£5 billion Export Refinancing Facility launched to boost UK exports

UK Export Finance, the UK’s export credit agency, has today launched its £5 billion Export Refinancing Facility.

Construction site in the Middle East

The Export Refinancing Facility (ERF) will enable UK-based exporters to offer competitive long-term financing to overseas buyers who require loans in excess of £50 million to purchase UK capital goods and services.

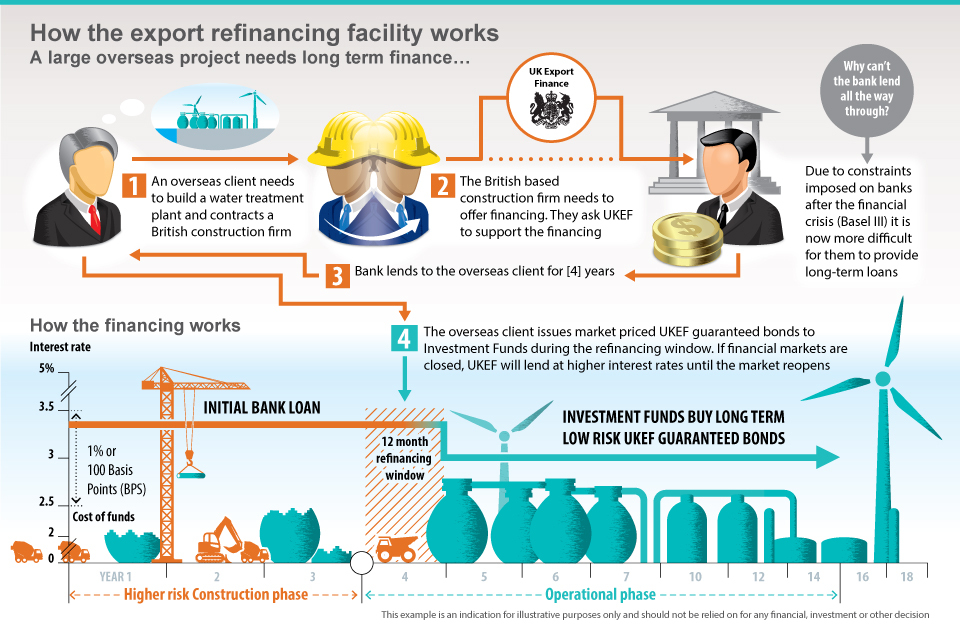

See an infographic that explains the new facility

The ERF is targeted at project sponsors in emerging markets who need long-term loans to finance investment-related capital goods and services for high value opportunities such as large-scale construction or infrastructure development projects. It allows overseas buyers to access the highly competitive funding of the debt capital markets to refinance export finance loans after their initial funding by the banks.

The ERF will support UK bids for these projects which typically involve lengthy contract negotiations. It is the first time this financing approach is being used for civil project finance by an export credit agency.

Under the new facility, UK Export Finance will guarantee repayment of bonds issued by the buyer to refinance the initial loan. This will allow the bonds to be competitively priced at a fixed rate, which takes account of the UK’s credit rating. Should the borrower be unable to refinance the loan, UK Export Finance will become the lender until alternative funding is found.

Trade Minister Lord Livingston said:

Increasing UK exports and giving UK exporters the support they need is key to our long-term economic plan to promote sustainable growth. The Export Refinancing Facility will help British firms succeed overseas by lowering the cost of finance for buyers who choose UK companies for their major projects.

Richard Adam, Group Finance Director at construction company Carillion Plc, said:

In an increasingly competitive market, we are pleased to see UKEF launching this new innovative product that complements their current toolkit and enables us to offer it to potential overseas project sponsors in the future.

Irene Graham, Executive Director of Business Finance at the British Bankers’ Association, said:

The BBA’s export finance banking specialists have worked closely with UKEF and HM Treasury on the development of this facility and are pleased it is now launched. Competitive pricing of UKEF-backed loans is key to UK exporters winning long-term export contracts, and we are supportive of a flexible ERF scheme that can further support long-term projects and finance options at competitive rates.

The new ERF is part of wider UK Export Finance plans to expand the ways in which it supports UK exports. Another example of this is the enhanced £3 billion Direct Lending Facility (DLF), also announced by the Chancellor of the Exchequer in last month’s Budget.

The DLF will see UK Export Finance lend directly to overseas buyers at the lowest interest rates allowed by international agreements. This facility, which complements the ERF, is expected to become operational by the end of June 2014*. Given the announced relaxation of eligible loan sizes, the DLF should be more attractive to a wider range of companies including mid-sized businesses, for whom UK Export Finance will be introducing specialised export finance advisers in the UK in 2014.

David Godfrey, CEO of UK Export Finance, said:

We are being more targeted and innovative in our support of UK exporters. In particular, we are building closer partnerships with banks and professional advisers to ensure UK exporters have the full range of support available for export success.

Professional services firm KPMG has worked with UK Export Finance on the department’s contribution to the UK’s growth and enterprise agenda. Jeremy Barker, KPMG’s director of corporate finance said:

KPMG has been working with UK Export Finance to improve UK competitiveness in overseas markets. We believe the launch of the ERF, along with other UKEF developments announced in the Budget, will put the UK in the frame for major overseas projects. Jon Coleman, Chairman of the British Exporters Association, said:

BExA welcomes the launch of the Export Refinancing Facility. This will help to ensure the availability of long term financing to support exports of capital and semi capital goods exports and overseas projects.

*Read details of the currently available DLF.

Infographic showing how the ERF facility works

Notes for Editors

- UK Export Finance is the operating name of the Export Credits Guarantee Department, the UK’s export credit agency and a government department. It complements the private market by providing assistance to UK businesses, principally in the form of insurance to exporters and guarantees to banks. UK Export Finance works closely with UK Trade & Investment (UKTI) to support UK export competitiveness and growth.

- The information available on the ERF at www.gov.uk/export-refinancing-facility includes: FAQs, description of main features, high-level infographic of how the facility works, eligibility criteria and application form.

- How ERF works: a typical ERF deal would see a bank provide a $150 million loan to an overseas buyer in order to purchase UK exports. The buyer will have the option at any time during the term of the loan to request that UK Export Finance guarantee a refinancing of the loan. This would normally be via issuing bonds in the debt capital markets. The UK Export Finance guarantee of repayment of the bonds will allow the bonds to be priced very competitively, taking account of the UK’s credit rating. In addition, if the buyer is not able to refinance the loan within the first year after the final date for its disbursement in full (the disbursement of the loan is often spread out over 3 to 4 years) for example because there has been a crash in the financial markets, UK Export Finance will undertake to take over the loan and become the lender until the debt capital markets (or another funding source) becomes available. If UK Export Finance takes over the loan in this way, a higher interest rate will apply.

- Why ERF is needed: following the 2007/8 international financial crisis and later the Euro crisis, European banks experienced severe difficulty in funding medium and long-term export finance in dollars. This was reflected in problems in accessing dollar funding that adversely impacted the competitiveness of UK exporters. While dollar funding pressures have eased as the euro crisis has ebbed, the main obstacle for commercial banks entering into new export credits is the lack of refinancing solutions. There is a continuing concern that a similar event could occur that will trigger a bank funding crisis. ERF is therefore designed to address past, current and future export finance challenges.

- The intention to develop an export refinancing facility was announced by the Chancellor of the Exchequer in 2012, with the 2014 Budget announcing the ERF would go live in April.

- Exporters and overseas project sponsors interested in the ERF can contact the UK Export Finance business enquiries helpline, +44 (0)20 7271 8010.

- UK Export Finance has introduced 18 regional trade finance advisers to give export credit advice to UK businesses. The number will soon be increased to 24, including three dedicated mid-sized business advisers, as part of a wider government initiative alongside UKTI to ensure comprehensive export support for MSBs.

Media enquiries: Andy Aston, Head of News and Corporate Communications

Email Andy.Aston@ukexportfinance.gov.uk

Mobile +44 (0)7458 047053

New business enquiries