Good Work Plan

Published 17 December 2018

Presented to Parliament by the Secretary of State for Business, Energy and Industrial Strategy by Command of Her Majesty, December 2018.

Cm 9755

ISBN: 9781528609272

Foreword

The UK has a labour market of which we can be proud. We have high employment rates, a wealth of job opportunities and increased participation amongst historically under-represented groups.

Since 2010 we have higher employment and lower unemployment in every region and every nation of the United Kingdom and wages are now growing at their fastest pace in almost a decade.

This success has been underpinned by an employment law and policy framework which strikes an effective balance between flexibility and worker protections. Businesses have been able to thrive and create jobs in record numbers as a result of flexibility and a celebration of innovation. Equally, workers in the UK have received protections and have benefited from this government’s commitment to fairness for all, including through the introduction of the National Living Wage.

As I set out in our Industrial Strategy, Britain is extraordinarily well-placed to benefit from the new industrial revolution. As a country that celebrates innovation and entrepreneurship and embraces technological advancement, our labour market is well-positioned to seize the range of opportunities offered by new technologies, emerging business models and changing ways of working.

With new opportunity comes new challenges. That is why the Prime Minister commissioned the independent Taylor Review of Modern Working Practices – to ensure that the UK labour market can adapt effectively to embrace these changes whilst ensuring the protection of workers’ rights in the UK. The first review of its kind internationally, the Taylor Review has ensured the UK is leading the way in tackling the new and emerging challenges posted by a changing world of work Matthew Taylor made a number of recommendations to government – the vast majority of which we accepted in early 2018. I launched 4 consultations alongside that response to ensure we establish the most effective way to deliver change. I am grateful to all respondents. Your input has been invaluable in helping us determine the next steps for implementing the review.

I am today presenting this government’s vision for the future of the UK labour market. A labour market that rewards people for hard work, that celebrates good employers and that is ambitious about boosting productivity and earnings potential in the UK.

At the heart of this vision is this government’s commitment to improving quality of work in the UK. I am proud to be the first Secretary of State to take responsibility for quality of work. I am grateful to those who have provided input to this groundbreaking work. This government will work closely with business and employers to ensure we realise the potential of quality work for all. I have also asked the independent Industrial Strategy Council to consider the most appropriate way to measure quality of work.

In the Good Work Plan the government also commits to a wide range of policy and legislative changes to ensure that workers can access fair and decent work, that both employers and workers have the clarity they need to understand their employment relationships, and that the enforcement system is fair and fit for purpose.

Delivering this ambitious programme of work will require close working between government and those representing the interests of employers and workers. I look forward to continued engagement going forward to implement these important changes.

Rt Hon Greg Clark MP

Secretary of State for Business, Energy and Industrial Strategy

Executive summary

Advances in technology and wider societal trends are changing how, when and where we work. As part of our Industrial Strategy we committed to ensuring the UK labour market remains successful and competitive and ready to embrace the benefits of these changes, including those brought by new employment models.

The Prime Minister has committed that we will not only maintain workers’ rights as the UK leaves the EU, but enhance them and this Good Work Plan demonstrates how the government will continue to do this. This Good Work Plan shows how we will continue to strengthen workers’ rights. The recent performance of the UK labour market should be celebrated. High employment rates, a wealth of job opportunities and increased participation across groups who have typically been under-represented is a great testament to the excellence of UK business to grow and innovate. As Matthew Taylor identified, the British model of flexibility works. But as well as benefiting from the rise in more flexible and varied ways of working, it is imperative that we prevent erosion of key protections workers should expect to rely on.

That is why the Prime Minister commissioned Matthew Taylor to conduct a review of the UK employment framework.

In February 2018 we responded to the review, accepting the vast majority of the recommendations made by Matthew Taylor. We also launched 4 consultations to seek views on the detail of implementing the recommendations, covering:

- employment status (joint with HMT and HMRC)

- increasing transparency

- agency workers

- enforcement

We received over 400 detailed responses from stakeholders and individuals. Following consideration of the responses, this plan sets out the action the government will take to implement the recommendations.

Through taking forward virtually all the recommendations made by Matthew Taylor, we will enhance the UK labour market and future-proof it to ensure further successes in a changing world. Integral to this approach is delivering on our commitment that fair and decent work should be available to all, including placing equal importance on quality work as well as quantity. We are committed to bringing about greater clarity in the law and within employment relationships, particularly as they apply to rights and responsibilities in evolving employment business models. When the law is broken, fair enforcement is also vital to a properly-functioning market. We will reform our enforcement approach to ensure it remains fit for purpose in the modern world.

Fair and decent work

At the heart of Matthew Taylor’s recommendations was an overarching ambition that all work should be fair and decent and for employers to offer opportunities that give individuals realistic scope to develop and progress. We fully share this ambition and set out in the Industrial Strategy the important role quality work can play in boosting UK productivity.

We will take firm action to tackle what Matthew Taylor termed one-sided flexibility, where some businesses have transferred too much business risk to the individual, sometimes at the detriment of their financial security and personal well-being. We will legislate to give all workers the right to request a more stable contract. Matthew Taylor identified that those employees that work intermittently over a period of time for the same employer can find it difficult to gain or access some employment rights. We will extend the time required to break a period of continuous service to make it easier for employees to access their rights.

Matthew Taylor looked in detail at the role of agency workers in the UK economy – an area of labour market flexibility that not only helps businesses to meet fluctuating demands, but also suits many agency workers and allows them to manage their own lives better. However, Matthew Taylor’s review, and our subsequent consultations, found that protections are not strong enough where this model of employment transfers all the risk to agency workers. We have deliberated carefully over the particular use of pay-between-assignment contracts which allow businesses an opt-out from equal pay arrangements between agency workers and their permanent workers. Fundamentally, we think prolonged use of these contracts is unfair and we accept Matthew Taylor’s recommendation to ban the use of this type of contract to avoid agency workers’ equal pay rights.

This is the first time that the government has placed equal importance on both quantity and quality of work and this groundbreaking approach will have significant benefits, both for workers and employers. We undertook to explore how to measure and assess job quality in the UK, acknowledging that Good Work means different things to different people. The Industrial Strategy set out 5 foundational principles of quality work:

- satisfaction

- fair pay

- participation and progression

- well-being, safety and security

- voice and autonomy

The work of the Industrial Strategy Council will inform how government adopts and tracks a set of metrics to measure quality of the work in the UK labour market. The measures should be applicable to employers, as it is in the interest of all businesses to tackle these issues directly and put into practice what the best already do. We will continue to work with employers to guide and support them in doing this.

In relation to improving voice and autonomy, we will legislate to reduce the thresholds of support for information and consultation rights so more people can benefit from them.

On the specific principle of fair pay the government has already taken strong action through increasing the National Living Wage. We will also take further action on how discretionary customer tips are treated. We know most businesses act in good faith and pass on tips workers earn for good service. However, we are aware there are a small number of employers who do not and who retain tips earned by their staff. The government therefore will legislate to ban employers from making deductions from staff tips. This legislation will mean a better deal for workers and a level playing field for employers. It will also ensure consumers can be confident in the knowledge that their tips are going to the staff they as intended.

Clarity for employers and workers

In order to address recent disagreements around the employment status of individuals, particularly those in new and emerging work arrangements, the law needs to be more transparent. Employers and individuals need to easily understand how the law applies to their particular situation. They also need to be clear on the terms and conditions both parties are required to enter into at the start of the relationship and understand what protections apply to stop problems emerging later. Matthew Taylor recommended that more needed to be done to make these relationships, rights and obligations more transparent.

We have already committed to extend to workers an entitlement to a statement of their rights on appointment. Following consultation, we set out later in this document the detailed information that must be made available at the start of a job. We are also setting out the specific information that agency workers must be given to help them make informed choices about the work they accept.

Having a separate framework for determining employment status for the purposes of employment rights and tax adds to the confusion for individuals and employers, and can drive behaviour detrimental to workers and more likely to result in noncompliance from a tax perspective. Matthew Taylor recommended that renewed effort should be made to align the employment status frameworks for the purposes of employment rights and tax to ensure that the differences between the two systems are reduced to an absolute minimum. The government agrees that this is the right ambition and will bring forward detailed proposals on how the frameworks could be aligned.

Matthew Taylor also recommended that, while the employment status framework works reasonably well for most people, government should do more to help individuals and businesses understand their rights and tax obligations in light of emerging business models.

He highlighted that the existing employment status tests have contributed to a lack of clarity faced by individuals and employers. Following consultation, we agree with his conclusion and we will legislate to improve the clarity of the employment status tests, reflecting the reality of modern working relationships. We will also improve the guidance and online tools available to help people understand their status.

Matthew Taylor also highlighted that an individual can have nearly every aspect of their work controlled by a business (from rates of pay to disciplinary action) and still be considered to be self-employed if a right for the individual to send a substitute to work in their place exists.

He recommended that the tests that determine whether someone is self-employed or has worker rights should place more emphasis on control and less on the notional right – rarely in practice exercised – to send a substitute, reflecting new business employment models.

Following consultation, we agree with his conclusion that businesses should not be able to avoid their responsibilities by trying to misclassify or mislead their staff. We will use the legislation we bring forward on employment status to tackle this issue.

As Matthew Taylor recognised, defining employment status and ensuring our legislation is fit for purpose in a changing world is not straightforward. We will continue to work closely with stakeholders to ensure that our reforms are effective, preserving the flexibility of the labour market while improving clarity for individuals. It is important that the government understands what the impacts of any change would be on people and businesses. We have commissioned independent research to find out more about those with uncertain employment status, which will help us to understand how best to support them when bringing forward legislation.

Fairer enforcement

We recognise the vital role effective enforcement plays in ensuring confidence to challenge when the law is broken and in creating a level playing field between businesses. Matthew Taylor called on the government to improve access to justice. We have already committed to extending state enforcement, on behalf of vulnerable workers, to underpayment of holiday pay. We set out in this document how this approach will mirror the tough financial penalties and enforcement approach that already applies to underpayment of the National Minimum Wage but also the support to aid compliance for businesses genuinely trying to understand and comply with the law.

In line with our enhanced approach to enforcement, we will increase state enforcement protections for agency workers where they have pay withheld or unclear deductions made by an umbrella company.

We will also legislate to increase the maximum level of penalty that Employment Tribunals can impose in instances of aggravated breach to £20,000. Further to this, we will legislate to create an obligation on Employment Tribunals to consider the use of sanctions where employers have lost a previous case on broadly comparable facts, building trust and the deterrence for all businesses to behave as most already do.

We expect the cumulative effect of these changes, combined with recent increases in the resources available to enforce employment law, to significantly change the enforcement landscape. Establishing the Director of Labour Market Enforcement has been an excellent innovation, in terms of improving coordination and sharing intelligence across agencies enforcing employment law, but we think we can go further. We will bring forward proposals in early 2019 for a new, single labour market enforcement agency to better ensure that vulnerable workers are more aware of their rights and have easier access to them and that businesses are supported to comply. This will provide a single point of contact for individuals and employers and will benefit from the additional powers and resources mentioned above.

This ambitious Good Work Plan builds on our modern Industrial Strategy by delivering a UK employment system which is fair, transparent and fit for the future. An economy and labour market which works for everyone.

Fair and decent work

At the heart of Matthew Taylor’s recommendations was an overarching ambition that all work should be fair and decent.

Everyone, regardless of where they live in the UK or which sector they work in, should be able to benefit from high quality jobs. Through the Industrial Strategy, the Secretary of State for Business accepted responsibility for quality of work within government and committed to working closely with employers to boost the quality of work in the UK. The Industrial Strategy also recognised the vital role quality work can play in enhancing UK productivity and the importance of creating workforces that are motivated, engaged and empowered.

For the first time the government has also taken the groundbreaking step of placing equal importance on the quality and quantity of work. Many successive governments have focused on boosting the quantity of work. This remains a key aim, but now that we have achieved record levels of employment, it is only right that we also focus attention on creating higher quality jobs. We want to lead the way internationally in offering high quality work for all.

The Prime Minister has committed that we will not only maintain workers’ rights as the UK leaves the EU, but enhance them, and this Good Work Plan demonstrates how the government will continue to do this.

One-sided flexibility

Flexibility has been a key factor behind the success of our labour market.

Matthew Taylor commended the benefits of this approach, including increased participation, worker satisfaction, and individuals being able to work in a way that suits them. We do not want to limit these benefits, which grow with new ways of working. Most employers use this flexibility responsibly, benefiting both their business and the individuals who work in it.

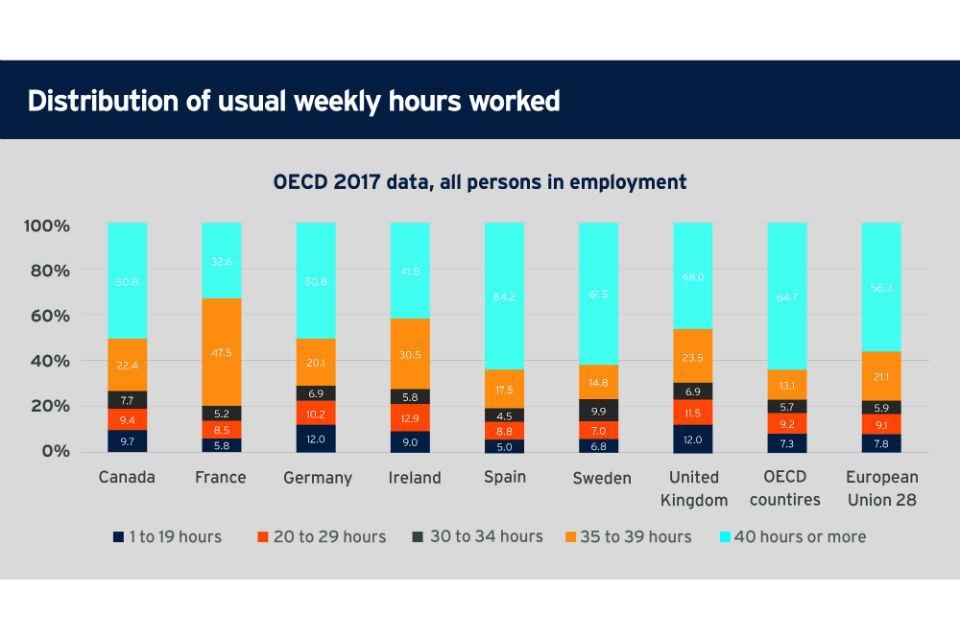

The UK has a more varied spread of people’s usual weekly working hours than most OECD countries, shown in the chart opposite. With underemployment rates declining since 2010, people are choosing to work in a way that suits them. This makes it more likely people can find jobs or work more hours. It also helps businesses meet customer demand.

Distribution of usual weekly hours worked graph (OECD 2017 data)

However, a minority of employers abuse the current system, transferring too much risk to the individual. This jeopardises workers’ financial security and personal well-being. Matthew Taylor termed this ‘one-sided flexibility’, giving examples of employers cancelling shifts at short notice or sending staff home when customer demand is low. He uncovered evidence of some individuals remaining on insecure, atypical contracts for long periods of time, when their working patterns were sometimes the same as permanent employees who had fixed, regular hours.

Right to request a more predictable and stable contract

We are committed to tackling this one-sided flexibility. Every individual should be able to benefit from the positives that can come with flexibility and not be left in a situation where they are unable to plan for the future, or face financial uncertainty as a result of irresponsible employment practices. That is why we will bring forward legislation to introduce a right for all workers to request a more predictable and stable contract.

Those who are content to work varied hours each week will be able to continue. However, those who would like more certainty will be able to request a more fixed working pattern from their employer after 26 weeks of service. We think it is important this right is available to both employees and workers, as everyone should have the right to request greater security in their working hours. For example, this might be greater certainty around the number of hours a person receives, or fixed days on which they will be asked to work. This will empower workers and give them greater control over their own lives.

Example of how the new right to request a more predictable and stable contract would apply

Ian works in a hotel on a zero hours contract and works varied days each week depending on customer demand. However, he always tends to work over 30 hours in a week, and many weeks he may do lots more. Ian decides to purchase his first property, and when applying for his mortgage he is told he is too high risk as he has no set hours.

Therefore, Ian goes to his employer and makes a request for a contract that guarantees at least 30 hours each week. The employer notes that Ian has worked for them for over 26 weeks. They look at the hours Ian has worked, their demand over the last year and their future forecast of bookings.

On evaluation, they decide they can accommodate this request and respond to Ian within the set 3-month timeframe. Ian is granted a 30 hour a week contract. While he still sometimes works more than this, he now has the certainty needed to gain his mortgage.

Extending the break in continuous service

Whilst modern approaches to working create new opportunities, there are also challenges associated with how employees accrue employment rights when they are working flexibly or for multiple employers. In the current system, employment rights are earned over time.

Matthew Taylor identified that those who work intermittently for the same employer can find it difficult to gain or access some of these rights because they may struggle to build up continuous service. Currently, a gap of one week in employment with the same employer can break what counts towards continuous service for calculating employment rights. To reflect the changing world of work we will legislate to extend this break to 4 weeks, allowing more employees to gain access to employment rights.

Protecting agency workers

All workers should be empowered to manage their own lives and have control and choice over the way in which they work. Agency workers can currently exchange their right to be paid equally to permanent counterparts (‘opt out’ from this part of the Agency Worker Regulations) in return for a contract guaranteeing pay between assignments. This was originally designed to give reassurance that they would continue to earn even during periods where there were gaps in work.

However, there is evidence that workers are not benefiting from this opt-out, known as the Swedish derogation. BEIS research[footnote 1] uncovered cases where pay between assignments does not happen because individuals can be kept on very long term contracts with an employer, without their right to equal pay. Umbrella companies or employment businesses can also devise schemes to keep their exposure to a minimum, many contrary to the requirements set out in the regulations.

In a time of full employment it is becoming increasingly unusual for agency workers to have gaps between their assignments, and some employers are instead simply using this opt-out to reduce the size of their paybill. Some employers have told us they have already moved away from this type of contract. However, without government action some agency workers will continue to lose out. That is why we are bringing forward legislation to repeal the Swedish derogation and ban the use of this type of contract to withhold agency workers’ equal pay rights. This will guarantee equal wages with those of comparable permanent workers for all long-term agency workers and prevent situations like those uncovered through BEIS’ research occurring in the future.

As proposed by Matthew Taylor, the government asked the Low Pay Commission to provide advice on the prevalence of one-sided flexibility, the impact of introducing a higher minimum wage for non-guaranteed hours, and alternative policy ideas to address the issue. Following research and consultation, the Commission agrees that one-sided flexibility is a problem in the modern economy. It does not endorse the proposal to introduce a premium to the National Living Wage for non-guaranteed hours worked but instead recommends alternative action. We welcome the Commission’s work and recommendations which are published alongside this document. As set out in this Good Work Plan, the government remains determined to tackle one-sided flexibility while retaining the flexibility that many people find so valuable. For example, we are taking action by introducing a right to request a more stable contract. The Commission had specific views on this policy, which we will consider as we develop legislation. Alongside this, we will consult on the Low Pay Commission’s other proposals.

Extract from BEIS research – an employment agency presenting their experience of how pay between assignments contracts are used

The agency has never used a pay between assignments model and does not believe that the Swedish derogation is being used as intended:

If you look at how it is actually being used, which is to circumnavigate the Agency Worker Regulations, it’s just something ethically we don’t want to do. Every single instance we’ve experienced (and there have been a large number of these) where we’ve been tendering for work or where our rates are being undercut by other agencies the way the derogation is being used is for workers to give up their right to equal pay after 12 weeks, but they are never paid between assignments and there are lots of artificial ways to get round this.

Examples the agency has seen of ways to avoid pay between assignments include a contractual stipulation for workers to be constantly available for work, with some contracts specifying anywhere in the UK and others giving a substantial radius. If people can’t accept this work (which may only be for a few hours) they do not receive pay between assignments. Another example is people with family commitments who can only work during the day being offered night shifts when they have no childcare arrangements. The agency has yet to see an example of a worker actually being paid between assignments.

Quality of work

Quality work means different things to different people.

For some people it is higher pay, for others it is greater flexibility or the opportunity to progress. Matthew Taylor noted 2 people could hold “diametrically opposed views of the same job”. The Industrial Strategy set out how we want continuous improvement in the quality of jobs, with the UK reaping the rewards in terms of enhanced growth and productivity. We undertook to explore how to measure and assess job quality in the UK, based on 5 foundational principles:

- satisfaction

- fair pay

- participation and progression

- well-being, safety and security

- voice and autonomy

The Carnegie UK Trust and the Royal Society of Arts brought together a group of social partners, academics and other experts to discuss how best to measure quality work. They presented their findings in a report in September 2018, providing a valuable contribution to this agenda, which government strongly appreciates. We have established an independent Industrial Strategy Council to develop measures of success for, and assess the progress of, our Industrial Strategy. The Carnegie proposals are an important source of effective evaluation metrics that the Council have been asked to consider.

The work of the Industrial Strategy Council will inform how government adopts and tracks a set of metrics to assess the implementation of the Industrial Strategy measures. Government will seek to also evaluate work to improve the quality of the work in the UK labour market against these metrics where applicable. To ensure employers understand their role in building work quality, and how it can help build their workforce’s productivity, the measures should be applicable to employers and individuals.

Satisfaction

Providing better jobs will help employers to attract and retain the talent they need to grow and thrive. Transparency around job quality will help individuals make better choices about work that suits their needs.

We will continue to work with representatives of business, workers and other stakeholders such as Acas, CIPD, CMI, Investors in People, and the Work Foundation to demonstrate the benefits of improving the quality of work and being transparent about the quality of work on offer.

Case study: the employer of choice strategy [footnote 2]

In 2011, after acquiring and integrating several businesses in a very short space of time, employee engagement results at Ricoh UK were disappointing. By working with Investors in People, Ricoh was able to face a hard truth and understand that the majority of its people did not want to be working there.

Determined to make Ricoh a place where people wanted to work, the company’s ‘One Ricoh’ transformation project addressed differing cultures by aligning employment terms and conditions across the organisation. This supported the goal of an affordable, sustainable, competitive and consistent reward and benefits package that increased engagement.

Good communication was key to its success, building on regular employee engagement surveys throughout the course of the project. The result was 2,700 new contracts, all re-signed, and much improved engagement. With more flexible working opportunities and streamlined processes, Ricoh optimised and revitalised its workplace which led to more engaged and empowered workers. Today, the company continues to focus on ensuring its people want to work for Ricoh.

Participation and progression

As we set out in the Industrial Strategy, we are committed to ensuring everyone benefits from work that is fair and decent with realistic scope for development and fulfilment. An important aspect of this is ensuring people have the skills they need to enter the labour market and perform effectively at work. Whether someone is in a permanent, full-time role, working part-time or in an atypical working relationship, securing sound basic skills will support them to succeed in the labour market and progress their careers.

Our technical education reforms will ensure individuals are able to access a wider range of training options as they enter the labour market. The development of employability skills, such as planning, communication and problem solving, will be integral to both the core and specialist components of T Level qualifications. We intend to publish guidance on this for T Level panels, including an employability skills framework, making this available to other organisations. This will contribute to dialogue around the transferable employability skills that are required in a range of jobs across the labour market. The Adult Education Budget (AEB) also supports adults to gain the skills and learning they need to equip themselves for work, an apprenticeship or further learning. Provisions covered include basic skills (English and maths) and the full range of level 2 and level 3 learning aims. From 2020, selected basic digital skills courses will also be fully funded, in recognition of the increasing importance of digital literacy in the modern labour market.

We also want all young people to understand the full range of opportunities available to them, learn from employers about work and the skills that are valued in the workplace, and have first-hand experiences of the workplace. This is why all schools will be expected to appoint a careers leader and use the Gatsby Benchmarks to improve careers provision, as set out in new statutory guidance.

In the context of new technology, increasing automation and a changing world of work, it is also essential that, in addition to developing transferable skills, individuals are also able to learn new skills throughout their working lives. The government is committed to supporting working adults to retrain, particularly where their current occupation could be threatened by automation. That is why we are developing the National Retraining Scheme - an ambitious programme designed to drive adult learning and retraining and to help the UK respond to a changing economy. In the 2018 Autumn Budget we announced a £100 million initial commitment to start the roll out of the National Retraining Scheme. This will play a key role in supporting people to progress in work, redirect their careers and secure the high-paid, high-skilled jobs of the future. This funding will allow us to launch elements of the Scheme next year.

Alongside our efforts to improve the evidence base around in-work progression, we will explore how greater transparency can change behaviours in the labour market. We will review how improving the display of job quality data on job sites, including the Department for Work and Pensions’ Find a Job, could improve people’s ability to find the right job for them.

Wellbeing, safety and security

Better quality work benefits both businesses and individuals. Research has demonstrated that happy and engaged employees experience less workplace stress and are more productive, and that businesses that have higher levels of employee satisfaction outperform their competitors.

The review [footnote 3] last year by Paul Farmer and Lord Stevenson highlighted the importance of supporting mental health in the workplace and set out some core standards for employers to adopt, meaning that employers can create a positive and supportive workplace culture themselves. Information and guidance for employers is freely available. [footnote 4] We know that many employers are already working diligently towards this goal, from small to large employers.

Fair pay

We are proud of the action we have taken to boost wages in the UK. More than 2 million workers benefited from the latest increase in the National Living Wage, which mean that a full-time worker will have seen their annual pay increase by over £2,000 since its introduction. The lowest paid (those at the fifth percentile of the earnings distribution) saw their wages grow by almost 8% above inflation between April 2015 and April 2018. This is faster than at any other point in the distribution. The government has an aspiration to end low pay. Next year, the government will set out the Low Pay Commission’s remit for the years beyond 2020. In the coming months, it will consult the Low Pay Commission (LPC) and others on this new remit, and as it sets policy will take account of the potential impact on employment and economic growth.

In some sectors, such as hospitality, tips, gratuities and service charges can be a significant part of staff income. Tips are also part of how consumers recognise and reward good service. We are pleased that most employers already pass on tips to the staff who earn them. However, we are aware that a minority of employers exploit their staff by retaining the tips they earn. This is contrary to basic fairness at work.

Responses to a government consultation on this issue gave a clear indication that government intervention is required to improve the treatment of discretionary payments for service.

Case study: wellbeing in the civil service

The Civil Service is already committed to leading the way in its approach to mental health, including work related stress and anxiety. It found significant and lasting cultural change is possible through a comprehensive, cost-effective set of commitments.

Encourage open discussion and conversations; breaking down the stigma attached to mental health at all levels, for example through senior manager role models talking openly about their mental health experiences.

Connect physical and mental health; it promotes awareness that stress and anxiety in the workplace have complex causes, which may also arise from personal circumstances.

Embed the importance of well-being into senior leadership. Well-being of staff, teams and organisations are part of performance objectives. Senior managers are helped to understand the impact of their decision-making, planning and actions on the well-being of their teams.

Provide managers with resources to help them manage mental health better. Managers receive a guide for discussions about mental health they may need to have with their teams, with advice on relevant actions and links to external resources [footnote 5].

Enable leaders, managers and staff to share experiences and best practice; through events and network groups, which can also help build peer-support.

Transform the support available to individuals; make it easier to identify, obtain and transfer workplace adjustments.

Train mental health first aiders. There are over 2,200 Civil Servants trained to help individuals in crisis and support their colleagues, alongside their day job. The Employee Assistance Programme also includes face to face counselling where appropriate.

Develop cutting edge Health & Well-being and Disability data dashboards. Gathering and reporting data provides indications of health and well-being, and drives action.

Therefore the government will legislate to ban employers from making deductions from staff tips. This legislation will offer a financial benefit to workers who will receive the tips they earn – many of these workers are earning the minimum wage. It will also give consumers reassurance that the money they leave in good faith to reward service is going to the staff as they intended.

Voice and autonomy

The Taylor Review highlighted that for work to be fair and decent, workers must have a voice. High levels of employee engagement improve organisational performance and boost productivity. As the ‘under new management’ case study demonstrates, and a government commissioned report identified [footnote 6] individuals who are engaged and involved in business decisions feel more empowered in the workplace, as well as more fulfilled.

Matthew Taylor also considered the Information and Consultation regulations and underlined their role in ensuring that employee voice is heard and has impact.

Experts have identified that voice arrangements result in a higher level of organisational commitment [footnote 7] and highlighted the benefits of giving employees a voice and acting on their input. [footnote 8] The regulations offer a framework to encourage long-term information and consultation arrangements between individuals and their employers and provide a mechanism for their views to be taken into account on major workforce reforms, issues such as restructuring. Matthew Taylor highlighted that, in order for these rights to be more accessible, the threshold of agreement required for information and consultation arrangements to be implemented needs to be reduced. Currently, a request to set up such arrangements requires at least 10% of employees to support it. We recognise that lowering the threshold is an important step in improving voice in the workplace.

We will therefore legislate to lower the threshold required for a request to set up information and consultation arrangements from 10% to 2% of employees. The 15 employee minimum threshold for initiation of proceedings will remain in place. To complement these legislative measures, we will also work with Investors in People, Acas, trade unions and other experts to promote the development of better employee engagement with a particular focus on sectors with high levels of casual employment and smaller firms.

Case study: under new management

Organisational change, such as new ownership, relocation or restructuring, can be a major source of stress for employees. A new owner and manager of a small garage in Cambridgeshire employing 10 staff sought to develop better workplace relationships. Rather than meeting after work, the team downed tools to have meetings within working hours, meaning employees were paid for their time. A staff survey also asked about immediate environmental concerns and issues affecting well-being.

Management quickly acted on the points raised, installing an improved kitchen and creating a quiet, clean break room. Employees contributed creative ideas for potential business growth and their successes were recognised. By acting on longstanding employee concerns, the new management helped the team cope with organisational change. This fostered better workplace relationships and reinforced the positive, productive culture so important for success in a customer-facing service business.

Clarity for employers and workers

There is an important link between having a flexible labour market and creating the right conditions for innovation and growth.

The UK has a global reputation as a great place to do business and we have one of the most flexible labour markets in the world. The success of our approach is demonstrated by employment and participation rates reaching historic highs. We are an attractive location for companies to set-up for the first time and to expand. Every 75 seconds a new business starts up in the UK and we are home to 5 of the top 10 fastest-growing businesses in Europe. The first foundation of our Industrial Strategy is to maintain and enhance the business environment in the UK. Ensuring our labour market adapts effectively to a rise in new business models and employment relationships is an important aspect of this commitment.

With innovation and change comes new challenges. Whilst the majority of employers take a balanced approach to working relationships, acting in the interest of both their business and the people who work for them, there are some who do not - whether that is deliberate or by accident.

UK employment and participation rate (%) at historic highs (Source: ONS 1971 to 2017)

Employment status

At the centre of these issues is employment status.

In the UK it is an individual’s employment status that determines which statutory employment rights apply and how much tax is required to be paid. The rise of new business models and employment practices have caused increasing numbers of disagreements around the employment status of individuals.

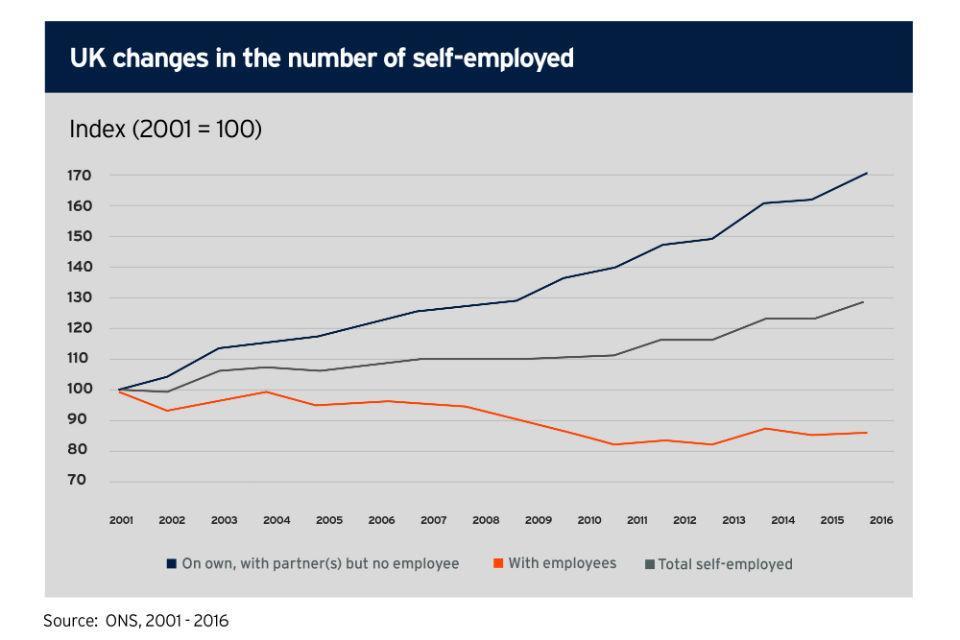

This has raised concerns that some businesses may not currently be providing people with the rights they are entitled to, while some individuals and businesses may not be paying the right taxes. Changes in the way people work has also seen a rise in the number of people working in the economy who are self-employed.

UK changes in the number of self-employed (Source ONS 2001 to 2016)

What is employment status?

Employment status is determined by the characteristics of the working relationship and not simply by what the contract says or what the employer tells their staff. In the UK tax system there is a 2-tier employment status framework of employed and self-employed.

For employment rights there is a 3-tier framework that consists of 2 statutory employment statuses of employee and worker, and a third category of self-employed, which is not defined in legislation. It is currently possible that someone with worker status for rights could be employed or self-employed for tax.

Employees tend to be people who do regular, standard work but do not have to be full-time and could be on a fixed-term contract. Employees are entitled to all statutory rights including those that require a period of qualifying service.

Workers tend to be people working in a more casual way, and on a job by job basis. Workers are entitled to day one rights that include National Minimum Wage, holiday pay and rest breaks.

An individual who is genuinely self-employed does not require legal protection to treat themselves fairly. A genuinely self-employed individual runs and manages their own business and, for example, has control over how, when and who carries out the work and negotiates the price of the work to be undertaken. They must comply with employment law if they use staff to carry out work.

Key tests used by the courts to establish worker status

In order to establish whether a worker’s contract exists (other than a contract of employment), the key tests used by courts are:

Contract – is there a contract between the individual and the employer?

Personal service – whether the individual is required to do the work themselves.

Individual is in business on their own account – the courts will also consider any other factors that are inconsistent with worker status including, where relevant:

- who has control over how, when, where and what work is carried out

- whether there is some form of commitment or obligation between the individual and employer, beyond that of just a contract

- whether the individual is integrated into the business of the employer.

For employment rights purposes, where there is a disagreement an individual can bring a claim to an Employment Tribunal and request that they determine their employment status. For tax purposes, HMRC enforce the employment status in the first instance, but where there is a disagreement between businesses and HMRC, cases can be referred to a tax tribunal to determine employment status. When the tribunals make a judgement on an individual’s status they will consider if a contract of employment exists or other worker’s contract and will take account of all the characteristics and factors relevant to that specific working relationship and arrangement. Where appropriate the courts will look at how it works in reality rather than just what is written in any contract. Legislation does not provide any detail about what constitutes a contract of employment or other worker’s contract and so the tribunals have established a number of tests, based on case law, to help them decide.

Clarifying the tests

Having a separate framework for determining employment status for the purposes of employment rights and tax adds to the confusion for individuals and employers, and can drive behaviour detrimental to workers and more likely to result in noncompliance from a tax perspective.

Matthew Taylor recommended that renewed effort should be made to align the employment status frameworks for the purposes of employment rights and tax to ensure that the differences between the two systems are reduced to an absolute minimum. The government agrees that this is the right ambition and will bring forward detailed proposals on how the frameworks could be aligned.

Matthew Taylor also recommended that, while the employment status framework works reasonably well for most people, government should do more to help individuals and businesses understand their rights and tax obligations in light of emerging business models. He highlighted that the existing employment status tests have contributed to a lack of clarity faced by individuals and employers. Following consultation, we agree with his conclusion and we will legislate to improve the clarity of the employment status tests, reflecting the reality of modern working relationships. We will also improve the guidance and online tools available to help people understand their status.

Matthew Taylor also highlighted that an individual can have nearly every aspect of their work controlled by a business (from rates of pay to disciplinary action) and still be considered to be self-employed if a right for the individual to send a substitute to work in their place exists.

He recommended that the tests that determine whether someone is self-employed or has worker rights should place more emphasis on control and less on the notional right – rarely in practice exercised – to send a substitute, reflecting new business employment models.

Following consultation, we agree with his conclusion that businesses should not be able to avoid their responsibilities by trying to misclassify or mislead their staff. We will use the legislation we bring forward on employment status to tackle this issue.

As Matthew Taylor recognised, defining employment status and ensuring our legislation is fit for purpose in a changing world is not straightforward.

We will continue to work closely with stakeholders to ensure that our reforms are effective; preserving the flexibility of the labour market while improving clarity for individuals. It is important that the government understands what the impacts of any change would be on people and businesses. We have commissioned independent research to find out more about those with uncertain employment status, which will help us to understand how best to support them when bringing forward legislation.

Clarity of information

Alongside improving clarity around employment status it is imperative everyone knows from day one of starting a job what rights they are entitled to.

The emergence of new employment relationships and a rise in atypical working has resulted in some workers not having access to all the information they need to fully understand their employment terms and conditions. Too often issues arise during an employment relationship because both parties were not clear on their rights and obligations from the outset.

Written statement

Once employees have worked for the same employer for longer than a month they are entitled to a written statement covering details of their employment contract and rights. They must receive this written statement within 2 months of starting work.

Matthew Taylor highlighted that the current legislation excludes workers, meaning some individuals do not have transparent information about their employment relationship. He recommended the government takes action to address this. We agree, and do not think this existing provision goes far enough. We believe all workers should have the same clarity as employees so they can fully understand what they are signing up to. That is why we will legislate to extend the right to a written statement to all workers, as well as employees.

In order for the information in the written statement to be useful, and allow individuals to make informed choices, the Taylor Review also highlighted that it needs to be made available much sooner than 2 months into employment. We agree, and will therefore bring forward legislation to make access to a written statement a day one right for both employees and workers. We also want to ensure the content of a written statement is as useful as possible to both the individual and the employer so will be expanding the information required.

Additional mandatory contents to be required in a written statement

We will be expanding the information that employers are required to provide as mandatory content in a written statement from day one (including any additional information provided for example through staff handbooks on sick leave and pay or other types of paid leave). The additional information to be included covers both new information, and information which employers are already required to provide. The additional information is as follows:

- how long a job is expected to last, or the end date of a fixed-term contract

- how much notice an employer and worker are required to give to terminate the agreement

- details of eligibility for sick leave and pay

- details of other types of paid leave such as maternity leave and paternity leave

- the duration and conditions of any probationary period

- all remuneration (not just pay) – contributions in cash or kind for example vouchers and lunch

- which specific days and times workers are required to work

All of the above is in addition to the current mandatory information that must be provided in a written statement.

Key Facts Page for agency workers

It is also essential that we address the issue of transparency in agency worker contracts. In agency work, pay can be handled by several different people and organisations, including the employment business, the hirer and sometimes an intermediary.

Understanding who is responsible for paying an individual and what deductions they are making can be difficult for the individual. For example, Matthew Taylor identified that, while most employment businesses that originally place a work-seeker do provide information about pay rate and methods, this information is still not always as clear to the work-seeker as it should be.

He also highlighted that some unscrupulous providers can seek to bury important information in the small print of long contracts, leading to confusion for agency workers and, in the worst cases, exploitation.

We are committed to tackling this lack of transparency. We will legislate to require all employment businesses to provide every agency worker with a Key Facts Page. This will include:

- the type of contract a worker is employed under

- the minimum rate of pay that they can expect

- how they are to be paid

- if they are paid through an intermediary company

- any deductions or fees that will be taken

- an estimate or an example of what this means for their take home pay

It is essential that this Key Facts Page is easy to understand and we will work with business groups to prepare guidance on the format.

It will be the responsibility of the employment business to issue a Key Facts Page and ensure the worker receives it. This will ensure employment businesses carry out appropriate due diligence regarding the other companies they work with within their supply chain, such as umbrella companies, and maintain some level of responsibility for the worker. The Employment Agency Standards Inspectorate will have powers for enforcing situations where a Key Facts Page has not been provided.

Holiday pay

A further area where Matthew Taylor identified individuals and employers would benefit from greater transparency is holiday pay entitlement. Paid time off is a basic protection that all workers are entitled to. In the majority of cases employers are diligent in ensuring their workers receive holiday pay and, in some instances, go over and above, offering holiday pay entitlement beyond the statutory minimum. However, some individuals and employers are unaware of holiday pay entitlements, highlighting a need for better information. Matthew Taylor also found evidence where individuals are either prevented from taking their leave or feel reluctant to request this from their employers.

The Taylor Review highlighted that awareness of entitlement remains one of the biggest barriers to individuals receiving the holiday pay they deserve.

We will launch an awareness campaign, targeted at both individuals and employers, to boost awareness and understanding to help ensure all workers are benefiting from their paid entitlement to leave.

It is vital that everyone has the information they need to comply with the law. We will introduce new guidance, including real life examples, to support the interpretation of holiday pay rules. This will be accompanied by an updated and improved holiday entitlement calculator and we are exploring the option of a new holiday pay calculator.

The review also identified some challenges which are limiting some workers, particularly those in seasonal and atypical roles, benefiting from their full holiday pay entitlement. Matthew Taylor advised that to address this we should increase the reference period for determining an average week’s pay from 12 weeks to 52 weeks. For example, there currently are opposing incentives for some employers and individuals as to when to take holiday. A 52 week reference period would prevent this and would result in greater flexibility for workers in terms of choosing when to take holiday. We will therefore legislate to extend the holiday pay reference period from 12 to 52 weeks. However, we will go further and set out in the next section other measures we will take to ensure vulnerable workers receive their holiday pay.

Example of how a 52 week holiday pay reference period would operate

Chitrita works in a large retail store, working on average 35 hours each week. May, June and July are quieter months for the store and so Chitrita typically works 25 hours per week. Under the current 12 week reference period for holiday pay if Chitrita takes holiday in August, immediately after this quieter time, her holiday pay will reflect her 25 hour working week. This means she will receive less holiday pay compared to busier times of the year.

However, once the reference period is extended to 52 weeks, Chitrita’s holiday pay would reflect her average hours for the entire year, which are usually higher than during these quieter months. This is a fairer approach for Chitrita and her employer as her holiday pay will better reflect her working hours across the year.

Fairer enforcement

Britain has some of the world’s strongest employment rights.

For these rights to be fully realised, the system for enforcing them must be clear, fair and efficient for both workers and employers. It should ensure a level playing field that prevents any employer from repeatedly ignoring their responsibilities. Workers should be confident their employment rights are enforced as strongly as their other rights.

There are 2 tiers of how employment rights are enforced – by the Employment Tribunal system, and by the state. Matthew Taylor concluded that this 2-tier enforcement framework works, but highlighted some concerns – including a sense that enforcement is not as easy as it should be for the worker.

Employment tribunals

If an individual believes they are not receiving their entitled rights, they can ultimately take the employer to an Employment Tribunal to arbitrate.

In the vast majority of situations, before a worker can lodge an Employment Tribunal claim, Acas must be notified to initiate their process of conciliation between the worker and employer. An Employment Tribunal claim in most cases can only be lodged after the exhaustion of Acas’s statutory duty to offer Early Conciliation. This system means that most disputes can be resolved without recourse to the courts and workers benefit from quicker resolution. The following diagram shows that of all notified claims, fewer than 6% are ultimately decided by an Employment Tribunal.

For those individuals who do bring a claim before an Employment Tribunal and receive a judgment in their favour, we would expect the redress to be made promptly by the employer. In some cases, employers continue to act improperly by not paying the awards set by a tribunal, meaning the worker is further aggrieved. We believe this is unacceptable and must end.

Flow of concilliation cases (2017 to 2018)

Modernising the tribunal service

The government is investing over £1 billion on the reform of the courts and tribunals, to transform the way that people experience the justice system. This is an ambitious programme of reform which will help to address some of the difficulties people face in enforcing tribunal awards that Matthew Taylor identified in his report. In particular, the programme includes two projects, the Employment Tribunal Project and the Civil Enforcement Project which aim to make it much simpler for people to bring and pursue Employment Tribunal claims, and more straightforward to enforce them if the award is not paid.

The Civil Enforcement Project includes the development of improved information and guidance for those who are considering taking enforcement action, making it available online as well as in the form of paper leaflets. This will explain more clearly, in straightforward language, the options available for users to enforce unpaid judgments and awards through different enforcement methods. We are currently testing the revised guidance to ensure that the information provided is clear and intelligible to lay users.

In the meantime, we will use the feedback we have already gathered from the project to review the existing paper guidance provided to those who have been granted an Employment Tribunal award with a view to improving the information provided about all of the options to encourage and enforce payment, for example through the BEIS Employment Tribunal penalty scheme, the Fast-Track High Court Enforcement Officer Scheme and the County Court enforcement options.

We will simplify the user’s journey through the lifetime of an Employment Tribunal claim, from the issue of a claim to the making of an award using digital service delivery. This project will also enable the capture of more and better data relating to claims and awards which we will be able to use to improve enforcement so that those using Tribunals should only have to provide information once.

Our vision is to build these reform projects into a seamless, end to end system which guides users through each stage of the process, and signposts at the relevant time all of the enforcement options available so that more people are paid what they are entitled to quickly and with the minimum of effort.

In addition to this reform programme, the BEIS penalty scheme will continue to offer a free scheme to individuals to register their unpaid Employment Tribunal award with an enforcement officer, who gives the employer a warning notice. If the amount owed is not paid within 28 days, the employer receives an additional penalty notice and must pay both the original amount and a penalty of up to 50% of the unpaid award. The BEIS penalty scheme has issued over 1000 warning notices since its introduction in 2016 and recovered over £1.5 million owed to workers who may not have otherwise received payment. This evidences the success of the scheme in encouraging payment as a result of government intervention.

Successful claimants should get what they are rightfully owed. While most workers receive the sums agreed as part of a conciliated settlement, too many individuals struggle to receive Employment Tribunal awards. Employers must also face consequences for avoiding paying what is owed. We will now name employers that are not paying their Employment Tribunal awards. At present, the main way we will be able to identify these employers will be using the BEIS penalty scheme, unless the worker opts out. Employers can avoid being named by paying the outstanding award when prompted. If no payment or successful representation is made we will include them in our list for publication.

Additional penalties

In lodging an Employment Tribunal claim, an individual should feel confident that an employer found against would be properly penalised. The Employment Tribunal process should also be able to take account of where an employer appears to be repeatedly breaching its obligations in the hope of gaining an advantage over its competitors.

Employment Tribunals already have powers to impose additional penalties where an employer has breached its obligations. These include imposing aggravated breach penalties, cost orders and uplifts in compensation. We know these are not currently used as widely as they could be and want to ensure all users of the Tribunal system are fully aware of the current powers. We will provide new guidance providing examples of how current powers can be best used. This will help all users understand the options available to make employers face the consequences of their actions. We will also bring forward legislation to raise the maximum limit of an aggravated breach penalty to £20,000 from £5,000. Employment Tribunals consider each case on its merits. The proportion of employers acting in breach of their obligations toward workers is small, and the minority facing subsequent tribunals on similar issues is even smaller. In these rare instances, it can only be concluded the employer is ignoring the law. We will provide a tougher enforcement regime where employment rights are breached repeatedly, on the same issue, by the same employer.

To tackle repeated breaches, we will bring forward legislation to facilitate the use of sanctions in cases of repeated breaches by the same employer. To ensure these powers are consistently used where relevant or applicable, we will place an obligation on employment judges to consider the use of these sanctions. In taking this legislation forward, we will refine our proposals in consultation with interested parties. This will focus in particular on time between breaches, types of breaches and how repeated breaches are demonstrated.

State enforcement

The Taylor Review examined how the state enforces some aspects of employment law where there is considered to be a higher risk of vulnerability or exploitation.

The 4 main bodies that enforce workers rights, in addition to the Police, are:

- Employment Agency Standards Inspectorate, who enforce agency workers rights

- Gangmasters and Labour Abuse Authority, who act on exploitation and where employers requiring a license are operating without one, and on trafficking and modern slavery

- Health and Safety Executive, who enforce the maximum limit on weekly hours worked and take action on poor working conditions

- HM Revenue and Customs, who act on non-payment of the National Minimum Wage

We created the post of Director of Labour Market Enforcement to provide strategic direction and coordination to the overlapping responsibilities of the Employment Agency Standards Inspectorate, the Gangmasters and Labour Abuse Authority and HMRC’s National Minimum Wage enforcement team.

Sir David Metcalf, who took up post as the first Director of Labour Market Enforcement last year, published his Enforcement Strategy 2018-2019 in May 2018. The Director’s Strategy reinforced a number of Matthew Taylor’s recommendations. We have published our response to the strategy alongside the Good Work Plan, committing to a vast majority of its recommendations, including increasing the number of frontline inspectors within the Employment Agency Standards Inspectorate and new powers for the Employment Agency Standards Inspectorate.

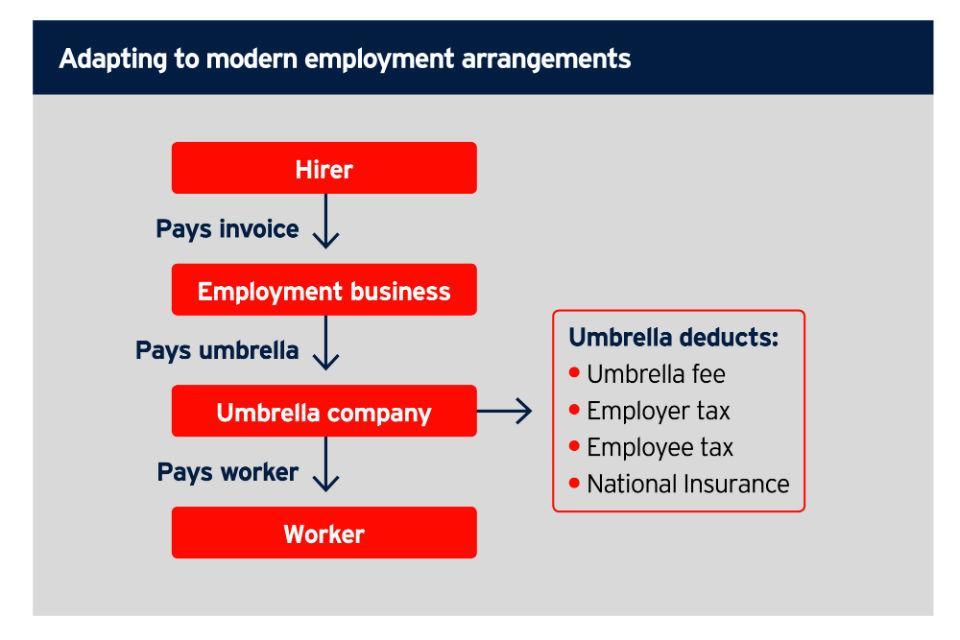

Adapting to modern employment arrangements

The Industrial Strategy outlined how a flexible workforce benefits the UK economy, and it creates opportunities for both employers and workers without a long-term commitment for either side.

As levels of self-employment and flexible working have increased, so has the number of umbrella companies acting as intermediaries between employers and workers. In simple terms, these relationships involve the employing firm paying the umbrella company, who in turn reimburse the worker. This helps employers reduce the cost and complexity of managing payroll systems.

The Taylor Review concluded that, while higher skilled, higher paid sectors are well served by umbrella companies, their role is more questionable for lower skilled, lower paid roles. The statutory protections for these workers have not kept pace with this increasingly common arrangement.

A significant drawback for workers is that the added layer of umbrella companies can create uncertainty – it can be unclear who their employer is. This means it is hard to know who to hold responsible for paying wages in full and on time, and who should be ensuring their employment rights are observed. Umbrella companies can also charge agency workers administration fees, which can be unclear to the worker.

The government will introduce legislation to expand the remit of the Employment Agency Standards Inspectorate to cover umbrella companies. This will empower the Employment Agency Standards Inspectorate to investigate complaints involving an umbrella company and take enforcement action where required. This action will focus on situations where agency workers have not received adequate pay and will protect decent employers from unfair competition.

We will continue to monitor the role of umbrella companies by ensuring the Employment Agency Standards Inspectorate work closely with HM Revenue and Customs and the Gang-masters and Labour Abuse Authority to identify any further enforcement or regulation required to tackle any detrimental aspects of the arrangement.

Adapting to modern employment arrangements

Accessing pay entitlement

In recent years, we have significantly raised the National Minimum Wage, and complemented it with the higher National Living Wage for those aged 25 years old and over.

The National Minimum Wage for those aged 21 to 24 years old will be £7.70 in April 2019 – compared with £6.19 for over-21s in 2012. This rise of over 24% – and over 32% for those aged 25 years old and over, with the National Living Wage to rise to rate of £8.21 – has given millions of lower-paid workers a well-deserved pay rise, but workers can only benefit if they are receiving the correct rate.

Where a worker is concerned they have not received the National Minimum Wage, National Living Wage or Statutory Sick Pay, they either pursue a claim through an Employment Tribunal or contact HM Revenue and Customs, who can investigate and ensure workers receive the money they are owed. Being able to call on HMRC’s investigators has enabled over 200,000 workers to access National Minimum Wage pay arrears in excess of £15.6 million in 2017 to 2018 alone.

Currently, workers concerned they have not received their holiday pay are usually limited to pursuing an Employment Tribunal claim. Matthew Taylor recommended that the state should take responsibility for enforcing receipt of holiday pay to ensure this issue is addressed. In line with our strong action to ensure the National Minimum Wage and National Living Wage are paid properly, we will introduce state enforcement of vulnerable workers’ holiday pay rights. We will bring forward legislation to enable enforcement of these rights, in line with what Matthew Taylor recommended. This will allow vulnerable workers who have not received their holiday pay entitlement to raise a complaint and the state enforcement body to pursue payment of arrears on the worker’s behalf, backed up by financial penalties. Government is also looking to reform Statutory Sick Pay and as part of this we will consider whether changes are required to the enforcement mechanism.

We expect the cumulative effect of these changes, combined with recent increases in the resources available to enforce employment law, to significantly change the enforcement landscape. Establishing the Director of Labour Market Enforcement has been an excellent innovation, in terms of improving coordination and sharing intelligence across agencies enforcing employment law but we think we can go further. We will bring forward proposals in early 2019 for a new, single labour market enforcement agency to better ensure that vulnerable workers are more aware of their rights and have easier access to them and that businesses are supported to comply. This will provide a single point of contact for individuals and employers and will benefit from the additional powers and resources mentioned above.

Responses to Matthew Taylor’s recommendations

Recommendation 1

The government should replace their minimalistic approach to legislation with a clearer outline of the tests for employment status, setting out the key principles in primary legislation, and using secondary legislation and guidance to provide more detail.

Response

We will bring forward legislation to improve clarity on employment status, reflecting modern working practices. We will also bring forward detailed proposals on how the tax and rights frameworks could be aligned.

Following the recommendations of the joint BEIS and DWP Select Committee, we will not be taking forward the recommended adaptations to the piece rates legislation.

Recommendation 2

The government should retain the current 3-tier approach to employment status as it remains relevant in the modern labour market but rename as ‘dependent contractors’ the category of people who are eligible for worker rights but are not employees.

Recommendation 3

In developing the test for the new ‘dependent contractor’ status, control should be of greater importance, with less emphasis placed on the requirement to perform work personally.

Recommendation 4

In redefining the “dependent contractor” status, the government should adapt the piece rates legislation to ensure those working in the gig economy are still able to enjoy maximum flexibility whilst also being able to earn the NMW.

Recommendation 5

In developing the new ‘dependent contractor’ test, renewed effort should be made to align the employment status framework with the tax status framework to ensure that differences between the 2 systems are reduced to an absolute minimum.

Recommendation 6

The government should build on and improve clarity, certainty and understanding of all working people by extending the right to a written statement to ‘dependent contractors’ as well as employees.

Response

Accept – we will extend the right to a written statement to all workers, make it a day one right for both workers and employees and set out new requirements for mandatory contents.

Recommendation 7

The government should build on legislative changes to further improve clarity and understanding by providing individuals and employers with access to an online tool that determines employment status in the majority of cases.

Response

Accept – this will be taken forward once status changes are in place.

Recommendation 8

The government should ask the Low Pay Commission to consider the design and impacts of the introduction of a higher NMW rate for hours that are not guaranteed as part of the contract.

Response

We asked the Low Pay Commission to consider this option and alternatives. We have received their conclusions and note the upcoming publication of the letter.

Recommendation 9

The government should extend, from one week to one month, the consideration of the relevant break in service for the calculation of the qualifying period for continuous service and clarify the situations where cessations of work could be justified.

Response

Accept – we will extend the consideration of the relevant break in service from one week to 4 weeks.

Recommendation 10

The government should do more to promote awareness of holiday pay entitlements, increasing the pay reference period to 52 weeks to take account of seasonal variations and give ‘dependent contractor’ the opportunity to receive rolled-up holiday pay.

Response

Accept – we will launch a holiday pay awareness campaign and increase the pay reference period to 52 weeks. We will not take forward the proposal on rolled-up holiday pay

Recommendation 11

The government should amend the legislation to improve the transparency of information which must be provided to agency workers both in terms of rates of pay and those responsible for paying them.

Response

Accept – we will introduce a Key Facts Page that must be made available to all agency workers at the start of each contract.

Recommendation 12

The government should introduce a right to request a direct contract of employment for agency workers who have been placed with the same hirer for 12 months, and an obligation on the hirer to consider the request in a reasonable manner.

Response

Accept – we will go further and introduce a right to request a more predictable and stable contract for all workers.

Recommendation 13

The government should act to create a right to request a contract that guarantees hours for those on zero hour contracts who have been in post for 12 months which better reflects the hours worked.

Response

Accept – we will go further and introduce a right to request a more predictable and stable contract for all workers.

Recommendation 14

The government should examine the effectiveness of the Information and Consultation Regulations in improving employee engagement in the workplace. In particular it should extend the Regulations to include employees and workers and reduce the threshold for implementation from 10% to 2% of the workforce making the request.

Response

We will reduce the threshold for a request to set up information and consultation arrangements from 10% to 2% of the workforce. The 15 employee minimum threshold for initiation of proceedings will remain in place.

Recommendation 15

The government should work with Investors in People, Acas, Trade Unions and others with extensive expertise in this area to promote further the development of better employee engagement and workforce relations, especially in sectors with significant levels of low-paid or casual employment.

Response

Accept – to complement the changes to the Information and Consultation Regulations we will work closely with Investors in People, Acas, Trade Unions and other experts to promote better employee engagement, particularly focusing on the areas Matthew Taylor identified.

Recommendation 16

The government should introduce new duties on employers to report (and to bring to the attention of the workforce) certain information on the workforce structure. The government should require companies beyond a certain size to:

- make public their model of employment and use of agency services beyond a certain threshold

- report on how many requests they have received (and number agreed to) from zero hours contracts workers for fixed hours after a certain period

- report on how many requests they have received (and number agreed) from agency workers for permanent positions with a hirer after a certain period

Response

Following the June Parliamentary clearance of the Companies (Miscellaneous Reporting) Regulations 2018 and the publication of the revised Corporate Governance Code we are continuing to closely monitor the impact of our corporate governance reforms. These changes will come into effect for reporting years starting 1 January 2019 or later.

We are currently conducting a Post-Implementation review assessing current reporting requirements, including large public interest entities reporting on their employees, which should be completed in early 2019.

Recommendation 17

The new Director of Labour Market Enforcement should consider whether the remit of EAS ought to be extended to cover policing umbrella companies and other intermediaries in the supply chain.

Response

Accept – we will extend EAS’s remit to cover umbrella companies in the supply chain.

Recommendation 18

The government should repeal the legislation that allows agency workers to opt out of equal pay entitlements. In addition, the government should consider extending the remit of the EAS Inspectorate to include compliance with the AWR.

Response

Accept – we will repeal this legislation.

Recommendation 19

HMRC should take responsibility for enforcing the basic set of core pay rights that apply to all workers – NMW, sick pay and holiday pay for the lowest paid workers.

Response