Guide to Tribunal Statistics Quarterly

Published 10 December 2020

1. Introduction

This document accompanies the Tribunal Statistics Quarterly and provides a background overview related to HMCTS Tribunals, focusing on concepts and definitions published in Ministry of Justice statistics. It also covers policy background and changes, statistical publication revision policies, data sources, quality and dissemination.

Additional chapters are included in the Tribunal and Gender Recognition Statistics bulletin, for certain quarters in the year, and have been summarised below:

-

September publication: includes an additional chapter and supporting tables relating to more detailed annual Employment and Employment Appeal Tribunal statistics.

-

December publication: this provides a more detailed breakdown of the Special Educational Needs and Disability (SEND) tribunals by academic year.

-

June publication: includes revised annual summaries of all tribunals and additional chapters relating to Adjournments, Postponements, Judicial Salaried and Fee-paid sittings. Also includes the rate of appeal to the SEND Tribunal for the prior calendar year.

Statistical Notices of Further breakdown to the published figures

The following are statistical notices of further tribunal breakdowns that have been published alongside the quarterly Tribunals and Gender Recognition Certificate Statistics in the past year:

March 2020

- An updated statistical notice on Immigration and Asylum (I&A) Detained Immigration Appeals (DIA) to include data to Q3 2019/20.

June 2020

- An updated statistical notice on Immigration and Asylum (I&A) Detained Immigration Appeals (DIA) to include data to Q4 2019/20.

December 2020

- An updated statistical notice on Immigration and Asylum (I&A) Detained Immigration Appeals (DIA) to include data to Q2 2020/21.

2. Structure and Overview of Tribunals

Tribunals are specialist judicial bodies which decide disputes in particular areas of law. Appeals to tribunals are generally against a decision made by a Government department or agency. The main exception to this is the Employment Tribunal where cases are on a party v party basis (specifically, employee versus employer). There are tribunals in England, Wales, Scotland and Northern Ireland covering a wide range of areas affecting day-to-day life. Her Majesty’s Courts & Tribunals Service (HMCTS) administers many of them although some are the responsibility of the devolved governments in Scotland, Wales and Northern Ireland. Please note that the quarterly statistics do not include data on tribunals not covered by HMCTS.

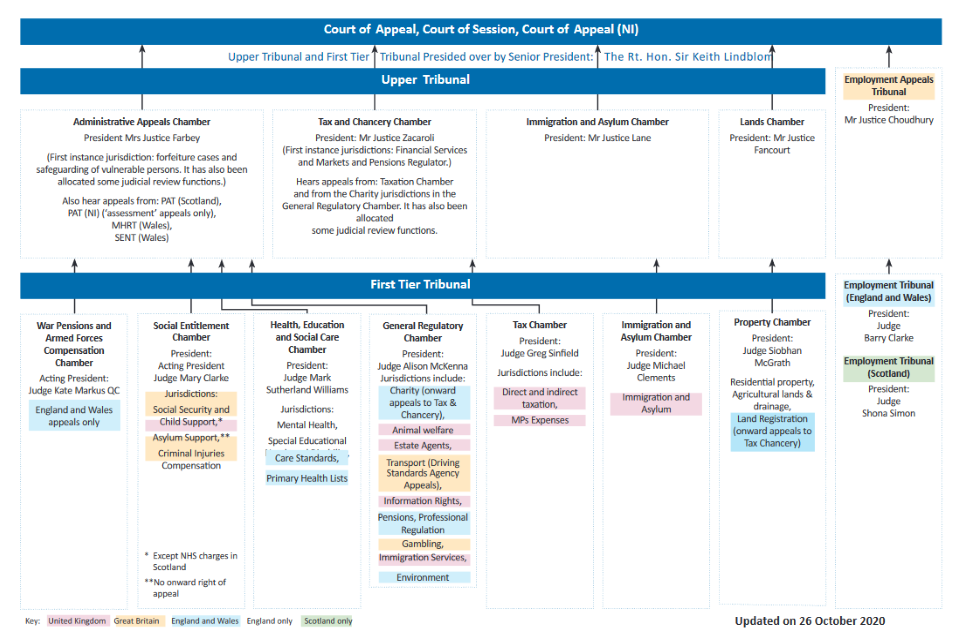

Tribunals have a two-tier structure (see Figure 1). The First Tier tribunal hears first instance appeals, primarily (but not exclusively) against certain decisions made by Government departments or other public bodies. The Upper Tribunal generally hears appeals from decisions of the First Tier tribunal although it also deals with certain matters at first instance.

The two tiers are divided into chambers which deal with particular areas of work. There are seven chambers in the First Tier Tribunal:

-

War Pensions and Armed Forces Compensation: deals with appeals against decisions made about the entitlement to, or amount of, pension or compensation awarded to ex-service personnel who have been injured, or sustained illness, during service in the Armed Forces.

-

Social Entitlement: mainly deals with appeals against decisions about a range of benefits and credits made by the Department for Work and Pensions, Her Majesty’s Revenue and Customs, and Local Authorities, but also appeals against decisions about Asylum Support and Criminal Injuries Compensation.

-

Health, Education and Social Care: this deals with a range of appeals including decisions taken under the Mental Health Act and assessments of Special Educational Needs.

-

Tax Chamber: appeals against assessments of direct and indirect taxation and also appeals in cases of MPs’ expenses.

-

Immigration and Asylum: appeals against decisions of the Home Office relating to permission to stay in the UK, deportation from the UK and entry clearance to the UK.

-

Property: primarily disputes about rent and land valuations.

-

General Regulatory: this deals with a wide range of matters, mainly in relation to regulated services, such as Charity, Information Rights, Claims Management, Gambling and Transport.

HMCTS is also responsible for a number of specialist tribunals, including, for example, the Gender Recognition Panel.

The Upper Tribunal has four Chambers: Tax and Chancery, Immigration and Asylum, Lands and Administrative Appeals.

In addition, HMCTS is also responsible for the administration of the Employment Tribunal and the Employment Appeal Tribunal, although these sit outside the unified structure.

Figure 1: First-tier and Upper Tribunal chambers

Appeals to the First Tier Tribunal are against the decisions from government departments and other public bodies. The Upper Tribunal hears appeals against decisions made by the First Tier Tribunal on points of law; specifically, an appeal made over the interpretation of a legal principle or statute. Further appeals may be made, with permission, to the Court of Appeal.

Tribunal judges are legally-qualified. Tribunal members are specialist non-legal members of the panel and include doctors, chartered surveyors, ex-service personnel or accountants. Tribunals often sit as a panel comprising a judge and non-legal members however in some jurisdictions cases may be heard by a judge or member sitting alone.

The Tribunal Statistics Bulletin covers information on receipts (i.e. cases received by HMCTS), the outcome of cases by category (e.g. cases disposed of at hearing) and the caseload outstanding (snapshot of live cases at a specific point in time). It also goes into more detail on the three largest tribunals, including statistics on the outcome of appeals and the mean and median time to clear appeals to these tribunals). The three largest tribunals based on volumes of appeals received are; Employment, Immigration and Asylum, and Social Security and Child Support. These three tribunals accounted for over 80% of all tribunal receipts in 2019/20.

2.1 Employment

Employment tribunals are independent judicial bodies established to resolve disputes between employers and employees over employment rights.

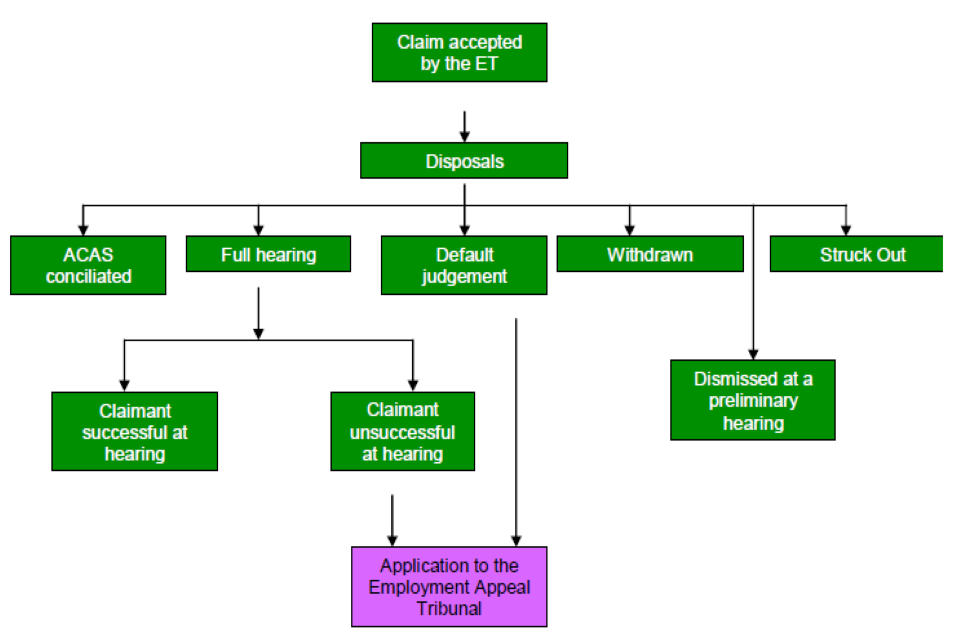

The following simplified flowchart shows the stages of Employment Tribunal (ET) receipts and disposals. Please note this is a simplified flowchart and does not cover all the possible processes involved.

Figure 2: Employment Tribunal receipts and disposals

* any decision of the ET may be appealed to the EAT, by either party

On 26 July 2017 the Supreme Court in its judgment in R (on the application of Unison) v Lord Chancellor ruled that Employment Tribunal and Employment Appeal Tribunal Fees Order 2013, SI 2013/1893 (“the Fees order”) which came into effect on 29 July 2013 was unlawful under both domestic and EU law because it had the effect of preventing access to justice.

Prior to the Supreme Court judgment, quarterly Tribunals publications included data on Employment Tribunal fees. Following the abolition of ET fees, a final analysis was published on 14 December 2017 covering statistics between 29 July 2013 (when ET fees were first introduced) and 26 July 2017 (when they were abolished). From March 2018, summary statistics relating to the employment tribunal fee refund scheme have been published in Tribunals Statistics Quarterly.

Employment Tribunal claims are counted as received (receipts) once the tribunal has accepted the claim as valid. Claims in employment tribunals can be classified into either single or multiple claims. Single claims are made by a sole employee/worker, relating to alleged breaches of employment rights. Multiple claims are where two or more people bring proceedings arising out of the same facts, usually against a common employer. Both single and multiple claims can involve one or more jurisdictional complaints. Where claims are grouped as multiples, they are processed administratively and managed judicially together. We call these groups of claims ‘multiple claims cases’.

A claim (either single or multiple) can be brought under one or more different jurisdictions, for example under Age Discrimination and Equal Pay. Therefore the number of jurisdictional complaints is always greater than the total tribunal claims received.

The trend in multiple claims is more volatile than single claims due to large numbers of claims against a single employer which can skew the national figures. For example, in September 2016 and March 2017, the large increases in ET multiple claims were due to two multiple airline cases relating to the working time directive jurisdiction. This was particularly prevalent prior to October 2013 when a small number of multiple cases against the airline industry had to be resubmitted each quarter.

Under the previous ET fees scheme, claims were separated into two distinct types, each attracting a different fee. ‘Type A’ claims were more straightforward, and so had a lower fee. These included claims about unpaid wages, payment in lieu of notice and redundancy payments. ‘Type B’ claims involved more complicated issues, and therefore attracted a higher fee. These types of claim tended to be those involving unfair dismissal or discrimination complaints.

Single claim cases had standard fees associated with them, whereas multiple claim cases had different fees depending on the number of claimants they contained. When a claim (either single or multiple) had more than one jurisdictional complaint and at least one of the complaints was a Type B, a Type B fee was payable.

Fee Refund Scheme

Following the Supreme Court ruling in July 2017 (as referenced above), all Employment Tribunal fees not fully remitted are eligible for a full refund. In addition, where a case was closed due to the non-payment of a fee, the claimant has been invited to reinstate the case (at the stage at which the fee was not paid).

The Ministry of Justice (MoJ) launched a fee refund scheme in October 2017, to reimburse those individuals that had previously paid a fee. The MoJ initially estimated the cost of this scheme to be approximately £33m. Applications may be made by an individual or organisation for each individual fee that was paid, however reimbursements are being made by the Ministry of Justice on a total claim basis, including if a claimant paid for more than one case.

Applications received by the MoJ will be processed to assess validity and the total amount due to each claimant. Refund payments are then made following completion of processing.

Reinstatements

Under the ET fee scheme, when a claimant did not pay the requested fee within the required timeframe, the case would have been struck out due to lack of fee payment. Following the Supreme Court judgement, claimants who had their case struck out for this reason were invited to reinstate their case at the point which it was closed. During October and November 2017, invitations were extended to all relevant claimants to apply to reinstate their case in this manner. Applications are reviewed to assess validity and feasibility to reinstate the case, before being logged as a new case receipt.

Employment Appeal Tribunal (EAT)

The main function of the Employment Appeal Tribunal (EAT) is to hear appeals from decisions made by Employment Tribunals. An appeal must be on a point of law, i.e. it must identify flaws in the legal reasoning of the original decision.

The Employment Appeal Tribunal will not normally re-examine issues of fact. It also hears appeals from (and applications relating to) decisions made by the Certification Officer or by the Central Arbitration Committee, however these are infrequent. The EAT may allow an appeal and substitute its own decision for that of the Employment Tribunal, or may remit it back to the Employment Tribunal for rehearing.

2.2 Immigration and Asylum

Immigration and Asylum appeals are against decisions made by the Home Office relating to permission to stay in the UK, deportation from the UK and entry clearance to the UK.

The First-tier Tribunal Immigration and Asylum Chamber (FTTIAC) is an independent Tribunal which deals with appeals against decisions made by the Home Office in immigration, asylum and nationality matters. The Upper Tribunal Immigration and Asylum Chamber (UTIAC) is a superior court of record dealing with appeals against decisions made by the FTTIAC.

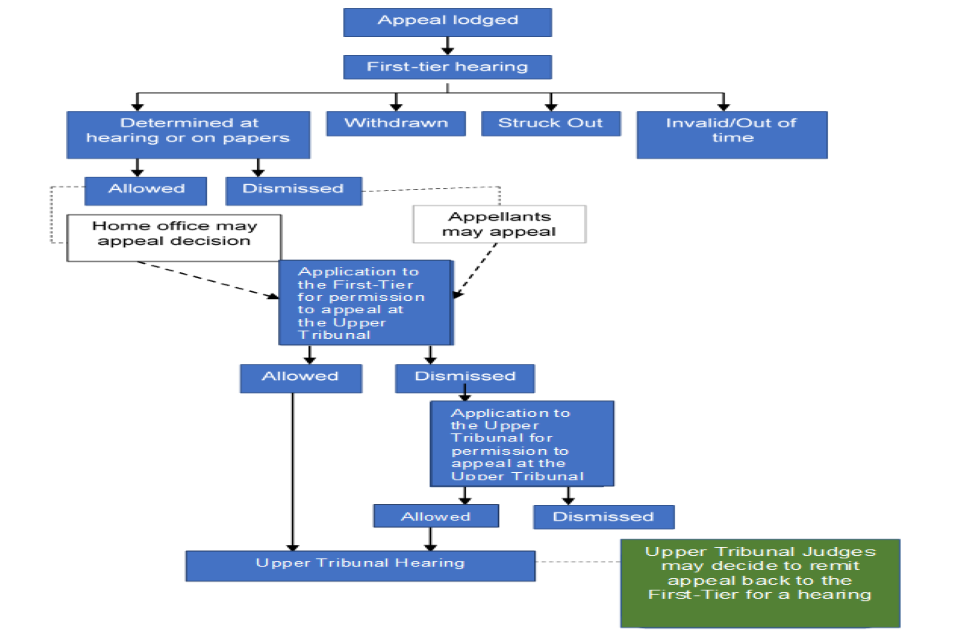

The following simplified flowcharts show the stages of FTTIAC Tribunal receipts and disposals. Please note these do not cover all the possible processes involved.

Figure 3: Immigration and Asylum Tribunal receipts and disposals

The introduction of the Immigration Act 2014 removed a number of existing appeal rights against Home Office decisions and refused applicants can now only appeal by first asserting a fundamental right to enter or remain in the UK. These rights are Protection, Removal of Refugee Status, Human Rights, or European Free Movement. Where appeal rights were removed and the applicant asserts the Home Office has made an error in its decision, there is now a right to an Administrative Review by the Home Office. Deprivation of Citizenship and some Deportation appeal rights were not affected by the implementation of the Act as the appeal right is given by European law.

The Immigration Act was implemented in full from April 2015. This was followed by a transitional period during which the FTTIAC received both pre- and post- Immigration Act appeals. Please see Chapter Policy Background and Changes for more information.

On 1 November 2013, the responsibility for most Immigration and Asylum Judicial Reviews (JRs) transferred from the Administrative Court to the Upper Tribunal, including a bulk transfer of 3,230 live cases. Subsequently, if a Judicial Review needs to be transferred between the two jurisdictions it will be re-registered by the importing office. This is because the Upper Tribunal and Administrative Court have separate case management systems and means that a case may be counted in both sets of figures, if it started the process in one and was concluded in the other. For the number of Immigration and Asylum JR cases that are dealt with by the Administrative court, these can be found in the Civil Justice Statistics Quarterly publication.

2.3 Social Security and Child Support

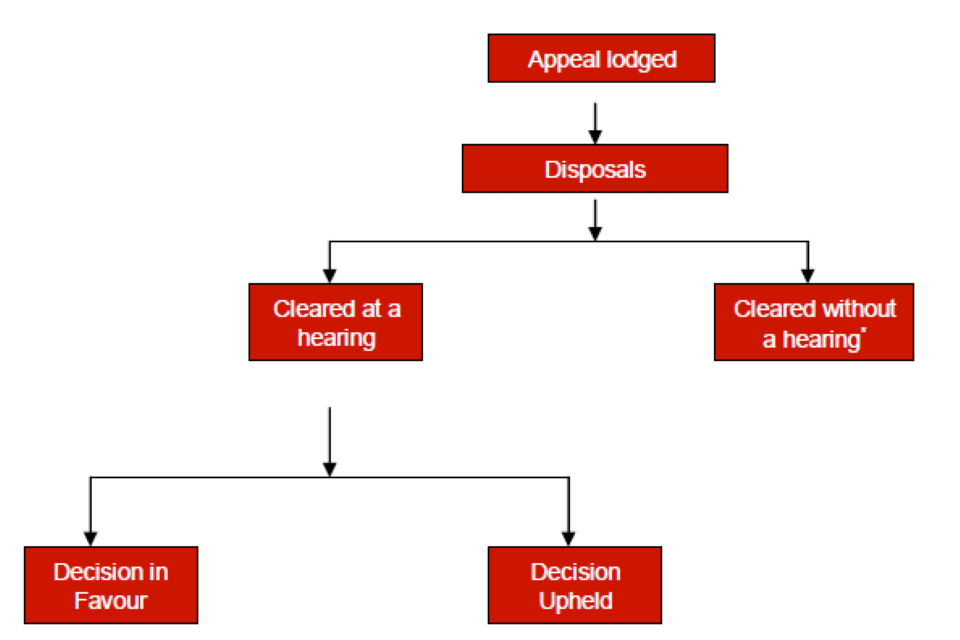

The following simplified flowchart shows the stages of Social Security and Child Support (SSCS) Tribunal receipts and disposals. Please note these are simplified flowcharts and do not cover all the possible processes involved.

Figure 4: SSCS Tribunal receipts and disposals

*Cleared without a hearing includes strike outs, superseded and withdrawals prior to a hearing.

SSCS tribunals usually account for the largest proportion of receipts – 41% of all tribunal receipts in 2019/20 were to the SSCS tribunal. Following the staged introduction of mandatory reconsideration from April 2013, the number of appeals declined in 2013/14, reaching their lowest in July to September 2014. Since then, the number of appeals has in general been gradually increasing. Universal Credit (UC) and Personal Independence Payment (PIP) appeals are currently the main benefit types – making up 73% of all receipts in the SSCS tribunal in 2019/20. PIP was introduced in April 2013 and is replacing[footnote 1] Disability Living Allowance (DLA) for people aged between 16 and 64 who need assistance with personal care or mobility as a result of a physical or mental disability. In addition to new benefit claimants being required to claim for PIP and not DLA, DWP are transitioning individuals already in receipt of DLA to PIP via a reassessment programme.

The composition of an SSCS Tribunal panel varies between appeal types – some appeals can be heard by a Judge sitting alone (such as appeals against decisions on Job Seekers’ Allowance) while some appeal panels include a Medical Member (MM), Senior Medical Member (SMM) or Disability Qualified Tribunal Member (DQTM).

2.4 Tribunal Venue Level Data

FTTIAC and the SSCS tribunal data are now routinely published at a venue level in accompanying FTTIAC and SSCS CSV files, within the suite of tribunal statistics CSV zip files.

SSCS Venue level CSV

The SSCS tribunal venue data was first published in the March 2018 publication, providing the following data:

-

Receipts

-

Disposals[footnote 2]

-

Disposals cleared at hearing[footnote 3]

-

Disposals not cleared at hearing[footnote 4]

From the June 2018 publication onwards, further information has been added to the data which includes:

-

Decisions upheld, for those cases cleared at hearing[footnote 5]

-

Decisions in favour, for those cases cleared at hearing[footnote 6]

-

Average number of weeks from receipt to final outcome, for appeals disposed of in the period

This SSCS venue data is grouped by benefit type, based on the following categorisation:

-

Personal Independence Payment (PIP) -– which replaced Disability Living Allowance from 8 April 2013, therefore this category also includes Disability Living Allowance reassessed cases.

-

Employment Support Allowance (ESA) – includes Employment Support Allowance and Incapacity Benefit reassessment. Employment Support Allowance was introduced in October 2008 and Incapacity Benefit reassessment followed in October 2010.

-

Universal Credit – separated out from the ‘other’ category from June 2019 publication onwards. Universal credit was introduced in 2013 to replace six means-tested benefits and tax credits: income based Jobseeker’s Allowance, Housing Benefit, Working Tax Credit, Child Tax Credit, income based Employment and Support Allowance and Income Support. It is being introduced in stages across the UK.

-

Others – data includes appeals under all other benefit types processed by the SSCS tribunal. For a full list of benefit types please see tables SSCS_1- SSCS_3 of the Main Tables published alongside this guide.

Total – the total number of cases received and cleared by the SSCS tribunal for all benefit types at each tribunal location (and nationally).

FTTIAC Venue level CSV

FTTIAC venue data was first published in the June 2019 publication, providing:

-

Receipts

-

Disposals

-

Percentage of disposals determined

-

Percentage of disposals withdrawn

-

Percentage of disposals stuck out

-

Percentage of disposals invalid

-

Percentage of disposals remitted

-

Determined at hearing / papers

-

Percentage of determined Allowed

-

Percentage of determined Dismissed

-

Average number of weeks from receipt to final outcome, for appeals disposed of in the period

FTTIAC venue data is grouped by the following:

-

Protection – appeals on the grounds that removal from the United Kingdom would breach the United Kingdom’s obligations under the Refugee Convention. These appeals were previously referred to as asylum appeals.

-

Revocation of Protection – appeals on the grounds that removal from the United Kingdom would breach the United Kingdom’s obligations in relation to persons previously adjudged as eligible for a grant of humanitarian protection. Previously included within the classification of asylum.

-

EEA Free Movement – on the grounds that Home Office decision is restricting rights under the EEA right to free movement.

-

Human Rights – appeals on the grounds that the decision to refuse a human rights claim is unlawful under the Human Rights Act 1998.

-

Others – data includes appeals under all other case types processed by FTTIAC. For a full list of case types please see tables FIA_1-FIA_3 of the Main Tables published alongside this guide.

-

Total – the total number of cases received and cleared by the FTTIAC tribunal for all appeal types at each tribunal location (and nationally).

Protection and Revocation of Protection cases are grouped together as Asylum/Protection/Revocation of Protection.

Where the number of cases for a hearing outcome is below five for a given benefit, the number of decisions upheld and in favour have been supressed, in order to comply with disclosure requirements. In some cases the total figures for that venue have also been supressed, where for example it would be possible to calculate supressed figures from the total figure provided. Supressed figures are indicated by a “~” notation, and are distinct from zero values.

Average Time Taken figures in the CSV files

The average time taken from receipt to final disposal outcome is published at a benefit level from June 2018 onwards for the SSCS tribunal and from March 2019 onwards for the FTTIAC. Weighted averages are provided at a national level in the published main tables (tables T_2 – T_3), as well as at a tribunal location level in the accompanying CSV file. Weighted averages for a combination of tribunal locations or benefit types can be calculated from the underlying data, using the following methodology:

-

Multiply the total number of disposals by average time to clearance, to obtain the weight.

-

Add the weighted scores together

-

Divide the weighted scores by the overall number of disposals, to arrive at the Calculation of Weighted Average (C.W.A)

An example of this calculation for eight Tribunal venues is shown below:

| Venue | Average Time (Weeks) | Total Disposals | Weight = (Sum of Average Time (Week) * (Sum of Total Disposals) | C.W.A |

|---|---|---|---|---|

| Barnsley | 20 | 75 | 1,500 | |

| Darlington | 31 | 106 | 3,286 | |

| Doncaster | 23 | 128 | 2,944 | |

| Durham | 30 | 123 | 3,690 | |

| Scarborough | 23 | 73 | 1,679 | |

| Sheffield Castle St | 24 | 361 | 8,664 | |

| South Shields | 38 | 136 | 5,168 | |

| York | 21 | 50 | 1,050 | |

| C.W.A = (Sum of Total Weight/Sum of Total Disposals) | 3,113 | 78,660 | 25 |

2.5 Gender Recognition Certificates

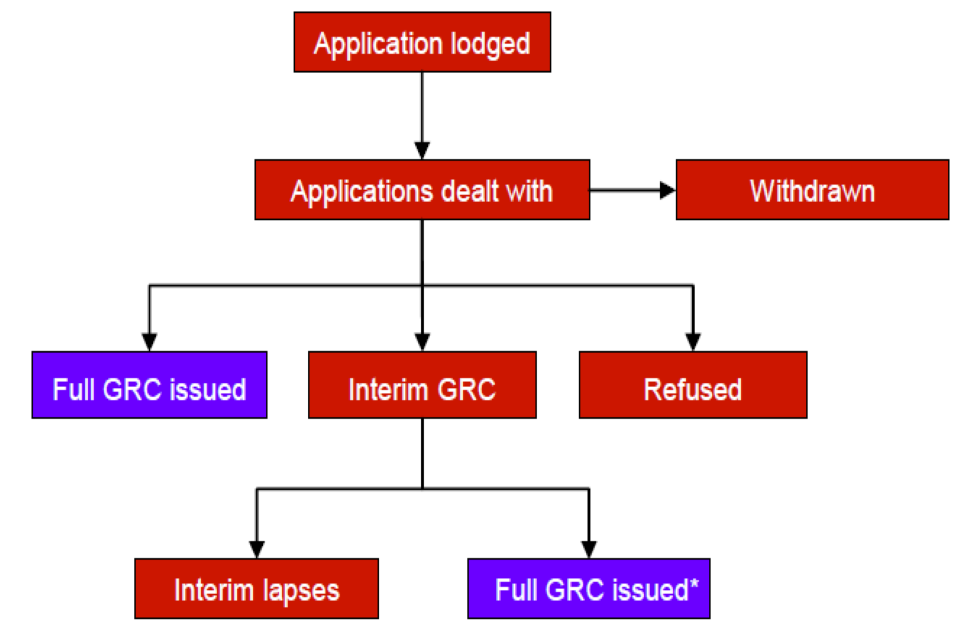

The Gender Recognition Panel (GRP) was established under the Gender Recognition Act 2004 (GRA), which enables transsexual people to change their gender legally and gain the rights and responsibilities of their newly-acquired gender. All applications are determined by the Panel and applicants who meet the GRA’s requirements are granted a Gender Recognition Certificate.

The GRP is part of Her Majesty’s Courts and Tribunals Service (HMCTS) and comprises of legal and medical members, supported by an administrative team. The panel sit in private and consider the documentary evidence supplied by the applicant in support of their application to have their gender recognised. The applicant is not required to appear in person.

The Marriage (Same Sex Couples) Act 2013 and the Marriage and Civil Partnerships (Scotland) Act 2014 introduced same-sex marriage which changed the process of obtaining a GRC. Prior to the act, a married individual wishing to obtain a GRC had to either divorce or annul their marriage using an Interim GRC and then if they wished to stay with their partner, they could form a civil partnership. The introduction of the act means in a pre-Act marriage where one individual wishes to obtain a GRC can be converted to a same-sex marriage with the consent of the spouse.

Interim certificates are granted to applicants who meet the criteria for gender recognition, but who:

-

are not eligible to remain married following their gender recognition because they were married under the law of Northern Ireland or

-

are eligible but either they and/or their spouse have decided that they do not wish to remain married after the issue of their full Gender Recognition Certificate or

-

are in a protected civil partnership[footnote 7] or Scottish protected civil partnership[footnote 8], where only one partner has applied for gender recognition (or where both have applied and only one is successful) or

-

are in a civil partnership but one which is not a protected or Scottish protected civil partnership.

In these circumstances, once the successful applicant has ended their marriage or civil partnership, they can then be issued a full GRC.

Under United Kingdom law, individuals are considered by the State to be of the gender – either male or female – that is recorded on their birth certificate. The Gender Recognition Act 2004 (GRA), which came into effect on 4 April 2005, enables transsexual people who experience severe gender variance to change their legal gender. They can do this by applying to the Gender Recognition Panel (GRP) for a Gender Recognition Certificate (GRC). A GRC entitles the individual to recognition of the gender stated on the certificate “for all purposes”. Those with a UK birth entry may use their GRC to obtain a new birth certificate recording their new name and legal gender.

Individuals seeking to change their gender status must provide the GRP with evidence demonstrating a diagnosis of persistent gender dysphoria; they have lived permanently in the acquired gender for two years or more; and intend to live in the acquired gender for the rest of their lives. Genital surgery is not a requirement however if this has taken place then the applicant must provide details.

There are three application processes for applying for a GRC:

- Standard track applications are submitted if the individual:

-

has been diagnosed with gender dysphoria,

-

has lived in the acquired gender in the UK for at least 2 years and

-

intends to live in the acquired gender for the rest of their lives.

- Alternative track applications are submitted if the individual:

-

has been diagnosed with gender dysphoria or had surgery to change their sexual characteristics,

-

lives in England, Wales or Scotland most of the time,

-

intends to live in the acquired gender for the rest of their lives,

-

is in (or has been in) a protected marriage or protected civil partnership and

-

has lived in the acquired gender for at least 6 years before 10 December 2014 (16 December 2014 for Scottish marriages and civil partnerships).

- Overseas track applications are those submitted under the overseas application process, on the basis of having changed gender under the law of an approved country or territory outside the United Kingdom.

The overseas process requires applicants to demonstrate that they have been legally recognised in their acquired gender in a country or territory that is listed in the Gender Recognition (Approved Countries and Territories) Order 2011. The list is available on the Ministry of Justice website www.justice.gov.uk/tribunals/gender-recognition-panel/overseas-application-process.

Under all circumstances, an applicant must also prove that they are at least 18 years of age at the date of application.

A full GRC issued by the GRP shows that a person has satisfied the criteria for legal recognition in the acquired gender. It is issued to successful applicants. From the date of issue, the holder’s gender becomes the acquired gender for all purposes. Such individuals are entitled to all the rights appropriate to a person of their acquired gender, for example the right to retire and receive state pension at an age appropriate to their acquired gender. A person whose birth was registered in the UK is able to obtain a new birth certificate showing their recognised legal gender.

An interim GRC is issued to a successful applicant if he or she is married and either needs (or wants) to end that marriage before a full gender recognition certificate can be issued, or is in a civil partnership at the time of the application. The interim certificate is issued to allow the applicant and his or her spouse or civil partner to end their marriage or civil partnership easily. It has no legal significance beyond this use. When the marriage or civil partnership is ended, a full GRC will be issued to the applicant.

Figure 5: The Gender Recognition Certificate process

2.6 Special Educational Needs and Disability

The First-tier Tribunal Special Educational Needs and Disability (SEND) jurisdiction hears appeals against the decision of local authorities in England relating to Education, Health and Care (EHC) plans. It also hears Disability Discrimination claims against schools.

For further information on children with special educational needs, please see the publication by the Department for Education below:

https://www.gov.uk/government/collections/statistics-special-educational-needs-sen

Special Educational Needs (SEN)

The First-tier Special Educational Needs and Disability (SEND) tribunal hears appeals against decisions of local authorities in England regarding special educational needs. Children or young people with Special Educational Needs may need extra help because of the effect of their needs on them accessing education. The law does not categorise special educational needs in types of needs but for statistical purposes these include profound and multiple learning difficulty; behavioural, emotional and social difficulty; and speech, language and communication needs.

Appeals to the tribunal can be made in relation to a number of different decisions a Local Authority would make relating to that system which include the refusal to assess a child with special educational needs.

The Children and Families Act 2014 reformed the system of support across education, health and social care to ensure that each of the services were organised with the needs and preferences of the child and their family firmly at the centre, from birth up to the age of 25. The Act introduced Education, Health and Care (EHC) plans – legal documents that set out the education, health and social care support a child or young person with SEN requires when their needs cannot be met by resources available to mainstream early years providers, schools and post-16 institutions. They are focused on the outcomes the child or young person wants to achieve and set out how the services will work together to support those outcomes.

Any child brought to the attention of the local authority as potentially having a special educational need after 1 September 2014 falls under the new scheme. Children with statements of special educational needs underwent a transition process to move them into the new EHC system by March 2018. That transition process is still underway for a small group of children and young people who have yet to be issued with EHC plans. For the period of transition, when both systems are being run in parallel, appeals to the SEND tribunal can therefore arise in relation to either SEN Legal Framework.

The changes brought in under the Children and Families Act 2014 have also extended the reach of the SEND Tribunal. The number of families who can now appeal has increased as a result of the extension of EHC plans to those aged 0-25 (with certain additional criteria attached to the upper age group) where previously statements of SEN covered only school aged children and those in the early years; the granting of appeal rights to young people themselves and those in custody; and because the transfer process from statements and LDAs to EHC plans has opened up new opportunities to appeal. When interpreting the statistics, changes should be treated with caution.

A review was carried out to assess how well the disagreement resolution arrangements established under the Children and Families Act 2014 are working for children and young people with SEND, and their families. Results from the review and the government’s response are published here:

On 3rd April 2018, as part of a two year trial, the SEND Tribunal’s powers were extended to allow it to make non-binding recommendations on the health and social aspects of Education, Health and Care (EHC) plans. It should be noted that the duration of the trial has recently been extended and it will now end on 31st August 2021.

This gives parents and young people a ‘single route’ to raise all their concerns about an EHC plan in one place. Parents and young people are now able to seek recommendations on the health and/or social care elements of an Education, Health and Care (EHC) plan – but only if there is an educational element to the appeal. Before the trial they could only appeal about the special educational needs and provision sections, and the placement section of EHC plans – health and social care issues would only be able to be addressed through alternative routes.

As a result of the SEND reforms, the MoJ and the Department for Education (DfE) publicly consulted on the future of the SEND Tribunal appeal rate between December 2017 and February 2018. The appeal rate to the SEND Tribunal is now published as a percentage of all ‘appealable decisions’ on a calendar year basis. The first such appeal rate, for the calendar year 2017 and three comparative periods from 2014 to 2016, was published as part of the June 2018 publication. For further details on the calculation of this new appeal rate please refer to the published tables.

On 6 September 2019, the Government launched a major review into support for children with special educational needs. The review aims to improve the services available to families who need support, equip staff in schools and colleges to respond effectively to their needs as well as ending what many regard as the ‘postcode lottery’ they often face. Work on the review continues.

Disability Discrimination Claims

Disability discrimination claims relate to appeals against a school or academy in England. Schools or academies must not discriminate against a child on grounds of disability in relation to admissions, the provision of education and access to any benefit, facility or service; or exclusions. It is also unlawful for a school to harass or victimise an applicant or child because of disability.

Disability discrimination may be:

-

discrimination arising from disability;

-

failure to provide a reasonable adjustment for a disabled child;

-

direct discrimination;

-

indirect discrimination;

-

harassment; or

-

victimisation

2.7 Adjournments and postponements

Throughout the Tribunal process a case may be adjourned or postponed.

-

An adjournment is where, on the day of the hearing, the Panel decides that, for whatever reason, the appeal/case cannot be finalised and has to put off making a final decision to another date (for example because further evidence is required).

-

A postponement is where a case is taken out of the list, prior to the commencement of the hearing – parties to an appeal can apply to the Tribunal to have the hearing postponed but it is the Tribunal’s decision as to whether such an application can be granted. The Tribunal can also postpone a case on its own volition.

Data on postponements and adjournments is published in June (Q4 Tribunal and Gender Recognition Certificate Statistics - January to March). It covers five tribunals; First Tier Tribunal (Immigration and Asylum Chamber), Upper Tribunal (Immigration and Asylum Chamber) , SSCS, Mental Health, Criminal Injuries Compensation; and Special Educations Needs and Disability.

2.8 Tribunal Judicial Salaried and Fee-paid sittings

Sittings by tribunal judges are divided into two categories:

-

Fee paid sittings relate to those sittings counted by tribunal judges who are only paid for the days they work, and therefore charge a fee for their time. Judges are paid per sitting (half day/whole day) and not according to individual cases.

-

Salaried sittings relate to those days counted by tribunal judges who are paid an annual salary for their work.

The proportion of fee-paid sittings to salaried sittings varies across tribunals. For example, in 2019/20, the majority of sitting days in the Mental Health were fee-paid (92%), whereas the majority of sitting days in the Employment tribunal were salaried (74%).

The high number of sittings for mental health hearings are in part due to listing practices differing for this tribunal, as the majority of these hearings occur outside HMCTS courts or tribunal buildings and in settings such as hospitals, care homes and rehabilitation units. As mental health tribunal hearings are not restricted to two sessions a day, like a court or a tribunal venue, more hearings, and therefore sittings, can occur. Also considerable flexibility is required as to availability and location of members of the mental health tribunal, requiring a greater proportion of fee-paid sittings if the needs of the patient or the responsible authority are to be accommodated and time limits are to be met. This is especially so given some cases have to be listed for hearing within 7 days of an application being received.

Social Security and Child Support (SSCS) tribunals use fee paid judges to increase the flexibility of the tribunal to deal with the volatility of the workload. It should be noted that SSCS ‘sittings’ are not comparable to the other tribunals, due to a difference in reporting. Half day sessions are recorded rather than whole sitting days and therefore comparisons across tribunals should be used with caution. Published statistics on SSCS judicial sittings (Table JSFP_1) do not include non-legal members.

Employment tribunal and Immigration and Asylum tribunal sitting days can finish earlier or later if the list has been cleared. They will all still be counted as full sitting days, even though some can last less than the SSCS half days.

For Immigration and Asylum tribunals, a minority of appeals are heard by 2 or 3 Judges. Only the sitting day for the panel chair is counted in the published statistics.

2.9 Other special tribunals

Agricultural Land

Settles disputes and other issues between agricultural tenants and landlords arising from tenancy agreements held under the Agricultural Holdings Act and certain drainage disputes between neighbours.

Asylum Support

The Home Office consider whether an applicant and their dependants meet the test of destitution and to what extent support should be provided (for example, accommodation and cash for essential needs). If the Home Office refuse to provide support or, after they have been providing support, decide to stop or withdraw it, an asylum seeker can appeal to the Asylum Support Tribunal against their decision.

Care Standards

We’re responsible for handling appeals against decisions by the Secretary of State for Education, the Secretary of State for Health, Care Quality Commission, Ofsted or the Care Council of Wales which exclude, remove or suspend you from a register to work with or care for children or vulnerable adults.

Charity

Hears appeals and reviews against the decision of the Charity Commissioner.

Claims Management Services

Hears appeals from businesses and individuals who provide claims management services in areas including: Personal injury, Criminal injuries compensation, Employment matters, Housing disrepair, Financial products and services and Industrial injury disablement.

Community Right to Bid

This jurisdiction was established by the Department for Communities and Local Government’s Localism Act. Its intention is to allow local communities the opportunity to make a bid for property/land that they feel adds specific value to the community.

Consumer Credit

Hears and decides appeals from licensing decisions made by the Office of Fair Trading. It also hears appeals against penalties issued under money laundering regulations.

Criminal Injuries Compensation

Considers appeals against decisions made by the Criminal Injuries Compensation Authority (CICA). They only deal with appeals on claims for compensation for criminal injuries made on or after 1 April 1996 under the Criminal Injuries Compensation Scheme.

Examination Boards

Regulated awarding organisations can appeal to the examination board tribunal if they disagree with a decision by Ofqual or the Welsh Government to impose a fine, the amount of the fine or recover the costs of taking enforcement action.

Environment

Hears appeals against notices and penalties issued by the regulators under the Regulatory Enforcement and Sanctions Act 2008. Any appeal will be against one of the following items: Stop Notice - issued by the regulator ordering the appellant to stop performing an action immediately; Fixed / Variable Monetary Penalty; Compliance Notice -instructing the appellant to do some action specified in the notice; Restoration Notice -ordering the appellant to restore the situation to what it was before he committed the offence; Non-Compliance Penalty; Non-Issue of Completion Certificate to show that the appellant has completed some agreed action; The non-granting of compensation by the regulator or appealing against the amount of compensation offered; Regulatory Cost Recovery Notice - ordering the appellant to pay the regulator’s costs.

Estate Agents

The Tribunal hears appeals against decisions made by the Office of Fair Trading relating to an order prohibiting a person from acting as an estate agent where for example a person has been convicted of an offence involving fraud or other dishonesty; an order warning a person where for example that person has not met their duties under the 1979 Act; a decision refusing to revoke or vary a prohibition order or warning order made under the 1979 Act.

Financial Services & Pensions Regulator

This is not separate Tribunal but part of the Upper Tribunal (Tax & Chancery) Chamber. The former resolves referrals on matters relating to certain decisions of the Financial Services Authority.

Food

Hears appeals against some of the decisions taken by these regulators: Food Standards Agency; Department for Environment, Food and Rural Affairs; Local Authority Trading Standards Departments. Does not deal with complaints about the regulators or appeals.

Gambling Appeals

Hears appeals against decisions by the Gambling Commission. Appeals come from license holders or applicants for licenses. Appeals follow the Commission’s own review process.

Gangmasters Licensing Appeals

Hears cases against the GLA in the event of a decision to revoke a license; refuse a license application; modify a license; or refuse consent to the transfer of a license.

Immigration Services

Hears appeals against decisions by the Office of the Immigration Services Commissioner, which regulates immigration advisers. Also considers disciplinary charges brought by the Office of the Immigration Services Commissioner against immigration advisers.

Information Rights

Hears appeals from notices issued by the Information Commissioner under the Freedom of Information Act. Relates to mainstream citizen needs about making a freedom of information request.

Lands

Resolves disputes concerning land, such as compulsory purchase of land or property, claims for compensation for loss of value to land or property because of ‘public works’.

Local Government Standards in England

Makes first decisions on local councillors referred for breaches of the Code of Conduct and hears appeals against decisions by local authorities’ standards committees. Was abolished under the Localism Act 2011.

Mental Health

Hears applications and references for people detained under the Mental Health Act 1983 (as amended by the Mental Health Act 2007) or living in the community following the making of a conditional discharge, or a community treatment or guardianship order.

Primary Health Lists

General Practitioners (GPs), Dentists, Optometrists and some Pharmacists need to be on a locally managed performers list before being able to provide NHS services within the area of a Primary Care Trust. The Primary Health Lists jurisdiction hears appeals/applications resulting from decisions made by Primary Care Trusts as part of the local management of such performers’ lists.

Professional Regulation (formerly Alternative Business Structures)

The Legal Services Act 2007 allows for lawyers and non-lawyers to work together to offer legal services-these are known as Alternative Business Structures. (ABS). The ABS will have to apply to an approved regulator for a license. The tribunal hears appeals against decisions of the regulator.

Residential Property

Provides an independent service in England for settling disputes involving private rented and leasehold property, including Rent Cases, Leasehold Enfranchisement Cases, Leasehold Disputes, Housing Act 2004 Cases, Park Homes Cases.

Reserve Forces Appeal

Hears appeals against decisions of Ministry of Defence with regard to call up for military service and exemptions.

Special Educational Needs and Disability

Parents whose children have special educational needs can appeal to the First-tier Tribunal (Special Educational Needs and Disability - SEND) against decisions made by Local Education Authorities in England about their children’s education.

First Tier Tax Chamber

Hears appeals against decisions relating to tax made by Her Majesty’s Revenue and Customs (HMRC). Appeals can be made by individuals or organisations, single tax payers or large multi-national companies. Appeals range from the relatively simple to the complex across both direct and indirect tax

Transport

The first-tier hears and decides appeals against decisions of the Registrar of Approved Driving Instructors concern[ing] approved driving instructors, trainee driving instructors, and training provider appeals as well as other matters - for example, bus service permits. The upper tribunal hears appeals against decisions of Traffic Commissioners in connection with the Heavy Goods Vehicles & Public Services Vehicles Operators Licensing Systems.

Upper Tribunal (Administrative Appeals)

Hears appeals against decisions of the General Regulatory Chamber, the Health, Education and Social Care Chamber, Social Entitlement Chamber, and the War Pensions and Armed Forces Compensation Chamber.

Upper Tribunal (Lands)

The Lands Chamber has jurisdiction to hear appeals against all decisions made by the Property Chamber, and the Leasehold Valuation and Residential Property Tribunals in Wales, except for those relating to land registration cases which must be made to the Tax and Chancery Chamber of the Upper Tribunal.

Upper Tribunal (Tax & Chancery)

The Upper Tribunal (Tax and Chancery Chamber) aims to assist those wishing to appeal against, or involved in decisions of the First–tier Tribunal in Tax or Charity cases and people wishing to refer matters relating to certain decisions of the Financial Services Authority and the Pensions Regulator. It also handles appeals against the decision of the Independent Valuer in the case of the Northern Rock shares valuation. It also has jurisdiction over Charity and Land Registration cases. The Tax and Chancery Chamber also has the power to judicially review decisions in certain circumstances. See also Financial Services and Pensions Regulator above.

War Disablement Pension

Social Security Benefit provided for people who were disabled in the Armed Forces between 1914 and 1921 or any time after 2 September 1939. Paid at a rate which varies according to the degree of disablement.

War Widow’s Pension

Social Security Benefit provided for widows of servicemen who died as a result of service in HM Forces. The standard rate of pension may be paid if the widow has a dependant child or is over 40 or is incapable of self support. The lower rate is paid to childless widows under the age of 40.

3. Policy Background and Changes

Employment Tribunals

Fees for Employment Tribunals and the Employment Appeal Tribunal were introduced for claims and appeals respectively received on or after 29 July 2013, alongside wider reform of procedural rules (following the Underhill Review of Employment Tribunal Rules).

For background information on the reforms please see:

www.justice.gov.uk/tribunals/employment

www.gov.uk/government/consultations/employment-tribunal-rules-review-by-mr-justice-underhill

As a result of the Underhill Review of Employment Tribunal Rules, three new outcome types (Table ET_3) came into effect. These were:

-

Dismissed Rule 27 – complaints dismissed by an Employment Judge after initial consideration of claim and response. An Employment Judge can dismiss a claim, or any part of a claim, if s/he considers that it has no reasonable prospect of success, or that the tribunal has no jurisdiction to hear the claim (or part thereof). This is a new provision introduced on 29th July 2013.

-

Dismissed upon withdrawal – under new rule 52, an employment tribunal shall issue a judgment dismissing a claim where the claimant withdraws it, unless certain criteria are satisfied. The operation and impact of this new provision is being monitored through these statistics.

-

Case discontinued – this records complaints dismissed under rule 40(1) where a party has not satisfied requirements in respect of paying a tribunal fee or demonstrating a case for remission.

On 26 July 2017 the Supreme Court in its judgment in R (on the application of Unison) v Lord Chancellor held that the Employment Tribunals and the Employment Appeal Tribunal Fees Order 2013, SI 2013/1893 (“the Fees order”) which came into effect on 29 July 2013 was unlawful under both domestic and EU law because it had the effect of preventing access to justice. Since it had that effect as soon as it was made, it was therefore unlawful and must be quashed.

As a result, from 27 July 2017 fees for Employment Tribunal and Employment Appeal Tribunal claims are no longer charged. All fees previously paid and not subject to a full remission are now eligible for a full refund. In addition, cases that were closed due to non-payment of a fee are now eligible for reinstatement at the stage at which the case was originally closed. For more information on the refund process please see:

On 6 April 2014, the Advisory, Conciliation and Arbitration Service (Acas) introduced Early Conciliation[footnote 9]. This means that anybody wishing to make an Employment Tribunal Claim must notify Acas first and be offered the chance to settle their dispute without going to court.

Social Security and Child Support

From April 2013, changes to the appeal process through the Welfare Reform Act 2012 began to be introduced. There were three changes:

-

DWP will reconsider all decisions before an appeal can be lodged (known as mandatory reconsideration);

-

appeals must be sent directly to HMCTS (known as direct lodgement);

-

there are time limits for DWP to return its responses to HMCTS[footnote 10].

Mandatory reconsideration and direct lodgement were introduced for Personal Independence Payment and Universal Credit appeals in April 2013. On 28 October 2013, they were introduced for all other DWP-administered benefits and child maintenance cases, and for appeals against decisions made by HMRC on 1 April 2014.

Direct lodgement means that up to 28 days (42 days in child maintenance cases) is now included in the HMCTS processing time, as appeal responses now need to be requested from the DWP and HMRC. DWP publish Mandatory Reconsiderations data for both PIP and ESA here:

https://www.gov.uk/government/collections/personal-independence-payment-statistics

Immigration and Asylum

Prior to the Immigration Act 2014, there had been changes to Family Visit Visa appeal rights. First, the Immigration Appeals (Family Visitor) Regulations 2012 which came into force on 9 July 2012 restricted the right of appeal to a narrower definition of family visitor[footnote 11]. Secondly, the Crime and Courts Act 2013 removed the full right of appeal for family visitors and this change came into effect for new visa applicants on 25 June 2013. A limited right of appeal still remains on Human Rights or Race Discrimination grounds.

Immigration Act 2014

The removal of appeal rights under the Immigration Act 2014 has been phased, initially focusing on applications made and refused in the UK under the Home Office’s points based system.

In October 2014, refusals for points based applications from students and their dependents had their associated appeal rights removed. Appeal rights were also removed for non-European Foreign National Offenders. In March 2015, the scope of the Immigration Act was extended to include the remaining points based decisions made in the UK. Finally, in April 2015, the Immigration Act was implemented in full for decisions made both in the UK and overseas.

Due to the phasing in of the new appeal rights under the Immigration Act 2014 and the additional steps introduced in some cases before a decision with an appeal right is given, the receipt of Post-Act cases from the points based decisions was slower than anticipated.

Since the Act was fully implemented, the majority of appeals result from refusals where these fundamental rights have been raised and considered as part of the initial application, allowing them to enter the appeal process more quickly.

Gender Recognition Certificates (GRC)

The introduction of the Marriage (Same Sex Couples) Act 2013 and the Marriage and Civil Partnerships (Scotland) Act 2014 changed the law in England & Wales and Scotland, meaning it is now possible for some married applicants to remain married while obtaining gender recognition. Prior to December 2014, if an applicant was married or in a civil partnership, they had to annul or dissolve the marriage/ civil partnership before being granted a full GRC.

Special Educational Needs and Disability Reforms

The Children and Families Act 2014 reformed the system of support across education, health and social care to ensure that each of the services were organised with the needs and preferences of the child and their family firmly at the centre, from birth up to the age of 25. The Act introduced Education, Health and Care (EHC) plans – legal documents that set out the education, health and social care support a child or young person with SEN requires when their needs cannot be met by resources available to mainstream early years providers, schools and post-16 institutions. They are focused on the outcomes the child or young person wants to achieve and set out how the services will work together to support those outcomes.

The number of families who can now appeal has increased as a result of the extension of EHC plans to those aged 0-25 (with certain additional criteria attached to the upper age group) where previously statements of SEN covered only school aged children and those in the early years; the granting of appeal rights to young people themselves and those in custody; and because the transfer process from statements and LDAs to EHC plans has opened up new opportunities to appeal. The SEND reforms are specifically designed to make the support system less adversarial.

As a result of the extension of EHC plans, the Ministry of Justice, in conjunction with the Department for Education, consulted in December 2017 – February 2018 on a change to the SEN appeal rate published in order to reflect the new wider population of potential appellants. Please refer to the document “Response to consultation on changes to the rate of appeal to the Special Educational Needs and Disability (SEND) Tribunal” included as part of the March 2018 publication for more details. The first annual (calendar year) appeal rate using this new methodology was published as part of the June 2018 publication.

4. Data Quality and Sources

Information presented in this report is management information drawn from a number of different administrative sources. Although care is taken when processing and analysing the data, the details are subject to inaccuracies inherent in any large-scale recording system and it is the best data that is available at the time of publication. HMCTS is examining the quality of management information. Thus, it is possible that some revisions may be issued in future publications.

The statistics are based on case management systems where a number of processes are recorded throughout the life of an appeal. In some instances, a case can re-enter the process or have a number of outcomes, meaning that there is not necessarily one receipt or one disposal per case. Thus, care should be taken when comparing receipts and disposals.

Data sources

The data presented in the Tribunal and Gender Recognition Certificate Statistics Quarterly is sourced from a number of administrative sources owned and managed by HMCTS, who provide the data to a central statistics team in MoJ for publication. The different Tribunals management information systems are listed below;

-

Immigration and Asylum: The database used by HMCTS to record Tribunal information with respect to Immigration and Asylum is called ARIA. ARIA went live in 2000 and holds around 150,000 records (receipts) per year.

-

Employment: ETHOS: The database used by HMCTS to hold information with respect to Employment (single and multiple) Tribunals. The database went live in 2007 and holds around 200,000 records per year. After a period of time after a case has closed (normally a year) the records are archived onto a separate database called COIT.

-

Employment Appeal Tribunal: The database used by HMCTS to store and process information with respect to Employment Appeal Tribunals is called Flymsys.

-

Employment Tribunal Fees: The data on fees and remissions was sourced from the Employment Tribunal Fees administrative system, which was used for case management and the processing of remission applications and fee payments.

-

Employment Tribunal Fee Refunds: The data on fee refund payments is taken from the Liberata payment system, used by HMCTS to process refund applications.

-

Social Security and Child Support: The database used by HMCTS to hold Tribunal information with respect to the Social Security and Child Support is called GAPS2. This database went live in 2007 and holds around 400,000 records per year.

-

Mental Health – The database used by HMCTS to record Tribunal information with respect to Mental Health Tribunals is called MARTHA. MARTHA went live in 2008 and holds around 30,000 records (receipts) per year.

-

There are also a range of smaller systems that hold information on the special tribunals. Some of this data is in the progress of being migrated onto the GAPS2 system. This includes information on Special Educational Needs.

Immigration and Asylum tribunal - differences with Home Office statistics

Asylum appeals data published by Home Office Migration Statistics are sourced from the Home Office Case Information Database (CID) and relate to main asylum applicants at the First-tier Tribunal Immigration and Asylum Chamber. Records on the database are updated from record-level data provided by HMCTS, who produce similar statistics for main appellants. This procedure provides consistent data across all datasets relating to asylum published in the release Immigration Statistics, but it is different from those published by the Ministry of Justice.

The Ministry of Justice statistics provide counts of principal appellants sourced from the HMCTS database. Within these statistics there tend to be higher numbers of principal appellants than main asylum applicant appeals because:

-

HMCTS has a wider definition of asylum appeals, including some human rights cases and appeals on extensions of asylum, humanitarian protection and discretionary leave; and

-

Principal appellants include some individuals classed as dependants by the Home Office.

The Home Office statistics on immigration and asylum appeals at First-tier Tribunal and subsequent stages are available from: www.gov.uk/government/collections/immigration-statistics-quarterly-release

Gender Recognition Certificates

Figures on Gender Recognition Certificates cover those that are applied for and granted by Her Majesty’s Courts and Tribunals Service’s Gender Recognition Panel (GRP). This panel is not a Tribunal but is presided over by a Tribunal Judge. The data are taken from a central database in the Ministry of Justice called GLiMR.

The figures presented in this bulletin are collected from officials at the GRP. The data collected are quality-assured and validated in a process that highlights inconsistencies between quarters, and other areas. Checks are made to ensure that each month’s data are arithmetically correct, with subtotals and grand totals correctly summed. Unusual values encountered are queried with the data supplier to confirm whether these are correct, or are an error in the information provided which requires amendment.

Explanatory Notes

The following symbols have been used throughout the tables in this bulletin:

| .. | = | Not available |

| - | = | Nil |

| (r) | = | Revised data |

Spreadsheet files of the tables contained in this document are also available to download along with csv files of historical information.

Users of the statistics

The main users of the Tribunals and Gender Recognition Certificate statistics are Ministers and officials in central government responsible for developing policy with regards to tribunals.

Other users include lawyers and academics, other central government departments such as the Department for Education, the Department for Business, Energy and Industrial Strategy (BEIS), the Home Office and the Department for Work and Pensions (DWP), and non-governmental bodies, including various voluntary organisations, with an interest in administrative justice.

5. Useful Publications

For previous publications of all Tribunals Statistics please see:

www.gov.uk/government/organisations/ministry-of-justice/series/tribunals-statistics

For more information on the context for this publication and the work of HMCTS, please see:

https://www.gov.uk/government/organisations/hm-courts-and-tribunals-service/about

Further information on the structure of the tribunal system can be found here:

www.judiciary.gov.uk/about-the-judiciary/the-justice-system/court-structure/

For information on Tribunal judgements please see:

www.bailii.org/databases.html#uk

Scotland

For information on non-MoJ Mental Health Tribunals Scotland please see:

www.mhtscotland.gov.uk/mhts/Annual_Reports/Annual_Reports_main

For Additional Support Needs Tribunals in Scotland please see:

https://www.healthandeducationchamber.scot/additional-support-needs/12

Information on the Private Rented Housing Panel (prhp), which help Scottish tenants and landlords resolve their differences can be found at the following link:

http://www.gov.scot/Topics/Built-Environment/Housing/privaterent/tenants/money/fairrent/phrp

Northern Ireland

For information on Tribunals in Northern Ireland not covered by this report please see the following publications:

www.courtsni.gov.uk/en-GB/Services/Statistics%20and%20Research/Pages/default.aspx

Employment Tribunals

In 2013, the former Department for Business, Innovation and Skills (BIS) published a study on claimants who had been successful at the employment tribunal and were awarded money:

www.gov.uk/government/publications/payment-of-employment-tribunal-awards

A further ad hoc analysis of the findings from the 2013 survey of employment tribunal applications published by BIS can be found here:

www.gov.uk/government/statistics/employment-tribunal-applications-2013-survey-findings

Latest quarterly statistics compiled by Acas on Early Conciliation can be found at the following location:

http://www.acas.org.uk/index.aspx?articleid=5203

The Employment Tribunal data differs slightly between the Tribunals publication and the Acas publication, for the following reasons:

-

There is a lag between original tribunal receipt and the case being input into the Acas system which means the data will always be slightly out of line.

-

Acas data excludes any case with no relevant jurisdictions and also any case which is a resubmission of an existing dispute (both of which would be included in the ET statistics).

-

Acas report on “net” cases, i.e. count each matter only once (not once-per-claimant), provided they have the dispute and representation in common. Therefore, if in ten claimant cases, three are linked, there are eight net cases (seven single plus one multiple).

Social Security and Child Support

The Department for Work and Pensions (DWP) publishes appeals data for Employment and Support Allowance (ESA) and Personal Independence Payment (PIP), for further information see:

https://www.gov.uk/government/collections/personal-independence-payment-statistics

First-tier Tribunal (Mental Health)

For more information about applications and outcomes against detention and community orders under the Mental Health Act (2016/17), please see:

http://www.cqc.org.uk/content/monitoring-mental-health-act-report

Registry Trust Statistics

Since 1st April 2009, details of enforced monetary tribunal awards relating to individuals, companies or businesses have been added to the Register. Details of an award are only added to the Register once steps have been taken in the high court or county court to enforce the award. The Register will then show the amount of the debt. Please see the following link for Statistics on this area:

https://www.registry-trust.org.uk/publications

Special Educational Needs and Disability (SEND)

For more information on Special Education Needs, please see the following page:

https://www.gov.uk/government/collections/statistics-special-educational-needs-sen

Gender Recognition Certificates

More information about the gender recognition application process and guidance notes can be found on the Ministry of Justice website at:

www.justice.gov.uk/tribunals/gender-recognition-panel

Further information about the Marriage (Same Sex Couples) Act 2013 can be found at:

Information on the Reform of the Gender Recognition Act 2004 currently being considered is available at the following location:

https://www.gov.uk/government/consultations/reform-of-the-gender-recognition-act-2004

Further information about the Marriage and Civil Partnership (Scotland Act) 2014 can be found at:

www.nrscotland.gov.uk/news/2014/same-sex-marriage-in-scotland-news

6. Glossary

This chapter covers terms used in the Tribunal and Gender Recognition Certificate Statistics Quarterly, focusing on concepts and definitions published in the Ministry of Justice statistical publications.

There are three main types of Tribunal, covering over 80% of all Tribunal work (as at 2019/20). There are also smaller ‘special’ Tribunals covering other more detailed activities. The main types of Tribunal are:

-

Immigration and Asylum (IA)

-

Employment Tribunals (ET)

-

Social Security and Child Support (SSCS)

-

Specials – other smaller Tribunals, including Mental Health

Academic year

Reporting year beginning and ending in September

Adjournment

Where, on the day of the hearing, the Panel decides that, for whatever reason, the appeal/case cannot be finalised and has to put off making a final decision to another date, for example because further evidence is required.

Appellant

A person who applies to a higher court for a reversal of the decision of a lower court.

Caseload outstanding

The number of cases outstanding at the end of the period and still waiting to be dealt with to completion.

Decision in favour (SSCS)

Decision in favour of the appellant.

Decision upheld (SSCS)

Decision made by the First Tier Agency and withheld by the Tribunal.

Disposal

A disposal is the closure of a case when work has ceased to be done. This can be through a claim being withdrawn, settled, dismissed or being decided at a hearing.

DWP

Acronym for the Department of Work and Pensions

Employment Tribunal Claim

A claim may be brought under more than one jurisdiction or subsequently amended or clarified in the course of proceedings, but will be counted only once.

Employment Tribunal Jurisdiction

The Employment Tribunal powers to hear a claim are determined by legislation, with statutory provisions defining the ambit of the jurisdiction that can be covered by a claim to an Employment Tribunal.

Employment Tribunal Jurisdictional mix

A claim may contain a number of grounds, known as jurisdictional cases. In any hearing, the tribunal has to decide upon the merits of the claim made under each jurisdiction; for example, unfair dismissal and sex discrimination. The total number of jurisdictions covered by each case gives a truer measure of caseload than the number of claims. The jurisdictions covered by ET are wide ranging, from discrimination and unfair dismissals to issues around salary and working conditions.

Employment Tribunal single and multiple claims

Claims to the Employment Tribunal may be classified into two broad categories – singles and multiples. Multiple cases are where two or more people bring cases, involving one or more jurisdiction(s) usually against a single employer but not necessarily so, for instance in TUPE cases, and always arising out of the same or very similar circumstances. As a multiple, the cases are processed together.

Hearing

The hearing is a meeting at which the tribunal panel considers evidence (either orally or paper based) and reaches a decision (where the decision may be to adjourn or to agree a final outcome).

HMCTS

Acronym for Her Majesty’s Courts and Tribunals Service

Hearing clearance (SSCS)

These are cleared via a Tribunal (could be a panel or member of the Judiciary sitting alone) with a decision/outcome.

Nitrates Vulnerable Zones (NVZ) Tribunal

From April 2016, the Tribunal hears appeals against the designation of NVZs by the Department for Environment, Food and Rural Affairs (DEFRA). The Tribunal is quadrennial and hears appeals in relation to NVZ notices issued once every four years to landowners by DEFRA.

Non-hearing clearance (SSCS)

These are cases withdrawn prior to a hearing, struck out or superseded. There is no Tribunal judgement.

Oral Hearing

A hearing where the party(ies) and/or their representative(s) attend (this can be by telephone or by video conference).

Outcome of hearing

The outcome of the hearing is the final determination of the proceedings or of a particular issue in those proceedings; it may include an award of compensation, a declaration or recommendation and it may also include orders for costs, preparation time or wasted costs either in favour or against an appellant. Note: ET records outcomes for each act (or jurisdiction), not for the hearing.

Paper Hearing

Consideration of the case using documents, and not requiring any physical appearance by the parties.

Postponement

Where a case is taken out of the list, prior to the commencement of the hearing – can be done by the applicant, or any other party.

Receipt

Volumetric term covering the acceptance of a case by a HMCTS Tribunal. Also known as a ‘case’ for Employment Tribunals.

Settlement

Cases settled without the need for a hearing. A third party may have been involved in the process.

Withdrawal

The applicant/claimant/appellant ceases action either before or at the hearing.

6.1 Immigration and Asylum Cases

Asylum

Appeals against a refusal to grant asylum, including asylum claims which raise Human Rights grounds.

Deportation

Appeals against deportation orders made against people by the Home Secretary.

Entry Clearance Officer (ECO)

Appeals generated by people who are not already in the UK, but have been refused permission to enter or stay in the UK for a fixed period of time, or live here permanently.

Family Visit Visa (FVV)

Appeals against decisions not to allow temporary visits to see family in the UK.

FTTIAC

Acronym for the First Tier Immigration and Asylum Chamber

Human Rights Appeals

A separate Human Rights Appeal category was introduced in the Tribunal in 2001, following the implementation of the Human Rights Act 1998 to allow the consideration of Human Rights arguments for cases where those grounds were not considered at the original human rights appeal. Since then, a range of in-country case types raising Human Rights grounds have been recorded under this category when they would have been more appropriately recorded against another case type. The Tribunal has made a recent change to its administrative processes to record such cases more suitably, which will explain any drop in numbers in the Human Rights (Other) appeal category.

Immigration Appeals (Family Visitor Regulations 2012)

Legislation which stated that foreign nationals who had been refused clearance to visit family on a short stay would also lose their right to appeal.

Managed Migration

Appeals generated by people already in the UK who have been refused permission to extend their stay here (either permanently or temporarily). This appeal type will also cover occasions where an individual has their permission to be in the UK revoked.

UTIAC

Acronym for Upper Tribunal Immigration and Asylum Chamber. Handles appeals for decisions made by the FTTIAC and also specific categories of Judicial Reviews.

6.2 Employment and Employment Appeal Cases

ACAS

Acas provides free and impartial information and advice to employers and employees on all aspects of workplace relations and employment law. They also provide conciliation and mediation services to help resolve workplace problems and avoid having to go to a tribunal

Age Discrimination

Discrimination or victimisation on grounds of age

Case Discontinued

This records complaints dismissed under rule 40(1) where a party has not satisfied requirements in respect of paying a tribunal fee or demonstrating a case for remission

Disability discrimination

Suffered a detriment, discrimination and/or dismissal on grounds of disability or failure of employer to make reasonable adjustments

Discrimination on grounds of Religion or Belief

Discrimination or victimisation on grounds of religion or belief

Discrimination on grounds of Sexual Orientation

Discrimination or victimisation on grounds of sexual orientation

Dismissed Rule 27

Complaints dismissed by an Employment judge and initial consideration of claim and response

Dismissal upon withdrawal (Rule 52)

An employment tribunal shall issue a judgement dismissing a claim where the claimant withdraws it unless certain criteria are satisfied.

Equal pay

Failure to provide equal pay for equal value work

National minimum wage

Suffer a detriment and/or dismissal related to failure to pay the minimum wage or allow access to records

Part Time Workers Regulations

Suffer less favourable treatment and/or dismissal as a result of being a part time employee by comparison to a full time employee

Race discrimination

Discrimination or victimisation on grounds of race or ethnic origin

Redundancy – failure to inform and consult

Application by an employee, their representative or trade union for a protective award as a result of an employer’s failure to consult over a redundancy situation

Redundancy pay

Failure of the Secretary of State to pay a redundancy payment following an application to the National Insurance fund

Sex discrimination

Discrimination or victimisation on grounds of sex, marriage or transgender

Suffer a detriment / unfair dismissal – pregnancy

Suffer a detriment and/or dismissal on grounds of pregnancy, child birth or maternity

Transfer of an undertaking - failure to inform and consult

Failure of the employer to consult with an employee rep. or trade union about a proposed transfer

Unauthorised deductions (formerly Wages Act)

One of three conditions has to be met for you to lawfully make deductions from wages or take payments from a worker. If this is not the case then the deduction is unauthorised. For the deduction or payment to be authorised it must be

-

required or authorised by legislation (for example, income tax or national insurance deductions;

-

authorised by the worker’s contract - provided the worker has been given a written copy of the relevant terms or a written explanation of them before it is made; or

-

consented to by the worker in writing before it is made

Underhill Review

A consultation led by Mr Justice Underhill which aimed to address the complex nature of employment tribunals

Unfair dismissal

Appeals on the grounds that an employer does not have a good reason for dismissing a person, or follow the company’s formal disciplinary or dismissal process.

Working Time Directive

Appeal by a person who has been served with an improvement or prohibition notice under the Working Time Regulations 1998. Can include complaints by a worker that employer has failed to allow them to take or to pay them for statutory annual leave entitlement and failure to limit weekly or night working time, or to ensure rest breaks.

Written pay statement

Failure to provide a written pay statement or an adequate pay statement

Written statement of reasons for dismissal

Failure to provide a written statement of reasons for dismissal or the contents of the statement are disputed

Written statement of terms and conditions

Failure to provide a written statement of terms and conditions and any subsequent changes to those terms

6.3 Social Security and Child Support

30 Hours Free Childcare Scheme