NHS Pension Scheme pension flexibility: response to consultation

Updated 5 February 2021

Introduction

The NHS pension scheme is a highly valuable part of the package of pay, terms and conditions for NHS staff. However, for a relatively small but important group of staff, the interaction between the NHS Pension Scheme and the pension tax regime has created significant challenges.

To encourage individuals to plan for their retirement the government provides tax incentives by allowing pension scheme contributions to be made tax-free. However, the cost of providing this tax incentive is very substantial at over £50 billion a year. To ensure sustainability, since 2010 there have been progressive restrictions on the amount that individuals can save into their pension tax-free.

The government applies two mechanisms:

- lifetime allowance limits the total amount of tax-free pension savings that an individual can make over their career. A tax charge is applied to pension savings above the lifetime allowance. The charge is deducted from the value of the pension pot. Individuals do not pay a lifetime allowance tax charge in cash

- annual allowance limits the amount by which an individual's pension savings can grow tax-free in the year. A tax charge is applied to pension savings above the individual's annual allowance. Members can either pay the charge upfront in cash or use the Scheme Pays facility to have the charge deducted plus interest from their pension pot at retirement

These allowances have reduced overtime, coupled with the introduction in 2016 of a tapering of annual allowance for high earners. For some NHS staff, mostly senior doctors, the relative generosity of the NHS pension scheme has meant that the growth in their pension exceeds their tax-free allowance.

This was causing financial concerns for some individuals in the NHS, with many looking at how they could prevent their pension growth exceeding their annual allowance and breaching the taper. Some sought to limit their pensionable and non-pensionable pay by declining additional work or responsibilities, and in some cases reducing their existing levels of commitment. Non-pensionable pay counts towards tapering of the annual allowance, increasing the size of tax charges but without adding to pension growth. Others considered leaving the pension scheme or seeking early retirement.

This presented a risk to the ability of the NHS to provide the services that patients need. In particular, the extra capacity provided by clinicians enables the reduction of waiting lists, rota gaps to be filled or essential supervision responsibilities being covered.

To help address this, the department consulted on a package of pension flexibility for NHS clinicians in the autumn of 2019. In summary the proposals were to:

- allow clinicians to reduce their rate of pension saving to fit within their tax allowance and pay correspondingly fewer contributions

- recognise that employers can recycle contribution savings into additional pay for staff who take up flexibility, to maintain the overall cash value of reward packages

- provide new tools and more information to support individuals in understanding their tax position and using the new flexibility

- test the principle of phasing in gradually the rate at which large pay increases contribute to pension growth, smoothing the tax impact

- make the Scheme Pays facility more transparent so that staff can better see the effect on their NHS pension

This document summarises the findings from the consultation, including responses to an earlier withdrawn consultation on initial proposals for a 50:50 flexibility, and sets out what the government has done to address the issue and what the department will do next following the consultation. It should be read in conjunction with the consultation document.

1. Consultation process

The proposals were subject to public consultation that began on 11 September 2019 and ended on 1 November 2019. The department had previously begun to consult on a 50:50 flexibility, where clinicians affected by the annual or lifetime allowance could choose to reduce their accrual by 50% and pay 50% fewer personal contributions. However, it was clear from the early responses that the proposal would not provide sufficiently broad flexibility for individuals to balance their pay, pension growth and tax liability.

The 50:50 consultation was therefore withdrawn and replaced by proposals for further flexibilities that went significantly beyond the narrow 50:50 flexibility.

A new document describing the rationale and revised proposals was published on the GOV.UK website and consultation platform. The document presented an initial assessment of any potential equality impact arising from the proposals where relevant to the Secretary of State for Health and Social Care's considerations under the Public Sector Equality Duty. Responses could be made through the consultation platform, by email or by post.

The department invited responses to ten consultation questions, inviting respondents to provide evidence (where available) to support their answer. Several questions asked respondents to suggest and comment on any potential equality implications of the proposals.

Over 2,200 responses were received in total. 1,160 were submitted through the consultation platform, 1,209 were received via email, and none by post.

While the proposals relate to the NHS Pension Scheme in England and Wales, a number of responses were received from individuals and representative organisations associated with the Scottish NHS. Changes to the NHS Pension Scheme for Scotland and Northern Ireland are a matter for their respective Governments and beyond the scope of this consultation.

Of the 2,264 responses received, the majority were from individual doctors and senior clinical staff. Stakeholder organisations such as trade unions, NHS trusts and foundation trusts, and medical accountancy firms also provided responses. The following organisations submitted responses:

- Bevan Brittan

- GMB

- ICAEW

- Income for the Third Age Ltd

- Local Government Pension Scheme (England and Wales) Scheme Advisory Board

- Luton and Dunstable University Hospital NHS Foundation Trust

- Moore Scarrott Healthcare Limited

- NHS Employers

- NHS Providers

- Prospect

- Royal Cornwall Hospitals NHS Trust

- Tameside and Glossop Integrated Care NHS Foundation Trust

- The Association of Independent Specialist Medical Accountants

- The Association of Local Authority Chief Executives and Senior Managers

- The British Dental Association

- The British Medical Association

- The Business Services Association

- The Hospital Consultants and Specialists Association

- The Investment & Life Assurance Group

- The Ministry of Defence

- The National Association of Specialist Dental Accountants and Lawyers

- The NHS Business Service Authority

- The NHS Pension Board

- The NHS Pension Scheme Advisory Board

- The NHS Pension Scheme (Scotland) Scheme Advisory Board

- The Royal College of Obstetricians and Gynaecologists

- The Royal College of General Practitioners

- The Royal College of Nursing

- The Royal College of Physicians and Surgeons of Glasgow

- The Royal College of Surgeons of England

- The Royal Marsden NHS Foundation Trust

- The Shelford Group

- The Universities and Colleges Employers Association

- The University of Sheffield

- UNISON

- Welsh Government

- Wesleyan

The NHS Pension Board and the Scheme Advisory Board for the NHS Pension Scheme in England and Wales responded to the consultation. The NHS Pension Board is a statutory board established under the Public Service Pensions Act 2013 with responsibility for assisting the Scheme Manager (the Secretary of State for Health and Social Care) in securing compliance with all relevant pension legislation, regulations and directions, and the Pensions Regulator's relevant codes of practice. The Scheme Advisory Board is also a statutory board, comprising trade union and employer representatives, that advises the Secretary of State for Health and Social Care on the merits of making changes to the NHS Pension Scheme.

2. Summary of proposals

This section summarises the proposals as outlined in the initial consultation document.

Flexible accrual

The NHS Pension Scheme, in line with the other major unfunded public service pension schemes, does not allow members the flexibility to tailor the rate at which their pension builds. Some clinicians were choosing to reduce their NHS income through declining additional discretionary work or NHS responsibilities.

The consultation set out proposals for a new flexibility within the NHS Pension Scheme for clinicians whose NHS work commitments mean they have a reasonable prospect of incurring an annual allowance tax charge. Discussions with the medical profession and employers highlighted the need for wide-ranging pension flexibility that would offer clinicians the ability to control the amount of tax-free pension saving they build up so that they can manage their tax liability without needing to reduce their workload. The proposed changes to the scheme would allow eligible clinicians to:

- choose before the start of each scheme year (1 April) a personal accrual level and pay correspondingly lower employee contributions. The accrual level chosen would be a percentage of their normal accrual level in 10% increments. For example, 50% or 60%

- fine tune their pension growth towards the end of the scheme year by updating their chosen accrual level when they are clearer on total earnings. For example, go from 50% to 60%. The updated accrual level would be higher than initial level and have retrospective effect from the start of the scheme year. Contribution arrears from the higher accrual level would be payable by the member and employer

Recycling of employer contributions

Where flexibility is used, both the member and their employer pay proportionately fewer contributions compared to normal, full rate accrual. The consultation noted that employers have the discretion to 'recycle' unused employer contributions into additional pay for staff who take up the flexibility. This would be to maintain the cash value of the reward package. Unused employer contributions could be paid as a non-recurrent lump sum at the end of the scheme year after any updating of the chosen accrual level.

NHS Employers published guidance on short-term approaches that employers can take locally to mitigate the impact of pension tax on their workforce in 2019-20. This included the potential for recycling unused employer contribution into extra pay. This guidance has been refreshed for the 2020-21 scheme year and is available on NHS Employers' website.

Phasing of pensionable pay increases

Substantial 'one-off' increases in pensionable pay can create a spike in pension growth and a higher annual allowance tax charge that is not replicated in subsequent years. The NHS Pension Scheme Advisory Board suggested that the amount by which the new pay level contributes towards member pensions could be gradually increased over a number of years to smooth such spikes. The consultation tested the principle of allowing the 'pensionability' of large pay increases to be phased and invited views on potential ways to give effect to this.

Availability of high-quality information

The department recognised that the interaction of tax, pay and pensions is complex. The department signalled intentions to work with employers and staff representatives to ensure that all clinicians who experience pension tax issues or concerns have access to high quality education and information to understand their tax liability and how the proposed flexibilities can be used to support individual circumstances and preferences.

The consultation outlined proposals to build on what is already available, and set out plans to commission a modeller to help individuals assess their pension tax position and options.

Improving Scheme Pays

HM Revenue & Customs (HMRC) require pension schemes to provide a Scheme Pays facility through which some individuals can meet their annual allowance charges.

The department has already maximised the coverage of Scheme Pays so that it can be used to settle an annual allowance charge of any value, in relation to NHS Pension Scheme benefits. This is beyond the statutory minimum requirement for Scheme Pays coverage. This means that no NHS Pension Scheme member is required to find money up front to pay their pension tax bill.

Under the NHS Scheme Pays facility the pension scheme pays the tax charge on behalf of the member directly to HMRC. This creates a debt that is repaid at retirement when the charge value (plus interest) is deducted from the member's pension before it is put into payment. Scheme Pays is available to all members of the NHS Pension Scheme.

The consultation proposed an alternative Scheme Pays method that would seek to provide greater transparency for members. This would involve annual member benefit statements showing the Scheme Pays deduction as an immediate pension debit. The intention is that members can see the adjustment to their pension at retirement as it increases with interest each year, and compare this with how their accrued pension also increases over time though annual pot revaluation or salary increase.

3. Government response to consultation feedback on the pension tax system

The consultation presented the rationale for the lifetime and annual allowances, which are designed to restrict the amount of pension saving that can be made tax-free. While the consultation did not specifically invite views on these tax policies, the vast majority of consultation responses did comment upon them and made suggestions on how the pension tax issue should be solved.

This section summaries those comments and sets out how the government has since addressed the taper issue by increasing the tax threshold. This was in fulfilment of a manifesto commitment to address the taper problem in doctors' pensions that was causing many to turn down extra shifts for fear of high tax bills. It also presents analysis that shows breaching the annual allowance and using Scheme Pays to meet the tax charge may be considered a sound financial decision.

Sections 4 to 8 of the document presents a summary and response to views received on the consultation questions asked in relation to the specific proposals.

Consultation responses

Most respondents took the view that providing flexibility was no substitute for tax reform. The British Medical Association (BMA) did not consider it possible for the impact of pension tax legislation to be resolved by changes to an individual pension scheme. They concluded that even the most appropriate and creative flexibilities would only be a workaround in the absence of tax reform. The NHS Pension Board offered similar views, recognising that the proposals were driven primarily by the impact of tax laws rather than being particularly matters of scheme design. The Royal College of Nursing welcomed an announcement by the Treasury to review the operation of the taper, concluding that reforming the tax system is a more effective approach to addressing the impact on NHS services.

The Royal College of General Practitioners agreed with this view, suggesting that flexibility in the NHS Pension Scheme would not be needed if not for the consequences of features of the wider pension tax system. Respondents noted that the impact of the tapered annual allowance in the NHS Pension Scheme, due in part to the generosity of the scheme, is viewed as punitive and unfair as members have no ability to control their pension growth.

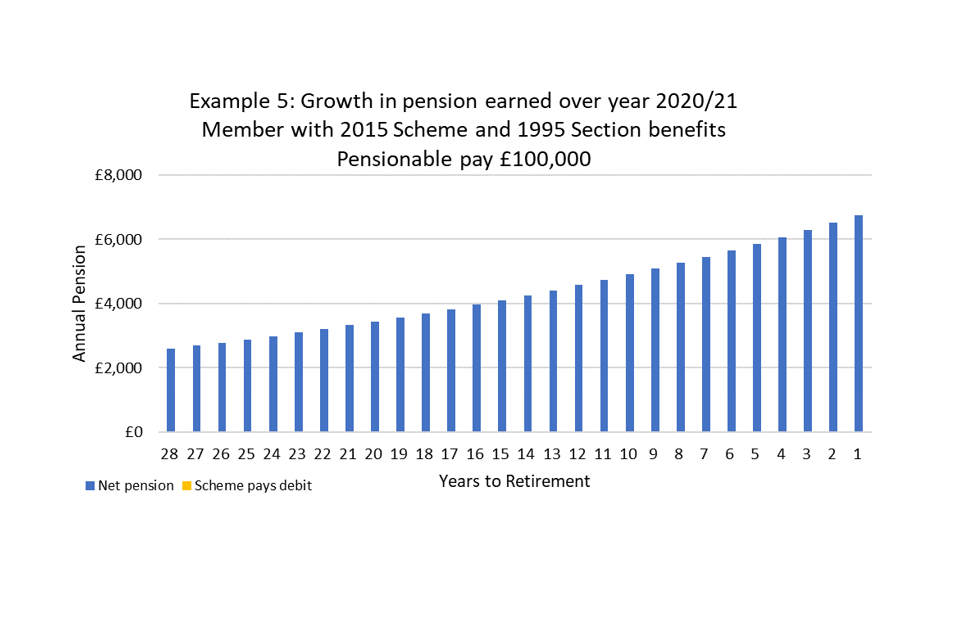

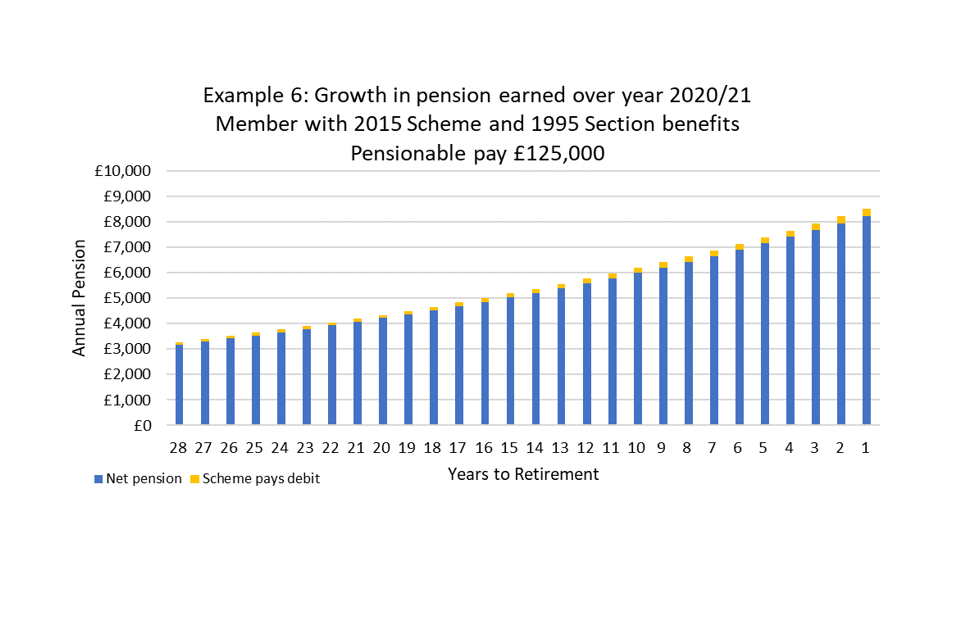

Furthermore, the BMA argued that the annual allowance is unsuited to defined benefit pension schemes, and that tax relief on pension contributions in a defined benefit scheme is already controlled by the lifetime allowance. They stated that there are significant issues for transition members due to the interaction between deferred benefits built up in the 1995/2008 final salary scheme and active benefits in the 2015 career average scheme. Members with benefits in both schemes are defined as transition members. An increase to a transition members pensionable pay will impact their benefits in both schemes, despite them only being active in the 2015 Scheme. An increase in pensionable pay will therefore increase the value of their final salary benefits, despite the member no longer actively contributing to the final salary scheme. This is because transition members retain a final salary link which allows their 1995/2008 benefits to be based on current pay. Although transition members will receive a higher pension outcome, the BMA argued that transitional benefits may increase the likelihood of an annual allowance charge for higher earners.

The BMA argued that transition members with a taxable income of over £110,000 are likely to be affected by the annual allowance. They referred to an Office of Tax Simplification published a report in October 2019 that suggested the impact of the annual allowance can be disproportionate for high earners in defined benefit schemes. In their consultation response, the Institute for Chartered Accountants in England and Wales (ICAEW) argued that 1995/2008 Scheme growth should be discounted from the tapering calculation.

Many respondents argued that the complexity of the tapered annual allowance calculation makes the impact worse, as members struggle to understand the operation of the taper and the affect it may have on their pension tax position. Respondents said the complexity of the taper prevented scheme members from making informed decisions about their pension benefits. It was highlighted that for some high earners, particularly GPs and dentists, earnings can fluctuate from year to year. This makes it difficult for such members to predict their potential tax liability at the start of a scheme year, so it is unclear if they can take on additional work without incurring a tax charge. Multiple respondents also pointed to the ongoing issues with NHS England's contract with Capita, and the administration of GP pension records. Final pensionable earnings for GPs are typically unavailable until after the self-assessment tax returns have been made which occurs after the scheme year closes. Respondents point to delays with the administration of GP pensions and the provision of information which hinders the ability of members to clearly understanding their pension growth and tax liability.

The BMA stated that the taper mechanism is beyond the comprehension of the most experienced accountants and tax advisors. This view was supported by a large number of public respondents who argued that it should not be so difficult to make an accurate estimate of pension tax liability, which is currently challenging without taking formal financial advice.

Respondents did offer suggestions for reform to the lifetime and annual allowances, with the aim of simplification and reducing the impact on NHS staff. The Association of Local Authority Chief Executives and Senior Managers argued that the lifetime and annual allowance thresholds should be increased, alongside the removal of the taper. NHS Providers made a similar suggestion of removing the taper or increasing the thresholds for taper and adjusted income. The Royal College of Obstetricians and Gynaecologists suggested increasing the annual allowance to £50,000 and the threshold for tapering from £110,000 to £150,000 in order to reduce the number of NHS Pension Scheme members in scope of the taper.

Baroness Altmann responded to the consultation, acknowledging the need to restrict tax-free pension saving but argued that the rules of the taper mechanism are complex, unfair and create difficulties for members in understanding their tax position. The Baroness also highlighted the 'taper cliff edge' where threshold earnings are over £110,000 and adjusted income is over £150,000 causing the taper to apply. Earnings below these thresholds will not cause tapering, but if the threshold is reached then the impact of tapering can be severe. The Baroness proposed that the tapering calculation should apply to the previous year's earnings rather than the current year's in order to allow members to plan properly, and that the taper should be changed to avoid the cliff edge of threshold and adjusted earnings.

Government response

The feedback received on the annual allowance taper and other suggested reforms, as summarised above, was passed to the Treasury to inform their review of the operation of the tapered annual allowance which followed the consultation process.

The government manifesto committed to addressing the tapered annual allowance problem in doctors' pensions, to ensure that hard-working staff do not find themselves reconsidering their NHS commitments due to the interaction between their pay, pension and the tax regime that surrounds this. The Prime Minister announced a rapid review of the pension taper issue and a commitment to bring forward a long-term solution quickly. The perception amongst NHS staff and pension industry commentators was that the taper had created an unintended impact on NHS services. The British Medical Association (BMA) and the Academy of Royal Medical Colleges were clear in their view that the solution lies in reforming pension tax policy.

Following the review, the government decided that a tax solution was the simplest way to address the issue. The government announced at Budget in March 2020 that the tapered annual allowance thresholds would increase by £90,000 from 6 April. The threshold income and adjusted income thresholds increased to £200,000 and £240,000 respectively, removing up to 96% of GPs and 98% of consultants from the taper calculation based on their NHS income, and individuals with earnings below £200,000 are now no longer in scope of the taper. These measures apply to all staff in the NHS and across the economy more broadly. A limited number of the very highest earners in the NHS, with income in excess of £200,000, will still remain in scope of the annual allowance taper. Although such members may still receive a tapered annual allowance breach, they will have £90,000 additional headroom before the charge applies and they will be assessed against a higher adjusted income.

The incentive to take on additional NHS work is now restored, and from 6 April 2020 clinicians can earn at least an additional £90,000 before reaching the new threshold income. These tax measures apply to everyone, including senior managers and other high earners in the NHS. Based on income from NHS work, raising the threshold income to £200,000 is estimated to take up to 98% of consultants and up to 96% of GPs out of scope of the taper. This is a £2 billion commitment over the scorecard period that supports clinical staff and has been welcomed by the NHS and representatives of the medical profession.

A tax solution to address the taper issue is the simplest to understand and administer; it directly targets the issue that has been raised, is fairer across different workforces and retains appropriate limits on tax-free pension saving for the very highest earners. As a consequence, the pension flexibility proposals set out in the consultation document will not be pursued.

The government's review concluded that raising the thresholds was the quickest and most effective way to solve the issue and delivers a tax solution which was preferred by most consultation respondents as a simpler alternative to flexibility that many feared would add to the complexity of the pension scheme. As a consequence, the department does not intend to proceed with proposals to introduce pension scheme flexibility for senior clinicians.

This decision removes the need for in-scheme flexibility, so the flexible accrual facility will no longer be introduced.

Raising the thresholds has the added benefit of applying equally across the wider public sector, such as to medics working in the armed forces as consultation respondents highlighted, and head teachers.

Without the flexible accrual facility, there is no longer a need for employers to offer contribution recycling as a matter of course, however, employers are encouraged to think flexibly about ways to support the small number of very high earners who are still within scope of the tapered annual allowance and also staff who have breached the lifetime allowance. The lifetime and annual allowances allow individuals to make significant amounts of pension savings tax-free, while ensuring incentives to save are targeted across society

Although flexible accrual will no longer be introduced, the department is committed to improving the availability of high-quality information to allow scheme members to better understand their pension tax liability. chapter 7 sets out that the department has commissioned NHS Employers to provide a ready reckoner tool to help pension scheme members understand their pension growth in more detail.

Using Scheme Pays to deal with an annual allowance charge

The government strongly believes that the annual allowance should not be viewed as a disincentive to take on additional work, and the Scheme Pays facility is a proportionate way for members to deal with an annual allowance charge. Scheme Pays allows members to meet the cost of a tax bill from the value of their pension benefits, without needing to find the funds upfront.

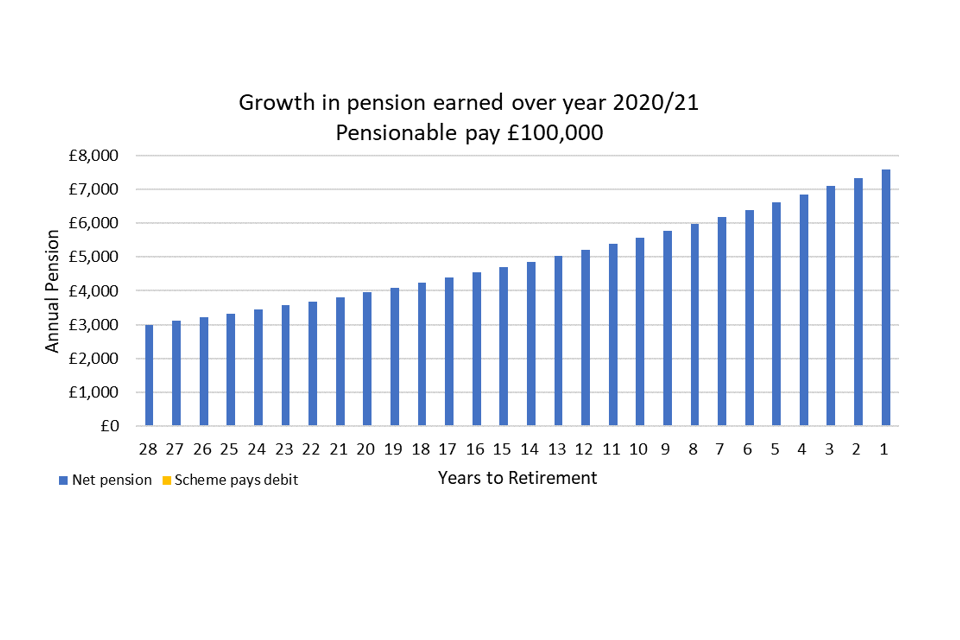

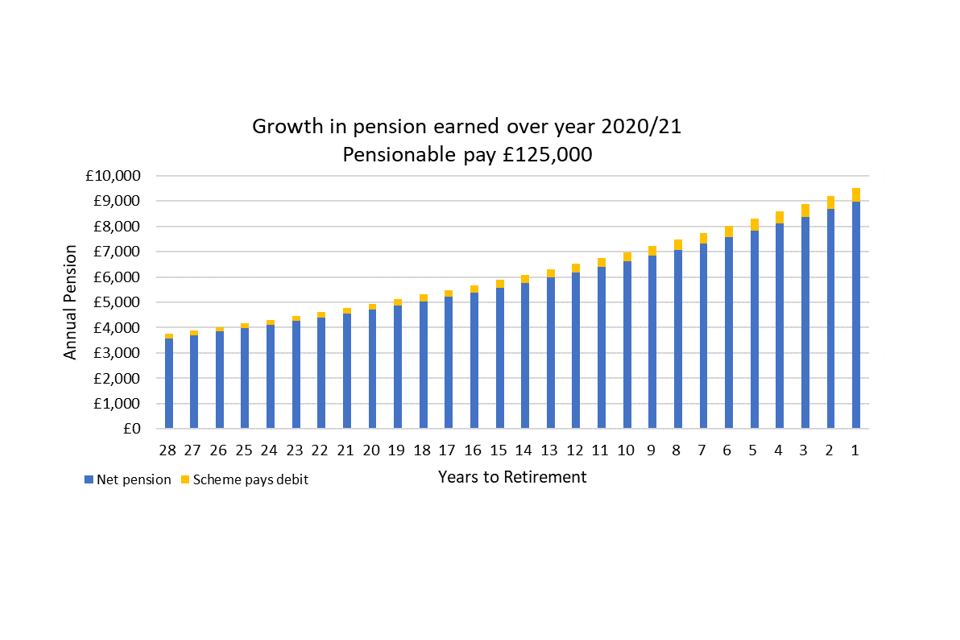

Chapter 7 provides detailed analysis from the Government Actuary's Department which shows that the Scheme Pays deduction at retirement, to deal with an annual allowance charge, is expected to be a relatively small proportion of the pension accrued that year. It may therefore be a sound financial decision to incur an annual allowance charge and use Scheme Pays to deal with it. Although Scheme Pays will reduce the value of the pension accrued, the growth in benefits represents a good return on the contributions made. Members are encouraged to seek regulated financial advice to explore their tax position and make informed choices about their pension.

4. The case for pension flexibility: summary of responses to Q1

This chapter presents a summary of responses received to Q1 which considered the staff groups in scope of the proposed pension flexibility

The case for pension flexibility

The consultation document recognised that the prospect or experience of annual allowance charges influences the behaviour of some NHS staff. Consultation respondents provided evidence that some doctors were choosing to manage their tax liability by reducing their NHS income to avoid crossing the taper threshold. NHS employers report that some consultants had or were planning to reduce their hours and decline additional discretionary work and responsibilities.

The consultation proposed pension flexibility as a more structured way for staff to balance their pay, pension growth and tax liability without having to change their NHS commitments. At present there is no flexibility within the NHS pension scheme for staff to adjust their pension saving to fit within their tax-free allowance. The consultation explained that the 'pay as you go' funding model for public service pensions meant that the reduction in contribution income through take up of flexibility has a short-term fiscal impact. Accordingly, the short-term cost of flexibility to the Exchequer needs to be weighed against the workforce benefits. The consultation stated that the government was prepared to provide flexibility to groups where there is evidence that their response to pension tax is affecting the delivery of public services.

The consultation proposed providing pension flexibility within the NHS Pension Scheme for clinicians whose work pattern and commitments mean they have a reasonable prospect of incurring an annual allowance tax charge. The rationale can be summarised as follows:

- there is evidence of behaviour change by consultants and GPs in response to the prospect of a tax charge. The nature of their work is typically sessional and enables a degree of flexibility over the level of commitments undertaken. In particular, additional work or responsibilities can be performed that attracts further remuneration. Managing annual allowance exposure by reducing the level of commitment to limit NHS income has a direct impact on service capacity

- the aim of the policy is to prevent the reduction of capacity in the NHS due to highly qualified clinicians leaving the workforce, turning down additional responsibilities or reducing their commitment to the NHS in order to manage their tax exposure

- the flexibility gives members an option to reduce the likelihood that they will incur large, regular annual allowance tax charges without requiring them to reduce their hours, not take on extra responsibilities, or leave the pension scheme

- the flexibility is not designed to advantage high-earning members but instead it is to neutralise or mitigate a disadvantage of continuing current working patterns or taking on further work and responsibilities while remaining a member of the NHS Pension Scheme

While the evidence of service impact is strongest for consultants and GPs, the consultation highlighted that other clinicians such as senior nurses and dentists can also incur annual allowance tax charges, particularly those with long service in the NHS Pension Scheme, and that they may have the flexibility in their roles such that they can choose to work fewer hours or not take on additional duties in response. Consequently, there is the potential for a similar impact on NHS service capacity and the delivery of patient care as that evidenced for senior doctors. The consultation invited and received evidence to test and confirm this position.

The consultation set out that there was a less clear case that annual allowance tax charges are creating similar retention and productivity issues in the non-clinical NHS workforce. While non-clinical staff may exceed their annual allowance, the department had not seen evidence that this caused a detrimental impact on capacity of NHS services and patient care. This may be because the nature of these roles provides less or no scope to vary or reduce working commitments or substantially increase their income through additional tasks and responsibilities. However, the consultation asked respondents to provide evidence of behaviour change of non-clinical staff that is detrimental to service delivery.

Clinical and non-clinical staff experience the tapered annual allowance in different ways, as the tapering calculation takes into account non-pensionable earnings. Non-pensionable work is more likely to be done by clinical staff, which can lead to them having a lower annual allowance and therefore a higher tax charge. However, non-clinical staff are less likely to perform non-pensionable work and will therefore will still benefit from an increased pension despite possibly incurring a tax charge, even net of Scheme Pays deductions.

Consultation question

The consultation sought views on the rationale for providing pension flexibility and to whom should it made be available. The following question was asked:

Q1. Who do you think pension flexibility should be available to?

Respondents were asked to choose from the following list and provide evidence to support their views:

- NHS GPs and consultants who may be affected by the annual allowance tax charge

- Other NHS clinicians who may be affected by the annual allowance tax charge

- Non-clinicians in the NHS who may be affected by the annual allowance tax charge

- All members of the NHS workforce, regardless of their tax position

- Other group

- None of the above

Summary of responses received to Q1

Three overlapping perspectives on eligibility were evident from the responses, with arguments raised for providing flexibility to:

- all clinical staff with a reasonable expectation of an annual allowance charge

- all staff with a reasonable expectation of an annual allowance charge

- all scheme members, regardless of their likelihood of a tax charge

The BMA argued that increased flexibility should be available to all NHS Pension Scheme members who are affected by pension taxation, and that to exclude non-clinical staff from the scope of flexibility would be divisive and unhelpful. The NHS Pension Board stated that flexibility should be made available to any scheme member with a reasonable expectation of a tax charge, to ensure that overall scheme participation levels are maintained.

Similarly, several respondents suggested that there could be equality issues if flexibility was provided only to clinical high earners with an expectation of an annual allowance charge, rather than all staff who incur such charges. The Royal College of General Practitioners highlighted that GP practices are often independent businesses, who meet patient demand with a small team of clinical and non-clinical staff. The fluctuating nature of their work can mean that both high earning clinical and non-clinical staff are required to take on additional work, and under the current proposal only the clinical staff would have access to flexibility. Several respondents suggested that the approach risked creating a two-tier workforce.

NHS Employers also argued that flexibility should be made available to all staff with a reasonable prospect of incurring a tax charge. They pointed to evidence showing that annual allowance charges were experienced by allied health professionals, scientists, long serving staff in both clinical and non-clinical roles paid according to the Agenda for Change framework, and very senior managers (VSMs). A survey conducted by NHS Employers shows that only 47% of board members are active scheme members, and trusts are reporting that VSMs are opting out of the scheme due to tax pressures and their inability to change their working pattern.

Consultation respondents set out 3 main arguments for extending flexibility to all scheme members who are impacted by the annual allowance.

First, there is evidence of VSMs opting out of the scheme, and there are also high vacancy rates for board level posts compared to clinical posts. The NHS Pension Scheme is a key part of the NHS reward package and therefore a key driver of recruitment and retention. Respondents argued the link between high vacancy rates for VSMs and the increased potential for poor performance, which reduces the quality of care provided to patients.

Second, the population of non-clinical high earners is small compared to clinical high earners, so the cashflow impact of extending flexibility is minimal.

Third, respondents highlighted the equality concerns of limiting the scope of flexibility to clinicians alone and excluding non-clinical high earners. These equality issues are expanded on in our updated PSED analysis at chapter 7.

The Shelford Group referenced evidence from the King's Fund, NHS Providers and the NHS Staff Survey in their consultation response. The King's Fund found that 37% of trusts reported having at least one vacancy at board level, and that certain board level positions had high vacancy rates; director of operations (9.4%), director strategy (9.4%) and HR director (8.6%). The King's Fund heard evidence that pension reforms to the lifetime and annual allowance have reduced the attractiveness of senior roles and dampened the enthusiasm of staff who might have applied for them. The NHS Staff Survey 2018 found that 31.4% of general managers agree or strongly agree with the statement that they often think about leaving their organisation, compared to 23.7% of medical and dental staff. 19.5% of general managers agreed or strongly agreed that they would leave their organisation as soon as they can find another job, compared to 9.9% of medical and dental staff. The NHS Staff Survey does not identify VSMs, so general managers are used as a proxy.

The Shelford Group also set out that limiting the scope of the proposed flexibility to clinical staff will create issues for 'clinical managers' such as medical and nursing directors. These senior staff split their time between clinical and non-clinical functions, meaning it is difficult to draw the line between work that qualifies for flexible accrual. Furthermore, the Shelford Group argue that excluding non-clinical staff will discourage clinicians from taking on further leadership posts, such as CEO roles. This view is supported by anecdotal evidence that pension tax is driving behaviour of non-clinical staff from a First Actuarial report, commissioned by NHS Employers, which says that senior managers are turning down promotions to avoid the annual allowance and are retiring early to avoid the annual allowance. Similarly, NHS Providers received evidence from trusts that not extending flexibilities to senior non-clinical roles risks deterring clinicians from taking on leadership roles which in turn deprives the NHS of valuable clinical leadership. They also highlighted that trusts value equitable treatment among their workforces and that targeted flexibility could be damaging to efforts to foster an inclusive and supportive culture.

The consultation set out that while the evidence of service impact is strongest for consultants and GPs, there is the potential for other clinicians such as senior nurses and dentists to also incur annual allowance charges. This is particularly true of staff with long service in the NHS Pension Scheme, and such staff may also have the flexibility in their roles such that they can choose to work fewer hours or not take on additional duties in response. The department therefore consulted on the basis that flexibility should be available to all clinical staff, including those beyond consultants and GPs, but invited evidence to test and confirm the position. Consultation respondents provided evidence to confirm that pension tax impacts other clinical staff. The Royal College of Nursing argued that senior nurses are impacted, and that nursing staff are changing their choices and behaviours in response to pension tax and are also turning down promotion to senior positions. The British Dental Association (BDA) provided evidence that 1 in 6 dentists under the age of 35 have opted out of the Scheme, 1 in 10 had brought forward their retirement date and a further 41% indicated that they are planning to do so.

Some respondents argued that flexibility should be available to all NHS Pension Scheme members regardless of their annual allowance position. GMB and UNISON concluded that all scheme members should have flexibility to improve the affordability of the scheme for lower earners and increase overall participation in pension saving. UNISON cited high opt outs amongst lower earners as an argument for extending flexibility to all staff, as their figures show that 87.18% of scheme opt-outs earn less than £30,000 a year. The NHS Pension Scheme Advisory Board and NHS Employers both expressed a similar view and suggested that affordability is a barrier to participating in the scheme for lower earners. The Royal Cornwall Hospitals Trust shared results from a survey of their staff which showed that 400 members of staff had opted-out of the NHS Pension Scheme. Around two-thirds had done left the scheme due to affordability, with only 20 clinicians opting-out to manage their pension growth for tax purposes. The senior clinical workforce is smaller than the wider workforce, so a direct comparison of opt-out numbers can be unhelpful.

Bevan Brittan argued that any offer which could increase take home pay should be offered across the workforce, and that lower earning staff have expressed an interest in having a cheaper albeit less generous pension offer. NHS Employers cautioned that providing flexibility only to high earning staff could create equality issues.

Government response

The department consulted on the basis that flexibility would be provided following strong evidence that the impact of the tapered annual allowance was prompting senior clinicians to reduce their working commitments or turn down extra work. Flexibility aimed to prevent the reduction of NHS capacity and give scheme members the ability to better manage their tax liability. The changes to the tax system announced at Budget achieve these goals without adding the complexity of flexibility.

We recognise the arguments made by respondents that flexibility should be provided to all members of the NHS Pension Scheme who have a reasonable prospect of annual allowance tax charges, including senior managers and other non-clinical staff groups.

We note the conclusion from NHS Providers that trusts value equitable treatment among their workforces and would view limited scope as divisive and damaging to their efforts to foster inclusivity. The tax solution applies to all scheme members, meaning non-clinical high earners can now earn at least an additional £90,000 before they reach the tapered annual allowance threshold. Scheme Pays is a proportionate way of dealing with a standard annual allowance charge, so the case for providing pension flexibility is diminished.

The department notes the arguments for providing pension flexibility to all staff irrespective of tax position, in particular to improve affordability and participation amongst lower earning staff. The government provides a rightly generous pension scheme for hard-working NHS staff to save for their long-term financial security in retirement. The tiered design of employee contributions is geared to provide lower earners with a discounted rate to encourage participation.

Several respondents pointed to scheme data Evidence provided by UNISON and GMB, supported by NHS Employers, shows that showing higher opt-out numbers are higher for lower earning staff. However, the scheme has a much larger population of lower earners, so it is unhelpful to compare total numbers. Respondents argued that high opt-out rates are damaging to scheme finances. The department has continued to monitor scheme participation rates using data from the Electronic Staff Register (ESR). Scheme membership remains high across all staff groups and Agenda for Change (AfC) bands, with typically 9 in 10 staff participating in the scheme. Between October 2011 and July 2019, the proportion of NHS staff who were members of the Scheme increased by 5.5%. Membership increased by 0.7% in the 12 months to July 2019 and 0.6% in the previous quarter from April to July. Participation increased for all bands of AfC up to but not including band 7, where it remained the same.

It is instead more helpful to compare opt-outs as a proportion of the earnings group. Annex A presents data from the NHS Electronic Staff Record (ESR) showing scheme participation figures at March 2020. Scheme participation rates is 89% for Agenda for Change band 2 staff. This compares to an 90% average participation across all NHS staff. While lower than other higher earning bands, the rate has been increasing since the introduction in 2013 of the requirements for employers to automatically enrol eligible employees into an occupational pension scheme. Participation rates in the NHS Pension Scheme compare favourably with private sector pension scheme participation. The Department for Work and Pensions published a report in June 2019 comparing the participation rates and savings trends between public and private sector pension schemes.

The report studied pension scheme data between 2008 and 2018. Although private sector pension scheme participation has risen since the introduction of auto-enrolment, participation in private sector schemes (85%) is still lower than the public sector (93%). The report also shows that scheme participation for lower earners in public sector schemes is higher than that of lower earners in private sector schemes.

The department keeps scheme affordability under review and agrees that maximising participation is important to ensure that all staff can benefit from pension scheme membership as a major element of their total reward package.

5. Flexible accrual facility: summary of responses to Q2 and Q3

This chapter presents a summary of the responses received to Q2 and Q3 which considered the flexible accrual facility proposal.

Flexible accrual facility proposal

The consultation proposed changing the NHS Pension Scheme to provide an optional 'flexible accrual facility' for staff with a reasonable prospect of incurring an annual allowance tax charge. The facility was designed to allow eligible staff to adjust their NHS pension saving to fit within their tax-free allowance, and so continue participation in the scheme. In outline, the proposal was to allow staff to:

- choose before the start of each scheme year (1 April) a personal accrual level and pay correspondingly lower employee contributions. The accrual level chosen would be a percentage of their normal accrual level in 10% increments. For example, 50% or 60%

- fine tune their pension growth towards the end of the scheme year by updating their chosen accrual level when they are clearer on total earnings. For example, go from 50% to 60%. The updated accrual level would be higher than the initial level and have retrospective effect from the start of the scheme year. Contribution arrears from the higher accrual level would be payable by the member and employer

Certain ancillary benefits such as a death-in-service lump sum, death in service initial survivor pensions, enhanced ill-health retirement would be payable in 'full'.

Where members take up flexibility, both the member and employer contribution are proportionately lower than the amounts that would otherwise be payable if the individual continued with full (unflexed) accrual. For employers this generates a saving. The consultation document noted that employers have the discretion to consider paying any unused employer contributions to members who take up flexible accrual.

Access to high quality information and tools to understand individual tax positions

The consultation document noted concerns that the complex interaction of tax, pay and pensions can take considerable amounts of individual time and resources to manage. To complement the introduction of new pensions flexibilities, the department would work with employers and staff representatives to ensure that those affected or concerned by pension tax have access to high quality education and information to understand their liability and how these new flexibilities can be best used to support individual circumstances and preferences.

The consultation document explained that the department would commission a modeller to help individuals assess options for using these flexibilities tailored to their personal circumstances. The intention was to support affected clinicians and their employers to agree programmed activities and other contractual commitments equipped with a clear understanding of their pension tax liability and how the flexibilities can be best deployed to deliver the right balance of incentives. Guidance and modellers commissioned by the department do not constitute financial advice, and staff are encouraged to seek professional advice when making financial decisions.

Consultation questions

The consultation asked the following questions on the suitability of the proposed flexibility and invited views on ways it could be developed further.

Q2. Do you think this proposal is flexible enough to balance their income, pension growth and tax liability?

Q3. If not, in what ways could the proposals be developed further?

Summary of responses received to Q2 and Q3

The previous chapter noted that most respondents considered the issue to be best solved through tax reform rather than pension flexibility. This is evidence in responses to consultation questions 2 and 3. 852 of 1161 respondents said they did not think the proposed flexibilities were enough to balance their income, pension growth and tax liability. Of those, 505 said that removing the annual allowance taper mechanism would be a more suitable solution. However, some respondents did provide views on the proposed flexibility.

The Royal College of General Practitioners welcomed the proposals and were broadly supportive of a more flexible NHS Pension Scheme. NHS Providers stated that the flexibilities will have a generally positive impact on clinicians' ability to manage their annual allowance tax liability, and Health Education England were broadly supportive of the proposals which align with the aim of the Interim People Plan to meet future healthcare demands. NHS Employers conducted a survey of employers in the NHS which found that 77% of employers feel that a tailored approach to accrual is flexible enough to allow clinicians to balance their income, pension growth and tax liability.

Respondents raised issues across a number of areas which have been grouped thematically.

Complexity and information

Several respondents, including the Royal College of Nursing, recognised that the proposed flexibilities would provide senior clinicians with a greater ability to manage their pension accrual, but highlighted that increased flexibility is likely to add to the complexity of the scheme. The NHS Pension Board also raised concerns about the proposed flexibilities adding to the administrative complexity of the scheme. Prospect concluded that the increased flexibility would be difficult to administrate and argued that clear communication will be needed to explain the details of the cost of ancillary benefits and reduced accrual to members and employers. The BMA stated that the proposed flexibilities are a much needed but temporary mitigation, with tax reform being the ultimate answer. The BMA also thought that the proposals would increase the complexity of scheme administration.

As well increasing the administrative complexity of the scheme, respondents expressed concerns that flexibility would make the scheme harder to understand for members. The ICAEW discussed the timing practicalities for making decisions on electing for flexibility. While this is relatively straightforward for salaried consultants, it is less so for GPs. Due to fluctuations in earnings during the year, and changes in practice profits, pensionable pay for GPs is sometimes not fully known until after the end of the scheme year. The ICAEW also pointed to delays in the processing of pension savings statements (PSS) and the administration of GP pensions by Primary Care Support England as a barrier to GPs properly using the flexibility.

Similarly, the BMA suggested ways in which the administration of the scheme could be improved to help members manage the impact of the annual allowance and the taper on their scheme benefits:

- all Total Reward Statements (TRS) should highlight that the value displayed for 1995 Scheme members who have purchased added years may not be accurate

- a letter to all affected 1995 Section members who have purchased added years setting out the potential inaccuracies of their TRS or PSS

- a review into the accuracy of PSS for those members with 1995 Section benefits who have purchased added years

- any member who receives a retrospective tax bill due to inaccurate added years data should be able to pay the charge using Scheme Pays, even if the deadline for Scheme Pays elections in that year has passed

- the Scheme Pays election deadline of 6 months should start from when the member receives their PSS from the NHS Business Services Authority (NHSBSA) rather from the end of the tax year.

- PSS should be available as part of TRS and be accessible electronically

- whileimprovements to online PSS are being made, all scheme members with pensionable pay in excess of £50,000 should automatically receive a paper PSS

- new TRS and PSS should contain a table of input data to enable members to check their PSS.

- previous version of TRS should be available to members online

- TRS should include consideration of additional pension and Early retirement Reduction Buy-Out (ERRBO) purchases

- the delays in information being provided to GPs as well as int inaccuracies and delays of information from PCSE must be resolved urgently

The Royal College of General Practitioners recommended that the Scheme Administrator explore options to provide 'live' in-year data on the accrual of pension benefits, to individuals in better understanding their pensions and the way these interact with wider tax and income. The Association of Independent Specialist Medical Accountants highlighted the increased strain that flexibility will place on the Scheme Administrator and asked whether the NHSBSA would have sufficient resource to implement it.

Alternative approaches or additional flexibilities

Respondents offered suggestions on how the proposed flexibility could be developed further. Income for the Third Age recognised that the greater the flexibility offer, the more opportunity for the member to balance income, pension growth and tax liability. They proposed a model where members could choose to accrue pension at 25%, 50%, 75%, 100% or 125%. The ability to revisit their choice in-year would not be needed as the option to accrue beyond 100% would allow for members to 'catch up' in subsequent years. The 125% option would be similar to the faster accrual facility currently offered in the Teacher's Pension Scheme. It was suggested that fewer accrual options would be easier to administrate and less complex for members to understand.

The University and Colleges Employers Association and the ICAEW argued that members should instead be able to apply a voluntary cap to their pensionable pay to allow greater control over their pension growth, and that members should have the ability to retrospectively change their pensionable pay cap.

The Royal College of General Practitioners concluded that the proposed flexibility overlooked the impact of the lifetime allowance, which they suggest is a potential prompt for GPs to take voluntary early retirement from the NHS. Several respondents noted that the Universities Superannuation Scheme had an 'enhanced opt-out' facility which would allow members to retain death in service and other ancillary protections without building further pension. They argued that a 'zero accrual' facility could help retain staff in service once they had reached their lifetime allowance or experience very high annual allowance charges. The University of Sheffield suggested that a zero-accrual facility could be suitable for members who have breached their lifetime allowance.

Employer contribution recycling

The majority of respondents, mainly doctors, argued that there should be mandatory recycling of unused employer contributions into additional pay if flexibility were implemented and taken up. The BMA strongly advocated that employers should be required to do this, as employer contributions represent part of the total reward package offered to NHS staff. They suggested a national approach could be devised where the employer continues to pay full employer contribution into the pension scheme. The scheme would then remit any unused contributions back to the member at the end of the year after any top up to pension accrual had taken place. Similarly, the BDA argued that there should not be a differentiated approach to recycling employer contributions back to members, as this would create equality concerns. The Royal College of General Practitioners also suggested that there be a new system for facilitating NHS Employers to pass on 'unused' employer pension contributions to staff who have either reduced their contribution rate, or who have opted out of the scheme altogether.

Similarly, the Hospital Consultants and Specialists Association argued that recycling should be mandated in order to avoid a 'postcode lottery' where some employers offer recycling and others do not, leading to a distorted labour market. They reported that a survey of their membership showed 56.6% would use flexibility only if it was accompanied by recycling.

The NHSBSA concluded that recycling of employer contributions is solely a matter for the employer, rather than an activity for a pension scheme administrator. Employers should consider, as the University of Sheffield suggested, flexible approaches to total reward for employees who have breached the lifetime allowance and maximised their ability for tax-free pension saving. This may include, where appropriate, contribution recycling for staff who opt-out of the scheme having breached the lifetime allowance.

Several respondents raised concerns about the impact of recycling employer contributions on employers who offer more than one pension scheme. The Ministry of Defence suggested that flexibility, with or without recycling, has the potential to put NHS Pension Scheme members of the armed forces in a more advantageous to position to that of members of the Armed Forces Pension Scheme. The Universities and Colleges Employers Association argued that recycling in the NHS Pension Scheme creates issues for Medical School employers who offer multiple public sector schemes.

Not all respondents recognised recycling as a positive step. NHS Providers argued that offering unused contributions to high earning staff who reduce their pension accrual manage their tax position would widen the gap between high and low earning staff groups. UNISON expressed discontent with the notion of contribution recycling as it has the potential to induce members to opt-out of the scheme and could undermine the NHS collective bargaining structures which are in place to deliver new pay agreements.

Ancillary benefits

Respondents were supportive of allowing members who reduced their pension accrual to retain ancillary benefits, calculated based on their unreduced pensionable pay. The Institute of Chartered Accountants in England and Wales noted that as they are greatly valued by scheme members and argued that the annual allowance should not force members to forego these benefits.

Respondents commented on how ancillary costs should be met where a member takes up flexibility and the effect on the amount available for employer contribution recycling. The consultation had proposed that the additional cost of paying ancillary benefits as if the member had not opted for flexibility, would be factored into the employer contribution payable under flexible accrual.

NHS Employers agreed with the consultation position that the amount available for recycling should be net of amounts that employers are required to pay to service past service deficits and cost cap corrections. Otherwise these elements would remain unfunded and as a mutual scheme the shortfall would feed through as a further pressure on the employer contribution rate at the next actuarial valuation of the scheme. NHS Employers concluded that it will be important to specify the amount available for potential recycling at each flexibility decile. Prospect highlighted the need for clear communications on the member and employer contributions required at each decile, to ensure fairness across employers.

The NHS Pension Scheme Advisory Board considered the position of a member taking up flexibility in comparison to the position of a member performing the same role but working less than full-time hours. The Board recommended that the department consider whether it is justifiable to offer more generous ill-health and death-in-service benefits to a flexible accrual member at no extra cost, compared to a part-time member when both members pay the same member contribution rate.

Government response

Complexity and information

The department recognises that the proposed flexibility would have created a degree of complexity for members in deciding the optimum level of pension growth to target based on their personal circumstances. Operating the flexibility would also have caused additional complexity for payroll providers and the scheme administrator in deducting the correct contributions from members and processing flexibility elections including revisions. The tax solution implemented by government therefore removes the need to introduce an additional layer of complexity.

As explained in chapter 7, the department has commissioned NHS Employers to produce a ready reckoner tool to allow members to anticipate a potential annual allowance charge.

The department recognises that obtaining up to date and accurate information on pension growth can be difficult for members, due in part to ongoing issues regarding NHS England's contract with Capita for the administration of GP pensions. NHS England hold a contract with Capita, who are responsible for the administration of GP pension records. As GPs are self-employed, Capita act as the employing authority in relation to their NHS Pension Scheme record keeping.

The Royal College of General Practitioners (RCGP) suggested that the NHSBSA should provide live pension accrual information to members. The NHSBSA has commenced development of delivering on demand pension information from their master IT system to members through the 'My NHS Pension' portal. They have undertaken extensive user research to understand their requirements and expectations with the aim of making tis available during 2021. However, the BSA is currently limited to annual updates of pay from employers, therefore, at best, the data available through 'My NHS Pension' will be data from the end of the previous scheme year.

The BSA has an ambition to move to receiving monthly updates from employers and have begun discussions with the Electronic Staff Register (ESR) as the largest NHS payroll provider about the feasibility of this. This is a significant piece of work but would make member digital experience more useful. This is likely to be a longer-term development.

In response to the BMA's suggestions to improve scheme administration, as of September 2020 the NHSBSA administration system is now able to automatically calculate the added years component for members who transitioned to the 2015 Scheme with legacy 1995 Section benefits.

Members can also expect to receive an annual benefit statement, typically in the form of a TRS. A mid-year TRS refresh went live in September 2020 which is the first bulk to use the new calculations and include the added years component for members with transitional service.

The election deadline of 31 July, of the year following the relevant tax year, is a legislative deadline for mandatory Scheme Pays that has been adopted by the NHSBSA for all Scheme Pays elections.

Notwithstanding that there are many reasons why a PSS may be delayed, most of which are outside the NHSBSA's control, HMRC guidance states that non-receipt of a PSS is no excuse for not submitting an estimated annual allowance tax charge by the election deadline. Where a PSS is unavailable before the election deadline, this does not mean that the member misses the opportunity to use Scheme Pays for that tax year. Members can make an election using their own estimate of the annual allowance charge. The estimate can be revised at any point for up to four years into the future. This provides members with the latitude to reassess their annual allowance tax liability and mitigates instances where there is delay or timing issues in BSA receiving the information necessary to produce a PSS in time for the election deadline.

The NHSBSA's remit is to provide a PSS for the 'relevant tax year', which includes pension input amounts for the previous three tax years. This is done automatically for members who exceed the standard annual allowance and on request for all other members. Extending the administrative effort so that paper statements are sent to all members earning over £50,000 would add a very significant cost and the benefit is unclear, given that members who think they may have a tax charge can already request a statement irrespective of earnings. The department and NHSBSA are mindful to keep scheme administration activities proportionate and economic, given that employers meet the cost of running the scheme.

The NHSBSA are considering the development of a portal to house all calculated TRS and PSS statements which members can access. This move should bring greater transparency for members.

NHS Pension Scheme members have expressed concerns, both in their responses to this consultation and elsewhere, about delays in receiving a Pension Saving Statement (PSS). A PSS confirms to an individual the change in value of their pension over a given year. Legislation requires that occupational pension schemes must send a PSS to each member whose pension growth in that scheme for the previous year exceeded the standard annual allowance of £40,000. Those scheme members should receive a PSS automatically by 5th October. Any members can request a PSS, for instance where they think their pension growth is lower than the standard allowance but also have further pension savings in another scheme, or their annual allowance has been tapered below the standard allowance.

The NHSBSA who rely on receiving timely and accurate information from employing authorities on pensionable pay and employment service to ensure they can accurately calculate pension growth and provide statements on time. The NHSBSA provided 20,945 mandatory PSS in 2016-17 and 12,655 for complete records in 2017-18 so far. This is alongside 18,357 on demand statements since 2nd August 2017. In response to the Association of Independent Specialist Medical Account's suggestion that the NHSBSA is under-resourced, we will consider whether the scheme levy needs to be increased to fund enhancements to scheme administration.

As many respondents have pointed out, there are issues regarding NHS England's contract with Capita which is leading to delays in information being submitted to the NHSBSA, and consequently delaying members receiving their PSS.

In August 2018, NHS England and Capita jointly appointed PricewaterhouseCoopers (PwC) to undertake a complete review of the pension service. They worked with the scheme administrator to implement a programme of work to address the issues as quickly and efficiently as possible. NHS England have a comprehensive action plan in place and a joint project is underway with Primary Care Support England (PCSE) to address the current and historical issues with GP pensions.

The review identified that 85% of incorrect or incomplete GP pension records relate to the two-year period 2015-17. During that time the BMA had advised their GP members not to complete end of year certificates confirming their pensionable earnings, as the BMA was engaged in a dispute with the department regarding the 'annualisation' rules that apply to the assessment of practitioner contributions. While remaining opposed to annualisation, the BMA in conjunction with NHS England are now instructing members to complete the necessary documentation to ensure their records are kept up to date.

Employer contribution recycling

The government provides a rightly generous pension scheme to ensure that NHS staff can build up financial security in retirement after dedicating their lives to looking after the nation's health. It follows that we wish to encourage staff to participate in the scheme.

The consultation document noted that NHS Employers had issued short-term guidance on possible local approaches that employers could consider taking to mitigate the impact of pension tax on their workforce in 2019 to 2020. This included consideration of recycling unused employer contribution into salary where an individual had opted out from the pension scheme due to tax concerns. The department notes the concerns raised about the potential for recycling to encourage members to leave the scheme. Increases to the tapered annual allowance thresholds mean that the vast majority of NHS Pension Scheme members are no longer impacted, and the incentive to opt-out of the scheme is now removed. NHS Employers have refreshed their guidance on local approaches that employers can take, particularly where staff have breached the lifetime allowance and therefore exceeded their allowance for tax-free pension savings.

6. Phasing the 'pensionability' of pay increases: summary of responses to Q4

The following section sets out responses received regarding the proposed phasing of pensionable pay increases, and responses to Q4 of the consultation.

Phasing pensionable pay increases

The consultation presented the scenario where one-off substantial increases in pensionable pay can create a spike in pension growth and a higher annual allowance tax charge that is not replicated in the subsequent years.

Large pensionable pay increases can occur as a consequence of contractual pay increments, promotions or taking on new significant duties such as a medical directorship.

The consultation therefore considered the principle of allowing phased pensionability of large pay increases, with pensionability defined as the amount by which the new pay level contributes towards the pension. The portion of the pay increase that is pensionable could be gradually increased (phased) to smooth pension growth spikes. For example, a 10% pay rise might be 50%, 75% and 100% pensionable over a 3-year period.

The desirability of phasing depends on the amount of final salary service that the member has. For members with CARE benefits only (or limited final salary benefits) it is possible that this option would not be beneficial and potentially leave them worse off than accruing their standard benefits with an associated annual allowance tax charge. Views were invited on whether this should be a member choice option.

The consultation also invited views on potential ways to give effect to phasing pensionable pay for high earning staff, should it be considered desirable following consultation. For example, the NHS Pension Scheme regulations defines what counts as pensionable pay. Alternatively, a formula could be used to regulate the amount of pay that is permissible as pensionable once a member earns above a threshold level and the pay increase is above a set percentage.

Consultation question

The consultation asked the following question:

Q4. We're proposing that large pay increases for high-earning staff should only be included in their pensionable income gradually. Do you agree or disagree with this proposal?

Summary of responses received to Q4

Responses to this proposal were largely positive, with respondents arguing that phasing pensionable pay increases would help senior clinicians to manage the impact of large pay increases on their pension tax position. The BMA recognised that the ability to phase pay increases would allow members to manage spikes in pay which could otherwise lead to an annual allowance charge. NHS Employers reported that 68% of the employers they had surveyed believed this would be a positive step and had evidence of staff turning down pay increases and pensionable National Clinical Excellence Awards due to the pension tax implication. The NHS Pension Scheme (Scotland) Scheme Advisory Board acknowledged phasing as a useful way to control pension growth from final salary benefits arising from large pay increases.

The BMA suggested that there should be employer contribution recycling where phasing is used, and also argued that members with transitional benefits between the 1995/2008 final salary scheme and active service in the 2015 Scheme should have a single pension input amount (PIA) for the two schemes combined. Currently a PIA, which presents the value of pension growth over a scheme year, is calculated separately for the 1995/2008 and 2015 Schemes. The BMA stated that a single PIA would negate the need for phasing.

A number of respondents argued that the ability to phase large increases in pensionable pay would add to the complexity of scheme administration and cloud a member's understanding of their tax position. The Royal Marsden NHS Foundation Trust said that phasing could create practical issues with overlapping of multiple pay increases being absorbed into pensionable pay. They also raised concerns about what should happen if a member leaves the scheme, leaves employment, or dies during the phasing period before the pay increase becomes fully pensionable. The NHSBSA agreed that the ability to phase pensionable pay increases would add to the complexity of administering the scheme.

In recognition that phasing would add to the complexity of scheme administration, and that it might not be the preferred option for all members, a large number of respondents questioned whether phasing of large pay increases should be optional or mandatory. The NHS Pension Scheme Advisory Board believed phasing should be optional, as did the Association of Independent Specialist Medical Accountants.

The BDA and individuals who responded using the template provided by the BMA explored the interaction between phasing of large pensionable pay increases and the recycling of unused employer pension contributions. These argued that it should be the member's choice to phase a pensionable pay increase and that unused employer contributions should be recycled on the full value of the pay increase. The concern was to avoid phasing resulting in a reduction of the overall total reward package.

The Association of Independent Specialist Medical Accounts also questioned how phasing could apply to GP Partners with fluctuating earnings. Although GPs have always had benefits calculated with reference to career average earnings rather than final salary, large variances in practice profits could lead to significant growth in the value of pension benefits. GP Partners are paid by an agreed share of practice profits, which may change year on year.

A number of respondents, such as the ICAEW, highlighted the possible impact that phasing of pensionable pay increases could have on the final pay controls policy. The Institute argued that phasing could cause issues for an employer where an employee who is close to retirement chooses to phase their pensionable pay, which may result in the employer receiving a final pay control charge.

Response to the points raised

The department notes the concerns raised by respondents that phasing, like accrual more generally, would have likely increased the complexity of the NHS Pension Scheme. This increased complexity would make the scheme increasingly difficult to administer and for members to understand. Updated analysis in chapter 7, discussed in chapter 3, shows that scheme pays is a proportionate way of dealing with an annual allowance tax charge that arise from large increases in pay. The ability to phase pensionable pay increases will therefore not be implemented.

7. Improving Scheme Pays: summary of responses to Q5

This section sets out responses to the proposed changes to Scheme Pays, and responses to Q5 of the consultation.

Scheme Pays

The Scheme Pays facility is an important method for scheme members to consider using to settle an annual allowance charge. Members can choose for the scheme to pay their annual allowance charge to HMRC on their behalf. The scheme recoups the value of the charge plus interest by deducting it from the member's pension benefits at retirement.

The advantage of using Scheme Pays is that members can meet annual allowance charges without needing to pay cash up front. The facility can also help reduce lifetime allowance charges as the pension is assessed against the lifetime allowance after the Scheme Pays deduction is applied.

All defined benefit occupational pension schemes have a mandatory Scheme Pays facility, while it is up to the individual pension schemes to extend the facility further to include voluntary Scheme Pays. Where a member uses Scheme Pays, legislation requires that a 'just and reasonable' actuarial adjustment is made to the value of member's pension benefits to account for the earlier payment of the annual allowance charge by the scheme. Schemes can therefore decide an appropriate method to use for their Scheme Pays facility. There are two methods used across the public service pension schemes: the 'notional defined contribution pot' (the NDC) method, and the 'debit' method.

The consultation explained that the NHS Pension Scheme currently uses the NDC method. This is where the scheme pays the annual allowance charge, but there is no immediate adjustment to the value of a member's pension benefits. The value of the annual allowance charge (plus the compounding interest) is converted to an amount of pension (and lump sum in the 1995 Section) at retirement. At that stage the amount is deducted from the value of the member's pension benefits at retirement.

The consultation set out that the Scheme Pays facility could be improved by making the method more transparent for members. The consultation invited views on switching to the 'debit' method used by other public sector schemes. Under the debit method, the pension value of the annual allowance charge is deducted from the value of the member's pension in the year it occurs, rather than at retirement. The debit is increased by the rate specified in Pension Increase Orders (typically the rate of CPI) each year to retirement and members are able to see the value of their pension minus Scheme Pays deductions on their annual benefit statements.

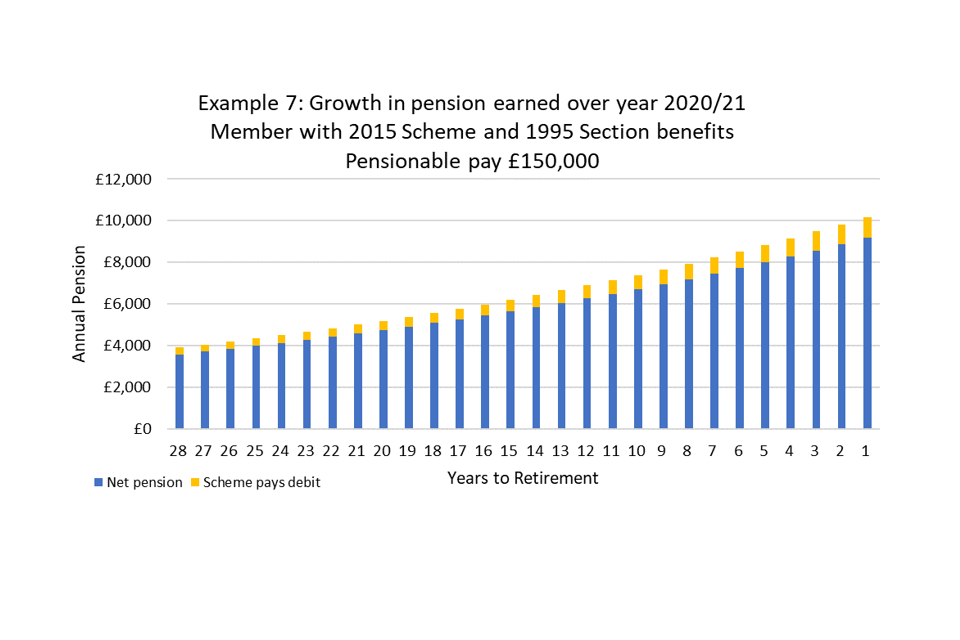

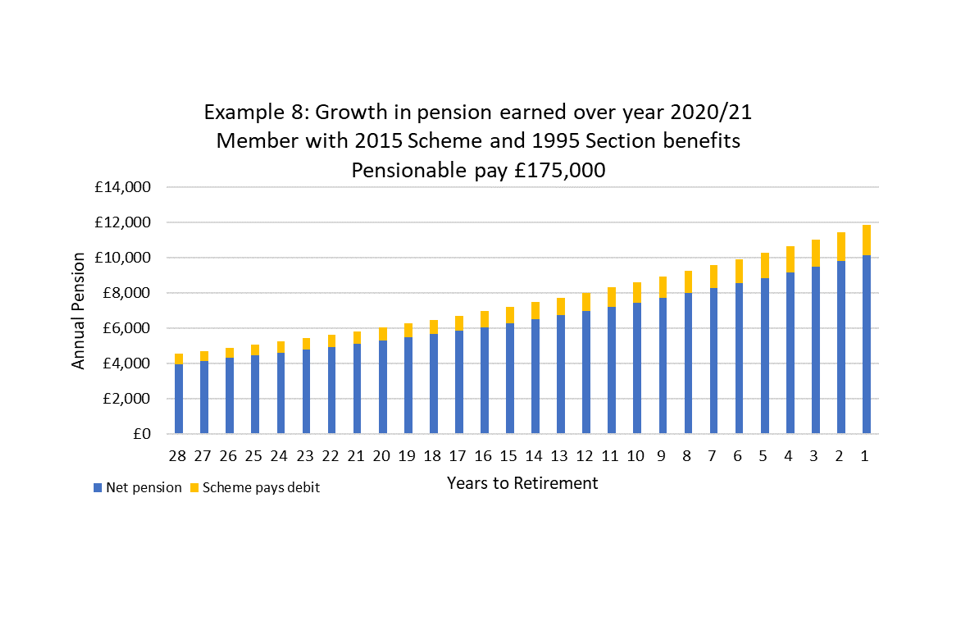

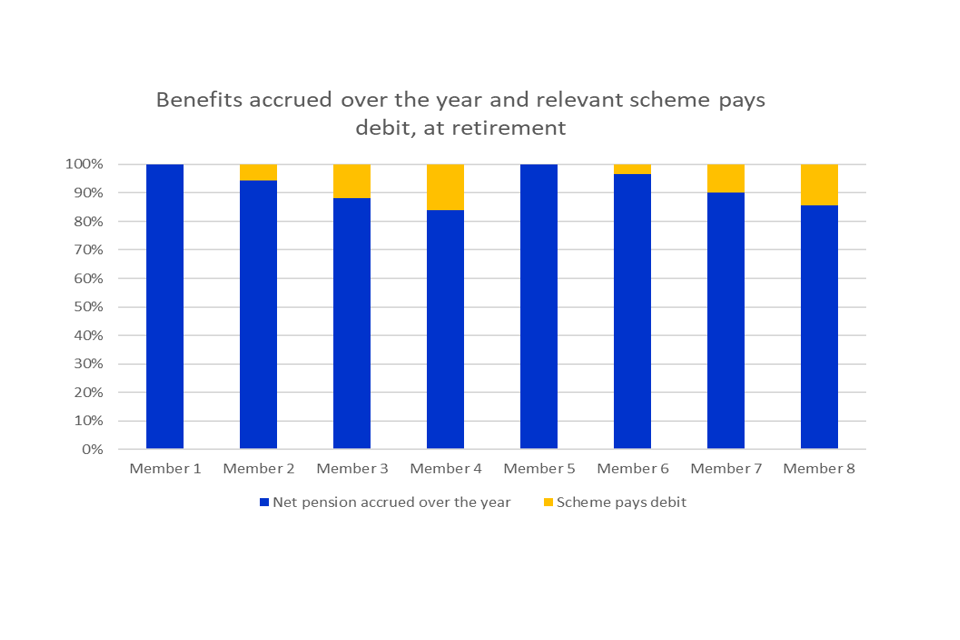

When the Scheme Pays facility was first introduced, the NDC method was adopted as the most suitable for the NHS Pension Scheme given the higher number of NHS Pension Scheme members who experience annual allowance who could request Scheme Pays, and the burden this would place on the scheme administrator. Across the public sector, the NHS has the greatest number of higher earners who are likely to be within scope of an annual allowance charge. The NDC method simplified the IT requirements around Scheme Pays at a time when the scheme administrator was under pressure to provide IT functionality to calculate the PIAs for all scheme members.