UK hydrogen strategy (accessible HTML version)

Updated 17 December 2024

Presented to Parliament by the Secretary of State for Business, Energy & Industrial Strategy by Command of Her Majesty

August 2021

Command Paper 475

Ministerial foreword

As the Prime Minister made clear when he launched his Ten Point Plan for a Green Industrial Revolution last year, developing a thriving low carbon hydrogen sector in the UK is a key plank of the government’s plan to build back better with a cleaner, greener energy system. With the potential to overcome some of the trickiest decarbonisation challenges facing our economy – including our vital industrial sectors – and secure economic opportunities across the UK, low carbon hydrogen has a critical role to play in our transition to net zero.

Working with industry, our ambition is for 5GW of low carbon hydrogen production capacity by 2030 for use across the economy. This could produce hydrogen equivalent to the amount of gas consumed by over 3 million households in the UK each year. This new, low carbon hydrogen could help provide cleaner energy to power our economy and our everyday lives – from cookers to distilleries, film shoots to power plants, waste trucks to steel production, and 40 tonne diggers to the heat in our homes.

Meeting our ambition means rapid ramp up of production and use of hydrogen over the coming decade. In every country of the UK, there are ambitious, world-leading projects ready to deploy at scale, saving carbon and creating jobs. These trailblazers will help us fully understand the costs around hydrogen, its safety where hydrogen is being used in new ways, and just how far it can contribute to reducing our emissions.

The time for real world action is now. We have developed the first ever UK Hydrogen Strategy to set out clearly the key steps we need to take in the coming months and years to deliver against the promise that hydrogen presents – an exciting moment for technology providers, energy companies large and small, investors, innovators, and government at all levels.

Our ambition for hydrogen goes beyond decarbonisation. It also means a focus on supporting industry to develop sustainable, home-grown supply chains, create high quality jobs, and capitalise on British innovation and expertise. It means incentivising private investment and looking to increase export opportunities. It means strengthening our industrial heartlands, boosting our economy and driving national growth.

The Hydrogen Strategy builds on our national strengths. UK companies are already at the forefront of global hydrogen technology development. Our geology, infrastructure and technical know-how make us ideally positioned to be a global leader in hydrogen. We have a strong history of collaboration between government, industry and innovators to tackle climate change and grow our economy.

Alongside this Strategy we are also publishing a number of consultations – seeking views on our preferred Hydrogen Business Model, the design of our flagship £240m Net Zero Hydrogen Fund, and a UK Low Carbon Hydrogen Standard. These are policies that industry, including members of the Hydrogen Advisory Council which I co-Chair, have told us are key to drive early expansion of the UK hydrogen economy. This substantial suite of documents is supported by a detailed Analytical Annex and a report on Hydrogen Production Costs.

Taken together, the UK Hydrogen Strategy and supporting policy package lay the foundations for a thriving hydrogen economy, one that can support our trajectory to achieving our world-leading Sixth Carbon Budget and net zero commitments. I look forward to continuing to work closely with industry, innovators and investors to deliver real action on hydrogen, with real benefits for UK businesses and communities.

The Rt Hon Kwasi Kwarteng

MP Secretary of State for Business, Energy & Industrial Strategy

Executive summary

Hydrogen is one of a handful of new, low carbon solutions that will be critical for the UK’s transition to net zero. As part of a deeply decarbonised, deeply renewable energy system, low carbon hydrogen could be a versatile replacement for high-carbon fuels used today – helping to bring down emissions in vital UK industrial sectors and providing flexible energy for power, heat and transport. The UK’s vision, resources and know-how are ideally suited to rapidly developing a thriving hydrogen economy. Our world-class innovation and expertise offer opportunities for UK companies in growing domestic and global markets. The UK Hydrogen Strategy sets out how we will drive progress in the 2020s, to deliver our 5GW production ambition by 2030 and position hydrogen to help meet our Sixth Carbon Budget and net zero commitments.

The scale of the challenge is clear: with almost no low carbon production of hydrogen in the UK or globally today, meeting our 2030 ambition and delivering decarbonisation and economic benefits from hydrogen will require rapid and significant scale up over coming years. The work starts now.

The UK Hydrogen Strategy takes a holistic approach to developing a thriving UK hydrogen sector. It sets out what needs to happen to enable the production, distribution, storage and use of hydrogen and to secure economic opportunities for our industrial heartlands and across the UK. Guided by clear goals and principles, and a roadmap showing how we expect the hydrogen economy to evolve and scale up over the coming decade, the Strategy combines near term pace and action with clear, long term direction to unlock the innovation and investment critical to meeting our ambitions.

Chapter 1 of the Strategy sets out the case for low carbon hydrogen, briefly outlining how it is produced and used today before explaining its potential role in meeting net zero and in providing opportunities for UK firms and citizens to be at the forefront of the global transition to net zero. It explains how our 2030 ambition can deliver emissions savings to help meet our carbon budgets, as well as jobs and economic growth, helping to level up across the UK. It sets out our strategic framework, including our vision for 2030, the principles guiding our action, challenges to overcome and our key outcomes by 2030. Finally, it outlines the important role of the devolved nations in the UK’s hydrogen story, and how government is working closely with the devolved administrations to help hydrogen contribute to emissions reductions and deliver local economic benefits across the UK.

Chapter 2 forms the core of the Strategy, setting out our whole-systems approach to developing the UK hydrogen economy. It opens with our 2020s roadmap, which sets out a shared understanding, developed in partnership with industry, of how the hydrogen economy needs to evolve over the course of the decade and into the 2030s – and what needs to be in place to enable this. The chapter then considers each part of the hydrogen value chain in turn – from production, to networks and storage, to use across industry, power, buildings and transport – and outlines the actions we will take to deliver our 2030 ambition and position hydrogen for further scale up on a pathway to Carbon Budget Six and net zero. Finally, it considers how we will develop a thriving hydrogen market by 2030 – including the market and regulatory frameworks underpinning it and their interaction with the wider energy system, and the need to improve awareness and secure buy-in from potential users of hydrogen.

Chapter 3 explains how we will work to secure economic opportunities across the UK that can come from a thriving hydrogen economy – learning from the development of other low-carbon technologies and building this into our approach from the outset. It sets out how we will: build world class, sustainable supply chains across the full hydrogen value chain; create good quality jobs and upskill industry to drive regional growth and ensure that we have the right skills in the right place at the right time; maximise our research and innovation strengths to accelerate cost reduction and technology deployment, and to capitalise on the UK’s world-leading expertise; and create an attractive environment to secure the right investment in UK projects while maximising the future export opportunities presented by a low-carbon hydrogen economy.

Chapter 4 builds on this to show how the UK is working with other leading hydrogen nations to drive global leadership on the development of low carbon hydrogen to support the world’s transition to net zero. It sets out the UK’s active role in many of the key institutions driving multilateral collaboration on hydrogen innovation and policy, and our ambition to actively seek opportunities for further collaboration with key partner countries to spur the development of thriving domestic, regional and ultimately international hydrogen markets.

Chapter 5 concludes the Strategy, setting out how we will track our progress to ensure we are developing a UK hydrogen economy in line with the principles and outcomes set out in Chapter 1 and our roadmap in Chapter 2. This chapter explains our approach – how we will be flexible, transparent, efficient and forward-looking in monitoring progress – and sets out the potential indicators and metrics we will use to track how we are delivering against our outcomes. This will help ensure that we can deliver our 2030 ambition and realise our vision for a low carbon hydrogen economy that drives us towards Carbon Budget Six and net zero, while making the most of the opportunities that hydrogen holds for the UK.

Chapter 1: The case for low carbon hydrogen

Low carbon hydrogen will be critical for meeting the UK’s legally binding commitment to achieve net zero by 2050, and Carbon Budget Six in the mid-2030s on the way to this. Hydrogen can support the deep decarbonisation of the UK economy, particularly in ‘hard to electrify’ UK industrial sectors, and can provide greener, flexible energy across power, heat and transport. Moreover, the UK’s geography, geology, infrastructure and expertise make it particularly suited to rapidly developing a low carbon hydrogen economy, with the potential to become a global leader on hydrogen and secure economic opportunities across the UK.

Hydrogen is one of a handful of new low carbon solutions which can help the UK to achieve its world-leading emissions reductions target for Carbon Budget Six (CB6), and net zero by 2050. As set out in the Prime Minister’s Ten Point Plan for a Green Industrial Revolution, working with industry, government is aiming for 5GW of low carbon hydrogen production capacity by 2030 for use across the economy. With virtually no low carbon hydrogen produced or used currently, particularly to supply energy, this will require rapid and significant scale up from where we are today.

The Ten Point Plan announced new funds and policies that will set us on the pathway to meet this ambition, including £240 million for government co-investment in production capacity through the Net Zero Hydrogen Fund (NZHF), a hydrogen business model to bring through private sector investment, and plans for a revenue mechanism to provide funding for the business model. Continued improvements in hydrogen technologies, enabled by pioneering UK research and innovation and international collaboration, will also be critical. The Ten Point Plan designated hydrogen as a key priority area in the Net Zero Innovation Portfolio, a £1 billion fund to accelerate commercialisation of low-carbon technologies and systems for net zero.

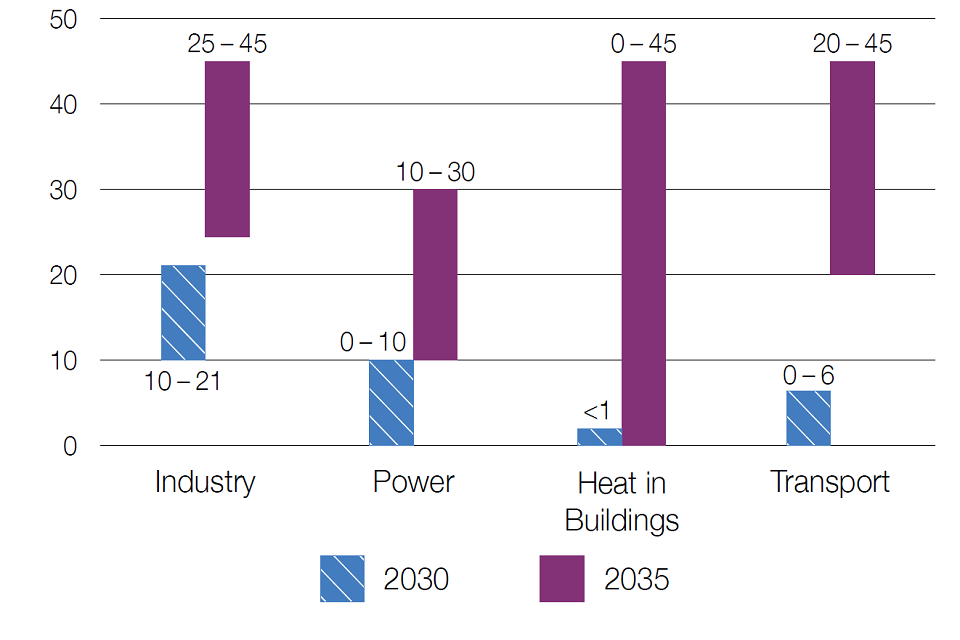

The 2020s will be critical for supporting energy users best suited to hydrogen as a low carbon solution to get ready to use it. We are accelerating work in this area. We are supporting fuel switching to hydrogen in industry through the £315 million Industrial Energy Transformation Fund and £20 million Industrial Fuel Switching Competition; establishing the evidence base for hydrogen use and storage in the power sector; rolling out demonstration competitions and trials (subject to funding) for the use of hydrogen in road freight, shipping and aviation; and pioneering trials of hydrogen heating – beginning with a hydrogen neighbourhood trial by 2023, followed by a large hydrogen village trial by 2025, and potentially a hydrogen town pilot before the end of the decade. We are working with the Health and Safety Executive (HSE) and industry to assess the potential for 20 per cent hydrogen blending into the gas network, and supporting the development of prototype ‘hydrogen-ready’ appliances such as boilers and cookers. The Energy White Paper, Industrial Decarbonisation Strategy and the recently published Transport Decarbonisation Plan set out further actions we are taking to bring forward hydrogen demand across industry, power, heat and transport.

This Strategy goes further, setting out a series of additional commitments and actions which show how government, in partnership with industry, the research and innovation community and wider civil society, will deliver our vision for a UK hydrogen economy.

By acting now we will be better positioned to stimulate domestic supply chains, enabling UK businesses to serve increasing international demand for hydrogen goods and services. Current evidence suggest that developing a UK hydrogen economy could also support over 9,000 jobs by 2030 – and up to 100,000 jobs by 2050 – across our industrial heartlands and across the UK. [footnote 1]

1.1 Hydrogen in the UK today

The UK has a longstanding history with hydrogen. Since the discovery of ‘inflammable air’ by Henry Cavendish in the mid-18th century, hydrogen has played a role in our everyday lives, from helping to fertilise our fields to providing part of the ‘town gas’ that lit our streets and heated our homes until the late 20th century.

There are almost no abundant natural sources of pure hydrogen, which means that it has to be manufactured. The most common production route is steam methane reformation, where natural gas is reacted with steam to form hydrogen. This is a carbon-intensive process, but one which can be made low carbon through the addition of carbon capture, usage and storage (CCUS) – to produce a gas often called ‘blue hydrogen’. Hydrogen can also be produced through electrolysis, where electricity is used to split water into hydrogen and oxygen – gas from this process is often referred to as ‘green hydrogen’ or zero carbon hydrogen when the electricity comes from renewable sources. Today most hydrogen produced and used in the UK and globally is high carbon, coming from fossil fuels with no carbon capture; only a small fraction can be called low carbon. [footnote 2] For hydrogen to play a part in our journey to net zero, all current and future production will need to be low carbon.

Current UK hydrogen production and use is heavily concentrated in chemicals and refineries. [footnote 3] This hydrogen, largely produced from natural gas (without carbon capture), is used as a feedstock, or input, into making other chemicals and plays a variety of roles in refineries to convert crude oil into different end products. In these two sectors, production and use of hydrogen usually happen on the same site, often integrated into a single industrial facility. Hydrogen is also used as a fuel, in far smaller volumes, across the UK. Hydrogen cars, trucks, buses and marine vessels are already operating and supported by a network of refuelling stations, with plans for hydrogen trains and aircraft underway. Hydrogen will soon be blended with natural gas and supplied safely to over 650 homes as part of a trial in Winlaton in the north-east of England.

British companies such as ITM Power, Johnson Matthey and Ceres Power are already producing the technology for low and zero carbon hydrogen, and they and many others are pushing new innovations all the time. The Orkney Islands in Scotland have generated global interest in a range of projects that show how challenges in a local energy system can sometimes be overcome with hydrogen; here producing hydrogen from excess renewable electricity that would otherwise has gone to waste, and using it to support decarbonisation of road transport, heat and ferry related activities. Across the UK, pioneering production and use projects have provided lessons, stimulated further research and innovation, and pointed the way to what is needed to deploy production capacity at pace and scale, and to unlock hydrogen as a low carbon fuel for new applications across the energy system.

1.2 The role of hydrogen in meeting net zero

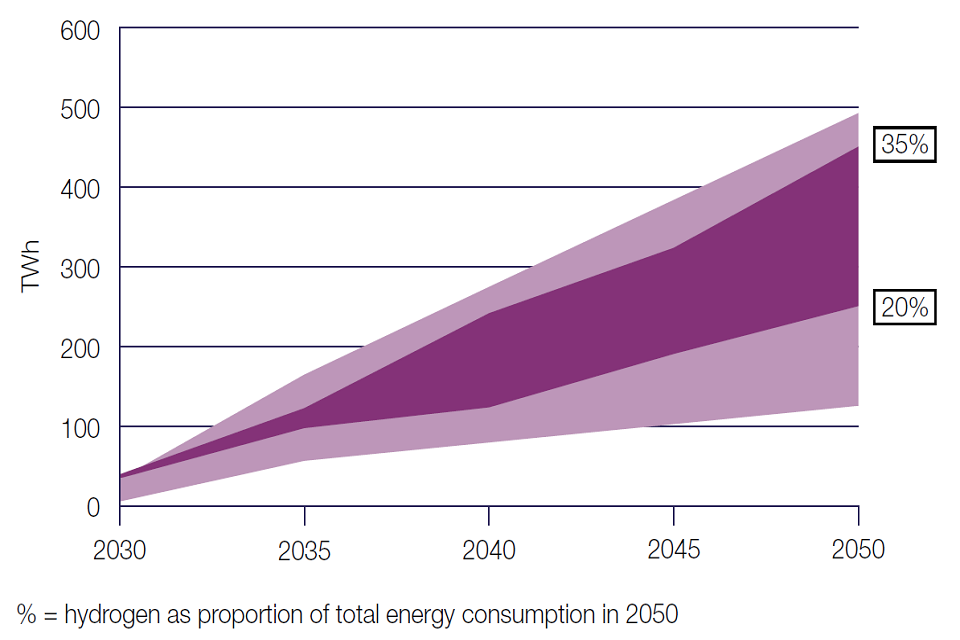

Low carbon hydrogen will be essential for achieving net zero, and ahead of that, meeting our world-leading CB6 target to reduce emissions 78 per cent on 1990 levels by 2035. Analysis by BEIS for CB6 suggests 250-460TWh of hydrogen could be needed in 2050, [footnote 4] making up 20-35 per cent of UK final energy consumption (see Figure 1.2 below). [footnote 5] The size of the hydrogen economy in 2050 will depend on a number of factors – including the cost and availability of hydrogen and hydrogen-using technology relative to alternatives, such as electrification, biomass and use of CCUS. Nonetheless, there is consensus, from the Climate Change Committee (CCC) and others, that we will need significant amounts of low carbon hydrogen on the system by 2050.

Figure 1.2: Hydrogen demand and proportion of final energy consumption in 2050

Source: Central range – illustrative net zero consistent scenarios in CB6 Impact Assessment. Full range – based on whole range from UK Hydrogen Strategy Analytical Annex. Final energy consumption from ECUK (2019).

As a gas, hydrogen has a distinct set of characteristics. It can be used in a fuel cell or combusted in a boiler, turbine or engine to generate heat or electricity. It can also be stored in various ways, including at very large scales, and can be transported to different end users, in much the same way as natural gas or liquid fuels today. Hydrogen is also an essential input to a range of chemical processes and in industrial production.

Low carbon hydrogen will play an important complementary and enabling role alongside clean electricity in decarbonising our energy system. It is suited to use in a number of sectors where electrification is not feasible or is too costly, and other decarbonisation options are limited. This may include generation of high temperature heat, as in industrial furnaces, and long-distance and heavy-duty transport. Similarly it is useful in areas where the flexibility and stability of a gas is valued, for example large scale or long duration energy storage and flexible power generation. However, hydrogen can only be considered as a decarbonisation option if it is readily available, at the right price, the right volume and with sufficient confidence it is low carbon. In addition, potential users must be able to purchase hydrogen-using equipment, with proper assurances about safety and reliability. This will be our focus for the 2020s, in order to deliver our 2030 ambition and set us on the pathway to CB6 and net zero.

1.3 The UK’s hydrogen opportunity

As a result of its geography, geology, infrastructure and capabilities, the UK has an important opportunity to demonstrate global leadership in low carbon hydrogen and to secure competitive advantage. Building hydrogen production and enabling use across multiple sectors will be critical for developing domestic capacity and capabilities, and securing green jobs across the UK.

Developing a hydrogen economy requires tackling the ‘chicken and egg’ problem of growing supply and demand in tandem, and the UK offers favourable conditions for both to readily expand. When it comes to production, our ‘twin track’ approach capitalises on the UK’s potential to produce large quantities of both electrolytic ‘green’ and CCUS-enabled ‘blue’ hydrogen. The UK reduced its power sector emissions by over 70 per cent between 1990 and 2019, [footnote 6] and generates more electricity from offshore wind than any other country. [footnote 7] The Energy White Paper, published in December 2020, sets out how we will expand renewable generation while decarbonising power sector emissions further, including through our ambition to quadruple offshore wind capacity to 40GW by 2030, and pursue new large-scale nuclear while investing in small-scale nuclear technologies. This low carbon electricity will be the primary route to decarbonisation for many parts the energy system, and will also support electrolytic production of hydrogen.

The Energy White Paper also sets out how the UK will deploy and support CCUS technology and infrastructure, with £1 billion of support allocated up to 2025 and a commitment to set out details of a revenue mechanism to bring through early-stage private investment in industrial carbon capture and hydrogen projects. The UK has the technology, know-how and storage potential to scale up CCUS across the country, unlocking new routes to CCUS-enabled hydrogen production.

Early deployment of CCUS technology and infrastructure will likely be located in industrial clusters. Many of these are in coastal locations, with important links to CO2 storage sites such as disused oil and gas fields. Government aims to establish CCUS in four industrial clusters by 2030 at the latest, supporting our ambition to capture 10Mt/CO2 per annum.

In turn, industrial clusters and wider industry are significant potential demand centres for low carbon hydrogen. Today, numerous industrial sectors from chemicals to food and drink are exploring the role that hydrogen can play in their journey to net zero. UK Research and Innovation’s (UKRI’s) Industrial Decarbonisation Challenge provides up to £170 million – matched by £261 million from industry – to invest in developing industrial decarbonisation infrastructure including CCUS and low carbon hydrogen.

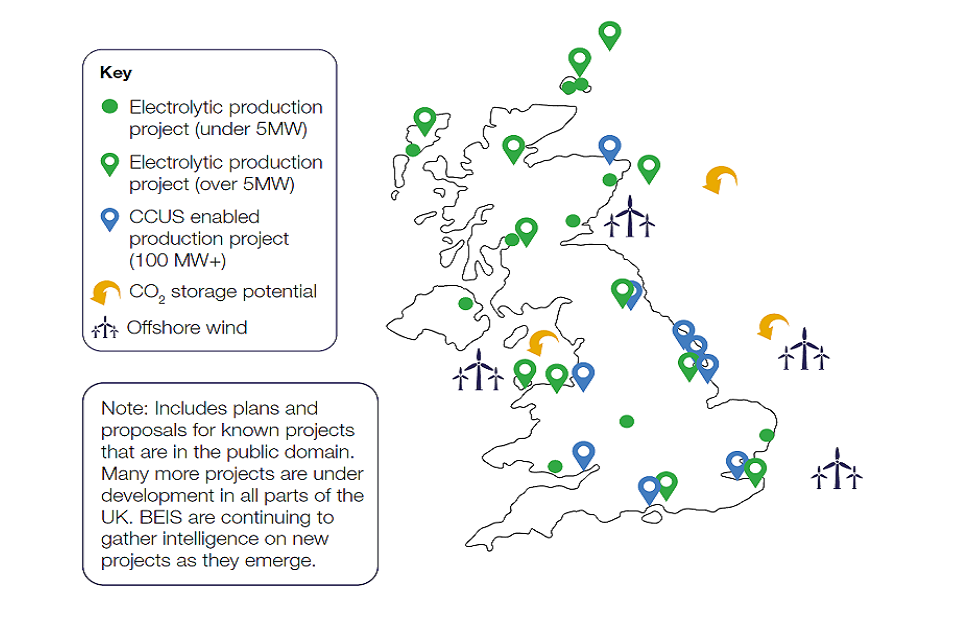

Figure 1.3: Proposed UK electrolytic and CCUS-enabled hydrogen production projects

The UK also has decades of experience in production, distribution, storage, use and regulation of gas. Our widespread use of natural gas for power generation and for heat in industry and homes means that we have potential supply routes and numerous potential use cases for hydrogen gas. The UK also has favourable geology for large-scale storage of hydrogen, and is already storing hydrogen in salt caverns and exploring storage in disused oil and gas fields under the North Sea.

In addition, our well-developed North Sea oil and gas sectors and experience in renewables mean that the UK has developed supply chain strengths and innovative companies across the value chain poised to take advantage of the economic opportunities from developing low carbon hydrogen technologies. UK companies such as ITM Power, Johnson Matthey and Ceres Power are already recognised as being at the forefront of hydrogen technology development worldwide. Building on this strong base, we will draw on lessons from offshore wind and other low carbon technologies and aim to capitalise on our world-leading expertise in research and innovation and decarbonisation to put the UK at the forefront of emerging global hydrogen markets and opportunities.

The UK is well positioned to be a world leader in low carbon hydrogen production and use, delivering green jobs and growth to support levelling up across our industrial heartlands and across the UK. But we can only realise these economic opportunities if we act now to put in place the necessary environment and support to develop robust supply chains, upskill our people and secure high-quality jobs, and lay the groundwork to unlock investment and export opportunities. Our strategy seeks to maximise the economic benefits from a UK hydrogen economy and seize the potential of both domestic and international markets.

1.4 Our ambition for a thriving hydrogen economy by 2030

We recognise the importance of a clear goal alongside long term policy frameworks in bringing forward low carbon technologies. Our ambition for 5GW of low carbon hydrogen production capacity by 2030 is a signal of the government’s firm commitment to work with industry to develop a strong and enduring UK hydrogen economy. This ambition is a means to an end, rather than an end in itself – positioning the UK hydrogen economy for the scale up needed to support CB6 in the mid-2030s and net zero by 2050, and to deliver clean growth opportunities across the UK. We use “our 2030 ambition” in places throughout this strategy as shorthand for this wider vision for the UK hydrogen economy by the end of the decade.

It is not possible today, in 2021, to predict with certainty the size of the future hydrogen market in a net zero energy system, nor the best pathway to reach that. We recognise that the UK has huge potential to produce and use low carbon hydrogen, and that many in industry think we could go further and faster. We welcome this drive and ambition and will continue to work with industry to deliver the strategic direction and supporting policy environment to achieve our 2030 ambition and position the UK hydrogen economy for the future growth and scale up needed for CB6 and net zero.

Delivering our 2030 ambition will yield significant emissions savings. Our modelling suggests that the use of low carbon hydrogen enabled by 5GW production capacity could deliver total emissions savings of around 41MtCO2e between 2023 and 2032, equivalent to the carbon captured by 700 million trees over the same time period. [footnote 8] This covers the period of the UK’s Fourth and Fifth Carbon Budgets (CB4 and 5), and will contribute to achieving our Nationally Determined Contribution (NDC) under the Paris Agreement of reducing emissions by 68 per cent compared to 1990 levels by 2030. Further scale up of low carbon hydrogen post-2030 would yield even larger emissions savings, and will play an important role in delivering CB6, to be set out in more detail in the government’s forthcoming Net Zero Strategy.

Our 5GW ambition would also mean the creation of a thriving new hydrogen industry, which could support over 9,000 jobs and £900 million of GVA by 2030. [footnote 9] Government investment in hydrogen to de-risk early projects could unlock over £4 billion of private sector co-investment up to 2030. [footnote 10] Our ambition also sets us on a promising pathway post-2030. Our analysis shows that, under a high hydrogen scenario, up to 100,000 jobs and £13 billion of GVA could be generated from the UK hydrogen economy by 2050. [footnote 11]

Many countries around the world have signalled the importance of low carbon hydrogen in reducing emissions, and there is an expectation that a global market for trade in hydrogen will develop in the long term. However, it is unlikely that market will be mature by 2030, meaning that the UK cannot, and would not want to, rely solely on low carbon hydrogen imports. An over-reliance on imports could create risks around the security of supply for hydrogen and associated investment in the wider value chain. It would also reduce opportunities for UK companies to leverage domestic capabilities and strengths and translate these into clean growth opportunities. In contrast, moving quickly to develop a strong UK hydrogen economy by 2030 can help ensure security of supply and wider investment, create high-quality and sustainable jobs, and position UK companies to take advantage of opportunities in international markets.

We aspire to take a leading global role in developing low carbon hydrogen technologies and markets, working with our international partners including through existing initiatives for collaboration. This will be particularly important in the lead up to the UK hosting COP26 later this year, as we seek to turbo-charge the development and deployment of low carbon technologies that will help countries achieve their clean energy transitions – but will continue beyond COP26, as we pursue opportunities to work with other leading global hydrogen nations in helping to build a global hydrogen economy.

1.5 A strategic framework for the UK Hydrogen Strategy

In developing a UK hydrogen economy, it will be important that we set clear and consistent direction to give industry and investors confidence and certainty, whilst remaining flexible to ensure that we act on learning from early projects and can take decisions which offer the greatest decarbonisation and economic value in the long term. Our strategic framework informs the policy direction and commitments set out in this strategy, and will guide our actions over the course of the 2020s to provide a coherent long term approach.

Our vision

Our vision is that by 2030, the UK is a global leader on hydrogen, with 5GW of low carbon hydrogen production capacity driving decarbonisation across the economy and clear plans in place for future scale up towards Carbon Budget 6 and net zero, supporting new jobs and clean growth across the UK.

Our principles

Our principles will guide future policy decisions and government action, providing clarity on future policy direction for investors and users:

- Long term value for money for taxpayers and consumers: To deliver value for UK taxpayers and consumers we will seek to minimise the cost of action, and drive down costs over the long term, as we reach for our 5GW ambition and beyond to CB6 and net zero.

- Growing the economy whilst cutting emissions: We will harness opportunity to create new, high-quality jobs to support levelling up, including in transition from existing high carbon sectors. We will ensure that the actions we take are aligned to our net zero target, recognising that hydrogen production will need to become increasingly low carbon over time.

- Securing strategic advantages for the UK: We will nurture UK capabilities and technological expertise to grow new industries of the future, so that UK companies can position themselves at the forefront of the growing global hydrogen market. We will support private sector innovation, develop policy to mobilise private investment and promote UK export opportunities.

- Minimising disruption and cost for consumers and households: We will build on our successful hydrogen research and innovation to date to reduce costs, address risks and provide safety and technical assurance of technologies at commercial readiness, focusing on ‘learning by doing’ in the 2020s to minimise disruption and cost for consumers and households, and prime the UK market for expansion.

- Keeping options open, adapting as the market develops: There are uncertainties around the role of hydrogen in 2030 and out to 2050, including the likely split of production methods and scale of demand. We will seek to ensure optionality to deliver a number of credible pathways to 2050, bringing forward a range of technologies that could support our 2030 ambition and CB6 and net zero targets.

- Taking a holistic approach: We will focus on what needs to be done across the whole hydrogen system, supporting coordination across all those who need to play their part, and ensuring we stay in step with developments in the wider energy system as the UK drives to net zero.

We recognise that there may be trade-offs within and between some of these principles at any point in time. For example, the levelised cost of hydrogen using electrolytic production technology is higher today than for CCUS-enabled hydrogen, and it will take time for production to reach industrial scale. That said, with the right support today, this technology presents a genuine opportunity for export of UK expertise and technology, and there is also significant potential for longer-term cost reduction with continued innovation, scale up of manufacture and access to increased amounts of low-cost renewable electricity. This is a clear example of the need to seek balance across these principles in current and future policy decisions.

Challenges to overcome

There are a number of strategic challenges across the value chain that will need to be overcome in order to produce and use hydrogen at scale in the UK:

- Cost of hydrogen relative to existing high carbon fuels: Although costs are likely to reduce significantly and rapidly as innovation and deployment accelerate, hydrogen is currently much more costly to produce and use than existing fossil fuels.

- Technological uncertainty: While some technology is already in use, many applications need to be proven at scale before they can be widely deployed.

- Policy and regulatory uncertainty: Hydrogen is a nascent area of energy policy; industry is looking to government to provide capital and revenue support, regulatory levers and incentives, assurance on quality and safety, direction on supply chains and skills, and broader strategic decisions.

- Need for enabling infrastructure: The use of hydrogen will require new networks and storage, as well as integration with CCUS, gas and electricity networks.

- Need for supply and demand coordination: Developing a hydrogen economy will require overcoming the ‘chicken and egg’ problem of needing to develop new production and use cases in tandem and balancing supply and demand, including potentially through storage over time.

- Need for ‘first-of-a-kind’ and ‘next-of-a-kind’ investment and deployment: Scaling up a low carbon hydrogen economy will require addressing ‘first mover disadvantage’ and other barriers to bring forward early projects while establishing a sustainable environment for increasing investment and deployment in the longer term.

The chapters that follow discuss these challenges in further detail and outline how government will overcome them to develop a thriving UK hydrogen economy.

Outcomes by 2030

As we head towards 2030, we will measure our success across a range of strategic outcomes:

- Progress towards 2030 ambition: 5GW of low carbon hydrogen production capacity with potential for rapid expansion post-2030; hope to see 1GW production capacity by 2025.

- Decarbonisation of existing UK hydrogen supply: Existing hydrogen supply decarbonised through CCUS and/or supplemented by electrolytic hydrogen injection.

- Lower cost of hydrogen production: A decrease in the cost of low carbon hydrogen production driven by learning from early projects, more mature markets and technology innovation.

- End-to-end hydrogen system with a diverse range of users: End user demand in place across a range of sectors and locations across the UK, with significantly more end users able and willing to switch.

- Increased public awareness: Public and consumers are aware of and accept use of hydrogen across the energy system.

- Promote UK economic growth and opportunities, including jobs: Established UK capabilities and supply chain that translates into economic benefits, including through exports. UK is an international leader and attractive place for inward investment.

- Emissions reduction under Carbon Budgets 4 and 5: Hydrogen makes a material contribution to the UK’s emissions reduction targets, including through setting us on a pathway to achieving CB6.

- Preparation for ramp up beyond 2030 – on a pathway to net zero: Requisite hydrogen infrastructure and technologies are in place with potential for expansion. Well established regulatory and market framework in place.

- Evidence-based policy development: Modelling of hydrogen in the energy system and input assumptions improved based on wider literature, qualitative and quantitative evidence and real-world learning. Delivery evidence from innovation and deployment projects collected and used to improve policy making.

We are developing clear indicators and metrics to monitor progress against these outcomes (set out in Chapter 5). This will be important to ensure that we remain on track to rapidly scale up activity across the hydrogen value chain over the course of the 2020s – so that we can realise our 2030 vision, and can position the UK hydrogen economy for scale up beyond this to CB6 and net zero, while making the most of the opportunities that hydrogen holds for UK businesses and citizens.

As our policy work progresses, we will provide regular updates to the work and actions outlined in this strategy – with the first of these updates expected in early 2022. We intend to publish these updates at half-yearly intervals to provide a clear signal of policy direction and provide industry and our other stakeholders with certainty as our thinking develops.

1.6 Hydrogen in Scotland, Wales and Northern Ireland

Developing a hydrogen economy is a whole-UK story, with potential to produce and use low carbon hydrogen right across the UK and provide local economic benefits, in support of UK and devolved administration net zero plans. The government is working with the devolved administrations to support research and innovation and deployment of low carbon hydrogen technologies, and there are already pioneering projects and companies producing and using low carbon hydrogen across Scotland, Wales and Northern Ireland.

Scotland has a key role to play in the development of a UK hydrogen economy, with the potential to produce industrial-scale quantities of hydrogen from offshore and onshore wind resources, wave and tidal power, as well as with CCUS – supported by a strong company base and valuable skills and assets in oil and gas, offshore wind, and energy systems. Economic analysis for the Scottish Government suggests that Scotland could deliver 21-126TWh of hydrogen per year by 2045, with up to 96TWh of hydrogen for export to Europe and the rest of the UK in the most ambitious scenario, delivering significant jobs and local economic benefits. [footnote 12] The Scottish Government published a Hydrogen Policy Statement in December 2020, which set out their vision for the development of a hydrogen economy in Scotland and ambitions for renewable and low carbon hydrogen generation. A Hydrogen Action Plan will be published later this year, supported by a £100m programme of investment from 2021 to 2026. [footnote 13]

Scotland is home to a number of world-leading hydrogen demonstration projects that are helping determine the role that hydrogen could play in Scotland and the UK’s future energy system. The European Marine Energy Centre in the Orkney Islands has a £65 million portfolio of renewable hydrogen projects that is still growing – providing a smaller-scale example of elements of a hydrogen economy (see case study below). Aberdeen is host to 25 hydrogen double decker buses which have helped establish the infrastructure to support an ecosystem of over 60 hydrogen fuelled vehicles of many shapes and sizes – a catalyst for the Aberdeen Hydrogen Hub initiative, which seeks to become one of the key model hydrogen regions in Europe. The H100 neighbourhood trial project in Fife is building a 100 per cent electrolytic hydrogen production and distribution network and installing 300 homes with new hydrogen boilers to demonstrate hydrogen for domestic heating in the UK (see case study at Chapter 2.4.3). In March 2021, the UK and Scottish Government also outlined plans to each invest £50m as part of Heads of Terms for the Islands Growth Deal, to support the future economic prosperity of Orkney, Shetland and the Outer Hebrides, including several projects providing support for hydrogen. [footnote 14]

Orkney Islands: BIG HIT project

BIG HIT (Building Innovative Green Hydrogen Systems in Isolated Territories) is a six-year, Orkney based demonstration project which aims to create an integrated low carbon and localised energy system establishing a replicable model of hydrogen production, storage, distribution and use for heat, power and transport. Funded by the Fuel Cells and Hydrogen Joint Undertaking, the project builds on Orkney’s Surf’n’Turf project – an innovative community renewable energy project using wind and tidal energy to produce hydrogen. State-of-the-art Proton Exchange Membrane (PEM) electrolysers in Eday and Shapinsay Islands produce hydrogen from electrolysis, using locally generated wind and tidal energy. This hydrogen is stored and used for heat, power and transport in the surrounding area. BIG HIT positions Orkney as an operational and replicable small scale Hydrogen Territory: the learning from BIG HIT will support wider replication and deployment of renewable energy with fuel cell & hydrogen technologies in isolated or constrained territories.

Wales has significant opportunities for low carbon hydrogen production and use. Its offshore wind and tidal and wave power potential, strong infrastructure networks and ports, research and development strengths, skills base and readily available internal markets provide a platform for deployment of hydrogen and fuel cell technologies under a favourable policy environment. The Welsh Government published a hydrogen pathway report in December 2020 [footnote 15] and is now finalising its strategic position on hydrogen, which it will publish in early autumn 2021. A complementary Welsh Hydrogen Business Research and Innovation for Decarbonisation (H2BRID) initiative is also being developed for launch around the same time to support the challenges set by the Welsh hydrogen pathway and invest in innovative hydrogen projects across Wales.

Wales is home to several pioneering hydrogen companies, projects and research clusters. Welsh SME Riversimple is designing, building and testing innovative hydrogen fuel cell electric vehicles. The Dolphyn FLOW study is exploring the feasibility of a 100-300MW commercial hydrogen wind farm off South Wales, to be expanded in future, with hydrogen pipelines to strategic locations along the Milford Haven waterway for transport and heat applications, and potentially to Pembroke Dock for marine operations. The Hydrogen Centre, part of the Baglan Energy Park at Neath Port Talbot, is the focal point for a series of collaborative projects between the University of South Wales and other academic and industrial partners. The Centre focuses on experimental development of renewable hydrogen production and novel hydrogen energy storage, as well as further research and development of hydrogen vehicles, fuel cell applications and hydrogen energy systems. The UK Government also recently announced capital funding of up to £4.8m (subject to business case) for the Holyhead Hydrogen Hub, a demonstration hydrogen production plant and fuelling hub for HGVs to serve freight traffic at Holyhead and port-side vehicles, which could be operational by 2023.

Northern Ireland is likewise well-positioned to accelerate hydrogen innovation and deployment, with its significant wind resource, modern gas network, interconnection to Ireland and Great Britain, availability of salt cavern storage and strong reputation for engineering and manufacturing. Northern Ireland Water will be procuring a new electrolyser for one of its waste water treatment works – the first project of its kind in the UK. The public transport operator, Translink, is introducing new hydrogen buses built by local company Wrightbus in Ballymena and is procuring a new hydrogen fuelling station. The GenComm project led by Belfast Metropolitan College has received funding from both the EU and UK Government to trial hydrogen production via electrolysis for hydrogen buses. The Department for the Economy is currently consulting on policy options for a new Energy Strategy, including on hydrogen, which will set out Northern Ireland’s energy focus and direction to 2050 and is expected to be published at the end of the year.

The UK Government is committed to working closely with the devolved administrations – including through the joint government-industry Hydrogen Advisory Council – to harness the UK’s full potential to develop a world-leading hydrogen economy, and to make sure that low carbon hydrogen can contribute to emissions reduction and clean growth across the United Kingdom.

Chapter 2: Scaling up the hydrogen economy

Our ambition is clear, and the opportunities are great. Government cannot do it alone – we will need the collective efforts of industry, the research and innovation community and the UK public to be able to scale up the hydrogen economy over the coming decade to achieve our 2030 ambition. We know that action is needed across the entire hydrogen value chain in the 2020s to support commercial, technical and user readiness for new technologies and to create a thriving market for hydrogen and associated goods and services. The progress we make this decade will be crucial to pave the way for further scale up of production and use from 2030 so that hydrogen can contribute to achieving CB6 and net zero.

This chapter sets out government’s whole-system approach to developing a UK hydrogen economy. It begins by outlining our ‘roadmap’ for the 2020s, our vision for how the hydrogen economy will develop and scale up over the course of the decade and into the 2030s, and how to enable this. The chapter then considers each part of the hydrogen value chain in detail and outlines the key steps that are needed to realise our 2030 ambition and position us for achieving our CB6 target. The chapter also sets out how we will create a thriving hydrogen market, supported by market and regulatory frameworks and with buy in and engagement from consumers and citizens. Further detail, including on demand by sector, factors influencing hydrogen supply mix, and analysis of the main barriers to hydrogen uptake across the value chain, is set out in our analytical annex.

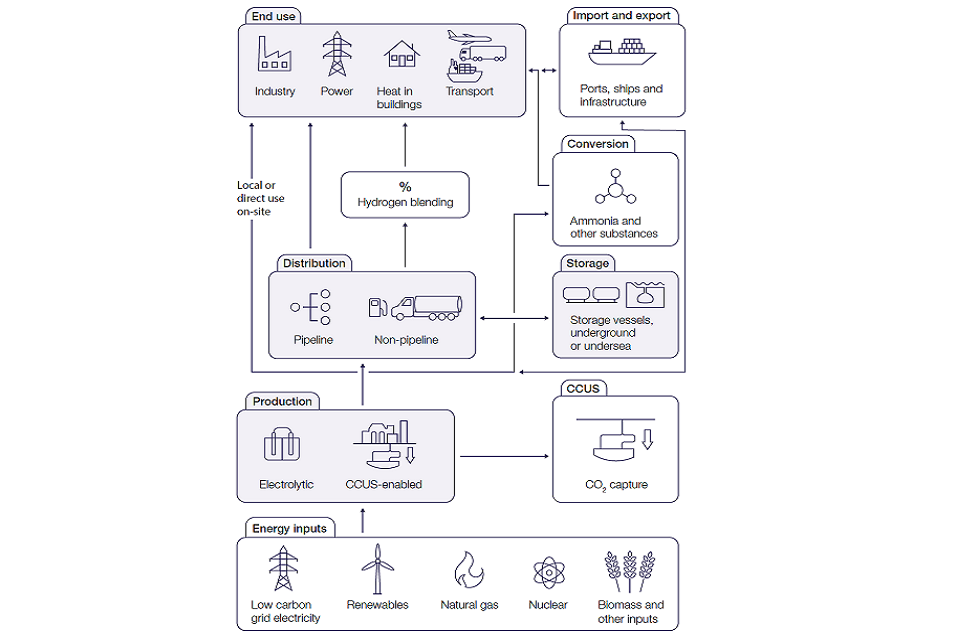

Figure 2: The hydrogen value chain

2.1 2020s Roadmap: a whole-system approach to developing a hydrogen economy

Our 2020s Roadmap (Figure 2.1 below) sets out our vision for how we expect the hydrogen economy will develop and scale up over the course of the decade, and what may be needed to enable this, framing the detail set out in the strategy. Developed in collaboration with industry through the Hydrogen Advisory Council, it is not a critical path, but is intended as a shared understanding and guide for what government and industry need to do during the 2020s to deliver our 2030 ambition and position the hydrogen economy for ramp up beyond this for CB6 and net zero.

The roadmap takes a ‘whole-system approach’ to developing the hydrogen economy, setting out how government and industry need to coordinate and deliver activity across the value chain and supporting policy, and how this will evolve over time. This will help bring forward early projects to build out the supply chain and enable learning by doing, while establishing the longer-term frameworks needed to develop a mature, competitive hydrogen economy and capture the resulting economic opportunities for the UK.

The roadmap is based around archetypes of a hydrogen economy we would expect to see in the early 2020s, mid-2020s and late 2020s, as well as by the mid-2030s for CB6. For each archetype, it sets out what supporting policies or activities need to be in place to deliver, with further detailed actions and commitments set out in the rest of the strategy. This roadmap and further detail offers a blueprint for implementation which will guide our work over the coming months and years.

Figure 2.1: Hydrogen economy 2020s Roadmap: Hydrogen economy ‘archetype’

Early 2020s (2022-2024)

- Production: Small-scale electrolytic production

- Networks: Direct pipeline, co-location, trucked (non-pipeline) or onsite use

- Use: Some transport (buses, early HGV, rail & aviation trials); industry demonstrations; neighbourhood heat trial

Key actions and milestones

- Launch NZHF early 2022

- Phase 1 CCUS cluster decision 2021

- Finalise low carbon hydrogen standard 2022

- Finalise business model 2022

- Heat neighbourhood trial 2023

- Value for money case for blending Q3 2022

Mid-2020s (2025-2027)

- Production: Large-scale CCUS-enabled production in at least one location; electrolytic production increasing in scale

- Networks: Dedicated small-scale cluster pipeline network; expanded trucking & small-scale storage

- Use: Industry applications; transport (HGV, rail & shipping trials) village heat trial; blending (tbc)

Key actions and milestones

- Aiming for 1GW production capacity 2025

- At least 2 CCUS clusters by 2025

- Heat village trial 2025

- Hydrogen heating decision by 2026

- Decision on HGVs mid-2020s

Late 2020s (2028-30)

- Production: Several large-scale CCUS-enabled projects & several large-scale electrolytic projects

- Networks: Large cluster networks; large-scale storage; integration with gas networks

- Use: Wide use in industry; power generation & flexibility; transport (HGVs, shipping); heat pilot town (tbc)

Key actions and milestones

- Ambition for 5GW production capacity 2030

- 4 CCUS clusters by 2030

- Potential pilot hydrogen town by 2030

- Ambition for 40GW offshore wind by 2030

Mid-2030s onward

- Production: Increasing scale & range of production – e.g. nuclear, biomass

- Networks: Regional or national networks & large-scale storage integrated with CCUS, gas & electricity networks

- Use: Full range of end users incl. steel; power system; greater shipping & aviation; potential gas grid conversion

Key actions and milestones

- Sixth Carbon Budget

Supporting policy and activity: what needs to be in place to deliver?

| Early 2020s (2021-2024) | Mid-2020s (2025-2027) | Late 2020s (2028-2030) | Mid-2030s onward | |

|---|---|---|---|---|

| Networks & storage infrastructure | Pipeline/ non pipeline/ co-location infrastructure in place Storage requirement and type(s) established for range of pathways (clusters, heat, power system) Decentralised storage in place |

Dedicated networks in place/ repurposed, expanded trucking & necessary centralised storage in place Links in place with existing gas, & electricity & new CCUS networks Future of gas grid decision, informing future network/ storage infrastructure development |

Large dedicated networks & storage in place (new or repurposed) | Regional & potentially national distribution networks in place Multiple storage sites in place Import/export infrastructure in place |

| Regulatory frameworks | Networks delivered through existing regulatory and legal framework Regulatory signals (e.g. H2 readiness) in place Wider standards (e,g. safety and purity) updated/in place Critical first-of-a-kind deployment barriers addressed Planning and permitting regimes in place |

Initial network regulatory and legal framework in place including potentially blending Initial system operation in place Further deployment barriers addressed – purity, installation, equipment Gas billing methodology in place |

Long-term regulatory and legal framework and role for regulation in place to support network expansion Long term system operator(s) in place Necessary regulations, codes and standards addressed and in place |

Framework in place enabling cross-border pipeline/ shipping trade Regulatory framework adapted as market matures |

| Market frameworks | Hydrogen business model (BM) finalised and in place Wider market framework structures and implications for BM understood Low carbon hydrogen standard in place Revenue support (RTFO) in place for transport sector |

Dedicated revenue support framework, financial arrangements & wider market frameworks in place and driving private investment Market framework aligned to wider energy system frameworks Hydrogen potentially blended into existing gas grid |

Long-term market frameworks, financial arrangements & market design in place | Competitive open market in place including path to subsidy free production and use |

| Grant funding | Capital grant funding mechanisms in place driving investment across production, as well as end use e.g. industry, transport | Capital grant funding supporting investment & project delivery alongside revenue support | Possible role for capital grant funding supporting investment & project delivery alongside revenue support | Competitive market drives bulk of private sector investment |

| Research & innovation | Programmes in place coordinating effort, support & de-risking/ demos for production, industry, transport, storage, heating R&I ecosystems in place supporting supply chain development |

Programmes in place & de-risking of less developed technologies for late 2020s/30s Questions addressed as technologies developed & deployed |

Programmes support and accelerate next generation technology development | Well-established R&I ecosystem continues to drive forward technological advances |

| Sector development | Sector & government work to develop UK supply chains & skills base | Framework in place to support supply chain & skills development, maximising value to UK Plc. | UK supply chains & skills base well positioned to support increased deployment & exports of technology, expertise & potentially hydrogen | UK supply chains & skills base capitalise on accelerated UK/ global deployment through exports of technology, expertise & hydrogen |

| International activity & markets | Key technology & regulatory barriers identified through coordinated effort/ info sharing Early progress made on technology innovation & cost reduction, standards & policy/ regulatory coordination |

Coordinated innovation, policy & regulation delivering accelerated deployment across value chain in key markets | Significant cost reduction & commercialisation driving deployment across multiple markets Framework to facilitate cross border-trade finalised |

Framework for international hydrogen trade and competitive open market in place |

| Public & consumer awareness | Critical end user consumer barriers understood e.g. heat, industry Civil society & regional stakeholders & community priorities understood |

End user consumer barriers addressed for early projects Civil society, regional stakeholders fully engaged |

Consumer acceptance secured across end use sectors Widespread support secured for hydrogen |

Hydrogen widely accepted as a decarbonised energy source |

| Private investment | FEED and FID secured for early 2020s projects Strategic partnerships with key organisations in place Private investment secured for small scale projects Private capital for innovation in place Financial sector engaged on hydrogen |

FEED & FID secured for large scale CCUS enabled/ mid 2020s projects Private investment and financial arrangements secured unlocking deployment Private investment in demonstration / innovation Investment in workforce – training, resourcing |

FEED and FID secured for large scale electrolytic/late 2020s projects Private sector investment in manufacturing facilities aligned to UK sector development opportunities New market entrants as market framework demonstrated |

FEED and FID secured for 2030s projects Private investment drives hydrogen economy expansion New market entrants & business opportunities secured |

| Industry development & deployment | Industry led technology development & testing across value chain (including with government support) Government engaged, including through formal consultation Consumers engaged including communities local to key hydrogen projects / participating in hydrogen trials Early 2020s projects constructed |

Continued technology development & testing across value chain to enable wider range of applications & less developed technology Demand for projects secured & necessary enabling infrastructure Leading larger scale on/off cluster projects developed – industry, power, transport, potentially blending Mid 2020s projects constructed |

Project partnerships in place to secure benefits of shared infrastructure Second phase on-cluster projects & new small-/ medium-scale projects Late 2020s projects constructed |

Post 2030 development & testing delivered New projects cluster/off cluster constructed and existing expanded |

2.2 Hydrogen production

Key commitments

- Ambition for 5GW of low carbon hydrogen production capacity by 2030.

- We will launch the £240m Net Zero Hydrogen Fund in early 2022 for co investment in early hydrogen production projects.

- We will deliver the £60 million Low Carbon Hydrogen Supply 2 competition.

- We will finalise design of UK standard for low carbon hydrogen by early 2022.

- We will finalise Hydrogen Business Model in 2022, enabling first contracts to be allocated from Q1 2023.

- We will provide further detail on our production strategy and twin track approach by early 2022.

There are a variety of different ways to produce hydrogen; whether this hydrogen is low carbon or not depends on the energy inputs and technologies used throughout this process. Current hydrogen production in the UK is almost all derived from fossil fuels, using steam methane reformation from natural gas without capturing and storing any of the resulting carbon emissions. At present an estimated 10-27TWh [footnote 16] of hydrogen is produced in the UK, mostly for use in the petrochemical sector. There is currently only a very small amount of electrolytic hydrogen production in the UK, mostly for use in localised transport projects or trials for different uses of hydrogen, such as blending into the gas grid. [footnote 17]

As we scale up low carbon production through the 2020s, we expect the main production methods to be steam methane reformation with carbon capture, and electrolytic hydrogen predominantly powered by renewables. But these are not the only methods that could play a role in our future energy mix.

The main hydrogen production methods expected to be deployed in the 2020s, and some methods currently under development that could play a role in the future, are included in Table 2.2 below. Further detail is included in the analytical annex and report on Low Carbon Hydrogen Standards published alongside this strategy.

Table 2.2: Overview of selected hydrogen production methods

| Production method | Definition | Carbon Intensity estimates [footnote 18] | Levelised Costs [footnote 19] | Role to 2030 / 2050 | Next steps |

| Steam methane reformation without carbon capture | Natural gas with methane reformation, mostly for use in petro-chemical sector | 83.6 gCO2e/MJ H2 (LHV) | SMR (300MW) 2020: £64/MWh 2050: £130/MWh |

Small amounts of existing supply have helped prove end use case in tests / trials. | Decarbonise existing use in industry |

| Steam methane reformation (SMR) or autothermal reformation (ATR) with carbon capture | Natural gas with methane reformation, but with CO2 emissions captured and stored or reused | ATR with CCS: 16.0 gCO2e/MJ H2 (LHV) SMR with CCS: 21.4 gCO2e/MJ H2 (LHV) |

ATR (300MW): 2020: £62/MWh 2050: £65/MWh SMR (300MW): 2020: £59/MWh 2050: £67/MWh |

Large scale projects expected from mid- 2020s, bulk supply to kick start UK hydrogen economy | Carbon capture and storage infrastructure needs to be in place |

| Grid electrolysis | Using electricity from the grid to electrolyse water, splitting it into hydrogen and oxygen. | 78.4 gCO2e/MJ H2 (note this is a blended figure using grid averages to calculate) | PEM (10MW): 2020: £197/MWh 2050: £155/MWh |

To be determined based on further policy development | Further engagement and analysis required, e.g. via the consultation on the UK Low Carbon Hydrogen Standard |

| Renewable electrolysis | Using clean electricity to electrolyse water, splitting it into hydrogen and oxygen | 0.1 gCO2e/MJ H2 (LHV) | PEM (10MW) (with dedicated offshore wind): 2025: £112/MWh 2050: £71/MWh |

Small projects expected to be ready to build in early 2020s | Scale up technology, reduce costs over time |

| Low temperature nuclear electrolysis | Low temperature electrolysis from existing nuclear facilities | Not modelled but expected low GHG emissions. | Not modelled by BEIS | Can apply existing technologies to current plants in the 2020s. | Further developments expected in 2020s. |

| High temperature nuclear electrolysis | High temperature nuclear power to electrolyse water | High temperature electrolysis: 4.8 gCO2e/MJ H2 (LHV) | Not modelled by BEIS | Could develop hydrogen from advanced nuclear for 2030s | Further innovation and developments expected in 2020s. |

| Bioenergy with carbon capture and storage (BECCS) | Biomass gasification with carbon capture and storage | -168.7 gCO2e/MJ H2 (LHV) | BECCS (473MW) 2030: £95/MWh (excl. carbon) £41/MWh (incl. carbon) 2050: £89/MWh (excl. carbon) -£28/MWh (incl. carbon) |

Could begin production in 2030s | Further innovation and developments expected in 2020s. Developing position further in forthcoming Biomass Strategy |

| Thermochemical water splitting | Direct splitting of water using very high temperature heat from advanced modular nuclear facilities | Not modelled but expected low GHG emissions. | Not modelled by BEIS | Could develop hydrogen from advanced nuclear for mid-late 2030s | Further innovation work to develop to commercial technology |

| Methane Pyrolysis | Heat splits natural gas into hydrogen and solid carbon | Not modelled, but expected low GHG emissions | Not modelled by BEIS | Nascent technology still to be proven at scale | R&D / Innovation |

Working with industry, the UK’s ambition is for 5GW of low carbon hydrogen production capacity by 2030. This ambition is based on our understanding of the pipeline of projects that could come forward during the 2020s, and takes into account the challenges, constraints and costs involved in delivering this. As we work towards this ambition, we would hope to see the first gigawatt of low carbon hydrogen production capacity in place by 2025. This is a fast-evolving market, however, and we will need to ensure we continue to develop our understanding as trends develop and policy decisions influence investments. We believe that working towards 5GW of production capacity by 2030 is a stretching but deliverable ambition, building on the UK’s strong track record of delivering significant cost reductions and large-scale deployment of offshore wind and solar power, and will put us on a credible trajectory aligning with a pathway to net zero. [footnote 20] Achieving this ambition is a key outcome for our strategy and is expected to bring forward over £4 billion of private investment in the period up to 2030.

To meet this ambition, the UK has committed to a ‘twin track’ approach to hydrogen production, supporting both electrolytic and CCUS-enabled hydrogen, ensuring we support a variety of different production methods to deliver the level of hydrogen needed to meet net zero. This approach sets the UK apart, giving us a competitive advantage and building on our strengths to ensure we can be confident in delivering our 2030 ambition and beyond. As outlined in Chapter 1, the UK’s skills, capabilities, assets, and infrastructure mean that we have the potential to excel in both electrolytic and CCUS-enabled low carbon hydrogen production. Supporting these and other potential production routes will enable us to develop low carbon hydrogen rapidly at scale while future-proofing our net zero ambitions. [footnote 21]

This twin-track approach has already underpinned successful innovation through our Low Carbon Hydrogen Supply Competition, which set out to support development and cost reduction of a wide range of world-leading technologies. This has supported projects including methane reformers with higher carbon capture rates, scaling up of modules and support for the automated manufacture of electrolysers, and work to evidence the feasibility of electrolysis from low carbon nuclear.

As set out in the analytical annex published alongside this strategy, the proportion of hydrogen which will be supplied by particular technologies depends on a range of assumptions, which can only be tested through the market’s reaction to the policies set out in this strategy and real, at-scale deployment of hydrogen across our complex energy system. Our Hydrogen Production Cost 2021 report suggests that, under central fuel price assumptions, CCUS-enabled methane reformation is currently the lowest cost low carbon hydrogen production technology. Given the potential production capacity of CCUS-enabled hydrogen plants, we would expect this route to be able to deliver a greater scale of hydrogen production as we look to establish a UK hydrogen economy during the 2020s. However, as referenced in Table 2.2 above, costs of electrolytic hydrogen are expected to decrease considerably over time, and in some cases could become cost-competitive with CCUS-enabled methane reformation as early as 2025. Given the range of uncertainties and variable assumptions in this area, and the rapid growth we need to meet our carbon budgets, we consider support for multiple production routes the most appropriate approach, rather than reliance on a single technology pathway.

How will we develop and scale up low carbon hydrogen production over the 2020s?

Our commitment to supporting multiple production routes will, we believe, bring forward the broad range of projects needed to ensure a rapid and cost-effective build out of the hydrogen economy. Greater competition will spur innovation, cost reductions and investment across the value chain. Deploying CCUS-enabled hydrogen capacity will achieve cost-effective near-term low carbon hydrogen production at scale, drive investment across the value chain (including transmission, distribution and storage), and pull a range of hydrogen technologies through to commercialisation. Alongside this, supporting the scale up of electrolytic hydrogen production can drive down costs to establish a cost-optimal and credible technology mix for our pathway to net zero. Our focus will be on promoting domestic production and supply chains, although we would expect to be an active participant in international markets as they develop, maximising export opportunities and utilising import opportunities as appropriate.

The first movers in the early 2020s are likely to be relatively small (up to 20MW) electrolytic hydrogen projects that can be deployed at pace, with production and end use closely linked, for example, at a transport depot or industrial site. By the mid-2020s we could start seeing larger (100MW) electrolytic hydrogen projects and the first CCUS-enabled hydrogen production facilities based in industrial clusters. At this stage producers could be catering for a growing range of customers across transport, industry and power generation as well as potential to supply hydrogen heat trials and blend low carbon hydrogen into the gas grid. By the end of the decade we could have multiple large CCUS-enabled (500MW+) production facilities across the UK, with extensive cluster networks and integration into the wider energy system. Achieving our 2030 ambition is expected to provide up to 42TWh of low carbon hydrogen for use across the economy.

Case study: ITM Power – electrolytic hydrogen production

Based in Sheffield, ITM Power are a world-leading manufacturer of PEM (proton exchange membrane) electrolysers, a technology for hydrogen production from water. The company’s new Gigafactory is the world’s largest electrolyser factory with a 1GW per annum capacity to produce renewable hydrogen for transport, heat and chemicals. In May 2020, ITM Power announced plans to establish a separate subsidiary – ITM Motive – to build, own and operate eight publicly accessible H2 refuelling stations.

Several ITM projects are supported by government. The company’s Gigastack project – led alongside Ørsted, Phillips 66 Limited and Element Energy – won funding from BEIS’ Low Carbon Hydrogen Supply Competition. Gigastack is developing electrolyser technology to produce renewable hydrogen at industrial scale.

The exact production mix by 2030 will be influenced by a range of factors, such as carbon pricing and the policies being consulted on in parallel to this strategy. Alongside this, investor confidence and market forces will dictate the type of projects that will come forward during the 2020s. In the longer term, electrolytic hydrogen offers greater carbon reduction potential and cost reductions, making it cost-competitive with CCUS-enabled hydrogen over time. [footnote 22] Using the 2020s to ‘learn by doing’, supported by research and innovation, will provide lead-in time needed to enable commercial production of electrolytic hydrogen at larger scale from the 2030s onwards, ensuring it can plug into a wider hydrogen value chain commercialised through large scale CCUS-enabled production.

Investors, developers and companies across the length and breadth of the UK are ready to build if the right policy environment is in place. We are aware of a potential pipeline of over 15GW of projects, from large scale CCUS-enabled production plants in our industrial heartlands, to wind or solar powered electrolysers in every corner of the UK. This includes plans for over 1GW of electrolytic hydrogen projects, ranging from concept stage to fully developed proposals, which are aiming to deploy in the early 2020s. Other production methods being proposed by industry include using biomethane or the electricity or heat from a nuclear reactor as energy inputs to hydrogen production.

Case study: Acorn Project – CCUS-enabled hydrogen production

Led by Pale Blue Dot Energy, the Acorn CCS and Hydrogen Project in St Fergus, Scotland (image left), aims to deliver an energy- and cost-effective process for low carbon hydrogen production for use in a range of applications including industrial fuel switching and decarbonising heating. The project, supported through BEIS’ Low Carbon Hydrogen Supply Competition, conducted engineering studies to evaluate and develop the advanced reformation process, including assessment of Johnson Matthey’s low carbon hydrogen technology and an alternative reformer technology.

From the 2030s onwards, we may see a wider range of production technologies coming to the market including more hydrogen from nuclear, using low carbon heat and power from small modular and advanced modular reactors, as well as bio-hydrogen with CCUS that can deliver negative emissions. A dynamic market will include multiple sources and end uses for hydrogen.

To meet our CB6 and net zero targets, there is likely to be a substantial ramp up in demand beyond 2030. Our analysis suggests that hydrogen demand could increase significantly in the early 2030s, suggesting 7-20GW of production capacity may be needed by 2035. [footnote 23] Demand could continue to increase rapidly over the 2030s and 2040s, requiring a corresponding increase in hydrogen production capacity to ensure there is sufficient supply to meet this.

In achieving our 2030 5GW ambition and delivering production levels needed for CB6 and net zero, we will have to work with industry and other stakeholders to better understand and overcome the barriers to growing a new energy vector for the UK. These barriers reflect the strategic challenges outlined in Chapter 1.5 and include:

- High production cost relative to high-carbon fuel alternatives.

- High technological and commercial risks for maintaining operation of first-of-a-kind projects and investment in next-of-a-kind deployment.

- Demand uncertainty due to current limited use of low carbon hydrogen in the UK.

- Lack of market structure, small number of end users potentially leading to the abuse of market power.

- Distribution and storage barriers, reflecting the current lack of sufficient carbon capture and storage and hydrogen transmission infrastructure.

- Policy and regulatory uncertainty, including the lack of established standards to define low carbon hydrogen (including non-emission standards), and related to the limited understanding of the regulatory impacts of hydrogen at a system-wide level.

Detailed description of these barriers can be found in the analytical annex (chapter 2).

What are we doing to deliver new low carbon production?

This strategy marks a turning point for low carbon hydrogen production in the UK. It is part of a comprehensive package of measures, set out by government alongside the strategy and beyond, that can help deliver our 2030 5GW production ambition and ensure that we are ready for the step-change needed in low carbon hydrogen production in the 2030s to help meet our CB6 commitments and put us on a pathway to net zero:

- Research and innovation: The UK is already at the forefront of research and innovation across the hydrogen value chain, reducing technological, environmental, social and economic barriers to production and end use. We also recently launched our £60 million Low Carbon Hydrogen Supply 2 Competition, which will develop novel hydrogen supply solutions for a growing hydrogen economy.

- CCUS infrastructure: In November 2020 we confirmed allocation of £1 billion for the Carbon Capture and Storage (CCS) Infrastructure Fund, to help overcome carbon capture, distribution and storage barriers and enable the establishment of a new CCUS sector. In May this year, we set out the details of the Carbon Capture, Usage and Storage (CCUS) Cluster Sequencing Process, which will look to identify at least two CCUS clusters for deployment in the mid-2020s. Projects within the clusters will have the opportunity to be considered to receive any necessary support including access to the CCS Infrastructure Fund, and business models for transport and storage, power, industrial carbon capture and low carbon hydrogen.

- Hydrogen Business Model: In the Prime Minister’s Ten Point Plan, we confirmed our intention to develop business models to help bring through investment in new low carbon hydrogen projects and help build UK capability to meet net zero. Since then, we have worked to develop a Hydrogen Business Model intended to provide long-term revenue support to hydrogen producers to overcome the cost challenge of producing low carbon hydrogen compared to cheaper high-carbon alternatives. We consider our preferred business model would provide an investable commercial framework for producers while also meeting government’s objectives for developing the low-carbon hydrogen market and ensuring value for money. Further detail on our proposals is set out in the Hydrogen Business Model Consultation published alongside this strategy. We intend to provide a response to this consultation alongside indicative Heads of Terms in Q1 2022.

- Net Zero Hydrogen Fund (NZHF): As set out in the Prime Minister’s Ten Point Plan, the NZHF will provide up to £240 million of government co-investment to support new low carbon hydrogen production out to 2025, kickstarting efforts to deliver our 2030 5GW ambition. The aim of the Fund is to support commercial deployment of new low carbon hydrogen production projects during the 2020s, helping to address barriers related to commercial risk and high production costs of hydrogen compared to fossil fuel alternatives. We are consulting on the design and delivery of the NZHF alongside the publication of this strategy, and we intend to launch the NZHF in early 2022.

- Low Carbon Hydrogen Standard: If we are to achieve our CB6 and net zero commitments, we must ensure that the hydrogen production we are supporting is sufficiently low carbon, while not stifling innovation and growth. To help address barriers related to policy and regulatory uncertainty, we have identified and assessed a series of options for a UK low carbon emissions standard that could underpin the deployment of low carbon hydrogen. Alongside this Strategy we have published a report, prepared for government by E4Tech and Ludwig-Bölkow-Systemtechnik (LBST), which explores a range of factors including maximum acceptable levels of greenhouse gas (GHG) emissions associated with low carbon hydrogen production and the methodology for calculating these GHG emissions. Alongside this strategy, we have also published our consultation on a ‘UK Low Carbon Hydrogen Standard’, which seeks views on the options for setting and implementing such a standard, and we intend to finalise design elements of a UK standard for low carbon hydrogen by early 2022.

Chapter 2.5 sets out a wider range of policy and regulatory levers which we are exploring to support the development of the hydrogen economy, including production.

Our future production strategy

In most of the pathways modelled by BEIS for CB6, hydrogen demand doubles between 2030 and 2035, and continues to increase rapidly over the 2030s and 2040s. By 2050, between 250-460TWh of hydrogen could be needed across the economy, delivering up to a third of final energy consumption. [footnote 24] Current analysis suggests that in 2050, hydrogen will be supplied through a mix of steam methane reformation with CCUS, electrolysis from renewable electricity, and biomass gasification with carbon capture and storage (BECCS), a position supported by the CCC’s CB6 advice. [footnote 25]

As the hydrogen economy expands and demand grows, researchers, innovators, investors and producers will respond with new technological advances that could deliver further production cost reductions or greater emissions savings. The role for other production methods, including existing and future nuclear technologies, methane pyrolysis, and thermochemical water splitting, will need to be assessed and integrated into our modelling as appropriate to give us an evolving picture of our future production mix. As we increase our understanding of the project pipeline, and the measures needed to overcome barriers to widespread deployment of a range of production technologies, we can form a better picture of our future production strategy. In doing so, we will continue to consider the wider environmental impacts of different methods of hydrogen production, such as resource requirements for land or water, or any potential changes in soil, water or air quality. The production of hydrogen is likely to need significant amounts of water and, together with industry, we will continue engaging with the Environment Agency, regional water resources groups and water companies to ensure appropriate plans are in place for sustainable water resources.

During 2021 we will gather further evidence through our consultations on a Hydrogen Business Model, the NZHF and the standard for low carbon hydrogen, and undertake additional work on our production pathway in line with CB6. This will give us a better understanding of the mix of production technologies, how we will meet a ramp-up in demand, and the role that new technologies could play in achieving the levels of production necessary to meet our future CB6 and net zero commitments. We will develop further detail on our hydrogen production strategy and twin track approach, including less developed production methods, by early 2022.