No Safe Havens 2019: introduction

Updated 16 May 2019

No Safe Havens 2019

No Safe Havens 2019 outlines how HMRC will ensure offshore tax compliance, helping achieve our overarching objectives[footnote 1]:

- to maximise revenues and bear down on avoidance and evasion

- transform tax and payments for customers

- design and deliver a professional, efficient and engaged organisation

We will do this by focusing on 3 areas:

- leading internationally

- assisting compliance

- responding appropriately

The UK has seen huge changes and improvements to offshore tax compliance in recent years. Since 2010, the government has introduced over 100 new measures to tackle tax non-compliance.

This image shows a graphic of coins with the caption: £2.9bn+ raised since 2010 by HMRC cracking down on offshore tax non-compliance.

These measures have secured and protected over £200 billion, ensuring that the UK tax gap is at a near record low[footnote 2] and helped transform HMRC’s approach to offshore tax. This has seen new offences and increased sanctions for those who seek to evade tax, as well as those who help them.

International developments, championed by the UK, have also seen dramatic changes in tax transparency. In the past, jurisdictions with strict banking secrecy rules would not supply information to HMRC.

Now, over 100 jurisdictions have committed to automatically exchange financial account information under the new international standard, the Common Reporting Standard (CRS).

In 2018, HMRC received information about the offshore financial interests of around 3 million UK resident individuals, or entities they control. We have begun using this data to detect possible non-compliance.

This image shows a graphic of UK map with the caption: 5.67m records received on UK taxpayers’ offshore financial accounts in 2018.

In addition, the UK has played a leading role in international initiatives to tackle multinational tax avoidance.

To ensure the largest corporates with overseas arrangements pay the right tax, the UK was at the forefront of multilateral action through the G20 and the Organisation for Economic Co-operation and Development (OECD) to reform international standards through the Base Erosion and Profit Shifting (BEPS) project.

The UK has also introduced the Diverted Profits Tax (DPT) to ensure multinational companies pay UK tax in line with their UK activities. In addition, organisations that fail to prevent their representatives from facilitating tax evasion can now be prosecuted.

No Safe Havens 2019 builds on HMRC’s achievements so far in addressing offshore tax non-compliance and expands the scope and ambition of the previous strategy.

Previously, No Safe Havens concentrated on offshore tax evasion. However, we recognise that the minority of customers who pay less offshore tax than they should, do so for a variety of reasons.

Some make mistakes, or attempt to avoid tax by exploiting the rules to gain an advantage Parliament never intended. Others seek to evade tax, and in doing so commit a crime.

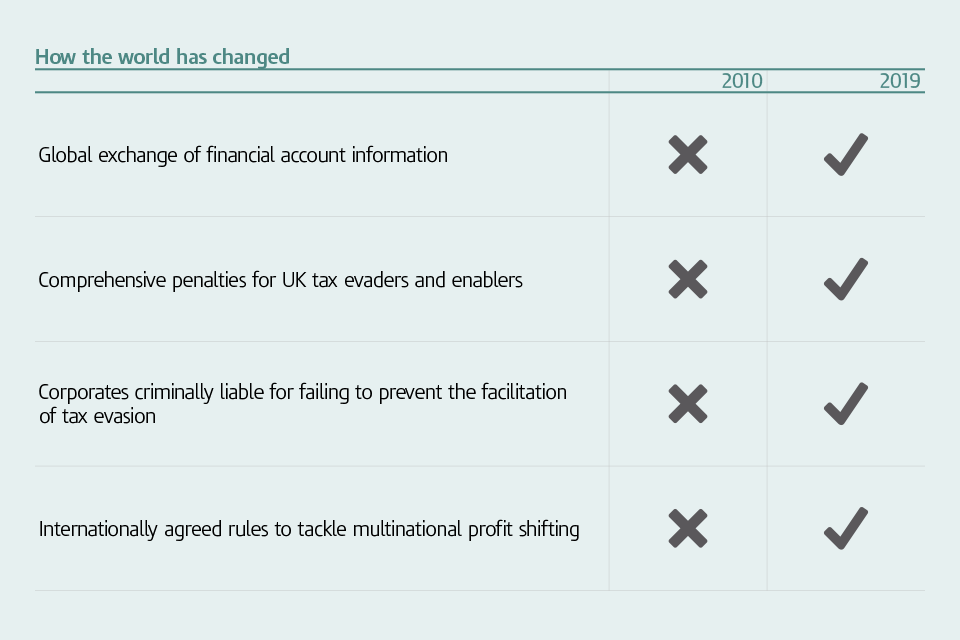

This graphic shows 4 ways that uncovering offshore tax evasion, and subsequent penalties, changed between 2010 and 2019.

This strategy sets out how we will tackle the whole problem of offshore tax non-compliance across that spectrum of behaviours, and all our customer groups.

This includes working with agents and intermediaries to help their clients avoid errors and make it simple for them to identify and correct errors. The unprecedented amount of data that HMRC is receiving from a range of sources is at the heart of our approach.

To tackle the range of reasons why our customers pay less tax than they should, we will focus our efforts on 3 key aims:

- leading internationally – championing international tax transparency. This includes improving international collaboration between tax authorities to ensure the correct UK tax is paid

- assisting compliance – helping customers get offshore tax right first time. This includes increasing customers’ awareness and understanding of their responsibilities. This also includes using new data and insights to design systems and processes to help meet everyone’s needs as we try to make tax as easy as possible

- responding appropriately – taking a proportionate approach to risk and behaviour. This includes helping those who make mistakes; robustly challenging those who avoid or evade tax; and applying sanctions to those who help them

Scope of No Safe Havens 2019

No Safe Havens 2019 brings together in one place HMRC’s approach towards offshore tax compliance. It covers a range of behaviours, from simple mistakes to avoidance and evasion.

The strategy sets out how we will ensure offshore tax compliance and tailor our approach, helping customers get it right first time where possible. Where we intervene, we will use an approach that is appropriate and proportionate to the tax at risk and the customer’s behaviour.

This is a compliance strategy to ensure people abide by the rules that Parliament sets. HMRC also leads international work to ensure those rules are appropriate and do not lead to unfair outcomes.

You can read the next section: No Safe Havens 2019: leading internationally.

-

Our strategy HM Revenue and Customs: 20 July 2017. ↩

-

Measuring tax gaps 2018 edition - tax gap estimates for 2016 to 2017, page 4. HMRC: 14 June 2018. ↩