Charging Ahead: Using location data to boost local EV chargepoint rollout

Published 30 August 2023

Commissioner’s Foreword

Transport networks need to become more efficient, greener and safer. Nowhere is this change felt more acutely than in the shift to zero emissions vehicles. As the number of electric vehicles (EV) on our roads grows, so too will demand for chargepoints. The charging network of tomorrow will need to deliver a seamless experience for EV drivers, which foremost means being able to find and access reliable chargepoints wherever they live.

The Geospatial Commission has been leading a multi-year programme highlighting the opportunities for advanced geospatial applications in the transport sector. The programme has identified how location data can support the future of mobility and next generation transport networks and called out ways to maximise its impact. We partnered with Innovate UK to invest £5 million through the Transport Location Data Competition which has stimulated the rapid prototyping of innovative geospatial solutions and bringing these to market.

I had the privilege of chairing the Transport Taskforce, bringing together practitioners across government, industry and academia to publish in 2021 ‘Positioning the UK in the Fast Lane’. This report set out the huge potential for location data to support a greener, faster, better transport sector across six opportunity areas.

One of these opportunities is the rollout of EV charging infrastructure. The government has committed to phasing out all new petrol and diesel cars by 2030 and the transition to EVs will be enabled by a dependable public charging network which gives confidence to drivers without private charging facilities, businesses and visitors. The government estimates that 300,000 public chargepoints will be needed as a minimum by 2030, a significant increase from the 44,000 as of July 2023.

In December 2022, we published ‘Getting to the Point’ which explored the role of location data to accelerate the rollout of EV chargepoints to build a network that works for everyone, everywhere. The report, which was the Geospatial Commission’s most read publication of 2022 and received widespread coverage, outlined four challenges to effective chargepoint rollout that location data can help overcome and committed the government to further action.

In our new report, ‘Charging Ahead: Using location data to boost local EV chargepoint rollout’, we deliver on our commitments and actions in ‘Getting to the Point’ to support local authority decisions about local chargepoint rollout. Geospatial applications can arm local authorities with evidence to rollout a public charging network that gives current and prospective EV owners the confidence to make their journeys, whether in a densely populated city or the countryside. Drivers need to have the same confidence that they can charge their EV as they have that they can refuel their current petrol or diesel vehicle.

The location of chargepoints is as important as the total number and our work has highlighted tangible applications for location data to drive targeted rollout. The government has recently laid regulations before Parliament that will mandate chargepoint operators to make location and availability data about their public chargepoints more accessible and standardised. This will enable new and existing products and services to provide a more accurate picture of existing chargepoints as well as providing consumers with confidence about where they can charge.

Local authorities have an important role to play in ensuring households without access to a private driveway can safely and reasonably access charging infrastructure. Sub-national transport bodies, like Transport for the North and Midlands Connect and the devolved administrations, are harnessing the power of location data into their demand modelling platforms, helping local authorities identify how many chargepoints, which types and where they should be targeted. The Department for Transport is developing a national-level dataset to help local authorities understand the percentage of dwellings in their area without off-street parking.

Location data is now prominent in private sector geospatial products and applications to help local authorities with their chargepoint strategies. Distribution network operators, such as UK Power Networks and Scottish and Southern Electricity Networks, are making data on grid capacity findable and accessible to local authorities to help plan for electricity demand. Companies like Field Dynamics offer data products on the location of properties with or without the space for off-street parking, layering multiple datasets and applying complex, interpretation algorithms. Mobile network operator data is beginning to be used to help transport planners infer demand hotspots for chargepoints.

Of course, there is more to be done. To fully realise the potential of location data to enable the future of transport and deliver the chargepoint network of tomorrow we must continue to identify and embrace the technological innovation which creates new opportunities for location data and applications to explore.

My thanks to all of those who have engaged with us over the last three years to deliver shared findings, objectives and actions across the transport sector including our local authority partners, industry representatives who attended our policy roundtables and our colleagues in government, particularly the Department for Transport.

Dr Steve Unger, Commissioner, Geospatial Commission

Executive summary

The UK transport sector is on an ambitious journey to zero emissions. By 2030, sales of new petrol and diesel cars will be phased out and by 2035 all new cars and vans will be zero emission at the tailpipe.

The transition to electric vehicles (EVs) will be enabled by a dependable public charging network which gives confidence to residents without at-home charging facilities, businesses and visitors[footnote 1]. The number of public charging devices has tripled to over 44,000 in the four years to July 2023 but more is to be done to deliver the 300,000 public chargepoints that the government estimates will be needed as a minimum by 2030[footnote 2][footnote 3].

The location of chargepoints is as important as absolute numbers. Consumers want chargepoints to be where they need them and for them to be easily accessible. Local authorities are ideally placed to identify the local charging needs of their residents, businesses and visitors. They also play a fundamental role in facilitating private sector investment and ensuring all communities have access to reliable public charging infrastructure, especially on-street charging devices.

Local authorities must make informed decisions about how many, which types and where chargepoints will be installed, based on demand and site suitability. Data-driven evidence should underpin these charging strategies and support the sourcing of appropriate charging infrastructure from the market.

Geospatial applications have the potential to become a strategic enabler for decisions about local charging infrastructure. Some local authorities already use location data when they evaluate availability, check site suitability in response to a citizen request or forecast future demand. However, there remains significant potential to improve decision making on where chargepoints should be situated through the use of geospatial applications.

In 2022, the Geospatial Commission published ‘Getting to the Point’, identifying the role of location data to model chargepoint demand, find suitable sites, create a seamless consumer experience and track rollout. The Geospatial Commission committed to a series of actions to support local authorities and businesses to better plan the rollout of EV chargepoints.

This report seeks to support local authority decisions about chargepoint rollout by identifying the breadth of geospatial applications currently available and five opportunities to better use existing location data, as well as new sources of information.

We have identified three core findings in our work:

1. Standardised and consistent data is fundamental to stronger analysis and new product innovation

Data standards are critical to ensuring that data is connected and reusable so that public and private sector providers can create innovative geospatial applications and services to drive better decisions about rollout and ultimately improve the consumer experience.

2. There is potentially untapped value in data held by the private sector to better inform chargepoint rollout

The private sector, from car leasing companies to telecommunications providers, hold potentially valuable data that could provide new evidence to better inform local authority decision-making.

While data sharing and data products for insight have been established in the private sector, there is an emerging demand to apply these to public sector use cases. Further access will depend on a careful consideration of the ethical issues, commercial sensitivities, financial cost and technical challenges in the application of personal data.

3. In the absence of definitive data, local authorities and modellers are innovating with proxy methods - with some success

Local authorities and modellers are developing innovative ways of utilising location data to fill information gaps where definitive data is either absent or too costly to develop. Investments in improving data findability and access are enabling the creation of proxy methods which give decision-makers adequate answers.

Building on ‘Getting to the Point’, this report explores five opportunities to improve local authority decision making through better data:

1.Understand the location and availability of existing chargepoints by making chargepoint operator data standardised and consistent

Knowing where current chargepoints are and their availability can help local authorities decide where to install new chargepoints. More accessible and standardised data about the location of chargepoints will help local authorities plan for provision and improve the charging experience for the consumer. In July 2023 the Department for Transport laid legislation to mandate chargepoint operators to provide open access to static and dynamic data about their chargepoints, including their location and availability and mandated the Open Charge Point Interface (OCPI) standard.

2. Understand consumer charging behaviour and travel patterns by using population movement data

Understanding the movement of people can help local authorities meet demand by identifying origin-destination flows, areas of high utilisation of chargepoints and dwell times. In ‘Getting to the Point’ we committed to examine how aggregated and anonymised mobility data could be applied to inform chargepoint rollout. Population movement data, such as aggregated and anonymised mobile network operator data, can enable inferences around driver behaviour, providing greater intelligence for local authorities and transport bodies on where to install chargepoints based on driver behaviour and travel patterns. However, we found that currently the data is not specific enough about what happens along a transport journey and that the data can vary significantly between the different data providers.

3. Identify the location of EVs by using commercially-held data about leased vehicles

Knowing where leased EVs are kept can help local authorities meet demand by providing a more comprehensive picture of how many EVs are actually in any given area. Around two-thirds of new EV registrations are made by corporate fleet owners and leasing companies. Existing data reflects where EVs are registered but not necessarily where they are located if they are leased or rented. This data is held by the private sector. There is a mutually-beneficial opportunity for the public and private sectors to test safe and commercially sensitive ways to unlock this data.

4. Identify existing electricity network capacity through better use of distribution network operator data

Knowing the availability of electricity network capacity in a specific location and the cost of new grid connections can help local authorities more efficiently meet demand. Access to this data varies depending on how the distribution network operator (DNO) collects, shares and visualises the data. DNO-backed development of tools to expedite site selection by easily modelling scenarios or auto-creating energy plans at neighbourhood level shows us what is possible now and in the future.

The government is taking action to improve data access and sharing. In January 2023 Ofgem published the ‘Electric Vehicle Smart Charging Action Plan’, setting expectations around data best practice for DNOs, including how their network visibility data should be shared in a common, open and consistent way to improve decision making across the sector. The Department for Energy Security and Net Zero are also currently assessing the evidence and recommendations from a six month feasibility study into an energy system ‘digital spine’ to improve data sharing and data standardisation, as well as to deliver interoperability across the energy sector.

5. Identify areas without off-street parking by using proxy data

Identifying off-street parking locations helps local authorities understand where public on-street charging is required. In ‘Getting to the Point’ we made a commitment to explore the creation of a geospatial dataset for off-street parking, considering existing sources of data and how to safeguard privacy.

The government is developing a national-level dataset to provide local authorities with a percentage of dwellings with and without off-street parking. There are a range of proxy methods which can provide local authorities with more granularity, where more specificity about where off-street parking exists is required.

Location data and its application in use case specific models can help local authorities make the right decisions about where to site chargepoints and support the continued expansion of the public charging network in a way that enables the transition to zero emission vehicles. This data can also inform wider decisions including about urban planning, traffic management and the utilisation and development of the electricity grid.

Section 1: Progress since ‘Getting to the Point’

The UK government has committed to ending the sale of new petrol and diesel cars from 2030. A robust and comprehensive charging network is required to support this transition, with a minimum of 300,000 public chargepoints needed by 2030. Current and prospective electric vehicle (EV) owners need to have the same confidence that they can charge their EV as they have that they can refuel their current petrol or diesel vehicle.

To build a chargepoint network that fosters this confidence, chargepoints must be rolled out where they are needed based on an understanding of current and future demand. Situating chargepoints in the right places ahead of demand will inspire confidence in drivers who have not yet made the switch, thereby accelerating the uptake of EVs.

Local authorities are at the heart of ensuring the chargepoint network meets that demand. Ensuring they have access to reliable and informative data and analysis will support efficient procurement and roll out in the most high-impact areas. They should be able to understand chargepoint demand for a given area, pinpoint the most cost-effective locations and select which of these will best meet the needs of the community.

The Geospatial Commission’s Approach

In December 2022, the Geospatial Commission published ‘Getting to the Point’. In it, the Geospatial Commission committed to deliver a feasibility study into how to widen access to demand modelling, examine the creation of a geospatial dataset for off-street parking and examine the potential role of aggregated and anonymised mobility data. Annex A provides a comprehensive update on the commitments made in ‘Getting to the Point’.

This report meets and develops our commitments to support local authority decisions on chargepoint rollout, using geospatial applications and data. It explores the range of analysis available and identifies the requirements, advantages and limitations of each.

We have worked with local authorities, sub-national transport bodies and demand modellers to understand the different types of data and analysis that support chargepoint location decision making[footnote 4]. We have also engaged with data owners to test the feasibility of data improvements that might support better decision making.

Demand modelling provides local authorities with estimations on the future spatial and temporal distribution of chargepoint networks. Local authorities can access a range of different applications, either from the public or private sector, which help them develop their evidence base for chargepoint rollout. Given the current challenges, it is not feasible for all local authorities to have access to demand modelling and it is unclear how much increasing its availability would benefit local authorities in the short term.

Government action to support chargepoint rollout

The UK government has already committed to supporting the transition to EVs through legislation, guidance and funding. In July 2023 government regulated that all UK public chargepoint operators must standardise payment methods and open public EV chargepoint data, with the aim of ensuring reliable charging and improving pricing transparency.

The Department for Transport laid the Public Chargepoint Regulations in July 2023. One year after the regulations commence, all chargepoint operators will be required to make location and availability data about their public chargepoints publicly available in the Open Point Interface protocol (OCPI) standard.

More than £800 million of the UK government’s funding has been made available through schemes, such as the Local Electric Vehicle Infrastructure Fund Pilot (LEVI) and the On-Street Residential Chargepoint Scheme (ORCS). LEVI has provided £57 million of public and private investment to 25 different local authorities across England to deliver nearly 4,400 chargepoints and gullies to scale up the delivery of local chargepoints and support drivers without off-street parking. A further £380.8 million funding has been made available over the next two financial years. ORCS remains available to all UK local authorities with £15 million available in 2023/24.

The LEVI fund aims to accelerate local chargepoint delivery and support residents without access to off-street parking have better access to EV chargers, as well as growing the charging network across the country. The fund is an important springboard to stimulate the commercialisation of the chargepoint market with the aim of producing a self-sustaining sector over time. Local authorities apply for funding to cover capital costs associated with chargepoint installation as well as funding on the salaries and overheads of officers working in EV infrastructure and procurement.

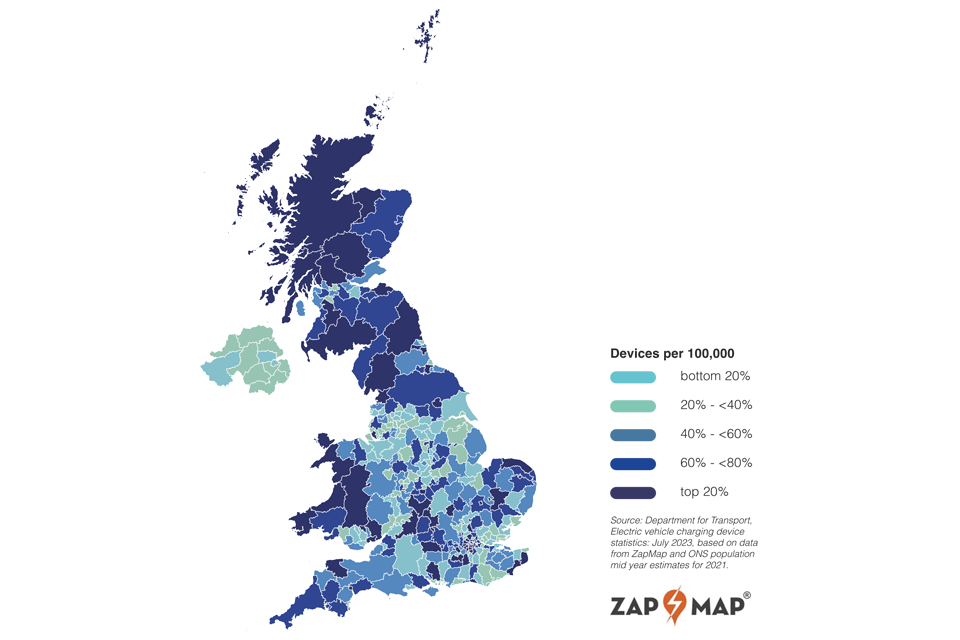

As shown in Figure 1 below, the geographical distribution of public chargepoints across the UK remains uneven. There are significant differences between nations, regions and local authorities - more than 30 per cent of chargepoints are in Greater London.

Public chargepoints do not need to be evenly spread and decisions about their installation will be influenced by levels of current and predicted future car ownership and access to private parking. An analysis of chargepoints per capita by local authority area as in Figure 1 ignores significant street-level differences in supply and demand.

Figure 1: The geographical distribution of public chargepoints across the UK

Section 2: Local authorities and chargepoint rollout

The role of local authorities

The rollout of EV charging infrastructure will continue to be led by the market. However, local authorities play a vital delivery role in creating an attractive investment environment for commercial chargepoint operators to provide, install and maintain chargepoints. At the same time they also ensure access to public charging infrastructure is widespread, particularly for households without access to off-street parking and for rural communities. They are responsible for overarching planning policies in their areas and usually own lamp posts, bollards and local car parks, which can be adapted to incorporate charging infrastructure.

As the pace of chargepoint rollout increases and the chargepoint operator market grows, the role of local authorities will need to adjust accordingly. Local authorities will need to be both more responsive to local consumer demand and more proactive in identifying areas that are left underserved by the market or households without off-street parking.

There are broadly two initiators for local authority procurement of chargepoint operator services:

-

Strategic initiation follows an internal decision or application to fund and progress EV charging infrastructure. The common initiator is either internally developed strategic plans, such as local transport plans or low-carbon initiatives or the development of business cases or direct applications for funding, such as for the Local Electric Vehicle Infrastructure (LEVI) fund or the On-Street Residential Chargepoint Scheme (ORCS).

-

Demand-led initiation follows local demand triggers, such as requests from residents for local authority to provide EV charging infrastructure on streets or places of interest. The channel for raising these requests varies from informal approaches to formal consultation initiated by the local authority.

A concessionary business model is widely used in the provision of public charging, whereby the infrastructure is funded largely through UK government grants and funding schemes, such as the LEVI fund, and the chargepoint operators earn revenue from charging. Alternative models involve either the chargepoint operators funding the infrastructure investment and charging EV drivers directly or the chargepoint operators providing the chargepoint for a fee and then managing the operation, payments, servicing and data collection.

The viability of chargepoint operators depends on generating sufficient revenue from the use of their chargepoint network. High traffic areas could provide operators with higher utilisation rates and in turn increased revenue. However, local authorities need to work with the market to avoid potential unintended consequences of areas with low demand being left behind.

Local authorities are therefore increasingly turning their focus to addressing gaps in public chargepoint provision. There is a need to identify poorly served locations, consider issues such as social inclusivity and provision across rural and urban communities. If targeted in the right way, robust and comprehensive charging networks could stimulate local economic development, enable improvements in air quality and create flourishing high streets and public spaces.

Some local authorities have begun to strategically rollout charging infrastructure but the focus of many has been reactive. Local authorities will need to consider chargepoint provision across geographic and administrative boundaries to ensure that there is a coordinated rollout across their local road network. They will need to understand charging demand including from visitors originating outside their area, the locations of commercial and private chargepoints and the better integration of the provision on local and strategic road networks.

Making the right decisions using location data

In order to deliver charging infrastructure, local authorities need an evidence base to inform how many chargepoints, which types and where chargepoints will be needed based on demand and physical site suitability. It is vital to know where and how demand will grow over time and how demand will spike across seasons.

A stronger and more robust understanding of chargepoint demand will enable local authorities to be more targeted in their rollout strategy. This in turn can help promote market efficiency and target public funding more effectively to where demand is not being met by the market.

Local authorities need to understand local needs and travel patterns both inside and across local authority boundaries, which informs an important understanding of current and potential areas of future demand. There is a plethora of proxy datasets that can be used to identify potential areas of growth, such as EV uptake rates, tourism patterns, car ownership and resident chargepoint requests, that can help to build the picture for decision makers.

Local authorities need to understand land ownership. Local authorities often own different types of land that can be suitable for chargepoints and decisions about chargepoint rollout are usually integrated with decisions about urban planning, traffic management and heat pump rollout. For example, car parks can be utilised to influence traffic flow and encourage uptake of different modes, such as park and ride.

Case study: How City of York Council use EV chargepoints to manage traffic flow

In 2020, City of York Council set out its plans to increase the number of publicly available chargepoints to support residents without off-street parking, visitors, tourists and commuters, reflecting the range of customers attracted to the city.

City of York’s charging strategy ensures that they take their wider transport policy into account when identifying new sites for installation. Particular attention has been paid to the links with active travel, public transport and traffic management strategies. It also considers grid connection constraints and local electricity generation by combining HyperHub developments with onsite photovoltaic, also known as solar energy, and battery energy storage technology.

This cross-modal approach aims to reduce demand on city centre chargepoints, increase availability for residents, and encourage the use of the existing park and ride system. It is supported by 33 electric buses that provide direct bus services from six locations around the ring road.

For chargepoints, a three-tier infrastructure approach has been adopted. Fast chargepoints are provided in residential areas, widely distributed Rapid chargers and dedicated Ultra Rapid charging hubs (HyperHubs). Two of the park and ride sites have been identified for significant increases in Fast chargepoint provision as a result of HyperHub provision nearby, enabling large grid connections to be secured.

By increasing provision of chargepoints at park and ride locations, City of York Council is using existing infrastructure and encouraging visitors, commuters and tourists to leave private vehicles at the periphery, reducing vehicle traffic in the City Centre.

A clear understanding of the existing and planned built environment is important too. This includes highways and road networks, pavement suitability, pavement width, street furniture, building and property types, car parks, whether the land is publicly or privately owned, residential parking, planned buildings, off-street parking and accessibility data.

Finally, knowing the availability of energy in a specific location helps local authorities to identify the viability, in terms of energy availability and cost, of chargepoint installation. Understanding this is fundamental to fast, efficient and cost-effective installation of chargepoints across the country.

To help answer these questions, there is an emerging location data and applications market to support local authorities to make decisions on the type, volume and location of their public chargepoints. There are two broad and interrelated component parts of this market - data supply and data analysis.

The data supply market covers organisations who collect, own and provide data that supports local authority decision making. Some of these organisations are in the public sector or regulated industries, supplying for example data about traffic flows and vehicle registrations.

Ordnance Survey, the national mapping agency for Great Britain, provides foundational location data on features, such as the road network, buildings and boundaries, through products such as OS MasterMap and the OS National Geographic Database. OS data is made available to the public sector through the Public Sector Geospatial Agreement (PSGA). The PSGA is a £1 billion investment over 10 years in national location data. It gives over 6,000 public sector organisations access to OS data and services via their online Data Hub.

The private sector market for this data is also growing, including chargepoint operators, which hold data on chargepoint location and use and service providers, such as Eco-Movement, Octopus Electroverse and Zapmap, who provide information on the location and availability of chargepoints. In other sectors, distribution network operators provide data on grid capacity and mobile network operators provide aggregated and anonymised data on population movement patterns.

There are a variety of types of data that can be used by local authorities in their decision-making process. Annex B, ‘data to support decision-making’, contains examples of commonly used data but this is not a comprehensive list. This data is often provided at different levels of granularity based on the issuing authority or the data stewards.

The data analysis market is made up of organisations which collect, aggregate and analyse location data and apply it to provide insights related to EV charging infrastructure. It covers organisations that provide analytical services to local authorities and chargepoint operators, and includes a range of public and private sector organisations.

For example, consultancies, such as Field Dynamics, who provide an off-street parking mapping tool; Cenex and Transport for the North, who provide some local authorities with free analysis support; and chargepoint operators such as Connected Kerb, who provide demand analysis as part of their end-to-end service.[footnote 5]

The feasibility of demand modelling

Local authorities use location data to inform decisions about how many and which types of chargepoints are needed and where. We have identified three broad types of approach to applying this data, each varying in spatial scale, breadth of data and analytical complexity. Determining which approach to use depends on the capability and needs of the local authority. The value of the approach is driven by the complexity of the use case and the temporal requirement. We set these approaches out in more detail in Annex C.

- Reactive, such as responding to resident requests, user engagement with residents and businesses to understand where the current need for chargepoints are.

- Spatial layering (also known as spatial/location allocation) uses a combination of datasets such as current chargepoint locations, local authority owned car parks, and housing type to identify current need and to exclude unfavourable locations.

- Demand modelling uses a combination of spatial data (often based on spatial layering) with behavioural data, past trends (for EVs and other similar markets) and the inclusion of projected future data, which can be used to forecast chargepoint need in a given area over various time periods.

‘Getting to the Point’ identified how demand modelling can provide planners with data-driven evidence to identify how many and what types of chargepoints need to go where and by when, taking into account local needs.

Demand modelling can provide local authorities with estimations on the future spatial and temporal distribution of chargepoint networks. Local authorities can access a range of different demand models, either from the public or private sector, which help them develop their evidence base for chargepoint rollout.

For example, the Electric Vehicle Charging Infrastructure (EVCI) Framework developed by the Transport for the North was developed to support local authorities and national government bodies in the planning and deployment of local EV charging infrastructure.

Other demand models for local authorities include the National EV Insight & Strategy (NEVIS) tool from Cenex, the EV Infrastructure Planning tool developed by Midlands Connect and Advanced Infrastructure’s Local Area Energy Planner Plus (LAEP+) which identifies suitable sites for energy projects.[footnote 6]

It is not feasible for all local authorities to have access to custom individual demand models and their value will depend on the specific needs of the local area. For local authorities with smaller geographical extents or populations, the requirement for a highly granular demand model may not be proportionate or cost effective. It may be more appropriate to consider a broader geographic spread and therefore generate economies of scale.

The acquisition, development and maintenance of a demand model relies on expert and technical resource which may not be available in all local authorities. Investment in this capability should also seek to leverage other policy areas, such as local level energy planning, to maximise return and value for money.

In addition, the cost of platforms, either internally developed or sourced externally, will be driven by local geographic specifications and the specificity and accuracy of the model outputs. The cost considerations are therefore likely to be greater compared to spatial layering applications.

Access to data does not automatically mean there is access to quality data. Data needs to be accurate, complete and maintained. Currently not all data is standardised or standardised in the same way. Furthermore, if metadata is missing it can often be difficult to assess the fitness-for-purpose of a dataset. Considerations and interpretations around the layering of the various datasets are necessary given the varying degrees of certainty around the multiple data inputs and the assumptions made when creating projected data.

The choice of what decision making tool a local authority should use will vary depending on organisational circumstances. Some local authorities may find demand modelling helpful and either create their own model or choose an existing model, whereas others might not be at the right stage of development.

Case study: How Transport for the North’s Electric Vehicle Charging Infrastructure framework is supporting local authority decision making about chargepoint rollout

Transport for the North (TfN) is using demand modelling to support local authorities in the north of England to plan and deploy their EV charging infrastructure. The Electric Vehicle Charging Infrastructure (EVCI) Framework applies regional analytics to develop a rich place-based understanding of charging needs, providing additional clarity on the scale and pace of change required to support a rapid and consistent transition to electric vehicles. It aims to support value-for-money, consistent and integrated public sector decisions and informing and enhancing collaboration with the private sector.

The EVCI framework provides local authorities with an advanced understanding of road network movements such as trip purpose, time of day, origin and destination and seasonal variation factors for cars, vans and HGVs, and what this means for EV charging requirements. It combines this with dynamic vehicle fleet projections, including an assessment of fuel changes in the fleet, variances across area types, distributions by socio-economic demographics and what this means for EV uptake to further inform charging needs.

The framework also seeks to help planners build a local picture of how land could be used, considering issues such as housing stock and parking, and offers the capability to share analysis with a high level of granularity and across a range of geographic views. It supports a whole-system approach through the application of an energy module, outlining grid capacity requirements on primary and secondary substations.

TfN is actively exploring enhancements to the framework through new partnerships and data sources. TfN is also in the process of making the EVCI Framework available to other sub-national transport bodies, meaning all local authorities in England will receive access to the tool.

Section 3: Boosting local EV chargepoint rollout

Better data can support better analysis which can enable better decisions. This section highlights five opportunities to improve access to and the quality of location data to support local authority decisions about where to install chargepoints whether they are taking a reactive, spatial layering or demand modelling approach. There are three themes that cut across these opportunities.

1. Standardised and consistent data is fundamental to stronger analysis and new product innovation

Data standards are critical to ensuring that data is connected and reusable so that public and private sector providers can create innovative geospatial applications and services to drive better decisions about rollout and ultimately improve the consumer experience.

2. There is potentially untapped value in data held by the private sector to better inform chargepoint rollout

The private sector, from insurance firms and car leasing companies to telecommunications providers hold potentially useful data that could provide new evidence to better inform local authority decision-making. While data sharing and data products for insight have been established in the private sector, there is a nascent market for public sector use cases. Further access will depend on a careful consideration of the ethical issues, commercial sensitivities, financial cost and technical challenges in the application of personal data.

3. In the absence of a definitive data set, local authorities and modellers are innovating with proxy methods - with some success

Local authorities and modellers are developing innovative ways of utilising location data to fill information gaps where definitive data is either absent or too costly to develop. Investments in improving data findability and access are enabling the creation of proxy methods which give decision-makers adequate answers.

Opportunity 1: Understand the location and availability of existing chargepoints by making chargepoint operator data standardised and consistent

As the private sector operates the majority of chargepoints, it also owns a significant amount of data about the UK’s charging network. In July 2023, the UK government laid the Public Chargepoint Regulations before Parliament that will standardise payment methods and open access to chargepoint operator data, with the aim of ensuring reliable charging and improving pricing transparency.

Data standards are critical to ensuring that data is interoperable so that public and private sector providers can create innovative geospatial applications and services to drive better decisions about rollout and, ultimately, improve the consumer experience.

Unlocking the data held by the private sector and applying the right standards, as set out in the chargepoint regulations 2023, will maximise its reusability and will drive innovative geospatial applications that improve decision-making about rollout and provide consumers with the confidence that they can charge wherever they travel in the UK.

Why this data is important

Knowing where existing chargepoints are, how they are used and their type can help EV chargepoint planners decide where to install new chargepoints and which type. Currently, local authority transport planners and external analysts can access information about the location of chargepoints by using commercial data sources.

Some local authorities have access to availability data. Paid-for chargepoint availability data is accessible from third parties who have partnerships with chargepoint operators, holding information such as location, connection type and maximum power.

What are the opportunities for improvement?

The market can more easily innovate with this data if it is shared in a standardised format. Standards provide the opportunity to build the right sharing framework for sectors to flourish by facilitating interoperability and potentially making it easier for new players to enter the market. Government laid regulations to mandate the data standard Open Charge Point Interface (OCPI).

More openly available data about the location of chargepoints, including workplace chargers and chargepoint availability, will help local authority planning and improve the consumer experience. A greater understanding of how privately owned and operated chargepoints are being used would be beneficial to local authority planners.

Standards assist in understanding how to interpret a dataset and its metadata and how to assess its fitness-for-purpose for a specific use case. With the variation in data models and data formats, standards can bridge the gap that aids machines in talking to machines and automating decision-making processes. Standards ensure datasets have greater usability, uptake and software support, as well as providing credibility.

Standards make interoperability easier because the data requirements are defined and data is expected to adhere to the rules of the standard. This helps drive innovation by making it easier for different applications to use the same datasets in different use cases. Additionally, standardisation makes it easier to include data in a wider database or data hub, thereby making it easier to discover.

Standards assist in data adhering to the FAIR principles - data should be Findable, Accessible, Interoperable and Reusable (FAIR). Furthermore, data has to be of the appropriate Quality and fit for purpose. In short, improvements to data must be Q-FAIR.

The OCPI standard supports connections between eMobility Service Providers, who have EV drivers as customers, and chargepoint operators. OCPI is used worldwide and adopted by many companies and several roaming hubs. It is free to use, independent and everyone can participate in its development.

OCPI seeks to accelerate the market for EV drivers by encouraging a single communication infrastructure where all market players are connected and improve mobility services to help EV drivers have an optimal user experience where all relevant information is available in real-time in a transparent way. The Office for Product and Safety Standards (OPSS) will enforce the regulations including the adoption of the data standard and ensuring that data is made freely and openly available.

What is being done

Data about the location of chargepoints and their availability is already collected by chargepoint operators and shared through partnerships, though data about availability is typically not shared publicly because of commercial sensitivity. Local authorities are also able to access data about chargepoints they have procured or will procure.

In July 2023, the Department for Transport laid regulations before Parliament to mandate chargepoint operators to provide open access to reference and availability data. This will come into effect by the end of 2023 and the mandate will be enforceable 12 months later.

The Office for Zero Emission Vehicles (OZEV) will not collect or hold the data centrally. Rather, chargepoint operators must make the data they provide machine readable, to OCPI standard, and changes to the chargepoint’s availability must be updated within thirty seconds. OPSS will enforce the regulations.

Case study: How the National Underground Asset Register (NUAR) is using standards to unlock the power of data

The Geospatial Commission is building a digital map of underground pipes and cables that will revolutionise how data related to subsurface assets is accessed and shared - the National Underground Asset Register (NUAR).

NUAR brings data together from across utility and telecommunications companies and the public sector and makes it available to planners and excavators through an interactive digital map. To do this effectively, the NUAR Data Model is based on an emerging international standard - the Open Geospatial Consortium Model for Underground Data Definition and Integration (or MUDDI). Adoption of this model enables data to be standardised and presented to end users in a clear and consistent manner. It also allows asset owners to gain insightful feedback on their data, improving the quality of data at source over time.

The first phase of NUAR (the minimum viable product) is now live in North East England, Wales, East Midlands, West Midlands and London. This includes all of the major energy and water providers, as well as smaller providers of these services, in addition to telecommunications companies, transport organisations and local authorities. The service will continue to be enhanced both in terms of functionality and the data it contains while being rolled out to the remaining regions in England and to Northern Ireland. Scotland already benefits from a system of this kind through the Community Apparatus Data Vault system which is managed by the Scottish Roadworks Commissioner. By the end of 2025 NUAR is intended to be fully operational.

Opportunity 2: Understand consumer charging behaviour and travel patterns by using population movement data

Analysing population movement supports a detailed understanding of travel patterns and driver behaviour on the transport network. Data to understand patterns of movement can be sourced through different approaches, more traditionally through data collection methods such as the National Travel Survey. The transport sector uses a range of qualitative and count-based methods to identify population movement and understand trends and change over time.

More recently, aggregated and anonymised population movement data (PMD) is being sourced through objects or sensors being carried by an individual. For example, mobile phones, smart devices and credit cards.

Aggregated and anonymised data can still have various levels of rich granularity while being conscious of privacy concerns. For example, average vehicle dwell time - the time people spend at a particular location - can be aggregated but still modelled on a street-by-street scale.

The Department for Transport and National Highways provides street-level data for every junction-to-junction link on the motorway and ‘A’ road network, and for some minor roads in Great Britain. Annual estimates of traffic on Great Britain’s roads are broken down by vehicle type, road category and geographic area. These are compiled using data from around 8,000 roadside 12-hour manual counts, continuous data from automatic traffic counters, and data on road lengths.

Furthermore, the Department for Transport road congestion and travel time statistics data is available for understanding the delay and speed on the Strategic Road Network and local ‘A’ roads with data provided commercially by INRIX and Ctrack based on GPS data.

Why this data is important

The growing PMD market has the potential to support public sector use cases and innovation including on national security, population statistical analysis, economics of the high street and transport. PMD can already tell us how transport use is changing, enabling us to update transport models which are used as the basis for scheme investment decisions, and for overall transport models which drive national priorities including decarbonisation and equalising opportunity.

Aggregated and anonymised data can still have various levels of rich granularity while being conscious of privacy concerns. For example, average vehicle dwell time - the time people spend at a particular location - can be aggregated but still modelled on a street-by-street scale.

Better understanding of travel patterns has the potential to transform local and national transport planning. The National Travel Survey is a household survey designed to monitor long-term trends in personal travel by residents of England. The survey collects information on how, why, when and where people travel as well as factors affecting travel, for example, car availability and where driving licences are held.

In order to make effective decisions about chargepoint rollout local authorities need to have an understanding of not just of how and when people are travelling and where to, but be able to infer who is travelling and why. As set out in ‘Getting to the Point’, aggregated and anonymised population movement data could be applied to inform chargepoint roll out.

Understanding the movement of people can help identify patterns of temporal demand and areas of high footfall. This can be used by local authorities, transport planners and businesses to model optimal chargepoint locations and types through understanding origin-destination flows, the movement of people from one place to another and dwell times.

What are the opportunities for improvement?

While traditional data sources about population movement in the transport sector cover a range of modalities, we heard from local authorities that greater granularity - spatially and temporally - is needed to better understand local travel patterns and intelligence on EV driver behaviours and chargepoint utilisation.

For example, open data about traffic from the Department for Transport is not able to be collected and broken down by fuel type, such as battery-electric versus internal combustion engine, as it is based on a combination of manual and automatic control points which can only count the number of vehicles. Whilst not expressly designed to do so, the National Travel Survey provides England-only analysis which is often not specific or bespoke enough to understand local points of interest or attractions including train stations, airports and shopping centres.

PMD can assist in a better understanding of driver behaviour as it is sourced through a device being carried by an individual and there is added potential to collect data from sensors in the built environment. This would further enable the modelling of the location of chargepoints which are not only well positioned on a network, but correspond to a demand for other facilities captured through trends in behaviour, such as the location of cafes.

Mobile Network Operator (MNO) data is one source of PMD and is captured by operators as a by-product through the everyday use of mobile phones. It can be procured in aggregated and anonymised form from MNOs themselves, who may also provide an analysis of the data. It can also be supplied by aggregators and value-add resellers. These companies include data processors and consultancies. This provides an opportunity for sector specific added insight and experience to contextualise data and develop products or solutions, such as for transport planners.

Different sources of data about population movement can work together and be combined to make interesting insights into population movement, for example MNO data complementing more traditional survey sources to add granularity.

What is being done?

The public sector is starting to use MNO data, including for EV chargepoint rollout. The data can provide additional insight that could help to support decision making. Transport for the North (TfN) has applied MNO data to their existing regional traffic model. Transport for the North’s Northern Highway Model (NoHAM) draws together the previous three regional traffic models for the region, providing a whole network view and capability to understand travel movements and demand right across the region. Transport for the North have experimented with the application of MNO data to enhance their existing modelling capability, specifically to adopt travel patterns from MNO to add to the richness and accuracy of modelled highway movements.

NoHAM draws together a wide range of data, including trip rates, traveller types and land-use, which provides a wide range of traveller segmentation. Synthetic demand is calibrated with the National Travel Survey and can then be combined with MNO data to improve quality. This is then calibrated using observed traffic counts and journey times to provide a final product. The model is applied to further understand planning assumptions for spatial plans, highway improvements, local airports, seaports and major trip destinations.

Midlands Connect (MC) is working with anonymised MNO data to add confidence to estimates of current travel markets, which then feeds into activities such as EV chargepoint demand. MC has found it useful for observed origin and destination trip information, in particular for less frequent activities like at an airport, a sporting event or changes over the seasons. Estimating more granular details about the traveller and their journey is being added by fusing the MNO data with other datasets. Data can vary between the different data providers but the technology used to collect this data is continually evolving and improving.

The Geospatial Commission recognises the opportunities and important considerations around the use of population movement data. By summer 2024 we will publish an assessment of the market for data about population movement, including its strategic importance, privacy and security implications and use in the public sector government to coordinate activity and lessons learned, and identify opportunities and challenges for use of this data.

Case study: How mobile network operator data is providing Transport for Wales with new insights

Aggregated and anonymised mobile network operator data is beginning to be used to help transport planners infer demand hotspots for chargepoints. Transport for Wales’ Preferred Network modelling tool, developed to support delivery of the Welsh Government’s electric vehicle charging strategy, utilises mobile network operator data to provide local authorities and other delivery partners with new evidence to install chargepoints in the right locations.

The Preferred Network modelling tool consists of a map, broken down into 1,909 Lower Layer Super Output Areas (LSOAs) across all 22 local authorities in Wales and uses mobile network operator data to create highway demand origin-destination matrices. The models are underpinned by mobile phone data, based on 2G/3G/4G signals transmitted between individual devices and network operator cell towers.

Trips are identified by tracking the movement of individual devices based on pings between the device and cell tower and a dwell time threshold is applied to represent the gap between different trips being made by the same device. Data is anonymised and then assigned to an appropriate zoning system for use in origin-destination matrices. Population level analysis can be done by combining the MNO data with population data and market share information provided by mobile phone operators.

A wide range of datasets can support further analysis, including automatic traffic counts, forming screen lines across an area, cordons around urban areas, and assessing demand by vehicle type. Data calibration takes place to ensure that the model is a reasonable representation of travel behaviour in a region.

By combining different sources of population movement data the Preferred Network modelling tool provides transport and infrastructure planners with new evidence and insights to contextualise data and develop solutions.

Opportunity 3: Identify the location of electric vehicles by using commercially-held data about leased vehicles

The private sector holds potentially valuable data that could provide new insights to better inform key public services. Although data sharing and data products for insight have been established between different private sector companies, such as Experian or from consumer financial services firms, there is a growing market for public sector use cases. There are opportunities to unlock more private sector data to make better decisions. However, there are ethical issues, commercial sensitivities, financial costs and technical challenges in the application of private and public sector held data.

Why this data is important

Understanding where EVs are kept overnight can provide local authorities and chargepoint operators with a more accurate picture of existing EV uptake in their area. We heard from local authorities and demand modellers that they find it challenging to determine an accurate and authoritative baseline of how many people have an EV in their area. Such information could help infer demand for public chargepoints by understanding areas with zero to low EV ownership. Conversely, areas where there is high EV ownership could imply sufficient access to at-home charging.

In 2022, 395,000 EVs were registered for the first time in the UK, an increase of 21 per cent on 2021 and 114 per cent on 2020. 22 per cent of all new cars registered in 2022 were electric vehicles. Consumers consider electric vehicles more expensive to own than their internal combustion engine (ICE) equivalent as the total cost of ownership for an average EV is still higher than for an ICE vehicle on a like-for-like basis.

Leasing an EV is the most popular purchasing preference, with many buyers using it as a way to spread the cost over fixed monthly payments rather than buying outright. It is estimated that only one in three new EV registrations are made by a private consumer, with the rest made by large corporate fleet owners and leasing companies.

What are the opportunities for improvement?

Data is only available on where EVs are registered, rather than where EVs are located and kept overnight. The Department for Transport publishes its quarterly vehicle registration statistics showing the type of vehicle and whether it is electric and the local authority where it is registered. At the end of December 2022, there were over one million EVs registered in the UK with 44 per cent registered to private individuals and 56 per cent registered to a company.

Registered vehicles are allocated to a local authority according to the postcode of the registered keeper. This is the keeper’s address for privately owned vehicles or the company’s registered address for company owned vehicles.

Official statistics acknowledge that the registered address does not necessarily reflect where the vehicle is located. This is especially true for large fleets kept by companies involved with vehicle management, private leasing or rentals. For example, Stockport had a total of 75,274 EVs registered, of which 97 per cent (73,313) were registered to a company. In Swindon, 37,429 EVs are registered, of which 98 per cent (36,094) were registered to a company.

These high percentages could be attributed to a large number of car leasing companies headquartered in the areas. Significant changes in the number of vehicles from year to year can also occur when these companies change their registered address.

Given that EVs are purchased by consumers increasingly through financing arrangements, such as leasing from companies, the current data on vehicle registrations does not provide an accurate and authoritative basis for understanding where EVs are located and kept overnight.

What is being done?

Identifying the location of EVs is likely to require the integration and analysis of multiple different data sources across the public and private sector. However, this would require careful consideration of not just safeguarding personal privacy but also managing commercial sensitivities.

The Driver and Vehicle Licensing Agency’s (DVLA) vehicle register holds the details of a vehicle’s registered keeper. These details may be disclosed to law enforcement authorities, private litigants and organisations as a first point of contact to establish where liability for an incident or event may lie. Other organisations may gain access to data provided they have reasonable cause[footnote 7]. DVLA’s vehicle register is primarily used to identify vehicles used on public roads, help with law enforcement, collect vehicle tax and help improve road safety. It holds information about each motor vehicle and the vehicle’s tax status. It also includes the registered keeper’s name and address, the date the vehicle was acquired and disposed of.

DVLA does not hold information on the location of where EVs are being used, rather than registered to private companies, as part of their fleet. Leasing and rental firms collect location information as part of their business operations. Leasing and rental companies are not required to publish information on the location of their fleet across the country as this is likely to be considered as commercially sensitive. Another potential source of this information is insurance companies.

Utilities providers, such as electricity companies, would also be a source of information on where EVs are located. Many companies are now providing dedicated tariffs for at-home charging however this data is not required to be made available. Electricity companies could provide information not just on location but also on consumption, which would enable an understanding of at-home charging behaviour and preferences.

While access to this data is not without considerable legal and practical challenges, there is a potential opportunity for the Department for Transport, the DVLA, regulators and industry to work together to test safe and commercially sensitive ways to make this information available to local authorities.

Opportunity 4: Identify existing electricity network capacity through better use of distribution network operator data

Site selection is an integral component of chargepoint roll out. The viability of sites can be assessed through different criteria and data as detailed earlier in this report. Local authorities can layer data sets together to identify the most suitable sites for their chargepoints. How this analysis is undertaken, the amount of data and data type will differ between different local authorities.

Site selection typically includes detailed assessments and surveys about prospective locations for chargepoints. Planners engage with local stakeholders and identify any legal considerations, including who owns the land and whether planning permission is required. Where sites are identified, submissions are made to the relevant distribution network operator to check if there is sufficient network capacity and to provide cost estimates for connection to the network.

Why this data is important

Knowing the availability of energy in a specific location helps local authorities to identify the viability, in terms of energy availability and cost, of chargepoint installation. Understanding this is fundamental to fast, efficient and cost-effective chargepoint installation across the country.

Access to energy information is a key enabler for local authorities to effectively roll out chargepoints. The data sharing between local authorities and distribution network operators (DNOs) is critical and something local authorities find is a key stumbling block during their roll out. Local authorities can find it difficult to obtain timely and granular data about the capacity, availability and cost of power at a given location.

What are the opportunities for improvement?

Local authority access to this data is mixed due to the variability across DNOs in how this data is collected, shared and visualised. Standardisation across DNOs in how data is collected, shared and visualised would allow local authorities to make quicker and more effective decisions about candidate locations for new chargepoints.

Conversely, DNOs could meet current and future demand better if they had improved access to local authority data about existing and planned infrastructure. There is an opportunity for better data sharing between local authorities and DNOs to ensure our grid is future proofed, as DNOs are aware where future demand will be, in an effective manner, through local authorities having timely data on grid capacity and connection costs.

What is being done

In January 2023 Ofgem published the Electric Vehicle Smart Charging Action Plan.It highlighted how Ofgem has set expectations around data best practice for DNOs, including how their network visibility data should be shared in a common, open and consistent way to improve decision making across the sector. In February 2023, Ofgem launched a consultation on updates to the Data Best Practice Guidance and the Digitalisation Strategy and Action Plan Guidance. The results of the consultation will be published in due course.

The Department for Energy Security and Net Zero commissioned Arup, Energy Systems Catapult and the University of Bath to conduct a six month feasibility study into an energy system ‘digital spine’ to improve data sharing and data standardisation, as well as to deliver interoperability across the energy sector. The Department for Energy Security and Net Zero is currently assessing the evidence and recommendations set out in the report.

In 2022, the government launched the Automatic Asset Registration innovation competition as part of the Net Zero Innovation Portfolio (NZIP). This offered up to £2 million to support the development of solutions to automatically register domestic energy assets, such as EV chargepoints, and to demonstrate the technical feasibility of a central asset register to hold this data. Enhanced visibility of assets across the system will support DNOs in strategic network planning and minimising the risk of grid constraints. Three successful projects were announced in September 2022, with feasibility studies due to be completed in early 2023.

Some DNOs are leading the way with data sharing between them and local authorities. The LAEP+ tool created by Advanced Infrastructure has data from Scottish and Southern Electricity Networks (SSEN) and other Distribution Network Operators which demonstrates the grid capacity along a road for the areas in the several DNO licence areas. The tool can be used to model scenarios involving different types of chargepoints and different combinations of charpoints spatially. Future iterations of the tool will facilitate the creation of decarbonisation plans per neighbourhood based on local data.

SSEN and UK Power Networks (UKPN), are developing LAEP+ to automatically create decarbonisation plans for neighbourhoods that inform local authority decisions about where to place EVs and other low carbon technologies like heat pumps. LAEP+ aims to provide this service to all Local Authorities within SSEN and UKPN distribution service areas, with the initial focus on domestic buildings and transport, before expanding later to include all buildings. The tool can help identify the cost of installing a chargepoint and what type of charger is suitable due to grid capacity.

Opportunity 5: Identify areas without off-street parking by using proxy data

In ‘Getting to the Point’, we committed to exploring the creation of a geospatial dataset for off-street parking, considering existing sources of data and how to safeguard privacy.

In the absence of definitive data, local authorities and modellers are innovating with proxy methods, with some success. Local authorities and modellers are developing innovative ways of utilising location data to fill information gaps where definitive data is either absent or too costly to develop. Investments in improving data findability and access are enabling the creation of proxy methods which give decision-makers adequate answers.

Why this data is important

Households with off-street parking, such as driveways or garages, are more likely to use their own private chargepoints for the majority of their charging needs. Households in neighbourhoods which do not have off-street parking will rely on public EV chargepoints, either on-street or in dedicated charging hubs.

Data about where off-street parking locations are helps local authorities understand where public on-street charging is required. Local authorities being able to identify areas where there are high levels of on-street parking is crucial for their bid development for schemes such as the Local EV Infrastructure Fund (LEVI).

What are the opportunities for improvement?

Local authorities and chargepoint modellers have a broad range of information requirements when it comes to identifying where off-street parking exists. Their information needs can vary from broad-based, neighbourhood level statistics through to highly granular spatial representations of off-street parking at street level.

Local authorities and modellers have different information needs, depending on their requirements. Some wanted detailed polygons (showing enclosed areas) of where off-street and on-street parking exists by individual streets while some wanted to know the exact number of buildings which have a dedicated driveway or garage by collecting specific data on off-street parking attributes.

Some wanted to understand at a neighbourhood level the percentage of housing with off-street parking. Some wanted to infer the extent of off-street parking using types of buildings, such as the number and location of terraced versus detached houses.

Some wanted to use sociodemographic information (for example Mosaic customer segmentation data) to infer wards and neighbourhoods where there is a high likelihood of off street parking.

The different information requirements vary in the extent to which local authorities and modellers need to have accurate and authoritative data. We found that in most cases local authorities are satisfied with starting off with “good enough” information which does not require very high levels of specificity and granularity.

What is being done

The Department for Transport has been investing in the development of a national-level dataset which provides local authorities with a percentage of dwellings with and without off-street parking.

Currently, local authority allocations for Department for Transport’s LEVI funding are calculated by multiplying an estimate of vehicles without parking by their characteristic score. This characteristic score is the sum of the number of chargepoints per 100,000 population plus, Index of Multiple Deprivation and rurality. The characteristic score is then scaled by estimates of vehicles without off-street parking.

The estimated number of vehicles without off-street parking is created from two different data sources. Firstly, an estimate is derived from a property attribute dataset of the level of households without off-street parking in local authorities. Secondly, these proportions are then applied to the total number of vehicles registered in each local authority.

To improve the accuracy of their data, the Department for Transport is developing a methodology to determine off-street parking using property sales data, including stated parking provision. The outputs from this work will be published on the Knowledge Repository, part of the LEVI Support Body offering. Local authorities will be able to see every local authority’s percentage of dwellings with and without off-street parking provision.

In addition, there are a range of existing approaches developed by the public sector and private companies which can provide local authorities with more granular and spatially explicit data on off-street parking provision and go some way to addressing local authority needs. These vary in their cost, complexity and specificity.

Some local authorities use satellite imagery, such as Google Maps and cross-check this with site visits., This method can be time consuming and is usually a manual process. Automatic methods can be computationally expensive and require a specific skill level. Satellite data excludes underground parking and garages.

Ordnance Survey AddressBase Plus is being used by some local authorities to identify residences with characteristics which are more likely to have off-street parking, such as detached properties. This method relies on assumptions around building types which can vary by region and produce different results for different local authorities.

Others have purchased data from Field Dynamics which uses Ordnance Survey data to create a highly granular model to assess the number of properties which have at least a 21.1m2 rectangle of adjacent outside space that is easily accessible from a road. This data is a paid-for product and is based on the assumption that space easily accessible is equivalent to space that could be used for parking and EV charging. Many rely on the cloud-based system for interpreting the data and creating various potential scenarios.

HM Land Registry data on property types is being used by some local authorities to identify areas where there is a high volume of terrace housing meaning that off-street parking would be unlikely. Some have used Advanced Infrastructure who have developed a tool showing availability of off-street parking, network capacity and proximity to existing charge points, for those that live in the areas that have enough data.

Acronyms

CPO - Chargepoint Operator

DESNZ - Department for Energy Security & Net Zero

DfT - Department for Transport

DNO - Distribution Network Operator

DVLA - Driver and Vehicle Licensing Agency

EV - Electric Vehicle

EVCI - Electric Vehicle Charging Infrastructure

FAIR - Findable, Accessible, Interoperable, Reusable

ICE - Internal Combustion Engine

LA - Local Authority

LAEP - Local Area Energy Plan

LEVI - Local Electric Vehicle Infrastructure

LSOA - Lower Layer Super Output Area

MC - Midlands Connect

MNO - Mobile Network Operator

MSOA - Middle Layer Super Output Area

NEVIS - National EV Insight & Strategy

NoHAM - Northern Highway Model

NUAR - National Underground Asset Register

NZIP - Net Zero Innovation Portfolio

OCPI - Open Charge Point Interface Protocol

ONS - Office for National Statistics

OPSS - Office for Product and Safety Standards

ORCS - On-Street Residential Chargepoint Scheme

OS - Ordnance Survey

OZEV - Office for Zero Emission Vehicles

PMD - Population Movement Data

PSGA - Public Sector Geospatial Agreement

SSEN - Scottish and Southern Electricity Networks

SSMT - Society of Motor Manufacturers and Traders

TfN - Transport for the North

UKPN - UK Power Networks

Acknowledgements

Advanced Infrastructure

BT

Cenex

City of York Council

Cornwall Council

Coventry City Council

Department for Energy Security and Net Zero

Department for Transport

Energy Savings Trust

Energy Systems Catapult

Field Dynamics

Hippo Digital

Kent County Council

Leeds City Council

Midlands Connect

Office for Zero Emission Vehicles

Oxfordshire County Council

Scottish and Southern Electricity Networks

Transport for London

Transport for the North

Transport for Wales

Virgin Media O2

Zapmap

Annex A: An update on actions from ‘Getting to the Point’

| Action | Update |

|---|---|

| The Geospatial Commission will deliver a feasibility study into how to widen access to demand modelling, including whether existing models can be scaled up. | Demand modelling can be a useful geospatial application for local authorities to develop a spatially targeted charging strategy, combining a wide range of assumptions, datasets and forecasts on electric vehicle (EV) uptake and consumer behaviour predictions. There are a range of applications that have been developed by the public and private sectors. Demand modelling is best used as one consideration alongside a variety of other factors, such as land availability, street constraints and traffic flows. However, demand modelling can be a highly technical and expensive approach. It is not feasible to expect all local authorities to develop their own demand modelling. Instead, to support a more coherent approach, local authorities would benefit from closer working with sub-national transport bodies who have developed their own demand models for EV charging. |

| The Geospatial Commission will explore the creation of a geospatial dataset for off-street parking, considering existing sources of data and how to safeguard privacy. | Understanding how many and which households do not have access to off-street parking was identified as a key information requirement by local authorities to effectively target on-street charging provision.The Department of Transport has been investing in the development of a national-level dataset which provides local authorities with a percentage of dwellings with and without off-street parking by local authority using property sales data of stated parking provision. Local authorities will be able to see a percentage of dwellings with and without off-street parking provision. While this dataset will be a helpful starting point, we have identified a range of approaches developed by the public sector and private companies which provide local authorities with more granular and spatially explicit data on off-street parking provision and go some way to addressing local authority needs. |

| The Geospatial Commission will examine how aggregated and anonymised mobility data could be applied to inform chargepoint rollout. | Understanding the movement of people can help identify areas of high demand and high footfall. This can be used by local authorities, transport planners and businesses to model optimal chargepoint locations. Contemporary examples of mobility data include aggregated and anonymised mobile network operator (MNO) data. However, the use of MNO data in transport modelling and planning from city to regional to national scale is not new.The application of MNO data by the local authorities for EV chargepoint rollout is nascent. There is potential to use MNO data to identify longer trips across multiple local authority boundaries, infer the reason for trips to better understand EV driver behaviour. There are currently limitations to using MNO data to identify EV drivers.By summer 2024, the Geospatial Commission will publish an assessment of the market for data about population movement, including its strategic importance, privacy and security implications and use in the public sector. |