Annual Report and Accounts 2020 to 2021

Published 15 July 2021

Annual Report and Accounts 2020/21 (for the year ended 31 March 2021)

Overview

The Competition and Markets Authority has a statutory duty to promote competition for the benefit of consumers.

Our aim is to make markets work well for consumers, businesses and the economy across the UK.

Chair’s foreword

Jonathan Scott, CMA Chair

This has been a year of significant change for the CMA. It began with us reorienting our activity in response to the coronavirus (COVID-19) pandemic, setting up a COVID-19 Taskforce to address new problems that arose for consumers and businesses, while moving almost seamlessly overnight to complete remote working. During the course of the year, we also assumed significant extra responsibilities on mergers and antitrust, as a result of the UK’s departure from the European Union (EU).

Our work is relentlessly focused on securing better outcomes for consumers. The amount that the CMA has achieved in 2020 to 2021, as outlined in this report, demonstrates how the organisation has responded to the pandemic – achieving all the goals originally set out in our Annual Plan, while at the same time dealing effectively with the additional areas of work prompted by COVID-19.

Throughout the year the CMA has responded quickly and effectively to protect consumers and assist businesses by tackling issues arising from the pandemic and the measures taken to contain it. Following our investigation of consumer protection issues in sectors such as holiday accommodation and package holidays, we secured hundreds of millions of pounds of refunds for customers whose holidays were cancelled. For example, £203 million secured in refunds for Virgin Holidays customers and £18 million for Love Holidays customers. We published guidance to help consumers understand their rights. We also published guidance on business cooperation to ensure that, while the economy was significantly disrupted, it would not prevent the supply of essential goods and services.

The CMA will continue to support the economic recovery from the pandemic by promoting competition and creating the conditions for investment for sustainable long-term growth.

At the same time as we were tackling consumer issues arising from the pandemic, we continued our extensive preparations to assume our new responsibilities arising from the UK’s departure from the EU. We committed the necessary resources to ensure that we had the people, skills and infrastructure in place to deal with these complex and resource intensive merger, antitrust and cartel investigations.

Since the end of the Transition Period, we have opened new merger and antitrust investigations in cases that would have previously fallen within the European Commission’s jurisdiction; and have published new guidance to assist businesses, such as our mergers assessment guidelines. We have also begun work to establish the new Office for the Internal Market (OIM) following the passage of the UK Internal Market Act. Meanwhile, the CMA has continued to contribute actively to international forums, working in partnership with other enforcement agencies around the world.

We are also in the process of developing the functions of the Digital Markets Unit (DMU), which launched in shadow form in April 2021. We published the advice of the Digital Markets Taskforce in December 2020, putting forward recommendations for the creation of a DMU to promote greater competition and innovation in digital markets. We continue to work to support greater coherence across regulation of digital markets, both domestically and internationally. In July 2020 we launched the Digital Regulation Cooperation Forum, alongside Ofcom and the Information Commissioner’s Office, to support closer cooperation across our work on digital markets. The CMA’s work in this area has already been influential in shaping discussions in the UK and more widely.

In a world where all markets are changing rapidly, we are focused on getting a better understanding of how they are changing and how this will affect competition and consumers. As set out when we launched our ‘CMA 2020s’ agenda in February 2020, we have been engaging with a wider and more diverse range of stakeholders than ever before, including more engagement with consumers, small businesses, and charities across the nations and regions of the UK.

Although we are doing all that we can within our existing powers and will continue to do so, we believe that legislative reform is necessary to bring about stronger, swifter and more flexible competition and consumer protection regimes, in order to safeguard the interests of consumers and to help improve public confidence in markets.

We welcomed the independent report from John Penrose MP and share his ambition for the competition and consumer regime. We look forward to working with government and others on his recommendations for reform of the regime.

It has been a privilege and honour for me to chair the organisation through this period of unprecedented change. It is a great team and there are exciting times ahead, as we take on the new responsibilities of the DMU; establish the OIM; and investigate more global cartel, antitrust and merger cases, working with partner agencies across the world. I have every confidence in the team’s ability to succeed.

The CMA’s staff have achieved a huge amount this year in the most difficult circumstances and this has been recognised externally with the Global Competition Review’s ‘Government Agency of the Year’ award. I would like to thank all of our colleagues for their efforts to ensure our resilience, both staff delivering our projects and those working to support the organisation and keeping it running smoothly in these most exceptional of times.

Jonathan Scott

CMA Chair

Year in highlights

Protecting consumers

Secured formal commitments across 5 investigations into consumer protection issues, including commitments from:

- Instagram to do more to tackle the risk of fake online reviews and prevent hidden advertising on its platform

- Care UK to refund residents of care homes who paid unfair fees

Response to COVID-19

-

received over 140,000 contacts from consumers

-

focused on 5 sectors in response to concerns about refunds for lockdown related cancellations; holiday accommodation; weddings and events; nurseries and childcare; package holidays; and airlines

-

secured formal commitments from 5 major package travel companies to refund consumers over £200m

-

secured commitments from companies in holiday rentals and weddings sectors, including the provision of refunds

Competition law enforcement

Resolved 9 Competition Act investigations

- issued 8 Competition Act infringement decisions, resulting in £52m of fines imposed

- accepted commitments to resolve 1 investigation

Personal responsibility for competition law breaches

- 10 company director disqualification undertakings secured

- 1 company director disqualification order sought and obtained from the court

| Years | 24 director disqualifications since 2016 |

|---|---|

| 2016 to 2017 | 1 |

| 2017 to 2018 | 0 |

| 2018 to 2019 | 2 |

| 2019 to 2020 | 10 |

| 2020 to 2021 | 11 |

Merger control in numbers

Approx. 600 transactions reviewed

- 38 phase 1 merger reviews

- 21 mergers cleared

- 9 referred to phase 2

- 6 accepted undertakings in lieu

- 1 found not to qualify

- 1 merger abandoned

- 0 intervention cases

- 9 phase 2 investigations

- 2 remittal cases launched

- 12 cases concluded

- 5 mergers abandoned

- 4 mergers blocked

- 1 merger cleared

- 2 mergers cleared with remedies

Market studies, investigations and reviews

Market studies: published report in online platforms and digital advertising; launched electric vehicle charging and children’s social care provision.

Market investigations: published report on funerals.

- Market review: published report on legal services sector.

Regulatory appeals

Completed 3 regulatory appeals in the aviation, energy and water sectors.

UK exit from EU

2 antitrust cases launched that would have previously been reserved to the European Commission.

Produced guidance for businesses and their advisers on the impact of EU exit on the CMA’s functions.

Extensive engagement with competition authorities across the world.

About us

The CMA is an independent non-Ministerial government department, taking on our powers as the UK’s lead competition and consumer authority in April 2014. We employ around 850 people, who are based mainly at our offices in London and Edinburgh, with smaller teams in Cardiff and Belfast. Since March 2020, staff have mainly been working remotely due to the COVID-19 pandemic. We adopt an integrated approach to our work, selecting those tools we believe will achieve maximum positive impact for consumers and the UK economy.

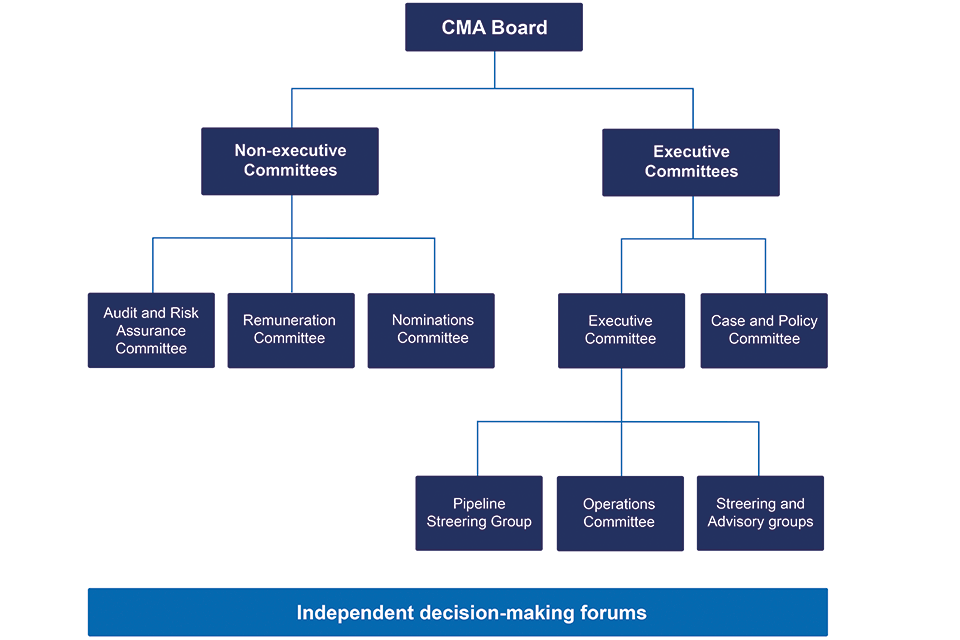

Governance

The CMA is funded by the taxpayer, and reports to Parliament through its annual plan and report. Our staff are civil servants. We are governed by a Board, comprising the Chair, the Chief Executive, executive and non-executive directors, and 2 members of the CMA Panel. The Chief Executive, as the CMA’s Accounting Officer, is responsible for the economy and efficiency of its handling of public monies. Some functions of the CMA must be performed by members of the CMA Panel who have clearly defined responsibilities and act as fresh decision-makers between the 2 phases of market and mergers cases to avoid confirmation bias. Our governance structure helps us to maintain our reputation for fairness, independence, integrity, rigorous analysis, careful handling of sensitive information, and efficient use of public money.

Estimated financial benefit to consumers

- annual average consumer savings of at least £2 billion in 2020 to 2021;

- over the 3-year period between 2018 to 2019, and to 2020 to 2021, the estimated direct financial benefit to consumers was over £7 billion

- for every £1 we spent on our operating costs, the average benefit to consumers over the last 3 years was £25

We consider our estimates to be conservative because they are based on cautious assumptions. They exclude the impact of a number of cases where the CMA’s intervention is likely to generate considerable consumer benefits, but these benefits were difficult to quantify sufficiently robustly. For example, we do not account for the CMA’s compliance and advocacy work, international activities or regulatory appeals.

The focus on direct financial benefits also means that we exclude many important, wider impacts on the competition regime. For example, we do not account for the deterrent effect of our actions and the impact of competition policy interventions on productivity. Overall, our estimates for the direct financial benefits capture only a part of the overall positive impact of the CMA’s work.

Chief Executive’s review

Andrea Coscelli, Chief Executive

Despite the considerable challenges and uncertainties in the past year, the CMA has had a strong performance, delivering a wide range of outcomes against the many commitments in our Annual Plan. This is in addition to the significant outcomes the CMA has achieved for consumers in response to the issues that arose as a direct result of the COVID-19 pandemic.

We have seen a record number of competition enforcement decisions and ensured personal accountability for competition law breaches through a significant jump in the number of director disqualifications.

We have secured hundreds of millions of pounds in refunds for consumers from events and holidays cancelled due to the pandemic, while continuing to progress our extensive portfolio of other consumer protection cases. We have led the thinking on ex ante regulation of digital markets and launched large-scale, complex antitrust and merger investigations into the activities of global businesses.

We have a duty to promote competition, both within and outside the UK, for the benefit of consumers, and our mission is to make markets work well in the interests of consumers, business and the economy. We believe this role is even more important as the economy begins to recover from the impact of the pandemic.

The interests of consumers are best served when businesses compete to win customers by offering them a better deal. When businesses compete effectively with each other, they cannot raise prices, or cut quality and service, without losing business. In order to retain existing customers, gain new ones and hence make more money, they need to develop new and better products or services and become more efficient. Businesses that are able to do this can increase their share of customers. Their competitors, meanwhile, must catch up with them in offering better value and innovative products and services if they are to avoid losing business. This process benefits consumers, businesses and the wider economy.

The cost of weak competition is borne by consumers in the form of higher prices and lower quality. This raises the cost of living, and it can hit the poorest households hardest. With fewer suppliers to choose from, and less innovation, consumers also suffer from reduced choice.

Just as consumers pay more when competition is weak, so businesses pay more than they should to their suppliers. And when markets are dominated by a small number of powerful firms, they can use their position to prevent other businesses from entering and growing.

We want to understand the changing needs of consumers and businesses and how they experience markets. In particular, we want to know where consumers are being harmed, either because their consumer rights are not being respected or because competition is not working well enough to ensure consumers are getting the goods and services they want at the right price. To achieve this, we are doing more to engage with a wider range of consumers, small businesses and charities. While we regularly engage with representative groups like Which?, Citizens Advice and the Federation of Small Businesses, this year we have launched new initiatives, such as our third sector outreach pilot, which is seeking to understand the views and concerns of a number of charities and third sector organisations, and our regional pilot programme seeking to improve our outreach in the regions.

We are committed to improving outcomes for consumers across the regions and nations of the UK. We have increased the numbers in our Edinburgh office and are continuing to expand our offices in other nations. In the past year we have sought to reflect diverse views from across the UK, by seeking input from people in different nations to our work on misleading green claims, the electric vehicles infrastructure and children’s social care. We delivered a series of online events in the nations, including events on our legal services work and the annual plan consultation; and we have continued our advocacy work with the devolved administrations and engagement with consumer bodies in the regions.

In this report, we set out how we have responded to the immediate issues raised by the COVID-19 pandemic, while at the same time achieving a huge amount in relation to the priorities set out in our Annual Plan. We have achieved all this despite almost universally working remotely in 2020 to 2021. For the vast majority of the last year, the CMA’s offices were closed. At the same time, many staff members found it necessary to take time away from work due to caring responsibilities. The CMA was able to reallocate resources to ensure that the most urgent and critical work could be completed on time.

Our achievements this year are a testament not just to our staff who work on the delivery of our casework, but also to our staff who support this delivery through their work on our people policies, facilities management and our agile information technology systems. Their hard work behind the scenes meant that our transfer from working in the office one day to almost entirely remote working the next was virtually seamless.

We highlight in this report the significant outcomes we have achieved for consumers, business and the UK economy both in response to the COVID-19 pandemic and against each of our planned priorities for 2020 to 2021: protecting consumers, in particular those in vulnerable circumstances; improving trust in markets; tackling concerns in digital markets; enhancing productivity and growth; climate change – supporting the transition to a low carbon economy; and taking on new responsibilities as a result of the UK leaving the EU.

Responding to the COVID-19 pandemic

As a direct result of our investigations, customers have been able to obtain hundreds of millions of pounds in refunds for events and holidays that were cancelled due to the pandemic.

The beginning of the 2020 to 2021 reporting year saw the CMA’s emerging response to the pandemic, both in terms of our response to the specific issues that impacted consumers and businesses as a result of the pandemic, as well as the significant changes we made to our working arrangements.

Early on we published guidance to reassure businesses that we would not take action against cooperation between businesses if this was necessary to protect consumers, for example, by ensuring security of supply of essential goods and services. At the same time, we made clear that the CMA would not tolerate unscrupulous businesses exploiting the crisis as a ‘cover’ for non-essential collusion. We also published guidance to help consumers know their rights and we updated our guidance on the CMA’s approach to merger assessments during the pandemic.

At the start of the pandemic, in March 2020, we set up the CMA’s COVID-19 Taskforce to monitor developments and gather evidence to enable us to intervene where we can, as quickly as we can.

We prioritised 5 sectors for consumer protection investigations: holiday accommodation; weddings and events; nurseries and childcare; package holidays; and airlines.

Case study 1: COVID-19 and package travel

Since March 2020, the CMA has received over 140,000 contacts from consumers.

The biggest problem being reported is businesses behaving unfairly in relation to lockdown-related cancellations with consumers often struggling to obtain fair refunds.

In response the CMA launched enforcement action to help ensure package travel operators comply with consumer law and that customers are not treated unfairly.

As a result of the investigations we secured formal commitments from a number of major package holiday providers (LoveHolidays, Lastminute.com, Virgin Holidays, TUI UK) to provide refunds without undue delay to customers.

These firms have to date refunded or committed to refund customers more than £200 million.

The CMA also wrote directly to 100 of the most complained about package holiday businesses and issued an open letter to package holiday businesses, reminding them of their obligations under consumer law.

The last year has been tough for everyone – including businesses – but that doesn’t mean that consumers, who are also struggling, should be the ones left out of pocket for holidays or other bookings that have been cancelled as a result of the pandemic.

In holiday accommodation, we secured formal commitments from a number of businesses that operate popular accommodation sites. Both Vacation Rentals (which operates Hoseasons and Cottages.com) and Skyes Cottages agreed to provide refunds to customers for holidays cancelled due to restrictions associated with the pandemic.

We published the CMA’s views on how the law applies in relation to contracts for wedding services affected by the pandemic to help customers understand their rights and to help businesses treat customers fairly. Following CMA action, Bijou Weddings Group agreed to change its policy to offer affected customers fairer partial refunds that more accurately reflect the services received up until the date of cancellation. We also issued an open letter to the early years sector, highlighting practices we considered were unfair or contrary to consumer law.

We provided advice to government on exclusion orders, which exempt certain types of agreement in specific sectors from competition law to help ensure risks to competition and consumers are minimised, including 2 in the groceries sector and others in the ferry transport and healthcare sectors.

Protecting consumers, including in particular those in vulnerable circumstances

In 2020 to 2021 the CMA has continued to take tough action to protect consumers and ensure they are not treated unfairly by businesses. This has been particularly important in the last year, as many more people in the UK are likely to have experienced vulnerability due to the pandemic.

Our pharmaceutical investigations ensure that essential drugs are available for patients when they need them, and that the NHS and ultimately taxpayers do not pay over the odds for these drugs.

Securing supply of essential drugs at affordable prices

We have issued a number of competition law enforcement decisions in the healthcare sector. We found that the pharmaceutical companies Amilco, Tiofarma, and Aspen took part in an illegal agreement in relation to the supply of life-saving medicine, fludrocortisone, that is relied upon by thousands of patients. This illegal agreement had resulted in the price of fludrocortisone supplied to the NHS increasing by up to 1800%. We imposed fines totalling almost £2.3 million and secured a payment of £8 million directly to the NHS.

In December 2020, the CMA accepted legally binding commitments from Essential Pharma to continue to supply the bipolar drug, Priadel, at an affordable price for at least 5 years. This followed a swift investigation into concerns that the company may have abused a dominant market position by proposing to withdraw the drug from UK patients. The withdrawal would have meant that thousands of patients would need to switch to an alternative, more expensive, treatment such as Camcolit, which is also owned by Essential Pharma, and caused disruption for patients and doctors, while placing an even greater financial strain on the NHS at a time of unprecedented pressure.

We also issued competition enforcement decisions against businesses in the £440 million musical instrument sector for preventing retailers from offering discounts, a practice known as resale price maintenance. Customers should be able to buy products at the best price without fear of paying over market value. These decisions mark the culmination of 5 separate investigations, covering major players across the sector. In 2 separate cases against Roland and Korg, the CMA imposed fines totalling £5.5 million, for breaking competition law by restricting online discounting of musical instruments. Despite having settled the case, Roland appealed against its fine to the Competition Appeal Tribunal (CAT), which in April 2021 rejected the appeal and upheld the CMA’s approach, increasing the fine from £4 million to £5 million; the CAT’s judgment signalled the importance of parties abiding by the settlements they agree with the CMA. In July 2020, the CMA issued a decision finding that the retailer, GAK, and Yamaha Music Europe had breached competition law.

This action follows fines imposed on 2 other leading suppliers (Casio and Fender) in August 2019 and January 2020.

Consumer protection law is designed to ensure consumers are given the right information to help them make informed decisions; to protect them from unfair trading; and to help them get redress when problems occur.

We continued our consumer protection investigation into care homes. In October 2020, the CMA secured more than £1 million in refunds for those NHS funded residents at Care UK’s premium care homes who paid an unfair additional fee towards essential care. Care UK has also formally committed to stop charging this additional fee to current and future residents at its homes.

In November 2020, we published draft guidance to help fertility clinics understand and comply with their obligations under consumer law. The final guidance was published in June 2021.

In December 2020, the CMA published the final report of its market investigation into funeral services, confirming its remedies for the sector. The final report set out further detail on the remedies intended to support customers when choosing a funeral director or crematorium and to place the sector under greater public scrutiny. These include an obligation for all funeral directors and crematorium operators to disclose prices in a manner that will help customers make informed decisions and a recommendation to government to establish an independent inspection and registration regime to monitor the quality of funeral director services. The report also concluded that the CMA should consider consulting on a future market investigation when the impact and consequences of COVID-19 on the funerals sector are sufficiently understood and the sector is more stable.

Our mergers work also covers markets that impact consumers, who may be vulnerable. Cases in the past year include the final implementation of the sale of Smartbox by Tobii, providers of assistive communication products which are bought for those who need them by the NHS, charities and schools. The CMA found that the merger could lead to a reduction in the range of products available and higher prices.

We also investigated and cleared the purchase of gene therapy provider Spark by Roche, the pharmaceuticals company. Spark provides treatments for patients with haemophilia. The investigation found that the NHS and patients would still have access to alternative treatments after the merger. In the educational resources sector, we found that Yorkshire Purchasing Organisation’s (YPO) anticipated acquisition of Findel potentially raised competition concerns in the supply of resources to educational institutions in the UK. The CMA found that a merger could leave educational institutions with fewer alternative suppliers and worse terms when purchasing educational supplies. YPO subsequently abandoned the deal.

In March 2021 the CMA launched a market study of children’s social care provision to establish why a lack of availability and increasing costs could be leading to the needs of children in care not being met.

Improving trust in markets

The most meaningful way to restore confidence in markets is to make them work better in the interest of consumers. The CMA has continued to use its powers to impose fines on businesses for engaging in agreements and other practices that reduce competition, raising prices and limiting innovation in markets. We have increasingly used our director disqualification powers to ensure personal responsibility for such breaches. We have launched enforcement action to protect consumers from mis-selling and unfair contract terms in markets. We have also examined mergers to ensure these do not reduce competition in markets, and in doing so harm consumers interests.

The CMA considers that individual directors should be held accountable when their companies break competition law. The CMA has powers to secure disqualification of such individuals from being directors of any UK company for up to 15 years. This is important to protect the public from directors who allow competition law breaches, and to focus directors’ minds on the importance of complying with the law.

Having ramped up the use of our powers, the CMA secured its first disqualification in December 2016, and in the 5 years since then has secured 24 disqualifications arising from Competition Act infringements, 11 of these in the past year alone. The disqualifications covered directors involved in a range of sectors, including construction, pharmaceutical and estate agency firms. This includes one case where disqualification was ordered by the court. In that case a director of a company involved in an arrangement between local estate agents to fix commission fees contested our view and, in July 2020, the court ordered the director be disqualified from holding any UK company directorship for a period of 7 years.

In a cartel we investigated in the healthcare sector, it emerged that a private hospital in the Spire group had instigated and facilitated an illegal arrangement with 7 consultant ophthalmologists to fix fees for initial private consultations for self-pay patients at £200. Initial consultations are an essential first step for people suffering from eye disorders. We imposed a fine on Spire of over £1.2 million.

We welcomed the judgment from the Competition Appeal Tribunal (CAT), which upheld the decision to impose a £25 million fine on FP McCann Ltd for participating in an illegal cartel in the supply of pre-cast concrete drainage products, reflecting the seriousness of the infringement. The CAT’s judgment reinforces the need for companies to engage in active competition and not cheat by colluding with their rivals to fix prices or share out the market between them.

As part of an investigation into the leasehold market, the CMA uncovered troubling evidence of potentially unfair terms concerning ground rents in leasehold contracts and potential mis-selling. We identified concerns that leasehold homeowners may have been unfairly treated and that buyers may have been misled by developers. In September 2020, we launched enforcement action involving 4 leading housing developers we believe may have broken consumer protection law in relation to leasehold homes.

In July and December 2020, we published updates on tackling the Loyalty Penalty welcoming the progress made in the 5 markets (mobile, broadband, cash savings, home insurance and mortgages) identified, with Ofcom and the Financial Conduct Authority introducing interventions, most recently in broadband, and general insurance.

We have continued to operate an efficient and effective mergers regime. Where mergers substantially reduce competition, this weakens the competitive pressures that incentivise businesses to keep prices down, improve quality and choice, and spur innovation. A strong and independent system of merger control prevents harm to consumers’ interests and can build further trust in markets.

We have taken tough action against the harmful effects of anti-competitive mergers, blocking or substantially remedying mergers that we considered would likely harm consumers interests. Other potential mergers have been abandoned, in response to the concerns raised about the likely impact on competition.

We blocked the merger of TVS Europe Distribution and 3G finding it would result in customers having limited alternatives to choose from when seeking replacement parts for commercial vehicles and trailers.

Case study 2: viagogo / StubHub merger

viagogo acquired StubHub in February 2020. In the UK, viagogo and StubHub have a combined market share of more than 90%.

The CMA concluded that the merger would lead to a substantial reduction in the supply of uncapped secondary ticketing platform services for the resale of tickets to UK events. This is likely to have led to customers facing higher fees or poorer service in future. The CMA accepted undertakings from viagogo to sell StubHub’s business outside North America (StubHub’s headquaters).

The CMA was mindful of the significant impact of COVID-19 on the live events industry through-out its investigation.

However, the evidence is that viagogo and StubHub would remain important competitors as and when the live events industry recovers.

Creating a fully independent StubHub international business will maintain competition in the UK and help ensure that the users of these ticketing platforms don’t face higher prices or poorer quality of service.

We accepted legally binding commitments to resolve the CMA’s concerns in a number of mergers in the healthcare sector, including medical device suppliers Stryker/Wright and private hospitals Circle/BMI.

Our tough approach towards investigating mergers meant that a number were abandoned after we highlighted serious competition concerns, including a merger between 2 companies that supply semi-submersible offshore accommodation, Profsafe and Floatel. Crowdcube and Seedrs, 2 of the largest equity crowdfunding platforms in the UK, also abandoned a merger after the CMA found it would likely reduce competition and innovation.

In October 2020 we requested that the European Commission transfer the review of the merger between Virgin and O2 to the CMA given the potential impact on consumers in the UK. The European Commission agreed and in December 2020 the case was referred for an in-depth phase 2 investigation. The merger was provisionally cleared in April 2021.

Our advocacy and compliance work is another powerful tool we can use to improve the way that markets work for the benefit of consumers and businesses, particularly as the economy begins to recover from the impact of the pandemic. This year we responded to several consultations and made submissions to a number of Parliamentary inquiries, including inquiries in the Devolved Nations, in the digital, audit and food sectors amongst others. We also issued a short guide on Competition law risk in September 2020.

In Scotland, we submitted responses to consultations on the legal sector and the regulation of electricians. In Wales, we responded to consultations in the transport sector – including electric vehicles. In Northern Ireland, we responded to the Economy Committee’s Micro Inquiry into the Department for the Economy Energy Strategy and the Northern Ireland Executive Programme for Government Framework Consultation.

Tackling concerns in digital markets

Online markets have formed a significant part of our work over the past year. We have sought to ensure that the many benefits of digitalisation for consumers are secured, while making sure that concerns are properly addressed.

Case study 3: Online platforms and digital advertising market study

In July 2020 the CMA published the final report of our market study into online platforms and digital advertising.

The dynamic nature of digital advertising markets and the types of concerns identified by the CMA are such that existing laws are not suitable for effective regulation.

We proposed that a new regulatory regime, in the form of a Digital Markets Unit, is needed so that users can continue to benefit from innovative new services; rival businesses can compete on a level playing field and publishers do not find their revenues unduly squeezed. The CMA will continue to take a leading role globally in relation to these issues as part of the CMA’s wider digital strategy.

The government agreed with our recommendation and committed to introducing legislation to create a new pro-competition regulatory regime to tackle the market power of technology giants like Google and Facebook.

The government announced that a Digital Markets Unit would be established within the CMA and a DMU was launched in shadow form within the CMA in April 2021.

The CMA’s concerns on expenditure and share of supply:

- In 2019, the UK expenditure on digital advertising was £14 billion, on search advertising was £7.3 billion and on display advertising was £5.5 billion

- Google and Facebook’s share of digital advertising is about 80%

- Google’s share of search advertising is over 90% and their revenue per search has more than doubled since 2011

People will carry on handing over more of their personal data than necessary, a lack of competition could mean higher prices for goods and services bought online and we could all miss out on the benefits of the next innovative digital platform

The report on our online platforms and digital advertising markets study has contributed to the global debate on the challenges to competition posed by the most powerful digital firms, and for example, was drawn on by the United States House Judiciary Antitrust Subcommittee in its recent report on competition in digital markets.

We welcomed the UK government’s response to our online platforms and digital advertising market study, published in November 2020. The government committed to introducing legislation to create a new pro‑competition regulatory regime to tackle the market power of technology giants like Google and Facebook. It also announced that it would establish a DMU within the CMA from April 2021 to begin work to prepare for this new regime.

Following the market study, in December 2020, the Digital Taskforce delivered its advice to government on the design and implementation of the UK’s new pro-competition regime for digital markets. The taskforce was commissioned by the government in March 2020 and was led by the CMA, working together with Ofcom, the Information Commissioner’s Office and the Financial Conduct Authority. The government is currently considering the Taskforce’s advice. It has committed to consulting on proposals for a new pro‑competition regulatory regime for digital markets in the first half of 2021 and to establishing this within legislation as soon as Parliamentary time allows.

The DMU was launched in shadow form within the CMA in April 2021 and will focus its work on preparing for the new regime to maximise operational readiness in time for the implementation of legislation, alongside continuing to support and advise government on establishing the statutory regime.

We will continue to use our existing tools effectively and efficiently to address problems in digital markets. This includes through antitrust and consumer protection law enforcement action, markets work, and merger assessment. The CMA’s operation of these tools will continue to play an important role in our digital markets work even once the DMU is established. Whilst enabling us to deliver outcomes for consumers and businesses, this work will also enable us to deepen our knowledge of digital markets and support us in considering where to prioritise focusing our new regulatory powers once they come into effect.

We continue to work to support greater coherence across regulation of digital markets, both domestically and internationally. In July 2020 we launched the Digital Regulation Cooperation Forum, alongside Ofcom and the Information Commissioner’s Office, to support closer cooperation across our work on digital markets. This was followed in March 2021 with an ambitious workplan setting out how we intend to work together to deliver effective, efficient, coherent regulation across digital markets for the benefit of consumers and industry. Internationally, we have continued to work closely with our counterparts in other jurisdictions across our work on digital markets, and this will be a priority for the year ahead, in particular through our work supporting the G7.

In May 2020, we launched an investigation into several major websites to see whether they are doing enough to protect shoppers from fake and misleading reviews. The CMA secured commitments from Instagram, operated by Facebook Ireland Ltd, to tackle the risk that people can buy and sell fake online reviews through its platform. We also obtained undertakings from Facebook Ireland Ltd, in October 2020 to implement a package of changes to tackle hidden advertising on Instagram. This signalled an important behaviour shift by a major platform and will make it much harder for people to mislead consumers by posting an advert on the photo and video sharing platform without labelling it as such.

In August 2020, following CMA action, StubHub addressed our concerns about its compliance with existing undertakings to the CMA. It also provided an expanded set of undertakings to address newer concerns about its use of misleading messages about ticket availability and the use of adverts for event listings on overseas events that may not have been compliant with UK consumer law.

This year the CMA, along with the Netherlands Authority for Consumers and Markets and the Norwegian Consumer Authority, took a leading role in the international effort to improve information available on the use of personal data by apps available in Apple’s App Store. This follows ongoing work from ICPEN (the International Consumer Protection and Enforcement Network), involving 27 of its consumer authority members across the world including the CMA.

There were important cases in our mergers work relating to digital markets. We cleared the proposed acquisition by Amazon of certain rights and a minority shareholding in Deliveroo following an in-depth investigation. We found that the level of investment would not substantially lessen competition in the sector. However, should Amazon acquire a greater level of control over Deliveroo, the CMA could initiate a further investigation. We also found it necessary to impose financial penalties on Amazon for its failure to provide complete responses to 2 statutory information requests. We will continue to use our powers to impose administrative penalties when businesses fail to comply with legal requirements to provide the requested information. We completed our phase 1 investigation into the merger of Facebook and Giphy. We found a realistic prospect of competition concerns in relation to digital advertising and the supply of GIFs.

The merger is now the subject of a phase 2 inquiry. Also in the digital space, a merger between Taboola and Outbrain, 2 leading providers of digital advertising to advertisers and publishers including major news sites, was abandoned following an investigation by the CMA. The CMA raised concerns that, if the deal went ahead, publishers in the UK would have a reduced choice of supplier for this type of digital advertising. Our updated mergers assessment guidance also included additional sections relevant to digital markets on dynamic competition and 2-sided markets.

Price comparison website under the spotlight

The CMA imposed a fine of £17.9 million on ComparetheMarket after it found that clauses used in the company’s contracts with home insurers breached competition law. These clauses prohibited the home insurers from offering lower prices on other price comparison websites and protected ComparetheMarket from being undercut elsewhere. They also made it harder for ComparetheMarket’s rivals to expand and challenge the company’s already strong market position as other price comparison websites were restricted from beating it on price. As a result, competition between price comparison websites, and between home insurers selling through these platforms, was restricted. The CMA found that this is likely to have resulted in higher insurance premiums in the £5.9 billion home insurance market (Mintel Home Insurance Report, December 2020).

This year the CMA has also opened an investigation into Google’s proposals to remove third party cookies and other functionalities from its Chrome browser. The CMA secured commitments from Google to address concerns about Google’s proposals and launched a consultation in June 2021 on whether to accept those commitments. We have also opened an investigation looking at Apple’s conduct in relation to the distribution of apps on iOS and iPadOS devices in the UK.

Enhancing productivity and economic growth Competition is good for consumers and good for business, and it also brings wider economic benefits. It helps ensure that people get a greater choice of better products and services at lower prices. It rewards those businesses which invest in the development of new and improved products to meet people’s needs. It spurs businesses to seek more cost-effective ways of making and selling those products, so boosting productivity. A strong economy is underpinned by markets that work effectively, where competition is driving innovation, efficiency and growth. In wellfunctioning competitive markets, businesses innovate and compete vigorously and fairly to attract customers’ business. Customers can make informed choices between suppliers on price, quality, innovation and service. This drives more competition and innovation. The CMA’s competition and consumer protection interventions contribute to making this process work effectively.

We have fined a number of businesses for cartels in the construction industry. While they might not be consumer-facing and the suppliers will not always be household names, these are essential components to key sectors of the economy. By stopping practices that push prices artificially high and weaken incentives to innovate, the CMA are protecting consumers and taxpayers as end-customers and improving Britain’s productivity and economic performance. This is critical to protecting and creating jobs.

Case study 4: pre-cast concrete drainage cartel

In recent years, we have imposed fines on a number of businesses for cartels in the construction industry, as well as using our powers to disqualify directors who engage in this activity from acting as directors in any business.

In October 2019 we imposed total fines of more than £36 million on 3 firms for taking part in an illegal cartel. The firms were based in various locations across the UK including Somerset and Northern Ireland.

Businesses can appeal our decisions to the Competition Appeal Tribunal (CAT), which one of the parties did in this case.

That appeal ended with a judgment from the CAT in December 2020 fully upholding our decision to fine that company £25.4 million.

The CMA also secured the disqualification of 4 company directors who took part in the cartel. In March 2021, 2 of the indivduals were disqualified for 11 years and 12 years, the longest period for any director disqualification secured by the CMA to date.

The message to directors is clear – you are personally responsible for ensuring that your company complies with competition law, and if it doesn’t you risk disqualification.

In November 2020 we found that 2 UK roofing lead firms had broken the law by entering into anticompetitive arrangements in the UK roofing materials sector. Both firms admitted their roles in the illegal cartel and now face fines of £1.5 million and £8 million respectively.

We also imposed fines on 2 companies who supply groundworks products of more than £15 million for illegally colluding to reduce competition and keep prices up. The products are used in a range of major housing and road developments, railway line works and water pipe upgrades.

We found the suppliers shared confidential information on future pricing and commercial strategy. They also coordinated their commercial activities to reduce uncertainty, including monitoring each other’s prices and challenging quotes they deemed too low.

Where mergers have the potential to substantially lessen competition, as indicated above, this can dampen incentives to innovate and reduce costs, thus could lead to lower productivity and price increases. A merger between building supply companies, Kingspan and Building Solutions, was abandoned after we highlighted serious competition concerns. We found that the proposed deal could potentially result in customers facing higher prices or lower quality products.

In our regulatory appeals work, in July 2020, the CMA published its final decision following an appeal from NERL, a subsidiary of NATs (the National Air Traffic Control) against the Civil Aviation Authority’s price control decision for 2020-2024. In March 2021 we published our findings following a redetermination of Ofwat’s price control for 2020-25 for 4 water companies. The decision by the CMA applies to over 8 million households served by Anglian, Bristol, Yorkshire and Northumbrian Water and allows for sufficient investment to ensure customers receive a sustainable quality of service. The CMA also dismissed an appeal by SSE against decisions made by Ofgem and granted permission to 9 energy companies to appeal against modifications made by Ofgem to their distribution licences.

In early 2020, the CMA was asked by the UK government to assess the state of competition in the UK. Our report was published in November 2020 and provided insights into the level and nature of competition across the economy and within a number of sectors. Although much of the study uses comprehensive analysis covering the last 20 years, with the most recent data from 2018, the CMA has also started assessing early metrics of how the COVID-19 pandemic has affected competition.

Climate change – supporting the transition to a low carbon economy

Concerns about climate change are changing market dynamics and consumer behaviours across the UK economy. The UK committed to a legally binding target of net zero emissions by 2050 and clean growth is crucial to achieving this goal. This includes plans to cut emissions in heavy industry and promote green recovery. We are continuing to develop capability to ensure that when delivering our statutory functions, we act in a way which supports the transition to a low carbon economy.

In November 2020, we launched an investigation into misleading environmental claims. The CMA is investigating how claims about the environmental impact of products and services are made including descriptions and labels used to promote products and services claiming to be ‘ecofriendly’, and whether they could mislead consumers.

40% of green claims made online could be misleading consumers

Although UK marketing practices have been the focus of the CMA’s examination, the CMA has also taken a leading role in looking at green claims in a global context. Work has been carried out alongside the Netherlands Authority for Consumers and Markets, as part of a project with ICPEN (the International Consumer Protection and Enforcement Network). A CMA co‑ordinated global review by ICPEN members of randomly selected websites has so far found that 40% of green claims made online could be misleading consumers.

We have also launched a market study into electric vehicle charging, to help ensure that this new and fast-growing sector works well for UK drivers. Traditional cars are a major source of greenhouse gas emissions and the UK government has brought forward the ban of new petrol and diesel vehicles to 2030. By getting involved early as electric vehicles and chargepoints are still developing, the CMA can work to ensure that consumers are treated fairly now and in the future.

In January 2021 the CMA published information to help businesses achieve environmental sustainability goals whilst staying on the right side of competition law. One of the ways businesses are striving to meet climate change targets or other environmental objectives is through ‘sustainability agreements’. It is important that competition law does not become an unnecessary obstacle to sustainable development, and that businesses are not deterred from taking part in lawful environmental initiatives for fear they may breach competition law. It is also important to make sure that markets remain competitive and open to innovation. The CMA’s information document aims to help firms navigate competition law as it currently stands.

Taking on new responsibilities, as a result of the UK leaving the EU

In the past year, the CMA continued its extensive preparations to ensure its readiness for its enhanced role which began in January 2021, along with the opportunities and challenges this will bring. Our experienced team worked closely with other government departments, especially the Department for Business, Energy and Industrial Strategy to refine the policies and legislation necessary for a smooth end to the Transition Period with the EU.

We have been closely monitoring the European Commission’s portfolio of cases and the pipeline of mergers with an EU dimension. In relation to mergers, the ‘pre-notification’ discussions that precede formal investigations have been ongoing with a number of merging parties for several months. Our updated mergers procedural guidance sets out how the regime will work going forward and how we will work with our international counterparts.

We have already opened new cases in antitrust and mergers as a result of the UK leaving the EU, including our investigation into the anticipated acquisition, worth an estimated $40 billion, of Arm by NVIDIA, Google’s proposed ‘Privacy Sandbox’ browser changes, and Apple’s conduct in relation to the distribution of apps on iOS and iPadOS devices in the UK. We have also published guidance on changes to our functions to support and inform businesses.

Ahead of the expiry of commitments made by British Airways and American Airlines to the European Commission, the CMA launched an investigation into the Atlantic Joint Business Agreement. To prevent an enforcement gap and given the exceptional market uncertainty due to COVID-19, in September 2020 the CMA imposed interim measures to extend the terms of the European Commission’s commitments for an additional 3 years until March 2024, by which time it is expected that the airline sector should be in a more stable position.

We remain determined to strengthen cooperation across the globe, bilaterally and multilaterally. Markets are increasingly global and the growth of digital ways of doing business means that different jurisdictions face many of the same challenges. Moreover, many issues cannot be fully addressed in isolation, but benefit from concerted action. We will continue our close engagement and cooperation with the European Commission, other competition and consumer agencies of the member states in the EU and globally. The Trade and Cooperation Agreement with the EU includes a provision that provides for negotiation of a separate agreement on cooperation with the European Commission and the competition authorities of the member states of the EU.

We will also remain members of international forums which are not part of the EU’s institutional structures, such as the OECD’s Competition Law and Policy Committee, the International Competition Network (as part of which we co‑chair the ICN mergers working group), and ICPEN (the International Consumer Protection and Enforcement Network). We continue to work closely with our international counterparts for example, together with the Netherlands Authority for Consumer and Markets, the CMA co‑led a project under the auspices of ICPEN, looking at green claims made online. The CMA also significantly contributed to the Best Practice Principles for Marketing Practices directed towards Children Online published by ICPEN.

In September 2020, we signed a Multilateral Mutual Assistance and Cooperation Framework for Competition Authorities (MMAC) along with counterpart organisations in Australia, Canada, New Zealand and the United States, marking a new chapter in inter-agency cooperation to address cross‑border anti-competitive activity in an increasingly global economy. The new framework includes a memorandum of understanding focused on reinforcing and improving existing cooperation and coordination on investigations.

More recently, in March 2021 we joined forces with counterpart organisations in the United States, Canada and Europe to consider our approach to investigating pharmaceutical mergers, to ensure that our investigations include fresh approaches that fully analyse and address the varied competitive concerns that these mergers and acquisitions raise. The G7 has invited the CMA to convene a meeting of G7 competition authorities in 2021 to discuss long term coordination and cooperation competition in digital markets.

Looking ahead – risks, challenges and opportunities

In the midst of the pandemic, which has had a huge impact on our caseload and brought significant changes to how our staff work on a day to day basis, this year has been more challenging than we could possibly have anticipated. As we look ahead, we continue to face uncertainty, due to the changing nature of COVID-19.

The CMA has an important role to play in building trust and confidence when people buy goods and services, which will be critical to the economic recovery from the pandemic. At the same time, we will remain alert to the risk of collusion, to mergers seeking to capitalise on the financial distress of businesses, and to attempts to exploit consumers.

We will continue our work of advising government across the UK in designing and implementing policy for economic recovery in a way that harnesses competition (which spurs innovation and growth) and protects consumers interests.

The UK’s exit from the EU presents challenges, but also opportunities for the CMA and for the UK’s competition and consumer protection regimes. We remain committed to making the most of these opportunities, while playing a bigger role internationally to promote competition and protect consumers.

We expect to continue to see a significant increase in our caseload for merger control and competition law enforcement and we have committed the necessary resources to ensure that we have the people, skills and infrastructure in place to deal with these complex investigations.

We have begun the process of establishing the Office for the Internal Market (OIM) within the CMA to deliver independent, technical advice, reporting and monitoring functions on intra-UK trade. This new role will commence in Autumn 2021.

We have now established the Digital Markets Unit (DMU) in shadow form within the CMA which, subject to final decisions by the government, will oversee and enforce a new pro‑competition regulatory regime for the most powerful digital firms. We will work to prepare for the new pro-competition regime as well as continuing to use our existing tools effectively and efficiently to address problems in digital markets.

All of these developments will have major implications for the work of the CMA and how we allocate our resources.

We will also continue our efforts to ensure we are an open and transparent organisation. Despite the sensitive nature of much of our work, we will endeavour to ensure that consumers and business understand more about our role, what we can and cannot do and how we make the decisions we make. We will continue to apply our updated approach to transparency in competition and consumer enforcement cases meaning that parties under investigation are now normally identified when opening cases. We will also continue to publish minutes of our Board meetings.

This year has been one of considerable change for the CMA as we continued our preparations to take on our new responsibilities amidst the global pandemic. Despite the challenges we have faced, our staff have made incredible efforts to deliver a huge amount for the benefit of consumers, businesses and the economy. We have no doubt that 2021/22 will bring further challenges, but we are confident that the CMA is prepared for those challenges and look forward to the opportunities presented by the changing landscape and our expanded role within it.

Andrea Coscelli CBE

Chief Executive and Principal Accounting Officer

13 July 2021

This year’s key moments 2020 to 2021

April 2020

- merger blocked: airline booking companies - Sabre and Farelogix

- mergers cleared: telecoms infrastructure companies Cellnex/Arqiva and food delivery companies Just Eat/Takeaway.com

May 2020

- mergers abandoned: building supply companies Kingspan/Building Solutions education publishers McGraw-Hill Education/Cengage Learning

June 2020

- director disqualifications: 1 pharmaceutical director and 2 estate agent directors

- issued fines imposed for RPM in the musical instrument sector

July 2020

- completed market study into online platforms and digital advertising market in the UK

- High Court judgment: Estate agent director disqualified following CMA decision

- issued decision on NATs/CAA price control

August 2020

- merger cleared: online restaurant food companies Amazon/Deliveroo

- StubHub makes changes to its UK site to address CMA concerns

- Director disqualification: pharmaceutical director

September 2020

- merger abandoned: digital advertising companies Taboola/Outbrain

October 2020

- £203m in refunds for Virgin Holidays customers

- Instagram to tackle hidden advertising after CMA action

November 2020

- merger abandoned: educational suppliers YPO/Findel

- imposed £17.9m fine on ComparetheMarket for competition law breach

- published report on the state of competition in the UK

- impose fines of over £9m for roofing lead cartel

December 2020

- CAT appeal: CMA decision upheld - concrete pipes cartel

- final report in funerals markets investigation

- LoveHolidays refund over £18 million for cancelled holidays

- Digital Markets Taskforce advice to government

- merger commitments: Hunter Douglas/247 window blinds

January 2021

- sustainability agreements: CMA issues information for businesses

- merger abandoned: Tronox/TiZir metallurgy

- merger commitments: CMA requires TVS Europe Distribution to sell 3G, commercial vehicle and trailer parts

February 2021

- director disqualification: construction director

- Lastminute.com paid a further £1m in refunds (to total £7m)

- CAT appeal: CMA decision upheld - pharmaceutical information exchange

- merger commitments: CMA requires viagogo to sell StubHub’s international business

March 2021

- launch of the market study into children’s social care

- director disqualifications: 5 construction company directors

- issued final decision on water price controls

- merger abandoned: Crowdcube/Seedrs crowd-funding platforms

Performance summary

Where we spent our money in 2020 to 2021

We incurred spending against parliamentary budgets for the year ending 31 March 2021 of £95.7 million. This expenditure corresponds to total DEL expenditure for the CMA. The significant areas of expenditure recorded include:

-

£69.6 million on our business as usual activities of protecting consumers through effective enforcement, operating an effective and efficient merger regime, making markets work better, being a strong voice for competition

-

£2.7 million on capital expenditure as we prioritised investing in Information Technology (IT) projects to ensure the resilience of our IT infrastructure, ensuring that we equipped staff and enabled them to adapt to working remotely and safely during the COVID-19 pandemic and fitting out the office space in our Belfast office as part of the wider government estates’ programme

-

£18.6 million to cover essential spending on the CMA’s expanded role now that the UK has exited the EU (including the potential administration of the future Subsidy Control regime)

Detailed explanations of the significant variances between the outturn and Estimate are included in the Directors’ report: financial review

2020 to 2021 was a challenging year as we had to manage pressures arising as a result of the uncertainties caused by the COVID-19 pandemic, while also continuing to increase our staff resources in preparation for the UK leaving the EU and delivering our commitments with regards to merger control and enforcement.

We have successfully delivered within our parliamentary budgets in 2020 to 2021, with effective financial management decisions delivering underspends across all our budgets, despite the challenges we faced this year.

COVID-19

We acted swiftly and effectively to manage our response to COVID-19. We enacted business continuity plans and quickly put in place actions to mitigate risks and ensure that our operations continued with minimum disruption. Staff affected by COVID-19 have been supported and communicated with on an ongoing basis. In line with government guidance, we closed all our offices across all the nations for most of this financial year resulting in all our staff working from home.

Due to the specialist skillsets we possess at the CMA, and our investment in Information Technology, we were able to react quickly to the initial impact of the pandemic by effectively and efficiently redeploying resources to set up the COVID-19 Taskforce while still ensuring that we discharged our statutory responsibilities effectively.

The COVID-19 Taskforce responded to unscrupulous and harmful practices observed during the pandemic, including price gouging of essential items, and failures to respect the refund rights of Consumers. Following the Taskforce’s investigation into sectors such as holiday accommodation and package holidays, we secured hundreds of millions of pounds of refunds for customers whose holidays were cancelled.

Our spending this year included additional costs for supporting staff with equipment they needed to work from home effectively as we implemented our remote working arrangements and moved from being office-based to a home-working organisation. Costs were also incurred for deep office cleaning, signage and security for reoccupying the Cabot, as well as other facilities management and associated specialist cleaning costs. We also had to purchase additional subscriptions for staff working from home (who were unable to access the news terminal in The Cabot) as this is required for our legal professionals to deliver their work effectively.

Fines income

We also collected £56.8 million from fines (penalties) under the Competition Act, imposed on companies across a variety of sectors, showing the tangible effect of the CMA in curtailing anticompetitive practices, all of which goes directly to central government resulting in a direct benefit to the public finances. This is reported separately in the CMA’s Trust Statement.

Corporate Governance Report

Directors’ report

Statutory powers

The CMA is a non-ministerial department. We derive our powers from the Enterprise and Regulatory Reform Act 2013.

Our functions include:

- investigating mergers that have the potential to lead to a substantial lessening of competition

- conducting studies and investigations into markets where there are suspected competition and consumer problems

- investigating businesses and individuals to determine whether they have breached UK competition law and, if so, to end and deter such breaches, and pursue individuals who commit the criminal cartel offence

- enforcing a range of consumer protection legislation, tackling issues which suggest a systemic market problem, or which affect consumers’ ability to make choices

- promoting stronger competition in the regulated industries (gas, electricity, water, aviation, rail, communications and health), working with the sector regulators

- conducting regulatory appeals and references in relation to price controls, terms of licences or other regulatory arrangements under sector-specific legislation

- giving information or advice in respect of matters relating to any of the CMA’s functions to the public, policy makers and to Ministers

Over the course of this reporting year, changes to legislation resulted in the CMA acquiring the following new powers and responsibilities:

- on 31 December 2020, following the UK’s exit from the European Union, the CMA assumed responsibility for merger and competition enforcement cases that previously had been undertaken by the European Commission

- the UK Internal Markets Act 2020 establishes the Office for the Internal Market within the CMA, which will monitor the functioning of trade within the UK and devolved governments and provide independent, technical advice to UK and devolved governments. It will become operational on 1 September 2021.

In December 2020, the UK government announced it would establish and resource a new Digital Markets Unit within the CMA from April 2021 to oversee a pro-competition regime for digital platforms. The government is expected to consult on the form and function of the Digital Markets Unit in 2021 and legislate as soon as parliamentary time allows.

Pension liabilities

Past and present employees are covered by the provisions of the Principal Civil Service Pension Scheme (PCSPS). Further information on pension liabilities is in the Remuneration Report and Note 3 of the Financial Statements.

Our staff

Despite the circumstances and challenges arising from the COVID-19 pandemic, the CMA has achieved a number of successes over the 2020 to 2021 reporting year to improve the engagement of its staff and strengthen its commitment to equality, diversity and inclusion. We remain committed to looking after the wellbeing and mental health of our staff and ‘Health and Wellbeing with Resilience’ has been a central theme of our Corporate Action Plan as we adjusted to life under lockdown and changed how we work. In May 2020, we signed up to the Mental Health at Work Commitment, which aims to promote and share best practice among employers by identifying common standards based on up to date research. This Commitment has helped us reinforce and consolidate what we have learnt over this reporting year. We also delivered a substantial programme of activity to support and promote staff wellbeing during Wellbeing fortnight in October 2020 and a further Winter Wellbeing programme in November 2020 that included the launch of virtual fitness sessions. In 2021, we were awarded Mind’s Silver Award in the Mind Employers Wellbeing Index, an external assessment of our wellbeing practices and support. The Silver Award is given to employers who have made demonstrable achievements in promoting staff mental health, demonstrating progress and impact over time.

We are passionate about developing our staff. Our Corporate Action Plan focused on encouraging all staff, including those from protected groups, to think about and take active steps to progress their careers. This has been a central theme for us this year, together with delivering a range of work to support managers to understand the career development opportunities available to their staff. To support this aim, we have launched a new Career Development Biography tool to staff at selected grades initially and as part of a pilot to support better quality career conversations with their managers with plans to roll this tool out to all staff in the next reporting year. We have also completed a successful pilot of our mutual mentoring programme, which paired staff from under represented groups with a senior partner from our Senior Executive Team and Senior Director cohort with plans to roll this out to the wider CMA next year.

We remain committed to creating a workplace that is free of bullying, harassment and discrimination, as well as building a broader culture of respect, to ensure the CMA is a great place to work for everyone. Building on our work in the previous reporting year, respect is now fully incorporated into Senior Civil Servant (SCS) mandatory corporate objectives and a new cohort of Respect Ambassadors have been recruited, which are a volunteer staff group who are a first point of contact for those concerned about behaviour, including bullying, harassment and discrimination.

This year, our staff engagement survey score has increased to 67%, an all-time high for the CMA and above the Civil Service average.

Our commitments to equality, diversity and inclusion

In August 2020, we published the CMA’s Equality, Diversity and Inclusion Strategy 2020 - 2024, which sets out how we will meet the requirements of the Public Sector Equality duty over the next 4 years. Our equality objectives for 2020 to 2024 are:

- building a diverse and inclusive workforce that reflects and understands the public we serve

- ensuring all colleagues are valued and can contribute to our success

- empowering and enabling all colleagues to thrive and prosper. The strategy will also be supported by the Diversity and Inclusion Action Plan, which sets out our road map for delivering our ambition.

To support these objectives, we have expanded our outreach activity related to our recruitment work, with a dedicated working group established to focus on this outreach work. A structured programme of activities is being implemented to attract talent from a more diverse pool, which includes engaging with a wide range of universities, working with relevant professional networks from under-represented groups and engaging with state secondary schools. In March 2021, the CMA launched 2 internal positive action development schemes. ‘Accelerate’ is a sponsorship programme aimed at Grade 6 and Grade 7 Black, Asian and ethnic minority staff looking for career progression and with aspirations to reach SCS level. ‘Aspire’ is a separate development programme aimed at supporting individuals from under-represented and minority groups, either from a minority ethnic background, or those with a disability or who identify as LGBTQ+, to navigate the next stages of their career.

The Board reviewed and we published our Ethnicity Pay Gap report for the first time in March 2021, which demonstrates an ethnicity pay gap exists. We are fully committed to undertaking considerable work to address this. The Board also reviewed the CMA’s most recent Gender Pay Gap report for 2019-2020, which showed a small gender pay gap for ordinary pay (mean and median) remains but found a further decrease for the second year in a row. Female representation with the SCS cadre at the CMA further increased for the second year in a row.

Further information is available on the CMA’s published Equality Scheme and on Staff report.

Auditors

Our Resource Accounts and the Trust Statement Accounts have been audited by the National Audit Office (NAO) and certified by the Comptroller and Auditor General, who was appointed under statute and is responsible to Parliament. The notional cost of the audit is disclosed in Note 4 Statement of Changes in Taxpayers’ Equity for the year-ended 31 March 2021 of the CMA’s Financial Statements and relates solely to statutory audit work. The auditors did not undertake any non-audit work during the 2020 to 2021 year.

The CMA Directors, including the Chief Executive, have taken all the steps necessary to make themselves aware of any relevant audit information and to establish that the CMA’s auditors are also aware of that information. In so far as we are aware, there is no relevant audit information of which the Comptroller and Auditor General, with support of the NAO, is unaware.

Accounting Officer

As Principal Accounting Officer, CMA Chief Executive Andrea Coscelli remains responsible, and with advice from the CMA Board, for ensuring that the CMA operates effectively and to a high standard of probity in relation to governance, decision-making and financial management. The CMA’s Principal Accounting Officer performs the roles and responsibilities of the Accounting Officer, including responsibility for the propriety and regularity of the public finances for which the Accounting Officer is answerable, for keeping proper records and for safeguarding the CMA’s assets, as set out in chapter 3 of Managing Public Money published by the HM Treasury.

In April 2018, the Chief Operating Officer, Erik Wilson, was appointed as Additional Accounting Officer with a specific responsibility for corporate and support services.

Directors’ report: financial review

Expenditure

Presentation of expenditure

The CMA’s expenditure is reported on 2 different bases in this Annual Report and Accounts. In addition to the primary statements prepared under IFRS, the Government Financial Reporting Manual (FReM) requires the department to prepare a Statement of Parliamentary Supply (SoPS) and supporting notes. The Statement of Comprehensive Net Expenditure (SoCNE) presents comprehensive net expenditure of £101.0 million. This compares to £98.1 million in 2019/20. This expenditure is calculated following accounting standards (IFRS) and guidance which are explained in more detail in note 1 and on a similar basis to those rules generally applied by private sector businesses.

The Statement of Parliamentary Supply (SoPS) presents total expenditure £103.4 million and compares this with the budget presented to Parliament of £115.0 million. These figures are calculated in accordance with HM Treasury’s Consolidated Budgeting Guidance, which differs in several respects with the accounting basis above.

An overview of our expenditure

Our Total Managed Expenditure (TME) was £103.4 million, broken down by HM Treasury’s spending categories as set out in the table below.

| 2020 to 2021 outturn (£000) | 2020 to 2021 budget (£000) | 2019 to 2020 budget (£000) | |

|---|---|---|---|

| TME | 103,407 | 114,973 | 115,495 |

| - Resource DEL | 93,055 | 101,673 | 95,292 |

| - Capital DEL | 2,657 | 3,300 | 17,574 |

| Total DEL [footnote 1] | 95,712 | 104,973 | 112,866 |

| - Resource AME | 7,695 | 10,000 | 2,629 |

| Total AME [footnote 2] | 7,695 | 10,000 | 2,629 |

We are accountable to Parliament for our expenditure. Parliamentary approval for our spending plans is sought through the Supply Estimates presented to the House of Commons, specifying the CMA’s delegated budget control totals, and asking for the necessary funds to be voted. We draw down these voted funds in-year from the Consolidated Fund as required.

The Supply Estimates include a formal description of the services (‘ambit’) to be financed. Voted funds cannot be used to finance services that do not fall within the ambit. Our Resource DEL budget for 2020 to 2021 was £101.7 million, including ringfenced budget cover of £19.9 million to cover essential preparatory spending for the CMA’s expanded role after the UK exited the EU (including the potential administration of the future Subsidy Control regime) and £2.8 million of budget cover to support operational pressures arising from COVID-19.

Our Capital DEL budget for 2020 to 2021 was £3.3 million and expenditure focused on Information Technology (IT) projects to ensure the resilience of our IT infrastructure and to equip staff to work from home with minimum disruption during the national lockdown.

Outturn

As set out in the SoPS, our 2020 to 2021 Resource DEL outturn was £93.1 million, comparative to a budget of £101.7 million.