Companies House annual report and accounts 2023 to 2024

Updated 27 August 2024

For the period 1 April 2023 to 31 March 2024

- Presented to the House of Commons pursuant to section 7 (1 and 2) of the Government Resources and Accounts Act 2000

- During the period of this report, Companies House was an executive agency of the Department for Business and Trade (DBT)

- Ordered by the House of Commons to be printed on 29 July 2024

- © Crown copyright 2024

- HC 155

- ISBN 978-1-5286-4770-0

Chair’s introduction

In last year’s Annual Report and Accounts, I reflected on how exciting it was to be joining Companies House at a pivotal point in their transformation.

Back in 2020, Companies House set out a 5-year strategy with the vision to be the most innovative, open and trusted registry in the world. They knew that delivering this vision was ambitious and would require both legislative reform and organisational transformation.

This Annual Report and Accounts for 2023 to 2024, concludes year 4 in the delivery of the strategy, and the planned programme of legislative reform passed its next major milestone with the Royal Assent of The Economic Crime and Corporate Transparency Act (ECCTA) 2023 in October 2023. This marks a significant moment in the history of the UK companies register as the implementation of the new registrar’s powers, from 4 March 2024, brings about the biggest changes since 1844.

The measures in this act of Parliament take Companies House a significant step closer towards realising their vision and their new strategic narrative was launched.

- We drive confidence in the economy by creating a transparent and accountable business environment.

- Use of our data informs business and consumer decisions, supports growth and helps disrupt economic crime.

Over time the changes will allow Companies House to actively improve the integrity of the UK registers and as the changes are implemented it’s important that a balance is maintained between tackling economic crime and the ease of doing business for law-abiding companies.

Thanks to the commitment and hard work of our brilliant people, they have begun to translate the legislation into practice and to deliver a reformed Companies House, which is fit for the future. The scale of the changes involved cannot be underestimated, but we’re excited to contribute further to both the growth of the UK economy and tackling economic crime for years to come.

John Clarke

Chair of main board

15 July 2024

Chief executive’s introduction

I am pleased to publish the annual report and accounts for 2023 to 2024.

Companies House has always played a key role in fostering confidence in the UK economy. We aim to be the most innovative, open and trusted registry body in the world and what we do here matters globally - from our Registers of Persons of Significant Control and of Overseas Entities, we are often first in line for creating a more dynamic, transparent and accountable business environment internationally.

The ECCTA 2023 will continue in that vein, promising to set a new global standard for the role of corporate registrars in fostering confidence by supporting the tackling of economic crime. I’m delighted that from 4 March 2024 my fellow registrars and I benefit from wide ranging, increased powers to promote greater confidence in our registers. Significant among these is our new, more active role, in combatting economic crime and tackling abuse of UK corporate structures.

In preparation for this, our fantastic Companies House colleagues in our Cardiff, Belfast and Edinburgh offices have worked tirelessly, not only to maintain our existing customer service standards, but to also completely overhaul, create and reimage many of our processes and functions.

In the operating context for this year, I am pleased to report, the Government Internal Audit Agency (GIAA) evaluation of the effectiveness and accuracy of Companies House reporting on key success indicators, received a ‘substantial’ audit opinion confirming the validity of Companies House reporting and the successful achievement of 6 out of the 7 ministerial targets. Our recruitment target was impacted by the announcement and timing of a headcount cap across government, which delayed our recruitment and onboarding.

None of this achievement would have been possible without our brilliant people, and I want to take this opportunity to thank them, and so many others who have helped us along this journey.

Louise Smyth

Accounting officer, Chief Executive Officer (CEO) and Registrar of Companies for England and Wales

15 July 2024

1. Performance report

Purpose of the performance report

This report provides an overview of our performance against our strategic goals and commitments in our annual business plan 2023–24 and has 2 sections: a ‘performance overview’ and a ‘performance analysis’.

Performance overview

The performance overview introduces Companies House, our purpose and vision and the strategic goals and objectives we set in our 5 year strategy 2020 to 2025. It also outlines our performance highlights as of 31 March 2024 and the board’s assessment of risk is presented within the governance statement of the corporate governance report.

Who we are

Companies House is an executive agency, sponsored by the Department for Business and Trade (DBT).

We drive confidence in the economy by creating a transparent and accountable business environment. Use of our data informs business and consumer decisions, supports growth and helps disrupt economic crime.

We employ around 1300 people in our UK offices. Company registrations for England and Wales are processed in Cardiff. Registrations for Scotland and Northern Ireland are processed in Edinburgh and Belfast.

What we do

We incorporate and dissolve limited companies. We examine and store company information and make it available to the public.

Further information on Companies House is available from GOV.UK.

Our strategy

Companies House strategy 2020 to 2025 sets out our purpose and vision:

To drive confidence in the UK economy and to be the most innovative, open and trusted registry in the world, with brilliant services delivered by brilliant people.

This strategy sets out our 6 strategic goals for the period. They reflect the vision of the organisation and our priorities.

Our strategic goals are:

- Our registers and data inspire trust and confidence.

- We maximise the value of our registers to the UK economy.

- We combat economic crime through active use of analysis and intelligence.

- Our brilliant services give a great user experience.

- Our culture enables our brilliant people to flourish and drives high performance.

- We deliver value through efficient use of resources.

Corporate transparency and register reform

The ECCTA 2023 followed the Economic Crime (Transparency and Enforcement) Act 2022 (ECTE 2022) and similarly seeks to address the threat of illicit finance whilst maintaining the ease of doing business for legitimate commerce.

The ECCTA 2023 amends the Companies Act 2006 to reform Companies House’s processes and furnish the registrars of companies with new statutory functions and objectives.

The ECCTA 2023 expands the statutory role of the Registrar of Companies for England and Wales (and equivalents in Scotland and Northern Ireland) beyond their previous remit of registering company information.

The registrars are now tasked with doing more to protect the integrity of the information on the register and seeking to prevent companies and others from carrying out unlawful activities. To support this the act equips them with new powers. This includes powers to query suspicious appointments or filings, request further evidence or reject filings.

A significant programme of secondary legislation is necessary to implement the reforms. Some 50 or more statutory instruments are likely to be needed to underpin all aspects of the operational roll-out. The Government intends to deliver these instruments in phases, designed to be closely aligned with the extensive operational transformation within Companies House.

The first phase of implementation commenced on 4 March 2024, encompassing the systems, process and organisational change needed to operate the new registrars objectives and powers and new legal requirements for companies.

DBT has laid the first report to Parliament on progress on the implementation of parts 1 to 3 of the ECCTA 2023.

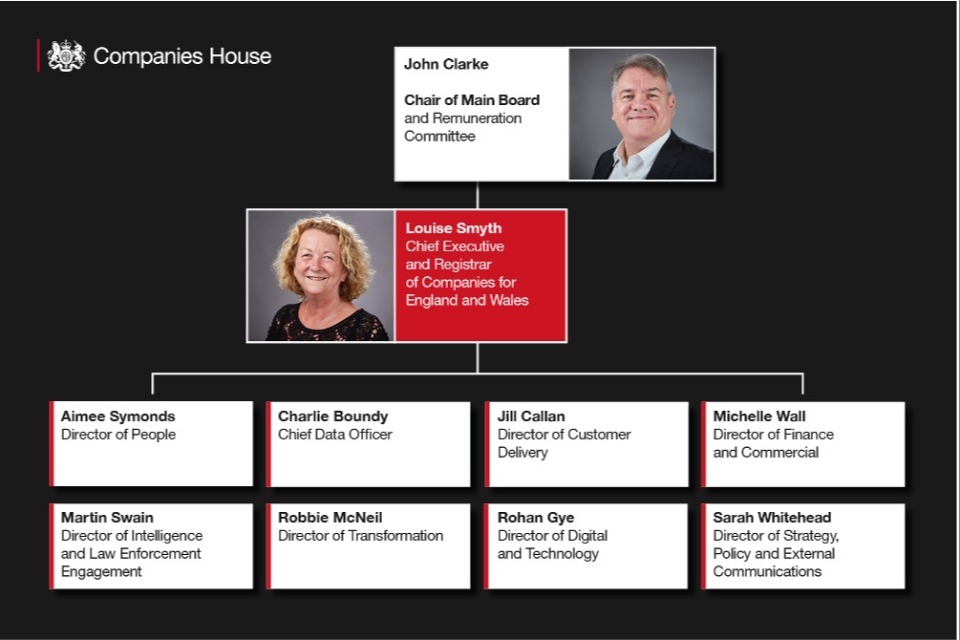

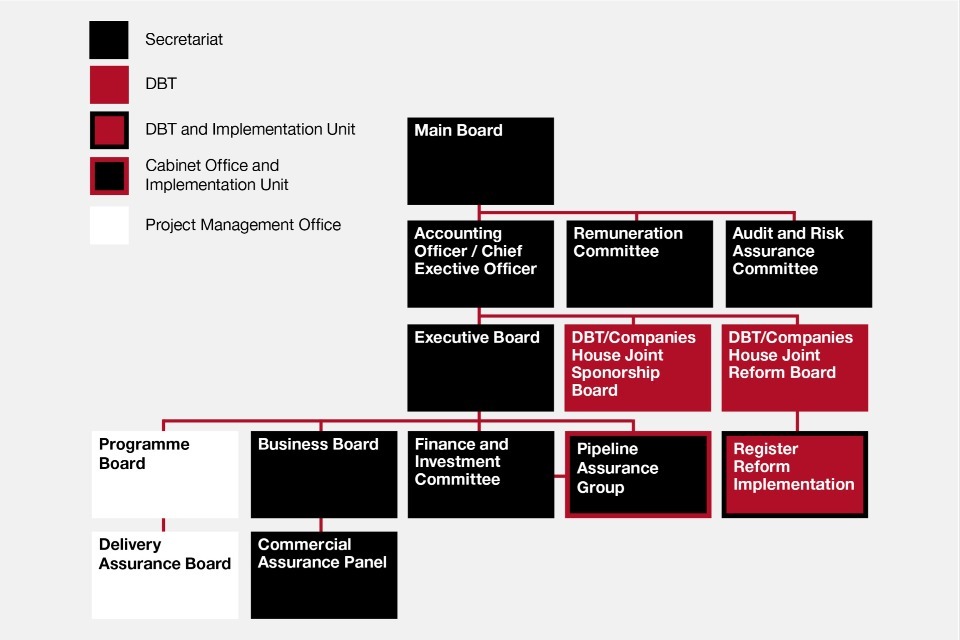

Organisational structure

Performance highlights 2023 to 2024

- UK register size (as at 31 March 2024): 5.35 million

- Incorporations: 890,684

- Dissolved companies: 663,167

- In liquidation: 109,352

- Companies in course of dissolution: 365,033

- Companies restored: 7,648

- Register of Overseas Entities: 30,776

- Paper purchase A4 ream equivalent: 3,174

- Rate of confirmation statements filed by companies as at 31 March 2024: 97.3%

- Number of times the register was accessed: 16 billion

- Rate of annual accounts filed by companies as at 31 March 2024: 98.3%

- Total filings accepted digitally: 13.1 million

- Total filings accepted: 14.3 million

- Digital take-up: 92%

- Customer satisfaction: 82%

More information on our annual statistics on companies, including the number of incorporations, dissolutions, and the total size of the register at Companies House, are available from Companies register activities: statistical release 2023 to 2024.

Performance analysis

Purpose

The performance analysis provides a detailed view of performance against the delivery of our Business Plan for 2023 to 2024, including the targets and main commitments we set ourselves under each of our strategic goals for the reporting period.

Performance outturn against our ministerial targets in 2023 to 2024

| Target | Output | Outcome |

|---|---|---|

|

Removal of records Remove in excess of 16,000 pieces of information relating to identity details and/or addresses used without permission, in order to minimise the risk of records kept by the registrars creating a false or misleading impression to members of the public. (using existing powers) |

34,934 Target met and exceeded |

Achieved |

|

Register of Overseas Entities Issue financial penalties for non-compliance in cases that we have identified and prioritised. |

Target met | Achieved |

|

Complete and up-to-date data 97% of companies on the register have filed a confirmation statement. |

97.3% | Achieved |

|

Digital service availability Digital services are available for a minimum of 99.5% of the time. |

100% Target met and exceeded |

Achieved |

|

Customer satisfaction 80% of customers satisfied with Companies House. |

82% Target met and exceeded |

Achieved |

|

Resourcing Increase the resource in the operations and intelligence teams by up to 241 new posts to enable legislative reform.* |

Resource in the operations and intelligence increased to enable commencement of legislative reform | Partially met Resource increased by 174 additional FTE for the commencement of new powers. |

|

Delivering value We will manage our expenditure within budgetary limits.** |

Successful completion of the external auditor review of the end of year accounts | Achieved |

The effectiveness and accuracy of Companies House reporting on key success indicators, has been evaluated by the GIAA. They provided a ‘substantial’ audit opinion confirming the validity of Companies House reporting.

*The GIAA confirmed that failure to meet the resourcing total can be attributed to the following factors which have contributed to a significant delay in being able to recruit:

- The announcement of a headcount cap across government part way through recruiting for new powers (September 2023) which delayed onboarding and recruitment.

- A delay in the approval of Companies House fee increases - on the basis that the increase was linked to the need to increase the headcount.

**The target ‘Manage expenditure within budgetary limits and utilise central government funding’ was excluded from the GIAA review, as it is delivered through successful completion of the external auditor review of the end of year accounts.

Risk management and assessment

Companies House actively manages risks across the business, and over the period April 2023 to March 2024, the principal risks were monitored and managed at Executive level.

Companies House’s executive board also considered a range of issues and highlights throughout the course of 2023 to 2024. The board’s management and assessment of risk is presented within the governance statement of the corporate governance report.

Strategic goal 1 - Our registers and data inspire trust and confidence

Our registers and data are accessed by a wide variety of users including companies, investors, researchers, credit reference agencies, law enforcement agencies and partners across government. The information we publish is used on its own and combined with data from other sources to make decisions, carry out investigations and support law enforcement.

The new powers and responsibilities of the ECCTA 2023 are designed to further improve trust and confidence in our registers.

Use of our new powers is a cultural shift for Companies House. It will also have a significant impact on our customers, and their experience of our registers. We know the impact that the false and malicious use of names and addresses used without consent has on individuals, and that such practices have been ongoing for some time. However, until this year our ability to rectify such misuse has been extremely limited. Given this, upon receipt of our new powers we prioritised targeting the retrospective removal and rectification of such false information in order to maximise confidence in the register and minimise distress to individuals. Tackling the backlog of potential false information for removal started on the first day of our new powers, 4 March 2024.

From 4 March to the end of March, Companies House has:

- commenced the process to remove names and addresses used without consent. This includes removals of People of Significant Control (PSC) and shareholders - previously those wishing to have their details removed would have had to apply to the courts.

- removed 4,000 registered office addresses

- removed 2,100 officer addresses and 2,300 PSC addresses

- redacted 3,600 incorporation documents to remove personal data used without consent

- removed 1,250 documents from the register, including 800 false mortgage satisfaction filings which would have previously required a court order

- contacted 3,800 companies with PO Boxes as their registered office address, to make them aware that this would no longer be legally compliant and requiring them to provide an alternative appropriate address. As of 1 April 2024, the number of companies on the register using a PO box has reduced to 1,900.

Where a company’s registered office is not appropriate, such as in instances of fraudulent use, Companies House will change the address to a default address. These companies will be struck off the register unless they can provide an appropriate address with evidence that they are entitled to use that address. There were 26,800 companies with a defaulted registered office address on the register on 4 March.

Data

We have taken significant strides in implementing a data management and data governance function to help improve the quality and control of our data. Importantly, we have successfully embedded a new Data Governance Framework into our Project governance. This has been supported through close collaboration with colleagues across all strategically important projects.

We have invested in improving our data maturity across the organisation, and our new Data Issues tracker allows colleagues to easily report to us data quality issues impacting a variety of areas across the organisation, and we have piloted a project aimed at improving the quality of data in our Persons of Significant Control Register.

Work on a cloud data platform solution continues to allow our Data Scientists to fully mobilise the value of our data to enable proposals for more sophisticated digital solutions and to help us with improving data quality - particularly through highlighting patterns and anomalies. We have also initiated an AI Steering Group with representatives from across the business to discuss opportunities and the implications for generative AI in the organisation.

Compliance

We are pleased to have maintained year-end compliance rates above 97% in each of the 4 years of our strategy, for both confirmation statements and annual accounts. With 97.3% of companies filing up-to-date confirmation statements at the end of 2023 to 2024, compared with 97.4% in 2022 to 2023; 97.2% in 2021 to 2022; 97.5% in 2020 to 2021 from the baseline of 97.2% at the start of our strategy.

Compliance for companies filling up to date annual accounts was 98.3% at the end of this financial year, which compares with 98.5% at the end of 2022 to 2023; 98.4% in 2021 to 2022 and 97.8% at the end of 2020 to 2021, from the baseline of 98.7% at the start of our strategy.

Strategic goal 2 - We maximise the value of our registers to the UK economy

Through our work to improve the accuracy of our registers, we build trust and confidence in the data we make publicly available. In doing so, we expect the use of our data to grow and broaden, creating additional value for the UK economy.

We are always seeking new ways to increase the company information we publish and to improve its accessibility so that it can be used easily. This will increase the value of the information we share and drive economic growth.

To progress towards our strategic goal of ‘we maximise the value of our registers to the UK economy’, during this period:

- We decommissioned our legacy search services, Companies House Direct (CHD), WebCHeck and the Extranet on 30 November 2023. These have been replaced with the more modern, fully accessible Find and update company information service.

- Information on the Register of Overseas Entities can also be accessed on the Find and update company information service.

- The key development work to deploy the functionality for corporate annotation to the registers was completed with work continuing on the development and deployment of prescribed annotations.

We paused our project to make company accounts information more accessible with new search functionality and our project to develop a full end-to-end digital service for providing certificates and certified copies, whilst higher priority, legislative reform projects for implementation from March 2024 took place.

The total number of companies on the register has increased throughout the strategy to March 2024. There are now over 5.3 million companies on the company register, from the baseline of 4.3 million at the start of our strategy.

The 12 months change in total companies register size this year was 234,000 compared with the baseline 12 month change figure of 148,869 at the start of our strategy.

Making company information publicly available

We are continuously looking for ways to improve the information we make available on companies, in the interests of public transparency and to support economic growth.

We know users value accessing the information we make available, including online through Find and update company information. Our registers were accessed over 16.5 billion times in 2023 to 2024, an increase from a baseline of 6.5 billion back in 2018 to 2019, and 9.5 billion in 2019 to 2020 at the start of our strategy.

Research commissioned by Companies House and the Department for Business, Energy and Industrial Strategy (BEIS) in 2019, found that the value of our registers to data users was between £1 billon to £3 billon. DBT has an active programme of data gathering, analysis and research and this year, research was commissioned to establish a baseline for the value of our registers to law enforcement agencies.

Strategic goal 3 - We combat economic crime through active use of analysis and intelligence

Partnership working to combat economic crime

Following the establishment of our Intelligence and Law Enforcement directorate in 2022 to 2023, we have continued to develop and embed this new function.

Our intelligence function has built strong relationships with partners in government, the regulatory and law enforcement sectors and the private sector.

The Insolvency Service is a key partner in the reforms, important steps have already been taken including the creation of Anti Money Laundering (AML) cells funded by the Economic Crime Levy, establishing a Memorandum of Understanding with Companies House to enable funding to flow into more complex investigation and prosecutions.

This year we have increased our role in combatting economic crime by:

- introducing more extensive legal gateways for data sharing with law enforcement, other government bodies and the private sector

- being a member of the Joint Money Laundering Intelligence Taskforce (JMLIT), a National Economic Crime Centre (NECC) led partnership between law enforcement and the financial sector to exchange and analyse information relating to money laundering and wider economic crime threats

- working closely with those in the AML regulated sectors, playing an active role in the Anti Money Laundering Supervisory Forum as well as engaging with the legal and accountancy intelligence sharing expert working group. In advance of the commencement of new and tailored new powers, we began sharing information using Regulation 52 of The Money Laundering Regulations. This sharing is already supporting work to Improve the integrity of the Register of Overseas Entities

- full sharing of information and intelligence with relevant partners under ECCTA 2023 has now begun

At the end of year 4 delivering against our strategy, we are pleased to have successfully achieved our strategic outcome to have an intelligence hub to support the creation and sharing of intelligence and have commenced implementation against our outcome to pursue those who misuse our registers.

By introducing enhanced intelligence capability and capacity to identify strategic and tactical threats of economic crime and fraud on the registers, we have developed a much greater understanding of how our data can be used by and shared with partners to help prevent, detect and investigate economic crime.

The number of requests we have received from law enforcement agencies has increased to 3,204 in 2023 to 2024, compared to our baseline of 1,500 in 2021 to 2022 and the number of corporate bodies’ details we have supplied in response this year was 6,163.

To progress against our strategic goal and outcomes to combat economic crime this year we:

- developed a compliance framework to inform decisions and actions associated with our powers now the ECCTA 2023 has come into force

- iterated the People with significant control (PSCs) discrepancy reporting service guidance to reflect the new requirements introduced in the new Money Laundering Regulations. This included a new definition of a material discrepancy and new requirement to report on an ongoing basis not just at onboarding. The planned changes were successfully implemented with further work ongoing in this area.

- continued our conversations with His Majesty’s Courts and Tribunals Service (HMCTS) on a project for digital integration into their case management system to enable Companies House to submit criminal prosecutions efficiently and effectively. HMCTS have moved this project into their 2025 to 2026 portfolio plan and the ECCTA 2023 broadens the scope for Companies House as we now have additional responsibilities for prosecuting criminal offences.

- implemented processes for the Register of Overseas Entities, encouraging compliance of those we believe are legally required to register, progressing through to issuing financial penalties for non-compliance and other offences

- progressed the technical development and stakeholder engagement and communication for the application process to onboard authorised corporate service providers (ACSPs), linked with the identity verification process

Work on the preparation of our Strategic Intelligence Assessment was completed by the end of March 2024 with ongoing work to complete the control strategy, before sharing.

Register of Overseas Entities

The Register of Overseas Entities (ROE) forms an important part of the government’s strategy to tackle global economic crime and strengthen the UK’s reputation as a place where legitimate businesses can thrive. The register is the first of its kind in the world and builds upon the UK’s global leadership in tackling corruption.

The aim of the register is to increase transparency and reveal the beneficial owners of overseas entities that own property or land in the UK.

The register has had a significant impact since it was launched with 30,776 overseas entities registered out of the estimated 32,000 in scope and the data on the register has been accessed more than 1 million times.

The UK ROE marked its first full year of operation and saw new processes implemented to encourage compliance of those we believe are legally required to register.

This included introducing a penalty regime in July 2023, in line with our public target for failing to register as an overseas entity. As part of this, all in scope entities, totalling some 3,000 entities that failed to register have received a penalty warning notice.

Enforcing compliance

Companies House guidance on the approach to enforcement was published in July 2023 to encourage compliance with the ROE.

Where help and advice does not secure compliance with regulatory requirements, Companies House uses a consistent and proportionate approach to enforcement.

Restrictions

Overseas entities that have not registered with Companies House, or have failed to comply with the updating duty, now face restrictions on selling, transferring, leasing or raising charges against their property or land. Overseas entities also cannot buy any new UK property or land without an Overseas Entity ID. Companies House continue to scrutinise information on the register, working with the UK Land Registry and other agencies to identify those that have failed to comply with their obligations.

Financial penalties

The registrars may impose a financial penalty when satisfied beyond reasonable doubt that an offence has been committed.

The next stage of activity is the application of charges to secure debt recovery where non-compliance continues.

Prosecution

Companies House may refer non-compliance with regulatory requirements for the ROE, to The Insolvency Service and other law enforcement agencies to be considered for prosecution. Prosecution will usually be considered for the most serious cases. Once a case has been referred, all decisions in respect of investigation, charging and prosecution rest with the prosecuting authority.

The ECCTA 2023 makes amendments which will bring the requirements for ROE into line with the new requirements for companies and secondary legislation will be required to implement a number of these measures.

Strategic goal 4 - Our brilliant services give a great user experience

This year we continued to set public targets for customer satisfaction and availability of our digital services, which were refined to reflect our operating environment. They represent the importance of brilliant services to the organisation and the people who interact with us and access our registers.

The outcome at the end of 2023 to 2024 was 82% of customers were satisfied with Companies House against a target of 80%. Over the period of the strategy our customer satisfaction score has declined by 10 percentage points from a high baseline satisfaction score of 92%. As the methodology and target definition have been refined since the start of our strategy in 2020, the trend figures are not directly comparable, across the 4 years.

A factor in the decline related to our contact centre, when this is excluded from our satisfaction data the result for this year is 82% against an earlier baseline of 87%. This year we took the decision to end our contact centre agreement and work commenced with a new contact centre provider from February 2024. The definition and methodology changes implemented at the start of the 2023 to 2024 financial year, resets the baseline to 82% for the final year of our strategy.

Informing customers and stakeholders

We’re committed to communicating effectively to make people aware of the changes to their obligations under the new legislation. By taking a firm but fair and evidenced-based approach to using the new powers, we’ll find a balance between tackling economic crime and minimising burdens on law-abiding companies, which make up the vast majority of entities on our registers.

The changes to UK company law campaign site was launched in November 2023, and is the central hub for customers and stakeholders to find out about the upcoming changes and how to comply with the new requirements.

Companies House has published a regular drumbeat of communication on their digital channels, including press notices with DBT and the Home Office, and 12 blog posts on GOV.UK focusing on different areas of the legislation.

Stakeholders have been kept updated and provided with opportunities to engage with Companies House around the changes. 26 separate industry-themed forums (accountancy, finance, civil society, law, data users, software providers), 24 stakeholder conferences and 13 bilateral meetings with key senior stakeholders have taken place. A video summarising the reforms with key messages around the phased implementation approach was shared by 87 stakeholders and partners.

In addition, a technical briefing raised awareness with trade press and consumer affairs journalists. Companies House issued 20 stakeholder newsletters to 615 stakeholders on their mailing lists and their annual reputation survey found that stakeholder support was high.

Other promotional activities included:

- advertisements and advertorials in the trade press spanning multiple sectors including accountancy, legal, business, and construction

- updating more than 50 pages on GOV.UK by 4 March providing guidance for the public

- using social media (X, Facebook, LinkedIn, YouTube) to reach company directors and agents. Companies House’s social media posts have had nearly 2 million impressions since the Economic Crime and Corporate Transparency Bill was introduced in Parliament. This resulted in nearly 55,000 new subscribers for their email newsletters, taking the total number to 546,139

- 19 newsletters have been sent to subscribers to encourage readiness and compliance. Most subscribers are company directors, with a smaller number of stakeholders, partners and interested citizens

- producing an explainer video series published on YouTube and embedded across the Companies House channels. The animated series covers key changes relating to the ECCTA 2023, including the actions required from 4 March. The first 4 videos in the series have received 2,631 views in total to 15 March 2024

- delivering live webinars targeted at company directors and intermediaries to support readiness and compliance with the first tranche of changes. Reaching 1,077 attendees and a further 2,195 views of the recorded presentation post-webinar

- approximately 6,000 customers have been contacted to advise them of specific actions they need to take

Companies House are utilising YouGov polls to track awareness among business leaders. In December 2023, awareness was at 22%. In March 2024, awareness had risen to 29%, showing an increase of 7%.

Digital services

We have again successfully exceeded our target with 100% availability for our online services. This has proved really challenging in the operating environment with a period of significant change to our online services and the implementation of the ECCTA 2023.

Digital enablement - the value digital take up would be if all filers chose to file digitally where possible has remained high throughout the period of our strategy with a baseline of 94.58% at the end of March 2020 and 94.69% at the end of March 2024.

Reputation

Our reputation is monitored via an annual independently run Public Sector reputation measurement and management tracker, amongst business leaders, the informed general public and stakeholders familiar with Companies House. The reputation scoring model is based on qualitative and quantitative research around what people think, feel and do in relation to an organisation.

There has been a slight decline from our baseline scoring at the start of our strategy period, but Companies House is still measuring as having a strong reputation. The slight decline should be viewed in the context of its alignment with wider public sector reputational decreases following the COVID-19 pandemic and other socio-economic factors.

Companies House has also maintained its position as being in the top 25 of the 80 public sector organisations tracked, in terms of our reputation.

Reducing paper

During 2023 to 2024, incoming mail weight decreased to around 61,137kg. This is a slight increase from 60,595kg in 2022 to 2023 and a substantial decrease on our pre-strategy baseline figure of 82,900kg in 2019 to 2020.

As part of our regional office moves, the decision was taken to consolidate our postal services to Cardiff, and we moved post from Edinburgh to Cardiff as part of the relocation in September 2023, with Belfast commencing diverting post to Cardiff from 4 March 2024.

In the final year of our strategy, we will be undertaking work to understand our future operational requirements and the development of our digital roadmap for our services as part of work on our next organisational strategy.

Paper purchase was 3,174 A4 ream equivalent this year. Whilst the trend shows a slight increase against last year’s 2,681 A4 ream equivalent we can report our overall reduction is ahead of the 50% target at 67 % when compared with the Greening Government Commitments baseline year in 2017 to 2018 figures when our paper purchase was 9,695 A4 equivalent reams.

Strategic goal 5 - Our culture enables our brilliant people to flourish and drives high performance

Companies House continues to build an inclusive positive culture to underpin our transformation journey and to ensure great user experience and service delivery for our customers. Commencement of implementation on the new legislation involved systems, process and organisational changes in order to operate the new registrars objectives and powers and new legal requirements for companies.

In September 2020, receiving Investors in People (IiP) Platinum status was a standout moment, success rested on our infrastructure and aspiring for Companies House to be the best it can be. Colleagues stepped up and broadened capabilities in ways that exceeded expectations and showed the high levels of integrity placed on living our values.

To progress our strategic goal of ‘our culture enables our brilliant people to flourish and drives high performance’, during 2023 to 2024, we were pleased to retain our platinum Investors in People status and together with our results from the Civil Service People Survey, we’ll be using these insights to inform our People action plans.

Through creative thinking, adaptable behaviour, bold ideas, and curious questioning, our people have enabled the business to push forward, adapt, and our data is now accessed by users more than 16 billion times in 2023 to 2024 from a baseline of 6 billion at the start of our 5-year strategy.

In our strategy, we committed to optimising our working environment to deliver hybrid working and maximise our use of government estate.

At the end of year 4, the handover to the Government Property Agency (GPA) completed and from 1 April 2024, Companies House becomes a tenant in a GPA owned and managed building, and all services and maintenance becomes the responsibility of the GPA. Through the transition we have worked in partnership with the GPA to ensure continuity of services, including safety of the building and building users through new GPA led Incident Command processes.

Companies House staff based in Cardiff are now working from our reduced footprint, and we have secured additional space from the GPA in the Crown Way building, on a short term flexible rental agreement where we are able to change the space with 1 months’ notice for new teams who are using the area for training and consolidation and the space is adapting as learning requirements evolve and new colleagues join.

The secure intelligence hub is now up and running with the appropriate access controls and behaviours to operate securely and the ROSA hub is in place following ROSA security guidance.

At the beginning of September 2023, our Edinburgh office moved to their new location, in Queen Elizabeth House in Edinburgh, one of the 2 government hubs in Scotland and we continue to work with the GPA on the move in Belfast to the Government Hub at Erskine House.

Upon completion of the Belfast move in 2024, we will have achieved our strategic ambition to optimise our working environment, deliver hybrid working and have maximised our use of government estate, by reducing our footprint by 60% and remain on track in meeting our Greening Government Targets.

| Location | From (m²) | To (m²) |

|---|---|---|

| Cardiff | 29,861 gross (the net area - without tenants paying rent on the space occupied was 21,888) | 8,837 split across a long - and short-term rental agreement |

| Edinburgh | 725 | 216 |

| Belfast | 560 | 144 |

Smarter working award

In May 2023, Companies House was assessed by the Smarter Working Programme on how our Smarter Working ambition has matured, and how we have embedded new ways of working into our day-to-day lives. Included in the assessment was our continued commitment to hybrid working, the way that we use the office to come together and collaborate, and the tools and environment we have to support our ambition.

We were pleased to achieve a Smarter Working ‘mature status’ award, recognising our commitment to Smarter Working, and the contributions that we’ve all made along the way.

At Companies House we are committed to supporting a healthy work life balance and have adopted hybrid ways of working which provide elements of choice and flexibility in where work is carried out provided the needs of the business can be met and we maintain high standards of performance.

At the end of year 4 of our strategy we are pleased to have successfully evidenced delivery of our strategic outcome to embed hybrid ways of working to support our strategy and transformation.

Equality, diversity and inclusion

In Companies House we recognised that we are on a journey to ensuring that the culture of the organisation is people led with equality, diversity and inclusion (ED&I) being an integral part of all that we do, and the services we deliver. Our equality, diversity and inclusion strategy sets out our vision, ambition and outcomes of our work and articulates how we aim to achieve them by 2025.

We have strong, enthusiastic people led networks, which now benefit from an ED&I steering group, ensuring our activities are aligned, have impact and deliver effective outcomes. We are delighted to have secured executive or corporate senior leadership sponsors, for all of our people networks.

Entering its second year, our ED&I steering group has continued to develop and has played a key role in ensuring that Companies House continues to deliver on its strategic objectives by monitoring development, delivery, and implementation of our organisational ED&I strategy. Following executive board review of our structure and implementation of directorate changes, we have expanded our membership to welcome representatives from Intelligence and Law Enforcement, Data Analytics and Research (DAR) as well as our new Women’s network lead and our lead for Welsh Language.

The group focussed on 4 areas for delivery during 2023, which were:

- continuing to raise the profile of equality impact assessments

- gender pay gap action plan

- disability pay gap report

- reverse mentoring

An updated equality impact assessments template has been produced alongside information in relation to when/where/why and who needs to complete these templates. Presentations continue to be delivered across the organisation to raise the profile and there has been a positive increase in completed EQIAs.

Gender pay gap

Gender pay gap legislation introduced in April 2017 requires all employers of 250 or more employees to publish their gender pay gap each year. The gender pay gap is the difference between the average earnings of men and women, expressed relative to men’s earnings.

Companies House gender pay gap and data report for 2023 was published on 28 March 2024.

Companies House is fully committed to ensuring the fair treatment and reward of all colleagues irrespective of gender, as well as any other protected characteristic including age, ethnicity, religion and/or belief, sexual orientation, and disability status.

Building strong external campaigns to showcase our inclusive culture is helping to draw in the diverse talent that we need to achieve our strategy. Our campaign content has attracted over 2 million impressions, 17,914 engagements and 16,211 click-throughs across our social media channels.

Following on from our Gender pay gap report (2023) we set up a gender pay gap working group as an opportunity to take an evidenced based approach to what our data is telling us in relation to our gender pay gap and to look at practical steps to move toward reducing this.

Although we do not have a statutory requirement to do so we have produced an internal report to look at our disability pay gap report and provided this as evidence to support our submission to continue to be a Disability Confident Leader. We were successful in our submission and have retained this status.

Reverse mentoring - following on from our successful pilot with our executive board we have completed cohort one of this programme and have received very helpful feedback from mentors and mentees - a report of findings has been produced and we are currently reviewing the approach to be taken for cohort 2.

Benchmarking of our data has been conducted for Companies House employees against the latest data sets published on the national census conducted in 2021 to 2022.

Our workforce data shows that 54.5% of Companies House are women, 7.98% are from ethnic minority background and 12.15% declare themselves as having a disability. Representation of women at Companies House is slightly higher than the UK population census figure of 51%, ethnic minority and disabled staff data shows underrepresentation when benchmarked against the population of England, Wales and Northern Ireland Census data of 19% ethnic minority and 17.74% disabled *(data for Scotland due for release later in 2024).

Our workforce data indicates that there is more to be done to improve our response rates from 70% (excluding prefer not to say), and 75% when this cohort is included, to effectively benchmark our position and continue the ongoing work towards our strategic ambition to reflect the diversity of our customers through our own diversity. The next publication of civil service statistics is due July 2024, and we will use this to support our benchmarking and data led approach to decision making.

Learning, skills and capability

To successfully deliver our corporate strategy, our people will need to grow and develop their skillsets and behaviours to deliver our ambitious plans and adapt to the challenges posed as we transform.

We must adopt different ways of working, increase our knowledge, and develop new skills to deliver on both our current and future strategic goals and achieve our vision of being the most open, innovative, and trusted register in the world.

Skills for leading and managing change

We launched our Lead and Inspire Programme, designed for inclusive and inspirational leadership as we want to develop and grow leaders at every level across the business through a significant period of change and transformation.

We launched our blended programme of development for the first cohort of 150 people in February 2023.

Lead and Inspire and the senior leadership programmes were both running at the start of this financial year. However, in light of Royal Assent of the ECCTA in October 2023, we paused both programmes, as we prepared for the implementation of new powers to create more time for people to focus on the technical training related to their new roles. This was a positive move, welcomed by staff. We have taken this time to review and iterate the programmes with a view to re-starting our leadership programmes in 2024 to 2025.

One Big Thing

One Big Thing is an annual initiative, where all civil servants take shared action on a reform priority. This year’s theme was data skills and was designed to empower civil servants to understand the value of using data insights in their day-to-day work as well as uplift data skills and confidence across all of the civil service.

As a specialist data business with key objectives around improving our data, it’s vital for Companies House to continue to invest in upskilling colleagues to support our transformation journey and respond to the evolving needs of our customers.

We asked colleagues of all grades, skills and experience to complete a minimum of 90 minutes’ worth of the training by March 2024 with a view to making foundational data literacy a core skill.

Future skills development and an emphasis on professions

In 2021 to 2022, we began the transition to skills development aligned to the Civil Service Professions Framework. All staff belong to a profession and the work in this area will guide consistent performance standards and evaluation of skills, career development and talent identification and management. Our work to embed the professions runs over a number of years.

This year we have taken stock of the roll out against the 4 types of government professions; operational delivery, policy, functional and specialist professions, to establish the right foundations for our future plans which will see everyone understanding the career pathways associated with their profession and establish ways to monitor their capability in line with their profession.

Pay and reward

In response to the Cabinet Offices 2023 pay guidance we submitted a pay flexibility business case. Our case was awaiting Treasury approval when the general election was announced meaning there was not sufficient time to gain approval pre-election. With the prospect of not receiving a decision until Autumn we decided to take an offer of a one year pay deal totalling 5% in line with the pay guidance. The funds were focussed on providing all colleagues with a consolidated pay increase and the creation of a scarce skills allowance to assist us in the attraction and retention of colleagues in roles where markets attract higher levels of wages.

Our in-year reward schemes attract high volumes of nominations, and our employee benefit platform continues to receive extremely high levels of engagement and use, and we continue to look for ways to improve our offer and work closely with our internal communications team to ensure colleagues are aware of the benefits their whole employment package offers them.

Employee experience

The 2023 Civil Service People Survey ran from 19 September to 23 October. 356,715 people, from 103 civil service organisations, completed the survey, giving an overall response rate of 65%.

The Civil Service People Survey provides an opportunity for staff to share what they think about working at Companies House and the insight from these surveys helps drive action and ensure a continued focus on the things that matter most to everyone at Companies House. The Companies House response rate this year was 87% and our engagement index increased by 2 percentage points to 67% compared with a civil service overall engagement score of 64%.

Through the year we carry out short pulse surveys using People Voice, our ‘in house’ survey tool, to focus in on areas that matter within Companies House and insights help further inform and shape our actions.

Recruitment

In 2023 to 2024, our workforce resourcing plan focused on having the right people in place at the right time, with the right skills to support the preparation for and implementation of the ECCTA 2023. We increased the resource in the operations and intelligence teams and have trained over 700 operational delivery professionals to commence the phased implementation of the reforms.

A workforce plan to March 2025 has been developed to outline people resource requirements to enable successful delivery of legislative reform, in year 5 of our strategy.

A strategic workforce planning group has been established and training was delivered to the group in February and March 2024. Establishing the group and investing in this training has been a really positive step forward in engagement with strategic workforce planning in preparation for the next spending review period.

Corporate social responsibility

Our corporate social responsibility activity ensures that Companies House acts on its commitment to being a responsible business.

Our people pillar

For our people, corporate social responsibility flows through our diversity networks, the way we work, and initiatives to support colleagues.

Community outreach

We partner with The Cardiff Commitment which is a part of Cardiff Council. Organisations and business in the Cardiff area pledge to support children and young people to understand: ‘the sorts of jobs and industries that are growing in Cardiff and the surrounding area and to support them to explore which jobs might be right for them.’

As part of this work, we are partner to 2 local secondary schools: Cathays High School and Ysgol Gyfun Gymraeg Glantaf, sitting on their termly business forums and offering support with mock interviews for pupils.

We also partner with Cardiff and the Vale College, attending a Careers Fayre for their students and offering employability sessions for students, and ran employability sessions with Cardiff People First an advocacy group for people with learning disabilities.

In partnership with Careers Wales, we delivered employability sessions for veterans and supported a STEM Ambassadors event.

Volunteering

Companies House staff have the opportunity to dedicate up to 3 days each year to volunteering. By supporting our local communities and the causes that matter most to us, we can improve our wellbeing, connect with our teams and feel a sense of achievement.

In the financial year 2023 to 2024, we have spent 86 hours volunteering in our local communities. We have donated £79,800 worth of furniture, plus fundraised £4,598.24 for local charities, including 314 easter eggs for local foodbanks.

Strategic goal 6 - We deliver value through efficient use of resources

Operating in central government

Following the Office for National Statistics (ONS) review of our sector classification, from April 2020 we were re-classified to form part of central government, relinquishing our trading fund status. This had no impact to our status as an executive agency. We are currently an executive agency of DBT following wider machinery of government changes that were announced in February 2023.

We work closely with officials and the DBT sponsorship team to ensure we continue to align our internal controls with evolving requirements.

The right resources when we need them

Delivering value for money has always been important for us, as is having the right financial resources to achieve the outcomes we want.

Through the government Spending Review process Companies House secured investment funding for transformation over 5 years of £108.1 million allocated across 3 Spending Review periods. We have invested in new capabilities to prepare for implementation of the legislative reforms as part of our wider transformation programme. This includes transforming our systems, services, structures and culture.

Our workforce plans continue to play a vital role in ensuring efficient and effective use of resources and our plans have been developed to outline the resources required to enable successful delivery of legislative reform to March 2025.

This year there was extraordinary demand for new commercial agreements alongside renewal of existing ones. With resource constraints in place, we focused on enabling the implementation of legislation and have been successful in accessing services from the commercial market and managing those contracts actively to deliver value.

We made appropriate and proportionate use of external delivery partner to help us develop our implementation plans and improve our status reporting. Proactive handover to our internal teams allowed ongoing ownership and development and resulted in the successful implementation of our new powers on 4 March 2024.

A self-assessment against the Public Value Framework was completed in 2022 to 2023 and the report approved by executive board. We are now taking forward an action plan for 2024 to 2025 and will continue to review as part of our ongoing self-assessment in line with Treasury guidance.

Managing public money

Our expenditure is effectively managed within delegated limits from the Department of Business and Trade. Companies House FIC are responsible for overseeing, monitoring, and reviewing stewardship of investments, including financial planning and performance of revenue and capital expenditure plans, and providing the executive board with a means of assurance regarding the organisation’s financial position and investments in support of delivering value through efficient use of resources.

Fees

Companies House is funded largely through fees. Fees are charged for most services, and where fees are in operation, they are set on a cost recovery basis in line with Managing Public Money. As part of the impact of legislative reform, we completed a project to review and assess our fee model to ensure this supports the new legislation and the Registrar of Companies (Fees) (Register of Overseas Entities) Regulations 2024 were laid before Parliament on 19 February 2024 and came into force on 1 May 2024.

Economic crime (anti-money laundering) levy

The Economic Crime (Anti-Money Laundering) Levy (‘the levy’) is part of the government’s wider objective, outlined in the Economic Crime Plan (ECP), to develop a long-term Sustainable Resourcing Model (SRM) to tackle economic crime. As one part of this SRM, and supported by ongoing government funding, the levy will aim to raise £100 million per year from the anti- money laundering regulated sector to pay for government initiatives outlined in the Economic Crime Plan to help tackle money laundering. This levy was first charged on entities that are regulated during the financial year from 1 April 2022 to 31 March 2023.

In addition to the investment for the transformation of Companies House, the government has made available multiple year funding of £19 million awarded via the Economic Crime Levy for new intelligence cells in Companies House (CH) and the Insolvency Service (INSS), allowing both agencies to plan to step up their Anti Money Laundering work. The first payments from the Economic Crime Levy were made in the financial year from 1 April 2023 to 31 March 2024.

Financial performance

Expenditure

HM Treasury (HMT) has a constitutional role in controlling public expenditure. Government departments need Treasury consent before undertaking expenditure or committing to spending.

All legislation that affects spending must have the support of the Treasury before it is introduced. Policy decisions with financial implications must be cleared with the Treasury before they gain approval by the Cabinet.

How expenditure is presented

Companies House’s expenditure is reported in the financial statements, in the statement of comprehensive net expenditure (SoCNE). This is prepared in accordance with accounting standards (International Accounting Standards (IAS)) and guidance which are explained in more detail in the accounting policies in note 1.

Overview of expenditure in 2023 to 2024

Services which cannot be funded through fees (such as enforcement activity), or where best public value is dependent on not charging fees (including some ways of searching the register), are funded centrally.

Penalties collected in respect of company accounts filed late with Companies House are paid entirely to HMT.

For expenditure on services and transformation activity which cannot be funded through fees, Companies House agree a budget with the Department for Business and Trade (DBT) as part of the spending review. The budget is agreed in accordance with HMT’s consolidated budgeting guidance, which differs in several respects from the accounting basis referred to above. It is against these limits that Companies House is held accountable for its performance and use of taxpayers’ funds.

HMT sets the budgetary framework for government spending. The total amount a department spends is referred to as the Total Managed Expenditure (TME), which is split into:

- Annually Managed Expenditure (AME)

- Departmental Expenditure Limit (DEL)

HMT does not set firm AME budgets. They are volatile or demand-led in a way Companies House cannot control. Companies House, alongside DBT, monitors AME forecasts closely and updates them annually.

HMT sets firm limits for DEL budgets, as DEL budgets are understood and controllable. The limit is set during a spending review which typically occurs every 3 to 5 years. DEL budgets are classified into Resource and Capital.

Overview of Companies House’s expenditure in 2023 to 2024

| 2023 to 2024 Budget £000s |

Actual £000s |

Variance £000s |

2022 to 2023 Actual £000s |

|

|---|---|---|---|---|

| Resource DEL | 30,436 | 28,207 | (2,229) | 9,207 |

| Capital DEL | 19,573 | 17,930 | (1,643) | (9,067) |

| Total DEL | 50,009 | 46,137 | (3,872) | 140 |

| Resource AME | 121 | (712) | (833) | 370 |

| Capital AME | 131 | 457 | 326 | |

| Total AME | 252 | (255) | (507) |

In year there was an IFRS16 remeasurement which resulted in a Capital DEL loss of £1.7 million. This was following the decision to significantly reduce the footprint within the Cardiff office from 1 April 2024 with the lease modification accounted for over a 4-year lease term. Companies House transferred the property to GPA on 31 March 2021 and leased the entire floor space at the Crown Way site, however the subsequently modified lease now contains the actual floor space occupied by Companies House.

This table is not a replica of the SoCNE reported in the accounts. The headings used in this table reflect budgetary classifications used within Companies House.

Statement of comprehensive net expenditure/resource

In the 2023 to 2024 financial year, the size of the register grew by 4.57% (compared to the size of the register in 2022 to 2023) which led to an operating income of £90.5 million (2022 to 2023: £88.7 million). The ROE has contributed an additional £3.3 million in service delivery income.

Operating expenditure in year totalled £120.8 million (2022 to 2023: £98 million) including staff costs of £74.8 million (2022 to 2023: £59.8 million). Operating expenditure includes £2.9 million of tangible assets transferred to the GPA following the reduction in footprint at the Cardiff office. The government transfer has been accounted for as a capital grant in kind and is capital neutral.

Non-staff operating expenditure decreased by £1.9 million from last year to £43.2 million (2022 to 2023: £45.1 million).

The underlying performance in departmental resource expenditure against budget was an overall underspend of £3.1 million. Goods and Service costs have been underspent by £2.8 million, driven by GPA facilities management costs being significantly below the anticipated values.

Depreciation and amortisation increased by £0.7 million to £7.8 million on the previous year (2022 to 2023: £7.1 million), due in part to the impact of the increase in the value of the property lease.

Statement of financial position/capital

Capital is underspent by £1.3 million. This is attributable to the lower than expected costs on the Cardiff, Edinburgh and Belfast property leases.

The statement of financial position (SoFP) as at 31 March 2024, has a total balance of Taxpayers equity £47.1 million (2022 to 2023 as restated: £37 million).

The gross book value of intangible assets has increased by £14.7 million, from £99.7 million to £114.4 million as a result of our transformation activity.

Companies House had a total cash balance of £9.4 million (2022 to 2023: £7.2 million) as at 31 March 2024. This is following £40.3 million (2022 to 2023 as restated: £21.8 million) of cash drawn down from DBT during the year, to fund working capital and more specifically transformation at Companies House.

Late filing penalties

The purpose of the late filing penalty (LFP) scheme is to promote the timely delivery of accounts to Companies House. Penalties were first introduced in 1992 in response to increasing public concern about the number of companies that failed to file their accounts on time or at all. It was thought that the prospect of incurring a penalty would be an incentive for companies to file on time.

Expenditure for the LFP scheme activity is not funded through fees but is agreed with government as part of the spending review. Penalties collected in respect of company accounts filed late with Companies House are paid entirely to HMT.

During the year £9.7 million (2022 to 2023: £10.4 million) was provided by DBT to enable the continued pursuit and handling of appeals and debt collection relating to the penalties issued due to the late filing of annual accounts.

Further detail on Companies House resourcing is available within the Trust Statement in this report.

Civil sanctions (financial penalties)

Through the ECTE 2022 and the ECCTA 2023, which received Royal Assent on 15 March 2022 and 26 October 2023, the government has reformed the role and the powers of the Registrar of Companies to tackle economic crime and improve transparency over corporate entities. This has resulted in the creation of a ROE, increased the scope of criminal offences and introduced a sanctions regime for non-compliance with the reforms. A civil sanction involves the registrar issuing a financial penalty as an alternative to criminal prosecution. This income is now reflected in the Trust Statement alongside the LFP scheme.

Expenditure for the civil sanction scheme activity is not funded through fees but is agreed with government as part of the spending review. Penalties collected in respect of non-compliance with the new powers and reforms adopted by Companies House are paid entirely to HMT.

During the year £0.2 million was provided by DBT to enable the pursuit and handling of appeals and debt collection relating to the penalties issued due to non-compliance with registering and updating the ROE.

Further detail on Companies House resourcing is available within the Trust Statement in this report.

Performance in other areas

Complaints

In 2023 to 2024, one case was referred to the independent complaint adjudicators. This is awaiting their consideration. Two further matters were raised but local resolution within Companies House was achieved after initial discussions. The cases were not taken forward for investigation.

The independent complaint adjudicators only accept complaints that have been through the Companies House internal complaints process. We publish our complaints procedure and aim to answer all formal complaints via enquiries@companieshouse.gov.uk within 10 working days. Only a small percentage of complaints we receive are escalated to the independent complaint adjudicators.

In 2023 to 2024, the Information Commissioner’s Office contacted Companies House to assist their investigations into complaints relating to 4 Freedom of Information requests and 2 Data Protection complaints. Our position was supported in all cases with no further action required.

Freedom of Information Act

We replied to 639 Freedom of Information requests in the period, 613 of which were met within the 20 day deadline for requests. 25 of the remaining 26 received a substantive response within a calendar month.

Companies House Welsh language monitoring report

The Welsh Language Commissioner is an independent body established by the Welsh Language (Wales) Measure 2011.

In December 2023, the Welsh Language Commissioner undertook a monitoring review of Companies House compliance with Welsh language duties and the outcome from the various services monitored showed improvement on the previous commissioner’s monitoring undertaken in 2021 to 2022.

We have maintained a Welsh language committee that meets regularly to monitor progress on compliance, along with our Welsh Language Unit who ensure that we provide a Welsh language service across all areas of the business. Membership of the committee is drawn from across the organisation and chaired by our Director of Digital and Technology.

Following the establishment of a new directorate for Strategy, Policy and External Communications within Companies House in July 2023, the Welsh Language Unit will be moving into this directorate together with the Scotland and Northern Ireland registrars to ensure jurisdictional and devolved issues are given the attention they need.

The latest report covers the period from 1 April 2022 to 31 March 2023 and was published on 24 April 2024 on GOV.UK.

Sustainability report

Mitigating climate change: working towards net zero by 2050

In 2021, the government published its Net Zero Strategy, setting out a pathway to reaching net zero greenhouse gas emissions by 2050. The strategy recognises the characteristics of the net zero challenge and requires action by multiple parties across the public and private sectors, and the need for taking a systems approach to policy will help to navigate this complexity. At the same time, the government also published the Heat and buildings strategy, providing further detail on decarbonising our homes, commercial, industrial and public sector buildings.

The UK has set the most ambitious target to reduce carbon emissions by 68% by 2030 compared to 1990 levels - and is the only major economy to have set a target of 77% for 2035.

Given the changed economic context, the government commissioned a review into its approach to net zero to better understand the impact of the different ways to deliver its net zero pathway on the UK public and economy and maximise economic opportunities of the transition.

The Independent Review of Net Zero - final report was published 13 January 2023 and in December 2023 the Department for Energy Security and Net Zero published the UK roadmap to net zero government emissions, a product of collaboration between the UK Government and the Devolved Administrations of Scotland, Wales, and Northern Ireland.

Official statistics published on 6 February 2024, confirm that the UK has cut emissions by 50% between 1990 and 2022. Despite rises in some sectors from 2021 levels, as the UK continued to recover from COVID-19, 2022 saw an overall fall in greenhouse gas emissions in the UK - with a decrease of 3.5% from 2021, and 9.3% lower when compared to 2019, the most recent pre-pandemic year.

Following machinery government changes in February 2023, accountability for Net Zero transferred from the Department for Business, Energy and Industrial Strategy to the Department for Energy Security and Net Zero.

The government has also recognised the recommendations of the Financial Stability Board’s (FSB’s) Task Force on Climate-related Financial Disclosure (TCFD) as one of the most effective frameworks for organisations to analyse, understand, and ultimately disclose climate-related financial information against.

The TCFD’s recommendations set out how organisations across sectors and geographies can assess and disclose their governance, strategy, risk management and metrics and targets related to climate change. Implementing TCFD’s recommendations aligns the UK public sector with global best practice. Companies House is adopting TCFD-aligned disclosure in a phased approach. The board’s governance around climate related risks and opportunities is presented within the accountability report, governance framework section and noted within this sustainability report on adapting to climate change.

Greening Government Commitments 2021 to 2025

The Department for Environment Food and Rural Affairs (Defra) co-ordinates the Greening Government Commitments (GGCs), which set out the actions UK government departments, and their agencies, will take to reduce their impacts on the environment in the period 2021 to 2025.

The GGCs for 2021 to 2025 were published in October 2021 and provide targets and supporting information highlighting what each central government department should be working towards to deliver environmental efficiencies, by reducing their overall greenhouse gas emissions (GHG). The reporting requirements for central government were published by Defra in December 2022.

Government Property Agency

On 1 April 2021, the Government Property Agency (GPA) took ownership of the Companies House Cardiff Office and the handover process, which commenced to the GPA completed this year.

From 1 April 2024 Companies House becomes a tenant in a GPA owned and managed building, and all services and maintenance becomes the responsibility of the GPA. Our staff are now working from our new Cardiff footprint, and we are working with the GPA to determine the long-term future for the Crown Way site.

At the beginning of September 2023, our Edinburgh office moved to their new location, and we are now situated in Queen Elizabeth House in Edinburgh, one of the 2 government hubs in Scotland. We continue to work with the GPA regarding the move of our Belfast Office to the Government Hub at Erskine House in 2024 to 2025.

The GPA’s 2020 to 2030 10 year strategy has been developed to transform the way the government estate supports public service delivery. The strategy provides a clear direction of travel and demonstrates where the GPA will improve the sustainability and condition of the estate and in the early part of their strategy, they have committed to developing an approach to the condition and sustainability of these buildings, informed by improving data.

Companies House environmental policy

Companies House is committed to sustainable development and works hard to continually reduce the effects of its activities on the global and local environment. Companies House environmental policy was last updated and published on 17 May 2024.

Whilst having a relatively low environmental impact, the goals and objectives of Companies House’s Environmental Management System (EMS) are aligned to the GGC targets, and specific activities and milestones are identified to meet them.

Companies House is aware that its day-to-day operations impact on the natural environment. These impacts are to be addressed through the implementation of the internationally recognised Environmental Management System ISO 14001:2015. The scope of the EMS covers all activities and services at Crown Way, Cardiff.

ISO 14001:2015 accreditation

Since 2002, Companies House has been certified to the International Environmental Management Standard, ISO 14001.

In demonstrating compliance, identifying continual improvements and efficiencies, our Environmental Management System (EMS) has been managed / maintained and was audited in September 2023. Our EMS is integral to, our current and future environmental performance, to ensure that any risks are effectively managed, with any negative impact on the environment being minimised as much as possible.

During the reporting period, Companies House has continued to maintain an effective and robust EMS, certified to the International Environmental Management Standard, ISO 14001:2015.

On 1 November 2023, our Total Facilities Management provider was onboarded to the GPA. Part of the transition process meant that all-associated environmental operational procedures were also transferred, and the day-to-day management was no longer the responsibility of Companies House.

However, the Companies House Executive Team are keen to ensure that Companies House retains the standard and environmental management remains high on its agenda. During the reporting period, work has been undertaken to identify how the standard can still be applied, and what procedures need to be put in place, to ensure we are in a good position for the next audit.

Companies House environmental working group

At the end of 2023 to 2024 the environmental working group (EWG) was disbanded since the GPA took responsibility for all associated building related environmental activities.

Internal Communications campaigns continue to raise staff awareness on minimising waste and promoting resource efficiency.

GGC targets and outcomes

Companies House continues to make positive progress against the GGC targets. The following table shows a summary of our performance in 2023 to 2024 and measures are reported against a 2017 to 2018 baseline.¹

| GGC targets by March 2025 | Outcomes 2023 to 2024 |

|---|---|

| GHG emissions | |

| Overall emissions- 62% reduction | 54% reduction |

| Direct emissions - 30% reduction | 29% increase |

| Ultra-low emission vehicle² - 25% of fleet by 31 Dec 2022 | No central car or van fleet to report against this target |

| Domestic flights - reduce emissions by 30% | 16% reduction |

| Waste | |

| Overall waste - 15% reduction | 46% reduction |

| Landfill - reduce to less than 5% of overall waste | 0% of overall waste |

| Recycling - increase to 70% of overall waste | 66% of overall waste |

| Remove consumer single-use plastic items | 2,431 items procured |

| Measure and report on food waste by 2022 | 3 tonnes |

| Paper use - reduce by 50% | 67% reduction |

| Water | |

| Usage - reduce by 8% | 30% reduction |

Notes:

- It should be noted that a reduction of staff onsite, since the COVID-19 pandemic has been a factor in the rate of reduction.

- Ultra-low emission vehicle: less than 50g CO2 per km.

Greenhouse gas emissions

| Emissions | Comparative data over the previous 3 year period of our 5 year strategy | GGC reporting baseline | |||

|---|---|---|---|---|---|

| 2023 to 2024 Tonnes CO2e |

2022 to 2023 Tonnes CO2e |

2021 to 2022 Tonnes CO2e |

2020 to 2021 Tonnes CO2e |

2017 to 2018 Tonnes CO2e |

|

| Scope 1 ¹ | 148 | 66 | 117 | 171 | 115 |

| Scope 2 ² | 602 | 605 | 723 | 826 | 1,499 |

| Scope 3 (Transmission loss of electricity) ³ ⁴ | 52 | 55.3 | 64 | 71 | 140 |

| Scope 3 (Official business travel (rail, taxi, air, underground - all offices) ³ ⁴ | 38 | 26 | 0.4 | 78 | |

| Total GHG emissions ⁵ | 839 | 752 | 904 | 1,067 | 1,831 |

Notes:

- Scope 1: direct emissions from sources owned or controlled (gas, biomass, fuel for fleet, and fugitive emissions). Biomass information to be included in Scope 1 from 2022 to 2023. Only includes for 82% for the building due to partial occupation. Biomass boiler was down during 3 separate months of this financial year and repairs took longer than anticipated negatively impacting our scope 1 emissions in 2023 to 2024.

- Scope 2: indirect emissions from consumption of purchased electricity or sources of energy generated upstream (offsite electricity generation).

- Scope 3: transmission loss of electricity and official business travel.

- Includes domestic and international travel emissions. But only domestic business travel is measured in GGC emissions reduction target, in the GGC targets and outcomes above. For a breakdown of domestic and international travel, see travel data below.

- Totals may not sum due to rounding.

Factors contributing to our reduction in greenhouse gas emissions include:

- reduction in our footprint and office space in our Cardiff and Edinburgh Offices

- improved IT practices and technology: introduction of more energy efficient monitors/laptops

- cloud migration reducing the demands on our cooling systems in our Data Centres

- installation of LED lighting across 85% of the building

- the introduction of modern hydro taps in our kitchens, that provide instant hot running water, negating the need to boil kettles

Greenhouse gas emissions - financial information

| Greenhouse gas emissions | Comparative data over the previous 3 year period of our 5 year strategy | GGC reporting baseline | |||

|---|---|---|---|---|---|

| 2023 to 2024 £’000 |

2022 to 2023 £’000 |

2021 to 2022 £’000 |

2020 to 2021 £’000 |

2017 to 2018 £’000 |

|

| Scope 1 (Gross expenditure on the purchase of energy (gas and electricity) | 865 | 687 | 623 | 613 | 562 |

| Official business travel (rail, hire cars, taxis, air and fuel) | 96 | 54 | 1 | 198 | |

| Total expenditure (on reported areas of energy) | 961 | 741 | 624 | 613 | 760 |

| Energy use | Comparative data over the previous 3 year period of our 5 year strategy | GGC reporting baseline | |||

|---|---|---|---|---|---|