DVLA's annual report 2014 to 2015

Published 24 June 2015

1. Non-Executive Chair’s introduction

Lesley Cowley

In October 2014, I joined DVLA as the agency’s first Non-Executive Chair. My role includes supporting our Accounting Officer and Chief Executive Oliver Morley and his Executive Team in delivering DVLA’s Strategic and Business Plans. Along with my fellow non-executive directors, I help provide strategic inputs and also regular oversight and scrutiny of DVLA performance.

This Annual Report & Accounts sets out DVLA’s performance and achievements for the year, a view of the organisation at the end of the financial year and includes a strategic plan of the organisation going forward.

2014 was a year of significant change and progress for DVLA. I have been impressed by the extent of change that was delivered during the year, especially around digital services and service excellence. At the same time, the agency has made significant cost savings and exceeded a challenging efficiency savings target.

2015 will bring more change and progress for DVLA, with significant changes to our IT, the abolition of the driving licence counterpart and business development opportunities that maximise our value as a service provider for government.

I would like to pay tribute to all of the DVLA staff who produced the 2014 outcomes and to thank them for their dedication and engagement. As someone who is passionate about both digital services and service excellence, I am proud to be working with you and to be part of such an exciting organisation going forward.

Lesley Cowley OBE,

Non-Executive Chair

12 June 2015

2. Chief Executive’s message

Oliver Morley

In 2014-15, DVLA successfully delivered an incredible amount of change, implementing digital policy and service reform simultaneously. These changes have moved us closer to our goal to get the right drivers and vehicles taxed and on the road as simply, safely and efficiently for the public as possible.

During the year we introduced:

- direct debit for the renewal of vehicle tax

- abolition of the tax disc

- the reduction of fees on certain driver transactions

- personalised registrations online, customers can transfer their personalised registration onto a retention certificate

Digital take-up of our services increased from 52.9% (in 2013-14) to 78.2%. Our customers can now view their driver record online including the facility for fleet operators to access their vehicle records, giving them the option to suppress the issue of registration documents saving them an estimated £3 million a year.

We have completed the final year of the £100 million efficiency savings target compared to the 2010-11 baseline which has been exceeded with a figure of £103 million.

In July 2014 the centralisation of Northern Ireland (NI) services in DVLA has made operational efficiency savings of £9 million. Motorists in NI now enjoy an enhanced range of online vehicle registration and licensing services.

In October 2014, Lesley Cowley joined the agency as the first ever Non-Executive Chair. Her appointment represents the completion of a very strong Board who will continue our transformation journey.

2015-16 will see us move away from our current IT provider. We have carried out significant work preparing for the move working closely with our colleagues at Government Digital Service (GDS) to develop our detailed approach.

We have yet another challenging year ahead of us. I am confident that we can continue to deliver whatever we set out to do.

Oliver Morley

Accounting Officer and Chief Executive, DVLA

12 June 2015

3. Highlights for the year

Highlights

Highlights

Awards

Awards

Awards

4. Strategic report

4.1 Who we are and what we do

DVLA is an Executive Agency for the Department for Transport (DfT) and responsible for maintaining over 45 million driver records and almost 38 million vehicle records. We are responsible for collecting around £6 billion of vehicle tax a year and limiting tax evasion.

Our goal

Our goal is to get the right drivers and vehicles taxed and on the road as simply, safely and efficiently for the public as possible.

How we manage our organisation

The agency has a framework document which has been revised and refreshed as agreed with the DfT, which establishes the governance, accountability, key relationships and financial management arrangements within which the agency operates. At the heart of these arrangements is the DVLA Board consisting of a Non-Executive Chair, Chief Executive (and Agency Accounting Officer), 3 Non-Executive Directors and 6 Executive Directors.

The Board meets formally eleven times a year and supports the Chief Executive in agreeing the Strategic and Business Plans with ministers through the DfT Director General, Roads, Traffic and Local Group.

For more information about how we manage our organisation see our Governance Statement or visit our website.

The purpose of this document

The Annual Report & Accounts should be read in conjunction with the DVLA Business Plan 2014-15 and sets out our performance and achievements for the year. For more information about DVLA visit our website.

4.2 Our Strategic plan

Our Strategic plan 2014-17 outlines our plans for our future and includes and responds to the recommendations from the Reilly Review into DVLA services carried out in 2013. The Plan details our vision and the objectives required to deliver our change agenda which will provide a centre of excellence of digital services for our customers.

DVLA digital services

2014-15 was a ground-breaking year for DVLA digital services with the introduction of a number of new online services to customers. As our digital transformation accelerates and expands, our customers are increasingly choosing to use our widening range of digital services. In 2014-15 take-up of DVLA digital services increased to:

- 75% for vehicle licensing (61% in 2013-14)

- 51% for driving licence services (33% in 2013-14)

Simpler licensing

Abolition of the tax disc

In October 2014, the paper tax disc, first issued in 1921, was abolished. DVLA, the police and other enforcement authorities use the electronic vehicle register to check if a vehicle is taxed and no longer have to rely on a physical check of a paper disc. Most on-road enforcement action now uses Automatic Number Plate Readers (ANPRs).

The vast majority of motorists pay their vehicle tax with latest figures confirming that 99.4% tax their vehicles on time. Abolishing the tax disc has removed an administrative inconvenience for millions of motorists and there are significant savings for fleet operators and other businesses from not having to handle the administration of tax discs.

Direct Debit

In October 2014, Direct Debit was introduced as an option for customers to pay their vehicle tax. Motorists can now pay vehicle tax by Direct Debit annually, biannually or monthly. There are no additional handling fees for annual payments but to limit the impact on the public finances, there is a small surcharge of vehicle tax for biannual and monthly payments.

Direct Debit

View driver licence online

DVLA’s view driving licence system was completed in March 2014 and the service went live in October 2014. The free digital service delivers a high quality, simple, customer focused channel that is cost-efficient allowing drivers to check their licence information online. This service is an enabler for the removal of the counterpart of the driving licence and is part of the Government’s Red Tape Challenge.

The service provides customers with a free 24/7 online facility to check their driving licence record and gives customers more flexibility and freedom to use DVLA services as and when they need to. The delivery of the service is in line with both the Government’s Digital Strategy and our goals to make services simpler, better and safer.

My Licence

DVLA has worked closely with the insurance industry to develop ‘My Licence’ which went live in December 2014. This allows drivers the option to allow insurers to check their driving entitlement and current penalty points, enabling quotes to be provided more easily and accurately, based on real time information. This service will deliver benefits for honest motorists and will reduce misrepresentation (whether accidental or deliberate), helping the fight against insurance fraud.

Removal of the paper counterpart to the photocard driving licence

DVLA wants to make it as easy as possible for motorists and businesses to access government services. Removal of the paper counterpart to the photocard driving licence reduces the amount of paper and the burden on drivers. This forms part of our commitment to the Government’s Red Tape Challenge to reduce unnecessary red tape.

The removal of the paper counterpart was scheduled for December 2014 but delayed until June 2015 to accommodate corporate stakeholders’ concerns over their readiness for implementation and also to avoid the industry’s busy calendar year end. We are continuing to work closely with the motor industry to ensure that their systems and processes are as ready as they can be before the changes are implemented.

Photocard

View Vehicle Record for fleets

The view vehicle record for fleets service was launched on 23 March 2015 and has been developed as an enquiry service for DVLA fleet scheme customers. The service allows fleet customers to access the vehicle records held against their respective fleet code through GOV.UK. This service will be available to all fleets and will also allow them to choose to suppress the issue of the vehicle registration certificate, saving them an estimated £3 million a year.

Vehicle management

In January 2015 we introduced the first vehicle management digital service. This service allows motor dealers to tell DVLA when a vehicle is sold into the motor trade.

Personalised registrations

DVLA’s personalised registrations service launched in March 2015, which allows individual and commercial customers to take a personalised registration number off their vehicles. This service allows the user to retain the registration number to assign to a vehicle at a later date. For more information about DVLA personalised registrations visit our website.

Excellent services

During the year we expanded our digital services to provide a simpler and easier service to our customers. This has been a successful year for delivering excellent customer service. Over the next few years, as set out in our Strategic Plan, we will continue to improve and expand our services to deliver the best services in government.

The re-accreditation of customer standards (see our highlights for the year) shows that DVLA continues to provide some of the best customer service in both the public and private sector.

DVLA Contact Centre

DVLA’s Contact Centre has successfully supported customers through a significant period of change. The Contact Centre provides an excellent quality of service and is one of the leading providers of these services within both the public and private sector.

Contact centre

Customer satisfaction

DVLA has always prided itself on excellent customer service and this is shown in the 2014-15 customer satisfaction survey which showed that 93% of customers were satisfied with our service.

New opportunities

Business development

In 2014-15 DVLA recruited a Head of Business Development and formed a Business Development team reporting directly to the Commercial Director.

A DVLA Business Development Strategy was approved by the DVLA Board in December 2014 and a 3 year Business Development Plan has also been developed. Many new opportunities and potential customers have been identified and a number of prospects are being progressed, with some at advanced stages. The agency has been selected as the preferred supplier of print work for a central government department and is awaiting proof of concept work to continue.

Since October 2014, DVLA has been processing grant applications from Charge Point suppliers received as part of The Electric Vehicle Homecharge Scheme, which is governed by the Office for Low Emission Vehicles (OLEV). This new work supports our Strategic Plan by creating new opportunities and helping maximise our value as a service provider for government.

The best of DVLA

Our staff

DVLA is committed to promoting equality and diversity both in the delivery of services to its customers and for the people it employs. As DVLA is changing to provide more of its services digitally, there has been a focus on developing our structures and people to meet the future needs of customers.

The agency’s key source of information for employees is the staff handbook, which includes terms and conditions, procedures and guidance about the employment relationship. The trade union is informed and consulted on changes which may have implications for the people they represent.

DVLA has a central corporate communications team that manages a core set of channels to provide staff with a regular communications aligned with the agency strategy. During the year the agency has focused on 2 way communications such as web chats and blogs (which include Executive Team sessions). Staff have access to both digital and paper based anonymous channels to raise concerns that require further information.

Over the past year:

- staff engagement – our engagement index result from the Civil Service People Survey 2014 was 60%, an increase of 4% from the previous year

- apprenticeships/work experience – we have launched operational and Information Technology Qualification (ITQ) apprenticeships and worked closely with Swansea University to attract and develop new talent to the organisation

- coaching – we set up a coaching network to support the increased numbers of people on talent and development programmes as a result of our work on implementing the Civil Service capability plans.

- performance management and reward – we implemented modernised employment contracts, in-line with the Civil Service reform agenda

- service management – we have restructured our business to develop an end to end view of our services which focuses on the needs of the customer. This represents best practice across government and reflects government digital service agenda and full service management

- recruiting specialist skills – we have introduced new ways of recruiting, using social media to attract the technology people we need to fill critical skills gaps

Headcount

The number of full-time equivalents (FTEs) that DVLA employs was 5,147 at 31 March 2015. Although above the target of 4,880, this is due to the agency taking on additional work with the introduction of direct debit payments for vehicle excise duty and in preparation for the planned abolition of the driving licence counterpart. The agency’s priority is efficiency, not headcount. If there is a need to hire local people to meet demand and this can be done efficiently, this remains a positive option.

Sick absence

The average working days lost to sick absence of 8.93 is 1.93 over the DfT standard target. This is disappointing. The reasons for this increase have been analysed in detail, an action plan has been developed and work has begun.

Diversity

At DVLA we are committed to being a responsible business and understand that we have a responsibility to support the people that work with us and the communities in which we work. We are committed to implementing the government’s policies on diversity and equality. The promotion of equality and diversity principles are incorporated into delivering inclusive services accessible for staff, customers and the general public. For more information visit our website.

DVLA’s Diversity Strategy provides the framework to help build an organisation responsive to change and one that recognises and supports the diverse needs of its staff and customers. Work continues to achieve a gender balance at Grade 7 and above, which is representative of the workforce as a whole. Events such as the International Women’s Day event organised by DVLA’s Chrysalis Women’s Group, aim to encourage women to develop their careers in DVLA.

gender split

There have been some changes at a senior level this year. All vacant posts on the DVLA Board have been filled, now 36% female. Although this represents some distance to go, this is progress. The lack of senior women leaders at DVLA is a long-term historical legacy and is clearly a major priority for us to address.

In 2014-15 activities included:

- a diversity conference - the conference focused on diversity and the importance of developing staff skills to deliver digital transformation

- Diversity Awards - DVLA’s Diversity Team was highly commended in the ‘Team of the Year’ category, in the 2014 Employers Network for Equality & Inclusion Awards, the UK’s leading employer network, covering all aspects of equality.

- DVLA’s Diversity Team worked with a number of local organisations including the Welsh arm of Recovery Career Service, an organisation that assists injured servicemen. The agency facilitated work placements to help those facing barriers in gaining employment

- the revised Harassment Contact Officer Network was launched in June 2014 to support any staff that might experience harassment or bullying

- the annual Diversity event was held in December 2014. The event involved local school children, Swansea Careers, DVLA Staff Networking Groups, Army Reservists and agency staff celebrating the season and raising money for the charity ‘Walking with the Wounded’

4.3 IT transformation

This year has seen significant work preparing for the move away from our current outsourced contract with IBM/Concentrix, to bring control and management of our IT services in-house in September 2015. We have continued to work closely with our colleagues at Government Digital Service (GDS) to deliver several key digital services, abolishing the vehicle tax disc and preparing for the removal of the paper counterpart to the photocard driving licence in June 2015.

The direction is to move away from more expensive and inflexible products, to using cheaper and more flexible services, combined with doing as much as we can ourselves. Solid progress has been made during the year to build the internal capability by creating partnerships with regional technology enterprises, universities and using the skills of our staff within the business. The strategy is ultimately focused on significant reductions in the costs of developing systems and procuring expertise whilst simultaneously improving products and growing a highly skilled and flexible workforce.

DVLA@TechHub

In November 2014 DVLA joined TechHub in Swansea which will build the agency’s capability and encourage locally based talent, digital entrepreneurs and technology companies to work in a unique environment to benefit by sharing resource, knowledge, experience and workspace. It will also work toward fostering a culture of mutual learning in the development of excellent digital services, applications and technologies.

TechHub

4.4 Change portfolio

The DVLA change portfolio has been re-aligned during the year to reflect the adoption of a digital service based approach supported by newly appointed business service managers. This continues the theme of shifting from existing systems to the newer platforms in order to protect services and business continuity and provide increasingly rich digital services to our customers.

Transformation Programme – this consists of 4 delivery portfolios aligned to the delivery of key services in the Vehicle, Drivers, Common Services and Corporate Services areas. Each includes a number of key initiatives and infrastructure work to ensure business operations continuity. These initiatives focus on further online provision but not at the expense of the quality of service offered under other channels.

Transition Programme – this deals with the transition away from our existing outsourced IT model and focuses on the development of a new agency operating model. This model will support the requirements that will enable us to take control, manage our own IT service and build the foundations of a more flexible, digital and customer focused organisation.

4.5 Financial review

The agency Accounts are made up of the Business Accounts and the Trust Statement.

Business Accounts

DVLA’s Business Accounts are segmented (see Business Accounts – Note 2) into:

- maintenance of the driver and vehicle databases and related services

- collection and enforcement of Vehicle Excise Duty (VED)

- sale of personalised registrations which represents commercial income generated directly from the public. DVLA retains income to recover its costs in administering personalised registration services with the excess paid directly to HM Treasury as Consolidated Fund Extra Receipts (CFERs)

- services delivered to other government departments

DVLA is funded by a combination of income from fees, cost recovery charges and supply funding from DfT. The DVLA seeks to break even year on year with the overall aim to provide value for money for the taxpayer.

Reduction in fees

In October 2014 we cut fees on a number of driver transactions as a result of efficiency savings on our running costs. The new fees have introduced price differentiation for some transactions between online and paper channels, reflecting the lower cost to deliver the online services. Amongst the changes, on some transactions, we introduced a price differential between online and paper channels; the first driving licence paper application fee is £43 and a digital application fee is £34, compared to a fee of £50 for either channel prior to the change. A 10 year renewal of a photocard licence paper application is £17, with the digital application being £14, compared to a fee of £20 previously. We estimate that cutting the cost of a driving licence will save drivers and businesses £150 million over the next ten years.

In addition, there will no longer be a 1, 2, or 3 year extension period for retaining a personalised registration; this has now been extended to 10 years. The reduction in fees is possible due to the fees and charges surplus generated by the agency in recent years, as shown within Note 2.

Financial results

This year has seen an increase in income against the 2014-15 Business Plan and prior year, with gross income collected of £541 million compared to the £479 million planned. The increase against plan is mainly due to:

- vehicle first registration volumes have continued to exceed forecasts by 6.2% which has generated an extra £9 million

- driver related volumes are above Business Plan by around 2.6% for the key fee paying transactions. The increased volumes alongside a delay in the implementation of reduced fees from 1 October to 31 October, has resulted in drivers income being £10 million higher than plan

- personalised registrations has seen a successful launch of the 64 and 15 number plates. Auctions and online sales have generated an additional £6 million and £13 million respectively above Business Plan

- a delay in the removal of the personalised registration retention fee from October to March has resulted in additional £10 million income

Total expenditure of £489 million for the year is slightly higher than the plan of £486 million. Within the expenditure there have been the following major variances:

- an increase in workforce related charges of £9 million resulting mainly from alignment of salary rates on implementation of Modernising Employment Contracts (MEC), as part of the Civil Service reform agenda and additional headcount throughout the year (see page 12) compared to plan. The MEC package included a pay award, revised terms and conditions, and additional payments to compensate for changes to pay and contractual terms

- agents’ fees have increased by £3 million mainly as a result of the new Heavy Goods Vehicle (HGV) Levy service charge in year and additional wheel-clamping activity. These increases have been partially offset by reduced front office contract costs due to increased channel shift

- ICT costs and professional services have decreased against plan mainly due to realignment of the change portfolio, project delivery costs reducing and changes in delivery approach

- our depreciation charge is £5 million higher than planned as a result of a review at the end of 2013-14 financial year on asset lives in conjunction with the agency transformation plans

4.6 Departmental Expenditure Limit position

As a government body, the agency has budgets set at the start of the financial year in respect of certain activities, known as the Departmental Expenditure Limit (DEL). The resource DEL outturn for the year of £94 million came in £35 million under plan primarily as a result of the additional income generated, as described above.

Efficiency

The agency has completed its final year of the £100 million efficiency savings target compared to the 2010-11 baseline. The target has been exceeded with a final figure of £103 million recurring and sustainable savings being generated with the key contributors being:

- reduced pricing on the Front Office Counter Services contract which has led to £17 million savings per annum

- realisation of the benefits arising from the Modernising Network Services (MNS) which contributed £30 million

- centralisation of Northern Ireland vehicles services has delivered £9 million, but represents a £12 million per annum saving going forward

- re-tendering of the wheel-clamping contract delivered savings of £7 million

DVLA delivered over £100 million of efficiency savings in the period 2010-2015 and has committed to deliver a further 7% reduction in 2014-15 with a total targeted 30% reduction in Net Operating Expenditure against a 2013-14 baseline by the end of March 2017. The agency is on target, achieving 10% efficiency savings this year.

Trust Statement

The Trust Statement sets out the VED taxation and fine revenue collected by the agency that is due to the Consolidated Fund.

This financial year has also seen the introduction of the HGV Road User Levy into the Trust Statement. Payment for VED by Direct Debit has been introduced in the year which has given customers the choice to spread the cost over 12 months.

During the year gross revenue amounted to £6.1 billion, which is a slight decrease on 2013-14 of £6.2 billion. Note 3 provides further details around the impact of the HGV Levy on Trust Statement revenue. VED evasion was last measured by a roadside survey carried out by DfT in 2013, where VED compliance was reported at 99.4% for 2013-14. A proportion of the lost VED is subsequently recovered through DVLA enforcement activity. The next survey is due in 2015.

4.7 Social responsibility

DVLA’s Software Development Community (DSDC) has teamed up with Code Club, Stemnet and local primary schools to teach the next generation how to code in South Wales. Code Club is a nationwide network of volunteer-led after-school coding clubs for children aged 9 to 11. The agency is helping to promote coding and technology primarily in the Swansea area, but also throughout Wales.

The clubs involving DVLA colleagues are run by volunteers. All of the volunteers are now registered Science, Technology, Engineering and Mathematics (STEM) Ambassadors as well as Code Club volunteers, working with young people to promote enthusiasm and learning.

To support our social corporate responsibility we have made an ongoing commitment to local schools and the community.

It supports talent development in-house and across Wales and shows the agency is creating employment opportunities for those with digital skills. This will help to ensure that DVLA has the skills and talent to manage and deliver our services now and in the future. Additionally it promotes DVLA as an employer of choice for those with digital skills.

Charity of choice

DVLA staff chose Wales Air Ambulance as the charity that they would support for 2014 and raised an incredible £21,389. The money raised was used to buy a scanning machine for their Swansea based helicopter.

The charity chosen by staff this year is LATCH – Welsh Children’s Cancer Charity that supports children with cancer and their families. To date staff have raised over £8,000.

Latch

4.8 Risk and uncertainty

Risk management is important to DVLA. Details of the risks identified and addressed in 2014-15 are outlined in the Governance Statement.

Our key risks moving forward are:

- those relating to business continuity

- the ongoing risks relating to fraud, error and debt

- the related risks associated with data breaches and poor data quality

- the ongoing risks to IT security which are mitigated through the IT change agenda, i.e. making new and existing systems as robust as is possible in transition

4.9 Sustainability

Further information on our sustainability performance is available in the report ‘Sustainability at DVLA’ published separately on our website. The following section, along with Appendix C details the minimum sustainability reporting requirements in accordance with the HM Treasury Public Sector Annual Reports: Sustainability Reporting Guidance 2014-15 and Greening Government Commitments (GGCs) Guidance.

2014-15 was the end of the reporting period of the GGCs. These have now been extended through to 2015-16. DVLA has exceeded all of the GGCs with the exception of its Greenhouse Gas (GHG) reduction. Explanations for the performance against each commitment can be found in the table below.

Greenhouse Gas Emissions

This overall commitment is made up of 2 components:

- emissions from travel

- emissions from the estate

The emissions created by business travel have been reduced during the 5 year period by 72.46%. This has been achieved through a number of methods including, undertaking less travel (reduction in miles), hiring/procuring lower emission vehicles and a mode shift from cars to rail.

Business miles

Total travel by mode

| Year | Air | Road | Own Car | Rail |

|---|---|---|---|---|

| 2010 -11 | 9.82 | 55.60 | 5.32 | 34.00 |

| 2011-12 | 10.36 | 49.94 | 2.36 | 39.17 |

| 2012-13 | 11.18 | 41.03 | 1.60 | 47.27 |

| 2013-14 | 13.19 | 45.23 | 1.34 | 41.04 |

| 2014-15 | 8.30 | 41.19 | 1.19 | 50.05 |

Average CO2 per car (Owned fleet, leased and hired)

| Year | CO2 |

|---|---|

| 2012-13 | 130.72 |

| 2013-14 | 125.50 |

| 2014-15 | 123.58 |

Emissions from the estate

The potential volatility of electricity factors had been recognised previously and past conversion factors were based on the average of the past 5 years. This rolling average reduced the likelihood of big variations year-on-year. However, the decision was taken by the Department for Environment, Food & Rural Affairs (DEFRA) and Carbon Smart in 2013 to use data from one year instead. This decision was made to provide an emission factor that was as close as possible to the actual year of reporting and it highlights the difference the energy mix in the national grid can make.

The methodology for calculating conversion factors has changed. Our final outturn based on the published conversion factor for the year was 19%, had the methodology not changed we would have achieved a more positive outturn of 22%, however, this would still miss the target.

Waste

Waste has been reduced by 46% from the baseline year due to the modernisation of our business.

Water

We continue to achieve good practice consumption figures for our water consumption at 4m³ per FTE (good practice is between 4 to 6m³ per FTE). However, this is based on office space only. We believe that if we were to look at our whole estate, a more realistic figure would be around 6m³per FTE. Our consumption has reduced since the baseline year by around 7% but we aspire to more. Please see Appendix C for further details on water.

Procurement

The GGC for sustainable procurement is to:

- procure sustainably and reduce supply chain impacts by embedding Government Buying Standards (GBS) in departmental and centralised procurement contracts where possible. We are committed to meeting the GBS best practice specifications wherever possible.

- all common goods and services are procured by the Crown Commercial Service (CCS), acting as a delivery agent on behalf of DVLA. The framework agreements/contracts established by the CCS include a full range of sustainable products that meet the GBS mandatory levels.

Transparency Commitments

Climate Change Adaptation - we have one property that is at risk from climate change – flood risk. The local council has invested large sums of money to mitigate the whole area from this risk. We have ensured that our business continuity plans are in place should we need to use them. We are also considering the longer term future of the sites for operational purposes.

Biodiversity and Natural Environment - we have taken positive action across our sites to improve the biodiversity, changing grass cutting regimes, leaving areas to grow more naturally and installing bird boxes. We have seen some excellent results.

Procurement of food and catering services - procurement of our food and catering services is done through our PFI contract. We undertake an annual check which meets the required guidelines.

Sustainable Construction - no construction activities have been undertaken in the past 12 months.

| Measure | Greening Government Commitment | 2009-10 Baseline | 2014-15 Target | Outturn 2014-15 | Target 2014-15 | Reduction Achieved 2014-15 |

|---|---|---|---|---|---|---|

| Greenhouse Gas Emissions | Reduce total carbon emissions levels to 75% of 2009-10 levels by 2014-15. (tCO2e) | 18,261 | 13,696 | 14,836 | 25% | 19% |

| Greenhouse Gas Emissions | Reduce Domestic Business Travel Flight levels to 80% of 2009-10 levels by 2014-15. (Number of Flights) | 1,747 | 1,397 | 258 | 20% | 85% |

| Waste | Reduce Waste Arising by 5% annually (25% by 2014-15), relative to 2009-10 levels. (Tonnes) | 2,196 | 1,647 | 1,182 | 25% | 46% |

| Water | Reduce water consumption to an average of less than 6m3 per person per year. (m3/FTE)(N.B. includes ‘Office’ accommodation only) | 4.58 | 6.0 | 3.72 | ||

| Administrative Paper | Reduce paper usage by 25% against the 2009-10 baseline by March 2015 or for those organisations who had already achieved that level of reduction, to at least maintain the reduced levels achieved in 2011-12. Equivalent A4 reams. | 67,065 | 50,299 | 27,482 | 25% | 59% |

4.10 DVLA key performance measures 2014-15

| Reform | DVLA Measure | Result |

|---|---|---|

| 1. Remove barriers for customers to encourage growth and reduce administrative burden (contributing to the Government’s Red Tape Challenge) | 1.1 Stop issuing the driving licence paper counterpart from December 2014 | Delayed until June 2015 |

| 1.2 Option for fleet operators not to hold a vehicle registration certificate (V5C) by November 2014 | Delivered March 2015 | |

| 1.3 Introduce Direct Debit option for paying vehicle excise duty by October 2014 | Delivered October 2014 | |

| 1.4 Stop issuing vehicle tax discs from October 2014 | Delivered October 2014 | |

| 2. Further digitise services we offer and drive user take-up | Launch initiatives/services that support the government digital strategy: | |

| 2.1 View driving record - provide customer access to view their driver record online by June 2014 | Delivered March 2014 | |

| 2.2 Vehicle management – provide the customer with a digital channel to allow them to update their vehicle record by March 2015 | Delivered January 2015 | |

| 2.3 Personalised Registrations – provide the customer with a digital channel to manage their personalised registration/s by March 2015 | Delivered March 2015 | |

| By March 2015 increase digital take-up of services: | ||

| 2.4 Vehicle licensing to 65% | 75% | |

| 2.5 Driver licensing to 37% | 51% | |

| 3. Introduce new and accelerated ways of delivering excellent digital services | Strategic Transformation Programme | |

| 3.1 Commercial transition – introduce greater commercial flexibility in IT services procurement by September 2015 | Ongoing | |

| 3.2 Transform IT services – to build flexibility into the way that IT systems are built moving from large, single use systems that are difficult to tailor, to an approach based more on component elements | ||

| Develop tooling, platform integration, quality engineering by June 2014 | Ongoing | |

| Platform data services by June 2014 | Ongoing | |

| Environment provisioning and platform security by September 2014 | Ongoing | |

| 3.3 Deliver common products and utilities e.g. payment mechanisms and enquiry services which will enhance and simplify the customer experience | ||

| Payment and customer authentication by December 2014 | Delivered December 2014 | |

| Audit and management information solutions by December 2014 | Delivered January 2015 | |

| 3.4 Move to a new target operating model including capability gap analysis and solutions such as developing skills ‘in-house’ by March 2015 | Delivered March 2015 |

| Customer service | DVLA Measure | Result |

|---|---|---|

| 4. Seek and act on customer insight and feedback | 4.1 Retain accreditation of the Customer Service Excellence standard | Retained |

| 5. Provide best in class contact centre | 5.1 Retain accreditation of the Customer Contact Association standard | Retained |

| 6. Customer satisfaction | 6.1 Carry out a customer survey to achieve or exceed 90% customer satisfaction | 93% |

| 7. Manage customer complaints effectively | 7.1 Reduce the proportion of formal complaints not resolved at first contact (against 2013-14 baseline) to 11.5% | 12% |

| 8. Comply with all standards relating to regulatory and official correspondence | 8.1 Comply with Freedom of Information Act providing 93% of requests for information within 20 working days | 100% |

| 8.2 Provide 100% response for answers to questions asked in Parliament within the required timescales allowed | 100% | |

| 8.3 Provide 100% draft replies to Ministerial correspondence within 7 working days | 99.5% | |

| 8.4 Reply to 80% of official correspondence passed on from Whitehall within 20 working days | 99% |

| Corporate responsibility | DVLA Measure | Result |

|---|---|---|

| 9. Hold data securely and use it to support the wider economy | 9.1 Retain Government Security Accreditation requirements for all systems | New systems accredited. Accreditation of certain existing systems is underway. |

| 9.2 Seek Ministerial approval for a data sharing strategy in relation to access of information from DVLA’s driver and vehicle records by April 2014 | Approved | |

| 10. Accuracy | 10.1 Vehicles – to maintain accuracy so that the registered vehicle keeper can be traced from details held on our record in 95% of cases | 95% |

| 10.2 Drivers – to improve accuracy of the driver record we will | ||

| Develop a baseline for accuracy of the driver records by September 2014 | New methodology developed and approved by January 2015 | |

| Deliver an improvement for accuracy of the driver record (against the September 2014 baseline) by March 2015 | Survey carried out in March 2015. Results showed that the driver record is 78% accurate, baseline going forward. | |

| 11. Pay our invoices promptly | 11.1 80% of invoices paid in 5 working days | 94% |

| Finance and efficiency | DVLA Measure | Result |

|---|---|---|

| 12. Manage our finances efficiently | 12.1 Complete £100 million efficiency savings compared to 2010-11 baseline | £103 million |

| 12.2 Keep to Departmental Expenditure Limit (DEL) – no overspend | Achieved | |

| 13. Give back to customers any savings we make by reducing fees | 13.1 Subject to public consultation, introduce reduced fees for some services to enable reduced costs to the motorist (including driving licences) by October 2014 | Introduced October 2014 |

| 14. Manage resources efficiently | 14.1 Ensure by March 2015 agency workforce (full-time equivalent) will number 4,880 FTEs | 5,147 FTEs |

| 14.2 Ensure the average number of working days lost (full-time equivalent) due to sickness is less than the DfT standard of 7 days lost | 8.93 days | |

| 15. Reduce impact on the environment | 15.1 Meet the Greening Government Commitments by 2015 (from the 2009-10 baseline). | |

| We will reduce emissions by 25% | 19% | |

| We will reduce waste generated by 25% | 46% |

Oliver Morley

Accounting Officer and Chief Executive, DVLA

12 June 2015

5. Directors’ report

5.1 Purpose of the Directors’ report

This report is presented in accordance with the requirements of the Companies Act 2006 (Strategic Report and Directors’ Report) Regulations 2013.

5.2 Members of the Board

Full disclosure of the serving directors for 2014-15 is available in the Governance Statement of this document.

Directors have declared that they hold no significant third party interests that may conflict with their board duties.

5.3 Pension liabilities

The employees of DVLA are civil servants to whom the conditions of the Superannuation Acts 1965 and 1972 and subsequent amendments apply.

The Principal Civil Service Pension Scheme (PCSPS) is an unfunded multi-employer defined benefit scheme. DVLA is unable to identify its share of the underlying assets and liabilities. Provision is made within the accounts to meet early retirement costs payable by DVLA up to employee’s normal retirement age.

5.4 Employees

Information about our policies and arrangements relating to staff is within the Strategic report.

5.5 External auditor’s remuneration

The external auditor did not undertake any non-audit work in the year.

5.6 Disclosure of audit information

The Accounting Officer has taken all steps that he ought to have taken to make himself aware of any relevant audit information and to establish that the agency’s auditors are aware of any relevant information.

5.7 Sickness absence data

The agency’s sickness absence measure is shown in the Strategic Report.

5.8 HM Treasury cost allocation and charging requirements

Full disclosure of the agency’s compliance with the cost allocation and charging requirements of HM Treasury is reported within Note 2 of the Accounts.

5.9 Personal data related incidents

Full disclosure of the agency’s data controls is made through the Governance Statement.

5.10 Future developments

The agency’s future developments are covered in section 3.10 of the Strategic Report.

Oliver Morley

Accounting Officer and Chief Executive, DVLA

12 June 2015

6. Remuneration report

6.1 Remuneration policy

The remuneration of senior civil servants is set by the Prime Minister following independent advice from the Review Body on Senior Salaries.

The review body takes account of the evidence it receives about wider economic considerations and the affordability of its recommendations. Further information about the work of the Review Body can be found at Office of Manpower Economics.

During 2014-15, the agency established its own Remuneration Committee in line with Board best practice, chaired by a Non-Executive Director. Further details can be found within the Governance Statement.

6.2 Service contracts

Civil service appointments are made in accordance with the Civil Service Commissioners’ Recruitment Code, which requires appointments to be based on fair and open competition but also includes the circumstances when appointments may otherwise be made. Unless otherwise stated below, the officials covered by this report hold appointments that are open-ended. Early termination, other than for misconduct, would result in the individual receiving compensation as set out in the Civil Service Compensation Scheme. The standard period of notice to be given by directors is 3 months.

6.3 Salary and pension entitlements

The remuneration and pension interests of the Chief Executive and Directors are set out in 6.9 - 6.12.

The senior civil servant annual pay award bonus is determined by performance. These pay award bonuses are awarded to the top 25% of senior civil servants. They are made to reward in-year performance in relation to agreed objectives, or short-term personal contributions to wider organisational objectives.

6.4 Salary

Salary includes gross salary, overtime, recruitment and retention allowances and any other allowance to the extent that it is subject to UK taxation. This report is based on payments made by the agency and recorded in these accounts. The Directors did not receive any non-cash benefits during the current or prior year.

6.5 Performance bonus

Performance is assessed annually for Directors through the appraisal processes stipulated by DfT and entitlement to performance enhancements or bonuses established in comparison across the DfT family through the departmental evaluation committee, chaired by the Permanent Secretary. The agency’s Remuneration Committee provides advice to DfT on performance of Directors.

6.6 Civil Service pensions

Pension benefits are provided through the civil service pension arrangements. From 30 July 2007, civil servants may be in one of four defined benefit schemes; either a final salary scheme (classic, premium and classic plus) or a whole career scheme (nuvos). The schemes are unfunded with the cost of benefits met by monies voted by Parliament each year. Pensions payable under classic, premium, classic plus and nuvos are increased annually in line with changes in Pension Increase Act 1971. Members joining from October 2002 may opt for either the appropriate defined benefit arrangement or a ‘money purchase’ stakeholder pension with an employer contribution (partnership pension account). Employee contributions are salary related and range between 1.5% and 6.85% of pensionable earnings for classic and 3.5% and 8.85% for premium, classic plus and nuvos. Increases to employee contributions will apply from 1 April 2015. Benefits in classic accrue at the rate of 1/80th of final pensionable earnings for each year of service. In addition, a lump sum equivalent to 3 years’ initial pension is payable on retirement. For premium, benefits accrue at the rate of 1/60th of final pensionable earnings for each year of service. Unlike classic, there is no automatic lump sum. Classic plus is essentially a hybrid with benefits for service before 1 October 2002 calculated broadly as per classic and benefits for service from October 2002 worked out as in premium. In nuvos a member builds up a pension based on his pensionable earnings during their period of scheme membership. At the end of the scheme year (31 March) the member’s earned pension account is credited with 2.3% of their pensionable earnings in that scheme year and the accrued pension is updated in line with Pensions Increase Act 1971. In all cases members may opt to give up (commute) pension for a lump sum up to the limits set by the Finance Act 2004.

The partnership pension account is a stakeholder pension arrangement. The employer makes a basic contribution of between 3% and 12.5% (depending on the age of the member) into a stakeholder pension product chosen by the employee from a panel of 3 providers.

The employee does not have to contribute but where they do make contributions, the employer will match these up to a limit of 3% of pensionable salary (in addition to the employer’s basic contribution). Employers also contribute a further 0.8% of pensionable salary to cover the cost of centrally provided risk benefit cover (death in service and ill health retirement).

The accrued pension quoted is the pension the member is entitled to receive when they reach pension age, or immediately on ceasing to be an active member of the scheme if they are already at or over pension age. Pension age is 60 for members of classic, premium and classic plus and 65 for members of nuvos.

Further details about the civil service pension arrangements can be found at the civil service website.

6.7 Cash Equivalent Transfer Values

A Cash Equivalent Transfer Value (CETV) is the actuarially assessed capitalised value of the pension scheme benefits accrued by a member at a particular point in time. The benefits valued are the member’s accrued benefits and any contingent spouse’s pension payable from the scheme. A CETV is a payment made by a pension scheme or arrangement to secure pension benefits in another pension scheme or arrangement when the member leaves a scheme and chooses to transfer the benefits accrued in their former scheme. The pension figures shown relate to the benefits that the individual has accrued as a consequence of their total membership of the pension scheme, not just their service in a senior capacity to which disclosure applies.

The figures include the value of any pension benefit in another scheme or arrangement which the member has transferred to the civil service pension arrangements. They also include any additional pension benefit accrued to the member as a result of their buying additional pension benefits at their own cost. CETVs are worked out in accordance with The Occupational Pension Schemes (Transfer Values) (Amendment) Regulations 2008 and do not take account of any actual or potential reduction to benefits resulting from Lifetime Allowance Tax which may be due when pension benefits are taken.

6.8 Real increase in CETV

This reflects the increase in CETV that is funded by the employer. It does not include the increase in accrued pension due to inflation, contributions paid by the employee (including the value of any benefits transferred from another pension scheme or arrangement) and uses common market valuation factors for the start and end of the period.

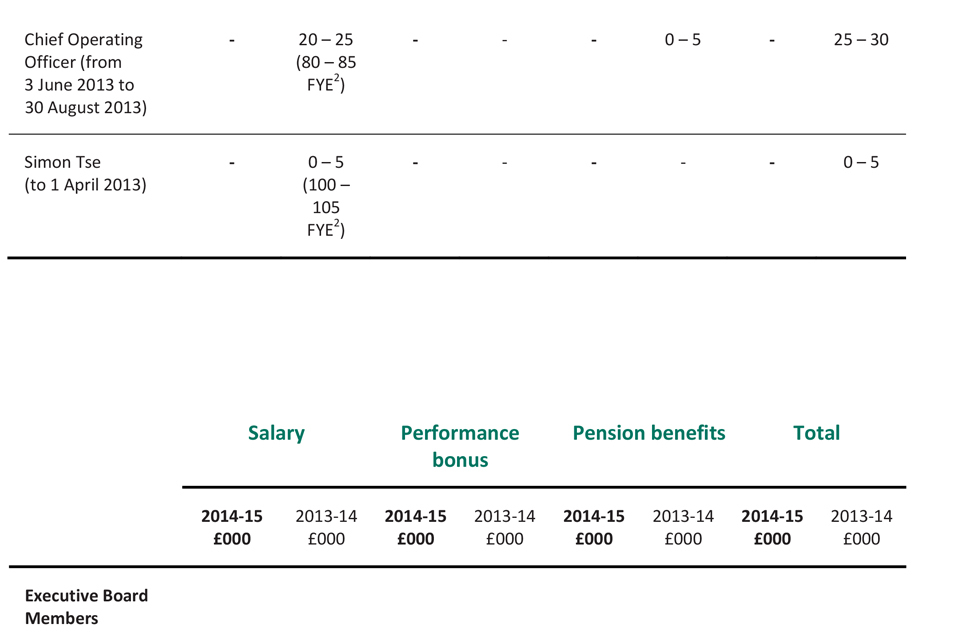

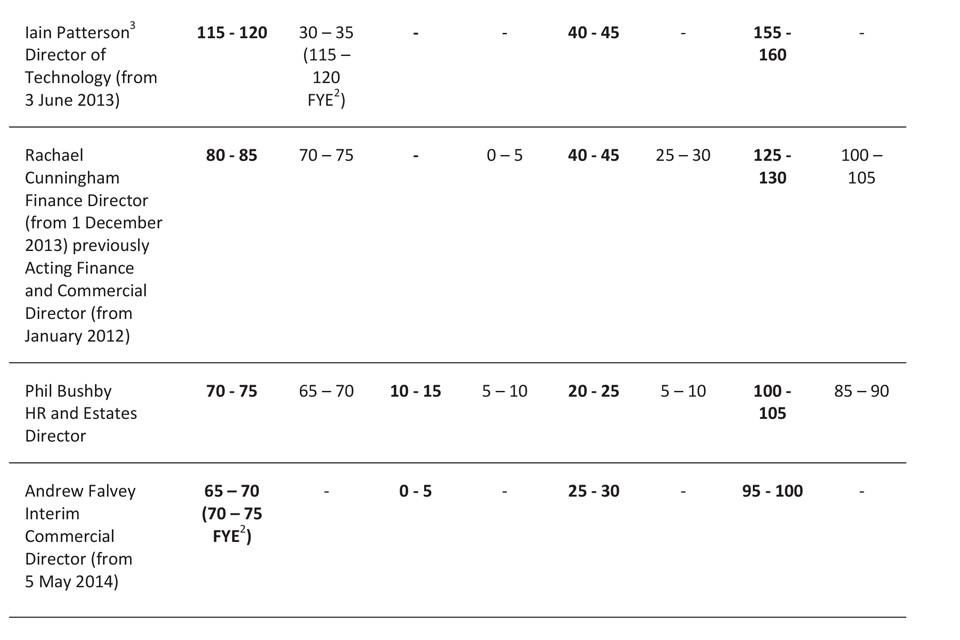

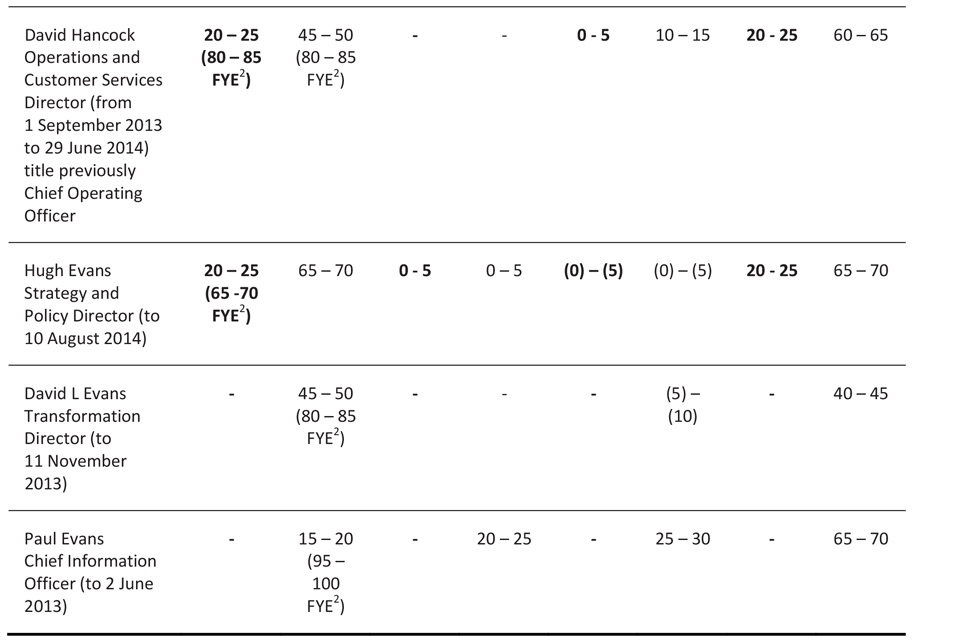

6.9 Remuneration of the Executive Board Members – audited single total figure of remuneration

Table

Table

Table

Table

Table

Notes

¹Oliver Morley does not participate in the PCSPS

²Full year equivalent

³Mr Patterson is employed by GDS as a full-time civil servant. Iain is paid directly by GDS.

Bonuses relate to those paid in 2014-15 in respect of 2013-14 performance. Bonuses to be paid in 2015-16 in respect of 2014-15 performance are yet to be determined. There were no benefits in kind.

6.10 Median staff pay multiples

| 2014-15 | 2013-14 | |

|---|---|---|

| Band of highest paid director’s total remuneration (£000) | 125 – 130 | 125-130 |

| Median total remuneration (£) | 21,791 | 20,760 |

| Ratios ⁴ | 5.85 | 6.14 |

| Number of employees receiving remuneration in excess of highest paid Director | - | - |

| Remuneration range for highest paid employee (£000) | 125 - 130 | 125-130 |

⁴The above ratios report the mid-point banded remuneration of the highest paid director in relation to the median remuneration of DVLA staff. The ratios are a reflection of the composition, by grade, of individuals employed at the agency.

Total remuneration within the calculation includes salary, non-consolidated performance related pay and benefits-in-kind. It does not include employer pension contributions and the cash equivalent transfer value of pensions.

6.11 Pension Benefits of the Executive Board Members – audited

Table

¹ Oliver Morley does not participate in the PCSPS. His CETV balance at 31 March 2014 was £5,000 and related to former membership of the PCSPS, no further contributions were made to this Scheme during the financial year.

6.12 Remuneration of the Non-Executive Board Members – audited

| 2014-15 | 2013-14 | |

|---|---|---|

| £000 | £000 | |

| Lesley Cowley (i) | 10 – 15 | - |

| Michael Brooks (ii) | 15 – 20 | 25 – 30 |

| Zillah Byng-Maddick (iii) | 0 – 5 | 5 – 10 |

| Christopher Morson | 15 – 20 | 5 – 10 |

| Emma West (iv) | 0 – 5 | - |

| Jim Knox (v) | - | 0 – 5 |

(i) Ms Cowley became Non-Executive Chair on 20 October 2014.

(ii) Includes remuneration in respect of DfT activities.

(iii) Ms Byng-Maddick became a Non-Executive Board member on 28 October 2013 and resigned on 30 April 2014. This payment relates to services during the 2013-14 financial year.

(iv) Ms West became a Non-Executive Board Member on 1 November 2014.

(v) Mr Knox resigned on 31 March 2013. This payment relates to services during the 2012-13 financial year.

Oliver Morley

Accounting Officer and Chief Executive, DVLA

12 June 2015