Carbon Capture, Usage and Storage: a vision to establish a competitive market

Published 20 December 2023

Ministerial Foreword

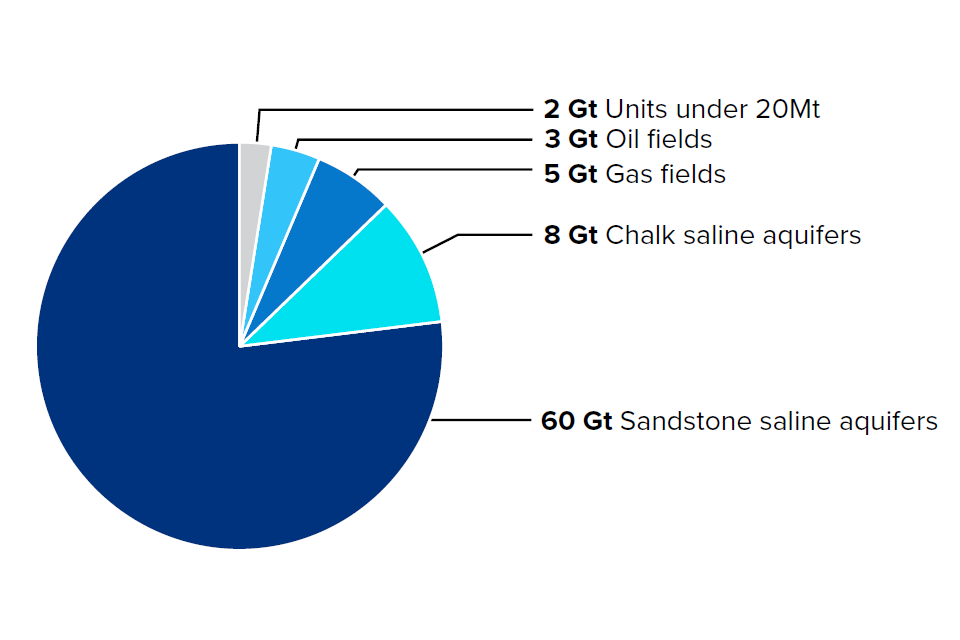

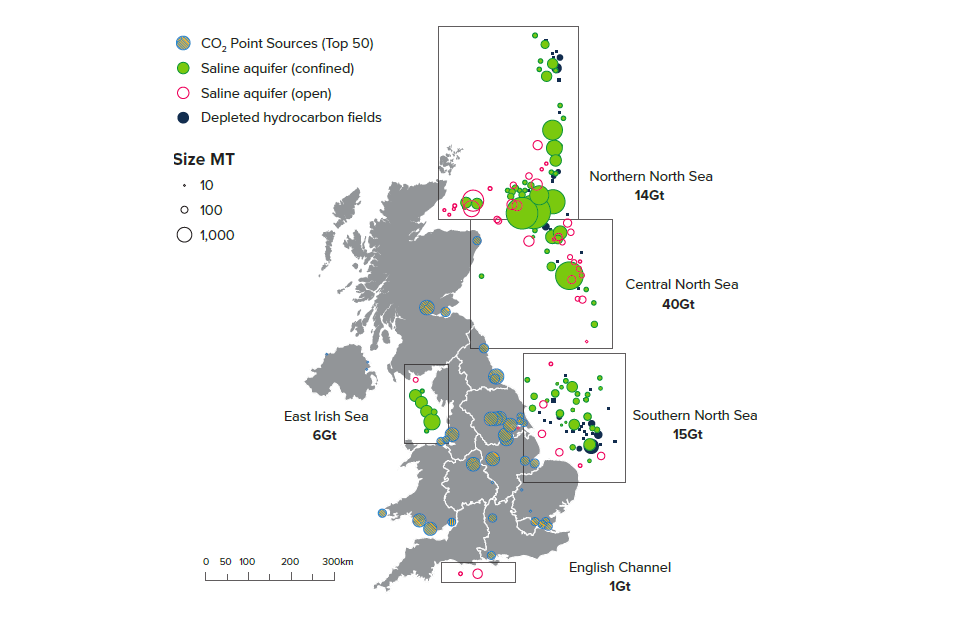

Carbon Capture, Usage and Storage (CCUS) will be a game-changer for the UK’s energy transition. With capacity to safely store up to 78 billion tonnes of CO₂ under our seabed – one of the largest such capacities in the world – we plan to develop CCUS into a highly valuable national asset that will help us reach net zero and boost our economy by up to £5 billion per year by 2050.

We have already decarbonised more than any other major economy since 1990, reducing emissions by nearly half while growing our economy by two thirds. Over the past 13 years, for example, the amount of electricity coming from renewables has increased fivefold. But CCUS gives us new options, such as helping heavy industry to be part of our net zero future, and the UK offering CO₂ storage services to other countries. We have the unique geology, infrastructure and know-how to lead the world in capturing and permanently storing carbon. On top of the environmental benefits, we will capitalise on the economic opportunities of carbon capture and storage.

In March 2023, the Chancellor announced up to £20 billion to support the initial deployment of CCUS. We want to create four CCUS clusters by 2030, storing 20 to 30 megatonnes of CO₂ a year, delivering 50,000 jobs and helping level up the UK. To support this, we have also announced the first eight projects of the ‘first-of-a-kind capture networks’ in North East England, North West England and North Wales, with plans to expand Track-1 clusters and establish Track-2 clusters in North East Scotland and the Humber.

But this is only the start, in this document, we set out a vision of what a market focused CCUS sector might look like, tapping into innovation and business know-how to drive the scale up and acceleration of CCUS deployment during the 2030s. That means creating a competitive market by the middle of the next decade that reduces costs and allows investors to build a thriving and self-sustaining CCUS industry. In this way, the private sector can drive the development of carbon capture, creating jobs and economic growth, and helping us achieve our carbon budget targets.

This is pioneering work, requiring close collaboration between government, industry and local regions where carbon capture clusters are forming. There will be significant challenges as we develop a viable pathway for CCUS, but the rewards will be unprecedented. By investing heavily in the early development of CCUS clusters, and today setting out our longer-term vision for a competitive market, we can meet those challenges and seize those rewards, so CCUS can achieve its full economic opportunity, and the UK can take a giant leap towards net zero.

Rt Hon Claire Coutinho MP

Secretary of State for Energy Security and Net Zero

Lord Callanan

Minister for Energy Efficiency and Green Finance

Executive summary

Establishing a UK CCUS market which will unlock economic opportunities

Since 2021, we have established the roll-out process and identified the first four Carbon Capture, Usage & Storage (CCUS) clusters for deployment in the UK by 2030. The government has committed up to £20 billion to establishing a CCUS sector in the UK, which will help unlock economic opportunities and will include significant investment in CCUS projects supporting up to 50,000 jobs. [footnote 1] Tapping into our 78 billion tonnes storage potential in the North Sea and assets can help us to maximise the economic opportunity from the transition to net zero and help create a commercial and competitive market.

There is an opportunity for UK supply chains in CCUS to develop new capabilities and secure a substantial global market share for CCUS technologies. A successful UK supply chain is key to creating and sustaining high-skill, high-value jobs and supporting low carbon growth in industrial clusters. The Carbon Capture and Storage Association’s (CCSA) Supply Chain Good Practice Guidance Document includes a headline voluntary content ambition of 50% UK content.

To enable the global advancement of CCUS, the UK government is leading and convening international engagement on CCUS through multilateral forums and bilateral relationships. Through this, we are committed to learning from others and sharing our own experiences of deploying CCUS as well as working with others to overcome the barriers to fully deploying CCUS.

Transition to net zero

The UK’s independent advisor on climate change, the Climate Change Committee (CCC), has said that CCUS is a ‘necessity, not an option’ for the transition to net zero. [footnote 2] Furthermore, the International Energy Authority (IEA) has said that CCUS is an essential component of a global transition to net zero, with an estimated 1 billion tonnes of storage capacity being required globally by 2030 for a net zero pathway consistent with 1.5 degrees. [footnote 3]

In a future net zero world, we will still need materials such as cement, steel, and chemicals. For many of these sectors, CCUS is the only viable route to decarbonise at the scale required for us to meet our targets. CCUS is key in creating new sustainable energy for the future. By using CCUS, we can generate more low carbon power and create a responsive clean energy system. CCUS can be used to decarbonise the production process for hydrogen and other low carbon fuels and to clean up our waste. Emerging technologies are also being developed that remove carbon directly from the atmosphere and create negative emissions; these will be essential for the UK to achieve net zero emissions by 2050.

Establishing a commercial and competitive UK CCUS market

Our vision is to make the UK a global leader in CCUS, creating a self-sustaining CCUS sector that supports thousands of jobs and reduces emissions to ensure a better environment for future generations.

We will make this vision a reality through the development of a commercial and competitive CCUS market, where we envisage the roles of government and industry evolving over time, through the following three phases:

-

Market creation: Getting to 20 to 30 megatonnes per annum (Mtpa) CO₂ by 2030

-

Market transition: The emergence of a commercial and competitive market

-

A self-sustaining CCUS market: Meeting net zero by 2050

Currently, we are progressing with the market creation phase with Track-1 and Track-2 cluster development and establishing a regulatory framework for the CCUS sector. Track-1 is in the process of negotiations. Track-1 expansion is being launched with the opening of an application window to expand the HyNet cluster, in parallel to this document to further strengthen the roll out. Track-2 will aim to establish two new CO₂ transport networks around Acorn (St Fergus, North East Scotland) and Viking CCS (the Humber) CO₂ storage sites. Government have updated on Track-2 simultaneously, setting out our proposed allocation approach of an ‘anchor’ and ‘buildout’ phase and high-level timelines, with the anchor project submission window opening in early 2024.

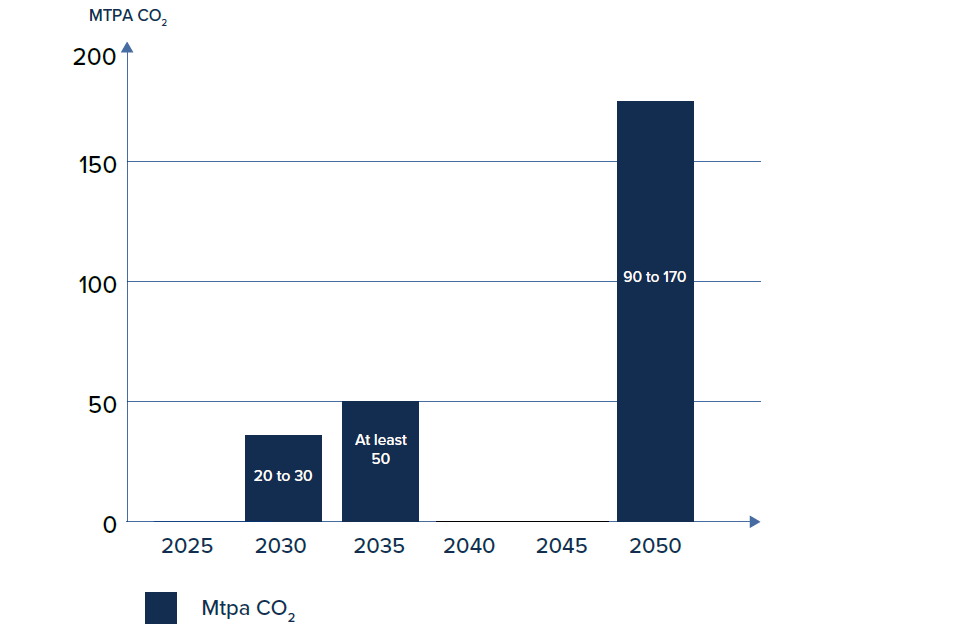

Beyond 2030, a significant ramp up in the commercial deployment of CCUS will be required in the UK to support the emergence of the sector, further support individual sector decarbonisation routes and deliver the expected contribution to Carbon Budget 6. By the mid 2030s, the amount of CO₂ annually stored may need to increase to at least 50 megatonnes per annum (Mtpa). [footnote 4] To achieve this, it is likely that the CCUS sector will need to increase the annual amount of CO₂ stored by at least 6 Mtpa each year from 2031.

This document sets out the steps to transition from the market creation phase to the market transition phase, where we envisage the emergence of a commercial and competitive market that efficiently accelerates deployment whilst driving costs reduction and reducing the degree of government support needed. In 2024, we intend to take forward work to enable the market frameworks necessary to support a market transition to a commercial and competitive market, including:

-

Launch a consultation on the design of an enhanced competitive allocation process for capture contracts.

-

Work with industry and wider stakeholders to consider the strategic direction for CO₂ transport networks, including developing an understanding of the degree of strategic co-ordination needed and any potential role for the Future System Operator.

-

Publish a call for evidence on how government envisages non-pipeline transport to be delivered in the UK.

-

Review the current regulations regarding third-party access to infrastructure to ensure they are fit for purpose for the regulated CO₂ transport network.

-

Working with stakeholders to develop policies to secure sufficient subsurface storage capacity, including to:

(a) support the North Sea Transition Authority (NSTA), The Crown Estate and Crown Estate Scotland as they continue to explore the optimal approach to carbon storage licensing and leasing,

(b) continue to streamline and strengthen the regulatory processes and interfaces for CO₂ stores,

(c) support the NSTA and other stakeholders on licensing and appraisal strategy to ensure sufficient CO₂ injectivity is available to meet projected demand,

(d) develop options to deliver a more competitive market for CO₂ transport and storage services and

(e) enable the management and delivery of the multiple government targets that place a demand on the finite resources of the seabed. -

Work with stakeholders to explore what actions may be required to enable a new commercial framework to support international imports.

-

Engage with industry to consider the role of Carbon Capture and Usage within the CCUS framework, where CO₂ is permanently abated via non-geological storage.

-

Publish the Green Jobs Plan – a roadmap to deliver a skilled and sufficiently sized workforce.

-

Establish an industry working group on the identification and timely adoption of cost reduction opportunities.

-

As part of the Autumn Statement on 22 November 2023, the Chancellor announced a £960 million Green Industries Growth Accelerator to support the expansion of strong, home-grown, clean energy supply chains across the UK, including CCUS. This will enable the UK to seize the significant growth opportunities presented by our transition to Net Zero.

These actions will help to further the development of the CCUS sector, driving the sector towards Phase Two: a market transition. The following chapter outlines the wide-ranging opportunities which could be afforded to the UK by the successful development of the UK CCUS sector.

Chapter 1: Opportunities of a New UK CCUS Sector

A UK CCUS sector will unlock economic opportunity

Carbon Capture, Usage and Storage (CCUS) is the process of capturing carbon dioxide for usage or for permanently storing it, deep underground, where it cannot enter the atmosphere. The UK is leading the development of CCUS and with the pace of CCUS activity accelerating across the globe, the UK has been rated amongst the top five nations globally for CCUS readiness. [footnote 5]

We have leapt from a standing start in 2021 to our current position, whereby we are taking forward the development of four CCUS clusters: HyNet (North West England and North Wales), East Coast Cluster (Teesside and the Humber, NorthEast England), Acorn (North East Scotland) and Viking CCS (the Humber).

We have announced up to £20 billion of funding to support the early deployment of CCUS in the UK. For CCUS to realise its full potential there is also a need for significant private sector investment and the financial gain could be significant. A recent supply chain report said that UK carbon capture and storage could be worth £100 billion to local manufacturing employers. [footnote 6]

We have focused on creating a stable, long term, supportive policy environment for CCUS deployment in the UK. Through the Energy Act 2023, we have established groundbreaking legislation which creates a robust regulatory framework for CCUS, managing cross-chain risks and enabling the deployment of projects. The CCUS business models are recognised for the unique way in which they will support significant investment in CCUS projects and thus the deployment of CCUS. [footnote 7]

There is a role for CCUS in supporting businesses to ensure a just transition to net zero. Our approach to establishing CCUS will create economic opportunity across the UK with up to 50,000 jobs that could be supported by 2030. [footnote 8] Individual clusters also estimate either supporting or creating thousands of jobs [footnote 9] in our industrial heartlands. UK Research & Innovation’s (UKRI) recent publication, A Plan for UK Industrial Decarbonisation, noted that each Industrial Decarbonisation Challenge (IDC) cluster expects to create or safeguard up to tens of thousands of jobs. [footnote 10] These projections illustrate the scale of the potential economic benefit provided by CCUS, both with respect to employment and general economic growth.

The UK has significant geological assets, with the UK Continental Shelf (UKCS) potentially having enough capacity to safely store up to 78 billion tonnes of carbon, one of the largest potential CO₂ storage capacities in Europe. The UK is fortunate to have sufficient storage to sequester our domestic emissions whilst also offering potential storage to international emitters, providing additional economic opportunities. Tapping into these North Sea resources and assets can help us maximise the economic opportunity inherent in the transition to net zero. The geology and its proximity to major emission centres provides a great opportunity for the UK to lead this new industry.

A technology critical to achieving net zero

The Climate Change Committee (CCC), the UK’s independent advisor on climate change, has said that CCUS is a ‘necessity, not an option’ for the transition to net zero. [footnote 11] In their latest progress report, the CCC said that CCUS will need to play a role in the decarbonisation of many sectors: notably industry, electricity generation and fuel supply. [footnote 12] Furthermore, the International Energy Authority (IEA) has said that CCUS is an essential component of a global transition to net zero, with an estimated 1 billion tonnes of storage capacity being required globally by 2030 for a net zero pathway consistent with 1.5 degrees. [footnote 13]

CCUS is essential for industry to decarbonise. In the future net zero world, we will still need materials such as cement, steel, and chemicals. For many of these sectors, CCUS is currently the only viable route to decarbonise at the scale required for us to meet our targets.

CCUS is critical for energy security. By using CCUS, we can build more dispatchable gas-fired power plants and Bioenergy with CCUS power plants (power BECCS), complementing renewable generation to ensure energy security that aligns with our net zero ambitions.

CCUS is key in creating new sustainable fuels for the future. CCUS can be used to decarbonise the production process for hydrogen, which can provide low carbon energy across the economy. CCUS can also be used in the production process for low carbon fuels, such as sustainable aviation fuels, which are significantly less carbon intensive compared to current jet fuels.

CCUS is also needed to reduce emissions from our residual waste sector. There are government policies in place aimed at reducing waste by preventing waste from being produced in the first instance and by increasing recycling and reuse. For the remaining residual waste, energy generation and the application of CCUS to capture the carbon that would otherwise be emitted into the atmosphere are ways to reduce the impact of managing and utilising the waste we do produce.

CCUS is essential for all these sectors, but to get to net zero we will also have to take advantage of emerging technologies that remove CO₂ directly out of the atmosphere and create negative emissions. [footnote 14] Foremost amongst these technologies is Direct Air Capture, which will be critical to deploy at scale to get us to net zero.

A future CCUS system will therefore enable multiple sectors to connect to a CO₂ transport network that will enable carbon to be transported from an emitting facility to a geological storage location, where the carbon will be safely stored permanently to ensure a cleaner environment for future generations.

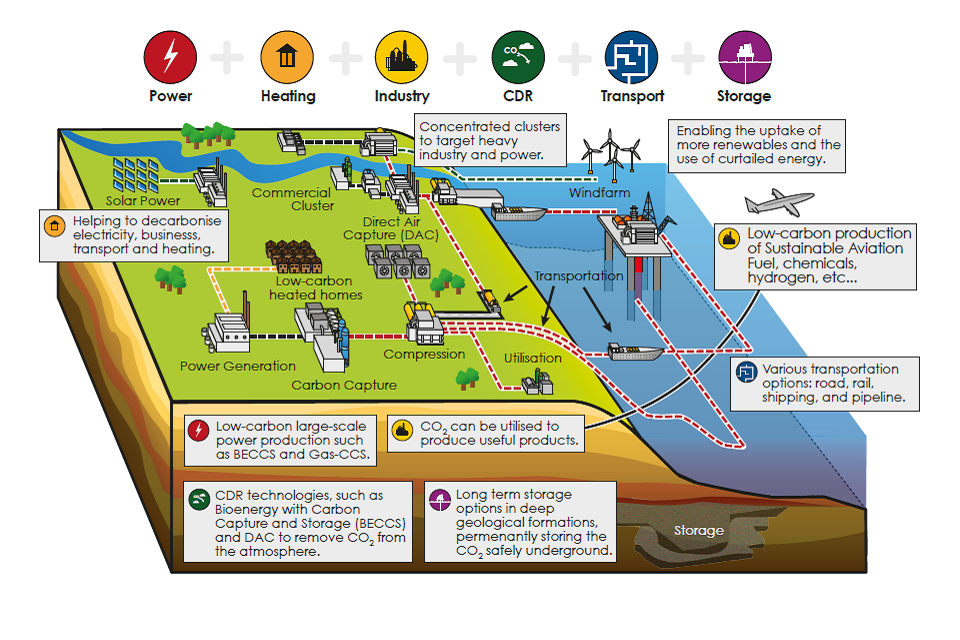

Figure 1: Explaining CCUS

CCUS & Net Zero: Carbon capture, utilisation and storage (CCUS) enables the production of low carbon power, decarbonised heating and industry, and carbon dioxide removal (CDR) technologies, to prevent/ remove CO₂ from the atmosphere and transport it to safe and secure storage sites, ensuring a smooth transition to Net Zero by 2050.

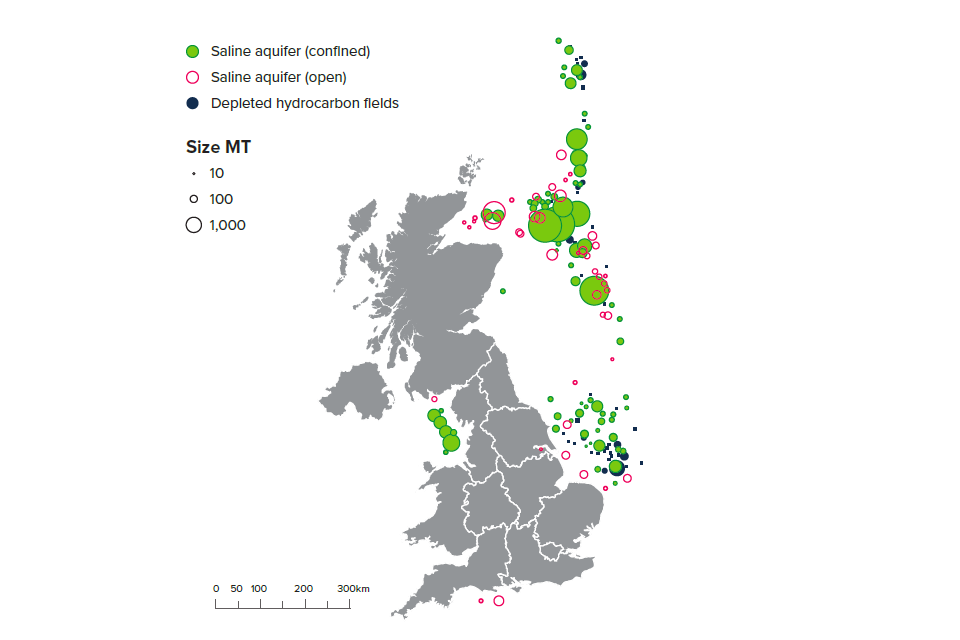

Figure 2: Map showing storage potential in the North Sea

Storage units with less than 20 Mt of storage capacity are not included in this figure.

An opportunity for UK supply chains

There is an opportunity for UK supply chains to develop new capabilities and secure a substantial global market share for CCUS technologies. The government is clear that a vibrant and successful UK supply chain is key to creating and sustaining high-skilled, high-value jobs and supporting low carbon growth in industrial clusters. To achieve this, government and industry must work closely together to address key strategic issues and barriers to investment, enabling UK supply chains to realise the economic benefits of a new CCUS sector. CCUS can then unlock further economic opportunities in sectors that are dependent on CCUS technologies such as cement.

Announced in the Autumn Statement in November 2023, the Green Industries Growth Accelerator is a £960 million package which will bolster UK manufacturing capacity and strengthen supply chains in high opportunity sectors like low carbon hydrogen, CCUS, electricity networks, nuclear and offshore wind. Throughout 2024 we will work with industry to carry out market engagement and develop an appropriate delivery mechanism that will maximise the economic opportunity for the UK, support key strategic elements of the supply chain and sustain jobs across our industrial heartlands.

The CCUS industry, through the Carbon Capture and Storage Association (CCSA), published CCUS Supply Chain Good Practice Guidance in July 2023, [footnote 15] setting out its strategy to build a domestic supply chain for the deployment of the first Track-1 CCUS clusters, as well as for the subsequent ramping up of the UK’s CCUS industry to serve a major and growing international demand. The document sets out a series of industry-led commitments, including its approach to promoting UK supply chain opportunities, creating and sustaining jobs through CCUS projects and investment in training and skills. The guidance also sets out a pathway for delivering UK content ambitions in CCUS projects that are consistent with those put forward in the North Sea Transition Deal (NSTD), including a headline voluntary local content ambition of 50%.

The government welcomes this industry-led approach. It builds on our work over the last year to identify potential opportunities to build UK supply chains for CCUS and capture maximum economic value in the UK. We are also building our evidence base to understand where best to focus efforts to realise the maximum benefit. In July 2023, we published two studies on opportunities for economic growth in the UK’s CCUS industry [footnote 16] and industrial carbon capture, usage and storage supply chain capabilities. [footnote 17] The studies outlined that:

- The onshore equipment cost of delivering our ambition to capture 20 to 30 megatonnes (Mt) of CO₂ per year by 2030 could be in the order of £3 billion to £4.5 billion and that the UK supply chain has significant opportunities to deliver on a significant portion of this spend. The capital spend in a typical capture plant could include around £20 million spent on column vessels, £4 million on column internals and £2 million on heat exchangers. These components have been identified as high value opportunities in the CCUS value chain where the UK has the potential to hold significant capacity in their manufacture and fabrication.

Alongside the opportunities presented in the manufacture of key components, there are significant strengths for the UK in engineering design, construction and construction management services. The UK has a long tradition of providing these services, which make up a significant part of the CCUS supply chain. This therefore represents a major economic opportunity for the UK, playing to a nationwide strength in high value technical design.

The UK also has the potential to become a world-leader in the provision of CCUS packages. [footnote 18] The rapidly developing supply chain already contains several UK companies which offer capture packages for industrial customers. We anticipate the emergence of a wider range of companies with competitive offerings as the sector continues to grow.

We are working to improve how we make best use of our offshore resources in an integrated way. The NSTA has launched the Energy Pathfinder [footnote 19] to provide real-time visibility of activity for new oil and gas field developments, decommissioning and projects to support the energy transition on the UK Continental Shelf (UKCS), including CCUS. This will help supply chain companies target the UKCS contract opportunities more effectively and give service companies confidence to invest in skills and new technologies.

The UK will also leverage its expertise internationally and generate significant economic benefits from exports. McKinsey analysis has found that CCUS uptake needs to grow by a factor of 120 by 2050 for countries to meet their net zero commitments, with some estimates ranging from 6 to 10 billion tonnes per annum of CO₂ captured. [footnote 20] There is a potential for £4 billion to £5 billion in Gross Value Added from UK CCUS exports by 2050, [footnote 21] which includes exporting our expertise and storage to other countries. The geology and the proximity to major emissions centres in north and west Europe provides the appropriate environment for the UK to lead this new industry to support international emissions reductions.

To capitalise on the UK’s world-leading potential, government and industry must work together to accelerate the supply of a skilled workforce for our low carbon sectors and provide support for workers in high carbon industries to transition into CCUS-related jobs. This is why we launched the CCUS Task and Finish Group, within the Green Jobs Delivery Group which has gathered evidence concerning the anticipated skills gaps, effectiveness of current industry and government support and future demand. This evidence will feed into the Green Jobs Plan, which government has committed to publishing in 2024 and which will inform future government interventions.

We will enable sectors to transition and develop a skilled workforce through support of the NSTD, a key commitment of which is to support the transition of existing parts of the oil and gas workforce to ensure that people and skills are transferable across the wider energy sector. [footnote 22]

To achieve this, government has supported the development of an Integrated People and Skills Strategy, which was published by the skills body OPITO in May 2022. [footnote 23] The Strategy identified the current lack of recognition of standards among different offshore energy sectors as a barrier inhibiting workers from pursuing opportunities across the offshore energy industry. Good progress is being made to address this by aligning cross-sector energy training, in particular, OPITO has been developing a digital energy skills passport with funding from the Scottish Government.

In addition, we will work to ensure that investors into the CCUS sector are aware of the benefits of Freeports, [footnote 24] including those looking to invest in the supply chain as well as along the value chain, including for instance in the next iteration of the CCUS Investor Roadmap, used with investors to showcase UK investment opportunities. [footnote 25]

An opportunity to advance CCUS internationally

CCUS is an essential component of a low-cost global transition to net zero. [footnote 26] By using CCUS to decarbonise, we can create a vibrant new sector that could create huge economic opportunities in the UK. We expect to see UK industry export goods and services helping the rest of the world to decarbonise.

To enable the advancement of CCUS globally, the UK government is convening and leading international engagement on CCUS through multilateral forums and bilateral relationships. Through this, we are committed to learning from others and sharing our own experiences of deploying CCUS, as well as working with others to resolve the barriers to large scale CCUS deployment. This participation in the international community includes the following:

-

The Clean Energy Ministerial (CEM) CCUS Initiative, which the UK co-leads. This aims to accelerate investment and facilitate knowledge sharing in CCUS. As co-lead, we contributed to several CCUS events at the 14th CEM in Goa, showcasing the work done to date on CCUS as well as thinking through the key challenges for scaling up the sector.

-

The Zero Emissions Platform [footnote 27] (ZEP), which facilitates CCUS collaboration between countries in Europe.

-

A Contracting Party member of the International Energy Agency’s Greenhouse Gas Research and Development Programme (the IEAGHG), through which we collaborate with international governments and industry stakeholders to further the development of CCUS globally.

-

A member of the North Sea Basin Task Force, which aims to develop common principles for developing, managing, and regulating the transport, injection, and permanent storage of CO₂ in the North Sea area. It includes members from Denmark, Flanders, France, Germany, the Netherlands, Norway, and the UK.

-

Co-sponsors of the global Carbon Management Challenge (CMC), which will set a collective, global ambition for carbon management. Ten countries launched the CMC at the April 2023 Major Economies Forum to accelerate the scaleup of CCUS and greenhouse gas removals as necessary complements to the deployment of other zero-carbon technologies and energy efficiency. We are working alongside countries across the globe, to drive the challenge forward. As well as working multilaterally, we work directly with several countries to exchange experiences of deploying CCUS and to unlock key investment opportunities. As a result, we are well placed to work with international partners to ease obstacles to progress and open up exciting global opportunities.

This Chapter has outlined the wide-ranging opportunities which could be afforded to the UK by the successful development of its CCUS sector. As outlined, these include unlocking economic opportunity by creating jobs and driving growth; aiding the UK in achieving its net zero goals; expediting the development of UK supply chains and improving the global development of CCUS technologies. The section which follows – Chapter Two – will lay out a pathway by which to realise these opportunities: a three-phase vision for the delivery of a self-sustaining CCUS sector.

Chapter 2: Our Vision for Creating a UK CCUS Sector

Our vision is to make the UK a global leader in Carbon Capture Usage and Storage (CCUS), creating a self-sustaining CCUS sector that supports thousands of jobs and reduces emissions to ensure a better environment for future generations.

The vision can be broken down into four guiding principles for the CCUS sector.

-

Decarbonising for future generations: aligning to a carbon budget compliant CO₂ abatement pathway.

-

Global leader: exporting the UK supply chain to help other countries build CCUS, as well as using UK CO₂ stores to sequester other countries’ emissions.

-

Creating growth and supporting levelling up: creating low carbon inward investment opportunities through support for a UK CCUS sector.

-

Building a self-sustaining CCUS sector: increasing private sector confidence in a growing CCUS market that leads to a reduction in government support.

Making this vision a reality will require close collaboration between government and the private sector to create a new UK CCUS sector. We envisage a three phased approach to developing the sector in the UK, where the government and private sectors’ respective roles change and evolve over time:

Phase 1 – Market Creation: Getting to 20 to 30 megatonnes per annum (Mtpa) CO₂ by 2030

During Phase 1, government’s role is to provide the leadership necessary to create an enabling environment for the sustainable long-term deployment of CCUS. The UK aims to have four CCUS clusters by 2030, each of which will contain projects spanning multiple capture sectors (subject to the successful conclusion of negotiations). This will put us on a course to meet our net zero targets and our sectoral decarbonisation ambitions. In this phase the government has selected or intends to select clusters and capture projects through the CCUS cluster sequencing process, with government funding allocated via bilateral negotiations. The cluster approach is intended to spread the cost, as well as making the transport infrastructure more cost efficient as it can be used by a larger number of industrial emitters. [footnote 28]

We have announced up to £20 billion of funding for early deployment of CCUS, which we expect to crowd-in billions of pounds of additional private capital, creating jobs and bringing investment to our industrial heartlands. To enable private sector investment, the government has developed CCUS business models and created an economic regulatory regime through the Energy Act 2023. The framework is designed to provide the long-term certainty needed to establish and scale up CCUS across the UK, including by offering protection to investors for specified high-impact low-probability risks that the market is currently unable to bear. Our approach to the economic regulation of CO₂ transport and storage is designed to be flexible, allowing for the gradual reduction of government support as the market matures whilst recognising that, at least initially, the early CO₂ transport networks will have monopolistic characteristics which will require an independent economic regulator.

We are working with a range of regulatory bodies to enable a fit-for-purpose regulatory framework. These bodies, all of which are vital to the delivery of CCUS, include the Office of Gas and Electricity Markets (Ofgem), the North Sea Transition Authority (NSTA), the Offshore Petroleum Regulator for Environment and Decommissioning (OPRED), the Health & Safety Executive (HSE), the Environment Agency, Natural Resources Wales and the Scottish Environment Protection Agency.

Phase 2 – Market Transition: The emergence of a commercial and competitive market

In Phase 2, we envisage the emergence of a commercial and competitive market. Cost reductions due to the maturity of CO₂ transport networks, technological developments and the de-risking of CCUS through government intervention in Phase 1 – alongside market factors such as the UK Emissions Trading Scheme (UK ETS) – will mean a reduction in the need for government funding.

From 2030, there will be a need for a continued ramp up in delivery of CCUS across multiple sectors of the economy and locations in the UK. This will require us to adapt our approach, placing an emphasis on speed and scalability with a move away from the government-led cluster sequencing approach to establishing clusters in Phase 1. We anticipate CCUS will have been de-risked and, for this reason, the private sector will be able to take on the risk for new CCUS projects, something it is currently unable to do.

The regulated asset base model of economic regulation for CO₂ transport and storage will remain in place during Phase 2, providing investors with long-term revenue certainty and allowing an independent economic regulator to address market failures associated with the natural monopoly characteristics of the infrastructure. We envisage there being a new process for the allocation of economic licences for CO₂ transport and storage, and the ability to grant licences transferred to Ofgem, as provided for by the Energy Act 2023.

During this phase industry will have become accustomed to working collaboratively to align timing needs for the development of capture projects with the need to access transport and storage services. During this period storage appraisal will be accelerated. CO₂ transport and storage operators will be transparently promoting their storage capacity and industry stakeholders will have increased confidence in CO₂ storage, driving further growth across the CCUS value chain.

Where funding support for emitters is still required, there will be a transition from the current approach of awarding all carbon capture contracts based on an assessment process and subsequent bilateral negotiations to one which is more streamlined and based on a competitive allocation process for the majority of projects. Where capture projects no longer require government subsidy and network capacity allows, government would look to become less involved in the process of allocating storage capacity, as emitters would seek to connect directly to a CO₂ transport network.

To ensure that all sectors can decarbonise, we will need to expand the CO₂ transport network, for both pipeline and non-pipeline solutions, to meet the evolving needs of users. During this period international CO₂ import networks would be enabled. We also anticipate that an approach to strategic coordination for CO₂ transport networks will be established.

Phase 3 – A self-sustaining CCUS market from 2035: Meeting net zero in 2050

By Phase 3, we envisage market conditions having emerged that allow for a self-sustaining CCUS market. We envisage a mature CCUS system incorporating different transport pathways, pipeline and non-pipeline, that can capture sufficient CO₂ to contribute to net zero whilst offering storage services to international emitters. During this phase, international companies would want to relocate to the UK to connect to a UK CCUS system. UK supply chains would assist other countries to accelerate and lower the cost of getting to net zero by helping other countries to use CCUS where necessary.

In transport and storage, we anticipate different ownership structures emerging as the market determines the most efficient model. Although we anticipate that onshore CO₂ transport networks will retain monopolistic characteristics, and therefore still be subject to economic regulation, the growth of storage capacity may lead to CO₂ stores providing competitive pricing as well as requiring adapted or reduced economic regulation.

Whilst we envisage that UK capture projects would have the potential to access multiple storage sites through multiple transport modes, we envisage a process for making new connections would be market-led and independent of government. In a market-led economy – in which value is attributed to capturing and storing carbon – the cost of capturing CO₂ would fall, allowing the CCUS sector to become self-sustaining and largely free of government support.

We have made good progress with the first phase of establishing a CCUS sector. However, transitioning from this to the second and third phase will require new policies that will see the role of government and the private sector evolving. Successful industrial cluster decarbonisation should result in clusters that are internationally competitive, enabling the decarbonisation of the supply chains and improving the value of products and services sold. [footnote 29]

The remainder of this document sets out the progress we have made with Phase 1, before outlining the steps we will be taking to transition to Phase 2. In so doing, it outlines how we plan to deliver on our long-term vision for a self-sustaining CCUS sector in the UK.

Figure 3: CCUS Market Phases

| Market creation phase: until 2030 | Market transition phase: 2030 – 2035 | Self-sustaining market phase: 2035 onwards | |

|---|---|---|---|

| Storage | Storage sites for first 4 clusters appraised and operational. Policies implemented to accelerate storage appraisal and development. | Increased confidence in CO₂ storage drives further growth across the CCUS value chain and leads to a pipeline of storage development and more stores becoming operational. | UK stores providing competitive pricing solutions and storage. Portfolio of stores is being developed to enhance competition and storage resilience. |

| Capture sectors | First CCUS deployment across all sectors: Industrial emitters, gas power plants, bioenergy power plants, greenhouse gas removal technologies, energy from waste, hydrogen and sustainable aviation fuels. | Continued CCUS deployment across all sectors: Industrial emitters, gas power plants, bioenergy power plants, greenhouse gas removal technologies, energy from waste, hydrogen and sustainable aviation fuels. | Continued CCUS deployment across all sectors but particular growth in GGRs: Industrial emitters, gas power plants, bioenergy power plants, greenhouse gas removal technologies, energy from waste, hydrogen and sustainable aviation fuels. |

| Networks | Four expanding CCUS clusters, a clear process for third party access arrangements, compatible across the Code, Licence and relevant legislation. | CCUS network expands and strategic coordination for CCUS networks. | CCUS system operational capable of meeting CCUS Net Zero contributions and importing CO₂. Increasing competition and resilience in the system. |

| Modes of transport | Pipelines and development of non-pipeline transport (NPT) projects underway, with projects becoming eligible for allocation process. | The introduction of NPT – road, rail and shipping. International imports enabled. | Full domestic and international transport modes in practice, in conjunction with competitive storage solutions. NPT is enabling the development of a CO₂ storage market. |

| Government Support | High levels of government support and leadership, government selects clusters with funding allocated through bilateral negotiations, competitive allocation of capture contracts commence at the end of this phase. | Reduced government support and diminishing need for government support packages and government allocates capture sector contracts competitively. | Low levels of government support as market developments significantly reduce the need for government funding and capture projects negotiate contracts with stores without government involvement. |

| Regulation | Energy Act, CCUS business models, and regulatory bodies establish regulatory framework for CCUS. | Ofgem allocates economic licence and emerging new economic models for transport and storage of CO₂. | Mature regulatory framework for CCUS, appropriate regulation for monopolies. Entire value chain unbundled and market determines most efficient economic models. |

| Economic Growth | Supply chains established with growth centred on first clusters, government funding crowds in billions of pounds of private capital, identification of early export opportunities. | As the market matures, private sector investment increases and facilitates economic benefits, such as job creation, exports and further investment in our industrial heartlands. | Supporting the creation of jobs, growth in our industrial heartlands and world leading CCUS supply chain with strong export line. |

| Public Perception | Increasing awareness of CCUS, key phase for public engagement. | Growing acknowledgement of the CCUS sector and support for its benefits. | Widespread public support for the CCUS sector and benefits. |

| Assumptions | ETS price signal High CCUS costs Market failures associated with first of a kind technology |

ETS price signal and other carbon management policies CCUS costs lower Demand side policies emerge Developing low carbon products market |

ETS price signal and other carbon management policies CCUS costs reduce further Demand side policies increase Mature low carbon products market |

Chapter 3: Phase One – Market Creation up to 2030

We have set the ambition to create four Carbon Capture Usage and Storage (CCUS) enabled clusters and store 20 to 30 megatonnes per annum (Mtpa) of carbon dioxide (CO₂) by 2030. In those clusters, low carbon industry, power generation and hydrogen production will be realised. New industries around greenhouse gas removal and sustainable aviation fuels will also emerge.

UK CCUS deployment is driven by specific 2030 sector ambitions, as outlined in the UK Net Zero Strategy and UK Hydrogen Strategy. The UK has a comprehensive set of ambitions, targets and commitments in place designed to drive UK CCUS deployment pre-2030 and beyond. These include:

-

Bringing forward multiple additional power CCUS projects by 2030 to put us on track to decarbonise the power sector by 2035, subject to security of supply.

-

Capturing 6 Mtpa of CO₂ from industry and at least 5 Mtpa of CO₂ from engineered Greenhouse Gas Removals by 2030.

Deployment of CCUS also assists in achieving several other government sector targets. Development of CCUS-enabled hydrogen supports our ambition of having up to 10 Gigawatts (GW) of low carbon hydrogen production capacity by 2030. The forthcoming sustainable aviation fuel (SAF) mandate has a target of reaching at least 10% SAF in the jet fuel mix by 2030; which will require a CCUS contribution.

CCUS projects are large-scale infrastructure projects which take many years to develop. They involve the establishment of complex stakeholder relationships and collaboration between many parties across several regulatory regimes. In this first phase of deployment of CCUS, government is providing the leadership necessary to create a sustainable CCUS sector which will deliver longer-term economic benefits for the UK.

Cluster sequencing and cluster expansion

In 2021, the government launched the CCUS cluster sequencing process: a cluster selection process which is structured into two ‘Tracks’. Subject to the conclusion of negotiations, our ambition is for Track-1 to deliver the first two CCUS clusters in the UK. The selected Track-1 clusters of HyNet and the East Coast Cluster are under negotiation. In March 2023 negotiations commenced with 8 potential capture projects within these two clusters. In the East Coast Cluster, the potential capture projects are Net Zero Teesside Power, H2Teesside and Teesside Hydrogen CO₂ Capture. In the HyNet Cluster they are Heidelberg Materials Cement Works Carbon Capture and Storage Project, Viridor Runcorn Industrial CCS, Protos Energy Recovery Facility, Buxton Lime Net Zero and Essar Energy Transition Hydrogen Production Plant. Government’s ambition is to start supporting the Track-1 CCUS clusters from the mid 2020s.

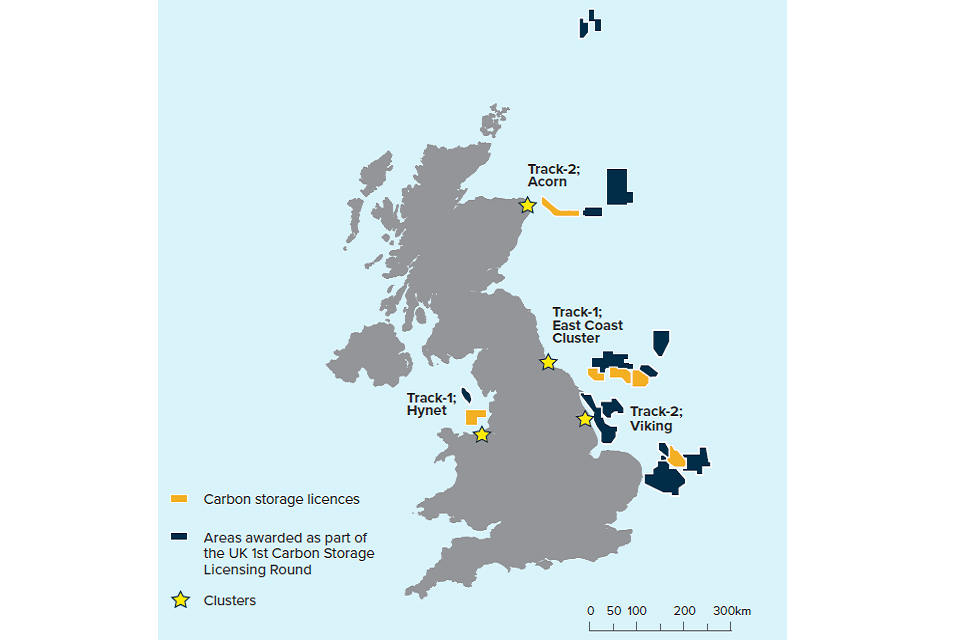

In July 2023, the government announced that the licensed stores and their respective transport and storage systems of Acorn in St Fergus, Scotland and Viking CCS project in Humber, England, were selected for Track-2 development. Our Track-2 aim is for the two additional clusters by 2030, incorporating lessons from Track-1. As outlined in the Track-2 Market Update, in early 2024, government will ask Acorn & Viking to submit plans for assessment of an ‘anchor phase’ of initial capture projects provisionally targeting deployment from 2028-29, subject to technical feasibility, affordability, and value for money. To provide context, government will also request that Acorn & Viking provide a provisional cluster expansion plan for a ‘buildout phase’ of additional network and storage expansion to enable additional projects. The anchor plans would need to be consistent with the requirement for the credible demonstration of connecting via pipeline to at least two projects for an initial phase of capture and enabling future phases of store and network expansion to enable both additional piped and non-pipeline transport (NPT) projects.

To further strengthen the Track-1 CCUS clusters we are launching a Track-1 expansion process in parallel to this document. This expansion process is initially designed to utilise further storage capacity within the HyNet cluster and will be developed to support further expansion of the East Coast Cluster in due course. By opening the Track-1 Expansion HyNet Process application window, full CO₂ transport network capacity is expected to be reached in 2030. Next to industry, power and low carbon hydrogen emitters greenhouse gas removal companies are also eligible to apply to Track-1 expansion. Users who are not requesting direct government CCUS support are also eligible to apply. These ‘unsupported users’ show that the UK is serious about transitioning to a self-sustaining CCUS market.

Organising for delivery

The successful collaboration of many parties across several regulatory regimes, and between the public and private sectors, will be critical to the success of enabling a sustainable CCUS sector. That is why as part of our delivery model we have established government-led Cluster Working Groups made up of government, capture projects, CO₂ transport and storage companies and regulatory organisations such as the North Sea Transition Authority (NSTA), the Office of Gas and Electricity Markets (Ofgem), the Health and Safety Executive and the Environment Agency. The aim of these working groups is to drive the development of collaborative solutions to the challenges that arise in delivering infrastructure projects of this complexity.

In developing our model to enable the delivery of CCUS and build the structures necessary to achieve our carbon budget targets, we have drawn on the expertise of the UK’s Infrastructure Projects Authority (IPA). The IPA is the government’s centre of expertise for infrastructure and major projects delivery. We are drawing on the IPA’s expertise as we recognise the importance of CCUS in delivering government’s ambitions and the delivery complexity associated with the deployment of CCUS.

Figure 4: CCUS Track-1 and Track-2 Process

Case study – Acorn: the catalyst for industrial decarbonisation in Scotland and beyond

Acorn is a joint venture between Acorn Partners Storegga, Shell UK, Harbour Energy and North Sea Midstream Partners.

Acorn proposes to play a major role in helping the UK and Scotland meet their net zero commitments, allowing industry to decarbonise while protecting and creating jobs. Re-purposed oil and gas infrastructure will be used to transport captured CO₂ emissions to permanent geological storage 2.5 kilometres under the North Seabed. The CO₂ will come from the Scottish Cluster, a collection of industrial, power and hydrogen businesses in Scotland’s Central Belt and North East. Acorn is also working to develop a blue hydrogen production facility at the St Fergus gas terminal, while its proximity to Peterhead Port could support broader domestic and international decarbonisation, with CO₂ being shipped into a dedicated terminal before onward transfer to the Acorn storage facility.

In July 2023, Acorn was selected by the UK government as one of two transportation and storage systems best-placed to deliver the government’s Track-2 objectives. In Track-1, Acorn is also a reserve cluster. As one of the four CCUS clusters, Acorn is expected to make a significant contribution to reach the UK’s target of 20 to 30 Mtpa CO₂ by 2030 and part of the 2 new CCUS clusters that together have the credible potential to store at least 10 Mtpa CO₂ by 2030 through a range of carbon capture projects.

Creating an economic regulatory framework for CCUS

Lessons have been learned from previous attempts to develop CCUS in the UK, including the issues of risk allocation that affect the deployment of CCUS in clusters. We have overcome this issue through the development of targeted commercial and economic regulatory frameworks. The frameworks have been developed through extensive engagement and collaboration with representatives from the many sectors and industries for whom CCUS is critical to achieve their decarbonisation objectives.

These regulatory frameworks are designed to address what are known as “cross-chain risks”. These risks are defined as risks where the acts or omissions of one party may cause a cost or negative impact to another. It is appropriate (subject to subsidy control and value for money) for government to play a role in mitigating some of these risks due to the nascent stage of the sector.

As CO₂ transport and storage networks are likely to be operated as natural regional monopolies, encompassing a range of different network users and emitters, operating under different commercial models, a framework of economic regulation is appropriate to protect network users from anti-competitive behaviours, including monopolistic pricing. The Energy Act 2023 establishes the legislative framework for the economic regulation of CO₂ transport and storage, with Ofgem as the independent economic regulator. This is described in more detail in the Annex. The Energy Act also establishes the primary legislative framework for the Industrial Carbon Capture, Greenhouse Gas Removals and Low Carbon Hydrogen Production business models. The framework is designed to:

-

attract private finance,

-

remove market barriers to investment, and

-

provide long-term revenue certainty to establish and scale up these industries across the UK.

The business models are tailored to different CCUS sectors and form the groundwork for the eventual commercialisation of the new industries, as they are designed to reduce government support over time. The business models include:

-

the Industrial Carbon Capture (ICC) and waste business models to de-risk deployment and provide ongoing revenue support for industrial and waste management emitters to decarbonise;

-

the Hydrogen Production Business Model to incentivise investment in new low carbon hydrogen production and encourage users to switch to low carbon hydrogen by making it a price competitive decarbonisation option [footnote 30]

-

the Dispatchable Power Agreement (DPA) contractual framework for power CCUS which will enable the deployment of flexible low carbon power to complement renewable electricity and nuclear power;

-

the power Bioenergy with CCS (power BECCS) business model, which will be a dual Contract for Difference rewarding negative emissions and the low carbon electricity co-product; and

-

the Greenhouse Gas Removals (GGRs) business model which will reward negative emissions to attract private investment and accelerate commercial deployment of a range of GGR technologies. [footnote 31]

The Energy Act 2023 sets out the powers and duties given to Ofgem as the economic regulator for CO₂ transport and storage and makes provision for government financial support. The support packages developed are described in more detail in the Annex. The Act allows for a new transport and storage economic licence allocation process to be established, once the cluster sequencing process is complete. At this point it is expected that the responsibility for granting transport and storage economic licences for CO₂ network operators will pass to Ofgem, provided the market is sufficiently mature and subject to the necessary secondary legislation being in place. The Energy Act 2023 also allows for different types of economic licences for CO₂ transport and storage to be created as the market develops and competition emerges.

Government is also working in close cooperation with CCUS delivery partners to develop a clear and effective CCS Network Code. This sets out the commercial, operational and technical arrangements for use and growth of the CO₂ transport and storage system. Following its implementation, the CCS Network Code can be further developed by industry as the CO₂ transport networks mature. The code includes governance arrangements that set out roles, responsibilities and processes around modification, including for non-parties who have a significant/material interest in its future shape and function. Third party access to transport and storage infrastructure will be governed by provisions in the economic licence and CCS Network Code. A legislative basis for access rights will be provided where needed by the Access to Infrastructure Regulations, which will have been reviewed to ensure they remain fit for purpose for CO₂ transport and storage infrastructure into the future.

Chapter 3 has laid out the features of the first phase of development for the UK CCUS sector: the market creation phase. As noted, government intends to establish four CCUS clusters during this first phase. It outlines government’s intention to collaborate closely with industry and regulatory bodies to deliver this phase and the legislative framework for the regulation of CO₂ transport and storage. The section which follows – Chapter 4 – will set out government’s vision for Phase 2 of the development of the UK CCUS sector: the market transition phase.

What is the Industrial Decarbonisation Challenge?

The Industrial Decarbonisation Challenge (IDC) is a £210 million programme, matched by £261 million from industry, and delivered by UK Research and Innovation (UKRI). The challenge is comprised of three strands:

(1) Deployment projects: The deployment projects have produced the engineering designs, simulations, commercial arrangements and impact assessments required to underpin the infrastructure needed to enable the deep decarbonisation of key UK industrial clusters. The projects comprise a mix of onshore projects that include pipework, gas compression, hydrogen production, gas storage and carbon capture, and offshore projects that include offshore storage of CO₂ and offshore pipework.

(2) Cluster Plan projects: Cluster Plans have been developed in the North West, Humber, Teesside, the Black Country, Scotland and South Wales, setting out how Net Zero targets can be achieved. These plans have also contributed to the development of a UK Wide Cluster Plan, which sets out how the UK can harness the power of the industrial clusters and drive the next phase of emissions reductions.

(3) Industrial Decarbonisation Research and Innovation Centre (IDRIC): IDRIC has over 60 research projects addressing key challenges / pathways for industrial decarbonisation. These projects support technology development and the creation of a positive enabling environment for industrial transition in the UK.

The IDC projects have provided the genesis for the development of the CCUS industry in the UK by readying the technology and path to net zero for the UK’s industrial clusters. In addition to this, supply chains, engagement with the local cluster communities and understanding of the skills needed to support the CCUS industry have grown through the development of the projects. Crucially, the IDC has encouraged and facilitated knowledge sharing, laying the foundation for collaboration both within and between clusters that is required to accelerate the cost-effective development of the CCUS industry.

UKR&I: The legacy of the Industrial Decarbonisation Challenge

Meeting Net Zero Targets

The Industrial Decarbonisation Challenge (IDC) is supporting the UK’s six largest industrial clusters to decarbonise at scale, reducing their emissions to meet world-leading net zero targets.

Driving clean growth and inward investment

Funding of cluster decarbonisation is drawing inward investment to the regions and can provide established British manufacturers with new, clean growth opportunities.

Protecting jobs and developing skills

Without industrial decarbonisation, a growing number of jobs in industry will be at risk. IDC has stimulated retraining and green skill development to underpin a revitalised UK industry.

Enhancing energy security

By supporting the development of decarbonised power facilities, the IDC is improving the UK’s future energy security.

Nurturing innovation and supply chains

Clean growth within the clusters is stimulating the development of innovative technologies in and beyond the clusters. These provide early, clean growth supply chain opportunities domestically and internationally.

Growing international trade and exports

IDC has fostered sharing between industrial partners to enable the UK to become a world leader in industrial decarbonisation to export skills and expertise, alongside longer-term opportunities to import CO2 for storage or to export hydrogen to Europe.

Document includes a map showing the position of the Scotland, Teesside, Humber, North West, South Wales and Black Country clusters.

Chapter 4: Phase Two – Market Transition

The emergence of a commercial and competitive market

The government’s ambition is to establish four CCUS clusters across the UK by 2030, with projects delivered across a range of sectors. Beyond 2030, a significant ramp up in deployment of CCUS will be required to further support individual sector decarbonisation routes and deliver the expected contribution to Carbon Budget 6. By the mid 2030s, the amount of CO₂ annually stored may need to increase to at least 50 megatonnes per annum (Mtpa). [footnote 32] To achieve this, it is likely that the CCUS sector will need to increase the annual amount of CO₂ stored by at least 6 Mtpa from 2031. Delivering this increase will require an evolving approach, placing emphasis on speed and scalability with a move away from the approach used to establish the first four clusters – subject to affordability and value for money. Less government intervention will be required to enable the establishment of new CO₂ transport networks and network expansion, meaning that industry will have to work collaboratively to align the timing between the capture projects and transport and storage networks.

During the market transition period, international CO₂ import networks will be enabled and storage appraisal will be accelerated. In this period, the market conditions will have changed due to growing confidence in CCUS technology and the de-risking of CCUS through existing government intervention in the first four clusters. This, together with developments in areas such as UK Emissions Trading Scheme (ETS) and potential mechanisms to mitigate carbon leakage, will mean a greater role for the private sector and a reduction in the need for government funding and support. Where funding support for capture projects is still required, there will be a transition to a process based on competitive allocation.

Taken together, these changes will enable the required expansion of the sector, provide support to individual sectors’ decarbonisation pathways and make significant progress in establishing a CCUS sector largely free of government support. Developing and embedding these changes in the CCUS market will be a multi-year, multi-stage process; further work is needed by government and industry to take this forward.

Figure 5: UK Government CCUS Roll Out Range of Ambitions

We anticipate that the key developments required to deliver this more market-led approach are:

-

Establishment of a new process for the allocation of economic licences for CO₂ transport and storage, and the ability to grant licences transferred to Ofgem, as provided for by the Energy Act 2023. Ofgem will carry out its functions in relation to the regulation of CO₂ transport and storage in line with its principal objectives and statutory duties established in the Energy Act. This will allow for the efficient and economical expansion of CO₂ transport networks, ensuring the interests of both current and future users of the networks are protected, and having regard to statutory carbon budgets and targets across the UK.

-

Capture contracts to be allocated through a more competitive process to accelerate the pace and scale of deployment and incentivise cost reduction. Regular scheduled allocation rounds, with the initial round expected around 2027.

-

Familiarisation with onshore and offshore CO₂ transport networks and increased competition in segments of the CO₂ transport and storage chain will allow new economic models for transport and storage to emerge, resulting in the evolution of the economic regulation of CO₂ transport and storage.

-

Existing business models for transport and storage and for carbon capture projects will continue to evolve to reflect a more market-led approach and the increased role that the private sector will play in managing cross chain risks.

-

Increasingly streamlined leasing, licensing and permitting processes across regulatory bodies will be developed, with the aim of accelerating subsurface storage appraisal. This will support the pace and scale of carbon storage appraisal required.

-

Non-pipeline transport (NPT) will be operational both onshore and offshore, linking emission sources with permanent geological storage. The government has been engaging closely with industry on the potential options for NPT and how these might be integrated into the wider CCUS landscape. To support industry in their work, the government will shortly publish a call for evidence on how it envisages NPT to be delivered in the UK. We anticipate that NPT projects will be eligible for selection as capture projects from 2025 onwards.

-

Consideration of the strategic direction for CO₂ transport networks, including developing an understanding of the degree of strategic co-ordination needed and any potential role for the Future System Operator.

-

Enabling the import of CO₂, to allow the UK to benefit from its strategic advantages, helping to lower costs to UK CO₂ transport network users and stimulating growth of Transport & Storage (T&S) infrastructure, which in turn will provide critical support for meeting our domestic CO₂ storage targets. The government will also explore the potential role of CO₂ exports in providing increased resilience in the UK CCUS sector.

-

Increasing market maturity will reduce the need for government support. Growing confidence in the T&S business means that the need for support packages currently offered as part of the cluster sequencing process will diminish as the market matures and the availability and depth of CCUS commercial insurance products increases. All stakeholders have a common interest in establishing a successful merchant market model for the acquisition of new customers and network expansion as rapidly as possible.

-

Innovation and cost reductions facilitated by the development of the global CCUS sector, the development of UK ETS and increasing ability for costs to be recovered by businesses, will reduce the amount of government/consumer funding required for capture projects. The government will also continue to explore policy options (such as carbon take back obligations or carbon storage obligations) to increase the investability of CCUS and reduce the need for government support.

-

Review of the existing regulations regarding third party access to CO₂ transport and storage infrastructure to ensure they are fit for purpose.

Development of CCUS market frameworks

The government will launch a consultation in 2024 on the future market frameworks for CCUS. The intention will be to develop a scalable model to efficiently accelerate deployment whilst driving cost reduction and reducing the degree of government support. This consultation will include proposals on introducing enhanced competitive allocation for CCUS and how this will interact with the wider policy landscape such as energy, industry, hydrogen, negative emissions and low carbon product markets.

It is anticipated that the outcome of this work will enable us to move to a system of regular allocation rounds to enable operations of new stores and their capture projects from the early 2030s, but the decision on this, and the accompanying detailed policy required, will be subject to the aforementioned consultation. How expansion of existing stores will interact with this work will also need to be determined. This could mean a mechanism for allocating capture contracts being in place from around 2027.

Alongside a consultation on allocating capture contracts, a process for the future allocation of transport and storage economic licences would need to be developed, and the ability to grant licences transferred to Ofgem at the appropriate time, as provided for in the Energy Act 2023. This process would need to consider the relationship between the submission of a licence application and the timing of capture contract allocation, as well as the award of both capture contracts and the economic licence.

To be consistent with a Carbon Budget 6 timeline, a process for applications for new economic licences for transport and storage may need to be in place from 2025/6, so that CO₂ transport networks can be sufficiently designed to run an allocation round for prospective capture projects. This would mean that the future market design will consider how best to ensure projects are sufficiently mature from both a transport and storage, and capture project perspective. For example, it may be that to be able to participate in a competitive allocation process, capture projects would need to be sufficiently progressed with their engineering studies and planning and consenting. Consideration will also need to be given on how to align the allocation of new economic licences for transport and storage with development of new storage facilities under the North Sea Transition Authority CO₂ storage licensing regime. The process will also consider the coordination needed between the CO₂ transport networks and capture projects initially selected for designs to be finalised, investment decisions taken and construction to commence.

Any implemented competitive allocation process will need to be specifically designed for the complex and interconnected nature of the developing UK CCUS industry. It will need to address how different projects, sectors and non-pipeline transport projects may participate given their differences, any interactions with existing allocation processes and markets, how allocation processes should reflect sectoral decarbonisation targets and how to provide sufficient visibility and confidence to enable businesses to invest in developing their projects. The process will also need to consider how prospective transport and storage companies will have sufficient visibility on the supply of CO₂.

The new market framework is likely to require further legislation, establishment of an allocation body and setting up of a new delivery framework to effectively enable a series of regular allocation rounds. Business models for both capture projects and CO₂ transport and storage (which could include different models for onshore transport, offshore transport and storage) will also need to adapt.

Cost and Funding

The government has announced up to £20 billion for the early deployment of CCUS in the UK and aims to establish four clusters by 2030. As we move beyond those CCUS clusters, it is the government’s view that the level of direct government funding will be significantly reduced and that the 2030s will see a significant shift to a CCUS sector largely free of government support. This transition will be driven by investor confidence in the sector; cost reduction driven by technical and market innovations; operational delivery; developments in the UK Emissions Trading Scheme (ETS) market; the availability of commercial insurance products and other government policies that impact CCUS investability.

The move to a more market-led approach will support this shift, with the allocation of capture contracts driving cost reductions and increasing the visibility of CO₂ supply for Transport and Storage Companies (T&SCos). Industry is expected to play a major role by identifying and adopting new and innovative low-cost solutions across the value chain.

Increasing investor confidence in the sector

In setting out the approach to establishing a CCUS sector, the government recognises that potential transport and storage company operators require confidence in both the supply of CO₂ from users and the ability to manage potential liabilities associated with a leak of CO₂ from the geological store. The Revenue Support Agreement [footnote 33] and Government Support Package [footnote 34] are bespoke contractual arrangements currently being offered to the Track‑1 clusters, to protect investors and facilitate investment in first of a kind transport and storage infrastructure. The need for such arrangements will be monitored and kept under review as the sector develops, but there is an expectation that market based products will be developed to manage these risks.

In the coming years, the ambition is that four clusters will, subject to the successful conclusion of negotiations, progress to construction and operations, demonstrating the viability of the transport and storage business model. There has also been – via the development of cluster decarbonisation plans and the government’s Power, Hydrogen and Greenhouse Gas Removal policies – increasing certainty in the supply of CO₂ for potential transport and storage licence holders. Additional policies outlined in this document – including competitive allocation of capture contracts, non-pipeline transport models and enablement of CO₂ imports – will further increase investor confidence in the sector.

Taken together, these developments will provide sufficient commercial certainty for potential investors. As a result, it is the government’s view that the Revenue Support Agreement will increasingly no longer be required during this market transition phase. It is also expected that the scope of any Government Support Package will be focussed on managing the risk of CO₂ leakage from the geological store where commercial insurance is unavailable.

Reducing costs for CCUS

As the CCUS market develops, both in the UK and globally, it is expected that the cost of capturing, transporting and storing a tonne of CO₂ (£/tCO₂) will reduce. This is in line with the experience of many industries that have gone through a rapid expansion and is supported by the more than £346 million of UK government investment for research, development and demonstration CCUS projects from 2004 to 2021. It is expected that part of the cost reduction will come from decreasing financing costs as confidence in the investability of the CCUS sector increases. Additional cost reduction will be driven by technical and market innovations across the full value chain, with some example areas being:

-

The development of next generation capture technologies with lower energy penalties.

-

Advances in compression and liquification techniques.

-

The development of modularised capture plants to reduce upfront capex and ongoing opex costs.

-

Service market offerings, including capture as a service, to reduce ongoing opex costs.

-

Better utilisation of CO₂ transport networks.

The government expects the UK CCUS industry to continue to lead the research, development, demonstration and adoption of these technical and market innovations, with targeted innovation support continuing through appropriate government support.

In 2024 we will establish an industry working group on the identification and timely adoption of cost reduction opportunities.

The introduction of a market-led allocation of capture projects will promote the adoption of lower cost technologies and approaches to CO₂ capture, reducing its cost. The approval of transport and storage economic licences and future network expansions will also drive the adoption of lower cost solutions and optimal use of CO₂ transport networks, reducing the overall cost of transporting and storing CO₂. In addition, we expect the development of a CO₂ import market will reduce costs for UK users of the CO₂ transport networks and diminish the need for government support. Taken together, these changes mean that the overall level of government support will be significantly lower in the 2030s.

Research, Development & Demonstration (RD&D)

The UK government facilitates research, development & demonstration into CCUS through offering several opportunities, such as up to £210 million via the Industrial Strategy Challenge Fund; up to £115 million from the £1 billion Net Zero Innovation Portfolio (NZIP) to develop CCUS and carbon removal technologies in the UK; up to £18 billion private financial capacity available from UK Infrastructure Bank for sectors including Hydrogen/CCUS, and £176 million of funding for sustainable aviation fuels which has been allocated through a series of grant funding schemes.

Development of other policies to increase CCUS investability

Investment in the sector has, to date, been primarily supported by the UK ETS and the CCUS business models, regulatory framework and financial support programmes established by government. As the CCUS market develops, the government expects a number of policies to play an increasingly important role in supporting CCUS investment, with a corresponding reduction in the direct CCUS support required. It also expects that industry will actively work with government to develop additional solutions to increase the investability in CCUS.

The continuing evolution of the ETS market will be a key driver of investability in CCUS. In its recent report [footnote 35] on developing the UK Emissions Trading Scheme, the government reaffirmed that net zero sits at the heart of its plans, with the scheme acting as a foundation for a thriving, decarbonised economy through 2050 and beyond. As part of this the UK ETS Authority announced that:

-

From 2024, the UK ETS cap will be aligned with the net zero trajectory.

-

The UK ETS will be expanded to domestic maritime emissions in 2026; energy from waste and waste incineration in 2028; and to allow for the transportation of CO₂ through non-pipeline transport.

-

The UK ETS Authority will consult further, including on future markets policy and inclusion of greenhouse gas removal technologies.

Policies to address carbon leakage will support industry to invest in and realise decarbonisation now and in the future, improving the investment case for carbon capture. The government consulted on ‘Addressing carbon leakage risk to support decarbonisation’ earlier in 2023 and received over 160 responses. This exploratory consultation sought views and evidence from a broad range of stakeholders on potential policies to manage future carbon leakage risk including a carbon border adjustment mechanism (CBAM), mandatory product standards (MPS), and other policy measures to help grow the market for low carbon products, as well as embodied emissions reporting that could support the implementation of these policies.

On 18 December 2023, the government published its response to the consultation, announcing that it will:

-

Implement a CBAM by 2027, applying a charge on the carbon emissions embodied in imports from the following sectors: aluminium, cement, ceramics, fertiliser, glass, hydrogen, iron and steel.

-

Work with industry to establish voluntary product standards that businesses could choose to adopt to help promote their low carbon products to customers.

-

Develop an embodied emissions reporting framework that could serve future carbon leakage and decarbonisation policies.

These measures will be subject to further consultation in 2024.

The government is working with the CCUS Council [footnote 36] to explore the impact of introducing a Carbon Take Back Obligation or Carbon Storage Obligation on companies that extract fossil fuels. If such a policy was introduced, it could provide support for investment in the CCUS sector. This work is at an early stage and we will continue to seek to understand how wider policies such as this may support the transition to a sustainable CCUS sector.

Specific policies may also be introduced for individual sectors that support decarbonisation and the use of CCUS. For example, the government is introducing a mandate on fuel suppliers to supply sustainable aviation fuel (SAF) from 2025. Fuel suppliers will be awarded tradable certificates, with a cash value, for the supply of SAF. The government’s consultation in spring 2023 on how the mandate will operate proposed that certificates will be awarded proportionately to the greenhouse gas (GHG) emissions of their fuels, with the greenest fuels receiving the greatest awards. The consultation included a specific question on whether GHG reductions from CCUS be rewarded under the SAF mandate and whether this reward should extend to net negative emissions. The inclusion of CCUS in SAF production could allow emission savings to be maximised, with the potential of producing negative emissions. The government response to the consultation will confirm the final design of the SAF mandate, including how CCUS is treated under the mandate.

The production process of low carbon fuels for other transport modes, like road and maritime, may be able to utilise CCUS. We will conduct further work to establish the role of CCUS in these applications and how similar incentives for the use of CCUS can be attributed to these fuels in both existing schemes like the Renewable Transport Fuel Obligation and any future schemes for modes beyond road and aviation.

It is expected that advances in the policy areas outlined will reduce the need for direct government support though CCUS capture contracts.

CO₂ Transport Networks

This section sets out our vision for the development and deployment of CO₂ transport networks, outlining both the challenges and opportunities. To achieve our decarbonisation targets, we will need to increase the amount of CO₂ stored by at least 6 megatonnes per annum (Mtpa) from 2031 to 2035. To deliver these ambitions, we will need to ramp up the UK’s CO₂ transport infrastructure, linking emissions to permanent geological storage.