Sector risk profile 2020

Published 26 November 2020

Applies to England

Executive summary

The focus of providers of social housing over the last few months has inevitably been on the impacts of the pandemic. COVID-19 has had an unprecedented impact on UK society and the economy since being declared a global pandemic in March. However, it is important not to lose sight of other ongoing sources of risk to providers’ continued viability, the achievement of their strategic objectives, delivering services to tenants, and maintaining compliance with regulatory standards.

The recent publication of the Social Housing White Paper has highlighted specific responsibilities surrounding increased stock quality standards and accountability to tenants, as well as a more proactive approach to consumer regulation. The publication of the Planning White Paper, the new shared ownership model, and the launch of the latest Affordable Homes Programme will also lead to significant changes to the operating environment for many providers. Expectations will continue to evolve, and providers must ensure they continue to adapt to a changing policy and operating environment.

The Quarterly Survey and Coronavirus Operational Response Survey show that to date the sector as a whole has coped well with the immediate financial and operational impacts from the pandemic, maintaining essential service delivery and a strong financial position. In the five years since we strengthened our regulatory standards on stress testing and took a more robust approach to enforcing these, we have seen substantial improvements in providers’ preparedness for unexpected shocks. Nevertheless, the outlook for the sector, the wider economy, and society remains unusually uncertain and, as the pandemic evolves, further impacts are likely to emerge, including to providers’ service delivery, tenant incomes, and the housing market. There is also the potential for continued uncertainty and further shocks as the UK transitions to new trading arrangements with the European Union. Provider Boards must navigate this uncertainty and continue to effectively manage risks.

This document highlights the most significant sources of risk to which providers are exposed. The breadth of risks set out in this report demonstrates the challenges and complexities that Boards must manage and mitigate. From these, the key themes that emerge are below.

Strategic choices

The sector faces a growing range of competing internal and external pressures which will demand strategic control and decision-making. The needs of current tenants must be balanced with future demands; choices must be made between essential ongoing investment in the existing housing stock and contributing to new supply; there is evidence that the cross-subsidy model of development financing is reaching its limits in some places; unprecedented levels of debt need to be raised and serviced.

At the same time social housing has been identified as an appealing investment class, attracting new investors to its strong Environmental Social and Governance credentials and driving the creation of new investment approaches. The sector faces difficult choices as to its future direction and purpose, which will require effective strategic-level control and risk management. Failure to make, justify and manage these choices effectively could have profound consequences for the sector’s reputation and viability and the experience of current and future tenants.

It is for Boards and governing bodies of registered providers to set the strategic direction for their organisations and manage the risks that arise from these, including where there are difficult trade-offs. Boards remain ultimately accountable to current and future tenants, funders, local and central government, and the regulator. Boards need to understand the reputational risk from not having regard to stakeholder expectations in their decision-making, including on public value and the provision of new supply, and be able to explain their choices to help manage that reputational risk.

Boards must ensure governance arrangements maintain effective control of operations and oversight of decision-making. Effective control, decision-making and business planning are reliant on the availability of robust data and advice. It is essential that Boards have the appropriate skills to understand and challenge the broad range of information and advice they receive. The need for providers to have effective risk management and well-developed risk mitigation strategies remains paramount.

Stock quality

The sector provides homes for around four million tenants. The quality of their homes affects tenants’ health, both physical and mental, and establishes the trust and confidence tenants have in their landlord. Housing is a long-term asset, and failure to understand stock and invest appropriately in it presents a substantial risk to providers and tenants. Providers must have an approach which maintains stock at Decent Homes Standard and prepares to meet evolving expectations, in particular in relation to building safety and energy efficiency. Providers have slightly reduced expenditure this year on capitalised major repairs in light of COVID-19 restrictions but are forecasting a sustained increase in expenditure over the next five years as these works are caught-up, and in light of increased safety and stock quality requirements.

Health and safety

Ensuring tenant safety is a fundamental requirement of all social landlords. Providers must meet statutory health and safety obligations including gas, electrical and fire safety, asbestos, legionella, and lifts. During the pandemic providers have had to be flexible to adapt services to continue to meet requirements. This is especially the case in the care and support sector which has been on the front line in managing the impacts of the COVID-19 pandemic. Over the past few months the sector has been preparing for renewed restrictions. Nevertheless, as the pandemic and policy response evolves it is important that providers continue to closely monitor and manage issues, as well as ensure suitable contingency plans are in place.

Reforms to building safety legislation are set out in the draft Building Safety Bill including the establishment of a new Building Safety Regulator housed within the Health and Safety Executive. Boards of registered providers will need to understand their responsibilities under this new framework and ensure continued compliance with statutory requirements.

Service delivery and accountability to tenants

Providers have reacted rapidly and flexibly to maintain service delivery in response to COVID-19. It is important to consider the impacts that such changes can have on diverse groups of tenants, particularly if they become part of a provider’s standard operating approach. It is critical to be transparent, being clear with residents about the changes and why they are necessary. The quality of a registered provider’s relationship with tenants reflects the culture of the organisation and ultimately underpins the trust and confidence that tenants and other stakeholders have in the organisation. The government’s Social Housing White Paper highlights the importance of accountability to tenants. Boards should be mindful of evolving requirements in this area.

New supply

The provision of new affordable housing is a key element of the government’s approach to ending the housing crisis, tackling homelessness, and providing aspiring homeowners with a step onto the housing ladder. Providers’ objectives will often similarly include the provision of housing to those whose needs are not currently being met by the market. Registered providers play an important role in meeting this demand, developing 56,000 new units in 2019/20, of which 49,000 were for sub-market rent or low cost home ownership. However, development carries significant risks that Boards will need to manage, including the potential for impacts to financial viability and strategic objectives, as well as providers’ reputation with stakeholders.

Boards will need to ensure they are managing risks to liquidity and financial covenants and assure themselves that they understand the implications from lower than forecast sales income, stress testing against feasible but severe scenarios. They also need to have assurance that robust arrangements are in place to ensure new homes are of good quality.

Financing

The sector has currently agreed £111bn in debt facilities, with £83bn of this debt drawn and repayable. Providers are forecasting increased reliance on debt to fund development programmes and projected increases in stock investment, with a need for £41bn in new debt facilities over the next five years. The increased reliance on debt in providers’ business plans is underpinned by assumed continued low interest rates in forecasts, which increases the risk associated with any rise in borrowing costs.

Boards must understand the trade-offs involved when financial decisions are taken. All financial products carry a certain degree of risk. Boards should ensure they have a well-articulated strategy which reflects their risk appetite and wider operating environment. It is crucial that Boards understand the merits and risks of all financial products they employ and that they are right for the organisation in delivering its objectives. They are also reminded of the importance of relationships and communication with funders.

1. Introduction

1.1 This publication highlights common strategic and operational risks that may pose a threat to providers’ viability and the successful delivery of their strategic objectives. The Sector Risk Profile describes both risks that most providers are likely to face and risks that may only affect a minority of providers. Boards of private registered providers and, where applicable, governing bodies of local authority registered providers should be alert to these risks.

1.2 The regulator remains firmly committed to a co-regulatory approach and expects all providers to have appropriate risk and control frameworks in place to limit the likelihood of risks to viability and delivery of strategic objectives crystallising, and to deal with the impact of risks as and when they do arise. The regulator’s main focus is to seek assurance from providers that they are meeting its economic and consumer standards. It has set out its expectations of providers’ risk management in the Governance and Financial Viability Standard and associated Code of Practice. We will also, under our current powers and remit, consider referrals made to us in relation to breaches of the consumer standards, as we prepare, in consultation with stakeholders, to implement the Social Housing White Paper and the move to a more proactive consumer regulation regime.

1.3 It is the role of each Board to assess its own risks in the round and satisfy itself that appropriate strategies are in place to mitigate these. The regulator will continue to challenge a provider where a risk that has been identified as material through our analytical work, engagement, or referrals is not captured in that provider’s risk and control framework, where we identify or are informed of significant weaknesses, or where risks crystallise.

Strategic choices

1.4 The sector faces a growing range of competing internal and external pressures which will demand strategic control and decision-making. The needs of current tenants must effectively be balanced with future demands; choices must be made in deploying capital between essential ongoing investment and improvement to the existing housing stock and contributing to new supply; there is evidence that the cross-subsidy model of development financing is reaching its limits in some places; unprecedented levels of debt need to be raised and serviced. At the same time social housing has been identified as an appealing investment class, attracting new investors to its strong ESG credentials and driving the creation of new investment approaches.

1.5 The sector faces difficult choices as to its future direction and purpose, which will require effective strategic-level control and risk management. Failure to make, justify and manage these choices effectively could have profound consequences for the sector’s reputation and viability and the experience of current and future tenants. Providers have a broad range of stakeholders, including current and future tenants, local communities, their funders, auditors, local and central government, and the regulator. Boards will need to consider how their decisions could affect the full range of stakeholders and clearly communicate and explain the strategic choices they have made.

1.6 It is for Boards and governing bodies of registered providers to set the strategic direction for their organisation, making informed decisions about their priorities. Boards must establish and clearly articulate their risk appetite, demonstrating how this has been informed by stress testing and by a clear understanding of the organisation’s assets and liabilities. Failure to do so could lead to under-investment in housing stock, poorer services to current and future tenants, and reputational damage at both the provider and sector levels. Ultimately, the effective management of the risks set out in this document will be dependent on providers’ good governance. Providers should ensure that they are compliant with their chosen Code of Governance including taking account of where those have been updated and revised to reflect evolving expectations, for example, in respect of diversity.

1.7 It is essential that Boards have the appropriate skills to understand and challenge the broad range of information and advice they receive. This is equally true where providers have entered into arrangements with counterparties, for instance with contractors and care providers, or in financing and joint ventures. Governance arrangements must maintain effective control of operations and oversight of decision-making, including in unregistered or non-charitable subsidiaries. It is provider Boards that are ultimately accountable. Boards will need to be able to rely on high-quality accurate data and advice to maintain control and make informed decisions, including on treasury, rents, development, disposals, and stock condition, including health and safety. High-quality data also underpins effective stress testing and mitigation planning.

1.8 The rest of this document sets out our view of the main risks currently facing the sector, drawing on provider forecasts and other data provided to the regulator where applicable. Risks are presented in the following main sections:

- Strategic risks

- Operational risks – service delivery

- Operational risks – existing stock

- Operational risks – development

- Financial and treasury management risks.

2. Strategic risks

2.1 Boards are required to make fundamental strategic decisions about their organisation’s objectives, recognising the frequent trade-offs inherent between these. Boards must consider their risk appetite and ensure that there is a measured approach to managing risks as an integral element of their business planning framework.

2.2 While the specifics of the shock associated with COVID-19 were unlikely to have been on many providers’ risk registers last year, many of the exposures and routes by which impacts could affect providers would previously have been considered in providers’ stress testing. Providers will need to continue to closely assess, monitor, and manage key operational and financial risk exposures over the coming months, establishing robust contingency plans. Board decision-making needs to be underpinned by detailed operating knowledge and high-quality data in order to detect crystallising risks or changes in operating environment that would necessitate implementing such plans.

Reputational risk

2.3 As independent organisations providers must make fundamental strategic decisions in order to meet their objectives, dealing with a range of sometimes competing demands from different stakeholders. Boards should consider the impact that strategic decisions will have on different stakeholders, including diverse groups of current and future tenants, and be prepared to explain the factors that influence their decisions. Failure to have regard to stakeholders’ expectations can have serious ramifications for a provider’s own reputation and that of the sector as a whole.

2.4 Reputational risk is inextricably linked to all risks faced by a registered provider. As organisations with a social purpose, the majority of which have charitable status, providers’ actions will continue to be scrutinised by a range of stakeholders such as tenants, local communities, national and local government, lenders, other regulators and the media.

2.5 Excessive pay and payoffs, incorrect rent setting, data breaches, poor complaints handling, building safety and stock quality have all recently led to criticism of providers from stakeholders. Providers themselves may not always agree with such criticism, but proactively managing the risk of adverse external perceptions and delivering the right outcomes is an integral part of establishing and maintaining effective relationships with stakeholders. It is imperative that Boards understand who their stakeholders are and what their expectations are, with effective mitigating strategies in place to manage reputational risk across their activities and business interests.

Complaints

2.6 It is important that providers have clear standards for handling complaints and whistleblowing reports, ensuring that they use lessons from complaints. The quality of a provider’s relationship with its tenants underpins the trust and confidence that tenants and stakeholders have in the organisation. The Housing Ombudsman has published its Complaint Handling Code,6 with providers expected to self-assess against the Code by the end of the year. The importance of providers delivering effective complaints handling applies to complaints from all tenants, including shared owners.

Diversification

2.7 Diversification into non-traditional business streams allows providers to potentially increase their turnover and supplement their rental income and grant funding. It also enables providers to invest returns back into their core activity of building and managing affordable and social rented homes and to enhance services to tenants. However, diversification introduces different risks from social housing activity, and failure to manage these can be detrimental financially and damage the reputation of the organisation. Poorly managed diversification may put social housing at risk.

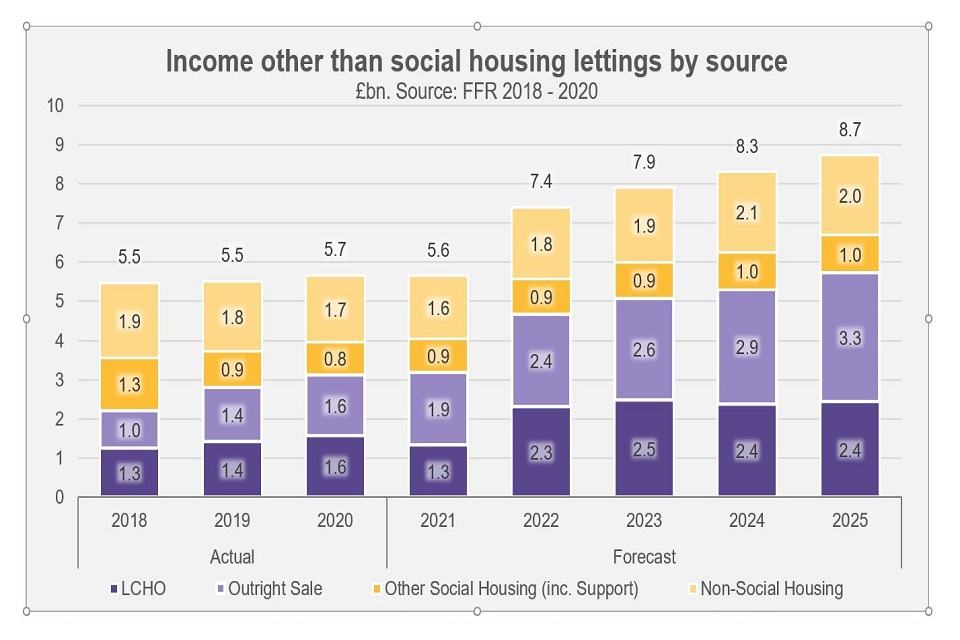

2.8 Diversification can include for example market sales, specialist care, student housing and commercial property. Around a quarter of annual turnover is now derived from non-social housing letting activity and this proportion is forecast to increase over the next five years. Some diverse activity, such as the provision of student housing, has seen increased health and safety and reputational risk following the impact of COVID-19.

Income other than social housing lettings by source

£bn. Source: FFR 2018-2020

| Low-cost home ownership | Outright sale | Other social housing inc support | Non-social housing | Total | |

|---|---|---|---|---|---|

| Actual | |||||

| 2018 | 1.3 | 1.0 | 1.3 | 1.9 | 5.5 |

| 2019 | 1.4 | 1.4 | 0.9 | 1.8 | 5.5 |

| 2020 | 1.6 | 1.6 | 0.8 | 1.7 | 5.7 |

| Forecast | |||||

| 2021 | 1.3 | 1.9 | 0.9 | 1.6 | 5.6 |

| 2022 | 2.3 | 2.4 | 0.9 | 1.8 | 7.4 |

| 2023 | 2.5 | 2.6 | 0.9 | 1.9 | 7.9 |

| 2024 | 2.4 | 2.9 | 1.0 | 2.1 | 8.3 |

| 2025 | 2.4 | 3.3 | 1.0 | 2.0 | 8.7 |

2.9 Boards must ensure that they have the required skills, information and advice to appropriately assess any move into a new business stream and monitor this on an ongoing basis. Boards must understand the full range of risks diverse activity can expose them to and ensure that such activity has a clear strategic role in meeting their organisation’s purpose and objectives. Furthermore, Boards must understand the potential risks associated with the finance and funding structures of non-social housing activities. Charitable providers must have regard to charity law when undertaking diverse activity.

2.10 We expect Boards to have appropriate governance structures and ring-fencing arrangements in place to ensure that social housing assets are not put at risk by, for example, guarantees or impairment relating to non-social assets. The regulator will seek assurance that the risks associated with providers’ non-social housing activities are commensurate to the reward that they achieve or make a clear contribution to their core purpose, and that social housing is not put at undue risk.

Value for Money

2.11 The wide range of pressures that the sector is currently facing creates a risk that providers either fail to achieve all of their strategic objectives or overstretch themselves financially in trying to meet them. As well as making evidence-based decisions about potential trade-offs, Boards need to ensure that they are making the most efficient use of their resources and assets to mitigate these risks. Continued uncertainty in operating environment and housing markets as well as changing stock quality and efficiency requirements are likely to result in consideration of both business models and Value for Money strategies.

2.12 Where providers’ revise their Value for Money strategy, they must be transparent about those changes while having regard to the Value for Money Standard and Code of Practice. This will allow stakeholders to reach an informed view of their overall performance in meeting their organisational purpose and objectives.

3. Operational risks - service delivery

3.1 Registered providers of social housing in England house around four million households from all backgrounds, including in some cases some of the most vulnerable members of society. Social tenants have limited choice of landlord, which is why the regulator sets consumer standards confirming the obligations that landlords have towards their tenants. Landlords must treat tenants fairly and with respect; consider how they address the diverse needs of different groups; act transparently; and ensure that they are accountable to their tenants for their actions. They also need to ensure that their homes are safe and decent. These are significant responsibilities and how they are delivered speaks to the culture of the provider.

3.2 There are currently several risks to providers delivering on their responsibilities to tenants, including, but not limited to, those presented by the pandemic. At the same time, with the publication of the Social Housing White Paper, the expectations on landlords have increased and will evolve further over the coming years. Boards will need to ensure that they can manage the risks to the delivery of their services to tenants and obligations under the current consumer standards, at the same time as preparing to meet the increased expectations of the new policy environment.

Delivering services to tenants

3.3 Providers have reacted flexibly to the disruption caused by COVID-19, undertaking substantial efforts and innovation to maintain services and communicate with tenants. Providers have reacted quickly to manage backlogs in non-emergency repairs and maintain essential services for vulnerable residents particularly those in receipt of care and support services - see Coronavirus Operational Response Survey reports.Drawing on the experience of the first wave of the pandemic, Boards need to ensure that mitigation plans are prepared to manage the operational risks from further periods of restrictions.

3.4 Many of the groups that have been most significantly affected by the pandemic, including those with disabilities, older people, and people from black and minority ethnic backgrounds are disproportionately concentrated in social housing. In addition, as across the whole population, a significant number of tenants will have already experienced unemployment or reductions in income or may do so in future; some will have moved onto Universal Credit for the first time.

3.5 In planning the delivery of services, it is important that providers consider the differential impacts of the pandemic on the needs of tenants, and how changes in services affect different groups. How an organisation takes account of its tenants’ needs, and how it interacts with tenants, is a key indication of organisational culture, and it speaks to why registered providers exist and their purpose.

3.6 The regulator has received increasing numbers of consumer standard referrals, finding a breach of the consumer standard leading to serious detriment in fifteen cases in 2019/20 (compared with six the previous year) - see Consumer Regulation Review. At a time of increased pressure on operations, it is important that robust governance is in place to continue to manage delivery of services to tenants and maintain compliance with consumer standards. Providers should ensure their operational decisions and communications with tenants and other stakeholders demonstrate transparency and accountability. Robust data and internal controls should underpin Board assurance that tenants are being treated with fairness and respect, and that their diverse needs are taken into account.

Health and safety risk

3.7 Ensuring tenants are safe in their homes is a fundamental responsibility of any social landlord. Private registered providers and local authorities must ensure that they comply with statutory health and safety obligations which provide for tenant safety, including gas, electrical and fire safety, asbestos, legionella, and lifts. These requirements apply to both existing, and to new build properties. Providers also have wider responsibilities such as fulfilling their legal duty of care to their staff.

3.8 Our recently published consumer regulation review sets out key themes with relevance to health and safety compliance in particular. The experience of regulatory engagement underlines the importance of registered providers adequately understanding the legislative requirements relating to health and safety compliance. This includes responsibilities to act on the outcome of checks where actions to prevent risks to tenants have been identified, and responsibilities where housing management services are delivered by a third party. It also highlights the importance of oversight and internal controls.

3.9 Good quality data and reporting is a critical part of ensuring effective oversight of health and safety and evidencing compliance. In a number of cases, the regulator has seen that a failure by registered providers to maintain good quality data about the homes where their tenants live means they may not know what is needed in terms of statutory checks or remedial work.

3.10 Good governance with respect to health and safety is especially important in managing the impact of COVID-19. It remains essential to take all reasonable steps to monitor and deliver statutory minimum requirements on health and safety, despite the increased practical challenges to doing so.

3.11 The draft Building Safety Bill sets out extensive reforms to building safety legislation, including the establishment of a new Building Safety Regulator. Registered providers will need to understand their responsibilities under this new framework, ensuring that they have comprehensive and effective building safety systems and programmes in place that provide assurance that buildings and their tenants remain safe. Failure to inspect and deliver safety remediations in a risk based and timely fashion can put tenants’ lives at risk, and also has a substantial impact on shared owners (and leaseholders), who can find themselves unable to sell and trapped in homes that no longer suit their needs. Where works may take time to implement, taking account of industry capacity and risk, providers must ensure that they communicate transparently with all residents.

3.12 Boards must understand the costs associated with the replacement of flammable materials and any implications on other planned major repairs expenditure, particularly for large and complex buildings. Boards must ensure that they have a detailed understanding of their stock, underpinned by good quality data, in order to effectively manage risks to health and safety.

4. Operational risks – existing stock

4.1 The core business for the sector is the provision of social housing. These homes generate an annual income of approximately £15 billion (over 70% of turnover), predominantly rent and service charge income. This income must cover day-to-day running costs, service debt and meet major repairs liabilities. Boards therefore have an important role in seeking assurance that the financial and operational risks associated with their day-to-day operations are well managed. For the majority of housing providers, these risks will relate to the effective management of their existing stock.

Existing stock quality

4.2 The sector must have an approach to ensure the quality of its housing stock is maintained at a decent standard. Boards must ensure that they continue to invest adequately to provide stock that is safe and of appropriate quality.

4.3 Providers’ stock is a long-term asset and Boards will need to ensure it continues to meet evolving stakeholder expectations, in particular with regard to building safety and energy efficiency. Failure to provide accommodation that is safe and of appropriate quality or to effectively respond when issues relating to stock quality arise can result in significant consequences for tenants, as well as having substantial implications for the trust and confidence that tenants and other stakeholders have in their landlord and a provider’s reputation. Failure to invest at the appropriate time can also lead to the deterioration of the stock, leading to greater expense at a later date, which could put pressure on both the achievement of other objectives and an organisation’s financial viability.

4.4 The Social Housing White Paper announced the government’s intention to review the Decent Homes Standard. Government’s response to the Building a Safer Future consultation set out its intention to transform the building safety system for new and existing stock. Boards will need to understand the implications of these changes and ensure new requirements are met. As a fundamental initial step, this is likely to include ensuring Boards are in possession of robust and up-to-date stock condition data that can be used as a basis to build a more detailed understanding, identify any current investment needs and plan to meet new requirements.

4.5 COVID-19 restrictions and social distancing has resulted in tenants spending more time at home and has underlined the link between housing quality and tenant health and wellbeing. Restrictions associated with COVID-19 generated significant increases in backlogs of non-emergency repairs, due to the inability of providers to undertake some works and lower reporting of issues by tenants. Quarterly Survey data shows major repairs expenditure in the sector in the first quarter of 2020/21 was half that previously forecast. Providers will need to address the impacts of this shortfall over time or risk building up permanent backlogs. Aggregate maintenance and major repairs spend is projected to be higher over the next five years when compared with previous forecasts, due in part to reprofiled works from 2020/21 and increased investment in existing stock (Financial Forecast Return 2020).

4.6 The social housing sector is further advanced than the private sector in the removal of aluminium composite material cladding. By October 2020, 97% of affected high rise blocks in the social sector had either completed or started remediation, compared with 64% in the private sector - see Building Safety Programme monthly data release October 2020. Nevertheless, there is continued scrutiny of the pace of remediation for a range of unsafe cladding systems to ensure tenants’ homes are safe.

4.7 Alongside ongoing remediation work to improve safety and stock quality, the government’s long-term commitment to achieve net zero carbon emissions by 2050 is likely to require increased energy efficiency standards from provider stock. The government is currently consulting on changes to required energy performance standards. Providers’ stock is a long-term asset, and required standards are likely to continue to evolve over its lifetime in response to changing policy requirements and climate change. 2020 Financial Forecast Return data indicate that the average (mean) nominal headline social housing cost per unit is expected to rise by 7.4% to £4,528 by 2024/25. The increase is predominately driven by a sustained increase in forecast maintenance and major repair expenditure from 2021/22 onwards. However, there is significant variation among providers, with some providers materially reducing forecast expenditure over the next five years.

4.8 Boards of providers must also ensure that they provide a cost-effective repairs and maintenance service to homes and communal areas. The regulator will seek assurance, including through In Depth Assessments, where it has concerns about stock quality and service performance.

Counterparty risk

4.9 Providers enter into contracts with a wide range of third parties, including funders, insurers, auditors, pension providers, construction and maintenance contractors, care providers, and in joint ventures. These can be effective ways to deliver key services, such as repairs, management and housing development functions. However, entering into contracts with third parties exposes providers to counterparty risk and in some cases, concentration risk. Contractors have faced significant pressure from the effects of COVID-19, particularly those in the construction sector and smaller firms more dependent on cashflow.

4.10 Providers that deliver their landlord services through contracts with third parties are exposed to counterparty risk and potentially have less control over the quality of services compared with providers that provide these directly. There has been a trend, particularly among for-profit providers, towards outsourcing substantially all landlord services. Boards should be aware they are ultimately responsible for meeting the consumer standards, and will be held accountable by the regulator even if the service provision itself has been outsourced.

4.11 Boards must have assurance that there is adequate management of all outsourcing arrangements in place, including monitoring of contractor robustness. Boards should also consider contingency plans for contractor failure, especially where a provider depends on a limited number of contractors.

4.12 It is ultimately Boards who remain accountable to their tenants and stakeholders. It is the responsibility of Boards to ensure that their organisations conform to all relevant policies, standards and law when outsourcing to third-party organisations. As part of that effective governance, they should seek assurance that where contracts are entered into with third parties that due diligence is undertaken to identify any potential conflicts that could breach regulation, legislation, or policy or cause reputational risk.

Supported housing

4.13 Supported housing accommodation makes up 15% of the sector’s social stock - see Statistical Data Return. In 2019 supported housing accounted for almost half (43%) of the stock held by small providers (fewer than 1,000 units) although the majority of supported housing is held by a small number of large providers.

4.14 Many supported housing and care providers have been in the front line managing the impacts of the COVID-19 pandemic. These providers have faced significant challenges to modify service delivery in order to meet statutory requirements to keep tenants, employees, and contractors safe, while dealing with increased staff absence and higher costs. Despite these pressures, providers report that they have been able to maintain essential service delivery and safe staffing levels. While staffing pressures and operational issues have eased significantly since April, these providers are in general preparing to meet the potential challenges of a second wave of COVID-19 over the winter flu season. Boards will need to continue to closely manage risks in this area.

4.15 Much of supported housing, especially where reliant on local authority contract funding, is inherently low-margin and vulnerable to fluctuating income and costs in the short term, or changes in government policy. COVID-19 has generally increased costs for supported housing providers which have seen increased staff sickness and self-isolation, enhanced PPE, cleaning, and hygiene measures, and increased insurance premiums. At the same time, providers have faced reduced incomes from higher void rates with a slowdown in placements from partner agencies. There may be increased pressure on support contracts in local authorities which are facing constrained financial positions due to COVID-19.

4.16 In the longer-term, providers who deliver support services may also face increased staff costs or potential shortages of care workers in the event of a less open migration policy following the UK’s exit from the EU. Further, the government has previously committed to reviewing how support services are funded, including the relationship between support and service charges. It is important that providers with significant supported housing operations understand funding risks, in particular the impact of loss of contracts.

4.17 The addendum to the 2018 Sector Risk Profile highlighted specific risks around specialised supported housing provided on a leased basis. The risks identified in this addendum continue to be a significant concern. The regulator has found governance failures leading to poor services and stock quality, and has lacked assurance about compliance with health and safety and rents requirements. The viability of some of the businesses operating predominately or exclusively on this model continue to be of concern given tight margins between net rents and lease costs. Business plans are frequently predicated upon assumed exceptions from the requirements of the Rent Standard – some providers have been unable to provide assurance to the regulator that this exception applies.

4.18 Many of these organisations have very limited balance sheet capacity, cash, or other assets that they can call upon if there are any interruptions to their cash-flows. Boards of such providers must be able to manage the risks of economic shocks and possible changes to government policy, including in the short term any increases in voids due to COVID-19 restrictions.

Rent setting and rental market exposure

4.19 The 2020 Rent Standard is now in force and applies to both local authority registered providers and private registered providers. The Rent Standard is based on an annual inflation increase of no more than the Consumer Price Index plus 1%, over five years from April 2020. Definitions and terminology may be different to the Welfare Reform and Work Act (2016) which determined rents up to 2019/20.

4.20 While most providers appear to set their rents appropriately, engagement with providers over recent years has highlighted scope for improvement. Failure to apply rent rules correctly or inappropriately applying exceptions from these can lead to over-charging tenants and, potentially, undermine business plans. In March 2020 the regulator published an addendum to the 2019 Sector Risk Profile on setting rents in social housing, setting out some of the themes that the regulator has found in its engagement with providers on rent. Rent compliance will continue to be an area of scrutiny for the regulator, and Boards and governing bodies should ensure that they have adequate assurance on the quality of their organisation’s internal controls on rents.

4.21 Boards and governing bodies should ensure that they understand the expectations with regard to service charges, including Affordable Rent where rents are inclusive of service charge. There must be appropriate controls in place to ensure compliance with all relevant law, particularly the Landlord and Tenant Act (1985), which sets the principle that service charges should only cover identified costs. Failure to manage service costs can adversely affect affordability and cause reputational damage.

4.22 Some providers have diversified into the private rented sector. As with other forms of non-social housing investment, it is important that Boards should have assurance that the level of return is commensurate with the level of commercial risk involved. While this can provide additional income, PRS stock has the potential to increase cash flow volatility as rent levels fluctuate more than in social rentals. Boards and governing bodies will need to understand and ensure that the risk from falling market rents can be mitigated. The regulator will seek assurance that Boards understand the risks and rewards of entering into this activity, and that these are appropriately balanced.

Rental income and arrears

4.23 The economic restrictions implemented in response to COVID-19 since March have been associated with a substantial increase in the number of tenants claiming Universal Credit, as well as downward pressure on employment income for many tenants. This in turn put pressure on providers’ rent collection early in the year. Quarterly Survey data show average (mean) current tenant arrears increased to 4.0% in Q1 2020/21 and remained at this level in Q2. Rent collection rates reduced to 97.2% in Q1 – the lowest level recorded since income data was first collected in 2013 – before recovering somewhat in Q2 to 98.3%.

4.24 The majority of providers have undertaken extensive preparation for the transition to Universal Credit, which is set to be complete by 2024. This included preparing for potential increases in tenant arrears due to the direct payment of housing costs to tenants. While the economic impacts of COVID-19 have precipitated a step-change in new claims, several operational and policy changes are likely to have reduced the risks to provider rental income. In particular, providers with Trusted Partner status now account for the large majority of tenants in the sector, with the associated Landlord Portal allowing for faster implementation of Managed Payment to Landlords and more efficient data sharing. There is the potential for further pressure on arrears from increased tenant unemployment and reduced incomes over the next few months. Providers will need to continue to manage this risk, continuing to support tenants to access benefits and responding flexibly to changed tenant circumstances.

4.25 There are still residual risks to providers from previous welfare reforms. Notably, the Benefit Cap still applies and has not been raised alongside other benefits uprating. This is likely to be a particular consideration for providers operating in areas with high rents such as in the South East outside of London, with substantial numbers of tenants in Affordable Rent tenures, and providers specialising in large units.

Costs and inflation

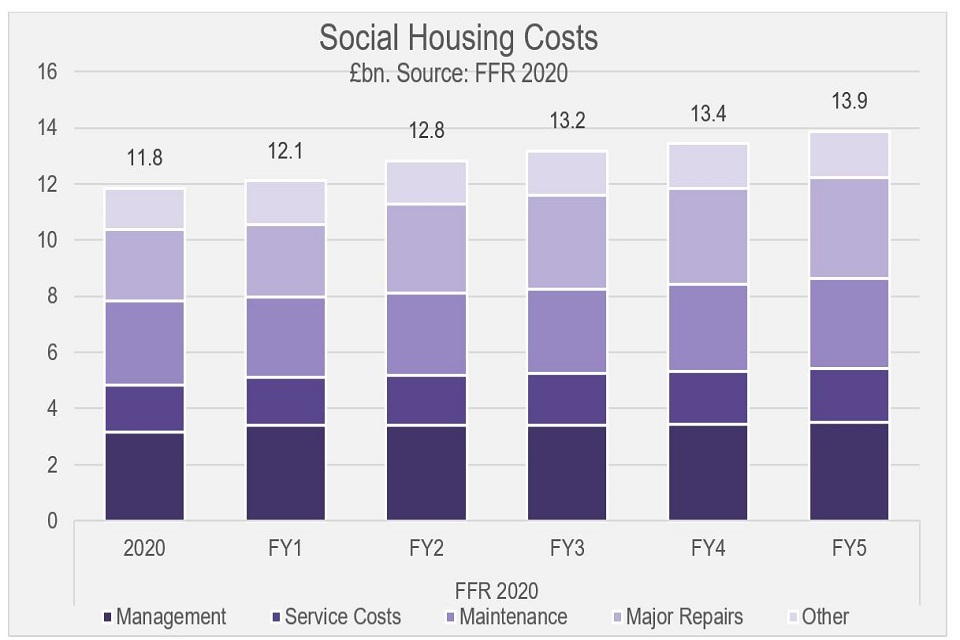

4.26 Providers’ costs are forecast to rise over the next few years, in part due to reprofiling of spending previously delayed by COVID-19 restrictions alongside planned remedial safety works and energy efficiency improvements to existing stock. Providers will need to manage their cost base effectively – failure to do so could impact on business resilience, with reductions in free cash flow, margins, and interest cover.

Social Housing Costs

£bn. Source: FFR 2020

| Management | Service costs | Maintenance | Major repairs | Other | Total | |

|---|---|---|---|---|---|---|

| 2020 | 3.1 | 1.7 | 3.0 | 2.5 | 1.5 | 11.8 |

| FY 1 | 3.4 | 1.7 | 2.8 | 2.6 | 1.6 | 12.1 |

| FY 2 | 3.4 | 1.8 | 2.9 | 3.2 | 1.5 | 12.8 |

| FY 3 | 3.4 | 1.8 | 3.0 | 3.3 | 1.6 | 13.1 |

| FY 4 | 3.4 | 1.9 | 3.1 | 3.4 | 1.6 | 13.4 |

| FY 5 | 3.5 | 1.9 | 3.2 | 3.6 | 1.6 | 13.9 |

4.27 The outlook for inflation is currently unusually uncertain. CPI inflation in the 12 months to September 2020 was 0.5%, which constrains rent inflation to 1.5% for 2021/22. In the medium and longer-term, inflation will be determined by the balance of changes in supply and demand in the UK and global economy. The UK’s transition to new trading arrangements with the EU may also have the potential to increase costs for providers, with falls in sterling exchange rates and possible trade disruption resulting in increased costs for imports. Changes to migration policy could have implications for provider’s employee and contractor costs, potentially seeing cost inflation rising faster than rental income.

4.28 It is important that Boards fully understand their cost base and capital requirements, ensuring that a range of inflation assumptions, including differential assumptions, are factored into their stress tests.

Data integrity and security

4.29 Failure to manage data integrity risk is indicative of a poor control framework and undermines Board oversight, control, and decision-making. Accurate data and up-to-date information is fundamental for Boards to monitor areas such as rent setting, financial management and loan covenant monitoring, stock condition, health and safety, and meeting consumer standards in general.

4.30 The widespread move to remote working and increased online service delivery as a result of COVID-19 was associated with a surge in phishing, malware, and ransomware attacks. Alongside this, many providers are now recording more data on tenants and visitors (for instance as part of Test and Trace) increasing exposure to data protection risks. While cloud-based services have allowed organisations to successfully react to the suddenly increased demand for remote working availability as a result of COVID-19, the number of attacks on customers’ cloud-based accounts has also risen, with increases in employee account hijack attempts and impersonation attacks. Breach reporting procedures must be embedded so confirmed personal data breaches can be reported to the Information Commissioner’s Office within statutory deadlines.

4.31 All providers must comply with the Data Protection Act 2018. Failure to abide by the requirements of the Act could lead to penalties for the landlord, and also lead to the potential for a breach of trust between the landlord and its stakeholders. Boards must seek assurance that their IT security function is safe and secure. Boards must also understand the risks of processing personal data with third parties. Mitigation includes due diligence on third parties’ security measures, using standard contractual clauses, documenting where data is located and ensuring compliance following departure from the EU.

4.32 Accurate and timely data underpins the regulator’s engagement with providers. As well as being able to meet statutory data protection requirements, providers need to ensure that they meet the regulator’s requirements for reporting of data. Failure to provide timely and accurate data will be reflected in the judgement of a provider’s compliance with the regulatory standards.

5. Operational risks - Development

5.1 The development of new housing, both social and non-social, remains a key priority for government. Registered providers play an important role in meeting this demand, particularly the continued requirement for additional affordable housing for those whose needs are not met by the market, including the growing numbers on council waiting lists. Over the past decade providers have delivered significant levels of new supply. In 2019/20, private registered providers were responsible for the development of 56,000 new homes, of which 49,000 were for sub-market rent or low cost home ownership. Providers forecast the development of 356,000 new homes over the next five years.

5.2 Development carries potential risks that providers need to manage, including impacts to financial viability and the achievement of strategic objectives, as well as providers’ reputation with stakeholders. These risks include those associated with the financing of the development and risks associated with the delivery of the development itself. Sub-market affordable housing supply depends on cross-subsidy in order to make the investment appraisal viable, whether that comes from grant, sales revenues, s106, or another source. It is important that Boards understand the specific risks associated with how they fund development and can mitigate the risks posed by the level of development debt, or sales risk, that they take on in delivering their development pipeline.

5.3 While the housing market had slowed somewhat in large parts of London over the past couple of years, in general the sector’s development model has been supported by a favourable market. The pandemic has created more significant economic uncertainty, including for the housing market, than the sector has experienced for many years and it is critical that providers continue to closely manage development risks – especially around sales programmes (see below). Further disruption may materialise over the next few months, with the potential for further impacts on the housing market and construction sector as a result of COVID-19 restrictions and the UK’s transition to new trading arrangements with the EU.

5.4 As well as managing risks associated with particular types of development, Boards will need to take a more strategic view of how changes in the market could affect their wider development funding model and the implications for the business as a whole. Planning reforms set out in the government’s planning white paper are likely to have implications for providers, with changes to infrastructure levies and the threshold for affordable housing requirements on private development likely to particularly affect providers reliant on s106 planning obligations for delivery of development programmes. The risk profile for providers with shared ownership will also be affected by changes to staircasing, Right to Shared Ownership, and the announcement of First Homes.

Low cost home ownership and market sales

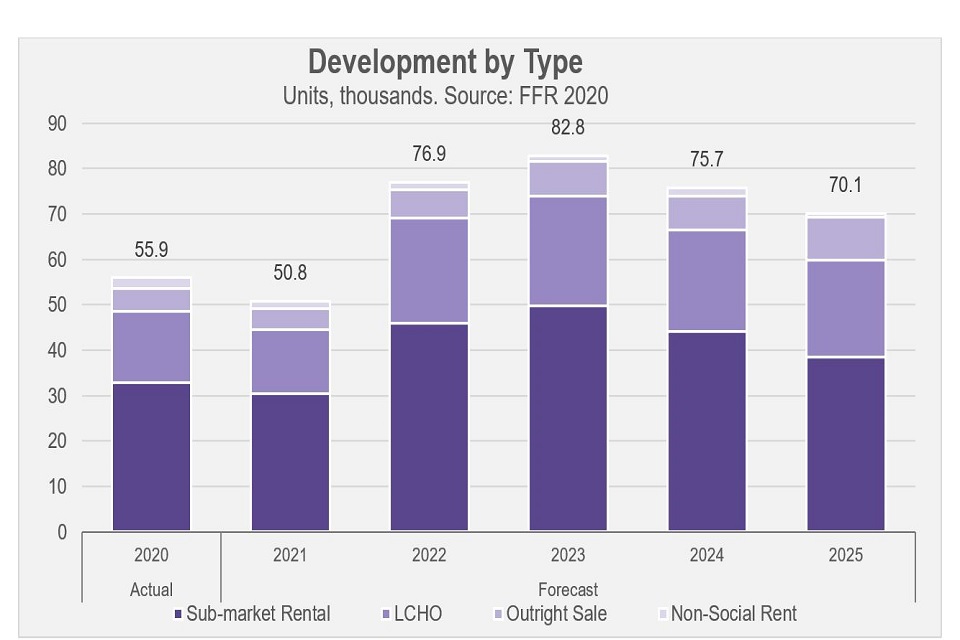

5.5 Low cost home ownership and outright market sales make up a significant part of the sectors’ current development programme, accounting for 40% of homes planned for development over the next five years. Development of market sale homes is concentrated in a relatively small number of providers.

5.6 Providers have reduced and reprofiled development forecasts in light of market uncertainty, COVID-19 disruption – including the planned withdrawal of government support following the end of the stamp duty holiday – and planned increases in expenditure on major repairs. Compared with last year’s forecasts, providers now assume substantially lower development over the next two years, with forecast development in 2020/21 36% lower and 13% lower in 2021/22. In particular, providers have made substantial reductions of around a third in forecast units developed for outright sale and for market rent over the next five years, compared with 2019 forecasts. In contrast, providers forecasts for development of low cost home ownership are less affected, recovering to a level comparable with 2019 forecasts from 2021/22 onwards.

Development by type

Units, thousands. Source: FFR 2020

| Sub-market rental | Low-cost home ownership | Non-social rent | Total | ||

|---|---|---|---|---|---|

| Actual | |||||

| 2020 | 32.8 | 15.7 | 5.1 | 2.3 | 55.9 |

| Forecast | |||||

| 2021 | 30.4 | 14.1 | 4.6 | 1.7 | 50.8 |

| 2022 | 45.9 | 23.2 | 6.4 | 1.5 | 76.9 |

| 2023 | 49.8 | 24.1 | 7.7 | 1.2 | 82.8 |

| 2024 | 44.2 | 22.3 | 7.5 | 1.8 | 75.7 |

| 2025 | 38.4 | 21.5 | 9.4 | 0.8 | 70.1 |

5.7 This marks a significant shift from the recent trend in a small number of providers of increasing market sales development in order to subsidise sub-market rented housing. The expected margin on new units over the next five years has substantially reduced compared with previous forecasts. Forecast margins on development for outright sale in 2020/21 are less than 10% – around half those in 2019 forecasts.

5.8 The forecast reduction in development for sale has the potential to reduce the level of sales risk to which some providers are exposed. However, sustaining forecast levels of investment in both new supply and existing stock at the same time is likely to put increased pressure on other funding sources. It is important that Boards understand the wider ramifications of this change for their overall business plans, and effectively manage the effects on development risk and debt. For example, some providers forecast maintaining previously planned levels of development for rent by replacing foregone sales receipts with increased levels of debt. Whilst mitigating sales risk, this approach will increase the importance of effective treasury management (see Finance and treasury management section).

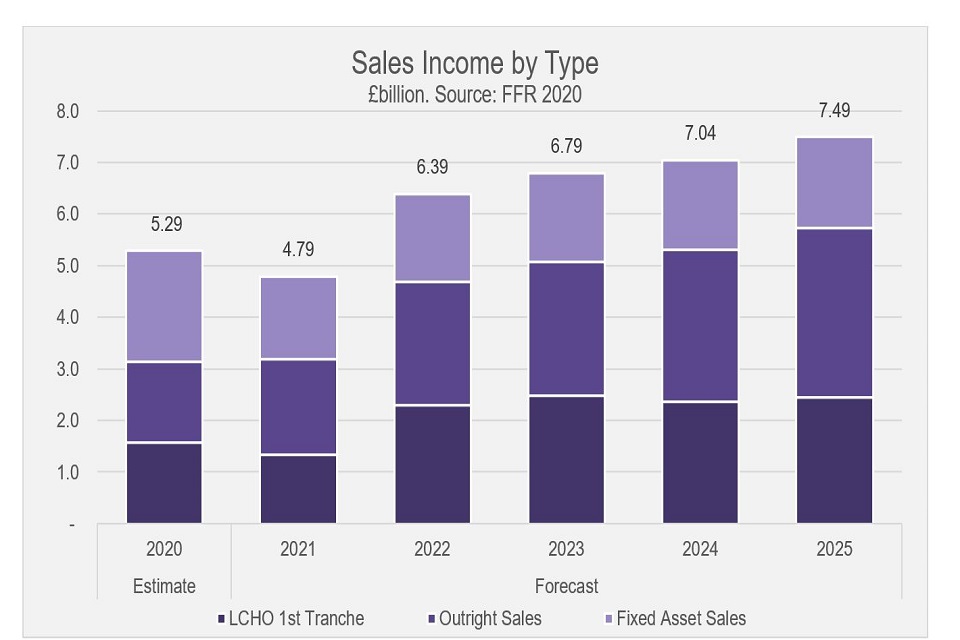

Sales Income by Type

£bn. Source: FFR 2020

| Low-cost home ownership 1st tranche | Outright sales | Fixed asset sales | Total | |

|---|---|---|---|---|

| Estimate | ||||

| 2020 | 1.57 | 1.56 | 2.16 | 5.29 |

| Forecast | ||||

| 2021 | 1.33 | 1.86 | 1.60 | 4.79 |

| 2022 | 2.30 | 2.38 | 1.71 | 6.39 |

| 2023 | 2.48 | 2.60 | 1.71 | 6.79 |

| 2024 | 2.37 | 2.94 | 1.74 | 7.04 |

| 2025 | 2.44 | 3.29 | 1.75 | 7.49 |

5.9 Despite the reduction in forecast development for sale, the level of economic uncertainty means providers need to continue to closely manage risks around their sales programmes. Boards must assure themselves that they understand the implications from lower than forecast sales income, stress testing against feasible but severe scenarios for house prices and transactions. Prospects for the housing market will depend substantially upon that for the wider economy and household incomes and employment in particular.

5.10 Effective management of liquidity and financial covenants is key. Unexpected shortfalls in market receipts increase the risk of overtrading and cash shortages. It is important that Boards understand the extent to which impairments of joint venture investments could affect registered providers, for instance through financial covenant calculations. Boards must understand the risk of default and factor the risk of impairment into their investment decision-making process, stress testing and control framework. The regulator continues to closely monitor providers reliant on asset sales to meet current and future interest payments.

Construction process risks

5.11 As well as the risks associated with financing development, and from exposure to market sales, the process of development itself can entail significant risks that require effective oversight and management. It is important that Boards have sufficient assurance that new properties will meet building regulations, statutory health and safety requirements and regulatory expectations such as the Decent Homes Standard. This is true whether the development is delivered by the landlord itself or acquired from a third-party developer or joint venture.

5.12 Boards should also be aware of changing stakeholder expectations with regard to construction methods as the government looks to drive improvements in decarbonisation, building safety, and design. Providers bidding for grant funding under the Affordable Homes Programme 2021-2026 will be expected to support the government’s strategic ambitions for the housing market, including promoting modern methods of construction, encouraging uptake of the National Design Guide, improving energy efficiency and sustainability, and encouraging the use of SME contractors. Where these represent significant differences from providers’ current practice, Boards should ensure they have the skills to fully understand the implications of the new development approach.

5.13 COVID-19 has led to significant disruption to construction, both during and since lockdown. It is important that providers have adequate internal controls in place to ensure that they are following all appropriate government guidance. Changes to working practices and supply chain disruption also risk delays to developments, or increased cost pressures. Where the development relies on a third-party contractor, or is delivered via a joint venture, counter party risk becomes increasingly important. Given the increased risk of business failure, including in the construction sector, during the economic downturn, it is important that providers have appropriate mitigation plans in place. Where the risk of development disruption is significant, it is important that providers understand any wider implications including possible impacts on contractual or planning obligations.

6. Finance and treasury management

6.1 Boards have a responsibility for oversight of liquidity, capital structures and maintaining adequate financing. It is important that funding is available for the organisation’s immediate cash flow requirements and provisions are in place to mitigate against feasible adverse scenarios. Boards should also set parameters that manage liquidity and ensure access to funds and security is readily available. It is also the responsibility of providers’ Boards to ensure that arrangements are in place for the effective management of refinancing risk and to stress test against changes in interest rates.

6.2 Boards must understand the trade-offs and compromises involved when financial decisions are taken. All financial products carry a certain degree of risk. Boards should ensure they have a well-articulated strategy which reflects their current risk appetite and wider operating environment. It is crucially important that Boards understand the merits and risks of all financial products they employ and that they are right for the organisation in delivering its objectives. They are also reminded of the importance of relationships and communication with funders and for those with bond financing to adhere to the guidelines outlined by the Investment Association.

Existing debt

6.3 As at September 2020, the sector has currently agreed £111bn in debt facilities, with £83bn of this debt drawn and repayable. Since March 2020 the Bank of England’s Monetary Policy Committee has maintained Bank Rate at an all-time low of 0.1%, with market expectations for Bank Rate to remain close to zero until 2023.

6.4 Many providers have responded to potential COVID-19 consequences by pulling back from their non-social housing activity including market sales. In addition, many providers have projected significant increases in spend on existing stock. The combination of these two factors is expected to supress EBITDA MRI interest cover levels in the next five years. The latest forecasts indicate that the aggregate cover for the sector over the next five forecast years is 165% (2019: 181%).

6.5 A tighter interest cover position increases the importance of effective monitoring of existing loan covenants to mitigate the risk of covenant breaches. It is also essential that providers have clear mitigation plans in place to avert potential breaches if income falls below forecast levels or interest costs are greater than anticipated. At March 2020 the proportion of fixed-rate debt (greater than one year) comprises 80% (2019: 76%) of the sector’s drawn borrowings, containing the risk from immediate increases in interest rates. The remaining debt is made up of floating or short-term rates for less than one year or otherwise exposed to fluctuation through inflation linking or callable/ cancellable options.

6.6 The London Inter-bank Offered Rate that underpins many financial and some non-financial contracts is expected to be phased-out by 31 December 2021. The Financial Conduct Authority and the Bank of England are working toward a replacement measure based on SONIA, and the first bilateral facility in the sector on a SONIA basis was agreed in late March. Providers should be examining all financial contracts for references to LIBOR and discussing transition with lenders. While some contracts will have fall-back provisions, renegotiation of loan documentation is likely and providers should consider seeking appropriate advice where this is the case.

New debt

6.7 Providers forecast a need for £41bn in new debt facilities over the next five years, a historically high level. While investor demand for sector debt remains high despite the disruption caused by COVID-19, failure to maintain investor appetite would lead to reduced capacity to deliver new development and capital investment. The increased reliance on debt in providers’ business plans is underpinned by assumed continued low interest rates in forecasts: should rates move higher the sector’s financial performance and ability to service debt would weaken.

6.8 The current high demand for ESG investments and increasing prevalence of ESG reporting standards has the potential to further increase the range of funders available to the sector and lower costs. However, ESG-based lending and reporting will bring new stakeholders and accountabilities to providers.

6.9 Credit ratings in the sector are clustered in the low-single A band. Increasing market exposure or weakening operating performance risks feeding through to falls in providers’ credit ratings. Provider ratings have historically been linked to the sovereign rating, and further falls in the UK rating could have a knock-on effect on providers. Falls in provider ratings, especially into low investment grade or further, could see decreased investor appetite resulting in upward pressure on margins, or changes in the range of potential investors.

6.10 Providers vary in size and their strategic purpose and aims differ; Boards should consider which funding option is right for them considering their objectives and risk appetite. The regulator does not favour any particular funding approach over another, but it does expect to see evidence that a critical assessment has been undertaken with use of independent, impartial, specialist external advice as appropriate, especially when considering innovative and/ or complex funding structures. It is imperative that Boards have the skills and expertise to be able to understand and effectively challenge the financial advice received.

6.11 Boards will need to manage relationships with investors and lenders and manage counterparty risk, particularly where long-term debt may be sold on to other parties. Boards should ensure they undertake robust stress testing to understand the sensitivity of business plans to decreases in investor appetite and potential changes to the cost and availability of debt.

Alternative funding models

6.12 While debt-funding accounts for the majority of the funding for private registered providers, alternative funding models have become increasingly prevalent in the sector. An increasing number of private investors have looked to invest in social housing products. This investment has been through the establishment of funds providing equity to (usually) for-profit registered providers, by way of lease arrangements, or through direct equity investment in registered providers. These approaches can bring their own risks in addition to those applicable to all providers.

6.13 Private investment has allowed some providers to target rapid growth in units under management, but this funding has the potential to be more expensive than debt. Furthermore, rapid growth can heighten the risk that managerial capacity may not keep pace. It is for Boards to assess the risks associated with any new types of funding they take on, ensure that there are no potential conflicts from the influence of funders over strategic direction and that the Board remains appropriately independent.

6.14 A recent trend has been the establishment of for-profit providers which are constituted primarily as funding vehicles, with limited substance and most functions outsourced. While this can be a valid approach, the Boards of such providers should be aware that they have the same landlord responsibilities as any provider and ensure that they own and manage the associated risks.

Pensions

6.15 Employer payments towards pension provision are today a standard part of most sector employees’ overall remuneration. The balance of financial risk will vary depending on whether schemes are defined contribution or defined benefit.

6.16 All schemes have membership and legal obligations. Many providers, however, have exposures to defined benefit schemes where the financial obligations have to be re-measured on a triennial basis, creating a risk of increasing costs if the scheme is found to be in deficit. Weak gilt yields, long-term reductions in interest rates, falls in equity value, and changes in benefit have resulted in many schemes being under-funded.

6.17 Additional cash payments will be required from exposed providers over an agreed period to close the deficit and must be reflected in providers’ financial statements. Boards should understand the potential implications for changed contribution levels arising from the Pensions Regulator’s defined benefit funding Code of Practice consultation.

6.18 Although most providers have taken a proactive approach to managing this risk, Boards should seek independent legal advice, where appropriate, to understand their risk exposure and impact on cash flow arrangements.

Fraud

6.19 Providers are exposed to fraud through the provision of services and supply. Changes to working practices as a result of COVID-19 restrictions will further heighten risks and may mean providers’ normal systems of internal controls are less robust. Fraud can have a significant negative impact to providers, disrupting their services or undermining the achievement of their objectives. Where fraud occurs, it is reputationally damaging and can have significant implications for viability and delivery of strategic objectives. Providers should ensure that they have robust control procedures in place, and seek appropriate professional advice when fraud is identified.

© RSH copyright 2020

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned.

Any enquiries regarding this publication should be sent via enquiries@rsh.gov.uk or call 0300 124 5225 or write to:

Regulator of Social Housing

7-8 Wellington Place

Leeds

LS1 4AP