Life Sciences Sector Deal 2, 2018

Updated 5 December 2018

Illustration of a molecule (credit: BlackJack3D/iStock - ID:682373850) [Credit: BlackJack3D/iStock]

Foreword

Last year the Life Sciences Sector Deal set out the first phase of implementing the Life Sciences Industrial Strategy through joint commitments between the government and the sector to invest in the United Kingdom’s life sciences landscape.

The agreements made in the first deal capitalised on the enormous opportunities for growth that the life sciences sector presents for the UK. We are seeing a continual flow of new investments across the health tech and pharmaceutical sectors since the deal was published, with this year’s second deal seeing more life sciences companies investing in the UK and creating high-quality, well-paid jobs. Life sciences is a sector that operates at the cutting-edge of technological developments.

Government investments in these emerging areas are being matched by greater contributions from the sector, and this is building on existing strengths spanning research and healthcare to create and grow new industries in the UK. It is right that NHS patients stand to benefit from these home-grown innovations. Data-driven technologies have the potential to transform the way the health system works and support faster and cheaper clinical research. We must ensure the system develops to encourage and spread these new technologies. Advanced therapies are making precision medicines, targeted to the individual patient, a reality here in the UK.

This second Life Sciences Sector Deal deepens our partnership with industry, universities and charities and demonstrates how the NHS is pivotal as a delivery partner. It contains significant action to address the Industrial Strategy Grand Challenges and our mission to transform the prevention, diagnosis and treatment of chronic diseases by 2030: it will support the creation of a cohort of healthy participants that will enable research into the hidden signs of disease and ways of diagnosing diseases early when interventions and treatments can be the most effective. The cohort will involve the public, the research community and industry with the results benefiting the whole health service – an example of the collective endeavours driving our modern Industrial Strategy.

We are taking action in the work underway from the first Sector Deal, and the new commitments set out in this deal, to achieve the vision of the UK as a top-tier hub for life sciences globally. The benefits will be felt by UK citizens through economic growth, good jobs and a strong and sustainable health service for future generations.

Rt Hon Greg Clark MP

Secretary of State for Business, Energy and Industrial Strategy

Rt Hon Matt Hancock MP

Secretary of State for Health and Social Care

Professor Sir John Bell GBE, FRS

Regius Professor of Medicine, The University of Oxford

Executive summary

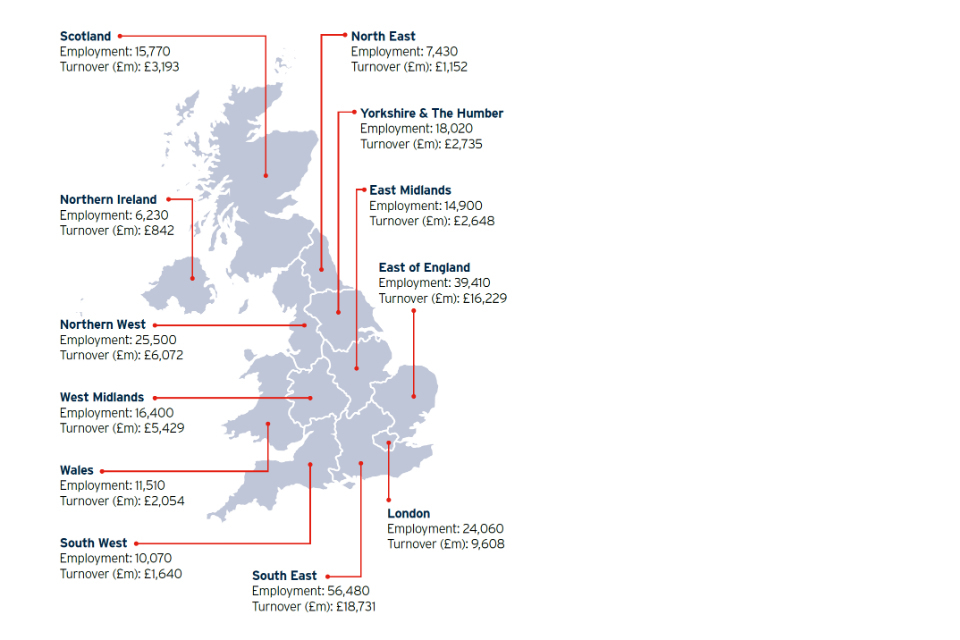

The life sciences industry is one of the most important pillars of the UK economy, contributing over £70 billion a year and 240,000 jobs across the country[footnote 1]. In 2017, a wide coalition of industry and charity partners, led by Professor Sir John Bell, published a bold Life Sciences Industrial Strategy[footnote 2] that set a clear direction for the sector’s future growth.

The strategy was underpinned by the very significant competitive advantages the UK already possesses – an outstanding research base in world-class universities; significant capabilities in clinical and translational medicine in the NHS; longitudinal datasets within a national healthcare system; the largest biotech cluster outside the United States; a highly-productive and skilled workforce; and strong capabilities in emerging fields, such as digital health and artificial intelligence (AI).

Taking these strengths as the basis for future growth, the strategy set out how to maintain and build on them under fierce international competition, and to capitalise on emerging opportunities. It set a roadmap for the UK to create whole new industries over the next 2 decades in the fields of early disease detection and genomics; digital technologies and data analytics; and in advanced therapeutics.

The strategy also set out the areas where key developments could fix issues which have slowed down growth; such as NHS uptake of innovative technologies; the difficulty in scaling UK biotech companies to create large, globally-successful entities; and the need to drive up research and development funding to remain globally competitive.

The government’s response to this call from industry came with the first Life Sciences Sector Deal[footnote 3], a key part of the modern Industrial Strategy. The deal included close to £500 million of government support for major new research programmes and over £1 billion of new industry investment. It brought together partners from across the pharmaceutical and health tech sectors, charities, government agencies and the NHS to deliver its vision at pace. Strong progress is being made on implementation:

- An investment of £85 million in our already world-leading genomics assets at UK Biobank has attracted significant support for what will be the largest whole genome sequencing project ever undertaken. A £30 million vanguard study, the first phase of work, is already underway, sequencing the first 50,000 participants.

- In digital technologies and data analytics, we are laying down the building blocks to realise the full potential of the scale and diversity of NHS data, while maintaining public trust in how data is used and maximising the benefits of innovation for NHS patients. Our 5 new centres of excellence in digital pathology and radiology will provide more precise diagnosis, applying AI tools to digital images to detect abnormalities more quickly and accurately than humans. They will also help to reduce costs.

- We are delivering on our aim to make the UK a global hub for advanced therapies and building an impressive end-to-end national infrastructure through a £146 million commitment to medicines manufacturing. This includes: doubling capacity at the Cell and Gene Therapy Catapult Manufacturing Centre; 3 new advanced therapies treatment centres; and 2 new innovation centres for vaccines and medicines manufacturing.

- The government, industry, the NHS and its partners are delivering on their clear commitment to work together to improve the innovation and access environment in the UK, with strong progress made on implementing the Accelerated Access Review[footnote 4], supported by £86 million in government funding.

One year on, we are now going further still through this second Life Sciences Sector Deal with significant additional measures and innovative programmes to secure a global lead in the areas of greatest opportunity for the UK. Together with the first Sector Deal, these programmes are building an ecosystem that will help life sciences to thrive in the UK:

- A major new commitment, backed by up to £79 million of funding, to develop a first-of-its-kind, world-leading cohort of healthy participants that will attract significant global investment from industry and charities. The project will enable research into the hidden signs of disease and the development of tools to detect and diagnose diseases earlier. This will lead to a type of ‘predictive prevention’ which is crucial to ensure the NHS has a sustainable future.

- A world-first commitment to sequence 1 million whole genomes in the UK within the next 5 years including 500,000 through the NHS in addition to the 500,000 in the UK Biobank project. Our broader aspiration is to reach 5 million genomic analyses in the same time-frame, truly making the UK the home of genomic healthcare.

- An additional £50 million investment in our digital pathology and radiology programme as a first step towards making this a truly national asset to support early and improved diagnosis across the UK and deliver more efficient NHS services.

- £37.5 million funding and a plan for a network of regional Digital Innovation Hubs, providing expert clinical research data services, data analysis and sharing capabilities. This is part of a wider programme delivering on the government’s tech vision to reform the architecture of technology in the NHS and make it work better for patients, clinicians and researchers.

- A wide-ranging new policy package to support uptake and adoption of innovation in the NHS and ensure the UK continues to be a world leader in health tech. Through its long-term plan and the recent branded medicines pricing deal, the NHS will set out how it will be a crucial national partner, acting as both a real-world test-bed and a beneficiary of many of the innovations flowing from the life sciences industry.

Wider policy measures are reinforcing this approach, including:

- A suite of measures to make our clinical research environment faster, more efficient, streamlined and innovative, including the use of digital platforms.

- A commitment to innovative regulation that ensures the UK framework keeps pace with emerging technology developments, such as artificial intelligence, and supports their entry into the NHS.

- A new package of skills commitments between the government and industry partners to help deliver the priority skills the sector needs now and to make the most of future opportunities.

- Ongoing work to deliver on our commitment to increase public and private R&D spend, reaching 2.4% of GDP by 2027

- Measures to support the supply of capital for innovative firms, helping them to grow, through the government’s Patient Capital Review[footnote 5]

Industry partners have responded to this significant commitment with further investment:

- UCB, a global pharmaceutical company, is investing in 1 of their 2 major global R&D hubs in the UK. This will involve a purpose-built, state-of-the-art facility to enable cutting-edge R&D, early manufacturing and commercial operations, with planned investment of £150 million to 200 million in the facility and around £1 billion total investment over 5 years. The transition to the new facility will support around 650 high-value jobs across R&D, enabling further collaborations with UK universities, biotechs and medical research charities

- Over £200 million of new investment from a wide range of companies, including GW Pharmaceuticals, Roche, Celgene, IQVIA Ltd. and Oxford Biomedica

The strength of the partnership between the government, the NHS and the life sciences sector is making the UK a global standard-bearer for discovery research and advanced manufacturing. We are committed to continuing the hard work of implementation over the coming years because the prize – a globally-leading UK life sciences environment – will deliver huge benefits to the people of this country through a stronger economy and a stronger NHS.

Key commitments

Ideas

To be the world’s most innovative economy.

Establishing the Health Advanced Research Programme

Life Sciences Sector Deal 1:

The government committed to initial collaborations in genomics and digital diagnostics, with leading health charities exploring concepts and structures to shape the future of the Health Advanced Research Programme.

Life Sciences Sector Deal 2:

| Sector action | Government action |

|---|---|

| * Wellcome Trust, the Bill & Melinda Gates Foundation and Cancer Research UK have come together with the government to define the concept of a Health Advanced Research Programme. | * The government is announcing a major new commitment to the ‘Accelerating detection of disease’ challenge, backed by up to £79 million from the Industrial Strategy Challenge Fund[footnote 6]. The challenge will build a world-first cohort of healthy participants to support research, early diagnosis, prevention and treatment across the major diseases. |

| * Wellcome Trust has committed to progressing very high-risk/high-reward pioneering science through a major £250 million commitment to their Leap Fund. | * Committing an additional £50 million investment in our digital pathology and radiology programme to help make this a truly national asset and deliver more efficient NHS services. |

| * Prof Sir John Bell will bring together leading health charities including Cancer Research UK, British Heart Foundation and Alzheimer’s Research UK on the government’s ‘Accelerating detection of disease’ challenge, which we also expect to attract significant further investment from the sector. | * Committing to sequence at least 1 million whole genomes within 5 years, including 500,000 whole genomes through the NHS. |

| * Genomics England will undertake development work on a new service to enable genomic volunteers to pay for a personalised report on their unique genetic makeup. With permission, the genetic data will be made available to researchers and scientists. |

Strengthening the UK environment for clinical research

Life Sciences Sector Deal 1:

Significant action has been taken over the last year to strengthen the environment for clinical trials. Sector collaborations between companies and academia are developing innovative clinical trials.

Life Sciences Sector Deal 2:

| Sector action | Government action |

|---|---|

| The government’s comprehensive plan to improve our clinical research environment has unlocked new commitments from companies: | We will further improve the speed and efficiency of clinical trials by: |

| * Celgene provides support for studies and is making a new investment in excess of £7m, with an overall £38m investment. | * Establishing 5 centres for late phase commercial research. |

| * With National Institute for Health Research (NIHR) facilitation support, IQVIA Ltd. will invest £24m over 5 years into a fourth UK Prime Site for clinical trials across the North of England. | * Exploring opportunities to recognise and incentivise NHS Trusts and GP practices acting as participant identification centres. |

| * IQVIA Ltd. and Genomics England are investing £20m over 5 years to develop services that will enable more efficient drug research. | * Continuing to improve research set-up timelines. |

| * The Brain Tumour Charity will invest £2.8m in the Tessa Jowell BRAIN-MATRIX, a trial aimed at increasing opportunities for brain tumour patients to try non-standard treatments. | * Addressing challenges in NHS workforce resourcing to deliver commercial research. |

| We will consolidate our world-leading position in delivering novel and innovative trials by: | |

| * Promoting the UK’s expertise in designing and delivering innovative trials. | |

| * Enabling industry, including SMEs, and the wider research community to access advice to support innovative trial design. | |

| * Delivering a skills programme to embed expert understanding of how innovative studies can be run across the NHS. |

Raising the intensity of R&D in the UK

Life Sciences Sector Deal 1:

Last year’s deal highlighted the commitment to increase investment in R&D to 2.4% of GDP by 2027 and various company investments.

Life Sciences Sector Deal 2:

| Sector action | Government action |

|---|---|

| We are seeing further commitments from companies demonstrating confidence in the UK’s science base: | We will build on action to increase the UK’s R&D spend to reach 2.4% of GDP by 2027 by: |

| * UCB will invest up to £150-200m in a state-of-the-art global R&D hub – a commitment which totals around £1bn over 5 years and will support 650 jobs. | * Working across UKRI and industry to develop a roadmap to achieve 2.4%. |

| * Roche will invest a further £30m in the UK including 100 new highly-skilled jobs by 2020. | * Announcing additional support at Budget 2018, including £1.6bn to strengthen the UK’s leadership in science and innovation. |

| * Celgene are investing over £22m in a 5-year drug discovery collaboration with Cancer Research UK. | * Setting the ambition to triple industry contract and collaborative R&D spend in the NHS to over £900m. |

| * Further oncology R&D investments include: £14m from Cancer Research UK into a London hub for cancer biotherapeutics research and treatment; £2.4m investment by Bristol-Myers Squibb into a project with the Francis Crick Institute and Cancer Research UK into AI analysis of lung cancer images. | |

| * An Electron Bio-Imaging Centre was opened by Diamond Light Source backed by a £15.6m grant from Wellcome Trust and UKRI, with £9m from ThermoFisher Scientific. | |

| * Eisai announced an extension to its UK investment in dementia research, a new 5-year collaboration with UCL. |

Business environment

To be the best place to start and grow a business.

Making the UK a global hub for advanced therapies manufacturing

Life Sciences Sector Deal 1:

The below measures build on £146 million support for medicines manufacturing from the Industrial Strategy Challenge Fund (ISCF), leveraging significant matched industry funding.

Life Sciences Sector Deal 2:

| Sector action | Government action |

|---|---|

| * Investors have recognised the strength in UK advanced therapy biotech companies with Orchard Therapeutics Plc, Autolus Ltd. and Freeline Therapeutics Ltd. raising significant finance in the second half of 2018. | Capitalising on the opportunities presented by advanced therapies: |

| * Bellicum Pharma Ltd., a cell therapy company, has committed to its first European investment in the UK with £2m and 20 jobs initially. | * A significant portion of the £146m ISCF support for medicines manufacturing announced in the first sector deal has been targeted at advanced therapies. |

| * UK companies are scaling up cell and gene therapy manufacturing including Oxford BioMedica Plc (£19m) and Roslin Cell Therapies Ltd. (£4m) planning to invest. | * NHS Blood and Transplant are expanding their infrastructure to facilitate adoption of cell and gene therapies. |

| * Autolus Ltd. is planning to invest a further £50m to expand its UK presence, including a new global headquarters. |

Supporting growth of life sciences manufacturing

Life Sciences Sector Deal 1:

In addition to advanced therapies manufacturing, last year’s Sector Deal committed support to drive growth in high-value medicines manufacturing, including for 2 new innovation centres for Vaccines and Medicines Manufacturing.

Life Sciences Sector Deal 2:

| Sector action | Government action |

|---|---|

| Industry are making new investments in life sciences manufacturing facilities and technologies: | The government is going further to build on progress seen in life sciences manufacturing since the sector deal: |

| * GW Pharmaceuticals has invested over £20m expanding its manufacturing facilities in Kent. | * £8m ISCF funding was announced as an initial step to facilitate the application of digitally-enabled technologies for medicines manufacturing. |

| *Eli Lilly and Company has committed £5m to research into more efficient medicines manufacture, in collaboration with Imperial College London and UCL. | * Up to £121m was announced for the Made Smarter Programme through ISCF wave 3 to support the transformation of manufacturing, including in life sciences. |

Improving UK environment for businesses to scale up

Life Sciences Sector Deal 1:

Last year’s deal outlined the government’s response to the Financing Growth in Innovative Firms[footnote 5] consultation, addressing scale-up issues with an action plan to release over £20 billion of patient capital investment over 10 years. We are now going further still through announcements made at Budget 2018.

Life Sciences Sector Deal 2:

| Sector action | Government action |

|---|---|

| * Many of the UK’s largest defined contribution pension providers will work with the British Business Bank to explore pooled investment in patient capital. | * The government is going further to increase opportunities for pension funds to invest in the sector by addressing regulatory barriers and announcing plans to help them invest in growing UK businesses through the British Business Bank (BBB). |

| * The UK BioIndustry Association is conducting analysis of life sciences investment to inform a campaign to promote investment and growth opportunities. |

NHS innovation and collaboration

Life Sciences Sector Deal 1:

The government committed to implementing the Accelerated Access Review, including £86 million funding to support innovators and the NHS. The sector is delivering collaborative programmes in the NHS to transform services and improve care.

Life Sciences Sector Deal 2:

| Sector action | Government action |

|---|---|

| Collaborations are demonstrating improvements to patient services: | We are now going further and committing to: |

| * The wound care industry is working with Academic Health Science Networks to improve patient outcomes and help local areas maximise budgets. Between them Smith and Nephew and Convatec are investing over £20m in UK R&D and academia. | * Build a stronger innovation ecosystem through a much enhanced and strengthened Accelerated Access Collaborative (AAC). |

| * Barts Health NHS Trust, Queen Mary University of London and other partners are working with the Department of Health and Social Care to develop a major new life sciences hub in Whitechapel. Total investment is expected to reach £500m. | * Improving patient access to more innovations – the AAC will be given greater flexibility over the number of products it can support, as long as they deliver good value. |

| * Improve the innovation infrastructure that underpins the AAC’s work through stronger testing infrastructure. | |

| * Tackle the challenge of spreading the best innovations across the system through a new health tech funding requirement. |

Innovative regulation

Life Sciences Sector Deal 1:

Last year’s deal included a suite of actions to support the UK environment for life sciences businesses. An effective regulatory environment that works for innovative, emerging new technologies is key to this.

Life Sciences Sector Deal 2:

| Sector action | Government action |

|---|---|

| The sector will work with the Medicines and Healthcare Products Regulatory Agency through its industry liaison groups to provide input and expertise as the agency develops its approaches to ensure that the regulatory framework delivers a strong business environment. | The Medicines and Healthcare Products Regulatory Agency (MHRA) has set out how it will be the most forward-thinking regulator, essential for a strong business environment for life sciences, by: |

| * Supporting advanced therapies manufacturing by developing a framework for point-of-care manufacture. | |

| * Leading the way on precision medicine by developing a clear UK regulatory pathway for genomic medicines and tests. | |

| * Promoting patient access and safety. |

Infrastructure

A major upgrade to the UK’s infrastructure.

Life Sciences Sector Deal 1:

The government committed to support the development of measures to improve the UK’s health data infrastructure, working with NHS England, NHS Digital and Health Data Research UK.

Life Sciences Sector Deal 2:

| Sector action | Government action |

|---|---|

| Industry is helping to pioneer the use of digitally-enabled research and digital technologies: | We are making the UK the home of data-driven life sciences research and innovation, improving outcomes for patients and the NHS by: |

| * The ORION-4 trial is a partnership between the University of Oxford’s Clinical Trial Service Unit, its Epidemiological Studies Unit and The Medicines Company on a new cholesterol-lowering investigational drug given just once or twice a year using digitally-enabled tools to lower costs, and identify sites and participants more easily. | * Ensuring secure and appropriate use of patient data. |

| * A group of innovators will be invited to validate their algorithms on synthetic datasets created as part of MHRA’s Regulator Pioneer Fund project. This pilot ultimately aims to prove the concept and act as a regulatory sandbox to help with product validation. | * Creating the right framework for commercial agreements involving data. |

| * Improving the UK’s health data infrastructure, including through investments to improve NHS Digital’s core services; and to develop the Local Health and Care Record Exemplars and the Digital Innovation Hubs programmes. | |

| * Supporting and expanding digitally-enabled clinical research. | |

| * Creating a regulatory framework fit for the future and able to keep pace with technological developments, such as AI. The MHRA has secured £740,000 from the Regulator’s Pioneer Fund to work with NHS Digital on developing a pilot in order to test and validate algorithms and other AI used in medical devices. |

Places

To have prosperous communities throughout the United Kingdom.

Life Sciences Sector Deal 1:

The government committed to implement a regional approach to the Sector Deal, working closely with devolved administrations and cluster organisations representing the sector.

Life Sciences Sector Deal 2:

| Sector action | Government action |

|---|---|

| The sector is proactively identifying growing areas of opportunity for life sciences in the UK regions and devolved administrations: | We are taking action to help areas with clear life sciences strengths to grow: |

| * Bruntwood in partnership with Legal & General Capital are investing £360m of capital, property and intellectual assets to create the UK’s largest portfolio of science and technology assets in the Northern Powerhouse and Midlands Engine initially. | * The government is renewing our offer of Life Sciences Opportunity Zone status to help areas raise their profile at an international level. |

| * New projects and partnerships are being developed across the devolved administrations and English regions, generating significant investment throughout the UK. | * The Department of International Trade, with the Office for Life Sciences and leading cluster organisations will work together to make the life sciences landscape easier for investors to navigate and support growth. |

| * Budget 2018 announced £20m to further develop the plan for the critical central section of East-West rail between Oxford and Cambridge. |

People

To generate good jobs and greater earning power for all.

Life Sciences Sector Deal 1:

The government and sector committed to work together to monitor the impact of the apprenticeship levy and to support standards brought forward by the sector.

Life Sciences Sector Deal 2:

| Sector action | Government action |

|---|---|

| The sector is developing new joint programmes targeted at key skills needs: | We are working to increase uptake of life sciences apprenticeships: |

| * Encouraging young people to study STEM subjects, eg The Association of the British Pharmaceutical Industry (ABPI) is supporting the British Science Association’s work to inspire young people about STEM through a competition around the Industrial Strategy Grand Challenges. | * The government is taking action on the apprenticeship levy to facilitate greater flexibility and improve uptake, particularly for SMEs. |

| * The Science Industry Partnership (SIP), with key partners, including ABPI and the BioIndustry Association will lead and deliver a Life Sciences 2030 Skills Strategy, funded by £100,000 from SIP, with further funding from trade association partners and the government. | * We are also committing to explore the potential for a pilot programme with UK Research and Innovation (UKRI), the Department for Education and the Education and Skills Funding Agency to better enable SMEs in the sector to take on apprentices. |

| * SIP is delivering on commitments to roll out regional approaches on skills, including apprenticeships uptake by building on the success of SIP Cambridge with a commitment to establish SIP Liverpool. | |

| The government is taking a range of further measures to develop the skills the sector needs, including: | |

| * Increasing uptake of science, technology, engineering and maths (STEM), through a new external working group, led by the Department for Education. | |

| * New UKRI programmes that are helping to deliver on opportunities that emerge through joint working between life sciences and other disciplines. |

Ideas

Illustration of a DNA strand (credit: iLexx/iStock - ID:485038074) [Credit: iLexx/iStock]

Establishing the Health Advanced Research Programme (HARP)

The Life Sciences Industrial Strategy set out a bold vision for a pioneering Health Advanced Research Programme (HARP) that would put the UK at the forefront of addressing the unprecedented challenges facing healthcare systems globally. It proposed that industry, charities and the NHS take on far-sighted, life sciences projects, underpinned by novel technology and higher-risk science. In the first Life Sciences Sector Deal, the government committed to working with partners to explore how this vision could be achieved.

In the last year, leading charities, including Wellcome Trust, the Bill & Melinda Gates Foundation and Cancer Research UK have come together with the government to determine how to make a success of the enormous opportunity HARP presents. This work identified 4 core categories of science and research opportunities that, taken together, create a powerful portfolio that will help the UK lead the way in tackling major global healthcare challenges.

Backed by £210 million of Industrial Strategy Challenge Funding (ISCF) from UK Research and Innovation (UKRI), the first set of HARP projects are now becoming a reality.

Category 1: Investing in long-term assets to sustain health research

In the first Life Sciences Sector Deal, we committed to a ground-breaking project to build on our world-leading genomics assets and ensure that the UK remains globally competitive in this area. The UK already has the largest, highest-quality whole genome database in the world through the 100,000 Genomes Project, which reached its target in December, but the first Sector Deal recognised that we cannot afford to stand still in the face of global competition.

While we are still at the early stages of using genomics to treat rare and hard-to-treat conditions, the strategic direction is that over the next 10 years the volume of genomic data combined with insights derived from clinical data and experiential data – including from wearables and Internet of Things devices – means genomics has the potential to become a key pillar of preventative healthcare, enabling much more precise advice and treatments.

In the space of the last year, the government has allocated £85 million of ISCF funding to kick start the whole genome sequencing of all 500,000 UK Biobank participants.

This will be the largest whole genome sequencing project ever undertaken and should be completed in 2 years. A £30 million vanguard study, representing the first phase of work, is already underway with the sequencing of the first 50,000 participants having begun in August 2018. And this project has already generated significant interest and potential new investment to the UK: several companies and charitable organisations are forming a partnership to work with the government on the project, demonstrating that the UK remains a leading destination for investment in cutting-edge genomic research. The government is continuing to work with Genomics England and other partners to progress the cancer genome sequencing announced in last year’s deal.

The government is now going further and faster in its commitment to drive advancements in personalised, targeted healthcare for the benefit of patients. In October 2018, the Health and Social Care Secretary announced an ambition to become the global leader in genomic care through:

- Launching the most ambitious genomics programme in the world to sequence at least 1 million whole genomes within 5 years, including 500,000 whole genomes through the NHS in addition to the 500,000 in the UK Biobank project. Our broader aspiration is to reach 5 million genomic analyses in the same time frame, truly making the UK the home to genomic healthcare.

- Making the NHS the first national healthcare system in the world to offer whole genome sequencing as part of routine care for NHS patients. During 2019, the new National Genomic Medicine Service will begin to offer whole genome sequencing to seriously ill children likely to have a rare genetic disorder and children with cancer, in addition to adults suffering from certain rare conditions or specific cancers.

In addition, Genomics England will undertake detailed development work on a new service to enable genomic volunteers to pay for a personalised report on their unique genetic makeup. As part of this and with the permission of these volunteers, the genetic data will be made available to researchers and scientists working on tackling some of our country’s greatest health challenges. Genomics England will work with NHS England and public and patient groups to lead the development of the service.

This joint commitment from the government and our industry and charity partners to building unique, long-term genomics assets will help attract further investment from the biopharmaceutical industry seeking to use large-scale genomic data to validate targets and produce more successful medicines. It will also enable the development of new and emerging UK-based technology companies, for example in DNA sequencing and annotation.

Category 2: Development programmes applying cutting-edge technology and science to current problems

The Life Sciences Industrial Strategy highlighted the important role artificial intelligence can play in healthcare –helping to reduce costs and provide more precise, earlier diagnosis – for example, transforming NHS services such as radiology and pathology by detecting abnormalities in digitised scans and tissue samples more quickly and accurately than humans.

In the first Life Sciences Sector Deal, the government committed to work with companies to shape a programme of NHS and industry collaboration, backed by Industrial Strategy Challenge Funding, that will ultimately develop and demonstrate new solutions at scale. Since then, the government has completed a competition to establish a network of 5 centres of excellence in digital pathology and radiology with AI, supported by £50 million from the Industrial Strategy Challenge Fund, to demonstrate how this can work in practice in the NHS. Major players including Philips, Roche Diagnostics, Canon, Siemens Healthineers, GE Healthcare and Leica are key partners with the NHS and academia in this ground-breaking programme, which has leveraged over £33 million in investments from industry and other sources and will put the UK at the forefront of leadership in digital pathology and radiology using AI.

The centres will work with innovative SMEs to identify, develop and learn new processes, practices, knowledge and skills, and to develop new products and services for the benefit of the NHS and patients that also have global commercial applications. Centres will work closely within their regional NHS partnerships, as well as national infrastructure, to develop and implement interoperability standards and to commit to the adoption of national standards as these are defined.

Coupled with other significant government investments in genomics, the image analysis from the centres will revolutionise understanding of the development of complex diseases, enabling the development of new tools for early diagnosis and new treatments targeted at specific diseases. The programme is an early deliverable under the Prime Minister’s Early Diagnosis and AI mission, demonstrating the opportunity for digitising care and using data with AI to enable scientific research and develop AI-based diagnostic tools.

In this second Life Sciences Sector Deal, the government is now going further and announcing additional investment of up to £50 million in our digital pathology and radiology programme as a first step towards making this a truly national asset to support early and improved diagnosis across the UK, and deliver more efficient NHS services. This will accelerate the speed at which the NHS and patients are able to realise the benefits from our investment and enable these benefits to be shared by everyone.

Category 3: Visionary programmes looking 20 years ahead to revolutionise healthcare

The Life Sciences Industrial Strategy highlighted an opportunity for the UK to lead the way globally in changing the healthcare paradigm so that we are proactive in identifying, preventing and treating disease early, rather than reactive in seeking to manage late-stage illness or merely prolong life. Since the Sector Deal last year, the Prime Minister has announced a mission to use data, AI and innovation to transform the prevention, early diagnosis and treatment of chronic diseases such as cancer, diabetes, heart disease and dementia by 2030, whilst the Health and Social Care Secretary has set out his vision for an NHS which spends much more of its resources on keeping people well and healthy for longer.

The scale of opportunity is enormous: success would mean saving many more lives, reducing NHS costs, attracting investment to the UK from global pharmaceutical and health tech companies, and helping new UK industries, for example, in data analytics and diagnostics, to grow. It would also empower all UK citizens to understand their individual risk of developing diseases as never before, and take steps to remain healthy for longer. In the UK, we are spending £97 billion a year on treating diseases, and only £8 billion on preventing them[footnote 7]. Cancer Research UK estimates that by 2033, if the number of late stage diagnoses were reduced by 50% just across bowel, ovary, prostate and lung cancer, each year over 55,000 more people would be diagnosed at an early stage rather than a late stage. This could result in over 22,000 fewer deaths within 5 years of diagnosis, per year[footnote 8].

In this second Life Sciences Sector Deal, the government is announcing a major new commitment of up to £79 million R&D funding[footnote 9] in the Accelerating Detection of Disease challenge under the Industrial Strategy Challenge Fund Wave 3, that is expected to leverage significant industry and charity matched funding from the life sciences sector. This will help deliver the Early Diagnosis Mission, announced by the Prime Minister in May 2018 – a key part of the Industrial Strategy’s AI and Data Grand Challenge – as well as delivering on a major recommendation in the Life Sciences Industrial Strategy.

Professor Sir John Bell will bring together UKRI, Cancer Research UK, the British Heart Foundation, Alzheimer’s Research UK and other leading health charities, the NHS and industry to build a first-of-its-kind, world-leading cohort of 1 million healthy participants initially, aiming to grow to 5 million. The project will support research, early diagnosis, prevention and treatment across the major diseases, including cancer, dementia and heart disease. This will be a ground-breaking national health programme that will develop new diagnostic tests through applying leading-edge AI and other cutting-edge technologies. It will attract additional global investment from the sector.

Case study: Leading the way in the early diagnosis of cancer

Oncimmune is a leading UK cancer diagnostic technology that has pioneered the development of a blood test that has the potential to transform the detection and diagnosis of cancer through the measurement of autoantibodies. The technology is being used as part of the Early Cancer detection test – Lung cancer Scotland (ECLS) study, which is believed to be the largest randomised trial for the early detection of lung cancer using a blood-based biomarker ever conducted.

The ECLS study is specifically targeted at a population with a lower risk of developing lung cancer, 0.5% compared to 2% or even 3.5% in other screening studies, successfully recruiting over 12,000 participants.

By utilising a simple blood test run on inexpensive standard laboratory equipment, the technology is frictionless, resulting in an unprecedented rate of recruitment compared to similar screening studies. The test was able to identify a small population for follow-up when compared to other screening programmes, significantly reducing the risks of false positives associated with large-scale screening trials.

Interim results have demonstrated that Oncimmune’s technology has the potential to save lives and avert costs to the NHS by detecting many more early-stage cancers (75% earlystage versus 20% today). By using a blood test, the screening approach is more acceptable to participants and has fewer implications for NHS imaging capacity.

Category 4: Very high-risk/high-reward pioneering science to create new technologies and breakthroughs

The Life Sciences Industrial Strategy was clear that delivery of the Health Advanced Research Programme’s (HARP) ambitions would require a coalition of partners and that charities would play a leading role.

This is particularly true of high-risk, high-ambition programmes that fall outside the remit of conventional life sciences funding because of the high level of risk involved.

Wellcome Trust has decided to play a significant role in filling this gap through a major new £250 million commitment to their far-reaching Leap Fund programme. This new, not-for-profit fund will place big bets on ambitious research programmes with the potential to fundamentally change science or transform health over a 5-to-10 year horizon. The fund will support researchers, engineers, innovators and technologists from around the world to pursue bold ideas at scale and speed, drawing inspiration from the technology and venture capital industries.

Strengthening the UK environment for clinical research

The UK’s expertise in clinical research is world-leading.

We continue to punch above our weight in many areas and rank second globally for commercial Phase 1 studies[footnote 10]. In 2017 to 2018, the National Institute for Health Research (NIHR) Clinical Research Network achieved record levels of recruitment with over 725,000 people taking part in clinical research studies, of which over 50,000 participants were recruited to studies sponsored by the life sciences industry, including 24 global-first patients. 99% of NHS Trusts were actively engaged in clinical research[footnote 11].

Responding to Life Sciences Industrial Strategy recommendations, the first Sector Deal committed to further improvements in our clinical research environment. Since then we have:

Made significant progress in delivery of NHS England and the NIHR’s commitments to 12 Actions to support and apply research in the NHS[footnote 12] by

- Awarding more than £950 million NIHR investment in research infrastructure in the NHS to translate findings from basic science to patient and healthcare benefit.

- Making it significantly easier to set up a study by implementing a new national model to manage excess treatment costs in non-commercial research.

- Simplifying processes for NHS research through a standard costing methodology, a model site agreement in the NHS standard contract and beginning to implement a single contract review to increase transparency and reduce variation.

- Removing the 70 day benchmark for clinical trials in favour of the publication of accurate performance data using a standard national framework[footnote 13].

- Increasing the uptake of the Clinical Practice Research Datalink in GP practices in England by almost 30% since the end of 2017.

- The Health Research Authority (HRA) and the Medicines and Healthcare Products Regulatory Agency (MHRA) piloting improvements to the approvals process - by offering a combined approach, researchers are receiving better quality and more efficient approvals in parallel rather than in sequence – which we are now rolling out more widely[footnote 14].

The life sciences sector is also delivering on commitments made in the first Sector Deal demonstrating that the UK is already a great place to do innovative clinical trials.

- Using anonymised electronic health records to improve efficient trial designs for mood disorders, the University of Oxford and Janss Pharmaceutica NV concluded that the NIHR-supported Clinical Record Interactive Search (CRIS) database can support effective identification of trial candidates. Wider application of this approach is being considered.

- The Medicines Company has begun the 2 projects announced in the first Sector Deal – the first with the University of Oxford to perform a large multinational cardiovascular disease clinical trial (see the ORION-4 case study). The second, with The Greater Manchester Health and Social Care Partnership, to improve the understanding, management and economics of cardiovascular disease has begun large-scale big data analysis to model the risk of heart disease using a medication to reduce certain risk factors.

- Wellcome Trust and the Bill & Melinda Gates Foundation are progressing with their aim of delivering more efficient and fit-for-purpose clinical trials for non-product registration trials. They are taking a global lead through an inclusive process in developing an alternative international equivalent to the good clinical practice guidelines, delivering on a recommendation in the Life Sciences Industrial Strategy. The African Academy of Sciences has recently become a partner of this joint initiative.

However, we can do more to improve our clinical research environment for both pharmaceutical and health tech companies. We will continue to improve speed and efficiency by:

- Establishing 5 purpose designed centres dedicated to late-phase commercial research in 2019 to 2020. Identified through NIHR Clinical Research Network (CRN) competition, the centres will offer rapid set-up of late phase commercial research, standardised contracting and delivery approaches where appropriate, and dedicated facilities and staff. They will increase the NHS’s capacity to deliver research, enabling significant growth and opportunities for patients to benefit from early access to innovation.

- Identifying opportunities to recognise and incentivise NHS Trusts and GP practices acting as participant identification centres. The NIHR CRN will explore mechanisms to ensure patients are offered the opportunity to participate in research of relevance to them, whether or not it is being delivered by their regular healthcare provider, making recommendations to the Department of Health and Social Care by spring 2019.

- Continuing to improve research set-up timelines by achieving HRA approval within timelines specified in the EU Clinical Trials Regulation; increasing the transparency of performance data through common use of the HRA/NIHR research study minimum dataset across NHS organisations, and providing industry with access to this data in a searchable format to inform site selection and intelligence-driven performance improvement.

- Addressing challenges in NHS workforce resourcing required to deliver commercial contract research. Working closely with industry and NHS Trusts, the NIHR CRN will investigate the workforce resource challenges in commercial contract research, and develop recommendations to government for innovative approaches to tackle them by summer 2019.

We also believe the UK can consolidate its world-leading position in delivering novel and innovative trials, making delivery of these studies ‘business as usual’ across the system. The Life Sciences Industrial Strategy proposed a strategic goal to grow the proportion of clinical trials with novel methodology over the next 5 years. Following on from excellent work by the Clinical Research Working Group, a partnership between industry and government, to identify innovation in trial design, we pledge to turn this vision into a reality by:

- Identifying and promoting the UK’s world-leading expertise in designing and delivering innovative trials, including opportunities for industry collaboration. We will work with NIHR early translational research infrastructure (NIHR Biomedical Research Centres, Clinical Research Facilities, and Experimental Cancer Medicine Centres) to make available details of their expertise in delivering innovative trials, making it easier for industry and other researchers to identify opportunities for collaboration. The NIHR CRN will also establish which NHS providers are able to deliver innovative trial designs to support faster site selection.

- Enabling industry, including SMEs, and the wider research community to access advice to support innovative trial design. The MHRA’s early engagement offer includes its Innovation Office where exploratory discussions can take place and a scientific advice service where experts can produce written guidance on a specific question relating to a product or study. This can be particularly helpful where trial aspects challenge the current regulatory framework. The MHRA will engage with industry to understand how it can further develop this offer by the end of 2019.

- Taking a range of measures to maximise the value of the UK’s unique data assets in clinical research, set out in full in the Infrastructure chapter.

- Delivering a skills programme to embed expert understanding of how innovative studies can be run across the NHS. The NIHR Clinical Research Network will deliver e-learning courses, designed to increase awareness and understanding of innovative trial designs, supplemented with targeted learning for specific groups.

- The government will explore with NHS England how they can publish an action plan on ways to optimise the use of real-world evidence.

Our comprehensive plan this year has helped to secure new commitments from the sector who recognise the UK as a leading place to invest and to undertake innovative trials:

- Celgene provides support for studies initiated by the researcher in areas including haematology, oncology and immunology. They are making a new investment in excess of £7 million and a total investment of £38 million. It will result in 12,500 UK patients receiving the best standard of care and novel treatments, free of charge to the NHS.

- With NIHR facilitation support, IQVIA Ltd. (formerly IMS Health & Quintiles) is committed to opening a fourth UK Prime Site to focus on the delivery of life-changing clinical research across the North of England. In addition, IQVIA Ltd. will invest up to £24 million over 5 years with the ambition of employing over 50 additional highly-skilled staff to drive additional trials across the UK. The Northern Prime Site will include NHS research-ready hospitals across the Greater Manchester, Leeds and Sheffield region, embracing a data-enabled approach to the design and delivery of hundreds of additional clinical trials and real world evidence studies to the benefit of thousands of NHS patients.

- IQVIA Ltd. and Genomics England have announced a new partnership, investing £20 million over 5 years to develop services to allow authorised researchers to run studies enabling faster and more efficient drug research, and to develop more robust evidence to support treatment value and greater access to personalised medicines for NHS patients.

- In May 2018, the Prime Minister announced £40 million over the next 5 years as part of the Tessa Jowell Brain Cancer Mission, doubling funding for brain tumour research. This will be invested through the NIHR to support a wide range of research and the mission’s running costs. The Brain Tumour Charity has now announced £2.8 million for the Tessa Jowell BRAIN-MATRIX trial, aimed at radically increasing opportunities for brain tumour patients to try nonstandard treatments. The NIHR will support the recruitment of patients, and start-up and delivery of the trial via the UK-wide Experimental Cancer Medicine Centres (ECMCs) and the Clinical Research Network. NHS England has also commenced a national neurosciences transformation project, a strand of which will focus on improving the pathway of care for neuro-oncology patients, building on existing work offering neuro-oncology patients access to dedicated outpatient clinics and pre-operative consultations with multidisciplinary teams. Health Education England is committed to ensuring the UK has leading neuro-oncologists to provide outstanding care and deliver ground-breaking research, so it is exploring further education and training opportunities such as credentialing in this area.

Raising the intensity of R&D in the UK

The UK has a world-leading science base, with 4 of the top 10 globally-ranked universities and with UK-based scientists winning more than 80 Nobel Prizes in chemistry, physics, and medicine - most recently winning chemistry prizes in both 2017 and 2018.

The Life Sciences Industrial Strategy emphasised the importance of building on this and continuing to increase R&D spend. In the Industrial Strategy white paper[footnote 15] and the first Life Sciences Sector Deal the government committed last year to work with industry to increase combined public and private expenditure on R&D to 2.4% of GDP by 2027, increasing to 3% over the longer term. In the last year UK Research and Innovation (UKRI) has been formally established to work in partnership with academia, research organisations, industry, charities, and the government to create the best possible research and innovation environment.

Building on this, Budget 2018 announced significant additional support for cutting edge science and technologies, including £1.6 billion to strengthen the UK’s global leadership in science and innovation. BEIS is working across industry and with UKRI to develop a roadmap that sets out the steps needed to reach the 2.4% ambition. A new ambition to triple industry contract and collaborative R&D spend in the NHS to over £900 million will provide a significant contribution to the overall 2.4% ambition.

Latest figures for 2017 show that the total spend on UK R&D by UK businesses was £23.7 billion. Of this, life sciences continues to be the largest contributor at 18% of the UK total, spending over £4 billion in R&D[footnote 16] and making excellent progress against significant commitments in the first Sector Deal:

- MSD announced last year that it would locate its new Discovery Centre in London. Since then, Dr Fiona Marshall was appointed as VP Head of Discovery Research at MSD UK and the plan is for 19 scientists to be in place by the end of the year, increasing to 150 new roles once the Centre is complete. The team of scientists will be studying cell homeostasis in the context of ageing that can lead to disease. The aim will be to identify mechanisms that can be targeted for new drug development for a range of diseases such as Motor Neurone disease, Parkinson’s disease and Alzheimer’s disease.

- In September 2018, Novo Nordisk opened its £115 million Oxford research centre, employing up to 100 scientists aiming to discover innovative treatments for Type 2 diabetes and cardiometabolic diseases.

As part of this second Sector Deal, we are seeing further new commitments from industry, reinforcing confidence in the UK’s R&D strengths and excellent science base:

The world-class research environment has led global pharmaceutical company UCB to invest in 1 of their 2 major global R&D hubs in the UK[footnote 17]. This will involve a purpose-built state-of-the-art facility to enable cutting-edge R&D, early manufacturing and commercial operations, with planned investment of £150 million to £200 million in the facility and around £1 billion total investment over 5 years. The transition to the new facility will support around 650 high-value jobs across R&D, enabling further collaborations with UK universities, biotechs and medical research charities, and build on UCB’s highly successful endeavours in researching and developing medicines in the UK to transform the lives of people living with severe diseases globally.

Roche will invest an additional £30 million in the UK, including £20 million over 3 years into a precision cancer research partnership with The Christie in Manchester. They will use cutting-edge foundation medicine genomic technology alongside big data to accelerate the next generation of digital clinical trials for rare cancers, making the UK a leading global hub for rare cancer trials and potentially benefiting nearly 5,000 patients annually. Roche will also invest £10 million into its Welwyn Garden City site in 2019 to 2020 while creating approximately 100 new highly skilled jobs.

Emphasising the strength of the UK cancer research ecosystem Celgene are investing over £22 million in a 5 year drug-discovery collaboration with Cancer Research UK to discover, develop and commercialise new anticancer treatments. This is one of many oncology R&D investments including: £14 million from Cancer Research UK to turn London into a world-leading hub for cancer biotherapeutics research and treatment; and a £2.4 million investment by Bristol-Myers Squibb to collaborate in a 1-year project, Rubicon, with the Francis Crick Institute and Cancer Research UK to assess the feasibility of using AI to analyse images of lung cancer study samples.

In September 2018, the Electron Bio-Imaging Centre (eBIC) in Harwell was opened by Diamond Light Source following the award of a £15.6 million grant from the Wellcome Trust and UKRI, with £9 million from ThermoFisher Scientific. Wellcome Trust subsequently invested an additional £9 million to significantly expand the facility. The facility is the first high-end cryo-electron microscopy (cryo-EM) facility worldwide to be embedded in a synchrotron and will firmly place the UK as a global leader in providing large-scale industrial access to cryo-EM for drug discovery and structural biology.

In May 2018, Eisai announced an extension to its investment in dementia research within the UK, a new 5-year collaboration with UCL, recognising the high standard of UK science and its universities.

In September 2018, KalVista Pharmaceuticals opened the anchor facility at the Porton Down Science Park, enabled by £5 million funding from 2 earlier Biomedical Catalyst grants. The facility will house its UK drug discovery and development group and will focus on development of new medicines for diseases with significant unmet need.

Business environment

Making the UK a global hub for advanced therapies manufacturing.

Pipette (credit: Randox Laboratories Ltd.) [Credit: Randox Laboratories Ltd.]

The first Life Sciences Sector Deal set out the government’s ambition to make the UK a global hub for advanced therapies manufacturing, responding to Life Sciences Industrial Strategy analysis that highlighted the emerging opportunities for the UK economy from new technologies such as cell and gene therapies. This ambition has been supported by a further £70.6 million of government funding for the Cell and Gene Therapy Catapult (CGTC) to build on our impressive existing national infrastructure and allow the UK to offer end-to-end capability in cell and gene therapies, from research to manufacturing, to clinical use and export, with the transformative benefits of these medicines being felt by NHS patients.

The UK’s capability in this field means we are securing highly-skilled jobs and accessing a global market estimated[footnote 18] to be worth between £9-14 billion per year by 2025. The UK is home to the highest number of cell and gene therapy commercial developers (64) in Europe, as well as the most cell and gene therapy clinical trials[footnote 19]. A cell and gene therapy cluster has formed in Stevenage, supported by the Stevenage Bioscience Catalyst and the Cell and Gene Therapy Catapult Manufacturing Centre: the Campus hosts 14 companies in this industry employing more than 350 people, that between them have raised over £680 million from commercial investors[footnote 20].

A significant portion of the £146 million Industrial Strategy Challenge Funding awarded for medicines manufacturing in the first Sector Deal has been directly targeted at advanced therapies:

- £12 million to double capacity at the Cell and Gene Therapy Catapult Manufacturing Centre. The CGTC opened its Manufacturing Centre in April 2018 to help cell and gene therapy developers build manufacturing capability, backed by £60 million of government investment. In September, the MHRA granted the Centre a Good Manufacturing Practice (GMP) licence, cementing its role as one of the world’s leading facilities for the development and production of cell and gene therapies. Companies are recognising the facility’s value and reaping the benefits. In 2018 2 further collaborators, Freeline Therapeutics and Adaptimmune, signed an agreement with the Catapult and discussions are already taking place for use of new capacity which is under construction at the facility.

- £5.5 million of capital support announced in the first Sector Deal has enabled leading UK viral vector manufacturers to expand their capacity:

- Cobra Biologics, an international contract development and manufacturing organisation in biologics and pharmaceuticals, received £2.5 million to support their £8 million investment in expanding their Keele site to enable production of commercial GMP quality viral vectors for advanced therapies, adding 25 new jobs onsite.

- £3 million of support enabled Oxford Biomedica to invest £19 million in a new manufacturing site which will enable them to target 25% to 30% of the global lentiviral vector bioprocessing market and create 100 new highly-skilled jobs.

- £21 million has been awarded to create 3 Advanced Therapy Treatment Centres (ATTCs). The ATTCs were set up in March 2018 to develop easily run solutions for the adoption of cell and gene therapies that can be rolled out across the NHS. The centres have attracted £5.7 million in co-funding from industry and involve over 20 different companies, in addition to NHS organisations, universities and national blood services.

- Over £12 million of the ISCF funding allocated for medicines manufacturing collaborative R&D projects has gone to advanced therapy projects, de-risking investment in innovation and attracting over £6 million of industry co-funding.

In addition to investments supported by Innovate UK, NHS Blood and Transplant (NHSBT) are expanding their human and capital infrastructure to facilitate the adoption of advanced cell and gene therapies. A new £16 million centre at Barnsley will include clean rooms to increase NHSBT’s capacity for the manufacture of advanced cell therapies, creating 12 highly-skilled new jobs. Further expansion of the Filton facility is proposed and will double NHSBT’s capacity for plasmid, viral vector and protein manufacture, creating 10 new specialist jobs.

These strong signals of UK commitment are generating significant industry activity:

- Investors have recognised the strength in UK-grown advanced therapy biotechs: Orchard Therapeutics raised $150 million (£117 million) from investors in Series C fundraising in August 2018 and $225 million (£175 million) in its initial public offering (IPO) in November 2018, to help it develop clinical programmes to treat rare inherited diseases. Autolus raised over £120 million through IPO in June 2018, while Freeline Therapeutics raised over £88 million of new capital in a Series B financing round.

- The UK’s ecosystem encouraged Bellicum, a clinical-stage cell therapy company, to locate its first European investment in the UK, initially committing £2 million and 20 jobs.

- UK companies are scaling up cell and gene therapy manufacturing capabilities: in addition to Oxford BioMedica’s £19 million investment in a new manufacturing site, we are able to announce that both Autolus and Roslin Cell Therapies Ltd. are investing in new manufacturing sites. RoslinCT, a cell and gene therapy contract development and manufacturing organisation is planning to invest a projected £4 million in the first phase of a new manufacturing facility in Edinburgh. This is expected to bring up to 50 new jobs and will provide commercial stage manufacturing services to advanced therapy developers.

Case study

UK-based company Autolus, spunout from University College London in 2014, is developing potentially life-changing T-cell cancer therapies. Initially supported by UK venture capital from Syncona, Woodford and Arix, and grants awarded by Innovate UK, Autolus recently raised over £120 million in a successful NASDAQ IPO. Autolus now employs more than 180 people. Building on its existing presence in London and as the first partner of the Cell and Gene Therapy Catapult Manufacturing Centre in Stevenage, Autolus is planning further investments of approximately £50 million in the UK. Over the next 3 years they intend to bring a new global launch manufacturing facility on-stream and expand their global headquarters and research laboratories, generating 100 high-value UK jobs.

Supporting the growth of life sciences manufacturing

The government has also supported a variety of projects that will drive up productivity in high-value medicines manufacturing more generally, in particular 2 pioneering new UK centres:

- The Medicines Manufacturing Innovation Centre, Strathclyde. The MMIC will help the UK lead globally in the development of process technologies for small molecule pharmaceutical and fine chemical manufacturing. The £56 million centre is supported by £13 million from the ISCF, as well as funding from Scottish Enterprise (£15 million), AstraZeneca (£7 million) and GSK (£7 million). It is expected to lead to £80 million in R&D investment by 2028, creating 80 direct jobs by 2023 with more indirectly.

- The Vaccines Manufacturing Innovation Centre, Oxford. The centre will help create new, cost effective ways of developing and manufacturing vaccines, building our resilience in the face of pandemic threats. Led by the Jenner Institute at the University of Oxford, Imperial College London and the London School of Hygiene & Tropical Medicine, the new centre has been awarded £66 million from the Industrial Strategy Challenge Fund. Additional funding of £10 million will come from commercial and other partners, including Janssen Vaccines & Prevention B.V. and MSD, and will be supported by bioprocessing expertise and training from GE Healthcare.

Government is continuing to go further to build on this strong progress:

- £8 million was announced in September 2018 as an initial step to facilitate the application of digitally-enabled methods or technologies to improve medicines manufacturing.

- Up to £121 million for the Made Smarter Programme through ISCF wave 3[footnote 21]. Announced at Budget 2018, this challenge will build on this to support the transformation of manufacturing, including in life sciences, through digitally-enabled technologies.

Industry are also making new investments in life sciences manufacturing:

- GW Pharmaceuticals, a pioneering UK-based biopharmaceutical company developing and delivering rigorously tested and regulatory-approved cannabis-derived medicines for seriously ill patients, has spent over £20 million expanding its manufacturing facilities in Kent in the past year and more than £100 million in R&D, creating 111 highly-skilled roles, with an additional 98 planned.

- Eli Lilly and Company has committed £5 million to fund research in collaboration with Imperial College London and UCL into the more efficient manufacture of medicines.

Improving the UK environment for businesses to scale up

The first Sector Deal outlined the government’s response to the Financing Growth in Innovative Firms consultation, addressing issues raised in the Life Sciences Industrial Strategy about supporting scale-up with an action plan to drive over £20 billion of patient capital investment over 10 years.

Since the first Sector Deal was published, private investment in UK life sciences has continued to grow: UK biotech companies raised more than £1.5 billion in the first 8 months of 2018, surpassing the 2017’s £1.2 billion total[footnote 22]. Venture capital is particularly strong with £900 million raised.

A full update on the package of measures set out in the first Sector Deal was published alongside Budget 2018[footnote 23]. A particular highlight for life sciences was the launch of the British Business Bank’s new £2.5 billion investment programme, British Patient Capital, and its investment of £9 million in the £250 million Dementia Discovery Fund, a specialist, 15-year venture capital fund that invests in novel science to create new medicines for dementia.

The government also set out a series of new actions that will help address the Life Sciences Industrial Strategy’s recommendation to increase opportunities for pension funds to invest in the sector by addressing regulatory barriers. For example, the government will consult in 2019 on the function of the pension charge cap to ensure that it does not unduly restrict the use of performance fees within default pension schemes. It also announced plans to help pension funds invest in growing UK businesses. Chaired by the British Business Bank, many of the UK’s largest defined contribution pension providers, including Aviva, HSBC, L&G, NEST, The People’s Pension, and Tesco Pension Fund, have committed to undertake a feasibility study to explore options and develop a blueprint for a pooled investment in patient capital.

The sector is also taking action on this issue: to complement the government’s work to give pension funds the confidence to invest in assets supporting innovative firms, the BIA is conducting a detailed analysis of life sciences investment by large institutional investors and private wealth managers to inform a strategic communications campaign to promote the investment and growth opportunities of early and growth-stage companies.

ONI – Next generation super-resolution microscopy

In 2016, ONI was founded as a university spin-out with the aim of making high-end life science research more accessible to every researcher on the planet by miniaturising Nobel prize-winning microscopy technology. ONI has recently completed a significant series A funding round with international investors and leading life sciences patient capital investor, Oxford Sciences Innovation (OSI). This investment has created an additional 100 high value jobs in Oxfordshire and will be used to create further local jobs in the coming years. Such an international investment is a vote of confidence in the UK’s science companies to grow and scale in the UK. In the future, ONI’s technology could have significant diagnostic applications particularly in the cancer space, as it can identify pathology on cells far more accurately than current state-of-the-art techniques used in the clinic.

How do the Life Sciences Sector Deals benefit SMEs?

SMEs comprise 82% of life sciences businesses, over 56,000 jobs (24% of employment) and £7.2 million in turnover[footnote 24]. UK life sciences spin-out companies outnumber the next largest sector (IT & digital) by almost 2 to 1[footnote 25]. This year we highlight:

- HM Treasury’s Patient Capital Review – in response, HM Treasury launched an action plan to drive over £20 million of patient capital investment to finance growth in innovative, high growth potential firms over 10 years.

- As part of this action plan, doubling the annual allowance for investments through the Enterprise Investment and Venture Capital Trust Schemes – after which UK BioIndustry Association’s (BIA) venture capital data for 2018[footnote 26] shows a large increase in fundraising for the sector in the second half of the year.

- Strengthening collaboration between the NHS and innovators through schemes to support innovative SMEs to develop products for the NHS and support to develop real world evidence and access to innovative trial design.

- Supporting the infrastructure needed for growth including: Industrial Strategy Challenge Fund support for Centres of Excellence in digital pathology and radiology; Advanced Therapy Treatment Centres; and, extending the Cell and Gene Therapy Catapult and Manufacturing centre. These programmes will support innovative SMEs to identify, and develop new products, processes and services that can be rolled out across the NHS. SMEs delivering jobs and growth in the UK include Puridify, now part of GE healthcare who opened their new factory in Stevenage in November 2018 and Purolite, with a new factory in South Wales in October 2018 supporting advanced global bioprocessing demand.

NHS innovation and collaboration

The Life Sciences Industrial Strategy set out a vision for a system that has NHS-industry collaboration at its heart, setting a challenge to create an innovation ecosystem that will deliver improved patient outcomes, service efficiency and economic growth, driving the innovation required to address the challenges that the health system faces.

In the first Sector Deal, we set out our initial steps to achieve this by committing to deliver on the recommendations from the Accelerated Access Review and tackle long-standing barriers to innovation in the NHS: a fragmented landscape where innovators find it hard to access support and the NHS has limited visibility of innovations in the pipeline; limited and variable NHS-industry collaboration leading to misalignment of product development and procurement with NHS priorities, or new technologies failing to provide sufficient evidence for uptake; and difficulty getting new technologies into NHS use and spreading what works.

One year on, we have made clear and concrete progress with partners: for example, the NHS is the first health system in Europe to agree access to CAR-T treatments, achieved through the fastest product approvals in the NHS’s 70-year history and supporting our goal to be a world-leading hub for advanced therapies. This success — with a disruptive technology that required a new pathway and route to market — provides a clear signal that the NHS is eager to embrace innovative treatments and can respond with flexibility and agility to adapt its processes, giving patients access to the most effective new treatments faster than ever before.

Across the system we have also seen improvements to the access environment. The average time from marketing authorisation to first NICE output is now 6 months, and to final NICE guidance is now 10.2 months —3.4 months quicker and 5.7 months quicker than 5 years ago[footnote 27]. And, the Innovation Scorecard shows that 77% of the medicines it measures were prescribed more than the previous year[footnote 28].

Industry and government have successfully reached heads of agreement for a new voluntary branded medicines pricing scheme. The new scheme will ensure patients benefit from access to the best available treatment, through faster adoption of clinically and cost-effective medicines, and demonstrates the government’s ongoing commitment to NHS sustainability, health innovation and the UK pharmaceutical sector.

The proposals are expected to include measures to improve uptake of transformative new medicines, as well as commitments from NHS England to provide more proactive uptake support and implementation planning for innovative, cost-effective medicines that provide a significant health gain. This includes committing to achieving uptake levels in the upper quartile of comparator countries for the 5 highest health gain disease classes; more and faster NICE appraisals for new medicines; increased support for small businesses, through exemptions from the cost control mechanism; targeted case management of commercial discussions with NHS England; and greater commercial flexibility for companies that offer the best value new medicines.

In addition to these significant achievements, we have taken the following additional steps to tackle the barriers to innovation:

To simplify and improve the fragmented landscape, we have:

- Established the Accelerated Access Collaborative (AAC) under the leadership of Lord Darzi to improve patient access to innovation. In October, we announced the first 11 products that we will support, potentially improving the lives of 500,000 patients. In early 2019 the AAC will select more products to accelerate through the system.

- Coordinated horizon scanning through ‘HealthTech Connect’, developed by NICE and NHS England to help innovators hold early discussions about market access, and give the NHS a better sense of emerging technologies.

We are strengthening collaboration and co-development between the NHS and innovators:

- £24 million from the Digital Health Technology Catalyst awarded to 26 SMEs is supporting growth in the digital health sector and developing digital solutions the NHS needs.

- £7 million under the NHS Test Bed programme (Wave 2) is helping 7 projects to support real world testing of innovations, and prove their suitability for scaling.

- A new scheme for SMEs has been established, with £1.5 million to design and undertake real-world evidence development and a further £4.5 million available over the next 2 years.

We are improving access to new technologies in the NHS:

- 3 medicines have been appraised and recommended through NICE’s fast-track appraisal process – delivering recommendations on average 4 months faster than standard appraisals.

- The new commercial function at NHS England is increasing the NHS’s capability to engage earlier, and more flexibly, with the life sciences sector.

- We have strengthened Academic Health Science Networks (AHSNs) with a clear mandate to work with industry and local NHS partners to: understand local health and care needs; support system navigation; provide access to testing; and support the adoption and spread of products in the NHS. This has underpinned AHSN engagement with 1,173 companies this financial year leading to 86 long term strategic partnerships for companies with the NHS.

- NHS England’s Innovation Technology Payment is supporting products to overcome procurement and financial challenges, with further products to be agreed in 2018 to 2019.

Progress on industry Sector Deal commitments