HMRC Annual Report and Accounts 2016-17 - Executive Summary

Published 13 July 2017

1. Who we are and what we do

1.1 Our mission

We are the UK’s tax, payments and customs authority, and we have a vital purpose: we collect the money that pays for the UK’s public services and help families and individuals with targeted financial support.

1.2 Our vision

Our vision is to be a world-class organisation.

1.3 Our values

We are professional

We are confident and expert in running HMRC, striving for clarity, consistency and excellence in our work, partnering with others and collaborating across teams to achieve great results, and enjoying what we do, proud to serve our customers and society.

We act with integrity

With high ethical standards, we are honest, fair, and even-handed in our treatment of others, exercising judgment and discretion, and holding ourselves to account for our actions.

We show respect

Empowering and trusting our colleagues and customers to do the right thing, we are friendly, courteous, inclusive and considerate, and recognising, valuing and celebrating the views, qualities and achievements of others.

We are innovative

We champion new and different ways of working to adapt and move with the times, having the courage and tenacity to challenge how things are done, committed to continuous improvement and to developing ourselves.

1.4 Our objectives

Our key objectives set out in our Single Departmental Plan are to:

- maximise revenues due and bear down on avoidance and evasion

- transform tax and payments for our customers

- design and deliver a professional, efficient and engaged organisation

1.5 Our strategic principles

To guide our decision-making, we follow a set of strategic principles for everything we do:

- Customer-centric: we understand our customers through data and insight, so we can better tailor and target our support

- Simplicity: we design our systems, products and processes around customers, to make it as easy as possible for them to deal with us

- Integration: we design a tax system that integrates with third parties and business software

- Proportionate and even-handed: we deploy our resources in a fair and targeted way to ensure no one is out of reach

- Cost-efficient: we use digital services and smart data to work more efficiently, driving down the cost of the tax system for customers and the public purse

We apply these not only to our core customer service and compliance work, but also to our other activities – from the tax credits and other benefits we administer, to our customs work and the support we provide to other public bodies and charities. We work and consult closely with a wide range of different groups and stakeholders, such as customer representatives and software developers, to make sure we are getting our strategy right.

1.6 What we do

We are one of the UK’s biggest organisations. At 31 March 2017, we had around 61,800 full-time equivalent employees in 145 buildings across the UK, collecting tax and duties from more than 45 million individuals and 5.4 million businesses. Tax credits benefitted 4.1 million families and around 7.2 million children and Child Benefit supported around 12.9 million children.

The UK is one of the largest economies in both the EU and the world and we play our part by making it easier for business to trade. We work closely with HM Treasury to design effective tax and customs policies and we play a vital role in supporting wider government aims, such as using tax reliefs to support economic growth, facilitating international trade through our customs processes, enforcing the National Minimum Wage and working with devolved administrations on tax and other matters.

To do this, and deliver for our customers in a changing world, we are building on the skills and expertise of our people and working in more collaborative and flexible ways. We are putting the right people in the right places, doing the right work, with the right skills, using the latest digital tools.

2. At a glance – our achievements in 2016 to 2017

£574.9 billion total tax revenues – £38.1 billion more than last year

We brought in record total tax revenues for the seventh consecutive year

£28.9 billion compliance yield generated

91.7% customer calls handled against our target of 85%

9.6 million customers submitted their Self Assessment tax return online by 31 January deadline

This was a record amount, with 1.7 million filing via their Personal Tax Account

Other key achievements:

- 83% success rate in taking action through the courts and tax tribunals, protecting £15 billion in tax

- 9.4 million customers have accessed their Personal Tax Account

- more than 5 million Business Tax Accounts available to small business customers in the country, with millions of businesses already using the service to file, pay and obtain help

- 96.2% of all customs checks cleared within two hours, against our target of 95%

- 987,014 tax credits customers renewed online using our digital service compared to 754,900 in 2015

- 71% of our waste recycled. 98% of our waste diverted from landfill

- 1,200+ apprentices recruited across 15 of our professions, including more than 900 in Operational Delivery

We’ve highlighted our achievements over the past year in this short animation:

3. Performance – how we did and our plans

For the seventh consecutive year we brought in record total tax revenues, this year amounting to £574.9 billion. In addition, we generated £28.9 billion of compliance yield last year which exceeded our target and comes from the action we took against individuals and businesses who attempted to break the tax rules.

Our analysis indicates that we continue to maintain one of the lowest tax gaps in the world. We remain strongly committed to pursue those who do not comply, prosecuting 886 criminals and fraudsters last year. We have organised our activity around a number of distinct customer groups and we can target our efforts more specifically to their needs, ensuring that the vast majority of UK taxpayers comply with their obligations and pay what they owe on time. Last year we collected a record £44.3 billion in debt, an increase of £1.6 billion.

3.1 Maximising revenues

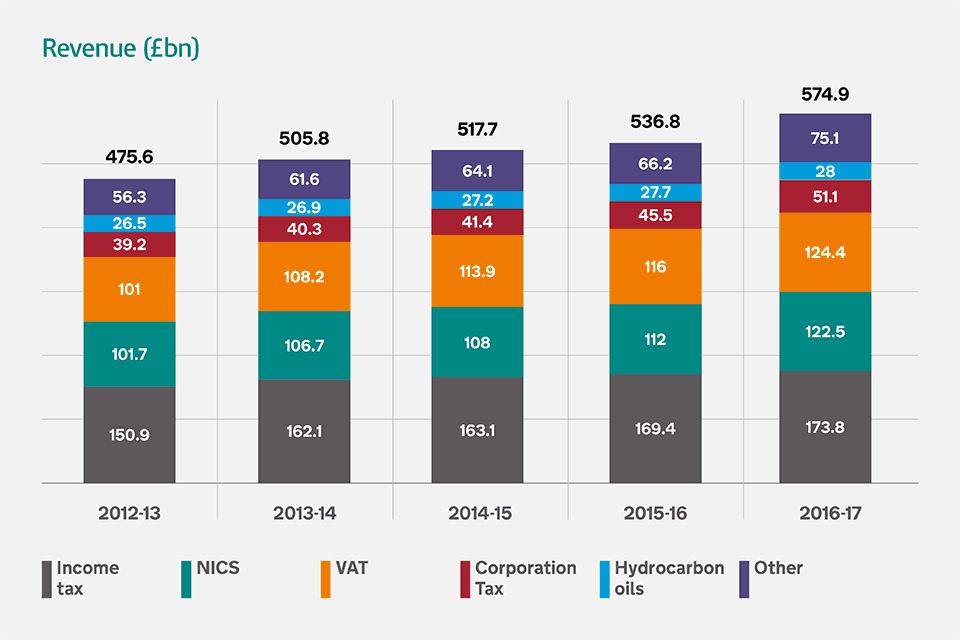

In 2016 to 2017, total revenue increased by £38.1 billion, or 7.1%, to £574.9 billion.

In summary, and compared to 2015 to 2016:

- Income tax (30% of total revenue), and National Insurance Contributions (21% of total revenue) increased 5.3% due to increases in employment levels, higher wages and changes to the way National Insurance Contributions are calculated for state pensions

- Value Added Tax (22% of total revenue) increased 7.2% due to higher receipts for the oils, gas and mining sectors which can be explained by the increased price of oil - there was also strong growth in the construction and chemicals/pharmaceuticals sectors

- Corporation Tax (9% of total revenue) increased 12.3% due to rising company profits

- Hydrocarbon oils (5% of total revenue) increased by 1.1%

- Alcohol (2% of total revenue) increased by 5.6% due to increases in duty rates, alongside a slight increase in consumer purchases for home consumption

- Stamp Taxes (3% of total revenue) increased by 6.2% due to the introduction of a higher rate for additional properties and the continuing increase in house prices

- Capital Gains Tax (1.5% of total revenue) increased by 15.1% due to the average gain per disposal of assets increasing by around 16%

- Tobacco (1.5% of total revenue) reduced by 4.4% due to the fall in cigarette consumption

A number of other taxes, including, Inheritance Tax, Insurance Premium Tax and Air Passenger Duty, accounted for the remaining 5%.

Figure 1: shows revenue (£bn)

3.2 Compliance yield

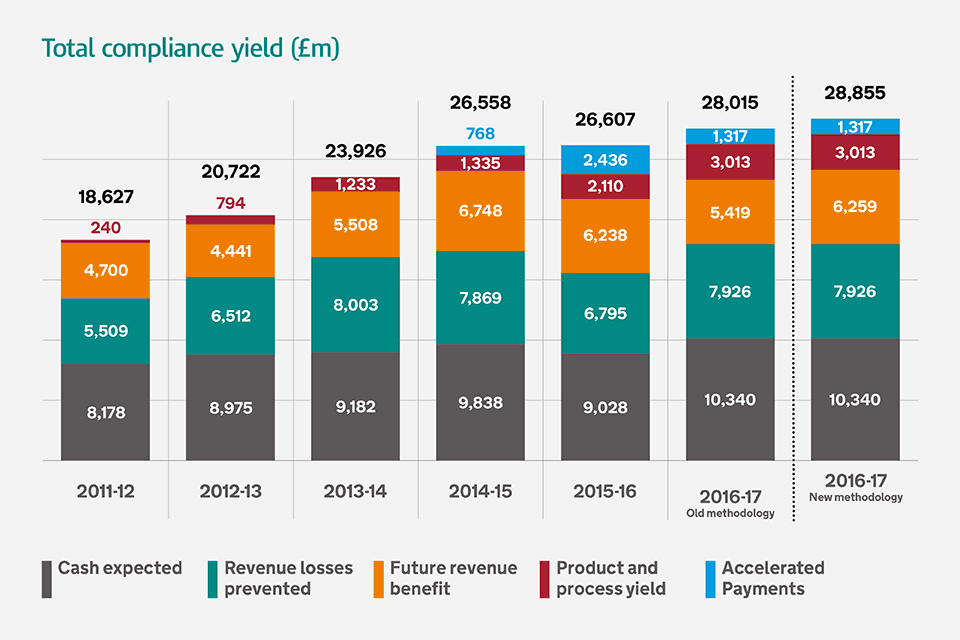

Our compliance yield includes billions of pounds that would have otherwise been lost to the UK through fraud, tax avoidance and evasion. We have strengthened our grip on those who deliberately cheat the system and continue to pursue those who refuse to pay what they owe.

We apply appropriate civil and criminal sanctions to this dishonest minority. The decision to carry out a criminal investigation is based on a number of factors, for example the nature and scale of the alleged fraud or our ability to obtain evidence to prove the case.

Compliance yield includes not only cash expected but also an estimate of the amount of revenue we prevent from being lost, together with the impact of legislative changes, process improvements and our current compliance activity on future customer behaviour.

Compliance yield also captures the impact of the Accelerated Payments regime, which requires individuals or businesses involved in tax avoidance schemes to pay the disputed amount of tax up-front, rather than keeping the money until the dispute is settled.

Compliance yield targets are set on an annual basis at the Budget. The 2016 to 2017 target of £27 billion was set on the new methodology for reporting future revenue benefit and was announced in the March 2016 Budget. We generated £28.9 billion against this target.

Following a recommendation from the National Audit Office, we published a technical paper in July 2016 setting out the changes we were making to the reporting of future revenue benefit.

The main components of our £28.9 billion compliance yield are:

-

£10.3 billion of cash expected – the amount of additional revenue due when we identify previous non-compliance, reduced by a discount rate to reflect the fact that some of the amounts that we identify will not be collected, for example where a business becomes insolvent. While the amount of tax due from these cases is very clear, we cannot trace every compliance assessment through to final payment so there is an element of estimation involved in this figure

- £7.9 billion of revenue loss prevented – the value of our activities where we have prevented revenue from being lost to the Exchequer that impacts on our tax receipts. This includes stopping fraudulent repayment claims, totalling £4.8 billion and disrupting criminal activity, which amounted to £3.1 billion

- £6.3 billion of future revenue benefit – the estimated effect of our compliance interventions on customers’ future behaviour

- £3 billion of product and process yield – the estimated annual impact on net tax receipts of legislative changes to close tax loopholes and changes to our processes which reduce opportunities to avoid or evade tax. This estimate is subject to independent scrutiny by the Office for Budget Responsibility

- £1.3 billion of revenue from Accelerated Payments notices – the disputed amounts of tax that people using tax avoidance schemes are now required to pay up-front within 90 days, as well as an estimate of the behavioural change that the policy has generated. Last year we issued more than 9,000 ‘follower notices’ to tax avoidance users with an associated accelerated payment to a value of more than £520 million. Follower notices urge tax avoiders to settle their tax dispute after court rulings in similar cases find in our favour, or face a penalty of up to 50% of the value of their tax and/or National Insurance in dispute. We issued 99 follower notice penalties last year, with a collective value of £6 million.

Figure 2: shows total compliance yield

If we calculate future revenue benefit using the old methodology (reporting future revenue benefit in the year we completed our compliance activities) our total compliance yield for 2016 to 2017 would be £28 billion, of which future revenue benefit would be £5.4 billion. The new methodology records future revenue benefit against the year in which the exchequer benefit is expected and amounts to £6.3 billion.

3.3 Tackling avoidance, evasion and non-compliance

Organised criminals

Criminals target the tax system, attempting to defraud the Exchequer of revenue, particularly from VAT, alcohol, tobacco and oils taxes and duties. HMRC uses a range of law enforcement, tax investigation, asset confiscation and other powers to tackle organised crime groups, disrupting their activity, dismantling their organisations and taking the profit out of their fraud.

Over the past six years we have brought more than 500 serious organised criminals to justice. We generated or protected £3.2 billion in compliance yield in 2016 to 2017 as a result of our investigations and enforcement action against organised crime. Our latest estimate of the tax gap for this group is £4.8 billion for 2014 to 2015.

Of our total compliance yield, approximately £5 billion cuts across different groups and cannot be allocated to a specific group.

Prosecutions

A total of 886 criminals and fraudsters were prosecuted in 2016 to 2017, mostly for tax-related offences, serving a collective total of 806 years in prison. We are committed to increasing the number of criminal investigations that we can undertake into serious and complex tax crime, focusing particularly on wealthy individuals and corporates, with the aim of increasing prosecutions in this area to 100 a year by the end of the Parliament.

Accelerated Payments

Last year, as planned, we reached the end of our three-year programme of issuing Accelerated Payment Notices (APN) to users of eligible avoidance schemes. APNs are one of the most significant tools that we have to tackle avoidance by individuals and companies, removing their ability to defer payment of tax in ongoing disputes involving marketed tax avoidance schemes. Since 2014 we have issued more than 75,000 notices worth in excess of £7 billion and collecting nearly £4 billion.

During the last year we issued more than 30,000 notices, worth £2.3 billion, with total revenue generated of £1.3 billion. This included £180 million of estimated compliance yield protected by APNs, through making the use of avoidance schemes less attractive to existing and potential avoidance scheme users.

Where a customer disagrees with an Accelerated Payment Notice, they have the right to make representations to us. Of the 75,000 notices issued we received a total of 40,000 representations.

So far we have considered more than 32,000 of these representations and around 90% of the notices were upheld as valid, with more than 80% confirmed in the original amount.

Three judicial reviews of the Accelerated Payments regime were heard last year, with the High Court confirming that the Accelerated Payments legislation, and our delivery of it, was legal, adding to the favourable decisions on two similar reviews heard in 2015 to 2016. Two of these three decisions are currently subject to appeal.

4. Transform tax and payments for our customers

We are transforming the UK’s tax and payments system with simple, secure and personalised digital services for our customers that helped deliver our best ever performance last year. We exceeded our targets across the board. More than 80% of customers told us they were ‘satisfied’ or ‘very satisfied’ with our digital services. More than nine million people accessed their Personal Tax Account. We handled more than 1.6 million webchats, and saw 92% of Self Assessment customers submit and pay their return online – more than ever before. For the first time we offered a permanent seven day a week service across our main helplines to make it easier for customers to contact us at a time that suits them. We answered customer calls in an average of under four minutes and exceeded our target for turning round customer post while receiving fewer new complaints.

Our expanding online services gave customers newer, easier, faster and more convenient ways to interact with us. We worked hard to build new digital services as alternatives to traditional ways for contacting us and ensuring customers are aware of these options, while also delivering strong performance within the more traditional routes of contact, such as phone or post. To ensure we were able to effectively monitor our digital service performance, we introduced three new digital targets for 2016 to 2017, as well as a new customer helpline target focused on waiting times.

Tax accounts give individuals, businesses and their authorised agents a more convenient real-time view of their tax affairs, providing them with greater certainty about the tax they owe and payments they are due to receive. These reforms will deliver the biggest transformation of the tax system in a generation, making it more effective, efficient and easier for taxpayers.

4.1 Use of our digital customer services

Since December 2015 we have provided individuals with their own digital Personal Tax Account and we will continue to promote the tax account as our range of online services expands.

Take up of the Personal Tax Account has been very strong with the number of individuals using their account exceeding our target of seven million, by December. Functionality increased as new services were added across the year, and new user numbers continued to grow to 9.4 million by March 2017.

Within the Personal Tax Account, customers can correspond with us using forms that can be filled in and filed online, known as iForms. We provided consistently good performance responding to iForms across the year, replying to 99% within seven days against a target of 95%.

At the same time, we provided every small business customer in the country with access to their own digital Business Tax Account and we expect most small businesses will be interacting with HMRC systems directly via accounting software, with roll-out completed by 2020 to 2021.

We recruited more than 800 new staff to further enhance our customer service with the introduction of a seven-day service across our main helplines from January 2017 so that customers have more opportunity to contact us at a time that suits them. Similarly, we have extended webchat availability up to 10pm on weekdays, 8pm on Saturdays and 4pm on Sundays. We developed a dedicated online forum and phone line for new businesses and self-employed individuals to get help and support about filing and paying their taxes for the first time, and to provide help with the transition to using our digital services.

For individual and business customers who want to use digital services, but are unable to, we put in place support for those who are genuinely digitally-excluded so that they remain able to get the help they need. This included the introduction of ‘co-browse’, a facility for customers who need further help with understanding how to use digital services. Our Needs Enhanced Support (NES) service provides support to customers who we have identified as needing extra help. Since the start of 2016 to 2017 the NES service has received just over 100,000 referrals from frontline staff and the voluntary community sector.

We wanted to achieve an average overall customer satisfaction rating of 80% for our digital services last year. The percentage of our customers that responded that they were either ‘satisfied’ or ‘very satisfied’ with the service, across all our digital services during 2016 20 2017 was 83%.

4.2 Customer calls and post performance

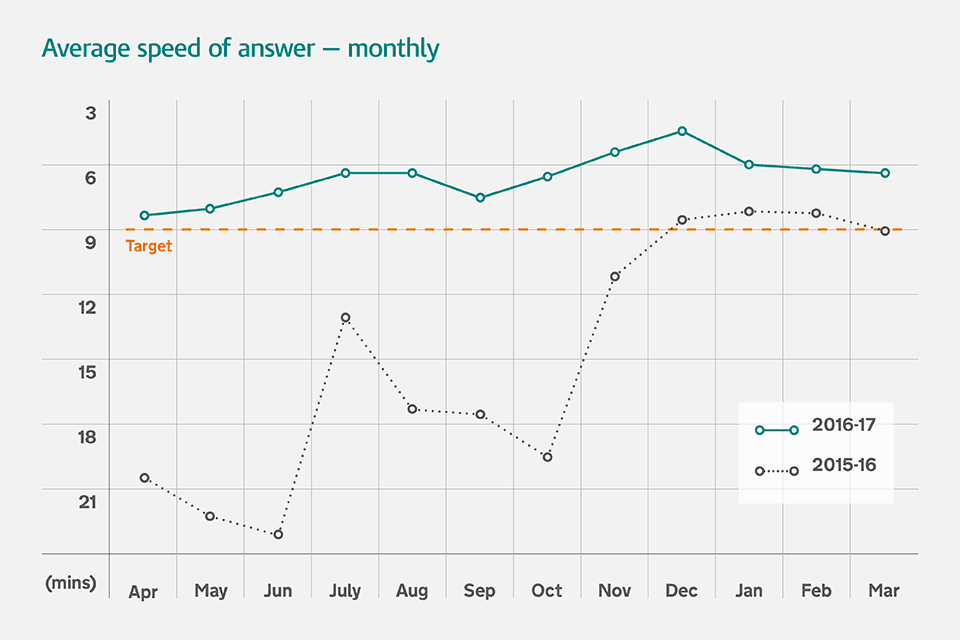

Our average speed of answering calls was strong across the year – 3 minutes 54 seconds against our target for the year of under six minutes. Our helplines have delivered consistently strong performance as a result of recruitment, more flexible working to deal with large fluctuations in demand and new online services that reduce the need for customers to call. We have introduced this new target on the average speed of answer, as call wait times give us a strong indication of how we are performing.

Figure 3: shows average speed of answering calls

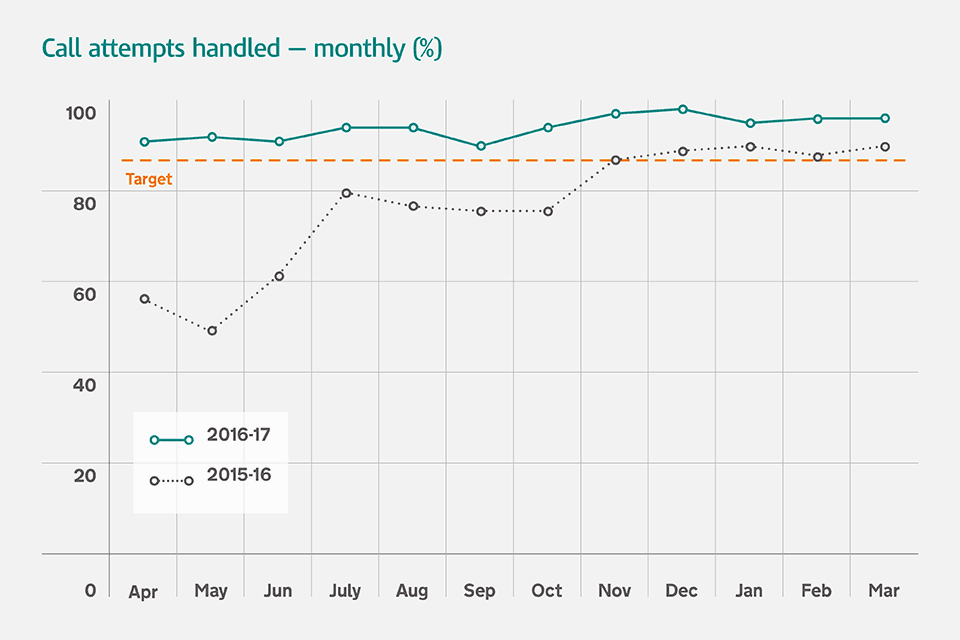

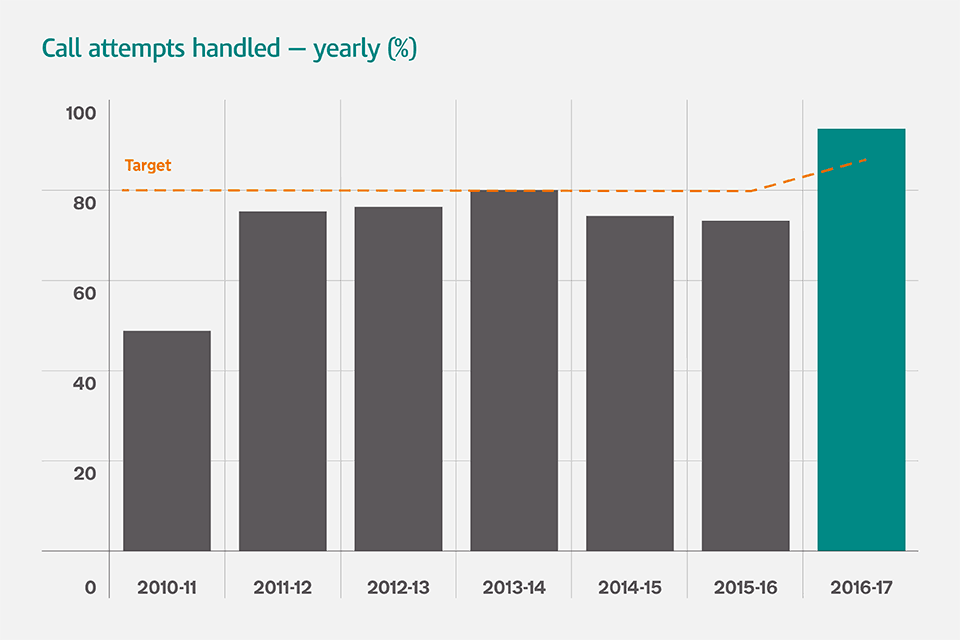

Our performance in call attempts handled was strong last year, with 91.7% of calls against our target of 85%.

Figure 4: shows call attempts handled – monthly (%)

Figure 5: shows number of call attempts handled – yearly (%)

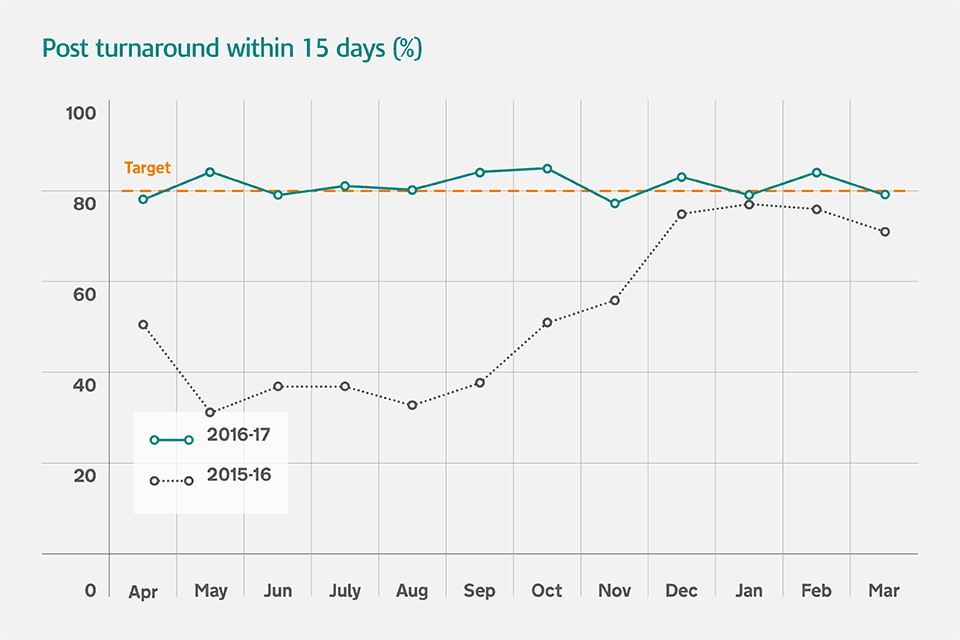

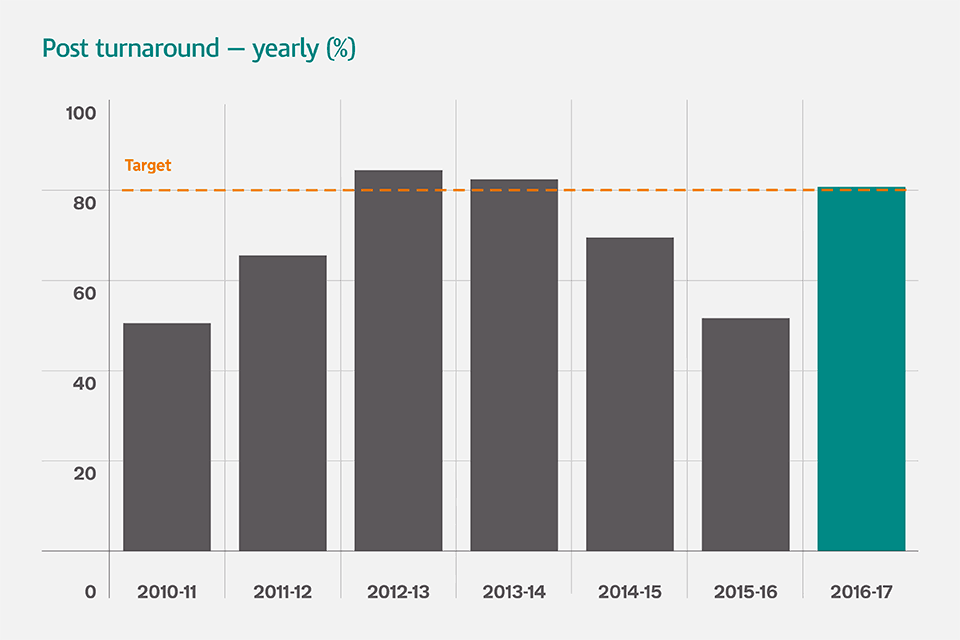

We met our target and turned around 81% of post within 15 working days against an 80% target. We also turned around 96.3% of post within 40 days, against our target of 95%.

Figure 6: shows post turnaround within 15 days (%)

Figure 7: shows post turnaround – yearly (%)

A total of 10.4 million (93%) of our customers filed their Self Assessment return on time in January, an increase of 1% on the previous year. A record 9.6 million (92%) of those customers filed online, up 1% on 2015 to 2016, with 1.7 million customers filing via their Personal Tax Account.

5. Design and deliver a professional, efficient and engaged organisation

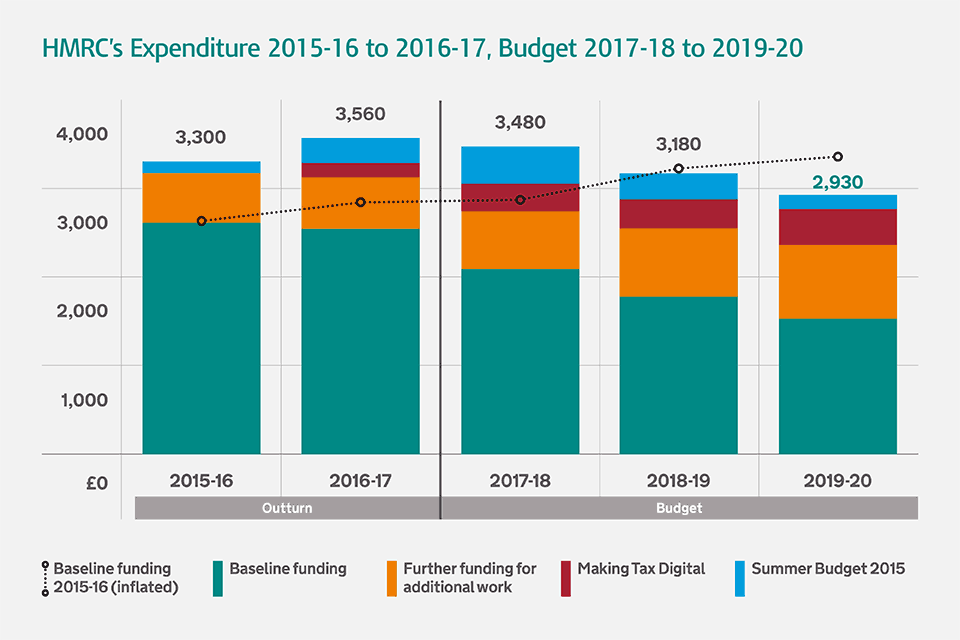

Everything we deliver in HMRC is through our people. Our emphasis on having the right people with the right skills in the right places has meant that our workforce management was one of our top priorities in 2016 to 2017. We are creating a world-class organisation fit for the future by delivering a more efficient organisation through investment of £2.1 billion in our people, technology and estate. By 2019 to 2020, this investment will lead to efficiency savings of £717 million a year.

5.1 Our people and professions

We have an active network of 22 professions in HMRC, from tax, policy, operational delivery and project and programme management, to IT, finance and analysis. As well as developing professional skills and expertise within HMRC, we play an active part in cross-government functions, for example Operational Delivery, Estates and Digital.

We re-structured the department around the customer into three main group – Customer Strategy and Tax Design, Customer Services and Customer Compliance – as well as a transformation group. These groups are supported by Corporate Services, including Digital and Information, Communications, HR, Finance, Commercial and Estates functions.

Strong leadership and management capability are needed as our leaders continue to take us through modernisation. We have continued to invest in all of our managers and leaders, around 36,000 people, through our Leadership and Management Academy and brought together information, guidance and tools in one place, making it easier for managers to find the information they need. We continue to offer all our people five days learning and development each year and during last year our staff achieved on average a total of seven days per person.

Our engagement score increased by two percentage points from 45% in 2015 to 2016 to 47% in 2016 to 2017. We are working with teams who have made a step change in their engagement levels to share their good practice and help the rest of HMRC to move towards the Civil Service benchmark (59% in 2016). Last year, as part of our work to improve diversity and inclusion, we were awarded gold status from Business in the Community for gender and race diversity in the workplace.

5.2 Workforce

We had around 61,800 full-time equivalent employees by 31 March 2017. We ran significant recruitment campaigns during 2016 to 2017, particularly into our customer compliance and customer service groups. Overall we recruited 7,714 full time equivalent. We brought in 192 people onto our Tax Specialist Programme via graduate recruitment and more than 1,200 apprentices. Continuing with our programme of modernisation, we closed 26 offices during the year. Since 31 March 2016 we supported 741 people to leave under exit schemes (149 of those funded from 2015 to 2016) through a mixture of voluntary and compulsory terms. From 1 April 2017 a further 112 people will leave, funded from 2016 to 2017 budget. In total last year, more than 5,100 staff (full-time equivalents) left HMRC through a combination of natural and managed reductions.

5.3 Our locations

We continue to transform our estate into modern, adaptable workspaces, creating new Regional Centres, serving every nation and region in the UK. These centres will bring staff into more cost-effective buildings, while making it easier for HMRC teams to collaborate and modernise the way we work.

We currently occupy 145 buildings in 92 towns and cities. Through the Building our Future locations programme we are taking the opportunity to build the estate we need to achieve our data-led compliance ambitions, to improve the conditions that people work in and to create Regional Centres where we can attract, develop and retain staff in the future.

The quality and location of sites continue to be at the heart of our overall assessment of value for money and have been part of the underlying principles behind our Regional Centre decisions from the outset. In particular, we continue to be committed to locating our Regional Centres in city centre locations, to ensure good transport links, making it possible for more of our people to move with us. This also gives us a choice of buildings, offering us modern working environments and the first-rate IT and facilities we need.

We have already secured two of our Regional Centre sites in Croydon and Bristol; teams are due to begin moving into Croydon in the summer of 2017 and Bristol is now under construction. We have also signed leases on our Specialist and Transitional Sites at Telford and Canary Wharf, respectively. We have preferred or shortlisted sites in all other eleven Regional Centre locations. Nine of these locations are already in advanced negotiations and all 11 will be delivered in line with our latest programme.

We completed the Salford showcase office, sitting alongside those already developed in Nottingham and Newcastle, to enable us to further test that the new space in Regional Centres fulfils our commitments on quality of design, fittings and services.

We expect the move to Regional Centres to save more than £300 million up to 2025, and result in annual cost savings of more than £90 million a year from 2026.

5.4 Our IT

We are transforming into one of the most digitally-advanced tax administrations in the world, so we become a digital-by-default organisation. As we transform, we are committed to reducing our operating costs and securing efficiencies in IT spend by bringing development and delivery of IT and security (including cyber) under our direct control. Our pioneering ‘Columbus’ programme is enabling us to develop our future operating model for IT which is based on a multi-supplier strategy, allowing us to take advantage of smaller, more flexible contracts with a range of suppliers. This will deliver better and cheaper IT at a sustainable cost for the future and bring us in line with modern technology organisations as we end our IT contract with Aspire in 2017.

We have already moved 60% of our services to faster, cheaper and more stable cloud-hosted platforms. We are consolidating previously disparate data sources, enabling our analysts to use specialist tools to exploit this information along with information from third parties to improve customer experience and support delivery of our Making Tax Digital transformation programme.

As we transform our estate we have rolled out 26,000 portable tablet devices enabling our people to work paper-free, more flexibly and more productively. We set up a process to take ideas from staff to make day-to-day processing tasks quicker and easier by doing some or all of the steps automatically using robotics.

We take the security of our customer data seriously. We are shaping and influencing how protective security is managed by working with other government departments on a number of security programmes. We have benefited from the government’s National Cyber Security Strategy helping us to invest in enhanced technical defences, implement cyber security improvements, build staff expertise and deploy external cyber security services, all to protect the department and its customers.

5.5 Expenditure and providing value for money

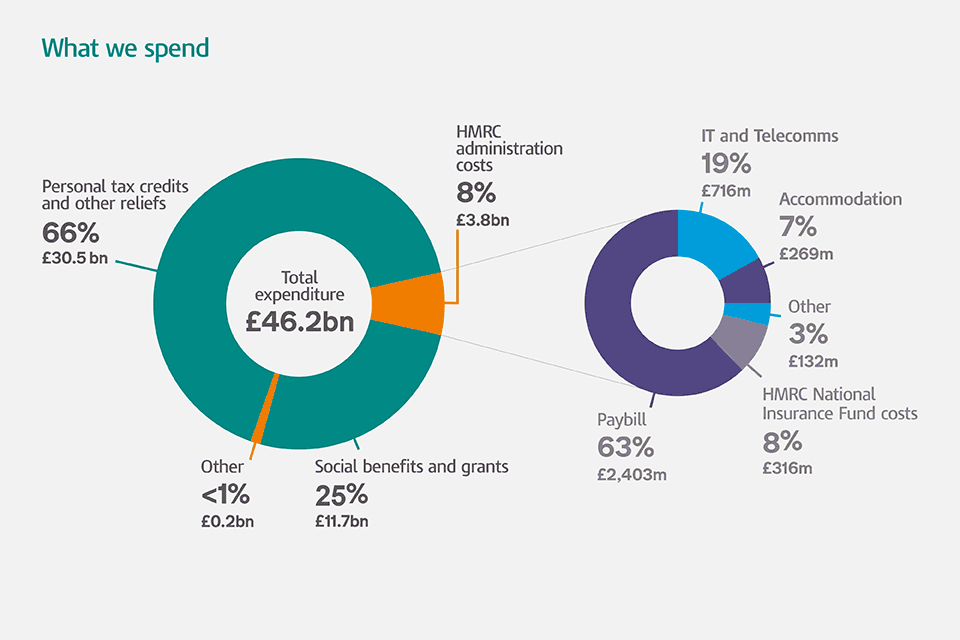

We continue to drive down the day-to-day running costs of the tax system to deliver better value for money for taxpayers and the country. The total cost of running the department in 2016 to 2017 was £46.2 billion consisting of £3.8 billion in administrative costs and the remaining £42.4 billion related to payments to our customers, including tax credits and Child Benefit.

The main items that make up administration costs are staff (£2.4 billion or 63%), IT (£716 million or 19%), National Insurance Fund (£316 million or 8%) and accommodation (£269 million or 7%).

The main items that make up our payments to customers are tax credits and other reliefs (£30.5 billion or 66%) and social benefits and grants (£11.7 billion or 25%).

Our future projected budget does not reflect the additional costs that may be incurred as a consequence of Brexit.

Figure 8: shows what we spend

Note:

- Numbers may appear not to sum due to rounding

- The chart above reflects the Departmental Group position

Figure 9: shows HMRC’s expenditure and budget 2015 to 2016, to 2016 to 2017, budget 2017 to 2018 to 2019 to 2020 (excludes depreciation)

5.6 Efficiency

Last year we achieved cost savings of £254 million from changes to contracts and transformational savings from IT and exploiting the digitisation of services that were previously paper based. Other cost savings have been generated by amending our processes so that customers need to contact us less, and encouraging customers to take up online services, including online tax accounts, webchat and iForms, where they would otherwise have contacted us by phone or letter.

We are committed to reducing our operating costs for the remainder of the Spending Review 2015 period, reaching £717 million of sustainable cost savings a year by the end of 2019 to 2020. £181 million of last year’s savings are sustainable and count towards this target.

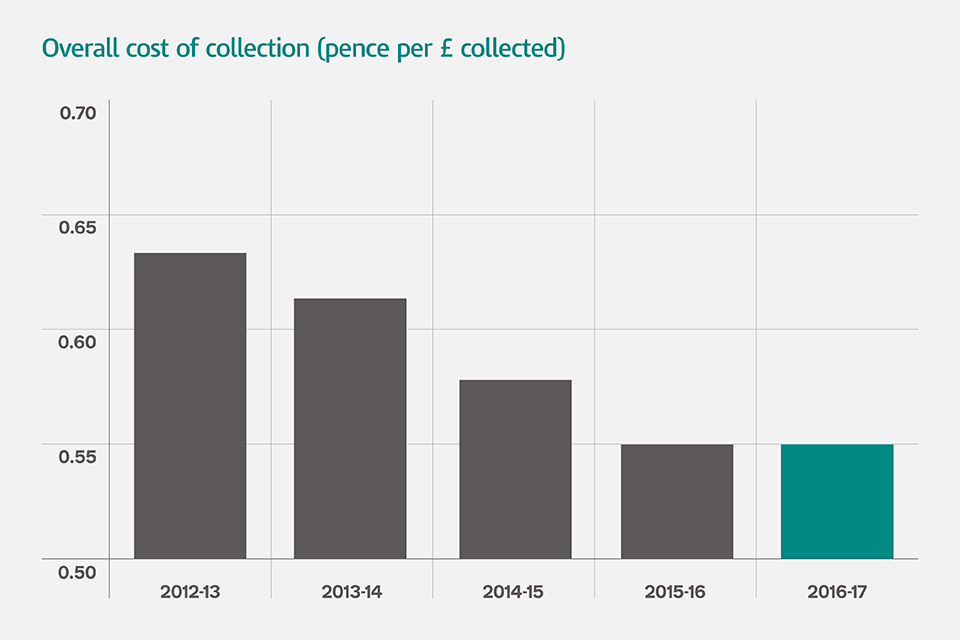

The efficiencies we have delivered, together with increasing revenues, mean that the cost of collecting taxes in the UK is less than a penny for every pound collected – from 0.63 pence in the pound in 2012 to 2013 to 0.55 pence in 2016 to 2017 (ie every £100 we collect costs £0.55).

Figure 10: shows the overall cost of collection (pence per £ collected)

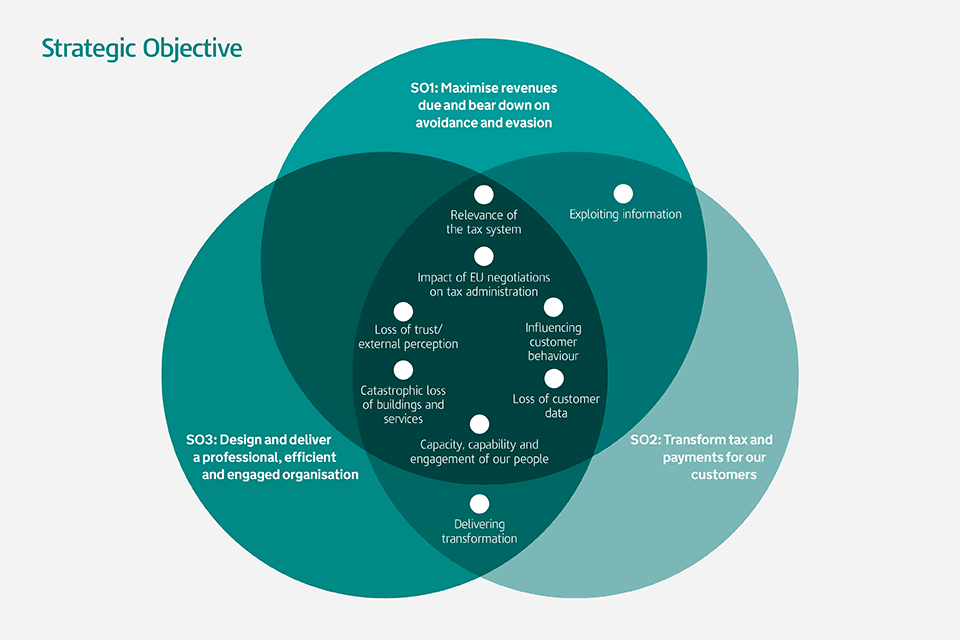

6. Managing risks to our objectives

During the year we refreshed the departmental-level risks to ensure our Executive Committee (ExCom) manage:

- the largest strategic risks

- those that cut across multiple areas within HMRC

- those where the risk to delivering them would impact upon more than one of our

- strategic objectives

The diagram below shows how the nine risks ExCom currently manage, link to our strategic objectives.

Figure 11: shows HMRC strategic objectives

These risks have the potential to affect:

- revenues for the Exchequer

- levels of confidence in the department

- our reputation with the public

6.1 The risks to delivering our objectives: what they are and how we deal with them

Relevance of the tax system to the economy

Principal risks

As a result of HMRC not recognising and addressing the opportunities and risks arising from the impact of the wider environment on its business and tax base, there is a risk that our product and process design, decisions and tax system may become out of step with social, economic, technological and demographic developments, leading to loss of confidence/integrity in the tax system and/or a reducing tax base, leading to a reduction in tax revenues.

Key mitigating actions

To manage this risk we are continuing to:

- identify future trends through horizon scanning of the external environment, and ensuring that findings are embedded into departmental strategy, policy and operational design

- improve the Policy Partnership, working openly and collaboratively with HM Treasury to develop policies that deliver ministerial priorities and are assured against the changing external environment

Exploiting information

Principal risks

We may fail to respond effectively to the business intelligence available to us – eg compliance insight or reasons for customer contact – leading to reduced revenue collection, a growth in the tax gap and/or weaker customer service.

Key mitigating actions

To ensure the data we hold is reliable, up-to-date and acted upon we are:

- creating a modernised storage and exploitation facility for customer sources of data, held in a consolidated, linked and standardised manner

- implementing a data quality programme to cleanse data and address the root cause of poor data quality

- improving our tools and analytics across all HMRC data, to help with the identification of hidden relationships and profiling

Influencing customer behaviour

Principal risks

We may fail to understand and influence customer behaviour in a way that maximises revenues and transforms our customer service, leading to inaccurate forecasting of customer demand, not living within our SR15 settlement and missed opportunities to design our customer-facing systems to promote tax compliant behaviour and making digital services the option of choice.

Key mitigating actions

To manage this risk we are:

- building upon the successful launch of the Personal Tax Account to design digital services which fully meet our customers’ needs

- ensuring our customers are fully supported to stay online through the introduction of new digital services

- reviewing and reducing the frequency with which we need to write to customers, as this can trigger unnecessary return contact

- making use of communications mediums, such as social media and webinars to share key messages with our customers

- investing in new technology to develop our frontline people as digital advocates to help them support customers to continue using our digital services

External perception/loss of trust

Principal risks

We may be seen by our stakeholders as ineffective, inefficient or as not treating everyone impartially, leading to weaker compliance and potentially an increase in the tax gap.

Key mitigating actions

To manage this risk we are:

- working internationally to close tax loopholes and cut avoidance

- investing in improved post and phone handling with additional people during peak periods and longer opening hours

- developing our online services for individuals and small businesses

- working to ensure fair media treatment of newsworthy events involving HMRC

Capacity, capability and engagement of our people

Principal risks

We may not have the right number of highly-skilled and engaged people in the right roles and professions, in the right places at the right time leading to a failure to deliver our business objectives.

Key mitigating actions

During the year we have continued to develop our people, looking at the skills we will require in the future. We are:

- developing our strategic workforce plans for each of our key business areas, to ensure the right number of people are recruited in the right locations to meet our future needs

- developing our long-term capability plans, modernising our professional learning and using the refreshed Leadership Academy, to provide training, guidance and information to far more of our people than ever before

- acting on employee feedback to identify and implement good practice across the organisation, making our processes more efficient and effective for customers and our people alike

Delivering transformation

Principal risks

We may not deliver a more modern tax administration with service improvements and efficiencies that allows us to: exploit digital channels to improve customer service; tackle more quickly those who do not engage with us or bend or break the rules; and live within our financial allocations.

Key mitigating actions

As a department we are delivering a transformation programme on an unprecedented scale. Managing this effectively is crucial to our future success. We are:

- building our capacity and capability through a range of interventions, such as:

- a major extension to our apprentice programme

- bringing in external expertise

- continuous internal recruitment

- providing more detailed information to HM Treasury and ministers regarding the effect of new initiatives on existing work, and carrying out scenario planning for various Brexit options

- using feedback from six large consultation exercises over the summer of 2016 to influence the design of our digital processes and services

Impact of EU negotiations on tax administration

Principal risks

We fail to identify and prepare for the challenges/ opportunities of the UK’s new relationships, leading to an insufficient ability to secure revenue, make payments and meet customer needs on exit from the EU.

Key mitigating actions

To ensure we understand and proactively prepare for the challenges and opportunities of the UK’s new relationship we:

- strengthened HMRC governance across the department, including establishing a central EU Exit Team, to develop a range of delivery options to support ministers’ outcomes and to inform cross-Whitehall activities

Loss of customer data

Principal risks

People may gain unauthorised access to our information assets through malicious electronic attack, human intent or an accidental event due to inadequate information risk control, leading to a significant loss of customer data. This may harm our ability to manage the tax and customs systems and result in a loss of public confidence and potential regulatory and legal action against the department.

Key mitigating actions

The safety of customer data is paramount in our thinking. To manage this risk we are:

- further developing our cyber-security command centres to help us identify and respond to cyber threats even more effectively

- implementing new verification checks for our digital services to help prevent fraudulent use of customer accounts

- driving the uptake of digital mail services to benefit from secure central data storage, thereby reducing the amount of customer-data assets physically held on our estate

Catastrophic loss of buildings and services

Principal risks

We suffer a significant incident that impacts systems, people or buildings leading to disruption to our tax collection and customer services and corresponding loss of public confidence.

Key mitigating actions

To manage this risk we are:

- improving IT resilience in our major systems through infrastructure virtualisation and the benefits of cloud technology

- updating our business continuity operating model, so that is supports our transformation programmes, particularly those around IT and our future location strategy

- implementing further improvements to our plans based on business continuity exercises undertaken during the year

7. Further information

Find out more about our:

- role and responsibilities

- governance and how we’re organised

- research programme

- statistics programme

Our key publications: