Operational guidance to implement a lifetime cap on care costs

Updated 16 January 2023

Applies to England

Executive summary

On 7 September 2021 the Prime Minister announced that from October 2023, the government will introduce a new £86,000 cap on the amount anyone in England will need to spend on their personal care over their lifetime. The reform will improve how social care in England is paid for and what care users should contribute. The result is what the government believes is a credible, deliverable and sustainable new charging system.

This consultation seeks views on the statutory guidance that sets out how the charging reforms would operate in practice, subject to Parliamentary approval. Feedback gained will be used to ensure it can be easily understood and is workable. Consultation responses will also be used to inform the government’s approach to supporting local authorities in their preparations for the reforms leading up to October 2023.

The new charging policy framework

At the heart of the reformed system is a cap on the amount that anyone in England will need to spend towards their personal care over their lifetime. The cap will be set at £86,000 in October 2023. This will provide financial protection from unlimited care costs and, as a result, give people peace of mind from knowing that they will keep more of their assets when paying for their care.

In addition, the reforms are increasing the point at which a person is eligible for local authority means-tested support. From October 2023 the upper capital limit (UCL) will rise to £100,000 from the current level of £23,250 and the lower capital limit (LCL) will increase to £20,000 from £14,250. This more generous means-testing limit means that more people will be eligible for some state support towards the cost of care earlier and reduces the amount that people will have to pay for their care each week. Anyone with assets under £20,000 will not have to pay anything for their care from their assets.

The amount of income that a person subject to the means test must be left with in applying the means-test – the ‘social care allowance’ – will rise in line with CPI inflation at 3% in April 2022.

Subject to Parliamentary approval, where the local authority is meeting a person’s needs, that is, where the local authority arranges the person’s care or provides financial support, they will meter based on what they are charged by the local authority to contribute towards their care costs, excluding any local authority support. Where the person fully funds and arranges their own care, they will meter based on what the cost would be to the local authority, if it were to meet their eligible care and support needs. This ensures the new system does not unfairly advantage those who can afford to pay more for their care and want to do so to reach the cap quicker.

To level the playing field between those who receive home care with those living in a residential care setting, under the capped system, after reaching the cap, everyone in residential care will remain responsible for meeting their daily living costs (DLCs), such as rent, food and utility bills. The component of a person’s care package attributable to DLCs will not count towards the cap on care costs. DLCs will be set as a national, notional amount, the equivalent to £200 per week in financial year (FY) 2021 to 2022 prices.

Implementing the new rules

The Care and Support Statutory guidance will be extended by 3 new chapters that will set out how the cap on care cost will operate in practice. See the accompanying document Implementing the cap on care costs: draft operational guidance.

The guidance clarifies that any type of service or support that meets an eligible need under the Care Act and is chargeable can count towards the cap. Support provided under other legislation will not count towards the cap.

A self-funder who arranges their own care will receive an independent personal budget (IPB), which will specify the amount the local authority would pay to their needs. In determining this, the guidance proposes that local authorities should follow the same principles as for direct payments that are already in operation. IPBs should be based, as far as possible, on the local authority’s best available up-to-date real-cost data and that where that is unavailable, local a ‘dummy purchasing’ process should be undertaken.

Local authorities should verify the spending of self-funders and can adjust a person’s accrued cost if they have not met their eligible needs. The guidance proposes a light touch approach to verification.

Facilitating greater choice is a key objective of the reforms. Government intends to lift current restrictions in legislation to enable everyone receiving local authority support to make additional payments for a preferred choice of accommodation, where affordable. These payments, known as ‘top ups’, will not count towards the cap. Local authorities should not be at risk of having to pay top ups in cases where the person becomes unable to pay. Therefore, while it is for the local authority to determine whether a person is able to pay, the guidance advises that they may consider a person as unable to pay if there is, for instance, a reasonable expectation that the top-up will not be affordable for the duration of the person’s expected care journey.

Furthermore, we are giving more people the option to benefit from their local authority’s expertise and support. Self-funders in domiciliary care are already able to request their local authority to arrange their care to meet their eligible needs. This right will be further extended to self-funders in residential care from October 2023. The guidance will tell local authorities that they must treat self-funders who ask their local authority to arrange their care like other users whose needs they meet under the Care Act 2014.

Care accounts will be used by local authorities to monitor people’s progress towards the cap. Care account statements will set out both a person’s current rate of progress towards the cap as well as total accrued cost. To ensure people are up to date with their progress towards the cap, care account statements should be sent every 6 months in an electronic format unless an alternative format works better for the individual.

Preparing for implementation

The Care and Support Statutory guidance will also include new guidance that sets out best practice expectations for local authorities to support them to prepare for these reforms in October 2023. See the accompanying document Implementing the cap on care costs: draft operational guidance.

This is to ensure that the transition to the new framework is smooth and effectively managed for the whole system, including people who use care and support, providers and local authorities.

This includes working to understand the likely changes in demand that will result from the reforms through self-funder populations; taking steps to raise awareness of the reforms, targeting where appropriate; and conducting ‘early’ needs and financial assessments of self-funders under the current system (newly falling under the means test or seeking to meter towards the cap) where appropriate from April 2023 onwards.

The introduction of reforms results in system and workforce capacity requirements for local authorities. Local authorities are required to understand and model the impacts for them and implement the required system upgrades (to account for cap and metering) and increase their workforce and operational efficiency as required (to meet additional demand for assessments and commissioning). We are working to support local authorities to meet these requirements centrally where appropriate.

1. About this consultation

1.1 Introduction

On 7 September 2021 the Prime Minister announced that from October 2023, the government will introduce a new £86,000 cap on the amount anyone in England will need to spend on their personal care over their lifetime. Introducing the cap will deliver a core recommendation of the 2011 Independent Commission on Funding of Care and Support.

The main purpose of this consultation is to seek views on the statutory guidance which sets out how a cap on care cost would operate in practice, as well as to inform how government can support local authorities in their preparations for its implementation from October 2023.

It is important that the guidance for local authorities is clear and operable so that local authority officials and other stakeholders are able to prepare successfully for implementation of this reform. To proceed straight to responding the consultation questions on the draft statutory guidance to implement the cap, continue to chapter 3, Implementing the new rules.

This chapter sets out the purpose of this consultation and how to respond to it.

Chapter 2, The new charging policy framework, explains the social care charging reforms, the underpinning rationale for change, and the intended impacts.

Chapter 3, Implementing the new rules, seeks stakeholders’ views on the draft guidance which explains how local authorities should implement the reforms set out in chapter 2 in practice.

Chapter 4, Preparing for implementation, seeks views on the draft guidance aimed at supporting local authorities in preparing for the implementation of the reforms in advance of October 2023. It also sets out the government’s plan to test implementation of the new rules with a few selected local authorities prior to October 2023.

1.2. What are the draft regulations and guidance underpinning the reforms?

The Care Act 2014 (‘the Act’) sets out the core legal duties and powers that underpin the care and support system. The Act also paved the way for the proposed charging reforms, with Section 15 of the Act containing provisions to create a cap on the costs of care.

The Act also contains powers which allow the government to make secondary legislation (regulations) that provide more detail on how the charging system should operate. This includes a set of regulations, made under section 15, which set the level of the cap and daily living costs as well as regulations which make provisions about care account statements, alongside amendments to existing regulations further described in 1.3. The statutory instruments will be laid before Parliament after the conclusion of this consultation exercise. We are not seeking views on the regulations as part of this consultation, but the regulations will reflect the overall the policy parameters and framework described in this document.

The reform package and draft regulations set out in this consultation document have been informed by the 2011 Commission on Funding of Care and Support’s recommendations as well as subsequent consultations in 2013 (Caring for our future: implementing funding reform) and 2015 (Care Act 2014: cap on care costs and appeals). The 2015 consultation was accompanied by draft statutory guidance.

This consultation presents an updated version of that guidance, incorporating the feedback from the 2015 consultation, as well as updates where the proposed approach in 2015 is no longer considered appropriate as the wider context has changed. The statutory guidance is intended to provide local authorities with the information they need to allow them to meet the legal obligations placed on them by the Act and the regulations. The Act imposes a legal duty on local authorities to act under the statutory guidance in exercising its functions under the Act.

Where the guidance uses the word ‘must’ it is a reference to a legal requirement in the Act or regulations. Where it uses the word ‘should’, it is a reference to expected best practice. Where it uses the word ‘may’ a local authority has legal or general discretion to act as it chooses (in line with public law obligations to act lawfully).

The legislation and guidance must be used by local authorities to carry out their duties to apply the social care charging rules locally. Additionally, people drawing on care and support, their families, representatives, the voluntary sector and providers of care and support should consider both to help them to understand the new charging system. The Local Government and Social Care Ombudsman and the courts should consider them in determining whether a local authority has acted within the law.

1.3. What will happen to the existing regulations and guidance under the Care Act 2014

The power to set a cap is already provided by the Act. Government intends to commence the provisions to allow for full implementation of a cap on care costs by October 2023 and most of the provisions relating to the cap on care in the Act will remain unchanged.

However, the government believes the cap, and the way that people meter (accrue costs) towards it, should operate differently to how the government envisaged in 2014. The government is amending Section 15 of the Act so that where a local authority is meeting someone’s needs, the costs that accrue towards the cap are the amount the individual is charged by the local authority towards the meeting of those needs. For an individual meeting their own needs, no amendment is being made and the costs that accrue towards the cap will be the amount their local authority would have paid to meet those needs.

The Act currently sets out that people who fall under the means test for local authority financial support would meter by their total eligible care cost irrespective of any local authority support they receive. The government believes that this is unfair because it means that 2 individuals with the same level of wealth and making the same contributions towards the cost of their care could potentially reach the cap at very different times, depending on their circumstances. The government believes it is fairer to people to meter towards the cap based on their financial contribution towards the cost of their care, while simultaneously ensuring the means-testing regime is sufficiently generous so as to ensure that people with modest assets will never have to spend as much as the cap. The government is therefore seeking to amend the Act to provide for this change, through clause 140 of the Health and Social Care Bill, which is currently being progressed in accordance with Parliamentary protocol.

Subject to the will of Parliament, the government also intends to make amendments to the Act of a technical nature to ensure the detailed mechanics of how people progress towards the cap are simple to understand and are fair for everyone. These changes, mainly in relation to personal budgets and independent personal budgets (IPBs) which are further explained in chapter 2, largely reflect the intentions of policy makers and Parliament when the Act was first enacted.

The draft statutory guidance is written to reflect the proposed changes to the Care Act.

Once the full legislative framework is in force in October 2023, it will leave the existing Care and Support regulations largely unchanged. There are, however, several regulations which will require changes, which will come into effect in October 2023.

Firstly, the Care and Support (Charging and Assessment of Resources) Regulations 2014 will be amended to extend access to means-tested financial support.

Secondly, amendments will be made to the Care and Support and After-care (Choice of Accommodation) Regulations 2014 to provide greater flexibility in allowing for first person top-up payments. Details of these changes are explained more fully in chapter 2 of this consultation document.

Thirdly, the Care and Support (Deferred Payment) Regulations 2014 will require amendment to allow for the revised lower and upper capital limits and introduction of the cap on care costs. These changes would increase the eligibility threshold of Deferred Payment Agreements, to allow more people to use them to ensure they are not forced to sell their home to pay for care in their lifetime.

Finally, the Care and Support (Direct Payments) Regulations 2014 will require alteration to extend direct payments to all residential care settings. A direct payment account can be used to combine a local authority contribution towards costs with that of an individual – the overall amount is then used by the individual to commission and pay for care. People who self-fund their care are able to continue to commission care themselves once they have reached the cap using this payment method from the local authority for their personal care costs.

Generally, none of the draft regulations referred to in this consultation will have any effect before October 2023. Some elements of these regulations may come into effect earlier for those local authorities that have been selected by the government and agreed to be ‘trailblazers’, allowing the department to test key aspects of charging reform before national roll out.

The care and support statutory (CASS) guidance issued under the Act will be expanded to provide guidance on the charging reform policies that will apply from October 2023. New chapters will be included on the cap on care costs, IPBs and care accounts. These 3 new chapters are the subject of chapter 3 of this consultation. Other consequential amendments to the CASS guidance will also be required, particularly in the chapters on personal budgets, charging and financial assessment and the annex on choice of accommodation. To allow respondents to consider the impact on the existing CASS guidance in full, the consequential changes that will be necessary are summarised in the section ‘Consequential amendments to the CASS guidance’ of the accompanying document Implementing the cap on care costs: draft operational guidance.

The CASS guidance will also be temporarily extended to include a dedicated chapter to help local authorities prepare for the implementation of the social care charging reforms in advance of October 2023. Following this consultation, the finalised guidance will replace chapter 23 of the CASS guidance (Transition to the new legal framework), which will be revised to reflect completion of the implementation of other sections of the Act.

We are consulting on this version of the CASS guidance because the government is making substantial and significant changes to that guidance. The government may choose to make further, less substantial, changes to the guidance in future without further formal consultation.

1.4 Purpose of this document

Through this consultation and beyond we seek to collaborate as widely as possible with stakeholders to further improve the guidance and our approach to implementation.

For the reforms to be successfully implemented, local authorities will need to fully comprehend and apply their core legal duties and powers under the new system. Similarly, for the guidance and the regulations to realise the Act’s ambitions for charging reform, people encountering the new system will need to fully understand the new policy framework, their rights and responsibilities, and how it benefits them. For that reason, it is critical that the statutory guidance is clear, comprehensive and operable.

To support the development of the updated guidance, we have worked with a dedicated group comprising local authority experts and representative bodies from organisations including:

- Local Government Association

- Association of Directors of Adult Social Services

- National Association of Financial Assessment Officers

- Solace

We are grateful for their expertise and input to date.

The feedback gathered through this consultation will be used to revise the guidance before publication in spring 2022. The guidance is designed to be iterative, therefore it will be regularly reviewed and improved prior to and following implementation in October 2023.

While the main focus of this consultation is to ensure the statutory guidance is fully understood and workable, we invite respondents to share their views about the approach we have taken to all aspects of the guidance.

1.5. Responding to this consultation

We will be accepting written submissions to the consultation until 11:45pm on 1 April 2022.

The easiest way to participate is by completing the survey.

Alternatively, you can submit your comments via email to chargingreformconsultation@dhsc.gov.uk.

To maximise opportunities for everyone to respond to this consultation we will continue to proactively engage with local authorities, stakeholder organisations and interested parties to raise awareness of this consultation and to encourage participation.

2. The new charging policy framework

2.1. Background

The case for reform

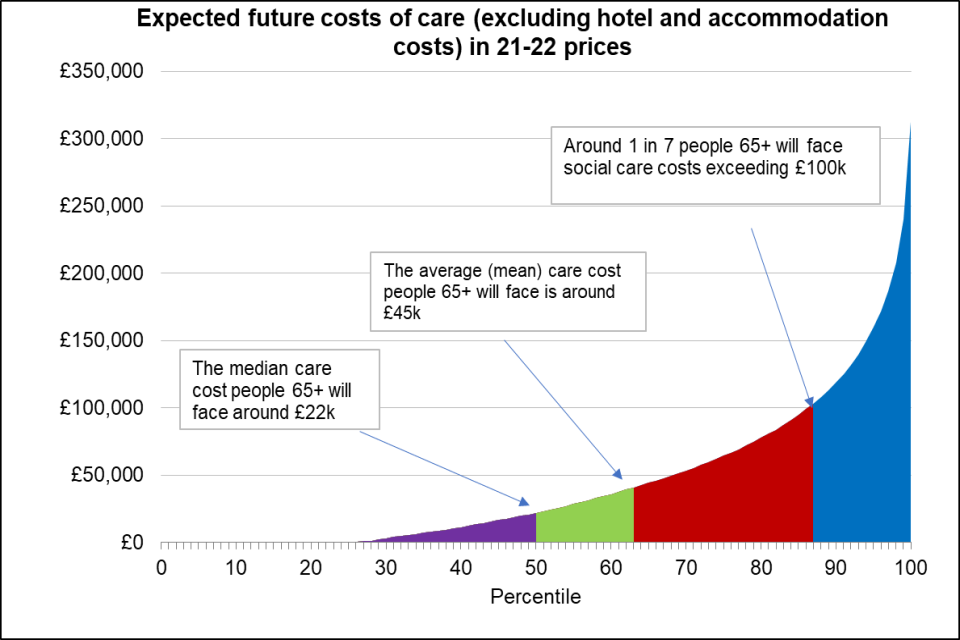

Care and support needs are unpredictable. Many of us will need some form of care and support over the course of our lives. Around 3 out of 4 adults over the age of 65 will face care costs in their lifetime. However, the amount we will be expected to spend will depend on the level of our needs. Some of us will be fortunate and spend a minimal amount, but 1 in 7 people will face care costs of more than £100,000, excluding hotel and accommodation costs (see figure 1). Roughly 1 in 10 individuals will face care costs above £120,000 over their lifetime.

Adult social care in England – unlike health care – is not free at the point of use. Support from the state is reserved for those with the lowest means. For everyone else meeting the cost of their care may mean spending everything they have, until they only have £23,250 of assets left. After that point, they receive some financial support from the local authority but continue to contribute to their care costs as far as they can afford to do so. This requirement to spend down your assets is often seen as unfair, particularly by those who have tried to plan and prepare for later life. It also creates fear that may delay people seeking the care they need at an early stage, as they try to preserve their assets to guard against the uncertainty of future care costs.

Figure 1: expected future lifetime costs of care for people aged 65 in FY 2010 to 2011, by percentile (2010 to 2011) in FY 2021 to 2022 prices, DHSC analysis based on Care Policy and Evaluation Centre (CPEC) modelling

Figure 1 shows that the median care cost for people aged 65 and over will be around £22,000; that the average (mean) care cost for people aged 65 and over will be around £45,000; and that around 1 in 7 people aged 65 and over will face care costs exceeding £100,000.

Paving the way for reform

For decades, successive governments have grappled with the question of how to reform the way that social care is paid for and what care users should contribute towards the cost of their care. In 2010, the government recognised that the current system for funding care and support was unfair and unsustainable and established the independent Commission on Funding of Care and Support. The Commission’s aim was to look into how the system of funding care and support in England could be changed to make it fairer. The Commission’s report identified that at the heart of the problem was the lack of an effective way for people to protect themselves from the risk of unpredictable care costs, as they would against other risks.

The Commission proposed a cap on the lifetime care costs that people face, supported by an extension to the threshold for means-tested financial support, and universal access to deferred payments. The then government accepted many of the recommendations, including capping care costs. The legal foundations for funding reform were included in the Act.

A universal deferred payment scheme run and administered by local authorities to allow individuals and their families to defer their care payments until the sale of their home has been in place since 2015. However, the main provisions of the Act introducing a cap on care costs were never enacted.

Ten years from the original Commission, inevitably priorities and challenges regarding the funding of social care are not the same as they were then. The new charging system as outlined in this document supports people in different ways, balancing how many people are supported and how, and the cost to the taxpayer. The result is what the government believes is a credible, deliverable, and sustainable set of reforms.

The reforms and how they will support people

The introduction of a cap on eligible care costs from October 2023 will, for the first time ever, limit the amount people will have to pay towards meeting their eligible care and support needs in their lifetime. The cap will be set at £86,000 in October 2023, which is equivalent to around 3 years of residential care. The level of the cap will be the same for all age groups.

The cap will provide people with more clarity about what they will be expected to contribute towards the cost of their care and what help they can expect from the state. This will not only bring much needed protection and peace of mind, but also certainty that will enable people to better plan, provide and prepare for possible future care needs.

The aim of the reforms is to create a fairer partnership between the person and the state to protect those with the highest needs from unlimited costs and to offer everyone peace of mind around the risks of needing care and support. The cap is key to achieving this, but it is not enough on its own. To truly meet this aim more financial support towards the costs of care is needed for those of modest wealth.

As recommended by the Commission, the reforms are increasing the point at which a person is eligible for local authority means-tested support. From October 2023 the upper capital limit (UCL) will rise to £100,000 from currently £23,250 and the lower capital limit (LCL) will increase to £20,000 from £14,250. As a result, many more people will get some government support as soon as they start to draw on care, and this will further reduce the level of asset depletion faced by people with modest wealth.

Once fully rolled out, the reforms mean government will support an extra 90,000 older care users at any time (360,000 today) compared to the current system. This is based on an additional 30,000 people benefitting from the changes to the means test only, and 60,000 benefitting from the cap (or cap and means test).

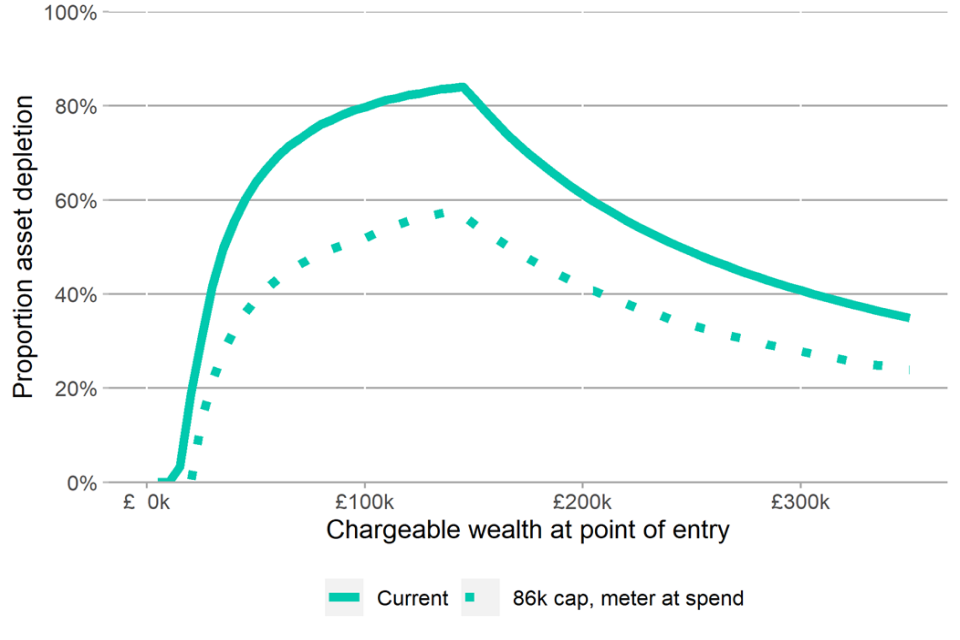

Figure 2 shows the impact that these reforms will have on the level of asset depletion people will face to pay for their care (based on the amount of assets they have when they go into care). The 2 lines show the asset depletion under the current system, and how it would change if we introduced the cap and the extended means-test.

In the current system, those of modest wealth (around £80,000 to £160,000 of chargeable wealth), face the risk of spending the highest proportion of their assets to meet their care and support needs. For example, someone with moderate levels of assets of £145,000 and median income of £239 per week could deplete around 84% of their assets over 5 years in residential care with care fees of £683 per week. Under the reforms this same individual would deplete around 57% over the same care journey and deplete around £40,000 less from their assets. It is for these people that the cap and extended means test provides the greatest protection.

Figure 2: possible asset depletion for people who spend 5 years in a care home with local authority care home rate of £683 per week in current system and reform system

Source: Based on DHSC modelling of an individual with an average weekly income for older adults of around £239 per week at the average local authority rate of around £683 per week and 5 years in residential care, by initial level of chargeable wealth (FY 2021 to 2022 prices).

While people who draw on domiciliary care are less likely to reach the lifetime cap because care fees in domiciliary care are generally lower, they can benefit substantially from the more generous means test.

As a result of these reforms, more people will come into contact with their local authority, either because they qualify for help as a result of the extension to means-tested support available or because they are progressing towards the cap. This provides a significant opportunity for them to access information and advice, and support to maintain their independence, remain active and connected in their communities and stay healthier for longer.

Further detail on how the reforms support people is included in the adult social care charging reform: impact assessment published on 5 January 2022. Government is seeking views on the assumptions and data used in the impact assessment.

We will continue to engage with relevant stakeholders directly but also welcome feedback via email to chargingreformconsultation@dhsc.gov.uk.

2.2. Overview of the new rules

Introduction

This overview is intended to introduce the new capped system and extended means test and explain its key features and rationale. It also signposts to subsequent chapters of this consultation which set out the workings of the policy or related operational questions in greater detail.

The cap and extended mean-tested

a) The cap on care costs

The cap on care costs will place a limit on the costs that people will need to spend to meet their eligible care and support needs. Where the term ‘care costs’ is used in this document, including the draft statutory guidance, this refers only to the personal care and support component of any care and support package, not daily living costs. (see ‘What does and does not count towards the cap’ and ‘Daily living costs’ below).

Subject to Parliamentary approval of an amendment being made to the cap provisions, progress towards the cap will be based on a person’s contribution towards the cost of their care as follows. Where the local authority is meeting a person’s needs, that is, where the local authority arranges their care or where the person receives financial support, they will progress based on what they are charged by the local authority to contribute towards their care cost, so this excludes any local authority support.

Where the person fully funds and arranges their care themselves, the person will progress based on what the cost would be to the local authority, if it were to meet the person’s eligible care and support needs (see ‘How people progress towards the cap’ in chapter 2).

From October 2023 the cap will be set at £86,000. This means the maximum amount anyone who starts receiving care after this date will have to pay for care to meet their eligible care and support needs will be £86,000, or the equivalent figure increased each year in line with inflation, as specified in Section 16 of the Act.

b) The extended means test

The means test for financial support will continue to work in the same way as it does currently: it determines what someone can afford to contribute towards the costs of their care based on the amount of assets and income a person has. The UCL will be set at £100,000 and the LCL at £20,000 in FY 2023 to 2024.

Means-tested support is available on a sliding scale. As now, this means that people who cannot afford to pay for their care from their income, and whose chargeable assets fall below £100,000 will be asked to make a contribution of £1 per week for every £250 in assets which falls between the lower limit and the upper limit towards their care and support. The local authority will meet any additional costs over and above the individual’s contribution from their income and their assets. Table 1 below illustrates how a local authority applies the charging rules to determine a person’s contribution.

A universal UCL of £100,000 responds to concerns raised in the 2015 consultation that a differentiated upper capital limit would add further complexity to an already complex system. It could also create perverse incentives for a person to move into a care home to protect their assets when there might be other, more appropriate options.

In applying the means test, people must be left with a certain amount of income. The levels of income are often called ‘the social care allowances’. The level of these differs depending on the care setting. Regulations set out the amounts. Both the Minimum Income Guarantee (the income a person receiving care outside a care home is left with after charges) and the personal expenses allowance (the income a person receiving care in a care home is left with after charges) have been frozen since 2015 but will increase in line with CPI inflation at 3% in April 2022.

Table 1: capital and maximum charges

| Assets | What do you pay? |

|---|---|

| Above the upper capital limit (£100,000 from October 2023) | Full cost – you are a self-funder |

| Between the capital limits (£20,000 and £100,000 from October 2023) | What you can afford from income plus a means-tested ‘tariff’ contribution from assets. The tariff is calculated as follows: for every £250 of capital between the lower and upper limit, an income of £1 a week is assumed, and this will be payable towards the cost of your care |

| Below the lower capital limit (£20,000 from October 2023) | What you can afford from income |

Introduction of the cap in October 2023

Anyone previously assessed by a local authority as having eligible care and support needs, either new entrants or existing social care users, will begin to progress towards the cap when legislation is brought into force in October 2023, unless the person is resident in a local authority that participates in the trailblazer initiative.

The cap will be implemented for adults of all ages, without exemption. To enable this, the local authority in whose area the person is ordinarily resident will set up a care account which will monitor progress towards the cap. Before the cap comes into effect, local authorities will be working to identify people who currently meet their own eligible needs to ensure that they can begin progressing towards the cap from the point it comes into effect in October 2023 (see ‘Carrying out early assessments’ in chapter 4).

Anyone determined to have eligible needs by a local authority after that date can begin progressing towards the cap from the date that they requested an assessment, or the local authority identified that they might need one. Costs accrued prior to October 2023 will not count towards the cap.

How people progress towards the cap

For the cap on care costs to be meaningful, it needs to be clear what does and doesn’t count towards the cap. Everyone with eligible needs will therefore be given a statement that sets out the cost that will count towards the cap – either in the form of a personal budget where a person’s needs are met by the local authority, or an independent personal budget (IPB) where a person fully funds and arranges their care themselves. These will be used to inform the care account, which shows by how much someone has metered towards the cap.

Personal budgets already exist, and since April 2015 have been a statutory requirement under the Care Act, to enable those whose needs are being met by the local authority to exercise greater choice and take control over how their care and support needs are met. To do this the personal budget sets out the total cost to the local authority of meeting the person’s eligible needs, as well as setting out the amount that the person will pay towards that cost and the remainder that the local authority will pay.

The overall approach to personal budgets will not be affected by the introduction of the cap and their core role will remain to support choice and personalisation. However, from October 2023, the personal budget will also provide the starting point for calculating the amount that counts towards the cap. This is the only change to the role of personal budgets.

Where a person has a personal budget (and receives local authority financial support towards their care costs) it is what the individual is charged, excluding the amount paid by the local authority, that will count towards the cap. Any daily living costs (see the section on ‘Daily living costs’ below) and any top-up payments the person or a third party has chosen to make will also be excluded. Daily living costs apply to those in residential care and are applied at a rate set in regulations.

The new system should not unfairly advantage those who can afford to pay more and want to do so to reach the cap quicker. Therefore, to ensure fairness, how self-funders who arrange their own care progress towards the cap will be based on what the cost would be to the local authority if it were to meet their eligible care needs. This link is set out in section 28 of the Act. The IPB will be the record that sets out what the cost would be to the local authority of meeting the person’s eligible care needs. It will be this ‘would be’ cost, less daily living costs where applicable, that counts towards the cap.

When local authorities determine what it would cost them to meet the person’s needs, they should apply the same principles that underpin the calculation of personal budgets under the current system: transparency, timeliness and sufficiency. Chapter 3 (see ‘Independent personal budgets’) sets out further detail and proposes an approach that local authorities may want to adopt.

Section 18(3) of the Act allows self-funders to request that their local authority arranges their care to meet eligible needs, in the same way as those who are supported by the means test. This right was commenced in 2015 in relation to domiciliary care and we plan to roll this out further from October 2023. For further detail see ‘Requesting that the local authority meets needs’ in chapter 3.

Table 2: personal and independent personal budgets

| Funding status | Care arrangement | They receive |

|---|---|---|

| Fully funds their care themselves | Arranges their care themselves | They receive an independent personal budget. It will set out what it what the cost would be to the local authority if the local authority was meeting the person’s eligible needs |

| Fully funds their care themselves | They ask the local authority to arrange care on their behalf under section 18(3) | They receive a personal budget. It will set out the cost of the care package that the local authority has arranged for them |

| Eligible for local authority financial support | Arranges their care themselves | They receive a personal budget. It will set out what it would cost the local authority to meet their eligible needs and what the person is charged to contribute towards this cost. They receive the local authority’s contribution towards these cost through a direct payment |

| Eligible for local authority financial support | The local authority arranges their care | They receive a personal budget. It will set out the cost of the care package that they have arranged for them and what they are charged to contribute towards it. The person will pay what they can afford from their income and assets towards the costs |

What does and does not count towards the cap

The cap on care costs will place a limit on the costs that people will need to spend to meet their eligible care and support needs. As set out, this will be based on what an adult is charged by the local authority towards the meeting of their eligible care and support needs or (in the case of self-funders arranging their own care) what the cost is or would be to the local authority if doing so.

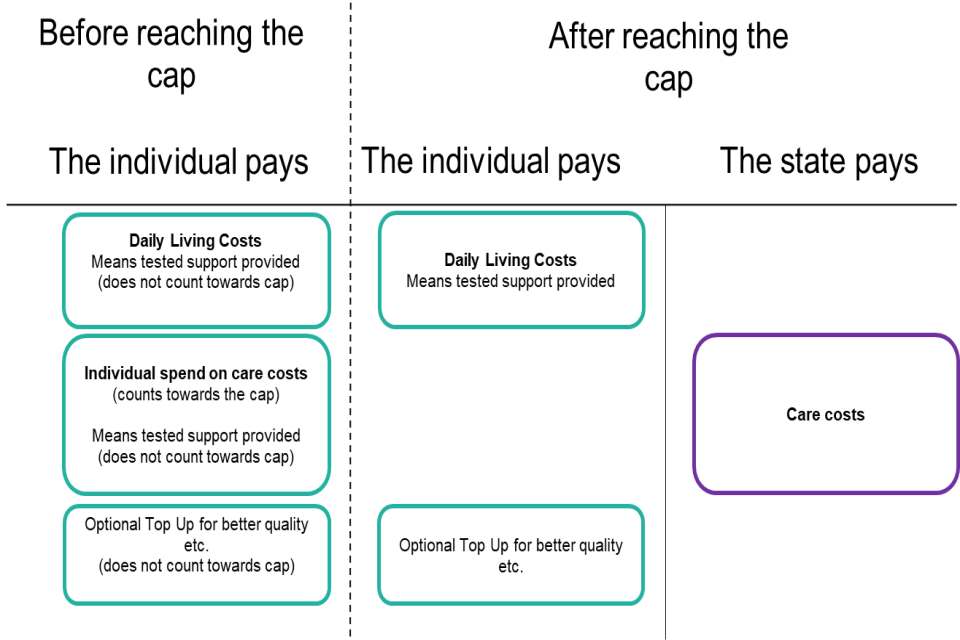

Care and support costs that count towards the cap are the costs of any provision that helps meet eligible needs as defined under the Act: as is currently the case, the local authority must assess the person’s care and support needs and then consider how those needs will be met. For example, whether someone’s needs are best met in a care home, whether they should have support in their own home, or whether they could benefit from community-based services. For those who fall within the means test, it is the person’s personal contribution towards the total cost of this agreed provision less daily living costs for those receiving care in a care home that will count towards the cap. Figure 3 illustrates how the cap will work in residential care and highlights the additional state contribution to cap people’s eligible care costs.

Care and support needs met through other legislation do not count towards the cap. Therefore, NHS funded Continuing Health Care and Funded Nursing Care, any free aftercare services provided under section 117 of the Mental Health Act 1983, will not count. The cost of any service not included in the personal budget or IPB because they are not meeting an eligible need under the Act, or any services the local authority has chosen to provide on a voluntary basis, will also not count towards the cap.

Daily living costs

Under the capped system, after they reach the cap everyone will remain responsible for meeting their daily living costs (DLCs) (for example rent, food and utility bills) as they would if living in their own home. This approach levels the playing field between those who receive home care with those living in a residential care setting. As recommended by the Commission on Funding of Care and Support, where someone’s needs are being met through residential care, DLCs will not count towards the cap on care costs. People will remain responsible for their DLCs throughout their care journey after they reach the cap.

The introduction of the concept of DLCs in the new system does not change the amount a person with eligible care needs will need to contribute towards the total cost of their care package as they progress towards the cap, that is, it does not affect what people are charged based on their financial assessment. Neither does it change what providers will be able to bill for before, and once, a person reaches the cap.

Local authorities and providers are not required to calculate actual DLCs for each person in a care home progressing towards the cap. Instead, DLCs will be set as a national, notional amount, the equivalent of £200 per week in FY 2021 to 2022 prices.

In setting DLCs at this level, £200 per week in FY 2021 to 2022 prices, we respond to concerns about affordability, particularly for those on lower incomes. If people were not able to meet daily living costs from their income, they would need to make up the difference from their assets, even after they reached the cap.

Top ups

As in the current system, those receiving care, or a third party such as a relative, may choose to make additional payments for a preferred choice of accommodation or care arrangement, for example, secure a premium room or furnishings.

Where a person’s care and support needs are being met by the local authority and the care planning process has determined that those needs are to be met in a specific type of accommodation (currently care homes, support living or shared lives accommodation), the person has a right to express a preference for particular accommodation of that type. The local authority can then charge for the additional cost over and above what the local authority would usually pay. This includes a preference for more expensive accommodation of the same type. Payments made to meet the additional costs associated with such choices are known as top-up payments.

When the upper capital limit for means-tested support is increased to £100,000 in October 2023, many more people will become eligible for, and begin to receive, local authority financial support. Others will become eligible for local authority financial support for the first time when they reach the cap on care costs. Government therefore intends to change the regulations to enable everyone receiving local authority financial support, which will include those who have reached the cap, to fund such top ups for their own care through their own means, where they can afford it.

These top-up payments, or any additional costs on top of the costs of meeting eligible needs, will not count towards the cap and will still be payable by the person once the cap has been reached. For more detail see chapter 3 ‘First-party top ups’.

Figure 3: how the cap will work in care homes (note that the cap interacts with the means test, which is not demonstrated here, and that DLCs are in FY 2021 to 2022 prices).

Figure 3 shows 2 situations of what costs a person is responsible for.

The first shows that before reaching the cap, the individual will pay for some or all of their care costs, daily living costs and top ups if they choose to.

The second shows that once they reach the cap, the individual will remain responsible for their daily living costs and any optional top ups while the state will pay for their care costs.

Care accounts

Everyone with a personal or independent personal budget will have a care account which keeps track of their progress towards the cap. Under the Act, local authorities will be responsible for maintaining care accounts for anyone ordinarily resident in their area with eligible needs for care and support. The care account will allow local authorities to keep track of people approaching the cap to ensure a smooth transition to local authority support, and to work with them to ensure that a person’s progress towards the cap is maintained should they move between local authorities.

The local authority will also be required to provide regular care account statements to keep people informed of their own progress towards the cap. This is to provide people with the means to plan and prepare for the future costs. We propose that statements will be sent digitally by default (although people will be able to request them in other forms) and on a 6-monthly basis. The regulations will set out what, at a minimum, should be included in a statement, including the current level of the cap and progress towards the cap to date that is, the accrued costs. See ‘Care accounts’ in chapter 3 of this document for further detail on local authority responsibilities for care accounts, and chapter 4 of this document on IT and system requirements.

Approaching and reaching the cap

If a person’s care account indicates that they are likely to reach the cap within 12 months of a statement being issued, the draft regulations require the local authority to notify the person of the date they are expected to reach the cap. The local authority should also provide the person with clear information about what will happen when they reach the cap and what action is needed. The local authority should then work with the person, or their representative, to ensure a smooth transition to local authority support.

At a practical level, the local authority should help the person to decide in advance how they would like their needs to be met when the cap is reached. What happens to the contract for any arrangements in place to meet the person’s care and support needs will be dependent on what is best for that person and what they want. For example, a person who has been meeting their own care and support needs may choose to receive a direct payment from the local authority in order to continue arranging their own care and support. They may alternatively opt for the local authority to assume responsibility for arranging their care and support.

Where a person is receiving care in a care home and they or a third party has chosen to make a top-up payment for a preferred choice of accommodation the local authority will need to make clear that the person or third party will continue to be responsible for meeting those costs if they wish to continue to remain in their current setting. Alternatively, the person could choose to move to a setting that is within the cost of their personal budget.

When a person reaches the cap, unless the person objects, the local authority becomes responsible for meeting the person’s eligible care and support needs and for paying the cost of the care to meet those needs. The person will remain responsible for meeting or contributing to their DLCs and any top-up payments they have chosen to make. Under the Act it is the responsibility of the local authority to inform the person that they have reached the cap.

Adjustments to the cap

The Act sets out clear parameters for how the level of the cap must be reviewed but does not prohibit changes at other times. Section 16 of the Act provides for an annual adjustment to the cap where the Secretary of State considers that there has been a change in the level of average earnings. Section 71 of the Act requires the Secretary of State to carry out a detailed review on the operation of the cap and to publish a report on the outcome of that review every 5 years.

When the level of the cap is adjusted, the extent of a person’s progress towards the cap will be maintained. For example, if a person is 50% towards the cap when the level of the cap is changed, adjustments will be made to ensure that the person’s progress remains at 50%.

Deferred payment agreements (DPAs)

The new reforms will complement the existing offer for deferred payment for people needing residential care that has been in place since 2015. Whilst the charging reforms ensure a person’s wealth is never fully at risk, the deferred payment scheme ensures people do not face the added stress of having to rush into selling their home to pay for care home fees and will have the flexibility to avoid selling their home within their lifetime. To support these reforms, government will lift the eligibility criteria for DPAs to match the new £100,000 UCL, and work with partners to review the existing scheme to understand how best to provide even more flexibility for people to defer their care payments.

3. Implementing the new rules

3.1 Introduction

Three new chapters will be added to the existing CASS guidance to set out how the cap on care cost will operate in practice. These 3 chapters are:

- Cap on care costs

- Independent personal budgets

- Care accounts

A full draft of each chapter can be found in the accompanying document Implementing the cap on care costs: draft operational guidance.

The chapter ‘Cap on care costs’ gives an overview of the new capped system. It describes how people register for the cap, what counts towards it, what happens when a person moves to another local authority, as well as the rules when a person approaches and later reaches the cap.

The chapter ‘Independent personal budgets’ covers what an IPB is and who it is for, how local authorities should calculate an IPB, how an IPB should be reviewed and revised, as well as how the spend of a person with an IPB should be verified.

The chapter ‘Care accounts’ explains eligibility for a care account, what information should be recorded in it, what information should be provided in a care account statement, adjustments to accrued costs, as well as questions around retention and portability of care accounts.

The 3 chapters are not to be viewed as standalone but as part of the existing CASS guidance. In implementing the cap on care costs, local authorities will, where applicable, need to refer to other chapters of the guidance. The exact position of the new chapters within the CASS guidance will be confirmed following this consultation.

The consultation questions we are posing on the draft guidance seek to understand whether certain aspects of the guidance are clear and workable. We are keen to get the views from all stakeholders. Therefore, where we ask whether aspects are clear, we want to understand whether the details and directions can be easily understood by local authority officials and easily communicated to care users to help them make informed decisions. Clarity may also refer to the guidance being consistent and comprehensive in its coverage. Where we ask whether aspects are workable, we are seeking to understand whether the directions give local authority officials sufficient discretion and protection where needed, and whether they are practicable.

Each of the following chapters focus on a different area of the guidance where we are looking for feedback. However, consultation questions cover all 3 chapters, and we welcome feedback on any aspect of the guidance.

3.2 What counts towards the cap and how this is calculated

The first chapter of the guidance ‘Cap on care costs’ provides further detail on how local authorities should calculate a person’s contribution towards the cap, that is, what counts towards the cap and what does not, and how a person’s personal budget or IPB should be set up so it can be used for metering purposes.

As set out in chapter 2, subject to the will of Parliament, a person’s progress towards the cap will be based on either what the local authority charges a person to meet their eligible care and support needs, or in the case of self-funders who arrange their care themselves, what the cost would be to the local authority if they were to meet the person’s need. What counts towards the cap is this amount less DLCs for those in residential care.

A person’s progress is based on the cost of meeting a person’s eligible care and support needs, where eligible needs are those defined as such under the Act. The introduction of the cap does not affect current eligibility. In line with the intention of personalisation in the Act, as part of the person’s needs assessment, local authorities must consider all of the adult’s care and support needs, establish the impact of those needs on the individual’s day-to-day life, and decide how the person’s needs will be best met. It therefore would not be possible for the guidance to specify any specific services that do and do not count towards the cap, as this may be different for every person. Any type of service or support that meets an eligible need and is chargeable can count towards the cap. This includes services such as meals on wheels and transportation that the local authority considers to be meeting eligible care and support needs.

In circumstances where it is agreed that preventative services, such as a stair lift, also meet a person’s current eligible needs, a person’s charge towards the cost of these can count. These are the only circumstances in which the cost of preventative services can count towards the cap: where a preventative service does not meet a current eligible need, it will not count towards the cap. Care and support needs met through other legislation also do not count towards the cap, including NHS-funded continuing healthcare and NHS-funded nursing care.

The draft guidance sets out further detail and explanations as to what counts towards the cap in the form of an overview table. It also sets out any implications for the calculation of a person’s metering rate, and what a local authority needs to consider when setting out information in a person’s personal budget or IPB, in order for it to be used for metering purposes.

As set out, where care is provided in residential care, DLCs need to be deducted from the cost of the person’s care package to meet their eligible needs (as set out in their personal budget or IPB) to arrive at the amount that meters towards the cap. DLCs are not included in the amount that meters towards the cap and people will continue to be charged for them once they reach the cap. For the purpose of deciding whether a care setting should be regarded as residential care in this context, and therefore whether DLCs need to be deducted, the local authority will need to consider whether the person is contributing any costs towards their accommodation separate to the cost of the care and support package. Where the person is for instance in receipt of any housing benefits, owns the home they live in, or pays some form of rent or other charge towards accommodation, then their care package should be considered as domiciliary care, and DLCs should not be deducted to arrive at the amount that counts towards the cap.

Question

The new chapter ‘Cap on care costs’ describes what counts and does not count towards the cap, and how local authorities should calculate this.

To what extent do you agree or disagree that the draft guidance on these areas is clear?

- Strongly agree

- Agree

- Neither agree nor disagree

- Disagree

- Strongly disagree

Please explain your answer

To what extent do you agree or disagree that the draft guidance on these areas is workable?

Where we ask whether aspects are workable, we are seeking to understand whether the directions give local authority officials sufficient discretion and protection where needed, and whether they are practicable.

- Strongly agree

- Agree

- Neither agree nor disagree

- Disagree

- Strongly disagree

Please explain your answer

Question

The new chapter ‘Cap on care costs’ also covers how people start metering towards the cap, what happens when a person progressing towards the cap moves to another local authority, and what happens when a person approaches and later reaches the cap.

To what extent do you agree or disagree that the draft guidance on these areas is clear?

- Strongly agree

- Agree

- Neither agree nor disagree

- Disagree

- Strongly disagree

Please explain your answer

To what extent do you agree or disagree that the draft guidance on these areas is workable?

- Strongly agree

- Agree

- Neither agree nor disagree

- Disagree

- Strongly disagree

Please explain your answer

3.3 Independent personal budgets

As set out in chapter 2, for the purpose of metering, a self-funder who commissions their care themselves will receive an independent personal budget (IPB). This will set out what it would cost the local authority to meet their eligible needs. Whereas personal budgets also fulfil other functions, enabling those whose needs are being met by their local authority to exercise greater choice and to take control over how their care and support needs are met, IPBs exist solely for the purpose of helping determine what costs will count towards the cap, so that all self-funders can meter towards the cap.

The second chapter of the guidance ‘Independent personal budgets’ sets out in further detail how local authorities should determine what the cost would be to them of meeting an adult’s eligible care and support needs.

The government does not want to create a system that is difficult to administer or unduly intrudes into a person’s life. It is therefore important that the guidance supports local authorities to take a proportionate approach to calculating these costs. It is also crucial that local authorities are encouraged to take into account the complexity of a person’s needs and their individual circumstances in assessing how to support their care needs, to support the government’s vision of personalisation as outlined in the Act. As the local authority is not responsible for meeting the person’s needs in these cases, they are not required to conduct a full care and support plan in the process of setting an IPB, though it may be appropriate to do so in some cases.

Specific guidance regarding processes relating to and best practice on the setting of personal budgets has already been published and came into force in April 2015. Though the IPB is a new concept introduced by the Act, the principles underpinning it are the same as those governing personal budgets. To ensure fairness, the statutory guidance for IPBs sets out that the calculation of the IPB should be based on the same principles as for personal budgets:

- transparency: a local authority must make clear to a person how their IPB has been calculated and on what basis, and that their IPB must reflect what the cost would be to the local authority of meeting their needs

- timeliness: local authorities should ensure that IPBs are finalised and communicated within a reasonable time of the needs assessment being conducted

- sufficiency: a local authority must have a reasonable expectation that the costs in a person’s IPB would be sufficient to meet their eligible needs according to their circumstances

Given that local authorities are not actually commissioning the person’s care and are under no obligation to prepare a full care and support plan, the draft guidance needs to set out further detail for how local authorities should go about calculating IPBs in practice. In drafting the guidance our aim has been to achieve fairness in the way in which different people progress towards the cap while allowing local authorities to take a proportionate approach to determining an IPB.

The guidance proposes that IPBs should be based, as far as possible, on the local authority’s best available up-to-date cost data. The local authority should, where possible, allocate an IPB based on the cost of equivalent care packages for people whose needs it has been meeting (for example, recently set personal budgets). Alternatively, where such data is unavailable, it should base the IPB on the cost of quality local provision, in the same manner as it would for a direct payment.

As the data each local authority holds will be variable, it will be for them to determine what data is available to best indicate real costs. The guidance makes clear that where relevant data is unavailable, local authorities should undertake a ‘dummy purchasing’ process.

While the local authority is under no legal obligation to develop a care and support plan, it should consider whether it may be necessary to do so, or to take a more tailored approach. This is because the local authority should always take into account the complexity of a person’s needs as well as whether individual circumstances are likely to have an impact on the cost of meeting them. People with complex needs should not be unfairly disadvantaged in the process of setting an IPB.

In calculating costs for an IPB, the guidance also states that local authorities should seek to minimise the influence of factors that may impact unit costs. For example, they should consider using average costs over a relatively recent period, rather than over unit costs, and draw on other relevant data. This will mitigate the risk of estimated costs being influenced by short-term variation in the cost of commissioning care of a certain type, such as the availability of beds on a particular day, or the unit cost savings associated with block contracts.

In developing our approach, we also revisited the proposal put forward in the consultation in 2015, which recommended that local authorities should base IPBs on an average of personal budgets set for people with similar needs. However, feedback indicated that such an approach would not be workable, especially for people with complex needs or drawing on domiciliary care.

Question

The new chapter ‘Independent personal budgets’ provides advice to local authorities on how to approach the calculation of an independent personal budget (IPB) and what principles to follow in doing so.

To what extent do you agree or disagree that the draft guidance on these areas is clear?

- Strongly agree

- Agree

- Neither agree nor disagree

- Disagree

- Strongly disagree

Please explain your answer

To what extent do you agree or disagree that the draft guidance on these areas is workable?

- Strongly agree

- Agree

- Neither agree nor disagree

- Disagree

- Strongly disagree

Please explain your answer

Question

The new chapter ‘Independent personal budgets’ also covers what an IPB is and who it is for, needs assessments for self-funders, how an IPB should be reviewed and revised, how the spend of a person with an IPB should be verified, and what happens when such a person moves to receiving local authority support.

To what extent do you agree or disagree that the draft guidance on these areas is clear?

- Strongly agree

- Agree

- Neither agree nor disagree

- Disagree

- Strongly disagree

Please explain your answer

To what extent do you agree or disagree that the draft guidance on these areas is workable?

- Strongly agree

- Agree

- Neither agree nor disagree

- Disagree

- Strongly disagree

Please explain your answer

3.4 Metering and adjustments to accrued costs

Where the local authority is meeting a person’s needs, a person progresses towards the cap by the amount they are charged for their care costs – less DLCs where applicable. Personal budgets must be used to set this out clearly and should be used as the starting point by local authorities to calculate a person’s cap contribution. As set out in chapter 2, for a self-funder who is commissioning their own care, the starting point to determine a self-funder’s progress towards the cap will be determined from their IPB.

The statutory guidance provides additional clarifications as to what happens in situations when a person’s actual spend is different to what is set out in their personal budget or IPB, the circumstances in which accrued cost can be adjusted to reflect this, and any verification of spend required.

Where needs are met by the local authority

In some case, the amount presented in a personal budget may differ to the actual costs that a person is charged. This could be due to, for instance, late changes to a person’s care schedule or temporary fluctuations in care needs. In these circumstances, the guidance proposes that the local authority may use care related invoices to establish what counts towards the cap. This does not affect existing obligations of the local authority to keep personal budgets up to date as far as possible.

A person will continue to accrue costs based on what they are charged for their care costs, even if they fall behind with paying the amount the local authority charged. The local authority should use established local debt recovery mechanisms to aim to recover any outstanding debt before the person reaches the cap.

Where in receipt of an independent personal budget

As set out above in ‘Independent personal budgets’, local authorities do not have to prepare a care and support plan for a self-funder who arranges care themselves. Accordingly, a self-funder should also not be under any obligation to meet their needs in any particular way in order to progress towards the cap, for example, through any specific care arrangement.

As set out in chapter 2, only the cost of meeting eligible care needs as defined by the Act accrue towards the cap. The guidance therefore sets out that local authorities should complete some form of verification to check if those with an IPB are in receipt of formal care that meets their eligible care and support needs as set out in their IPB.

Where it is apparent the person has not met their eligible needs fully, or substituted meeting their needs with informal care, the local authority should amend the care account to reflect this. To facilitate this, and to help mitigate any safeguarding risk, local authorities are able to require the person to provide evidence of the cost of any arrangements they have made to meet their needs.

We consider a light touch approach to verification will often be proportionate. The draft guidance asks for verification at regular intervals, for instance coinciding with the person’s annual review to minimise bureaucratic burdens. However, the local authority may review the persons spend more frequently if they choose to and should in particular consider conducting additional checks in the beginning stages of a person’s journey towards the cap.

The local authority should consider the most appropriate and accessible method of conducting verification. This could, for example, involve a request to see a care contract, care receipts, or bank statements. Where possible, the local authority should consider working with care providers to automate such verification of spending, subject to a person’s consent.

Following verification, a local authority may adjust a person’s accrued costs to ensure that the amount which accrues towards the cap is in accordance with the requirements of the Act. A local authority may also adjust a person’s accrued cost if they have become aware of temporary changes in the person’s circumstances which resulted or would have resulted in a change to the cost to the local authority of meeting their needs for that period. Consideration should be given to the administrative burden of making adjustments to ensure they are only made where it is proportionate to do so. Generally, accrued costs should not be adjusted to reflect changes of less than 6 weeks in duration.

A local authority should not adjust accrued costs in any other instance, including in cases where there is a minor discrepancy between the values contained in an IPB and those reflected in an individual’s actual contribution towards the meeting of their needs.

Question

The new chapters ‘Independent personal budgets’ and ‘Care accounts’ describe a need for local authorities to verify the spending of those who self-fund their own care. They also outline when a local authority has the option to adjust accrued costs retrospectively.

To what extent do you agree or disagree that the draft guidance on these areas is clear?

- Strongly agree

- Agree

- Neither agree nor disagree

- Disagree

- Strongly disagree

Please explain your answer

To what extent do you agree or disagree that the draft guidance on these areas is workable?

- Strongly agree

- Agree

- Neither agree nor disagree

- Disagree

- Strongly disagree

Please explain your answer

3.5 First-party top ups

Where a person’s care and support needs are being met by their local authority and the care planning process has determined that those needs are to be met in a specific type of accommodation, the person has a right to express a preference for particular accommodation of that type. This includes a preference for more expensive accommodation of the same type. Payments made to meet the additional costs associated with such choices are known as top-up payments. The local authority must arrange the preferred accommodation if they judge that the person paying the top up is willing and able to pay for the likely duration of the care journey, the paying person enters into a written agreement with the local authority that must be regularly reviewed, and the following conditions are met:

- the accommodation is of the same type as that specified in the care and support plan

- the accommodation is suitable in relation to the person’s assessed needs

- the accommodation is available

- the provider of the accommodation is willing to enter into a contract with the local authority to provide the care at the rate identified in the person’s personal budget on the local authority’s terms and conditions

As set out in chapter 2, top-up payments will not count towards the cap and will still be payable once the cap has been reached.

Currently, the person drawing on care and support can only enter into top-up agreements themselves (‘first-party top ups’) when their property is subject to the 12-week property disregard or when they have entered into a DPA. In all other circumstances, only third parties such as family and friends can enter into top-up agreements.

Government wants to facilitate choice for everyone who receives local authority financial support and can afford to make additional payments for a preferred choice of accommodation, enabling them to spend their own money in the way they wish. We therefore plan to lift restrictions on first party top-up arrangements currently in the Choice of Accommodation Regulations 2014, to allow people who want and can afford to do so to make affordable and sustainable ongoing top-up payments from their own financial resources.

Accordingly, the scope of the statutory guidance will be expanded to cover first party top-ups under the new arrangements, as reflected in the table of anticipated consequential amendments in the accompanying document Implementing the cap on care costs: draft operational guidance. The rules for top-up payments which apply currently will otherwise remain the same.

Everyone who enters into a top-up arrangement, including first parties, should make an informed choice without compulsion. They need to be aware of the potential consequences should they no longer be able to meet the costs associated with their choice. One such consequence – which should be included in the written agreement – is that the person may be moved to a less expensive setting where this would be suitable to meet their needs. This provides both people and local authorities with the necessary degree of certainty and protection.

The extension of the means-test threshold and the cap itself mean that top ups for a preferred accommodation should be affordable for a larger proportion of those whose needs are met by the local authority than under the current system. Nonetheless, it is crucial that the local authority can protect itself from the risk of having to pay the top up in cases where the person themselves becomes unable to pay, and where moving to a less expensive setting, for example, would not be appropriate.

To balance the greater facilitation of choice against the need to protect local authorities, we propose to include additional advice in the existing CASS guidance (annex A: choice of accommodation and additional payments) that where a local authority determines that a person is unable to pay a top up, they may refuse the request. It is to the discretion of the local authority to determine when a person is unable and able to pay. However, the guidance advises that a local authority may consider a person as unable to pay if there is, for instance, reasonable expectation, on the basis of evidence (for example, in the form of bank statements and budgeted care needs), that the top up will not be affordable for the duration of the person’s expected care journey. Local authorities should not refuse to -ups in any other circumstances. Where a local authority has allowed a top up, it should review such evidence at least annually to ensure that any agreed top up remains affordable.

Our recommended approach builds on feedback from the consultation in 2015, which indicated further clarification was needed on when to deem top ups as unaffordable, in order to protect both local authorities and individuals wishing to pay a top up.

The proposed changes to annex A in the existing CASS guidance can be found in the accompanying document Implementing the cap on care costs: draft operational guidance under the table of consequential amendments to the CASS guidance.

Question

Amendments to annex A of the CASS guidance ‘Choice of accommodation and additional payments’ provide guidance to local authorities on when to allow and refuse first-party top ups.

To what extent do you agree or disagree that the draft guidance on these areas is clear?

- Strongly agree

- Agree

- Neither agree nor disagree

- Disagree

- Strongly disagree

Please explain your answer

To what extent do you agree or disagree that the draft guidance on these areas is workable?

- Strongly agree

- Agree

- Neither agree nor disagree

- Disagree

- Strongly disagree

Please explain your answer

3.6 Requesting that the local authority meets needs

What does section 18(3) do?

Section 18(3) of the Act means that local authorities must meet a person’s eligible care and support needs if both the following apply:

- the person asks them to

- the local authority finds (through an assessment) that the person has eligible care and support needs (defined as such under the Act)

This means that, once section 18(3) is fully commenced, everyone, even those with enough money to pay for their care, will be able to ask their local authority to meet their eligible needs by arranging their care, although people who can afford to will still pay. Currently, people who can afford to (and therefore) pay for their own care and need care at home can already ask their local authority to meet their needs by arranging their care, for example, if they need someone to come to their home or if they need to go to daytime services. Under the reforms to be introduced in October 2023, this will start being extended to those whose needs are best met in a care home. People who are eligible for help from their local authority to pay for their care already have their needs met by their local authority, and this will continue in the reformed system.

Why section 18(3) is important

We want care to be fair and accessible for everyone, whether they fund their own care or get financial support from their local authority. Making sure that people can benefit from their local authority’s expertise and support by asking that their local authority meets their needs by arranging their care is part of this. It is also important to the new cap on care costs because the cap is based on how much local authorities pay for care.

Finally, section 18(3), when combined with Fair Cost of Care funding, will make the overall system fairer and more sustainable in the long term. Local authorities will move towards paying a fair and sustainable rate for care, which will benefit even those self-funders who do not choose to ask their local authority to arrange their care but who will meter towards the cap at fairer and more sustainable rates.

How will section 18(3) work in practice?

Section 18(3) is an important part of the cap on care costs, and extending its commencement is going to bring a lot of change to the adult social care market.

Most people who can afford to (and therefore) pay for their own care but who ask their local authority to meet their needs by arranging their care, will also choose to progress towards the cap on care costs and doing this will feel like a single process.

Once a self-funder decides to ask their local authority to meet their needs by arranging their care, the local authority will treat them in the same way it treats other users. All of the guidance local authorities must follow about how to meet individuals’ needs will apply in the same way, regardless of how someone funds their care.

Implementing section 18(3)