Planning Inspectorate Annual Report and Accounts 2022-2023

Published 29 June 2023

Applies to England

For the period 1 April 2022 to 31 March 2023

Presented to the House of Commons pursuant to Section 7 of the Government Resources and Accounts Act 2000.

Ordered by the House of Commons to be printed on 29th June 2023.

HC 1543

Any enquiries regarding this publication should be sent to:

Planning Inspectorate

Temple Quay House

2 The Square

Temple Quay

Bristol

BS1 6PN

Tel: 0303 444 5000

Email:

General Enquiries: enquiries@planninginspectorate.gov.uk

Press Enquiries: press.office@planninginspectorate.gov.uk

This publication is available in large print.

Preface

This document combines performance and financial data with analysis to help readers better understand our work. It covers the period 1 April 2022 to 31 March 2023.

In line with our values of being open and fair, it is designed to support accountability and transparency, describing how we have used taxpayer’s money to deliver for our customers. To be accessible and understandable the analysis is set out in three sections; our performance, accountability, and financial data.

The Performance report and analysis is divided into three sections:

- Performance overview – Opening with an introduction from our Chief Executive and Chair of the Board, the Performance Overview provides a review of our performance in 2022/23, including the challenges, successes and strategic risks, and our delivery plans for 2023/24.

- Performance report – Sets out our organisation and the context in which we operate.

- Performance analysis – A closer look at the data and analysis of our operational performance, broken down by the services we provide. Our performance in terms of customer service, environment and sustainability and finance is also covered.

The Accountability report covers our Chief Executive and Chief’s responsibilities to Parliament, the arrangements we have in place to discharge our public duties and the internal controls we have in place to comply with all required regulations. A remuneration and staff report sets out the pay and benefits received by the executive and non-executive Board members, disclosures on pay and pensions policies and details of staff numbers and costs.

The Financial statements outline our income and expenditure for the 2022/23 financial year with the notes to the accounts to enable readers to understand these results.

A note on the data used in this report:

Data are accurate at the time they were drawn from administrative systems but as we use live operational systems this data is subject to change. Revisions to previously published data are made when changes in the data materially change interpretation of PINS performance or when a change is greater than 5%. Revisions are only made to FY21/22 onwards as changes to some administrative systems leaves us unable to reliably replicate data from previous years. Corrections will always be made if computational errors are identified in previously published data.

Board Chair’s Statement

The Planning Inspectorate plays a key part in delivering the places and priorities, infrastructure, homes, jobs, community assets, healthy and sustainable communities and environments England needs. This is possible through the inputs of our partners, stakeholders, customers and Ministers who have worked with us this year on our drive to deliver and improve.

2022/2023 has seen the Inspectorate have a laser like focus on the delivery of our strategic plan at a time of both internal change and external uncertainty. This is critical to ensure we play our part in delivering the places and priorities, infrastructure, homes, jobs, community assets, healthy and sustainable communities and environments needed in England, and Wales (through our National Infrastructure Project application service). We are part of a wider delivery system and legislative and policy framework. We continue to use our knowledge and experience to collaborate to encourage innovation and improve performance and delivery. The experience of our customers is driving our work to improve the quality and timeliness of our decisions, reports and recommendations. I am grateful to my colleagues, our partners, stakeholders, customers and Ministers who have worked with us this year on our drive to deliver and improve. Below are some of the highlights.

Local plans can shape a local area for the future. Research told us that local people want to be involved in their development but struggle to navigate the complex system. To help address this, we made six short films to explain the process.

We continued to receive high levels of casework which presents resource and speed challenges. In response we have had to prioritise. This year we focused resources on delivering in areas of casework that will provide the greatest value from an economic and community perspective, such as inquiries, local plans and National Infrastructure. Once it was clear that improvements in these areas could be maintained, we began to focus on hearings which delivered results in stabilising and improving timeliness in these areas. We also increased our Inspector capacity and continued to invest in our digital services. But we still have more to do, our next area of focus will be appeals decided after written exchange of evidence.

This year the Inspectorate has worked collaboratively with Government departments to make the consenting regime for National Infrastructure such as energy and transport better, faster, greener and fairer. In February 2023 the resulting Government Action plan was published, and the Inspectorate will deliver its part of the plan.

We are working with our sponsors (Department of Levelling Up, Housing and Communities) on different aspects of planning reform including the proposals within the Levelling Up and Regeneration Bill and their implementation.

We are transforming our internal systems over the next few years, they will become the foundation for the way we provide services and integrate both data and our services with the wider planning system. We have worked constructively with Local Planning Authorities on a digital portal for appeals and national infrastructure applications, with real time learning shaping its design. Appellants in 200 Local Planning Authorities have access to the new digital appeals service as of the end of March 2023.

We could not deliver without our dedicated and knowledgeable work force. Like many organisations, recruiting, retaining and growing talent in a competitive market has required innovative approaches which has provided the opportunity to bring in new and diverse talent. For example:

- 13 apprentices enrolled at the Inspectorate in 2022/23, more than doubling our intake from 2021/22.

- The Inspectorate is one of the first Boards to host a Non-Executive Director Apprentice through the new UK National Non-Executive Director Apprenticeship Program. You can read our first non-executive director apprentice bio under the Directors report section.

- Participation in the Royal Town Planning Institute Explore programme and the Spring Board programme, both of which enable participants to undertake work experience with us and ensures the Inspectorate better reflects the communities we serve.

- Taking steps to improve our gender pay gap.

A key role for the Board is to ensure stewardship of public funds. I am therefore very pleased that once again our external auditors have given us an unqualified audit. I am grateful for the challenge and support of both our internal and external auditors.

Senior leadership of the Inspectorate has undergone significant change this year and I wish to pay tribute to our former Chief Executive Sarah Richards, who led so effectively, and our former Director of Corporate Service Navees Rahman, who both left us. Together they contributed to an organisation better equipped to respond to and prepare for future demands on the organisation and the planning system. I am pleased to welcome our new Chief Executive Paul Morrison and his refreshed executive team.

My fellow Non-Executive Directors have made an enormous contribution and will all step down at the end of their terms during the forthcoming year and I thank them for the challenge, guidance and support they have offered the Inspectorate during their term.

Trudi Elliott Chair of the Planning Inspectorate Board

Chief Executive’s Statement

This is an exciting time to join a respected organisation where expertise and a profound sense of public duty is embodied across the Inspectorate. I look forward to working with colleagues and partners in the year to come to build on the successes outlined in this report.

It is a pleasure to be writing my first, of what I hope will be many, Chief Executive Officer statements in the Planning Inspectorate’s Annual Report. Having only arrived in December I can take little personal credit for the successes the report describes. But I can derive pride in being part of an organisation that has delivered them. In keeping with that spirit, I should start by paying tribute to my predecessor as CEO, Sarah Richards and our outgoing Director of Corporate Services Navees Rahman who so ably led the Inspectorate as an Interim CEO between Sarah’s retirement and my arrival. As I look to the future I am certainly standing on the shoulders of giants. Given that, this statement slightly breaks from the mould of an annual report looking over the year just gone, and has perhaps a greater focus on the year to come.

At one level the message for the coming year, is more of the same. The core purpose of the Planning Inspectorate will remain as it ever was; to make fair, open and impartial decisions, reports and recommendations in a timely manner. We will achieve that by continuing to invest in our people, driving the service we deliver to customers and improving our processes and systems, particularly in the data and digital field. But while the fundamentals of our approach remain the same, they will play out against the backdrop of significant changes to policy which will require us to continue to engage across the planning system. In this statement I want to say a little more about each of these areas.

People

In preparing to take on this role I spoke to a range of stakeholders across the planning system. I was struck by the breadth and depth of the regard in which the Inspectorate was held in terms of its professional reputation. That respect rests on the expertise and profound sense of public duty that is embodied across all the professions that make up the Inspectorate. The approach to recruiting, retaining, training and ensuring the continuing engagement and wellbeing of our incredible staff was a priority for my predecessor, as is captured in the progress described in this report on all those areas, and will remain so for me.

Service Delivery

The conversations reflected the progress we had made in our service delivery. The Independent Review of Planning Inquiries undertaken by Bridget Rosewell led to significant improvements in timeliness of planning appeals heard through an inquiry and in this last year the same principles were applied to planning appeals heard by hearing leading to similar improvements. This has been noticed, but the improvements only applied to planning appeals heard through an inquiry or hearing, which constituted around 5% of all planning appeals received. We cannot hide that in 2022/23 we received more casework across our services than we were able to decide which leads to cases taking too long. Working on turning this around will be a key operational priority in the coming year.

Data, digital and innovation

Part of the solution to improve delivery will be to continue to close our vacancy gaps. But it also must result from our ongoing work to improve processes, particularly through our digital and data programmes. 2022/23 is the year we emerged from lockdown, into the new normal we all predicted during the pandemic. We will build on the innovation that difficult period accelerated, for example that saw more of the work we are doing taking place online. The overhaul of our digital systems saw some new services come online in 2022/23 and that will continue to roll out. But in the coming year we will also have a particular focus on the less visible but equally essential developments around our data and back-office IT. This will give us a foundation to deliver more effective and easier to use systems for years to come.

New Policies

Our role is to implement the Government’s policies. We will work with my erstwhile colleagues in the Planning Directorate in the Department for Levelling Up, Housing and Communities (DLUHC) on implementing key policy priorities such as the planning provisions in the Levelling up and Regeneration Bill, changes to the National Planning Policy Framework and the NSIP reform.

Taking a system view

As well as DLUHC, we work with a range of other departments with a role in the planning system such as the Departments for Environment, Food and Rural Affairs, for Transport and, for Energy, Security and Net Zero (formerly part of BEIS) and their families of arms-length bodies as well as every Local Planning Authority and a range of users across sectors and communities. We want to be generous in using that vantage point to help connect the dots in a complex system and work with partners across all tiers of Government and other sectors in the design of polices and services that are deliverable and do what is needed to ensure the country gets the development it needs and communities want.

This is an exciting time to join an impressive organisation. So I will end by thanking everyone who made the successes in this report happen and I look forward to working with colleagues and partners in the year to come.

Paul Morrison, Chief Executive, Planning Inspectorate

2022/23 At a glance

258 decisions issued for planning appeals determined by inquiry, with the average time taken decreasing.

Provided recommendations to a Secretary of State on 10 National Infrastructure Applications within statutory timeframes.

33 Reports issued for Local and Development Plans.

Appeal Planning Decision Service launched in June 2022, with approximately 200 LPAs joining the pilot by March 2023.

17,456 decisions and recommendations on appeals, applications and examinations. This is comparable to 2021/22.

95 New inspectors recruited, increasing our capacity to deliver more decisions.

Invested in the future by enrolling a record number of apprentices, participating in outreach activities and hosting work experience to encourage young people into planning.

Local Plan explainer videos go live on the Inspectorate’s YouTube channel in November to help everyone understand the examination service.

Published set of experimental statistics to provide more transparency and clarity on performance against Ministerial Performance Measures.

Introduction

The Planning Inspectorate deals with National Infrastructure Planning applications in England and Wales, and examinations of Local Plans, planning appeals, and other planning-related casework in England. We do this fairly, openly and impartially with a customer-focus.

Our work

In England, our Inspectors deliver decisions and recommendations across our three public services: examinations, appeals and (also in Wales) applications. We make sure development is carefully considered and that the right homes and developments are allowed in the right places and valued green spaces are protected. We ensure that proposed developments meet future needs for the economy, environment and society and that the communities’ views on large infrastructure applications are heard. We uphold and promote quality, assuring the checks and balances of the planning system, so that our decisions are fair, impartial and open. We examine Local Authorities’ development plans, which set the framework for local economic, social and environmental priorities. We have specialist experts able to advise and decide cases on a wide range of environmental, ecological, historic and tree and high hedges matters. We share our expertise with a number of our stakeholders to enable good planning.

Our headquarters are in Bristol and we employ in the region of 887 staff. Around half of these are home-based Inspectors, all of whom are professionally qualified (for example, as town planners, architects, lawyers or engineers). We offer a hybrid working environment for our support staff, who carry out a wide range of functions.

These include supporting the delivery of casework; liaising with the public; providing direct support to Inspectors and formal decision making for some types of casework. They provide essential organisational support through the provision of Corporate Services such as Finance, Commercial, HR and Digital and Data Services. As well as Communications, Customer Services, Corporate Governance, Future Strategy and Change, Innovation and Knowledge & Information management.

Our Strategy

Our Strategic Plan, published in October 2021, centres on a vision to:

Provide our customers with high quality, timely and efficient services that support the nation’s recovery from the COVID-19 pandemic by engaging, empowering and equipping our workforce and by delivering ambitious policy changes.

This is underpinned by three core strategies: a Customer Strategy to act as a vision for our service delivery, and two enabling strategies that provide the foundations for its delivery. The enabling strategies focus on our People and on Data and Digital Improvement.

Customer Strategy

The customer strategy is a cross-cutting strategy which influences all areas of the organisation to ensure we are customer focused. This strategy focuses on:

- Understanding the needs of our customers to inform our improved digital services.

- Engaging with our customers to ensure our services are easy for customers to use and that they are kept informed on the progress of their case throughout.

- Using insights to drive and prioritise customer focused change and innovation.

- Improving the timeliness and quality of our decisions and recommendations.

Data & Digital Strategy

Data and digital capabilities are key to improving our services and the planning system. This strategy focuses on:

- Improvements to our digital services underpinned by our customers needs.

- Utilising technology and data to allow our customers to easily engage with us.

- Enabling data to move across the planning system.

- Invest in new digital and data capabilities.

- Provide our people with the technology they need to deliver.

People Strategy

Successful delivery of our vision is reliant on our people and creation of the conditions that enable them to thrive. This strategy focuses on:

- Developing our leaders.

- Ensuring our workforce is reflective of the communities we serve.

- An inclusive culture which prioritises wellbeing.

- We have the right people, with the right skills. Delivering on this strategy will enable our people to deliver high levels of performance for our customers.

Aligned with these, our sponsoring department, the Department for Levelling Up, Housing and Communities, set six priorities for the Inspectorate for the 2022/23 financial year. Our progress against these priorities is outlined below:

Plan-making

Ensuring LPAs deliver robust Local Plans which help shape well planned sustainable communities that determine the future pattern of development.

We have:

- Encouraged Local Planning Authorities to use our advisory visits to help them get their plans in good shape and deal with challenges well before submission.

- Completed 34 examinations in 2022/23

- Launched a series of short films to explain the process of examinations to support communities to get involved, following research that open and easily understandable information would make the process more accessible for all.

- Worked in close partnership with colleagues in DLUHC by providing Inspector expertise in helping shape and test policy changes proposed, and to ensure the Inspectorate is operationally ready to receive the anticipated changes.

NSIP reform and the British Energy Security Strategy

The shared vision across government is to create improvements to the consenting process for major infrastructure that facilitate energy security, deliver transport connectivity and the needed water and waste management facilities.

We have:

- Worked closely with departmental colleagues in developing and implementing National Infrastructure Planning Reform.

- In collaboration with all the involved Departments (DLUHC, DESNES, DfT and DEFRA), developed and delivered an Action Plan published on 23 February 2023. This sets out a comprehensive, whole system approach to strengthening the resilience of the system and making infrastructure consenting better, faster, greener and fairer. The Inspectorate will remain centrally involved in delivering these reforms over the coming years.

- Ensured the Inspectorate is operationally ready to implement the ongoing changes.

- Recruited and trained additional staff to increase capacity for handling national infrastructure applications expediently and service an increase in demand.

- Used direct testing and learning to inform our reform programme, through piloting enhanced preapplication options mainly on the A66 National Highways and Lower Thames Crossing DCOs.

- In 2023/24 we will continue to progress opportunities for streamlining secondary legislation and guidance and identifying and developing ways for greater standardisation to reduce the amount of information that needs ‘re-examining’ in every examination.

- For a full set of the improvement measures and the Inspectorate’s role in delivering these visit the NSIP action plan.gov.uk

Operational performance recovery on appeals

The Inspectorate prioritised appeal timeliness against the backdrop of continuing to receive more casework than we could decide in 2022/23.

We have:

- Continued to prioritise completing cases with the biggest economic impact, in line with governmental expectation. For appeals, this is those requiring a hearing or inquiry, which are generally those which have the greatest community interest and potential to provide homes, jobs and community facilities.

- As a result, for planning appeals decided after an inquiry we decided 258 appeals, and for planning appeals decided after a hearing we decided 570 appeals. For both types of appeals, this figure is more than in 2021/22 and more than we received. This demonstrates the positive impact of applying focus to improving their performance.

- For planning appeals decided after a written exchange of evidence we decided a comparable number of appeals to 21/22 and confirmed this would be the next area of focus after planning appeals by hearing. Our performance is reported on a monthly basis, these statistical releases can be accessed at Planning Inspectorate.gov.uk.

- Increased our capacity by recruiting and training more Inspectors and other decision makers, using our commercially contracted inspectors to the full extent of their availability and training inspectors in different areas to increase flexibility in the way we deploy them.

- Continued to invest in the technological foundations which provide the opportunity for process efficiencies and experiential service improvements.

- For further information, see our operational performance from the Our operations section.

People and workforce

An appropriately resourced, diverse and inclusive inspectorate.

We have:

- Continued to embed our strategic workforce plan, focusing particularly on Inspector recruitment. This has resulted in 95 new Inspector appointments being made and a further 51 promotions in 2022/23. Work has begun on our wider workforce requirements looking at our support functions and the many other professions employed at the Inspectorate.

- Continued to deliver on our ED&I strategy and increased resources dedicated to delivering against our commitments.

- Made significant improvements to the relevance and inclusivity of our people policies.

- Developed an approach to apprenticeships and outreach.

- For further information, visit the Our People section.

Finance

We have:

- Continued to develop our monthly forecasting process ensuring that our focus is based on materiality and risk. The validity of financial planning assumptions made throughout the organisation are tested by the finance team, who act as a critical friend and undertake sensitivity testing. Cashflow forecasting has been integrated into the month end processes and we test the robustness of the balance sheet in the context of the forecast.

- Developed our processes to ensure continued compliance with Government Functional Standards.

- In 2023/24 we will complete the review of our methods of forecasting income and plan to introduce further measures to enhance risk sensitivity testing and speed up debt recovery.

Operational Delivery Transformation

Delivering the Inspectorate’s digital services.

We have:

- Progressed designs for a new planning appeals service which will be easier, faster and more cost effective. The first part of these improvements focuses on the appeal submission form, and we have introduced a new form for submitting full planning (s78) and householder appeals in some local authority areas of England. Over time, we will be adding additional LPAs and new features to the service.

- Begun work on the design and development of other case types, such as appeals for listed building consent and enforcement.

- Begun work to improve the design of the LPA questionnaire and statement submission process.

- Worked with DLUHC and third-parties to determine the priorities to shape the development of data standards and a data-driven planning system, and will continue to do so.

What we plan to do in 2023/24

Business Plan

The Inspectorate has launched a Business Plan for the coming financial year 2023/24 which focuses on five priorities we believe are critical to addressing the main challenges of the day. These include meeting our customers’ expectations on the timeliness and quality of our services; adapting to changes to the wider planning system; the pace and scale of technological change; and the challenges we continue to face around recruitment. The plan is underpinned by a reporting framework detailing how we will take action to progress these priorities and how we will measure the impact of our work.

Strategic Plan

The organisation had been considering the need to revise its Strategic Plan and towards the latter part of the financial year, the case for doing this was agreed with the Executive Team, Board and sponsoring department. The emerging Strategic Plan, which we plan to launch in the autumn of 2023, will set out in detail how we will bring about significant improvements to our services in the three year period 2024-27. The plan will be structured around a set of principles that will benefit our customers, our sector and society more broadly. We will continue to work closely with DLUHC and other sector partners to test our thinking and to ensure that our plan is robust and equips the Inspectorate to achieve our goal of a quicker, more certain, backlog-free and cheaper operation.

Our statutory framework

We work within a legal framework consisting of Acts of Parliament and secondary legislation.

Our part in the planning system

In England we operate a plan-led system where Local Plans are used to decide how much land should be set aside to build new homes, offices, factories, warehouses, shops and other things, usually over the next 10 to 15 years. They also show areas where development should be limited for some reason. These are then used to make decisions on planning applications for individual development proposals.

At the Planning Inspectorate we examine the soundness of Local Plans, determine a range of appeals and applications, and make recommendations on Nationally Significant Infrastructure Projects. We help deliver the government’s objectives to overcome some of the big challenges facing the country, such as climate change, housing provision and achieving sustainable development.

Three key Acts

There are three Acts of Parliament which are particularly significant for our work.

The Planning and Compulsory Purchase Act 2004

Covers the Local Plans system, as well as the statutory duty “to determine planning applications and appeals in accordance with the development plan, unless material considerations indicate otherwise.”

The Town and Country Planning Act 1990

Covers the right to appeal for planning, enforcement, and lawful development certificate cases, as well as our ability to determine the procedure for a variety of case types.

The Planning Act 2008

Covers the consenting regime for Nationally Significant Infrastructure Projects.

There is more legislation for other areas of our work, such as listed buildings, rights of way and environmental appeals.

The rules and regulations

Sitting underneath the Acts, secondary legislation provides the detail to the statutory framework. For example, it defines what development can take place without seeking planning permission and when one requires prior approval. It also sets out how to make applications and appeals and how we must handle them.

Our statutory duties

The statutory framework ensures the fair operation of the planning system. But we also carry out other statutory duties, such as those under the UK General Data Protection Regulation or the Public Sector Equality Duty. When doing so we must ensure that the parties involved in our casework are meeting their own obligations.

Three things on our radar

Environment Act 2021

This Act made provision for a wide range of measures, many of which apply to planning. Some of those measures are now in force, while many others need secondary legislation and/or consultation on aspects of policy development and will come forward over the next few years. We are monitoring the process to ensure we are aware of, and ready for, the changes when they happen.

NSIP Reform

This is a government-led initiative that aims to improve the process for Nationally Significant Infrastructure Projects (NSIPs). It challenges stakeholders to remove barriers and work faster together within the current framework of the Planning Act 2008. The Reform Action Plan published in February 2023 sets out the timetable for a series of significant actions beginning in Spring 2023 and continuing over the next couple of years.

Reforms to the planning system and Levelling Up the UK

The government intends to reform the planning system and will do so by creating new legislation and policies. The Levelling Up and Regeneration Bill is progressing through parliament, and the government has consulted on changes to the National Planning Policy Framework which it expects to implement this year. We are closely monitoring the progress of these to ensure that we are ready for when they happen so we can continue to operate within the statutory framework in the interests of all those involved in the planning system.

Our risk profile

As the world challenges us and as we change and evolve, we use risk management to systematically mitigate the threats that could keep us from realising our Strategic Plan 2021-2025.

Strategic risk management

We actively manage our strategic risks to make best use of public money, maximise our performance and achieve our objectives. Each strategic risk is owned by a member of the Executive Team who assess it using a five-by-five scoring matrix. We rate the impact by considering the consequences of the risk. We rate the likelihood by considering the probability of the risk materialising. Each risk is categorised and a risk appetite is agreed which defines the level and type of risk exposure we will tolerate to achieve our strategic vision. The Executive Team are responsible for setting the risk appetite and will draw upon the risk appetite statement when managing the strategic risks. Periodically the effectiveness of our Risk Management process and internal control is reviewed by our Internal Audit service provided by the Government Internal Audit Agency.

Our risk profile through 2022/23

Table 1 summarises the strategic risk profile for the Inspectorate and the changes over the past twelve months. We conduct biannual horizon scanning to identify cross-cutting risks that may impact on the Inspectorate. This includes identification of political, economic, social, technological, legal and environmental factors. These factors may impact on our existing risks and help us identify new risks.

Our risk profile at the end of the 2022/23 financial year shows that the scores for all our risks are between 9 and 20. There has been movement in the scores throughout the year. However, when comparing the scores as at 31 March 2022 and 2023, only one risk score differs. One strategic risk has been closed and five new risks have been added to the register, demonstrating ongoing review of the relevance of the risks and effectiveness of mitigations.

This risk heatmap shows each strategic risk plotted against how likely the risk is to occur and the impact it would have if it did.

Key: Risk categories

Risk appetite explanation

Averse

Avoidance of risk and uncertainty in achievement of key deliverables or initiatives is key objective. Activities undertaken will only be those considered to carry virtually no inherent risk.

Minimalist

Preferences for very safe business delivery options that have a low degree of inherent risk with the potential for benefit/return not a key driver.

Cautious

Preference for safe options that have low degree of inherent risk and impact on performance.

Receptive

Willing to consider all options, seeking to achieve a balance between a high likelihood of successful delivery and a high degree of benefit and value for money. Activities may carry, or contribute to, a high degree of residual risk.

Eager

Eager to be innovative and to choose options based on maximising opportunities and potential higher benefit even if those activities carry a very high residual risk.

Table 1. The Inspectorate’s strategic risk profile 2022/23

| What is the risk and our appetite? | Risk category and related strategies | Mitigations delivered in 2022/23 /Future Mitigations | Risk score movement | |

| 1. Data Protection - Lack of robust controls and an immature culture of data governance could lead to a data breach. Averse | Compliance/Legal/Regulatory and Data and Digital Strategy | Delivered:• Data Protection Impact Assessments carried out for all new work and a number of retrospective (DPIAs) were carried out and identified no high risks. • Review completed into Redaction policy and guidance in place. • Majority of Local Authorities (LPAs) have signed a data sharing agreement.Future:• Work underway to ensure full compliance with redaction policy. • Continue to work with LPAs to put in place Data Sharing Agreements where required. | 12 - No Change | |

| 2. Failure to embed changes - Due to limited capacity, the Inspectorate’s digital public services may not be fully operational or provide enough value to customers and taxpayers.Receptive: Willing to consider all options, seeking to achieve a balance between a high likelihood of successful delivery and a high degree of benefit and value for money. | Operational Delivery and Customer Strategy | Delivered:• Procured 3rd Party Software Engineering partner agreement to provide additional resource support. • Increased focus on recruitment from Digital & Data Leadership Team. • Implementation of Service Model to highlight areas of under resourcing and to better balance priorities and workloads.Future:• Continue to fill Data and Digital vacancies reduce reliance on external support. • Continue to develop Data and Digital service model including improving capability. • Improve ability to meet new demands. | 16 - No Change | |

| 3. Failure to manage stakeholder and customer relationships and communications, or a badly handled error, could impact our reputation. Minimalist | Reputation and Credibility and Customer Strategy | Delivered:• Launched Customer Service Desk monitoring software enabling better complaint outcomes and data on complaint outcomes. • Insights gathered through monitoring media/social media to take prompt action on emerging issues. • Used stakeholder matrix to manage relationships. Future:• Further develop Customer Strategy and Customer Survey. • Identify further opportunities to develop the reach and automation of media/social media/ stakeholder monitoring. • Review the corporate narrative in line with the refresh of our Strategic Plan. | 9 - Reduced from 12 | |

| 4. The submission of a single, large, complex, high-profile and controversial application, or overlapping of several smaller cases, could surpass our capacity to deliver Nationally Significant Infrastructure Project applications.Averse | Operational Delivery and People Strategy and Customer Strategy | Delivered:• Training for an extra 30 Inspectors. • Extra support staff roles recruited.Future:• Developing the skills and capabilities of our inspectors so we can assign them to a wider range of cases. • Automating digital systems to manage demand more flexibly. • Improving our knowledge of applications being prepared so that we are ready to receive them. • Working with applicants to improve the consistency and standard of information we receive with new applications. | 16 - No Change | |

| 5. Failure to address health, safety and wellbeing could result in a major accident, incident, near miss or ill health.Averse | People and People Strategy | Delivered:• Procurement of new Display Screen and Equipment system and the subsequent use of it to assess the health and safety of our people when working from a desk. We have identified and put in place additional, or changed existing, equipment requirements for our people based on these assessments. • Lone working and personal safety now business as usual following roll out of policy and procedures. • New risk assessment procedure rolled out, delivered training on how to follow it, and provided risk assessment templates for teams to adapt for their own purpose. • The stress project group developed a survey which was completed by staff and the results used to inform action plan.Future:• To mitigate the driving risk, develop driving policy, procedure and training. Update the driver handbook and risk assessment. • Develop policy and procedure to improve the reporting of accidents, incidents and near misses. Including implementing improvements to investigation, feedback and lessons learned. • Deliver stress project group action plan. | 16 - No Change | |

| 6. Lack of intelligence analysis leads to failed identification of external changes and misinformed strategic direction which would negatively impact on our customer service.Cautious | Operational Delivery and Customer Strategy and People Strategy and Data and Digital Strategy | Delivered:• Horizon scanning approach piloted. • Established a futures function to enable us to better understand our external environment and reduce blind spots. Ensuring we better understand uncertainties, are prepared for potential threats and opportunities, and that we can adapt to remain resilient and relevant in a changing environment.Future:• Establish a network for understanding and capturing intelligence about potential future changes and ensure that this is fed in and used in relevant decision making. | 12 - No Change | |

| 7.Not meeting user expectations because of the mismatch between demand and insufficient operational resource which could lead to an increased uncertainty and cost for the planning system.Minimalist | Reputation and Credibility and Customer Strategy and People Strategy | Delivered:• Secured the continued service of contractor inspectors and adapted our approach to make it easier for new contractors to work for us. • Extra inspectors, apprentices and support staff recruited. • Ensured inspector induction and training is inclusive.Future:• Developing the skills and capabilities of our inspectors so we can assign them to a wider range of cases. | 16 - No Change | |

| 8. Legal framing of the appeals service allows for user behaviours and unpredictable demand for services which results in us never being able to meet expectations with increased uncertainty and cost for the planning system. Minimalist | Reputation and Credibility and Customer Strategy People Strategy Data and Digital Strategy | Delivered:• Proposed actions to DLUHC for reducing appeal demand by keeping decision making in local communities.Future:• Updating our procedural guidance and DLUHC’s Planning Practice Guidance to help keep decision making in local communities. • A new approach to managing deadlines. • Reviewing our approach to accepting appeal scheme amendments to help keep decision making in local communities. • Conducting research on why appellants appeal. | 12 - No Change | |

| 9. Failure to identify future capability requirements could put at risk the delivery of the Strategic Plan resulting in the workforce not having the capabilities we require. Eager: To be innovative and maximise opportunities to develop and resource the required capabilities for the future. | People and People Strategy | Delivered:• A strategic workforce plan produced and published for Operational Delivery and Planning Inspector professions. • Designed a three year Learning and Development strategy.Future:• Strategic workforce planning for Strategy and Corporate Services. • Continuous review of the Operations workforce plan, particularly accounting for new scenarios and skills forecasting that has been done and is ongoing. • Deliver our agreed three year Learning and Development strategy. • Agree the resourcing required to successfully implement a sustainable approach to strategic workforce planning. | 16 - No Change | |

| 10. Failure to identify, integrate and quality assure data could result in delays and increased costs when making changes and innovating in response to planning system-wide improvements. Minimalist | Reputation and Credibility and Data and Digital Strategy | Delivered:• Work progressed throughout the year to develop the Operational Data Warehouse (ODW). As a result of this, at the start of 2023/24 about half of the Inspectorate’s data estate will be transferred from the test environment to the ODW production - including human resource and application casework data. This is a substantial milestone in making data available and easier to access across the Inspectorate, reducing the possibility of data being lost or hidden.Future:• Complete the transfer of the Inspectorate’s data estate into the ODW – to provide a trusted and accurate master data set to improve how efficiently and accurately we can analyse and improve our performance. • Produce a data quality framework to enable and empower information owners to understand and improve the quality of data. • Improve integration with internal and external data, this will further prepare the Inspectorate for NSIP and planning reforms. | 16 - No Change | |

| 11. Holding high numbers of vacancies could lead to business plan objectives being delayed or not delivered, a decline in staff wellbeing and underspend.Eager: To be innovative and maximise opportunities to minimise the risk of high vacancies. | People and People Strategy | Delivered:• Identified the capacity of the recruitment team. • Filled non priority roles with contractor or service contract backfill. • Prioritised recruitment campaigns.• Completed a continuous improvement review of our recruitment process.Future:• Continue to review recruitment opportunities in the face of a very competitive market. • Consider how the work of the Pay and Reward Project will feed into this risk mitigation. | 20 - New Risk | |

| 12. As a result of strike action, we may experience staff walkout which could affect ability to achieve objectives/casework.Averse | Operational Delivery and People Strategy and Customer Strategy | Delivered: • We have developed and agreed a partnership way of working document facilitated by the Advisory, Conciliation and Arbitration Service.• We have formed a project working group with Trade Unions on pay and reward and continue to develop informal working relationships.• We have developed plans to ensure that our line managers know their accountabilities on days of strike action.Future:• Continue to work in partnership with Trade Unions and to build constructive working relationships. | 10 - New Risk (Strike Action: PCS) 15 - New Risk (Strike Action: Prospect) | |

| 13. Future operational changes, as a result of policy reforms, are not fully understood or embedded.Minimalist | Reputation and Credibility and People Strategy and Customer Strategy and Data and Digital Strategy | Delivered:• Advised on draft legislation including procedures for examining local plans.Future:• Continue to work with DLUHC to understand the implications of Planning Reform and other policy changes, allowing future operational changes to be planned and embedded. | 9 - Reduced from 16 | |

| 14. Not able or ready to fully realise the change expected by NSIP reform. Minimalist | Reputation and Credibility and People Strategy and Customer Strategy and Data and Digital Strategy | Delivered:• Developed collaborative working relationships with DLUHC across NSIP Reform workstreams. • Advised on draft legislation and National Policy Statements. • Secured funding for additional employees to support NSIP Reform.Future:• Securing ongoing funding to support NSIP Reform. • Continue to work with DLUHC to ensure future operational changes are planned and embedded. | 16 - New Risk |

Our stakeholders and customers

In our Strategic Plan, we outline our ambitions to increase our customer focus, recognising the importance of gaining a deeper understanding of who our customers are and the best ways to serve them and their diverse needs.

Our Customers

We have a varied group of customers across our appeals, applications, and examinations services. Our customers include Local Planning Authorities for examinations, appellants and planning agents for appeals, and applicants (including government departments) for applications. Our work also serves local residents, developers, landowners, statutory consultees and special interest groups as well as a diverse mix of stakeholders, described below. Our Customer Strategy sets out our ambitions to continuously improve our customers’ satisfaction with, and experience of, our services. We gather customer feedback from interactions with the Customer Service team and through the formal complaints process. This allows us to understand in more detail our customer’s needs and identify parts of the customer experience where we should improve. We want to listen to what our customers are telling us, and look at both short and long term measures that will lead to a better service. Additionally, throughout the design and development of our new digital services, we have conducted user research sessions with stakeholders to ensure these services are built with users at their centre. You can read more about this in the Our Customer Service section

Our Stakeholders

We recognise the importance of good stakeholder relationships, and the benefit they can bring to the Inspectorate. In addition to our customers, our key stakeholders include: ministers and officials at the Department for Levelling Up, Housing and Communities and other governmental bodies, Local Planning Authorities, communities, professional bodies, and news and trade media. Engaging with our stakeholders and keeping them informed about our activities, successes and challenges is of ongoing importance to us. Since surveying our stakeholders in the summer of 2021 on the Future Operating Model for Events we have issued updated guidance on how we run events taking on board the comments and suggestions of our stakeholders. We now have a more inclusive method for managing and running inquiry and hearing events for all those involved. In December we re-launched a regular stakeholder survey to collect in the views, ideas and concerns of our stakeholders. The questions are designed to gather information on how well we demonstrate living our values in our work rather than case-specific feedback. The feedback will help identify areas for improvement. Our self-assessment rating against the communication functional standard is ‘good’.

Our Interactions

The Planning Inspectorate is organised in three directorates. Operations is our largest directorate and is at the forefront of our interactions with customers. Inspectors and caseworkers interact with customers and stakeholders throughout their work on cases and often directly when visiting sites and when holding inquiries and hearings. Our Corporate Services Directorate has close relationships with the Department for Levelling Up, Housing and Communities and other governmental bodies. The Strategy Directorate includes a Communications team that manages our relationship with the media and the Customer Service team that helps customers troubleshoot any issues they may have.

Our People

We have been embedding new working practices and a new culture to help the organisation adjust to a post-pandemic working environment, with a focus on delivering core business as usual activities, such as recruitment, in what has been a challenging external environment. We continue to focus on creating an inclusive, modern workplace that supports and provides opportunities for our people.

Headcount of staff - AA to Grade 6

659 Operational Delivery Staff, 422 Inspectors and 237 Caseworkers 127 Support staff

Our workforce is made up of Inspectors, all of whom are professionally qualified (for example, as town planners, architects, lawyers or engineers), and support staff who carry out a wide range of functions. As set out in our People Strategy, successful delivery of our vision, to provide high quality, timely and efficient services to our customers, is reliant on our people and ensuring the conditions are in place to enable them to thrive.

Recruitment, Resourcing and Workforce Planning

We have continued to embed our strategic workforce plan with an emphasis on Planning Inspectors. We have invested in focused resources to attract and appoint to our Inspector roles. This has resulted in 95 new Inspector appointments being made and a further 51 promotions throughout 2022/23, supporting both our need to ensure we increase the casework capacity of Inspectors and ensuring our ability to handle more complex planning decisions. We continue to examine the future requirements for this profession to ensure we have the right people in place at the right time to deliver our casework.

We have begun work on establishing our wider workforce requirements looking at our support functions and the many other professions employed at the Inspectorate but recognise there is further work to do in workforce planning more widely.

We have developed our online presence within the recruitment market with the launch of our careers site on the Civil Service Jobs platform and are now utilising more online advertising. During the year we have made 163 appointments to the Inspectorate and 121 promotions through fair and open competitions, with all appointments made based on merit.

Watch our video What’s it like to work as a Planning Inspector?

Equality, Diversity, and Inclusion (ED&I)

We have continued to deliver on our ED&I strategy throughout 2022/23 and have been working on refreshing the strategy for the coming years to remain in line with best practice.

We have made significant improvements to the relevance and inclusivity of our people policies, both through the introduction of new policies, and through updates to existing policies with significant contributions from our employee networks, wider Civil Service and partnership organisations. We have received excellent feedback on the introduction of our Menopause policy and have been asked to present to other Government departments to demonstrate good practice in this area.

Graph 1 - EDI Breakdown

| 2019 | 2020 | 2021 | 2022 | 2023 | Civil Service (31/03/2022) | |

|---|---|---|---|---|---|---|

| Disabled staff | 10.44% | 9.33% | 8.72% | 8.37% | 7.64% | 14.00% |

| Staff from ethnic minorities (excluding white minorities) | 3.29% | 3.47% | 5.03% | 6.04% | 6.14% | 15.00% |

| Female staff | 46.18% | 44.09% | 44.91% | 45.22% | 46.73% | 54.50% |

| Lesbian, gay, bisexual and ‘other’ staff | 5.07% | 3.76% | 3.75% | 4.71% | 4.65% | 6.10% |

Our HR team has welcomed two new posts; one dedicated to ED&I and one for Apprenticeships and Outreach, giving us focused resource to support the organisation in these areas. And we have developed an approach to apprenticeships and outreach designed to support the ambitions in our ED&I strategy. Throughout 2022/23, the Planning Inspectorate took part in and hosted multiple events to encourage diversity and inclusivity, including Bristol Pride, the RTPI Explore Programme and the Springboard. The Explore and Springboard programme’s gave students the opportunity to spend time at the Planning Inspectorate, with access to work experience, expertise and coaching. Alongside this, we have enrolled a record number of apprentices for the Planning Inspectorate in 2022/23, more than doubling our intake from 2021/22 this year.

The Gender Pay Gap

Our most recent gender pay gap figure is 11.8% for 2022, down from 13.1% in 2021. We have distinct groups of staff: office-based staff and home-based Planning Inspectors, approximately a 50/50 split. Our gender pay gap is structural, meaning it is directly attributable to the large proportion of senior Planning Inspectors being male; and the substantial proportion of administrative roles being occupied by females.

Graph 2 - Gender pay gap over five years

| 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|

| Gender pay gap | 15.3% | 11.6% | 13.1% | 11.8% |

On a grade-by-grade basis across office-based staff gender pay gaps are small. This year, we have taken active steps to recruit more female Planning Inspectors, from a range of industries, to begin narrowing the pay gap further. However, we recognise it will take long-term solutions to fully address this, as set out in our ED&I Strategy.

Graph 1 shows the diversity of the Inspectorate’s workforce for 2022/23. For further information, please refer to our December 2022 statistical release detailing a comparison of the diversity of the Inspectorate’s workforce over time.

Health, Safety and Wellbeing

We continue to successfully embed the actions from our health, safety and wellbeing project. In 2022/23, we completed and implemented all tasks relating to lone working and personal safety for our Planning Inspectors. We also began the roll out of a new display screen equipment system that will give us the assurance that all our people can work safely, whether they are at home or in the office. We have started the delivery of the risk assessment training that will cover implementation of the risk assessment policy and procedure for our line managers. Throughout 2023/24 we will continue to develop policies and procedures with a focus on driving for work and accident/incident and near miss reporting.

Future Ways of Working

We have successfully delivered against our Future Ways of Working project which aimed to ensure that we have a positive, inclusive hybrid working culture. This was designed to enables us to attract and retain the people we need to deliver effectively for our customers. Our HR policies have been reviewed and amended to reflect our desired ways of working, including updates to the flexi-time policy and new guidance on hybrid working.

We have worked with our line managers to give them the skills and support they need to lead teams in a hybrid environment, delivering our first Line Manager Conference in December 2022. We have also redesigned our estate to encourage face to face collaborative working and building work is now underway to implement this.

Engagement, Learning and Development

We have made substantial progress in designing a new approach to modernise and improve our approach to learning across the organisation. In January 2023, a detailed delivery plan for the coming years was agreed with our Executive Team and work is now underway to begin establishing the function. The plan, which is fully aligned to our People Strategy and Strategic Plan, sets out our key learning objectives for the next 3 years based around the priority areas of:

- Embedding a learning framework and culture that is clear and accessible to our people.

- Establishing expectations and baselines around development in key skills areas.

- Building our Civil Service professions, establishing curricula to support professional development routes.

- Embedding talent management processes to ensure we are meeting both current and future skills requirements.

Our people engagement score in October 2022 was 65%. The result equalled our scores in 2020 and 2021, which were our best results for over a decade. This year we have also equalled the Civil Service benchmark for the first time. We specifically saw improvement in our focus area of “opportunities for career development” and we scored higher than the Civil Service benchmark in all aspects of Learning and Development and People Management.

Change and Innovation

Proactively preparing for the future, ensuring we better understand uncertainties, are prepared for potential threats and opportunities, and that we can adapt to remain resilient and relevant in a changing environment.

This year we have delivered a number of changes, some of which have been mentioned elsewhere in this Annual Report. Through our Change and Innovation portfolios we have ensured that all changes have been governed appropriately, ensuring that our approaches make the best use of our limited resources and budget. For all changes, we have ensured that we retain focus on the impact of the changes on our customers and our people.

Change Portfolio

We have:

- Worked to identify the changes required to support the Government’s Levelling up agenda, and to deliver the NSIP Reform programme.

- Taken the learnings from the pandemic, and delivered clarity on our ways of working, resulting in our people adopting a flexible approach to where they work, providing a balance of working from home and the office, with time in the office concentrated on networking and collaboration activities.

- Reviewed the use of our office space; resulting in a reduction in space of over 50%, and working with the Government Property Agency to ensure a good working environment for all our people whilst refurbishment work takes place.

- Implemented a new telephony service, removing the need for physical handsets and providing an easy to use and inclusive service for all users.

- Rolled-out new IT devices to all users, reducing the risk of hardware failure and taking advantage of new, more energy efficient equipment

- Implemented improved systems to support our workers’ Health, Safety and Wellbeing, including:

- Improvements to our lone working advice and support systems;

- o The implementation of a new system to assess and respond to our people’s requirements; along with the provision of specialist support kit where needed.

- Delivered training to support the review of risk.

Next year, we will continue to work on projects relating to reforms of the planning system, improvements to our digital services to benefit both our customers and the wider sector, and changes that will improve the support and development of our people.

Innovation

In last year’s annual report, we outlined how we had established and developed capabilities in innovation. Our approach to innovation has continued to evolve over the last year, alongside our portfolio of innovation projects. We have refined our approach to empower internal business sponsors, increasing engagement and ownership. We have reviewed our strategic focus areas, to ensure they are still where we believe innovation will deliver most value and are in line with our Strategic Plan. They continue to be:

- maintaining an appropriately skilled and trained workforce; and

- transforming how we work through digital automation.

We continue to develop an innovation portfolio that focuses effort on:

- maintaining and strengthening our core services;

- developing new opportunities; and

- preparing for potential disruptive challenges.

This allows us to test ideas that have the potential to deliver varying degrees of impact, from lower-level incremental improvements, through to transformative new ways of working.

We have continued to establish and develop other strategic capability, such as our Futures function. This allows us to take a systematic approach to exploring our external environment, to identify emerging issues and trends. We are bringing external thinking and ideas into the organisation; a critical feed for innovation. This is allowing us to better understand and explore uncertainties and proactively prepare for the future.

Case Study:

One of our innovation projects is helping us explore how our casework demand and workforce requirements are likely to evolve in the next decade. Through this work we have:

- Captured a picture of the current state of the organisation (e.g. significant recent trends across casework, capability, and ways of working).

- Explored significant external trends across a PESTLE framework (Political, Economic, Sociological, Technological, Legal and Environmental) that are relevant to the planning environment.

- Developed six future scenarios based on combinations of these trends.

- Identified a range of priority and common implications across these scenarios.

- Developed options that we could explore in more detail (across our operating model) to prepare for these potential implications and inform the next phase of the project.

This example highlights by anticipating how our operating environment may change in the future, we can proactively prepare by taking action to improve the resilience of our workforce and how we deliver our services.

Our Quality Assurance Processes for Decision Makers

The quality of our work is important to maintain the confidence of all those involved in planning, including the public, politicians and developers. By quality we mean everything relating to the content of the final decision and the procedures and processes that lead up to that.

Planning Inspectors, and other decision-makers at the Planning Inspectorate, are responsible for the high quality of their decisions, reports and recommendations. Organisationally, however, we support them in achieving this.

This support begins with the comprehensive introductory training that we provide to all new decision makers, in whatever area of the organisation they will be operating. This training focuses on how to evaluate and balance competing evidence in order to reach well-reasoned, justified and impartial conclusions. While in training, all decisions are read by experienced Inspectors, seconded specifically to support and to mentor trainees. Our decision makers, whether in training or otherwise, are never told what conclusions they should reach.

Beyond this, decision makers have access to frequent updates on changes to guidance, policy and legislation. They are also provided with focussed, additional training, through various mechanisms, on different areas of work as required.

We are developing, as an iterative process of continuous improvement, an overarching Quality Assurance Framework (QAF) beneath which casework area specific Control Plans will explain in more detail how we assure, as part of a rolling programme, integral to our work, the quality of our decisions. This QAF will formalise existing feedback loops, with data (collected from peer reviews, line manager discussions, customer feedback and lessons from litigation) being examined for trends and issues, which can be addressed through the provision of additional learning opportunities and revised guidance. This will feed into our continuous improvement process, ensuing the ongoing, high quality of decisions, recommendations and reports, for the which the Planning Inspectorate is justifiably renowned.

Additional, individual service area initiatives are set out below.

- Plans: all local plan reports and all letters relating to “soundness” are quality assured by an independent panel of senior Inspectors.

- Appeals: a proportion of appeal decisions are selected randomly, on a rolling basis, for reading by more experienced Inspectors. Issues and trends arising from this reading are directed into the feedback process, with additional training and guidance provided as required.

- National Infrastructure: all national infrastructure reports are read by an independent senior Inspector, to ensure that the quality of drafting and reasoning is appropriate.

Our three public services

Across our services, our independent Inspectors decide cases and make recommendations in an open, fair and impartial way. This means they consider the evidence, make sure everyone can respond to the evidence of others and keep an open mind without prejudging one view over another.

Across England (and Wales for National Infrastructure), our Inspectors provide decisions and recommendations across our three public services: examinations, appeals and applications.

To do this:

We make sure development is carefully considered, that the right homes are constructed in the right places, and that green spaces are protected. We have specialist experts able to advise and decide cases on a wide range of environmental, ecological, historic, tree and high hedges matters.

We examine Local Plans that set the framework of economic, social and environmental priorities for Local Authorities.

The work of our Inspectors is supported by skilled professionals delivering casework support, specialist advice, customer service, corporate services, knowledge management, project management and digital expertise.

We make sure that proposed developments meet future needs for the economy, environment and society and that the community’s views on large infrastructure applications are heard.

We uphold and promote quality, assuring the checks and balances of the planning system, so that decisions are open, fair and impartial.

Our operations

In 2022/23 we received more casework than we could decide. To make the most of scarce resources, we continued to focus on improving outcomes for casework with the greatest economic and social value. We saw improvements by concentrating on priority areas of casework in turn. We also increased our Inspector capacity and continued to invest in digital.

In 2022/23 we took a strategic decision to dealing with casework, by focusing on casework with the greatest individual potential for economic impact and community interest:

- Local Plans, which provide certainty for short and long-term investment across the country.

- Infrastructure, such as energy generation, transport, ports, reservoirs, water pipelines and waste disposal which are essential for the country to function.

- Appeals requiring a hearing or inquiry, which are generally those which have the greatest community interest and greatest potential to provide homes, jobs and community facilities.

- Secretary of State work critical for public services including High Speed 2 casework, drought orders and permits to keep water supplies going, compulsory purchase orders and planning applications in Uttlesford District, where the Secretary of State has removed some local powers due to poor performance.

- However, these cases are typically resource intensive, with the result that despite improvements in these areas, overall in 2022/23 we received more casework across our services than we could decide.

Our remaining resource has progressed other casework such as planning and enforcement appeals, and some specialist casework decisions made following an exchange of written evidence.

To help us improve further, we have increased our capacity by:

- recruiting and training more Inspectors and other decision makers;

- using our commercially contracted Inspectors to the full extent of their availability; and

- training Inspectors in different areas to increase flexibility in the way we deploy them.

We have continued to invest in the technological foundations which provide the opportunity for process efficiencies and experiential service improvements. These tools will provide the digital public services our customers and employees expect and need that cannot be achieved with our legacy software systems. We are working closely with the Department for Levelling Up, Housing and Communities to ensure our new digital services align with the wider ambitions for the digitalisation of the planning system.

Supporting Communities to plan for their future: Our Examinations Service

The places where people live and work significantly affect their lives and wellbeing. Councils and some other organisations produce Local Plans and other plans with their communities to identify how they will prepare for the future. We independently assess if the plans meet the legal, procedural and policy tests for them to be used.

- 23 local plans submitted to us for examination - The fewest submitted in any of the last five years

- 33 virtual and face to face opening examination hearings were held - The Inspector will examine the evidence and hear from councils, communities, landowners and others

- 33 reports on the Local Plans were examined

- £3.4m income in 2022/23 - Lower than the average of the last five years, reflecting fewer examinations

The fall in Local Plans being submitted and examined has reduced our income from examinations work. However, examinations are costing more on average and taking longer to conclude. This reflects a context where national policy is evolving and there is increasing polarisation of views around the development and the environment that can make plan proposals more controversial.

In most cases our Local Plan examination reports recommended changes to achieve a sound plan and to pass the legal tests. Sometimes this meant recommending removing policies or introducing new ones, amending the wording of a policy or changing a housing requirement. We worked pragmatically and constructively with all those involved to help achieve this. We expect the number of Local Plan submissions to increase once reform proposals have progressed. In anticipation we have started to train additional Inspectors to lead Local Plan examinations. We trained an extra five Inspectors in Local Plan examinations this year.

In February 2022 we received the largest plan we have examined: Places for Everyone, the draft plan from the Greater Manchester Combined Authority covering nine Greater Manchester Districts. It plans for the period up to 2037, with just under 165,000 homes (including 50,000 affordable homes), over five million square meters of employment floorspace and a range of measures aimed at improving the built and natural environment. A panel of three Inspectors opened the examination in March 2022 and it continued throughout the year.

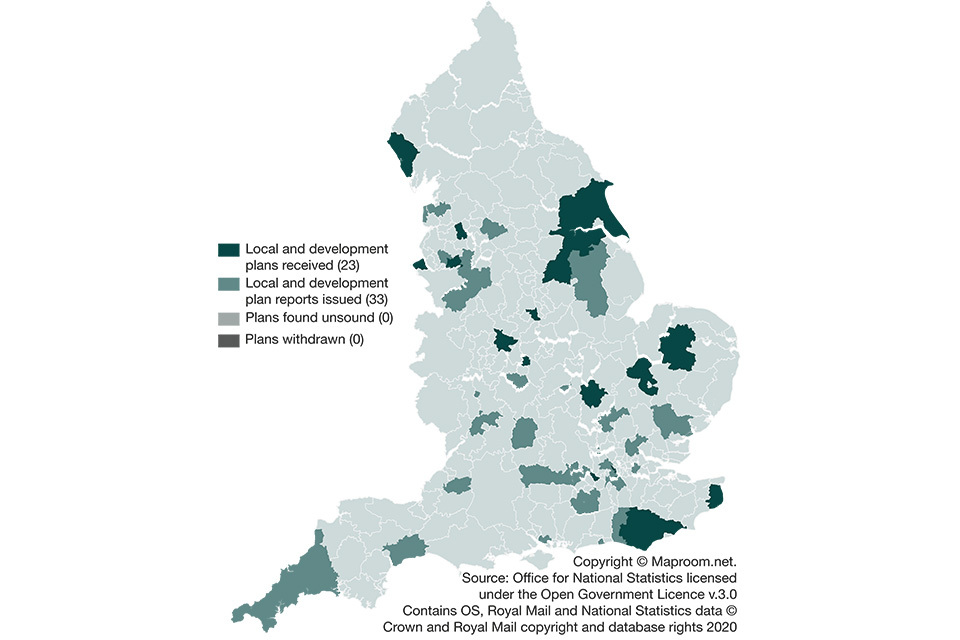

The below map shows all of the Local Plans submitted and the reports issued in 2022/23. This year four local plans were received and the reports issued in the same year.

Case Study: Examinations Service

We released five Local Plan explainer videos this year. They are designed to help communities understand how examinations work, how communities can have their say and what to expect. Our videos are in non-technical language and are supported by subtitles and graphics to ensure they can help as many people as possible.

Communities are an essential part of a Local Plan examination process. The Inspector chairs meetings (called hearings) around specific issues as part of the examination process. Some citizens want assurance that the examination is open, fair and impartial. Others wish to watch when hearings take place, whilst others will have an active role explaining their views at a hearing.

The examination is much more than the hearings themselves, but it is at the hearings where communities see the Inspector examining the issues and evidence first-hand. For many people their involvement in a Local Plan examination will be the first time they have ever experienced anything like it.

Our five short new videos are designed to make the examination process clearer and easier to understand, help communities understand what happens, how to prepare and help build confidence around taking part, whatever their background or previous experience.

- What is a Local Plan and how are they prepared?

- The Local Plan examination

- How can I have my say during a Local Plan examination? Written Statements

- Hearing sessions

- What happens after the hearing sessions?

In all our work we do our best to ensure that we are being as inclusive as we can be. Our videos are:

- Free to access, 24 hours a day, all year round.

- Explained in non-technical language.

- Subtitled to help customers who are, for example, hearing impaired or find subtitles helpful to understanding what they can hear.

- Supported by graphics to help understanding of the content.

- Carefully colour contrasted to make them understandable to as many people as possible.

Supporting a fair planning system through our appeals service

Our appeals service is critical to a fair planning system. Our Inspectors are independent of councils, applicants and communities and consider the evidence with openness, fairness and impartiality.

Reasons for appeals vary. Councils and some other organisations like National Park Authorities and Mayoral Development Corporations can refuse planning applications; they might give you an enforcement notice requiring you to do something or stop doing something; and sometimes they don’t decide applications in time. You can find the relevant organisation for your area at https://www.planningportal.co.uk/find-your-local-planning-authority.

The Inspectorate is here if you want someone independent to re-consider decisions from these organisations on planning applications or enforcement notices, or to decide an application where they have taken too long. Our Inspectors independently review the information and evidence and, in most cases, visit the site and nearby area before deciding the case.

This service also provides independent Inspectors to consider evidence and make decisions for other work including:

- Tree preservation order works, hedgerow removal and anti-social high hedge appeals.

- Public rights of way such as when proposals include changes to access rights to the network or when there are objections to a new right of way.

- Compulsory purchase orders, where some organisations can purchase land even if the owner does not want to sell. This is normally because the land is needed for an important project such as a road, railway or a development important for the area. We independently assess whether the compulsory purchase order should go ahead.

We are accountable to Parliament through the Secretary of State for Levelling Up, Housing and Communities, who monitors our appeals service performance through these Ministerial measures seeking us to:

- make our decision times faster and make decisions in a more consistent time range;

- increase the proportion of appeals that are valid when they submitted; and

- publish information about the number of cases we quality assure.

Appeals are decided through one or more of the three approaches.

Written exchange of evidence

Most of our appeals are decided by Inspectors after seeing written evidence and usually visiting the site. This is often called “written representations”. The appellant, the Local Planning Authority, local people, businesses and anyone else interested in the appeal make their comments in writing and the Inspector decides the case after reviewing the evidence.

Hearing

For these appeals, those submitting the appeal, the Local Planning Authority, local people, businesses and anyone else interested in the case make their comments in writing. The Inspector then chairs a structured discussion around some or all the issues to help them test the evidence. These hearings generally finish in one day. Inspectors often visit the site as well, and then prepare their decision.

Inquiry

Inquiries are held for the most complex appeals and for some other casework like ‘called in’ planning applications where the Inspector will make a recommendation to the Secretary of State rather than decide the case themselves, and compulsory purchase orders. The appellant or applicant, the Local Planning Authority, local people, businesses and anyone else interested in the case make their comments in writing. At the discretion of the Inspector, people can also make their views known verbally at the inquiry. Inquiries are more formal than hearings and evidence is tested by cross examination, normally by barristers representing the main parties interested in the appeal. After visiting the site, the Inspector then makes their decision or recommendation.

In 2022/23:

Incoming work