The Patent Office Annual Report and Accounts 2021 to 2022

Published 19 July 2022

The Patent Office Annual Report and Accounts 2021/22

The Patent Office

Annual Report Presented to Parliament pursuant to section 121 of the Patents Act 1977, section 42 of the Registered Designs Act 1949 and section 71 of the Trade Marks Act 1994, and accounts presented to Parliament pursuant to section 4(6) of the Government Trading Funds Act 1973 as amended by the Government Trading Act 1990.

The Patent Office is an Executive Agency of the Department for Business, Energy and Industrial Strategy.

2021/22 Annual Report & Accounts

Ordered by The House of Commons to be printed 19 July 2022

HC 296

© Crown copyright 2022

ISBN: 978-1-5286-3230-0

E-Number: E02726003

Chair’s statement

Harry Rich - Intellectual Property Office Steering Board member

Harry Rich is Registrar of Consultant Lobbyists, Chair of the Valuation Tribunal Service, non-executive director of the Press Recognition Panel, governor of the Glasgow School of Art, an Executive Coach and business advisor. He is a non-practising solicitor, Companion of the Chartered Management Institute and Fellow of the Royal Society of Arts

Harry was Chief Executive of the Royal Institute of British Architects and of Enterprise UK, Deputy Chief Executive of the Design Council and developed and sold two businesses. He has been a board member of the Advertising Standards Authority, the government’s Creative Industries Council and the US-based Design Management Institute.

The role of the Intellectual Property Office (IPO) Steering Board is to support, constructively challenge and provide leadership to the Executive Board, including the Accounting Officer, by providing strategic advice and guidance on the operation and development of the IPO.

During 2021/22, in addition to oversight of delivery and finances, the Steering Board has provided advice and guidance on the refresh of the IPO Strategy to 2026, Corporate Priorities, One IPO Transformation Programme, accounts and risk management.

I was appointed as Chair of the IPO from 1 October 2021 and have been impressed by the quality, skill and commitment of the IPO’s executive and non-executive leadership. I want to express my thanks to Kevin Orford for his stewardship of the IPO Steering Board as Interim Chair.

Over the past year the Covid-19 pandemic presented unprecedented challenges to the IPO, to our people and to our customers. Our teams across the organisation worked with immense professionalism, commitment, and flexibility to ensure that we continued to meet our customers’ needs and develop the IPO for the future.

I am pleased to report that we met all our Ministerial targets and made considerable progress in delivering the IPO’s Strategy. Launched in 2018, our strategy sets out how we will support the Government’s ambition of making the UK the most innovative country and the best place to start and grow a business. We aim to support this by making life better through intellectual property (IP) and our ambition of being the best intellectual property office, by delivering excellent IP services, by creating a world leading IP environment and by making the IPO a brilliant place to work.

Over the past year we have seen unprecedented demand across our rights areas. We have made significant progress in reducing our patent backlog and have seen a significant increase in demand for both trade marks and designs. Our overall customer satisfaction score demonstrates that we have continued to provide excellent customer service across all registered rights. Our people have continued to deliver for our customers in extremely difficult circumstances, adapting to changing customer needs and continuing to put our customers at the heart of everything we do. Our people are our greatest asset and are at the forefront of our continued success. The annual IPO People Survey showed that we maintained our overall engagement score and we remain a Civil Service High Performer for employee engagement. A GIAA audit of our culture took place in 2021 and we received excellent feedback about how we have informed and connected with our people during the pandemic. We continued to support remote working and have invested significantly in adapting our offices to support hybrid working.

We move into 2022/23 with huge ambition to deliver the key priorities of our new strategy to 2026 and to play a fundamental role in ensuring the UK becomes the most innovative and creative country in the world. As well as further improving and delivering our core services, we will embark on the next phase of our One IPO Transformation Programme, which will align the IPO’s services to an increasingly digital environment, ensuring a continued focus on our customers and on our support of our people.

I would like to personally thank the whole IPO team for their professionalism and dedication over another challenging year and for working together to deliver the achievements set out in this annual report.

Chief Executive’s introduction

Tim Moss: Intellectual Property Office, Chief Executive Officer

I am delighted to introduce the Annual Report and Accounts for 2021/22

Our Corporate Plan 2021/22 was the fourth and final year under our Intellectual Property Office Strategy 2018/2021. Although the Covid-19 pandemic presented challenges for us, we delivered significant achievements over the year including:

-

excellent customer satisfaction, reducing our patent backlog by 98% and registered record levels of trade marks and designs;

-

completing all the foundation work necessary to ensure we can deliver Transformation successfully and making significant progress toward completing the work to design our new services based on copious customer research;

-

submitting policy proposals to Ministers to meet the future challenges and opportunities of Artificial Intelligence (AI);

-

developing key strategic aims within Europe and agreeing to establish an IP attaché post in Brussels to maximise the impact of our new relationships with EU partners;

-

successfully launching the Counter-Infringement Strategy to address IP crime and infringement over the next five years; and

-

remaining a high performing organisation in the Civil Service People Survey

It has been a successful year

This report sets out the detail of our achievements this year and I am pleased to provide my perspective on our performance over 2021/22.

Like all organisations the IPO continued to be affected by the Covid-19 pandemic and throughout the year a high percentage of our workforce worked remotely. As we began to emerge out of the Covid-19 pandemic with the easing of restrictions during 2021/22, our teams worked brilliantly to support our workforce to move to a hybrid working model and we invested further in upgrading our infrastructure to support this.

Delivering IP for our customers remains central to what we do at the IPO and we have continued to provide excellent customer services, achieving a customer satisfaction score of 88% in quarter 4 and exceeding our target of 85%. This is despite seeing increased demand of 2.4% for patent searches, 8.5% for examination requests, 16.1% for trade marks and 71.8% for designs. In dealing with this record level of workload we recruited additional staff and continued to monitor demand to ensure we have the right resource in place to support our services and our customers.

This year we delivered the next steps of our customer strategy, implementing our ‘closing the loop’ framework to help us resolve customer experience issues and updated our quarterly customer satisfaction survey to improve our understanding of the needs of our changing customer base post-Brexit. We also supported businesses to recover from the impact of the Covid-19 pandemic by launching our new financial support scheme for innovative, high-growth potential Small and Medium-Sized Enterprises (SMEs).

We are consistently ranked as having one of the best IP regimes in international indices [footnote 1] and most recently this was confirmed in the US Chamber 2022 International IP Index where we were ranked second.

To understand how Artificial Intelligence (AI) impacts the IP framework and to meet future challenges and opportunities, we took forward 11 actions over the course of the year and further developed our understanding of the interaction between AI and IP. We carried out a further Call for Views on AI and IP and have submitted policy proposals to Ministers, ready to deliver new legislation as part of the Retained EU Law Bill.

As part of the EU-UK Trade and Cooperation Agreement, we held our first IP Specialised Committee (IPSC) with the Commission and its Member States covering a range of IP matters including legislation and policy developments. During the year we developed our key strategic aims within Europe and held several bilateral meetings with European countries to set the foundations for the IPO to strengthen relationships and enhance our cooperation across leading countries in support of IPO interests. To further support our objectives in Europe and the EU, the IPO Board approved the recruitment of a European IP attaché based in Brussels and during the year we also continued to increase the UK’s influence at the World Intellectual Property Organisation (WIPO).

We continued to reach out to educate businesses, young people, and universities about the importance of IP by publishing a Business Lifecycle framework, implementing our cross-government IP Capability strategy, launching an IP in Education framework; and we extended our flagship IP for Research Education programme.

Reducing IP crime and infringement remained a key priority this year and we published our Counter-Infringement Strategy 2022 to 2027. We significantly strengthened our Intelligence Hub and made headway in reducing crime and infringement, with highlights including our support to a multiagency investigation led by the North West Police Intellectual Property Crime Unit into the use of self-storage facilities by organised crime groups in the Manchester area. Approximately 55 storage units were searched, and over 200 tonnes of counterfeit goods were recovered, with an estimated value of over £500 million.

The IPO is already a great place to work and we are committed to making it a brilliant place to work. We maintained our engagement score in the Civil Service People Survey, and we remain a Civil Service High Performer. A Government Internal Audit Agency (GIAA) audit of our culture took place in 2021 and focused predominately on our engagement response to the Covid-19 pandemic.

The findings were hugely positive and showed how we have informed and connected our people during the Covid-19 pandemic, leaving them feeling supported, valued, and included.

The physical and mental health of our employees is paramount and many of the employee initiatives we put in place at the start of the Covid-19 pandemic have remained. We have continued to invest significantly to allow our people to move to a hybrid working model, and to provide a welcoming and safe return to the office for those who wish to work on-site.

Looking forward

Our ambition is to be the best IP office in the world and going forward our 2022/23 Corporate Priorities build on this and support the UK’s ambition to be the most innovative and creative country in the world. Our focus over the next year will be continuing to deliver our core IP services alongside our Transformation programme, which will transform our services to our customers by making better use of modern digital technology. We will also further develop the IP Framework to keep pace with societal change; and continue to create an environment where our people can thrive through our ‘One IPO’ approach. We will work to build upon our culture to ensure our people are supported, focusing on our organisational needs, including leadership development, hybrid working and organisational design.

The achievements and successes through this year demonstrate our ability to address challenges and our commitment to making life better through IP. This has only been possible through the incredible dedication and hard work of everyone at the IPO. I have recently announced that after 5 years as CEO of this amazing organisation I will be moving on at the end of August. The team at the IPO have delivered so much in that time, through Brexit and Covid, and have a real focus on serving the customer and supporting each other. They are a fantastic staff group and I am immensely proud to be their CEO and thank them for their great work.

Tim Moss CBE

Chief Executive and Accounting Officer

14 July 2022

Performance report

Part 1: Overview

As the UK government body responsible for IP, the IPO’s purpose is ‘Making life better through IP’. IP underpins our economy, drives innovation and investment is vital to tackling the world’s largest challenges. We must support those who research, create, and invent, strengthening the UK’s position as a global science superpower and an innovation nation. We want the UK to be the best place in the world for inventors, creators, and innovators to build on their ideas and find success; IP is fundamental in achieving these ambitions.

Our organisation is led by the Chief Executive and Accounting Officer, Tim Moss. The IPO has seven directorates each headed by a director. The IPO corporate governance structure comprises of the Executive Board (IPOB), supported by three subcommittees and a Transformation programme board, the Steering Board and the Audit and Risk Committee, each with complementary functions. Our non-executives provide advice and an external perspective to the organisation and further details of our corporate governance structure is described in our Framework Document [footnote 2] and in our Governance Statement.

Our Strategy [footnote 3] sets out a framework for how we will support the UK to be the most innovative and creative country in the world. To help deliver the ambition set out in our strategy, we develop and agree an annual corporate plan, setting out our key priorities for the year and how we plan to achieve them. The IPO’s performance is measured against key targets, including those which are set annually by the Minister, following consultation with the Chief Executive and the Steering Board.

This section of the Annual Report and Accounts reflects the performance of the organisation against our Ministerial Targets and Corporate Priorities set out in the 2021/22 Corporate Plan, providing a view of progress, and outlining future plans to support achievement of our strategic objectives. Details of the key risks faced during the year can be found in the Governance Statement.

IPO Strategy:

IP touches everything that makes modern life more enjoyable, easier, safer, and prosperous. Our work gives researchers, inventors, and creators, whether as individuals or businesses, the confidence to invest their time, energy, and money in doing something new - making life better.

We are helping the UK to become the most innovative and creative country in the world. In doing this we will:

Deliver excellent IP services

Delivering IP services for our customers is central to what we do at the Intellectual Property Office (IPO) and to be excellent we know that we must:

-

deliver timely, reliable, and quality services;

-

provide end to end digital services that support our vision of providing ‘One IPO’ services and are the same quality services that customers receive elsewhere; and

-

ensure that our data helps our customers, through improving services and increasing knowledge

Create a world-leading IP environment

The UK has a world class IP system; however, this is only part of the picture. We want the whole IP environment to be world leading and our strategic approach is to:

-

provide certainty to our stakeholders by developing the legislative and policy framework;

-

increase IP’s impact through awareness and education; and

-

reduce IP crime and infringement

Make the IPO a brilliant place to work

The IPO is already a great place to work, and we want to make it a brilliant place to work, where everyone is dedicated to providing the best services for our customers. Our three key focus areas are:

-

having solid foundations to retain and attract the right people;

-

having a great culture, with shared values and behaviours, a respect of difference and a common purpose; and

-

having healthy people working in a healthy environment

Our awards

Our awards: Investors in People, Stonewall Diversity Champion, Carer Confident, Silver Corporate Health Standard, Chwarae Teg, Bronze Business Disability Forum, Disability Confident Leader, Gold Cycling Friendly Employer, Top 10 Employer 2020

Performance summary

We have achieved our Ministerial targets and have made significant progress against our Corporate Priorities. Key highlights from 2021/22 include:

-

exceeding a challenging customer satisfaction target of 85% with an average customer satisfaction score of 88% (Ministerial target);

-

processing a record number of trade marks (16.1% increase) and designs (71.8% increase);

-

reducing our backlog of overdue examination requests by 98% from 6,007 at the start of the year to 141 at the end of the year;

-

issuing 97% of Tribunal decisions within our key timeliness target of 90%;

-

opening our new digital renewals service, that reduces renewal time for IP rights from 5 days to 5 minutes, for all customers;

-

concluded a major three-year project with the Brazilian IP office to dramatically improve IP services, supporting domestic innovators as well as UK exporters and investors;

-

recruited a new IP attaché based in the Gulf Cooperation Council, delivering IPO objectives in a significant region for UK trade and investment;

-

played a central role in bilateral and multilateral trade negotiations supporting UK interests in free trade agreements and ongoing discussions on IP and health;

-

submitting policy proposals to Ministers following the analysis of the Call for Views on Artificial Intelligence and Intellectual Property, which were formally agreed (Ministerial target);

-

completing a Call for Views to better understand how the current framework for Standard Essential Patents is functioning to support innovation and to establish whether change is needed;

-

delivering a new Counter-Infringement Strategy that sets the vision to ensure the UK stays at the forefront of this work, setting up an IP intelligence centre of excellence and the right structures and processes to deliver a step change on IP infringement at home and internationally;

-

receiving the Gold Workplace Wellbeing award from mental health charity, Mind, and being ranked fifth in the UK;

-

achieving an efficiency outturn of 17.1% (Ministerial target);

-

retaining our Silver Fairplay Employer award, showing our commitment to making the IPO a fair place for everyone;

-

maintaining our overall engagement score of 73% in our Annual People survey, the highest level of engagement since the current Civil Service People Survey was launched in 2009, and remaining a Civil Service High Performer for employee engagement; and

-

adapting our workspaces and investing in infrastructure to ensure that we could support a hybrid model of working, both now and in the future

Part 2: Performance analysis: Review of IPO business 2021/22

Financial summary

The financial performance and position for 2021/22 reflects an unusual but successful year for the IPO.

Despite the ongoing uncertainties associated with Covid-19 and the UK’s departure from the EU, we have proactively anticipated and delivered the increased and unprecedented levels of demand these have generated.

During this time, we have also significantly increased output to successfully tackle and clear backlogs of fee bearing work. As a result, we have recorded a record high operating income figure of £164 million (£122 million in 2020/21).

In order to meet demand, we have scaled up our frontline and support services with a mix of permanent and temporary staff which accounts for the majority of our increase in spend. Overall, costs were £137 million for the year (£122 million in 2020/21); the net impact is an unusually high retained surplus of £27 million for the year (£53 thousand deficit in 2020/21).

The retained surplus has been added to our general reserve which stands at £113 million at the end of the reporting year (£87 million at the end of 2020/21), with cash and cash equivalents increasing to £111 million (£99 million at the end of 2020/21).

This level of reserve will cover known liabilities, including funds held on behalf of deposit account customers and the EPO, planned transformation and other investment related activity and, given our self-funded status, working capital.

Looking forward to 2022/23, our working assumptions and Corporate Plan budget demonstrate a more stable position in terms of demand for our services and a closer alignment of operating capacity and costs. A reduction in reserves to normal working capital levels is expected in the medium term as our investment in transforming our services continues.

We have also begun scoping work for a potential review of our fees, to ensure these are aligned with volume and cost predictions as we transform our services.

Ministerial targets

Our Ministerial Targets are set annually, aligned with wider government objectives and our ambition and strategy. These are laid in Parliament in a written Ministerial Statement. We prioritise our work around these targets.

We measure our performance against these targets and report to our Steering Board, IPO Board (IPOB) and committees. This is done through reports outlining: current delivery status; delivery confidence; route to green for any targets reporting amber or red; and an analysis of progress. These are all reviewed and discussed monthly.

Our targets for 2021/22 and performance against these are set out below:

Customer

- average overall customer satisfaction with the IPO of 85% or more in Quarter 4 2021/22

Target exceeded: 88%

Future proofing the IP Framework:

- consult on changes to patent and copyright law to meet the future challenges and opportunities of artificial intelligence, and present recommendations to Ministers by Quarter 4

Target met and work delivered in full: Policy proposals were presented to Ministers and formally agreed.

Efficiency:

-

delivering our services efficiently through continuously improving our systems, processes, and ways of working to make things better for our customers and our people. Our target is to achieve efficiencies worth at least 3.5% of our core operating costs.

-

during the year we achieved £1.8m in savings from our commercial activity, process efficiencies in our policy and support areas worth £250k, and an increase in outputs in our rights granting that secured £16m net additional income. This included processing 59% more trade marks and 133% more designs than the previous year.

Target exceeded: 17.1%

-

we recognise that net additional income - increased income off-set by marginal cost increases - is not a direct measure of efficiency, however this has been used as a proxy indicator in this calculation for many years. Given the exceptional result this year due to the high volume of additional trade mark applications received and the significant backlog cleared, we are developing alternative measurements of our efficiency for future years.

-

in addition to the Ministerial Targets, we are required by HM Treasury to achieve a Return on Capital Employed (ROCE) of at least 3.5%, over a five-year period

Target exceeded: 28.2%

- this target has also been affected by the exceptional conditions this year, with the high volume of additional trade mark applications received and the significant backlog cleared creating a higher return. ROCE is expected to return to normal levels in future years.

Corporate priorities 2021/22

Delivering excellent IP services

We are committed to putting our customers at the heart of the IPO and this is reflected in our efforts to deliver excellent IP services.

During 2021/22 we experienced unprecedented demand, and this impacted our ability to meet some of our customer service standards. However, we made concerted efforts across our operational teams to recruit and train new staff, and improve processes, all of which enabled us to improve our performance throughout the year. These improvements have been appreciated by customers who continued to rate our services highly; this year we exceeded a challenging customer satisfaction target score of 85% with a result of 88% in quarter four. We have also increased transparency around our performance by publishing our customer service standards [footnote 4] online.

This year we continued implementing our ‘closing the loop’ framework to help us resolve long-running customer experience issues by using our customer experience dashboard as a basis for our work. As of March 2022, we made progress on 95% of issues with 36% fully resolved, resulting in improved customer experience, further removal of delays and barriers and increased efficiency of our internal processes. We expanded our communications regarding how we ’close the loop’ on customer feedback, both internally and externally, through the IPO Blog and our social media videos. Close monitoring of customer feedback and contact with our Information Centre allowed us to respond rapidly to emerging issues.

Understanding our customers is crucial to delivering excellent IP services. We updated our quarterly customer satisfaction survey to help us understand the needs of our changing customer base post-Brexit, and commissioned research to understand if timeliness targets for patents services are fit for purpose.

The IPO webpages [footnote 5] are a valuable resource for our customers and are often the first place people go to find out more about IP. This year a cross-IPO project, in collaboration with an external research partner and the Government Digital Service, has reviewed our online ‘pre-apply’ guidance to ensure it can be found and understood. We began to implement some beneficial changes, and plans are in place to make further improvements over the next financial year.

Image of a mobile phone - text within image 'During the year we capture approximately 10,000 pieces of customers feedback'

Customer relationships are key to understanding business, inventor, and creator needs. We reviewed our approach to managing our relationships with customers, to ensure we take a strategic approach in line with our customer strategy. This work included benchmarking with other IP offices and Government departments and our new customer relationship framework will be implemented in 2022/23.

During the year we received 262 complaints and captured approximately 10,000 pieces of customer feedback. The IPO Customer Charter [footnote 6] and complaints procedure [footnote 7] can be found on our website. This valuable insight from our customers informed the areas of focus set out above, including improving the timeliness of our services and our efforts to close the loop on customer issues.

To support businesses to recover from the impact of the Covid-19 pandemic, we launched our new financial support scheme for innovative, high-growth-potential Small and Medium-Sized Enterprises (SMEs) and received 301 applications for funding support, exceeding our target of 285. The estimated value of the scheme was £1.33 million.

We have also reached a record number of businesses through our IP Audits scheme, which provides part-funding towards a specialised service carried out by an IP professional to support businesses to identify, manage and protect their IP assets so they can maximise their value.

Timely, reliable and quality services

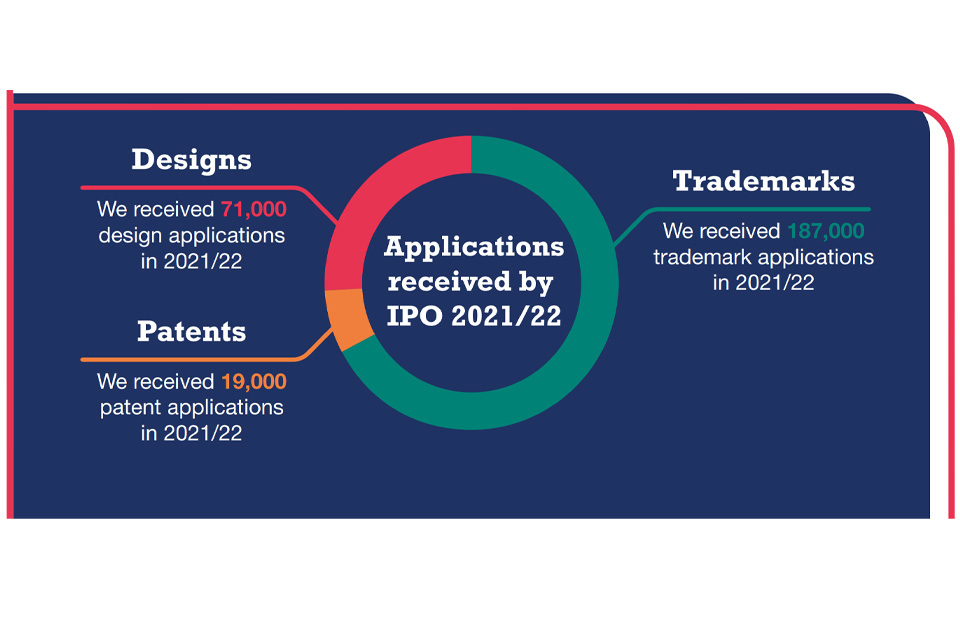

We have continued to ensure high quality rights granting, rights management and tribunal services for patent, trade mark and design customers and we continued to see an overall growth in demand for our services. We have made significant progress clearing our backlogs of cases and the following graphs and commentary provide more detail for patents, trade marks and designs:

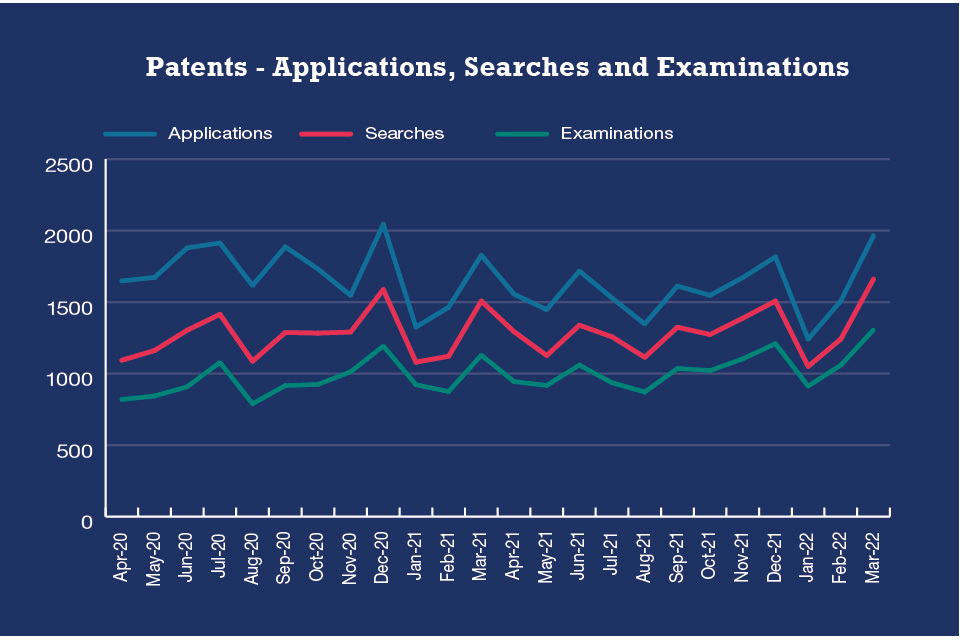

Patents - Applications, Searches and Examinations graph

We received 19,000 patent application requests in 2021/22, a decrease of 7.8% compared with 2020/21.

There were 15,600 requests for searches made in 2021/22, a 2.4% increase compared with 2020/21. We also received 12,400 examination requests, an 8.5% increase on the previous financial year.

We delivered 96.9% of requests for an accelerated two-month turnaround for search, publication, and examination against a target of 90%.

We maintained our turnaround for searches done in-house at six months, with only 859 searches over six months old remaining to be done at the end of the year.

We nearly eliminated our backlog of overdue examination requests, which stood at 6,007 at the start of the year, reducing it to 141 at the end of the year.

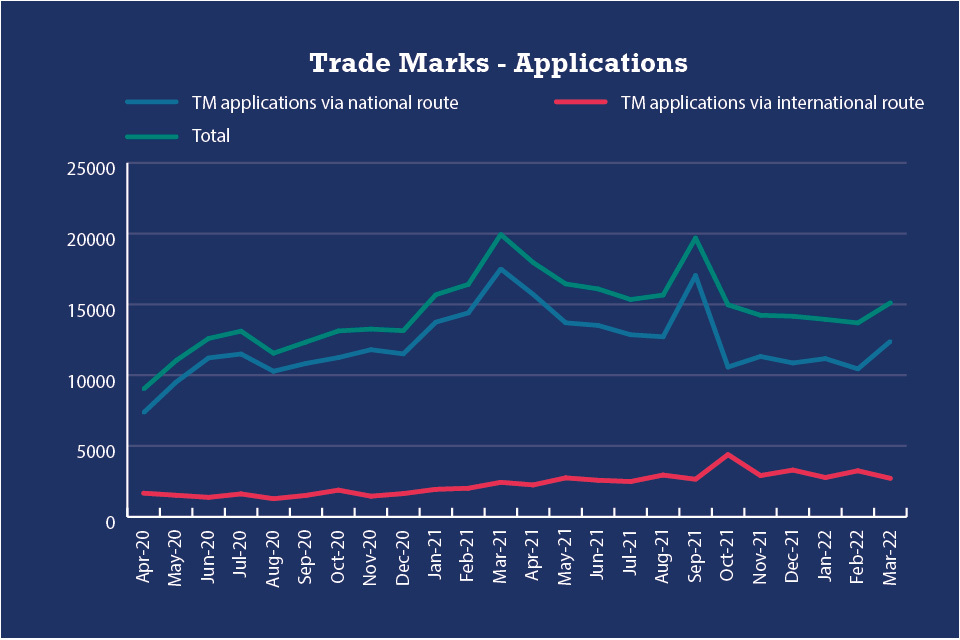

Trade Marks - Applications graph

We received a record level of 187,000 trade mark applications in 2021/22, an increase of 16.1% over 2020/21.

This was made up of 152,000 national trade mark applications in 2021/22, an increase of 8% compared with 2020/21.

There were 35,000 international trade mark applications, an increase of 72.3% compared with 2020/21.

The World Intellectual Property Office (WIPO) saw a 71% increase in UK designations in Q4, 2021/22 compared to the previous year, and these will flow through to us in 2022/23.

Although our input has increased significantly this year, we have reduced our backlog to return to our normal customer service standards which has improved our customer satisfaction for our trade mark services. At the beginning of the year, it took around 3 months to examine a trade mark, this has now returned to our previous standards of 5-15 days. We will monitor demand to ensure we have appropriate resource to continue to support our services and achieve our high level of customer satisfaction going forward.

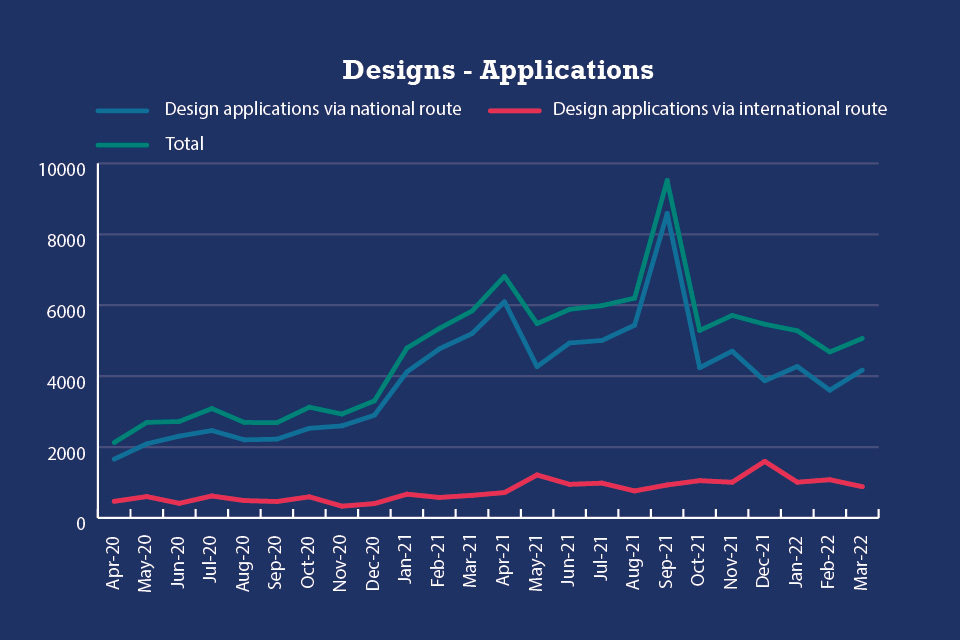

Designs - Applications graph

We received a record level of 71,200 design applications an increase of 71.8% over 2021/22.

This was made up of 59,000 national design applications in 2021/22, an increase of 68.6% compared to 2020/21.

There were 12,200 international applications received in 2021/22, an increase of 93.9% compared to 2020/21.

As a result of our record levels of input, our time to examine a design application increased to around 8 weeks during the first part of the year, however since the start of 2022 we have returned to our normal customer service standards of 5-15 days to examine an application.

This has been reflected in improved levels of customer satisfaction for our designs service.

We will monitor demand to ensure we have appropriate resource to continue to support our services across trade marks and designs and achieve our high level of customer satisfaction going forward.

For trade mark and design ex parte hearings [footnote 8], we met our target to issue reports within 10 working days of a hearing.

Our Tribunal service issued 97% of decisions within 12 weeks of a hearing or within 12 weeks of all submissions being filed or the deadline date.

Applications received by the IPO by 2021/2022

End to end digital & data

This has been an unprecedented year as we emerged further out of the Covid-19 pandemic and moved increasingly to a hybrid working model. We continued to support services and staff remotely, as well as a growing number of people returning to our offices. We developed our hybrid working model with the introduction, in our offices, of collaboration technologies, the piloting of a digital desk-booking system and improvements to the remote management of devices. Furthermore, we onboarded a significant number of new starters to the IPO, representing a 30% increase in our workforce. Despite this, the overall availability of our business-critical internal systems remained above our 99% target, at 99.9%. However, for our customer-facing systems we fell just below our 99.5% availability target, with a result of 99.4%, largely attributed to the age and legacy nature of our current systems, and increased demand.

Our One IPO Transformation Programme will deliver outstanding customer-focused services, fit for the 21st century and we made significant progress over the last year. As set out in our 2021/22 Corporate Plan, the priority for this year was to move into the delivery phase and start building our new services.

Over the last year we have:

-

opened the new digital renewals service, that reduces renewal time for IP rights from 5 days to 5 minutes, for all customers;

-

talked to over 100 customers to understand what they need from our new digital services and test and refine our initial thinking;

-

developed prototypes of the new IPO customer accounts, as part of the Manage IP service;

-

completed initial research to understand what customers need from the Secure IP service;

-

started initial research to understand what customers need from our Research IP service, which will allow customers to search and analyse UK IP rights;

-

built a Business Change team and a network of change agents across the business;

-

engaged and communicated with our people every step of the way to ensure they can be part of the change and help shape the benefits Transformation will bring; and

-

worked closely with the Government Digital Service (GDS) to ensure our plans align with their requirements

To support our commitment of being a data-led organisation and the need to have data at the heart of our transformational thinking, we unified our IT and Data teams into a single department. Our Data team matured significantly under the guidance of our interim Chief Data Officer and published an agreed Governance Roadmap and appointed Data Governors and IPO home-grown Stewards to support our Data Owners. Our Centre of Excellence was further strengthened by the implementation of a Data Sharing Office, to manage the sharing of IPO data with both public and private organisations.

Our Data Strategy is integral to our ‘One IPO’ Transformation Programme, with a new workstream created to introduce a strategic Data Tool and deliver against best practice plans for migration, cleansing, storage, and processing of data. The workstream will also drive the quality rules to be implemented and enforced, to deliver a consistent, compliant data access layer. This will provide trusted accessible data for our future IT services, for longer term exploitation.

Transformation is a strategic priority for the IPO, and we have made significant progress over the last year, through the building of common technology components that will underpin our new Digital Services. The common components will enable a building block approach that allows easy configuration of new services and the ability to flex and adapt to meet future needs. These have been built on Cloud technologies, creating truly scalable and highly available platforms to support the ever-increasing demand for our IPO services now and in the future.

Creating a world leading IP environment

Developing the Legislative and Policy Framework

Our focus this year has been to work across government and with key stakeholders to ensure that IP plays a key role in unleashing innovation, and making sure the IP framework is fit for the future by building in agility, so that is it responsive to the changing needs of innovators, creators, businesses and consumers.

To align with the government’s ambitions on Artificial Intelligence (AI) technology and following the publication of the Call for Views on AI and IP [footnote 9], we took forward 11 actions over the course of the year and further developed our understanding of the interaction of AI and IP by:

-

completing two studies, one on AI and enforcement and the other on the impact of IP on investment in AI;

-

holding a series of university-led seminars, each focusing on a different aspect of AI and IP;

-

working with domestic partners and internationally in a range of forums;

-

developing guidelines on patent exclusion practice for AI inventions;

-

consulting further on AI authorship, inventorship, and text and data mining; and

-

considering further uses of AI technology in the IPO’s operations

Following the Call for Views, we submitted policy proposals to Ministers which were formally agreed, meeting our Ministerial target.

To understand the most appropriate exhaustion of rights regime for the UK, the government launched a twelve-week public consultation beginning in June 2021 and closing on 31 August 2021. Over 150 responses were received from a range of sectors including health, retail, and the creative industries. In January 2022 the government published a ‘Summary of Responses’ [footnote 10] to the consultation which set out an overview of the range of views received. However, the government also announced that an initial analysis of consultation responses had indicated that there was insufficient quantitative data to understand the economic impact of alternatives to the UK’s current exhaustion regime. As such, the government elected to maintain the existing exhaustion regime and reconsider the evidence before it comes to a decision in 2022. Despite this, we continued to liaise closely with key departments and engage key stakeholders to discuss next steps and provided further advice to the Minister on ways to capture views on the UK’s future regime.

During the year we worked closely with government partners to negotiate modern and ambitious IP elements within the new trade agreements with Australia and New Zealand. We engaged successfully with the Crown Dependencies and Overseas Territories to extend international treaties, and to allow them to trade and engage within the international IP ecosystem. We successfully extended The Treaty of Rome, The WIPO Copyright Treaty and The WIPO Performances and Phonograms Treaty to Gibraltar.

In October 2021, as part of EU-UK Trade and Cooperation Agreement, we held our first IP Specialised Committee (IPSC) with the Commission and its Member States. The meeting covered a range of IP matters including legislation and policy developments and featured positive and open discussions, resulting in working level meetings with the Commission across several policy areas.

During the last year we developed and mapped out our key strategic aims within Europe and set these out in the new International Strategy. We held several bilateral meetings with European countries which set the foundations for the IPO to strengthen relationships and enhance our cooperation across leading countries in support of IPO interests. A key achievement was affirming our relationship with Switzerland and signing a Declaration of Intent in February 2022 which formalised our future engagement and set out a range of commitments from both Offices to collaborate on areas of mutual interest. To further support our objectives in Europe and the EU, the IPO Board approved the recruitment of a European IP attaché based in Brussels and we expect to fill this post by the end of quarter two, 2022/23.

Ensuring the copyright framework remains balanced and fit for purpose, whilst encouraging creativity, innovation and fair outcomes for all users, continued to be a key priority this year. Our teams worked with colleagues across government to consider issues in the music streaming industry and commissioned research on equitable remuneration, contractual adjustment mechanisms, and reversion of copyright. We began engaging with music industry representatives via a music industry Contact Group and ran technical working groups on streaming metadata and contract transparency. In preparation to join the Beijing Treaty on Audio-visual Performances, we ran a Call for Views seeking stakeholder input on how the UK should implement the Treaty.

We have also carried out a postimplementation review of changes made in 2016 to Section 72 of the Copyright, Designs and Patents Act 1988. The review [footnote 11] was published online in February 2022, and recommended that the existing legislation should be retained, with the government to provide further guidance in this area.

In line with the government’s commitment to ‘levelling up all areas of the UK’, we developed our new IPO Places Strategy which sets out how we will move to a places-focused approach across all our activities over the next three years and how we will support the aims of the recently published Levelling Up White paper [footnote 12]. As part of our Places Strategy, we continued to develop our regional policy posts, with three advisors based in the West Midlands, Greater Manchester and West of England who work with our regional partners, including Local Enterprise Partnerships, Growth Hubs and Combined Authorities. We expanded the remit of these posts to support knowledge exchange and provide guidance on international markets. We have developed new strategies to reflect our expanded work, along with a revised framework to set out clear objectives for the roles. Our advisors continued to build capability and capacity within their regions and worked successfully with local policy makers to influence the inclusion of IP in regional support. This includes funding and support programmes for SMEs with ambitions to innovate and grow, and targeted IP training to empower local advisors. These activities worked to encourage behavioural change in decision makers, local advisors and innovators through raising the importance of IP as an asset within the innovation journey.

Increasing IP’s impact through awareness and education

So that businesses have the right information, guidance, and support at the right time to make informed decisions about their IP assets, we developed and published a Business Lifecycle framework and shared it with our partner organisations. The framework uses questions to help businesses identify what they need to know and how to find guidance and support. Furthermore, the framework helps businesses make informed decisions about strategic use of their IP assets so they can be confident when investing time, energy, and money in innovation.

Over the last year we implemented our cross government IP Capability Strategy to ensure civil and crown servants recognise and reflect IP in their policy making, identify and effectively manage IP, and make informed decisions involving IP. We helped develop guidance on knowledge asset management in government and developed and delivered IP training sessions to Civil Service professionals across government to support management of knowledge assets. We also piloted the cross-government IP Capability educational materials across government to thoroughly test them, and we are developing them into digital resources to provide a tailored, interactive learning experience to meet the needs of Civil Service professionals across government. Our IP training approach will also help to support the network of IP experts across the Civil Service, to improve cross government IP capability.

We want young people from primary, to higher education to understand IP and how it supports innovation, enterprise, and creativity. Learning about IP will help prepare young people for employment, develop responsible digital citizens, support levelling up across the UK, and inspire the next generation of innovators and entrepreneurs. We developed and launched an IP Education Framework following extensive review with a diverse range of stakeholders. Designed to support teachers and educators to introduce IP concepts, so young people can identify, protect, and effectively use IP, and respect others’ IP, the framework takes a structured approach from primary to university level and will continue to support the delivery of the IP Education Framework through the provision of free online resources for teachers and educators.

Understanding the role of IP in research collaboration, commercialisation, and career development is critical to IP being viewed as an asset. We increased IP capability in the Higher Education sector by extending our flagship IP for Research education programme, reaching over 70 Higher Education Institutions across the UK and sponsored institutions to develop and deliver their own events.

We want innovative, IP intensive businesses to be able to use their IP as an asset to gain access to the right type of funding, at the right time, so that they can grow. We developed our IP in Finance strategy to build on our work to date and support wider government strategies, including the UK Innovation Strategy [footnote 13]. We worked with partners to enhance our understanding of the IP knowledge and skills that investors, lenders and businesses need to unlock finance for IP-intensive businesses. We also commenced work to broaden our knowledge of other countries’ approaches to IP-backed financing to help us understand what works.

Reducing IP crime and infringement

In February of this year, we published the revised Enforcement Strategy, now rebranded the Counter-Infringement Strategy [footnote 14]. As the culmination of several years’ work, gathering evidence, building proposals, and engaging with experts in the field, the strategy marks a step change for the ambition of the IPO in this area. The new strategy focuses on getting the right structures and processes in place to allow us to work more effectively on IP infringement at home and internationally, making UK IP rights, and those owned by UK businesses overseas the best protected in the world.

The foundation of our new strategy relies initially on developing a better strategic understanding of the threat and over the past year, the IPO’s intelligence resource has undergone significant transformation. Starting the year as an ‘Intelligence Hub’ with eleven staff, the team expanded to a total of twenty-seven staff, including a team of seven intelligence analysts, an augmented financial intelligence team, and a new team of seven intelligence development and research officers. Recruiting and embedding such a significant number of new staff whilst working remotely was extremely challenging and only possible through the support of all our original team members. The team are continuing to conduct a review of their processes and procedures, and a project is underway to gain access to intelligence systems, tools, and databases to ensure we can effectively support our partners across law enforcement, industry and government to tackle serious IP crime and infringement.

In addition to the expanded intelligence team, we recruited specialist liaison posts within trading standards regional teams, additional support posts for UK Border Force and several additional posts internally to the team to support delivery of the Counter-Infringement Strategy; support for the revised IP Crime Group; delivery of a new cross Whitehall forum and to bolster our resources working on trade. While this expansion was underway, the team also maintained a busy output of business-as-usual activities including policy development, outreach, capacity building and providing operational support for our partners in tackling IP crime.

Our teams provided intelligence and research to support Operation Monty, a National Market Group operation targeting the sale of counterfeit goods on Instagram, with the aim of removing online sellers. Over 400 online traders were reported to Instagram for removal and take-down.

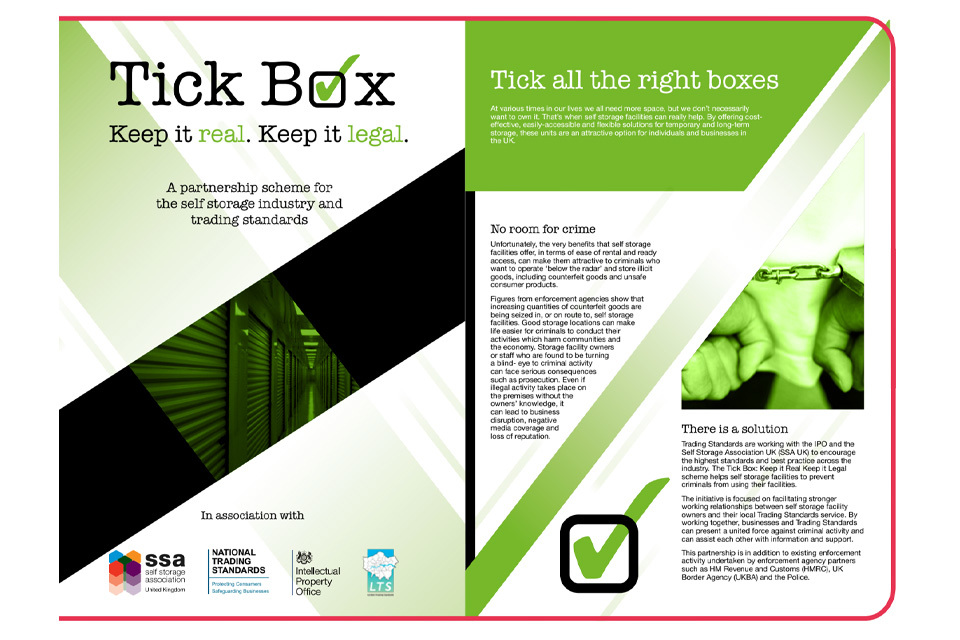

We completed the first phase of our project looking at the use of self-storage businesses to facilitate IP crime. Work on self-regulation in partnership with the Self-Storage Association has been encouraging and we continue to work closely with National Trading Standards to support enforcement action.

Tick Box - Keep it real. Keep it legal.

In September of this year, we supported a multiagency investigation led by the North West Police Intellectual Property Crime Unit into the use of self storage facilities by organised crime groups in the Manchester area. Approximately 55 storage units were searched, and over 200 tonnes of counterfeit goods were recovered, with an estimated value of over £500 million. A significant amount of cash, and the manufacturing equipment required to make counterfeit perfume, including white spirit and screen-wash, were also seized.

During the year we established UK multi-agency steering groups to engage with a range of overseas law enforcement projects including European initiatives with relevance to UK interests. As a consequence, representatives from the IPO funded Police Intellectual Property Crime Unit (PIPCU), Police Service Northern Ireland (PSNI), National Trading Standards, Office Product Safety and Standards, National Food Crime Unit, Border Force, Her Majesty’s Revenue and Customs, Medicines and Healthcare Products Regulatory Agency and the IPO had direct involvement with these important international projects. Work on third party threats to the IP system under Project Ultro also continued, looking at false invoices, misuse of the IPO logo and suspect trade mark registrations.

We remained committed to making infringement activity socially unacceptable, and as part of a wide range of research to support enforcement policy development, we commissioned behavioural change research which will inform our plan to run a pilot awareness campaign in summer 2022. The pilot campaign will focus on the beauty and hygiene sectors, but it is anticipated that the insights gained will support future activity across a wide range of sectors. To further support trading standards officers, we continued our training and capacity building work, with a key element being a project with the Chartered Trading Standards Institute to develop a comprehensive training package. We hope that this work will soon lead to the reintroduction of an intellectual property module to the formal qualifications on offer for trading standards officers, embedding expertise in IP at the very heart of this key enforcement agency.

Making the IPO a brilliant place to work

Solid foundations

As a growing organisation we face some exciting challenges and opportunities to make sure IP and the IPO plays a full part in making the UK the most innovative and creative country in the world. We reviewed our ambition and activity in the people space, re-setting our Brilliant Place to Work focus and priorities for the next five years. We scanned the external and internal context for opportunities and challenges, such as: economic recovery; hybrid working; the competition for talent, especially in digital; the pace of change generally and the increasingly complex role of leaders. We also recognised our strengths: we have talented, engaged people, and want to build on strong cultural foundations underpinned by shared values and principles (the Deal) and our people feeling supported, valued, and included to enable their best work. We identified four key people outcomes:

-

being more future-focused in our thinking and planning so we are ready and able to adapt and respond to change - driving activity like enhanced workforce planning; strategic resourcing; horizon scanning; building in flexibility in systems, processes and our organisation design

-

supporting our people to thrive in a less certain work context - paying attention to mental, physical, and social wellbeing; effective leadership; a flexible hybrid working model; and constant underpinning of our culture of trust, inclusion, and the Deal

-

skills, capability, and career development that sets us up for the future

-

One IPO approach (corporate first, functional second) underpins all that we do

We have incorporated these people outcomes into the IPO Strategy refresh and the 2022/23 IPO corporate plan priorities.

With increased customer demand and Transformation, recruitment activity has been significant during this past year with a high influx of vacancies, particularly in rights granting and IT, with digital resourcing particularly challenging. We ran 260 advertised recruitment campaigns, appointed 229 new members of staff including Patent Examiners, Policy Advisors, IT Specialists and science, technology, engineering, and mathematics (STEM) Returners. To bridge the skills gap in IT, we adopted a ‘Grow Your Own’ strategy to develop and train existing staff, as well as recruiting new staff at a junior level with the aim to coach and nurture them to gain the relevant skills. A great example of this is our Future Steps initiative which recognises the internal potential and development of existing staff to ensure our people remain our greatest asset. To support increased recruitment activity, we appointed an HR Resourcing Manager, Talent Acquisition Specialist, IT Recruitment Officer, and an Onboarding Lead who began to focus on implementing inclusive initiatives and enhancing the retention of our people by creating a memorable experience and great first impression for new starters.

We retained our strong commitment to embracing diversity and promoting equal opportunities and launched several schemes and initiatives across the IPO. We also extended some existing initiatives, for example, investing into another STEM Returner scheme, placing four people in Patents for seven months. We also implemented some new schemes, the investment into Code First Girls (CFG), a Not-for-Profit Social Enterprise that trains women and non-binary individuals in IT skills, with a view to securing five skilled professionals in an IT role in September 2022. We entered new territory this year with the innovative Life Chances schemes, supporting the Civil Service ambition to be the most inclusive employer in the UK and become a role model for other public and private sector organisations, and potentially opening up social mobility opportunities for citizens.

We reviewed our recruitment processes, making many changes to how we advertise and communicate with prospective candidates, ensuring a consistent approach and enhancing our ability to target a more diverse audience. We have revamped our Diversity Dashboard to include equality data from recruitment statistics so we can track the diversity of our candidates.

To ensure we are fit for purpose for the future, our IPO Board (IPOB) undertook a review of our organisation design to ensure that we are set up as effectively as possible to deliver our strategy. We agreed a new target operating model, aligning our functions around Strategy, Policy, and Services. Based on that model we have agreed a new design that will be implemented in 2022/23.

We ran 260 recruitment campaigns appointing 229 new members of staff - including trade mark examiners, patent examiners and IT specialists

Culture: One IPO

Building upon and strengthening our One IPO culture is a real team effort, and to know if we are heading in the right direction, we need to be able to demonstrate our progress. We developed our culture matrix as a tool to articulate and measure the One IPO culture through 2021/22. We further developed our original prototype this year by understanding the data that sits behind the matrix and by improving the user experience through a clear and accessible interface. These changes allowed us to highlight and track culture change and, in time, we will be able to use this tool to understand what decisions or actions influence culture at the IPO.

A Government Internal Audit Agency (GIAA) audit of our culture took place in 2021 and focused predominately on our engagement response to the pandemic. The findings were very positive, and we received great feedback about how we informed and connected our people during the pandemic, leaving them feeling supported, valued, and included. Our annual People Survey results showed that we maintained our overall engagement score of 73% from 2020, the highest level of engagement since the current Civil Service People Survey was launched in 2009, and we remain a Civil Service High Performer for employee engagement. Scores across all key drivers remained similar to last year, and so our areas for corporate action remain the same and align with our work on Transformation, organisational design, and our continued hybrid working journey.

These are:

-

leadership and managing change - continued focus on trusted, visible, and capable leadership;

-

organisational culture and behaviours - a focus on understanding the impact of hybrid working on our working relationships and on our part in the wider IPO community; and

-

workload and how we work - developing our understanding of the logistics of hybrid working including articulating what that means for our space, technology, people policies, and our customers

To ensure we have the right skills in place for current and future challenges we focused this year on developing the capability of our leaders. The ability to have the best conversations remains a key part of our programme, and we supported our leaders to adapt their skills, so they remain relevant in our changing environment. Our peer-agreed leadership behaviours provide us with the foundation for an upcoming programme of development for our IPO Board and leaders at all levels. Our core leadership and management package has been nominated for several Investors in People and Civil Service Awards, commending our focus on developing our people.

We worked with senior leaders to support them in demonstrating their commitment to inclusion and used our well-known cultural principles to create a meaningful, action-focused inclusive leadership commitment.

Our inclusion plan, and accompanying actions cover 7 key priority areas:

-

striving for an inclusive and diverse workforce;

-

promoting an Inclusive IPO;

-

improving our data and statistics;

-

social mobility;

-

development and talent pipelines;

-

respect at work; and

-

decision-making, policies, and procedures

We ran a campaign around the importance of diversity data declaration which led to increased declaration rates across all protected characteristics. Questions about socio-economic background will be included on our HR system soon so we can also track social mobility within the IPO. We also recruited and trained 46 ‘Accessibility Champions’ who are passionate about embedding an ‘Accessibility First’ mindset into our culture. Our Creative and Print team have developed a series of training resources supporting everyone to make our internal and external digital content accessible.

The Gender Inclusive Language project sets out how we can be as inclusive as possible in the language we use for our people and customers. During the year, we began identifying a list of documents where we currently use gendered language and soon, we will use the expertise of our people to crowd-source recommendations that can be implemented in the present, as well as those that will influence the future services we deliver to customers as part of Transformation.

Externally, we are still well-regarded for our inclusive approach, retaining our Silver award in the Chwarae Teg Fairplay employer index and Disability Confident Leader status. We were also nominated by Chwarae Teg for the Fair Employer of the year award, where we were shortlisted as a finalist.

As part of our work for this year we have continued our focus on enhancing our interventions to increase the representation of women in our STEM roles. Although women make up nearly half of our workforce, the majority of them are in non-specialist roles. Our patent examining roles attract higher salaries due to their specialism, however, only 23% of these are taken up by women (a 1% improvement on our 2020 figures).

Although this issue is not exclusive to the IPO, we need to address any perceived barriers that are preventing women from pursuing a career in STEM. Our Gender Pay Gap [footnote 15] (our last published figures, 31 March 2021) was as follows:

-

mean pay gap: 18% in favour of men; and

-

median pay gap: 30% in favour of men

The comparison of mean and median pay in the IPO shows a gap in favour of men which is higher than the national pay gap of 15.4% (median), and not dissimilar to the gender gap in the field of STEM where women are consistently under-represented. According to estimates based on the Office of National Statistics’ Labour Force Survey and compiled by the WISE Campaign (2019), women make up only 24% of the UK core-STEM workforce. A high proportion of women are part-time and employed at lower grading levels in support roles (corporate and operational) which skews the average. 69% of our part-time workers are women. We recognise that the significantly higher proportion of men within our more highly paid technical specialist cadre, results in a material gender pay gap based on the required reporting methodology. We also recognise that the greater proportion of men in our highest grades is also reflected in the gender pay gap analysis.

Whilst the overall mean and median gender pay is still significant at 18% and 30%, we are pleased to report a reduction in our mean over the last three years from 20% in 2018/19, 19% in 2019/20 and 18% in 2020/21. The IPO is committed to fair pay irrespective of gender and this is echoed in our annual inclusion and diversity report. It is something that we, as an organisation, take very seriously and reducing our gender pay gap will continue to be a priority focus for our brilliant place to work strand in 2022/23.

Image of Margaret Bonham - Quote "I'm really excited about continuing in a STEM job, I felt I'd been away from science for so long that this would not have been an option. I'm delighted the IPO has give me this opportunity."

We are actively seeking to recruit more women into our specialist roles with the support of our STEM ambassadors and our Women’s Network. Work to date includes:

-

we invested in a further STEM Returner scheme this year which places qualified and experienced people in STEM roles for seven months to bridge the gap in their CV following a period out of the STEM environment. The scheme has proven an excellent way to encourage underrepresented groups into STEM areas;

-

we invested in structured training programmes with Code First Girls, whose aim is to increase the number of Women and Non-Binary people in the tech sector. Our collaboration has seen people of all ages and backgrounds trained and prepared for a career in the tech environment and will see an increase of women and non-binary people in the tech workforce throughout the UK;

-

we continue to review and reshape our recruitment practices to ensure we attract more diverse talent, using recruitment data from every stage of our process to understand where we need to improve; and

-

we have worked with women in our organisation to understand barriers to progression and promotion. As a result, we’ve developed a parents’ network to ensure everyone has practical and effective mentoring when returning from long-term leave and have increased our support around barriers such as Grief, Menopause, Mental Burden, and Imposter Syndrome

We are committed to a zero-tolerance approach to bullying and harassment and the 2021 People Survey results highlighted a reduction in people experiencing bullying, harassment, or discrimination within the IPO. Although slightly lower than levels elsewhere in the Civil Service, we are clear that our people should not be subjected to bullying and harassment. To support our efforts, we held training sessions around a board game designed to encourage debate and discussion on difficult scenarios and received excellent feedback on this approach.

Our Respect at Work campaign continues, and we launched an informal reporting tool to capture unacceptable experiences throughout the organisation in real time. The reports helped us respond to issues with training, team workshops and office-wide communications such as our Just Because campaign, which challenges misconceptions and disrespectful behaviour. We continue to develop bite-size videos which are shaped from feedback in the business; our videos on delivering and receiving feedback have had excellent responses with 81% of respondents saying the videos helped them evaluate their own behaviour, 88% saying the videos helped them evaluate other people’s behaviour and 83% saying the videos helped them clarify what unacceptable behaviour is.

Healthy people, healthy environment

The Covid-19 pandemic placed requirements upon us and our people to develop and adapt the ways in which we work, both now and in the future. During the year we provided a range of support services for both home and office-based colleagues. The Resilience Workstream, which was set up as part of our initial Covid-19 response, continued to meet on a regular basis to co-ordinate our wellbeing programme. Many of the initiatives implemented at the start of the pandemic remain in place, including regular mental health first aid sessions, manager workshops, and office funded licenses for the ‘Headspace’ mindfulness app. We also continued our virtual relaxation sessions and brought in expert speakers on a range of wellbeing subjects.

Throughout the year we regularly asked our people how they are feeling and what additional support they needed. In response to these surveys, we implemented further support including, i-Act mental health training for managers, suicide prevention day awareness, stress awareness, mental health first aider bereavement training, grief café, time to talk, and sessions covering financial wellbeing, sepsis awareness, and Marie Curie awareness (grief and loss support). While many of our initiatives are office-wide, we also supported our directorates, who experienced their own challenges, and worked with senior teams to implement tailored approaches for our people.

To make our workplaces welcoming, convenient and somewhere where people can socialise with colleagues and improve their physical health, we revamped the wellbeing facilities at our Concept House main office. We also upgraded the shower and changing facilities and have provided new cycle storage areas, along with a range of IPO bikes that our people can borrow. We have officially opened our new gym, iMove, and will also soon be unveiling an improved wellbeing suite where people can connect with colleagues.

During the year we doubled the number of London based staff and implemented a booking app so that people working at 10 Victoria Street can check availability and book a desk as needed. The onsite booking app for our Newport site will be made available to all staff in early summer 2022. We invested in our sites to enhance our hybrid working capability and have five surface hubs available to use in Concept House and approximately 32 meeting rooms will be fully equipped for hybrid meetings.

Discussions have taken place during the year on how to meet the requirement to transfer our property freehold into central Government ownership; further work is needed to resolve some outstanding issues associated with the transfer mechanism, ongoing funding arrangements and occupancy agreement. We are working closely with Government Property Agency (GPA) and other stakeholders on these matters and expect to conclude this work later in 2022/23.

Corporate and social responsibility

As an organisation we allow up to six days a year where our people can get involved in community activities which are outside of their usual field of expertise. The Covid-19 pandemic continued to impact our Corporate Social Responsibility programme with many organisations still unable to restart their volunteering activities. Despite this disruption, we have been successful in securing some volunteering opportunities for our people. We have recruited heavily, and our teams remained keen to make a difference to the community, while at the same time making connections with new colleagues.

Some of our people were keen to work in their local communities and we arranged a number of litter picking sessions during the year. We worked with the Brecon Beacons National Park and provided an IPO team to help with removal of Himalayan Balsam. We also took part in a virtual volunteering project with Bristol Zoo.

As we adapted our office space for hybrid working, we were left with stocks of unwanted furniture, and we were able to provide some of this to the Sea Cadets and a number of services within the Aneurin Bevan University Health Board who were very grateful for our help.

Sustainability report

Introduction

The pandemic has continued to affect our environmental performance over the past year. While the majority of our people have continued to work from home, we have seen a steady stream of people return to our sites too.

We set up a Hybrid Working Steering Group to provide people with the support, clarity and tools to work in a hybrid way. We have had to adapt our site and ways of working to enable this, but this has also given us opportunities to improve. We have taken the opportunity to help our people to travel sustainably whilst at the same time improving their physical wellbeing. We also continued to improve the energy efficiency of our buildings by starting a project to replace all our lighting with LEDs.

We started our Net Zero journey this year and this will be our focus going forward. We’ve set ourselves a corporate target for the next financial year to agree a plan on how and when we will achieve Net Zero and to complete any year one actions identified.

Carbon emissions from offices

To start our Net Zero journey, we commissioned independent experts to baseline our performance and to provide recommendations on how and when we can achieve Net Zero for our Newport estate. That work will continue in the coming year as we work towards our corporate target.

Electricity usage increased slightly compared to last year to reflect the increase in recruitment and on-site working. Although there are still fewer staff in our buildings since before the pandemic, the IT servers, which are one of our biggest users of electricity, have been working to full capacity.

Gas has shown a significant increase compared to previous years. Following the replacement of the gas metering equipment last year to correct longstanding metering problems, we have been able to more accurately monitor our gas usage (costs were previously accrued to reflect a more accurate charge). We changed gas supplier at the beginning of the 2022/23 financial year and will resolve any invoicing/accrual queries once we receive our final bill from our previous supplier. We believe the final costs to be relatively low value and finalised within the next financial year.

| 2017/18 | 2018/19 | 2019/20 | 2020/21 | 2021/22 | ||

|---|---|---|---|---|---|---|

| Tonnes CO2 | Gas Electricity |

206 1,279 |

171 865 |

241 635 |

182 453 |

687 393 |

| Related energy consumption (kwh) | Gas Electricity |

1,120,473 2,846,408 |

928,975 2,782,104 |

1,313,780 2,289,060 |

2,432,439 1,634,765 |

3,750,278 1,700,877 |

| Financial implications (£) | Gas Electricity CRC Efficiency Scheme |

117,319 421,863 28,603 |

124,462 464,231 19,672 |

89,902 391,058 n/a |

98,478 285,832 n/a |

98,147 299,802 n/a |

Carbon emissions from travel

Very little business travel took place during the year although air and rail travel have now resumed. With many meetings now routinely held virtually we are hopeful that the impact of travel on our environmental performance will remain at significantly lower levels for the foreseeable future.

We have continued to deliver additional kit and furniture to make it easier for people to work from home. In addition, we have started a large-scale programme to replace our legacy homeworking kit. This means that our van usage has shown an increase in mileage compared to last year. We have mitigated the impact of this by replacing our leased diesel van with two plug in hybrid models.

Government fleet electric vehicles

During the year we replaced our leased diesel van with two plug in hybrid models meaning that 100% of our fleet are Ultra Low Emissions Vehicles (ULEV) in line with the government Fleet Commitment. We will now start planning for the next phase of the commitment which involves the future replacement of these to Zero Emission Vehicles (ZEV) to meet the 2027 deadline.

As people return to our offices, we want to encourage them to travel sustainably. During the year we invested in this area by:

-

providing new loan bikes to help people who may be considering cycling;

-

implementing a new cycle to work scheme with a higher spend limit;

-

improving our changing and showering facilities; and

-

providing a more secure and improved area for bike storage

| 2017/18 | 2018/19 | 2019/20 | 2020/21 | 2021/22 | ||

|---|---|---|---|---|---|---|

| Non-Financial Indicators (kg CO2) | IPO Owned Vehicles | 3,220 | 3,210 | 2,603 | 2,690 | 3,259 |

| Air Travel* | 125,335 | 132,743 | 142,919 | - | 9,829 | |

| Rail Travel | 32,890 | 43,370 | 26,890 | - | 3,650 | |

| Road Travel | 50,480 | 47,590 | 44,170 | 621 | 3,185 | |

| Taxis | 1,760 | 1,800 | 1,880 | 2,356 | 1,270 | |

| Financial Implications (£) | Travel Expenditure (UK) | 675,526 | 811,359 | 661,178 | 32,887 | 90,588 |

| Travel Expenditure (Overseas) | 358,850 | 305,995 | 352,905 | 4,063** | 16,691 |

-* Air travel now includes long haul, short haul and domestic flight data

-** Non-refundable travel costs and credit in relation to travel that was unable to take place

Use of finite resources (water and paper)

Water usage has shown an increase on last year. This is entirely due to a major water leak on our Newport site which meant that our usage for two months was significantly above normal levels. That has now been rectified and our current water usage is at similar levels to the previous year.

Paper has increased slightly as on-site activities continue to grow. Alongside this our agenda to transform our services means that we are unlikely to see the levels of printing experienced before the pandemic.

| 2017/18 | 2018/19 | 2019/20 | 2020/21 | 2021/22 | ||

|---|---|---|---|---|---|---|

| Non-Financial-Indicators | Water consumptions (m3) Paper Consumptions (A4 reams equivalent) |

5,055 7,500 |

5,406 6,650 |

4,951 6,118 |

2,928 880 |

6,129 1,300 |

| Financial implications (£) | Water consumptions costs Paper costs |

19,426 22,445 |

19,474 29,672 |

21,891 24,285 |

7,483 4,918 |

10,917 7,762 |

Waste

Waste has shown a slight decrease compared to last year. We are continuing to reduce the levels of waste that we send to landfill and are hopeful that this will be eliminated by the end of the next financial year, with all waste either recycled or used for energy recovery.

Consumer single use plastics

We’ve made good progress in removing Consumer Single Use Plastics (CSUP’s) from our estate. Prior to the pandemic we worked with our site neighbours ONS to remove all CSUPs from the on-site catering outlets. The on-site facilities processes are proving more of a challenge and we are currently working with the facilities and print teams and our stationery supplier to see how we can remove or re-use the single use plastics that they use. This commitment will form part of our Sustainability Strategy due to be launched in 2022/23.

As we adapt our office space for hybrid working, we have continued to donate surplus furniture and equipment to local organisations. This year two local schools, the NHS, and Newport Sea Cadets have all benefitted from our donations.

| 2017/18 | 2018/19 | 2019/20 | 2020/21 | 2021/22 | ||

|---|---|---|---|---|---|---|

| Non-Financial Indicators (Tonnes) | Total Waste | 393 | 204 | 301 | 203 | 174 |

| Waste recycled with energy recovery | 60 | 70 | 71 | 44 | 30 | |

| Waste recycled without energy recovery | - | - | - | - | - | |

| Re-used/Recycled | 263 | 104 | 188 | 112 | 104 | |

| ICT Recycled and Reused | 2 | 1 | 15 | 18 | 15 | |

| Waste Composted | 4 | 4 | 4 | - | - | |

| Landfill | 64 | 25 | 23 | 29 | 25 | |

| % Recycled | 67% | 53% | 68% | 64% | 68% | |

| Financial Implications (Disposal Costs (£)) | Total Waste | 40,880 | 37,664 | 39,128 | 40,374 | 44,757 |

| Waste recycled with energy recovery | n/a | n/a | n/a | n/a | 11,336 | |

| Waste recycled without energy recovery | - | - | - | - | - | |

| Re-used/Recycled | 26,566 | 27,257 | 35,734 | 20,932 | 23,227 | |

| ICT Recycled and Reused | n/a | n/a | n/a | n/a | 4,212 | |

| Waste Composted | - | - | - | - | - | |

| Landfill | 14,314 | 10,407 | 3,394 | 19,442 | 5,983 |

Information and cyber security

Our security and privacy strategy detail our approach to information handling across the organisation, including cyber security, and we continued to follow central guidance on the government security approach. This year we redrafted the IPO Security strategy and policy to account for the release of the Government Security Standard 007 (GovS 007), the National Cyber Security Strategy and NCSC’s Cyber Assurance Framework (CAF). The IPO continues to be certified against ISO 27001:2013 and has successfully verified its PCI DSS compliance.