Annual Report and Accounts 2021 to 2022

Published 21 July 2022

Annual Report presented to Parliament, the Scottish Parliament, Senedd Cymru, and the Northern Ireland Assembly pursuant to paragraph 14(3)(a) of Schedule 4 to the Enterprise and Regulatory Reform Act 2013 (as amended by section 40(4) of the United Kingdom Internal Market Act 2020).

Accounts presented to the House of Commons pursuant to section 6(4) of the Government Resources and Accounts Act 2000.

Accounts presented to the House of Lords by Command of Her Majesty.

Ordered by the House of Commons to be printed on 21 July 2022.

Chair’s foreword

This has been a year of significant change for the CMA. We have worked hard to protect consumers at a time of economic and geopolitical uncertainty, while at the same time taking on substantial and important new functions.

Keeping markets competitive is today more important than ever, as consumers struggle with the rising cost of living and businesses seek to grow in the aftermath of the pandemic.

When competition is weak, the cost is borne by consumers in the form of higher prices and lower quality goods and services. This raises the cost of living, at a time when it was already rising due to shortages resulting from shipping bottlenecks, exacerbated by the war in Ukraine. Competitive markets are also essential to creating the conditions for investment and sustainable long-term growth in the UK. Competitive markets drive innovation, increasing our productivity, meaning we can produce more with less.

It is in this context that the CMA has worked to deliver significant benefits for consumers, businesses and the wider economy across all the priorities set out in our Annual Plan 2021 to 2022.

In the past year we have taken our place as a global competition and consumer authority, assuming substantial additional responsibilities following the UK’s exit from the European Union (EU) and decisions by the UK Government to confer important new functions on the CMA. We have risen to the challenges arising from EU exit and grasped the opportunities to ensure that our actions protect UK consumers. We have launched the shadow Digital Markets Unit (DMU), set up and launched the Office for the Internal Market (OIM), and recommenced our work on the UK’s future subsidy control regime by preparing for the creation of the Subsidy Advice Unit (SAU), each of which brings a new set of powers, functions and responsibilities. We have also tackled a growing number of complex, multinational merger and antitrust[footnote 1] cases, often with a digital focus. At the same time, we have continued our focus on ensuring local and regional markets work well for the people living in those areas.

We have taken action to protect consumers, particularly the vulnerable, from breaches of competition and consumer protection laws and poorly functioning markets. This has ranged from imposing fines on pharmaceutical companies for breaches of competition law, to issuing guidance for IVF clinics on consumer rights, recommending improvements in the provision of children’s social care and putting in place new legal obligations to give better support for consumers when arranging funeral services.

In all our activity, we have been fostering competition to promote innovation, productivity and growth. We operate a strong and independent system of merger control to ensure businesses retain the incentives to compete, innovate and grow. Where businesses undermine competition by engaging in agreements which harm consumers, we have used our powers to impose fines and made use of our director disqualification powers to ensure individual accountability for wrongdoing. We have also responded quickly and effectively to significant problems identified in markets.

We have fostered competition in digital markets, ensuring that the benefits of digitalisation for consumers are secured, while making sure that their concerns are properly addressed, including through securing legally binding commitments from Google to address competition concerns over its Privacy Sandbox and requiring Facebook (now Meta) to sell Giphy, after finding that the deal could harm social media users and UK advertisers. We also launched our consumer focused ‘Online Rip-Off, Tip-Off’ campaign fronted by Angellica Bell and aimed at helping consumers who shop online to spot and avoid sneaky sales tactics.

We have supported the transition to a low-carbon economy. We have developed our understanding of how climate change affects markets, exercising our functions in a way that supports the transition to a low carbon economy. For example, making recommendations and enforcing competition law to support the growth of effective competition in electric vehicle charging, publishing advice on the use of ‘green’ claims and providing advice to the Secretary of State for Business, Energy and Industrial Strategy, on how competition and consumer regimes can better support the UK’s net zero and sustainability goals.

While delivering on all these priorities, we have continued to increase our engagement with consumers, businesses and charities across the nations and regions of the UK, building on our initiatives to get closer to consumers and improve our understanding of the issues they are facing, in light of on-going uncertainty over the coronavirus (COVID-19) pandemic in the past year and more recently the rising cost of living.

We welcome the government’s proposed new legislation to strengthen competition and consumer policy[footnote 2]. We consider that these proposals would promote fair, open and competitive markets and protect the interests of consumers, as well as helping fair-dealing businesses to grow, enter new markets, and compete with large incumbents.

I would like to thank all our staff across the organisation in all 4 nations for their achievements delivering our priorities, despite the continued uncertainty. Covid restrictions meant that most of our staff had to continue to work from home for part of the year. With the help and support of colleagues across corporate services, in providing the technology to allow us to continue to work seamlessly, and in sharing best practice and developing new ways of working, we were able to respond to the challenges impacting consumers, as a result of the pandemic, while continuing to deliver on our plans for the year.

We are excited at the prospect of further growing our presence in the nations and regions, both through our offices in Belfast, Cardiff and Edinburgh and through plans for new offices in the English regions. We have announced a new Microeconomics Unit in Darlington, as recommended in the independent report by John Penrose MP. Our Microeconomics Unit will expand the CMA’s existing economic research and evaluation function, produce the annual State of Competition report and carry out research into supply-side reforms to improve productivity. We are also opening an office in Manchester, which will be the home of the new DMU.

Enormous thanks go to Andrea Coscelli, who ends his term as Chief Executive Officer (CEO) in summer 2022, for his leadership, drive and resilience through difficult and uncertain times. He has ensured that the CMA has continued to promote effective competition in markets, with his thought leadership on the regulation of digital markets globally, while delivering impactful remedies to tackle problems where they arise, and ensuring consumers are protected and can enjoy the benefits of healthy, competitive markets.

With a new Chair and interim CEO due to take over in the coming year, this will be the last Annual Report from both Andrea and myself, and we are confident that as we leave the CMA, it is in robust health and in strong hands.

Year in highlights

Protecting consumers from unfair practices

-

Secured formal commitments from businesses across 7 investigations into consumer protection issues, including in relation to unfair ground rents for leasehold properties and autorenewals in antivirus software

-

Obtained a court order, declaring that Teletext Holidays and Alpharooms.com broke consumer law, to highlight the importance of travel firms respecting consumers’ refund rights

-

Published consumer law guidance/principles for businesses and consumers in our anti-virus autorenewals, IVF and misleading green claims investigations.

Protecting consumers from anti-competitive behaviour

-

Resolved 7 Competition Act investigations, including into pharmaceuticals, online advertising and lighting sectors

-

4 Competition Act infringement decisions – £404.1 million of fines imposed (the highest level of fines ever imposed since the Competition Act came into force in 2000)

-

Director disqualification secured, bringing the total disqualifications secured since November 2016 to 25, signalling directors’ personal responsibility for non-compliance

-

Launched 7 new Competition Act investigations

Merger control in numbers

-

827 transactions reviewed, up from approximately 600 last year

- 60 phase 1 merger cases opened:

- 55 concluded:

- 34 mergers cleared (includes 1 ‘de minimis’ clearance)

- 10 referred to phase 2

- 6 accepted undertakings in lieu

- 1 merger was abandoned

- 4 mergers were found not to qualify

- In addition, 3 public interest intervention cases were considered (1 was referred to phase 2 and counted above)

- 55 concluded:

-

10 phase 2 investigations opened:

- 8 concluded:

- 2 mergers cleared

- 2 mergers cleared with remedies

- 3 mergers blocked

- 1 merger abandoned

- 8 concluded:

Market studies, investigations and regulatory appeals

-

Market studies:

-

Launched 2 studies into mobile ecosystems and music streaming

-

Concluded the studies into electric vehicle charging and children’s social care

-

Market investigations:

-

Launched an investigation into the supply of land mobile radio network services

-

Regulatory appeals:

-

Published our final redeterminations of Ofwat’s price control for 4 water companies

-

Reached our final determination in the appeals by 9 energy companies

About us

About us

The CMA is an independent non-ministerial government department and has been the UK’s primary competition and consumer authority since 2014. We employ around 875 people, who are based mainly at our offices in London and Edinburgh, with growing teams in Cardiff and Belfast and plans to open offices in the North of England. We adopt an integrated approach to our work, selecting those tools we believe will achieve maximum positive impact for consumers and the UK economy.

Governance

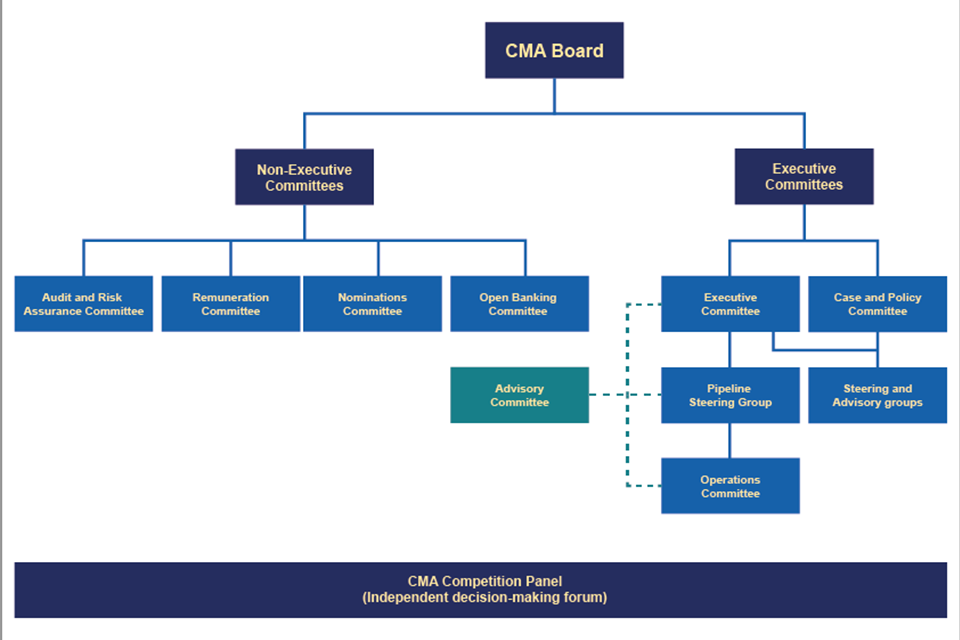

The CMA is funded by HM Treasury and reports to the UK Parliament through its Annual Plan and Annual Report. This year marks the first time that the CMA’s Annual Report will also be laid in each of the devolved legislatures. Our staff are civil servants. We are governed by a Board, comprising the Chair, the Chief Executive, executive and non-executive directors, and 2 members of the CMA Panel. The Chief Executive, as the CMA’s Principal Accounting Officer, is responsible for the economy and efficiency of its handling of public monies. Some functions of the CMA must be performed by members of the CMA Panel who have clearly defined responsibilities and act as fresh decision-makers between the 2 phases of market and mergers cases to avoid confirmation bias. Our governance structure helps us to maintain our reputation for fairness, independence, integrity, rigorous analysis, careful handling of sensitive information, and efficient use of public money.

Estimated financial benefit to consumers

Each year the CMA estimates the direct financial benefit of our work on consumers. We consider our estimates to be conservative because they are based on cautious assumptions.

-

Annual average consumer savings of at least £2 billion in 2021 to 2022

-

Over the three-year period between 2019 to 2020 to 2021 to 2022, the estimated direct financial benefit to consumers was over £6 billion; and

-

For every £1 we spent on our operating costs, the average benefit to consumers over the last 3 years was £22.50.

These estimates exclude the impact of a number of cases where the CMA’s intervention is likely to generate considerable consumer benefits, but these benefits were difficult to quantify sufficiently robustly. For example, we do not account for the CMA’s compliance and advocacy work, international activities or regulatory appeals.

These estimates only include the direct financial benefits of our work and so they exclude many important, wider impacts on the competition regime. For example, they do not account for the deterrent effect of our actions and the impact of competition policy interventions on productivity. Our literature review (PDF, 2.61MB) on the deterrent effect from competition authorities’ work found good evidence of the existence of a substantial deterrent effect, with surveys estimating deterrence ratios of between 4.6:1 and 28:1 for cartels, which imply that many more cartels are deterred for each one that is caught.[footnote 3] This is supported by case specific evaluations of the impact of a selection of the CMA’s decisions in competition act investigations.[footnote 4] Overall, therefore, our estimates for the direct financial benefits capture only a part of the overall positive impact of the CMA’s work

Chief Executive’s review

Despite continuing to face considerable challenges and uncertainty in the past year, the CMA has built on the last couple of years with another very strong performance, delivering on all our commitments in last year’s Annual Plan, and responding quickly and flexibly to new challenges as they presented themselves. At a time when households across the UK are feeling the effects of the rising cost of living, ensuring that markets are competitive is more important than ever before. This report gives a summary of our performance, highlighting our key work.

In our competition enforcement work, we imposed fines of over £400 million on pharmaceutical companies for breaches of competition law in supplies of important medicines to the National Health Service - the highest level of fines in any year in the history of the UK regime. The impact of these cases on the NHS – and ultimately the UK taxpayer – was significant. For example, prior to April 2008, the NHS was spending approximately £500,000 a year on hydrocortisone tablets. This had risen to over £80 million by 2016. The investigation into these practices is part of the CMA’s ongoing work in the pharmaceutical sector, with 3 cases concluded this year and 2 further cases brought to a close with infringement decisions the year before, bringing the total number of infringement decisions in this sector in the last 2 years to 5, of which 3 are now subject to appeal at the Competition Appeal Tribunal (CAT).

In line with our new expanded responsibilities, we also opened 4 new competition enforcement cases in global digital markets, working with the Information Commissioner’s Office to bring the Google Privacy Sandbox case to a close with legally binding commitments from Google designed to address competition concerns while protecting privacy. We have also opened investigations into Apple app store payments and the use of data by Facebook (now Meta).

We have continued to investigate mergers that we consider would likely harm competition and consumers’ interests, with the potential for higher prices, reduced choice and ultimately less innovation and growth. We reviewed 827 merger transactions, up from approximately 600 last year. We opened 60 formal merger control reviews, concluded 55 and referred 10 for in-depth reviews. We completed 8 phase 2 mergers at year end - 2 of which were cleared, 2 were resolved with remedies, 3 were blocked while a further case was abandoned after we raised concerns. We also secured positive judgments from the CAT and the Court of Appeal for the approaches we took in our Sabre/Farelogix and Facebook/Giphy cases.

We have continued to take strong action under consumer protection laws in response to issues raised as a result of the impact of the pandemic and the travel restrictions that were in place, including further action to secure refunds for consumers for cancelled holidays, advising the Secretary of State for the Department of Health and Social Care (DHSC) on the PCR testing market and securing commitments from PCR test providers to improve terms and pay refunds promptly.

At the same time, we have been progressing other important consumer protection investigations in a variety of areas, including leasehold, anti-virus software and fake online reviews. We freed thousands of leaseholders from increasing ground rent terms that saw them trapped in homes they struggled to sell or mortgage. We secured undertakings from anti-virus software firms to pay refunds to consumers who were automatically renewed, when it was not their choice. We opened formal enforcement cases against Amazon and Google in relation to fake online reviews. We also published guidance on consumer rights in IVF fertility clinics and commenced a compliance review, and published advice to help businesses comply with the law on misleading environmental claims about products (often called ‘greenwashing’) and to advise shoppers on what to look out for, with a commitment to review and take action, where necessary.

We have published our recommendations to the Scottish, Welsh and UK governments for improvements in the provision of children’s social care. We have progressed our market study looking at mobile ecosystems and the market investigation into Airwave Motorola, after the CAT upheld the CMA’s decision to open a market investigation into the mobile radio network used by the emergency services. We have also issued decisions following regulatory appeals in the water and energy sectors.

We have had success in appeals to the CAT against our decisions imposing fines for anti-competitive agreements, including the CAT upholding our decision to fine Roland for restricting retailers’ ability to discount in the supply of musical instruments and a decision upholding our findings in pay for delay deals. We have also had success on appeal in our approach to our mergers work. We had judgments from the CAT confirming our approach to assessing the share of supply test in Sabre/Farelogix, and from the Court of Appeal confirming our approach to interim enforcement orders in Facebook/Giphy.

Following the High Court judgment dismissing the CMA’s enforcement action against Care UK in relation to upfront administration charges, we updated and reissued our consumer law advice for care home providers (PDF, 1.13MB). Given the narrow subject matter of the High Court judgment, the vast majority of the advice remains as originally stated, though changes have been made to reflect the High Court’s approach in relation to administration charges.

We launched the shadow Digital Markets Unit (DMU) in April 2021, which has been preparing for the government’s proposed new pro-competition regulatory regime and pending legislation, it has coordinated the use of our existing powers to tackle harmful practices in digital markets, for example, the Facebook/Giphy merger and the Mobile Ecosystems market study.

This is alongside the launch of the Office for the Internal Market (OIM), which has been building relations across the nations, carrying out research on the functioning of the internal market and publishing our first overview of the UK internal market.

The Subsidy Control Bill was enacted in April 2022. We are now preparing for the launch of the SAU.

We have stepped up our work to advise governments in the UK on designing and implementing policy in a way that harnesses competition, promoting post-pandemic growth and protecting the interests of consumers. We continued our significant outreach across the nations and regions of the UK. We have worked with governments across the 4 nations, the Department for Business, Energy and Industrial Strategy (BEIS) and others providing advice in specific areas, such as PCR testing, shipping, transport, sustainability and digital markets. This can have far reaching effects, for example the government accepted our recommendation to add ‘promoting effective competition’ as one of the statutory objectives of public procurement, a sector that is worth £284 billion a year.

We have recruited and developed talented people with the right skills to ensure that we have the relevant knowledge and expertise at all levels to rise to the challenges we face and deliver strong positive solutions for UK consumers. We also have a dedicated independent panel, whose members play a key role in the decision making on important merger and market cases and regulatory appeals. They make evidence-based and fair decisions backed up by well-argued reports, maintaining the highest standards of integrity, impartiality and objectivity at all times. Many panel members have significant expertise in competition law or competition economics or both. Other panel members bring other experiences and skills - in intellectual property or commercial law, in M&A and corporate finance, other forms of regulation or consumer interests – which are equally valuable.

I will highlight in this report the significant outcomes we have achieved for consumers, business and the UK economy against each of our planned priorities for 2021 to 2022: protecting consumers and driving recovery during and after the coronavirus pandemic; taking our place as a global competition and consumer protection authority as we assume our new responsibilities after the EU Exit transition period; fostering effective competition in digital markets; and supporting the transition to a low carbon economy.

Protecting consumers and driving recovery during and after the coronavirus pandemic

As the UK continues to emerge from the coronavirus (COVID-19) pandemic and faces significant increases in the cost of living, protecting consumers and promoting competition will be more important than ever before.

When the cost of living increases, the poorest households will be hit hardest. With fewer suppliers to choose from, and less innovation, consumers also suffer from reduced choice.

The CMA plays an important role to promote competition and protect consumers or when it believes it can improve the way in which markets work. This is particularly important in building trust and confidence when people buy goods and services, which will be critical to the economic recovery.

We want to ensure that as consumers, we all get more of what we want at the best possible price, while improving productivity and facilitating sustainable growth, job creation and better living standards in the economy as a whole. It is also important that consumers are well-informed and able to shop around to find the best deals. This drives companies to seek to win business by competing on range, quality, price and innovation.

We also want to ensure that we take into account the needs of the most vulnerable in our society, such as those on low incomes; people without access to online services or those who struggle to use them; or people with poor mental health who may avoid or fear change.

Protecting consumers, with a particular focus on protecting the vulnerable, from breaches of competition and consumer protection laws and poorly functioning markets

The impact of the coronavirus pandemic continued to inform our work over the past year. In particular, concerns raised about the price, reliability and quality of PCR testing led us to issue an open letter to PCR providers on compliance with consumer law. We advised the UK Government on ways to make the PCR testing market work better and secured changes from 3 leading PCR testing providers, Randox, Dante Labs and Expert Medicals. All 3 firms made changes to their terms and conditions to improve their practices.

We also undertook further work in the travel sector. We secured further commitments from TUI to give clearer information about refunds upfront to customers whose holidays were cancelled due to the pandemic. We also successfully obtained a court order declaring that Teletext broke consumer law by failing to refund customers within the legally required timeframe.

We have continued to work hard to enforce consumer protection law across a range of other important sectors, protecting consumers from unfair behaviour by businesses, including in markets like leasehold property and healthcare (IVF).

In 2021 to 2022 we have made significant progress in our ongoing investigation into the leasehold sector, addressing concerns about clauses that double ground rents and about misleading sales practices.

Case study 1: Leasehold

In September 2020 the CMA launched enforcement action against 4 housing developers in relation to possible breaches of consumer protection law in the residential leasehold sector. We then wrote to a number of other businesses setting out our concerns and requiring them to remove harmful terms from their contracts.

In response to our action, Taylor Wimpey, Countryside, Aviva, and 15 other freeholders committed to remove terms that cause ground rents to double in price. These terms mean people often struggle to sell or obtain a mortgage on their leasehold home.

In addition, Persimmon agreed to offer leasehold house owners the opportunity to buy the freehold of their home at a discounted price, better reflecting what they expected when they originally bought their house.

We will continue to work hard to free leaseholders from these problematic terms and will now be putting other housing developers under the microscope.

We have helped to tackle concerns about auto-renewing subscriptions. We secured refund rights for customers of leading suppliers of antivirus software, McAfee and Norton. Following CMA action, both companies extended refund rights to all customers who had been auto-renewed. In the online games sector, we also secured improvements from Microsoft for Xbox online players following concerns about Microsoft’s use of auto-renewing subscriptions.

We launched a consumer protection law enforcement investigation into Groupon over concerns it is failing to provide some customers with cash refunds and to deliver all products within advertised timeframes. Groupon subsequently committed to offer refunds and improve customer service.

In June we published our IVF guidance on consumer rights to make clear to fertility clinics their legal obligations to treat people fairly and to help patients understand their rights. We teamed up with Lorraine Kelly to publicise the guidance and warned clinics that they could face enforcement action if they don’t follow the rules.

In competition enforcement, we have continued to prioritise cases where we can achieve the greatest impact to ensure that customers are able to buy products at the best price, something that is even more important when the cost of living is increasing.

We have continued our important work investigating anticompetitive conduct in the pharmaceutical sector, with a view to ensuring that the NHS, and ultimately the taxpayer, does not pay more than they should for essential medicines and treatments, and that consumers who depend upon these drugs and treatments do not lose out. We have concluded 3 more of our Competition Act investigations in the pharmaceutical sector, resulting in a record level of fines being imposed at over £400 million, reflecting the gravity and impact of the conduct. This included imposing fines totalling over £260m for competition law breaches in relation to the supply of hydrocortisone tablets; over £100m for inflating the price of thyroid tablets; and over £35m for an illegal arrangement in the supply of important NHS prescription anti-nausea tablets.

We have also fined Dar Lighting £1.5 million for breaking competition law by restricting the level of discounts retailers could offer online. With so many businesses operating online, it is vital that fair competition is maintained across all sectors, so that consumers get a fair price. We applied a 35% increase as part of the fine calculation, because the supplier failed to take sufficient action after 2 written warnings from the CMA relating to allegations of illegal price fixing, known as resale price maintenance. This decision should act as a warning to companies that resale price maintenance is illegal and that warning letters issued by the CMA are to be taken seriously and not to be ignored. The CMA has issued millions of pounds worth of fines in recent years to firms including in the lighting and musical instrument sectors for preventing retailers from offering discounts online.

We have continued to use our powers to investigate markets which can have a real impact on people’s lives, particularly those who are experiencing vulnerability or hardship for a variety of reasons, including when going through difficult periods of their lives.

Following our in-depth market investigation into the funerals sector, we have put in place legal obligations to assist funeral directors and crematorium operators to better support their customers in arranging a funeral that meets their needs and budget. The new legal obligations are set out in the Funerals Market Investigation Order 2021. The legal requirements for funeral directors include displaying a Standardised Price List in their window at their premises and on their website.

We also published the final report of our market study into children’s social care provision. We have made a set of recommendations to the UK, Scottish and Welsh governments to address these issues and will continue working with them to support implementation, should they decide to take them forward.

Case study 2: Children’s social care

In March 2022, the CMA published the final report in our market study into children’s social care.

There are over 100,000 looked-after children across England, Scotland and Wales. The current annual cost for children’s social care services is around £5.7 billion in England, £680 million in Scotland and £350 million in Wales. The market study highlighted and reflected the significant differences between the 3 nations.

We raised concerns that local authorities were hamstrung in their efforts to find suitable and affordable placements in children’s homes or foster care.

We found that action is needed to address concerns, including a shortage of appropriate places in children’s homes and with foster carers.

We recommended the development of national and regional bodies to support local authorities in finding suitable placements for children. We also sought to address concerns about the financial stability of private children’s home providers and high profits in the sector.

It is also imperative that the CMA maintains effective merger control when we are all facing increasing price pressures. Mergers and acquisitions that reduce competition can reduce the incentive for businesses to offer lower prices. We will continue to investigate mergers to ensure that consumers across the UK do not lose out, as a result of more concentrated market structures, which can lead to higher prices and less innovation.

In June we accepted undertakings for the completed acquisition by Bellis Acquisition Company 3 of Asda Group after competition concerns were raised. We were concerned that the purchase could lead to higher petrol prices in some parts of the UK.

We issued our final decision in the merger of JD Sports and Footasylum following the remittal from the CAT. We maintained our initial view that the deal caused competition concerns and could lead to a substantial reduction in competition and a worse deal for Footasylum’s customers. We instructed JD Sports to sell Footasylum and also found it necessary to impose a fine of £5 million on the parties for breaching an order that prohibited the companies from exchanging commercially sensitive information without prior consent.

Also this year, the CMA cleared the merger between Virgin Media and O2. The CMA was initially concerned that the merger could lead to increased prices or a reduction in quality of services. However, following an in-depth phase 2 investigation the independent panel concluded that the deal was unlikely to lead to any substantial lessening of competition and it was unlikely to increase prices.

The CMA published its final redeterminations of Ofwat’s price control for 4 water companies and delivered our final decisions into appeals from 9 energy companies against modifications made to their licences by GEMA, Ofgem’s governing body.

We have continued to engage with third sector organisations, hearing from a wider variety of charities and third sector organisations this year and learning more about the issues impacting the consumers they interact with, to inform our work in consumer protection and competition.

Supporting the UK economy by fostering competition to promote innovation, productivity and growth

We have a duty to foster and promote competition for the benefit of consumers by continuing to operate a strong and independent system of merger control. Such a system is vital in promoting innovation, productivity and growth. It is also crucial in protecting consumers interests – something that is particularly important as we continue to see the impact of the rising cost of living and the ongoing conflict in the Ukraine.

We have continued to investigate mergers that we consider would likely harm competition and consumers’ interests, with the potential for higher prices, reduced choice and ultimately less innovation and growth.

In some cases, our rigorous analysis of the impact of mergers on competition and consumers at phase 1 has led to companies abandoning their proposed mergers. For example, the merger between Imprivata and Isosec was abandoned, following our initial phase 1 investigation. Imprivata and Isosec provide secure authentication management solutions to healthcare providers in England. These technologies can give staff protected access to sensitive patient data sourced from a central NHS IT system. We found evidence that the 2 companies are important rivals in this area, both providing secure authentication management solutions to healthcare providers in England. We found that competition between the 2 was expected to grow and that if the merger went ahead as planned it would have an impact on the NHS and other healthcare providers across England, which in turn could potentially lead to taxpayers receiving poorer value for money.

We accepted legally binding commitments in a number of mergers to resolve serious concerns about competition and the potential impact on consumers. These included commitments from Cellnex to sell over 1,000 telecoms tower sites to address serious competition concerns over its purchase of CK Hutchinson’s UK towers.

We undertook an in-depth phase 2 investigation into the purchase of Babcock’s oil and gas offshore helicopter transportation services business by CHC. The independent group of panel members were concerned that the merger would reduce competition between an already limited number of suppliers in a market that is vital to the smooth running of the North Sea oil and gas industry, when pressure on energy prices is already severe. To address the concerns, we are requiring CHC to sell the business it bought from Babcock.

We also issued our final decision following a reassessment of the purchase of GBST by rival FNZ after our initial decision to block the merger was appealed to the CAT. In our reassessment, the group of panel members found that the purchase could significantly decrease competition in the supply of retail investment platform solutions which, in turn, could lead to UK consumers who rely on these platforms to administer pensions and other investments facing higher costs and lower quality services.

Our in-depth phase 2 investigation into the merger into Dye & Durham / TM Group is ongoing. Both businesses provide a ‘one-stop’ property search service to clients in the property market under a variety of brands. We have provisionally found that the merger substantially lessons competition in the supply of property search services and could lead to higher costs for conveyancers, estate agents and mortgage brokers, which could be passed on as higher fees for people and businesses buying or selling residential and commercial properties.

We successfully defended against a challenge in the CAT from Sabre following our decision to block its proposed merger with Farelogix. Both companies supply software solutions which help airlines to sell flights via travel agents including those that operate online. We were concerned that the merger could result in less innovation. The judgment from the CAT endorsed our approach to the assessment of the merger.

In competition enforcement, we opened an investigation in March into suspected anti-competitive conduct in connection with the ongoing procurement process for the contracts to supply services at Heathrow and Derwentside Immigration Removal Centres.

In October we opened a market investigation into Motorola’s Airwave network, the mobile radio network used by all emergency services in Great Britain. The CMA’s decision to move straight to a market investigation without a reference from phase 1 was successfully defended in the CAT. The CMA is concerned that the market for the supply of the mobile radio network used by all emergency services in Great Britain might not be working well, resulting in a more expensive service for customers and, ultimately, the taxpayer.

We will continue to use our director disqualification powers in competition enforcement cases to ensure individual accountability for wrongdoing. Since the power was first used in 2016, there have been 25 director disqualifications arising from Competition Act investigations, covering directors involved in a range of sectors, including construction, pharmaceutical and estate agency. Of this number, the CMA have secured the disqualification of 24 individuals through the agreement of undertakings, (including 2 disqualifications for the same person). There has been one case where disqualification was ordered by the court. Most recently, in December, we disqualified a director for his involvement in an information exchange infringement arising out of the CMA’s Nortriptyline investigation.

We have also continued our work on Open Banking which was initiated in 2017 as part of a package of remedies following the CMA’s retail banking market investigation. The CMA ordered the 9 largest UK banks and building societies to create and pay for an Open Banking implementation Entity (OBIE) to develop and deliver the open banking standards. As of January 2022, there were over 5 million users of services powered by Open Banking technology.

In March 2022, we published a consultation response on the future governance arrangements for Open Banking. This response took into account the findings of an independent investigation into allegations relating to conduct at the OBIE, following which the CMA has worked with key stakeholders to strengthen and improve the governance framework for OBIE.[footnote 5] Alongside publication of the CMA’s response to the consultation, the creation of a Joint Regulatory Oversight Committee was announced by regulators and government to oversee the design and set up of a future entity and develop Open Banking beyond the scope of the CMA’s Order.

In May 2022 the CMA published the findings and recommendations of a review by Kirstin Baker, an independent non-executive Director of the CMA, to identify the lessons from Open Banking for the CMA in its approach to designing, implementing and monitoring remedies in its market investigations. When publishing Ms Baker’s findings, the CMA committed to implement her recommendations in full; and to report publicly next year on progress in its work programme on remedies.

Taking our place as a global competition and consumer protection authority as the CMA assumes new responsibilities after the EU Exit Transition Period

We have taken our place as a global competition and consumer protection authority. Our extensive preparations ensured that we had the necessary people, skills and infrastructure in place to carry out our expanded role outside the EU. As a result, we have progressed complex, multinational cases that would have previously been reserved to the European Commission and further strengthened cooperation with our international counterparts. At the same time, we have started to operate the shadow DMU; we have launched the OIM; and recommenced our work on the UK’s future subsidy control regime by preparing for the creation of the SAU under the Subsidy Control Act 2022.

Alongside the competition enforcement cases set out in more detail below, we have concluded important merger investigations looking at businesses operating in markets across the world. For example, in the investigation into the merger of NVIDIA / Arm, we worked closely with competition authorities in other countries to carefully consider the impact of the deal. The merger was subsequently abandoned in February 2022 following a referral to an in-depth phase 2 investigation after our phase 1 investigation found potential competition and national security concerns.

Also, in February 2022 we accepted legally binding commitments following a phase 1 investigation into the anticipated acquisition by S&P Global Inc. of IHS Markit. We worked closely with other international agencies during our initial phase 1 investigation which found some competition concerns involving the supply of certain commodity price assessments in the UK. We were initially concerned that the reduction in competition could lead to worse outcomes for customers, however, we consider the divestments offered are sufficient to deal with those concerns.

We also blocked a merger between Cargotec and Konecranes in March after finding the merger would have resulted in a substantial lessening of competition, which could have raised prices for consumers. This investigation was conducted in parallel with other international authorities.

Case study 3: Cargotec/Konecranes

In March 2022 we blocked the $5 billion merger of Cargotec and Konecranes following an in-depth phase 2 investigation.

We found that the merger would harm competition in the supply of a wide range of container handling equipment products, leaving UK customers with few remaining alternative suppliers. This could have had serious consequences for UK port terminals and other customers, including higher prices and lower quality products and services.

Cargotec and Konecranes submitted remedies to seek to address these concerns but we found that these lacked important capabilities, so would not have enabled strong competition.

Martin Coleman, chair of the CMA inquiry group, said:

“These are global businesses that make significant sales to UK customers, which is why it is critical for us to ensure that competition in the UK is protected.”

The investigation was conducted in parallel with other authorities, including the European Commission, the Department of Justice and the Australian Competition and Consumer Commission.

To ensure we exercise our functions to best effect, we work closely with our counterparts in the UK and across the world, including continuing our strong relationship with the European Commission and national competition authorities in EU Member States.

We have worked closely with BEIS as it develops proposals for a major upgrade to the UK’s consumer protection framework. This relates specifically to our powers to investigate and enforce consumer protection law, and would include the power to directly sanction breaches. This will further cement us as a global authority in the consumer protection field.

We have continued our close engagement and cooperation with other international partners on a wide variety of issues. This includes our fellow participants[footnote 6] in the Multilateral Mutual Assistance Cooperation Framework (MMAC), as well as the European Commission and national competition and consumer agencies within the EU and worldwide. We believe this kind of collaboration can amplify our impact. In April we joined forces with our counterparts in Australia and Germany to set out the need for robust merger enforcement to drive post-pandemic economic growth.

We have remained active and committed participants in important forums like the Organisation for Economic Co-operation and Development, the International Competition Network, the International Consumer Protection and Enforcement Network and the United Nations Conference on Trade and Development.

Working with other competition authorities from the ‘Five Eyes’ nations - the CMA alongside the United States Department of Justice, the Australian Competition and Consumer Commission, the Canadian Competition Bureau and the New Zealand Commerce Commission - we have put supply chains on notice that those attempting to use supply chain disruptions as a cover for illegal anticompetitive conduct, including collusion, will face the full force of the law. The launch of the working group follows concerns about higher prices resulting from supply chain disruption across the economy. Many businesses and individuals have worked hard to minimise the impact of these disruptions. We are concerned, however, that some unscrupulous businesses could take advantage of the disruptions to engage in anti-competitive collusion and practices that cheat other businesses and ultimately consumers.

The OIM was launched in September 2021 to provide independent advice, monitoring and reporting in support of the effective operation of the UK internal market. In April 2022 BEIS confirmed the appointment of the OIM’s first Chair, Murdoch MacLennan, who will also be a Non-Executive Director on the CMA Board. BEIS is currently progressing the recruitment of the OIM’s panel.

The OIM aims to help trade flow freely within the UK internal market, allowing people and businesses to trade across the UK without additional barriers based on which nation they are in. It reports on how effectively companies are able to sell their products and services across the 4 nations and provides independent technical and economic advice to all 4 governments on the effect on the UK internal market of specific regulatory provisions that they introduce. The OIM will ensure that it demonstrates transparency, independence, analytical rigour and even-handedness and works to become a centre of expertise on internal market matters which, consistent with its statutory functions, can be a resource for businesses, policy makers and other stakeholders across the whole of the UK.

In March 2022, the OIM published its first analysis of the UK internal market. Overview of the UK Internal Market’ report This first-of-a-kind report demonstrates the scale and importance of trade between the 4 nations, which is likely to exceed £190 billion annually. It found that Scotland, Wales and Northern Ireland trade more with the rest of the UK than with the EU or the rest of the world and identified limitations in the data currently available. The OIM will continue working collaboratively with all 4 nations to help address these limitations in intra-UK trade data.

The Subsidy Control Act came into force in April 2022. We are now preparing for the launch of the SAU later in the year. We have been recruiting to the new team that will operate the SAU and taking forward work to ensure the SAU is ready to launch later in the year.

We have also made a recommendation to the UK Government on new UK ‘block exemption’ legislation to give automatic exemption from the prohibition on anti-competitive agreements to pro-competitive ‘vertical’ agreements between companies (replacing existing EU regulation currently retained in UK law). This will provide businesses with certainty about the compatibility of their distribution arrangements with competition law and protect consumers from harmful agreements. We will be reviewing the other EU ‘block exemption’ regulations retained in UK law in due course, in order to make further recommendations to the UK Government, including in relation to regulations relating to R&D agreements, motor vehicle distribution, and container shipping.

Fostering effective competition in digital markets

The CMA’s work in digital markets has been influential in shaping discussions and policy-making in the UK and more widely. Following the publication of our market study into online platforms and digital advertising and the subsequent advice of the Digital Markets Taskforce in 2020, putting forward proposals for a pro-competition regime for digital markets, the shadow Digital Markets Unit was launched in April 2021. The DMU will oversee a new regulatory regime for the most powerful digital firms, promoting greater competition and innovation in these markets and protecting consumers and businesses from unfair practices. Other international organisations have now taken a similar approach.

The DMU will look closely at the practices of the most powerful digital firms, taking action against harmful practices as well as proactively opening-up markets to promote greater opportunities for new and innovative competitors. As we wait for our formal powers, we are building our expertise and continuing to progress digital cases using existing powers.

We progressed several key competition enforcement cases in digital markets that would previously have been overseen by the European Commission. We have now investigated or are investigating 4 international digital antitrust cases, often working in parallel with the European Commission and other international agencies. This includes our investigation into Google’s proposals to replace third party cookies functionality with its Privacy Sandbox tools.

Case study 5: Google Privacy Sandbox

The CMA accepted commitments from Google in February 2022 relating to its proposed removal of third-party cookies from the Chrome browser (known as the Privacy Sandbox proposals).

We conducted an in-depth investigation and extensive engagement with Google and market participants, including 2 formal public consultations. We were concerned that the proposals would cause online advertising spending to become even more concentrated on Google. The proposals could also have undermined the ability of online publishers, such as newspapers, to generate revenue and continue to produce valuable content in the future.

The commitments, which were revised following our initial consultation, address the CMA’s competition concerns and Google has also said that they will be rolled out globally. They include:

-

The CMA and the Information Commissioner will be involved in the development and testing of the Privacy Sandbox proposals.

-

Google will engage in a more transparent process than initially proposed.

-

Google will not remove third-party cookies until the CMA is satisfied that its competition concerns have been addressed.

-

Commitments to restrict the sharing of data within its ecosystem and to not self-preference its advertising services.

We will supervise Google to ensure the Privacy Sandbox is developed in a way that benefits consumers. We are working closely with the Information Commissioner’s Office (ICO) to oversee the development of the proposals, so that they protect privacy without unduly restricting competition and harming consumers.

We are also investigating whether Facebook (now Meta) might be abusing a dominant position in the social media or digital advertising markets through its collection and use of advertising data. In March 2021, we launched a case investigating Apple following complaints that its terms and conditions for app developers are unfair and anti-competitive. We have also recently launched an investigation into Google and Facebook (now Meta) looking at concerns that they hampered competition in markets for online display advertising services.

We have also investigated several significant digital mergers, including Nvidia/Arm, S&P Global/IHS Markit, Imprivata/Isosec, FNZ/GBST (as mentioned above), and the completed acquisition of Giphy by Facebook (now Meta).

Case study 4: Facebook/Giphy

The CMA found that the completed acquisition by Facebook (now Meta) of Giphy may give rise to competition concerns in both the supply of display advertising in the UK, and in the supply of social media services worldwide (including in the UK). As such, we directed Facebook to sell Giphy.

The independent CMA group of panel members reviewing the merger concluded that Facebook would be able to increase its already significant market power in relation to other social media platforms by:

-

denying or limiting other platforms’ access to Giphy GIFs, driving more traffic to Facebook-owned sites, which already account for 73% of user time spent on social media in the UK, or

-

changing the terms of access for example by requiring TikTok, Twitter and Snapchat to provide more user data in order to access Giphy GIFs.

In a recent judgement, the CAT endorsed the CMA’s finding that the merger between Facebook and Giphy substantially reduced dynamic competition.

During the course of the merger investigation, Facebook was fined £50.5 million for breaching an order imposed by the CMA. Facebook was required, as part of the process, to provide the CMA with regular updates outlining its compliance with the order. Facebook significantly limited the scope of those updates, despite repeated warnings from the CMA.

By requiring Facebook to sell Giphy, the CMA is protecting millions of social media users and promoting competition and innovation in digital advertising.

In our consumer protection work to tackle the sale of fake online reviews, we have secured further commitments from Facebook to make it harder for people to find groups and profiles that buy and sell fake reviews. We have also opened an investigation into Amazon and Google over concerns that they are not doing enough to combat fake reviews on their sites.

In December we published our interim report following our market study into Apple’s and Google’s mobile ecosystems. We provisionally found that Apple and Google were able to leverage their market power to create largely self-contained ecosystems making it extremely difficult for any other firm to enter and compete meaningfully with a new system. Our report set out a range of actions that could be taken to address these issues. The final report was published in June 2022 and we are now consulting on a proposed market investigation reference.

In January, we launched a market study into music streaming to build a view as to whether competition in this sector is working well or whether further action needs to be taken. Our investigation will examine the market from creator to consumer, paying particular attention to the roles played by record labels and music streaming services.

The Data, Technology and Analytics (DaTA) unit provide the important technical skills needed for our work on digital markets. The unit has continued to build several bespoke tools to scrape data and monitor markets. Its engineers and data scientists already collect and analyse large, complex and rich datasets for cases, such as our investigations into fake online reviews, and analyse the algorithms and technical systems used by large technology firms that affect the daily lives of consumers and the functioning of important digital markets (e.g. digital advertising). Its Behavioural Hub applies an understanding of consumers and their interactions with the interfaces of digital firms. It contributes to the design of technical remedies, such as interoperability or techniques for anonymous data sharing. Overall, the DaTA unit’s technological expertise allows us to challenge companies and hold them to account more effectively. We have also advised competition authorities looking to develop similar capabilities to our DaTA unit in a model that is being copied around the world.

Our Behavioural Hub has begun important cross-cutting work with our Consumer and Advocacy Teams on the use of Online Choice Architecture. They have been providing technology insights on emerging and developing markets encountered by consumers, working closely with the DMU. This work has also resulted in the publication of a discussion paper and a large evidence review of how poor and manipulative design can harm consumers and markets. In May the CMA hosted a conference event on Online Choice Architecture with international and UK speakers from academia, major digital firms and consumer organisations.

In a first for digital regulators in any country, we are building greater clarity and consistency in digital regulation through the Digital Regulation Cooperation Forum. We are continuing to work closely with our counterparts in the Financial Conduct Authority, Information Commissioner’s Office (ICO), and Ofcom to strengthen cooperation and promote greater coherence across regulatory approaches. Working in collaboration with our partners, we will enable coherent, informed and responsive regulation of the UK digital economy which serves citizens, consumers and businesses and enhances the global impact and position of the UK.

In May, we published a joint statement, alongside the ICO, setting out our shared views on the relationship between competition and data protection in the digital economy – a world first. The recent launch of the new digital regulation research portal brings together over 80 pieces of recent research on emerging and future digital developments from 8 regulatory bodies, ensuring that this body of knowledge is publicly available to inform the current debate.

In November the CMA hosted an Enforcer’s Summit to lead work to strengthen cooperation between G7 competition authorities in relation to digital markets, to promote understanding of respective approaches to competition issues in digital markets and to discuss long term collaboration and cooperation. Following the summit, we issued a joint statement with the Federal Trade Commission and the Antitrust Division of the Department of Justice highlighting the close relationship among our agencies and affirming our intent to strengthen collaboration and coordination with one another.

Supporting the transition to a low carbon economy

Climate change remains a hugely important issue across the world and at home in the UK. Its implications will affect global and domestic markets and, as a result, UK consumers.

To help tackle climate change, the UK Government is committed to a legally binding target of net zero carbon emissions by 2050 and clean economic growth is crucial to achieving this goal. At the CMA, supporting this transition continues to be a strategic priority. We provide this support through the cases we take on and the advice we provide to all 4 governments in the UK and others.

We have continued to prioritise work in markets where current practices could impede the successful transition to a low carbon economy in the future. For example, the electric vehicle charging market study where, in our final report, we set out measures to ensure that a national network of electric vehicle chargepoints will be in place ahead of the 2030 ban on the sale of new petrol and diesel cars. Our recommendations will promote strong competition, encourage more investment, and build people’s trust, both now and in the future. We also investigated long-term exclusive arrangements in the supply of chargepoints, which resulted in commitments from Gridserve, the owner of The Electric Highway, a major chargepoint operator in Great Britain, that will open up competition and increase choice of electric chargepoints in motorway service areas.

Using our consumer protection functions, we continue to raise awareness around the use of environmental or ‘green’ claims by businesses. In September, we published guidance for businesses to help them understand and comply with their existing obligations under consumer law when making environmental claims about their goods and services. This was followed in October by guidance for shoppers on what to look out for. We then started our first compliance review in January, beginning with a review of environmental claims in the fashion retail sector.

Case study 6: Green Claims Code

In this last year, the CMA has published its Green Claims Code to help businesses understand how to communicate their green credentials whilst complying with their existing obligations under consumer law and reducing the risk of misleading shoppers.

The code stipulates that green claims must:

- Be truthful and accurate

- Be clear and unambiguous

- Not omit or hide important information

- Only make fair and meaningful comparisons

- Consider the full life cycle of the product

- Be substantiated

We followed that up with our Green Claims Code for shoppers, with tips to help consumers identify products and services with genuine environmental credentials.

Our work seeks to deal with concerns that too many businesses are falsely taking credit for being green at a time when more people than ever are considering the environmental impact of a product before making a purchase.

Following on from its publication, the CMA has commenced a review of environmental claims in the fashion retail sector. The CMA plans to look at other sectors in due course.

According to some estimates, fashion is responsible for between 2 and 8% of global carbon emissions and many consumers are trying to choose more environmentally sustainable options when buying clothes.

In mergers, we have provisionally found that the merger of Veolia Environnement S.A. and Suez S.A would lead to a loss of competition in the supply of several waste and water management services in the UK. Both companies are active across the waste management supply chain from the collection of waste to the operation of facilities for composting and incineration and landfill sites. They also supply water and wastewater management services to industrial customers. We found that the loss of competition could lead to more costly and lower quality services, and in turn to higher council tax bills, as local councils and some businesses would have less choice when procuring key waste and water management services. This is all the more important at a time when local authority budgets are already stretched, and waste management services have to evolve to help achieve Net Zero targets.

In March this year, we published advice to the Secretary of State for Business, Energy and Industrial Strategy on how competition and consumer regimes can better support the UK’s net zero and sustainability goals, addressing the current landscape, any possible changes, and actions the CMA can take now. We will have to be bold to help tackle this climate emergency.

Looking ahead, we are taking on new work in the climate change and sustainability space, and recently launched an investigation into suspected anti-competitive conduct affecting the sustainable use of resources in the automotive industry – including in relation to the recycling and recyclability of old or written-off vehicles, specifically cars and vans.

We are aware of the importance of tackling climate change to our staff, and we are committed to continuing to improve in this area as an organisation.

We are committed to meeting the Greening Government Commitment targets, which set out to:

-

reduce water consumption

-

reduce greenhouse gas emissions

-

minimise waste

-

ensure sustainable procurement of products.

These targets aim to promote our responsibility for the environment within the business and encourage the communication and implementation of sustainability initiatives. These targets have been set to improve our environmental performance. All commitments will be included in the Greening Government Commitments Report.

CMA 2020s: Getting closer to consumers

Our ‘CMA in the 2020s’ activities are structured around the need to: understand the changing needs of consumers and how they experience markets; explain our role, our decisions and the reasons for them in all our external communications; and advocate in the consumer interest on regulatory, policy and legislative matters. Such activity has become even more important, as we seek to understand the impact of the rising cost of living on consumers, businesses and the economy.

We continue to extend our outreach to people and businesses across the nations and regions of the UK and to use that experience to inform our casework. This builds on the expansion of our remit and offices, as we begin to grow our presence in the north of England. In November we announced that we will establish offices in Manchester and Darlington. Manchester will be the home of the new DMU, and a new CMA Microeconomics Unit (MU) is to be co‑located with the government’s new Economic Campus in Darlington. The MU will take on the CMA’s existing economic research and evaluation function and carry out research into supply-side reforms to improve productivity.

We have published a second State of Competition report. This report is an assessment of how well competition is working in the UK and what that means for people and businesses. It shows a worrying combination of trends. We are seeing markets getting more concentrated, companies enjoying higher mark-ups and the biggest firms maintaining their leading positions for longer. It also finds that the poorest households are likely to suffer the effects of these changes the most. This is at the very time when they are already being hit by sharp rises in the cost of essential items. We will use our findings to direct our work to keep markets competitive and protect consumers at this crucial time.

The CMA is a member and key contributor to the work of the Consumer Protection Partnership (CPP) which is chaired by BEIS and brings together many of the enforcers and consumer bodies across the UK consumer landscape. This year we helped to develop the survey commissioned by BEIS on behalf of the CPP to listen to what consumers could tell us about their experiences of consumer detriment. The survey was published in April 2022 as part of the Consumer Protection Study.

We continue to have regular engagement with Citizens Advice and Which? at a strategic level through quarterly meetings. We hold operational meetings with relevant consumer bodies across the UK to share intelligence and horizon scan for emerging areas of consumer detriment. These organisations are key contributors to and supporters of a range of CMA work, in particular consumer enforcement projects. We are also working with Consumer Scotland as it establishes itself in the consumer landscape and look forward to building a close relationship between the organisations.

We have also progressed our outreach work with Citizens Advice which was substantially delayed due to the pandemic. The first pilot site visits to Citizens Advice took place in May 2022 with a range of staff members attending a Citizen Advice centre to learn more about the work of Citizens Advice, the range of issues they encounter and how we can work even better together in the future. These pilot visits will help to inform any enhancements that need to be made to the programme and also to identify relevant CMA staff who are most likely to benefit from such a visit.

We worked closely with Citizens Advice on the planning and roll-out of the CMA’s Online Rip-Off Tip-Off campaign. By also partnering with Citizens Advice Scotland, Advice Direct Scotland, the Consumer Council for Northern Ireland and the Money Guiders Network on this campaign, we reached consumers across the UK nations and regions.

We have stepped up our engagement with business organisations across the UK, including a range of sector and trade associations. We have also forged productive relationships with stakeholders in the North West and North East of England in line with the CMA’s new regional hubs. We have ongoing engagement with the Confederation of Business Industry NW and NE, Manchester Digital and the Leeds Digital Festival. We held round tables with Local Enterprise Networks and regional arms of the Federation of Small Businesses and the Institute of Directors.

We have also continued to engage with third sector organisations across the UK as part of our Getting Closer to the Third Sector project, hearing from a wider variety of third sector organisations and through them the consumers they interact with. Our areas of focus include race, poverty and inequality, climate change and mental health and well-being. This year we have further expanded the project to include the experiences of children and younger people, and older people. We will continue to develop these important stakeholder relationships and use the insight from the third sector organisations we are engaging with to help inform our prioritisation of our casework. We will use the network of contacts we have established through this work in the third sector to understand more about how the rising cost of living is impacting consumers and how that might be able to inform our work in consumer protection and competition more generally.

This is in addition to our engagement with colleagues internally on equality, diversity and inclusion, with the launch of our advisory committee (AdCo). AdCo is a diverse team of individuals from across the CMA who work together to improve diversity of thought at senior levels of the CMA. AdCo provides insights and advice to inform, support and constructively challenge senior decision-making.

We have also continued with our significant outreach with legislatures across the Devolved Nations, following last year’s elections in Scotland and Wales, and with the UK Parliament. We have responded to inquiries and consultations on a range of topics, including post-pandemic growth, and have engaged directly with Parliamentary Committees. This has included appearances before both the House of Lords and Scottish Parliament Committees to discuss the role of the OIM, and the Public Bill Committee on the role of the SAU.

Looking ahead – opportunities, challenges and risks

We will continue to face significant opportunities and challenges in the coming year as we establish our work on the substantial new responsibilities and functions conferred upon us, with an expanding remit and an organisation that is growing across the nations and regions (in particular in the North of England). We continue to face uncertain times ahead, even as we hope to emerge from the worst of the pandemic. The path to recovery is uncertain, hikes in the cost of living are unprecedented in recent times, and the war in Ukraine is impacting supply chains and markets. In times like this, it is more important than ever before that we remain agile and flexible in how we work and what we work on; that we lead the way in developing solutions as problems arise; and that we continue to act to protect UK consumers through challenging times.

The CMA has an important role to play in building trust and confidence when people buy goods and services, which will be critical to the economic recovery. We will continue to focus on high impact enforcement of competition and consumer law. We will remain alert to the risk of anti-competitive collusion, to mergers seeking to reduce competition and capitalise on the financial distress of businesses, and to attempts to exploit consumers, small and medium-sized enterprises (SMEs) and microbusinesses

Climate change also has the potential to bring more economic shocks and a potentially disruptive adjustment and adaptation process in a number of sectors, particularly those that are fossil-fuel intensive. We recognise the vital importance to each and every one of us of tackling the climate change emergency and supporting the drive to achieve net zero. Effective competition is vital to support recovery and sustainable future growth, and to ensure that people get a greater choice of better products and services at lower prices. We will continue to prioritise work that can support the development of healthy markets in sustainable goods and services.

Some of the CMA’s work, such as merger control, is ‘non-discretionary’: and it must be carried out irrespective of the wider context in which the CMA operates; and there are statutory deadlines which apply. We have more discretion with much of our other work and we will prioritise those areas where we can add most value and have the greatest impact.

Looking back

As Chief Executive, I would like to echo the Chair’s thanks to all our staff for everything we have achieved in the past year and indeed in the 6 years, since I took over as CEO of the CMA. As I prepare to leave the organisation and hand over to Sarah Cardell, our Interim CEO, I have reflected on the changes we have seen over my time. Over those years, we have faced many challenges and there has been an enormous amount of change in the organisation.

We have grown by 50% for a start, as we prepared for and took over our new responsibilities and functions. We have expanded our presence outside of London and are continuing along that path to achieve greater representation and understanding of the issues facing consumers wherever they live in the UK. We have moved offices, followed very soon after by another move to an entire organisation working from home, something which we achieved almost overnight without a break in service, thanks to the resilience of our staff, and aided by significant work to plan and updates to our technology that coincided with the timing of the pandemic restrictions.

In the work we have done, we have made a visible difference to the lives of consumers across the UK. During the pandemic, our ability to respond rapidly to the evolving crisis meant that we secured hundreds of millions of pounds in refunds for events and holidays cancelled due to restrictions. We achieved significant positive results for patients, the NHS and ultimately the UK as a whole with our cases in pharmaceutical sectors, stopping and deterring practices which had the potential to increase prices for important lifesaving medicines. We have deterred those seeking to abuse their positions and restrict competition by disqualifying directors to ensure individual accountability for wrongdoing.

We created our DaTA Unit which over the years has built a variety of new capabilities to support the CMA in delivering its objectives. We have been at the forefront of competition agencies around the world in advancing the thinking and practical application about how to regulate digital markets effectively. Our advice outlined a modern pro-competition regulatory regime for digital markets to govern the most powerful tech firms – those with ‘strategic market status’ (SMS) – meaning those with substantial, entrenched market power and where the effects of that market power are particularly widespread or significant. We have established a new DMU, already operating in shadow form, to ensure the ‘rules of the game’ are clear up-front, and work with powerful tech firms to ensure they comply with them. We are progressing a significant portfolio of work in digital markets to secure the benefits for consumers and prevent exploitation from powerful digital businesses.

The CMA has consistently monitored market and merger activities to ensure vigorous and effective competition to help keep prices down. For example, we have taken a robust approach to those mergers that are anti-competitive and leave households or businesses likely to face higher prices, lower quality products or less choice. This included blocking the proposed merger between Asda and Sainsbury’s in April 2019, in part due to concerns that it would lead to increased prices in the important grocery market.

Thanks to the efforts of our staff at the CMA during my time at the organisation, we have secured enormous improvements in competition and consumer protection for the benefit of the public.

This year’s key moments

April

CMA intervention leads to further Facebook action on fake reviews

CAT increases fine after musical instrument firm breaks settlement bargain

May

‘Green’ claims: CMA sets out the dos and don’ts for businesses

CAT upholds infringement decision for pay for delay pharma deals

CMA gives Virgin and O2 merger green light

June

Norton extends refund rights after CMA action

CMA issues IVF guidance on consumer rights

Accepted undertakings for the completed acquisition by Bellis of Asda to address competition concerns

July

CMA recommends further action on electric vehicle charging to meet Net Zero

August

CMA calls for stronger laws to tackle illegal ticket resale

Open letter to PCR Providers on compliance with consumer law

September

CMA action makes funeral prices clear for grieving families

Following CMA action, leaseholders with Countryside Properties are freed from costly contract terms

Office for the Internal Market opens for business

October

Groupon commits to offer refunds and improve customer service

CMA opens investigation into Motorola’s Airwave network

CMA fines Facebook over enforcement order breach

November

CMA requires JD Sports to sell Footasylum

CMA to open up electric vehicle charging competition on motorways

CMA directs Facebook to sell Giphy

December

CMA secures changes from major PCR testing provider

CMA concerned that Apple and Google duopoly limits competition and choice in mobile markets

CMA finds Veolia / Suez merger raises competition concerns

January

CMA disqualifies pharma director

CMA launches probe into music streaming market

February

CMA fines firms over £35m for illegal arrangement for NHS drug

NVIDIA abandons takeover of Arm during CMA investigation

CMA to keep ‘close eye’ on Google as it secures final Privacy Sandbox commitments

March

Children’s social care market study outcome

CMA publishes environmental sustainability advice to government

First official analysis of UK’s internal market published

Performance summary