DWP annual report and accounts 2022 to 2023

Updated 7 August 2023

Applies to England, Scotland and Wales

Annual Report and Accounts 2022-23 for the year ended 31 March 2023

Accounts presented to the House of Commons pursuant to section 6 (4) of the Government Resources and Accounts Act 2000

Annual Report presented to the House of Commons by Command for His Majesty

Ordered by the House of Commons to be printed on 6 July 20

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3/

Where we’ve identified any third-party copyright information you will need to obtain permission from the copyright holders concerned.

This publication is available on our website at: www.gov.uk/official-documents

Any enquiries regarding this publication should be sent to us at:

Finance Director General’s Office

5th Floor, Caxton House

6-12 Tothill Street

London SW1H 9NA

ISBN 978-1-5286-4261-3

E02933881 07/23

Printed on paper containing 75% recycled fibre content minimum.

Printed in the UK by HH Associated Ltd. on behalf of the Controller of His Majesty’s Stationery Office.

Performance report: Secretary of State’s Foreword

The hallmark of a civilised society is one that improves the day to day lives of its citizens and helps them to build a secure and prosperous future, while protecting the most vulnerable.

This is DWP’s overarching mission. It delivers the many different services, programmes and support the Department provides across the country, whether that is helping people to thrive in work, ensuring people can enjoy the retirement they deserve, supporting disabled people to live independently or delivering extra financial support to those most in need.

In a challenging year when families have been feeling the pressure from global price rises caused by supply chain pressures following the pandemic and Putin’s illegal invasion of Ukraine, I’m proud that DWP has been at the forefront of delivering this vital support.

At an impressive pace and scale, DWP provided cost of living payments to over 7 million low-income households, with millions of additional payments going to pensioners and disabled people. In the year ahead, we are administering further cost of living support to households that need it. Our Household Support Fund has also continued to enable councils across England to help families with the cost of groceries, bills and other essentials. I am pleased that we are extending this support again for 2023-24. Together with extra funding for Scotland, Wales and Northern Ireland, this represents £1 billion of additional funding to help people in every part of the UK.

In addition, we have also increased working-age benefits by 10.1% and protected pensioners with the biggest ever increase to the state pension, honouring our manifesto commitment on the triple lock. We have also improved the uptake of Pension Credit, increasing access to pension benefits.

This is what a compassionate society looks like.

Alongside this focus on protecting the most vulnerable, the government is investing £3.5 billion over the next 5 years to boost workforce participation and grow the economy. Through a wide-ranging new package of measures, we will reduce economic inactivity, which has risen from an historic low before the pandemic.

This means delivering new employment programmes and support, targeted for those specific groups who face the greatest barriers to the labour market, for example the over 50s, parents and disabled people. Through Transforming Support: The Health and Disability White Paper, we will improve the way the disability benefits system works to better support and incentivise disabled people and those with health conditions to start, stay and succeed in work. This will build on our 2017 ambition to see 1 million more disabled people in work, a milestone we reached 5 years earlier than planned.

For claimants who are already in the labour market, we are bringing more people into intensive support and increasing expectations to help them progress and make it less likely they fall into inactivity.

To ensure public funds go to those who need it most, we are cracking down on fraudsters. Every pound we lose to fraud is a pound less we have to invest in public services, to reduce national debt or to return to taxpayers.

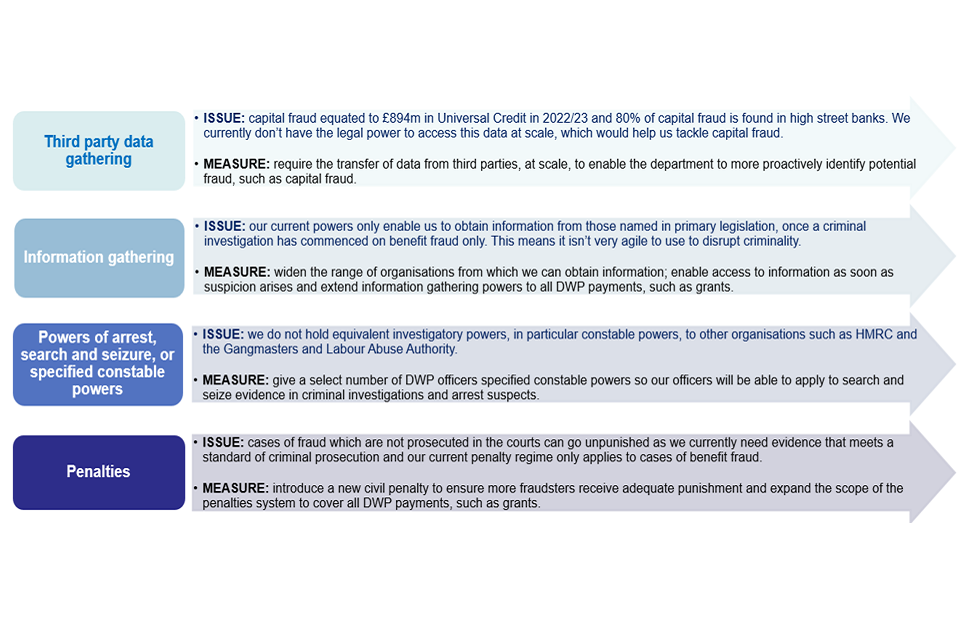

That’s why, through our £900 million Fraud Plan launched last year, we are targeting those who seek to abuse the system. In 2022-23, we saw fraud and error rates fall. This is encouraging but there is still much to do. Our Fraud Plan will help drive down rates further and save billions by bolstering our counter-fraud frontline and, in due course, bringing forward a raft of new powers to catch and punish fraudsters.

In the year ahead, we will build on the important progress we have made in 2022-23 to ensure the welfare system provides a strong financial safety net that protects the most vulnerable. Alongside this, through our workforce participation measures, and with a focus on innovative employment support and concerted wider action across government to break down barriers, we will fill posts and fulfil potential. In turn, this will support our wider priorities to halve inflation, get debt falling and grow the economy.

Rt Hon Mel Stride MP

Secretary of State for Work and Pensions

Permanent Secretary’s overview

DWP continues to play a pivotal role for the country. The government’s focus on growing the economy by bringing more people into the labour market from inactivity demonstrates our role in supporting economic growth. Alongside that, the continuing elevated levels of demand for benefits, demonstrate the importance of our role in supporting the vulnerable.

Over 2022-23 we have continued to play an essential role in helping people move into and progress in work by delivering Way to Work and Plan for Jobs. We have increased our dedicated support for the 50 plus age group, while continuing to provide individually tailored Work Coach support to young people aged 16-24. Our Autumn Statement and Spring Budget measures help us to continue to reduce unemployment, focus on the drivers of economic inactivity and start to transform the benefits system for people with disabilities.

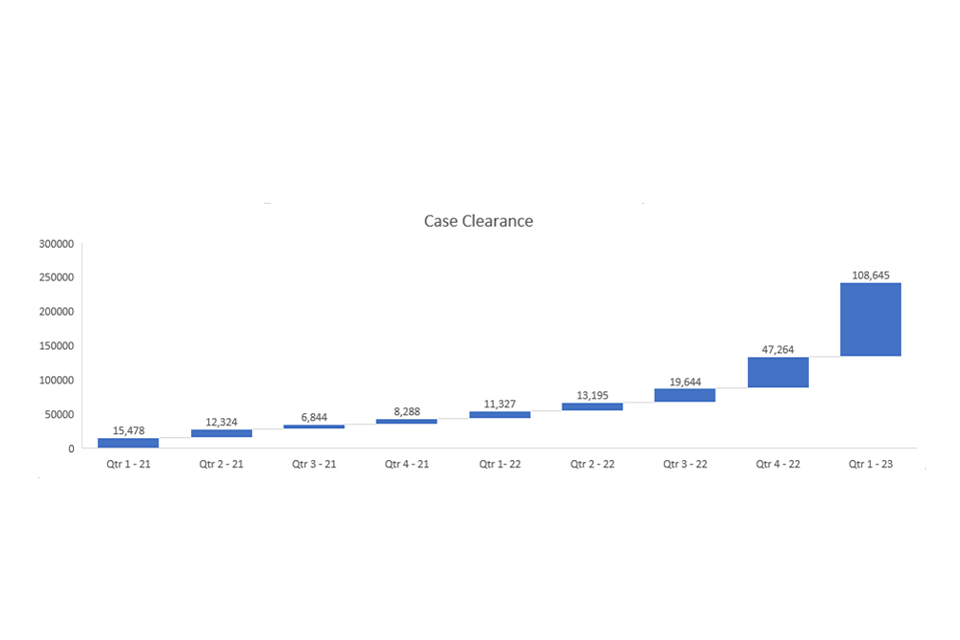

The increased service demand has created extra pressure on the Department. We have continued to drive delivery, clearing backlogs and modernising our services. Throughout the year we have made strides in boosting efficiency and productivity for the benefit of those we serve. For example, by increasing our clearance rate for Pension Credit by 250%, we have been able to support the large growth in new claims that we have seen this year.

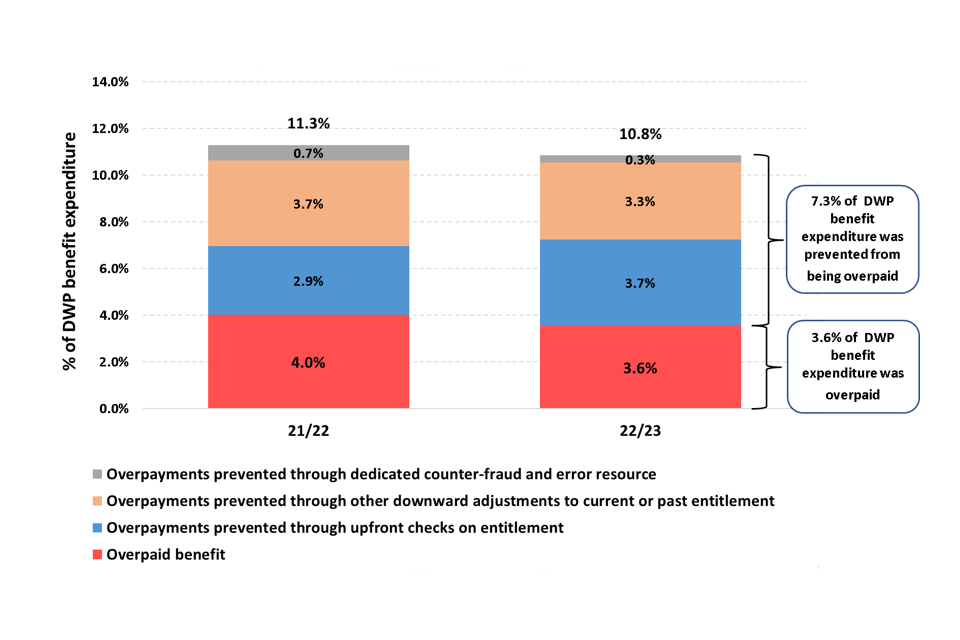

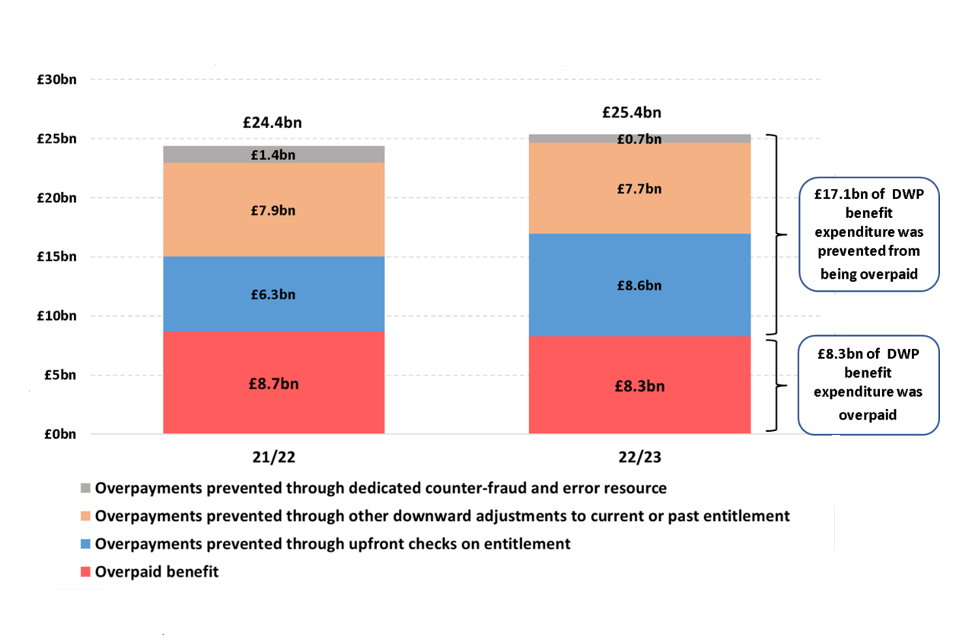

Overpayments of fraud and error have reduced by 10% compared to last year, although there is still an immense challenge ahead to tackle loss, with fraud growing across the economy. In May 2022, we published our ‘Fighting Fraud in the Welfare System’ plan. This has been backed by additional funding to boost frontline defences. We have also started to make progress in driving fraud out of the system through our Targeted Case Review in Universal Credit.

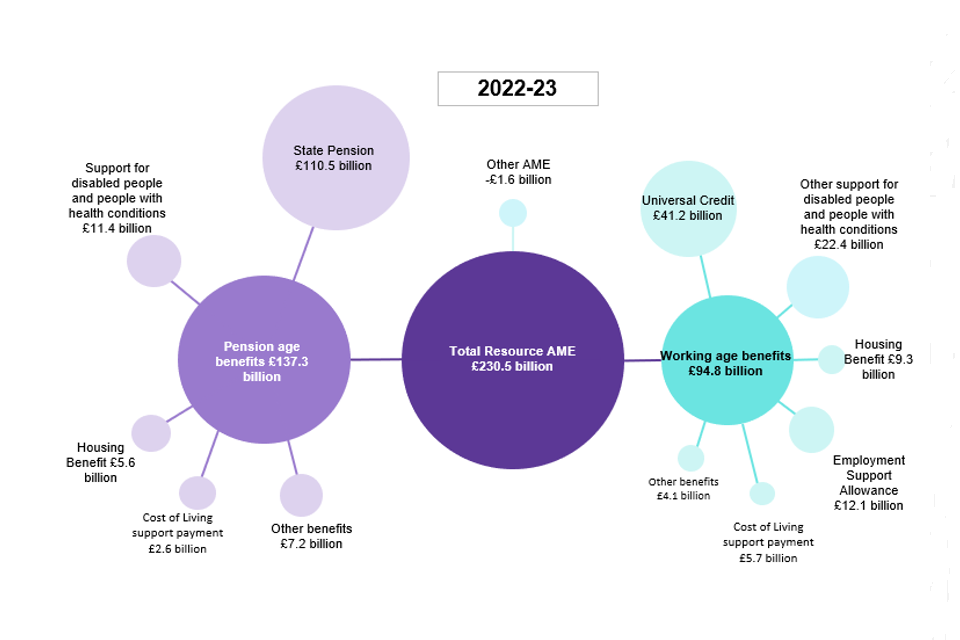

We spent £230.5 billion in Resource AME, which covers benefits paid through the welfare system in 2022-23 including £94.8 billion on people of working age and approximately £137.3 billion on pensioners. Of total welfare spend, around £33.8 billion was spent on benefits to support disabled people and people with health conditions.

In another extraordinary year colleagues at DWP have adapted quickly and shown resilience throughout. I am particularly proud of our quick-footed approach to support the delivery of new Cost of Living payments in response to the challenging economic environment. In 2022-23 we have provided this targeted support to customers totalling over £8 billion. This support will continue into the next financial year with further payments being made for households receiving means-tested benefits, tax credits and qualifying disability benefits and pensioner households. We have also played a significant role in helping Ukrainian refugees settle into the UK. We helped families requiring access to benefits, housing and employment. On top of that, with the sad passing of Her Majesty Queen Elizabeth II, colleagues brought forward millions of payments so that customer payments were not affected by the funeral arrangements.

Our Values, We Deliver, We Adapt, We Care, We Value Everybody and We Work Together describe DWP when we are at our best. I am proud of all that our 85,000 colleagues have achieved this year for the benefit of those we serve.

Peter Schofield

Permanent Secretary and Accounting Officer

Performance overview

This section provides a summary of the purpose, plans and performance of the Department for Work and Pensions. This includes an overview of our organisation, services and structure.

DWP Overview

Our Vision and Our Role

DWP aims to improve people’s day to day lives and help them build financial resilience and a more secure and prosperous future. We do this by helping people to move into work, and supporting those already in work to progress, with the aim of increasing overall workforce participation. We help people to plan and save for later life, while providing a safety net for those who need it now. We want to deliver excellent services to the millions of customers every day, including the most vulnerable in society, improving their customer experience while maximising value for money for the taxpayer.

The services we offer improve the daily lives of millions of people. Every day, we support thousands of people to move into work and progress. Through our Jobcentre Plus offer and our key services and programmes we support individuals to develop the skills they need to live more independently, including supporting disabled people and those with long-term health conditions. We work with others across government to tackle the root causes of poverty, improve financial resilience, and support families with children.

Our people are our biggest asset, and ensuring they have the right skills and capability to deliver is essential to realising our vision. To deliver our vision we continue to focus on our 3 core objectives. Everyone in DWP has a role to play in achieving them.

Our Values

Our values guide how we work with each other, customers, and others. Understanding how we live up to them helps us learn for the future.

- we care

- we deliver

- we adapt

- we work together

- we value everybody

Every colleague, regardless of position, rank, or place, is essential to achieving our goals and realising our vision.

Our Services

| Service user groups | Our Services |

|---|---|

| People seeking employment | Jobcentre Plus provides personal tailored employment advice combined with detailed knowledge of local labour markets to match people to suitable job vacancies and help those in low-paid work to progress and increase their earnings through our network of jobcentres. |

| People seeking employment | ‘Find a job’ online site, allows jobseekers to search for work at a time convenient for them, offering jobseekers and employers a simpler and more streamlined way to log in and access their information. |

| People seeking employment | Universal Credit: The government believes that the best way to support peoples living standards is through good work, better skills and higher wages. Through Universal Credit, the government has designed a modern benefit system that ensures it pays to work and withdraws support at a steady rate as claimants move into and progress in work. |

| People seeking employment | DWP Youth Offer is the wrap around scheme for young people to access vital skills, training and employment opportunities. DWP’s Youth Offer commenced in September 2020 – increasing support offered to young people aged 18-24 in the Intensive Work Search group on Universal Credit. |

| People seeking employment | DWP’s Sector-based Work Academy Programme (SWAP) placements offer training, work experience and a guaranteed job interview to those ready to start a job. These allow people to learn the skills and behaviours that employers in particular industries look for. |

| People seeking employment |

Kickstart (for 16-24 year olds) enables participants to gain work based experience through paid 6 month roles, to improve their chances of progressing into long-term sustainable work. The final participants ended their posting at the end of September 2022. |

| People seeking employment | Fuller Working Lives is an employer-led strategy that aims to increase the retention, retraining and recruitment of older workers by bringing about change in the perceptions and attitudes of employers. |

| People seeking employment | Restart supports people who have been unemployed for at least 9 months. Restart launched in summer 2021 in England and Wales, with Scotland and Northern Ireland receiving funding. |

| Disabled people and people with health conditions | The Work and Health Programme provides support to disabled people and people with health conditions on a voluntary basis. The programme also supports people who have been unemployed for more than two years. |

| Disabled people and people with health conditions | Intensive Personalised Employment Support provides personalised, intensive support for disabled people who have complex barriers to work and who the Work Coach considers to be more than 12 months from the labour market. |

| Disabled people and people with health conditions | Disability Confident is a business-led scheme that puts employers firmly at the centre of a national movement to increase employment opportunities for disabled people, encouraging employers to think differently about disability and to take action to improve how they attract, recruit, and retain disabled employees. |

| Disabled people and people with health conditions | Access to Work is a scheme tailored to an individual’s needs, providing financial assistance for pre-employment (work experience, supported internships and traineeships) and during employment. |

| Disabled people and people with health conditions | Personal Independence Payment helps people between age 16 and pension age with the additional costs associated with a disability or long-term health condition. |

| People planning for or in retirement | The Money and Pensions Service ensures that people have access to the information and guidance they need to help them make effective financial decisions over their lifetime. |

| People planning for or in retirement | Pension Credit protects pensioners on a low income by topping up any income already received to a standard minimum amount, with higher amounts for pensioners with caring responsibilities, a severe disability or certain housing costs. |

| People planning for or in retirement | The Pensions Regulator protects UK workplace pensions by making sure employers, trustees, pension specialists and business advisers fulfil their duties to scheme members, and by ensuring they meet their automatic enrolment duties. |

| Children and families | Get Help Arranging Child Maintenance is a free service to help parents decide the best maintenance arrangement for themselves and their children. The service also supports parents to put a maintenance arrangement in place. |

| Children and families | The Statutory Child Maintenance Scheme can arrange child maintenance on behalf of separated parents who may be unable to agree a child maintenance arrangement between themselves. |

| Children and families | The Reducing parental conflict programme aims to decrease the number of children that have to live with damaging levels of parental conflict, by giving parents access to evidence based support to increase collaboration, whether they are together or separated. |

Our Structure

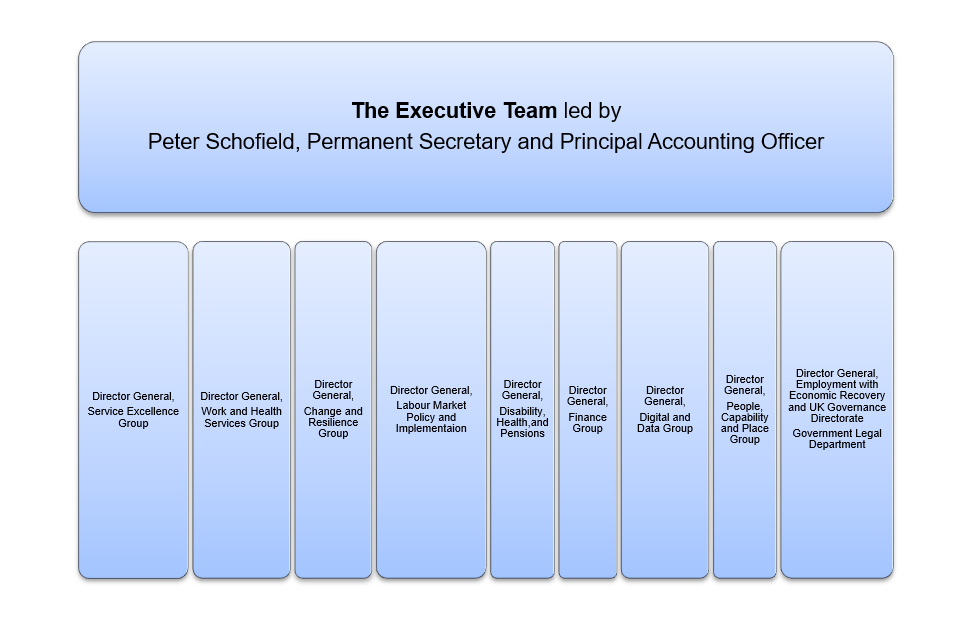

We are led by the Secretary of State for Work and Pensions and the Permanent Secretary who is our most Senior Civil Servant. As of the 31st of March 2023, there were 84,944 people working in our departmental group, which includes our core department and our arm’s length bodies.

As of March 2023, our Director General led groups are:

Our Priority Outcomes

This summary provides an at-a-glance overview of how we worked towards delivering our Priority Outcomes in 2022-23.

This high-level overview is expanded upon in the Performance Analysis section of this report which includes further details of our activities and further analysis of progress against performance indicators.

| Priority Outcome 1 | Maximise Employment across the country to aid economic recovery following COVID-19 |

|---|---|

| Summary | We have continued to play an essential role in providing support to individuals and families whose livelihoods have been impacted as the country continues to build back from the pandemic through a range of support including Way to Work and Plan for Jobs, supporting individuals to move into and progress in work. |

| Performance Metrics | Employment rate of 16-64 year olds. UK and regional Employment rate of 16-24 year olds. UK and regional Number of Kickstart participants Number of Job-Entry Targeted Support (JETS) participants Number of Sector based Work Academy Programme (SWAP) participants Number of Starts on Restart |

| UN Sustainable Development Goals | SDG1: No poverty SDG4: Quality education SDG5: Gender equality SDG8: Decent work and economic growth |

| Performance Analysis | See Performance Analysis |

| Priority Outcome 2 | Improve opportunities for all through work, including groups that are currently under-represented in the workforce |

|---|---|

| Summary | We have continued to offer comprehensive support to help people we know are currently under-represented in the workforce to start, stay, and succeed in work. This includes disabled people and people with health conditions, those over 50, serving prisoners, and people undergoing clinical treatment for substance dependency. |

| Performance Metrics | Disability employment rate gap (%) |

| UN Sustainable Development Goals | SDG3: Good health and well-being SDG8: Decent work and economic growth |

| Performance Analysis | See Performance Analysis |

| Priority Outcome 3 | Address poverty through enabling progression into the workforce and increasing financial resilience |

|---|---|

| Summary | We spent £230.5 billion in Resource AME, which covers benefits paid through the welfare system in 2022-23 including £94.8 billion on people of working age and £137.3 billion on pensioners. Of total welfare spend, around £33.8 billion was spent on benefits to support disabled people and people with health conditions. Through the Cost of Living Payments, we have provided additional targeted support to claimants who needed it most. We have provided over 7 million households on means-tested benefits with Cost of Living Payment up to £650, costing a total of over £8 billion. |

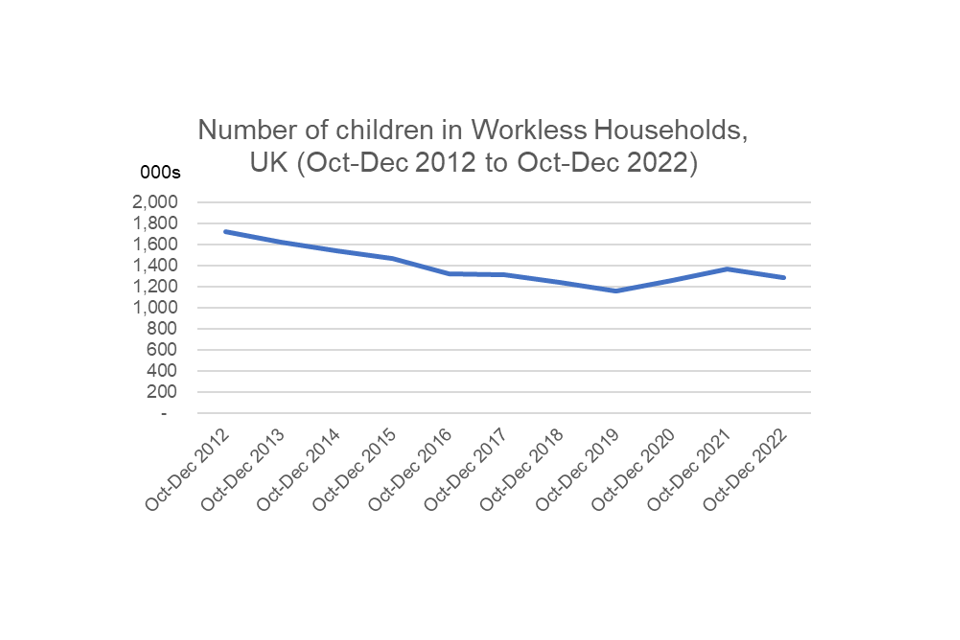

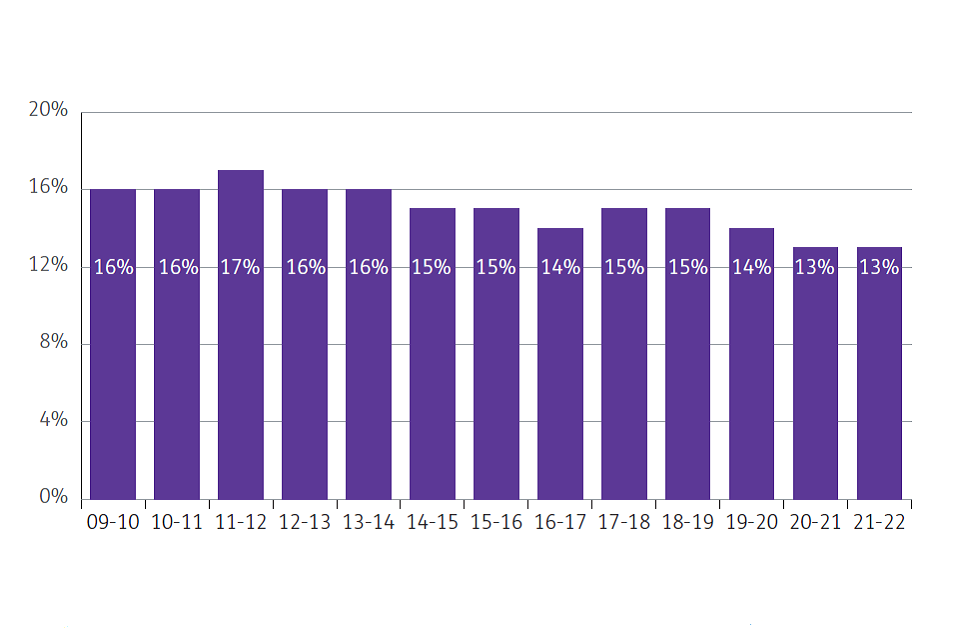

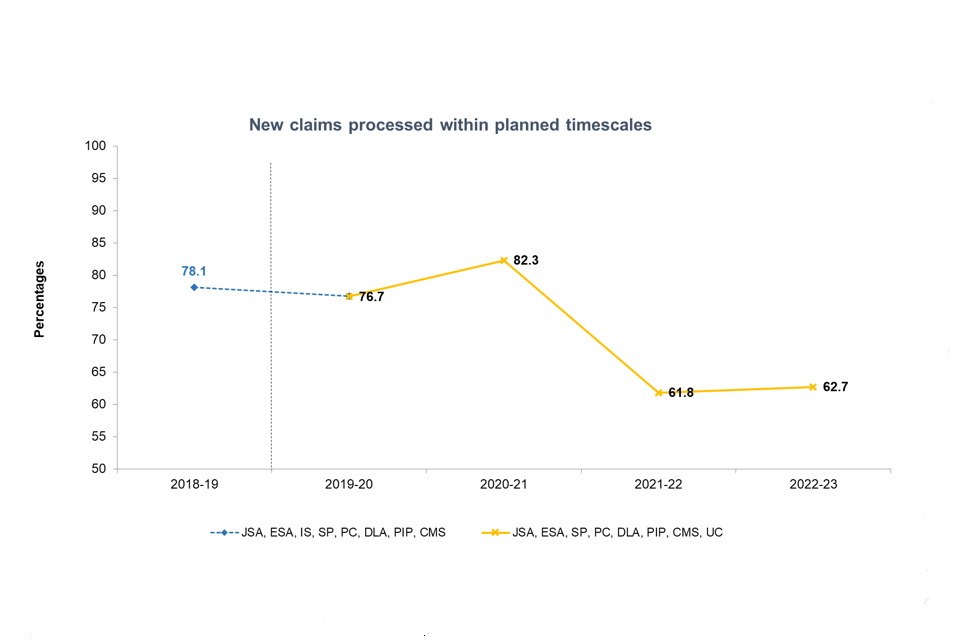

| Performance Metrics | Absolute poverty before housing costs (%) Number of children in workless households Percentage of claims processed within planned timescales |

| UN Sustainable Development Goals | SDG1: No poverty SDG5: Gender equality SDG8: Decent work and economic growth |

| Performance Analysis | See Performance Analysis |

| Priority Outcome 4 | Deliver a reliable, high-quality welfare and pensions system which customers have confidence in |

|---|---|

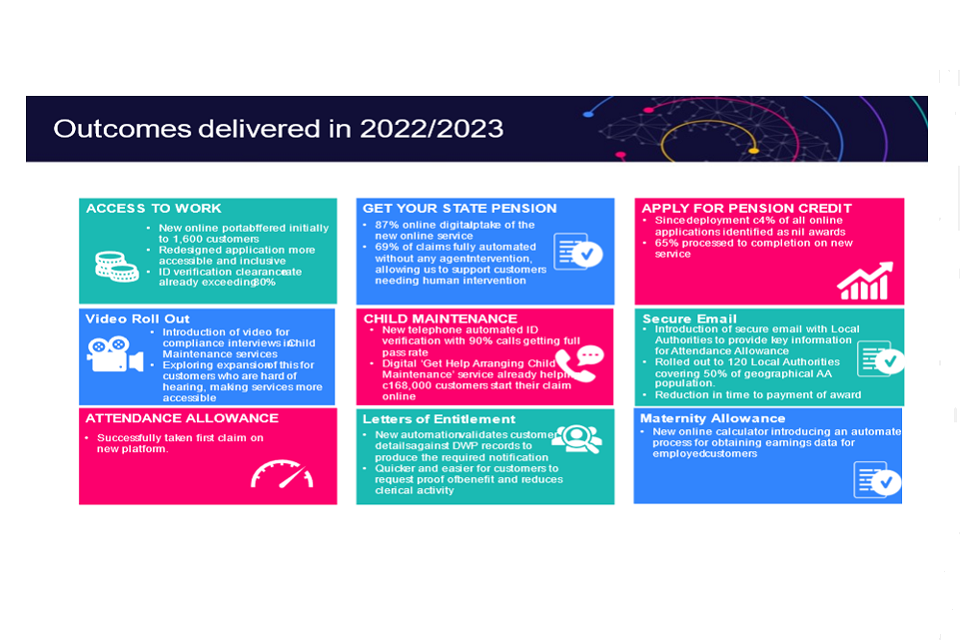

| Summary | Throughout 2022-23 we have continued work to modernise how we deliver some of our key services to improve customer experience and simplify processes. Exploiting digital solutions to make it easier for customers who are able to self-serve, so that our staff can provide additional support to customers with complex needs. We have worked to strengthen our complaints and appeals process, learning lessons to help improve customer satisfaction levels going forwards. Last year, our Fraud Plan mapped out our proposals for reducing fraud and error. This year, we have seen a fall in fraud and error, in part due to the re-introduction of the controls removed during the pandemic. An extra £900 million investment over 3 years is helping boost our frontline defences still further, whilst the introduction of Targeted Case Reviews will help detect Universal Credit overpayments and underpayments and drive down fraud across future years. |

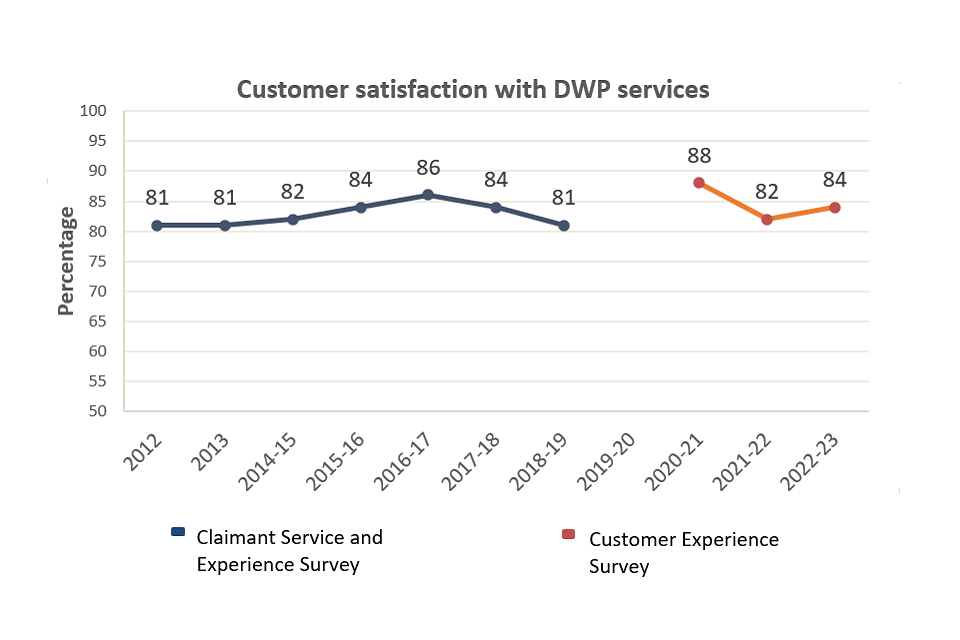

| Performance Metrics | Percentage of claimants satisfied with DWP services overall. For the following metrics, see the Fraud, Error and Debt section Gross monetary value of fraud and error (by value and proportion) Monetary value of official error |

| UN Sustainable Development Goals | SDG16: Peace, justice and strong institutions |

| Performance Analysis | See Performance Analysis |

Our Strategic Enablers

Further detail on the key activities facilitating the department to execute its strategy and deliver outcomes can be found in the Performance Analysis section of this report.

| Strategic Enabler 1 | Workforce, Skills, Location |

|---|---|

| Mandatory Objectives | Investing in skills, championing expertise and strengthening leadership Reflecting the country we serve and creating opportunities around the UK |

| Performance Analysis | Performance Analysis |

| Strategic Enabler 2 | Innovation, Technology, Data |

|---|---|

| Mandatory Objectives | Finding new ways to solve problems to deliver for the public Seizing the full potential of data and technology |

| Performance Analysis | Performance Analysis |

| Strategic Enabler 3 | Delivery, Evaluation, Collaboration |

|---|---|

| Mandatory Objectives | Achieving excellence in project and public service delivery. Making it easy to collaborate and provide a seamless experience for the public |

| Performance Analysis | Performance Analysis |

| Strategic Enabler 4 | Sustainability |

|---|---|

| Mandatory Objectives | Improving the environmental performance of our estate and operations to reduce negative environmental impacts. |

| UN Sustainable Development Goals | SDG7: Affordable and clean energy SDG11: Sustainable cities and communities SDG12: Responsible consumption and production SDG13: Climate action SDG15: Life on land |

| Performance Analysis | Performance Analysis |

Risks impacting the delivery of DWP’s objectives

Introduction

The Department’s operating environment has remained challenging throughout 2022-23 due to COVID-19 legacy impacts, cost of living pressures, and the wider economic environment. Persistent uncertainty driven by external factors at home and abroad, has meant that the Department has continued to operate in a rapidly changing environment.

DWP’s risk management approach

In last year’s accounts, we set out our top 3 risk themes for 2022-23:

1. Stabilisation, recovery, and transformation of services, increasing capacity and capability to maximise delivery.

2. Fraud, error, and debt.

3. Leading the national effort to get people into jobs, improve lives, help communities, and rebuild the economy.

These principal risk themes remain current and have continued to affect delivery during this financial year while being affected by domestic, international, and economic developments. Throughout the year, the Executive Team has been focused on developing and delivering mitigations to our principal top level risks, ensuring that there are robust plans in place to manage them. Although there is still more to do, we have made significant progress to make the organisation more resilient and secure. Our key areas of focus include:

- Managing the continued high demand for DWP services (due in the main to legacy impacts for COVID-19 and the cost of living). Our response has included moving resources to underperforming areas to support recovery.

- Delivery of our ambitious programme of change, and transformation as well as keeping delivery of existing and new priorities on track. This has required ongoing assessment of affordability and deliverability including our capacity to absorb and integrate new people and new work effectively.

- The wellbeing and safety of our people and industrial relations due to demand for our services, claimant stress factors and the economic climate.

- Cyber-threats and increasing global insecurity where we have made significant progress on making our IT more resilient and secure, increasing our protection against cyber-attacks and other external threats.

- Driving down fraud and error and managing debt effectively across our services.

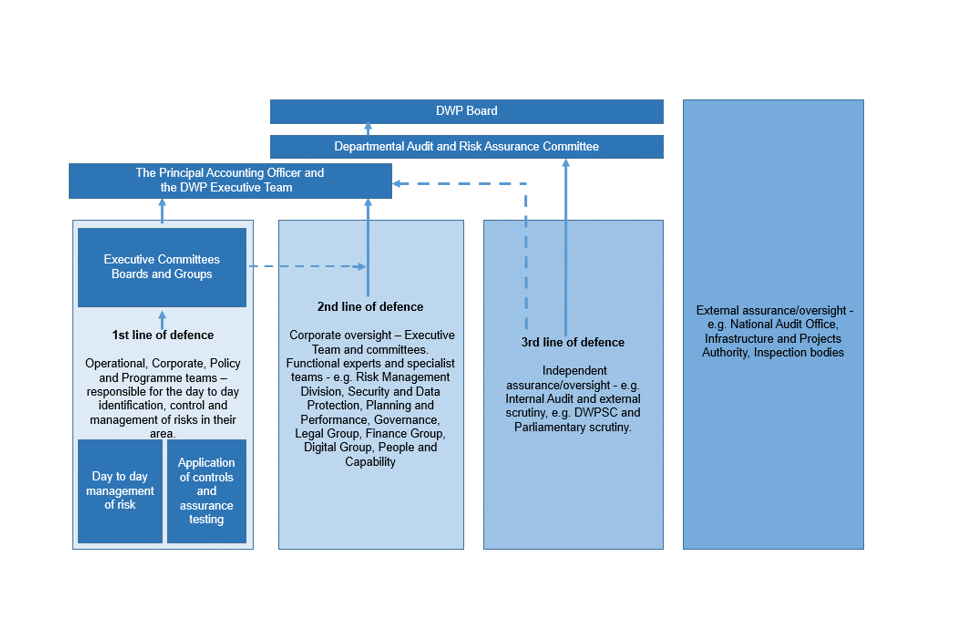

During 2022-23 the Risk and Control Assessment (RCA) programme has continued to provide assurance on the effectiveness of internal controls and risk management across the Department. The programme supports each Director General by providing second line assurance on the effectiveness of the internal control environment and we will continue to test the effectiveness of mitigations in place as our risk landscape evolves. A more detailed statement on the main issues and risks that DWP has managed through 2022-23 can be found in the Governance Statement

Chief Finance Officer Review

Our Finances

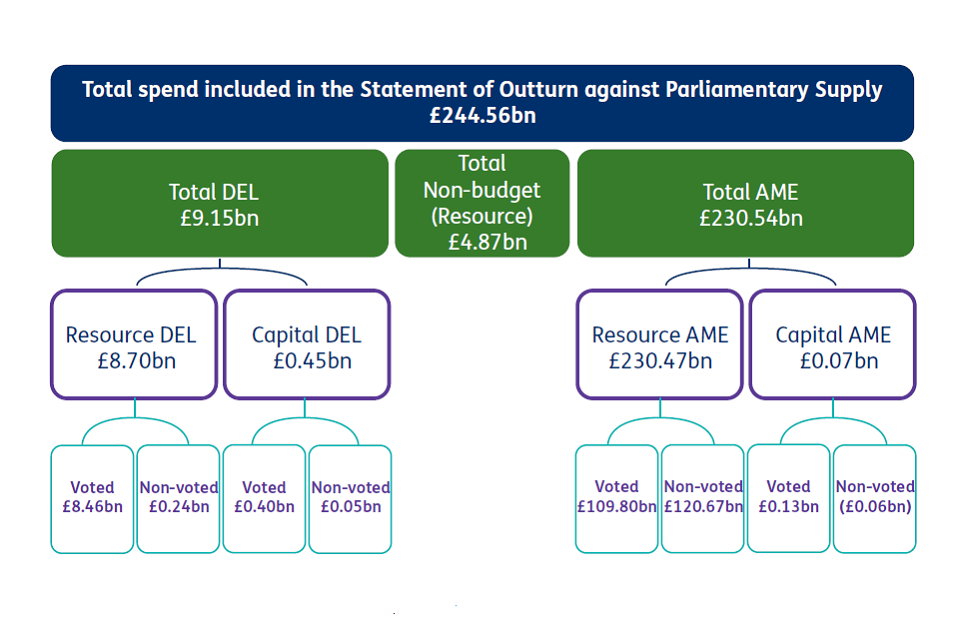

We have one of the largest expenditure budgets of any department across government. The Department’s running costs are covered by the Departmental Expenditure Limit (DEL) and most welfare spending is classified as Annually Managed Expenditure (AME).

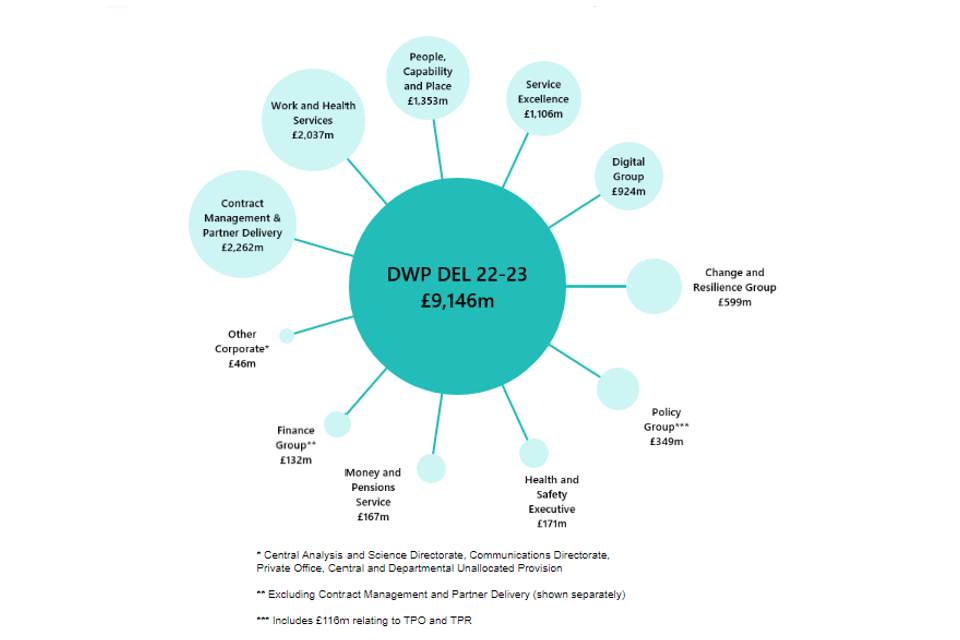

The cost of running our department in 2022-23 was £9,146 million, paid from DEL. We also paid out £231 billion in benefit, pension, and Social Fund payments from Resource AME, including over £8 billion for Cost of Living Payments, and £70 million from Capital AME including £16 million on Support for Mortgage Interest payments and £110 million in Universal Credit Advances, offset by recoveries of £63 million of Social Fund loans, in 2022-23. See a detailed breakdown of our expenditure.

For information on spending rends and more detailed analysis of budget changes please see the DWP Main and Supplementary Estimate Select Committee Memoranda on parliament.uk

Departmental Expenditure Limit 2022-23

The chart below shows how we spent our DEL budget of £9,146 million, broken down by organisational group.

DWP’s 2022-23 budget was initially set at Spending Review 21 (SR21) at £8.3 billion (excluding depreciation). As the economic environment evolved, the Treasury made additional funding available, including to support those most in need via the Household Support Fund. At Supplementary Estimates funding was adjusted to reflect changing requirements. This included adjustments for Kickstart and Restart as economic growth was stronger than initially forecasted. The Department also reprofiled funding through a surrender of some underspends in 2022-23 in return for a corresponding increase for the following year to enable delivery across the Spending Review settlement period.

In 2022-23 the Department focussed on:

- maximising employment across the country including funding continuing labour market programmes introduced in the Plan for Jobs such as the Restart scheme (£435 million) to provide 12 months of tailored support to long-term unemployed people, Kickstart scheme (£222 million), and significant funding for Work Coaches to ensure all unemployed claimants who are looking for work on UC can benefit from personalised Work Coach support.

- enhancing the welfare system to deliver for working age and pensioner customers. This included digital activity to support delivery of benefits and transform how customers interact with the welfare system and to upgrade and maintain DWP estates and an additional £146 million to improve the department’s capability and capacity to detect and deter benefit fraud.

- helping those in financial difficulties including through the extension of the Household Support fund (£842 million) to support those most in need with the rising cost of living as part of government response to global inflationary challenges. This was in addition to delivering the Cost of Living Payments, which is outlined below.

- delivering additional Work Coach support to help eligible older workers find work through the expansion of DWPs 50+ offer and increasing support to those on Universal Credit with the increase of the Administrative Earnings Threshold to 15 hours from January 2023.

Annually Managed Expenditure (AME)

Our Expenditure

We make benefit and pension payments to over 20 million people to support them through life events such as being out of work, retirement and disability.

In 2022-23, Total Resource AME was £230.5 billion, including Cost of Living Payments, details of which are set out as below. This was around £14.6 billion (almost 7%) more than in 2021-22 mainly driven by the inclusion of Cost of Living Payments worth over £8 billion. This increase is also as a result of the annual uprating of pensions and benefits, the continued roll-out of Universal Credit, which includes payments formerly made through personal Tax Credits paid by HM Revenue and Customs, and higher outturn for disability benefits also increased spending.

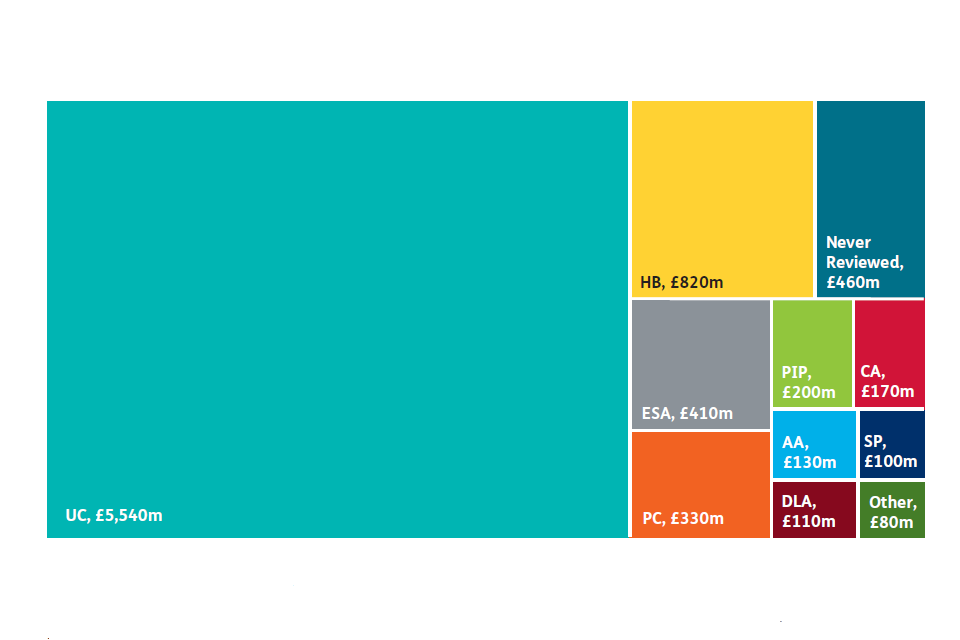

The chart below shows a breakdown of the Total Resource AME.

Total Resource AME

Overall, 60% of our benefit spending went to pensioners, with the State Pension (£110.5 billion), accounting for almost half of all spending. The cost of the State Pension increased by £6.0 billion (6%) from 2021-22.

Nearly 30% (£65.2 billion) supported disabled people and people with health conditions (including pensioners). This is an increase of £2.1 billion (5%) from 2021-22.

Around £54.7 billion was spent on a range of other benefits, with the majority (£39.3 billion, over 70%) going to working age people (including £26.5 billion to UC (excluding payments relating to incapacity or carer), and £5.7 billion to means-tested and disability benefits Cost of Living Payments), and the remainder to pensioners. This is an increase of £7.7 billion (16%) from 2021-22.

Further to the above Resource AME expenditure, we spent £70 million on Capital AME in 2022-23, including £16 million Support for Mortgage Interest payments, £110 million Universal Credit Advances and £7 million Estates dilapidations, this was offset by £63 million net recoveries of Social Fund loans.

| DWP AME benefits expenditure summary | 2022-23 expenditure £bn | 2021-22 expenditure £bn |

|---|---|---|

| Pension age benefits | 137.3 | 127.7 |

| State Pension | 110.5 | 104.7 |

| Support for disabled people and people with health conditions | 11.4 | 10.6 |

| Housing Benefit | 5.6 | 5.5 |

| Other benefits | 7.2 | 6.9 |

| Cost of Living Support Payment | 2.6 | 0.0 |

| Working age benefits | 94.8 | 87.4 |

| Universal Credit | 41.2 | 40.6 |

| Other support for disabled people and people with health conditions | 22.4 | 19.9 |

| Housing Benefit | 9.3 | 10 |

| Employment Support Allowance | 12.1 | 12.7 |

| Other benefits | 4.1 | 4.2 |

| Cost of Living Support Payment | 5.7 | 0.0 |

| Total benefit expenditure | 232.1 | 215.1 |

| Other AME | (1.6) | 0.9 |

| Total Resource AME | 230.5 | 216.0 |

More detailed information on benefit expenditure outturn and forecasts can be found in our benefit expenditure tables on GOV.UK

Cost of Living Payments

Through the Cost of Living Payments announced in May 2022, we have provided over £8 billion in additional targeted support to customers who needed it the most.

Eligible households received:

- Up to £650 Cost of Living Payment to those on means tested benefits

- A £300 one-off payment to all pensioners

- A £150 one-off disability Cost of Living Payment to those on non-means tested disability payments

In total, more than 7 million households on means-tested benefits received up to £650 in Cost of Living Payments and a further 6 million people who qualified for disability benefit received a one-off £150 disability Cost of Living Payment, at a total cost of £5.7 billion.

Over 8 million pensioner households received a pensioner Cost of Living Payment of £300 alongside their winter fuel payment in November/December 2022, at a total cost of £2.6 billion.

We will make further Cost of Living Payments in 2023-24, with the most vulnerable households receiving up to £1,350.

Welfare Cap

The welfare cap is a limit on the amount that government can spend on certain social security benefits and tax credits. HM Treasury sets the level of the cap and the year in which it will apply, normally at the first fiscal event of each new Parliament. It also sets a pathway for relevant welfare spending in each year running up to the year of the welfare cap. HM Treasury also sets a percentage margin for the cap and pathway in each year.

The cap is formally assessed by the Office for Budget Responsibility (OBR) at the first fiscal event of each new Parliament. The current welfare cap applies to 2024-25, with the next formal assessment at the first fiscal event of the next Parliament.

If the OBR’s formal assessment shows that the welfare cap is breached, then the Secretary of State for Work and Pensions will either:

- Lay a paper before the House of Commons proposing government policy measures which will reduce welfare spending to within the level of the cap; or,

- Explain to the House of Commons why a breach of the welfare cap is considered justified

A debate on a votable motion will then be held in the House of Commons, normally within 28 sitting days, on the suitability of the Secretary of State’s response to the breach.

At Spring Budget 2023, we saw that expenditure subject to the welfare cap is forecast to be £4.1 billion above the cap plus margin in 2024-25. This breach is mainly driven by higher forecasted demand for disability benefits.

Catherine Vaughan

Director General, Finance

Performance Analysis

This section expands on the Performance Overview section and includes details of our activities and further analysis of progress against performance indicators.

Priority Outcome 1- Maximise employment across the country to aid economic recovery following COVID-19

Introduction

We have continued to play an essential role in providing support to individuals and families who have been impacted by the pandemic through Way to Work and Plan for Jobs, helping people to move into and progress in work.

Employment levels have remained high. As of January 2023, all countries and regions of the UK now have more people in Pay As You Earn Employment than in January 2022. Unemployment is below its pre-pandemic rates and the number of people claiming unemployment-related benefits has fallen significantly since the pandemic peak. However, economic inactivity amongst working age individuals remains high and the economic inactivity rate currently sits at 21.04%, which is above the pre-pandemic historic low rate of 20.2%. For more information please see Priority Outcome.

As we look to the future and following announcements made at Spring Budget 2023, we will be working across government to deliver an additional wide-ranging package of measures designed to support people to enter work, and to increase and extend their working lives. These measures focus on key groups who we know face additional barriers to work, including disabled people and those with health conditions, the over-50s, parents and carers.

Achievements and Progress

Jobcentre Plus Support

Our Jobcentre Plus network has continued to provide vital support to individuals. Work Coaches use their local knowledge and expertise to provide personal and tailored support to help people move closer towards and into work and progress. They build positive relationships with claimants to encourage them to overcome barriers to work, to search and apply for jobs and to increase their hours and earnings. As part of this tailored support, Work Coaches use their skills and knowledge to refer people to wider support and services relevant to the individual needs of the claimant, some of which are set out in more detail later in this section.

Work Coaches, supported by work psychologists, help customers with complex needs. They are also able to access other sources of support such as the Flexible Support Fund (FSF), to help with additional costs, including upfront childcare and additional travel costs linked to a new job. The FSF can also be used to commission training to meet the needs of local jobseekers and employers. For more information on how Work Coaches have supported disabled people and those with health conditions please see Priority Outcome 2 ‘Continuing and developing support’.

Plan for Jobs

Throughout the pandemic, the government provided unprecedented levels of support to the economy. Plan for Jobs also included key DWP programmes, such as Restart and Kickstart, alongside other measures to boost work searches, skills, and apprenticeships. As we see the unemployment rate fall below pre-pandemic levels, some of these programmes have closed while others continue to support people as shown below.

Restart began in July 2021 and is providing up to 12 months of intensive, tailored support to help Universal Credit (UC) and Jobseeker’s Allowance claimants who have been unemployed for more than 9 months move into sustained employment. Through regular contact with participants, providers develop a strong understanding of individuals’ employment history, skills, aspirations, and needs to develop the right package of support to help each person succeed. As of the end of April, 450,000 people have started this scheme since July 2021 and 150,000 people have reported first earnings.

Kickstart was designed to support 16 to 24 year olds on UC at risk of long-term unemployment. The programme launched in September 2020 and provided funded, 6-month jobs. Kickstart ended in September 2022 having supported over 163,000 young people.

Job Entry: Targeted Support (JETS) was launched to support UC and New Style Jobseeker’s Allowance claimants who had been unemployed for at least 13 weeks to re-enter employment. This scheme provided up to 6 months light-touch personalised employment support to help people effectively re-engage with the labour market and focus on job search by building on providers’ links with local employers. JETS referrals ended on 30 September 2022 and the last participants finished the programme in April 2023. JETS supported 340,000 customers in total.

Sector-based Work Academy Programmes (SWAPs) help customers compete for local jobs. SWAPs offer training, work experience and a guaranteed interview for a job or apprenticeship; helping businesses with recruitment and enabling customers to learn the skills and behaviours employers want and need. SWAPs are being used to fill jobs in sectors such as construction, health and social care, logistics, hospitality, public sector, and security. As of 12 March 2023, jobcentres have delivered 91,600 SWAP starts in 2022-23. The 2023 Spring Budget provided additional funding for an extension of 40,000 SWAP starts across the two financial years. This will enable DWP to deliver 80,000 SWAP starts in both 2023-24 and 2024-25.

Way to Work

The recovery from the COVID-19 pandemic was accompanied by record levels of vacancies and, as a result, the government introduced the Way to Work campaign on 26 January 2022, with a commitment to see 500,000 moves into work by customers by the end of June 2022.

Way to Work was aimed at job-ready claimants on Universal Credit (UC) and New Style Jobseeker’s Allowance claimants in England, Scotland, and Wales. Way to Work saw us working closely with employers, building on our experience through the Kickstart scheme whilst strengthening our core support through additional Work Coach time and by ensuring jobseekers kept to the agreements they made in their Claimant Commitment. The campaign exceeded its target. Vacancies are down from their record high, but there remains more to do to help support people into work to fill employers’ vacancies.

In-Work Progression

As well as supporting people to move towards and into work, the government is committed to supporting people in low-paid jobs to progress, helping them increase their earnings and move into better-paid jobs. To achieve this, we have reshaped some of our key services:

- Firstly, we have raised the Administrative Earnings Threshold (AET) in Universal Credit (UC). The AET determines the level of Work Coach support that UC claimants receive, with claimants earning less than the AET receiving the most intensive Work Coach support. In September 2022, we raised the AET to £494 per calendar month for individual claimants and £782 per calendar month for couples. This was equivalent to an individual working 12 hours per week (previously the equivalent of 9 hours) at the National Living Wage (NLW) rate and to a couple working 19 hours (previously the equivalent of 14.4 hours) between them. In January 2023 we raised the AET further. It is now £617 per calendar month (equivalent to working 15 hours per week) for individual claimants and £988 per calendar month for couples (equivalent to working 24 hours per week).

- These changes to the AET mean that almost a quarter of a million more UC claimants will receive support from a Work Coach on a weekly or fortnightly basis and agree appropriate steps to progress in their employment and increase their earnings. These claimants will also be eligible for access to training and intensive job-seeking support.

- Jobcentres are being assisted by a network of 37 new District Progression Leads across Great Britain. Progression leads will work with partners including local government, employers, and skills providers to identify and develop opportunities and address barriers that can make it hard for people to progress, such as childcare, transport or lack of appropriate skills provision.

- Secondly, we have introduced a new In-Work Progression Offer for working claimants with earnings above the AET, backed up by £99 million of funding from the 2021 Spending Review. In 2022-23 we have been focused on offering voluntary in-work progression support. This has now been rolled out across Great Britain. We now estimate that around 1.2 million low-paid benefit claimants will be eligible to volunteer for support to progress into higher-paid work. This support is being provided by Work Coaches and is focussed on removing barriers to progression, such as confidence, skills or access to help with childcare costs and providing progression support and provision of advice, including identifying training opportunities.

Support for Older Jobseekers

For People over 50

We are increasing our dedicated support to the 50 Plus age group by introducing Additional Work Coach Time at 13, 26, and 39 weeks into their claim for Universal Credit. This provides more time to recognise and address some of the additional challenges people in this age group can face, both staying in and returning to work. From February 2023 this became operational across the entire Jobcentre Plus network.

From September 2022 each of the 37 Jobcentre Plus districts was supported by a 50Plus Champion. The 50Plus Champions work collaboratively with Work Coaches, employers and stakeholders to raise awareness on the importance of supporting older jobseekers as well as to identify opportunities to tailor provision and recruitment to support this group’s return to work.

Through financial resilience, health and skills planning for those in their 40s, 50s and 60s, the Mid-Life MOT supports older workers to stay in and return to work, and plan towards their retirement. From January 2023 we began the roll-out of the Mid-Life MOT across the Jobcentre Plus network. We also issued an Invitation to Tender on 6 January 2023 to identify providers for a Mid-Life MOT programme to be delivered through employers direct to their employees.

DWP’s Youth Offer

We also continue to provide individually tailored Work Coach support to young people aged 16 to 24 claiming Universal Credit (UC). DWP’s Youth Offer includes 3 elements:

- The Youth Employment Programme is a structured 13-week programme of intensive Work Coach support, focused on helping young people access work-related support and find employment.

- Youth Employability Coaches provide flexible support to young people who are experiencing complex needs and barriers, such as homelessness, to assist them in finding work.

- Youth Hubs combine employment support from a Jobcentre Plus Work Coach and place-based support from partner organisations with an in-depth understanding of local jobs and skills gaps, to help young people into work across Great Britain.

Our Approach to Key Sectors

As well as the support we offer for all jobseekers and all jobs, we know that there are specific challenges that need to be addressed to help our customers start, stay, and succeed in work in key sectors, such as haulage and social care. Our approach throughout 2022-23 has been to work with other government departments and businesses to understand and address the specific employment challenges key sectors face, including on recruitment, retention, and progression. Jobcentres across the country are delivering tailored support to jobseekers and employers. New initiatives launched this year such as the Green Jobs Delivery Group and the Digital Skills Council ensure that government and industry work closely together to support key sectors. Working closely with other departments, the actions were taken to support key sectors, which include refreshing and updated guidance for Work Coaches and jobseekers challenging misconceptions; running public facing communications campaigns centred around key sectors; promoting SWAPs, Skills Bootcamps, and other skills support; work with local authorities to shape Bus Service Improvement Plans; and working with a wider range of employers.

Our Performance

The key metrics below show progress made over 2022-23 towards achieving our priority outcomes as we saw an increase to both the overall and youth employment levels on the year, though both remain below pre-COVID-19 levels. We will continue to monitor our key metrics in 2023-24.

UK Employment rate: 16-64 years (2012-2023)

The latest available data, covering January to March 2023, shows the UK employment rate at 75.9% for working-age adults (between 16 and 64). The rate has increased by 0.3 percentage points on the year but remains 0.7 percentage points lower than December to February 2020 (prior to the impact of COVID-19).

At a regional/national UK level, the majority saw an increase in their employment rate on the year.

UK employment rate - 16 to 64 years (2012 to 2023)

Source: Employment rate (aged 16 to 64, seasonally adjusted): % - Office for National Statistics (ons.gov.uk) and X01 Regional labour market: Estimates of employment by age – Office for National Statistics (ons.gov.uk)

UK Employment rate: 16-24 years (2012-2023)

The latest available data, covering January to March 2023, shows the UK employment rate at 55.5% for young people (aged 16-24). This is more than 20 percentage points below the UK employment rate for people aged 16-64. The employment rate for young people has increased by 1.1 percentage points on the year and remains 0.14 percentage points lower than December to February 2020 (prior to the impact of COVID-19).

At a regional/national UK level, 7 of 12 regions and nations had a reduction in the employment rate for young people.

As noted above, we are providing additional support to young people to help them move towards and into work through our Youth Offer.

*UK figures are seasonally adjusted whilst the regional figures are not.

Source: X01 Regional labour market: Estimates of employment by age – Office for National Statistics (ons.gov.uk) and A06 SA: Educational status and labour market status for people aged from 16 to 24 (seasonally adjusted) – Office for National Statistics (ons.gov.uk)

Priority Outcome 2 - Improve opportunities for all through work, including groups that are currently under-represented in the workforce

Introduction

Ensuring that everyone is able to and has the opportunity to enter and progress in work remains a key priority for the Department. We know that groups that were under-represented in the labour market were disproportionately affected by the COVID-19 pandemic, and throughout 2022-23 we continued to provide much needed support to help them to start, stay, and succeed in work.

Figures released by the Office for National Statistics in May 2022 showed that the number of disabled people in employment had increased by 1.3 million between 2017 and 2022, delivering on the government goal to see 1 million more disabled people in work in the decade to 2027[footnote 3].

Long-term trends of falling economic inactivity were reversed during the pandemic with increases predominantly driven by an increase in those reporting long-term sickness as the main reason for economic inactivity[footnote 4]. The increase has predominantly been seen amongst those aged 50 to 64. However, between April to June 2022 and January to March 2023 overall economic inactivity decreased by 0.4 percentage points (or 161,000 people – 7,000 of which were aged 50 to 64). Conversely, long-term sickness, as the main reason for economic inactivity, continues to rise – up 2.4 percentage points (or 164,000 people) between April to June 2022 and January to March 2023.

We have focused support on groups that are under-represented including disabled people and people with health conditions, ex-offenders and people undergoing clinical treatment for substance dependency. By introducing more dedicated resource in the Jobcentre network, increasing capacity in our contracted provision, creating stronger links between work and health, and developing new channels for information sharing, we improved the support we offer to these key groups. But we are not complacent and DWP continues to work with other departments and stakeholders to build on existing initiatives, to deliver additional support, including the extensive package announced in Spring Budget 2023, and the reforms set out in the Health and Disability White Paper.

Achievements and Progress

Working with Health Systems

Disabled people are more likely to fall out of work and, once out of work, are less likely to return. Employment is a wider social determinant of health and being in good employment is, in general, better for people’s health. The Joint Work and Health Directorate (JWHD) is a collaboration between DWP and the Department of Health and Social Care (DHSC) established to drive improved work and health outcomes for disabled people and people with health conditions. It has improved alignment of employment and health systems to deliver evidence-based programmes, trials, and tests.

The Employment Advisers in NHS Talking Therapies programme is designed to help with common mental health conditions such as stress, anxiety, and depression. Through the Employment Advisers in NHS Talking Therapies programme, we are co-locating employment advisers alongside therapists to offer combined psychological and employment support.

Following positive evidence from evaluation published in April 2022 - which included a finding that two thirds (68%) of those who accessed the service reported either remaining in work or finding work 12 months after using the service - we were able to secure a further £122 million of funding over this Spending Review period to expand the service throughout England[footnote 5].

In October 2022 we announced we would increase the reach of the existing programme from 40% to 100% coverage across all NHS Talking Therapies services in England, to provide combined employment support and talking therapy to 100,000 people per year by 2024-25.

Improving the Use of the Fit Note

Together with DHSC, we remain committed to improving the use of the Fit Note. We worked with professional and regulatory bodies to implement changes that would support better work and health conversations.

In April 2022 we amended the existing regulations, removing the requirement for a signature in ink to authorise fit notes. Instead, a new version of the form was introduced which means fit notes can now be completed, authorised, and sent digitally if that is the patient’s preference. This makes it easier for patients to access, store and share their fit note with DWP or their employer - reducing paper and risk of requiring a re-issued fit note. To better draw upon the skills and experience of other healthcare professionals, from 1 July 2022 we changed the regulations to enable Registered Nurses, Occupational Therapists, Physiotherapists and Pharmacists, in addition to doctors, to certify fit notes within their scope of practice[footnote 6].

Drawing on the skills and experience of these healthcare professions working as part of multi-disciplinary teams, fit notes can be a more effective tool in managing sickness absence. We are now monitoring and evaluating these regulatory changes through commissioned qualitative research and internal quantitative analysis.

Influencing Positive Employer Behaviours

In the response to the Health is Everyone’s Business consultation, on proposals to reduce ill-health related job loss, we committed to continuing to work across departments and with external stakeholders to raise awareness and understanding around existing rights and responsibilities under the Equality Act 2010[footnote 7]. This includes the duty to make reasonable adjustments. Since November 2022, strengthened Health and Safety Executive guidance has given a set of clear and simple ‘principles’ that employers would be expected to apply to support disabled people and people with health conditions in the work environment.

To help support in-work activity around disability and health, we have created an integrated, tailored employer Information and Advice service. The service is publicly available in national live testing and helps employers to understand their legal responsibilities.

Using a directed guidance approach, the service supports employers through key considerations and suggests practical steps to consider individual employee needs and make adjustments to aid recruitment and retention. The service can be found at: Support with Employee Health and Disability - GOV.UK (dwp.gov.uk)[footnote 8]

Occupational Health (OH) continues to be a focus in helping disabled people and people with health conditions to remain and thrive in work. We have progressed our programme of OH reform to improve disparities in access for Small and Medium Enterprises (SME) and the self-employed, including through developing the test for a financial incentive scheme.

In January 2023, we launched a £1 million fund to stimulate innovation in the OH market, focused on increasing access to and capacity in OH. The fund encourages the development of new models of OH tailored to SME and the self-employed through better use of technology. Options for a financial incentive scheme for SME and self-employed people to access OH are being developed for further testing

Through the Disability Confident scheme, we provide employers with advice, support, and free resources to help them attract, recruit, retain and develop disabled people in the workplace[footnote 9].

The scheme is promoted widely, including by working closely with the Disability Confident Business Leaders Group, which includes senior representatives from major businesses throughout the UK. The scheme, and the business benefits of disability employment, are also promoted through the Work and Health Programme Providers, Jobcentre Plus, other stakeholder events, communication campaigns, social media channels, and through GOV.UK (www.gov.uk)

As of 31 March 2023, there are approximately 17,500 members of the Disability Confident scheme, and they estimate over 11 million employees working in their businesses. Once again, we are working in collaboration with the Business Disability Forum to include 3 Disability Confident Awards for employers who have actively encouraged the employment of disabled people during the last year.

Following the Thriving at Work review in 2017, the Mental Health and Productivity Pilot (MHPP) began in July 2019 to support employers across the Midlands understand and act on the link between mental health and productivity[footnote 10]. The pilot offers a package of resources which work towards ensuring employees are happy, satisfied, and able to thrive at work.

DWP has extended funding for the MHPP for a further 18 months from April 2022 to December 2023, meaning the MHPP has continued to deliver support this year and will provide robust evaluation to support future policy development. The MHPP has delivered promotion and prevention interventions to over 800 employers with potential reach of over 650,000 employees. An interim report for the MHPP was released in October 2022 evaluating the initial phase of the pilot. The final evaluation will be produced during the next financial year[footnote 11].

During 2022-23, we received a significant increase in applications to the Access to Work scheme and have recruited new staff to meet this demand and reduce the time it takes to make decisions. We have prioritised new applications with an imminent start date and renewal applications, whilst working to reduce all wait times and improve processes.

To further help the decision-making process for Access to Work applications, we are delivering a series of Adjustments Passport pilots. An Adjustment Passport provides a living document of an individual’s adjustments and in-work support needs. This helps an individual have a structured conversation with jobcentre plus Work Coaches and potential employers, and can reduce the need for an Access to Work assessment.

Following a successful pilot in the Jobcentre Plus Health Model Offices in 2021, an Adjustment Passport was rolled out in May 2022 to support disabled jobseekers and raise awareness of Access to Work. In addition, an Adjustment Passport pilot supporting transition from education programmes started in February 2023.

Continuing and Developing Support

Through Jobcentre Plus, we started trialling Additional Work Coach Support, a new offer providing more Work Coach support for disabled people and people with health conditions to help them move closer to and into employment. This increased one-to-one personalised Work Coach support is available for claimants receiving Universal Credit or Employment Support Allowance, who are awaiting their Work Capability Assessment and those who have been found to have limited capability for work or ‘limited capability for work and work-related activity’ that want, or could benefit from, more help to move into work. For claimants who have been found to have limited capability for work and work-related activity following a Work Capability Assessment, all participation in this support and time spent with Work Coaches is voluntary.

This support became available in two-thirds of jobcentres from May 2023 and will be available nationally by 2024. Current rollout is being informed by feedback from the initial trial in one-third of jobcentres.

Work Coaches are supported by Disability Employment Advisors (DEAs) who provide expert knowledge on how to support disabled customers.

Supported Employment Programmes

The recent Budget announced funding for a new employment programme called Universal Support. Universal Support is designed to help disabled people, people with health conditions and people with additional barriers to employment into sustained work by using an internationally recognised supported employment model of employment provision. The supported employment model is based on the concept of ‘place and train’, which incorporates 5 stages: engagement, vocational profiling, job finding, employer engagement and on and off the job support. Through these 5 stages, supported employment provision helps match someone to a job that is right for them at the earliest opportunity, trains them to do the job in the way the employer wants it done and provides personalised, ongoing support to sustain their employment. Universal Support will include help for the individual to address issues like debt, manage their health condition and help employers to put in place job shaping or other adjustments to accommodate the individual’s needs. Eligible people will be able to opt into Universal Support and receive up to 12 months support.

Universal Support will start delivery in 2024 and expand to support at least 50,000 people a year at its capacity. It is important US reflects local job opportunities and aligns with other national and local employment support. As such, we are engaging with a wide range of key local area stakeholders, employers, providers, and experts in delivery of ‘place and train’ support to inform design and delivery decisions.

As part of the first phase of Universal Support, DWP and the Department of Health and Social Care are funding several areas to deliver Individual Placement and Support in Primary Care (IPS-PC).

Delivered in health settings with referrals primarily made via healthcare and community pathways, IPS-PC is an important part of our response to combatting health related inactivity contributing towards greater productivity and economic growth. It is aimed at people with physical or common mental health disabilities to support them to access paid jobs, and then support both the individual and their employer to ensure that the job is sustained. The service will also support people struggling in work or off sick to retain employment and prevent inactivity.

Following a competed grant exercise, 6 places (covering 30 Local Authority (LA) areas) will deliver IPS-PC in England from April 2023 until March 2025, supporting up to an estimated 12,400 disabled people with common physical or mental health disabilities to secure or retain employment. Areas delivering IPS-PC will support early delivery of ‘place and train’ model outlined above.

Through Contracted Employment Provision

Many individuals benefit from more intensive employment support delivered under contract by external organisations.

The Work and Health Programme (WHP) provides personalised support to disabled people and disadvantaged groups who are motivated to work and expect to find it within 12 months. Using the expertise of private, public, voluntary, and community sector providers, the WHP helps participants with a wide range of barriers to work receive coordinated and holistic support, including agencies working with families, ex-offenders, care leavers, refugees, drug and alcohol users, and veterans, amongst others.

Rolled out across England and Wales between November 2017 and March 2018, by February2023, 260,000 people had started the programme, 110,000 people started work and 68,000 people achieved a sustained job outcome or 6 months of being in self-employment. Around 3-quarters of starts on the programme who achieve a first earnings outcome are disabled people.

The programme continues to build on the experience of what has worked well in the past and learning lessons from other contracted provision. The programme has been extended from November 2022 to September 2024 providing additional support for around another 100,000 people.

The Intensive Personalised Employment Support (IPES) programme is voluntary provision for unemployed and inactive disabled people who have multiple barriers to employment, which may be a combination of personal and work-related barriers. This may be an impairment or condition which significantly increases their barriers to work for example, a learning disability or barrier such as homelessness, substance misuse or low self-esteem. Providing intensive and flexible support from a dedicated key worker for up to 15 months, with an additional 6 months intensive in-work support for those who gain employment, IPES integrates with local, specialist support organisations to build a holistic package around each individual participant.

IPES is the most intensive of our contracted employment support. It was launched in December 2019 in England and Wales to provide support for up to 10,000 people over a 4 year period. To meet the expected increase in demand for support we increased available places from January 2022 to raise the total number of disabled people being supported on the programme to over 11,000 across the life of the programme.

The Local Supported Employment (LSE) programme is designed to enable more people with learning disabilities and/or autism to access the support they need to start and sustain employment, and is delivered through the ‘place and train’ model.

Following a successful proof of concept, we have provided funding to 23 lead local authorities to deliver LSE across England and Wales from November 2022 to March 2025. LSE will support around 2,000 adults with learning disabilities, autism, or both to move into and stay in work through intensive one-to-one support over the entire programme period.

Other under-represented groups

Prison leavers have access to our network of 200 Prison Work Coaches (PWC) covering all prisons in England, Wales, and Scotland. PWCs provide training, employment support, and benefits support before release. We have begun testing different ways for prisoners to start Universal Credit claims and their claimant commitment before release, working with the Ministry of Justice in 15 prisons. Our aim is that prisoners can access Universal Credit and advance payments more quickly on release.

Individual Placement and Support for Drug and Alcohol Dependency (IPS-AD) provides employment support alongside clinical treatment for substance dependency, enabling individuals to overcome barriers that often limit participation in the labour market.

IPS-AD was trialled in 7 Local Authority (LA) areas in England between 2018-2021. As recommended in Dame Carol Black’s independent review of drugs and announced in the Government’s Drug Misuse Strategy in December 2021, IPS-AD is now being rolled out to all 150 LA areas in England by March 2025[footnote 12]. To date, the programme has been expanded to cover over

Our Performance

The key metrics below show progress made over 2022-23 towards achieving our priority outcomes.

Disability Employment

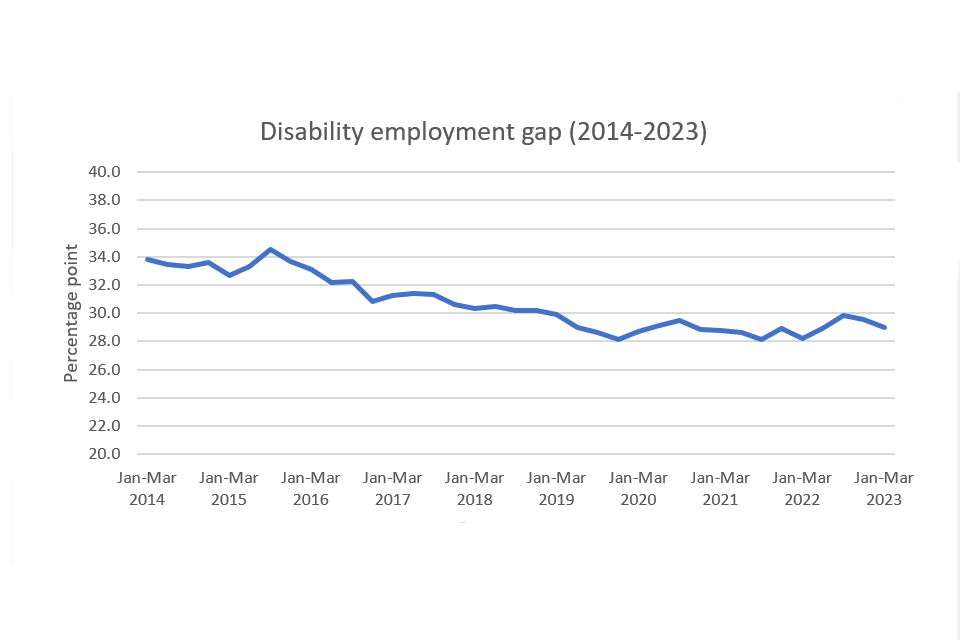

There were 5.1 million disabled people in employment in January to March 2023, an increase of 2.2 million since January to March 2014 (the earliest comparable date), and 320,000 since January to March 2022. In addition to the number of disabled people in employment, we continue to monitor the disability employment gap, the difference between the disabled and non-disabled employment rates. The gap has decreased by 4.8 percentage points over the last 9 years, from 33.8 percentage points in January to March 2014 (the earliest comparable date), to 29.0 percentage points in January to March 2023. However, it has increased by 0.8 percentage points over the last year, from 28.2 percentage points in January to March 2022. These measures are ‘outcome measures’ reflecting the real-world improvements the government wants to see, rather than direct measures of DWP performance. They are affected by external factors such as the size of the underlying disabled population and overall labour market performance, as well as DWP activity.

Priority Outcome 3 - Address poverty through enabling progression into the workforce and increasing financial resilience

Introduction

DWP provides a vital safety net to those who need it and are committed to tackling poverty and supporting people on lower incomes. The economic environment has been very challenging throughout 2022-23, contributing to the continued high levels of inactivity and impacts of rising cost of living pressures, which disproportionately affect the most vulnerable in society. DWP’s focus has rightly been on supporting our claimants adversely impacted by changing economic circumstances.

We spent £230.5 billion in Resource AME, which covers benefits paid through the welfare system in 2022-23, including £94.8 billion on people of working age and children, and £137.3 billion on pensioners. Of total welfare spend, £33.8 billion was spent on benefits to support disabled people and people with health conditions.

In addition to the direct payment of benefits, we also play an important role in ensuring that people have the stability of a safe and secure home, itself an important stepping stone to finding employment. To help people with their housing costs, we have ensured the administration of around £30 billion in 2021-22 of housing support through Housing Benefit and Universal Credit.

Achievements and Progress

Supporting the most vulnerable

Cost of Living Payments

We have provided over 7 million households on means-tested benefits with Cost of Living Payments up to £650, costing a total of over £4 billion. 6 million people who receive a qualifying disability benefit also received a one-off £150 Disability Cost of Living Payment, at a total cost of £0.9 billion. Over 8 million pensioner households received a Pensioner Cost of Living Payment of £300 alongside their Winter Fuel Payment in November/December, at a total cost of over £2 billion. For people who need additional support, we have also provided £842 million to enable two extensions to the Local Authority run Household Support Fund in England, so Local Authorities can provide households with further help with the cost of essentials throughout 2022-23.

Universal Credit (UC) is the cornerstone of our benefit system combining 6 legacy benefits into one to support individuals in work on low incomes, those who are out of work and those who unable to work. As set out in Priority Outcome 1, we have continued to expand support for UC claimants to progress into better-paid jobs through increases to the Administrative Earnings Threshold (AET) and the introduction of a new In-Work Progression Offer.

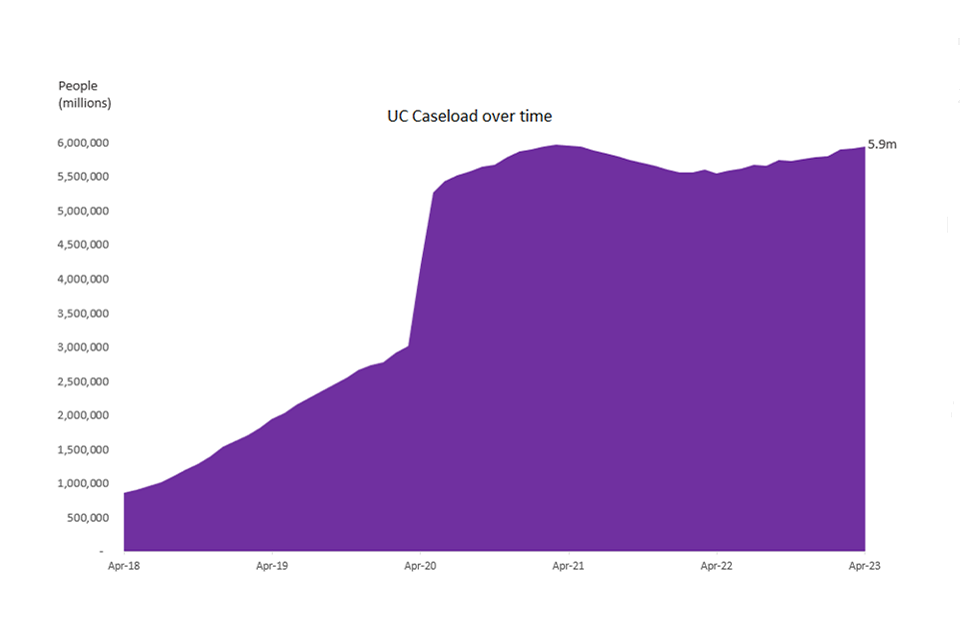

The latest statistics for April 2023 show that there were 5.9 million people claiming UC. In March 2023, 2.2 million people or 38% of the caseload were in employment.

The Move to UC programme is making good progress through managed moves to move claimants on to UC from legacy benefits, with our strategy for implementing the final phase of UC. Learning from how UC has operated during the pandemic and from key insights, we have revised the working strategy for the migration of approximately 2.6 million households from legacy benefits and tac credits to UC by 2024. In April 2022, we published our 2022 to 2024 strategy for implementing the final phase of UC, ‘Completing the move to Universal Credit’.

In May 2022, we started a multi-location approach across the country with a small number of claimants, being brought into the mandatory migration process. We continue to develop our processes and systems to scale the migration process and complete the migration of legacy benefit claimants to UC.

As part of the 2022 Autumn Statement, the Chancellor announced a delay in the moving of Employment and Support Allowance (ESA) only and ESA with Housing Benefit (HB) onto UC until 2028. This provides a welfare saving of around £1 billion by 2027-28, as overall UC is more generous than the benefits it replaces. ESA claimants are still able to make a claim for UC if they believe that they will be better off, and this will not affect the managed migration of other legacy benefits onto UC.

In January 2023 we also published findings from the initial managed migration Discovery work, for moving remaining benefit and tax credit claimants to UC, ‘Completing the move to Universal Credit: Learning from the Discovery Phase’. In April 2023, we began increasing the number of migration notices that we are issuing to tax credit only claimants throughout 2023-24[footnote 13]. This expansion will incrementally expand across all of Great Britain, notifying approximately 500,000 households of the need to claim Universal Credit, to continue to receive financial support from the government.

Bereavement Support Payment

Bereavement Support Payment (BSP) was introduced in April 2017 and replaced Widowed Parents Allowance, Bereavement Allowance, and the Bereavement Payment. 41,000 (81%) were receiving the standard rate, while 9,600, who were entitled to Child Benefit, (19%) were receiving the higher rate.

Support for disabled people and people with health conditions

Personal Independence Payment (PIP) provides financial support to working-age individuals with a long-term health condition or disability with extra costs. PIP replaced Disability Living Allowance (DLA) for new working age claims and for existing DLA recipients who were aged 16 to 64 on 8 April 2013 or reached age 16 since then. From April 2022 to March 2023, the Department received 851,000 claims for PIP, of which 773,000 were new claims and 78,000 were DLA reassessments across England and Wales. In comparison, from April 2021 to March 2022, the Department received 715,000 claims for PIP, of which 643,000 were new claims and 72,000 were DLA reassessments across England and Wales. We have continued to see high levels of PIP claims over the year and have worked hard to process new claims and change in circumstances promptly, with new claims now being cleared in 13 weeks on average, down from 26 weeks in August 2021.

Health Transformation Programme

The Health Transformation Programme (HTP) will transform benefit services for disabled people and people with health conditions by developing and creating a single new Health Assessment Service (HAS) and by transforming the entire Personal Independence Payments (PIP) service.

The programme is taking a long-term phased approach that will move us away from the current ways we are operating gradually and carefully. The programme is currently focussed on building the foundations and creating the environment to enable us to begin to transform these services for the future.

In our two small-scale in-house test sites – the Health Transformation Area (HTA) – we have continued to develop, test and iterate the new HAS and PIP service on a small scale, ahead of national expansion from 2029. We have now completed assessments for over 7,500 cases.

We are procuring new assessment provider contracts worth approximately £2 billion over their lifetime, which will run from 2024–2029. They will replace the current model with a single supplier for all functional assessment services in a geographic area and provide the foundation for the new HAS. Alongside the new assessment provider contracts, we will be providing the IT to support PIP assessments, consistent with our approach to providing IT for the Work Capability Assessments (WCA). The contract for the PIP IT managed service was signed in May 2022. Providing the IT opens up the market by removing a barrier to entry for new assessment providers.

We continue to test our new online Apply for PIP service, which will provide customers with a greater choice over the channels they use to interact with the Department. We are testing this at small scale, currently inviting up to 300 claimants per week to make their claim online.

The National Audit Office (NAO) commenced a Value for Money study into HTP in July 2022, with the report published in June 2023. The Public Accounts Committee will be examining the NAO report in a hearing in July. The Department will be considering the recommendations of the NAO and the PAC carefully, in due course.

Health and Disability White Paper

We published Transforming Support: The Health and Disability White Paper in March 2023[footnote 14]. Responding to the Health and Disability Green Paper consultation, it sets out our plans to transform health and disability support so that more disabled people can start, stay, and succeed in work and to improve people’s experience of the health and disability benefits system. At the centre of the White Paper are plans to transform the benefits system for the future so that it focuses on what people can do rather than what they cannot and gives people the confidence to try work. This includes removing the Work Capability Assessment so that in future there is only one health and disability assessment – the PIP assessment.

This will require primary legislation which we will aim to take early in a new Parliament when Parliamentary time allows. These reforms will then be rolled out to new claims only on a staged, geographical basis from 2026-27 at the earliest. We expect the new claims roll out to be completed by 2029, when we will then migrate the existing caseload onto the new system.

Special benefit rules

The Department is committed to providing support to people who are nearing the end of their lives. For people in this position, the Special Rules allow simple and fast access to financial support through the benefits system. Those eligible under the Special Rules get their claims fast-tracked, which means they do not have to wait as long to start getting payments. They are not required to take part in a functional assessment and, in most cases, those claiming will qualify for the highest rate of benefit.

For many years, the Special Rules have applied to people who are likely to have 6 months or less to live, but recent changes mean that they now apply to people who are likely to have 12 months or less to live. The new 12 month Special Rules criteria aligns with the end of life approach in the NHS where clinicians are encouraged to identify individuals who may be in their final year of life and consider what support they may need, including financial support.