CMA Annual Plan consultation 2022 to 2023

Updated 24 March 2022

Consultation information

Scope of this consultation

The consultation is intended to give interested parties the opportunity to provide views and comments on the Competition and Markets Authority’s (CMA) proposed Annual Plan for 2022 to 2023, which sets out the organisation’s direction and main themes for the coming year.

Questions for the consultation

We hope that this draft Annual Plan gives you a clear indication of our proposed themes for the year ahead, and we look forward to receiving your feedback and suggestions.

We welcome views by email or using the webform on the consultation’s webpage, ideally with reference to the following questions:

- Do you agree with the overall direction and themes of focus for the CMA set out in the draft Annual Plan 2022 to 2023?

- Are there any changes that you think we should make to our main themes for 2022 to 2023?

Duration

2 December 2021 to 5pm on 21 January 2022

How to respond

When responding, please state whether you are responding as an individual or representing the views of an organisation. We ask that any comments be submitted in writing via the webform on the consultation’s webpage or by email to general.enquiries@cma.gov.uk by 5pm on 21 January 2022 at the latest.

For enquiries, please email general.enquiries@cma.gov.uk.

After the consultation

We will consider all responses to the consultation and publish a summary of the responses, along with a final version of the Annual Plan, by the end of March 2022.

Compliance with the Cabinet Office Consultation Principles

This consultation is compliant with the latest Cabinet Office Consultation Principles. The Cabinet Office Consultation Principles criteria can be found on the Consultation Principles guidance page.

Data protection and confidentiality

Please note that any personal data that you supply will be processed by us in line with data protection legislation.[footnote 1] We will only retain and use your personal data for the purposes of our work (to ensure that we take your response into account) and we will then securely delete it. We will not share your personal data with any third party.

For more information about how the CMA processes personal data, please see our Privacy Notice.[footnote 2]

We will summarise all responses and publish this summary. It will include a list of organisations that responded, but not people’s personal names, addresses, or other contact details.

Before publishing information, we will have regard to any restrictions placed on us by the law. If you consider that your response contains information which is commercially sensitive or confidential for some other reason, please identify it, mark it as commercially sensitive or confidential and explain why.[footnote 3]

Please note that information and personal data supplied to us in consultation responses may be the subject of requests by members of the public under the Freedom of Information Act 2000 (FOIA).[footnote 4]

Feedback about this consultation

If you wish to comment on the conduct of this consultation or make a complaint about the way this consultation has been conducted, please send an email to: general.enquiries@cma.gov.uk

Susan Oxley, Director of Strategy, CMA

Foreword

During the past year, the CMA has risen to the significant challenges arising from the need to assume substantial additional responsibilities as a result of the UK’s departure from the European Union (EU), while responding quickly and effectively to protect consumers and assist businesses by tackling issues arising from the coronavirus (COVID-19) pandemic. We have launched the shadow Digital Markets Unit (DMU), set up and launched the Office for the Internal Market (OIM), and recommenced our work on the UK’s future subsidy control regime by preparing for the creation of the Subsidy Advice Unit (SAU), each of which brings a new set of powers, functions and responsibilities. We have also published the first Annual State of Competition report. At the same time, the volume of complex, multinational merger and antitrust cases, often with a digital focus, continues to grow.

In the coming year, as the UK continues to emerge from the coronavirus pandemic, promoting competition will be more important than ever before. Competitive markets are essential to creating the conditions for investment and sustainable long-term growth in the UK. They drive innovation, increasing our productivity, meaning we can produce more with less.

The cost of weak competition is borne by consumers in the form of higher prices and lower quality. This raises the cost of living, and it can hit the poorest households hardest. With fewer suppliers to choose from, and less innovation, consumers also suffer from reduced choice. That is why we will continue to be ambitious in our plans, delivering benefits for consumers and businesses in all parts of the UK. We will work relentlessly to protect consumers from unfair business behaviour. We will respond quickly and effectively to significant problems identified in markets, promoting competition with a focus on supporting the UK’s path to sustainable economic recovery and future growth.

The CMA has an important role to play in building trust and confidence when people buy goods and services, which will be critical to the economic recovery. We will continue to focus on high impact enforcement of competition and consumer law. We will remain alert to the risk of anti-competitive collusion, to mergers seeking to reduce competition and capitalise on the financial distress of businesses, and to attempts to exploit consumers, small and medium-sized enterprises (SMEs) and microbusinesses.

In 2021/22, we secured hundreds of millions of pounds of refunds for consumers affected by the impact of the pandemic and related restrictions. We will continue to progress our extensive portfolio of consumer protection cases to ensure consumers have confidence in markets, knowing their rights will be upheld, when they buy goods and services.

We are making strong progress with our substantial portfolio of mergers and antitrust cases, that would previously have been dealt with by the European Commission (EC). For example, we are consulting on the undertakings from Google in relation to concerns about their proposal to remove third-party cookies from Chrome. We are investigating the merger of NVIDIA/Arm in parallel with the EC and the US. We will take on more such cases in the coming year.

We recognise the vital importance of the UK’s commitment to net zero. We will continue to prioritise cases where practices could impede the successful transition to a low carbon economy, building on work such as the electric vehicle charging market study, the investigation into long-term exclusive arrangements in the supply of chargepoints and the CMA’s Green Claims Code, which is part of wider awareness campaign for both businesses and consumers on the claims businesses make about their ‘green credentials’. In early 2022, we will deliver our advice to government on how the competition and consumer regimes can better support the UK’s net zero and sustainability goals.

The DMU has been established in shadow form. Once operational, it will oversee a new regulatory regime for the most powerful digital firms, promoting greater competition and innovation in these markets and protecting consumers and businesses from unfair practices. In the meantime, we will continue to progress cases in the digital sphere.

We have made strong progress delivering the goals set out in our 2020/21 Annual Plan despite the restrictions in place due to the pandemic. We are in the process of restarting some activities such as inspections and site visits. These are important tools in support of much of our casework.

We are committed to continuing our work to better understand the issues facing consumers, including the vulnerable; to explain our decision-making and how it helps consumers; and to be a more visible, vocal advocate for consumers. Through our work under the CMA 2020s initiative, we have been engaging with a wider and more diverse range of stakeholders than ever before, including more direct engagement with consumers, small businesses, local authorities and charities across the nations and regions of the UK.

We will continue to grow the CMA’s presence across the nations and regions of the UK in order to be closer to consumers and to improve our understanding of, and ability to tackle, the distinct issues faced by people across the UK. We will grow our existing presence in Cardiff, Belfast and Edinburgh; and we will set up a new Microeconomics Unit (MU) in Darlington, as recommended in the independent report by John Penrose MP.[footnote 5] The MU will expand the existing economic research and evaluation function, produce the annual State of Competition report and carry out research into supply-side reforms to improve productivity. We are also opening an office in Manchester, which will be the home of the new DMU.

We will continue to strengthen our relationships with national and international partners and agencies, leading the thinking on cutting-edge developments in competition and consumer policy across the world. In a first for digital regulators in any country, we will build greater clarity and consistency in digital regulation through the newly established Digital Regulation Cooperation Forum (DRCF). Working with our counterparts in the Financial Conduct Authority, the Information Commissioner’s Office and Ofcom, we will enable coherent, informed and responsive regulation of the UK digital economy which serves citizens and consumers and enhances the global impact and position of the UK.

Our work embedding our new functions and responsibilities is well underway. We remain alive to the ongoing difficulties faced by businesses and markets, as we emerge from the pandemic. We will continue to be ambitious in our drive to promote competition and protect consumers, prioritising the areas of work that will deliver the greatest impact for consumers, business and the economy.

We are now consulting on the themes that we intend to focus on in 2022 to 2023. The CMA will continue to fulfil its duty to promote competition and protect consumers, as well as embedding its new functions. We propose to do so with a focus on the following themes:

The image shows our key themes as follows: Protecting Consumers; Fostering competition to promote long term growth right across the UK; Promoting competition in digital markets; Supporting low carbon growth; Delivering our new responsibilities

The UK government has identified a package of legislative reform proposals and areas for further consideration in its consultation, ‘Reforming Competition and Consumer Policy: Driving growth and delivering competitive markets that work for consumers’.[footnote 6]

Taken together, the CMA considers that these proposals would promote fair, open and competitive markets and protect the interests of consumers, as well as helping fair-dealing businesses to grow, enter new markets, and compete with large incumbents.

Our achievements in the past year and the delivery of our far-reaching plans for the coming year rely on the hard work, commitment and dedication of our colleagues. We would like to thank all of the staff at the CMA for their efforts, including those who work on the delivery of our statutory functions, those who provide expert legal and economic advice and those who perform essential supporting roles, in areas from facilities management to information technology systems, during these exceptional times.

Photo of Jonathan Scott

Jonathan Scott, Chair of the Competition and Markets Authority

Photo of Andrea Coscelli

Andrea Coscelli CBE, Chief Executive of the Competition and Markets Authority

About the CMA

The CMA is an independent non-ministerial UK government department and is the UK’s principal competition and consumer protection authority. We work to ensure that consumers get a good deal when buying goods and services, and that businesses operate within the law. Our statutory duty is to promote competition, both within and outside the UK, for the benefit of consumers, and our mission is to make markets work well in the interests of consumers, businesses and the economy.

We derive our powers from the Enterprise and Regulatory Reform Act 2013[footnote 7] and our work is overseen by a Board and led by the Chief Executive and senior team. Decisions in some investigations are made by independent members of the CMA Panel.

Our functions include:

- Investigating mergers that have the potential to lead to a substantial lessening of competition. If a merger stands to reduce competition, the CMA can block it or impose remedies to address such concerns;

- Conducting studies, investigations or other pieces of work into particular markets where there are suspected competition and consumer problems. The CMA can take action – and recommend action be taken by others – in markets where competition may not be working well;

- Investigating businesses to determine whether they have breached UK competition law and, if so, to end and deter such breaches, including by fining businesses and seeking the disqualification of directors of the companies involved, as well as pursuing individuals who commit the criminal cartel offence;

- Enforcing a range of consumer protection legislation, tackling issues which suggest a systemic market problem, or which affect consumers’ ability to make choices;

- Promoting stronger competition in the regulated industries (gas, electricity, water, aviation, rail, communications and health), working with the sector regulators;

- Conducting regulatory appeals and references in relation to price controls, terms of licences or other regulatory arrangements under sector-specific legislation;

- Giving information or advice in respect of matters relating to any of the CMA’s functions to the public, policy makers and to Ministers about how they can design and implement policy in a way that harnesses the benefits of competition, and protects and promotes the interests of consumers; and

- Providing technical advice, reporting and monitoring in relation to the UK internal market.

- From Autumn 2022, providing advice, reporting and monitoring in relation to the SAU.

We adopt an integrated approach to our work, selecting those tools we believe will achieve maximum positive impact for consumers and the UK economy.

We have a UK-wide remit. As well as our London office, where most of our staff are based, we have a significant presence in Edinburgh as well as offices in Belfast and Cardiff. We are also opening an office in Manchester which will be the home of the new DMU, and will be setting up a new Microeconomics Unit in HM Treasury’s Darlington campus.

The CMA is committed to being a great place to work. We want our staff to work in an organisation that is continually learning and improving, providing them with an excellent work life experience and career development opportunities. Our People Strategy ensures delivery of that ambition, with priorities under Culture, Capability, Commitment and Capacity.

Under our hybrid operating model, we want everyone to feel a strong sense of belonging and connectivity with a CMA that is modern, resilient and forward thinking. We are embedding a culture and ways of working that reflect our UK-wide presence, enable us to do our best work and lead balanced and healthy lives, all built on a foundation of inclusivity and respect. This will enable us to continue to attract and retain talented people in a competitive labour market.

Building a diverse and inclusive workforce, including at senior levels, that reflects and understands the public we serve remains a priority for us. We have made good progress in delivering our 4-year diversity and inclusion strategy which goes significantly beyond the minimum requirements of equality legislation. In 2022 we will press ahead with our 2-year focused action plan that enables the delivery of the strategy. We will soon be publishing our first Disability Action Plan, aligned with the national strategy, to support the career progression and opportunities for disabled colleagues.

As part of our Race Action Plan, we have made some progress in supporting career progression for under-represented groups, but there is more we must do. In the coming year we will embed the operation of our Advisory Committee to lend a more diverse perspective to Executive- and Board-level decision making and actively seek to improve our diversity at senior levels within the organisation, with a particular focus on ethnic minority representation.

Overview of the CMA’s recent and ongoing activity

We will enter 2022 to 2023 with a substantial volume of ongoing work. At the time of publication, we have 14 competition enforcement cases, 13 consumer protection cases, 36 merger investigations (including 5 Phase 2 reviews), 3 market studies and a market investigation under way. So far in the year 2021/22, since April 2021, we have issued 2 infringement decisions, imposing £367.8m in fines. In addition, 3 of our decisions have been appealed to the Competition Appeal Tribunal. All our cases can be found on our CMA cases page.

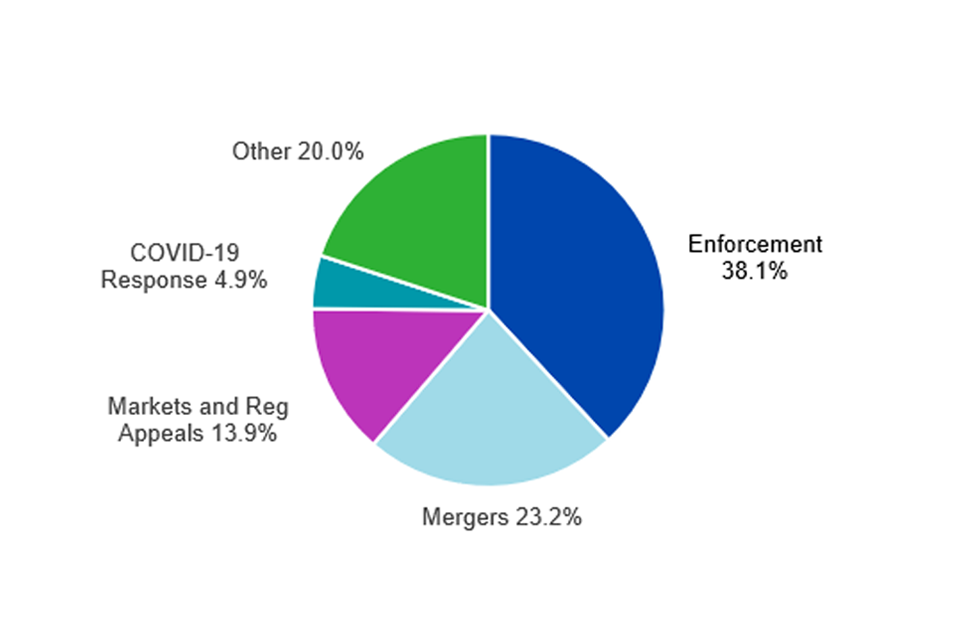

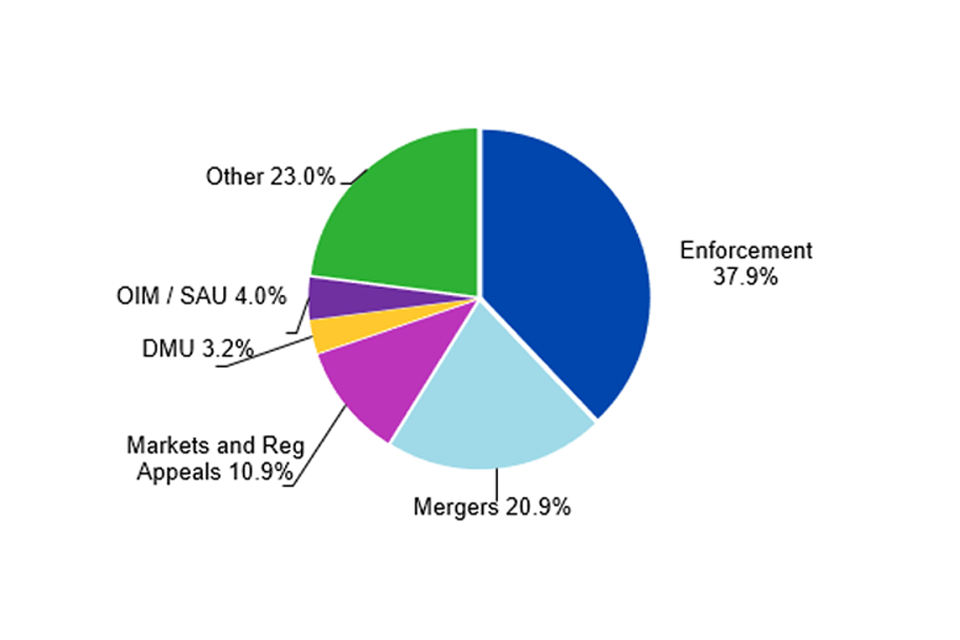

The charts below illustrate how CMA staff time has been split across different types of work over the past 2 years.

The distribution of staff time for the period October 2020 – September 2021 includes resources allocated to our newly established functions, namely the DMU and the OIM. The latter category also includes preparatory work for the SAU (established by the Subsidy Control Bill 2021 and currently going through Parliament). The ‘Other’ category includes the following project areas: Policy and International, Advocacy and Pipeline, as well as our work on the Digital Markets Taskforce and State of Competition projects.[footnote 8]

Whilst the share of total staff time allocated to mergers, markets and regulatory appeals appears to have fallen over the 2 periods, the absolute numbers of staff working across these functions has increased. The CMA has recruited successfully, expanding to fulfil its new functions and responsibilities, enabling us to increase the numbers undertaking our important work in enforcement, mergers, markets and regulatory appeals.

Our work responding to COVID-19 is not presented separately for the period October 2020 – September 2021. Much of this work is now embedded in our day to day activity and carried out within teams across the CMA.

Distribution of staff time Oct 2019 - Sep 2020

"

Distribution of staff time Oct 2020 - Sep 2021

Note: ‘Other’ incorporates tool/project areas (for example Policy, Advocacy, Pipline and Litigation) which staff record time against.

Our main themes for 2022 to 2023

Competition is good for consumers and good for business, and it also brings wider economic benefits. It helps ensure that people get a greater choice of better products and services at lower prices. It rewards those businesses which invest in the development of new and improved products to meet people’s needs. It spurs businesses to seek more cost-effective ways of making and selling those products, so boosting productivity, innovation and sustainable economic growth.

It is also important that consumers are well-informed, active and able to shop around to find the best deals. This drives companies to seek to win business by competing on range, quality, price and innovation.

However, it can be confusing and time-consuming for consumers to shop around; and the practices of some suppliers can exacerbate these problems in some markets. The most vulnerable in our society, such as those on low incomes; people without access to online services or those who struggle to use them; or people with poor mental health who may avoid or fear change, can face even greater challenges engaging in markets.

We want to ensure that as consumers, we all get more of what we want at the best possible price, while improving productivity and facilitating sustainable growth, job creation and better living standards in the economy as a whole.

The CMA intervenes where necessary to promote competition and protect consumers or when it believes it can improve the way in which markets work. The CMA’s interventions therefore seek to promote open competition and to encourage greater availability of products and services. The provision of accurate, non-deceptive information between businesses and customers is crucial to underpinning consumer trust. Where that is not possible or sufficient, our experience shows that different interventions may be necessary, for instance remedies which actively help consumers to interact in markets or shop around.

We remain committed to ensuring that we deliver significant positive outcomes for consumers, businesses and the economy using the full range of our existing toolkit. We will continue to enforce competition and consumer law; and carry out merger investigations and our markets work. We will also continue our work of advising governments and public authorities across the UK in designing and implementing policy for economic recovery in a way that harnesses and improves competition and protects the interests of consumers.

This is crucial at a time when governments will be very active, intervening in more markets in new or more in-depth ways, often at pace, seeking to address the ongoing impact of the pandemic and stimulate post-pandemic growth across different sectors.

We will maintain our work in relation to medium and smaller businesses, which play an essential role in economic growth and many of which have been particularly affected by the pandemic, as they can also be the victims of anti-competitive practices.

Some of the CMA’s work, such as merger control, is ‘non-discretionary’: it must be carried out irrespective of the wider context in which the CMA operates; and there are statutory deadlines which apply. We have more discretion with much of our other work and the CMA must decide how to prioritise this in a way that best delivers on its statutory duty to promote competition for the benefit of consumers.

We prepared well to take on our new responsibilities after the UK exited the EU, planning for new functions, recruiting many new staff, including recruiting in Edinburgh, Cardiff and Belfast to help equip us with greater knowledge of priorities in the constituent nations of the UK. However, this is a period of considerable change for the CMA, as for many others. The number and complexity of the mergers and antitrust cases we are reviewing is continuing to increase; we are expanding our work in digital markets ahead of the launch of the DMU; we have launched the OIM and are planning for the establishment of the SAU. Although these challenges will continue to limit our flexibility in what we can deliver this year, we will continue to be ambitious in our plans to focus on issues that really matter to UK consumers. We will ensure that our work is directly relevant to people’s everyday lives and that we further cement the CMA’s place at the heart of UK economic life.

In this context, we will continue to promote competition and protect consumers, as well as embedding our new functions. When exercising our functions, we propose to focus on the following themes:

- Protecting consumers from unfair behaviour by businesses, during and beyond the COVID-19 pandemic

- Fostering competition to promote innovation, productivity and long term growth right across the UK

- Promoting effective competition in digital markets

- Supporting the transition to low carbon growth, including through the development of healthy competitive markets in sustainable products and services

- Delivering our new responsibilities and strengthening our position as a global competition and consumer protection authority

Protecting consumers from unfair behaviour by businesses, during and beyond the COVID-19 pandemic

We will focus our work on taking tough action to protect consumers from anti-competitive and unfair trading practices by businesses, during and beyond the pandemic. It is particularly important that we continue to engage with consumers, across each of the nations and regions of the UK, including those who may be experiencing vulnerability, to seek to understand their needs as we deal with the ongoing impact of the pandemic. Many more people are likely to have experienced vulnerability, as a result of the pandemic, and there could be a rise in the number of consumers vulnerable to some form of exploitation. Increases in the cost of living, particularly for essential products and services, and the consequences for real disposable income, will limit the choices available to some consumers, leaving them more exposed to less scrupulous traders. These effects can be more pronounced for the lowest income households. The harmful effects of any unfair and anti-competitive practices are likely to be felt particularly acutely by vulnerable consumers, who may be less able to afford the higher prices and less able to go to a different shop, or to go online, to get a better deal.

We will continue to progress our work responding to the harmful practices that emerged during the pandemic. In 2020/21 we secured commitments to refund consumers for package holidays that were cancelled due to the restrictions imposed as a result of the COVID-19 pandemic. We also wrote to over 100 package travel firms reminding them of their obligations under consumer law.

We have advised the government on ways to make the PCR testing market work better and we opened investigations into 2 PCR testing firms who may be breaking the law. We will consider taking further action in this area where necessary. Some firms have been accused of having failed to provide tests and results in a timely manner or at all. Others appear to falsely advertise tests at very low prices when they are either not available at that price or include hidden conditions, such as where the tests must be collected from.

We will continue to act in areas where we receive the highest volume of complaints, as we did in the package holiday sector and PCR testing market. We will also continue to follow up with those companies that previously provided undertakings agreeing to refunds for services disrupted by the restrictions as a result of COVID-19 then failed to pay them. We will work to rebuild consumer trust in areas affected by the pandemic, and we will work closely with businesses to help them demonstrate that they are treating customers fairly.

We have continued to work with other regulators, international and domestic partners including Trading Standards, Which? and Citizens Advice, to help get the best possible understanding of the challenges facing consumers during the pandemic. We will continue this outreach, including plans for a rolling programme of visits to Citizens Advice, and look to embed the activities into the core of how we go about our day to day work across the organisation. Going forwards, we will also embed the practices we initiated through our ‘Getting closer to the third sector’ work (see Understand markets and consumers better section), which has helped us to develop our understanding of the changing needs of consumers and how they experience markets. We will continue to engage with these organisations on a longer-term basis and use the intelligence gained from these interactions to help inform our work.

In addition to our work directly linked to the impact of the pandemic, we will also continue to progress enforcement in other areas of consumer protection law. We will focus on supporting the economy as it emerges from the pandemic, both by protecting consumers through targeted enforcement action and supporting businesses with guidance on what they need to do to comply with the law. We will continue to take action in a variety of markets where consumers suffer detriment on issues such as leasehold housing, misleading green claims, fake and misleading online reviews, and social media endorsements.

We will ensure our actions tackle problems affecting consumers right across the nations and regions of the UK. We recently wrote to Danske Bank, one of the largest banks in Northern Ireland, regarding a second breach of the SME Banking Undertakings, after they failed to refund all customers affected by their first breach.

We are committed to continue to investigate areas where poorly functioning markets are affecting members of society who may be particularly vulnerable due to their circumstances. As a direct result of CMA action, there are now legal obligations in place to assist funeral directors and crematorium operators to better support their customers in arranging a funeral that meets their needs and budget. The new legal obligations are set out in the Funerals Market Investigation Order 2021. The legal requirements for funeral directors include displaying a Standardised Price List in their window at their premises and on their website.

We have also published the interim report of our market study into children’s social care provision, including children’s homes and fostering, outlining significant concerns about the availability of placements and the profits of private providers. Our interim report found that there are too often no placements available that fully meet the needs of children. We are now considering ways to tackle these issues, including recommendations to the UK and devolved governments. Our priority remains identifying the best ways to ensure children can get the right care. Our final report is due to be published in March 2022. To test our thinking, we will be holding a number of workshops involving a range of stakeholders from England, Scotland and Wales (the nations within scope of the market study), given the different policy, legislative and regulatory frameworks in each of those nations.

We published IVF guidance to ensure patients are treated fairly, and in line with their consumer rights. We will be closely monitoring the sector and will consider enforcement action if we believe businesses are not complying.

In competition enforcement, we will continue to prioritise cases where customers are unable to buy products at the best price. In the musical instrument sector, we issued 2 musical instrument makers a total of £5.5 million in fines for preventing retailers from offering discounts, a practice known as resale price maintenance. We are also investigating suspected breaches of competition law in respect of the supply of domestic lighting products, again relating to suspected resale price maintenance.

We will conclude our ongoing investigations into companies that are suspected of charging excessive and unfair prices or of engaging in anticompetitive conduct, with a view to ensuring that the NHS, and ultimately the taxpayer, does not pay more than they should for essential medicines and treatments, and that consumers who depend upon these drugs and treatments do not lose out. In competition enforcement, we have concluded our 2 largest Competition Act investigations in the pharmaceutical sector, resulting in over £360 million in fines being imposed. We found that the pharmaceutical company Advanz charged excessive and unfair prices for supplying liothyronine tables which are used to treat thyroid hormone deficiency. In another case, we found that Auden Mckenzie and Actavis UK charged the NHS excessively high prices lasting almost a decade for hydrocortisone tablets. Both decisions are currently under appeal to the Competition Appeal Tribunal (CAT).

We will continue to investigate mergers to ensure that consumers across the UK do not lose out as a result of more concentrated market structures, which can lead to poorer outcomes. We recently accepted undertakings for the completed acquisition by Bellis Acquisition Company 3 Limited of Asda Group Limited after competition concerns were raised. We were concerned that the purchase could lead to higher petrol prices in some parts of the UK.

Our Behavioural Hub[footnote 9] provided crucial underlying analysis and support for consumer enforcement cases, including against McAfee and Norton, who recently settled with the CMA offering pro-rated refunds to customers who have been auto-renewed, when they did not want to renew their subscriptions. These behavioural insight specialists will continue to work closely with our consumer, markets, and remedies teams; including with the aim of furthering our knowledge of consumer vulnerability, and potential measures to alleviate it.

We welcome the proposals laid out in the UK government’s consultation on reforms to competition and consumer policy.[footnote 10] Taken together, these proposals will promote fair, open and competitive markets and protect the interests of consumers. We remain of the view that stronger consumer protection law and stronger powers for the CMA – including the introduction of administrative decision-making and fining powers for civil infringements – would help to prevent and address more effectively some of the harmful practices that might arise as the economy recovers and adapts.

Fostering competition to promote innovation, productivity and long term growth right across the UK

We have a duty to promote competition for the benefit of consumers, and we aim to make markets work effectively. The CMA’s work will focus on promoting competition and protecting consumers to encourage innovation, productivity, and sustainable economic growth, as the UK continues to deal with the ongoing impact of the pandemic. The CMA will secure this by:

- blocking or remedying anti-competitive mergers, and by punishing and deterring businesses which agree to restrict competition (for example by fixing prices or sharing markets), or abuse their market power by using it to dampen competition or exploit customers;

- taking tough action in enforcing consumer protection law, to protect consumers and ensure they are not treated unfairly by businesses, and to help them get redress when problems occur;

- taking action – and recommending action be taken by others – in markets where competition may not be working well; and

- advising governments across the UK in designing and implementing policy in a way that harnesses competition and protects and promotes consumers interests.

As we emerge from the pandemic, there are a number of risks to competition. Businesses may fail at a higher rate as the economy recovers and adjusts to a new normal in which consumer preferences have changed eg an increased preference for and willingness to shop online. These same pressures have prompted new businesses to merge, or to be acquired by stronger competitors. Meanwhile, trade has been impacted by a number of factors, including restrictions on travel and increases in shipping costs. All of these factors tend to reduce competitive pressure on businesses within the economy, with potentially adverse consequences for consumers, businesses and the wider economy.

We will remain vigilant, using our powers against conduct that would harm consumers. The CMA will carefully assess mergers which could weaken competition, raising prices and reducing quality, innovation and choice, and address possible breaches of competition and consumer law. We will clamp down on cartels and other collusive behaviour which seek to keep prices up, imposing fines on businesses that break the law. To this end, we are currently investigating suspected anti-competitive arrangements in the financial services sector, and also in the supply of construction services in Great Britain.

We will continue to use our director disqualification powers in competition enforcement cases to ensure individual accountability for wrongdoing. Since the power was first used in 2016, we have secured 24 director disqualifications, covering directors involved in a range of sectors, including construction, pharmaceutical and estate agency. We currently have a number of director disqualification cases in the pipeline, including ongoing proceedings to disqualify a director for his involvement in an information exchange infringement arising out of the CMA’s Nortiptyline investigation.[footnote 11]

We will promote growth across all of the nations and regions of the UK by remaining alive to issues that threaten competition in the Devolved Nations. We are currently investigating CHC’s completed purchase of Babcock’s Aberdeen-based oil and gas offshore helicopter business. We are concerned that the loss of one of only 4 suppliers could lead to higher prices and lower quality services for customers.

We will not hesitate to take legal action when businesses fail to comply with legal requirements imposed during an investigation, such as a requirement to provide requested information or a requirement to comply with an initial enforcement order.[footnote 12] We recently took Norton, a leading anti-virus software supplier, to Court for failing to provide the information we requested to investigate auto-renewing contracts. We have also imposed a fine of £50.5 million on Facebook for breaching orders we imposed during the investigation into their purchase of Giphy.

We will examine markets that are not working well. In July we launched a consultation on whether to launch a market investigation into Motorola’s Airwave network – the mobile radio network used by all emergency services in Great Britain. In October we confirmed our decision to launch an investigation into initial concerns that the supply of the Airwave network in Great Britain is not working well, resulting in significant detriment to consumers and the taxpayer.

As we continue to deal with the economic impacts of the pandemic, the CMA will continue to provide robust and independent advice to governments across the UK. Supporting and challenging them to design policy, regulation and legislation that helps to ensure that the interests of consumers are protected, and competition is supported, given its critical role in fostering sustainable recovery and growth.

Our response to the issues caused by the pandemic has demonstrated our ability to be agile and flexible as an organisation, by getting close to emerging issues and reacting quickly to deal with them. We have learnt lessons from the experience and have adopted much of this learning as best practice, which we can continue to rely on to respond as future issues arise. We will remain agile, engaging closely with consumers to understand any potential problems in markets as they arise, responding swiftly, where we can, to tackle the issue and ensure markets work well for consumers, businesses and the economy.

Promoting effective competition in digital markets

Competition encourages businesses to offer better value and innovative products and services, which is crucial in driving improvements in productivity and growth. This process benefits consumers, businesses and the wider economy. The dynamic and innovative nature of digital markets means there is huge potential for value creation. It is imperative that we ensure the many benefits of digitalisation for consumers are secured, whilst making sure that concerns are properly addressed and encouraging these markets to operate in a way that fosters innovation and growth.

The use of digital has been growing across all sectors of the economy, with consumers and businesses increasingly shifting their trading online. This has been accelerated over the last 2 years by the pandemic, with more consumers across the UK relying on digital alternatives. With the end of the COVID-19 restrictions, many consumers may maintain their online habits, meaning more consumers could encounter problems in digital markets.

The emergence of tech giants has presented competition authorities around the world with new challenges that require a new approach. That’s why the CMA is taking a leading role in tackling these challenges to promote competition and innovation, to the benefit of consumers, as well as the many businesses who rely on these important services.

The Digital Markets Unit (DMU) was established in shadow form in April 2021. The DMU will oversee a new regulatory regime for the most powerful digital firms, promoting greater competition and innovation in the markets in which these firms operate, and protecting consumers and businesses from unfair practices. The DMU will look closely at the practices of the most powerful digital firms, taking action against harmful practices as well as proactively opening-up markets to promote greater opportunities for new and innovative competitors.

The CMA is working closely with the UK government, following the consultation on proposals for the new pro-competition regime. Powers for the DMU and for the new regulatory regime will require legislation. The UK government has committed to legislating when Parliamentary time allows. In the interim, the DMU has been established within the CMA, on a non-statutory basis to focus on operationalising and preparing for the new regime.

We will continue to use our existing tools to address problems in digital markets. This includes our work investigating mergers that have the potential to lead to a substantial lessening of competition in digital markets, such as the review of the Facebook/Giphy, and Adevinta/eBay mergers. We will continue to progress our portfolio of competition enforcement cases investigating issues in digital markets, including our investigation into Apple following complaints that its terms and conditions for app developers are unfair and anti-competitive. We are also investigating whether Facebook might be abusing a dominant position in the social media or digital advertising markets through its collection and use of advertising data.

We are launching a market study into music streaming to build a view as to whether competition in this sector is working well or whether further action needs to be taken. We are also carrying out a market study into Apple’s and Google’s mobile ecosystems over concerns they have market power which is harming users and other businesses.

We are now considering responses to a consultation on commitments offered by Google to address concerns about its proposal to remove third-party cookies on Chrome. The CMA is working closely with the Information Commissioner’s Office (ICO) in this case and will continue to work closely with the ICO to assess the effectiveness of alternatives to third party cookies being developed under the proposals. We are concerned that, without regulatory oversight and scrutiny, Google’s alternatives could be developed and implemented in ways that impede competition in digital advertising markets.

We will also continue with our focus on consumer enforcement in digital markets, building on our work in areas such as fake reviews, social media endorsements, online gambling, and secondary ticket platforms. We will continue to monitor those companies that have provided commitments to change their behaviour and will not hesitate to act where we identify breaches.

The Data, Technology and Analytics (DaTA) unit provide the important technical skills needed for our work on digital markets. The unit has built and is building several bespoke tools to scrape data and monitor markets. Its engineers and data scientists already collect and analyse large, complex and rich datasets for cases (eg on search or digital advertising). Its Behavioural Hub applies an understanding of consumers and their interactions with the interfaces of digital firms. It contributes to the creation of technological remedies, such as interoperability or techniques for anonymous data sharing, and the creation of new techniques, such as analysing and understanding firms’ algorithms. Overall, the DaTA unit’s technological expertise allows us to challenge companies more robustly on technical grounds. It is also helping us to understand the powers and develop the data and analytical skills that are needed for the CMA and DMU.

We will continue to work with our counterparts in the Financial Conduct Authority, Information Commissioner’s Office and Ofcom through the Digital Regulation Cooperation Forum (DRCF). This cooperation provides greater clarity for people and businesses on digital regulation, enables us to build a comprehensive view of industry trends and technological developments with regulatory implications, and build skills and capability more efficiently.

Given the global nature of the issues related to digital markets, we will continue our efforts towards international cooperation and collaboration, with a view to fostering coherence and consistency in approaches, to prevent a fragmented regulatory landscape. In particular, as part of the UK’s G7 Presidency, the CMA was asked by the UK government to host an Enforcer’s Summit to lead work to strengthen cooperation between competition authorities in relation to digital markets. This included convening a summit of G7 competition authorities, along with this year’s guests, in November 2021, to promote understanding of respective approaches to competition issues in digital markets and to discuss long term collaboration and cooperation.

Supporting the transition to low carbon growth, including through the development of healthy competitive markets in sustainable products and services

Supporting a wider effort to make our economy cleaner and greener is one of the CMA’s top priorities. Concerns about climate change are changing market dynamics and consumer behaviours across the UK. The UK committed to a legally binding target of net zero emissions by 2050;[footnote 13] and sustainable growth is crucial to achieving this goal. More than ever, it is important that public bodies, businesses, non-governmental organisations and consumers consider their contribution to the achievement of the UK’s Net Zero and environmental sustainability goals. We want to make sure that the competition and consumer enforcement regimes are able to play their part too where possible. We are continuing to expand our capability to ensure that when delivering our functions, we act in a way which supports the transition to a low carbon economy. At the same time, we will continue to take steps towards further reducing the CMA’s own carbon footprint as an organisation.

The Secretary of State for Business, Energy and Industrial Strategy (BEIS) wrote to the CMA asking us to provide advice to the UK government on how the tools available under competition and consumer law can better support Net Zero and sustainability goals, including preparing for climate change.[footnote 14] We launched a call for inputs to help inform the advice we will provide, which closed on 10 November 2021. We are looking to provide advice for the Secretary of State in early 2022, the advice will then be published at a later date.

We will ensure that businesses engaged in sustainability initiatives know how to comply with competition law and do not unnecessarily shy away from those initiatives on the basis of unfounded fears of being in breach of competition law. We have produced an information sheet to help businesses and trade associations better understand how competition law applies to sustainability agreements and where issues may arise.

Working alongside other global authorities, we found that 40% of green claims made online could be misleading.[footnote 15] We published a “Green Claims Code”, to help businesses comply with the law and prevent people being misled by environmental claims, which could erode consumers’ trust. The CMA warned businesses they have until the New Year to make sure their environmental claims comply with the law. We will carry out a review of misleading green claims early in 2022 and be ready to take action against offending firms.

We will continue to prioritise cases where practices could impede the transition to a low carbon economy, building on work such as the electric vehicle charging market study. The report highlighted our concerns that access to chargepoints can be a ‘postcode lottery’ across the UK, with significant variation between the nations and regions of the UK, with some areas at risk of getting left behind. For example, compared to the UK (and England) average of 39 public chargepoints per 100,000 population, Scotland has 49, Wales 31 and Northern Ireland 18. There’s also variation within regions - Yorkshire and the Humber has less than a third of the number of public chargepoints per head compared to London, and variations can be found across Local Authorities in all 4 nations.[footnote 16] The market study report set out a package of recommendations to UK governments designed to help meet the scale of the overall challenge, unlock competition along motorways, target rural gaps, boost investment in on-street charging and develop a charging sector that people can trust, and which is as easy to use as filling up with petrol / diesel, both now and in the future.

Following on from the market study, we have been investigating long-term exclusive arrangements between the Electric Highway – a ChargePoint provider – and 3 motorway service operators – MOTO, Roadchef and Extra.[footnote 17] The CMA is concerned that these arrangements make it difficult for other operators to provide competing chargepoints at motorway service stations. This could result in drivers losing out on the benefits of competition such as greater provision, more choice, competitive prices and reliable, high-quality chargepoints. We have now launched a public consultation on the commitments proposed by the companies. By getting involved early, as these markets are still developing, the CMA can work to ensure that consumers are treated fairly, now and in the future. Our work improving markets such as this will increase consumer confidence and encourage public take-up of sustainable alternatives.

We recognise the importance of cooperating with stakeholders within the UK and internationally on climate change, as with other matters. Following our successful regional engagement pilot in the North West of England, we are looking to expand this work across other areas of the UK (see the understand markets and consumers better section). In addition, the CMA’s outreach programme to the third sector has engaged successfully with third sector organisations gathering input on areas such as our work on misleading green claims (see paragraph above) and electric vehicles charging (see paragraphs above). We will build on these relationships to continue facilitating a dialogue on the relationship between competition policy and sustainability.

Delivering our new responsibilities and strengthening our position as a global competition and consumer protection authority

Our extensive preparations have ensured that we have the necessary people, skills and infrastructure in place to carry out our expanded role outside the EU. As a result, we have progressed cases that would have previously been reserved to the EC; we have launched the OIM; started to operate the shadow DMU (see promoting effective competition in digital markets; and recommenced our work on the UK’s future subsidy control regime by preparing for the creation of the SAU.

The OIM officially launched on 21 September 2021. It has been tasked with supporting the effective operation of the UK internal market using its economic and technical expertise, following the UK’s departure from the EU. It will provide reports to the Scottish government, the Welsh government, the Northern Ireland Executive and UK government. The OIM will shine a light on how effectively companies are able to sell their products and services to people across the 4 nations, post-Brexit. The OIM will listen to concerns and report to all governments on any barriers faced by businesses. In order to facilitate this, we have designed a Report an Internal Market Webform through which businesses and other stakeholders can share their experience of how the UK internal market is working.

The Subsidy Control Bill, which was introduced to Parliament in June 2021, will, if enacted, establish the Subsidy Advice Unit (SAU) within the CMA. The SAU will have a role in monitoring and reporting on the overall functioning of the new subsidy control regime, as well as providing non-binding advice to public authorities on a small number of individual subsidies and schemes that are most likely to have distortive or harmful effects. Referral to the SAU will be voluntary for “Subsidies of Interest” and mandatory for “Subsidies of Particular Interest” (which will be defined in regulations to be made by BEIS before the commencement of the new regime). It will allow public authorities to obtain an objective view on their assessments before granting a subsidy, while ensuring they can act swiftly and do not suffer unnecessary delays. We are following the progress of the Subsidy Control Bill through Parliament and liaising closely with BEIS to prepare for the setting up of the SAU (likely to be launched, subject to timing of Royal Assent, in Autumn 2022).

We have also made a recommendation to the UK government on new UK legislation to exempt pro-competitive ‘vertical’ agreements between companies (replacing existing EU regulation currently retained in UK law), which will provide businesses with certainty about the compatibility of their distribution arrangements with competition law and protect consumers from harmful agreements. We will be reviewing the other EU regulations retained in UK law in due course, in order to make further recommendations to the UK government, including in relation to regulations relating to R&D agreements, motor vehicle distribution, and container shipping.

We will continue to publish any relevant guidance as our functions and powers develop. We also remain open and ready to speak to businesses, consumers and consumer groups and other interested parties who may have more specific queries or concerns regarding the CMA’s new functions or the exercise of our current ones.

In mergers and antitrust, we will continue to pursue those larger and more complex cases with a global dimension. We are now progressing cases that would have previously been reserved to the EC. This includes investigating Google’s proposals to remove third party cookies and other functionalities from its Chrome browser (see promoting effective competition in digital markets section), and the anticipated acquisition by Facebook, Inc. of Kustomer, Inc. We have also launched an investigation of the merger between Cargotec Corporation and Konecranes plc in parallel with other authorities, including the European Commission, the Department of Justice and the Australian Competition and Consumer Commission.

As the CMA embraces its expanded role, it is even more important for us to forge strong relationships across the world, and work with partners both closer to home and further afield in order to protect consumers within and outside the UK. With markets becoming increasingly global and the growth of digital markets mentioned above, different jurisdictions face many of the same challenges. It is imperative that we have strong inter-agency co-operation to address cross-border anti-competitive activity and consumer protection issues in an increasingly global world.

We will continue our close engagement and cooperation with a range of international partners on a wide variety of issues. This includes our fellow participants in the Multilateral Mutual Assistance Cooperation Framework (MMAC), as well as the European Commission and national competition and consumer agencies within the EU and worldwide. We believe this kind of collaboration can amplify our impact – for example, in April we joined forces with our counterparts in Australia and Germany to set out the need for robust merger enforcement to drive post-pandemic economic growth.[footnote 18] We will seek to build on these international relationships and remain active and committed participants in important forums like the Organisation for Economic Co-operation and Development, the International Competition Network, the International Consumer Protection and Enforcement Network and the United Nations Conference on Trade and Development.

It is also important that we work closely with our partners closer to home. Alongside the Information Commissioner’s Office, we recently highlighted the strong overlap between promoting and protecting competition in digital markets and safeguarding people’s data. The statement was the first of its kind globally, and we will continue to set a positive example for our international counterparts, demonstrating our position as a world leading competition authority.

Strong, independent competition and consumer protection law enforcement also has an important part to play in international trade agreements that the UK may enter into, ensuring that businesses from both parties can compete fairly to the benefit of consumers. We will continue to work closely with the UK government as they put strong new trade relationships in place with key partners.

CMA 2020s

At the beginning of 2020, the CMA set out our ambition to bring the CMA closer to consumers and their needs. Much progress has already been made. We are internalising many of the lessons learned through the process and are adopting these, as best practice for how we engage with consumers to understand their issues, explain our role and advocate on their behalf.

We have been engaging with a wider and more diverse range of stakeholders than ever before, including more engagement with consumers, small businesses, and charities across the nations and regions of the UK. We will continue this outreach and look to embed the activities into the core of how we go about our day-to-day work across the organisation.

With more engagement with stakeholders across the UK, including in the Devolved Nations, we will continue to improve awareness and compliance with competition and consumer law; to build understanding of the CMA’s role; and to obtain input into how our work can serve society better. In the same way as we did last year, we will continue to hold virtual meetings and events regarding our Annual Plan this year, across the nations and regions of the UK to improve our understanding of the issues facing consumers and businesses and explain our work.

In addition to our London, Edinburgh, Cardiff and Belfast offices we are opening an office in Manchester which will be the home of the new DMU and setting up a new MU in HM Treasury’s Darlington campus. By growing our presence outside of London, we hope to get closer to consumers across the nations and regions of the UK.

1. Understand markets and consumers better

We will continue to develop our understanding of the changing needs of consumers and how they experience markets, wherever they are in the UK. This will include monitoring the state of competition and how markets are changing as a result of the ongoing impact of COVID-19, as well as on the functioning of the UK Internal Market.

The Behavioural Hub (see the protecting consumers from unfair behaviour by businesses, during and beyond the COVID-19 pandemic section) and Data and Technology Insight team in our DaTA unit (see the promoting effective competition in digital markets section) will continue to build the evidence base on Online Choice Architecture (OCA) and are now focusing on a work programme, which could include publishing some research and guidance pieces on OCA, providing advice to government and a communications campaign in 2022.

We will continue our ongoing engagement with Third Sector Organisations to gain better insight and views on areas of our work, including the effects on vulnerable consumers, so that we can consider how that insight might continue to inform our work. This outreach will include plans for a rolling programme of visits to Citizens Advice as we look to embed the activities into the core of how we go about our day-to-day work across the organisation.

Following our successful regional engagement pilot in the North West of England, we are currently evaluating the pilot with a specific focus on digital markets and SMEs and are looking to expand this work with stakeholders across the North of England, to include both the North East and Yorkshire and Humberside. We will also extend our targeted engagement with business communities in Bristol and the surrounding areas.

2. Explain why competition matters, and the CMA’s work and priorities

We will continue to work to improve awareness across the UK of how well-functioning, competitive markets serve consumers, businesses and the wider economy. From ongoing Board engagement across the nations and official-led outreach with government and stakeholders, we will continue to explain how the CMA’s work supports this objective, and the rationale for our priorities, plans, and selection of projects, for example using videos and social media posts that help to explain our work in a user-friendly way, showing the detail behind the announcements. And we will continue to work with the business community to explain the importance of competition and consumer law, and how to comply with it.

We will continue our work to ensure the information we produce is accessible to all, complying with all relevant accessibility legislation. The CMA digital team will continue to publish documents in HTML, and further develop other digital channels and journeys, to ensure everyone can access the important information produced by the CMA.

Using a wider range of tools and channels (for example, video content and social media), we will continue to broaden the audience for our messages. As well as creating social media posts which easily explain the CMA’s work or views, we have also had a number of well-known celebrities provide voiceovers for our tailor-made social media posts.

3. Advocate for consumers’ interests

We advocate to promote competition in the consumer interest on regulatory, policy and legislative matters, through our recommendations and advice to government and public authorities. We will continue to provide robust and independent advice to governments across the UK. Supporting and challenging them to design policy, regulation and legislation that helps to ensure that the interests of consumers are protected, and competition is supported, given its critical role in fostering sustainable recovery and growth.

We will continue to arrange various meetings with stakeholders to introduce the OIM and improve awareness of its functions. We are also engaging with the devolved administrations and UK government departments about the OIM.

We will continue to develop our outreach proposals considering how our regional engagement can be expanded across the rest of the English regions and how these activities best complement and dovetail with engagement in the nations.

Our campaigns work continues to raise awareness of issues that affect consumers, including most recently on our Green Claims Code. We are planning a consumer-focused awareness campaign to empower consumers when shopping online, which will be launched in early 2022.

Resources

The Spending Review 2021 (SR21) allocated the CMA’s budget for 2022 / 2023 as a Resource Departmental Expenditure Limit (RDEL) budget (excluding depreciation) of £112.5 million and a Capital budget of £9.5 million.

This settlement continues to include funding in support of the CMA’s core functions as well as funding for the newly formed SAU and OIM. Funding provided for 2022 / 2023 ensures the CMA can continue its vital work promoting competition for the benefit of consumers, across the nations and regions of the UK, keeping prices low for consumers and driving innovation and productivity, which will be crucial in supporting the post-coronavirus pandemic economic recovery.

The CMA has also received ongoing financial support for a dedicated DMU and an additional £1.1 million in 2022 / 2023 to further support its continued expansion in anticipation of the introduction of a Digital Competition Bill. Additional funding of £1.0 million, to fund the CMA’s growth across the nations and regions of the UK, and £2.4 million for emerging pressures (for example inflationary and increases to National Insurance Contributions) has also been provided to the CMA in 2022 / 2023.

As Accounting Officer, the CMA’s Chief Executive is personally responsible for safeguarding the public funds for which he has charge, for ensuring propriety and regularity in the handling of public funds and the day-to-day operations and management of the CMA. The Accounting Officer is supported in discharging these duties by an additional Accounting Officer, the Chief Operating Officer.

-

In responding to the consultation, you will be supplying us with personal data (your email contact details, for example). Personal data is information which relates to a living individual who may be identifiable from it. ↩

-

It includes information about your rights in relation to your personal data, including how to contact us and how to complain. ↩

-

See Transparency and Disclosure: Statement of the CMA’s policy and approach (CMA6). ↩

-

In responding to such requests, we will take into account any comments you have made about confidentiality. See also CMA6 (see footnote 3 above) about the CMA’s approach to FOIA requests. ↩

-

“Power to the People: stronger consumer choice and competition so markets work for people, not the other way round” John Penrose (February 2021), page 15. ↩

-

We also have new powers for the OIM, which officially launched on 21 September 2021, which are set out in the UK Internal Market Act 2020. The CMA will have further powers linked to the SAU which will be established by the Subsidy Control Bill 2021 which is currently going through Parliament. ↩

-

In early 2020, the CMA was asked by the UK government to assess the state of competition in the UK. Our report was published in November 2020 and provided insights into the level and nature of competition across the economy and within a number of sectors. We are continuing to monitor the state of competition in the UK. ↩

-

The BH was launched to improve our understanding of consumers’ needs as well as how businesses design and target their products and services. ↩

-

Reforming Competition and Consumer Policy: Driving growth and delivering competitive markets that work for consumers – CMA Response to Consultation. ↩

-

This ensures that companies continue to compete with each other as they would have without the merger, and prevents the companies involved from integrating further while a merger investigation is ongoing. ↩

-

UK becomes first major economy to pass net zero emissions law Scotland set a target for net-zero emissions of all greenhouse gases by 2045, Climate change. ↩

-

Global sweep finds 40% of firms’ green claims could be misleading. ↩

-

These figures were updated in October 2021 and can be found by following this link Official statistics overview: Electric vehicle charging device statistics: October 2021. ↩

-

UK, Australia and Germany issue statement on merger control. ↩