Wet line contamination: best practice guidelines

Wet line contamination involves the cross contamination of road fuel with rebated fuels, which will either be red diesel or kerosene.

Section 1: background and overview

Background

This guidance covers the wet line metering system in use for trade. Wet line delivery systems have been around for many years but the nature of the delivery system causes an issue of potential fuel contamination. Wet line contamination involves the cross contamination of road fuel with rebated fuels, which will either be red diesel or kerosene.

While some wet line contaminations are genuine accidents such malpractice still impacts upon the UK Revenue with a loss of around £5 million per annum.

HM Revenue and Customs (HMRC) policy is that any contamination of road fuel with any detectable levels of rebated markers is unacceptable and, without prejudice to any other action, the fuel cannot remain in the market place as road fuel.

Rebated fuels are marked with hidden chemical markers, and, in the case of red diesel, a dye, to distinguish them from duty-paid fuels. The presence of any of these chemical markers in road fuel is conclusive proof under the Hydrocarbon Oil Duties Act 1979 (HODA) that there is rebated fuel present and so there is an immediate statutory contravention. This makes the fuel liable to forfeiture and, as a result, any vehicle or tank that contains the fuel is also liable to forfeiture.

HMRC operates a zero tolerance of statutory markers in road fuels. We will not allow fuel that has the presence of markers, which can be identified by the field tests carried out by the Road Fuel Testing Unit (RFTU), to be used or supplied as road fuel.

HMRC maintains a zero tolerance to contaminated fuel in the road fuel supply chain. We do not adopt a percentage allowance as this approach would:

- undermine the ability to detect fraud of laundered fuels

- create difficulties in determining in which part of the supply chain the contamination occurred

Action taken

With the introduction of Accutrace S10 on 1 April 2015, HMRC has demonstrated to the trade that its new detection systems can now detect any level of contamination. HMRC has found that wet line contamination is predominantly found in deliveries of small quantities of fuel (under 5000 litres).

HMRC has asked industry to continue using the system that is in place. HMRC believe that where the agreed procedures are followed, no detectable level of wet line contamination should occur. If a detection occurs this could be from a line change that was actioned at the delivery or immediately before the delivery. Industry are recommended to route the vehicles so line changes are kept at a minimum.

The trade has prepared a Code of Practice (CoP), which HMRC has contributed to and agreed. HMRC has produced guidance for officers to follow when a contamination has occurred that could be a result of wet line delivery. This guidance is published on GOV.UK, along with the CoP endorsed by the Northern Ireland Oils Federation (NIOF) and the Federation of Petroleum Suppliers (FPS).

Technical detail

Road fuel tanker

This is the tank used to carry hydrocarbon oils in a safe environment on public roads. It is usually made up of a number of compartments within a tank, (which are referred to as pots in the trade), of which there can be up to 7 depending on the tanker type. The tanker can be fixed to a rigid vehicle chassis or a trailer attached to articulated HGV, this will be dependent on the size and use to which the tanker would be put. Smaller tankers tend to be rigid and used for smaller commercial supplies domestic deliveries in rural areas and agricultural deliveries.

Delivery system

The method of transference for fuel, from storage into the tanker or from the tanker into storage.

Loading system

The delivery system used at oil depots to transfer oil from bulk storage into the tanker. This is a dedicated single line system and no cross contamination can occur.

Dry line delivery system

These are the large pipes that tankers carry which allow connection from the pot manifold to the storage tank where delivery is to be made. They will allow full transfer from the pot to the storage tank. After delivery the pipes are disconnected for storage on the tanker, and by then they will contain no fuel (dry). Some rigid vehicle tankers operate a Dry Line hose reel delivery system, which means after each delivery the delivery hose is emptied by air blown down the system. The Wet Line delivery operation is the more common of the 2 systems.

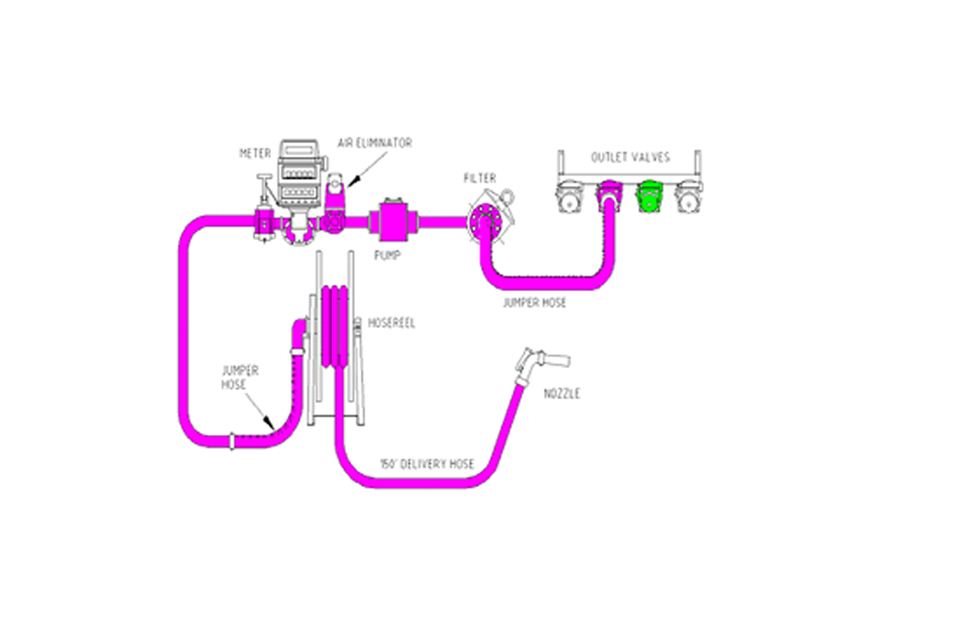

Image showing wet line delivery system

A typical wet line system is shown above. In this system the manifold floods with fuel from the selected pot and is gravity fed via the pipework to the filter/cargo pump. The manifold remains wet unless the supply of fuel from the pot is stopped which enables the pump to clear the fuel from the manifold, but not from the pipework and cargo pump which remain wet and can cause low level contamination as the 2 products mix.

Cross contamination

The term that refers to mixing of 2 different fuels, potentially with different duty rates from each other.

Detectable levels of marker

The amount of marker added to rebated fuels is stipulated in law and when this is fully marked it would be referred to as 100%. The field tests carried out by the RFTU officers are able to detect the presence of rebated fuels to extremely low levels. Where necessary, independent verification as to the level of contamination is sought by having a sample tested at the laboratory of the government chemist.

The average wet line delivery system contains 100 litres of fuel depending on vehicle design. A smaller delivery of fuel can be between 500 and 1000 litres. If the whole wet line were cross contaminated this would produce contamination between 10-20% if none of the best practice procedures were adopted during the delivery and there was blatant malpractice.

If the procedures were properly adopted there would still be a possible co-mingling of oils due to manifold content and pump and meter turbulence. Industry estimate this could be between 5 and 25 litres if the product was changed, dependent on the metering system installed on the vehicle.

Industry have advised that line changes should be kept to a minimum for deliveries of 500 litres and not actioned on deliveries below this volume.

Section 2: industry code of practice

Calibration of a delivery tanker wet line system to minimise product contamination

1.Detail

By law, mixing of a taxed road fuel with a rebated fuel is forbidden. Following discussions with HMRC on minimising this contamination, with input from the NIOF and the FPS, we have developed the following code of practice to provide some guidance to distributors on minimising the risk of cross contamination when delivering rebated and non-rebated fuels from the same vehicle.

If the procedures were properly adopted there would still be a possible co-mingling of oils due to manifold content and pump and meter turbulence. Industry estimate this could be between 5 and 25 litres if the product was changed, dependent on the metering system installed on the vehicle.

Industry have advised that line changes should be kept to a minimum for deliveries of 500 litres and not actioned on deliveries below this volume.

To minimise the effect of possible cross contamination being caused during deliveries from a vehicle carrying more than one product, it is strongly recommended that drivers are educated to minimize line changes when changing from rebated to non-rebated fuels, or visa-versa, to reduce the possibility of cross contamination.

2. Procedure

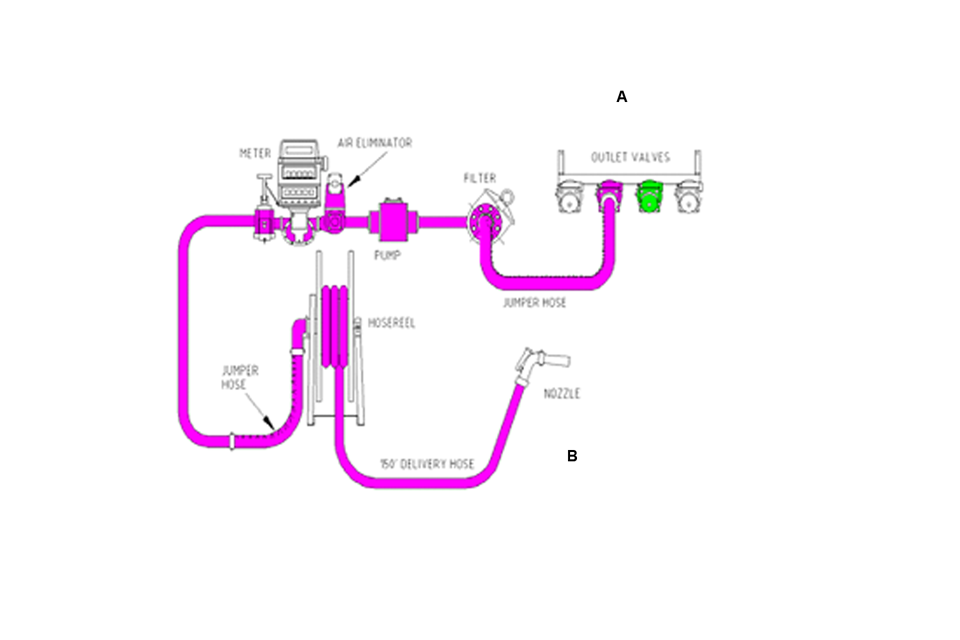

Calibration of a delivery system consists of measuring and recording the total liquid volume of the system from the outlet valve, A, to the end of the delivery nozzle, B, (see figure below).

Image showing calibration of wet line delivery system

In order to make an effective and complete product change for the delivery system, and to minimise contamination, this volume must be known.

The entire delivery system of a vehicle (the coloured area in the figure) is first primed with kerosene (light yellow in colour) and the delivery is then changed over to marked gas oil (red in colour), replacement of kerosene in the system is considered to be complete when the first traces of red marker dye become evident (a yellow to pale orange endpoint).

The volume, X, required to effect the complete replacement is recorded and this information is provided to the driver by means of a vehicle label/document, and maintained as a company record for that vehicle.

Carry out the method 3 times to ensure that the results obtained are repeatable within acceptable limits and use the highest of the total volume results obtained for the vehicle label and record).

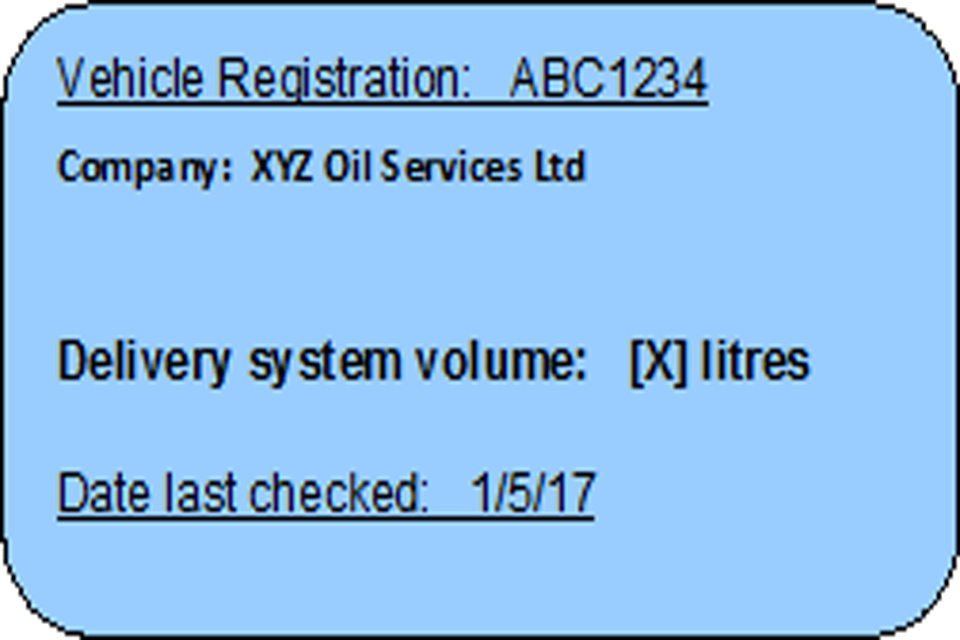

3. Vehicle label

To enable a driver to minimise contamination, the total system volume calculated and recorded during calibration, X, should be made available on the calibrated vehicle. This record should be retained within the cab of the vehicle and the driver made aware of its location stating the date of the most recent calibration.

One example of a suitable label is shown below.

Image showing vehicle label

4. Records

A record of the initial calibration results for each vehicle should be retained in the company records, a repeat calibration check on the vehicle should be carried out at least every 6 months and additionally if the hose is replaced or repaired, for example. following damage.

Example of a typical vehicle wet line volume record chart

Procedure for delivering and recording different products from a road tanker using a wet line delivery system

Principle

The product that is in the wet line system should be known at all times so that appropriate action can be taken to minimise cross contamination of products. A procedure similar to that given below should be used for recording this.

Procedure for completing the record sheets

Each vehicle should be provided with a record sheet, in duplicate, for completion by the driver. A new record sheet should be used each time the tanker loads.

Example of a suitable record sheet is given in Figure A1.

Before loading the vehicle, check the product that is in the wet line system. This should be recorded on the record sheet.

Procedure for delivery

Deliveries where the oil in the wet line system is the same as that being delivered:

(a) Set the meter to a volume equal to the required delivery volume.

(b) Deliver the set volume into the customer’s tank.

Deliveries where the product in the wet line system needs to be changed to another product for the next delivery:

(a) If the next delivery is a different product, set the meter for the volume to be delivered less the volume of the wet line system.

(b) Deliver the set volume into the customers’ tank and where the metering system allows.

(c) Change the delivery system to the compartment containing the product for the next delivery. Set the meter to the volume of the wet line system and complete the delivery.

Procedure for line change

(a) Electronic meters with a product return system

Set the meter equal to the volume of the wet line system and, using the product return system and a dummy printed delivery ticket, charge the system with the product for the next delivery. Mark the dummy delivery ticket with the details of the change, for example kerosene to derv, and retain it with the record sheet.

(b) Mechanical meters with product return system

Set the meter equal to the volume of the wet line system and, using a dummy, handwritten delivery ticket, charge the system with the product for the next delivery. Mark the dummy ticket with the details of the change, for example kerosene to derv, and retain it with the record sheet.

Records

The paperwork carried with the tanker for loading and deliveries should enable stock reconciliation of the load to be carried out and rapid identification of any contamination/mixing if it occurs. It should also enable identification of customers who may have contaminated product.

The completed record sheets should be retained as part of normal business records.

Additional procedures

The delivery wet line system must not be used to fill vehicle running tanks with small quantities of diesel.

Driver training should consider wet line contamination, when switch loading of products between loads, small quantities in compartments and company policy to deal with these issues to help reduce the level of risk.

Section 3: HMRC operational response

HMRC’s procedures and expectations when dealing with wet line contaminations

This section covers the contamination of duty paid fuel with rebated fuel, where the contamination is suspected to have been caused by an accident with a wet line delivery system.

The average wet line delivery system contains 100 litres of fuel depending on vehicle design.

If the existing agreed procedures were properly adopted there would still be a possible co-mingling of oils due to manifold content and pump and meter turbulence. Industry estimate this could be between 5 and 25 litres if the product was changed, dependent on the metering system installed on the vehicle.

These procedures do not replace the law, but are merely our operational interpretation.

If there is conflict between these procedures and the legislation, the legislation always takes precedence.

This document details the procedures to be followed in dealing with these cases and also gives the trade an understanding of what they can expect when accidents do occur. It represents current policy and is liable to change at short notice.

This policy is not prescriptive and it is necessary for each case to be considered on its own merits. Any instances of conflict should be reported by Officers to Oils Policy for them to review the procedures.

Email: oils.policymail@hmrc.gov.uk.

Background

HMRC operates a zero tolerance of statutory markers in road fuels. We will not allow fuel that has the presence of markers, which can be identified by the field tests carried out by the RFTU, to be used or supplied as road fuel.

Any action taken must ensure that all the individual circumstances of the case have been taken into consideration, of the policy in this document, and of any issues in connection with proportionality. The zero tolerance is intended to ensure that contaminated fuel is not available for supply or use as a road fuel.

There are 2 main delivery systems employed when delivering fuel from a tanker, the reason for this is because not every system is suitable for delivery into every type of storage container.

Dry line

There is the large hose delivery whereby the hoses will be connected together to enable the fuel to be discharged, and then the hoses are disconnected and put back on the vehicle. There will be a small amount of fuel left in these vehicle discharge systems after delivery which will be dependent on the proficiency of the cargo pump. There is also a dry line hose reel delivery system, which means after each delivery the delivery hose is emptied by air blown down the system.

Wet Line

In some circumstances there is the need to monitor the delivery more closely and these deliveries tend to be made using a ‘wet line’ delivery system. 98% of deliveries are now made using the wet line system. The wet line system tends to use a longer hose with a discharge gun on the end and the whole system constantly contains fuel. As these systems are used to deliver differing products, it is necessary for the trade to employ stringent controls to ensure contamination between the differing products does not occur.

The Wet Line delivery operation is the more common of the 2 systems.

A CoP has been agreed with the trade to which oil suppliers should adhere in order to avoid unnecessary contaminations.

Despite this, there is still potential for accidents to occur, and it is necessary for the Department to deal with these to ensure that contaminated oil is removed from the road fuel supply chain.

Wet line contamination is a breach of:

The Hydrocarbon Oil Regulations 1973, regulation 43 states that:

No person shall mix:

(a) Any fuel oil, gas oil, kerosene or light oil in respect of which a rebate of duty has been allowed.

(b) Any oil which has been delivered for home use without payment of duty.

with any oil on which no rebate of duty has been allowed except under and in accordance with the terms of either approval granted by the Commissioners under the mixing Regulations or a licence granted by the Commissioners and, where they so require in relation to such a licence, after paying an amount equal to:

(i) in the case of oil on which rebate has been allowed, the rebate allowable on like oil at the rate for the time being in force

(ii) in the case of oil delivered without payment of duty, the duty chargeable on like oil at the rate for the time being in force

Section 24(1) HODA 1979 provides that the commissioners may make regulations for the purposes of various sections of the Act and in particular for the purposes specified in Schedule 4 to this Act.

Schedule 4 sets out subjects for regulation under section 24 HODA 1979.

These include, at paragraph 4:

As to mixing of oil

Imposing restrictions on the mixing with other oil of any rebated oil or oil delivered without payment of duty.

The consequences of breaching regulation 43 of the 1973 Regulations can be found in Section 24(4) HODA 1979.

Section 24(4) HODA 1979 sets out

Where any person contravenes or fails to comply with any regulation made under this section his contravention or failure to comply shall attract a penalty under section 9 of the Finance Act 1994 (civil penalties), and any goods in respect of which any person contravenes or fails to comply with any such regulation shall be liable to forfeiture.

And a civil penalty under section 9 Finance Act 1994 is permitted for a breach of regulation 43, as well as forfeiture (which would enable seizure under section 139 Customs and Excise Management Act 1979).

NB: In every instance of wet line contamination the oil must be seized. When considering whether to restore, HMRC officers must base their decision upon the individual facts.

Expectations of HMRC when a contamination as a result of a wet line delivery is discovered

1.Contaminations reported to HMRC after discovery by the supplier

It is the supplier’s responsibility to notify HMRC of all instances where mixing has occurred.

Where a supplier realises they have supplied a mixture of oil detailed within this section, they must notify HMRC within 24 hours of the error being discovered. The supplier should contact HMRC and ask them to pass the information to the local RFTU as a matter of urgency.

When HMRC has been notified that mixing has occurred, the supplier should await advice from the RFTU and:

- have available for inspection by HMRC all records in relation to the load from which the delivery was made and evidence that the supplier is complying with the agreed CoP

- provide details to HMRC of:

- the date of contamination

- the quantity and type of product that was delivered

- the quantity and type of any oil that was in the storage tank prior to delivery

- the name, address and telephone number of the customer

While there is always scope for an accident to occur, there is an expectation that, where a supplier is abiding by the CoP, these will be limited. HMRC will attend the site of the contamination where the officer will provide instructions, ensuring the product is seized and removed from the road fuel supply chain. Consideration may be given to offering restoration of the fuel to the supplier on condition that it is dealt with as directed by the HMRC officer and getting the distributor to uplift it at their own expense.

The relevant factors are:

- duty is normally due at the time the mixing took place - in these voluntarily reported incidents involving road fuel, no duty will be charged on that section of the uplifted product that is rebated fuel

- if prior to the uplift the customer has inadvertently used a reasonable amount of rebated product, there may be a requirement to recover the rebate allowed on this fuel - HMRC Assurance staff should consider the recovery of this duty from the supplier and that a record is attached to their Registered Dealers in Controlled Oil (RDCO) file

- where an identifiable amount of rebated product has been mixed with road fuel, and this can be quantified from a stock reconciliation, HMRC will need to consider raising an assessment and that a record is attached to their RDCO file

- a civil penalty under section 9 Finance Act 1994 is permitted for a breach of regulation 43 - in all cases take into consideration the reasonable excuse provision at section 10 Finance Act 1994 which provides for exceptions to liability under the section 9 provisions

2.Contaminations reported to HRMC after discovery by the customer

When a customer contacts HMRC claiming that they have had a contaminated delivery, the following information should be established:

- details of the customer

- details of the supplier

- whether they have contacted the supplier (if not they must)

- details of the delivery for example date, time, type of fuel ordered etc

- why they think there is a problem with the supply they have received

- that the contaminated fuel is not used

The incident must be referred immediately to the local RFTU as a decision needs to be made within the same working day on how to deal with the reported incident.

HMRC will attend the site of the contamination where the officer will provide instructions, ensuring the product is seized and removed from the road fuel supply chain.

The supplier (if known) should be contacted so that they can have a representative at the customer’s premises when the RFTU officers are present.

NB: This is not mandatory but they should be given the opportunity to attend to avoid later problems of not having witnessed samples being taken or disputing that the fuel was contaminated

The contaminated fuel should not be restored when:

- there are genuine concerns that the product is likely to be misused

- the supplier’s details are not known, and the supplier refuses to acknowledge the incident and will not uplift the product

3. Contaminations discovered by HMRC at the customer’s premises

In these instances HMRC have to make a decision whether they suspect fraud on the part of the supplier or the owner of the fuel, or whether it could be an accidental contamination.

If it is considered to be accidental, the supplier will be contacted to uplift the product. If the issue is considered more serious, HMRC will visit the supplier’s premises to establish the extent of the problem and to discuss the issue with them.

Where contaminated fuel is discovered in a customer’s bulk tank, all the facts will need to be established. It is already standard procedure, where a commercial vehicle is discovered with rebated fuel in its running tanks, for RFTU officers to return to the operator’s home base and test other vehicles and bulk stock. Refer to section 7.

A decision has to be made whether there is fraud involved in the case or whether it is an accidental contamination at the point of supply.

The following are indicators to be considered:

- level of contamination

- does the percentage contamination suggest a wet line accident?

- has there been a recent delivery of bulk stock?

- does the owner have all records in relation to the delivery and previous deliveries?

- does the customer always use the same supplier?

These are not exhaustive and all relevant aspects must be taken into consideration.

Where it is felt that the incident may be an accidental contamination, the supplier should be contacted and asked to attend the site. This is not mandatory but they should be given the opportunity to attend to avoid later problems of not having witnessed samples being taken or disputing that the fuel was contaminated.

In addition:

- a civil penalty under section 9 Finance Act 1994 must be considered for a breach of regulation 43. In all case take into consideration the reasonable excuse provision at section 10 Finance Act 1994 which provides for exceptions to liability under the section 9 provisions

- these cases have to be reported to the necessary HMRC teams so that a record is attached to their RDCO file

- the supplier’s premises need to be visited, and assurance should be sought as to why the supplier had not noticed the incident if abiding by the terms of the CoP

If the decision is made that this is part of a more widespread problem, the incident should also be reported to the necessary HMRC teams and referred for a post detection audit to undertake a stock reconciliation to determine the extent of the problem.

4. Contaminations discovered by HMRC at the supplier’s premises

HMRC will consider all contaminations of a supplier’s own stock tank to be a serious matter.

It will be necessary to consider all aspects of the business activity, and the business will be the subject of enquiries to establish what has occurred. This will probably involve an interview of key personnel and an audit of business records.

HMRC will seize contaminated goods. When considering whether to restore the oil, HMRC officers must base their decision upon the individual facts.

If the incident is isolated and considered a one-off, deal with the circumstances as detailed in section 1.

Where the supplier has no plausible explanation, the detection should be treated on the basis that there may be fraud involved.

In determining whether restoration is appropriate:

- if the supplier has caused the contamination they should bear the cost by uplifting and disposing of the product themselves.

- where fraud is suspected and there are strong suspicions that the oil is likely to be misused elsewhere, the oil should be seized not restored and disposed of in accordance with HMRC’s current contract for the haulage, storage and disposal of seized fuel products, chemicals and associated equipment

NB: There is no facility to recover the cost of uplift and disposal from any party where HMRC has undertaken this task.

A civil penalty under section 9 Finance Act 1994 must be considered for a breach of regulation 43. In all cases take into consideration the reasonable excuse provision at section 10 Finance Act 1994 which provides for exceptions to liability under the section 9 provisions.

The incident should also be reported to the necessary HMRC Teams and referred for a post detection audit. A record should also be attached to their RDCO file.

5. Position as regards duty adjustments

If the oil is to be downgraded or destroyed, there may a request for the duty to be repaid. A distributor does not normally pay any duty, they normally will only pay the market price for the fuel, which will include the duty that had to be paid when the product was released for consumption onto the home market.

As a result duty cannot be repaid, unless the oil is returned to a tax warehouse, and even then, HMRC can only repay the duty to the original taxpayer, which is almost certainly the refiner or importer who accounted for duty at the duty point when the oil was released onto the home market.

It may be possible for the supplier to arrange for the producer/importer to take the product back for re-grading. This will sometimes be undertaken at remote marking premises. In these instances it is a commercial decision between the 2 parties as to whether any credit is given to the supplier for any duty that may be able to be reclaimed from HMRC by the producer/importer.

NB: A supplier cannot make a claim for any direct repayment to them by HMRC of that portion of the price of the fuel they consider is duty.

When oil is mixed, a new duty point is created and duty becomes payable on the new oil, but allowance can be made for the duty that would already have been paid on certain portions of that mixture, whether this be the full or partly duty-paid parts of the mix:

- where an identifiable amount of rebated product has been mixed with road fuel, and this can be quantified from a stock reconciliation, and some had already been sold as road fuel

- HMRC will need to consider raising an assessment and it may become necessary for HMRC to collect duty on the portion of the mixed product that was rebated fuel

If the oil can be returned to the duty point, which could be a duty-suspended import warehouse or a duty-suspended refinery warehouse, but not a remote marking premises (as they are outside of the duty suspension regime), and the duty payer can demonstrate to the satisfaction of HMRC that they are correctly downgrading the oil, a duty adjustment may be made on the taxpayer’s HO10 or by some other method, after consultation with an HMRC Excise Officer.

Any transaction between the supplier and the duty payer will be a commercial decision between themselves and the transaction is nothing to do with HMRC.

HMRC will need to be satisfied that the duty payer has properly dealt with the downgrading of the product and has the proper evidence of duty payment etc. before they can make any adjustment on their return.

NB: If the supplier (for example, the customer of the taxpayer) chooses to downgrade with HMRC’s approval, see section 6 as this is a commercial decision and no duty will be repayable to them by HMRC.

6. Disposal of contaminated product

Where duty-paid road diesel has become accidentally contaminated with a rebated product, it will no longer meet the specification for road diesel, and as such must be removed from the supply chain as road fuel. HMRC maintains a zero tolerance to contaminated fuel in the road fuel supply chain and it must be removed from circulation.

If the company has had a number of incidents in a short period of time, consideration would need to be given as to whether these were accidental. If these incidents have happened too regularly, HMRC may be less willing to allow all of the below concessions, as the circumstances could no longer then be described as ‘exceptional.’

The correct way to dispose of the oil would be for it to go back to approved marking premises and then have marker concentrate added so that it complies with The Hydrocarbon Oil (Marking) Regulations 2002 as red diesel.

As outlined in section 5 there cannot legally be any payment of compensation for the duty element of the product by HMRC to the supplier in these cases. Registered Remote Marker’s premises are not tax warehouses and the product is not returned into duty suspension for marking in these circumstances.

The supplier may determine that it is not commercially viable to deal with contaminated oil in this manner, due to transport and handling costs. The product may be perfectly suitable for use as rebated gas oil in machinery, but it is unlikely that contaminated oil will be added to kerosene stocks, as the addition of diesel contaminant to kerosene will make the fuel unsuitable for use in domestic kerosene heating systems.

A request may be received for the contaminated product to be mixed with existing stocks of marked rebated gas oil (red diesel). Addition of contaminated oil to red diesel will result in the product being under marked and no longer compliant with The Hydrocarbon Oil (Marking) Regulations 2002. In addition a further mixture would be produced contrary to HODA 20AAA and 20AAB.

NB: All seized oil is to be disposed of in accordance with the HMRC contract. Where a supplier picks up contaminated oil, they must dispose of, or recycle this oil in the most efficient way, while also complying with the legislation.

7. Road vehicles that have had contaminated fuel in their running tanks

Road vehicles must be fuelled with duty-paid fuel and must not have any presence of rebated fuel anywhere in their vehicle fuel system.

The slightest trace of rebated fuel in a vehicle system can be detected when carrying out vehicle testing in the field. A positive reaction to statutory markers present in rebated fuel makes the fuel and vehicles liable to forfeiture and they can be seized.

When a vehicle has contained rebated fuel:

- by accident due to a contamination

- due to illegal use of rebated fuel by the operator

It is the owner/operator’s responsibility to remove the fuel as soon as it is discovered, and definitely before it is used again on the public highway.

HMRC will not get involved in draining contaminated fuel from any vehicle, unless the fuel is seized and disposed of in accordance with the HMRC contract.

The owner/operator should be told to undertake the following operation to remove all traces of rebated fuel from the vehicles running tanks and fuel system:

- the vehicle must be drained of all fuel in the tank

- fill the tank and flush the fuel system with 5 litres (one gallon) of duty- paid road diesel

- drain this added fuel from the fuel tank

- change the vehicles fuel filters

- fill the cleaned vehicle’s running tanks with duty-paid road diesel

Records should be retained to show this operation has been fully undertaken.

If the vehicle is again detected with rebated fuel in the running tanks, this will be treated as a separate contravention, and action will be separate and in addition to any previous action.

8. Formal samples

HMRC will test oil that may be contaminated by taking official samples for possible evidence and further forensic testing as appropriate at the laboratory of the government Chemist. The taking of official samples is covered in legislation and can be found in the Hydrocarbon Oil Regulations Regulation 47. The formal sample is split into three portions in accordance with Schedule 5 of the Hydrocarbon Oil Duties Act 1979: one for evidence; one for forensic analysis; and one for the individual in charge of the vehicle/receptacle from which the sample was drawn.

Key best practice rules for suppliers:

- if access is restricted at the supply depot for correct sampling procedures from a storage tank, then controlled sampling should be considered with agreement. If a vehicle compartment is used, then the sampling grade must match the previous loaded grade

- if a sample is taken from the API outlet of a compartment, then care must be taken to ensure that any residue from any previously load is removed if different

- diesel residue (quantity) in any wet line delivery hose must not be flushed into a vehicle running tank for line changing purposes (High risk of contamination levels)

- vehicle compartments must be emptied if loading a different grade (reduce the risk of contamination)

Suggested Health and Safety rules for both HMRC inspectors and supply depot:

- site rules and induction to be implemented

- if sampling is taken from the top of a compartment, then a risk assessment must take place before access is allowed

- supervision of HMRC inspectors whilst on site

Disclaimer

This document has been produced by NIOF and the FPS to give guidance only. It is not a legal or binding contract and no director or officer can guarantee that a distributor following this procedure will be exempt from legal action by HMRC or any other party.

Updates to this page

-

The link to use to contact HMRC has been updated.

-

First published.