Planning Inspectorate Annual Report and Accounts 2024/25

Published 26 June 2025

Applies to England

For the period 1 April 2024 to 31 March 2025

Presented to the House of Commons pursuant to Section 7 of the

Government Resources and Accounts Act 2000.

Ordered by the House of Commons to be printed on 26 June 2025

HC 1051

Any enquiries regarding this publication should be sent to:

Planning Inspectorate

Temple Quay House

2 The Square

Temple Quay

Bristol

BS1 6PN

Tel: 0303 444 5000

Press Enquiries: press.office@planninginspectorate.gov.uk

This publication is available in large print.

Preface

This document combines performance and financial data with analysis to help readers better understand our work. It covers the period 1 April 2024 to 31 March 2025.

In line with our values of being open and fair, it is designed to support accountability and transparency, describing how we have used taxpayers’ money to deliver for our customers. To be accessible and understandable, the analysis is set out in three sections: our performance, accountability, and financial data.

The Performance report and analysis are divided into four sections:

-

Performance Report - opening with an introduction from our Chief Executive and Chair of the Board, the Performance Report provides a review of our performance in 2024/25, including the challenges, successes and strategic risks.

-

Introduction - sets out our organisation and the context in which we operate.

-

Business Plan Performance - a closer look at the data and analysis of how we performed against our three ambitions.

-

Our Performance - analysis of our operational performance, broken down by the services we provide. Our performance in terms of our people, environment and sustainability and finance is also covered.

The Accountability section covers our Chief Executive and Chair’s responsibilities to Parliament, the arrangements we have in place to discharge our public duties and the internal controls we have in place to comply with all required regulations. A remuneration and staff report sets out the pay and benefits received by the executive and non-executive Board members, disclosures on pay and pensions policies and details of staff numbers and costs.

The Financial statements outline our income and expenditure for the 2024/25 financial year.

A note on the data used in this report:

Data are accurate at the time they were drawn from administrative systems, but as we use live operational systems this data is subject to change. Revisions to previously published statistics are only made when changes in the data materially change interpretation of Planning Inspectorate performance, or when a substantial change to data is expected to move statistics of more than 5%. Corrections will always be made if computational errors are identified in previously published data.

This publication includes a change to how the number of homes allowed on appeal are counted. These figures are now presented as estimates, rounded to the nearest 1,000. The five years of data displayed in Graph 1 have been recalculated to use a consistent method across the time series.

You can view more Planning Inspectorate statistics and data, and read about our data sources, by visiting Statistics at Planning Inspectorate.

If you have questions about any of the statistics contained in this document, please email: statistics@planninginspectorate.gov.uk

Performance Report

This section opens with an introduction from our Chief Executive and Chair of the Board. It provides an overview of our performance in 2024/25 including our highlights, who we are and our performance against the Business Plan.

Chief Executive’s Introduction

This report marks the first year of our 2024–27 strategy—a shared commitment to deliver timely, high-quality and cost-effective decisions, recommendations and advice.

That mission depends on something deceptively simple: flow. For the planning system to work well, cases must move. When they don’t—when work gets stuck in backlog or drifts outside service standards— our ability to serve the public falters.

That’s why one of our key priorities this year has been clearing the backlog. And we’re on track. We began the year with 13,500 open appeal cases and ended with 12,184. That’s a meaningful step toward our goal of 8,500 open cases by March 2027—the level we know is necessary to meet our service standards sustainably.

This is not just a numbers story. It’s a people story. Our progress reflects the professionalism and determination of colleagues across the Planning Inspectorate, and the strength of engagement from partners throughout the system. We’ve kept delivery high while laying the foundations for the future: shifting to a service model that reflects the real journeys of users, investing in data and digital, and securing the resources we need to grow responsibly.

Our reputation is not built just on what we deliver, but how we deliver it. Openness, fairness and impartiality remain essential to every aspect of our work. This year’s work to increase our quality assurance, performance on complaints, and the proportion of High Court challenges upheld, all demonstrate that we are not only maintaining, but actively strengthening those values. In a complex system under pressure, it is this integrity that underpins confidence – in our decisions, our people, and our role in the planning system.

We’ve done all of this with an eye on the horizon. The government’s ambitions in this Parliament— to build 1.5 million new homes, consent to 150 major infrastructure projects, and achieve full local plan coverage—set a clear and stretching direction. Supporting that agenda will take more than throughput. It will take a planning system that flows, connects, and delivers with confidence.

This year has shown what’s possible when we align purpose with partnership. We’re not at the finish line, but we are moving, together, in the right direction.

Paul Morrison

Chief Executive Officer

Board Chair’s Introduction

The Inspectorate plays a crucial role in enabling the delivery of the homes, infrastructure, jobs, community assets, healthy and sustainable communities, and environments the country needs.

We are part of a wider delivery system, and the government could not have been clearer on their missions and priorities, and the need for us all to increase our pace, efficiency, and innovation to deliver them. The Inspectorate is up for this challenge and our strategic plan outlines the approaches we are using to do this whilst maintaining the quality our stakeholders expect from us. I am grateful to ministers for the interest they have shown in our work.

The Annual Report describes our relentless focus throughout 2024/2025 on performance improvement and its impact. Our work on the backlog of enforcement cases has seen us decide 25% more cases and introduce a faster timetable. I am particularly grateful to those local planning authorities who have been available to collaborate closely with colleagues at the inspectorate to ensure our new case work management systems work seamlessly with the householder appeals digital process. This will help all parties perform better, get things right first time, saving resources and speeding up the process. Colleagues have shared experience and knowledge through online sessions and social media events to help participants and parties engage more effectively.

Our customers’ experience drives our work to improve certainty and timeliness whilst maintaining quality and professionalism. This year we have improved our complaints process, reducing the complaints backlog by 87% and the enquiries backlog by 92%, ensuring we learn from complaints more swiftly. Complaints themselves have reduced from 14% of cases to under 5%. Stakeholders have been generous with their time and their experience of engaging with us, and the operation of the wider planning system. This has helped us enhance and shape our services and prepare for the future. I thank them for this.

This year the Inspectorate has worked collaboratively with government departments and stakeholders to implement the action plan for national infrastructure to make the system even faster and more efficient. We have met the target for each of the 17 decided projects. We have also advised on another 80 potential projects. Over the next two years we are expecting a significant increase in projects and are preparing for this.

Local plans can shape a local area for the future. This year we received more than in recent years, but less than required for full plan coverage. We are expecting an increase in submissions next year following an updated approach to local plan examinations, set out by the housing minister, providing clearer housing requirements for local plans, with further policy clarity to come. We are preparing for this.

We could not deliver without our dedicated and knowledgeable workforce. Like many organisations, recruiting, retaining and growing talent in a competitive market has required new approaches. This year we launched our three-year people plan and the PINS Way, which aims at enhancing the experience and performance of our individual and collective impact. We have improved our learning and development offer and have worked with the Cabinet Office to ensure we can recruit the increase in skilled staff we require for the coming years’ increased workload. I am proud that we have 35 apprentices within the Inspectorate and welcomed our third Boardroom Apprentice at the beginning of 2025. This year, our Gender Pay Gap reduced by 1%, but we are working with renewed effort on how to close this. We have seen powerful work undertaken by staff networks. I am pleased that we have continued to improve our Civil Service People Survey scores.

A key role for the Board is to ensure stewardship of public funds and the sustainable use of resources. This report illustrates the achievements from action on our environment plan with a clear focus on our own impact, as well as the wider planning system. Once again, our external auditors have given us an unqualified audit report. We also received a very positive report on our Board effectiveness. We are delivering on our productivity plan to ensure that in a time of very constrained public finances we deliver more with the resources we deploy. I am grateful for the challenge and support of both our internal and external auditors and for the demanding standards and strong support we receive from our sponsor department the Ministry of Homes, Communities and Local Government (MHCLG). We continue to provide them with delivery experience to support their policy work.

My fellow non-executive directors have made an enormous contribution to the support and challenge the Board offers. The work of our Audit and Risk Assurance Committee has been critical in managing our risks and ensuring value for money, preparedness, and efficiency. As I enter the final year of my second term as Chair, I am proud of the organisation my successor will join. MHCLG will be launching the search for a new Chair this summer.

I am grateful to my colleagues, our partners, stakeholders, customers, peers, and Ministers who have collaborated with us this year on our drive to deliver and improve.

Trudi Elliott

Board Chair, Planning Inspectorate

2024/25 at a glance

We saw an increase to our capacity with the net addition of 47 people to the organisation, improving our ability to deliver more decisions and recommendations.

28,000 homes (approximately) approved during 2024/25 due to appeal, which would not have been built originally.

In the past five years, our inspectors have granted planning permission for 115,000 homes after councils refused permission or failed to make a decision. These account for 7% or approximately 1 out of every 13 new homes.

We worked with 144 local planning authorities through the Householder Appeal Service pilot, unlocking new functionality for the entire appeals process.

25% more appeals were decided this year than in 2023/24 for tree preservation orders, high hedges and hedgerows.

We examined 44 local plans, with 22 found sound, ensuring that the proposals meet the future needs of citizens and business and giving security to local areas planning their development.

We provided 17 national infrastructure applications recommendations to Secretaries of State, and gave advice to 80 pre- application NSIPs, which provide our communities with roads, railways, reservoirs and electricity.

Introduction

Our purpose is to maintain a fair planning system, support significant infrastructure development and help communities shape where they live.

Who are we and what do we do?

The Planning Inspectorate is an executive agency of the Ministry of Housing, Communities & Local Government (MHCLG). We are responsible for making decisions and providing recommendations on a range of planning-related issues across England (and a smaller range of issues across Wales). We make decisions and recommendations across our five public services: national infrastructure, examinations, appeals, rights of way and common land and applications. We employ a large cohort of planning specialists and work alongside other parties to support the development of the wider planning sector.

Our contribution

Across England (and Wales for national infrastructure), our independent inspectors decide cases and make recommendations in an open, fair and impartial way. This means they consider the evidence, make sure everyone can respond to the evidence of others and keep an open mind without prejudging one view over another.

To do this, we make sure development is carefully considered, the infrastructure the country needs is supported, the right homes are constructed in the right places, and that green spaces are protected. We have specialist experts able to advise and decide cases on a wide range of architectural, environmental, ecological, engineering, heritage, public access and tree matters.

England operates a plan-led system where policies in local plans, produced by local planning authorities (usually local councils), are used to decide how much land should be set aside to build new developments, such as homes, offices, factories and shops, usually over a period of 10 to 15 years. They also show areas where it has been decided that development should be limited. These local plans are used to make decisions on planning applications for individual development proposals. We examine these local plans, which set the framework of economic, social and environmental priorities for local authorities, ensuring that the proposals meet citizens’ and business future needs.

Against this foundation, local planning authorities make decisions on individual planning applications. The Inspectorate’s appeals service provides citizens and developers with a right to appeals these decisions, reconsidering each case in a fair, open and impartial way. We uphold and promote quality and fairness, providing crucial checks and balances for the planning system.

Alongside these services the Inspectorate makes recommendations to government on significant infrastructure development proposals. We make sure that these proposals meet the future needs of our society, balancing economic growth and environmental considerations, and ensuring that the community’s views on large infrastructure applications are heard. In so doing, we pave the way for vital transport, electricity and other crucial infrastructure rapidly to be built.

The work of our inspectors is supported by skilled professionals delivering casework support, specialist advice, customer service, corporate services, knowledge management, project management and digital expertise.

There are five Acts of Parliament which are particularly significant for our work:

The Planning and Compulsory Purchase Act 2004

Covers the local plans system, as well as the statutory duty on decision-makers to determine planning applications and appeals ‘…in accordance with the [development] plan unless material considerations indicate otherwise.’

The Town and Country Planning Act 1990

Includes the right of appeal for planning, enforcement, and lawful development certificate cases, as well as our ability to determine the procedure for a variety of case types.

The Planning Act 2008

Sets out the consenting regime for Nationally Significant Infrastructure Projects (NSIPs), and powers relating to other parts of the planning system.

The Levelling-up and Regeneration Act 2023

This covers a wide range of planning related matters. Some provisions have come into force (such as those relating to NSIPs), but many others are awaiting secondary legislation before they can commence.

There is more legislation affecting other areas of our work, such as for listed buildings, rights of way and environmental appeals and measures to underpin technology changes in energy and protection of the marine environment.

The Energy Act 2023

This received Royal Assent in October 2023 and aims to transform the UK’s energy system and support its transition to a low-carbon economy. The Act brings in changes and initiatives that will greatly affect the energy industry, the people involved in it, consumers, and the environment.

The rules and regulations

Sitting underneath the Acts, secondary legislation provides the detail to the statutory framework. For example, it defines what development can take place without seeking planning permission. It also sets out how to make planning applications and appeals and how they should be considered.

Our statutory duties

The statutory framework ensures the fair operation of the planning system. But we also carry out other statutory duties, such as those under the UK General Data Protection Regulation or the Public Sector Equality Duty. When doing so we must ensure that the parties involved in our casework are meeting their own obligations.

Planning reform

On 11 March 2025 the government published a Planning and Infrastructure Bill. We will closely monitor the Bill’s progress, as well as the government’s ambitions for planning reform in general, so as to be ready for when any changes take effect.

How we work

We have a long history of living by our values of openness, fairness and impartiality. Our roots stretch back to the Housing and Town Planning Act of 1909 and the birth of the UK planning system. For over a century we have upheld and promoted quality, assuring the checks and balances of the planning system; our decisions and recommendations have made a profound difference to the country we live in. We take this privilege, and its associated responsibility, as seriously as ever. Our values shape our culture and ways of working and guide us in delivering a responsive and improvement-focused customer service. They define our strategic approach, are integral to our daily operations and help us to attract and retain the right people. Our headquarters are in Bristol and we employ in the region of 950 staff. Around half of these are home-based inspectors, all of whom are professionally qualified (for example town planners, architects, lawyers or engineers). We offer a hybrid working environment for our support staff, who carry out a wide range of functions from supporting casework to the running of the organisation.

How we engage with our customers

We strive to achieve a great customer experience through a range of advice and support channels:

-

Website, articles, customer service

-

Systems, applications

-

Case officers, updates, process information

-

Decision, user experience, next steps FAQs

-

Quality assurance

-

Customer service

-

Customer feedback and failure demand

Our Strategy 2024-2027

Our 2024-2027 Strategic Plan was launched in 2024. It sets out our mission and ambitions for the next three years.

At the heart of the strategy is a relentless focus on the things our users want us to do: provide consistently timely and high-quality decisions, recommendations and advice. The plan has a clear focus but expansive look. It builds on the progress we have made, the excellence of our people and the strength of our relationship across the planning system.

By 2027 we will have:

-

Delivered NSIP services in line with new timescales and requirements.

-

Implemented a programme of work with local planning authorities which sees more planning decisions determined at a local level.

-

Seen a reduction in the amount of new evidence submitted at appeal for inspectors to consider.

-

Developed our GOV.UK and back office case management services for the submission and management of all appeals and application casework, evidence and communications.

-

Increased our productivity and reduced the unit cost of our decisions.

-

Explored options to amend our pay and reward frameworks.

-

Standardised and better categorised our appeals data to enable more forensic examination of appeal types and trends.

-

Improved our Inspector Development Programme to build the expertise of our staff to deliver our services more consistently and efficiently.

-

Met our performance targets for all casework areas in a consistent timely manner.

-

Worked in partnership with government departments and agencies to help design and advise on the delivery of policy ambitions relevant to our activities.

-

Reduced the environmental impact of our casework and processes.

Business Plan Performance

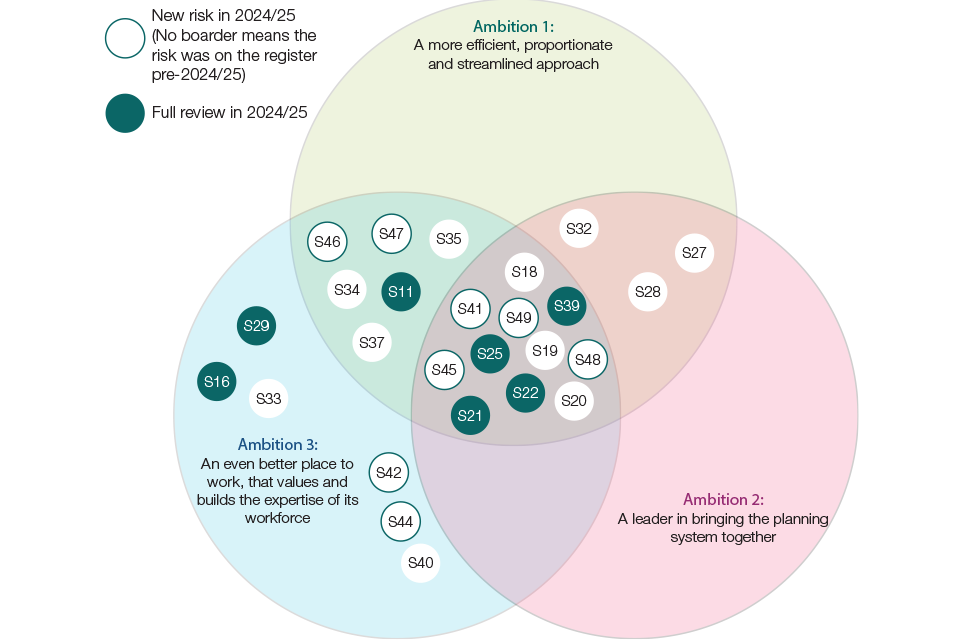

In our 2024/25 Business Plan we committed to delivering against the mission and ambitions of our Strategic Plan. Here we set out in detail the progress we made.

The 2024/25 Business Plan launched a programme of work to drive up the productivity of the organisation and the efficiency of our casework delivery. Our sponsoring department, MHCLG, has set a list of ministerial performance measures against which we are assessed, including the target of issuing appeals decisions by written representation within 16-20 weeks and appeals decision by hearings and inquiries within 20-26 weeks. Significant improvement has been made across a range of our casework and performance measures, but there is still much work to do before we can claim to have achieved the targets set out in our strategy.

| Success Measures/Workstreams | 29 | |

|---|---|---|

| Fully achieved | 19 | |

| Partially achieved | 8 | |

| Missed | 2 |

Timeliness

Performance in 2025…

-

As of end March 2025, we took an average of 25 weeks (median) to decide a written representation appeal compared to an average of 28 weeks (median) as of end March 2024 and our year-end target of 24-26 weeks (median). Although this is improving, we have further to go before all these cases are decided within 20 weeks.

-

As of end March 2025, we took an average of 27 weeks (median) to decide a hearing appeal compared to 32 weeks (median) as of end March 2024 and our year-end target of 28 weeks (median). We have made significant progress towards meeting the ministerial timeliness measure.

-

As of end March 2025, we took an average of 27 weeks (median) to decide an inquiry appeal compared to 47 weeks (median) as of end March 2024 and our year-end target of 36 weeks (median). We have made significant progress towards meeting the ministerial timeliness measure.

-

As of end March 2025, we had approximately 5,347 open cases which had been with the Inspectorate for longer than 20 weeks (or 26 weeks for hearings and inquiries), which is higher than 4,621 as of end March 2024 and our year- end target of 3,700. Some of this rise in overdue cases can be attributed to a rise in overdue enforcement appeals, where a backlog built up whilst we were focusing on other casework. But this performance must be balanced against our strong progress in reducing the overall number of open cases on our systems, which fell from 13,219 as of end March 2024 to 12,086 as of end March 2025, and leaves us in a much improved position for meeting timeliness targets in the coming year and beyond.

-

As of end March 2025, we took on average 117 days to examine a local plan, compared to 134 days in 2023/24. We will need to continue to make progress in this area to meet the government’s requirements for faster delivery of local plans in the coming years.

-

As of end March 2025, we submitted our recommendations to Secretary of State before or within the statutory deadline of nine months from the preliminary meeting for all NSIP applications.

Quality

Performance in 2025…

-

At the start of 2024/25, we began a new approach to testing the quality of our appeal decisions, introducing a new system based on inspector managers reading issued appeals. This approach confirms that the overall quality of our decisions remains high and provides valuable insights to identify and address common errors and to inform our advice, training and development.

-

As of end March 2025, we upheld an average of 1.06% of customer complaints when compared against number of appeals cases decided, which is an improvement on our 2023/24 position of 1.6% and our target of 2%.

-

As of end March 2025, we received an average of 5.67% of customer complaints when compared against number of appeals cases decided, which is an improvement on our 2023/24 position of 9.4% and our target of 8%.

-

As of end March 2025, the average proportion of High Court challenges found in favour of the Inspectorate was 66%, which is similar to 2023/24.

Cost-effectiveness

Performance in 2025…

- The 2024/25 tracking of the unit cost of our casework showed that we have maintained our position towards being more cost-effective.

Business Plan Delivery

-

In 2024/25, we completed 10 out of 22 workstreams that we set out to deliver in the Business Plan. The remaining workstreams will continue into the 2025/26 Business Plan year either as reformed/next stage workstreams or as service level activities.

-

Key achievements delivered in 2024/25 were:

-

We rolled out a new end-to-end householder appeals service process to 5 local planning authorities, leading to a simplified process and reduction in decision times for the appellant. See ‘Case study: Appeals service’.

-

We received ministerial approval for expansion of the streamlined process for householder appeals to other appeal types and commenced work on legislative changes and implementation.

-

We implemented actions from the NSIP Reform Action Plan including, launching a chargeable pre-application service which recovers costs from applicants. See ‘Case study: Applications service’.

-

We delivered improvements to our Learning and Development processes, including the launch of a core induction package, and a line managers hub, which included line manager standards and induction.

-

We prepared and developed systems to support new ‘Crown Development’ casework for implementation in May 2025.

-

We implemented changes to our Operational Data Warehouse and new casework and management information, leading to improved casework planning.

-

-

Across the workstreams, 14 benefits have already been achieved with a further 45 on target for future realisation. Benefits predominantly support productivity improvement, financial savings and customer/staff engagement.

Our Business Plan 2025/26

Our 2025/26 Business Plan covers the second year of our Strategic Plan. The plan describes how the Inspectorate will be supporting the delivery of the government’s milestones set out in the ‘Plan for Change’, namely the delivery of 1.5m houses, 150 Development Consent Orders and up-to-date local plan coverage, whilst maintaining our focus on our mission to provide consistently timely, high- quality and cost-effective decisions, recommendations and advice.

Our Performance

In 2024/25, following the pivot to our 2024-27 Strategic Plan, we have been systematically removing backlogs to ensure that we meet our March 2027 casework targets. Therefore, we continued to focus on maintaining our performance in casework areas where our decisions are timely and meet quality standards, and reducing the number of undecided older cases in other casework areas.

In the early 2020s, we received more casework than we could decide. We prioritised and focused our resources on dealing with casework with the greatest individual potential for economic impact and community interest, such as:

-

Local plans, which provide certainty for short- and long-term investment across the country

-

Infrastructure, such as energy generation, transport, ports, reservoirs, water pipelines and waste disposal, which are essential for the country to function

-

Appeals requiring a hearing or inquiry, which are generally those which have the greatest community interest and greatest potential to provide homes, jobs and community facilities

-

Secretary of State work critical for public services, including High Speed 2 casework, drought orders and permits to keep water supplies going, compulsory purchase orders, and planning applications in areas where the Secretary of State removed some local powers due to poor performance.

By 2023/24, we had reduced casework in those priority casework areas and started focusing on other casework areas, especially planning appeals being considered by an exchange of written evidence. We needed to reduce the number of undecided cases by around three thousand, by increasing the number of decisions and deciding thousands of appeals already older than 20 weeks. We also adopted a faster timetable for enforcement inquiry appeals, reflecting the timetable we previously adopted for planning appeals decided after a hearing or inquiry.

In 2024/25, we continued this focus on reducing the number of open planning appeals considered by an exchange of written evidence and reducing older cases. We also added enforcement appeals by inquiry and hearing to that focus and expanded the faster timetable to enforcement appeals by hearing.

We continued to invest in the technological foundations which provide the opportunity for process efficiencies and experiential service improvements. These tools will provide the digital public services our customers and employees expect and need, which cannot be achieved with our legacy software systems. We are working closely with MHCLG to ensure our new digital services align with the wider ambitions for the digitalisation of the planning system.

We also started to focus more on improving our productivity. For instance: our digital services include increased automation, where possible; we have been exploring using artificial intelligence to support semi-automated redaction of sensitive content in online evidence; and we started trialling shorter decisions for some appeals.

We are determined for the improvements in our performance to continue, and ministers have provided resources to support this work. In 2025/26, we have been able to secure increases to our Resource Delivery budget (to £97.9m), which will primarily be invested in additional inspectors and digital staff to deliver the extra demands being placed on the Inspectorate, and a Capital Budget of £15.0m, which will primarily be invested in our digital Core Services (Appeals) and NSIP Reform programmes.

The section below sets out the analysis of our operational performance throughout 2024/25. It begins with a case study, spotlighting the work of our customer team, which is integral to our core value of providing excellent customer service. Following this, we take an in-depth view of three of our core services: local plan examinations, appeals and infrastructure applications.

The analysis of our operational performance is supported by performance data. More details on the technical definitions underpinning these measures can be found in our regular statistical releases.

Case study: Delivering excellent customer service

Being customer-focused is a core value of the Inspectorate. We serve a varied group of customers across our examinations, appeals and applications services, including local residents, businesses, developers, landowners, communities, special interest groups, planning agents, local planning authorities and government departments. Customer service underpins how we deliver our services to this varied group: from inspectors issuing decisions and advice, to case officers providing information about a customer’s case as it progresses. We therefore recognise the importance of reviewing our customer feedback, analysing this and proactively making changes to address the key issues.

Through this process, three key areas were constantly called out by customers: delayed responses, difficulty reaching the Inspectorate, and wanting clarity on our process. As a result, we changed our web form to create an easy and quick click-though mechanism, enabling the customer to contact us with simplicity and ease, providing a self-serve solution. The web form enabled customers to use drop-downs to easily tell us their issue, while simultaneously allowing us to route specific issues to subject matter experts within the team. This effort saw our channel of choice shift from 65% via email, to 67% via web form at the close of 2024/25. These changes have allowed us to optimise our service providing efficiency gains that have reduced our response times significantly. As we closed the financial year, all customer workstreams have achieved our customer promise service level of 80% within timescale, for the first time since pre-COVID.

We developed insight capacity and collaborated across the organisation to address common issues, friction and pain points from our customers. A monthly insight report was introduced, enabling informed decision-making that has since shaped elements of our new and current system, performance management and inspector training. This has contributed to complaints reducing by 20% on the previous year’s volume. We have also partnered with our professional leads to begin discovering how inspectors can be better equipped to understand customer expectations, creating customer shadow opportunities to gain first-hand perspectives for our inspector colleagues. There are now discovery plans in place to introduce customer-centric training as a standard protocol, with insight derived from actual customer feedback and interactions.

Moreover, to increase the quality of our overall experience, we have created the capability to build a framework that will encompass the entire customer journey, outlining areas of success and improvement. More importantly, the customer focus has seen a culture shift within the business and is being high considered in all aspects of innovation, improvement and standards.

This holistic approach transformed the team’s ability to manage workloads and address customer needs effectively, increasing customer satisfaction and trust. Customers are now more likely to feel that they are getting the right results from the Planning Inspectorate and be satisfied with the resolutions of their complaints or query. These results not only highlight an impressive operational achievement, but also a cultural shift towards prioritising customer satisfaction and service excellence. This journey serves as an inspiring model of what can be achieved through teamwork, innovation, and a relentless focus on the customer.

Supporting communities to plan for their future: Our Examinations Service

The places where people live and work significantly affect their lives and wellbeing. Councils, and some other organisations, produce local plans and other plans with their communities to identify how they will prepare for the future. We independently assess if these plans meet the legal, procedural and policy tests for them to be used.

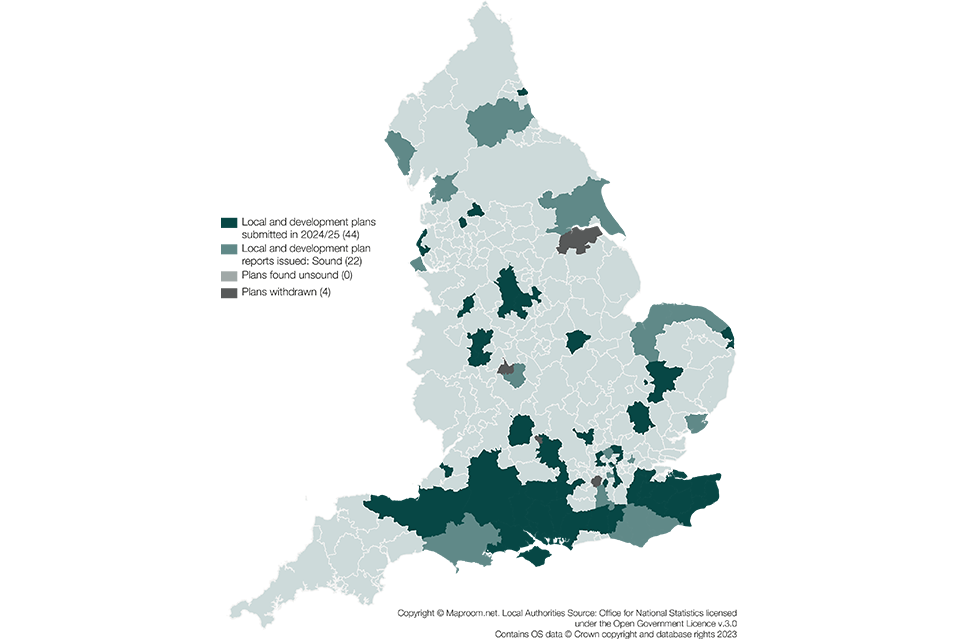

This year, 44 local plans were received, and 22 reports were issued. The map below shows all the local plans submitted and the reports issued in 2024/25. The number of plans we received for examination began to rise sharply at the end of 2024 in response to government being clear that the proportion of the country covered by local plans needed to increase, so that the development and investment the country needs is properly planned.

In most cases, our local plan examination reports recommended changes to achieve a sound plan and to pass the legal tests. Sometimes this meant recommending removing policies or introducing new ones, amending the wording of a policy or changing a housing requirement. We worked pragmatically and constructively with all those involved to help achieve this, as required by successive governments.

On 31 July 2024, the minister instructed inspectors to adjust our approach and only use pragmatism where it is likely a plan is capable of being found sound. Consequently, where plans have been deficient and not easily fixed at examination, we have been advising local planning authorities of this so that they can decide whether they wish to withdraw the plan from examination.

In total, the number of local plans we received in 2024/25 was higher than in recent years, although still lower than the average number of plans we have received in previous years. This reflects the context of rapidly-evolving national policy on plan-making, which has now settled. The fall in local plans being submitted and examined has reduced our income from examinations work, but this has begun to change. Our 2023/24 Annual Report identified that examinations were taking longer to conclude.

We expect the number of local plan submissions to increase further, and for their content and evidence base to evolve as provisions set out in the Levelling Up and Regeneration Act are implemented. In anticipation of these changes we have established a team to implement the necessary changes and trained five additional inspectors to lead local plan examinations. A much more significant inspector recruitment and upskilling drive is in train for 2025/26 to match the large volumes of local plans we are anticipating.

Case study: Examinations service

Dartford Local Plan

In December 2021, Dartford Borough Council submitted the Dartford Local Plan for examination. Dartford is bisected by the M25 Motorway and the A2, with the land to the north of the A2 having a predominantly urban character, including the town of Dartford itself, which contains around 70% of the borough’s population. Around half of the land within the borough is designated as Green Belt with most of the Green Belt to the south of the A2, interspersed with villages and hamlets. The population of Dartford Borough grew by around 29% between 2004 and 2020: the largest increase across Kent districts.

As submitted, the plan provided for 12,640 new homes based on a housing requirement of 790 dwellings each year. This was 40 dwellings each year above the level generated by the Standard Method for calculating the housing requirement at the time. The additional housing was based on the potential capacity of sites across the borough and would be capable of contributing to meeting wider housing needs in this part of Kent.

The proposed new housing was to be delivered on existing sites, principally within the urban area of Dartford and at the new community at Ebbsfleet Garden City, where significant development had already taken place as part of its long- term regeneration strategy. The plan proposed over 100,000 sqm of additional employment floorspace, taking advantage of land available close to the Ebbsfleet International rail station.

The inspector identified concerns with the approach towards some sites within the urban area of Dartford. The council was relying on them as part of its housing strategy, but the sites were not formally identified as allocations for development within the submitted plan. Further explanation was sought as to how these sites would be positively supported for housing development and Main Modifications to the Plan prepared to give these sites a formal status to support their delivery.

To meet the need for additional Gypsy and Traveller sites, the council proposed identifying new sites and regularising existing unauthorised pitches. However, the existing sites were all located within the Green Belt. The inspector identified that no assessment had been made to justify this in the Green Belt and the council was tasked with producing further evidence to justify the release of the sites. The additional evidence enabled the inspector to conclude that exceptional circumstances had been demonstrated to justify the release of these sites from the Green Belt and provide additional pitches to meet the identified needs.

Following receipt of additional information and following further specific hearing sessions, the inspector was able to identify Main Modifications to make the plan sound.

Following consultation on the Main Modifications in autumn 2023, and the receipt of the inspectors’ Report in January 2024, the plan was subsequently adopted by the council in April 2024.

Supporting a fair planning system through our Appeals Service

Our appeals service is critical to a fair planning system. Our inspectors are independent of councils, applicants and communities. They consider the available evidence with openness, fairness and impartiality.

Councils and some other organisations like National Park Authorities and Mayoral Development Corporations make decisions on a variety of matters in their area. You can find the relevant organisation for your area at www.planningportal.co.uk/find-your-local-planning-authority. The matters they decide include:

-

applications for planning permission and to display advertisements, works to listed buildings, works to protected trees, applications to remove hedgerows in the countryside, and complaints about anti-social high hedges

-

whether to serve legal notices (called “enforcement notices”) where they think harmful unauthorised development has taken place

-

public rights of way, such as changing access rights to the network or making new public rights of way

-

compulsory purchase orders, where some organisations can purchase land even if the owner does not want to sell. This is normally because the land is needed for an important project such as a road, railway or a development important for the area. We independently assess whether the compulsory purchase order should go ahead.

The Inspectorate is here if you want someone independent to re-consider these decisions, or to decide the case where they have taken too long. Our inspectors independently review the information and evidence and, in most cases, visit the site and nearby area before making their decision.

We are accountable to Parliament through the Secretary of State for Housing, Communities and Local Government, who monitors our appeals service performance through ministerial measures seeking us to:

-

make our decision-making times faster and make decisions in a more consistent time range

-

increase the proportion of appeals that are valid when submitted

-

publish information about the number of cases we quality assure.

Appeals are decided through one or more of the following three approaches:

Written exchange of evidence

Most of our appeals are decided by inspectors after seeing written evidence and usually visiting the site. This is often called ‘written representations’. The appellant, the local planning authorities, local people, businesses and anyone else interested in the appeal make their comments in writing and the inspector decides the case after reviewing the evidence.

Hearing

For these types of appeal, the appellants, the local planning authorities, local people, businesses and anyone else interested in the case, make their comments in writing. The inspector then chairs a structured discussion around some or all the issues to help them test the evidence. These hearings generally finish in one day. Inspectors often visit the site as well, and then prepare their decision.

Inquiry

Inquiries are held for the most complex appeals and for some other casework, like compulsory purchase orders, and ‘called in’ planning applications, where the inspector make a recommendation to the Secretary of State rather than deciding the case themselves. The appellant or applicant, the local planning authorities, local people, businesses and anyone else interested in the case make their comments in writing. At the discretion of the inspector, people can also give their views verbally at the inquiry. Inquiries are more formal than hearings and evidence is tested by cross examination, normally by barristers representing the main parties interested in the appeal. After visiting the site, the inspector then makes their decision or recommendation.

In 2024/25:

Incoming work

We received around 14,703 planning appeals, which is our largest area of work. This is slightly lower than in 2023/24.

We received about 3.60% more enforcement appeals than in 2023/24, which follows successive years of increases. These cases are also typically more time consuming than simple householder appeals. We are now receiving more enforcement appeals than before the pandemic.

Other appeals include works to protected trees, community infrastructure levy notices, environmental, hedgerow regulation, anti-social behaviour high hedges, a range of casework relating to public rights of way and different types of compulsory purchase order. Of particular note amongst this casework in 2024/25, we decided 18 cases for compulsory purchase orders and 32 necessary electricity wayleaves during the year. These are procedures which can help important schemes go ahead, but can mean landowners are required to sell land or give access to the land even if they do not wish to. A landowner losing rights over their land is a very significant step, so these cases often involve inspectors hearing evidence on very sensitive and important issues.

Appeals received

Around 50% of the appeals we receive each year do not have all the information or evidence we need to be able to start work on the case. This means that consideration of the appeal is delayed whilst we wait for that information or evidence to be provided. The appeal is ‘invalid’ until we have everything we need. Appeals requiring hearings and inquiries are more likely to be invalid when they are first submitted. The new digital services we have developed are user-focused and support customers to submit the right information with their appeal the first time. They will be increasingly available for customers through 2025.

Allowed appeals

The overall proportion of appeals our inspectors allowed remained comparable with previous years. In the last year, three out of every ten appeals were allowed, meaning that the inspector’s decision permitted a development where the original decision did not. Across England in 2024/25, around 21,047 homes were granted planning permission on appeal. This is around a 26% increase compared to 2023/24, but remains significantly lower than the number in each of the previous three years as fewer homes were considered through the appeal process.

Graph 1 - Number of appeals allowed and number of homes granted permission

| 2020/21 | 2021/22 | 2022/23 | 2023/24 | 2024/25 | |

|---|---|---|---|---|---|

| Number of homes | 24,000 | 30,000 | 30,000 | 24,000 | 28,000 |

| Percentage of cases allowed | 27% | 31% | 29% | 29% | 30% |

What is a percentile?

If you arrange a group of numbers from the smallest to the largest, a percentile is a way of expressing where a value falls within that range of other values. For example, if we tell you the 25th percentile for decision times, then you know that 25% of decisions are issued in less time (or the same time) as that.

All our graphs show the following:

-

90th percentile

-

75th percentile

-

50th percentile

-

25th percentile

-

10th percentile

How long we took to decide appeals in 2024/25

Over time our ministers expect us to make decisions faster and in a more consistent time range. This helps provide certainty to our customers.

As in other years, in 2024/25 our decision times varied between different types of appeal. This was because the process to reach the decision is different. It was also because some appeal types (generally smaller development proposals) have a queue of appeals waiting for an inspector to be allocated to decide them, and these take longer than those where an inspector is allocated as soon as we receive the appeal (generally larger development proposals).

Planning appeals decided after a hearing or inquiry are now generally much faster than they were a few years ago. Since 2022/23 we have focused more of our inspectors on these more strategic case types to make these decisions faster. We also implemented a faster timetable for planning appeals to be decided by hearing which reflects the timetable used for inquiries and then also applied that to timetable to enforcement appeals by inquiry from early 2024 and to enforcement appeals by hearing from winter 2024. Since 2023/24, we have focused more inspectors onto planning appeals by written exchange of evidence to reduce the number of appeals waiting for a decision.

For planning appeals decided after an inquiry, we:

-

decided 198 appeals, 15% fewer than in 2023/24

-

received a comparable number of appeals requiring an inquiry

-

continued progress to be more consistent in our decision times

-

continued progress to decide more appeals within 26 weeks

-

average decision times have improved over the last ten years.

Graph 2 - Median decision time for planning appeal cases decided by inquiry

| Median decision time in weeks - 10th Percentile | Median decision time in weeks - 25th Percentile | Median decision time in weeks - 50th Percentile | Median decision time in weeks - 75th Percentile | Median decision time in weeks - 90th Percentile | Median decision time in weeks - 100th Percentile | |

|---|---|---|---|---|---|---|

| 2020/21 | 24 | 28 | 40 | 53 | 67 | 275.14 |

| 2021/22 | 22 | 25 | 33 | 53 | 76 | 211 |

| 2022/23 | 21 | 25 | 31 | 41 | 64 | 154.71 |

| 2023/24 | 22 | 24 | 30 | 44 | 64 | 171 |

| 2024/25 | 21 | 24 | 27 | 34 | 48 | 191 |

For planning appeals decided after a hearing, we:

-

decided 576 appeals, slightly more than 2023/24

-

continued the progress from 2023/24 with speeding up these decisions and becoming more consistent in decision times

-

in 2024/25, 72% of these appeals were decided within 26 weeks, compared to 57% in 2023/24 and 49% in 2022/23.

Graph 3 - Median decision time for planning appeal cases decided by hearing

| Median decision time in weeks - 10th Percentile | Median decision time in weeks - 25th Percentile | Median decision time in weeks - 50th Percentile | Median decision time in weeks - 75th Percentile | Median decision time in weeks - 90th Percentile | Median decision time in weeks - 100th Percentile | |

|---|---|---|---|---|---|---|

| 2020/21 | 22 | 30 | 42 | 51 | 65 | 135.86 |

| 2021/22 | 25 | 34 | 46 | 62 | 80 | 191 |

| 2022/23 | 18 | 24 | 44 | 67 | 105 | 226.71 |

| 2023/24 | 18 | 22 | 26 | 46 | 93 | 211 |

For planning appeals decided after written exchange of evidence, we:

-

Decided slightly more appeals than 2023/24 and decided more than we received as we continued to focus on improving our performance for these appeals. The number of open appeals of this type fell by 1,591.

-

The median decision time was comparable to 2023/24. Although we decided around 29% of cases in 20 weeks or fewer, continuing to decide and reduce the number of older cases means the average decision time was 29 weeks, compared to 30 weeks in 2023/24.

-

Became more consistent in our decision times. The quickest 10% of decisions took 14 weeks or less, as in 2023/24. The slowest 10% of decisions took 40 weeks or more, compared to 52 weeks or more in 2023/24. The continued focus on reducing older cases puts us in a good position to improve our decision time consistency further in 2025/26.

Graph 4 - Median decision time for planning appeal cases decided by written representations

| Median decision time in weeks - 10th Percentile | Median decision time n weeks - 25th Percentile | Median decision time in weeks - 50th Percentile | Median decision time in weeks - 75th Percentile | Median decision time in weeks - 90th Percentile | Median decision time in weeks -100th Percentile | |

|---|---|---|---|---|---|---|

| 2020/21 | 13 | 16 | 22 | 29 | 38 | 157 |

| 2021/22 | 13 | 17 | 23 | 31 | 40 | 206 |

| 2022/23 | 13 | 19 | 26 | 37 | 49 | 270 |

| 2023/24 | 14 | 20 | 29 | 38 | 52 | 194 |

| 2024/25 | 14 | 19 | 26 | 33 | 40 | 141 |

For enforcement appeals decided after a hearing or inquiry, we:

-

Decided 592 appeals, around 73% more than 2023/24, as we focused on reducing the number of both open cases and older cases. The number of appeals awaiting an inquiry reduced from a high of over 600 in 2020/21 to 325 in 2022/23, 244 in 2023/24 and 65 in 2024/25. In 2024/25 we reduced the number of enforcement appeals awaiting a hearing from 418 to 116.

-

From October 2024 started running enforcement hearing appeals on a faster timetable, like planning appeals decided after a hearing or inquiry and enforcement appeals decided after an inquiry.

-

Did not make our decision times more consistent as we continued to close long standing cases, and this 10% of cases continued to take much longer. The fastest 10% of inquiry decisions are getting faster compared to previous years because we progressed new appeals on a faster timetable.

Graph 5 - Median decision time for enforcement appeal cases decided by hearing

| Median decision time in weeks - 10th Percentile | Median decision time in weeks - 25th Percentile | Median decision time in weeks - 50th Percentile | Median decision time in weeks - 75th Percentile | Median decision time in weeks - 90th Percentile | Median decision time in weeks - 100th Percentile | |

|---|---|---|---|---|---|---|

| 2020/21 | 46 | 60 | 78 | 89 | 108 | 118 |

| 2021/22 | 39 | 46 | 62 | 75 | 106 | 197 |

| 2022/23 | 43 | 68 | 87 | 119 | 184 | 268 |

| 2023/24 | 24 | 44 | 80 | 102 | 134 | 220 |

| 2024/25 | 23 | 35 | 57 | 86 | 110 | 302 |

Graph 6 - Median decision time for enforcement appeal cases decided by inquiry

| Median decision time in weeks - 10th Percentile | Median decision time in weeks - 25th Percentile | Median decision time in weeks - 50th Percentile | Median decision time in weeks - 75th Percentile | Median decision time in weeks - 90th Percentile | Median decision time in weeks - 100th Percentile | |

|---|---|---|---|---|---|---|

| 2020/21 | 44 | 69 | 88 | 101 | 126 | 172 |

| 2021/22 | 44 | 64 | 91 | 118 | 137 | 196 |

| 2022/23 | 44 | 67 | 82 | 129 | 224 | 254 |

| 2023/24 | 24 | 44 | 80 | 102 | 134 | 220 |

| 2024/25 | 21 | 26 | 47 | 72 | 100 | 209 |

For enforcement appeals decided after written exchange of evidence, we:

-

Decided 1,688 appeals. This was slightly lower than 2023/24 as we focused more on hearing and inquiry casework this year.

-

Took slightly longer on average to decide appeals than 2023/24. For 2024/25 the median decision time was 54 weeks, the highest it has been for five years. Now we have improved performance in other casework areas, we have started to transfer more inspectors onto this casework to improve these decision times.

-

Became slightly less consistent in our decision times as we focused on other casework. The quickest 10% of decisions took 25 weeks, whilst the slowest 10% took 99 weeks.

Graph 7 - Median decision time for enforcement appeal cases decided by written representations

| Median decision time in weeks - 10th Percentile | Median decision time in weeks - 25th Percentile | Median decision time in weeks - 50th Percentile | Median decision time in weeks - 75th Percentile | Median decision time in weeks - 90th Percentile | Median decision time in weeks - 100th Percentile | |

|---|---|---|---|---|---|---|

| 2020/21 | 19 | 24 | 33 | 44 | 60 | 241 |

| 2021/22 | 17 | 21 | 31 | 47 | 74 | 184 |

| 2022/23 | 20 | 29 | 46 | 70 | 88 | 249 |

| 2023/24 | 27 | 38 | 52 | 67 | 81 | 194 |

| 2024/25 | 25 | 36 | 55 | 80 | 96 | 171 |

For rights of way cases decided through written exchange, hearing or inquiry, we:

-

decided 243 cases, slightly fewer than 2023/24 as we focused on other work

-

became no less consistent in our decision times

-

further reduced the number of undecided inquiry cases from 30 at the end of 2023/24 to 28 at the end of 2024/25.

Graph 8 - Median decision time for rights of way

| Median decision time in weeks - 10th Percentile | Median decision time in weeks - 25th Percentile | Median decision time in weeks - 50th Percentile | Median decision time in weeks - 75th Percentile | Median decision time in weeks - 90th Percentile | Median decision time in weeks - 100th Percentile | |

|---|---|---|---|---|---|---|

| 2020/21 | 27 | 41 | 54 | 69 | 84 | 121 |

| 2021/22 | 27 | 37 | 68 | 91 | 110 | 183 |

| 2022/23 | 33 | 39 | 64 | 92 | 130 | 209 |

| 2023/24 | 29 | 43 | 62 | 90 | 106 | 188 |

| 2024/25 | 29 | 39 | 60 | 80 | 105 | 152 |

For tree preservation order, high hedge and hedgerow appeals, we:

-

Decided 25% more appeals than 2023/24 and closed more than we received. Our contracted inspectors started to work on this casework to increase the number of decisions we make.

-

We became no less consistent in our decision times overall compared to 2023/24, but about half of decisions took slightly longer as we focused on other casework.

Graph 9 - Median decision time for tree preservation order, high hedge and hedgerow appeals

| Median decision time in weeks - 10th Percentile | Median decision time in weeks - 25th Percentile | Median decision time in weeks - 50th Percentile | Median decision time in weeks - 75th Percentile | Median decision time in weeks - 90th Percentile | Median decision time in weeks - 100th Percentile | |

|---|---|---|---|---|---|---|

| 2020/21 | 17 | 29 | 45 | 62 | 79 | 113 |

| 2021/22 | 12 | 15 | 22 | 36 | 90 | 149 |

| 2022/23 | 15 | 20 | 28 | 47 | 79 | 177 |

| 2023/24 | 17 | 24 | 37 | 57 | 84 | 163 |

| 2024/25 | 34 | 46 | 67 | 89 | 108 | 160 |

Case study: Appeals service

Our GOV.UK digital appeals service consists of a new beta website to replace the ageing Appeals Casework Portal (ACP) and a new casework management system used by our case officers and inspectors to replace the ageing and inflexible current software.

Since 2023, appellants in all local planning authorities have been able to choose to submit householder and planning appeals through either the beta GOV.UK website or the Appeals Casework Portal. In either case, the appeal form and related information is sent to our current case management software.

Our householder appeals service pilot

In September 2024 we started a pilot with the London Borough of Barnet. This was expanded in December 2024 to include a further four local planning authorities: Bromley, Greenwich, Havering and Richmond. In these trial areas, appellants must use the beta GOV.UK website to submit their householder appeals, which then go directly into our new case management software.

We have received 147 appeals to date through the pilot. The pilot has demonstrated for the first time seamless integration between the beta GOV.UK website and new case management software, whilst unlocking new functionality for the entire appeals process. These features include, but are not limited to:

-

a portal for local planning authorities for questionnaire submission, managing multiple appeals, and highlighting of upcoming actions

-

content improvements to the beta GOV.UK website so appeals are submitted correctly the first time, saving everyone time

-

automated emails and the removal of manual letters and the need to cross-copy submissions between the appeal parties

-

enhanced data collection, such as receiving the appeal form and questionnaire as data, and the recording of missing documents as data, opening opportunity for analysis and improvement of the service

-

a simplified user interface for both internal and external users, which meets the latest inclusivity and accessibility standards.

Feedback

We have worked closely with the pilot local planning authorities and our employees to gather feedback, fix issues and make improvements.

The local planning authorities have been pleased with the simplicity of the system, with comments including:

- the “questionnaire really looks simplified”,

- there are a “lot less questions and things to go through”,

- there is “less information required to upload so find it really useful”.

Our case officers and managers have been equally positive, stating that:

- “The user interface is intuitive and easy to navigate, making the entire process more streamlined and efficient.”

- “The appeal form is shortened and easier to read and makes the validation process easier.”

- there are “Fewer clicks”

- there is “No cross-copying required”

Inspectors have commented:

- “After finding things a little unsettling at first, as everything felt so different to the safe familiarity of our software, I can say that my experience so far has been positive. The new system is well laid out, logical and simple. It’s easy to use and move between different areas to quickly get the information I need to do my job.”

- “I like the way you can see everything clearly and drop down and close and you’re basically on the same page the whole time “

- “I really like the simplicity of it… Just needs some tweaks.”

In March, we expanded the service to all planning appeals being available in the pilot areas, whether considered by written representations, hearing or inquiry. As well as these three procedure types, this includes new features such as the ability for third parties to comment, the ability for us to redact these comments, an appellant/ agent portal to keep track of their submissions, and the associated automated notifications for the additional stages of the full planning appeal process.

Once we have received sufficient feedback to be assured the system is working as expected, we will expand this to all local planning authorities during 2025.

We are also building all remaining appeal types that use the Appeals Casework Portal into the new service, as well as improving the service available in the pilot areas. This has built confidence with our stakeholders and reduces the risk for those users joining the service during 2025.

Driving economic growth and clean power through our Applications Service in England and Wales

Through our applications service, we consider the biggest infrastructure developments in the country, using government policy to examine them and recommend which should go ahead. We also make decisions for Secretaries of State on other applications. Whatever the application, our independent inspectors hear the views of communities, and act with openness, fairness and impartiality in reaching their recommendation or decision.

Nationally Significant Infrastructure Projects (England and Wales)

Our communities all use and rely on our nation’s infrastructure for:

-

power stations and wind farms generating electricity

-

major roads, railways, ports and airports moving people, food and other products around the country and between countries

-

reservoirs providing fresh water from taps, and sewage treatment works processing waste water.

These are the largest and most complex development projects in the country, and they are critical to the nation’s future. They take years to develop. Certainty over the process and avoiding delays are important for everyone. Delays can lead to uncertainty for communities, infrastructure not being ready when needed, increased costs for the taxpayer and some projects no longer being financially viable. We provide advice throughout the application period, identifying where the projects need improvement or where more evidence is needed to explain them.

We consider the interests of developers, local authorities, local communities and other interested parties, whether it is consistent with government policy, and anything else that is relevant. We then recommend to the Secretary of State whether these projects should go ahead.

In 2024/25, we completed the work to accept all new applications within 28 days of receipt (a statutory requirement), as we have done in previous years. And we provided recommendations to a Secretary of State on 17 national infrastructure applications, all within statutory time frames. This is a comparable volume of work to what we have processed in the last few years.

As well as investment in transport infrastructure, England and Wales is seeing considerable growth in infrastructure proposals related to energy generation and distribution, and carbon capture. This means we need to have inspectors with expertise in all these areas.

In addition to making recommendations on 17 applications, we also provided advice on approximately 80 potential infrastructure projects. These projects are likely to become applications in the next few years. Our advice is aimed at making sure those applications are supported by the right information and address the issues likely to be considered when they are examined.

The Inspectorate charges for considering NSIP applications. Our income from NSIP applications increased from £11.5m in 2023/24 to £16.7m in 2024/25. £2.1m of this was from additional casework, £2.2m from the new NSIP pre-application service that was launched in October 2024 and £0.9m from inflationary fee increases (6.7% based on September 2023 CPI).

Improving the infrastructure consenting process

The current consenting process for national infrastructure was created in 2008. Throughout 2024/25 we continued to implement the cross-government action plan published on 23 February 2023. The action plan is intended to build resilience, trial faster models of consenting for some projects, remove delays in parts of the process and support the system to cope with the likely increase in projects.

Our supporting work included:

-

implementing enhanced pre-application advice, including having an inspector involved in providing advice;

-

fast track procedures for parts of the consenting process;

-

implementing a charging regime for pre-application advice so our costs in this are no longer paid by the taxpayer; and

-

making significant supporting updates to our advice and guidance.

Planning applications in Bristol, Chorley, Lewes, St Albans and Uttlesford Districts (England)

The Secretary of State has powers to designate local planning authorities where their performance falls below expected standards. Uttlesford District Council was designated in July 2022, the first time a council has been designated since 2013. Chorley Council was designated in December 2023. Bristol and St Albans were designated in March 2024. Lewes was designated in May 2024.

This means applicants in Chorley, Lewes and Uttlesford Districts can apply for planning permission directly to the Secretary of State where their application proposes ‘major development’, such as ten or more homes or development on a site over one hectare. We provide both advice to potential applicants and handle applications on behalf of the Secretary of State. Across the designated authorities:

-

6 requests for advice were received; and

-

8 applications for major development were received (and 10 decisions issued).

In Bristol and St Albans Districts it means applicants can apply for planning permission directly to the Secretary of State where their application proposes ‘non-major development’, such as one to ten homes or up to 1000sqm of commercial floorspace. We handle applications on behalf of the Secretary of State.

- 42 applications for non-major development were received (and 25 decisions issued).

The volume of major applications we received reduced by around 45% compared to 2023/24, but the growth in non-major applications was significant. Only three applications were received in 2023/24.

Common land and other applications (England)

We also decide other applications for government, including applications for work on common land and town and village greens. Common land has a long history based on ancient rights under British common law and remaining common land is now publicly accessible. About 3% of England is common land.

Many applications for works on Common Land can be small, but they are often vital to providing electricity or gas as essential services, for public safety or for local councils providing safe footways or public transport facilities. In 2024/25 we received slightly fewer applications than in 2023/24 and decided a comparable number of applications to that previous year. Average times for decisions were comparable.

Case study: Applications service

The Inspectorate has now implemented actions from the NSIP Reform Action Plan and has launched its new chargeable pre-application service. This service provides support to applicants as they prepare their applications for nationally significant infrastructure schemes and its positive impact is already being felt.

Driving improvement through proportionality and innovation

The former government’s NSIP Reform Action Plan was aimed at speeding up the planning process for nationally significant infrastructure projects. The Inspectorate continues to deliver on its actions from the plan, using new components including programme plans and principal areas of disagreement statements to facilitate examinations that are both focused and proportionate. Stakeholders have provided positive feedback on our commitment to shorter, more concise recommendations, with several recommendations issued ahead of the statutory six-month timeframe.

One notable success in adopting such a proportionate approach was the examination of the Rivenhall (Essex), Integrated Waste Management Facility and Energy Centre. By tailoring the process to the unique characteristics of the proposal, the operational team and Examining Authority efficiently managed the examination, which included just two virtual hearings and a limited number of written questions. This streamlined approach enabled the examination to conclude in fewer than four months (instead of six), with a comprehensive report finalised in just two months (instead of three) and a decision issued by the Secretary of State well within the three-month statutory period.

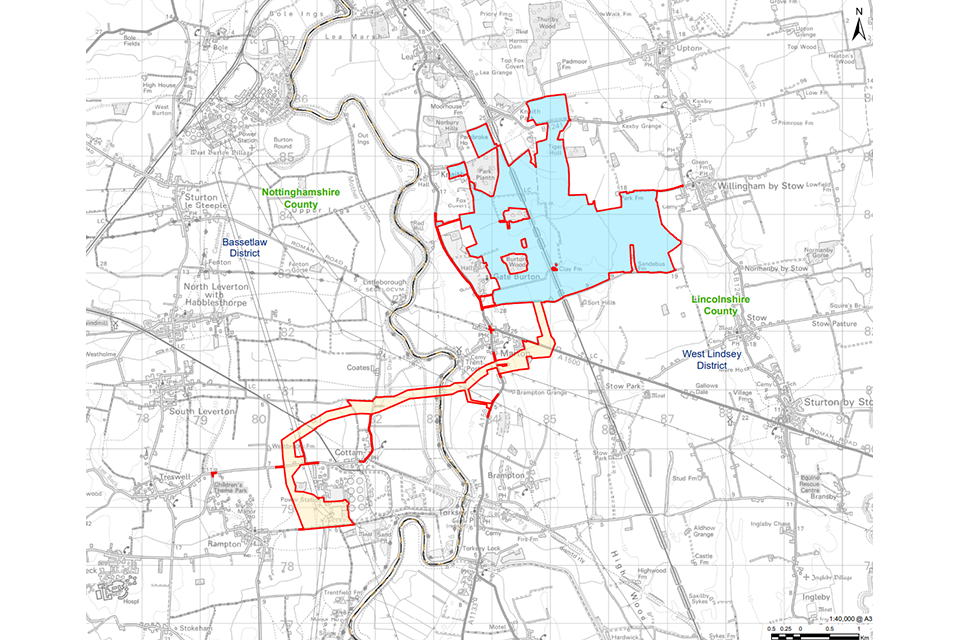

The Inspectorate also demonstrated innovation in its approach to the Gate Burton Energy Park project—a solar generation facility with battery storage and grid connection infrastructure in Lincolnshire. Early identification of overlapping applications for solar projects in the same region allowed the Inspectorate to devise a strategy for managing interrelated and cumulative impacts holistically, while maintaining the integrity of individual examinations. This initiative, supported by operational teams, introduced the use of a shared ‘Interrelationships Document,’ enabling effective coordination and minimising stakeholder burden. Gate Burton set the standard for this strategy, bringing efficiencies to overlapping examinations without compromising quality or process integrity.

Gate Burton – Order Limits Plan

Building on these successes, we are using internal fora to track issues across project types, maximising the efficiency of our examinations and enhancing the pre-application process. These efforts reflect our commitment to continuous improvement, ensuring that our services remain effective, adaptive, and customer focused.

Gate Burton Energy Park

Our People

We are fortunate to have highly engaged colleagues who are key to our success. Our ambition is that by March 2027, the Planning Inspectorate will be “an even better place to work, that values and builds the expertise of its workforce”.

People Strategy

This year we launched a three-year Strategic People Plan to set out the priorities and actions to deliver our ambition that by March 2027, the Planning Inspectorate will be ‘an even better place to work, that values and builds the expertise of its workforce’. Our Strategic People Plan aligns with the same five themes of the Civil Service Strategic People Plan (shown below).

-

Learning, Skills and Capabilities

-

Pay and Reward

-

Employee Experience

-

Recruitment, Retention and Talent

-

High Performing HR Function

We are well on our way to achieving our ambition, which has been reflected in the rise of engagement scores for our People Survey.

Learning, Skills and Capabilities

We have continued to mature our learning organisation. This year we have introduced a new Learning and Development infrastructure, which has modernised our core learning offers, making them more accessible and relevant for our people. We have developed a suite of tools to build our line management capabilities, including launching a new line-manager resource hub and induction offer. We’ll be embedding this over the 2025/26 year as well as launching a new line manager development programme.

We have established a new Capability Framework which clearly sets out the capabilities that we need across our organisation. The framework is aligned to our values and provides individuals and their managers clarity to support development, performance discussions, and wider workforce planning.

We have continued to support 35 people through apprenticeship schemes, with 24 enrolling in 2024/25 which is higher than our forecast of 17. Approximately half of these apprentices are undertaking degree level or higher qualifications including the RTPI Apprentice Level 7 and Chartered Manager Level 6 courses.

From the 2024 Civil Service People Survey results we’ve seen an increase of engagement in our Learning and Development theme, including an increase of six percentage points in people saying they can access opportunities when required, and 80% of respondents saying that they are “learning on a regular basis from working with my colleagues”.

Pay and Reward

This year we applied the full flexibilities offered by the Civil Service Pay Remit process, which included offering all eligible colleagues an uplift of at least 4.26%. Our Pay and Reward Project, made up of representation from across the business, including each of our Trade Unions, concluded with the launch of our first Reward Strategy in early 2025.

Graph 10 – mean gender pay gap over five years

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Gender pay gap | 11.6% | 13.1% | 11.8% | 14.6% | 13.7% |

Our most recent gender pay gap figure is 13.7% at the mean for 2024, down from 14.6% in 2023. We recognise that our gender pay gap is directly attributable to the high proportion (49%) of our workforce being in the planning professions which has traditionally been a male-orientated career. This professional demographic is reflected amongst our colleagues: whilst over half of the first inspector grade are now female, less than one third are female at the highest inspector grade. Another factor in the decrease in the gender pay gap between 2023 and 2024 is the changes to the appointments and structure of our Executive Team having, through fair, open and merit-based recruitment, made a number of female appointments to our senior team.

Our Equality, Diversity and Inclusion (EDI) plan and Reward Strategy recognise that we require long-term solutions to fully address our gender pay gap.

Employee Experience

We use a variety of communication channels to engage with our employees, providing them with updates, information on how they access resources and support and to gather feedback on their experiences to help identify any areas of concern. We work with three Trades Unions and a wide range of employee networks to hear the voice of the organisation, helping us shape initiatives and inform our decisions.

This year our employee engagement score rose two points and edged us even further above the Civil Service benchmark. In summer 2024 we ran an independent Colleague Experience Assessment for our operations colleagues to better understand their experience of working at the Inspectorate.

The results helped inform a number of activities, including the development and launch of ‘The PINS Way’; a simple charter outlining the core values, behaviours, and expectations that define our organisational culture.

‘The PINS Way’ elements comprise:

- Operate as one

- Network and engage

- Evolve and enrich through learning

- Put our customers at the heart of service delivery

- Invest in our success

- Nurture positive culture

- Spark curiosity

Graph 11 – EDI breakdown

| 2021 | 2022 | 2023 | 2024 | 2025 | Civil Service (31/03/2024) | |

|---|---|---|---|---|---|---|

| Disabled staff | 8.72% | 8.37% | 7.64% | 8.14% | 9.17% | 16.90% |

| Staff from ethnic minorities (excluding white minorities) | 5.03% | 6.04% | 6.14% | 8.25% | 7.48% | 16.80% |

| Female staff | 44.91% | 45.22% | 46.73% | 48.21% | 49.40% | 54.50% |

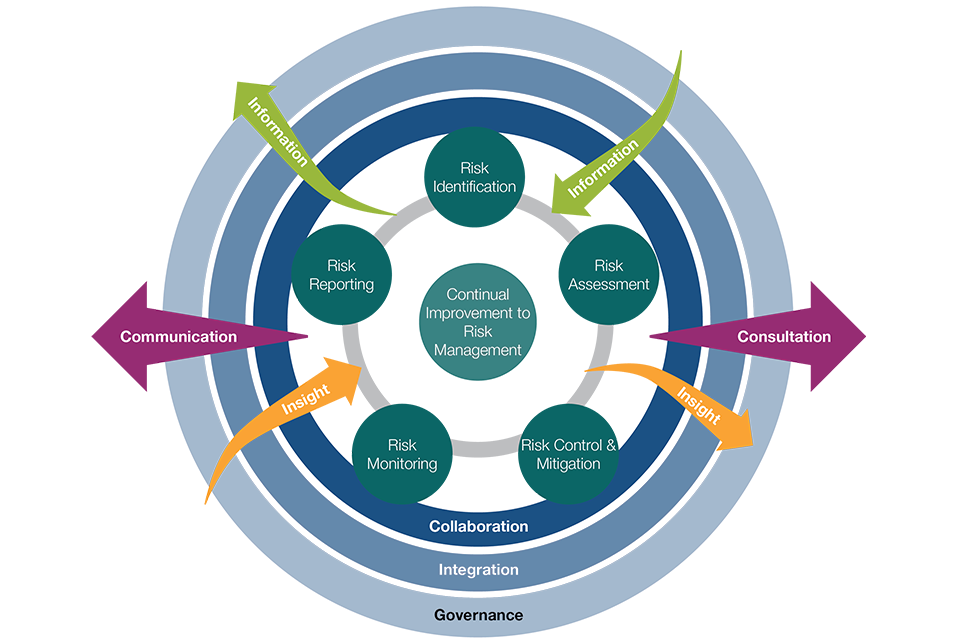

| Lesbian, gay, bisexual and ‘other’ staff | 3.75% | 4.71% | 4.65% | 5.82% | 5.45% | 6.90% |