NHS Pension Scheme: proposed amendments to scheme regulations

Updated 7 March 2023

Applies to England and Wales

Introduction

The NHS Pension Scheme is designed to offer significant value in retirement to people who have chosen to dedicate part or all of their careers to serving the public through the NHS. Backed by the Exchequer, the NHS Pension Scheme offers the security of a guaranteed income in every year of retirement for all its members, on some of the most generous terms available from a pension scheme.

The legal framework for the NHS Pension Scheme

There are 2 NHS Pension Schemes: the new reformed 2015 Scheme; and the older, closed scheme which is divided into the 1995 and 2008 Sections. Accordingly, there are 3 sets of regulations under which entitlement to pension and other benefits are calculated:

- the National Health Service Pension Scheme Regulations 1995 (SI 1995/300) (the ‘1995 Regulations’)

- the National Health Service Pension Scheme Regulations 2008 (SI 2008/653) (the ‘2008 Regulations’)

- the National Health Service Pension Scheme Regulations 2015 (SI 2015/94) (the ‘2015 Regulations’)

Proposed changes to scheme rules

The Department of Health and Social Care (DHSC) keeps the rules of the pension scheme under review to ensure it continues to help the NHS attract and retain the staff needed to deliver high quality care for patients. This consultation document proposes changes to the NHS Pension Scheme:

- new retirement flexibilities

- aligning the timing of CPI inflation rates used for revaluing pension benefits and the annual allowance tax calculation

- scheme access for primary care networks (PCNs)

- technical updates to member contributions provisions

Consultation process

DHSC welcomes views on the proposals set out in this document to amend NHS Pension Scheme regulations.

Consultation questions

Respondents are invited to consider the following questions:

Question

Do you agree or disagree that the new retirement flexibilities should be introduced as proposed in this consultation document?

- agree

- disagree

- don’t know

If your response is ‘disagree’ or ‘don’t know’, please explain why.

Question

Do you agree or disagree that the changes to the pension rules regarding inflation should be implemented as proposed in this consultation document?

- agree

- disagree

- don’t know

If your response is ‘disagree’ or ‘don’t know’, please explain why.

Question

Do you agree or disagree that changes to scheme access should be introduced as proposed in this consultation document?

- agree

- disagree

- don’t know

If your response is ‘disagree’ or ‘don’t know’, please explain why.

Question

Do you agree or disagree that the technical updates to member contributions provisions should be implemented as proposed in this consultation document?

- agree

- disagree

- don’t know

If your response is ‘disagree’ or ‘don’t know’, please explain why.

Question

Are there any further considerations and evidence that you think DHSC should take into account when assessing any equality issues arising as a result of the proposed changes?

- yes

- no

- don’t know

If your response is ‘yes’ or ‘don’t know’, please explain why.

How to respond

Comments on the proposals and draft legislation can be submitted online.

By email: nhspsconsultations@dhsc.gov.uk

By post:

NHS Pensions Policy Team

Department of Health and Social Care

Area 2NE Quarry House

Quarry Hill

Leeds, LS2 7UE

The consultation will close at 23.45 on 30 January 2023.

New retirement flexibilities

Background

In Our plan for patients, DHSC committed to bringing forward new retirement flexibilities that would help to reduce waiting times by allowing the NHS to retain its most experienced staff. This section of the consultation document sets out DHSC’s plans in more detail.

Eligible members of the NHS workforce belong to one of the 2 existing schemes. The final salary defined scheme, or legacy scheme, is made up of the 1995 and 2008 Sections and is now closed to new members. All new NHS staff join the 2015 Scheme, a career average revalued earnings (CARE) scheme that provides benefits based on average earnings over a member’s career. The key differences between the schemes, other than the way benefits are calculated, are different normal pension ages (NPAs) and accrual rates, as shown in the table below.

Table 1: comparison of scheme, retirement age and accrual rate

| Scheme or section | NPA | Accrual rate |

|---|---|---|

| 1995 Section | 60 | 1/80th |

| 2008 Section | 65 | 1/60th |

| 2015 Scheme | State Pension Age | 1/54th |

The 2015 Scheme was introduced as part of wider reforms implemented by regulations made under the Public Service Pensions Act 2013. As part of these reforms, public service pension scheme members within 10 years of retirement were originally given transitional protection, and so remained in their legacy pension schemes.

In December 2018, the Court of Appeal found this protection to be discriminatory against younger members. This has become known as the ‘McCloud judgment’. The government accepted the judgment applies to other public service schemes, including the NHS, and has set out how the discrimination will be remedied. This is known as the ‘McCloud remedy’.

Options for retirement

At the time the 1995 Section was designed, retirement patterns were understood to be relatively binary; staff would typically work full-time until claiming their benefits and retiring. After this point, members were unlikely to return to NHS service, and the rules of the NHS Pension Scheme restricted the incentives to do so by preventing any further pension accrual.

However, we understand that retirement today is often a gradual process over many years, rather than a hard cliff edge. We are aware that staff value the ability to retire flexibly, in a way that suits their work/life balance. The new retirement flexibilities outlined in this section of this consultation document have therefore been designed to offer staff increased options at the end of their careers, so that they can partially retire or return to work seamlessly and continue building pension after retirement if they wish to do so.

Also, as a result of the McCloud remedy, all eligible staff were moved to the 2015 Scheme for future accrual from 1 April 2022. This means that some members will now have service in both the 1995 Section and 2015 Scheme, which have different rules on how members can claim their benefits. We have therefore designed the proposed retirement flexibilities to address this issue and ensure that the rules are aligned for all members of the NHS Pension Scheme.

Proposed changes

The package of new retirement flexibilities DHSC is proposing that the 1995 Section includes:

- pensionable re-employment

- partial retirement

- removing the 16-hour rule

As well as supporting members’ work/life balance and giving them a greater degree of flexibility around how they take their pension benefits, we have also designed these measures to support patient care. If members of the NHS Pension Scheme are able to continue working longer but more flexibly in ways that suit both individuals and employers then the NHS will also continue to benefit from their skills and experience. This could provide an important boost to NHS capacity at a crucial time and help tackle care backlogs.

We are also proposing to make a number of small changes to the 2008 Section and 2015 Scheme. More information about the proposed changes is provided in the relevant sections of this consultation document.

Pensionable re-employment

Under the existing regulations of the NHS Pension Scheme, members who take their 1995 Section benefits are not permitted to build up any further pension in the 2015 Scheme. If they do return to work, this is on a non-pensionable basis. Because the 1995 Section does not have any late retirement factors (LRFs), if members choose to leave these benefits unclaimed after the normal pension age (NPA), they do not increase in value.

Now all members have been moved to the 2015 Scheme for future accrual, these rules could cause problems for those who need to carry on working to be able to afford to retire but wish to claim their 1995 Section benefits when they are most valuable.

We therefore propose an amendment to allow members who take their benefits in the 1995 Section to return to work and build further pension in the 2015 Scheme, if they wish. We think that this may help some retired staff to bridge the gap between claiming their NHS pension benefits and receiving their State Pension. This could in turn support NHS capacity, as allowing staff to build up further benefits in the 2015 Scheme may make returning to service more attractive.

DHSC is also intending to allow members who are currently non-pensionable in the 1995 and 2008 Sections, because they have breached the maximum service limits, to join the 2015 Scheme. The age limit for 2015 Scheme membership (75) will apply as normal.

Under the proposal, members with special class status (SCS) would still be subject to abatement until age 60 under normal circumstances. This would mean that their pension is reduced if their pension plus salary after returning to work exceeds their pre-retirement income. However, abatement for SCS members is currently suspended until 31 March 2025. More information on the suspension of abatement is provided in the next section of this consultation document.

Partial retirement

Under the current 1995 Regulations, members are currently unable to partially retire, or to take some of their pension benefits whilst continuing to work and build further pension. Taking part of your pension benefits is also sometimes known as ‘draw down’.

This is different to the rules for 2008 Section and 2015 Scheme members in the NHS Pension Scheme, and for members of other comparable public service pension schemes, such as the Teachers’ Pension Scheme and the Civil Service Pension Scheme. We think that increasing the level of flexibility may have a positive impact on some members’ work/life balance later in their careers, when they may prefer to retire more gradually, reducing their work commitment for a period of time before retiring completely.

Furthermore, the McCloud remedy may mean that some staff aged 55+ are able to retire earlier than they previously planned, which when combined with other factors, could have an impact on NHS capacity. A lack of partial retirement in the 1995 Section may discourage staff from remaining in the workforce for longer than they might if more flexible options were available.

We are therefore proposing an amendment to the 1995 Section regulations to allow members to partially retire and claim up to 100% of their 1995 Section benefits whilst continuing to work and accrue further pension in the 2015 Scheme. Under this proposal, on reaching minimum pension age (currently 55), members will become eligible to partially retire if they reduce their pensionable pay by at least 10%. For GPs, a 10% reduction in commitment would be required. Members with a protected minimum pension age of 50 will be able to partially retire from age 50.

We believe the proposal for partial retirement will better support members’ work/life balance and may also help the NHS to retain valued experienced staff in the workforce, as members may wish to partially retire and work for longer than they had previously planned. For those impacted by pension tax, this proposal would also allow them to manage their tax position by partially retiring and remaining in work, rather than opting out of the NHS Pension Scheme or leaving the NHS completely. We think that this is especially important in the current context, as maximising workforce capacity by retaining experienced staff will be crucial to reducing elective care backlogs.

The following example sets out how an example member could make use of the proposal for partial retirement:

Example

Nurse currently aged 61 at the top of Agenda for Change band 7, who has service in the 1995 Section and is now accruing benefits in the 2015 Scheme.

Under the proposed plans, the member can take 100% of their 1995 Section pension under partial retirement at age 61, and then work for 2 further years at 0.75 FTE (building further pension in the 2015 Scheme), before retiring completely at age 63.

At age 61: 1995 Section pension = 100% of £16,515 annual pension, plus 1995 Section 3 x lump sum = £49,546.

At age 63: 2015 Scheme pension = £2,610 accrued pension including revaluations x 0.808 early retirement adjustment for taking benefits 4 years early = £2,109 annual pension.

This example is for illustration only.

The option to partially retire would be open to all members, although SCS members would be subject to abatement under normal circumstances until age 60.

However, as set out in the previous section of this document, abatement for SCS members has been suspended since 25 March 2020 as part of a series of ‘retire and return’ easements designed to support capacity during the pandemic and subsequent pandemic recovery period. These easements have allowed retired and partially retired staff to return to work in the NHS or increase their working commitments without impacting their pension.

From 25 March 2020 to 25 March 2022, the retire and return easements were provided by section 45 of the Coronavirus Act 2020, one of the pieces of emergency legislation introduced to provide the government and the NHS with the tools required to deal with the COVID-19 pandemic. Since 25 March 2022, these easements have been continued through temporary modifications to NHS Pension Scheme regulations made by Part 3 of the National Health Service Pension Schemes (Member Contributions etc.) (Amendment) Regulations 2022 (‘the 2022 Regulations’).

These temporary modifications were originally due to expire on 31 October 2022 but the expiry date has been extended through an amendment to the 2022 Regulations by the National Health Service Pension Schemes (Member Contributions etc.) (Amendment) (No. 3) Regulations 2022. As a result, all of the temporary easements will now expire on 31 March 2023, except for the suspension of SCS members abatement, which will expire on 31 March 2025.

To ensure consistency with the 2008 Section and the 2015 Scheme, under the proposal for partial retirement abatement will apply to 1995 Section members who choose to partially retire (reducing their pensionable pay by at least the required 10%) but whose terms of employment later change again so that their pensionable pay increases to more than 90% of what it was before the original reduction. As outlined above, drawdown abatement for members of the 2008 Section and 2015 Scheme is currently suspended until 31 March 2023 through the retire and return easements and will resume on 1 April 2023.

We propose that new regulations will be added to Part E of the 1995 Section, setting out the rules governing partial retirement. These rules will follow the approach to partial retirement taken in the 2008 Section and 2015 Scheme.

Timings for the availability of partial retirement will be confirmed following the consultation findings and subsequent decisions on final policy design, but it is expected to be implemented in late spring 2023.

Other proposed changes in relation to partial retirement

Allowing 100% drawdown in the 2008 Section and 2015 Scheme

Under the current 2008 Section regulations and 2015 Scheme regulations, members can only claim a maximum of 80% of their benefits. However, under DHSC’s plans, members who partially retire would be able to claim, or ‘draw down’, up to 100% of their 1995 Section benefits under partial retirement.

To ensure that the partial retirement provisions are aligned across the 1995 Section, 2008 Section and 2015 Scheme, DHSC is also proposing to amend the relevant provisions governing partial retirement in the 2008 Section (regulation 2.D.5) and 2015 Scheme (regulation 84) to permit the maximum drawdown of 100% instead of the existing 80%.

The 2008 Section and 2015 Scheme already have late retirement factors, which is a benefit for members who want to retire after their normal pension age and have their pension benefits remain in the scheme, where they are subject to revaluation. The change DHSC is proposing, to allow up to 100% drawdown, will not remove this benefit for members, but it will offer them more flexibility if they do want to partially retire and take 100% of their pension benefits.

Correcting regulation 86(3) in the 2015 Scheme

Furthermore, when designing the provision for partial retirement, DHSC noticed an error in regulation 86(3) of the 2015 Regulations surrounding abatement, following retirement from that scheme where members hold additional pension (AP).

Under the 2008 Section regulations, if members who partially retire are subject to abatement, then their AP continues in payment, whereas under the 2015 Scheme regulations the AP is also subject to abatement. DHSC’s view is that AP should not be subject to abatement, and so the drafting of the 2015 Scheme regulations contains an error which DHSC intends to correct. Regulation 86(3) states that the member’s pension mentioned in regulation 85(2) will be abated to zero. However, DHSC’s view is that regulation 86(3) should only refer to the member’s pension in regulation 85(2)(a) and (b) being abated to zero, because regulation 85(2)(c) refers to the member’s AP.

The NHS Business Services Authority (NHSBSA), who administer the NHS Pension Scheme, have confirmed that no members who have partially retired from the 2015 Scheme have been subject to abatement in respect of their AP.

Removing the 16-hour rule

Under the current 1995 Regulations, members who choose to take their pension benefits and then return to work can only work a maximum of 16 hours per week in their first month back without impacting their pension. DHSC is anecdotally aware that this rule can be administratively difficult for employers to manage, and it may also discourage staff from returning to work, or increasing their commitment to more than 16 hours per week after their first month back. The 16-hour rule is also not a feature of the 2008 Section or 2015 Scheme regulations for NHS staff, or of other comparable public service pension schemes.

DHSC is now proposing an amendment to the 1995 Section regulations to permanently remove this rule. This would apply to all members, including SCS members. This amendment has been designed to complement the proposal for pensionable re-employment in the package of retirement flexibilities, by allowing staff to have a smooth transition back into work after claiming their 1995 Section benefits and allowing them to maximise the hours they contribute, if they wish, without impacting their pension.

DHSC is therefore proposing that regulation S1 of the 1995 Section regulations, which contains the 16-hour rule, will be permanently removed from 1 April 2023.

The 16-hour rule has been suspended since 25 March 2020 as part of the retire and return easements explained in the previous section of this document. The suspension of the 16-hour rule is due to continue until 31 March 2023, the day before DHSC plans to permanently remove it.

Removing regulation R4(8) from the 1995 Section

Regulation R4(8) applies to members with more than one employment and means that if they retire from at least one NHS employment, they can remain working in the NHS and still be entitled to claim their pension, provided they do not work for more than 16 hours per week. This is the same number of hours members can currently work on their first month back after retirement without impacting their pension. Given that DHSC plans to permanently remove the 16-hour rule, it has considered that it is also appropriate to remove regulation R4(8).

Because DHSC is intending to introduce pensionable re-employment, if this regulation remained in place, from 1 April 2023 impacted members would be able to claim their 1995 Section benefits and continue working and building further pension in the 2015 Scheme, without a break. DHSC believes that this may be unfair on members who work more than 16 hours per week and wish to continue without a break, as they would be required to take partial retirement and reduce their pensionable pay by at least 10%, whereas members impacted by regulation R4(8) may not need to.

There is also not a similar rule in the 2008 Section or 2015 Scheme, which means that members with more than one employment must cease them all to be able to claim their pension. Therefore, to align the rules of the 1995 Section, 2008 Section and 2015 Scheme, DHSC is proposing to permanently remove this regulation from 1 April 2023.

Changes to the pension rules regarding inflation

Background

Alongside new retirement flexibilities, ‘Our plan for patients’ committed to ‘correcting pension rules regarding inflation’ in the NHS Pension Scheme. The rapid increase in Consumer Price Index (CPI) inflation has shown there to be a timing mismatch between the CPI rate that is used to revalue accrued benefits in the NHS Pension Schemes and the CPI rate that is allowed for in annual allowance (AA) tax calculations. Aligning these timings will ensure that the AA measures only the pension growth that occurs above inflation.

Pension benefits in the 2015 Scheme

The amount of pension a 2015 Scheme member earns each year is determined by what is known as the ‘build-up rate’. In the 2015 Scheme the build-up rate is 1/54th, so members earn a pension of 1/54th of their pensionable earnings each scheme year. For active members of the 2015 Scheme the pension they earn is increased yearly by a percentage rate, known as ‘in-service revaluation’. This continues to occur yearly until a member retires or ends their active membership of the 2015 Scheme before retirement.

The percentage rate of in-service revaluation is determined by a yearly Public Service Pensions Revaluation Order (the Treasury Order), plus an additional 1.5%. Treasury Orders are the method by which HM Treasury notifies the value of the CPI change to be applied as part of the in-service revaluation. The pension earned in a scheme year, 1 April to 31 March, is added to the aggregate pension earned in previous scheme years and increased by the in-service revaluation rate. The in-service revaluation rate may go up, remain the same or even go down and be a negative amount. If a member leaves the 2015 Scheme before 31 March, they become entitled to a proportion of the in-service revaluation after 31 March. The proportion is dependent on how far through the scheme year the member left the scheme.

If a member leaves the 2015 Scheme to retire, the in-service revaluation stops, they receive a proportion of the in-service revaluation after 31 March and while in payment the 2015 Scheme pension increases yearly by the ‘pensions increase rate, determined by the yearly Treasury Order. The pensions increase is used to maintain the value of public service pensions against rises in the cost of living. If the CPI is a negative amount, the pensions increase is zero.

Members who leave the 2015 Scheme but who have not yet retired receive a proportion of the in-service revaluation after 31 March and, following this, have their deferred 2015 Scheme pension increased yearly by pensions increase.

Pension benefits in the 1995/2008 Scheme

Pension benefits in the 1995/2008 Scheme for medical, dental and ophthalmic practitioners, as a group referred to as ‘practitioners’, are calculated as using a career average revalued earnings (CARE) method. Practitioner pensionable earnings, for each scheme year a practitioner is an active member, are uprated using a factor known as the ‘dynamising factor’. Practitioner pensionable earnings are multiplied by the relevant dynamising factor yearly. The practitioner pension accrual rate is then 1.4% in the 1995 Section and 1.87% in the 2008 Section, of the total uprated practitioner pensionable earnings amount.

Practitioner pensionable earnings earned up to the closure of the 1995/2008 Scheme on 31 March 2022 – and if appropriate a practitioner pensionable earnings credit in respect of any added years being purchased – are uprated yearly using dynamising factors aligned to the pensions increase, the CPI rate used to increase NHS pensions in payment, plus an additional 1.5%. The 1995/2008 Scheme closed on 31 March 2022 and all practitioners were moved to the 2015 Scheme. As a result, the uprating continues for as long as the practitioner remains an active member of the 2015 Scheme. The percentage rate of CPI, to be added to the additional 1.5% to determine the dynamising factors, is confirmed in the yearly Pensions Increase (Review) Order by the Secretary of State for Work and Pensions.

The annual allowance

The annual allowance (AA) is the maximum amount of pension savings an individual can make in any one tax year, from 6 April to 5 April, that benefit from tax relief. The standard AA limit is currently £40,000. However, the limit can be tapered down to a lower tapered AA for very high earners. The growth in pension savings during a tax year is referred to as the pension input amount (PIA).

The PIA is based on how much the value of the individual’s accrued pension has gone up from the ‘opening value’ immediately before the start of the tax year to the ‘closing value’ at the end of the tax year. If an individual’s PIA is more than their AA, the individual may be liable to pay tax on the amount that is over their AA.

The intention is that the PIA should only consider growth in pension savings above inflation and so the opening value is uplifted by the CPI, from the previous September, in the calculation of the PIA.

CPI disparity

The 2015 Scheme in-service revaluation and the calculation of the PIA both use CPI. However, there is a disparity between the CPI used for the in-service revaluation of the 2015 Scheme pension and the CPI used to increase the opening value, as part of the calculation to determine the PIA.

The Treasury Order has come into force on 1 April each year since the introduction of the 2015 Scheme. This means that the 2015 Scheme earned pension up to 31 March was revalued on 1 April. In contrast, the opening value of 2015 Scheme pension on 5 April is increased by an earlier September’s CPI percentage rate.

The issue for practitioners with CARE benefits in the 1995/2008 Scheme is similar to the issue for practitioners and other members with CARE pensions in the 2015 Scheme. Dynamising factors are currently applied to practitioner pensionable earnings on 1 April. In contrast, the opening value of 1995/2008 Scheme benefits is uplifted by an earlier September’s CPI amount.

Effectively there is a one year CPI disparity for both the uprating of 1995/2008 Scheme pensionable practitioner earnings, and the in-service revaluation of the 2015 Scheme earned pension. Recent higher inflation means that this mismatch has become more acute, leading to more members being potentially at risk of breaching their annual allowance.

For the 2022 to 2023 tax year, the September 2022 CPI of 10.1% is higher than it has been in recent years. This higher CPI will lead to high in-service revaluation of 2015 Scheme earned pension up to 31 March 2023. However, the CPI increase to the opening value of NHS Pension Scheme pension in the PIA calculation is based on the lower value of CPI in September 2021 of 3.1%. This increases the risk of annual allowance tax charges for 1995/2008 Scheme practitioners and 2015 Scheme members for tax year 2022 to 2023 as a result of the higher inflation.

Proposed changes to the 2015 Regulations

DHSC is proposing to move the date that the yearly in-service revaluation is applied to 2015 Scheme earned pension from 1 April to 6 April, from 6 April 2023.

This will align the CPI used in both these calculations with the CPI used in the increase of the opening value of 2015 Scheme pension benefits, for determining the PIA. Moving the date by 5 days means that the same CPI percentage rate is used, meaning that the PIA calculation will only consider growth in pension savings of above inflation.

HM Treasury are proposing to make changes to the Public Service Pensions Revaluation Order 2023 to move the revaluation date and align the CPI rates for the 2015 Scheme. The amendments we are proposing to make to the 2015 Regulations will be to facilitate the correct application of this, and future, Treasury Orders.

Therefore, we propose that minor amendments to the 2015 Regulations are solely focused on the schedule 9 interpretations of: ‘index adjustment, ‘AP index adjustment’, ‘leaver index adjustment’ and ‘leaver AP index adjustment’, as well a minor amendment in regulation 105, regarding the definition of ‘re-valued pensionable earnings’.

The 1995 Regulations and the 2008 Regulations

DHSC is proposing to move the date that dynamising factors are applied to 1995/2008 Scheme practitioner pensionable earnings yearly from 1 April to 6 April, from 6 April 2023.

The process by which the uprate is applied to the 1995/2008 Scheme is set out in: paragraph 11 of schedule 2 of the 1995 Regulations; and regulation 1 of Part 3D of the 2008 Regulations. Both the 1995 Regulations and the 2008 Regulations draw on the Pensions (Increase) Act 1971 and the Social Security Pensions Act 1975, for an explanation as to how the CPI annual increase figure is defined. As the 1995 Regulations and the 2008 Regulations do not set a specific date on which the dynamising factors need to be applied, there is no requirement to change either the 1995 Regulations or the 2008 Regulations to implement this proposal.

Benefits of changing the scheme rules regarding inflation

Changing the revaluation date by 5 days, from 1 April to 6 April, aligns the rate of CPI used in the CARE revaluation in the NHS Pension Scheme and the pension benefit growth calculation, for AA purposes. This ensures that the AA operates as intended in relation to NHS pensions, and the high inflation environment does not create larger tax charges for senior clinicians on the pension earned this year. Consequently, from tax year 2022 to 2023 onwards, the calculation to determine the PIA will properly measure growth above inflation in the NHS Pension Scheme.

For members unaffected by the AA, the proposed change will have no effect on the amount of NHS pension benefits they are entitled to on retirement.

Changes to scheme access policy

Background

Access to the NHS Pension Scheme can be provided in multiple ways depending on the organisation and the type of service being delivered. The majority of NHS Pension Scheme members qualify for automatic access to the scheme because of their NHS employment with one of the following organisations:

- a special health authority (SpHAs)

- a local health board

- an NHS trust

- an NHS foundation trust

- the NHS Commissioning Board (now legally known as NHS England)

- an integrated care board (ICB)

Within the primary care sector, access to the NHS Pension Scheme is provided to staff working for or in:

- a general medical services (GMS) practice

- a personal medical services (PMS) practice

- an alternative provider medical services (APMS) contractor

- an out of hours (OOH) provider (voluntarily by application)

- a non-GP provider

Within dentistry, scheme access can be provided to dental contractors and practitioners.

In addition to the above ‘automatic’ routes into the scheme, scheme access is also provided on application to independent providers (IPs) and direction or determination employers.

An IP is an organisation that holds a qualifying contract and that, prior to April 2014, would not have qualified as an NHS Pension Scheme Employing Authority (EA) under any access route.

Qualifying contracts are the NHS Standard Contract, NHS Standard Sub-Contract, APMS Contract, and Local Authority Contract.

With effect from 1 April 2014, an organisation that holds any of these contracts and does not qualify as an employing authority under any other access route may apply, if it so wishes, to become an IP.

NHS Pension Scheme access in IPs is restricted to staff who satisfy the ‘wholly or mainly’ criteria, which means they must spend at least half of their time working on the qualifying contract.

Access for direction or determination employers is also provided upon successful application to the scheme. A direction or determination can be ‘closed’ or ‘open’. Closed access means access is restricted to the individual listed on the document and is typically provided following a TUPE (transfer of undertakings, protection of employment) transfer. Open access is provided to certain staff groups who support the delivery of NHS services, such as clinical academics working in university medical schools. Open access allows new recruits to access the scheme on the condition that they satisfy the terms of the direction or determination.

The department strives to ensure the NHS Pension Scheme access policy and corresponding regulations accurately reflect the way in which services are structured and delivered. In recent years, the structure of primary care has developed significantly, which means that pension scheme regulations require an update.

The department has conducted a review of scheme-access policy within primary care, working with NHS England to propose amendments to NHS Pension Scheme regulations. The purpose of these amendments is to ensure scheme regulations accurately reflect the way primary care services are delivered and that primary care structures that are being encouraged by the department and NHS England can access the NHS Pension Scheme.

Primary care networks

To meet the changing needs and increasing demand on primary care services, GP practices are working together with community, mental health, social care, pharmacy, hospital and voluntary services in their local areas in groups of practices known as primary care networks (PCNs).

PCNs build on existing primary care services and enable greater provisions of proactive, personalised, coordinated and more integrated health and social care for people closer to home. They aim to shift primary care services from reactively providing appointments to proactively caring for the people and communities they serve.

There are currently around 1,250 PCNs across England. These are based on GP-registered patient lists, and typically serve communities of between 30,000 to 50,000 people. PCNs are small enough to provide personal care but large enough to have impact and economies of scale through better collaboration between GP practices and others in the local health and social care system.

The purpose of PCNs is to integrate care by the formation and continued operation of networks that deliver care in a more personalised way. NHS England has further information on PCNs on its website.

PCNs are led by clinical directors who may be GPs, general practice nurses, clinical pharmacists or other clinical professionals working in general practice from within the PCNs core network practices.

NHS Pension Scheme access for PCNs

The flexible and integrated design of PCNs has created issues regarding NHS Pension Scheme access. PCNs may arrange themselves in a number of different ways of employing staff and holding contracts. The difficulty for the NHS Pension Scheme is that it can be unclear whether staff are working directly on a qualifying contract if their employer is in a different part of the network to the organisation who holds the contract. PCNs are not legal entities but are instead a cluster of GP practices. This makes it harder for the scheme to assess whether staff are working on a qualifying contract.

The NHS Pension Scheme requires a single point of contact for participating employers to ensure that staff who are accessing the scheme are delivering NHS services. This accountability is also important in ensuring participating employers comply with NHS Pension Scheme regulations, and that the scheme can hold them accountable for any potential issues such as non-payment of contributions and issues that require intervention from The Pensions Regulator (TPR).

However, it is also important that the NHS Pension Scheme continues to act as a valuable component of the total reward package provided to NHS staff, and that pension access issues are not a barrier to the delivery of services.

Following discussions with NHS England, the scheme has developed 8 PCN scenarios that capture the most common ways in which PCNs are organised to comply with the above principles of NHS Pension Scheme administration. Over the last few years, time-limited access, up to 31 March 2023, has been provided to PCNs that meet one of the 8 scenarios shown in the annex to this document, to ensure continued delivery of services.

Access has been provided to 31 March 2023 on the basis that the department would review NHS Pension Scheme regulations and make arrangements to provide permanent access to PCNs.

In addition, the department has listened to advice from NHS England stating that access for PCN sub-contracting arrangements should also be provided with NHS Pension Scheme access, due to the way in which PCN services can be sub-contracted between networks and providers.

Proposed changes

Access for PCNs

The department is proposing to amend NHS Pension Scheme regulations to provide permanent scheme access to PCNs who meet one of the 8 scenarios set out in the annex below.

To achieve this, we propose amending the definition of a ‘medical contractor’ at Paragraph 3 of Schedule 5 of the 2015 NHS Pension Scheme Regulations to add PCNs to the list of medical contractors. This would allow officer (employed) staff to access the scheme when working for PCNs.

Regulation 18 (1) (d) sets out that practitioner members (such as self-employed GPs) can access the scheme if they are medical practitioners as defined in (Part 3) paragraph 6 of schedule 5 of the 2015 NHS Pension Scheme Regulations. This paragraph references a medical practitioner as defined at Regulation 166. We propose to add PCNs to the list of qualifying bodies that a medical practitioner can pension income from at Regulation 166 (3).

For the purposes of the NHS Pension Scheme regulations, PCNs will be defined by adding the list of scenarios shown in the annex of this document into a schedule. This means that only PCNs who arrange themselves in one of the 8 scenarios shown will be given permanent access to the NHS Pension Scheme.

Each of the scenarios in the annex, except scenarios 3 and 6, would be given automatic access to the scheme and would not need to make an application. Scenarios 3 and 6 do not qualify for automatic access because the organisation delivering NHS services does not hold a qualifying contract. However, permanent access to the scheme will be granted through direction or determination order to PCNs who can show that they meet the terms of scenarios 3 or 6.

Access for PCN sub-contractors

The department recognises the need for PCN sub-contracting arrangements to have access to the NHS Pension Scheme to ensure continued service delivery.

Currently, the NHS Standard Sub-Contract is the only sub-contract that is a qualifying contract for pension access. However, NHS England has recently published a Standard PCN Sub-Contract, which we propose to add to the list of qualifying contracts in NHS Pension Scheme Regulations at regulation 150(3) of the 2015 Scheme.

The department proposes that clinical organisations that qualify for NHS Pension Scheme access through an existing alternative route, such as by holding a qualifying contract, will be given ‘classic’ access to the scheme through the Standard PCN Sub-Contract. This means that all practice staff working on the sub-contract can access the scheme. GP providers and salaried GPs would be eligible to access the scheme as practitioner members. Practice staff would access the scheme as officer members. In addition, locum GPs could pension income received from their work on the sub-contract.

Organisations that hold the Standard PCN Sub-Contract but who do not qualify for NHS Pension Scheme access through an alternative route would be able to join the scheme through the IP route. This means that only staff who meet the ‘wholly or mainly’ criteria of spending at least 50% of their time working on the qualifying contract could access the scheme. It also means that all staff, including GPs, must enter the scheme as officer members. Locum GPs would not be eligible to pension income performed for an IP.

Organisations who hold the Standard PCN Sub-Contract would be required to apply to the NHS Pension Scheme for access. Access would be considered on the same basis as is currently done for the NHS Standard Sub-Contract, whereby:

- employers would be required to follow the Standard PCN Sub-Contract to access the scheme, and scheme access would not be provided as a result of using any other type or form of sub-contract

- the employer who subcontracts out the work would be required to be an NHS Pension Scheme Employing Authority

The department is clear that the above proposed changes would not extend access to the NHS Pension Scheme to any staff groups or professions that have not previously had access to the scheme. Instead, the policy changes intend to ensure continued scheme access is provided to clinical and practice staff working in primary care.

Technical updates to member contributions provisions

From 1 October 2022, the department introduced changes to the member contribution structure, including changing the amount that members pay for their pension benefits. This was the subject of a previous consultation document: NHS Pension Scheme: proposed changes to member contributions.

Following these changes, some technical updates are required to ensure that practitioners have paid the correct amount of member contributions for the 2022 to 2023 scheme year.

Updates to practitioner reconciliation process

Unlike officer members, all practitioners have their contribution rate based on in-year, annualised pay. This is the same as the process before the changes that came into force on 1 October 2022. Following the end of the scheme year, relevant practitioners (for example, GP providers and salaried GPs), must declare their final pensionable earnings within 11 months of the end of the scheme year.

Given that the changes came into force on 1 October 2022, part way through the 2022 to 23 scheme year, there are some regulatory changes required to the reconciliation process used by practitioners at the end of the scheme year.

The department proposes to make amendments to the 2015 Regulations to allow practitioners to apportion their earnings so that they pay contributions in accordance with the member contribution structure that was in place at the time their pensionable earnings were earned.

The contribution structure that was in force until 30 September 2022 is shown in table 2 below.

Table 2: member contribution structure between 1 April 2015 and 30 September 2022

| Tier | Pensionable earnings (WTE) | Contribution rate |

|---|---|---|

| 1 | Up to £15,431 | 5.0% |

| 2 | £15,432 to £21,477 | 5.6% |

| 3 | £21,478 to £26,823 | 7.1% |

| 4 | £26,824 to £47,845 | 9.3% |

| 5 | £47,846 to £70,630 | 12.5% |

| 6 | £70,631 to £111,376 | 13.5% |

| 7 | £111,377 and above | 14.5% |

(‘WTE’ means ‘whole-time equivalent’.)

The contribution structure that came into force on 1 October 2022 is shown in table 3 below.

Table 3: member contribution structure from 1 October 2022

| Tier | Pensionable earnings (rounded down to the nearest pound) | Contribution rate from 1 October 2022 |

|---|---|---|

| 1 | Up to £13,246 | 5.1% |

| 2 | £13,247 to £16,831 | 5.7% |

| 3 | £16,832 to £22,878 | 6.1% |

| 4 | £22,879 to £23,948 | 6.8% |

| 5 | £23,949 to £28,223 | 7.7% |

| 6 | £28,224 to £29,179 | 8.8% |

| 7 | £29,180 to £43,805 | 9.8% |

| 8 | £43,806 to £49,245 | 10.0% |

| 9 | £49,246 to £56,163 | 11.6% |

| 10 | £56,164 to £72,030 | 12.5% |

| 11 | £72,031 and above | 13.5% |

Under the 2015 Regulations, practitioners are required to pay contributions at the rate specified in the relevant table in regulation 31 that corresponds with their certified or final pensionable earnings. If they are not required to certify their pensionable earnings then their contribution rate is based on their pensionable earnings for that year. There are also supplementary provisions in regulations 38 and 39 of the 2015 Regulations for calculating member contributions for medical practitioners, non-GP providers and dental practitioners as part of the reconciliation process.

Currently, the formulae in regulations 38 and 39 require practitioners to annualise their pensionable earnings for the relevant scheme year and apply the appropriate contribution rate in regulation 31. However, these formulae operate on the basis that there is only one member contribution rate table applicable to the relevant scheme year. Therefore, to ensure that practitioners pay the correct contribution rate for their pensionable earnings during the scheme year 2022 to 2023, the formulae in regulations 38 and 39 will need to be updated to ensure that the contribution rates shown in table 2 above apply to practitioner pensionable earnings during the period 1 April 2022 and 30 September 2022 and the contribution rates shown in table 3 apply from 1 October 2022 to 31 March 2023.

It is intended that table 1 of regulation 31 of the 2015 Regulations will be split into 2 parts to reflect the mid-year rate change that came into force on 1 October 2022. The amending regulations will mean that ‘Table 1A for scheme year 2022 to 2023’ shows the rates that will apply for the period 1 April 2022 to 30 September 2022 and ‘Table 1B for scheme year 2022 to 2023’ shows the rates that will apply for the period 1 October 2022 to 31 March 2023.

Most practitioners, including type 2 practitioners (salaried GPs), locum GPs, dental practitioners and ophthalmologists, will be able to accurately identify which month during scheme year 2022 to 2023 their pensionable earnings relate and therefore can apply the contribution rate that corresponds to that period. Therefore, we propose to modify the provisions in regulation 38 to enable the correct rate to be applied for each relevant period. For example, a salaried GP who is employed throughout the whole of the 2022 to 2023 scheme year on a salary of £120,000, will pay member contributions at a rate of 14.5% on their earnings between 1 April 2022 and 30 September 2022. From 1 October 2022, they will pay 13.5% on their earnings.

The end of scheme year reconciliation process for type 1 practitioners (GP providers) will operate slightly differently because the nature of their pensionable profits means that it would be administratively unrealistic to be able to accurately apportion exactly when in the year those pensionable profits were earned.

We therefore propose to insert a new formula to enable type 1 practitioners to apportion their annual pensionable earnings for each relevant period with reference to the number of days worked during each period. Members will then pay contributions based on the apportioned earnings at the rates specified for each relevant period (table 2 between 1 April 2022 and 30 September 2022, and table 3 between 1 October 2022 and 31 March 2023).

Example

At the end of the 2022 to 2023 scheme year, a type 1 practitioner calculates that they received pensionable profits of £115,000 over the year. They were a type 1 practitioner throughout the year and because they are a type 1 practitioner they cannot accurately calculate when the pensionable profits were earned within the year.

The practitioner will pay member contributions of 14.5% on the proportion of their pensionable income earned between 1 April 2022 and 30 September 2022, based on the previous contribution rate table.

The period of 1 April to 30 September is 183 days, so the calculation would be £115,000 / 365 x 183 = £57,657.53. Therefore, the practitioner pays 14.5% member contributions on £57,657.53. On the remaining 182 days between 1 October 2022 and 31 March 2023, their pensionable earnings will be £57,342.47 and they will pay contributions at a rate of 13.5%.

If a practitioner only became a type 1 practitioner part-way through the year (or retired part-way through the year) then the calculation needs to be adjusted.

Example

A member joins a GP partnership as a type 1 practitioner on 1 September 2022 and their share of the pensionable profits for the 2022 to 2023 scheme year is £70,000.

Firstly, their pensionable profits for the full year and the annualised amount will be used to find the appropriate contribution rate. Annualising the pensionable profits gives a sum of £120,519 (£70,000 / 212 x 365 = £120,519). This means that the rate for the period between April and September will be 14.5% and the rate for the period between October and March is 13.5%.

Secondly, the pensionable profits for each period will need to be calculated. Given that the member joined the partnership on 1 September 2022, they were a GP provider for 30 days in the April to September period. They were a GP provider for 212 days in the 2022 to 2023 scheme year.

This means that their pensionable profits for the April to September period will be calculated as £9,905.66 (£70,000 / 212 x 30 = £9,905.66). The rate for this period is 14.5% (based on annualised earnings of £120,519), making the payable contributions £1,436.32.

The remainder of the pensionable profits (£60,094.34) is therefore deemed to have been earned in the October to March period (£70,000 / 212 x 182 = £60,094.34). The rate for this period is 13.5% (based on annualised earnings of £120,519), making the payable contributions £8,112.74.

Finally, the 2 sums should be added together to find the total amount of contributions that are payable for the 2022 to 2023 scheme year (in respective of the member’s pensionable profits from this role). For this practitioner, their member contributions would be £9,549.06.

Any return of contributions or payment of underpaid contributions, will be determined at the end of the scheme year, following the established current process.

A practitioner who also has an officer post will have the contribution rate for their officer post determined separately to their practitioner post.

Updates to scheme year dates

In advance of the 2023 to 2024 scheme year, we propose to update the title of the tables in regulations 30 and 31 of the 2015 Regulations. These tables set out the pensionable earnings tiers and contribution rates for each scheme year. Whilst the titles of the tables will be updated, the pensionable earnings tiers and contribution percentage rates will not change. The proposed changes will involve amending the scheme year dates and to clarify the fact that there has been a change to the contribution rates that happened mid-scheme on 1 October 2022, part way through the scheme year.

Public sector equality duty

The Public Sector Equality Duty is set out in section 149 of the Equality Act 2010 and requires public authorities, in the exercise of their functions, to have due regard to the need to:

- eliminate unlawful discrimination, harassment and victimisation and other conduct prohibited by the 2010 Act

- advance equality of opportunity between people who share a protected characteristic and those who do not

- foster good relations between people who share a protected characteristic and those who do not

This involves having due regard, in particular, to the need to:

- remove or minimise disadvantages suffered by people due to their protected characteristics

- take steps to meet the needs of people from protected groups where these are different from the needs of other people

The equality duty covers the 9 protected characteristics: age, disability, gender reassignment, marriage and civil partnership, pregnancy and maternity, race, religion or belief, sex (gender) and sexual orientation.

DHSC has considered the impact of the proposed changes in the context of this duty below. DHSC invites respondents to help refine this initial analysis by contributing further perspectives or identifying where there might be other equality impacts to consider.

New retirement flexibilities

Sex

The Equalities Act 2010 lists ‘sex’ as a protected characteristic. Data for the NHS Pension Scheme is also divided by sex. However, it is important to note that sex and gender are 2 different concepts. A person’s gender identity is not always the same as the sex assigned to them at birth, and some people may not identify as having a gender or as non-binary. Gender reassignment is also a protected characteristic under the Equality Act 2010.

The proposed retirement flexibilities will be available to all members regardless of sex. However, in developing the proposals, DHSC has considered the potential impacts of the new retirement flexibilities on members from this perspective, taking into consideration members’ salary progression, career breaks and work patterns.

The NHS is a female dominant workforce, and the majority of NHS Pension Scheme membership is female. Including pensioner members, approximately 1.9 million people have service in the 1995 Section of the NHS Pension Scheme. Of these members, approximately 79% are female and 21% are male.

Within the NHS Pension Scheme as a whole, male members tend to receive higher pensions than female members. The National Audit Office’s (NAO) 2021 report on public sector pensions stated that, in 2019, the average pension for male members of the NHS Pension Scheme was £17,541, compared with £6,440 for female members. The difference in average pension payments from the NHS Pension Scheme is 63%, which is greater than the average of 29% (Teachers’ Pension Scheme) and 47% (Civil Service Pension Scheme), which also have a more equal ratio of male and female members.

The gap between the average pension for male and female members may be attributed to several factors, including differences in pay, working patterns and career breaks due to maternity and caring responsibilities. As well as receiving higher pay than female employees, generally across the public sector male employees are less likely to work part-time and have gaps in their length of service. This is partly due to female members being proportionally more likely to have career breaks due to maternity and caring responsibilities. However, it is worth noting that not all female members will take parental leave or have caring responsibilities.

If the proposals for partial retirement and pensionable re-employment are not implemented, members who claim their 1995 Section benefits will be unable to accrue any further pension benefits in the 2015 Scheme. However, in light of the information above on average pension payments from the NHS Pension Scheme, it is possible that female members may be more likely to need to build up further pension than male members.

Therefore, DHSC has considered that the new retirement flexibilities are likely to benefit female members. They may also help to reduce the current gap in average pensions for male and female members of the NHS Pension Scheme. If the retirement flexibilities are not implemented and members cannot build up any further pension after taking their 1995 Section benefits, female members may be more likely to feel the impact of this than male members.

Age

DHSC has also considered the potential impact of the new retirement flexibilities on members in different age cohorts.

As this consultation document sets out, to introduce the new retirement flexibilities DHSC plans to amend the 1995 Section regulations. Because the 1995 Section closed to new members in 2008, the membership of this section is typically older.

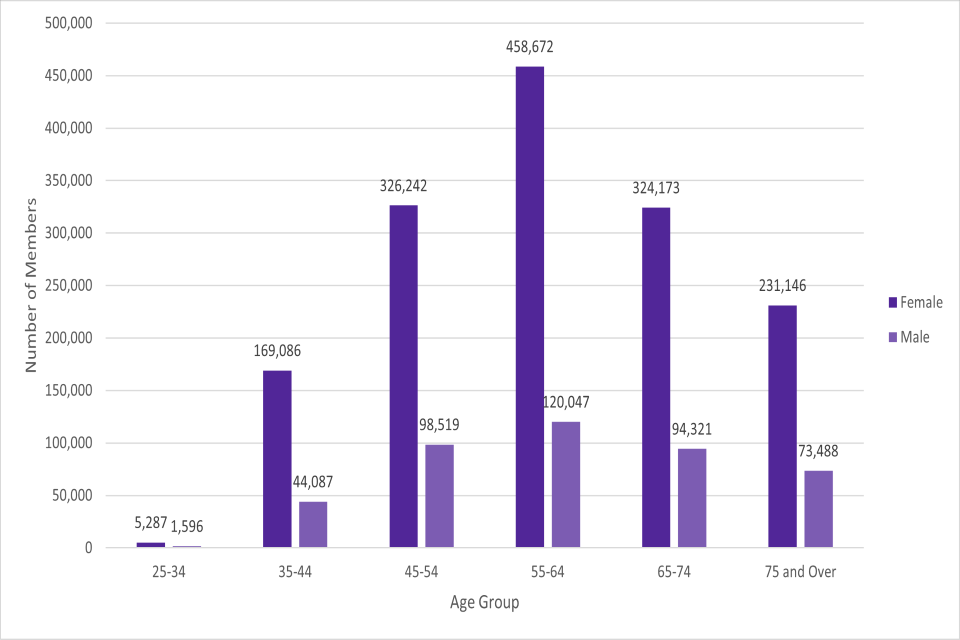

Therefore, if the proposed retirement flexibilities are implemented then it would be primarily older members who would benefit from them. The chart below shows the breakdown of all members, including pensioner members with service in the 1995 Section by sex and age group.

Chart 1: age and sex breakdown for members with service in the 1995 Section (source: NHS Business Service Authority)

If implemented, the new retirement flexibilities will allow older members to retire more flexibly, in a way that supports their work/life balance later in their career. They will also give members the ability to build further pension in the 2015 Scheme after claiming their 1995 Section benefits.

Provisions for partial retirement and pensionable re-employment already exist within the 2008 Section and 2015 Scheme. This means that younger members, who are more likely to be members of the 2008 Section or the 2015 Scheme, will already have access to flexible retirement and would not be negatively impacted by the introduction of this option in the 1995 Section. The 16-hour rule, which DHSC is proposing to permanently remove, has never been a feature of the 2008 Section or the 2015 Scheme, and so this change should not impact on members of the 2008 Section or 2015 Scheme, who are more likely to be younger.

If the new retirement flexibilities are not implemented then members of the 1995 Section, who are more likely to be older, will not have the same retirement flexibilities when they retire as other members who are more likely to be younger. However, younger members are also more likely to be further from retirement due to their age and it is therefore difficult to draw a direct comparison.

The 1995 Section regulations currently require members to leave service to claim their pension and do not provide late retirement factors. This means that members who claim their pension at a later age do not benefit from doing so through increased pension. Under the current regulations, if members do choose to leave service and crystallise their benefits, then they won’t be able to build up further benefits in the 2015 Scheme. Therefore, retiring at a later age means that some members might miss out on the pension benefits they could have accrued during this time.

DHSC therefore designed the proposal for partial retirement to address this issue. Whilst DHSC’s original intention was to introduce partial retirement on the same basis as that currently offered in the 2008 Section and 2015 Scheme, which allow members to draw down a maximum of 80% of their benefits, DHSC proposes that members be permitted to draw down up to 100% of their 1995 Section benefits. This approach ensures that no element of members’ benefits is required to be left unclaimed. If the proposal for partial retirement is not implemented, it is possible that this might have a detrimental impact on some younger members of the 1995 Section.

Furthermore, the proposal to amend the 2008 Section and 2015 Scheme to allow for 100% draw down will ensure that the partial retirement provisions are aligned across the 1995 Section, 2008 Section and 2015 Scheme. This means that whilst the new retirement flexibilities will be of most benefit to members of the 1995 Section, they will not benefit from any more flexibility than members of the 2008 Section or the 2015 Scheme, who are likely to be younger.

Special class status

Special class status (SCS) is a historic provision awarded to certain professions which, subject to qualifying criteria being met, allows members to retire at age 55 without a reduction to their benefits. It is a continuation of the arrangements that existed before the start of the NHS in 1948 and closed to new members on 6 March 1995. As SCS members therefore tend to be older, DHSC has considered the impact of the new retirement flexibilities on SCS members as part of the age section of this analysis.

DHSC’s view is that, given these members already benefit from getting to take their pension early, without actuarial reduction, it is proportionate for them to be subject to abatement under normal circumstances if they decide to make use of the proposed provision for partial retirement or pensionable re-employment between the ages of 55 and 60. This is in line with existing abatement provisions in the 1995 Section, which ensure fairness to all scheme members and protect the public purse from the impact of staff continuing to work full time whilst in receipt of generous pension benefits.

Because SCS does not exist in the 2008 Section or 2015 Scheme, the implementation of the flexibilities for SCS members will not have an impact on members of the 2008 Section and 2015 Scheme, who are more likely to be younger.

Given that the majority of SCS members are female, there is also some read across to the analysis on sex. However, as the proposals will apply to SCS members regardless of sex, DHSC has considered that the flexibilities will not impact members beyond the ways outlined above.

Disability

The proposals will apply to all members regardless of disability. However, DHSC has considered the potential impact of the new retirement flexibilities on members with disabilities.

The 2021 NHS Workforce Disability Equality Standard (WDES) stated that 3.7% of staff (52,007) in NHS trusts and foundation trusts in England declared a disability through the NHS Electronic Staff Record (ESR). This is significantly lower than the 21% of working-age adults in the UK who reported having a disability in the Family Resources Survey for financial year 2020 to 2021.

There is some evidence to suggest that disabled people are more likely to work part-time. Data from the Office of National Statistics (ONS) on disability and employment shows that working disabled people were more likely to work part-time than non-disabled people, with 32% of disabled people working part-time in comparison with 21.3% of non-disabled people.

Given that those who work part-time are more likely to have accrued smaller pensions and so may be more likely to need accrue further pension after taking their 1995 Section benefits, DHSC has considered that the proposals are likely to benefit members with disabilities.

For the same reason, DHSC has considered that if the proposals are not implemented this could have a detrimental impact on members with disabilities.

Pregnancy and maternity

There is limited data available on this group specifically in relation to the NHS workforce. However, DHSC has considered the potential impact of the proposals on members who have this protected characteristic as part of our analysis on sex.

Ethnicity, sexual orientation, religion, marital or civil partnership status and gender re-assignment

The proposed retirement flexibilities will be available to members regardless of ethnicity, sexual orientation, religion, marital or civil partnership status and gender reassignment . DHSC does not consider that the proposals raise any specific equality issues for members in relation to these characteristics.

Changes to the pension rules regarding inflation

The proposed changes are primarily a technical amendment to address the CPI disparity between the pension input amount calculation, for annual allowance purposes, and CARE revaluation in both the 2015 Scheme and 1995/2008 Scheme.

DHSC has considered the impact of the proposed changes and has concluded that they do not directly engage with any protected characteristics. Moreover, to leave the pension rules regarding inflation unchanged may have a perverse outcome for older members, who have more service in the NHS Pension Scheme and more potential to have higher pensionable earnings. Without the proposed changes these members are more likely to have a tax charge, or a higher tax charge, when, like in September 2022, inflation is higher than usual.

Changes to scheme access policy

The primary purpose of the proposed changes to NHS Pension Scheme regulations with effect to scheme access policy is to ensure staff working in primary care can continue to access the NHS Pension Scheme.

The department intends that the impact of these changes is that the same staff groups that have previously had access to the NHS Pension Scheme will continue to do so when working for PCNs.

Staff working in or for GP practices, such as GP providers, salaried GPs, GP locums and medical and non-medical practice staff, have previously had access to the NHS Pension Scheme. It is our intention that these groups continue to access the scheme when working in or for PCNs.

The NHS Pension Scheme is a key part of the total reward package for NHS staff, and it is important that the pension scheme is not a barrier to the delivery of services.

The department has regard for ensuring that individuals with protected characteristics are not disproportionately impacted by policy changes. However, the department does not believe that any considerations regarding protected characteristics are engaged by these proposed changes.

NHS Act 2006 duties

The powers granted under this clause have been considered in regard to the NHS Act 2006, but are unlikely to be relevant to these duties:

- promoting a comprehensive health service (section 1)

- quality improvement (section 1A)

- the NHS Constitution (section 1B)

- health inequalities (section 1C)

- promoting autonomy (section 1D)

- research (section 1E)

- education and training (section 1F)

- reporting on and reviewing treatment of providers (section 1G)

The family test

Former Prime Minister David Cameron announced in August 2014 the introduction of a new family test. Whilst not a legal requirement, the test is designed to ensure policy is developed with a family perspective. Strong and stable families and family relationships, in all their forms, play an important role in society. Whether intended or not, a wide range of government activity has a direct or indirect impact on family. The family test evaluates the potential impact of policies on family relationships.

The primary purpose of an occupational pension scheme is to provide an income for a member in retirement. This provides financial security in retirement that can be key to a family unit. The aim of this policy change is to ensure access to the NHS Pension Scheme, which is a valuable vehicle for retirement saving, is protected for staff working in primary care.

Technical updates to member contributions provisions

The impact of the changes to the member contribution structure were considered as part of a previous consultation process. Further information, including equality analysis, can be found on the GOV.UK website at NHS Pension Scheme: proposed changes to member contributions.

The technical amendments that are contained in this consultation are required to give effect to the policy that was previously consulted on. Therefore, a further equality analysis has not been provided. However, if respondents do have equality concerns, then they are invited to include their concerns in their responses and the department will consider them in further detail.

Annex: example scenarios

Access rules for the most common types of PCNs, based on an example scenario of 8 new staff being employed:

Scenario 1

PCN model

Practice A is the nominated payee and employs all the 8 new staff. Practice A allocates the funding amongst the 4 practices that form the PCN. The practice A staff may work across all the practices.

NHS Pension Scheme access

All 8 employees have NHS Pension Scheme access.

The non-GP salaried employees are practice staff in NHS Pension Scheme terms. Any salaried GPs are type 2 medical practitioners and must complete their pension forms every year.

Where a GP locum is deputising for an absent GP, they may pension their income.

Notes

Practice A is the NHS Pension Scheme employing authority for the practice staff. NHS England (NHSE), and/or Primary Care Support England (PCSE), is the employing authority for the salaried GPs. Practice A must submit a revised estimate of pensionable income form listing any new GPs.

The practice partners at all 4 practices must pension the profitable element of the additional PCN and/or ARRS funding.

If practice A is reimbursed by practices B, C and D, in respect of the 8 staff practice A cannot pension the reimbursed income because it would mean it has been pensioned twice.

Scenario 2

PCN model

Practice A is the fund holder and allocates the funding across the PCN.

Each of the 4 practices employs 2 new staff. The staff may work across the PCN or within their own practices.

NHS Pension Scheme access

All 8 staff have NHS Pension Scheme access.

The non-GP salaried employees are practice staff in NHS Pension Scheme terms. Any salaried GPs are type 2 medical practitioners and must complete their pension forms every year.

Where a freelance GP locum is deputising for an absent GP (or engaged on a temporary basis) they may pension their income.

Notes

Practice A is the employing authority for its practice staff.

The same applies for practices B, C and D. NHSE and/or PCSE is the Employing Authority for the practice-based salaried GPs.

The practices must submit a revised estimate of pensionable income form listing any new GPs.

The practice partners must pension any profitable element of the additional funding. Any reimbursement between the practices is not pensionable.

Scenario 3

PCN model

Company or federation W is created to oversee the PCN and may also be the fund holder or disclosed agent but is not an employing authority. It directly employs the 8 new staff. Company or federation W retains some or all the PCN funding to cover their overheads, including the 8 new staff.

The 8 company or federation W staff work across the PCN.

NHS Pension Scheme access

The 8 company or federation W employees do not have automatic access to the NHS Pension Scheme because the company or Federation is not an employing authority. The employed staff may have temporary access to the NHS Pension Scheme until 31 March 2023 under a direction or determination order, but only if they are directly assisting in the performance of GMS, PMS, APMS, PCN or ARRS.

Any self-employed individuals (including GPs and GP locums) working for the company or federation W do not have NHS Pension Scheme access.

Notes

If company or federation W wants the 8 staff to have access to the NHS Pension Scheme it must apply to the NHSBSA’s scheme access team for temporary direction or determination status until 31 March 2023.

The (A, B, C and D) practice partners must pension any profitable element of the PCN funding.

Subject to consultation outcome the intention is that time-limited access up to 31 March 2023 would be replaced by permanent access.

Scenario 4

PCN model

Company or federation X is overseeing the PCN and may also be the nominated fund holder or disclosed agent and is already a classic APMS or employing authority because it holds an APMS contract and all the shareholders are GPs. It directly employs the 8 new staff. Company or federation X retains some or all of the PCN funding to cover their overheads, including the new staff. The 8 employees work across the PCN.

NHS Pension Scheme access

All 8 employees have NHS Pension Scheme access. The non-GP salaried employees are practice staff with company or federation X as their employing authority.

The employing authority for the GPs is NHSE or PCSE.

Salaried GPs are type 2 medical practitioners and must complete their pension forms every year.

Where a freelance GP locum is deputising for an absent GP (or engaged on a temporary basis) they may pension their income.

Notes

NHS Pension Scheme access is allowed because there has been a variation to the existing APMS contract held by company or federation X.

Company or federation X must submit a revised estimate of pensionable income form listing any new GPs.

Company or federation X and the 4 practices must pension any PCN or ARRS profits.

If Company or federation X is reimbursed by any of the 4 practices in respect of the 8 staff, it cannot pension the reimbursed income because it would mean it has been pensioned twice.

Scenario 5

PCN model

Company or federation Y is overseeing the PCN and may also be the nominated fund holder or disclosed agent. It is an independent provider or employing authority as it holds an APMS contract but not all the shareholders are GPs.

Company or federation Y directly employs the 8 new staff who all work across the PCN.

Company or GP federation Y retains some or all of the PCN funding to cover its overheads, including the 8 new employed staff.

NHS Pension Scheme access

All 8 staff have NHS Pension Scheme access, assuming that their PCN or ARRS work falls within company or federation Y’s APMS remit.

All 8 staff are officers, including any salaried GPs.

Company or federation Y is the employing authority for all the employees, including salaried GPs.

Self-employed individuals (including GPs) do not have NHS Pension Scheme access.

Notes

NHS Pension Scheme access is allowed because there has been a variation to the APMS contract.

Company or federation Y must comply with Independent Provider pension legislation.

The 4 practices must pension any PCN or ARRS profits.

Scenario 6

PCN model

Company or federation Z is overseeing the PCN and may also be the nominated fundholder or disclosed agent and is an Independent Provider or employing authority as it holds an NHS Standard contract.

Company or federation Z employs the 8 new staff who work across the PCN.

Company or federation Z retains some or all of the PCN funding to cover their overheads, including the 8 new staff.

NHS Pension Scheme access

There is no automatic NHS Pension Scheme access because the staff are not spending more than 50% of their time on the Standard contract.

They may be afforded temporary access to the NHS Pension Scheme until 31 March 2023 under a direction or determination order if they are assisting in the performance of PMS, APMS, PCN or ARRS.

All 8 staff would be officers, including salaried GPs. Self-employed individuals, including GPs, do not have NHS Pension Scheme access.

Notes

If Company or federation Z wants the 8 staff to have access to the NHS Pension Scheme it must apply to the NHSBSA’s scheme access team for temporary direction or determination status until 31 March 2023.

The practices must pension any profitable element of the PCN or ARRS funding.

Subject to consultation outcome the intention is that time-limited access to 31 March 2023 would be replaced by permanent access.

Scenario 7

PCN model

An NHS trust or foundation trust is overseeing the PCN and may also be the nominated fund holder or disclosed agent and directly employs the 8 new staff who work across the PCN.

The trust or foundation trust retains some or all of the funding to cover their overheads.

NHS Pension Scheme access

All 8 trust employees, including any salaried (employed) GPs, are officers in NHS Pension Scheme terms.

Any self-employed individuals (including GPs) working for the trust do not have NHS Pensions Scheme access.

Notes

All 8 employees are officers regardless of their duties or location.

The practices must pension any profitable element of the PCN/ or ARRS funding.

Scenario 8

PCN model

All 4 practices (A, B, C and and D) receive the additional funding either individually or through one PCN fundholder bank account.

The 8 new staff are jointly employed by all 4 practices and work across the network.

NHS Pension Scheme access

Because a PCN is not a legal entity and therefore not an employing authority, the non-GP staff only have access to the NHS Pension Scheme (as practice staff) if they have 4 individual concurrent part-time contracts of employment with each of the 4 practices.

Any salaried GPs may only have NHS Pension Scheme access if they have individual contracts of employment with each of the 4 practices. As type 2 medical practitioners they must complete their pension forms every year.

Notes

If there are 4 individual part-time practice staff contracts of employment any (aggregated) hours in excess of whole-time are not pensionable.

A salaried GP’s pensionable pay is not restricted to whole-time .

The employing authority in respect of the GPs is NHSE or PCSE.

The practices must submit a revised estimate of pensionable income form listing any new GPs.

The practice partners must pension any profitable element of the additional funding.

Any reimbursement amongst the 4 practices is not pensionable otherwise it would mean it has been pensioned twice.

Privacy notice

Published 5 December 2022

Summary of initiative or policy

This consultation sets out proposals to make amendments to NHS Pension Scheme regulations. The proposals are to introduce partial retirement flexibilities to the 1995 Section of the NHS Pension Scheme, fix the CPI disconnect issue in the revaluation of doctors’ pensions, allow staff working in PCNs to access the scheme, and to make technical amendments to the calculation of member contributions for GPs to ensure they pay the correct rate over a full year.

As part of the consultation process, respondents are invited to complete an online survey to provide their views on the proposals.

The consultation will run from 5 December 2022 to 30 January 2023.

Data Controller

Department of Health and Social Care is the Data Controller.

What personal data we collect