Annual Report and Accounts 2015 to 2016

Updated 14 September 2016

Applies to England and Wales

Performance report

(a) Overview

Statement by the Interim Chair

I am delighted to contribute to this year’s Annual Report and Accounts. As the organisation’s Senior Independent Director I was honoured to be asked to serve as Interim Chair following the departure of our former Chair Mark Boyle and this is one of the many pleasant tasks that have fallen to me in that role.

To begin with I would like to pay tribute to Mark, who took over as Land Registry’s first independent Chair in October 2011. Mark oversaw many positive changes in the way the organisation is run and perceived during his four-and-a-half-year tenure. I would like to thank him for the work that he has done, a sentiment which I know will be reflected by his colleagues on the Land Registry Board. Mark saw Land Registry become a more efficient, more productive and more innovative organisation under his leadership.

As Interim Chair my role is to lead my colleagues on the Board in achieving our shared vision and goals for Land Registry until a permanent appointment is made. I am working in partnership with Chief Executive and Chief Land Registrar Graham Farrant to represent and promote the organisation in our dealings with our customers, stakeholders and ministers.

The Government has consulted on the options to move the operations of Land Registry into the private sector from 2017. Whatever the Government decides about the future ownership of Land Registry, the Board will play its part in developing any future operational and ownership options and formulate a strategy to deliver the way forward chosen by the Government. This will be a key decision for the organisation and it will be our task to see this through in a manner that provides reassurance and confidence to the public and Land Registry’s key customers and stakeholders.

In the latter respect we were all pleased by the success of the stakeholder event hosted at the Royal Society last November. We look forward to making that an annual tradition and continuing to make Land Registry a more open and inclusive organisation. Increasingly Land Registry has become a business that listens to its customers, its stakeholders and its people. As a Board we very much want to help this culture to grow further and to improve our standing across the wider property sector.

I know our new Chair will find, on their appointment, an impressive organisation with a rich history, a track record of success and a dedicated and professional workforce.

Foreword by the Chief Executive and Chief Land Registrar

I am pleased to report that my first year as Chief Executive and Chief Land Registrar has been another very successful year in Land Registry’s history.

When I became Chief Executive and Chief Land Registrar last June one of my immediate priorities was to review our Business Strategy. I invited all our colleagues to take part and their ideas and opinions influenced our choice of a new vision and values for Land Registry which I believe better reflect the vital role we play in the property market and wider economy.

Our vision and values

Your land and property rights: guaranteed and protected

We give assurance

We have integrity

We drive innovation

We are professional

Our new vision and values reflect our core commitment to the integrity of the Land Register, which remains one of my highest priorities. For our colleagues this represents a welcome restatement of the central purpose to which many have devoted their working lives and provides clarity of purpose for our new recruits. Indeed we have reaffirmed our central mission of maintaining the integrity of the register and increased the resources we devote to ensuring home buyers and sellers can rely on our professionalism and expertise. We also believe this will be welcomed by our customers and stakeholders.

This last year we received more than 30 million applications, ranging from simple electronic requests for information and official searches which form a critical component of the conveyancing process to applications to change the register. This increase in workload over the year has been a huge challenge for our casework teams who have responded by exceeding our targets for customer satisfaction and the quality of our registrations. The number of titles in the Land Register climbed to almost 24.5 million with almost 88% of England and Wales now registered. However we are still taking longer to process certain types of applications than we would like or our customers have come to expect and we remain focused on improving our speed of service.

We recognised we would need to recruit to respond to our rising workload and we have undertaken our first large-scale recruitment in almost a decade. Building on the 150 new recruits we welcomed last year, which included 80 apprentices, this year 330 new colleagues joined Land Registry, including another 57 apprentices.

But we have not stopped there; we are prioritising the most urgent applications and we have launched a new online tracker, Application Enquiry, so customers can view the progress of their applications.

Application Enquiry is just one example of the progress we have made in digitising the register and registration services. We now handle virtually all of our applications electronically, with 94% received via our Business e-services, and we scan the remaining paper applications so our teams can treat them in the same way.

During 2015/16 we made good progress in creating a digital Land Charges service, a digital register view service and a digital mortgage service as well as starting work on a new technology platform to underpin all our services. These have now been launched either as live products or as ‘betas’ and we are already receiving positive feedback from our customers – further improving our digital and IT capabilities.

On that note I had the pleasure of accompanying members of the team who developed our ground-breaking MapSearch service to Buckingham Palace to accept the 2015 Civil Service Award in the Digital category, building on the award we won in the Innovation category the previous year. We were honoured to speak to Her Majesty the Queen about MapSearch and how it makes it quicker, easier and cheaper for our business customers to check the register and obtain property details. We are also delighted to be a feature of this year’s Civil Service Live where we will share our experiences from MapSearch with civil servants from across the country.

We have also made good progress in building a single digital register for Local Land Charges under the powers granted to us by the Infrastructure Act 2015 and we have just launched a second consultation to get the views of our stakeholders on the specifics of its implementation. Working with the 326 English local authorities which hold Local Land Charges data, we intend to substantially improve the speed and consistency of service for customers. We are funding the £190 million programme from our reserves and I was delighted to meet many of the stakeholders at our first Local Land Charges conference in November.

We are already a significant holder and publisher of data thanks to the size and richness of the Land Register. We released four new datasets during the year, including the Overseas Companies dataset which supported the Prime Minister’s pledge for greater transparency on foreign ownership of property in the UK.

We also have provided further stability to the Executive Team thanks to the appointment of a permanent Director of Digital Services, John Abbott. John joined us from Ordnance Survey in January and succeeded Jon Parry in that role and also takes over the Board-level responsibilities for Information Systems following the retirement of Rowland Coombs. I would like to place on record my thanks to Rowland and Jon for their contributions to Land Registry.

I would like to thank our departing Non-Executive Chair Mark Boyle for his unstinting efforts to direct Land Registry and to achieve some very real efficiencies and improvements in our services, including the push to become more digital, and for his personal support during the last year.

We are now in a strengthened position at all levels of the organisation to meet the challenges ahead of us. Everyone from our apprentices to our directors are working together and with a renewed sense of purpose to live up to our vision and values.

Following the Chancellor’s Autumn Statement, the Government is consulting on the options for moving the operations of Land Registry to the private sector from 2017. The directors and I have worked hard to ensure that the normal operations of Land Registry continue to be our focus, while working with government on assessing the options and taking account of the consultation responses received.

This could represent the biggest change for Land Registry since it was created in 1862 but in reviewing our achievements this year I remain confident that we are prepared for whichever option the Government chooses.

The result of the referendum held on 23 June was in favour of the UK leaving the European Union. The impact of this decision on the UK economy is uncertain. Land Registry’s business and fee income is related to levels of activity in the wider property market as well as to property prices and we will therefore need to consider how this might affect our medium term financial planning and to determine whether we need to adjust our resourcing strategy and fee levels in order to ensure that we fulfil our responsibilities as a trading fund. In the short term the business has sufficient cash reserves to manage the immediate impact of any reduction in income.

Graham Farrant, Chief Executive and Chief Land Registrar

28 June 2016

Statement of purpose and activities of the organisation

Her Majesty’s Land Registry was established in 1862. We are a non-ministerial government department, an executive agency (since 1990) and a trading fund (since 1993) that makes no call on funds voted by Parliament. By statute we are required to ensure that our income from fees covers all of our expenditure under normal operating conditions.

From 2011 certain statutory functions relating to Land Registry are vested in the Secretary of State for Business, Innovation and Skills. Within his department our sponsor minister is the Minister for Small Business, Industry and Enterprise.

Our principal function is to keep a register of title to freehold and leasehold land and charges throughout England and Wales and to record dealings with land once it is registered. On behalf of the Crown we guarantee title to registered estates and interests in land.

This report deals with our Land Charges and Agricultural Credits departments separately from our main business but the accounts are given for Land Registry as a whole (see note 2 in the accounts).

Our functions are entirely statutory. We have no prerogative powers. The Land Registration Act 2002 empowers us to deal with “the business of registration under this Act” and is our primary governing statute.

The Infrastructure Act 2015 enabled Land Registry to become the sole registering authority for Local Land Charges. We are currently working on the provision of a single centralised digital service for Local Land Charges and will have wider powers than those contained in the Land Registration Act 2002 to develop new services to benefit the wider property market.

The head of Land Registry is the Chief Land Registrar, appointed under statute by the Secretary of State for Business, Innovation and Skills. The Chief Land Registrar is also Land Registry’s Chief Executive and Accounting Officer. The Chief Executive is responsible for the effective and efficient day-to-day management of Land Registry, subject to financial and legislative parameters. Full details of the roles and responsibilities of the Secretary of State and the Chief Land Registrar are set out in our framework document 2012.

Information on our volumes of work, including our intake for statutory services, is contained in Appendix A and Appendix B.

Fee income and business performance

Income

We derive income from our statutory services and from commercial services.

Section 102 of the Land Registration Act 2002 states that fees may be prescribed for ‘dealings’ with Land Registry. This covers fees in respect of our statutory services, which are those applications to Land Registry in respect of land registration, such as applications to register a transfer or charge of a property or to obtain an official copy of the register.

Authority for the level of fees on applications to Land Registry stems from a fee order made by the Secretary of State for Business, Innovation and Skills under section 102 and laid before Parliament. Orders are made with the advice and assistance of the Land Registration Rule Committee (an advisory non-departmental public body representing stakeholder and legal interests) and the consent of HM Treasury. Our current fees were established under the Land Registration Fee Order 2013.

The fee order covers applications for: registering title to land for the first time (‘first registrations’); dispositionary first leases; transfers of part of registered land; applications affecting a registered title (‘dealings’); and a range of services relating to inspection, copies and searches of the register.

In line with the principles established in Managing Public Money Land Registry are conducting a review of fees and charges during 2016/17, taking into account the recent financial surpluses and our future financial plans.

Land Charges and Agricultural Credits

Under the Land Charges Act 1972, we maintain registers of Land Charges, pending actions, writs and orders affecting land and other encumbrances registered against the names of owners of property, which are not registered under the Land Registration Acts. Under Section 16 of the Act, the Secretary of State for Business, Innovation and Skills has the authority to set fees by means of statutory instrument with the consent of HM Treasury. The current fees are specified in the Land Charges Fees Rules 1990 as amended by the Land Charges Fees (Amendment) Rules 1994.

In addition, under the Agricultural Credits Act 1928 we maintain a register of agricultural charges made under Part II of the Act. Under Section 9 of the Act, the Secretary of State for Business, Innovation and Skills has the authority to set fees by means of statutory instrument with the consent of HM Treasury. The current fees are specified in the Agricultural Credits Fees Order 1985.

Commercial income

Section 105 of the Land Registration Act 2002 gave the Chief Land Registrar authority to “provide, or arrange provision of, consultancy or advisory services about the registration of land in England and Wales or elsewhere”. Section 35 of the Infrastructure Act 2015 broadens these powers to enable Land Registry to provide (a) consultancy and advisory services about land and other property in England and Wales or elsewhere and (b) information services and services relating to documents or registers, relating to land or other property in England and Wales.

Our Commercial Services function was established in 2004 under the authority of section 105, for the purposes of identifying ways of giving more effective access to our data and also of adding value by creating specific services.

The focus of the commercial activity has subsequently shifted from the development of new commercial services and revenue raising to providing better access to data through the publication of datasets.

We currently offer 17 products within our commercial portfolio, under a mixed pricing model, including a range of data cleansing, spatial and data verification services.

We comply with our duty not to cross-subsidise our commercial services with fee income in respect of our statutory services. Development costs for new products may be funded from cash held returns but these costs are recovered from future revenues. In line with “Managing Public Money Annex 6.2 Charging for Information”, the charges for most of our commercial services are set on a ‘cost plus’ basis, but some reflect a market rate. Data publication pricing is based on the three principles of open data: free, cost recovery and trial access.

Strategy

Our Business Strategy was endorsed by ministers in December 2012 but we have been updating the core elements during this year. The objectives are outlined within the Governance statement in this annual report and accounts.

Our vision and values

Your land and property rights: guaranteed and protected

We give assurance

We guarantee our services and provide confidence to the property market

We drive innovation

We are forward thinking, embrace change and are continually improving our processes

We have integrity

We value honesty, trust and doing the right thing in the right way

We are professional

We value and grow our knowledge and professional expertise

Our 2013–2018 strategic targets

The 2012 Business Strategy set out 12 targets to be achieved over the five-year period.

| Original target | Forecast performance to 2018 |

|---|---|

| 99% of information services and 60% of registration services to be lodged electronically by 2017/18 | Achieved |

| Digitisation of local land search data and reduction of the average cost of local searches by 20%, improving the average speed of service by two days by 2017/18 | Digitisation of local land search data and reduction of the average cost of local searches by 20%, improving the average speed of service by two days by 2017/18, for those authorities where the Chief Land Registrar has served notice for responsibility |

| A 60% increase in productivity driven by digital by default by 2017/18 | A 45% increase in productivity by 2017/18 |

| Payment of a special dividend of £100m in 2013/14 and a further planned £100m in 2014/15 contingent upon market conditions | Achieved |

| Implementation of a sustainable model to make 100% of licensable data available to all by 2017/18 either for free or at marginal cost | Remains a key target but timing under review pending decisions on the potential privatisation |

| Access to data provided to all customers through an online application in 2013/14 | Achieved |

| 100% of all licensed data available to W3 data standard level 4 by 2017/18 | Remains a key target but timing under review pending decisions on the potential privatisation |

| Customer satisfaction maintained at no less than 96% | Maintain target at 90% |

| Net Promoter Score maintained at no less than 50% by 2017/18 | Target relinquished |

| Introduction of a free property alert service to the public in 2013/14 | Achieved (as Property Alert) |

| Recruitment to strengthen the Executive Team and better align accountabilities to deliver the Business Strategy by the end of 2013/14 | Achieved |

| Employee engagement levels to be in top half of the Civil Service by the end of 2014/15 | Not achieved |

We have achieved five of the strategic targets. We relinquished the target on net promoter score and modified the customer satisfaction target, both in the context of the provision of digital service, as opposed to provision of bespoke customer service. We have made good progress on our other strategic targets and measuring our units processed per post per day against the 2012/13 Business Plan budget we have achieved a 35.8% efficiency improvement to 31 March 2016.

Key issues and risks

In the Spending Review and Autumn Statement 2015, the Government announced its intention to “consult on options to move operations of the Land Registry to the private sector from 2017” and this commitment was repeated in the Budget in March 2016. Land Registry is making appropriate preparation for any transition and change of status, while continuing to focus on day-to-day land registration activities.

Currently there are 15 strategic risks, four of which are within the specified risk appetite in terms of impact and likelihood. The most significant risk is that we do not have the right numbers of people with the right skills to meet current and future business needs. Primarily this relates to frontline staff and the need to reduce the backlog and challenges for senior staff relating to the workstreams arising out of a transition and change of status. Further information is available in the Governance statement.

Explanation of going concern basis and significant liabilities

Land Registry is the statutory provider of land registration services and there is continued demand for those services; on statutory land registration, on Agricultural Credits and on Land Charges.

The volume of intake forecast for 2016/17 is 31.4 million applications equating to 12.6 million units, which is in excess of 2015/16; and there were no financial difficulties in 2015/16 under the fee order in place.

The provision of Land Registry services may alter in terms of operating model but there is no greater risk to the organisation’s continued activity. Our medium-term financial plans give no indication there is currently an increased risk to demand for land registration services.

Our year in figures

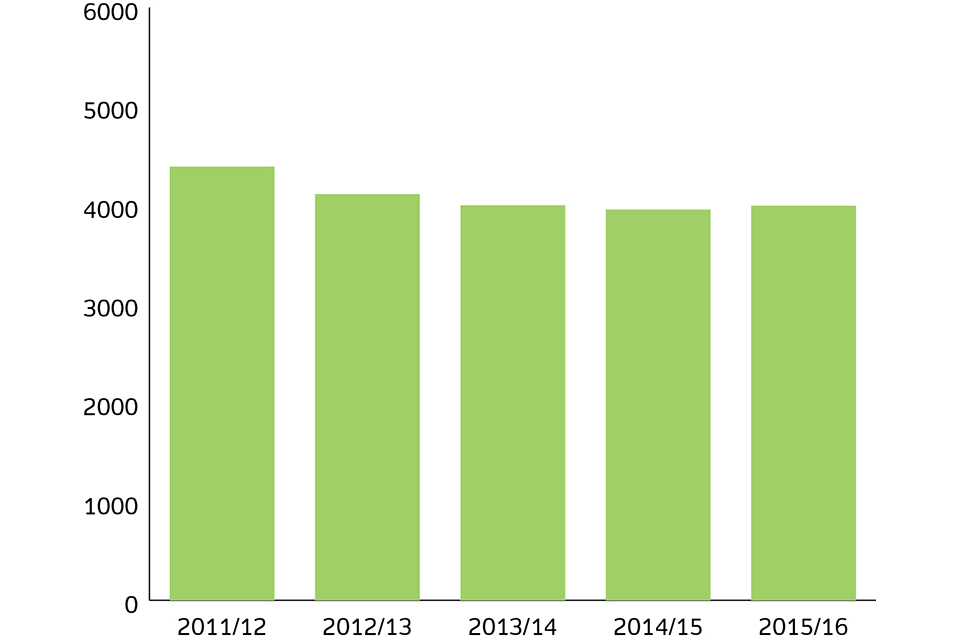

- Number of employees at 31 March: 4,486

- 60% women

- 40% men

- average full-time equivalent 4,035

- including 119 apprentices

- Customer satisfaction score: 94%

- Total number of applications for services:

- total: 30,20,012

- electronic 28,224,225

- Number of awards: 3

- for diversity (Employers Network for Equality and Inclusion)

- MapSearch (Civil Service Digital Award)

- Lean (Institute for Continuous Improvement in Public Services)

- Registered titles: 24.5 million

- Registered land: 87.9%, of 15.4 million hectares in England and Wales

- Income: £295 million

- Operating costs: £254 million

- Retained surplus: £21.1 million

- Dividend: £13.6 million

Our year in focus

We give assurance

A buoyant property market meant registrations rose for the sixth consecutive year. To cope with our increasing workload we:

-

undertook our biggest recruitment programme since the late 2000s, welcoming more than 250 permanent recruits and 57 apprentices

-

called on the expertise and dedication of our staff who responded by increasing local office productivity by 1.6%

-

increased overtime hours and moved staff with suitable experience back into casework roles

-

centralised the processing of certain application types to make them more efficient

-

enhanced and developed our range of digital services

Less costly, more efficient

Providing official copies of the register and associated deeds is integral to the conveyancing process, with around 10 million applications per year. By centralising the processing of application types into specialised teams, consolidating file storage from multiple suppliers to a single supplier, introducing new scanning technology and promoting digital alternatives to customers we have cut the number of staff involved from 116 people across 14 locations from 2012/13 to 56 people in one office today. The costs associated with paper, printing and postage have fallen from £1.57m per year to £0.57m. Digital applications for associated deeds rose from 68% to 96%.

Some customers encountered longer registration completion times than they were used to in the past as we experienced an increase in our works in progress, particularly those which involved the registration of new titles, as demand increased. We:

-

continued to prioritise applications required for property transactions and mortgage applications, with 98% of information services applications processed within two days

-

launched our new, free Application Enquiry service which allowed our business customers to view the progress of their applications online

-

surpassed our 98% target for the quality of our registrations.

At 94% our customer satisfaction for the year was comfortably above our target.

The Land Register has grown steadily since it was created in 1862 but in recent years the number of titles added each year has accelerated. Over the past two years we have:

-

added 1% of the land mass of England and Wales every six months, moving close to 88%

-

increased the number of titles in the register to close to 24.5 million.

We continued to strengthen our counter-fraud activity and measures, with:

-

the number of active Property Alert accounts almost doubling to just under 30,000

-

our Property Fraud Line reaching its third anniversary having received nearly 3,000 calls and emails from members of the public seeking help to protect their homes

-

an external counter-fraud conference featuring speakers including the Metropolitan Police

-

an internal Fraud Awareness Week promoting key messages

-

staff joining police in leafleting the public as part of Operation Rogue Trader

Our lawyers worked with the Law Commission on a review of the Land Registration Act 2002 which could have significant implications for future practice and represented Land Registry in a rare Court of Appeal case, Swift 1st Limited v Chief Land Registrar, which clarified important aspects of the law regarding indemnity.

Faster conveyancing

Our Local Land Charges Programme is regarded by the Government as a key element in improving the conveyancing process and providing assurance to the property market. Searching for Local Land Charges – which are binding obligations, prohibitions or restrictions on a property – in advance of a sale can be slow and expensive. By delivering a single Local Land Charges register for England under the powers given to us by the Infrastructure Act 2015 we will provide confidence and consistency to customers. We have started to build the register, working with the 326 English local authorities which currently hold the data.

We have integrity

This was the first year where all our applications were handled electronically, either as digital submissions or through front-end scanning, other than first registrations as we don’t scan deeds. This was thanks to:

-

the effectiveness of our Business e-services

-

the popularity of our 50% discount for electronic applications

-

the success of our scanning service in turning paper applications into electronic documents

-

the developing role of our case management ‘workflow’ system in distributing electronically mobile work around the organisation.

We reviewed our progress against our Business Strategy and updated our vision and values to ensure they were relevant and resonated throughout the organisation. Every member of staff had the opportunity to have their say on their development and we ran a comprehensive training programme to ensure that all of our staff knew the vision and values.

A modern working environment

Our Coventry Office moved from its home of 20 years, Leigh Court, to allow a free school to take its place. We moved our operations to city centre Earlsdon Park and also transformed the working environment for the 200-plus staff by using more modern working methods, including hot desking and improved information communications technology. Daily team meetings are held around plasma screens with up-to-date information rather than in front of a wall of paper print-outs. We share the building and facilities with Civil Service colleagues from the Department for Education and the Local Government Ombudsman.

Continuous improvement

Our ‘Coventry GoSee’ learning resource helps staff understand how to apply the principles of continuous improvement effectively. A tour of Coventry shows ‘Lean’ processes in real-life situations. By putting participants firmly in the role of a customer they are able to identify waste, observe the flow of work and find ways of improving customer satisfaction. They see good and bad cases of systems thinking, visual management and dealing with bottlenecks, as well as many examples of managing workflow and variation in demand and waste. The project won the Institute for Continuous Improvement in Public Services Special Innovation Award 2016.

Collaboration across the organisation helped find multi-million pound savings to meet our target of achieving a 5% reduction in running costs. Our efficiency measures included a:

-

£1.7 million reduction in computer hire, maintenance and depreciation costs by finding more cost-effective ways to replace our equipment

-

£0.6 million reduction in utility and security costs as we reduced the size of our estate under our Estate Strategy

-

£0.5 million reduction in our contract spend with the DX delivery network

-

£0.9 million reduction in spending on scanning paper documents as their number continued to decline

We drive innovation

We improved our digital capability and performance as we moved closer to our ambition of being digital by default. We:

-

developed new services by agile principles in multi-disciplinary teams which pool their expertise to solve problems and take the service through customer research and testing, prototype building and launch

-

worked with the Government Digital Service to test our prototypes against the highest standards

-

ensured our customers can always apply electronically by achieving a near perfect performance on the availability of our e-services, keeping them running 99.96% of the scheduled time

-

started building a new technology platform capable of supporting the comprehensive digital services of the future

Our new digital services to improve the conveyancing process included our:

-

Bankruptcy Register, providing an improved search service to mortgage lenders and others (launched in April 2016)

-

Find Property Information service, allowing anyone to search the register online by property and log in to obtain further details (in development)

-

Digital Mortgage service, allowing borrowers to digitally sign their mortgage deeds (in development)

Royal recognition

Business customers saved just over £2 million in fees in 2015/16 by using our free MapSearch service in favour of a traditional search of the index map. The online mapping tool was created to allow business customers to check whether a property is registered, view its location and obtain its title number and details of tenure. Just over four million searches were made during the year but our customers weren’t the only people to show an interest. MapSearch won a Civil Service Award in the digital category and the team representing Land Registry had the honour of talking about the service to Her Majesty the Queen.

Our data releases meet the demand for open and transparent government and provide the raw material for innovative businesses to create new products and services. We released four new datasets, including:

-

Additional Price Paid Data, making information about repossessions, buy-to-lets and transfers to non-private individuals available free of charge

-

National Polygon and Title Descriptor, allowing customers to view, download, host and interrogate our entire index map for the first time

-

Overseas Companies, revealing more than 100,000 freehold and leasehold titles owned by companies incorporated overseas

Tackling corruption through transparency

Releasing the Overseas Companies dataset was an important step in fulfilling the Prime Minister’s promise to tackle corruption and tax avoidance through greater corporate transparency. We routinely record whether a company buying a property is registered in the UK or overseas. However delivering the details of more than 100,000 freehold and leasehold titles was nevertheless a huge team effort delivered to a very tight timescale. We identified more than 20,000 titles requiring investigation and updated their register entries where necessary, producing a high quality dataset.

We are professional

To achieve our Business Strategy vision of a workforce of “highly professional and motivated knowledge workers”, we:

-

invested in our current staff, our new recruits and our apprentices, increasing the average number of training days per employee from 5.2 to 7.1

-

adopted a People Strategy with input from across the organisation, ensuring we have a workforce clear on their priorities and focused on delivery and we have the capability, capacity and culture to undertake our digital and technical transformation

-

gained a much more detailed understanding of our resourcing needs by developing a workforce plan and tactical recruitment plan

-

created a change framework putting people at the heart of change processes

-

encouraged diversity, reaching 61st place in the Stonewall Top 100 and winning the Representative Workforce category of the Employers Network for Equality & Inclusion Awards

-

recognised outstanding individuals in the inaugural LR Leisure People Awards, with management working with the LR Leisure Committee

With rising workloads, a large number of staff approaching retirement and the need for new digital skills it has never been more important to plan our future recruitment. Our recruits included:

-

permanent casework executives from both within and outside the Civil Service

-

57 apprentices to join the 78 who arrived the previous year. Our scheme is one of the biggest and most productive in government with the apprentices working on live casework from the very start of their two-year apprenticeship. They have demonstrated their value not only in casework, but also in their insights into digital working and systems development. Some have already secured permanent executive roles

-

16 new lawyers to enhance our legal expertise. Their training was a two-way process as they brought new skills and knowledge to Land Registry, such as digital awareness and recent litigation experience in private practice

Up-to-date training

The long hiatus since our last large-scale recruitment programme meant we needed a completely revamped training course for our new caseworkers. Much of the existing training material was out of date and technology had moved on. A cross-office team designed and built a new package to a tight two-month deadline. Managers, trainers and ‘buddies’ in each recruiting office used it as the basis of their training programme while also learning from their own and their counterparts’ experience as they put it into practice.

Our levels of staff engagement improved steadily despite the challenges of the year. We:

-

carried out quarterly Pulse surveys

-

published regular blogs by the Chief Executive and the directors

-

encouraged staff to comment freely and publicly in response to the blogs

-

created a Unified Communications system allowing staff to communicate and collaborate with each other from their desks via video, audio or instant messaging and on-screen sharing

(b) Performance analysis

Key annual performance indicators and milestones

The performance indicators and milestones were approved by the Minister and are aligned to the new strategic values which were established as part of the Business Strategy refresh. They measure key aspects of day-to-day business along with planned change milestones designed to support the Business Strategy.

| Key annual performance indicator/objective | Performance | |

|---|---|---|

| We give assurance | ||

| A1 | The percentage of customers who rate our overall services as good, very good or excellent to achieve 90% | 94% |

| A2 | Substantive registrations to pass at least 98% of defined quality checks | 98.06% |

| We have integrity | ||

| I1 | A 5% reduction in running costs compared with the budget for 2014/15 | Met |

| I2 | Unit cost to be £19.91 (based on a planned volume of 11.8 million units) | £19.49 |

| I3 | Achieve at least 12 units processed per full-time equivalent post per day based on a planned volume of 11.8 million units | 12.09 |

| We drive innovation | ||

| Inn1 | Average external e-service availability at 99.6% or higher during published service hours | 99.96% |

| Inn2 | We will establish two public beta services operating on the GOV.UK website by the end of March 2016 | Not achieved |

| Inn3 | We will release a further four datasets by 31 March 2016 including price paid information on commercially owned properties | Achieved |

| We are professional | ||

| P1 | Maintain a consistent index score calculated from a basket of four measures designed to measure motivation and performance of our workforce (see note 1) | Met |

| P2 | To achieve an improvement in the engagement score for leadership and managing change over two years of 15% compared with the 2014/15 baseline | Two-year target |

| P3 | Capability Milestone 1 – In 2015/16 to achieve an overall increase in the engagement score of 2%, with a 4% improvement in leadership and managing change in the Civil Service Survey and a 4% improvement in response to senior managers taking action on results from the survey |

3% 6% 12% |

| P4 | Capability Milestone 2 – 75% or more of the apprentice intake are still on the scheme at 31 March 2016 | 93% |

| P5 | Capability Milestone 3 – By the end of March 2016 we will have refreshed the workforce through a new starter rate of 4% | 7.4% |

| Note 1: The indicator measures organisational health indicators such as development days, sickness and fairness in distribution of performance marks across protected characteristic groups. The pass score is less than 11. |

We achieved:

-

all seven of the key performance indicators (KPIs) relevant including an additional target to reduce our running costs by 5% that was set by the Minister after the KPIs had been agreed, and

-

four of five milestone targets

We also made good progress on the two-year target to improve the engagement score for leadership and change by 15%.

The milestone that was not achieved was the provision of two new public beta services on GOV.UK. In fact we developed three (not two) digital services last year – a digital bankruptcy service for the Insolvency Service, the digital register view and digital charges. These products were developed and were available by 31 March but not on GOV.UK, but while the exact requirements were not met, this still represented very significant progress.

Finance Director performance analysis

Revenue

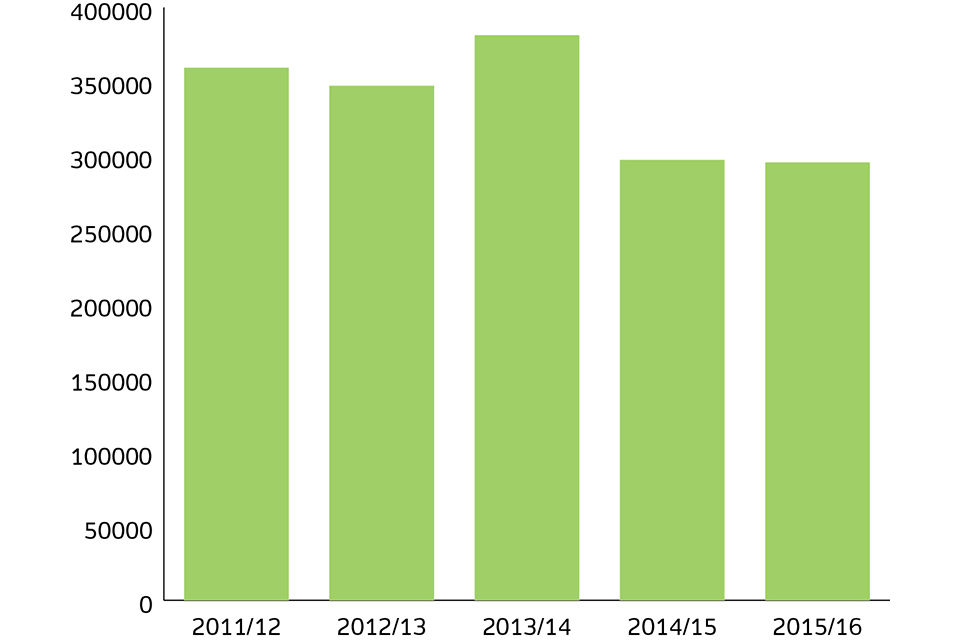

Our total revenue was £295.4m (2014/15: £297.1m), down £1.7m (0.6%) year on year. This was primarily as a result of the continued impact of our discount for electronic lodgement of dealings, but part compensated by rising intake volumes and rising house prices putting fees into higher bands. Transaction volumes excluding bulk register updates of 11.7m units (2014/15: 10.9m units) were up 0.8m (7.3%) on the prior year. Bulk register updates were comparatively low in 2015/16.

£’000

income

Operating costs

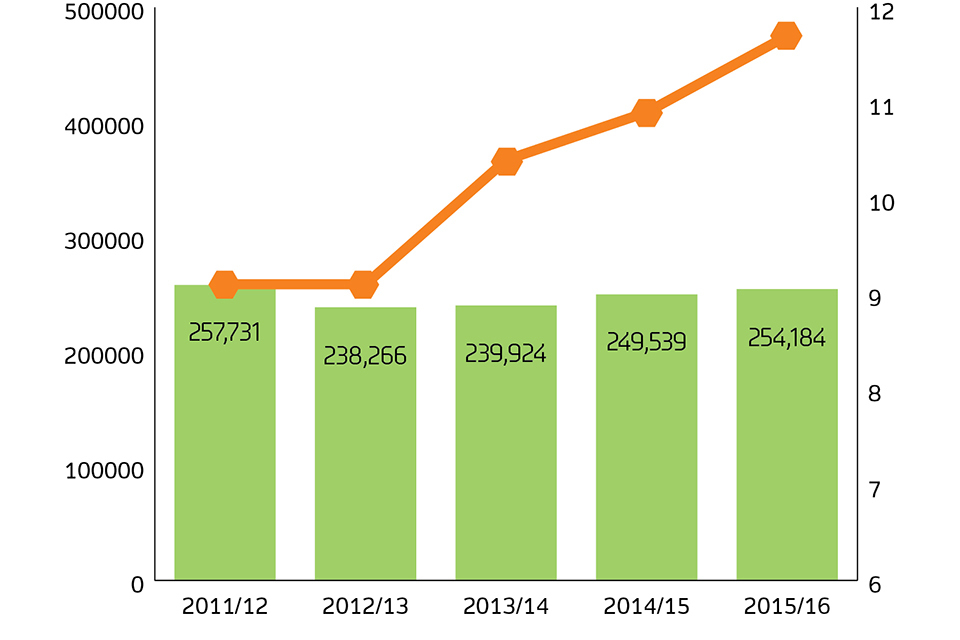

Our operating costs of £254.2m (2014/15: £249.5m) included staff costs of £168.2m (2014/15: £165.2m). Salary costs rose by £3m (1.8%), although full-time equivalent (FTE) average headcount increased from 4,033 to 4,035 over the year. This includes our apprentice scheme, disclosed separately, in note 4.2, which shows an increase to 99 average FTE (2014/15: 39). The salary increase reflects a combination of overtime, pay award and the national insurance changes.

Operating costs are affected by an increase to the outstanding claims provision of the indemnity fund of £2.1m (2014/15: £2.8m decrease) and an increase to the incurred but not reported (IBNR) provision of £9.1m (2014/15: £11.5m, see details in Other costs).

Other costs

There were finance lease charges of £0.7m (2014/15: £0.9m) and amortisation and depreciation of e-service systems of £3.5m (2014/15: £3.5m). Costs were offset by investment income of £1.8m (2014/15: £1.9m). Our impairment of non-current assets on buildings was £6.5m (2014/15 £1.1m). This followed a full valuation exercise to review the valuations of our buildings and reflect the most up-to-date market evidence.

Overall costs are £260.7m (2014/15: £260.5m). This is an increase of £0.2m (less than 0.1%). The underlying trend reflects a drive for efficiency, being 32% cumulative from 2008/9, the year of the property market crash, on the cost of service ignoring inflation (40.7% after accounting for inflation). The surplus before dividend for the year is £34.6m (2014/15: £36.6m).

Indemnity Fund

Schedule 8 to the Land Registration Act 2002 requires us to indemnify third parties against loss caused by mistakes in the register, mistakes in search results and loss of documents. Most of our indemnity claims arise as a result of mistakes in the register, and some of these mistakes are the result of forgery of documents such as charges. We provide for these claims under our Indemnity Fund, which covers both known claims and the liability for IBNR claims. External review and valuation of these provisions is conducted annually by Lane Clark & Peacock LLP, our actuaries.

In 2015/16 we paid £8m for 1,003 claims, compared with £8.3m for 968 claims in 2014/15. The largest claim paid this year was for a forged charge, settled for £530,000. This settlement of the large claim (in common with a number of others) had been delayed pending the outcome of the Swift Court of Appeal hearing, in which Land Registry was ordered to pay a lender indemnity for its loss arising from a forged charge, settling the law in this area under the Land Registration Act 2002. Fraud (usually by way of forgery) remains the single most significant cause of indemnity payments and this reflects the general trend over the past decade or so.

The original maximum value of the substantive claims paid was £8.6m but these were settled for £6.4m, a reduction of £2.2m. During the year a further 365 claims valued at £5.5m were settled for no value. Of these 22 were for fraud and were valued at £3.7m. During the year 1,384 new claims were received totalling £15.8m, including 57 fraud claims valued at £7.2m.

We recovered £0.2m under our statutory rights of recourse, compared with £0.1m last year. Recourse figures tend to vary considerably from year to year, reflecting the unpredictable interplay of legal and factual elements which will determine the viability of achieving any recovery, see Appendix F.

Indemnity Fund provision

This year the value of the outstanding claims provision increased to £10.5m (2014/15: £8.4m). The impact of this increased provision was a charge of £2.1m to our operating costs (2014/15: £2.8m reduction). Further information, including sensitivity analyses, can be found in note 16.2 in the accounts.

Indemnity Fund IBNR provision

This year the value of the Indemnity Fund IBNR provision has increased to £74.3m (2014/15: £65.2m). The impact of this increased provision was a charge of £9.1m to our operating costs (2014/15: £11.5m) The change is caused by three factors, the change in prescribed HM Treasury long-term discount rate increasing the provision by £14.9m, offset by a reduction in provision for unreported/reopened Swift claims of £4.5m and a reduction caused by changes in reporting patterns and average claim costs of £1.3m. Further information, including sensitivity analyses that reflect the estimated nature of the IBNR liability and susceptibility of the provision to fluctuation, can be found in note 16.2 in the accounts.

Dividends

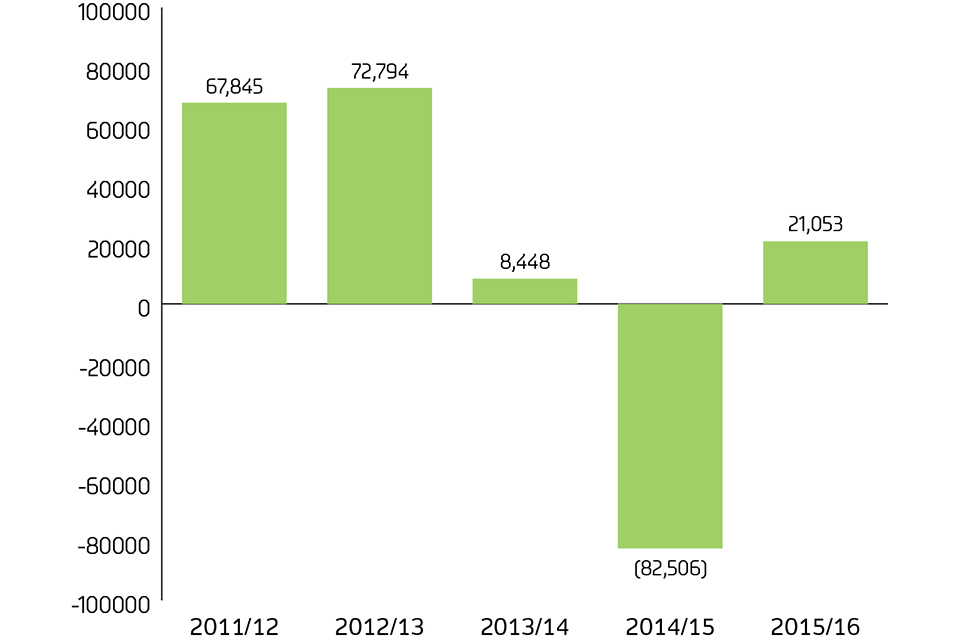

A dividend of £13.6m (2014/15: £19.1m) is based on a 3.6% return on capital employed (2014/15: 4.6%). This left a retained surplus of £21.1m (2014/15: £82.5m deficit, after special dividend of £100m).

Statement of financial position

The statement of financial position remains robust. Net assets rose to £373.6m (2014/15: £360.3m). Closing cash was £443.9m (2014/15: £397.8m).

Non-current assets

The 14 office buildings we occupied at the end of the year provided a total of 67,078 square metres of office space. Our total spend on property (including rent, business rates and service charges) and facilities management (including utilities, post and reprographics) was approximately £23m. Our expenditure on contracted-out services with facilities management provider Carillion was £10.1m.

Our Coventry Office was sold to the Education Funding Agency for £4.6m. Staff were relocated to leased accommodation at Earlsdon Park in Coventry.

At Nottingham the northern plot of our former Chalfont Drive site was sold to Bellway Homes for residential development for £9.4m, to be paid in instalments with a down payment received in 2015/16 of £4.75m and £4.65m due in January 2017.

Our leased accommodation for our former York Office, which had been sublet, was vacated and the lease terminated.

We continue to share surplus space in our properties with other government departments and commercial tenants and this year has seen further co-locations including with BAE Systems at Weymouth Office. Our tenants now occupy 22,725 sqm (25.5%) of the whole estate. This has enabled a further reduction in our estate occupancy per full-time employee, which has fallen from 13.67 sqm to 11.46 sqm. The operational estate is currently 69% occupied.

The value of our estate is now £55.6m with no assets classified as held for sale (2014/15: £85m, which included assets held for sale of £12.2m). The reduction is due to a downward revaluation of £5.6m, an impairment charge of £6.5m, disposals with a net book value of £16.1m and a depreciation charge of £1.2m.

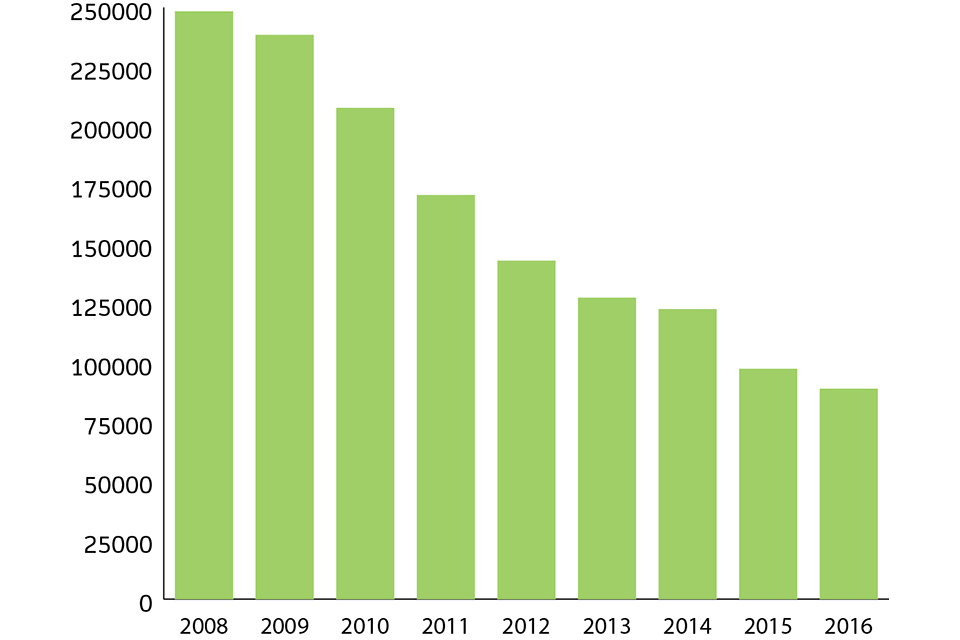

The graph below summarises the progress made in reducing the size of the estate since 2008. It reflects our commitment to demonstrating consistent improvements in the effectiveness and efficiency of our estate in support of the Government’s Efficiency and Reform Agenda.

Whole estate size 2008 – 2016 (m2)

whole estate size

The estate was externally valued by Cushman & Wakefield. The overall movement was a fall in value of £29.4m following the disposal of Leigh Court in Coventry and the northern lot of Chalfont Drive, Nottingham. We have three properties meeting the definition of investment property (the second floor of Weymouth Office, Old Market House in Birkenhead and the Earl House Extension in Hull, which are let on a commercial basis).

Our total capital spend, primarily on information communications technology (ICT) equipment, was £5.6m (£5m tangible and £0.6m intangible).

Treasury Management

Management of liquid assets is governed by the Land Registry Trading Fund Order 1993, the Additional Assets Order 1996, the Extension and Amendment Order 2003 and the framework document 2012. Non-operating cash balances are maintained in interest-bearing accounts at the Government Banking Service and the National Loans Fund with the balance held with a UK commercial bank.

Performance

Performance is as reported in Performance analysis.

Future activities: Business Strategy and Business Plan

Our future activities are driven by the Business Strategy, which was approved by ministers in December 2012. This strategy, which is now incorporated within our overall Business Plan 2013/18, incorporates our objectives and a new vision that sets out an ambition to achieve significant change. Details are covered in the performance section.

Main trends affecting future activities

The main trend affecting future activities is the level of housing market activity. This is reviewed constantly using a range of indicators from internal and external sources. Our assumption for the 2016/17 year is that activity will be 12.9m units, including 0.4m bulk register updates. This is higher than the activity for 2015/16 (11.9m units including 0.2m bulk register updates).

Directorships and significant interests

Directorships and significant interests are covered in the corporate governance report.

Key relationships

We maintain close relationships with our suppliers through our procurement and contract management processes. Our key suppliers for the year included TNT, Carillion and IBM. The performance of these key suppliers is closely monitored to ensure the contracted service is being delivered effectively, improvement opportunities are sought and we continue to receive good value for money.

Our key suppliers are monitored in line with the relevant strategic risk and we are taking further steps to enhance our open book contract management activity.

Significant use continues to be made of cross-government contracts, in line with the Cabinet Office’s procurement policy.

HM Revenue & Customs

Following a tax compliance audit by HM Revenue & Customs, a provision of £1.2m has been provided. Details of provisions can be found in note 16.1.

Pensions

Details of how pension costs and liabilities are treated in the accounts can be found in note 1.7 and note 4.4 in the accounts and in the remuneration and staff report.

Payments

We comply with the Late Payment of Commercial Debt (Interest) Act 1998 and the Better Payment Practice Code. During the year we paid 92.5% of undisputed invoices received from suppliers within five working days (2014/15: 93.1%).

Principal risks and uncertainties

We face challenges and risks to the achievement of our strategic and business objectives. Key current strategic risks relate to our Business Strategy and the capability and capacity required to deliver our ambitious programme of business change.

Strategic risks are managed at Land Registry Board level. Directorate risk is managed by each director. Programme and project risk is managed within parameters set for the relevant boards. Information risk is managed in line with CESG (the national technical authority for information assurance) guidance. Risk is escalated where the risk appetite is exceeded and an adverse impact on targets, reputation or operations could arise.

Auditors

The accounts have been audited by the Comptroller and Auditor General (C&AG). The cost in respect of services relating to the statutory audit for 2015/16 was £65,000 (2014/15: £65,000).

Catherine Vaughan, Finance Director

28 June 2016

Performance on other matters

Land registration

We registered 283,840 hectares for the first time, taking the total registered area to 13,557,628 hectares or 87.93% of England and Wales. This is despite the testing market conditions and the reduced remaining area of unregistered land.

The calculation of the total land area is complicated. We are working to improve the methodology which has to take account of a number of factors. These include, for example, the property footprint on the ground, the registered properties above ground floor level and the registration of rights below ground, for mines and mineral rights, and the land around the coast, which varies subject to the tides.

Public Sector Information Holder

We fulfill our role as a Public Sector Information Holder by adhering to the Data Protection and Freedom of Information Acts. We take the protection of our information seriously and mandate annual Responsible for Information learning for our staff. We have augmented this training by promoting good practice in the areas of cloud collaboration sites and email security. Our Senior Information Risk Owner (SIRO) oversees an information risk management process, which is measured through external accreditation (ISO27001) and independently challenged self-assessment (using the Information Assurance Maturity Model – IAMM).

Significant changes

On 24 March 2016 the Government launched a consultation about the options to move Land Registry operations into the private sector. Responses were required by 26 May and at the time of publication no decision had been announced by the Government.

Responsible business

We are committed to performing as a responsible business, and to providing encouragement and support to our people to enable them to contribute to that aim.

With the support of Business in the Community, and through their own endeavours, Land Registry people have continued to participate in a range of volunteering activities including voluntary work in the community and as magistrates. We continue to encourage and support them to do so with the assistance of our volunteering policy and supportive managers. In 2015/16, 262 members of staff undertook volunteering across a range of activities, providing support to others while gaining valuable experience and skills they can bring back to Land Registry. For example, working alongside volunteers from other organisations in the area, members of staff from our Plymouth Office volunteered as job coaches with the Shekinah Mission as part of their Ready for Work programme designed to help people get back into work. Our staff also work with Plymouth City Council as Appropriate Adult and Referral Panel Members, and with Crisis to help their work for homeless people.

Charitable fundraising has continued to be a prominent part of our commitment to responsible business, with many events taking place across our offices to raise money for a number of national and local charities. These have included taking part in fun runs and other sporting events, cake sales and collecting for food banks, as well as supporting national events such as Sport Relief and Movember. In February staff raised £5,841.23 for World Cancer Day through a range of coordinated activities across our offices.

All our offices have a dedicated Health and Wellbeing Committee, encouraged and supported to develop initiatives and activities to promote healthy lifestyles and the physical and emotional wellbeing of our people. Wales Office retained the Gold Corporate Health Standard, the national quality mark for workplace health promotion in Wales.

We ensure we pay our suppliers’ invoices promptly to assist with their cash flow and business planning and we share ideas and expertise in responsible business with other government departments, particularly in the environmental and sustainability fields.

LR Leisure, our national sports and social association, organises events throughout the year including a festival, a walking challenge, an arts and photographic competition, a team quiz and various sporting tournaments as well as entering teams in Civil Service tournaments. In October it held the inaugural LR Leisure Awards to recognise the hard work and dedication of staff who support sports and leisure activities and give their time to volunteering and charity work.

Open and full information

We received 442 Freedom of Information requests, of which 433 were answered within 20 working days.

Sustainability report

We manage the delivery of land registration in an environmentally responsible way. We utilise our Environmental Management System (EMS) to ensure we are continually improving and working towards the required targets set as part of the Greening Government Commitments (GGC) and the Greening Government ICT requirements. This report is delivered in line with the 2015/16 guidelines supplied by HM Treasury.

We continue to be accredited to the environmental ISO14001 standard which independently ratifies our performance across the full range of sustainability activities.

Current performance against the 2009/10 sustainability baseline data is as follows against the draft GGC targets.

| Area | Achieved | Proposed draft target for 2020 | On target? |

|---|---|---|---|

| Carbon | 41% reduction | 31% reduction | Yes |

| Waste arising | 44% reduction | Reduce the amount of waste generated by at least 25% | Yes |

| 97% recycled | Recycle or compost at least 70% of waste | Yes | |

| 3% to landfill | Landfill less than 10% of waste | Yes | |

| Water consumption | 36% reduction | 25% reduction (self-imposed) | Yes |

| Paper consumption | 39% reduction | Reduce our paper use by 60% from 2009/10 baseline | Yes – changes to Land Registry digital delivery will continue to deliver a reduction in paper consumption |

In addition the following requirement within the GGC continues to be delivered.

- Continue to pursue public procurement practices that are sustainable, so that the Government buys more sustainable and efficient products with the aim of achieving the best overall value for money for society.

Departments will report on the systems they have in place and the action taken to support this commitment, including:

-

to embed compliance with the Government Buying Standards in departmental and centralised procurement contracts, within the context of government’s overarching priorities of value for money and streamlining procurement processes

-

to understand and reduce supply chain impacts.

Performance data against draft GGC targets

| Area | Performance | ||

|---|---|---|---|

| Actual | 2020 reduction target | ||

| Energy: greenhouse gas emissions, all areas within scope | Carbon emissions (tonnes) | 8,392 | 9,776 |

| Expenditure (£) | 1,641,835 | ||

| Waste | Consumption (tonnes) | 1,106 | 1,484 |

| Expenditure (£) | 212,993 | ||

| Water | Consumption (m³) | 36,396 | 38,346 |

| Expenditure (£) | 173,819 |

Governance

Compliance with environmental legislation is managed through the Sustainability Governance Framework and compliance meetings with Carillion. This is managed through the Sustainability Manager by our Senior Facilities Business Partners and Carillion.

Overall delivery of additional requirements of GGC

The draft targets continue to drive central government to be more sustainable and ensure the requirements of the Climate Change Act (2008) of a reduction of 31% by 2020 in greenhouse gas emissions is delivered.

Climate change adaptation

Climate change impacts are considered during the delivery of building works and projects.

We utilise information delivered in building condition surveys and forward maintenance plans as part of our sustainability reduction strategy during major refurbishments relocations or significant building plant replacement. The Climate Change Adaptation Plan is kept under continuous review.

Biodiversity and the natural environment

Biodiversity improvements continue to be introduced where financially viable through Carillion. In particular improvements have been made by a number of initiatives with grounds maintenance. Changes to the planting processes have allowed the contractor to promote biodiversity by encouraging bees and butterflies.

Other areas of significance

Ten of our offices are taking part in a European initiative called Save@Work with SevernWye energy consultants to reduce energy through behavioural change.

Carbon

| Greenhouse gas emissions | 2015/16 | 2014/15 | 2013/14 | 2012/13 |

|---|---|---|---|---|

| Non-financial indicators (tCO2e) | ||||

| Total gross emissions for scopes 1 and 2 | 7,835 | 8,048 | 8,404 | 10,447 |

| Electricity: green/renewable | 1,195 | 2,306 | 2,780 | 2,265 |

| Total net emissions for scopes 1 and 2 (ie having removed renewable elements) | 6,640 | 5,742 | 5,624 | 8,182 |

| Gross emissions scope 3 travel (gross emissions scope 3 includes all available business travel) | 557 | 608 | 724 | 893 |

| Total gross reported emissions | 8,392 | 8,656 | 9,128 | 11,340 |

| Non-financial indicators (mWh) | ||||

| Electricity: purchased (grid, combined heat and power, and non-renewable) | 12,956 | 12,902 | 12,200 | 15,943 |

| Electricity: renewable | – | – | – | – |

| Gas | 7,325 | 6,989 | 8,355 | 11,567 |

| Other energy sources | – | – | – | – |

| Total energy | 20,281 | 19,891 | 20,555 | 27,510 |

| Financial indicators (£’000) | ||||

| Expenditure on energy | 1,641 | 1,684 | 1,810 | 2,043 |

| Expenditure on accredited offsets (eg Government Carbon Offsetting Fund) | – | – | – | – |

| Expenditure on official business travel | 1,222 | 1,142 | 1,240 | 1,127 |

Notes:

- data includes other government departments in occupation of our estate, but excludes data relating to non-government tenants.

- Ordnance Survey and the NHS who use Land Registry data centre services report their carbon consumption directly to government. This equates to 2,674,431KWh, resulting in the removal of 1,338 tonnes of carbon.

- throughout this report our consumption data includes government tenants sharing our estate but excludes data relating to non-government tenants.

The greenhouse gas draft target is to reduce emissions by 31% by March 2020 over the baseline data for 2009/10.

Gross emissions have fallen by 40.8% over the baseline and by 5.6% over the previous year.

Consumption has increased over the last year. This is due to the recruitment of 250 permanent recruits, 57 apprentices and additional tenant numbers in some locations and an increase in working hours across the estate.

The cost of the Carbon Reduction Commitment to the organisation was £163,452.

Our overall reduction in carbon emissions since 2009/10 is 41%. See Appendix E for historical trend data.

Waste management

| Waste | 2015/16 | 2014/15 | 2013/14 | 2012/13 | |

|---|---|---|---|---|---|

| Non-financial indicators (tonnes) | |||||

| Hazardous waste | 1.6 | – | – | – | |

| Non-hazardous waste | Landfill waste | 31.9 | 105 | 101 | 379 |

| Reused/recycled waste | 972.0 | 802 | 858 | 1,042 | |

| Energy from waste | 6.6 | – | – | – | |

| Total waste arising | 1,012.1 | 907 | 959 | 1,421 | |

| Financial indicators (£’000) | |||||

| Hazardous waste | – | – | – | – | |

| Non-hazardous waste | Landfill waste | 4 | 180 | 144 | 197 |

| Reused/recycled waste | 208 | 99 | 146 | 218 | |

| Incinerated waste | – | – | – | – | |

| Total waste costs | 212 | 279 | 290 | 415 |

The waste draft target is to reduce the amount of waste generated by at least 25% from a 2009/10 baseline and strive to reduce it further, recycle or compost at least 70% of waste, and landfill less than 10% of waste.

The organisation is currently meeting all of the draft targets with performance as follows: the amount of waste generated reduced by 44%, the amount of waste recycled, diverted or composted is at 97% and landfill is at 3% of waste.

Waste management is delivered through two routes. Paper waste is managed through a confidential waste disposal contract outside of the facilities management contract. All other waste management is delivered through the facilities management contract with Carillion.

Of the waste arising 826 tonnes is paper sent for processing through the closed loop paper recycling provision within government. This paper equates to 66% of our total waste arising.

Our overall reduction in waste production since 2009/10 is 44%. See Appendix E for historical trend data.

Water consumption

| 2015/16 | 2014/15 | 2013/14 | 2012/13 | |

|---|---|---|---|---|

| Non-financial indicators (cubic metres) | ||||

| Consumption | ||||

| Supplied | 36,395 | 38,153 | 36,037 | 31,230 |

| Abstracted | – | – | – | – |

| Total consumption | 36,395 | 38,153 | 36,037 | 31,230 |

| Financial indicators (£’000) | ||||

| Total supply costs | 173 | 188 | 228 | 236 |

The water draft targets are to continue to further reduce water consumption from a 2009/10 baseline. This allows departments to set their own internal targets for water reduction and report on their progress against these. Additionally departments will continue to report on office water use (m³ per FTE).

A 36% reduction in water consumption has been achieved against a target of 25%. Consumption per FTE, including staff on Land Registry sites from other government departments, is 7.7m³.

Paper usage

The draft paper reduction target to reduce our paper use by 60% from a Land Registry baseline year of 2011/12 shows a current improvement of 39% over A4 equivalent paper use. Our continued move to the delivery of digital services will have a significant impact on paper requirements over the next few years.

Sustainable procurement against GGC

The Corporate Procurement Team continue to work to maintain and, we hope, improve on Level 3 (Practice) across all categories in the Sustainable Procurement Flexible Framework maturity model. By working with our business stakeholders and key suppliers, the Cabinet Office’s Government Buying Standards is now embedded into our procurement processes.

Key suppliers are to identify and progress opportunities for making social and environmental improvements. We have continued to work on sustainability issues as highlighted by:

-

recent procurement activities for shredding, where 100% of confidential waste is now recycled in the UK, compared with the previous process where waste was taken to Germany

-

the printer refresh, working with Carillion on corporate social responsibility issues and ensuring the application of the buying standards for a refresh of all our printers.

We continue to support local charities and will also be working with Carillion through Business in the Community to support our chosen charity, Hospice UK.

Other information

Rule Committee

The Rule Committee was constituted under the Land Registration Act 2002 to provide advice and assistance originally to the Lord Chancellor but now, since the transfer of ministerial responsibility for Land Registry to the Department for Business, Innovation and Skills, to the Secretary of State in making land registration rules and fee orders under the Act.

The Rule Committee was involved in the following activities in the past year.

(1) In March 2015, the Department for Business, Innovation and Skills completed a Triennial Review of the Land Registration Rule Committee and published a report containing its recommendations and conclusions.

(2) On 2 June 2015, the Rule Committee met to consider the recommendations and conclusions in the report. The Rule Committee resolved to accept the recommendations and conclusions and determined the steps to be taken to give effect to the same.

(3) In November 2015, the Royal Institution of Chartered Surveyors nominated Carl Calvert as their representative on the Rule Committee in accordance with the Land Registration Act 2002, section127(2)(g). Carl Calvert replaced David Powell who retired after serving on the Rule Committee since its inauguration in 2002.

The Rule Committee was not called on to give advice and assistance to the Secretary of State during the past year as no land registration rules or fee orders were made by the Secretary of State in that period.

Policy and Stakeholder Unit

Our Policy and Stakeholder Unit incorporates international and domestic policy and development, stakeholder engagement and public affairs. It ensures our interests are properly represented domestically and globally and the importance of land registration and its benefits are promoted to others. The unit sits as part of the Chief Land Registrar’s Office, giving Land Registry a presence across government and counterpart organisations overseas.

In 2015/16 we responded to 16 Land Registry written and oral Parliamentary Questions and supported other departments with responses to their questions. Key pieces of policy work this year have included participation in a cross-government working group exploring the recording of beneficial ownership information for overseas companies that wish to buy property in England and Wales or bid for public contracts in England. This work is part of the Government’s anti-corruption agenda, and as a first step to improve transparency of foreign ownership we released our Overseas Companies property ownership dataset in March.

We have also been working across government to increase transparency in the property market, including by increasing the visibility of information relating to options to purchase or lease land, which was a commitment announced in the Budget statement.

Land Registry staff hold positions within various global forums. In support of British foreign policy we assist with the development of land administration overseas. We participated in a United Nations Economic Commission for Europe (UNECE) mission to Armenia in April 2015. Our involvement in the UNECE 2014 mission to Uzbekistan was also formally recognised by UNECE with its publication of the Country Profile in March 2016.

This year there have been significant pieces of work with Rwanda and the Republic of Azerbaijan, and we have taken part in a UK Trade & Investment-sponsored trade mission to Uganda and Tanzania.

In the last year we have also hosted educational study visits for representatives from many jurisdictions including China, Indonesia, Malaysia, Nigeria, Rwanda, South Korea, Turkey and Uganda, and hosted ministerial visits for officials from our counterpart organisations in Indonesia, Iraqi Kurdistan and Tanzania.

The unit organised a stakeholder event hosted by Chief Executive and Chief Land Registrar Graham Farrant in November 2015 at the Royal Society, bringing together major stakeholders for the first time in this way. Its success has now established this as an annual event with 2016, we hope, seeing a larger and broader mix of domestic and international stakeholders.

Graham Farrant, Chief Executive and Chief Land Registrar

28 June 2016

Accountability report

Corporate governance report

(a) Directors’ report

Pension liabilities

Details of the treatment of pension liabilities are available in note 1.7 and note 4.4 to the accounts and in the Remuneration and staff report.

Details of directors and boards

Land Registry Board

The remit of the Land Registry Board (LRB) is supervisory and advisory. The LRB is responsible for governance and public accountability, sets the Land Registry strategy and assists the Chief Executive and Chief Land Registrar in his ultimate responsibility as Accounting Officer for the governance and performance of Land Registry.

The LRB terms of reference which were first approved in 2012 were revised during 2015/16.

The LRB meets formally 10 times per year, with additional meetings as and when required. The Chair, the Chief Executive and Chief Land Registrar and the Finance Director also held quarterly meetings with the shareholder executive (transferred to UKGI 1 April 2016 – UK Government Investments).

Land Registry Board membership

| LRB membership | |

|---|---|

| Mark Boyle (Chair) | Non-Executive Chair (to 31 March 2016) |

| Tim Franklin | Non-Executive Director and Senior Independent Director (Interim Chair from 1 April 2016) |

| Catrina Holme | Non-Executive Director |

| Gerard Connell | Non-Executive Director |

| Leo Geddes | Non-Executive Director |

| Graham Farrant | Chief Executive and Chief Land Registrar (from 1 June 2015) |

| Craig Lester (note: attends as an observer) | Assistant Chief Executive (from 11 January 2016) |

| John Peaden | Director of Operations and (from 19 March to 31 May 2015) Interim Chief Executive and Chief Land Registrar |

| Catherine Vaughan | Finance Director |

| Note: Mike Westcott-Rudd attends as legal adviser |

Executive Board

The Executive Board (EXB) is chaired by the Chief Executive and Chief Land Registrar and its members are Land Registry’s executive directors. The EXB is responsible for the delivery of Land Registry’s Annual Management Plan and for the day-to-day operational management of the business. The Board meets on a monthly basis and met on 10 occasions throughout the course of the year.

| Executive Board membership | |

|---|---|

| Graham Farrant (Chair) | Chief Executive and Chief Land Registrar (from 1 June 2015) |

| Craig Lester | Assistant Chief Executive(from 11 January 2016) |

| John Peaden | Director of Operations and (from 19 March to 31 May 2015) Interim Chief Executive and Chief Land Registrar |

| Alasdair Lewis | Director of Legal Services and Deputy Chief Land Registrar |

| Catherine Vaughan | Finance Director |

| Caroline Anderson | Director of Human Resources & Organisational Development |

| Rowland Coombs | Director of Information Systems (to 31 March 2016) |

| Jon Parry | Interim Director of Digital Services (from 5 January 2015 to 24 January 2016) |

| John Abbott | Director of Digital Services from 25 January 2016 |

| Mike Westcott-Rudd | Legal Adviser to the Board |

| Attendees | |

|---|---|

| Nicky Heathcote | Head of the Chief Land Registrar’s Office |

| Paul Dowse | Head of Strategy |

Audit Committee

The committee supports the LRB and the Accounting Officer by seeking assurance on the risk management framework, the control framework, governance and compliance with policies, procedures and external standards and statutory requirements.

| Audit Committee membership | |

|---|---|

| Tim Franklin (Chair) | Non-Executive Director |

| Gerard Connell | Non-Executive Director |

| Derrick Palmer | Non-executive member |

| Attendees | |

|---|---|

| Graham Farrant | Chief Executive (from 1 June 2015) |

| Catherine Vaughan | Finance Director |

| Grahame Hughes | Head of Internal Audit |

| Representative of the National Audit Office | National Audit Office |

Remuneration and Nomination Committee

The committee agrees pay strategy and authorises the annual pay review for Land Registry Senior Civil Service staff and agrees a strategy for succession to the LRB and EXB.

| Remuneration and Nomination Committee membership | |

|---|---|

| Catrina Holme | Non-Executive Director |

| Gerard Connell | Non-Executive Director |

| Graham Farrant | Chief Executive and Chief Land Registrar (from 1 June 2015) |

| John Peaden | Interim Chief Executive and Chief Land Registrar (from 19 March to 31 May 2015) |

Register of interests

A register of interests is maintained at Land Registry Head Office. See note 20 to the accounts for related party disclosures.

Personal data-related incidents

| Category | Nature of incident | Total |

|---|---|---|

| I | Loss of inadequately protected electronic equipment, devices or paper documents from secured government premises | 4 |

| II | Loss of inadequately protected electronic equipment, devices or paper documents from outside secured government premises | 7 |

| III | Insecure disposal of inadequately protected electronic equipment, devices or paper documents | – |

| IV | Unauthorised disclosure | 9 |

| V | Other | 1 |

| Total | 21 |

Conflicts of interest

There are no conflicts of interest reported.

(b) Other accountabilities

Health and safety

We have continued to develop our health and safety guidance, processes and policies with assistance from Carillion. The challenge, as always, is to keep pace with changes in working practices and ensure our health and safety policies continue to be fit for purpose in a modern office environment. We have continued to monitor our main health and safety risks, in particular driving for work to ensure that the health, safety, and wellbeing of our staff is protected while working out of the office.

The total number of accidents reported by Land Registry staff at work was 100 with two accidents reported to the Health and Safety Executive under the Reporting of Injuries Diseases and Dangerous Occurrences Regulations. The three-year Accident Reduction Strategy has reached its conclusion this year and we are now considering how we take this initiative forward to ensure that the improvements in accident reduction are maintained.

We have retained our certification to OHSAS18001, the British Standard for health and safety management. This was first achieved in June 2014 and has been maintained following six-monthly external audits. The standard is seen as the benchmark for health and safety management systems and provides an assurance that we are aligned with recognised best practice.

Service standards

Details of the service that customers can expect from us.

For 2016/17 we have new internal standards designed to increase the speed of our services and to reduce the backlog of work.

Welsh language service

More information about our Welsh language service.

Complaints

We recorded 2,088 complaints in 2015/16 compared with 4,262 in 2014/15.

Although there was a fall in the complaints recorded, overall more customer comments and feedback have been captured than ever before.

The overall proportion of upheld complaints was 40%. Customer feedback about delays in our processing of some registration applications was the most common area of upheld complaint, comprising 29% of the total.

We reviewed our complaints procedure, to increase our people’s awareness of the importance of effective feedback handling and recording. This included sharing information, expertise and best practice. We also developed and launched new tools and processes for feedback reporting and analysis and updated a staff training package on complaints handling and recording. The roll out of this will continue into the first quarter of 2016/17.

We also participated in a Cabinet Office initiative on complaints handling in the public sector, involving providing an online form specifically for complaints. We continue to work with the Cabinet Office on this initiative alongside other government departments.

Use of our Customer Relationship Management tool has facilitated further opportunities to learn from and act on customer feedback and improve our overall service. Examples of this included:

-

enhancements to:

-