on in this strategy.

Alignment across governments

Many aspects of health policy and operational management are devolved and therefore it is for the devolved administrations to determine priorities and approaches for addressing these. However, some areas of health policy are reserved. Consequently, it is widely recognised that actions and initiatives in one country are likely to have an effect on other parts of the United Kingdom. This is particularly true in England due to its larger population, which in turn drives a much higher demand for medtech products and services.

In view of this, while the strategy sets out priorities and actions that will be taken forward in England, we are keen to ensure that the implications that this work may have for the other parts of the United Kingdom are recognised, and that we continue to work collaboratively across the nations so that the UK as a whole can benefit from the improved outcomes. This principle of continued engagement and collaboration also applies to specific initiatives within the devolved administrations in the interests of sharing learning and drawing on the breadth of expertise and experience present from across the UK for the benefit of all.

In keeping with this, the strategy has been developed through collaboration across the UK with industry, our delivery partners and the devolved administrations. Although there are different organisations and approaches across Scotland, Wales, Northern Ireland and England, there are many areas of synergy, and strong consensus on the value of medtech and the need for an increased focus on this area.

We will continue to work closely with the devolved administrations, the NHS in Scotland and Wales, Health and Social Care Northern Ireland, and all other health and care organisations across the UK to facilitate delivery of our vision in all parts of the UK, with the aim of improving patient outcomes for all.

Aligning with broader strategic aims

Wider government priorities

The importance of the medtech sector means many of the top-level priorities of the government impact the sector, and in turn the sector can have significant impact on these priorities. These priorities are reflected in many government policies and strategies, including but not limited to:

- Build back better

- Life Sciences Vision

- Levelling up white paper

- Taskforce on Innovation, Growth and Regulatory Reform report

- UK research and development roadmap

The ambitions of the medtech strategy have been designed to align with wider government priorities such as:

- growing the UK economy by supporting a vibrant medtech industry, helping secure the position of the UK as a global science superpower

- clearing the backlog of elective care by helping to reduce pressure on the NHS, using fewer resources and delivering better outcomes through informing effective healthcare purchasing, championing sustainability, embracing innovative technology and improving health data

- capitalising on post-EU exit opportunities by building our own regulatory regime for medical devices to improve patient safety, increase transparency and promote innovation

- levelling up by creating an environment for the medtech industry to thrive, increasing opportunities for careers that develop specialists in local areas across the UK

- boosting research and development and supporting innovation and adoption by encouraging ambitious innovative research and supporting the processes to turn innovative ideas into tangible benefits for patients and healthcare professionals

- strengthening the union by working together to share knowledge and best practice to deliver benefit for the UK as a whole

For further detail on alignment with wider government strategy, see Annex B: areas for shared engagement.

Building on supporting infrastructure

UK research and development supports the entire medtech product lifecycle, from early development through to implementation, and this sustains and stimulates the pipeline of medtech products, driving innovation while generating the evidence required for adoption. UK research and development funding, through funders such as the National Institute for Health and Care Research (NIHR) and UK Research and Innovation (UKRI), represents an area of strength where multiple government initiatives and strategies combine to deliver a wider goal.

The structures in place have clear aims and strong relationships with all parts of the health and care system. For example, the NIHR research infrastructure, which facilitates early translational, clinical and applied health research, brings together leading academics, clinicians and NHS providers to work with medtech innovators, to help them generate the evidence needed by MHRA and NICE. This underlying research and development system, coupled with sources of research and development funding, make the UK an attractive place for both industry and academia to base their research, providing expertise to deliver research studies and linkages to support pull-through to the UK health and care system. The UK research and development environment represents an area where multiple partners work effectively together to deliver a consistent and comprehensive landscape. As such, the strategy does not seek to fundamentally change these existing structures, but rather to work with and build upon them, as it is recognised that they are vital enablers in delivering the vision for medtech.

The support of key enablers in the UK landscape provides an environment for medtech to thrive. In the Medicines and Healthcare products Regulatory Agency (MHRA) and the National Institute for Health and Care Excellence (NICE) we have internationally respected regulatory and guidance bodies with world-class standards and a strong patient focus. The route to market can be relatively fast. Regulatory systems have shown their ability to respond with agility to global incidents - for example, 22 critical products were given exceptional use authorisation in a rapid response to the COVID-19 pandemic. Work is already underway to maximise opportunities in the current landscape, such as new regulatory powers post-EU exit. The regulatory space has clear ownership with work well underway to maximise opportunities in the current landscape. However, we do recognise that regulation is a fundamental part of realising our ambitions, so we will work closely with our regulators to ensure that our priorities are supported by the appropriate regulations and guidance.

We will continue to work with system stakeholders to deliver this ambitious vision, including the NHS Transformation Digital Policy Unit, on the areas of overlap between physical devices and digital tools to implement this strategy and guide the development of future NHSE digital strategies.

Supporting existing sector initiatives

As well as the many positives in the sector, there are some areas that could be further strengthened. Several of these areas have already been identified and are the focus of existing initiatives that are already well developed and resourced and are well aligned with our vision. These range from sustainability initiatives to routes to market, from data programmes to frameworks to improve patient safety. To name only a few, some important examples include:

- the work towards the new UK Medical Devices Regulatory Framework

- the NHS Core20PLUS5 approach to tackling health disparities at both national and system levels

- progress to meet the NHS net zero ambition

- the work across the Accelerated Access Collaborative (AAC) for ground-breaking innovations

- the actions following the publication of the Independent Medicines and Medical Devices Safety Review

These programmes are owned by many of our delivery partners across the medtech sector, and have well-developed evidence, governance and implementation plans in place.

Sustainability is an important issue, and one which is highly relevant to medtech. In England, the NHS carbon footprint contributes up to 4% of greenhouse gas emissions. Over 60% of the total NHS carbon footprint sits within the supply chain, with 10% attributed directly to medical equipment. There is also the issue of single-use plastic, where initiatives have shown the NHS can greatly improve waste and save costs through reducing its consumption, without compromising patient care or safety (see the Great Ormond Street Hospital reducing single use plastics case study).

We need to embrace sustainability, meet the NHS net zero targets by 2045, and promote innovation that can deliver clinically safe and effective products that are better for the planet. Sustainability is a broad and important area, with a clear plan and owner in the form of Greener NHS. In this strategy we will concentrate our focus on where aligning with sustainable initiatives can support medtech priorities such as supply resilience.

For more detail on these initiatives and how they align with the strategy, see Annex B: areas for shared engagement.

Our 4 priority areas

Having considered the broader landscape and current activity, we have identified the gaps and opportunities where we wish to prioritise additional effort. Together with the existing work in the sector, the following priority areas will support us in delivering the right product, for the right price, in the right place.

Priority 1: resilience and continuity of supply

Continuity of supply of medtech is critical to the provision of ongoing care to patients and so must be robustly guaranteed. Medtech supply chains are reliant on multiple nations and vulnerable to disruptions to global trading agreements and models created by global events and actions of nation states. The capacity of supply chains to respond to shocks is limited, and when there are shortages, it is often difficult to source compatible alternatives. There is currently a high reliance on stockpiles to ensure continuity of supply. Multiple organisations have a responsibility to ensure supply is robust and that the supply of medical technologies continues in the event of emerging issues. There is a clear need to set direction of travel for the mid and long term in a way that proactively addresses resilience and pre-emptively plans for and mitigates risks to supply that exist in the current system.

Priority 2: innovative and dynamic markets

Innovative medtech offers an important opportunity to improve patient outcomes and help deliver best value for taxpayer money. Despite this, it is not always clear what the health and social care system wants and needs, and this can be further complicated by high levels of unwarranted variation in product use across the NHS, and barriers to switching between products. There are many initiatives and pathways designed to address specific challenges, in particular new and transformative product innovations. The area would benefit from additional coherence and co-ordination for new and existing products in the system to help ensure patients have access to the best products, faster.

Priority 3: enabling infrastructure

In order to deliver our ambitions in the medtech sector we need an underlying framework of enablers that will support our work. A lack of enablers in the sector can limit the opportunities for positive change. A lack of clear data and metrics can make it difficult to understand both the current situation and emerging trends in the sector. Unclear mechanisms for engagement can limit the collaboration and collective action achieved across government, industry and the wider health and care system. Improving these areas will lift barriers to delivering patient outcomes, and allow us to take clear, well-informed decisions across the sector.

Priority 4: specific market focusses

Medtech represents an exceptionally diverse area, so any approach must recognise the complexity of this sector. Although there are many similarities across medtech, many issues and challenges are specific to particular types of technology, clinical specialties, patient populations and place of use. Making meaningful difference means focussing on, understanding and tackling these specific problems as well as working towards an overall vision. We will look to proactively identify these areas and ensure we adapt our broader strategy to best meet their specific needs.

The following sections outline the key challenges in each of the priority areas, and how we plan to address them.

Figure 4: current activity and identified gaps for strategy priority areas that contribute to the medtech vision

Figure 4 sets out which wider government priorities and selected sector initiatives contributed to the development of the medtech vision, and the gaps identified which will be addressed by the 4 priority areas. The wider government priorities are across the whole of the UK and include strategies, white papers and reports such as build back better, the Life Sciences Vision, levelling up, UK research and development roadmap, the UK innovation strategy and the Cumberlege report.

Selected sector initiatives are:

- sustainability (NHS) - this includes net zero, single use plastics and resource efficiency

- innovation (NIHR and AAC) - this includes research investment, access and horizon scanning

- research (HRA) - this includes transparency, ethnical reviewing and promoting patient interests

- regulation (MHRA) - this includes safety and UK MDR

- supply and distribution (NHS Supply Chain) - this includes procurement, range management and logistics

- international leadership (DIT) - this includes exports, growth and inward investment

- procurement (NHS) - this includes capability building, balanced evaluation and competition

- clinical quality (NICE, Health Technology Wales) - this includes evaluation and innovation

- digital (NHS Transformation Directorate) - this includes digitalisation, data, innovation and transformation

Priority 1: resilience and continuity of supply

Continuity of supply of medical equipment, devices and consumables is essential for the consistent delivery of safe, high-quality patient care. The UK medtech sector has functioned well through a variety of commercial and logistical models to maintain continuity of supply across an extensive range of products. The variety of suppliers, supply channels and products available has provided a level of systemic resilience that has largely insulated the health and social care system from short-term supply disruptions.

However, increasing consolidation in the sector and globalisation of production and supply chains has reduced some of this resilience, exposed the sector to a broader range of threats and made it more vulnerable to global events and actions of nation states. Recent events including the COVID-19 pandemic and the war in Ukraine, and the subsequent disruption of global trading and logistics systems has brought to light vulnerabilities within many critical medtech supply chains where an over-reliance on single locations or sources of materials and supporting services exists. It is reasonable to expect that more of these global events will happen in the future. Recent developments in the geopolitical landscape signal the potential for far greater disruption in the future. We must therefore put systems, plans and strategies in place to proactively prepare for emerging risks in a way that will allow us to effectively mitigate impacts as and when they arise, as well as improving the overall resilience of global supply chains.

A shared responsibility for supply resilience

It is recognised that government needs to play a part in securing continuity of supply, especially in the face of major incidents and events. However, supply resilience needs to be at the forefront of considerations for medtech businesses’ sourcing, production and supply chain models, particularly for the most critical medical technologies.

Strengthening contractual requirements could support this - however, we also acknowledge the value that voluntary initiatives can bring in establishing best practice principles of supply resilience management more broadly across the sector.

UK medtech flexible manufacturing capacity and capability

The globally extended nature of supply chains coupled with limited UK based production capability and capacity presents a further vulnerability to supply. While it is recognised that not all products will be wholly made in the UK, maintaining the basic capabilities to support production of a broad range of medical technologies requires greater focus. Existing schemes, such as the Life Sciences Innovative Manufacturing Fund, will support this ambition to support growth in the UK life sciences sector and to improve the UK’s ability to respond to major shocks or trading constraints.

Establishment of these capabilities and capacity also has a role to play in the realisation of our ambition to establish greater use of commercially viable and resilient circular economy models for medical technologies where the supporting infrastructure for reuse, remanufacture and materials recovery will need to be located near to the point of use.

Supporting interoperability

The widespread use of equipment designed only to work with proprietary consumables (only available from a single supplier) increases vulnerability to supply disruption events as it is not possible to use alternative consumable products and replacing entire systems quickly is often impractical given limited availability of replacement equipment, training requirements and financing pressures. The impact of this was felt sharply in intensive and critical care areas at the height of the pandemic and placed undue pressure on already overstretched logistics systems through the need to carry products across duplicated ranges.

While it is recognised that in some cases designing bespoke consumables to work with equipment can help design in safety, experiences of the past couple of years call for a fresh look at the way products are designed and the scope to remove unnecessary inflexibility, especially where the supply arrangements for these products are insufficiently resilient. Where there are clear safety benefits to proprietary models there is a need to establish a range of heightened resilience requirements for the suppliers of these systems that reflects the risk to patient lives and wellbeing presented in the event of a disruption.

Industry has worked effectively in the past with the health system and government to develop universal design specifications and standards which incorporate critical safety elements - for example, the development of ENFit and associated standard ISO80369-3 to prevent potentially fatal errors in the connection of enteral feeding tubes.

Resource security and efficiency

The high prevalence of single use devices supplied into the UK health and care system created additional pressure when responding to the rapid increases in patient demand created by COVID-19. In many cases production and logistics systems had insufficient capacity to continue supplying devices in quantities required. Some of this pressure could have been alleviated if products and supply models were designed to facilitate greater decontamination, reuse or remanufacture of devices. The heavy reliance on single use models of supply also heightens exposure to volatility and vulnerabilities in the supply of raw materials and components, as highlighted by trade restrictions resulting from the conflict in Ukraine.

Moving towards devices that are designed to be decontaminated and reused, or that can be remanufactured, would help to reduce our reliance on both raw material availability and the capacity of production and logistics. To achieve long-term resilience in supply, the medtech industry increasingly needs to design products in a way that reduces the demand on virgin materials, makes better use of recycled materials and ultimately increases the extent to which the supply of medtech can shift to support significantly higher levels of reuse, remanufacture and materials recovery.

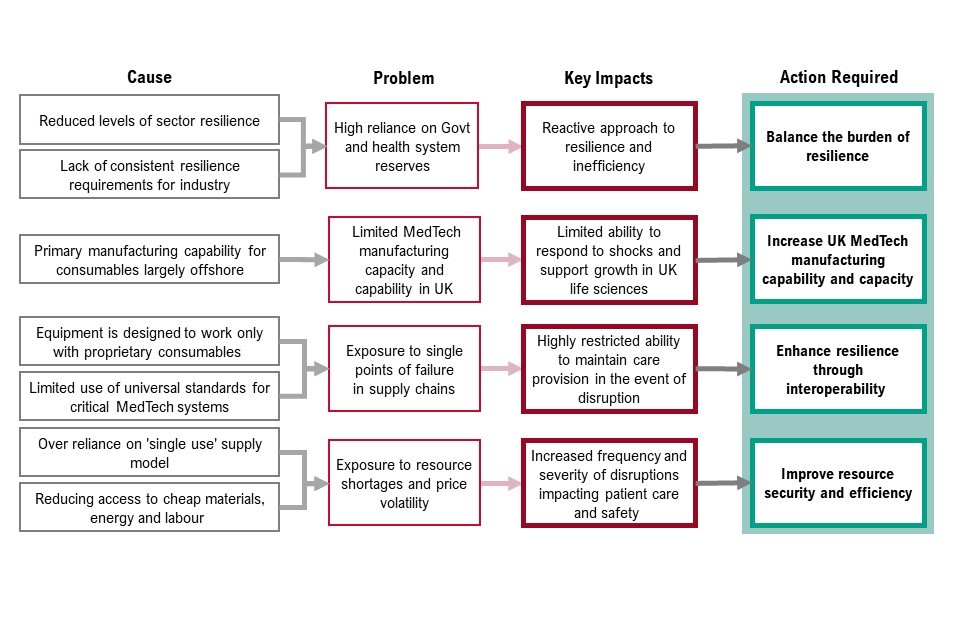

Figure 5: causes and actions for priority 1: resilience and continuity of supply

Figure 5 sets out the cause, problem, key impacts of priority 1 and the corresponding actions required. These are:

- reduced levels of sector resilience and lack of consistent resilience requirements for industry means there is high reliance on government and health system reserves. This causes a reactive approach to resilience and inefficiency. To address this, we must balance the burden of resilience

- primary manufacturing capability for consumables largely offshore means there is limited medtech manufacturing capacity and capability in the UK. This causes limited ability to response to shocks and support growth in UK life sciences. To address this, we must increase UK medtech manufacturing capability and capacity

- equipment is designed to work with proprietary consumables and limited use of universal standards for critical medtech systems means there is exposure to single points of failure in supply chains. This causes highly restricted ability to maintain care provision in the event of disruption. To address this, we must enhance resilience through interoperability

- over reliance on single use supply model and reducing access to cheap materials, energy and labour mean exposure to resource shortages and price volatility. This causes increase frequency and severity of disruptions impacting patient care and safety. To address this, we must improve resource security and efficiency

The aims of priority 1 will be achieved by:

- balancing the burden of resilience: we will work with NHSE on the development of procurement policy to promote the proportionate application of requirements for resilience, alongside an assessment of the potential for voluntary initiatives and regulatory enhancements that can facilitate a proactive approach to supply resilience

- increasing UK medtech manufacturing capability and capacity: we will work with industry, OLS, the Department for Business, Energy and Industrial Strategy (BEIS) and the UK health and care system in identifying the manufacturing capability and capacity that is needed in the UK to substantively enhance the UK medtech sector’s resilience, and to assess synergies with the wider Life Sciences Vision and other government aims to identify viable models for investment

- enhancing resilience through interoperability: we must clearly identify areas of care where proprietary models are unwarranted. As far as possible, the health system should adopt clinically appropriate standardisation specifications to support interoperable systems. Where this is not possible, we should work with industry to establish minimum supply resilience standards for proprietary systems

- improving resource security and efficiency: we must reduce the volume of single use devices used in the UK health and care system through the increased adoption of multi-use and remanufactured solutions, while maintaining quality and safety of patient care. We should reduce the overall quantity of plastics and the proportion of virgin fossil hydrocarbon-based plastics used in medtech products, exploring the scope to make greater use of recycled materials and biopolymers. We will seek collaboration with industry and research partners to facilitate a shift to increased resource efficiency. We will explore how we can create an environment that supports commercially viable models that increase levels of reuse, remanufacture and materials recovery, taking into consideration supporting services such as decontamination and conformity assessment

These actions will help deliver the following benefits:

- greater resilience to global shocks and reduced levels of disruption of the supply of medtech will enhance system performance through less interruptions to the efficient delivery of safe, high-quality care products for patients, improving patient experience and outcomes

Priority 2: innovative and dynamic markets

Whether looking at regulation, procurement or product selection, the UK medtech market largely embodies the principles and approaches of a free and open market. While regulation exists to protect patients by ensuring minimum standards, choice and competition are the primary market mechanics.

Choice, whether exercised by patients or healthcare professionals, has driven significant benefits. However, it is not without challenges, primarily the sheer volume of products on the market. Today MHRA have almost 2 million different products registered for use in the UK, of which we estimate that around 500,000 different product types are regularly used in the NHS. Most individual trusts will use around 30,000 different products - this is a tremendous number of products to navigate.

To make it more challenging, stakeholders report that of the 500,000 products regularly used, the majority of these claim in some way to be innovative. Although these claims are generally genuine, they often refer to incremental innovations and improvements. The challenge for the UK health and care system is intelligently exercising choice across such a diverse range of products and innovations in a way that maximises value for money, where patient outcomes are a fundamental component of that value. To address this challenge, a common language and framework for discussing and communicating innovation is needed.

This abundance of products contributes towards the widely acknowledged ‘adoption challenge’: products may reach the market, but they can struggle to be procured and used in the NHS when there are multiple competing products, many of which are claiming similar innovations with competing benefits.

Previous attempts to address adoption have primarily focussed on setting up supplementary innovation support, processes and funding streams that identify and implement products in highly specific priority fields. These operate in addition to the main routes to market. This approach has improved adoption in certain areas, but the proliferation of schemes created has increased the complexity that innovators need to navigate. Critically, these schemes are primarily focussed on innovative, individual, pre-market devices and are small compared to the overall scale of the medtech market. Despite some specific successes, this approach has not addressed the underlying structural adoption challenge. This means that innovative, new technologies take longer to reach patients than might be necessary.

Contracting and pricing levers may be able to tackle some of the issues of the adoption problem. However, to address the root cause of the challenge, we need to create a coherent, end to end environment that provides increased clarity, alignment and a reasonable apportionment of risk for innovators, clinical and commercial professionals.

Effectively exercising choice

Meaningfully comparing product quality, performance and pathway cost is difficult and resource intensive. Exercising this choice effectively across such a broad range of products is especially demanding in a health and care system which is already facing staffing and monetary pressures.

Most assessments rely primarily on reports done by others but there are variations in specification, and standards between evaluations. By the time they start to be adopted into the market, most medtech products have been evaluated multiple times, by multiple different people against multiple differing standards, through both formal and informal pathways. There is no national repository of evaluations or consolidated NHS view of product quality.

These multiple competing evaluations create significant cost, inefficiency, confusion and frustration for both the UK health and care system and industry partners, creating a situation where most suppliers can provide at least one piece of evidence that confirms their product is the best. Inappropriate comparators, lack of consideration of the cost of change and a gap between theoretical and real-world experience of using the products are often cited as issues. Adopting a new product can also require wider changes, such as additional user training, patient education and even modifications of clinical pathways. The resources needed to implement these can be significant, and the system only has a finite capacity to make changes. The appropriate use of real-world evidence in support of a robust, class based, evaluation process is therefore essential to support effective decision making and choice.

In this environment, despite theoretically having significant choice and a plethora of innovations to choose from, lack of clear evidence to allow meaningful comparisons across a class of products means the risks of moving away from a known product are often perceived by the system to outweigh the potential benefits. This results in relatively low levels of switching between products and suppliers in practice. The high amount of product variation and low levels of product switching impacts the ability to achieve the right product, in the right place, for the right price (see Lord Carter’s 2015 report on productivity in NHS hospitals). The appropriate use of real-world evidence in support of a robust, class based, evaluation process is therefore essential to support effective decision making and choice. By focussing on a smaller number of products that represent the best options for patients and the best value for money, the system can help guide meaningful clinical choice and reduce unwarranted variation.

National clinical and technical product leadership

We already have some areas of exceptionally strong clinical leadership, where national clinical teams build consensus on specifications among healthcare professionals, evaluate products against best practice, patient experience and outcomes, and highlight where innovative technologies are most needed. Typically, this happens for complex surgical items, although there are notable exceptions in other areas such as wound care. However, many products, especially those that are not exclusive to individual specialisms, do not enjoy the same level of clinical focus and leadership across a class of products.

Even accounting for local variations in services, there are more similarities than differences in how the UK health and care system uses most products. Expanding this clinically led national approach across all areas of medtech would significantly simplify the commercial landscape for both industry and the health and care system.

Focussing innovation in the right places

At a strategic level, the UK health and care system provides industry with an overall signal of future intent through high level strategies such as the NHS Long Term Plan and the healthcare missions of the government’s Life Sciences Vision. In addition to this, the medtech industry takes many steps to understand demand more granularly, but given the many diverse communities of patients, healthcare professionals and other professionals across the NHS, these signals can be divergent and disconnected from clinical and commercial processes. In the absence of a clear central signal across the breadth of products, it often ultimately falls to industry to drive the direction of product development.

Industry often describes the difficulty of accurately predicting where innovation will be widely adopted. Given the risk, cost and complexity, it is logical for industry to prioritise incremental improvements of existing products over developing transformative innovations, even if these could potentially have a greater impact on NHS services. Where industry does take a chance on these transformative innovations, the cost of any commercially unsuccessful products can be significant.

The response to the COVID-19 pandemic has shown industry’s capability to respond, at speed, to clear granular demand signals from the NHS. Lateral flow tests, ventilators and respiratory support equipment were developed and manufactured rapidly against nationally provided target product profiles. We need to learn from this experience and provide industry with a clearer, more granular demand signal for it to respond to across all products, and the confidence of intent to buy through a clear procurement and commitment-based process to reduce commercial risk.

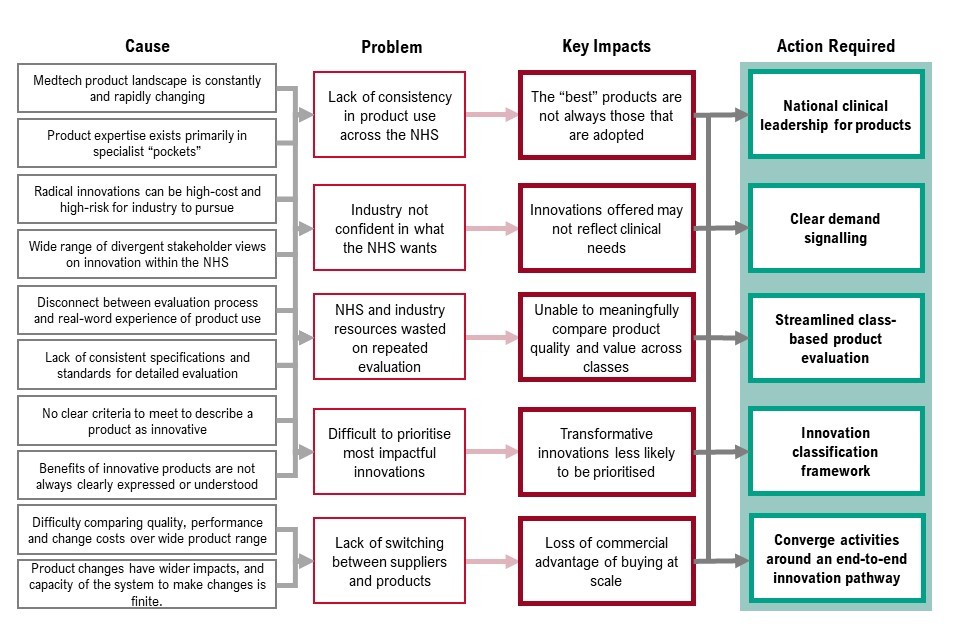

Figure 6: causes and actions for priority 2 - innovative and dynamic markets

Figure 6 sets out the cause, problem, key impacts of priority 2 and the corresponding actions required. These are:

- the medtech product landscape is constantly changing and product expertise exists primarily in specialist pockets - this means there is a lack of consistency in product use across the NHS. As a result, the best products are not always those that are adopted - to resolve this we need national clinical leadership for products

- radical innovations can be high cost and high risk for industry to pursue and there is a wide range of divergent stakeholder views on innovation with the NHS, which means industry is not always confident in what the NHS wants. As a result, innovations offered may not reflect clinical needs - to resolve this we need clear demand signalling

- disconnect between evaluation process and real-world experience of product use and lack of consistent specification and standards for detailed evaluation mean NHS and industry resources are wasted on repeated evaluation. As a result, we are unable to meaningfully compare product quality and value across classes - to resolve this we need streamlined, class-based product evaluation

- there are no clear criteria to meet to describe a product as innovative and benefits of innovative products are not always clearly expressed or understood. This means it’s difficult to prioritise the most impactful innovations. As a result, transformative innovations are less likely to be prioritised - to resolve this we need an innovation classification framework

- there is difficulty comparing quality, performance and change costs over a wide product range, and product changes have wider impacts, and capacity of the system to make changes is finite. This means there is lack of switching between suppliers and products and, as a result, loss of commercial advantage of buying at scale. To resolve this, we need to converge activities around an end-to-end innovation pathway

The aims of priority 2 will be achieved by:

- national clinical leadership for products: we must take the excellent examples of strong clinical product focus, consideration of the patient voice, support for specification setting, product evaluation, and usage guidance, and adopt these principles more broadly across product classes

- clear demand signalling: we must work towards providing industry with a co-ordinated national signal on detailed priorities for innovation by product segment. We must seek to reflect the priority of these signals within established processes, including regulatory, research, evaluation and procurement processes - for example, exploring options for volume commitments or purchasing at scale to support industry confidence in bringing new innovations to market while securing the best value for the health and care system

- streamlined, class-based product evaluation: health partners must work together with industry to develop a streamlined system of product evaluation that is regarded by both as the gold standard. In addition to quality and cost considerations across the product pathway, evaluations should consider a broad range of product comparators, the costs and risks of transition, and incorporate real-world evidence from product usage in specialist NHS test facilities

- innovation classification framework: we must work collaboratively with our stakeholders to agree a meaningful way to classify innovation that should include a commonly agreed language and a way to determine the value of innovation in terms of impact, be this value for money, efficiency, or patient outcomes and experience. This framework should assist the system in understanding incremental versus transformative innovations and prioritising their evaluation and adoption

- converge activities around an end to end innovation pathway: we need to create a clear, scalable, end to end pathway that meets the needs of the UK health and care system and industry. This will support the development of the Innovative Devices Access Pathway (IDAP) which aims to enable manufacturers to provide their innovative devices to healthcare professionals and patients at the earliest, safe opportunity

These actions will help deliver the following benefits:

- clearer signals on what the health and care system wants means greater clarity for industry on where innovation focus should be placed, and faster adoption of prioritised products to tackle diseases and health issues sooner

- clearer communication around innovation will enable the NHS to focus on the most innovative products that make the biggest impact on patient outcomes

- more appropriate product selection will reduce the administrative burden on health and care professionals, and lead to better patient outcomes and better value for money. Faster adoption of prioritised innovative products enhances the UK’s positioning as a great place to develop products

Priority 3: enabling infrastructure

Ensuring delivery of the medtech vision will also require the further development of key enablers. In other comparable sectors, such as medicines, there are clear systems, processes and data collections. These cover most products in great levels of detail and granularity and are underpinned by contractual relationships with industry. The medtech sector has not yet developed these enablers to the same level of maturity or scope. This has been sufficient while the sector has been in a relatively stable and steady state, however the ever-increasing complexity of the market, the pace of innovation and the challenges around major shocks such as the pandemic necessitate a new approach that will build a stronger infrastructure of enablers. This will allow us to be more proactive in the sector - for example, by using data and stakeholder engagement to drive better demand signalling.

These vital enablers underpin all the priority areas we have identified, and if we are to successfully deliver our vision, we must improve and expand these strong foundations.

Data

Existing data initiatives

Data continues to be a priority area for enabling improvement in the health sector. The Independent Medicines and Medical Devices Safety Review, chaired by Baroness Cumberlege, has resulted in the creation of a Pelvic Floor Registry and more focus on patient safety. DHSC and NHS Transformation Directorate published its final data saves lives strategy in June 2022, setting out how we’re harnessing the potential of data in health and care while maintaining the highest standards of privacy and ethics.

Since January 2021, all medical devices have been required to be registered with the MHRA before they can be placed on the market in Great Britain. This is enabling a greater degree of information to be shared across the healthcare system and public, while enhancing MHRA’s market surveillance activities. There is also a range of commercial data held by NHS organisations like NHS Supply Chain.

These initiatives (across safety, regulation, procurement and commercial areas) have tended to be independent of one another, resulting in pockets of very rich data but with gaps and difficulties in creating a more joined up picture.

Improving data standards and linkages

Data collection and management in medtech is currently purpose led rather than approached holistically for the sector - there are a range of registries, databases and survey collections maintained by different organisations on different topics and sub-sectors for different end purposes. The decentralised nature of medtech data means there is no single data standard, making it difficult to cross-reference data from different sources at a national scale. The scale of the market (around 2 million products) further compounds this complexity. Lack of central oversight limits governance for data development meaning important data is often missed or difficult to find. The lack of standards also results in lower data quality. This fragmented data landscape makes it difficult to build up a central picture of UK medtech in a consistent, transparent and practically useful way. Having higher quality, joined-up, comprehensive data for medtech will make it easier to compare products, reducing search time and making it easier to make informed choices to select the right product, at the right price, in the right place.

Encouraging proactive data collection

Data collection in medtech is often driven by short-term needs and responses to incidents. This was highlighted in the Independent Medicines and Medical Devices Safety Review, which noted that registries are often established only after safety issues have been identified. The ability to gather and understand data in a more proactive way could result in significant patient benefit in the medium term.

One of the most important lessons from the pandemic was the need for a more systematic and proactive approach to data gathering on equipment. There is a clear need to gain insights to answer retrospective, real-time or future looking questions with sufficient accuracy, so that sound, timely decisions can be made routinely and flexibly. We are looking to build on this momentum and drive further improvements in this space with the development of the National Equipment Tracking Information System (NETIS).

By encouraging proactive data collection and improving data standards and linkages, we can work with our partners across the medtech industry and the UK health and care system to build the medtech data system over time and gradually reduce the effort it takes to navigate the current medtech landscape and allow for a greater number of priority areas of focus.

Relationship with industry

Creating channels for industry and government to engage centrally

Overall, there are many examples of strong partnerships and working relationships between government and the medtech industry, on specific topics, or in response to individual events. In these relationships can be found gold standards for best practice in collaboration, and proof that a collaborative mindset can be designed into the avenues through which we work. However, many of these relationships focus on broader issues than medtech alone, or conversely are focussed on responding to very specific needs or incidents. As a result of this, government and industry can engage in inconsistent ways, driven by their priorities and pressures at any given point in time, rather than building a broader strategic relationship centred around the needs of the medtech sector.

To progress our joint priorities, industry and government must find a way to engage in a more open and collaborative way that recognises and acknowledges and commits to tackle them with collective action. This will only be possible if the right supporting infrastructure to support this is put in place.

We want to strengthen our collaborative working with industry increasingly over time, building from specific moments of engagement into systems and processes that guide both health and care system and industry activities. We recognise that the diversity and scale of the industry makes it challenging to build a central representative voice, and that this will take time to develop and perfect - however, the benefits to the industry and government over the longer term are likely to be transformative.

Identifying priority areas for collaboration

We have already identified several priority areas where a collaborative approach with industry can be particularly impactful. These include:

- joint development of a circular economy approach that will enable greater utilisation of reuse, remanufacture and material recovery within the medtech market, as part of our actions identified in priority 1

- working together to drive improvements in data collection and sharing, including encouraging the approach of ‘collect once, use often’

- collaborating with industry to understand inflationary pressures with the view to devise a long-term policy position as part of our overarching aim of ‘right price’

We will continue to work with industry on these and other important areas as part of our ongoing commitment to collaborative working.

Figure 7: causes and actions for priority 3: enabling infrastructure

Figure 7 sets out the cause, problem, key impacts of priority 3 and the corresponding actions required. These are:

- data is focussed on individual purposes (for example, purchasing), there is a lack of national data standards and varying quality across sources, general acceptance of lack of transparency, and data collection is often reactive (for example, a response to an incident) rather than proactive. This means there is a lack of compatibility between data sources, inaccurate and incomplete data, it is time-consuming to get the right information and there are patches of data with no holistic overview. As a result, it is effort intensive to undertake systemic data analysis so can only focus on a limited number of priorities - to address this we must build a trusted data picture

- no structured mechanism for collective action between industry and government, and government and industry choose routes of engagement inconsistently according to their priorities and pressures. This means relationships are transactional rather than holistic and as a result, it is difficult to agree and execute shared direction and strategy for the sector. To address this, we need to establish a collaborative partnership with industry

The aims of priority 3 will be achieved by:

- building a trusted data picture - we must increase the proactive gathering of data regarding medical technology. We must champion increased data quality as well as standards and linkages and work with all stakeholders to encourage the approach of ‘collect once, use often’. We will ensure this data is built upon, shared and used in a consistent manner without gaps or discrepancies. This must be supported by a common nomenclature and system of markers. We will work with our health and care system partners to create a reliable and trusted picture that informs what is needed to deliver on operational and strategic objectives

- collaborative partnership with industry - we must establish a culture of collaborative working between industry, government and the clinical and commercial communities of the health and care system. We must create an environment where frank discussions and transparency are the norm, while respecting commercial sensitivities. We will use this collaboration to set shared vision and direction for the medtech sector

These actions will help deliver the following benefits:

- clear and timely signals when there are issues with products will allow us to take swift action to ensure continuity of patient care

- more efficient use of existing equipment and more transparent pricing will help to achieve better value for money

- stakeholder agreement on the data picture will enable coordinated action making it easier to use data across different datasets. This will form a basis for more insights and proactive action to be taken

Priority 4: specific market focusses

While medtech represents an exceptionally diverse range of products, the majority of these are designed, developed, selected and procured through broadly comparable systems and predominantly face common challenges. The overarching vision and priorities of the strategy have been developed to be relevant to all parts of this broad sector. However, we recognise that some specific segments of the market face particular challenges. In these areas, we will work to apply the principles of the strategy at a more granular level. This may be in the form of tailoring the broader elements of the strategy to best fit the needs of a particular market, or through supporting the aims of the strategy through the addition of specific actions to tackle singular issues.

This approach has already been used with success in other areas of the health and social care system. There is significant ongoing work around the use of digital and artificial intelligence both in medtech products and as standalone products, and during the pandemic dedicated strategies were adopted to ensure sufficient respiratory, renal and enteral capacity.

We expect that the areas of focus will change and expand over time as market conditions and clinical requirements change. At present, we believe there are 2 main medtech areas that would benefit from an increased focus:

- medtech in the community

- diagnostics

Medtech in the community (appliances)

The vast majority of medtech spend is in secondary care, but there is also significant spend, roughly £1 billion a year, in community care, including primary care. These medtech items are used day to day by patients in the community and are also known as appliances. They include continence products, such as stoma or ostomy bags, dressings for long-term wound care, and reagent strips for home testing (for example, of blood glucose or ketones).

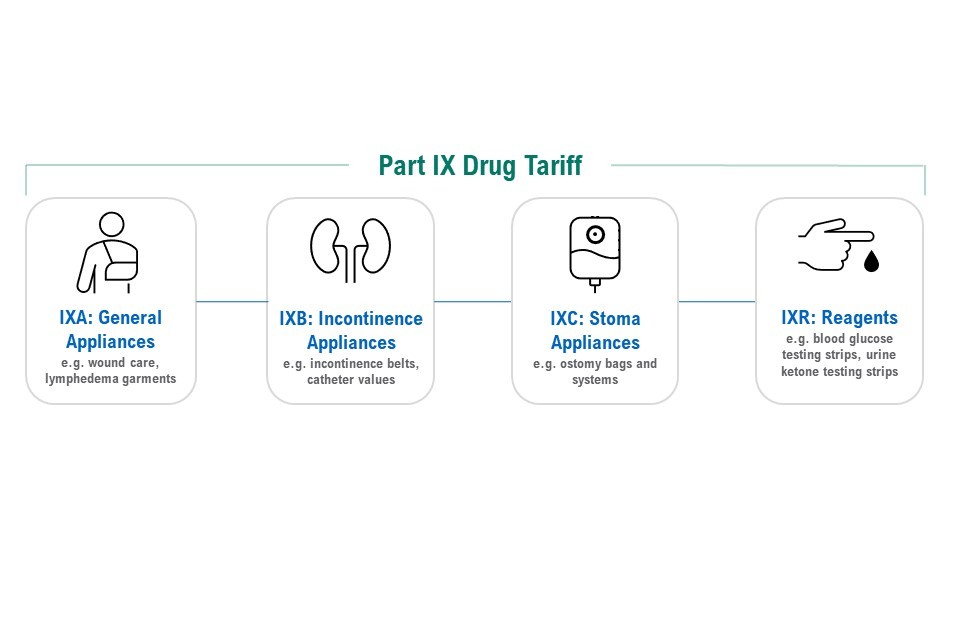

Figure 8: components of the Part IX Drug Tariff

The figure illustrates the 4 components:

- IXA: general appliances - for example, wound care, lymphedema garments

- IXB: incontinence appliances - for example, incontinence belts, catheter values

- IXC: stoma appliances - for example, ostomy bags and systems

- IXR: reagents - for example, blood glucose testing strips, urine ketone testing strips

Although these products are typically identical to those used in secondary care, in the community they are sourced and supplied through fundamentally different supply chains and mechanisms to reach patients. Suppliers apply to be listed on Part IX of the Drug Tariff, patients are prescribed products (in the same way as medicines) and have their prescriptions dispensed either through local pharmacies or, given the specialist nature of many of the products, through dedicated dispensing appliance contractors (DACs).

The mechanics by which appliances are provided to patients in the community have changed little since they were established in the 1980s, in stark contrast to the rapid development of medtech and the substantial evolution of community care services over this same period.

While the fundamental principles of these mechanics, Part IX prescription and reasonable choice remain generally sound, there is opportunity to review and improve these arrangements to better reflect today’s operational environment, and to deliver better outcomes for patients and the taxpayer.

The specific differences in mechanics and supply chain bring opportunities and challenges alike, and these need to be factored into a more focussed strategy for medtech in the community:

- promoting meaningful choice: while the current system is based on choice, it is not always easy for patients, healthcare professionals, or purchasers to exercise this choice in practice. We intend to support choice through making it easier to compare, contrast and select the most appropriate products

- modernising administrative arrangements: today’s system has its roots in a one size fits all approach originally dating from the 1980s. There are significant opportunities to rationalise existing processes, creating faster access and systems that are better aligned across primary and secondary care

- embracing new commercial and service models: since its inception, a variety of new approaches have been developed that today work in parallel to the Part IX system. We need to maximise the opportunity these provide while maximising transparency and ensuring quality

These actions will help deliver the following benefits:

- patients and clinicians will be supported to make better choices about the products available to them to treat and manage their conditions

- modernised administrative arrangements will streamline and increase the speed of our systems, allowing them to perform more efficiently

- transparency of systems across the NHS will enable better decisions and reduce variations in service between places

Diagnostics

Medtech products play a vital role in diagnostic services, which are crucial to supporting preventative care and the delivery of world leading, safe and effective treatment. The NHS carries out over 1.5 billion diagnostic tests every year and more than 85% of clinical pathways involve a diagnostic test (see Item 5: diagnostics capacity). Diagnostics are a significant part of the UK Life Sciences sector, with £2.9 billion in turnover and employing more than 15,000 people in the UK.

Figure 9: components that sit under diagnostics

The figure illustrates the 5 components of diagnostics are:

- imaging services - for example, CT scans and MRI scans

- pathology - for example, biopsies and blood tests

- endoscopy - for example, colonoscopy and gastroscopy

- physiological measurements - for example, electrocardiograms or lung function tests

- genomics - for example, genetic rare diseases screening

Diagnostic services include imaging services, pathology, endoscopy, physiological measurement and genomics. All these services are vital to ensuring that patients get the right care quickly and efficiently.

Over the last 2 years, the COVID-19 pandemic has demonstrated the importance of fast and accurate diagnostic testing, genome sequencing and the existence of robust diagnostic infrastructure to process and share results. The wide adoption of home lateral flow testing has demonstrated the potential for increased use of diagnostics outside formal clinical settings to support earlier diagnosis.

Demand for diagnostics is continuing to rise and waiting lists have increased following the reduction in availability of services during the pandemic, so it is vital that we continue to improve and expand our diagnostic capacity. In tackling these challenges, we have an opportunity to move to a more patient-centric model of care, and to better connect our world-leading life sciences sector with the NHS to transform elective diagnostics with the latest technologies.

Diagnosis closer to the patient

Community diagnostic centres (CDCs) provide a range of elective diagnostics away from acute facilities. These centres will reduce pressure on hospitals, improve patients’ access to tests, increase capacity, and speed up diagnosis and referral for treatment through a more productive, efficient, personalised and integrated model of care.

Digital and technological transformation

Innovation will play a critical role in the future of diagnostic services, so we must ensure that research and development is directed towards diagnostics in a way that maximises impact. We need to make sure that we maintain the focus on advancing diagnostic technologies and adoption across the NHS to support better treatment and outcomes for patients and help the NHS to focus resources where they are most needed.

Digital transformation of diagnostics through new technologies such as artificial intelligence (AI) will also enable the current imaging and pathology workforce to optimise their working patterns and better support the growth in capacity of imaging services. This will transform how people receive their tests and test results, delivering more accurate and timely results.

Based on broad engagement across the diagnostics sector, 4 areas for priority action in the diagnostics sector have been identified that will facilitate increased access, earlier diagnosis, innovation adoption and efficiency.

These 4 diagnostic priorities are:

1. Elective recovery

We must support the NHS to adopt more efficient models of care that will help tackle the elective backlog. We will establish up to 160 CDCs by March 2025, supported by appropriate workforce plans. We will build pathology network maturity, and deliver enhanced digital infrastructure that will improve efficiency, interoperability and availability of diagnostics across the health system.

2. Early diagnosis

We will work to improve patient outcomes through early detection and diagnosis, meaning patients can receive treatment when there is a better chance of achieving a complete cure. We will utilise additional capacity and increased public awareness and acceptance of self-administered testing built through the pandemic to increase uptake of early screening. We will also enable earlier diagnosis of cancer and detection of relapses through the rapid introduction of new genomic technologies.

3. Industry engagement

We will provide clear demand signalling to industry to support innovation in the UK diagnostics sector. The existing NHSE Demand Signalling Programme will work with a clinical advisory group to identify and drive innovations that support early diagnosis and will have the greatest impact on health outcomes. An NHS-led review of diagnostics commissioning will ensure benefits across the pathway are recognised, and that regulatory and evaluation processes are simplified and clarified. This aligns with the broader medtech priorities of national clinical leadership for products, clear demand signalling and streamlined evaluation.

4. Pandemic preparedness

We will use the legacy of investment during COVID-19 to ensure preparedness for any future pandemic. UKHSA, through the Centre for Pandemic Preparedness, will work in conjunction with NHSE and the pathology networks to ensure that diagnostic facilities are ready for future pandemics and that existing infrastructure and latent capacity is capable of being mobilised.

These actions will help deliver the following benefits:

- providing more efficient and effective models of care and detecting and treating diseases earlier will support elective recovery in the health and care system by reducing pressure on acute services and will improve patient experience and outcomes

- access to CDCs will offer care to patients outside of hospital settings in a way that is more personalised, convenient and supports improved patient access to healthcare

- promoting the UK as a thriving global hub of diagnostic innovation and advancement will support and enhance the UK’s reputation as a great place to develop products

- supporting the health system to scale up diagnostic testing and genome sequencing rapidly and effectively will help to mitigate the greater impacts on wider society and the economy of any future disease threats

Conclusions and next steps

Medtech is a large and diverse industry that plays a significant role in both the UK economy and the UK health and care system. It has largely operated without significant central intervention and approaches to date have been driven by need rather than through a planned strategic approach.

Medtech products and markets have developed rapidly, and together with the changes brought about by the UK leaving the EU and lessons we have learnt from COVID-19 we need to act now to ensure that the sector is sustainable for the future, and that our resources are focussed where they will improve the overall health of the nation.

We will do this by making sure the health and social care system can reliably access safe, effective and innovative medical technologies that support the continued delivery of high-quality care and excellent patient outcomes in a way that makes the best use of taxpayer money, delivered by our vision of ‘right product, right price, right place’.

Recognising the work that is already underway within the sector, we see 4 key priority areas for fresh national focus:

- resilience and continuity of supply

- innovative and dynamic markets

- enabling infrastructure

- specific market focusses