Practice guide 69: Islamic financing

Updated 9 September 2019

Applies to England and Wales

Please note that HM Land Registry’s practice guides are aimed primarily at solicitors and other conveyancers. They often deal with complex matters and use legal terms.

To view the update history for this practice guide, please see practice guide 69: update history.

1. Introduction

The theological basis for Islamic finance stems partly from the traditional prohibition of usury or interest, which means that interest-based lending may not appeal to followers of Islam. Islamic finance products have been structured to avoid the payment of interest. These financial products have been developed so that they fall within the regulatory and legal framework of England and Wales and so introduce no new concept in HM Land Registry terms. They are available in the UK to Muslims and non-Muslims alike.

The three forms of contract are:

This guide also discusses the emergence of the Islamic bond or sukuk market.

1.1 Retention of documents submitted with applications

Original documents are normally only required if your application is a first registration.

If your application is not a first registration, then we will need only certified copies of deeds or documents you send to us with HM Land Registry applications. Once we have made a scanned copy of the documents you send to us, they will be destroyed. This applies to both originals and certified copies.

However, any original copies of death certificates or grants of probate will continue to be returned.

2. Ijara wa Iqtina mortgage

Ijara is a lease of an item by its owner to a customer and Ijara wa Iqtina is a lease of an item usually followed by the eventual sale of the item to the customer at the end of the lease term. In the case of a property purchase using Ijara wa Iqtina, the bank will purchase the property chosen by its customer for an agreed price and then will grant a lease to the customer. The lease will usually be long enough to require registration under the Land Registration Act 2002. This type of mortgage is used both for financing a house purchase, and for existing homeowners switching from an interest-bearing mortgage.

The customer’s monthly ‘mortgage’ payments will normally comprise both the rental payment as well as an amount held by the bank to act as a guarantee that the customer will be able to pay for the purchase of the property at the end of the lease term. The monthly ‘mortgage’ payments are fixed in such a manner that the bank gets back its principal sum along with some profit.

The bank also gives an undertaking to the customer to transfer the reversion of the property to the customer at the end of the term or when the arrangement is ended. When the customer wants to sell or end the arrangement, they can give notice at any time to the bank and the property is then either transferred to the customer for the price originally agreed less the on-account payments, or the customer can direct the lender to sell on to a third party, arrangements being made for the termination of the lease.

2.1 Documents required

You will need to send HM Land Registry:

- a transfer of the reversion to the Islamic financier (the reversion is the estate out of which the lease is granted; it might be freehold, but could be another leasehold), and

- a lease of whole to the customer

If there is an agreement or ‘promise to sell’ the reversionary estate, you may apply to note this on the register as an agreed or unilateral notice. See practice guide 19: notices, restrictions and the protection of third party interests.

The customer might also sign a ‘promise to buy’ the reversion but if this does not create a burden on land (which is unlikely) it will not be capable of being noted.

To find out what happens to documents submitted with application forms, see Retention of documents submitted with applications.

2.2 Stamp Duty Land Tax and Land Transaction Tax

Provided the statutory conditions are fulfilled the lease, the transfer of the reversion and any intermediate transfers of shares in the freehold are relieved from Stamp Duty Land Tax or Land Transaction Tax, as is the initial transfer if the customer is the registered proprietor.

Both the transfer to the Islamic financier and the lease to the customer are potentially notifiable transactions. If they exceed the threshold for notification to HM Revenue & Customs or the Welsh Revenue Authority, you will need to send HM Land Registry a land transaction return certificate (form SDLT5 or LTT certificate).

Please contact HM Revenue & Customs for further details regarding Stamp Duty Land Tax or the Welsh Review Authority for further details regarding Land Transaction Tax.

2.3 Fees

In common with other government departments, our fees are based on the amount of work involved and are assessed under the current Land Registration Fee Order as follows:

- transfer to lender – scale 1 (if for value) or scale 2 (if not for value)

- lease to customer – scale 1

- agreement – schedule 3; no fee is payable if it is lodged at the same time as the other applications

See HM Land Registry: Registration Services fees.

2.4 When the Ijara wa Iqtina arrangement has come to an end

When the Ijara wa Iqtina arrangement has come to an end, you should send HM Land Registry a transfer of the reversion to the customer and, if desired, an application to merge the lease back into the reversion. If you have registered an agreement, this can be removed using form CN1 (agreed notice) or form UN2 or form UN4 (unilateral notice).

The transfer to the customer is a potentially notifiable transaction for Stamp Duty Land Tax or Land Transaction Tax. If the consideration exceeds the threshold for notification to HM Revenue & Customs or Welsh Revenue Authority, you will need to send HM Land Registry a land transaction return certificate (form SDLT5 or Land Transaction Tax certificate).

A fee is payable on the transfer to the customer, assessed under scale 1 of the current Land Registration Fee Order (if for value) or scale 2 (if not for value), see HM Land Registry: Registration Services fees. No fee is payable for the merger or removal of notice, provided the application is made at the same time as the transfer.

2.5 Default by the customer

Should the customer default there may be a provision for the bank to require the customer to repurchase the property or to allow for its sale, free from the occupational lease. In that case we would expect to see a transfer to the customer or a third party, together with an application to merge the lease into the reversion.

Alternatively the bank may rely on the usual remedies for non-payment of rent and seek determination of the lease. See practice guide 26: leases: determination.

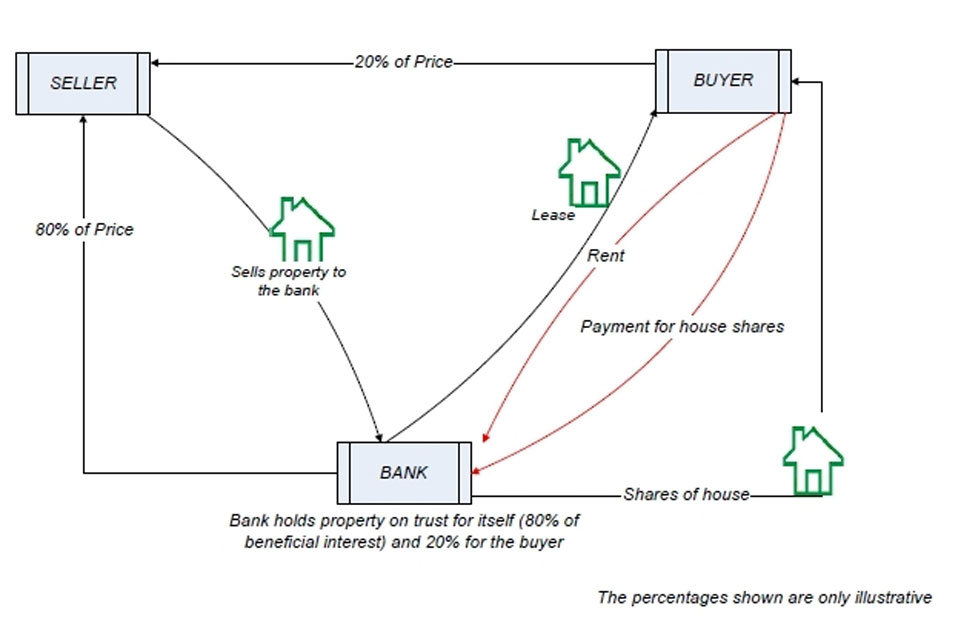

3. Diminishing Musharaka (partnership)

Musharaka means ‘partnership’ or ‘joint venture’ and is used for home purchase financing. There are various ways in which this partnership can operate in the context of a home purchase plan. Typically, a customer would like to purchase a house for which they do not have sufficient funds. In these circumstances the bank might, for example, agree to pay 80 per cent of the purchase price, the remaining 20 per cent being paid by the customer. The legal title is transferred to the bank, the bank and the customer, or a third party trustee and then the property is leased to the customer.

The property is normally held on trust for the bank and the customer. A separate diminishing partnership contract is entered into between the bank and the customer to split the beneficial interest in the property depending on each party’s contribution to the purchase price. In our example, the bank would be entitled to 80 per cent of the beneficial interest while the customer’s beneficial interest would be 20 per cent.

After the property is purchased, the customer uses the property for their own residential purposes and pays rent to the bank for using its 80 per cent share in the property. The lease to the customer will normally be a registrable disposition and may also be charged to the bank.

In addition to the rental payment, over time the customer buys the bank’s beneficial interest in the property and eventually becomes owner of the bank’s 80 per cent share. At this stage, the customer’s total rental payment is zero and the title will be transferred to the customer at HM Land Registry. This example is illustrated in Diagram A below.

The Diminishing Musharaka mode of finance allows the bank to claim rent according to its proportion of ownership in the property and at the same time allows the bank periodic returns of the principal finance sum, as it is repaid in stages.

The bank will give an undertaking to the customer at the outset to transfer back the property at the end of the term or when the arrangement is ended.

This type of mortgage is used for financing a house purchase, and for existing homeowners switching from an interest-bearing mortgage.

Diagram A – Diminishing Musharaka mortgage

image 1

3.1 Documents required

You will need to send HM Land Registry:

- a transfer of the reversion to the bank, the bank and the customer, or a third party trustee; given the nature of the transaction, it is likely that the bank and customer will be beneficial tenants in common in unequal shares

- if the transfer is to a sole proprietor who cannot give a valid receipt for capital money, an application to enter a restriction in Form A

- a lease of whole to the customer

If there is an agreement or ‘promise to sell’ the reversionary estate, you may apply to note this in the register as an agreed or unilateral notice. See practice guide 19: notices, restrictions and the protection of third party interests.

To find out what happens to documents submitted with application forms, see Retention of documents submitted with applications.

3.2 Stamp Duty Land Tax and Land Transaction Tax

Provided the statutory conditions are fulfilled the lease, the transfer of the reversion and any intermediate transfers of shares in the freehold are relieved from Stamp Duty Land Tax or Land Transaction Tax, as is the initial transfer if the customer is the registered proprietor.

Both the transfer to the Islamic financier and the lease to the customer are potentially notifiable transactions. If they exceed the threshold for notification to HM Revenue & Customs or Welsh Revenue Authority, you will need to send HM Land Registry a land transaction return certificate (form SDLT5).

Please contact HM Revenue & Customs for further details regarding Stamp Duty Land Tax or the Welsh Revenue Authority for further details regarding Land Transaction Tax.

3.3 Fees

In common with other departments, our fees are based on the amount of work involved and are assessed under the current Land Registration Fee Order as follows:

- transfer to the bank, the bank and the customer, or a third party trustee – scale 1 (if for value) or scale 2 (if not for value)

- lease to customer – scale 1

- agreement – Schedule 3; no fee is payable if it is lodged at the same time as the other applications

See HM Land Registry: Registration Services fees.

3.4 When the Diminishing Musharaka arrangement comes to an end

When the Diminishing Musharaka arrangement has come to an end, you should send HM Land Registry a transfer of the property back to the customer, and, if desired, an application to merge the lease back into the reversion. If you have registered an agreement, this can be removed using form CN1 (agreed notice) or form UN2 or form UN4 (unilateral notice).

The transfer to the customer is a potentially notifiable transaction for Stamp Duty Land Tax or Land Transaction Tax. If they exceed the threshold for notification to HM Revenue & Customs or Welsh Revenue Authority, you will need to send HM Land Registry a land transaction return certificate (form SDLT5 or Land Transaction Tax certificate).

A fee is payable on the transfer to the customer, assessed under scale 1 of the current Land Registration Fee Order (if for value) or scale 2 (if not for value), see HM Land Registry: Registration Services fees. No fee is payable for the merger applications or removal of notice to protect the agreement, provided the application is made at the same time as the transfer. The deed of surrender is subject to a fee under the current Land Registration Fee Order.

4. Murabaha

Murabaha is a sale of an item to a buyer where the seller expressly mentions the cost they have incurred on the commodities to be sold and sells it to another by adding some profit or mark-up which is known to the buyer. To implement a Murabaha mortgage, a bank will buy from the seller the property that is required by its customer for an agreed price, and immediately sells it to the customer at an agreed profit margin over cost. Thus, Murabaha is not a loan given on interest; it is a sale of a commodity for money.

The customer will pay the price of the property in instalments over several years, and mortgage the property to the bank in order to secure the instalments that are due. A simple Murabaha arrangement for home finance is shown in Diagram B.

Diagram B – Murabaha

image 2

4.1 Documents required

You will need to send HM Land Registry:

- a transfer of the property to the bank

- a transfer by the lender to the customer, and

- a charge in favour of the bank

To find out what happens to documents submitted with application forms, see Retention of documents submitted with applications.

4.2 Stamp Duty Land Tax and Land Transaction Tax

The liability to pay Stamp Duty Land Tax or Land Transaction Tax is structured to mirror a conventional mortgage financed purchase, so the appropriate tax will be payable on the first sale by the seller to the bank, if it exceeds the threshold. Relief can be claimed on the second sale, subject to a few exceptions.

Both transfers are potentially notifiable transactions. If they exceed the threshold for notification to HM Revenue & Customs or the Welsh Revenue Authority, you will need to send HM Land Registry a land transaction return certificate (form SDLT5 or Land Transaction Tax certificate).

Please contact HM Revenue & Customs for further details regarding Stamp Duty Land Tax or the Welsh Revenue Authority for further details regarding Land Transaction Tax.

4.3 Fees

In common with other departments, our fees are based on the amount of work involved and are assessed under the current Land Registration Fee Order as follows:

- transfer to the bank – scale 1 (if for value) or scale 2 (if not for value)

- transfer to customer – scale 1

- charge – scale 2 (no fee if lodged at the same time as the transfer)

See HM Land Registry: Registration Services fees.

4.4 When the Murabaha arrangement has come to an end

You should discharge the charge using DS1, ED or e-DS1. See practice guide 31: discharge of charges.

4.5 Default by the customer

The bank’s remedies in the case of default are the same as for a conventional charge. Therefore a transfer under power of sale using form TR2 would be the usual application.

5. Sukuk

Sukuk can be regarded as a form of investment-backed bond (sukuk is the plural of ‘sakk’ and means ‘financial certificates’). However, a sukuk is distinctively different from a bond issued to evidence a loan (where the loan must be repaid with interest) and instead constitutes a partial ownership in an asset (Sukuk al Ijara) or business (Sukuk al Musharaka). For the purposes of this guide we are only looking at Sukuk al Ijara.

Sukuk al Ijara is likely to be used in connection with very large property transactions, such as shopping centres, hotels or portfolios of properties. In this arrangement, the finance provider will buy the customer’s property themselves, or more likely it will be sold to a specially established company known as a ‘special purpose vehicle’. The special purpose vehicle (or the finance provider) will lease back the property to the customer, who pays rent. The special purpose vehicle or finance provider then issues sukuk or bonds to investors, who derive an income based on the property asset.

When the arrangement comes to an end, the bank transfers the property back to the customer. Such arrangements are exempt from Stamp Duty Land Tax and Land Transaction Tax, but to prevent stamp duty evasion by others, a charge is placed on the property by HM Revenue & Customs or the Welsh Revenue Authority as appropriate, which is removed when the property is transferred back to the customer.

By way of illustration, company X requires £100 million for the purposes of expanding its business. X sells land valued at £100 million to a special purpose vehicle. Company X also promises to buy back the land at the end of year 10.

The special purpose vehicle issues a 10-year sukuk to the investors. In return for the £100 million, the special purpose vehicle leases back the land to X for a period of 10 years for £12 million per year. From the perspective of Company X this is a way in which they can raise capital. From the investors’ point of view, the sukuk is a type of bond investment where the initial capital is repaid together with a rental return (rather than interest). This above example has been illustrated in Diagram C below.

Diagram C – Sukuk al Ijara

image 3

5.1 Documents required

You will need to send HM Land Registry:

- a transfer of the property to the bank or special purpose vehicle

- a lease by the bank or special purpose vehicle to the tenant, and

- a first legal charge in favour of The Commissioners of HM Revenue & Customs or the Welsh Revenue Authority – see Stamp Duty Land Tax and Land Transaction Tax (if there are other charges registered, they will have to be postponed in priority to this first charge)

To find out what happens to documents submitted with application forms, see Retention of documents submitted with applications.

5.2 Stamp Duty Land Tax and Land Transaction Tax

HM Revenue & Customs and the Welsh Revenue Authority have agreed that such arrangements are exempt from Stamp Duty Land Tax and Land Transaction Tax, provided certain conditions are met to prevent them being used for land tax avoidance. One of these conditions is that the bank or special purpose vehicle will execute a first legal charge in favour of HM Revenue & Customs or the Welsh Revenue Authority to cover any liability for any land tax, interest and penalties that may become due.

If they exceed the threshold for notification to HM Revenue & Customs or the Welsh Revenue Authority, you will need to send HM Land Registry a land transaction return certificate (form SDLT5 or Land Transaction Tax certificate).

Please contact HM Revenue & Customs for further details regarding Stamp Duty Land Tax, or the Welsh Revenue Authority for further details regarding Land Transaction Tax.

5.3 Fees

Our fees are based on the amount of work involved and are assessed under the current Land Registration Fee Order as follows:

- transfer to the bank or special purpose vehicle – scale 1 (if for value) or scale 2 (if not for value)

- lease to customer – scale 1

- charge – scale 2 (no fee if lodged with the transfer application)

See HM Land Registry: Registration Services fees.

5.4 When the term of the sukuk ends

When the term of the sukuk ends, you should send HM Land Registry a transfer of the property back to the customer subject to the charge in favour of HM Revenue & Customs or the Welsh Revenue Authority and, if desired, an application to merge the lease back into the reversion.

Once you have the registration completion statement and title information document, you should send them to HM Revenue & Customs or the Welsh Revenue Authority, who will then discharge their charge.

The transfer to the customer is a potentially notifiable transaction. If it exceeds the threshold for notification to HM Revenue & Customs or the Welsh Revenue Authority, you will need to send HM Land Registry a land transaction return certificate (form SDLT5 or Land Transaction Tax certificate).

A fee is payable on the transfer to the customer, assessed under scale 1 of the current Land Registration Fee Order (if for value) or scale 2 (if not for value), see HM Land Registry: Registration Services fees. No fee is payable for the merger or removal of notice, provided the application is made at the same time as the transfer.

6. Property price information

Transactions that are not open market sales are not included in our database of property prices, to ensure these figures are not distorted.

7. Things to remember

We only provide factual information and impartial advice about our procedures. Read more about the advice we give.