HMRC Annual Report and Accounts 2017 to 2018 - Executive Summary

Updated 2 August 2018

1. Our vital purpose

We are the UK’s tax, payments and customs authority: we collect the money that pays for the UK’s public services and help families and individuals with targeted financial support.

2. Our objectives

Our objectives, set by the government, are to:

- maximise revenues due and bear down on avoidance and evasion

- transform tax and payments for our customers

- design and deliver a professional, efficient and engaged organisation

The taxes and duties we collect fund the UK’s schools, hospitals and other important services that we all rely on.

We also pay tax credits and Child Benefit, enforce the National Minimum Wage and administer the government’s Tax-Free Childcare scheme.

So our work touches the lives of virtually everyone in the country – it’s no wonder we’re one of the UK’s biggest organisations, with more than 59,000 fulltime equivalent employees nationwide.

3. Our vision

Our vision is to be a world class organisation

To achieve our vital purpose in a changing world, we are transforming and modernising the way we work – putting customers at the heart of everything we do.

We’re proud of this ambition, and the values that underpin it:

- we are professional

- we act with integrity

- we show respect

- we are innovative

4. The difference we made in 2017 to 2018

We’ve highlighted our main achievements in a short video: HMRC Achievements 2017 to 2018

£605.8 billion generated for UK public services and other government priorities – a 5.4% increase on last year

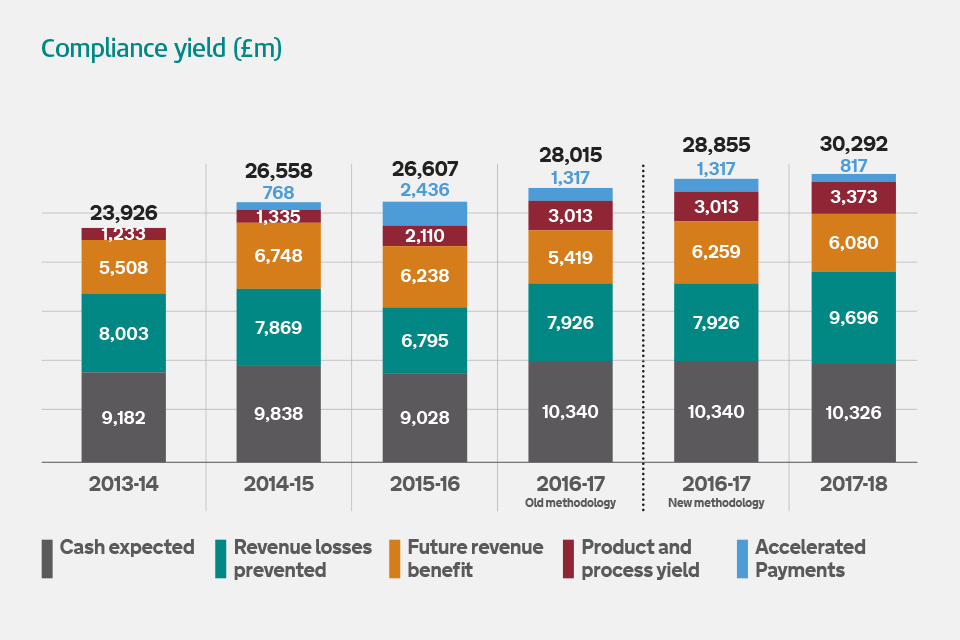

£30.3 billion additional tax secured through our work to tackle error, avoidance and evasion – 5% higher than last year

15 million customers using Personal Tax Accounts to manage their tax affairs online since launch

78% successful outcomes for appeals heard in the tribunals and courts - protecting £37 billion in tax

Other key achievements:

- 96.6% of customs checks cleared within 2 hours, against our target of 95%

- more than one million customers renewed their tax credits online - a 6% increase

- 46.7 million calls received – and we beat our 5 minute target for average speed of answer

- 80.7% customer post turned around within 15 days

- £229 million efficiency savings we made for the UK taxpayer

HMRC First Permanent Secretary and Chief Executive Jon Thompson talks about our achievements over the past year in this short video:

HMRC Achievements 2017-2018 - Jon Thompson

Read more about our performance (PDF, 3.57Mb).

5. Maximising revenues due and bearing down on avoidance and evasion

Maximising the collection of the tax and duties that are legally due goes to the heart of our vital purpose. We help the honest majority to get their tax right and make it harder for the dishonest minority to cheat the system.

We know it’s much better and more cost effective to help customers get their tax affairs right from the start, rather than spend time and resources fixing mistakes after they happen.

That’s why we’re using powerful new tools to analyse our data and produce richer insights into our customers’ needs and behaviours. It means we can tailor our customer services, spot emerging risks, and act faster to prevent problems before they occur.

Crucially, it also means our specialists can respond with maximum impact to tackle deliberate tax avoidance and evasion.

5.1 Our strategy

Our strategy is to:

- segment customers by type and size, and tailor our customer services based on behaviours, capabilities and the level of risk

- promote compliance and prevent non-compliance as early as possible in each customer’s relationship with us, while responding strongly to deliberate non-compliance

- reduce the likelihood of disputes by helping more customers to get their affairs right, but where disputes occur to resolve them by agreement or through litigation – whichever best secures the tax that is legally due

5.2 This year’s performance highlights

These were:

- £605.8 billion record total revenues

- £30.3 billion compliance yield

- more than 90% successful tax prosecutions

5.3 Segmenting customers and tailoring services

Everything we do starts with what we know about our customers, and how we can make it straightforward for them to register, file and pay the right tax at the right time. That’s why we’re re-orienting our systems and processes to meet the needs of 5 different groups — and using digital technology to enable more customers to manage all their tax affairs in one place.

We define our 5 customer groups as:

- 45 million individuals: customers who have incomes below £150,000 and assets below £1 million.

- more than 5 million small businesses: customers who have a turnover below £10 million and fewer than 20 employees

- 500,000 wealthy individuals: customers who are individuals with incomes above £150,000 and assets above £1 million.

- 170,000 mid-sized businesses, charities and public bodies: customers who have turnovers between £10 million and £200 million or have 20 or more employees.

- 2,000 large businesses: we broadly define a customer as a large business if it has a turnover exceeding £200 million — although we also look at other factors, such as their UK and global footprint or the sector they operate in.

Read more about individuals customer focus (PDF, 464Kb).

Read more about small businesses customer focus (PDF, 505Kb).

Read more about wealthy individuals customer focus (PDF, 685Kb).

Read more about mid-sized businesses customer focus (PDF, 542Kb).

Read more about large businesses customer focus (PDF, 492Kb).

5.4 Promoting compliance and preventing non-compliance

When we talk about compliance, we simply mean paying the right tax at the right time, in line with the tax rules.

The best way to tackle non-compliance is to prevent it happening in the first place – and that’s about providing good customer service for the majority as well as cracking down on the minority who break the rules. This approach is at the heart of our strategy to maximise tax revenues for the UK’s public services.

Our total revenues

In 2017 to 2018, our strategic approach to compliance helped total tax revenues to reach £605.8 billion, an increase of £30.9 billion, or 5.4%, on 2016 to 2017. The figure below represents money received and due to HMRC after accounting for money we repaid and owed.

Image showing total tax revenues for the 5 tax years between 2013 to 2014 and 2017 to 2018.

Total revenues are driven by the overall level of activity in the economy and the rates of taxation, allowances and reliefs set by Parliament.

In summary, compared to 2016 to 2017:

- Income Tax (31% of total revenue), and National Insurance contributions (21% of total revenue) increased 6.8%. The amount of revenue raised for these 2 taxes are closely linked to the number of people in employment and wages levels, both of which increased during this period

- Value Added Tax (VAT) (21% of total revenue) increased 3.4%. Higher receipts for the oils, gas and mining and the leisure and business sectors were seen during this financial year

- Corporation Tax (9% of total revenue) increased 4.3%. Many sectors experienced rising company profits, particularly the industrial and commercial and finance sectors

- hydrocarbon oils (5% of total revenue) decreased by 0.4%

- stamp taxes (3% of total revenue) increased by 7.8%, which was mainly due to the continuing increase in house prices

- alcohol (2% of total revenue) increased by 1.8% due to increases in duty rates in March 2017

- tobacco (1.5% of total revenue) remained static

- Capital Gains Tax (CGT) (1.3% of total revenue) decreased by 7.1% due to the reduction in the rates of CGT from 18% to 10% where a person is not a higher rate tax payer. The higher 28% rate reduced to 20%.

- Insurance Premium Tax (1% of total revenue) increased by 37.8%. There was a rise in the standard rate from 10% to 12%

A number of other taxes, including, Inheritance Tax, Bank Levy and customs duties, account for the remaining revenue.

The tax gap

Measuring the tax gap: the UK’s tax gap is the difference between the amount of tax that should, in theory, be paid to HMRC, and what is actually paid.

In 2016 to 2017 (the latest year for which figures are available), we collected 94.3% of the estimated tax revenue due, maintaining the tax gap at its lowest level for 5 years - at 5.7%. There has been an overall downward trend in the tax gap, which has reduced from 7.3% in 2005 to 2006 to 5.7% in 2016 to 2017, with some year-on-year variations.

Protecting revenues at risk

Every year, through our compliance work, we collect or protect billions of pounds that would have otherwise been lost to the UK through fraud, tax avoidance, evasion and non-compliance.

We’ve strengthened our grip on those who deliberately cheat the system and continue to pursue those who refuse to pay what they owe, applying civil and criminal sanctions as appropriate to this dishonest minority.

In 2017 to 2018, we:

- generated £30.3 billion in compliance yield against our target of £28 billion, an increase of £1.4 billion from 2016 to 2017

- protected £37 billion tax through litigation activity

- prevented £6.2 billion revenue losses by tackling non-compliance, such as stopping fraudulent repayment claims

Image showing compliance yields for the 5 tax years between 2013 to 2014 and 2017 to 2018.

5.5 Tackling avoidance and evasion

We want the tax system as a whole to support and encourage customers to get things right – but we’re also cracking down on the minority who deliberately bend or break the rules. When we see problems, we don’t hesitate to respond – and we never give anyone preferential treatment, whether they’re an individual or a multinational corporation.

Organised criminals

We use the full range of criminal and civil powers to investigate tax cheats and to tackle organised crime groups, disrupting their activity, dismantling their organisations and taking the profit out of their fraud.

We generated or protected £3.3 billion in compliance yield in 2017 to 2018 as a result of our investigations and enforcement action against organised crime — and 887 serious organised criminals have been brought to justice since 2010. Our latest estimate of the tax gap for this group is £5.4 billion for 2016 to 2017.

Offshore avoidance and evasion

High-profile data leaks like the Paradise and Panama Papers reveal the challenge involved in tackling offshore avoidance and evasion. The systems used to avoid and evade tax through offshore structures are complex — but if we suspect wrongdoing, our expert analysts use leading-edge technology to unpick these structures and trace them back to individuals.

We also benefit from the Common Reporting Standard, which was developed by the Organisation for Economic Co-operation and Development, after a drive by the G20 nations to develop a global standard for the automatic exchange of financial account information. It’s now a rich source of information for us and will be in future.

Last year, over 140 individuals were the subject of criminal investigation for offences associated with offshore tax evasion, including 4 arrests and a further 6 interviews under caution relating solely to the Panama Papers.

Since 2010, we’ve brought in more than £2.8 billion from domestic and global initiatives to tackle offshore tax evaders. Since June 2012, 26 individuals have been successfully prosecuted, resulting in over 100 years of custodial sentences and 12 years of suspended sentences.

Disguised remuneration

Last year, Parliament passed legislation targeted at ‘disguised remuneration’ tax avoidance schemes, where people are paid by loans instead of ordinary remuneration to avoid income tax and National Insurance contributions.

The changes Parliament introduced to fix this long-standing form of avoidance included a new charge on outstanding disguised remuneration loans, which protected £290 million in 2017 to 2018. The charge applies to loans outstanding at 5 April 2019, and we expect to protect £2.5 billion for the UK’s vital public services from it by 2021.

We’re continuing to litigate this type of scheme — and we won a high-profile Supreme Court case during the year against RFC 2012 (formerly The Rangers Football Club) which confirmed our view that earnings cannot be diverted to avoid tax.

Off-payroll working in the public sector

The off-payroll working rules (off-payroll working in the public sector: reforming the intermediaries legislation) are designed to ensure that those who work through a personal service company (PSC), who would have been employees if they were directly engaged, pay broadly the same employment taxes as if they were employed.

There is significant non-compliance with the rules, which costs hundreds of millions of pounds in lost tax receipts.

In April 2017, the government reformed the rules for engagements in the public sector. As a result, we estimate that an additional £410 million of income tax and National Insurance contributions has been collected in 2017 to 2018.

Tax avoidance promoters

The vast majority of tax advisers play by the rules and help their clients pay the right amount of tax. However, there is a small minority who seek to help their clients bend the rules and to pay less tax than they owe.

We have a suite of powers to tackle promoters and enablers of tax avoidance schemes, designed to change behaviour and influence those involved to move out of promoting and enabling for good, with various sanctions and penalties for those who don’t. We are using these powers to challenge all major promoters of avoidance schemes.

We are also using a range of other approaches to disrupt their activities, including making 3 complaints to the Advertising Standards Authority about misleading adverts. All have been upheld and apply to anyone promoting similar schemes, not just the promoter of the arrangement referred.

5.6 Reducing the likelihood of disputes

The strategies we’re following to promote compliance and prevent non-compliance — as well as our new digital services for customers — are designed to reduce the likelihood of disputes by helping more customers to get their tax affairs right. Inevitably, some disputes do still occur.

When they do, we always resolve them in accordance with the law and our published litigation and settlement strategy (LSS) and code of governance for resolving tax disputes.

Our bottom line is clear: we treat all customers fairly and even-handedly — no matter who they are or how complex their tax affairs may be.

6. Transforming tax and payments for our customers

We’re making it straightforward for people and businesses to pay the right tax and claim the right entitlements at the right time, by launching user-friendly digital services.

We’ve made real progress in reorienting our systems and services to become a data-led organisation, so we can make paying tax and claiming entitlements easier. Millions of customers are now using HMRC’s Personal Tax Accounts and Business Tax Accounts to handle their tax affairs quickly and easily online.

In 2017, we also introduced Simple Assessment, which removes the need for some customers to complete a tax return at all. Last year we expanded the range of digital tax account services available – tax credits customers can now use them to renew their annual awards, and we can adjust tax codes in real time to avoid underpayments and overpayments.

6.1 Our strategy

Our strategy is to:

- use sophisticated digital tax accounts and other online services as our main way of interacting with customers, making it easier for them to see their affairs in one place and harder for them to make mistakes – but still provide direct support to those who need it

- support intermediaries to play an active role in collecting tax and providing data, so we rely less on customers providing their own data

- welcome the use of agents to represent customers where they add value in helping their clients to get their affairs right

6.2 This year’s performance highlights

These were:

- 15 million Personal Tax Account customers since launch

- 93.5% Self Assessment customers filed on time

- 4.28 Average minutes to answer customer calls

6.3 Digital tax accounts and direct support

The number of customers using our digital tax accounts continued to grow during 2017 to 2018. To date, around 15 million people have accessed Personal Tax Accounts – and our Business Tax Accounts are used by more than 3 million businesses.

This is important for the overall transformation of our customer services. Not only do digital tax accounts make it quicker and more convenient to pay the right tax at the right time, they reduce pressure on our more traditional customer services.

We wanted to achieve an average customer satisfaction rating of 80% for our digital services in 2017 to 2018. The number of survey responses we received increased by 43% from 6.7 million to 9.6 million and the percentage of customers who were either ‘satisfied’ or ‘very satisfied’ across all our digital services was marginally under 80% at 79.8%. We continue to listen to our customers to help us improve our service offering.

Through our Making Tax Digital for Business programme, we’re working to give businesses modern, digital services that make it easier for them to get things right. Increasingly, we’re working in partnership with the software industry so businesses, and their tax agents, can use products and services that interact seamlessly with our own systems.

In April 2018, we launched a pilot for business customers, which allows them to use approved software to generate and send their quarterly VAT return from their digital records, rather than logging in to the HMRC portal and typing in the information. We plan to roll this out to all businesses with a taxable turnover above the VAT threshold (£85,000) from April 2019.

6.4 Customer phone calls

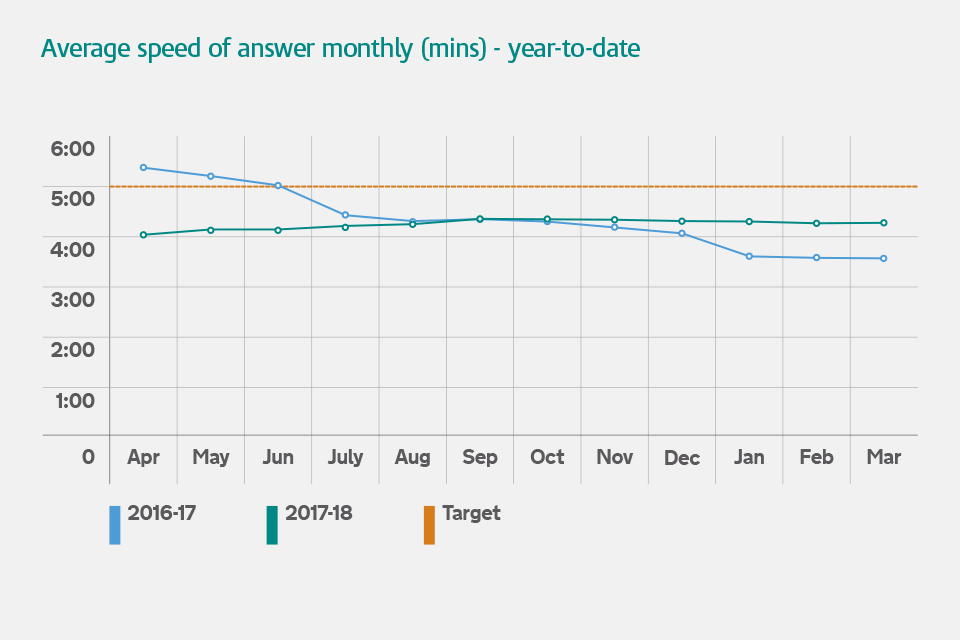

Image showing the average speed of answer for 2017 to 2018, set against the target of 5:00 minutes, and compared with 2016 to 2017.

We received 46.7 million phone calls to our contact centres in 2017 to 2018. This is a decrease of 10% in demand to speak to an adviser, as more customers use our digital services — but so far customer demand hasn’t dropped by as much as we expected it to after we introduced digital channels.

Phone contact remains an important element of our interaction with customers, so we offer a 7-day telephony service and our customers are supported by automated messaging to access information and appropriate services.

Thereafter, for customers who need to speak to an adviser, our average speed in answering calls was 4 minutes and 28 seconds this year. This is within the 5 minute target we are funded by government to deliver, but was slower than the 3 minutes and 54 seconds we achieved in 2016 to 2017.

The percentage of customers who waited 10 minutes to be connected to an adviser was 14.6% against our target of no more than 15%. Going forward, we’ll continue to strive to optimise our phone performance within the funding available.

6.5 Customer post

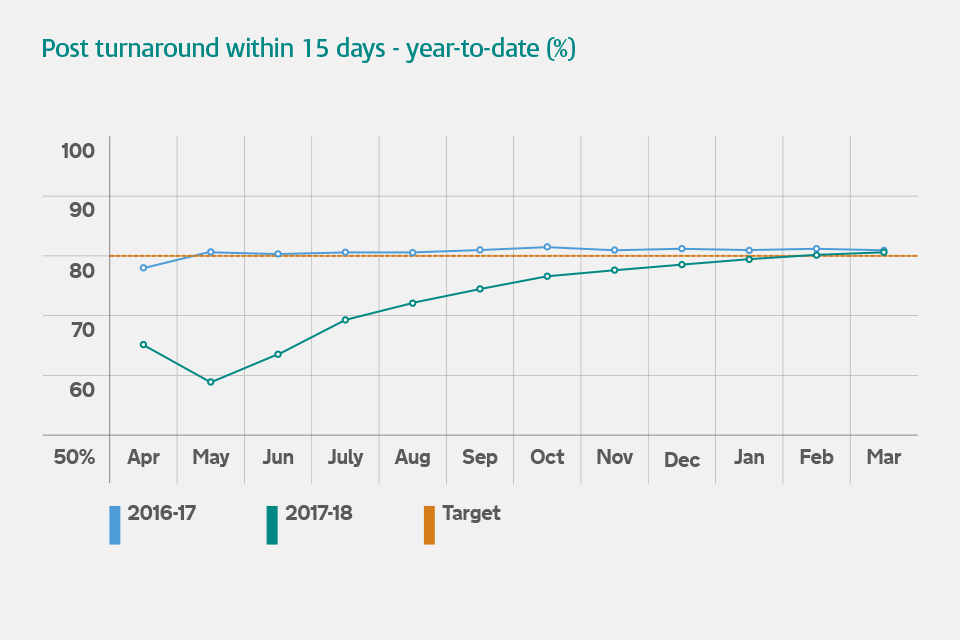

Image showing the percentage of post handled within 15 working days for 2017 to 2018, set against the target of 80%, and compared with 2016 to 2017.

We received around 18 million items of post in 2017 to 2018, compared to around 20 million in 2016 to 2017 – that’s around a 10% reduction. Out of 12.9 million post items where customers required a response, we turned around 80.7% of post in 15 days, beating our target of 80%, and 97.1% of post in 40 days, beating our target of 95%.

We experienced a dip in our post turnaround performance during the first quarter of the year, due to a peak in our telephony demand driven by the tax credits renewals period. This meant we had less flexibility to move resources between phone calls and post than we do at other times of the year. After we put a recovery plan in place, our performance improved from the second quarter.

6.6 Benefits and credits

£26.2 billion paid out in tax credits in 2017 to 2018

£11.7 billion paid out in Child Benefit in 2017 to 2018

HMRC doesn’t just collect tax revenues. We’re also responsible for administering tax credits and Child Benefit – and this work is vital to supporting families with children, tackling child poverty and helping to ensure work pays more than welfare.

Last year, tax credits helped around 3.8 million families and 6.8 million children, while Child Benefit supported around 12.9 million children. Our priority is to pay customers on time and make sure they receive their correct entitlement.

This year we maintained our performance in processing new tax credits and Child Benefit claims and changes of circumstances for UK customers, which took us an average of 13.8 days against a target of 22 days.

For international customers the average was 55.6 days against a target of 92 days. Over one million customers renewed their tax credits online — the most popular means of renewal, and a 6% increase.

6.7 Intermediaries and agents

It’s a crucial part of our strategy to work with independent third parties to improve our performance. We’re actively working with those who can help us to support our customers and collect tax – such as employers, through their role in administering Pay As You Earn, or others who can collect data to pre-populate digital tax accounts, such as banks and building societies.

We’re also working closely with software developers to ensure that our own plans are aligned with software being developed for business customers. The more straightforward we can make it for businesses to pay their taxes and interact with us using their own software, the more efficiently we can maximise revenue collection.

Agents can also play a key role in helping people comply with their tax obligations, and we welcome their use where they add value in helping their clients to get their affairs right. We’re developing our services for tax agents, so they can deal with us across all taxes on behalf of their clients.

We know we have work to do, as in our most recent customer survey, only 47% of agents felt they had a positive overall experience dealing with HMRC. To support them, we’re investing in a new digital service and we’re strengthening our engagement with agents and their professional bodies. We’ve also published a revised HMRC standard for agents.

7. Designing and delivering a professional, efficient and engaged organisation

To deliver for our customers in a changing world, we are building on the skills and expertise of our people, and working in new, more collaborative and flexible ways.

We’re putting the right people in the right places, doing the right work, with the right skills, using the latest digital tools.

We’re opening 13 new regional centres across the UK over the next few years. These modern and cost-effective buildings will enable our workforce to work together in innovative new ways to support our customers.

We’re also designing new and effective tax and customs policies, systems and processes – and the changes we’re making have benefits for other government departments and play a vital role in supporting the government’s overall agenda.

7.1 Our strategy

Our strategy is to:

- move towards a more highly skilled and sustainable workforce through better training, development and by creating a new, modern network of large regional centres

- use our assets and capabilities to deliver wider government aims, and to design new services and systems that other government departments can use in the future

7.2 This year’s performance highlights

These were:

- 12 regional centre sites secured to date

- 4,604 full-time equivalent employees recruited

- £229 million in sustainable cost savings

7.3 A skilled and sustainable workforce

At the end of 2017 to 2018, HMRC had 59,332 full-time equivalent employees, more than 2,000 fewer than the previous year.

We want to make HMRC a great place to work, where everyone knows they are valued and will be treated fairly, regardless of background, working pattern or who they know. Our latest staff engagement score is 50% – a significant improvement – but we know we have more to do to increase this further.

An important part of this is creating a greater range of career opportunities – we had 22 professions within HMRC last year, including tax, policy, operational delivery, project and programme management, IT, finance and analysis, and we promoted more than 4,000 people this year.

We’re also investing in the skills our people need to deliver for our customers. Every single HMRC employee gets a full 5 days of funded training and development every year, pro rata for part-time staff.

7.4 Our technology

Technology is crucial to HMRC’s transformation. We’re investing in new digital tools for our people, to date we’ve provided more than 43,000 mobile tablet devices so our experts can work more flexibly and access our systems wherever they happen to be.

Cloud-based data

We are moving our data to cloud-based storage, which is not only faster and cheaper to run but increases our resilience by improving our capacity to recover should some extraordinary event impact on our ability to operate normally.

Strengthening data security

As a data-rich organisation, data security is extremely important to us and we continuously monitor and detect for fraud and misuse of our systems, including the internet, using specialist technology.

We are very conscious of our role in safeguarding our customers’ information. We have put training and guidance in place to support our implementation of the new General Data Protection Regulation (GDPR) and we will continue with our progress in complying with the regulation.

New IT contracts

To get the best value for money for UK taxpayers, we have replaced our outsourced IT contract with a series of smaller, more flexible contracts, which are already delivering services for less money.

We’re also developing our approach to the way we manage our data by moving from developing one large repository for our data, called the Enterprise Data Hub, towards smaller, modular platforms that we can more easily change and adapt to meet our data needs in the future.

7.5 Moving to our new regional centres

In July 2017 we opened our Croydon Regional Centre, which is the first of a network regional centres we’ll open across the UK over the coming years. It’s a glimpse into the future of HMRC: we’re gradually moving out of office buildings that are no longer fit for purpose and into fewer modern buildings equipped with the high-speed digital infrastructure we need.

Overall, our estate reduced in size from 145 buildings in 92 towns in 2016 to 2017 to 119 buildings in 76 towns in 2017 to 2018. Eventually, we expect to be located in just 13 regional centres, along with 5 specialist sites and 7 transitional sites.

By bringing our people together into newer and larger sites, our teams will be able to collaborate more effectively to improve customer service and tackle avoidance and evasion – using state-of-the-art data and risk assessment tools. Moving to regional centres will save more than £300 million up to 2025.

The programme will deliver annual cash savings (compared to 2015 to 2016 costs) of £74 million in 2025 to 2026, rising to around £90 million by 2028, while improving customer service and modernising how HMRC works.

7.6 Expenditure and budget

We’re driving down our day-to-day running costs to deliver better value for money for taxpayers and the country.

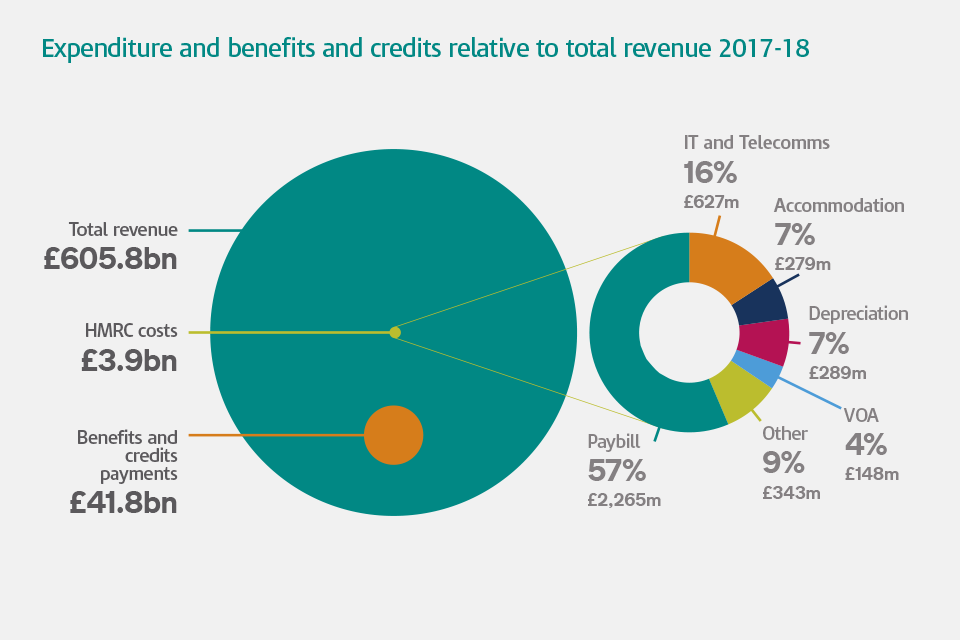

Image showing expenditure and benefits and credits relative to total revenue for 2017 to 2018.

Over the last 5 years, our baseline funding has reduced due to the sustainable efficiencies we have delivered. We have also received funding to carry out additional work requested by ministers, such as Help to Save.

At the government Spending Review 2015, we were given funding to invest in HMRC’s Transformation for 2016 to 2017 onwards.

Since the Spending Review, further funding has also been provided for tackling avoidance and evasion. In 2017 to 2018, we also received funding to support EU exit work.

7.7 Saving money for the UK taxpayer

We’re committed to reducing our operating costs and we’ve exceeded our Spending Review commitment to make £177 million of sustainable cost savings in 2017 to 2018, achieving £229 million. This brings the total so far over the Spending Review period to £410 million, against the target of £380 million.

The efficiencies we have delivered, together with increasing revenues, mean that the cost of collecting taxes in the UK is less than a penny for every pound collected – down from 0.61 pence in the pound in 2013 to 2014 to 0.53 pence in 2017 to 2018.

7.8 Delivering across government

HMRC is first and foremost responsible for generating the revenue that enables the government as a whole to function, but our impact on the government’s aims goes well beyond this.

We support growth in the economy by delivering targeted tax reliefs — towards research and development, for example — and our customs clearance processes are vital to ensuring smooth international trade.

We work closely with devolved administrations and other government departments — such as with the Department for Business, Energy and Industrial Strategy on National Minimum Wage and Anti-Money Laundering regulations.

8. Our accountability

Our accountability sets out how we operated HMRC in a transparent way in 2017 to 2018. The section includes:

- how we govern HMRC, including how we manage risks

- Principal Accounting Officer’s report

- how we resolve tax disputes

- our workforce, including staff numbers, diversity and costs

- remuneration report for senior staff

- public and stakeholder accountability

- Parliamentary accountability

Read more about our accountability (PDF,1.74Mb).

9. Our accounts

This section incorporates HMRC’s Trust Statement and Resource Accounts for 2017 to 2018. The section includes:

- foreword to the accounts

- The Trust Statement audit report of the Comptroller and Auditor General to the House of Commons

- The Resource Accounts: Certificate of the Comptroller and Auditor General to the House of Commons

- Trust Statement

- Resource Accounts

- glossary to the financial statements

- statistical tables

Read more about our accounts (PDF, 947Kb).